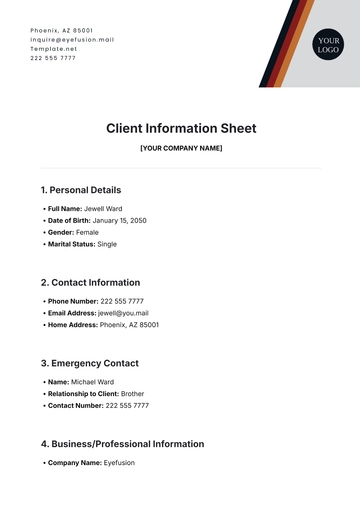

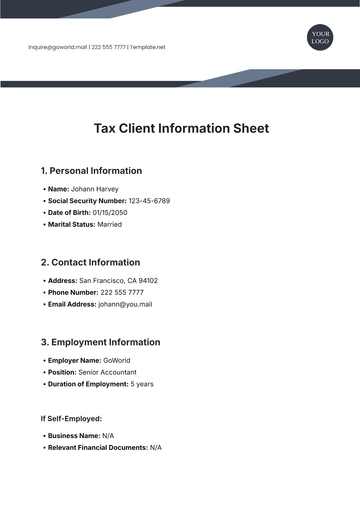

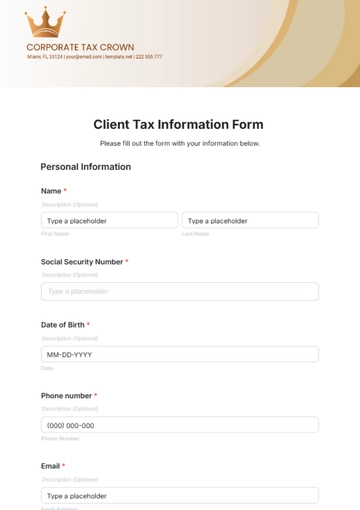

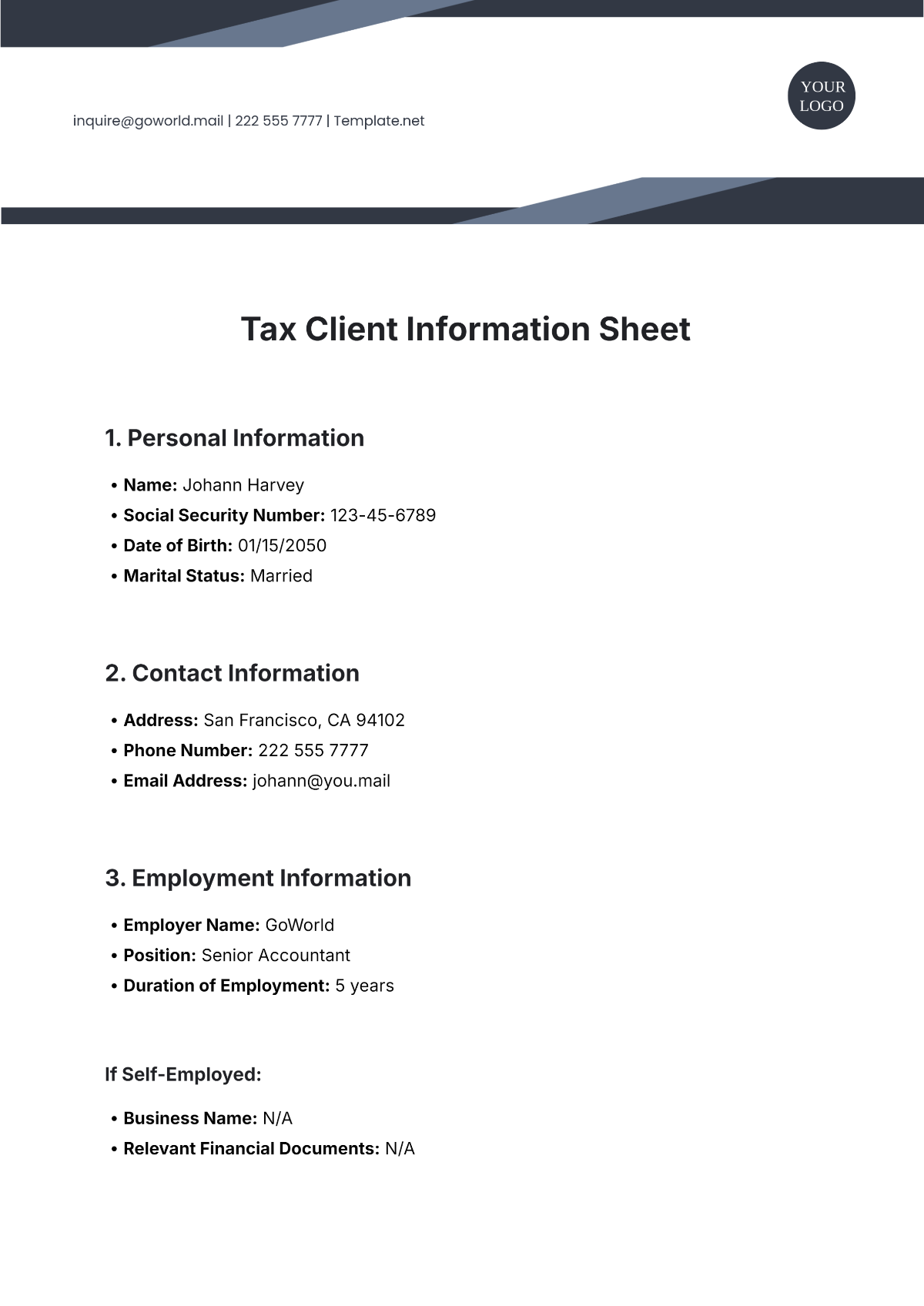

Free Tax Client Information Sheet

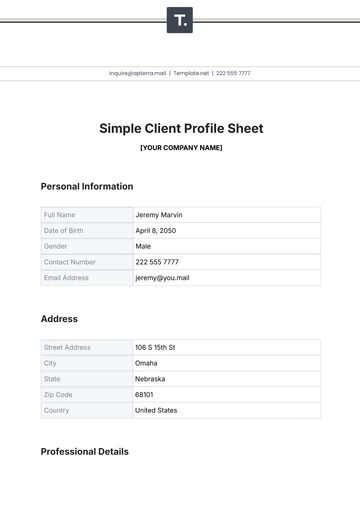

1. Personal Information

Name: Johann Harvey

Social Security Number: 123-45-6789

Date of Birth: 01/15/2050

Marital Status: Married

2. Contact Information

Address: San Francisco, CA 94102

Phone Number: 222 555 7777

Email Address: johann@you.mail

3. Employment Information

Employer Name: GoWorld

Position: Senior Accountant

Duration of Employment: 5 years

If Self-Employed:

Business Name: N/A

Relevant Financial Documents: N/A

4. Income Details

Wages: $85,000 (Attach W-2)

Rental Income: $12,000 annually (Attach lease agreements and rental income receipts)

Dividends: $1,500 annually (Attach 1099-DIV)

Other Income: $2,000 (Attach bank statements or applicable financial records)

5. Deduction and Credit Information

Medical Expenses: $4,500 (Attach medical bills and insurance statements)

Charitable Donations: $2,000 (Attach donation receipts)

Educational Costs: $3,000 (Attach Form 1098-T and receipts for qualified expenses)

6. Filing History and Tax Preferences

Previous Filing History: Filed for the past 10 years

Filing Status Preference: Married Filing Jointly

Refund Disbursement Preference: Direct Deposit (Attach voided check or bank routing information)

Upon completion, please review this form for accuracy and completeness. Once verified, submit all necessary documentation in person or via secure electronic transmission to ensure the protection of your sensitive information.

Prepared by: [YOUR NAME], [YOUR COMPANY NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

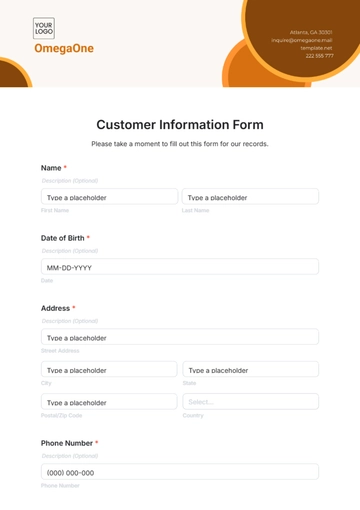

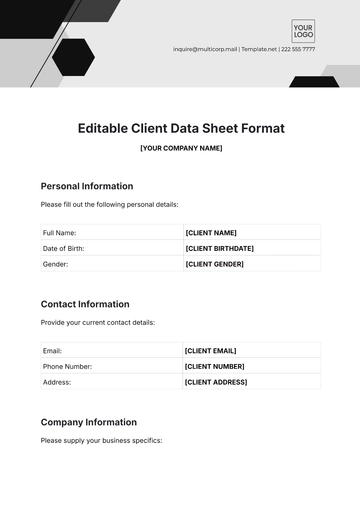

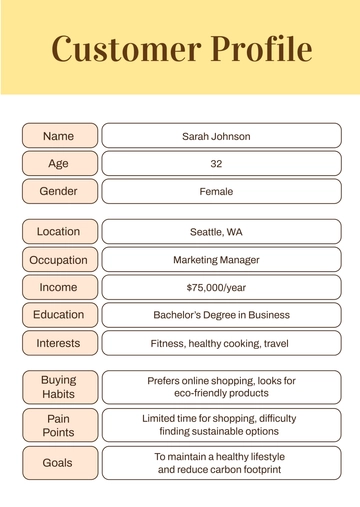

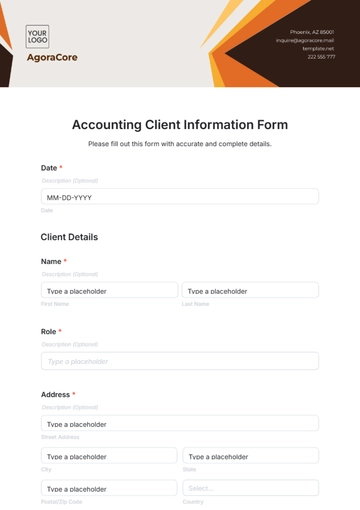

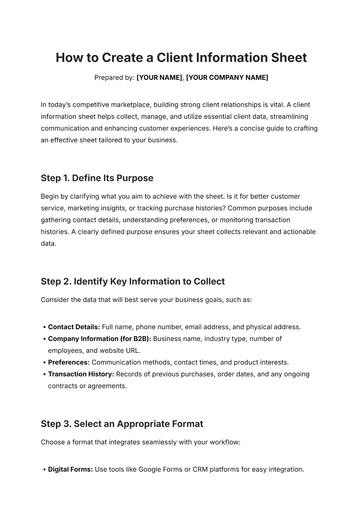

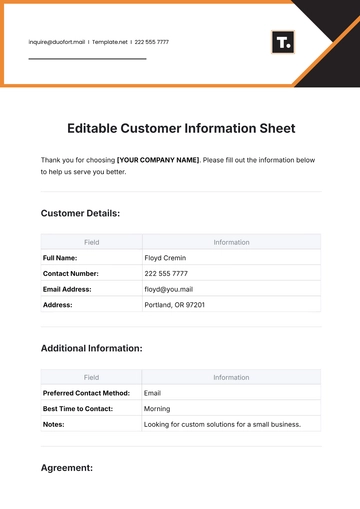

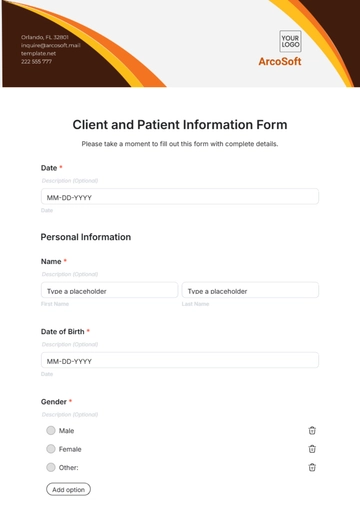

Manage tax client details effortlessly with Template.net’s Tax Client Information Sheet Template. Fully customizable and editable in our AI Editor Tool, this template organizes financial records, contact details, and filing history. Ideal for accountants and tax professionals, it ensures efficient client management, accurate reporting, and seamless service delivery. Get it now!

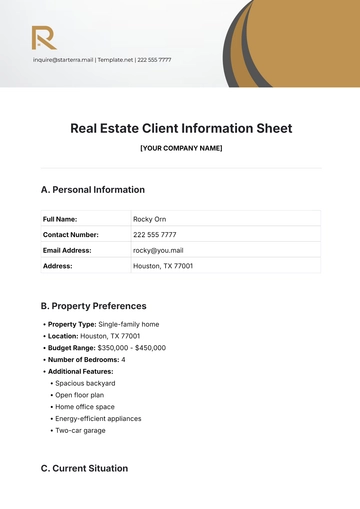

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

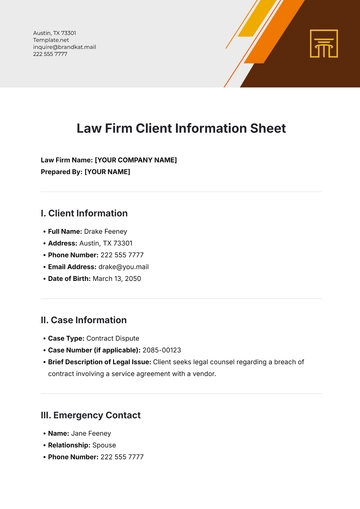

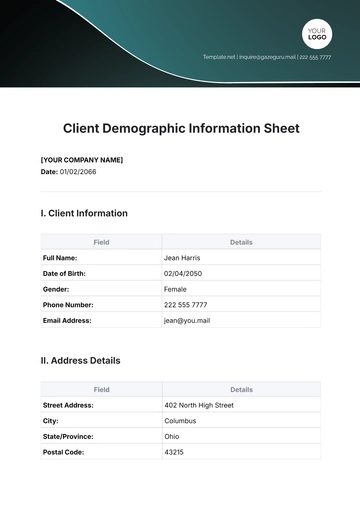

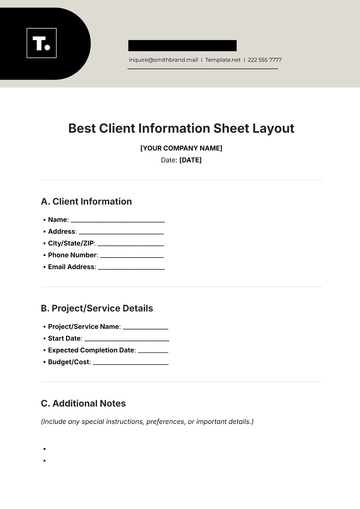

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet