Free Corporate Expense Report

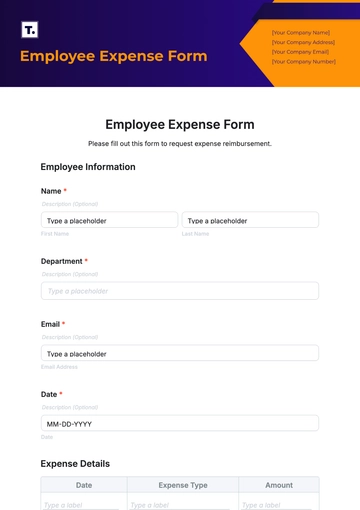

I. Employee Information

A. Employee Name

[Employee Name] is a highly skilled Sales Manager with five years of experience in managing high-value accounts. The employee specializes in creating innovative sales strategies and maintaining strong relationships with key clients. This report reflects [Employee Name]’s adherence to the company’s financial guidelines and professionalism in handling business expenses.

B. Employee ID

The employee ID [00000] is a unique identifier used to streamline administrative and payroll processes. It ensures precise tracking of expense claims and helps the accounting department match reports with the employee’s financial records. Using a consistent ID system minimizes errors and improves efficiency during audits.

C. Job Title/Department

As a Sales Manager, [Employee Name] leads a team focused on meeting and exceeding quarterly sales targets. The Sales Department is integral to the company’s growth strategy, as it generates new opportunities and maintains client satisfaction. The business trip outlined in this report was crucial to securing a multi-million-dollar contract renewal.

D. Supervisor/Manager's Name

[Manager Name], the direct supervisor, is responsible for evaluating the necessity and compliance of the submitted expenses. With extensive knowledge of the company’s policies, [Manager Name] ensures that all expenditures contribute directly to organizational goals. The approval of this report reflects [Manager Name]’s trust in [Employee Name]’s judgment and professionalism.

E. Date of Report Submission

The report was submitted promptly on January 7, 2050, following the completion of the business trip. Timely submission is critical for ensuring efficient reimbursement and maintaining accurate financial records. The report aligns with the company’s expectation that all expenses be documented and submitted within five business days of the trip's conclusion.

II. Expense Summary

A. Total Amount Requested for Reimbursement

The requested reimbursement amount of $[00] represents all expenses incurred during the business trip. This total includes travel, lodging, meals, and incidental costs that were necessary for achieving the trip’s objectives. Each expense has been categorized and detailed to provide a clear breakdown of the total amount.

B. Purpose of Expense (Business Justification)

The purpose of this trip was to engage with Tech Innovators Inc., a long-term client, to finalize a new partnership proposal. This proposal aims to expand the scope of collaboration, potentially increasing annual revenue by $[00] million. By meeting in person, [Employee Name] successfully addressed client concerns, presented tailored solutions, and reinforced the company’s commitment to excellence.

C. Expense Period (Start and End Dates of Expenses)

The expenses in this report cover the period from December 15, 2050, to December 17, 2050, aligning with the business trip’s itinerary. This timeframe includes travel, accommodation, and meetings conducted during the trip. All expenses incurred outside this period, such as preparation costs, have been separately noted but are not included in this report.

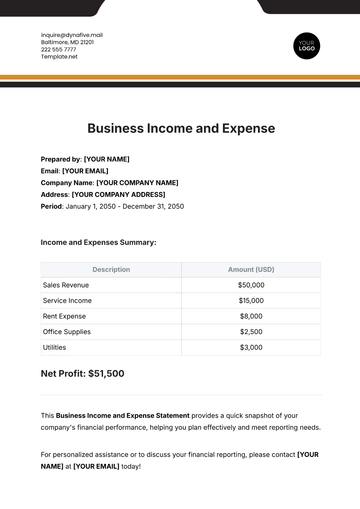

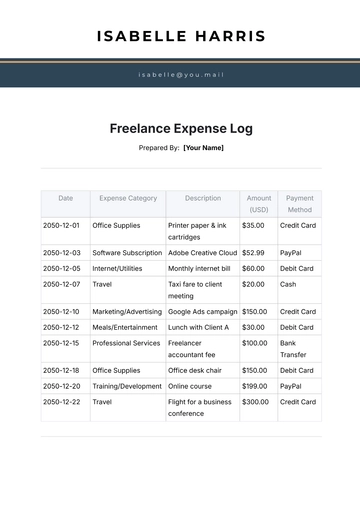

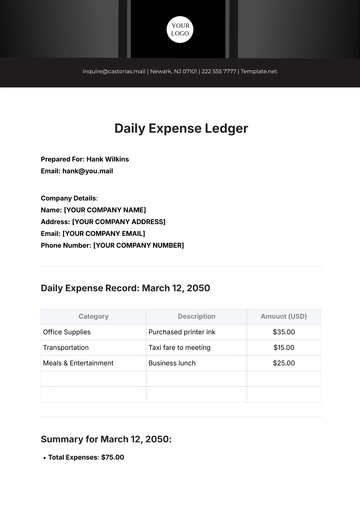

III. Detailed Expense Breakdown

A. Travel Expenses

Item | Date | Amount ($) | Description |

|---|---|---|---|

Airfare (Round Trip) | Dec 15, 2050 | 450.00 | Flight from New York to San Francisco |

These travel expenses were essential for attending in-person meetings with the client. The airfare and car rental were pre-approved, while the accommodation was booked at a hotel within the company’s allowable rate. Taxi fares and parking fees were kept to a minimum to reduce costs.

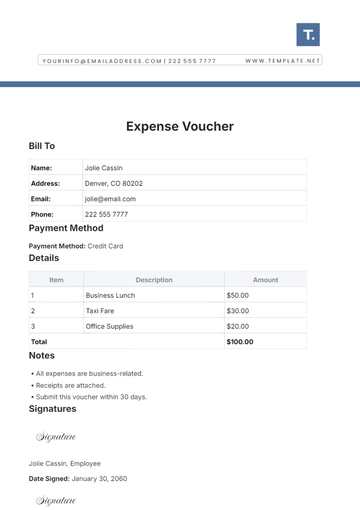

B. Meals & Entertainment

Item | Date | Amount ($) | Description |

|---|---|---|---|

Dinner with Client | Dec 15, 2050 | 150.00 | Business dinner at The Waterfront |

Meals included discussions of key business strategies and client contract terms. The dinner with the client was a productive meeting focused on finalizing proposal details. Costs were kept within the per diem limits established by the company.

C. Office Supplies or Equipment

Item | Date | Amount ($) | Description |

|---|---|---|---|

Presentation Materials | Dec 14, 2050 | 35.75 | Printed brochures for client meetings |

Brochures and presentation materials were created to enhance the client’s understanding of our services. These materials played a critical role in visually communicating our proposed solutions. The printing service was selected based on its quality and cost-effectiveness.

D. Miscellaneous Expenses

Item | Date | Amount ($) | Description |

|---|---|---|---|

Parking Fees | Dec 16, 2050 | 20.00 | Parking near the client’s office |

Miscellaneous expenses include parking fees incurred during the client meeting. These expenses were necessary for ensuring punctuality and convenience. Efforts were made to minimize incidental costs wherever possible.

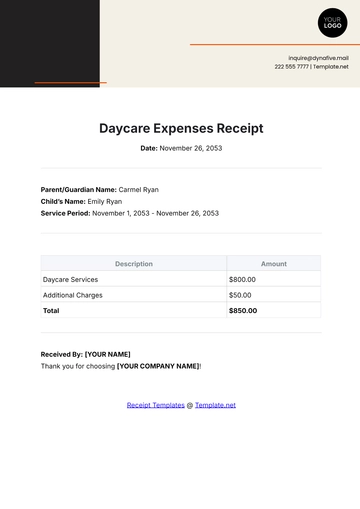

IV. Receipts and Supporting Documentation

A. Receipts for Each Expense

Scanned copies of all receipts are attached to this report for verification. These include receipts for airfare, hotel accommodation, meals, car rental, and parking fees. Each receipt has been cross-checked against the corresponding expense in the report for accuracy and completeness.

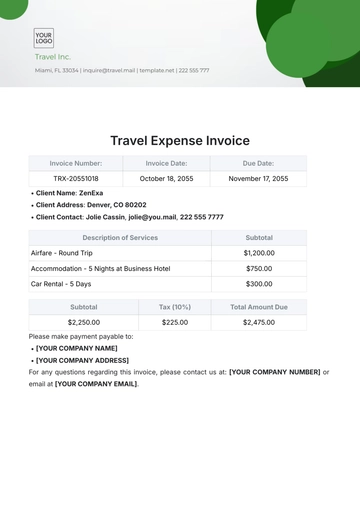

B. Invoices

Invoices for the car rental and presentation materials have been included in the report. The car rental invoice provides details of the rental period, charges, and payment confirmation. Similarly, the invoice for printed brochures itemizes the costs for design, printing, and delivery.

C. Credit Card Statements (for Verification of Payments Made)

Credit card statements for December 2050 are attached as evidence of payment for all reimbursable expenses. Highlighted entries include airfare, hotel bookings, and meals incurred during the trip. These statements validate the claims made and ensure transparency in the reimbursement process.

V. Expense Compliance and Company Policy Adherence

A. Verification of Expense Policy Compliance

Ensuring Expenses Align with Company Guidelines

The expenses submitted in this report adhere to the company’s Travel and Expense Policy as outlined in the employee handbook. Each expense is business-related, falls within allowable limits, and is accompanied by a receipt or invoice for verification. A review of the policy confirms that no personal or non-reimbursable items have been included.

Adherence to Per Diem Rates

All meal expenses have been checked against the company’s per diem rates for San Francisco, which is $[00] per day. The actual expenses incurred for meals during the trip averaged $[00] per day, well within the allowable limits. By staying below the maximum rate, [Employee Name] demonstrated financial responsibility and policy compliance.

B. Confirmation of Non-Reimbursed Expenses

Acknowledgment of Any Non-Reimbursable Expenses (Personal Costs)

Non-reimbursable expenses, such as personal entertainment, were excluded from this report. For example, additional hotel amenities like spa services were paid for by [Employee Name] and not submitted for reimbursement. This ensures that only legitimate business-related costs are being claimed.

Clarification of Any Exceptions

No exceptions to the company’s Travel and Expense Policy were requested or required for this trip. The nature and scope of the expenses fit entirely within the predefined guidelines. This alignment simplifies the approval process and avoids delays in reimbursement.

VI. Managerial Approval

A. Manager/Supervisor's Signature

Approval of Expenses for Reimbursement

[Manager Name] reviewed the detailed expense breakdown and confirmed that all expenses were essential for achieving the trip’s objectives. By signing off on this report, [Manager Name] has validated the necessity and appropriateness of the expenditures. This approval reflects the supervisor’s confidence in [Employee Name]’s adherence to company policies.

Confirmation That Expenses Are Legitimate and Business-Related

The expenses outlined in the report are directly tied to the successful negotiation of a $[00] million annual contract with Tech Innovators Inc. All receipts and supporting documentation further substantiate the legitimacy of these claims. [Manager Name] attests that the expenditures were vital for the business trip’s objectives and align with the company’s strategic goals.

B. Date of Approval

The report was officially approved by [Manager Name] on January 8, 2050. Approval on this date ensures that the reimbursement process can proceed without unnecessary delays. This timeline aligns with the company’s standard practice of submitting and approving reports within five business days of the trip's completion.

VII. Finance or Accounting Department Review

A. Review of Expense Report for Accuracy

Validation of Receipts and Totals

The finance team conducted a thorough review of all attached receipts to ensure accuracy. Each receipt was matched against the report’s entries, confirming that the total reimbursement amount of $[00] is correct. Any minor discrepancies were resolved through follow-up with [Employee Name] prior to finalizing the report.

Ensuring Proper Allocation of Expenses

Expenses were allocated to the Sales Department budget under the designated cost center for travel and client meetings. Proper allocation ensures that departmental budgets reflect actual expenditures and supports accurate financial reporting. This process helps maintain transparency and accountability within the company’s financial structure.

B. Accounting Review for Payment

Payment Method (e.g., Direct Deposit, Check)

The finance department confirmed that the reimbursement would be processed through direct deposit to [Employee Name]’s payroll-linked bank account. Direct deposit is the preferred method as it ensures a secure and timely payment. The bank details were verified to avoid delays or errors in the transfer.

Processing of Reimbursement

The reimbursement request was entered into the accounting system on January 9, 2050, following managerial approval. Payment is scheduled for January 10, 2050, aligning with the company’s biweekly reimbursement processing cycle. This streamlined process ensures that employees receive reimbursements promptly after approval.

VIII. Final Approval and Reimbursement Processing

A. Final Signature

The Finance Manager provided the final signature, confirming the report’s compliance with financial policies and procedural requirements. This signature signifies that all expenses were thoroughly reviewed and meet the company’s standards for reimbursement. A scanned copy of the signed approval form has been retained for record-keeping and audit purposes.

B. Date of Reimbursement Processing

Reimbursement was officially processed on January 10, 2050, ensuring timely payment. Processing on this date aligns with the company’s standard procedures for expense reimbursements. The prompt turnaround reflects the efficiency of the company’s financial operations.

C. Payment Method and Details

Amount Reimbursed

The full reimbursement amount of $[00] was approved without adjustments. This total represents the verified, legitimate business expenses incurred during the trip.

Payment Method

The reimbursement was deposited directly into [Employee Name]’s bank account ending in [0000]. An email confirmation was sent to [Employee Name] with details of the payment, including the transaction reference number, for their records.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Organize your business finances effortlessly with Template.net's Corporate Expense Report Template. Fully editable and customizable, this professional tool streamlines tracking expenses for approvals and audits. Paired with our intuitive AI Editor Tool, you can tailor every detail to suit your needs. Simplify financial reporting today with a template designed for precision and ease!