How to Create an Expense Sheet

Prepared by: [Your Name]

In both personal and professional contexts, managing finances effectively is crucial. One of the best tools for tracking financial resources is an expense sheet. An expense sheet provides an overview of your expenditures, helping in budget management and financial planning. This guide will walk you through the process of creating an expense sheet, offering detailed steps and considerations.

Understanding the Purpose of an Expense Sheet

An expense sheet is a detailed record of your financial outflows. It serves several purposes, such as aiding in budget planning, tracking spending habits, preparing for tax season, and helping to identify areas where you can cut costs. Whether you're managing a household budget or overseeing a business, a well-maintained expense sheet can be invaluable.

Getting Started: Choosing a Format

Before creating an expense sheet, decide on the format you will use. Common choices include spreadsheets (like Microsoft Excel or Google Sheets), dedicated accounting software, or even pen and paper for smaller or personal budgets. Digital formats typically offer more functionality, such as automatic calculations and data sorting, which can save time and reduce errors.

Creating Your Expense Sheet

Once you've chosen your format, you can start building your expense sheet. Below are the essential steps for creating a comprehensive expense sheet:

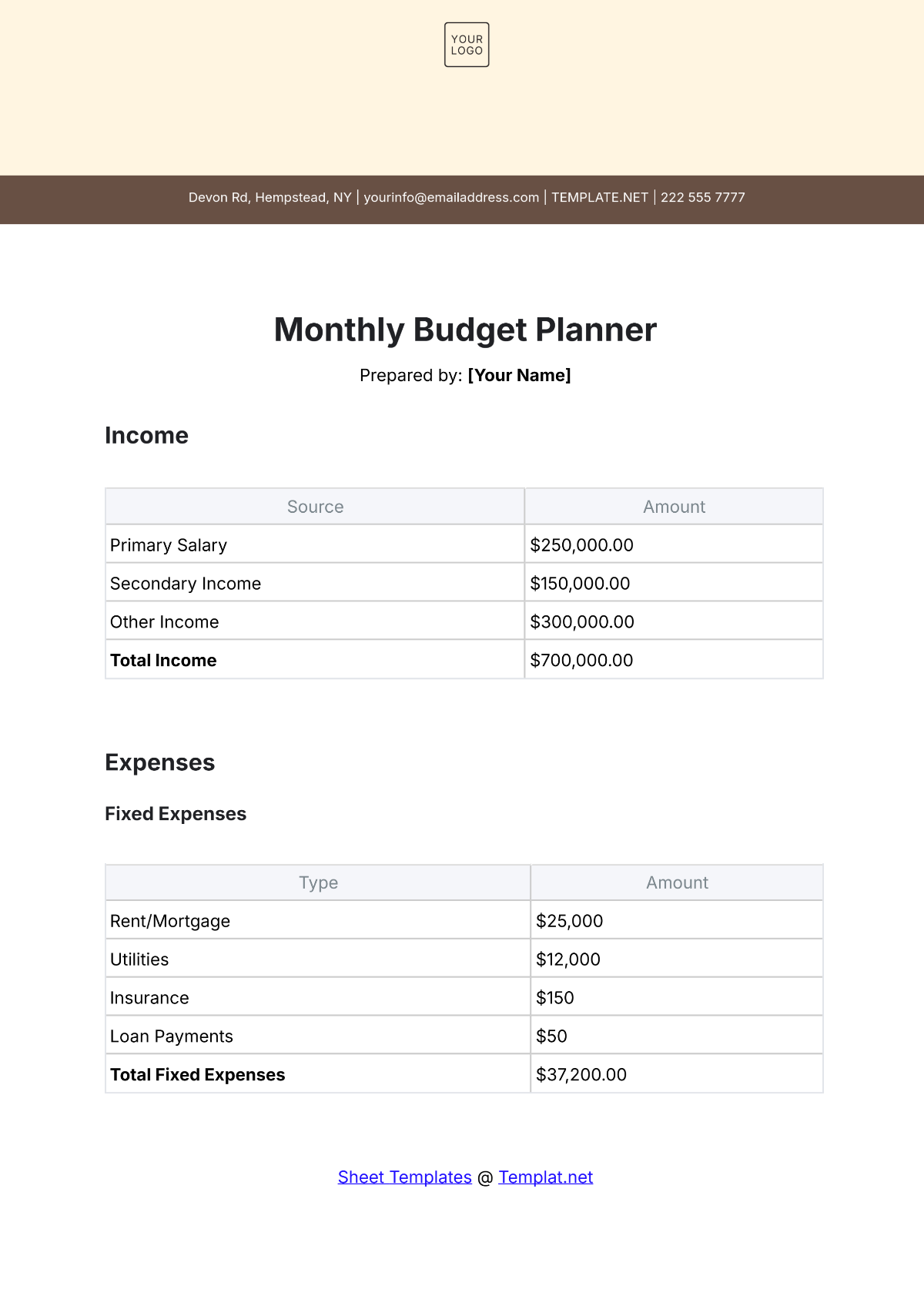

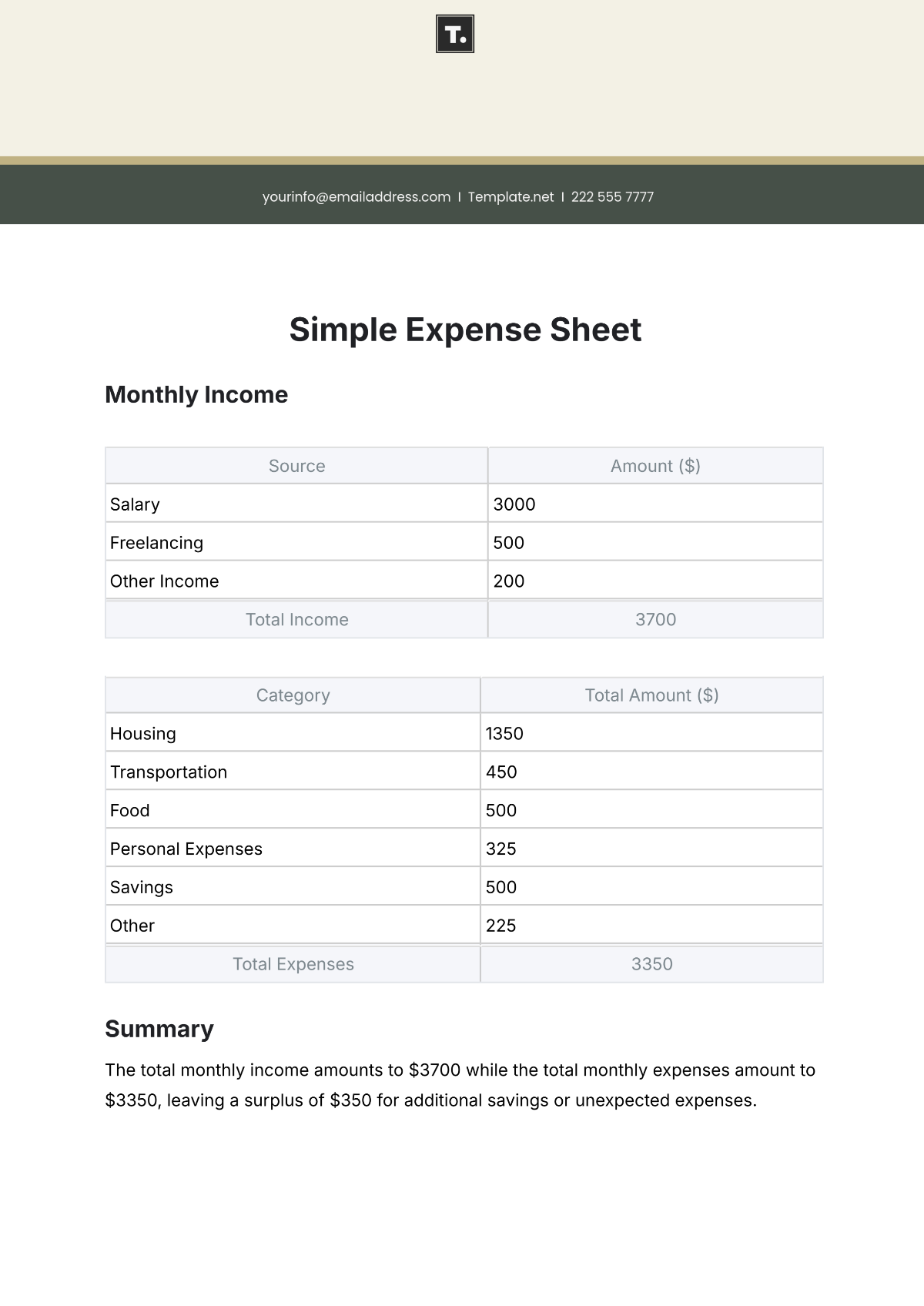

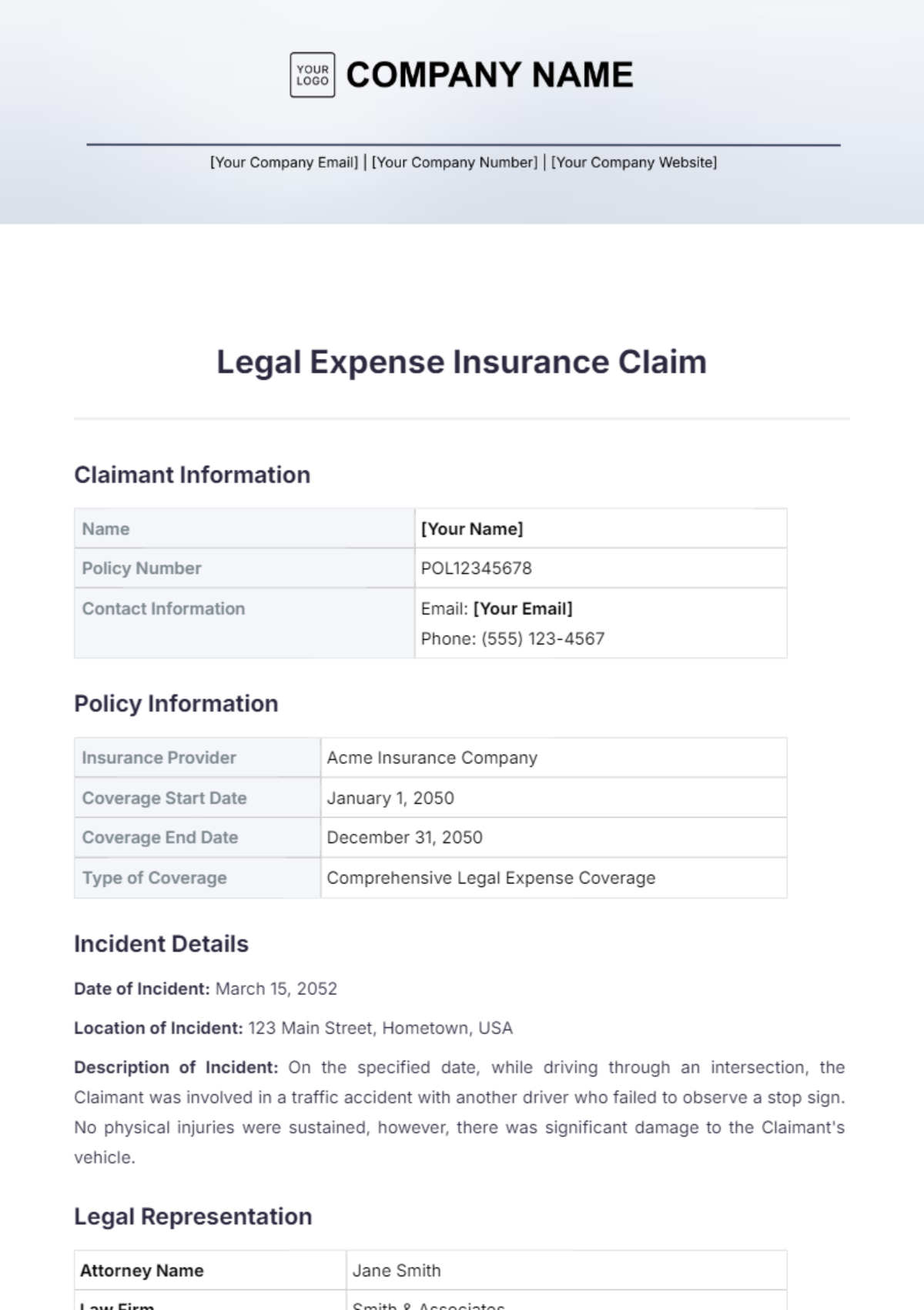

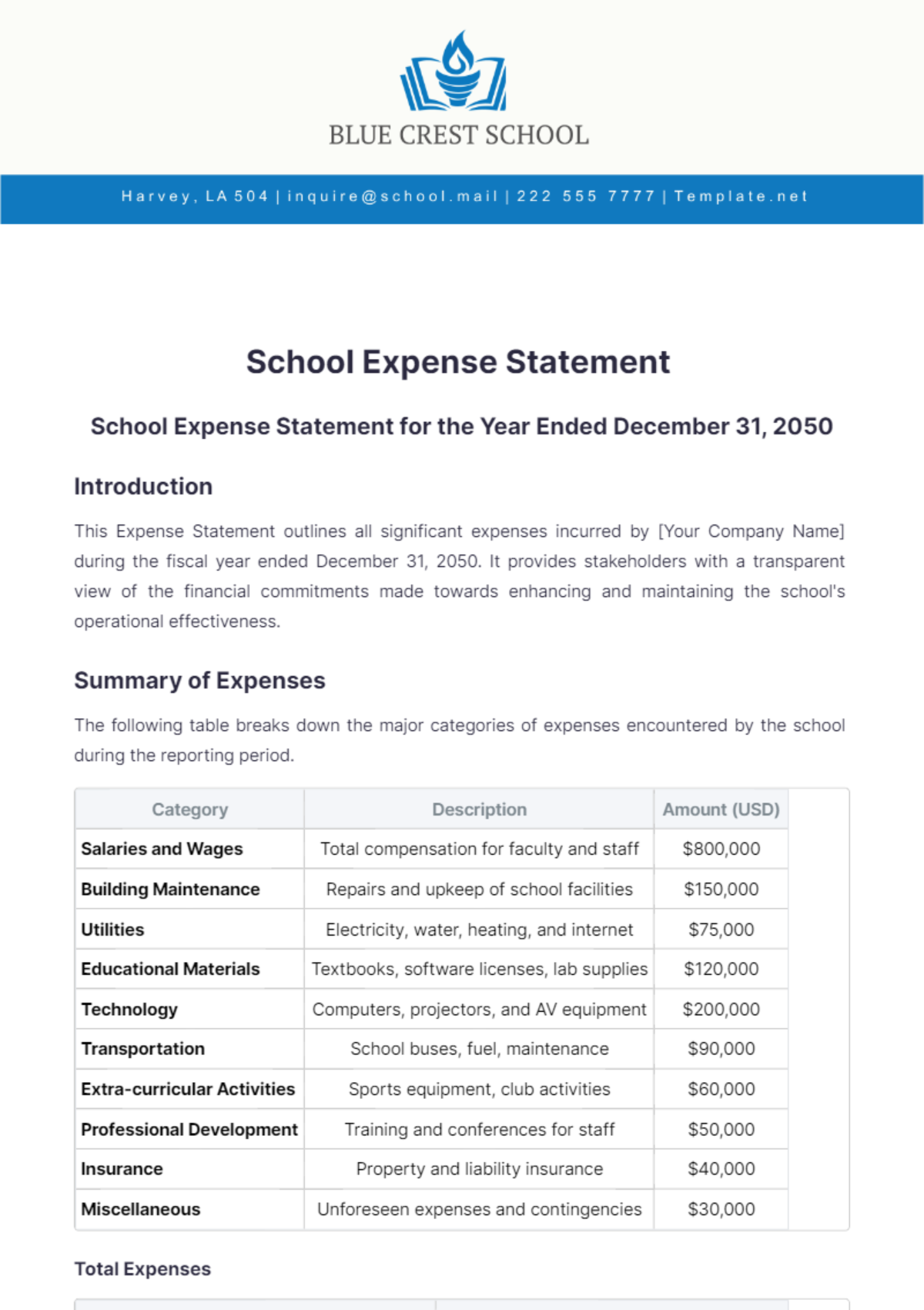

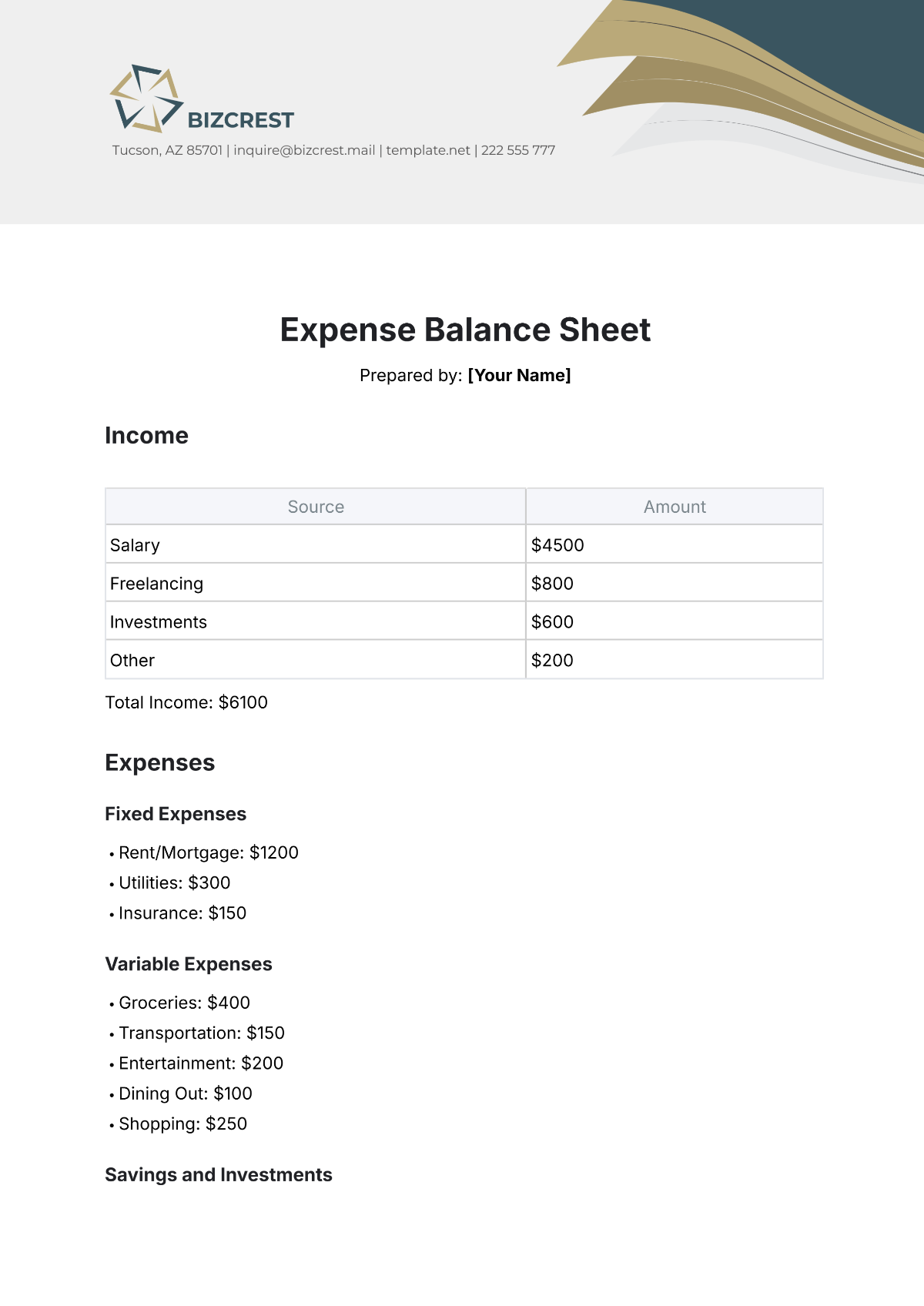

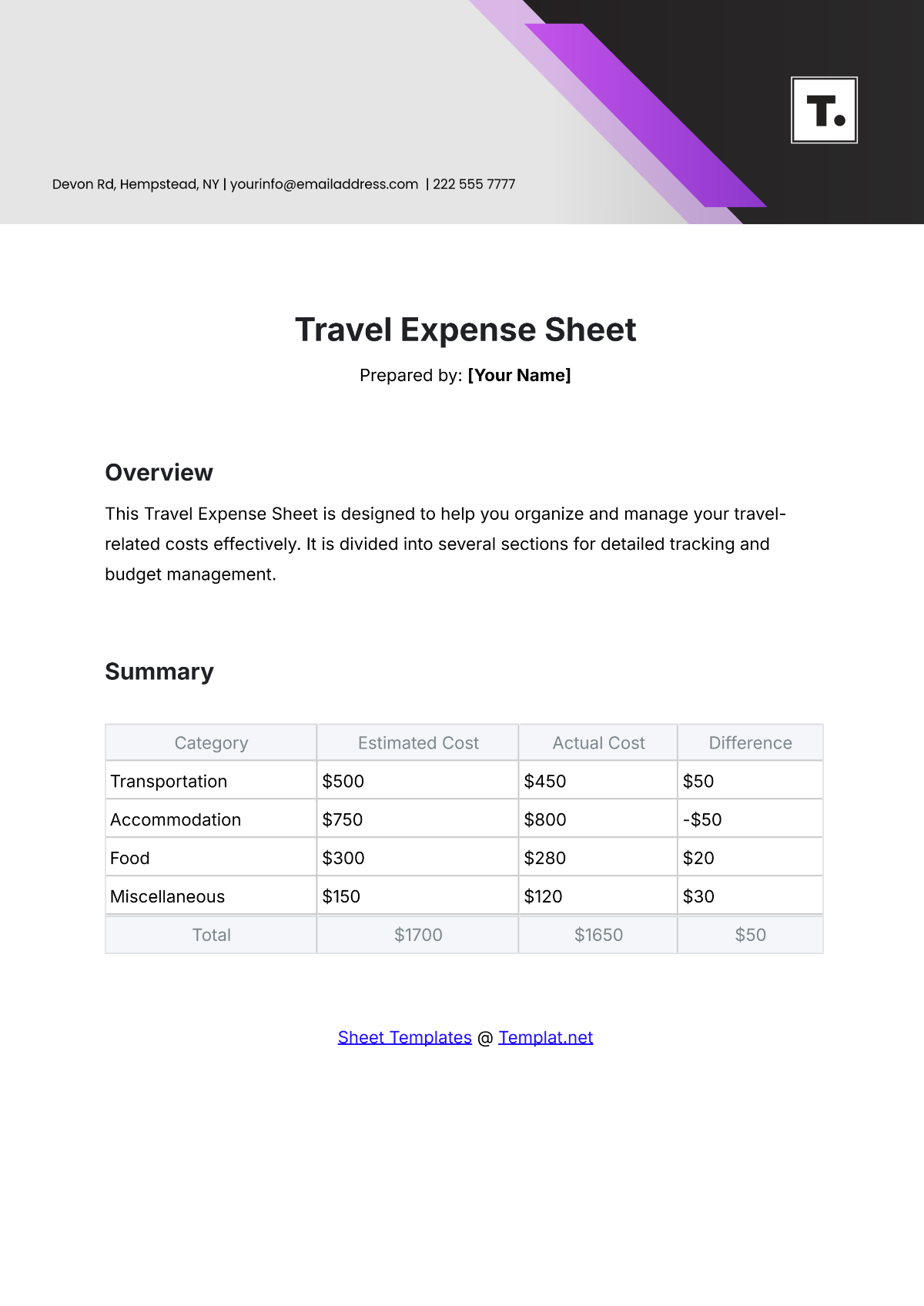

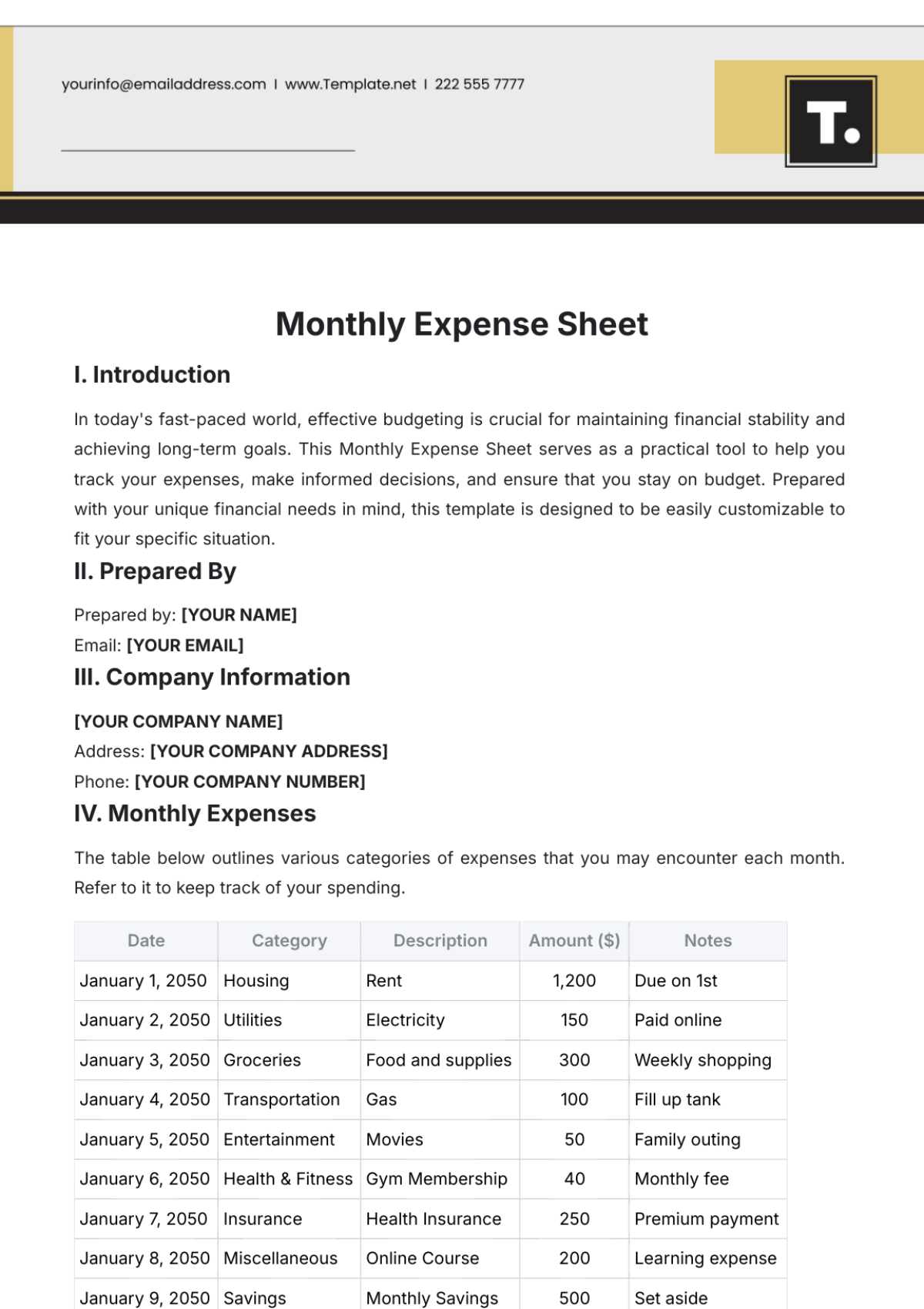

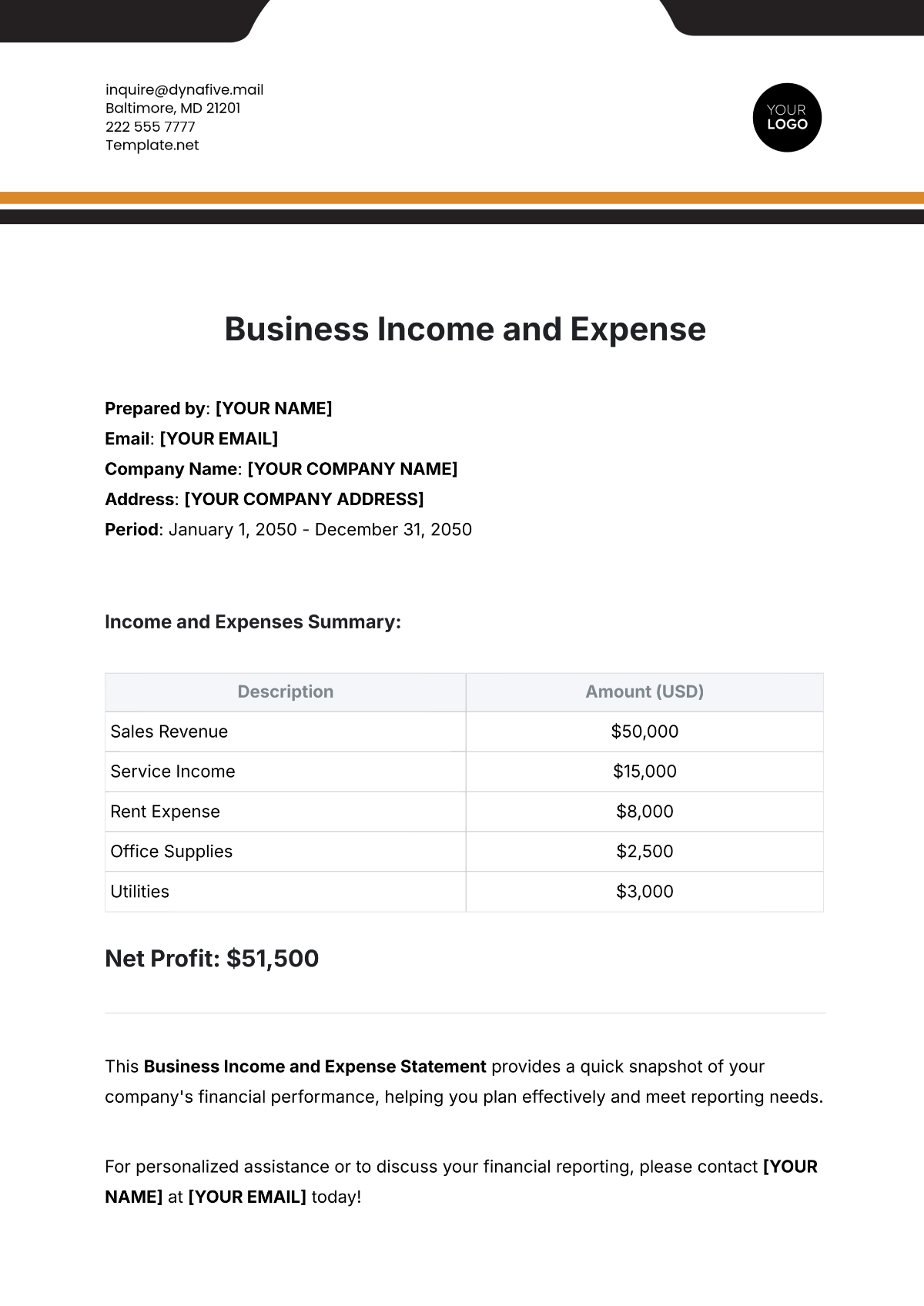

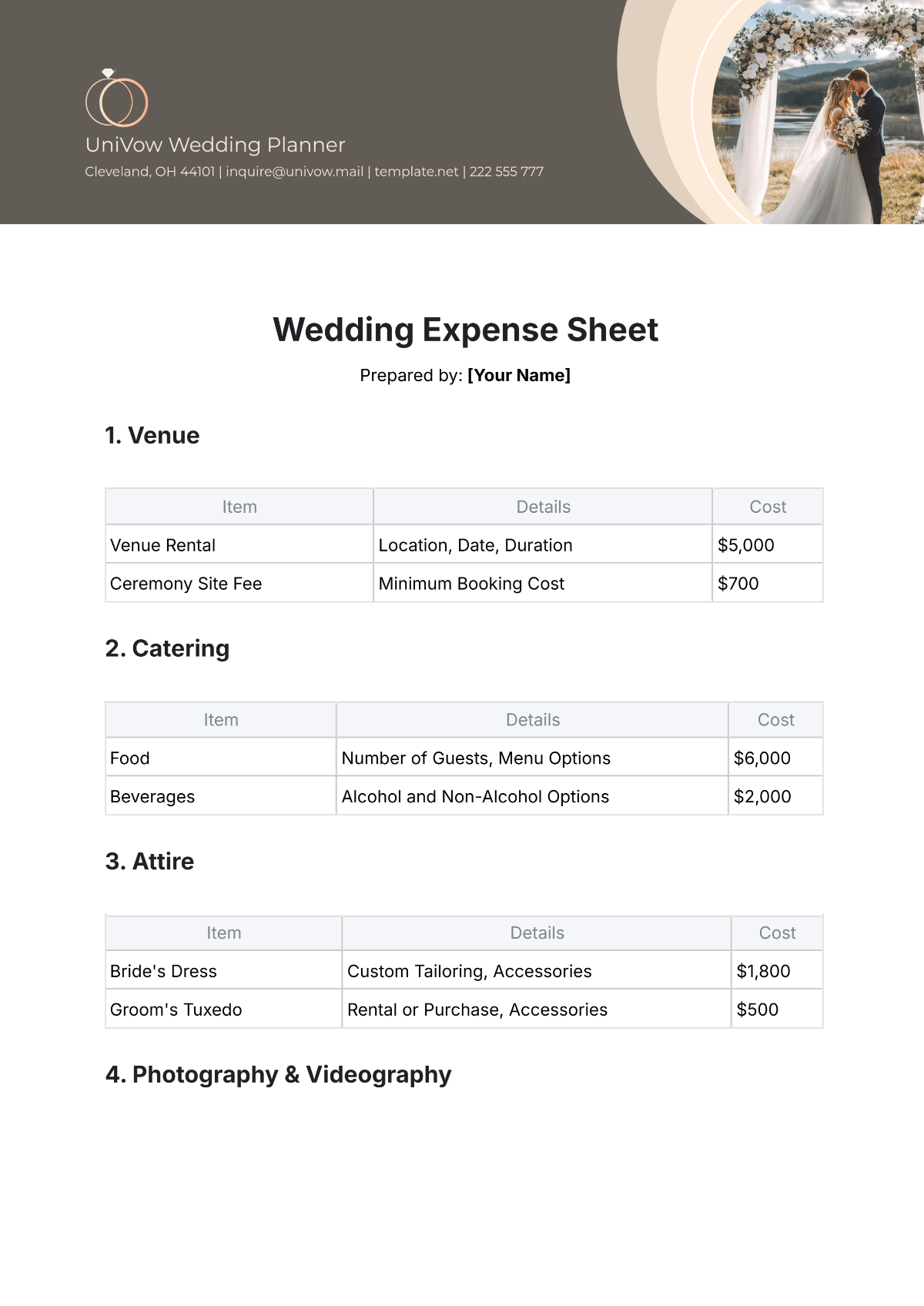

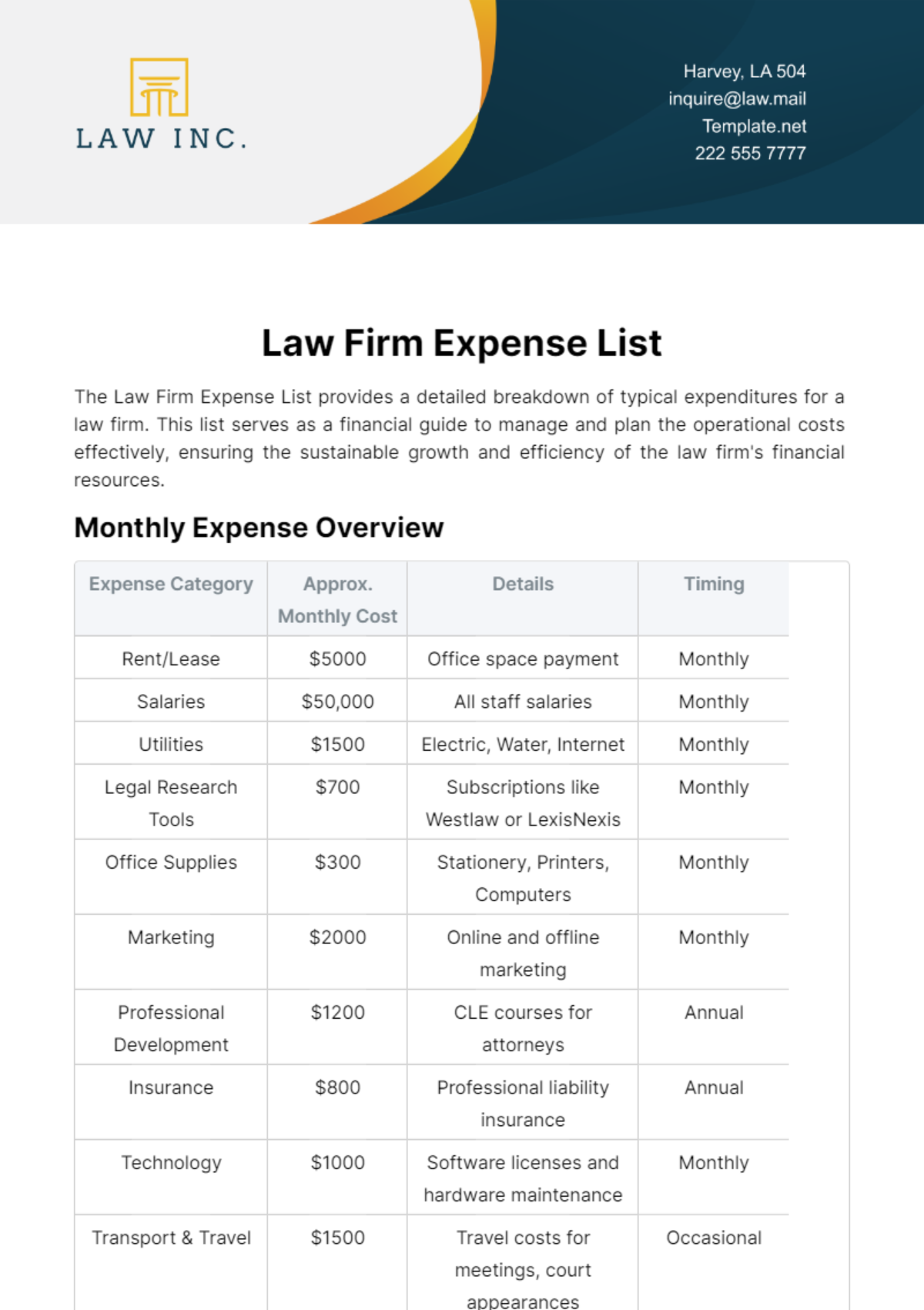

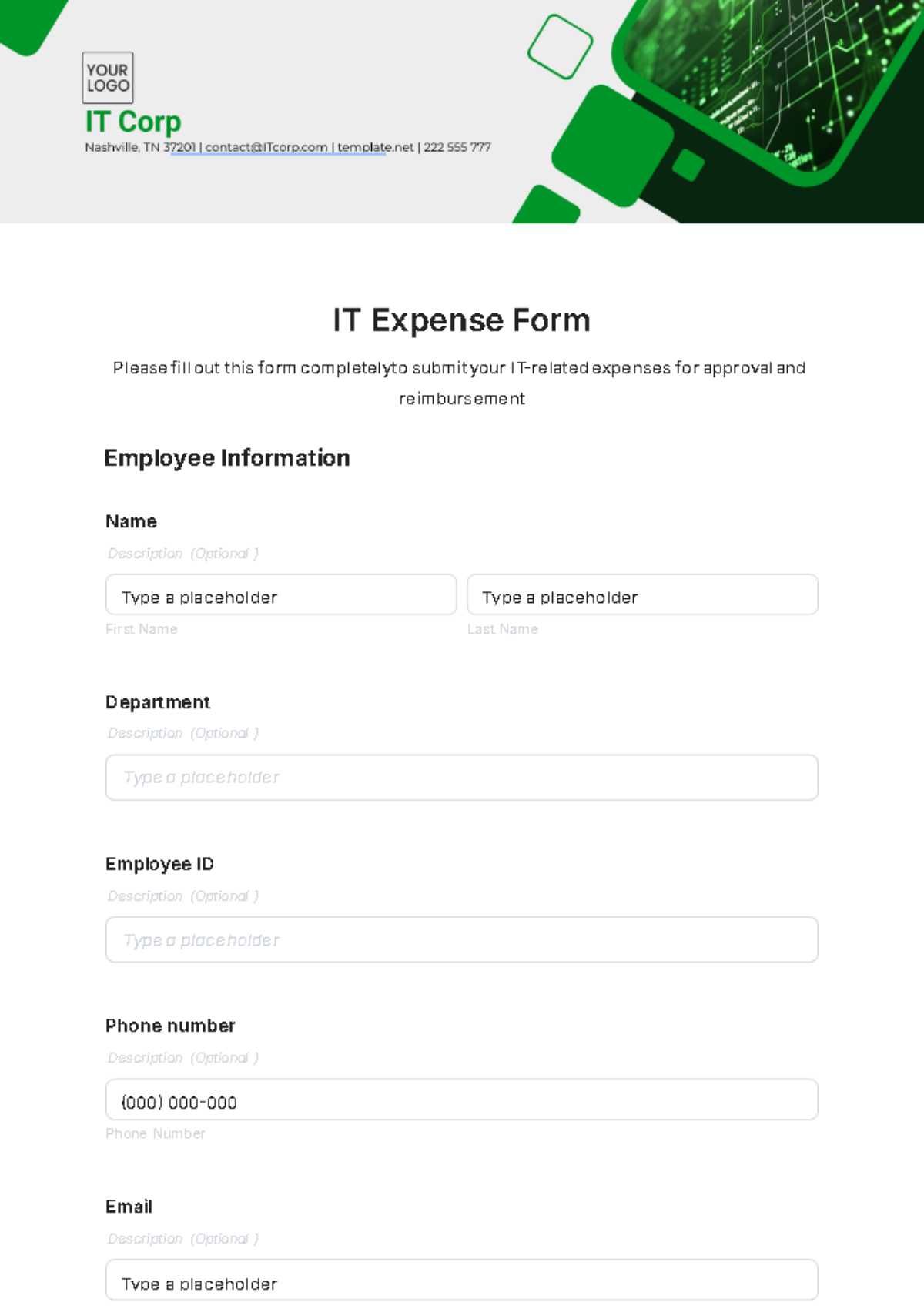

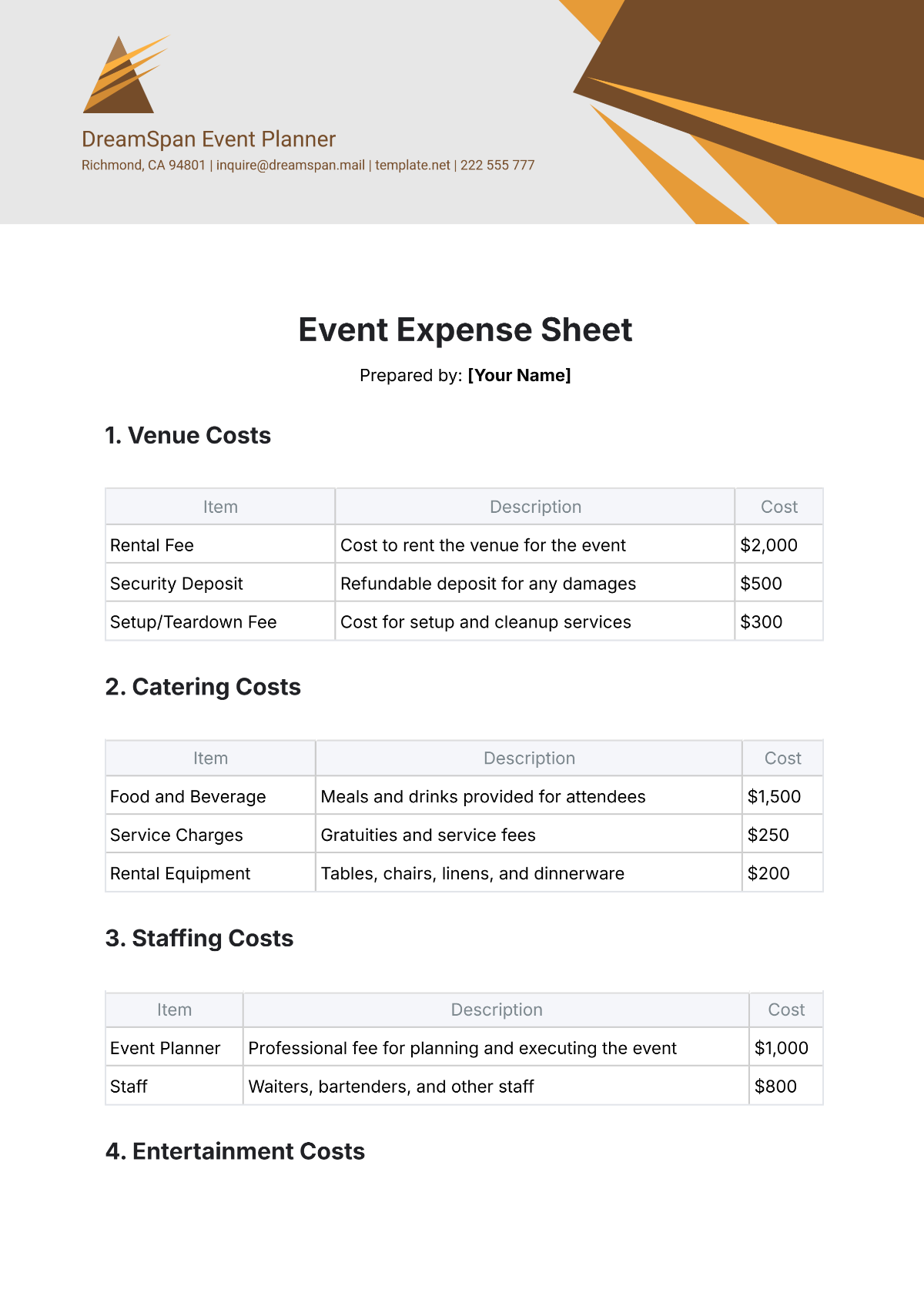

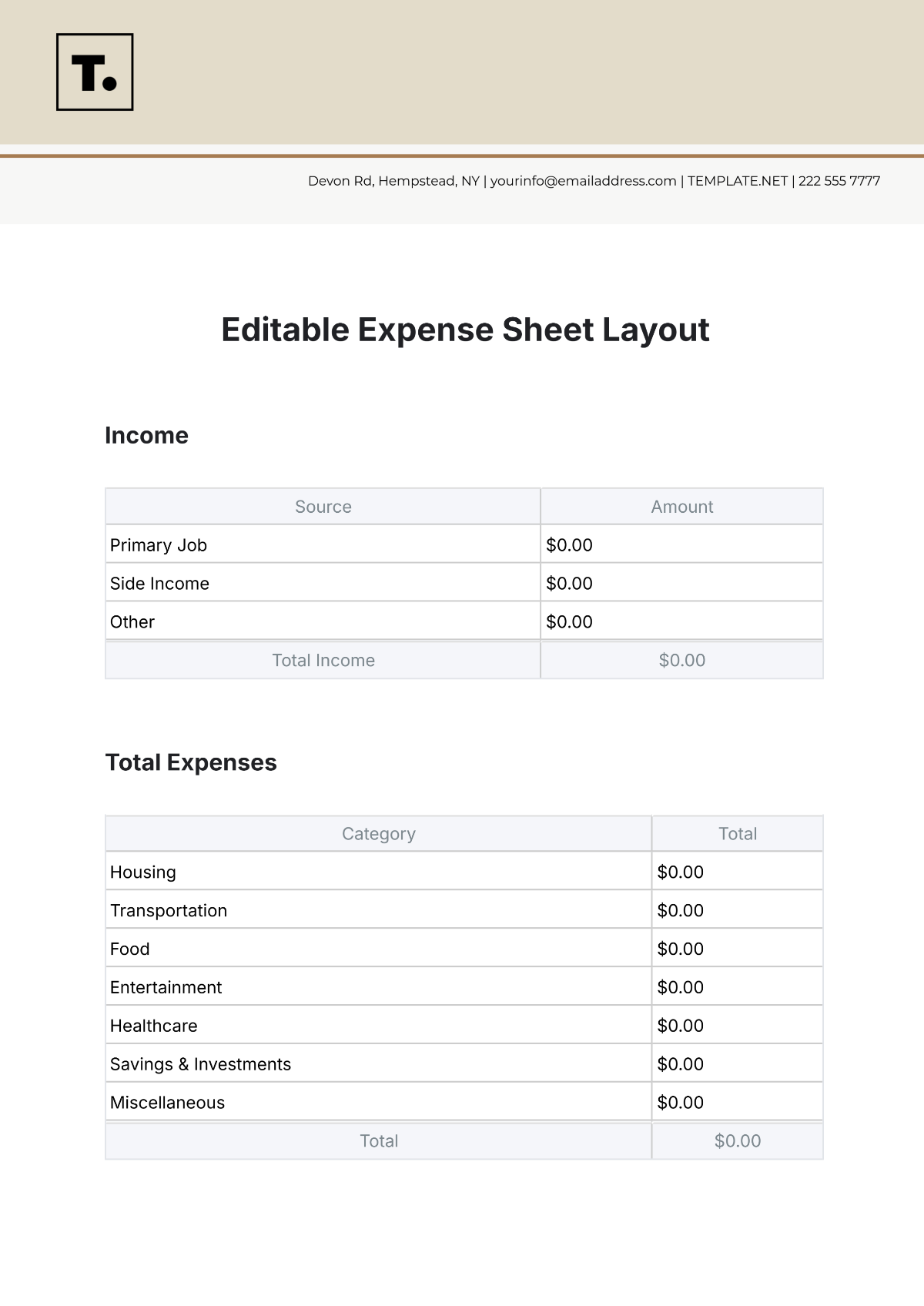

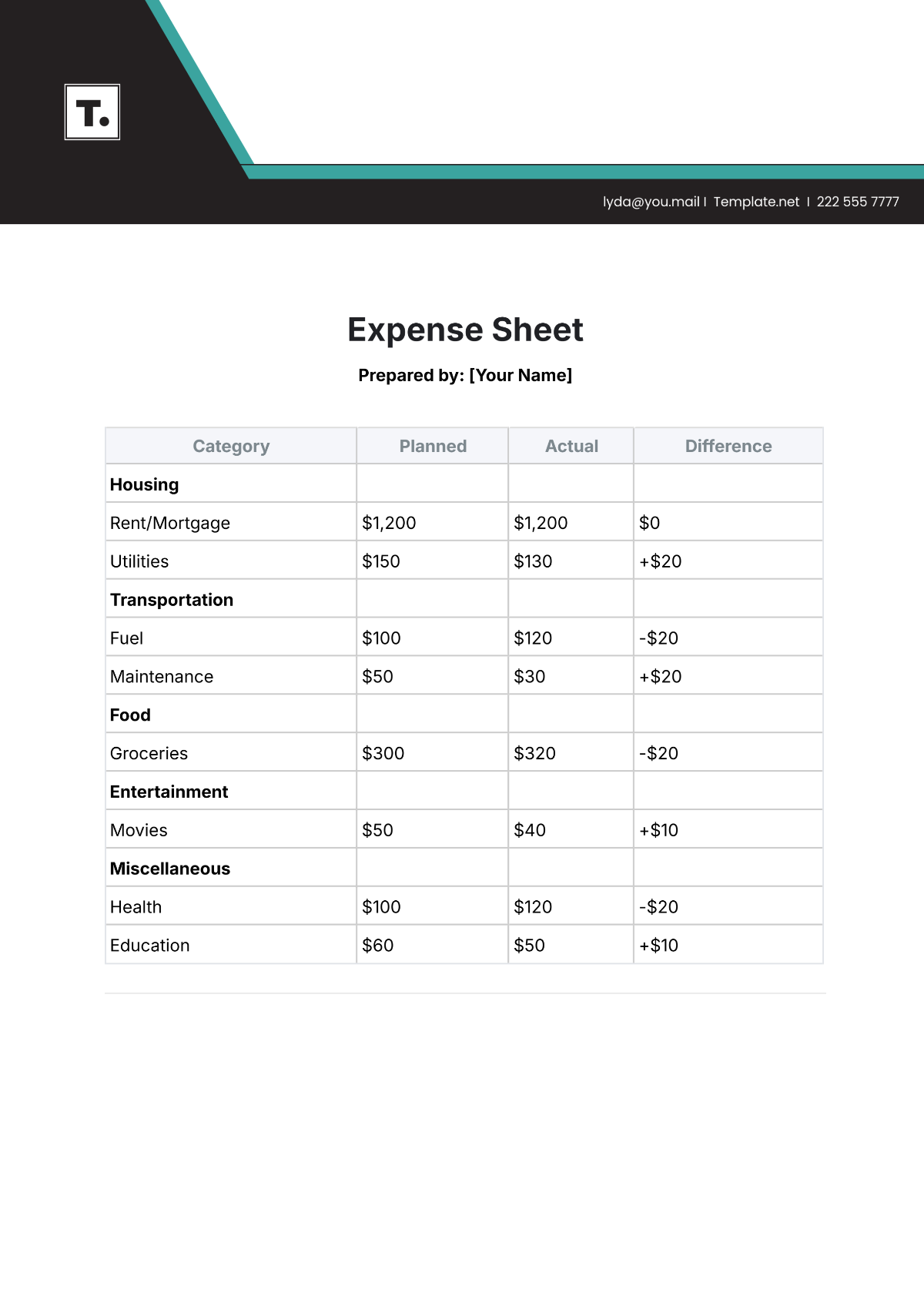

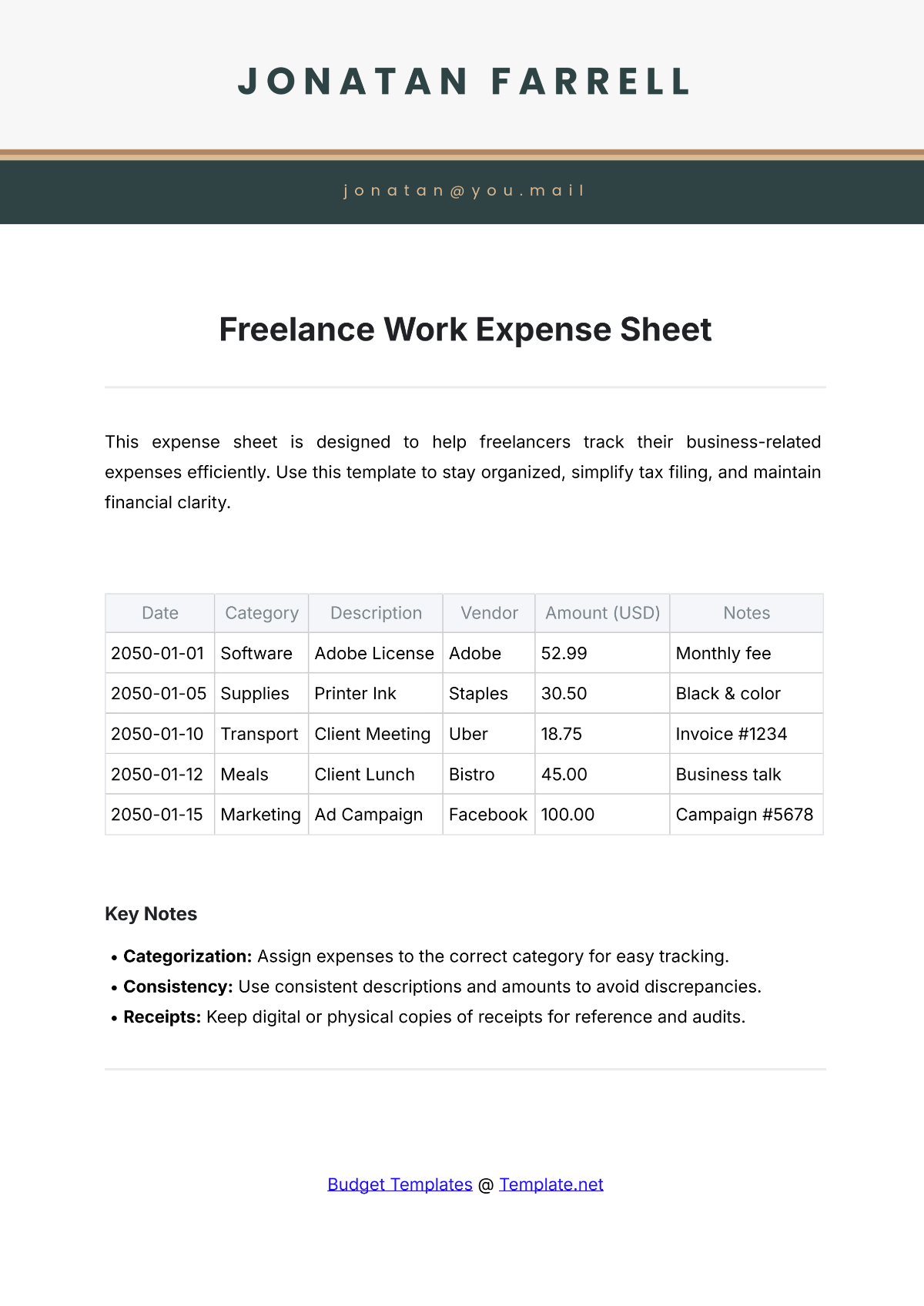

Step 1: Define Categories

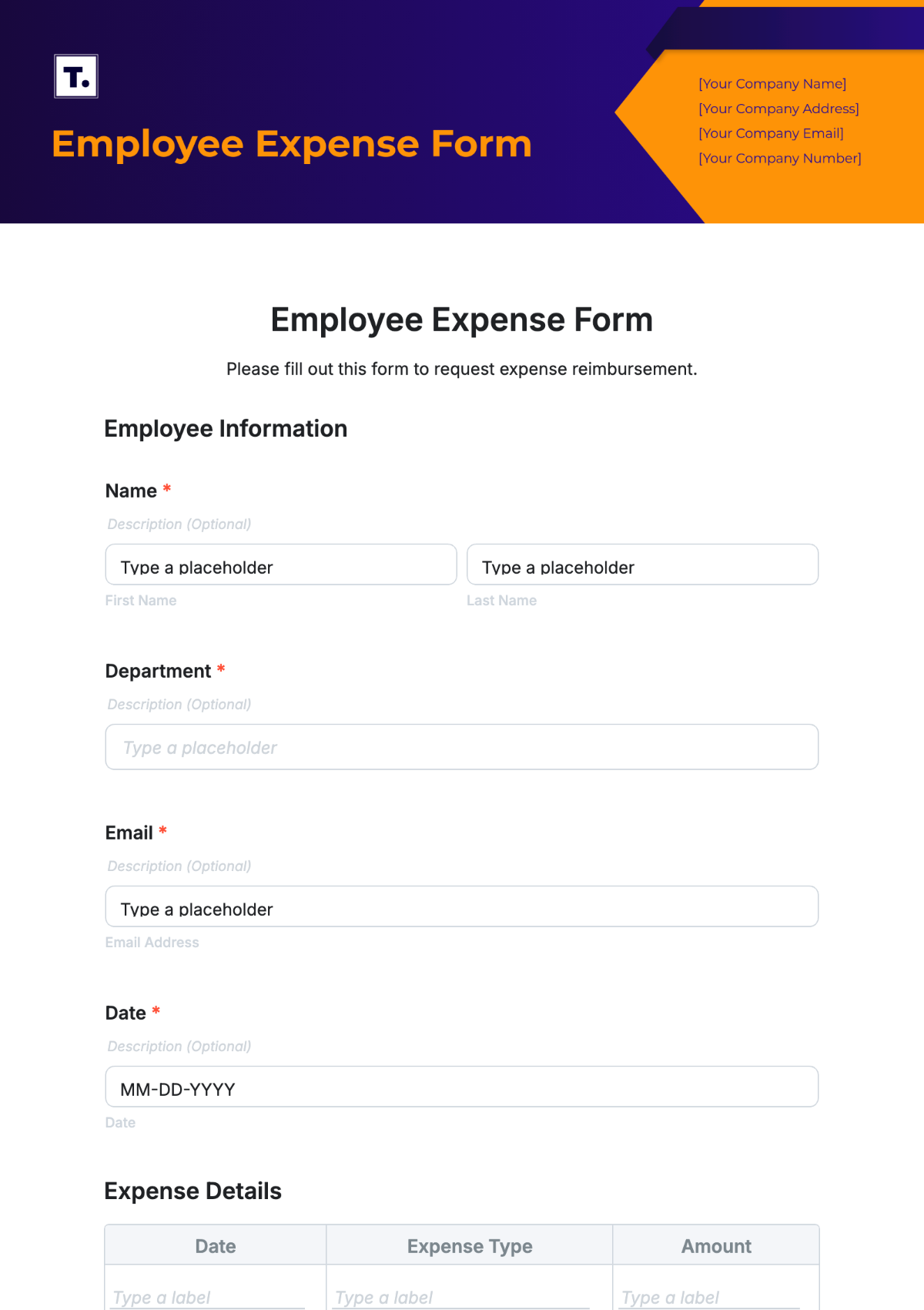

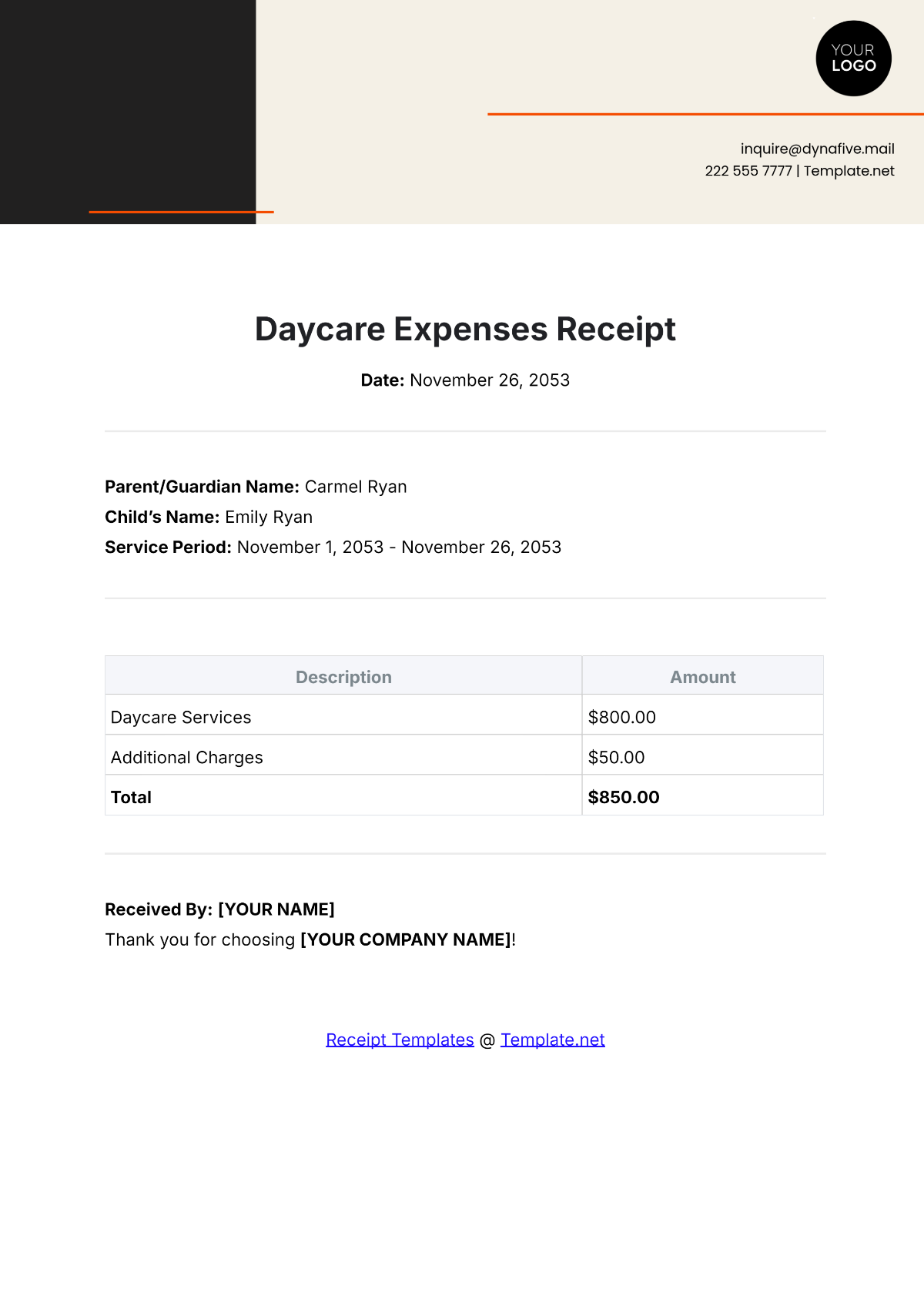

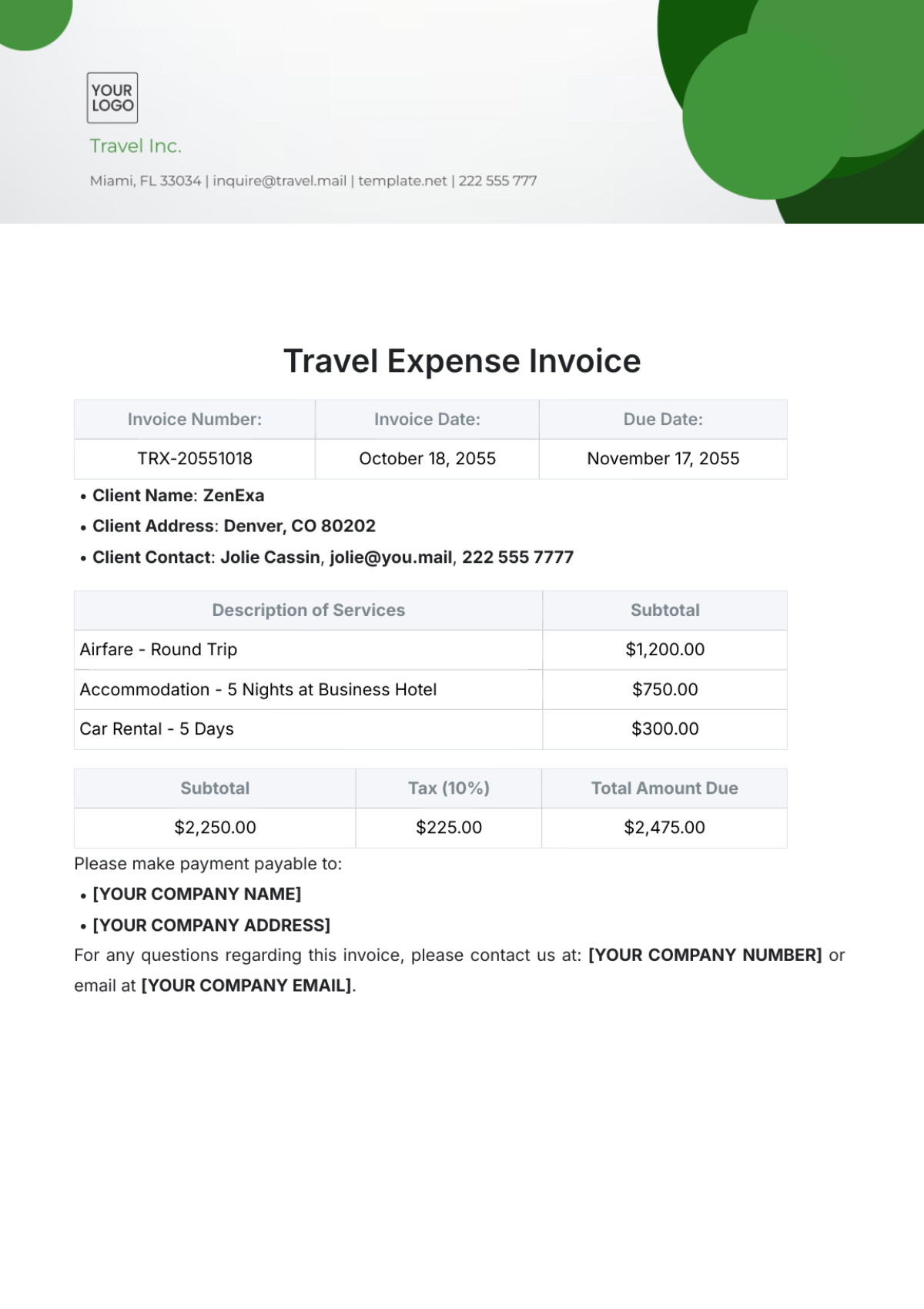

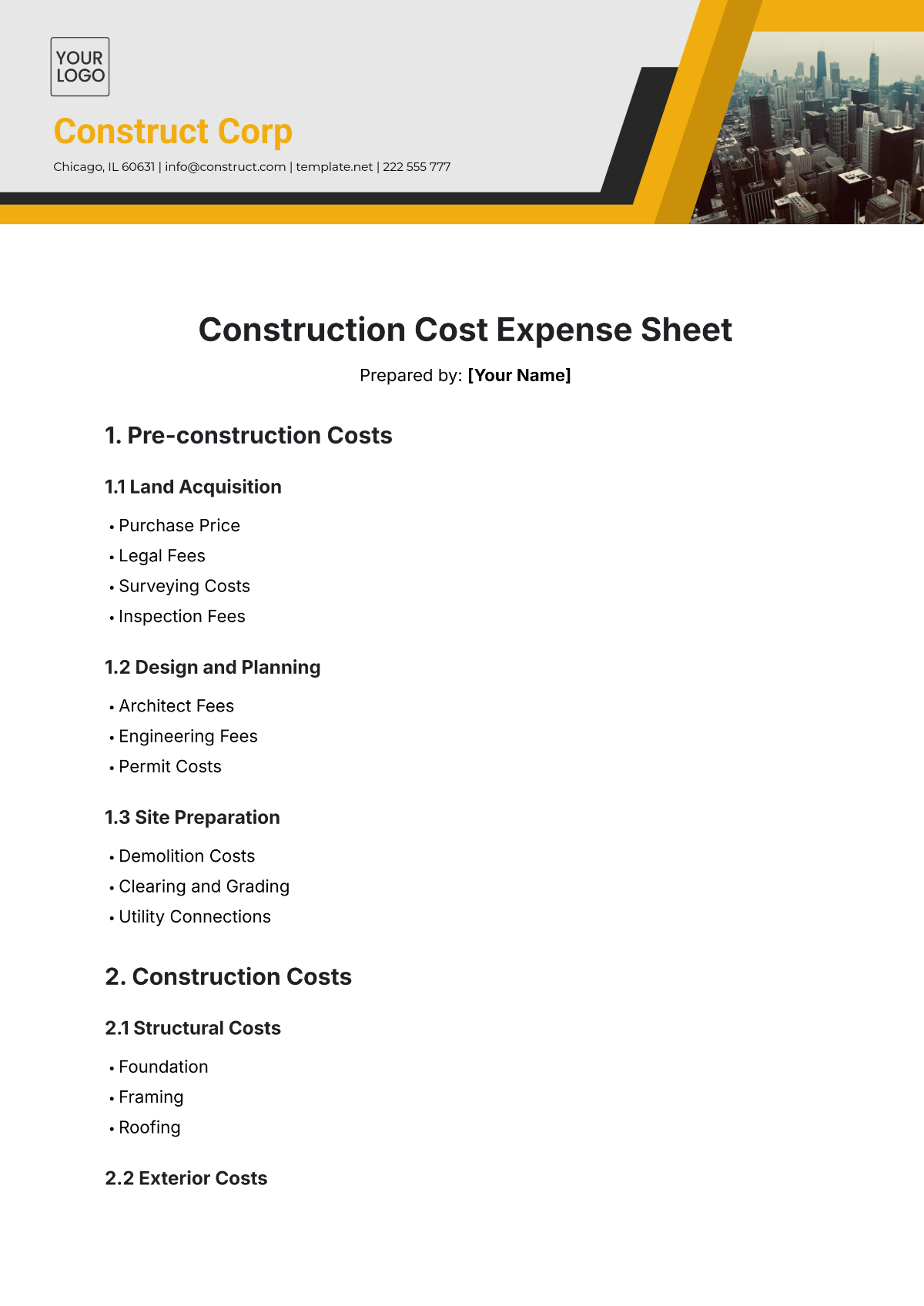

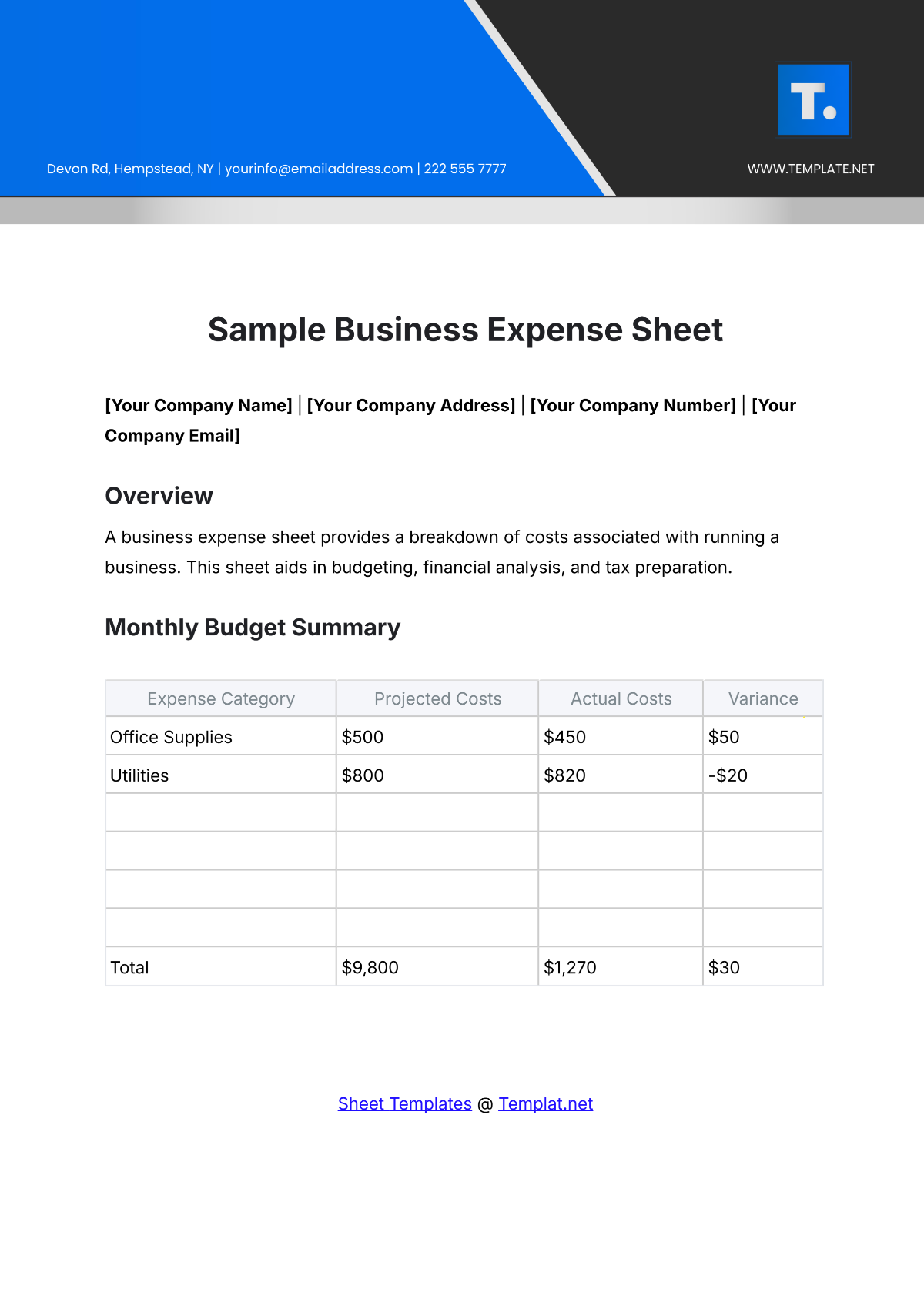

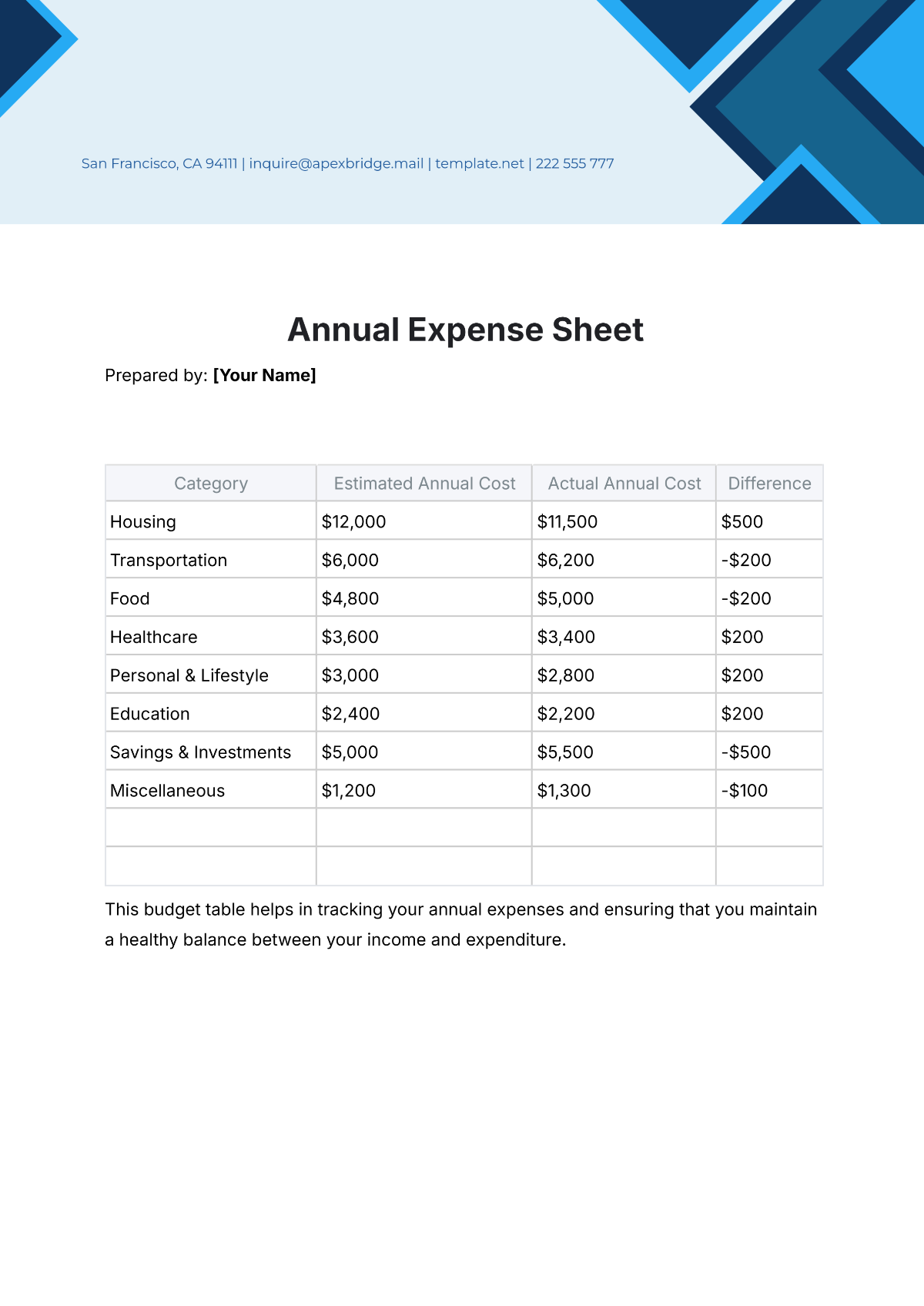

Identify the categories of expenses that are relevant to your financial needs. Common categories include housing, utilities, groceries, transportation, insurance, entertainment, and miscellaneous expenses. For business purposes, you might also include categories such as supplies, travel, salaries, and office expenses.

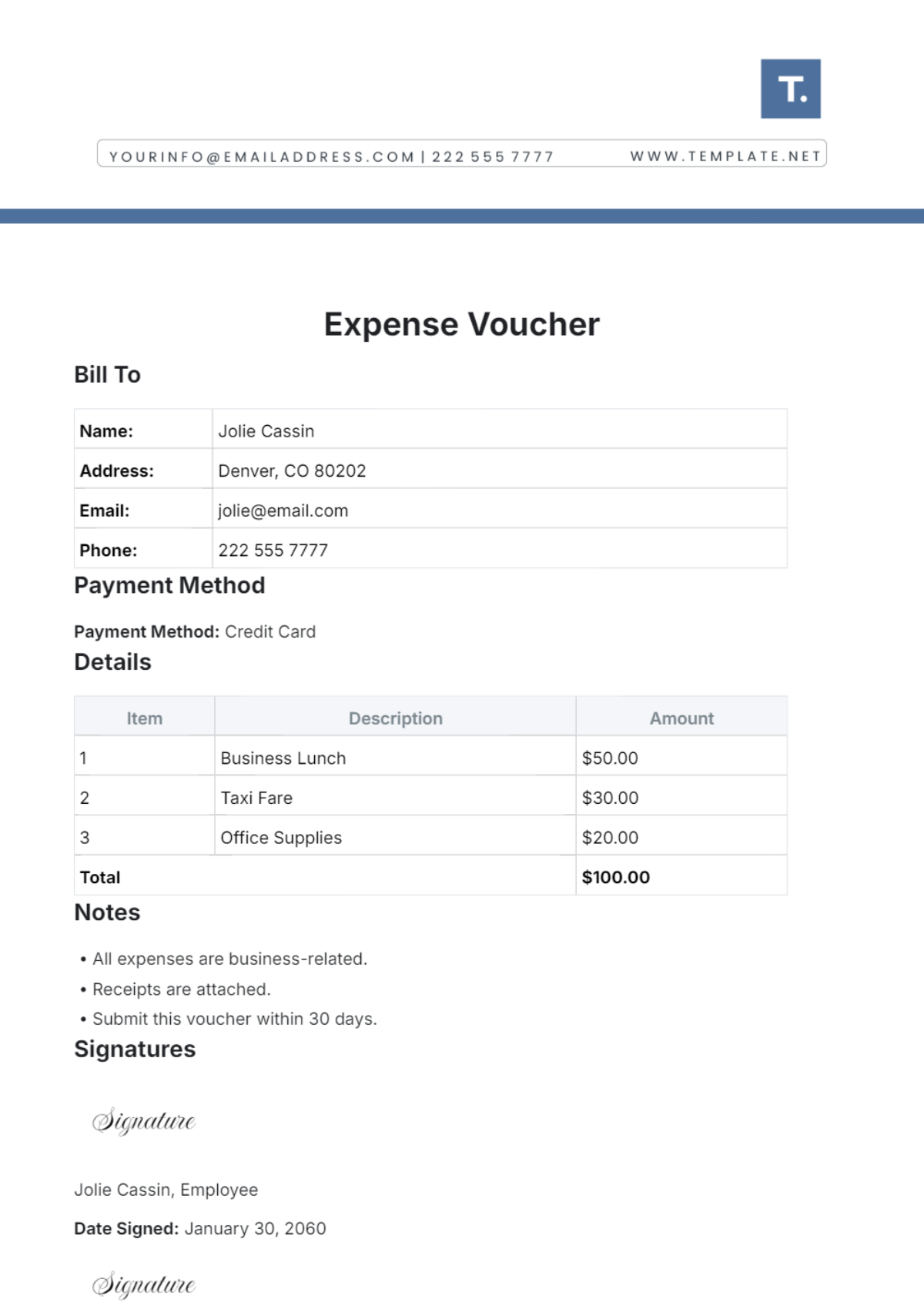

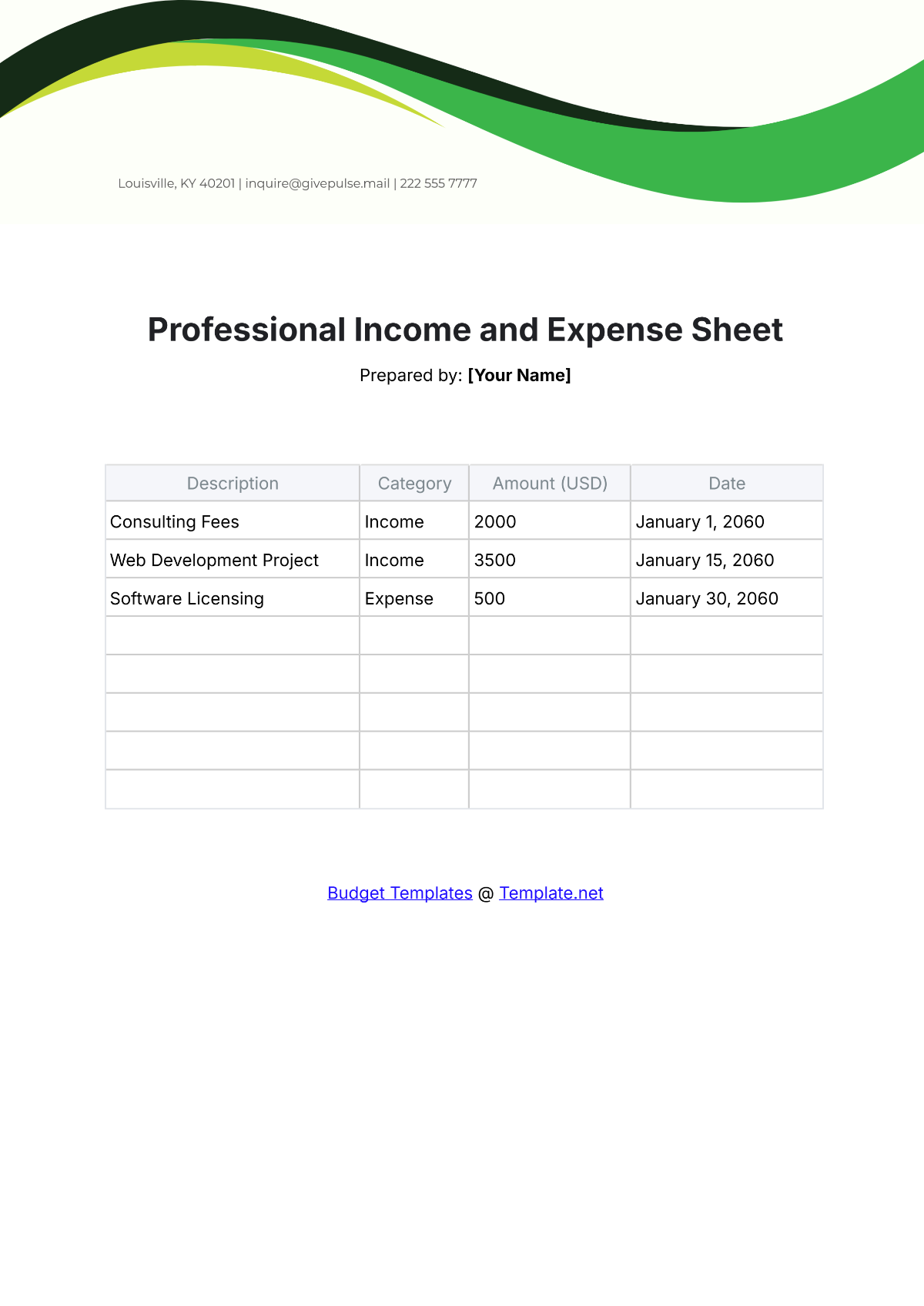

Step 2: Set Up Columns and Rows

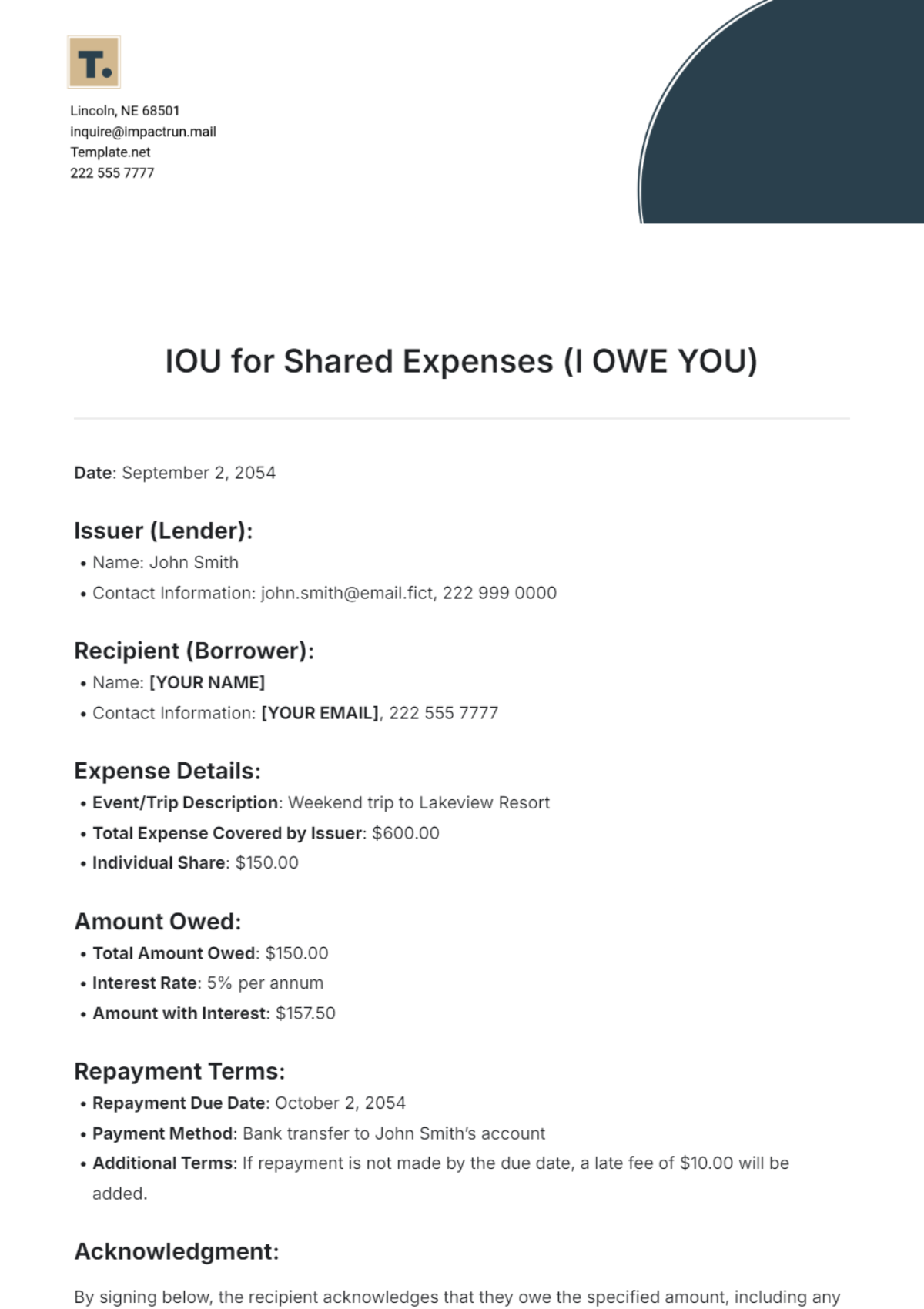

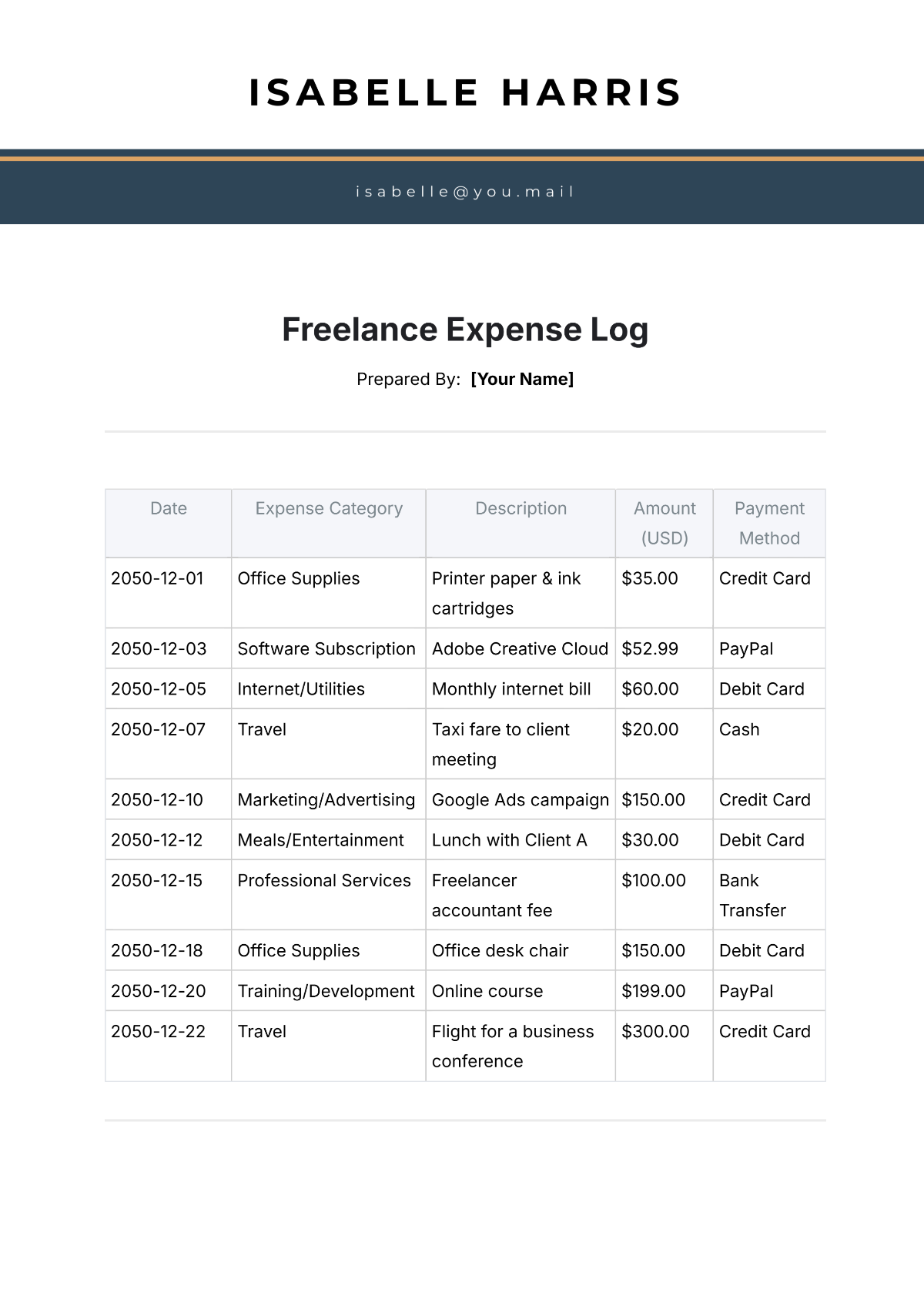

In a spreadsheet, create columns for each piece of data you need to track. Typical columns might include:

Date: When the expense occurred.

Description: A brief note on the nature of the expense.

Category: The expense category from Step 1.

Amount: The monetary value of the expense.

Payment Method: How you paid (e.g., credit card, cash, direct debit).

Notes: Any additional remarks or details.

Rows will then contain individual expenses, with each expense item recording the details across these columns.

Step 3: Enter and Record Expenses

Regularly input your expenses into the sheet. Consistency is key in ensuring that your expense sheet reflects accurate financial data. Consider setting aside time weekly or daily for this task, based on the frequency of your transactions.

Step 4: Review and Analyze

Periodically review your expense sheet to analyze spending habits. Look for patterns, such as spikes in specific categories, which might indicate the need for adjustments in your budget. Use the data to devise strategies to enhance your financial management, such as cutting unnecessary expenses.

Utilizing Technology for Efficiency

Take advantage of technological solutions to streamline your expense tracking. Many apps and software solutions can import data automatically from bank transactions or receipts, reducing manual entry. Additionally, these programs often offer analytical tools to better interpret the data collected.

Conclusion

Creating and maintaining an expense sheet may seem daunting at first, but it can simplify your financial management significantly. By following the steps outlined here, you'll be able to construct an effective expense record-keeping system that provides invaluable insights into your spending and budgetary habits. Remember, the key to maximizing the utility of an expense sheet is regular maintenance and review, which will ultimately lead to better financial health and decision-making.