Free General Accountant Job Description

Free Download this General Accountant Job Description Design in Word, Google Docs, PDF, Apple Pages Format. Easily Editable, Printable, Downloadable.

A General Accountant has a big role to play in business. If you’re planning to hire one for your company, you should make sure to have a job description that’s clear and concise to avoid conflict and misunderstanding of the role in the future. Get started with our well-written General Accountant Job Description template that will aid you to communicate better. Make this your company's own just by simply replacing highlighted words with your own details. For added convenience, download it anytime, anywhere on any of your mobile devices. Don’t waste anymore of your time, avail this Accountant Job Description template today!

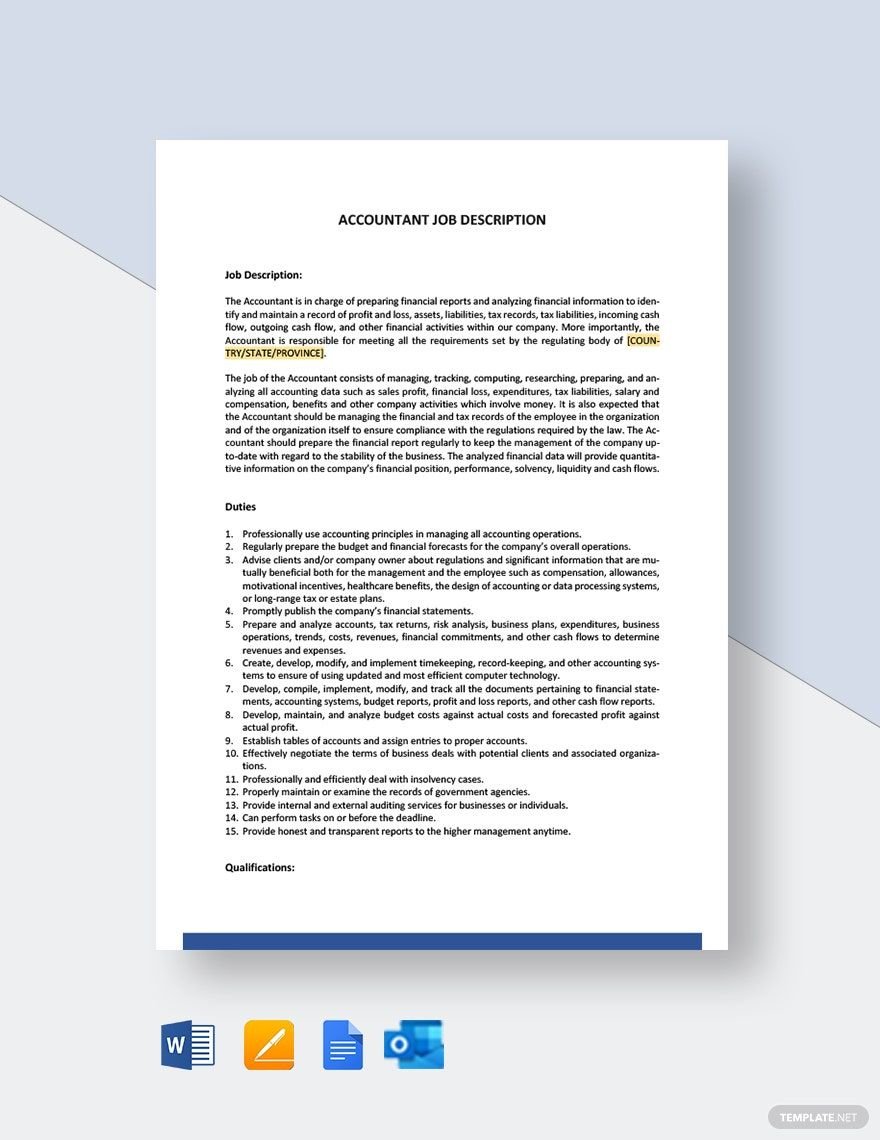

ACCOUNTANT JOB DESCRIPTION

Job Description:

The Accountant is in charge of preparing financial reports and analyzing financial information to identify and maintain a record of profit and loss, assets, liabilities, tax records, tax liabilities, incoming cash flow, outgoing cash flow, and other financial activities within our company. More importantly, the Accountant is responsible for meeting all the requirements set by the regulating body of [COUNTRY/STATE/PROVINCE].

The job of the Accountant consists of managing, tracking, computing, researching, preparing, and analyzing all accounting data such as sales profit, financial loss, expenditures, tax liabilities, salary and compensation, benefits and other company activities which involve money. It is also expected that the Accountant should be managing the financial and tax records of the employee in the organization and of the organization itself to ensure compliance with the regulations required by the law. The Accountant should prepare the financial report regularly to keep the management of the company up-to-date with regard to the stability of the business. The analyzed financial data will provide quantitative information on the company’s financial position, performance, solvency, liquidity and cash flows.

Duties:

- Professionally use accounting principles in managing all accounting operations.

- Regularly prepare the budget and financial forecasts for the company’s overall operations.

- Advise clients and/or company owner about regulations and significant information that are mutually beneficial both for the management and the employee such as compensation, allowances, motivational incentives, healthcare benefits, the design of accounting or data processing systems, or long-range tax or estate plans.

- Promptly publish the company’s financial statements.

- Prepare and analyze accounts, tax returns, risk analysis, business plans, expenditures, business operations, trends, costs, revenues, financial commitments, and other cash flows to determine revenues and expenses.

- Create, develop, modify, and implement timekeeping, record-keeping, and other accounting systems to ensure of using updated and most efficient computer technology.

- Develop, compile, implement, modify, and track all the documents pertaining to financial statements, accounting systems, budget reports, profit and loss reports, and other cash flow reports.

- Develop, maintain, and analyze budget costs against actual costs and forecasted profit against actual profit.

- Establish tables of accounts and assign entries to proper accounts.

- Effectively negotiate the terms of business deals with potential clients and associated organizations.

- Professionally and efficiently deal with insolvency cases.

- Properly maintain or examine the records of government agencies.

- Provide internal and external auditing services for businesses or individuals.

- Can perform tasks on or before the deadline.

- Provide honest and transparent reports to the higher management anytime.

Qualifications:

A. Education:

- A four-year bachelor’s degree in Accounting or Account Management

- Advanced degree in Accounting is a plus

- Preferably a Certified Public Accountant (CPA) or Certified Management Accountant (CMA)

B. Experience:

Proven working experience as an accountant or in any relevant field

Worked as an Accountant for [NUMBER] year(s)

C. Knowledge and Skills

- Excellent or highly trainable in accounting software [DETAILS]

- Strong attention to detail and confidentiality

- Excellent with basic math operations

- High analytical skills

- Good listening and communication skills

- Organized with the documents and efficient in time management

- Deadline-oriented

- Observes a methodical approach and possesses good problem-solving skills

- Has good teamwork ability, possesses integrity, and is self-motivated

- Business acumen and interest

Work Schedule:

The Accountant normally works [NUMBER 1] hours per week from [DETAIL 1]. The official working time is from [TIME] until [TIME 1].

Compensation and Benefits Package:

The Accountant rightfully receives a non-taxable basic salary pay of [NUMBER 2], an allowance of [NUMBER 3] for [TYPE], overtime pay, bonus pay, sick leave and vacation leave, and other benefits such as [DETAIL 2].

Career Development:

The company is set for expansion and the Accounting department is growing. There is plenty of room for career growth and opportunities.

Company and Work Location:

[COMPANY NAME] is located in [COMPANY ADDRESS].