Free Corporate SWOT Analysis

I. Introduction

A comprehensive corporate SWOT analysis is a valuable tool for evaluating [Your Company Name]'s internal capabilities, external market conditions, and long-term strategic positioning. This analysis helps identify areas for improvement, growth potential, and external challenges that may impact the company's future performance. As we move into the year 2050 and beyond, the business landscape is continuously evolving, with technological advancements, shifts in global consumer preferences, and macroeconomic changes shaping how companies operate. In this ever-changing environment, the ability to adapt and leverage strengths, while addressing weaknesses and threats, will be key to ensuring sustained success for [Your Company Name].

In addition to its traditional strengths, [Your Company Name] is poised to harness opportunities in emerging sectors, such as green energy and artificial intelligence, which are expected to drive growth in the coming decades. However, with increasing competition, regulatory changes, and global economic uncertainties, [Your Company Name] must also navigate various challenges. By analyzing these factors, the company can make informed decisions to secure its position as a market leader in the years to come.

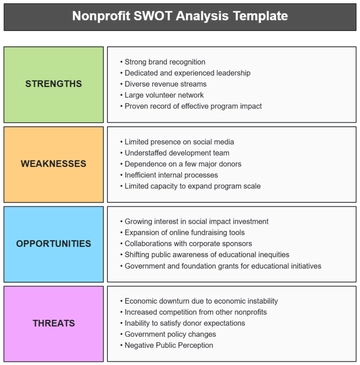

II. SWOT Analysis Framework

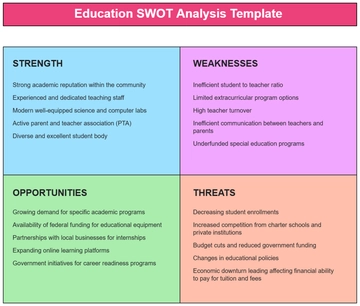

A. Strengths

Strengths represent the internal capabilities of [Your Company Name] that provide a competitive advantage. These assets enable the company to outperform competitors and thrive in the market.

1. Core Competencies

Innovative Technology and Expertise: [Your Company Name] has built a reputation for pioneering innovative solutions that meet the needs of an increasingly tech-savvy global consumer base. The company’s robust research and development arm, supported by an annual R&D budget of $[5 billion], continuously introduces new products that lead to market differentiation. With a team of leading experts in AI and machine learning, [Your Company Name] is at the forefront of developing cutting-edge technology that enhances its product portfolio and drives customer engagement.

Robust Financial Health: Financial stability is one of the company’s greatest strengths, as demonstrated by its consistent annual revenues of $[15] billion as of 2050. With low debt levels and strong cash flow, [Your Company Name] is well-positioned to weather economic volatility and invest in long-term growth opportunities. The company's ability to secure large-scale investments allows for aggressive expansion into new markets while maintaining a competitive edge.

Brand Equity: Over the decades, [Your Company Name] has developed a highly recognized and respected brand, known for its commitment to quality, customer satisfaction, and reliability. Its global customer base, now exceeding [10 million], continues to support the company’s products and services, demonstrating a high level of brand loyalty. With a long-standing history in the market, the company’s brand is synonymous with innovation, trustworthiness, and dependability.

2. Operational Efficiency

Streamlined Supply Chain: A significant strength of [Your Company Name] is its efficient, cost-effective supply chain management. Through the use of advanced technologies such as blockchain and IoT, the company ensures transparency, traceability, and reduced costs in its procurement processes. The automation of key processes has led to significant reductions in lead times, allowing the company to respond more quickly to consumer demand. Additionally, the implementation of AI-driven predictive analytics has optimized inventory management, minimizing waste and lowering operational costs.

Sustainable Practices: [Your Company Name] has made a strong commitment to sustainability, with a goal of achieving net-zero emissions by 2055. The company’s dedication to green practices has led to the implementation of energy-efficient technologies across its operations. In 2050, [Your Company Name] saves approximately $[2 billion] annually through its energy-efficient initiatives. This commitment not only helps reduce operational costs but also appeals to environmentally conscious consumers and investors.

3. Human Capital

Diverse Workforce: One of [Your Company Name]’s core strengths is its highly diverse workforce. With employees spanning over [75] countries, the company benefits from a broad range of perspectives, ideas, and cultural experiences, which fosters creativity and innovation. This diversity enhances the company’s ability to develop products and services that appeal to a global market.

Continuous Training Programs: As part of its commitment to employee development, [Your Company Name] allocates $[1 billion] annually for training programs to ensure that its workforce stays up-to-date with the latest industry trends and technologies. By providing employees with access to continuous learning opportunities, the company ensures its talent pool remains at the forefront of innovation and is equipped to handle the challenges of an increasingly complex business environment.

B. Weaknesses

Weaknesses are internal factors that limit [Your Company Name]’s ability to achieve its objectives and may hinder its competitive edge. Addressing these weaknesses will be crucial for maintaining long-term growth.

1. High Dependence on Key Markets

Regional Concentration: Although [Your Company Name] has experienced substantial success in North America, with [65%] of its revenues derived from this region as of 2050, this high concentration exposes the company to regional economic fluctuations. Economic downturns, trade restrictions, or policy changes in key markets could significantly impact the company’s overall revenue stream. The company must diversify its market presence to reduce its dependency on any single geographic region.

Customer Over-Reliance: A single major client contributes approximately [10%] of the company’s annual revenue, which creates a dependency risk. If this customer were to reduce their spending, switch to a competitor, or end the relationship altogether, [Your Company Name] could experience a significant financial setback. Diversifying the customer base will help mitigate this risk and ensure a stable revenue stream.

2. Technology Adoption Challenges

Legacy Systems: While [Your Company Name] is an innovator in many areas, certain departments continue to rely on outdated systems that hinder operational efficiency. These legacy systems are increasingly becoming a barrier to the adoption of newer technologies and can lead to issues such as slower processing times, security vulnerabilities, and integration challenges. Upgrading these systems is a necessary step to stay competitive in the long term.

Integration Costs: The transition to newer technologies, such as AI and cloud-based infrastructure, requires significant upfront investment. In 2050, [Your Company Name] expects to incur integration costs of $[3 billion] to overhaul outdated systems, which will temporarily strain its capital expenditure but is necessary to remain competitive in the rapidly evolving tech landscape.

3. Organizational Complexity

Overlapping Business Units: One challenge faced by [Your Company Name] is organizational inefficiency due to overlapping business units. Some departments and functions are duplicated across different regions, leading to redundancies in operational processes and resource allocation. This complexity increases the time and cost required to make decisions and implement strategic initiatives. Streamlining these departments will enable the company to improve agility and reduce overhead.

Leadership Gaps: High turnover in senior leadership positions over the past few years has created a lack of strategic continuity. This has led to shifting priorities and a lack of long-term vision in certain areas of the business. Strengthening the leadership pipeline and providing more robust succession planning will help stabilize leadership and ensure a consistent strategic direction.

C. Opportunities

Opportunities are external factors that [Your Company Name] can leverage to grow and improve its competitive position. By capitalizing on these trends, the company can unlock new revenue streams and expand its market share.

1. Emerging Markets

Expanding Middle-Class Population: The global middle class is projected to grow by [30%] by 2060, particularly in regions such as Southeast Asia and Sub-Saharan Africa. This expanding consumer base presents a significant opportunity for [Your Company Name] to introduce its products and services to new markets. By tailoring its offerings to local preferences and needs, the company can tap into this emerging demand for high-quality, innovative products.

Smart Cities and Urbanization: As the global urban population is expected to reach [70%] by 2060, the demand for smart city solutions will skyrocket. These cities will require advanced technologies for energy management, transportation, and urban planning. [Your Company Name] can position itself as a leader in providing these solutions, including smart infrastructure and AI-driven city management systems.

2. Technological Advancements

Green Energy Revolution: As governments and corporations worldwide push for cleaner energy solutions, [Your Company Name] has the opportunity to invest in renewable energy, including solar, wind, and battery storage technologies. With an anticipated market growth rate of [8%] annually, green energy could contribute $[5 billion] to the company’s revenue by 2055. This aligns with [Your Company Name]’s sustainability goals and will further enhance its corporate social responsibility initiatives.

AI and Automation: The continued rise of artificial intelligence and automation presents substantial cost-saving opportunities. By incorporating AI into customer interactions, product development, and operational processes, [Your Company Name] could reduce costs by $[1 billion] annually, while improving overall efficiency and customer satisfaction. The increasing demand for AI solutions offers an avenue for the company to expand its product offerings in a rapidly growing market.

3. Strategic Partnerships

Collaborations with Startups: Partnering with innovative startups can give [Your Company Name] early access to disruptive technologies and new business models. Through joint ventures and acquisitions, the company can accelerate its entry into new markets and improve its competitive advantage.

Government Contracts: [Your Company Name] has the potential to secure lucrative government contracts for research, development, and technological deployment. In particular, contracts related to AI, cybersecurity, and green energy present significant opportunities for long-term growth. By establishing strong relationships with governments and regulatory bodies, the company can unlock new avenues of revenue.

D. Threats

Threats are external factors that could undermine [Your Company Name]’s ability to achieve its objectives. It is crucial to identify these threats early and develop strategies to mitigate their impact.

1. Economic Uncertainty

Global Recession Risks: A global economic slowdown, which some analysts predict may occur by 2051, could significantly reduce consumer spending and corporate investment. Such economic uncertainties pose a threat to revenue growth, particularly in mature markets.

Currency Fluctuations: Given the global nature of its operations, [Your Company Name] is exposed to currency risks. Volatile exchange rates can erode profit margins and increase the cost of raw materials and manufacturing. The company must develop hedging strategies and consider regional diversification to mitigate this risk.

2. Competitive Pressure

Market Saturation: As the markets in which [Your Company Name] operates mature, competition intensifies. Established competitors and new entrants offering innovative solutions at lower prices can erode market share. The company must focus on continuous product innovation, superior customer service, and operational efficiency to maintain a competitive edge.

New Entrants: The low barrier to entry in certain sectors, especially in technology and software development, means that startups and disruptive companies are continually entering the market. These new entrants often offer lower-cost alternatives, which may appeal to price-sensitive customers. [Your Company Name] must invest in brand differentiation and premium offerings to maintain its market leadership.

3. Regulatory Challenges

Data Privacy Laws: Increasingly stringent regulations regarding data privacy and protection, particularly in the European Union and North America, will require [Your Company Name] to allocate significant resources to compliance. Non-compliance could result in hefty fines and reputational damage. It is crucial that the company adopts proactive measures to protect customer data and meet regulatory requirements.

Taxation Policies: Governments around the world are raising taxes on corporate profits, which could reduce [Your Company Name]’s profitability by [10%] in key markets. Changes in taxation laws, such as digital service taxes, may affect the company’s operations in certain countries. Preparing for these regulatory changes will be vital to maintaining profitability.

III. Summary Table

Category | Key Factors |

|---|---|

Strengths | Innovative technology, financial health, operational efficiency, human capital. |

Weaknesses | Market dependence, outdated systems, organizational complexity. |

Opportunities | Emerging markets, green energy, technological advancements, partnerships. |

Threats | Economic uncertainty, competition, regulatory changes. |

Key Factors in the Summary Table

Strengths: These are factors that give [Your Company Name] an advantage over competitors. The company’s innovative technology, financial health, and efficient operations form a solid foundation for sustained success. The talented workforce and diverse talent pool also contribute to a dynamic and adaptable company culture.

Weaknesses: These are areas where [Your Company Name] needs to improve to maintain a competitive advantage. Heavy dependence on certain geographic markets, outdated systems, and organizational complexity are all internal factors that could hinder growth or affect the company’s ability to respond to market changes effectively.

Opportunities: These refer to external factors or trends in the marketplace that could provide growth prospects for [Your Company Name]. Leveraging emerging markets, the green energy movement, and technological advancements presents multiple avenues for growth, while strategic partnerships could also accelerate expansion and market share acquisition.

Threats: These are external challenges that could affect [Your Company Name]’s ability to compete effectively. Economic downturns, rising competition, and stringent regulations are significant risks that could impact profitability and market share if not managed properly. The company must monitor these external factors and implement strategies to counteract any adverse effects.

IV. Data Analysis

To facilitate a clearer visualization of the key metrics identified in the SWOT analysis, the following table presents relevant data:

Metric | Value (2050) |

|---|---|

Annual Revenue ($ Billion) | 15 |

Employee Training Budget ($ Billion) | 1 |

Market Revenue Dependence (%) | 65 |

Emerging Markets Revenue Potential ($ Billion) | 5 |

Compliance Cost ($ Billion) | 1 |

Analysis of Data

Annual Revenue: This data point highlights [Your Company Name]’s solid financial foundation. The $[15] billion in revenue is a testament to its ability to generate consistent income. This figure provides a benchmark to track against future financial performance. A chart reflecting this revenue over time can help identify growth trends and shifts in market conditions.

Employee Training Budget: The investment of $[1] billion in employee training annually showcases the company’s commitment to maintaining a skilled and innovative workforce. This level of investment also reflects the company’s awareness that talent development is crucial to sustaining long-term competitive advantages.

Market Revenue Dependence: With [65%] of revenues coming from one geographic region, this data underscores the risk posed by the concentration of the company’s operations. A pie chart illustrating this geographic reliance would clearly highlight the need for regional diversification to mitigate risks from any one market.

Emerging Markets Revenue Potential: Projecting $[5] billion in revenue from emerging markets by 2055 presents a significant growth opportunity for the company. This data can be used to demonstrate the potential value of focusing on developing regions, where consumer demand is expected to increase significantly in the coming decades.

Compliance Cost: As part of its strategy to comply with global regulations, [Your Company Name] is projected to spend $[1] billion on compliance initiatives. The ability to track these costs and their impact on profitability over time is essential for planning future strategies, particularly in regions with evolving legal requirements.

V. Strategic Recommendations

A. Addressing Weaknesses

1. Diversifying Markets

Expanding operations in emerging regions, such as Southeast Asia, Latin America, and Sub-Saharan Africa, is crucial for reducing dependence on a single market. By tapping into new consumer bases in these regions, [Your Company Name] can mitigate the impact of potential regional economic downturns. As these markets continue to experience rapid growth in the coming decades, it is vital that the company tailors its products to local needs.

Action Plan:

Research emerging consumer trends in key regions, including preferences for environmentally-friendly products, digital solutions, and e-commerce platforms.

Invest in region-specific marketing campaigns to strengthen brand presence and build local customer loyalty.

Build partnerships with local distributors, suppliers, and governments to streamline market entry and adapt quickly to cultural nuances.

Estimate potential revenue from these regions by setting growth targets of approximately $[5 billion] by 2055. This can diversify risk and reduce the financial impact of fluctuations in current markets.

2. Modernizing Technology

To remain competitive in the global market, [Your Company Name] must prioritize updating outdated systems across departments. Modernizing these systems is essential for improving efficiency and supporting the implementation of AI, automation, and other emerging technologies.

Action Plan:

Invest $[3 billion] over the next [5] years in updating core IT infrastructure, focusing on cloud computing, data analytics, and cybersecurity.

Hire a team of specialized experts to facilitate the integration of modern systems while ensuring minimal disruption to ongoing operations.

Leverage AI-driven systems to streamline customer interactions, product development, and inventory management, which could yield cost savings of up to $[1 billion] annually.

Develop a roadmap for a phased system integration approach to mitigate risks during the transition process.

3. Simplifying Organizational Structure

One of the main weaknesses identified in the SWOT analysis is organizational complexity due to overlapping business units. Reducing these redundancies is necessary to improve efficiency and allow for quicker decision-making.

Action Plan:

Conduct an organizational audit to assess the structure and identify areas of overlap and inefficiency.

Create cross-functional teams to streamline decision-making processes and improve collaboration between departments.

Implement centralized leadership for key strategic initiatives, empowering leaders to make faster decisions while maintaining alignment with corporate goals.

Set measurable targets for streamlining operations, such as reducing internal coordination costs by [20%] within the next [2] years.

B. Leveraging Opportunities

1. Green Energy Investments

Given the global push for cleaner energy solutions, [Your Company Name] should prioritize its investment in green technologies, including solar, wind, and energy storage solutions. This would not only align with the company’s sustainability goals but also capture a share of the rapidly growing green energy market, which is projected to expand at a rate of [8%] annually.

Action Plan:

Allocate $[2 billion] annually for renewable energy R&D and partnerships with other companies in the sector.

Explore government incentives, grants, and subsidies for green energy projects that can offset initial investment costs.

Develop a comprehensive green energy strategy to offer customers renewable energy products and services, further establishing [Your Company Name] as a leader in sustainability.

Forecast a revenue growth of $[5 billion] from green energy products and services by 2055.

2. Strategic Alliances

Forming partnerships with both established companies and startups can enable [Your Company Name] to adopt disruptive technologies and gain access to new markets. Through joint ventures, mergers, or acquisitions, the company can bolster its presence in high-growth sectors such as AI, cybersecurity, and green energy.

Action Plan:

Identify potential startup partners specializing in emerging technologies that complement the company’s existing product portfolio.

Establish a corporate venture capital arm to actively invest in promising startups with high potential.

Foster collaborations with universities and research institutions to drive joint innovation.

Set an internal target of securing at least [5] strategic partnerships or acquisitions annually to foster growth and expansion.

C. Mitigating Threats

1. Economic Diversification

To shield itself from potential economic downturns, [Your Company Name] should develop contingency plans focused on improving its cost structures and increasing financial resilience.

Action Plan:

Build a diversified portfolio that includes recession-proof products or services, such as basic consumer goods or essential technology solutions.

Implement cost-cutting measures, such as automating key processes, outsourcing non-core activities, and renegotiating supplier contracts.

Maintain a financial reserve of at least [10%] of annual revenue to buffer against any sudden economic downturns.

2. Enhancing Compliance Frameworks

As regulations continue to evolve globally, particularly concerning data privacy, tax laws, and environmental policies, [Your Company Name] must invest in compliance technologies and processes to stay ahead of regulatory changes.

Action Plan:

Deploy AI-driven compliance tools to track global regulatory updates and ensure that all operations adhere to local and international laws.

Hire dedicated teams of compliance experts to handle complex regulatory challenges in key markets.

Conduct regular internal audits to ensure full compliance with data protection, tax, and environmental laws.

Budget $[1 billion] annually for compliance activities to manage risk and avoid fines or legal disputes.

3. Strengthening Competitive Position

To combat increasing competition, [Your Company Name] must focus on differentiating its product offerings and enhancing customer loyalty. This can be achieved through continuous innovation, improved customer service, and value-added products that cater to evolving market demands.

Action Plan:

Develop a comprehensive innovation strategy, focusing on high-demand sectors like AI, renewable energy, and health tech.

Invest in customer experience initiatives, such as personalized service, 24/7 support, and loyalty programs.

Strengthen marketing efforts to highlight the company’s unique selling propositions, such as sustainability, cutting-edge technology, and superior customer service.

Track competitors’ offerings and set a target of maintaining at least a [15%] market share advantage over rivals within the next [5] years.

VI. Conclusion

The SWOT analysis of [Your Company Name] offers a thorough understanding of the internal strengths, weaknesses, as well as external opportunities and threats. Through the effective implementation of the strategic recommendations outlined above, the company can address its weaknesses, leverage opportunities for growth, and position itself to mitigate external threats. By focusing on technological innovation, regional diversification, and sustainability, [Your Company Name] can ensure its competitive advantage well into 2050 and beyond. The company must stay agile, embrace emerging trends, and continuously monitor both internal and external factors to achieve sustained long-term success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Assess your business’s strengths, weaknesses, opportunities, and threats with the Corporate SWOT Analysis Template from Template.net. This editable and customizable template helps you perform a thorough SWOT analysis for strategic decision-making. Modify it using the AI Editor Tool. Download today to gain valuable insights into your corporate strategy.