Free Distressed Real Estate Property Meeting Minute

Meeting Details

Date: March 15, 2053

Time: 10:00 AM - 12:00 PM

Location: Conference Room A, Main Office

Attendees: John Doe, Jane Smith, Robert Brown, Emily White, Michael Green

Purpose

The meeting was convened to discuss distressed real estate properties, evaluate potential investment opportunities, and formulate strategic plans for property acquisition and management.

Agenda

Welcome and Introduction

Overview of Current Market Conditions

Identification of Distressed Properties

Discussion of Investment Strategy

Risk Assessment and Management

Action Items and Next Steps

Q&A and Closing Remarks

Discussion Points

Welcome and Introduction

John Doe opened the meeting by thanking the attendees for their participation. He emphasized the growing importance of targeting distressed real estate properties and highlighted the potential advantages these opportunities could offer in the current market environment.Overview of Current Market Conditions

Jane Smith provided a detailed analysis of current market conditions, with a particular focus on the rising number of distressed properties. She noted that foreclosure rates have increased, making this an ideal time to explore investment opportunities in these properties.Identification of Distressed Properties

Robert Brown presented a comprehensive list of distressed properties in strategically chosen locations. These properties were selected based on a thorough financial analysis and their promising potential for long-term value appreciation.Discussion of Investment Strategy

Emily White led the discussion on potential investment strategies, highlighting bulk buying, negotiating favorable purchase terms, and concentrating efforts on locations with the highest growth potential as key tactics for maximizing returns.Risk Assessment and Management

Michael Green discussed the various risks involved in investing in distressed properties. He stressed the importance of conducting thorough due diligence and creating robust contingency plans to mitigate potential financial and operational risks.Action Items and Next Steps

Compile a detailed report on identified properties (Responsible: Robert Brown)

Develop a draft investment strategy proposal (Responsible: Emily White)

Conduct risk assessments for top-priority properties (Responsible: Michael Green)

Schedule follow-up meeting (Responsible: John Doe)

Q&A and Closing Remarks

The meeting concluded with a Q&A session, allowing participants to address specific concerns and suggestions. John Doe wrapped up the meeting by reiterating the team’s commitment to a well-defined, strategic approach in handling distressed real estate properties moving forward.

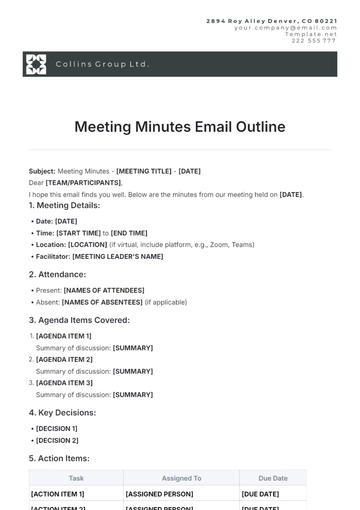

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Distressed Real Estate Property Meeting Minute Template, offered by Template.net, is the perfect solution for documenting your property meetings. This customizable template allows you to easily capture key details with a professional layout. It's downloadable, printable, and fully editable in our AI Editor Tool, making it convenient and adaptable to your needs. Streamline your meeting documentation process and keep your records organized with this user-friendly template.