Free Chief Financial Officer Job Description

Free Download this Chief Financial Officer Job Description Design in Word, Google Docs, PDF, Apple Pages Format. Easily Editable, Printable, Downloadable.

Are you looking for a template to help you properly define and describe the role and responsibilities of a Chief Financial Officer? If so, then take a look at our premium Chief Financial Officer Job Description template. This ready-made file allows you to create a well-formatted document detailing the primary responsibilities for managing the company's finances, including financial planning, management of financial risks, record-keeping, financial reporting, and other related tasks. You can customize this file however you want to better reflect your company's culture. Do not waste any more time staring at your screen, download this template right now to maximize its benefits.

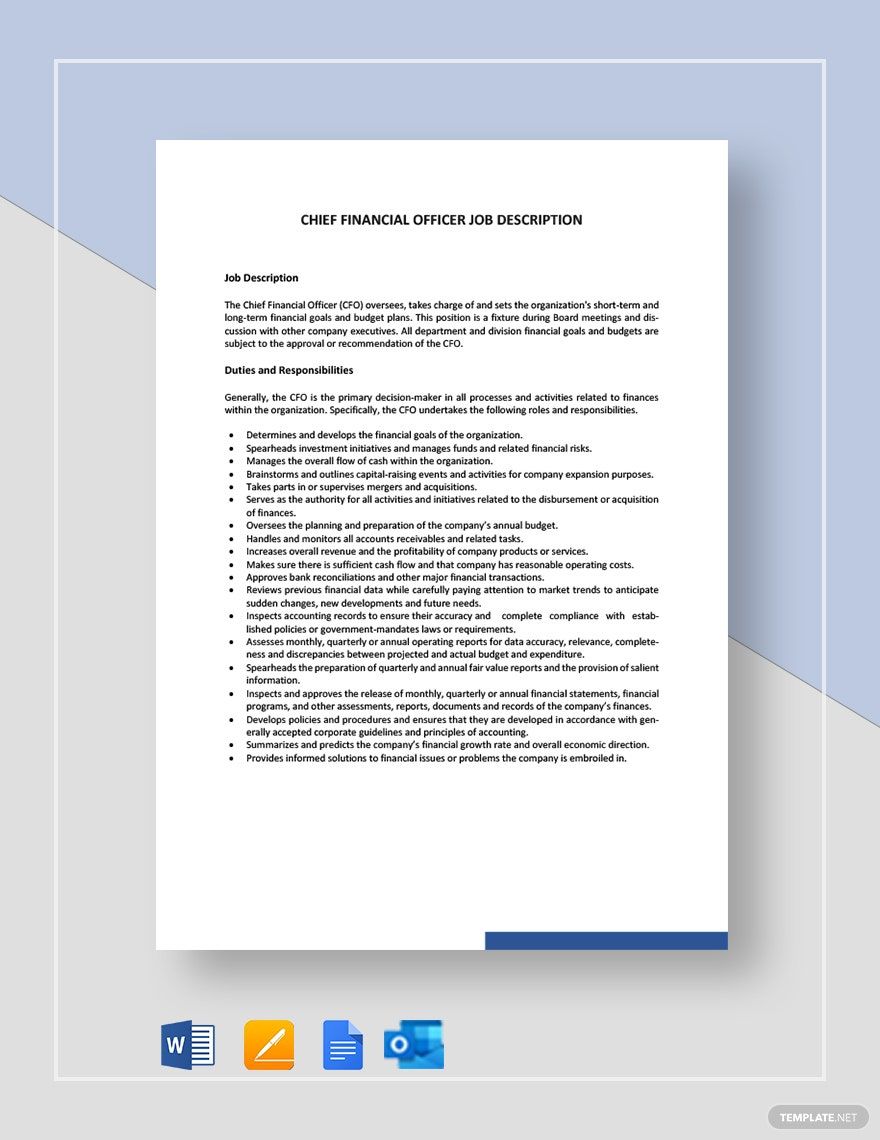

CHIEF FINANCIAL OFFICER JOB DESCRIPTION

The Chief Financial Officer (CFO) oversees, takes charge of and sets the organization's short-term and long-term financial goals and budget plans. This position is a fixture during Board meetings and discussion with other company executives. All department and division financial goals and budgets are subject to the approval or recommendation of the CFO.

Duties and Responsibilities

Generally, the CFO is the primary decision-maker in all processes and activities related to finances within the organization. Specifically, the CFO undertakes the following roles and responsibilities.

- Determines and develops the financial goals of the organization.

- Spearheads investment initiatives and manages funds and related financial risks.

- Manages the overall flow of cash within the organization.

- Brainstorms and outlines capital-raising events and activities for company expansion purposes.

- Takes parts in or supervises mergers and acquisitions.

- Serves as the authority for all activities and initiatives related to the disbursement or acquisition of finances.

- Oversees the planning and preparation of the company’s annual budget.

- Handles and monitors all accounts receivables and related tasks.

- Increases overall revenue and the profitability of company products or services.

- Makes sure there is sufficient cash flow and that company has reasonable operating costs.

- Approves bank reconciliations and other major financial transactions.

- Reviews previous financial data while carefully paying attention to market trends to anticipate sudden changes, new developments and future needs.

- Inspects accounting records to ensure their accuracy and complete compliance with established policies or government-mandates laws or requirements.

- Assesses monthly, quarterly or annual operating reports for data accuracy, relevance, completeness and discrepancies between projected and actual budget and expenditure.

- Spearheads the preparation of quarterly and annual fair value reports and the provision of salient information.

- Inspects and approves the release of monthly, quarterly or annual financial statements, financial programs, and other assessments, reports, documents and records of the company’s finances.

- Develops policies and procedures and ensures that they are developed in accordance with generally accepted corporate guidelines and principles of accounting.

- Summarizes and predicts the company’s financial growth rate and overall economic direction.

- Provides informed solutions to financial issues or problems the company is embroiled in