Take complete control over your finances by employing persons solely responsible for your business finances. This is where our Treasurer and Controller Job Description template comes in. Get a controller who prepares your financial statements and reports and treasurers who are able to communicate with bankers, shareholders, and potential investors. Find suitable candidates using our template as basis for your qualifications. Give your company control over accounts and the ability to get loans and investments. Get the edge over your competition by having balanced financials and meeting financial targets after employing appropriate and well trained treasurers and controllers using our template. Get it by downloading now!

Know more about this Template

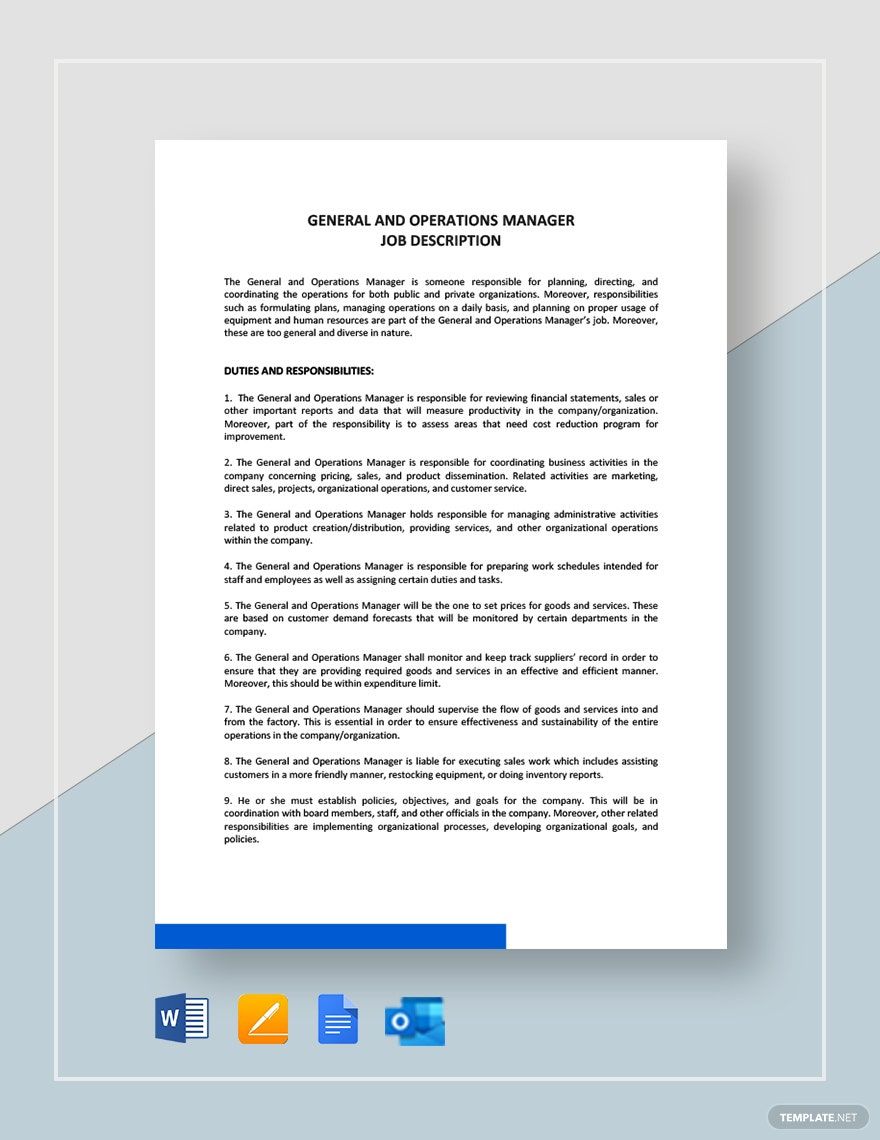

TREASURER AND CONTROLLER JOB DESCRIPTION

Job Title

TREASURER AND CONTROLLER

Job Description

This position comprises the obtainment, venture and arranging of monetary exercises in all parts of the association or organization.

Responsible to

[NAME]

Responsible for

Ultimately charge of the bookkeeping of cash received, spent and contributed by the association or organization and in addition the accounting activities of the association or organization and guarantee that every one of the outcomes are consistent to the generally accepted principles on accounting or with the international financial reporting standards.

Location of the Role

[ADDRESS]

PURPOSE OF THE JOB

Accounting is a standout amongst the most crucial parts of the business association or organization and an appropriate accounting is of need.

Appropriate accounting is imperative since it helps in keeping the records of the association or organization stable.

Fundamentally, a financial controller is the head accountant of the company. They administer different accountants and direct the planning of money related reports, for example, wage proclamations and monetary records.

The treasurer fills in as the defender of an organization's esteem and funds from budgetary dangers that emerges from business exercises. Customarily, a treasurer is under the accounting division.

The Treasurer and Controller must have:

1. The capacity to produce or utilize distinctive arrangements of principles for combining or grouping things in various ways.

2. The capacity to recall data, for example, words, numbers, pictures, and methods.

3. The capacity to rapidly understand, consolidate, and sort out data into significant examples.

4. The capacity to listen and comprehend data and thoughts displayed through spoken words and sentences.

5. The capacity to peruse and comprehend data and thoughts displayed in writing.

6. The capacity to apply general guidelines to particular issues to create answers that make sense.

7. The capacity to see subtle elements at short proximity.

8. The capacity to think of smart and unusual thoughts regarding a given theme or circumstance, or to create imaginative approaches to take care of an issue.

9. The capacity to use the privilege numerical strategies or solutions to take care of an issue.

10. The capacity to add, subtract, divide, or multiply rapidly and effectively.

11. The capacity to impart data and thoughts in talking so others will get it.

12. The capacity to convey data and thoughts in writing so others will get it.

13. The capacity to tell when something isn't right or is probably going to turn out badly. It does not include taking care of the issue, just perceiving that there really is an issue.

14. The capacity to talk plainly so others can comprehend.

15. The capacity to master things or activities in a specific request or example as indicated by a particular administer or set of standards.

KEY ACCOUNTABILITIES

1. Empowering and building common respect and trust among colleagues.

2. Speaking with individuals outside the association, speaking for the association towards the clients, the general population, government, and other outer sources. This data can be exchanged face to face, in writing, or by phone or email.

3. Watching, accepting, and generally acquiring data from every single applicable source.

4. Giving data to managers, colleagues, and subordinates by phone, written, email, or face to face.

5. Planning occasions, projects, and exercises, as well as those crafted by others.

6. Utilizing PCs to program, write programming, set up capacities, enter information, or process data.

7. Observing and checking on data from materials, occasions, or nature, to distinguish or evaluate issues.

8. Staying up with what is the latest and further applying new learning to activity.

9. Creating valuable and helpful working associations with others and keeping up them after some time.

10. Giving direction and master guidance to administration or different departments on specialized, frameworks, or process-related points.

11. Checking and controlling assets and regulating the spending of cash.

12. Deciphering or clarifying what data means and how it can be utilized.

13. Arranging, coding, ordering, figuring, classifying, evaluating, or confirming data or information.

14. Giving direction and heading to subordinates, including setting execution benchmarks and checking execution.

15. Performing everyday regulatory assignments, for example, keeping up data documents and handling printed material.

16. Examining data and assessing results to pick the best solution and take care of issues.

17. Entering, deciphering, recording, putting away, or keeping up data in writing.

18. Distinguishing data by arranging, evaluating, perceiving contrasts and recognizing changes in conditions or occasions.

19. Building up long-run goals and indicating the methodologies and activities to accomplish them.

20. Utilizing important data and individual judgment to decide if occasions or procedures follow laws, controls, or benchmarks.

21. Creating, outlining, or making new applications, thoughts, connections, frameworks, or items, including contributions that are artistic.

DUTIES

1. Get ready or direct arrangement of monetary explanations, business movement reports, money related position conjectures, yearly spending plans, and additionally reports required by administrative offices.

2. Dissect the monetary subtle elements of past, present, and anticipated that would distinguish opportunities for development and areas where change is required.

3. Direct or facilitate reviews of organization accounts and money related exchanges to guarantee consistency with state and government prerequisites and statutes.

4. Monitor and assess the execution of accounting and other financial staff; suggest and actualize faculty activities, for example, advancements and rejections.

5. Monitor the financial activities and points of interest, for example, hold levels to guarantee that all lawful and administrative necessities are met.

6. Keep up current information of authoritative approaches and methods, government and state arrangements and mandates, and current bookkeeping norms.

7. Manage employees performing money related detailing, accounting, charging, accumulations, finance, and planning obligations.

8. Arrange and direct the budgetary arranging, planning, acquirement, or venture exercises of all or part of an association.

9. Create interior control approaches, rules, and methods for activities, for example, budget administration, money and credit administration, and accounting.

9. Assess requirements for acquisition of assets and speculation of surpluses and make fitting proposals.

10. Lead staff training and advancement in planning and money related administration areas.

11. Give guidance and help to other authoritative units in regard to accounting and planning strategies and methods, and productive control and usage of budgetary assets.

12. Get and record demands for distributions; approve payment as per disbursement thereof in accord to the methods.

QUALIFICATIONS

Essential Specification:

1. Knows how to utilize arithmetic to take care of issues.

2. Utilizing rationale and thinking to recognize the qualities and shortcomings of elective arrangements, conclusions or ways to deal with issues.

3. Thinking about the relative expenses and advantages of potential activities to pick the most proper one.

4. Understanding composed sentences and sections in business related records.

5. Conveying successfully in writing as proper for the audience.

6. Conversing with others to pass on data adequately.

7. Deciding how a framework should function and how changes in conditions, tasks, and the environment will influence results.

8. Distinguishing complex issues and investigating related data to create and assess choices and execute arrangements.

9. Understanding the ramifications of new data for both present and future critical thinking and basic leadership.

10. Checking/Assessing execution of one's self, other people, or associations to make changes or make restorative move.

Desirable Specification:

1. Information of monetary and accounting standards and practices, the budgetary markets, banking and the examination and reporting of monetary information.

2. Learning of business and administration standards associated with vital arranging, asset allotment, HR modeling, authority procedure, generation techniques, and coordination of individuals and resources.

3. Learning of arithmetic, polynomial math, geometry, analytics, measurements, and their applications.

4. Learning of laws, legitimate codes, court procedure, points of reference, government regulations, executive orders, office rules, and the vote based political process.

5. Learning the structure and substance of the English dialect including the importance and spelling of words, principles of composition, and language structure.