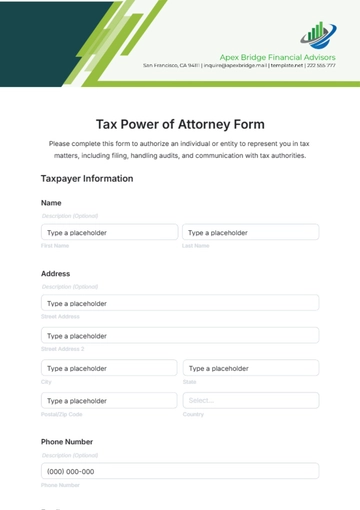

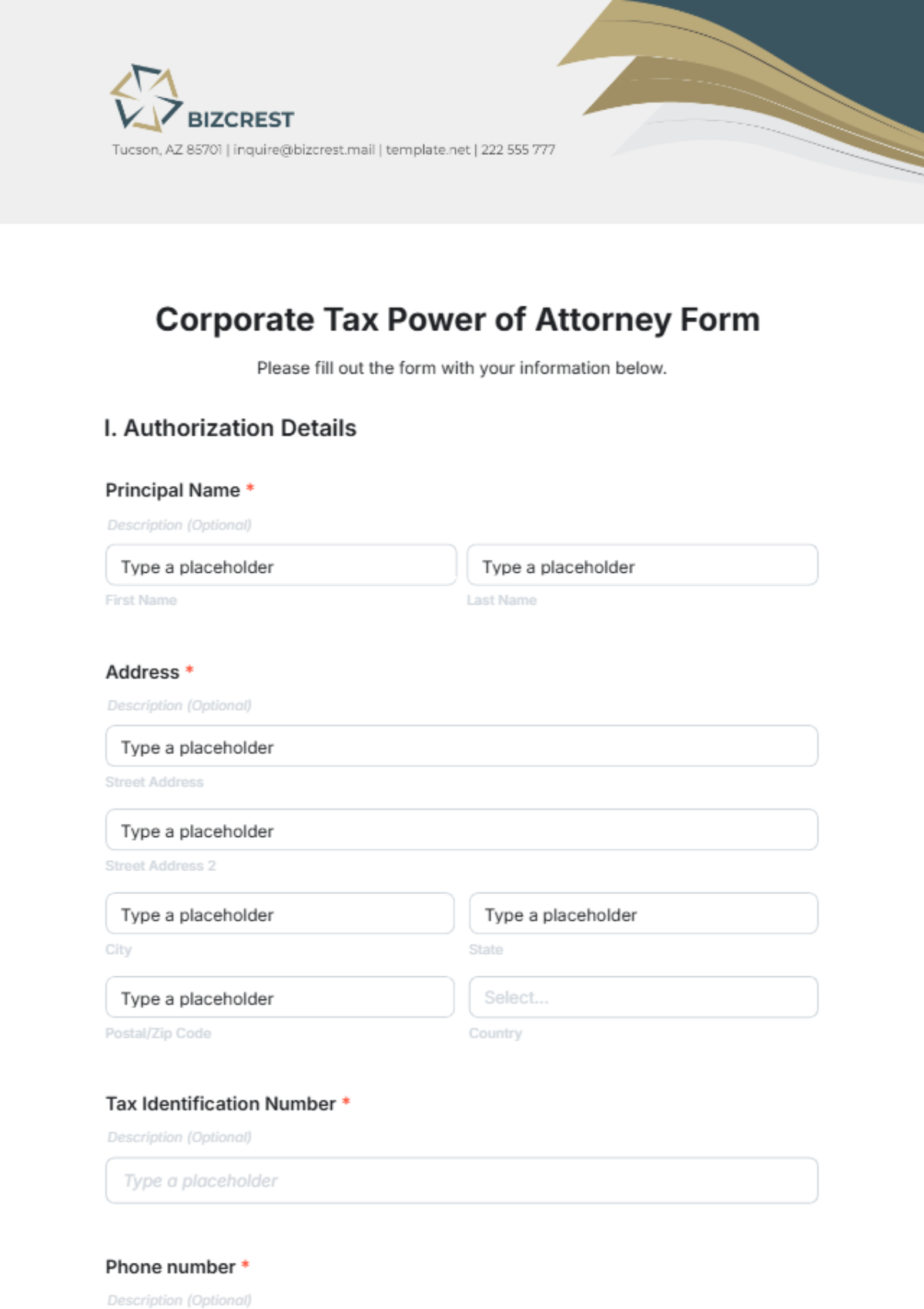

Free Corporate Tax Power of Attorney Form

Please fill out the form with your information below.

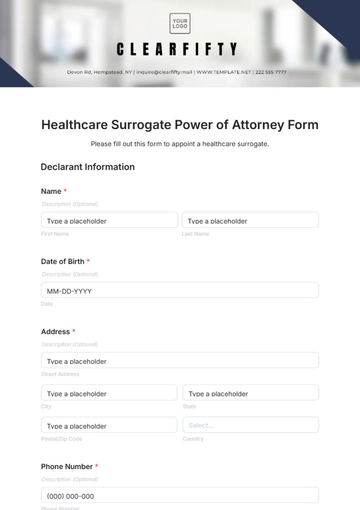

I. Authorization Details

Principal Name

Address

Tax Identification Number

Phone number

Authorized Representative Name

Address

Phone number

Relationship To Principal

II. Scope of Authorization

The Principal authorizes the Attorney-in-Fact to:

Represent the corporation before tax authorities for tax matters related to:

Income Tax

Payroll Tax

Sales Tax

Sign and file tax documents on behalf of the corporation.

Access and review confidential tax information.

Negotiate and settle tax liabilities with tax authorities.

III. Effective Date and Duration

This Power of Attorney becomes effective on

Revoked by the Principal in writing.

The following date:

The completion of specified tax matters.

IV. Revocation

The Principal reserves the right to revoke this Power of Attorney at any time by providing written notice to the Attorney-in-Fact and relevant tax authorities.

V. Acknowledgment and Signatures

By signing below, the Principal affirms the authorization of the Attorney-in-Fact for the purposes stated in this document and agrees to its terms.

Principal Attorney-in-Fact

Date:

Power of Attorney Form Templates @ Template.net

Thank you for your submission!

We appreciate you taking the time to submit.

Create free forms at Template.net

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Empower seamless tax representation with our Corporate Tax Power of Attorney Form Template. Streamline the authorization process for tax matters, ensuring clarity and compliance. Edit effortlessly with our AI Editor Tool, customizing the template to meet your corporate needs with precision. Simplify document creation and focus on managing your business effectively. Download and start today!