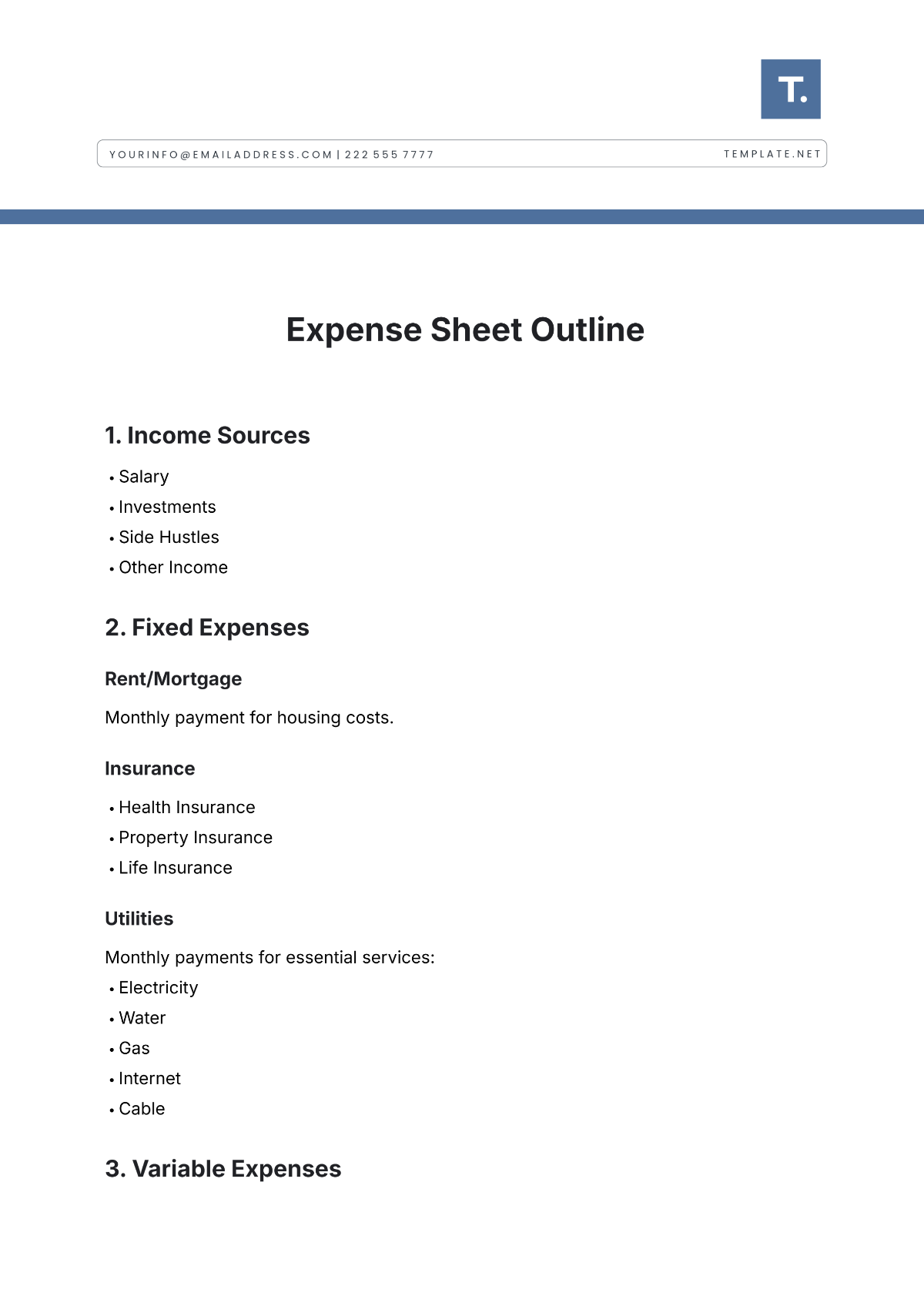

Expense Balance Sheet

Prepared by: [Your Name]

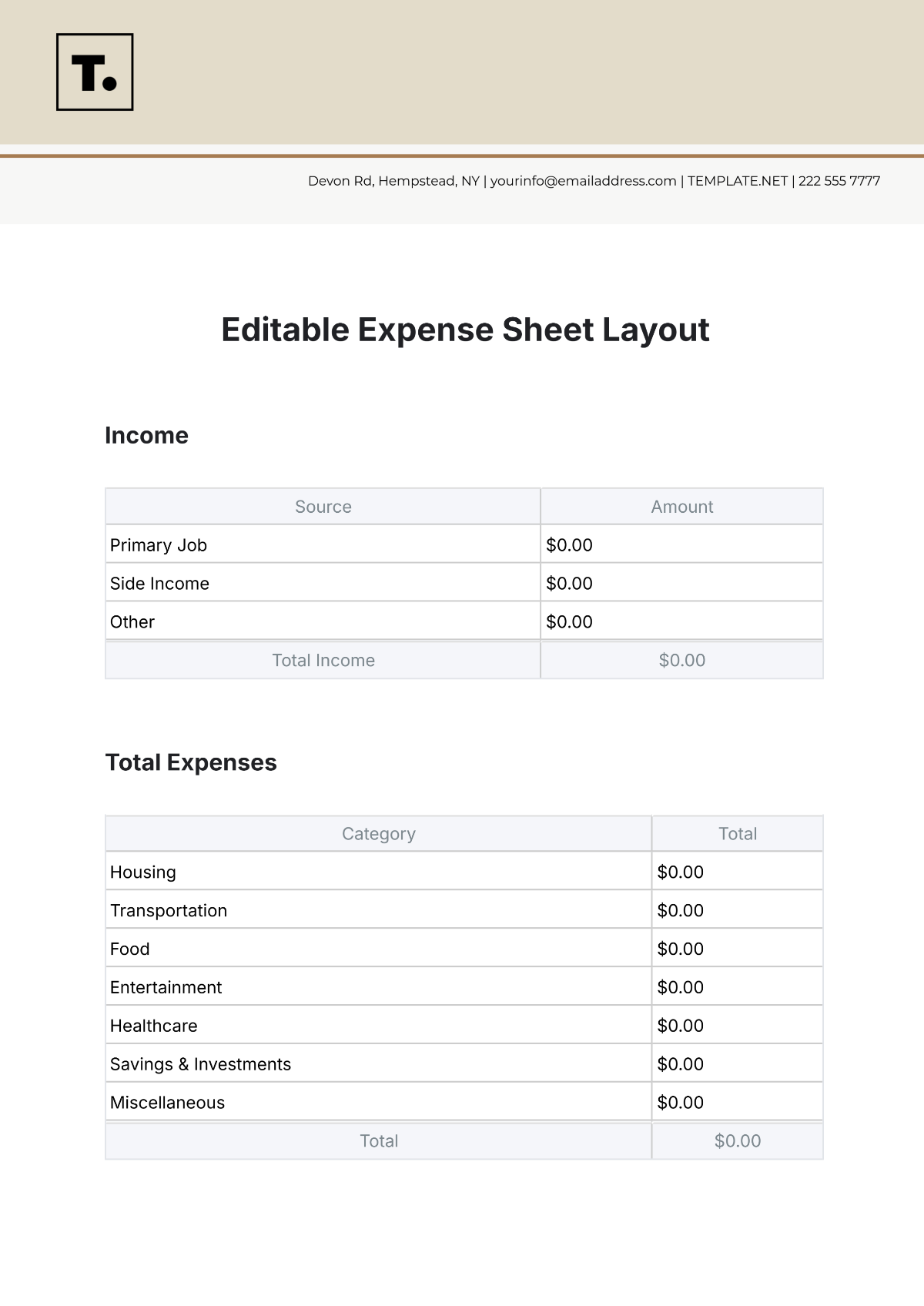

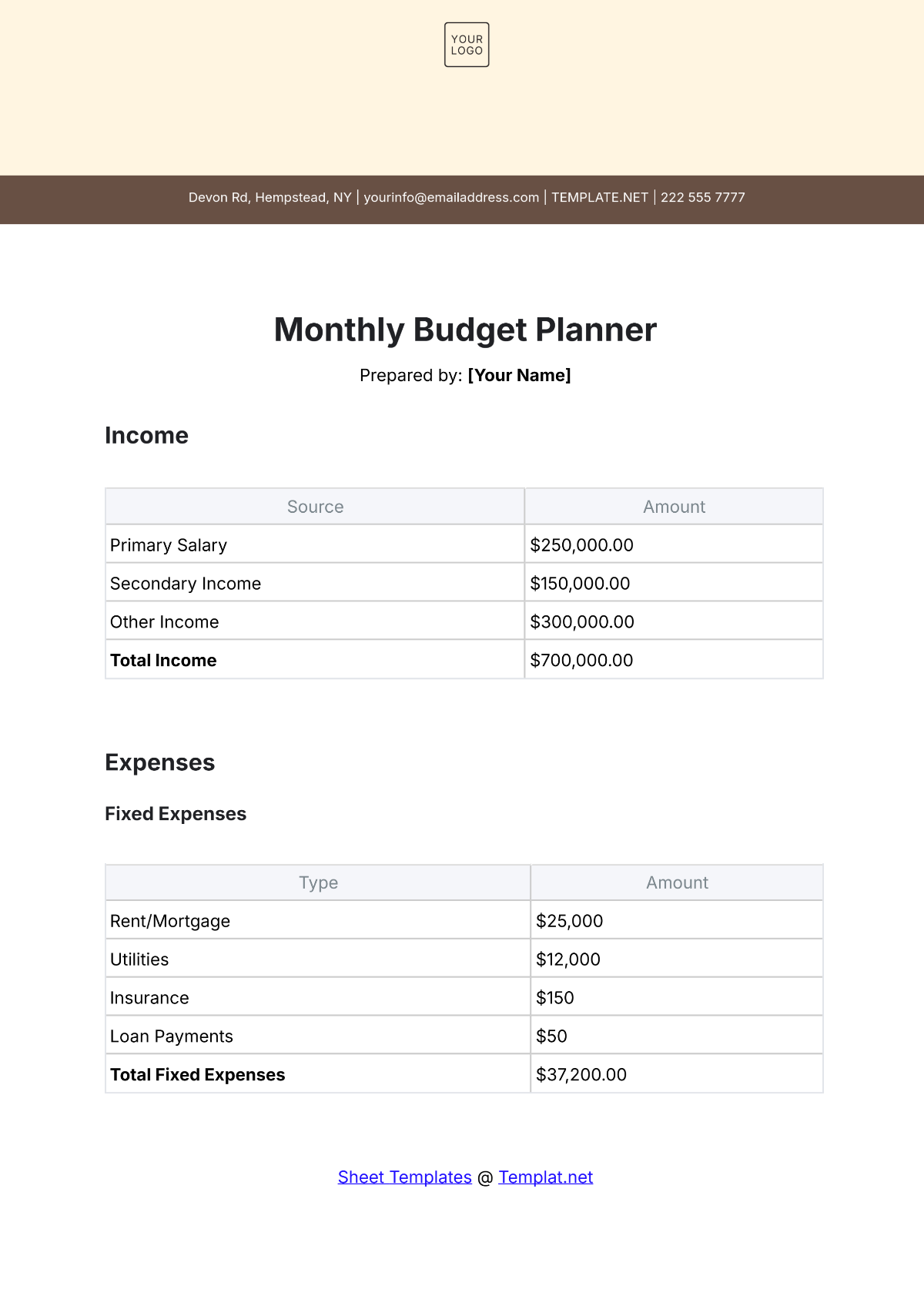

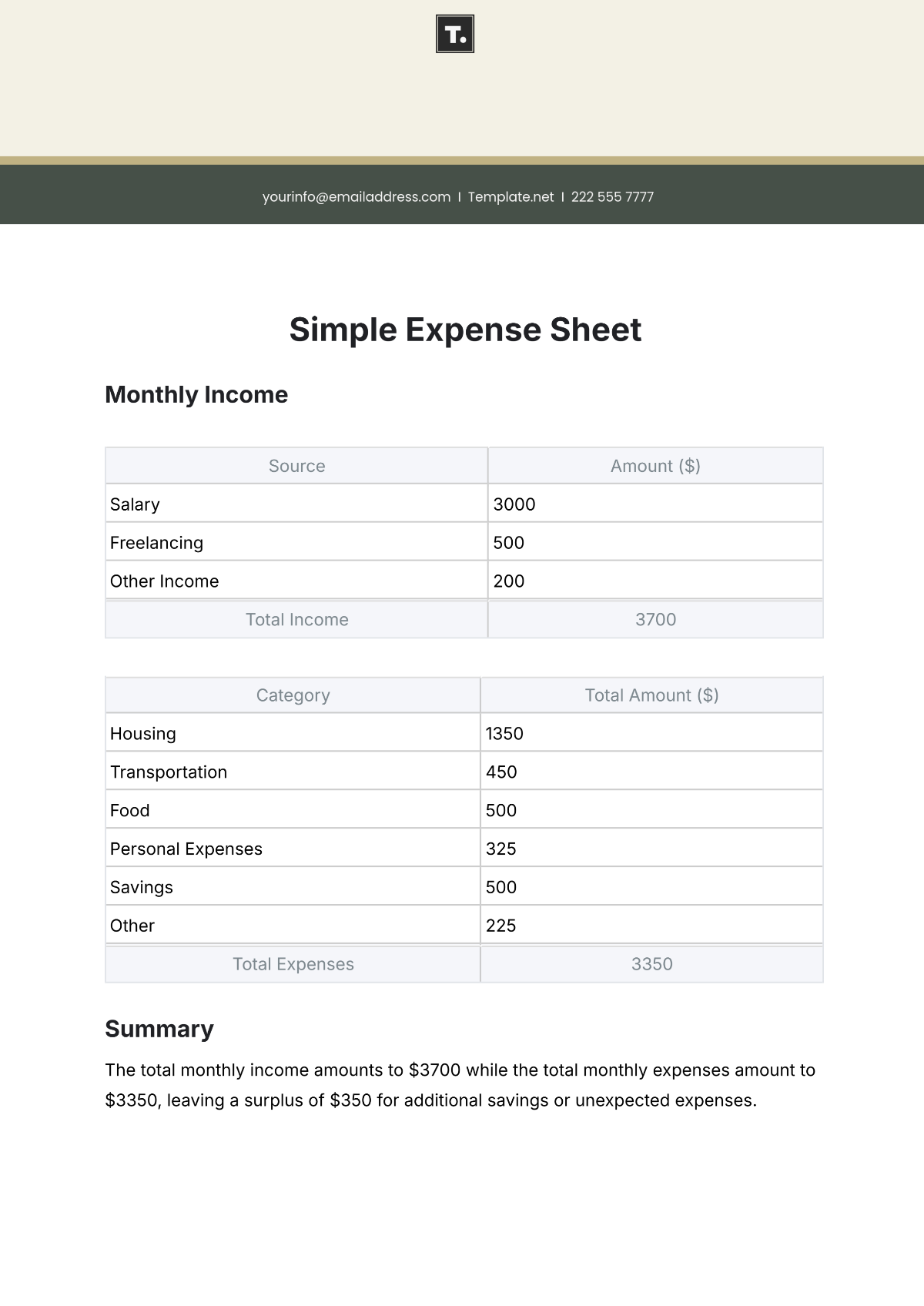

Monthly Income

The total amount of income expected for the month, including salary, bonuses, and any other sources of revenue.

Salary: $4,000

Freelance Work: $500

Investment Returns: $200

Total Monthly Income: $4,700

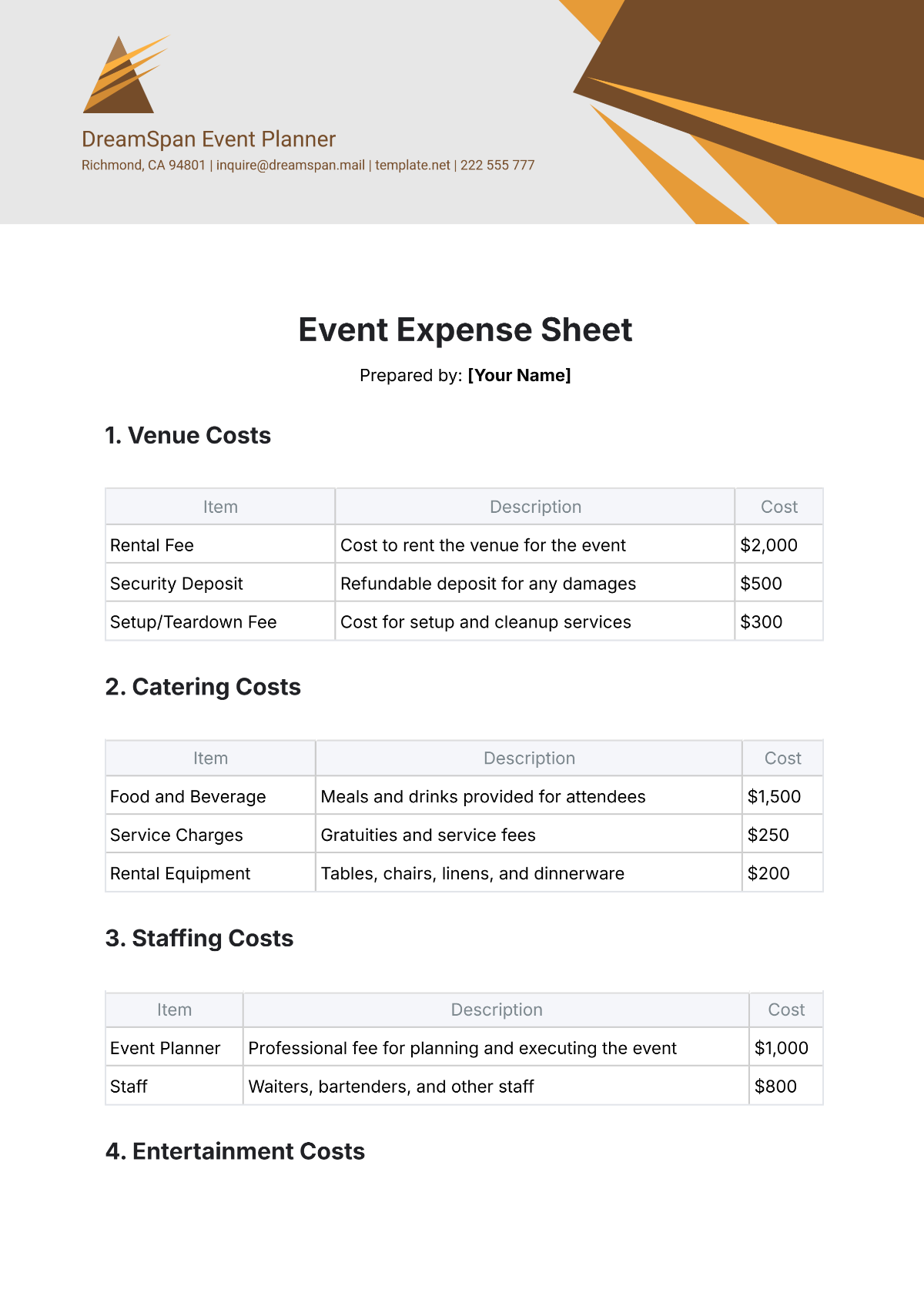

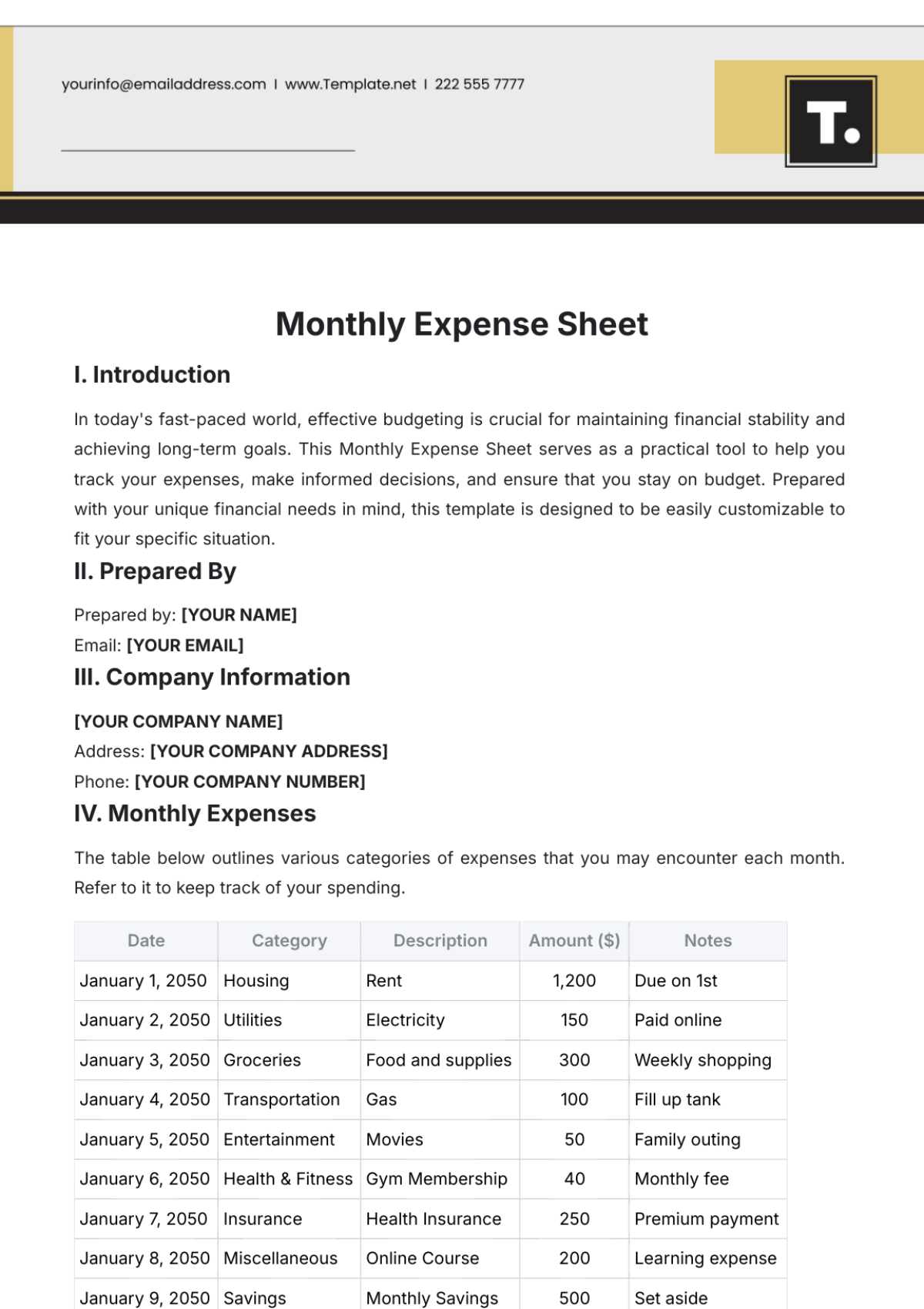

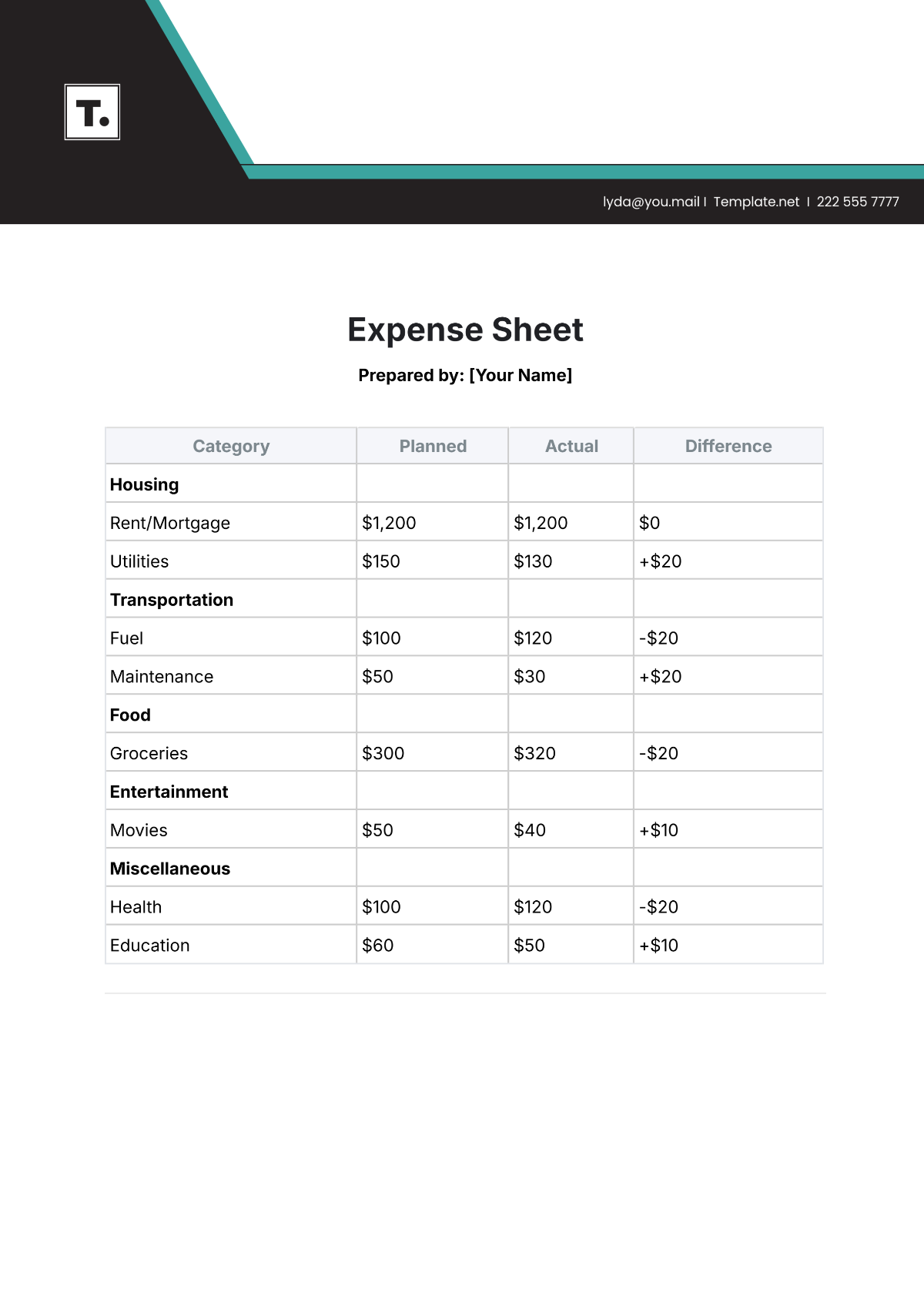

Fixed Expenses

Expenses that remain constant each month and are necessary for daily living.

Mortgage/Rent: $1,200

Utilities (Electricity, Water, Gas): $150

Internet & Phone: $100

Insurance (Health, Car, Home): $250

Monthly Subscriptions (Streaming, Fitness): $50

Total Fixed Expenses: $1,750

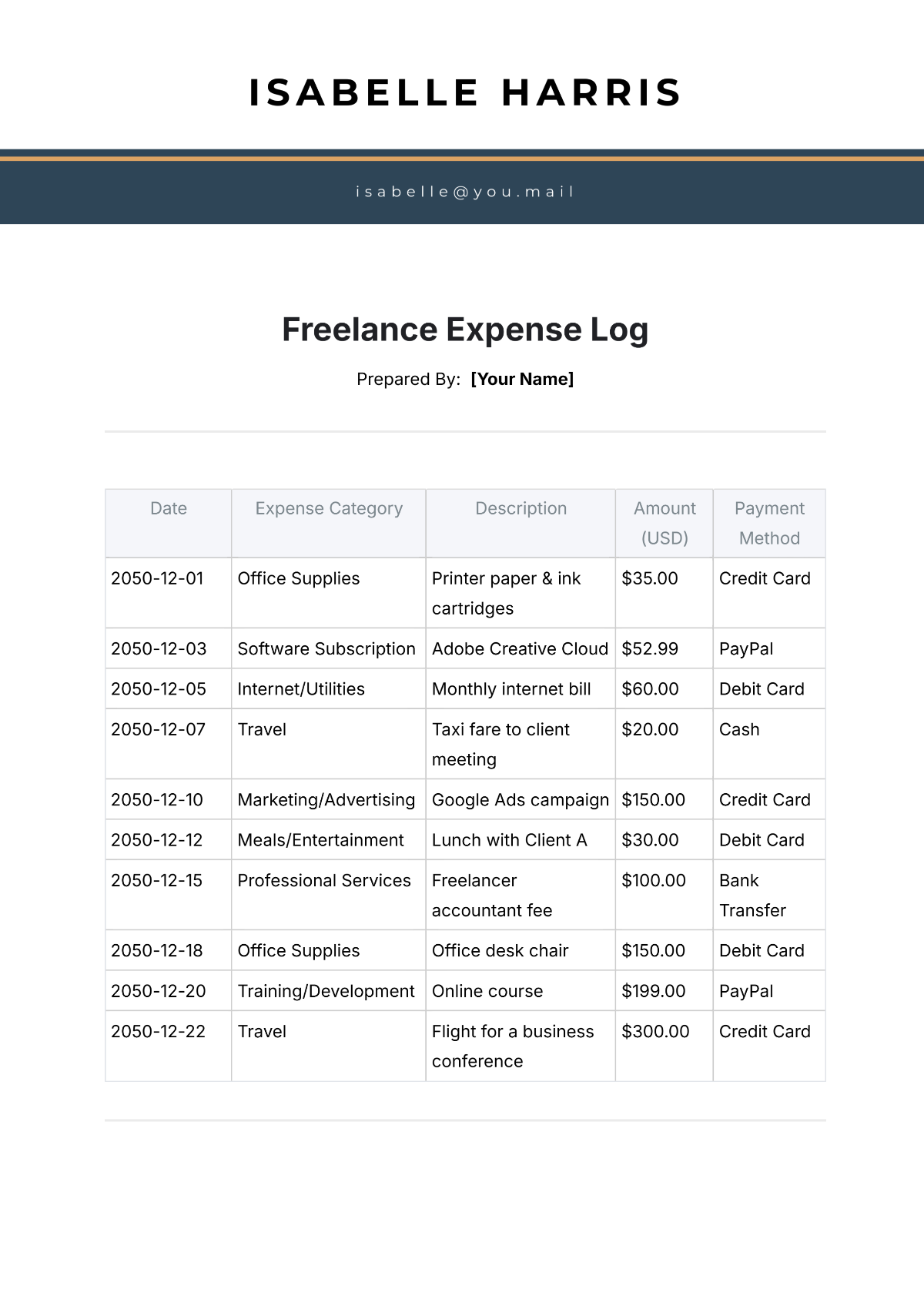

Variable Expenses

Monthly expenditures that can fluctuate based on usage, lifestyle, and choices.

Groceries: $300

Transportation: $200

Dining Out: $150

Entertainment: $100

Clothing: $80

Total Variable Expenses: $830

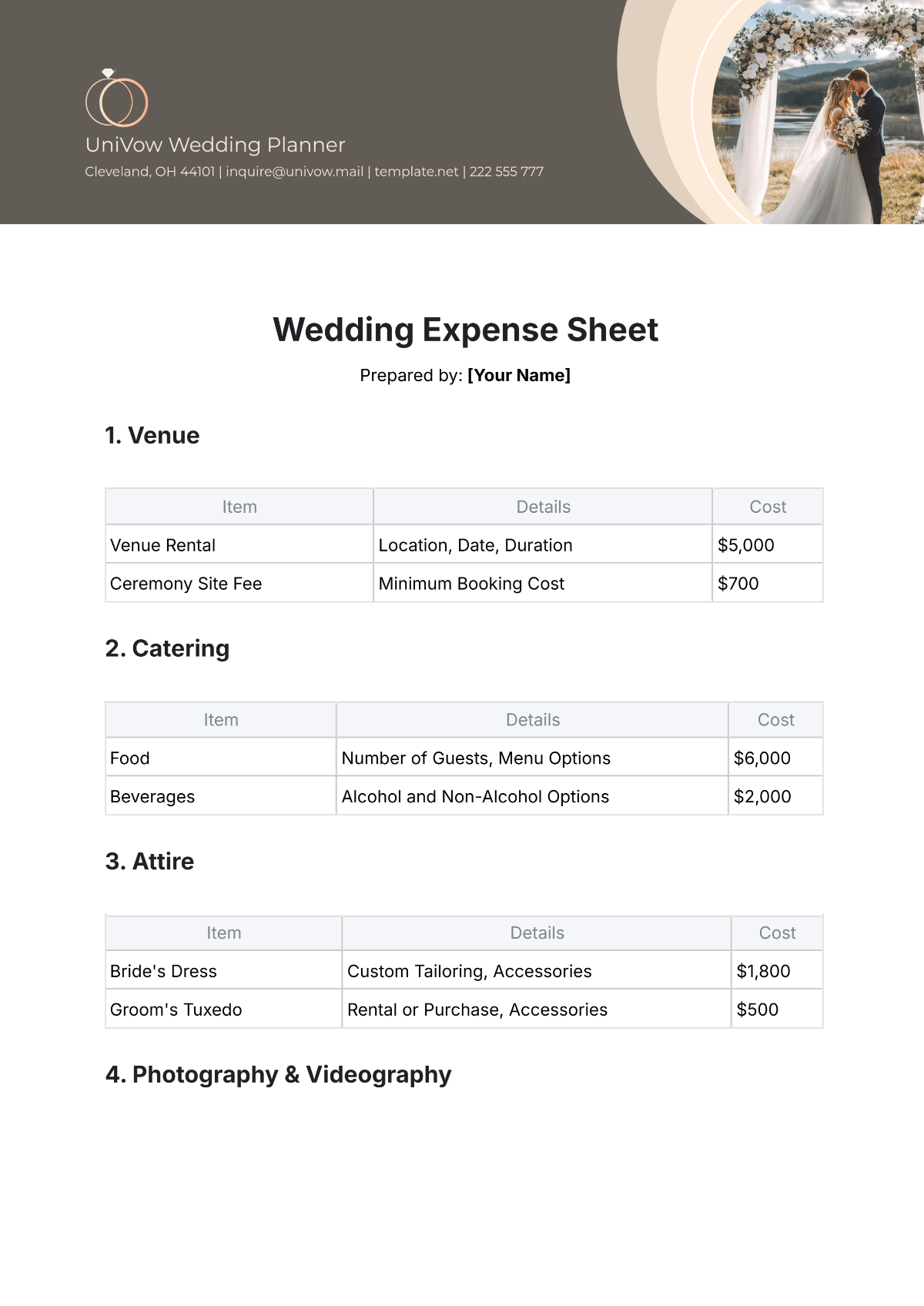

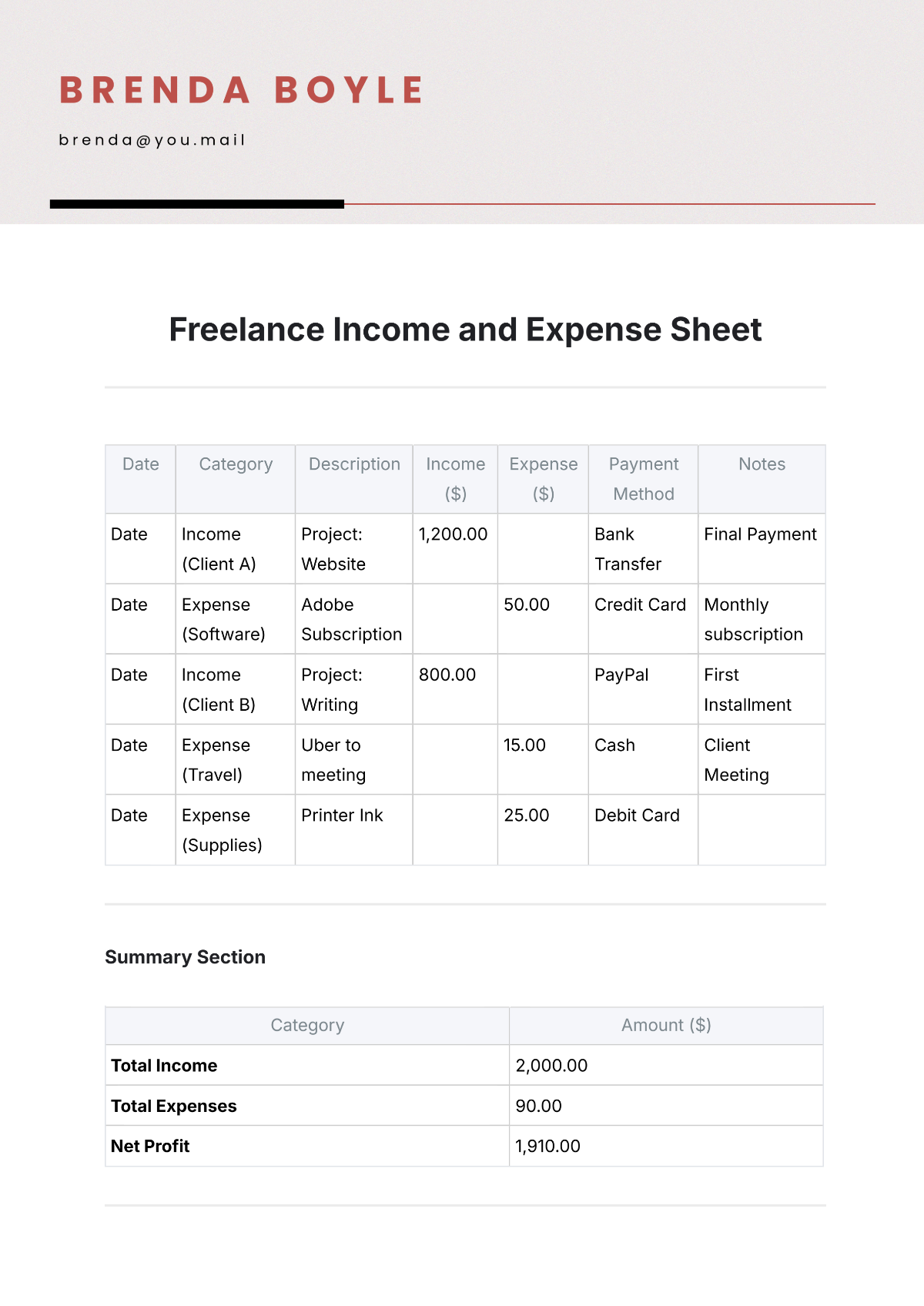

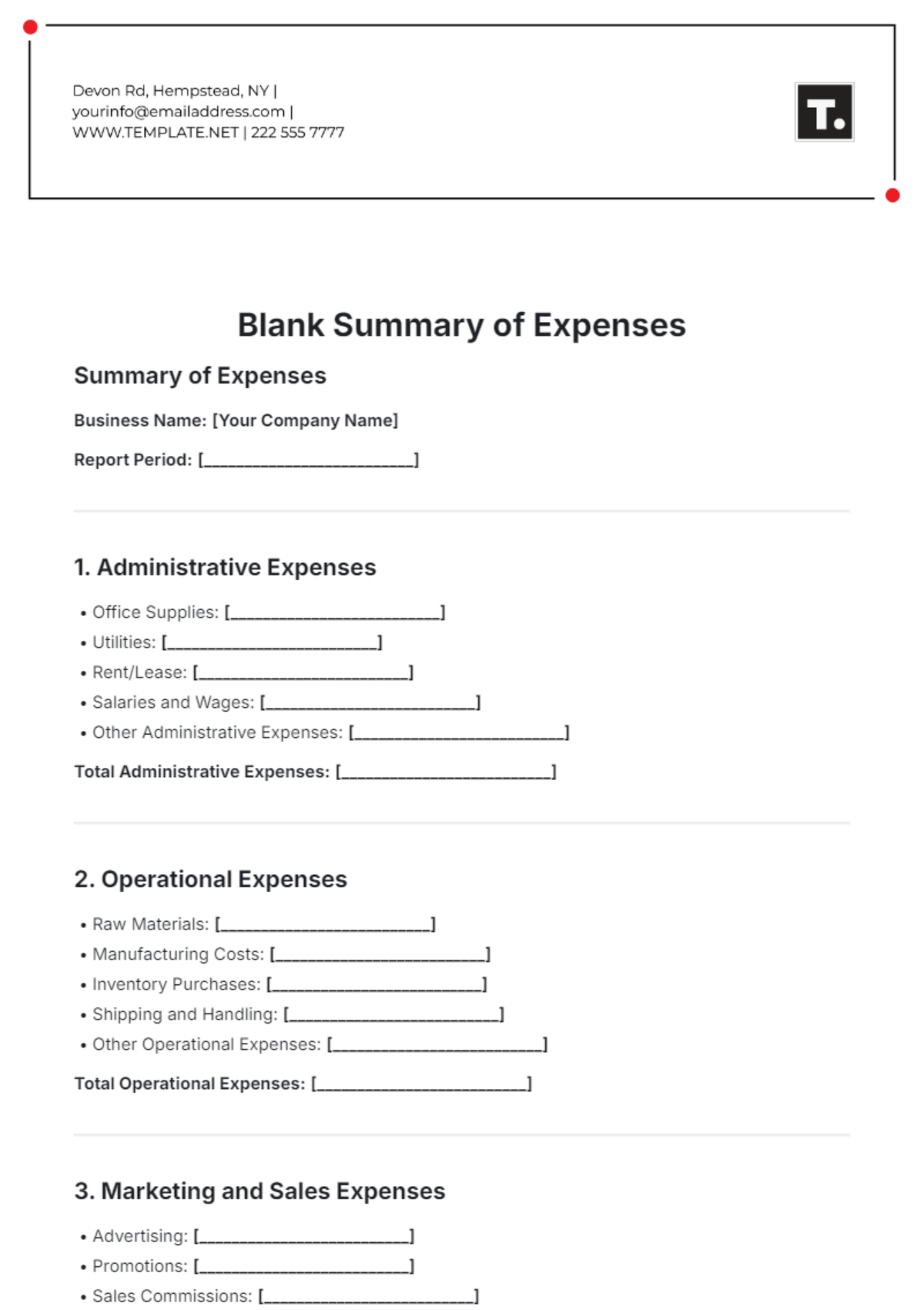

Savings & Investments

Allocations of income for future use or financial growth, including accounts and stocks.

Emergency Fund Contribution: $300

Retirement Account Contribution: $400

Stock Investments: $200

Total Savings & Investments: $900

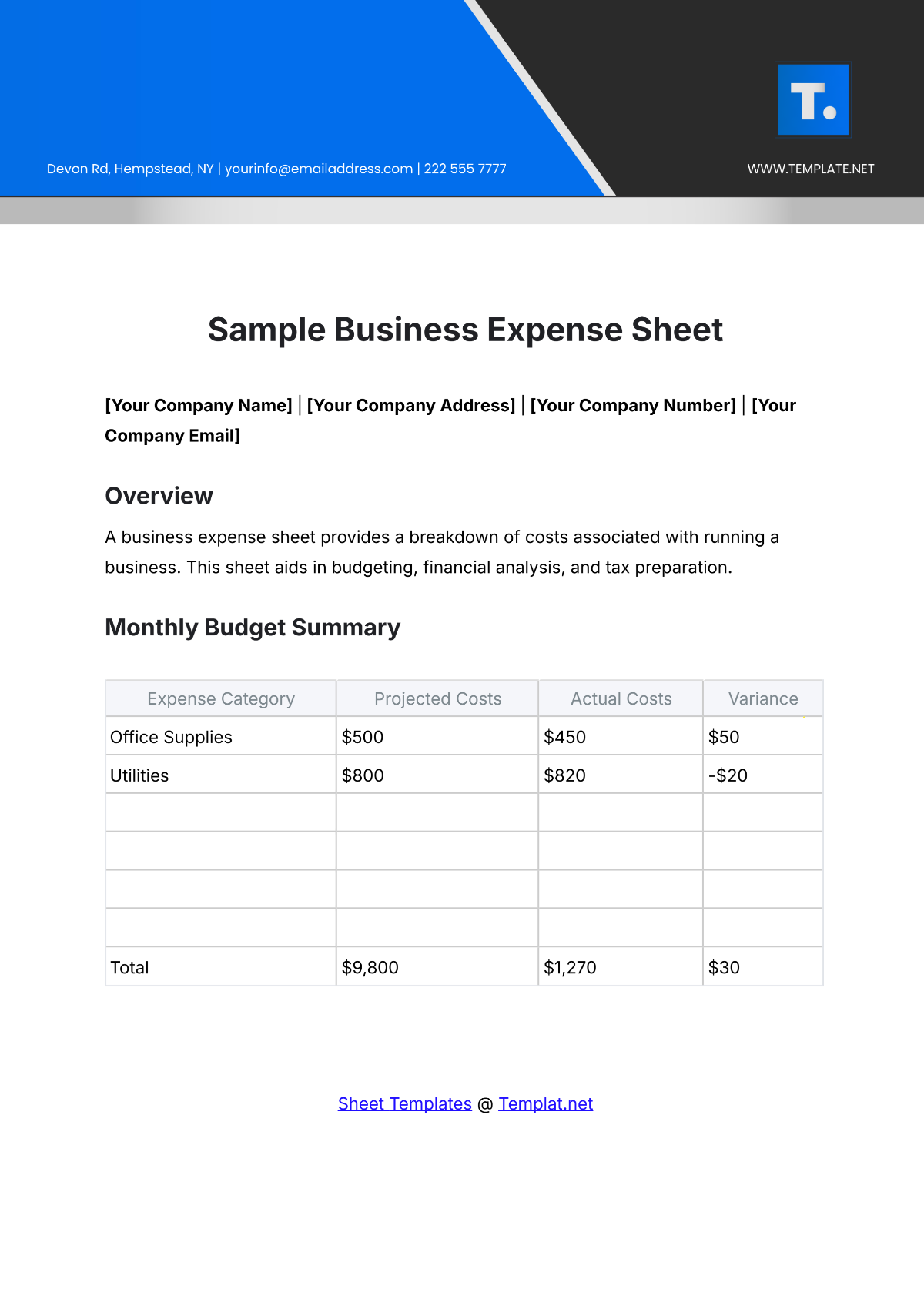

Total Monthly Expenses

Summation of all monthly expenses, including fixed and variable costs.

Fixed Expenses + Variable Expenses = Total Monthly Expenses

Total Monthly Expenses: $2,580

Balance Overview

Calculation of remaining balance after all expenses have been deducted from income.

Total Monthly Income - Total Monthly Expenses - Savings & Investments = Balance

Remaining Monthly Balance: $1,220

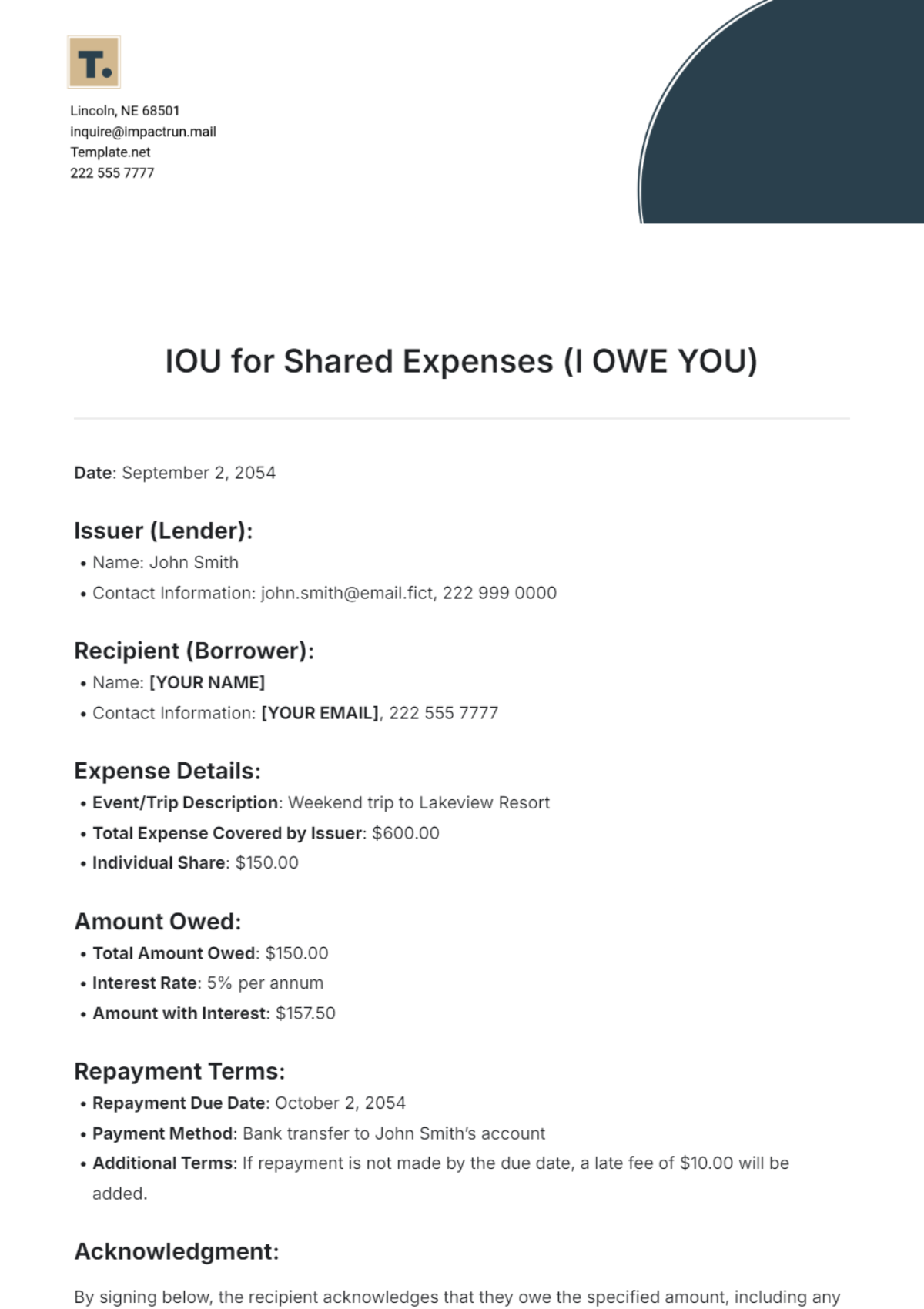

Financial Goals

Aim to increase savings and reduce unnecessary spending to further improve financial health and achieve desired objectives.

Reduce Dining Out to $100

Increase Emergency Fund Contribution to $400

Review and minimize subscriptions