Free Professional Due Diligence Real Estate Meeting Minute

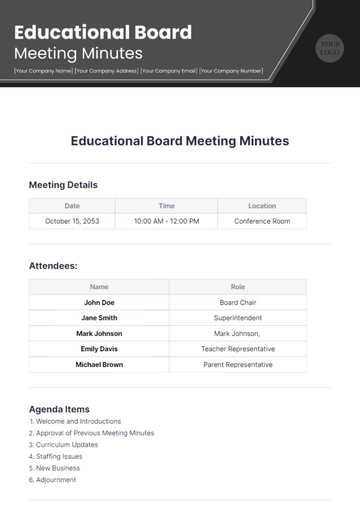

Meeting Details

Date: | October 15, 2053 |

Time: | 10:00 AM - 12:00 PM |

Location: | Conference Room B, Main Office |

Participants: | [Your Name], Jane Smith, Robert Brown, Emily Gray |

Objective

The purpose of this meeting was to conduct a comprehensive professional due diligence review concerning the prospective real estate acquisition. This involved discussing financials, legal considerations, operational implications, and risk assessments associated with the property.

Agenda

Introduction and Overview

Financial Assessment

Legal Considerations

Operational Implications

Risk Assessment

Next Steps

Discussion Summary

Introduction and Overview

[Your Name] initiated the meeting by providing an overview of the property in consideration, highlighting its potential benefits and strategic value for the company.

Financial Assessment

Jane Smith presented the preliminary financial analysis, outlining the potential return on investment and cash flow projections. Key financial metrics were discussed, including:

Purchase price and valuation

Expected revenue and expenses

Break-even analysis

Financing options

Legal Considerations

Robert Brown outlined the legal due diligence requirements, focusing on the following areas:

Title search and deed verification

Zoning and land use regulations

Environmental assessments

Existing lease agreements and tenant rights

Operational Implications

Emily Gray discussed the operational aspects, considering how the acquisition could affect current operations. Emphasis was placed on integration feasibility and long-term operational efficiency.

Impact on current operations

Staffing requirements

Potential for facility upgrades or modifications

Risk Assessment

The team collectively reviewed potential risks associated with the acquisition, including:

Market volatility

Regulatory changes

Maintenance and depreciation risks

Community and stakeholder impacts

Next Steps

The following action items were identified as necessary steps to move forward:

Conduct a comprehensive financial audit - Jane Smith

Finalize the legal review and documentation - Robert Brown

Prepare an operational integration plan - Emily Gray

Review and address identified risks - All participants

Schedule the follow-up meeting in two weeks to discuss findings

Conclusion

The meeting adjourned at 12:00 PM with a clear understanding of the next steps and responsibilities. Participants acknowledged the importance of conducting thorough due diligence to ensure a sound investment decision.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Professional Due Diligence Real Estate Meeting Minute Template, offered by Template.net, is a customizable and downloadable solution for real estate professionals. This template helps streamline the documentation process for meetings, ensuring clarity and accuracy. It's fully editable in our AI Editor Tool, making it easy to personalize, and printable for convenient record-keeping. Perfect for professionals seeking a reliable, efficient way to capture key meeting details.