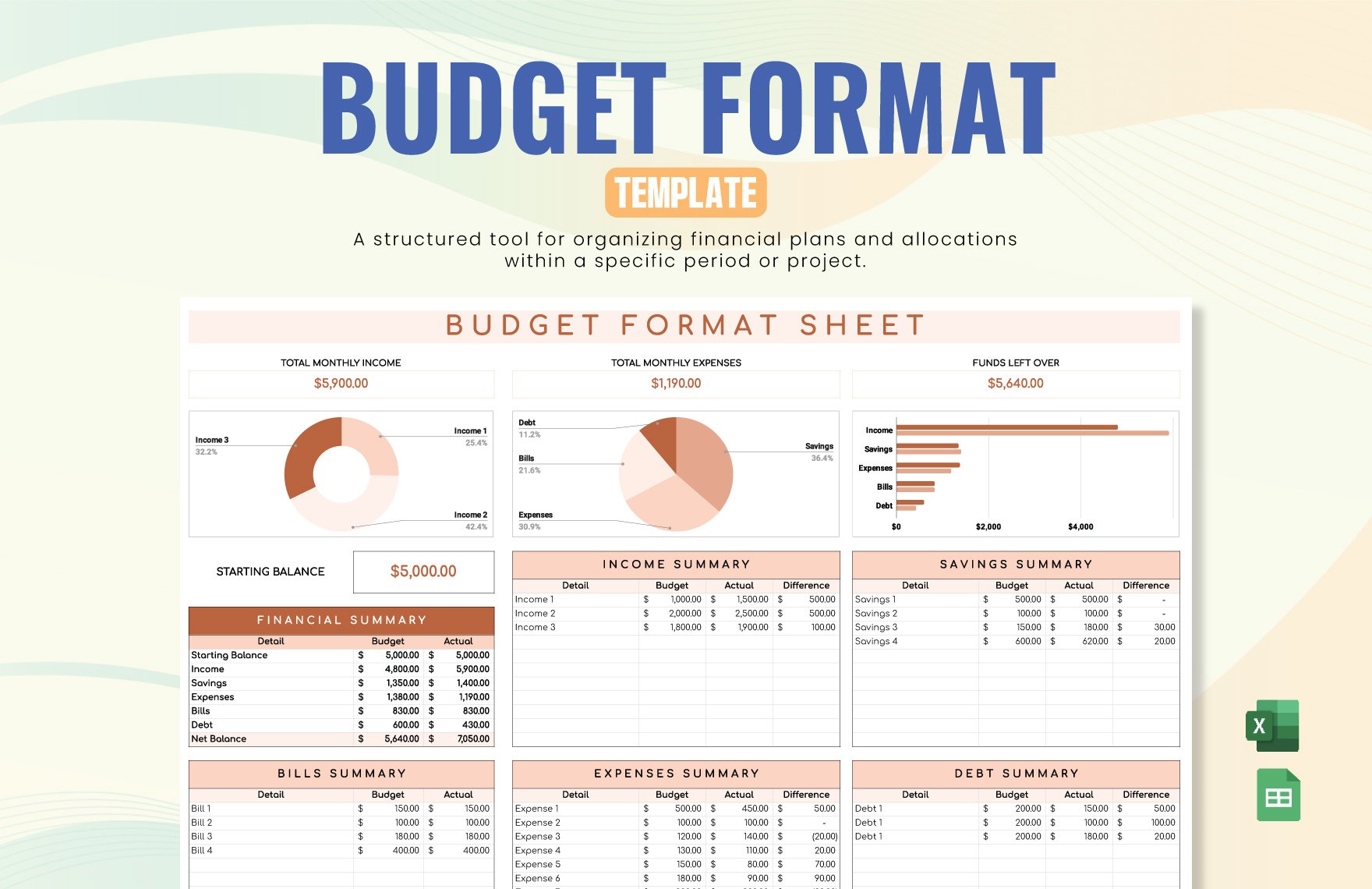

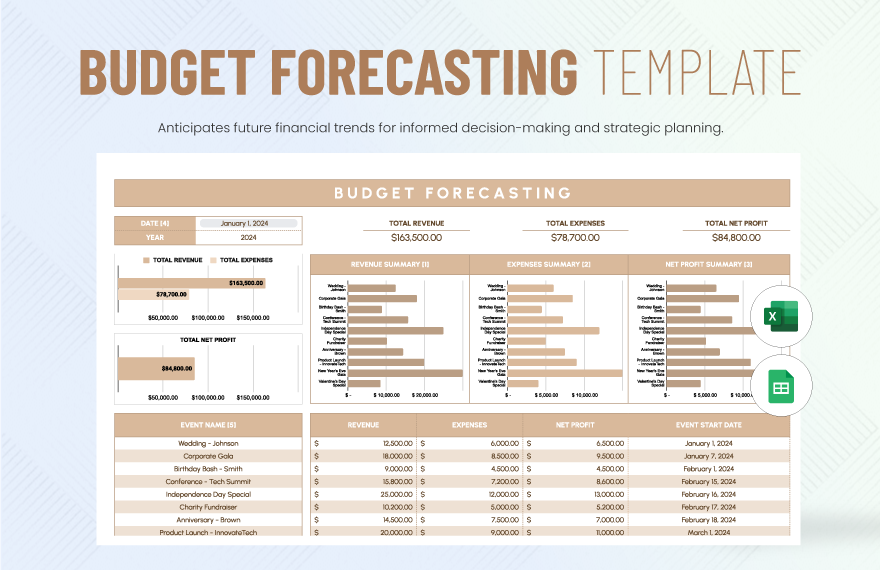

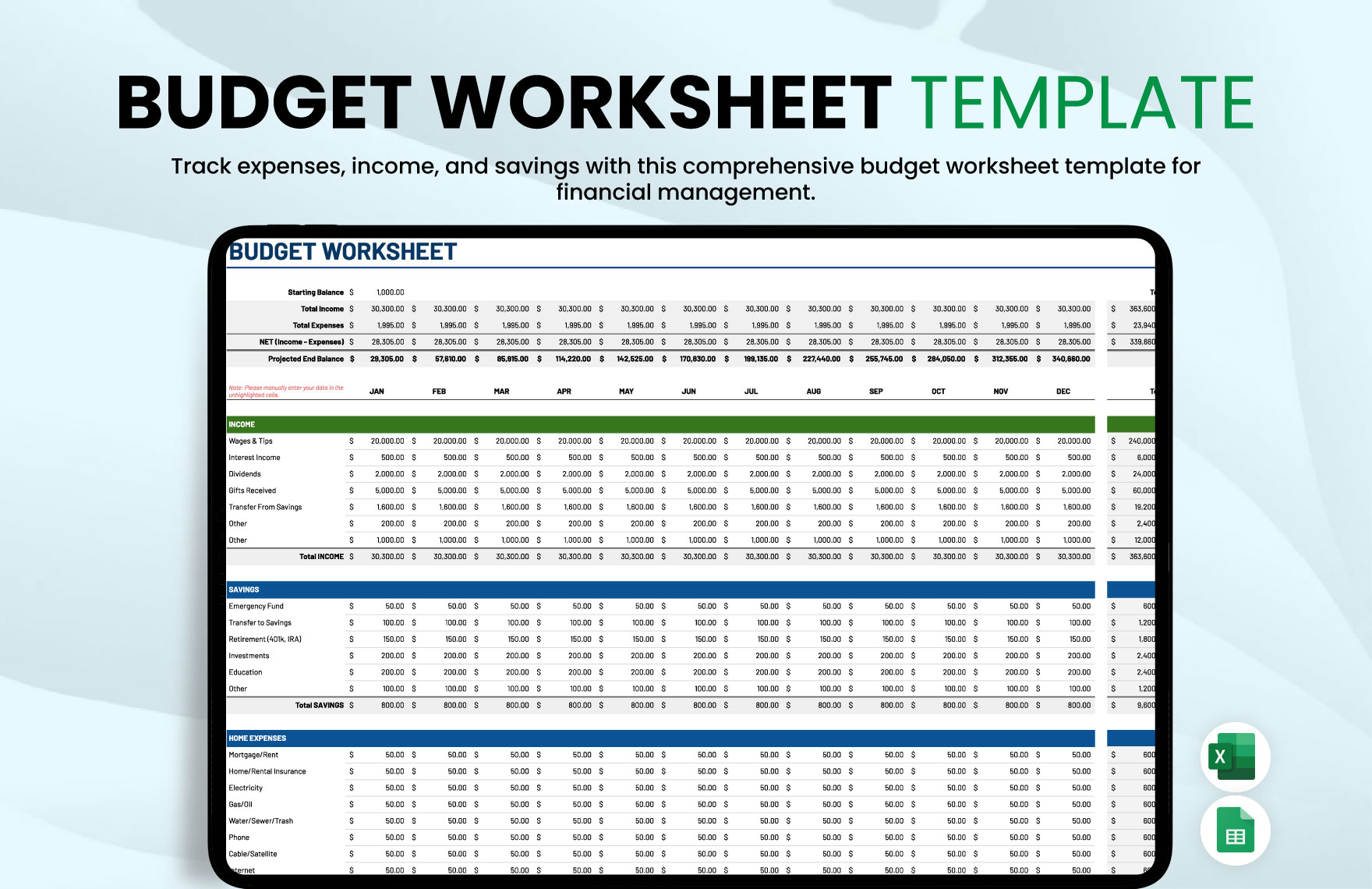

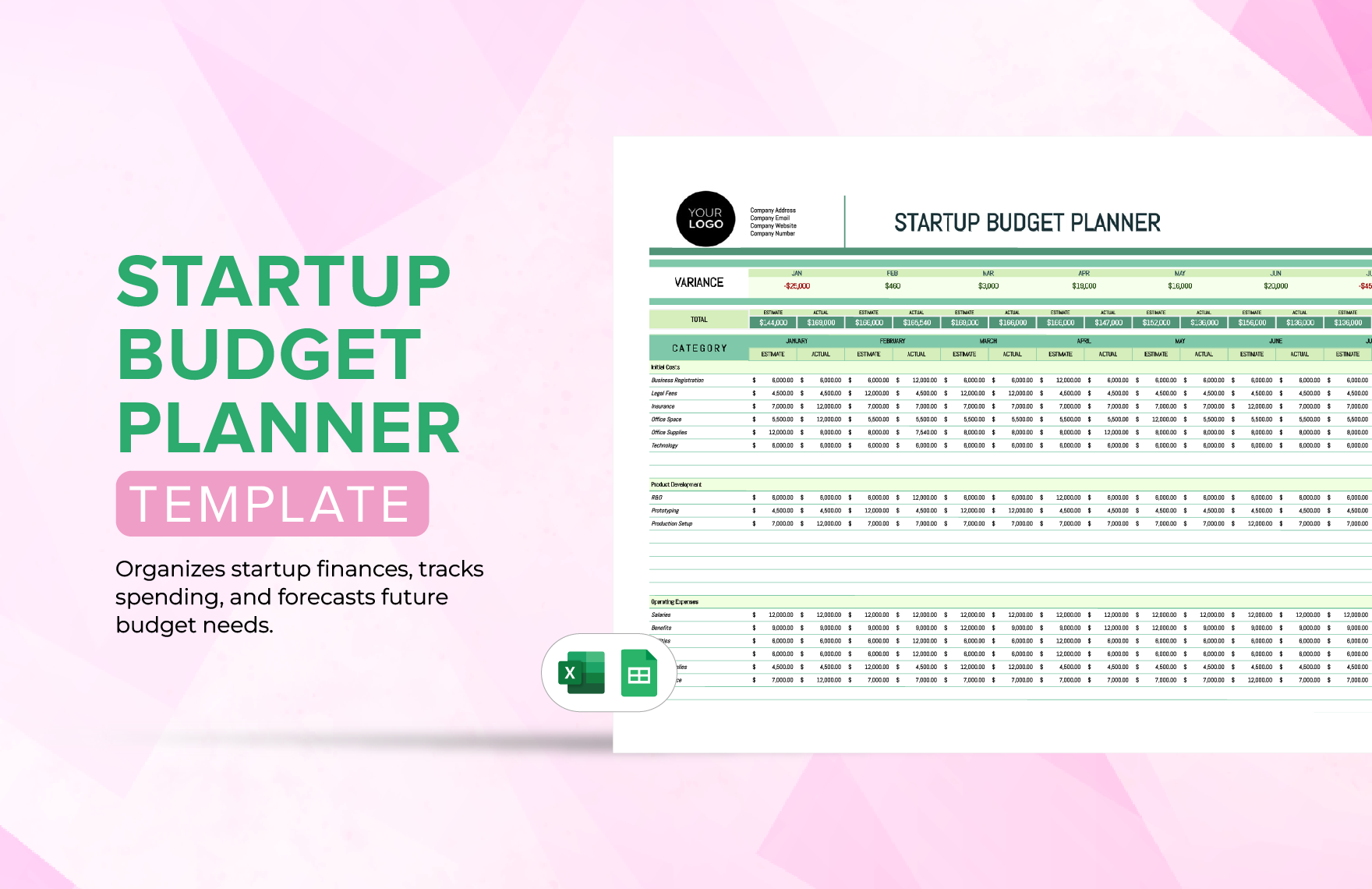

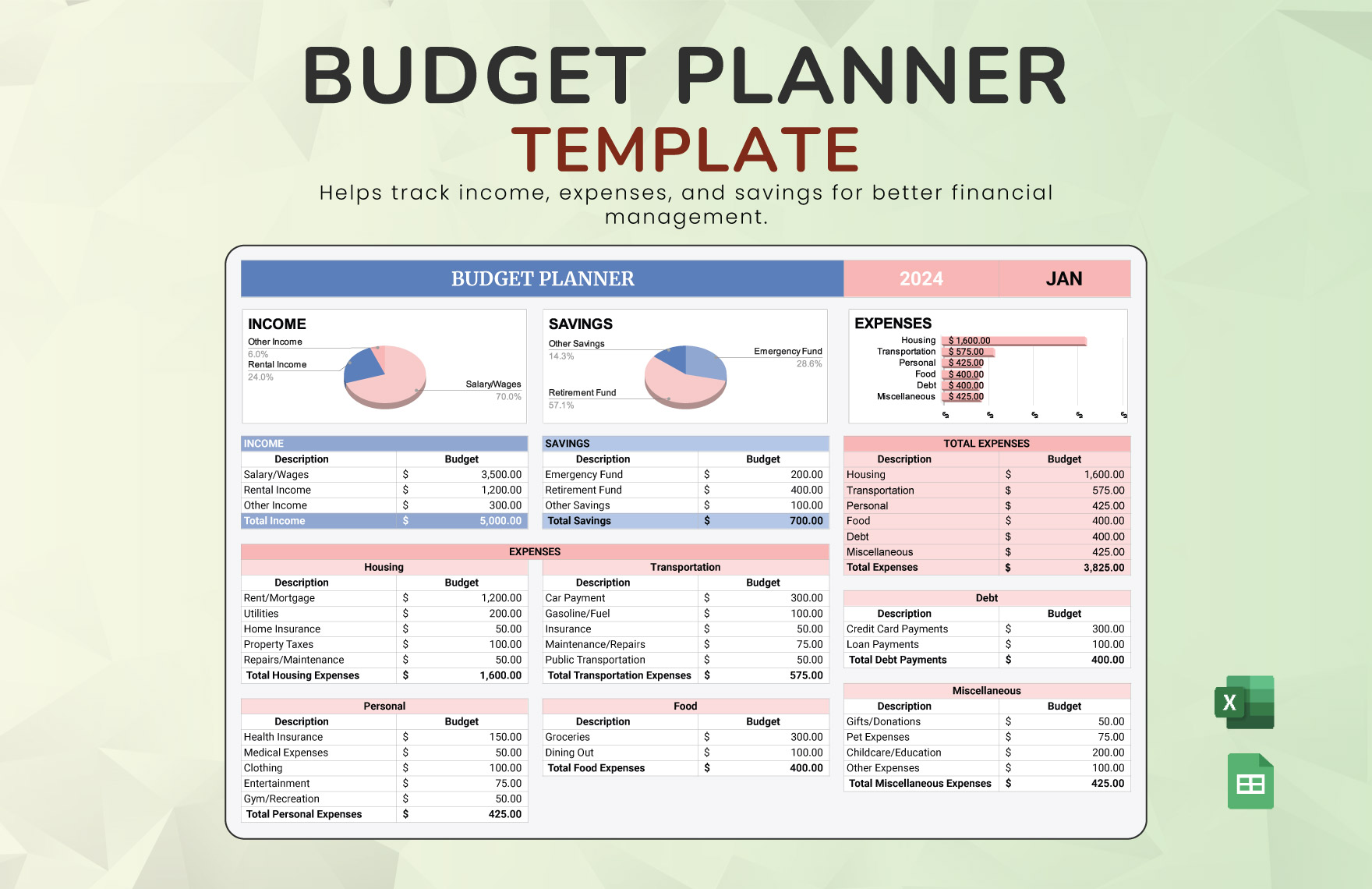

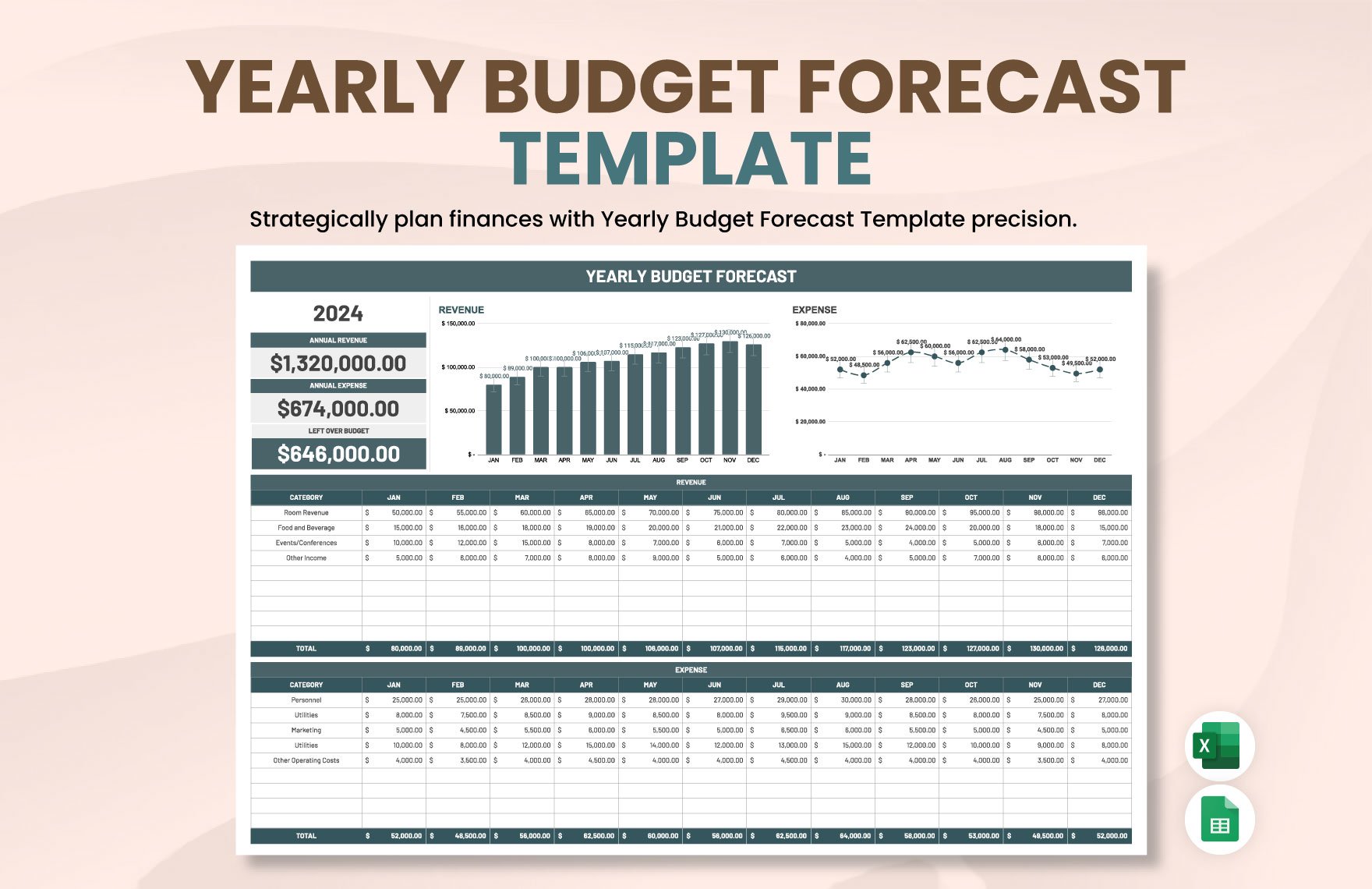

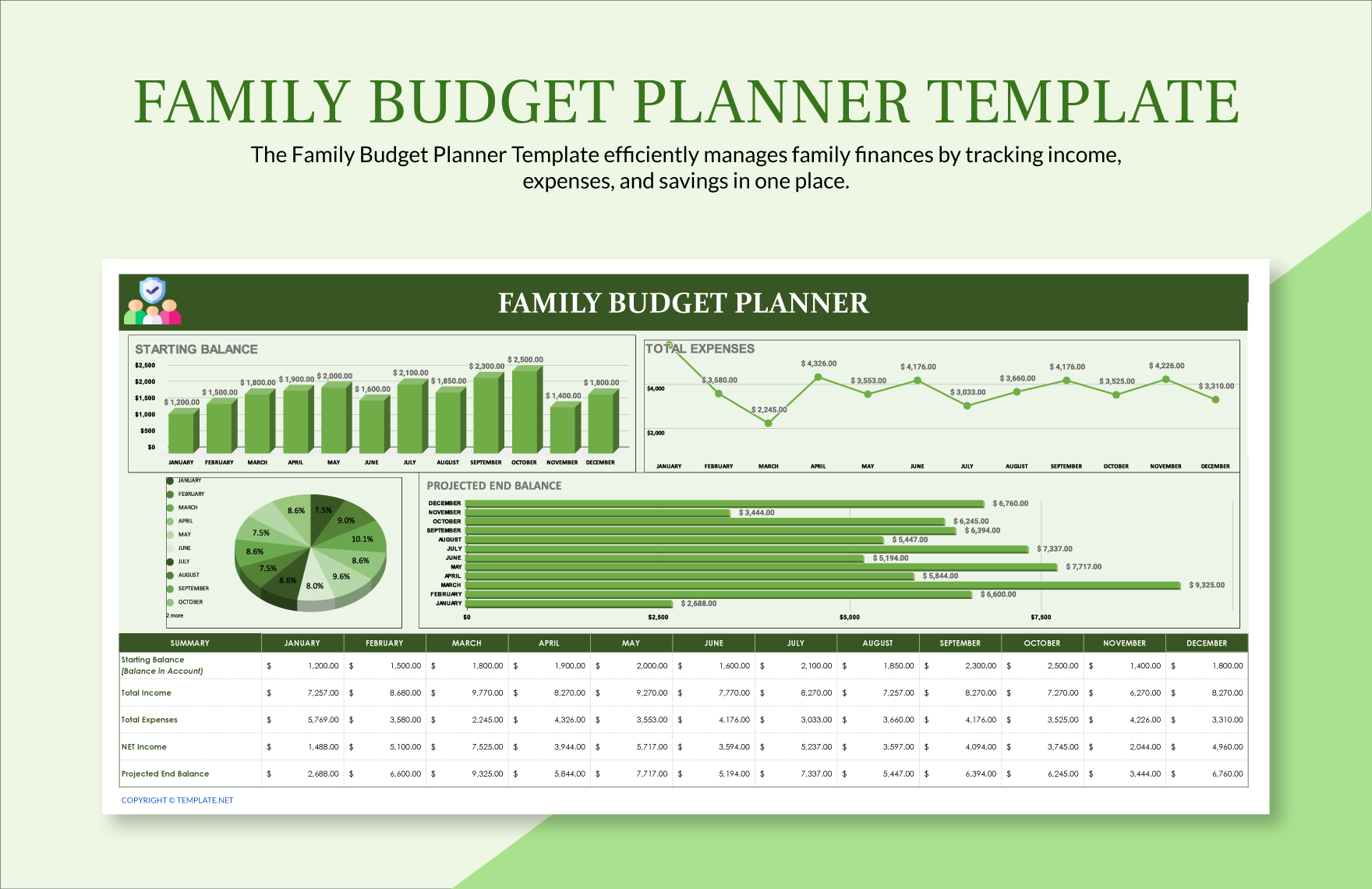

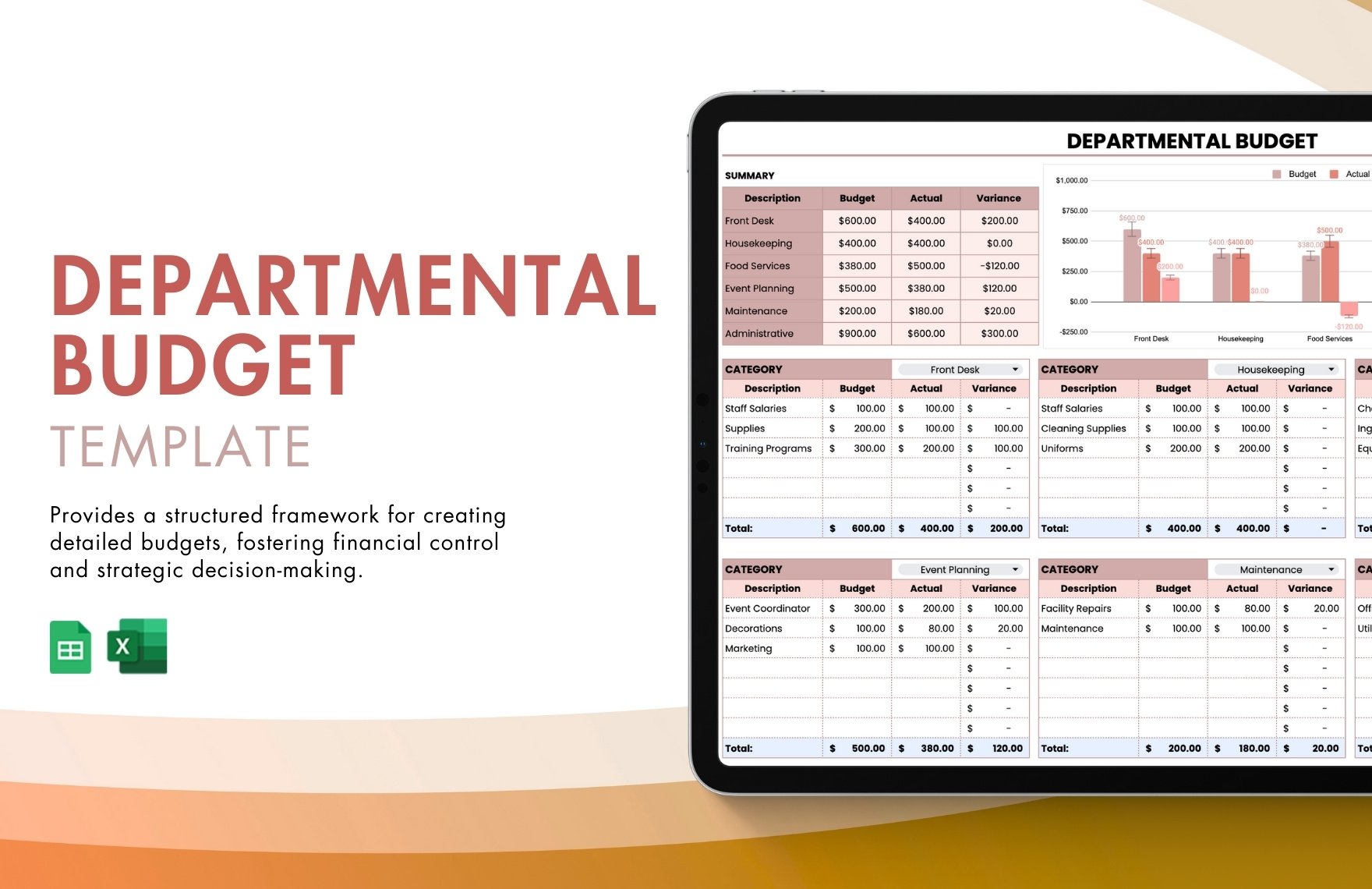

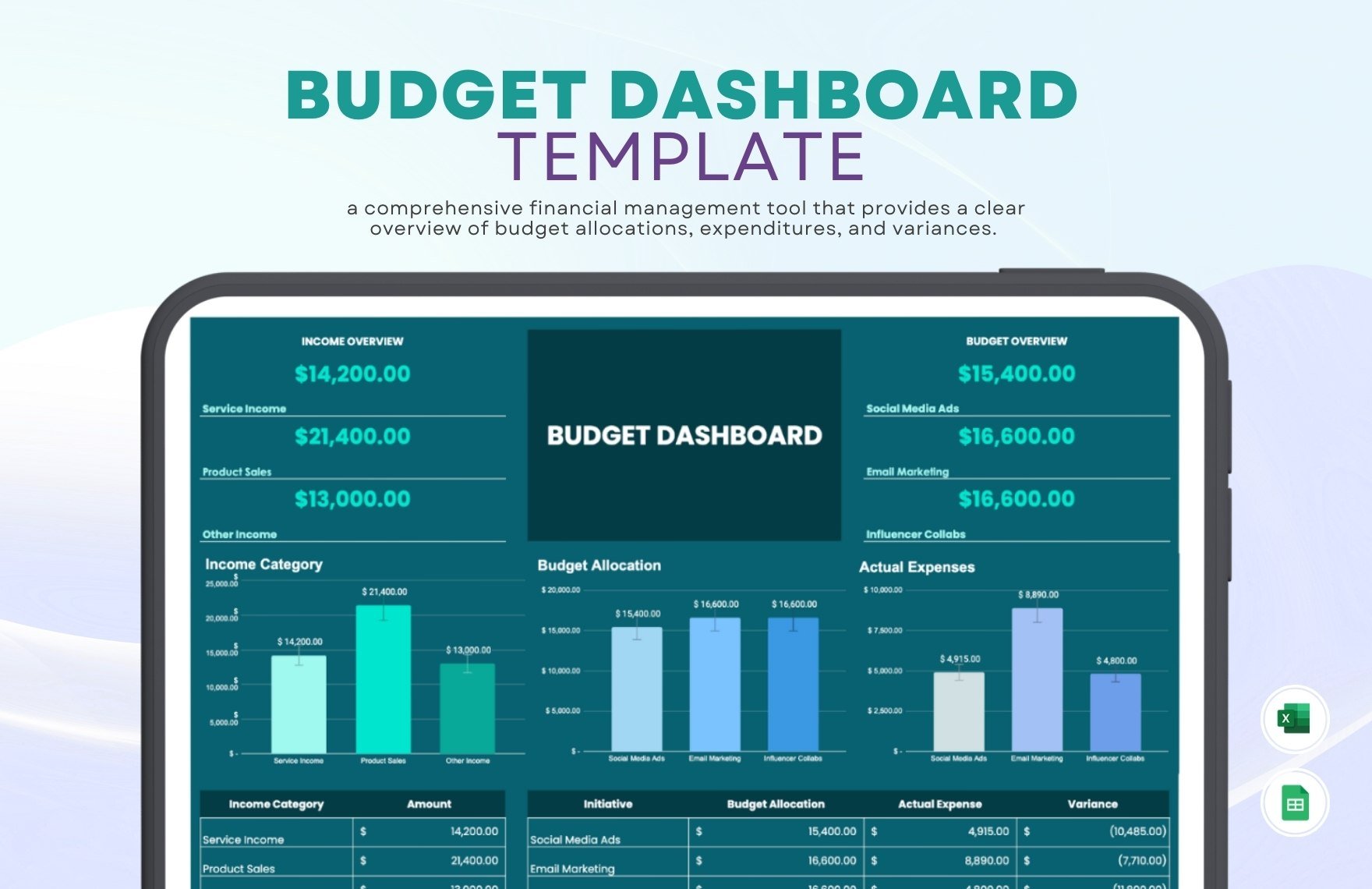

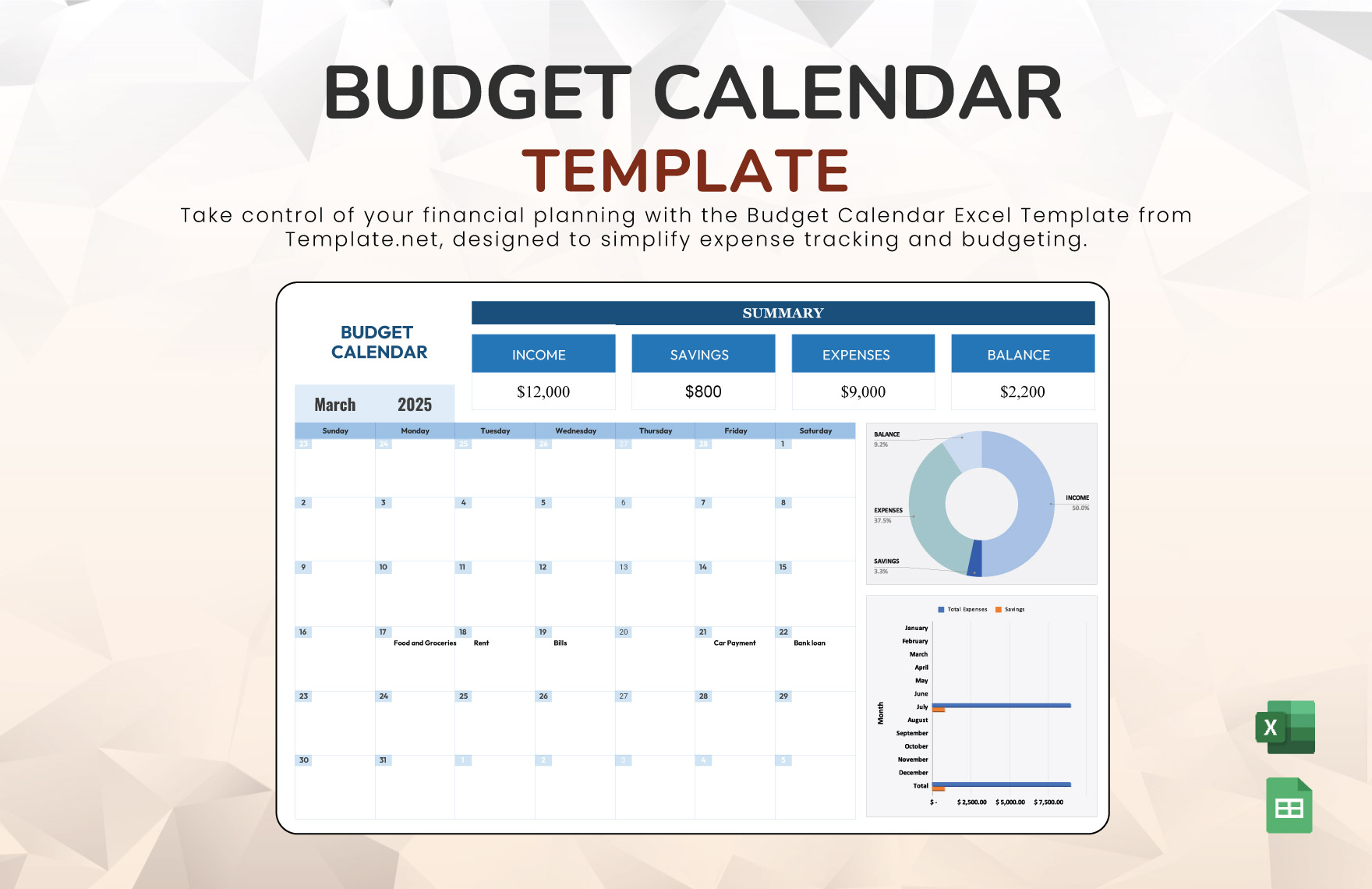

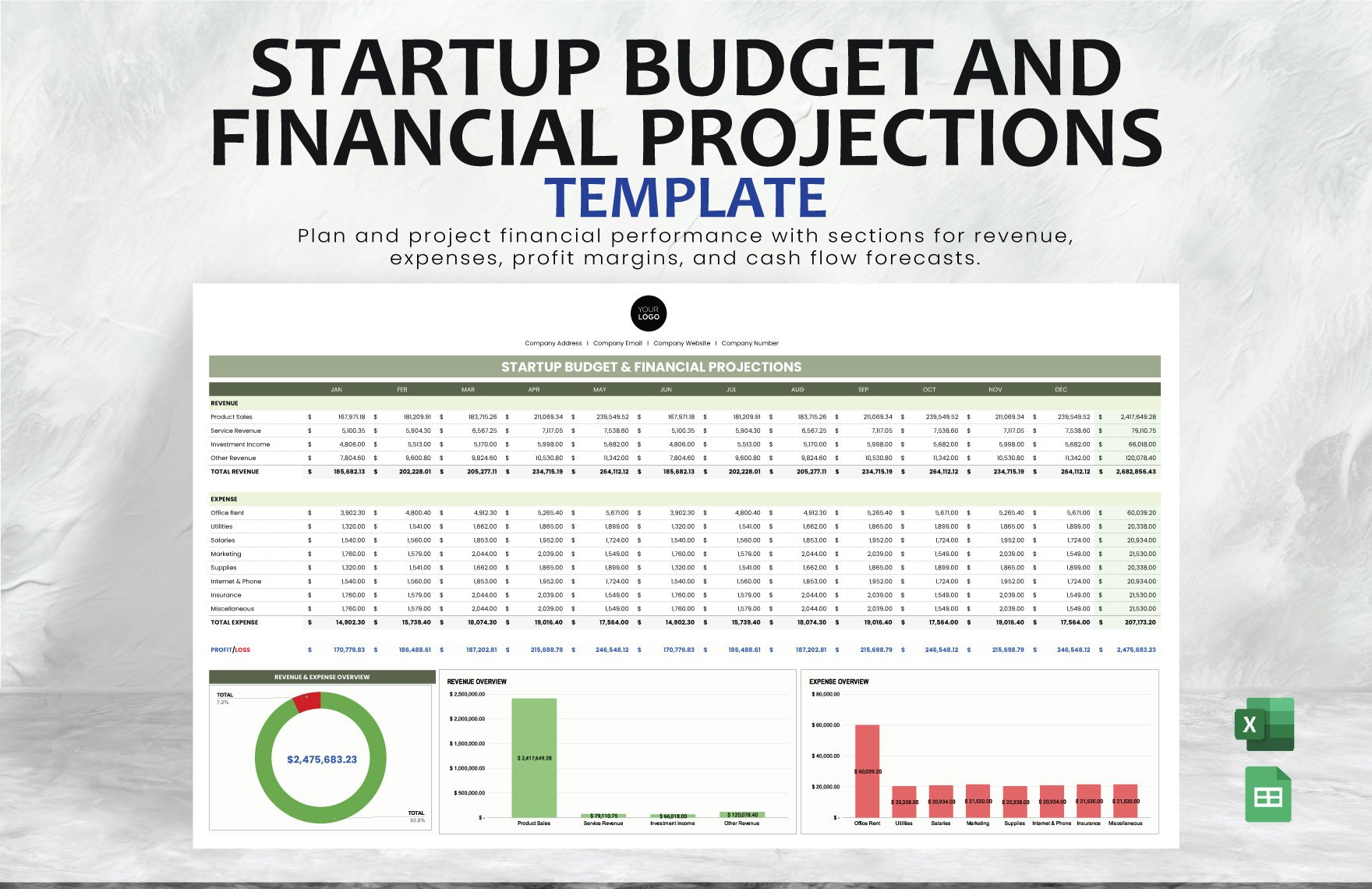

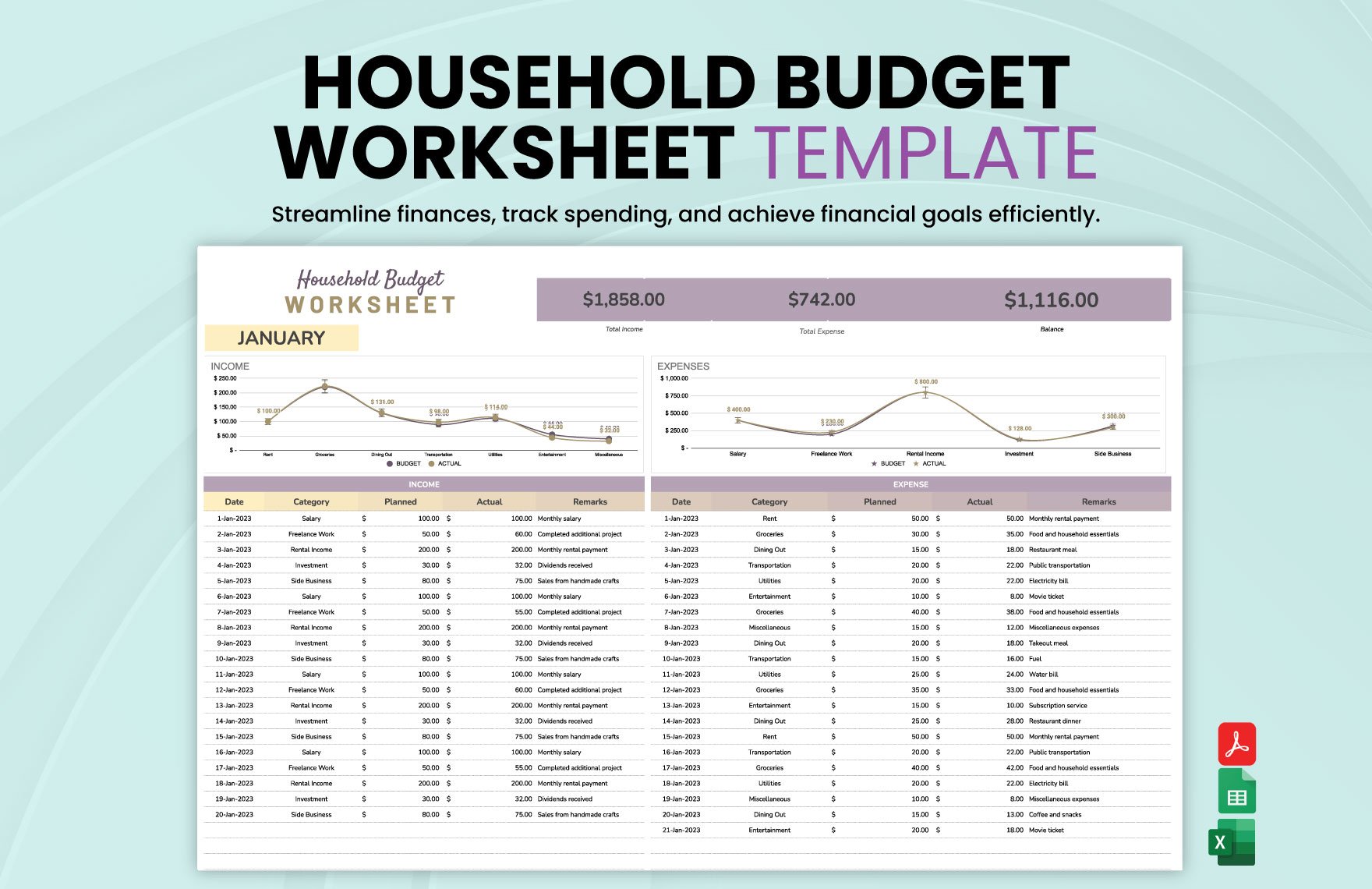

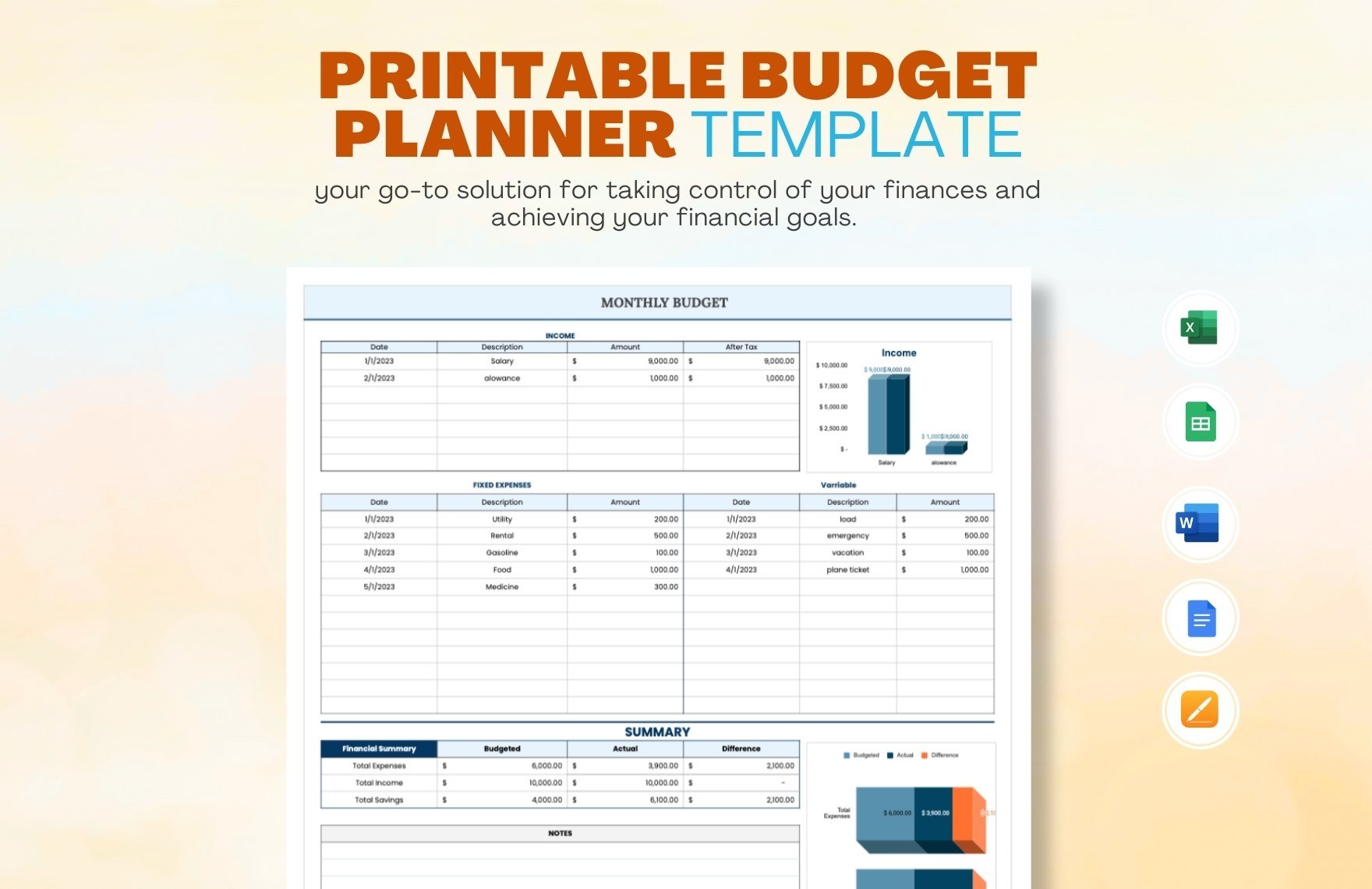

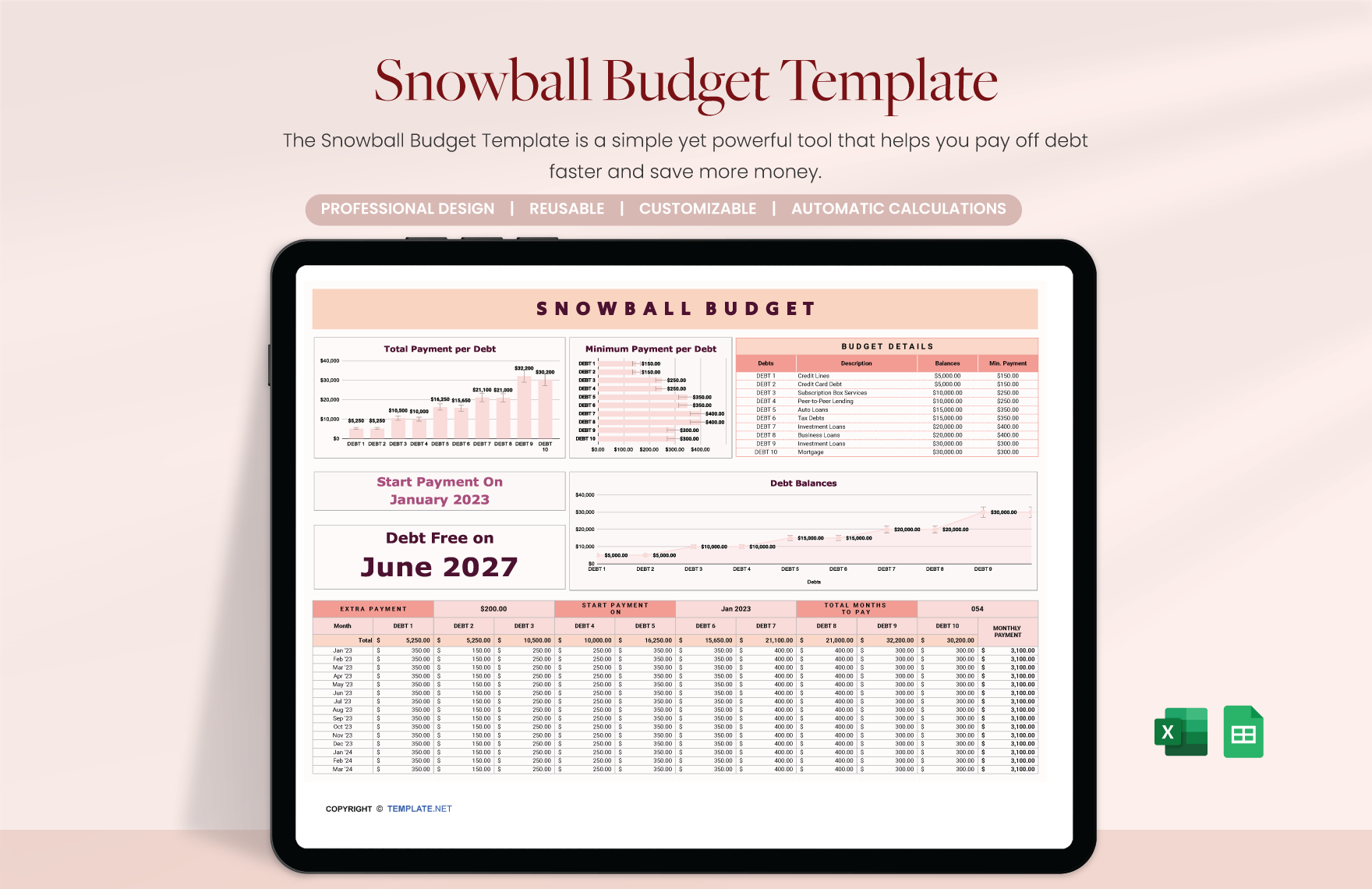

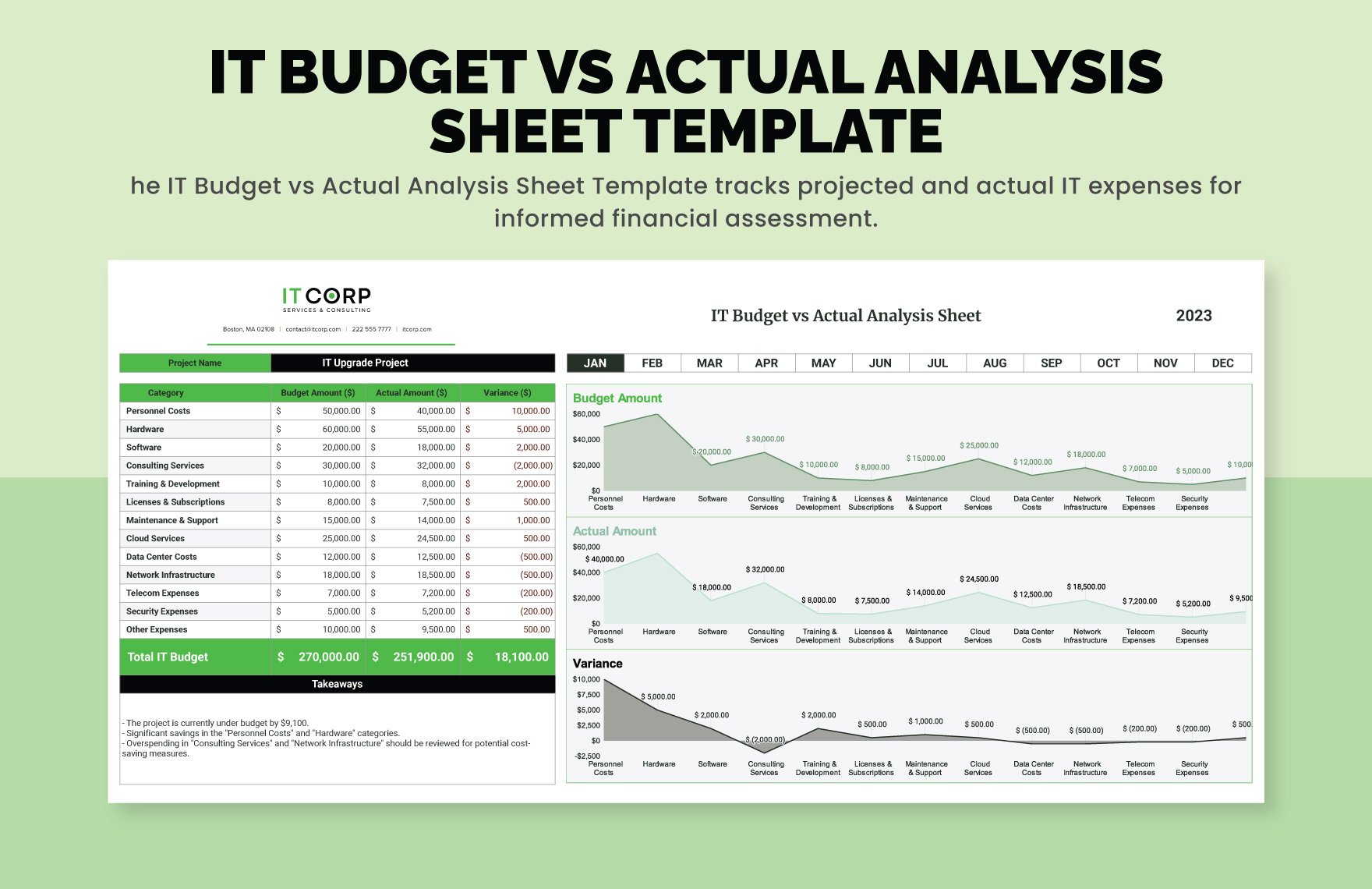

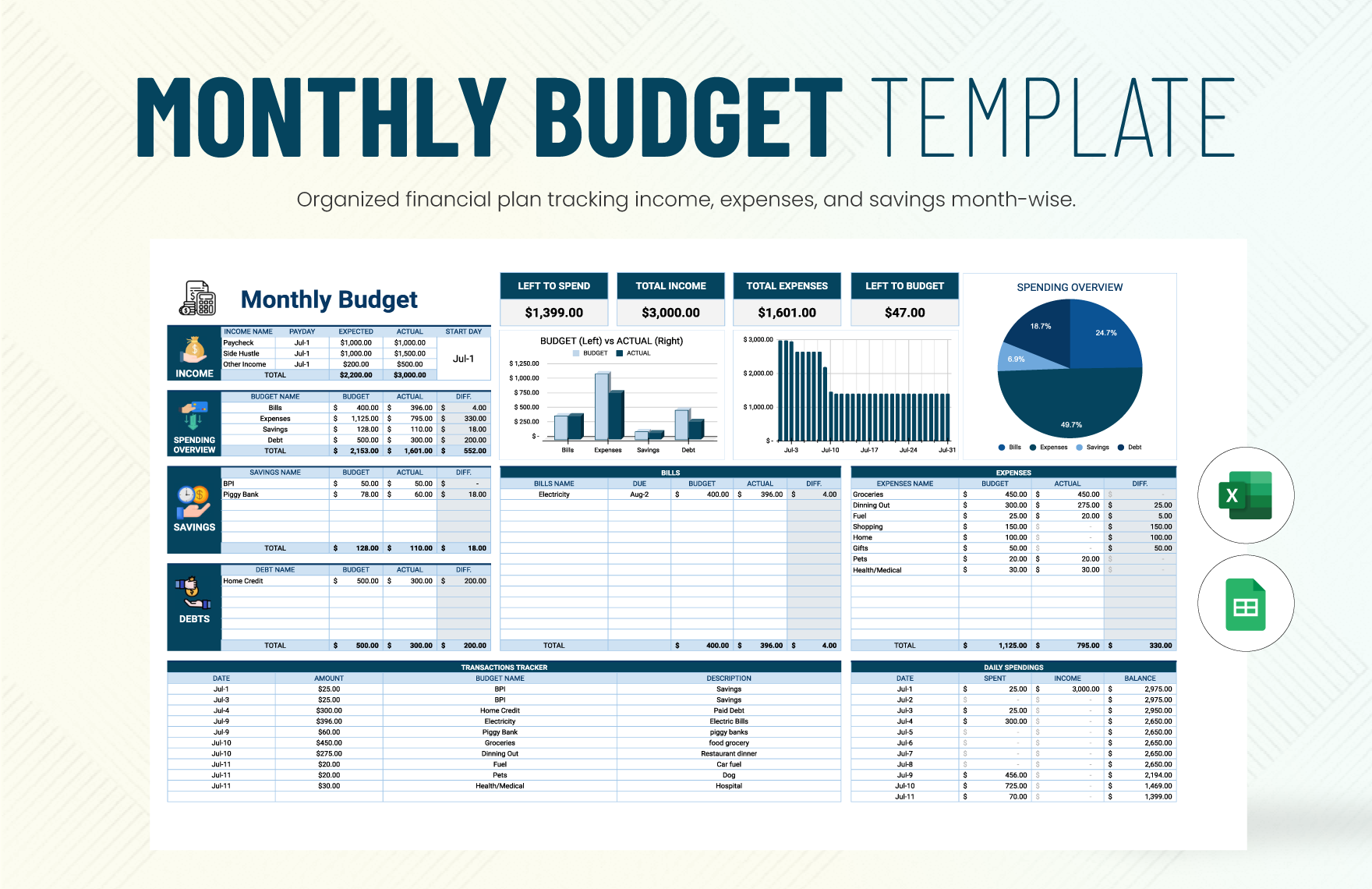

Don't drown yourself with debt and save yourself from being chased by an angry mob of debt collectors. Control your high expenses and learn how to save in a breeze with these professionally written Budget Templates in Google Sheets for free. Take a closer look at our monthly budget, business budget, family budget, budget worksheet, and budget planner, and ensure yourself a clear financial picture of your daily projects or activities. 100% customizable, downloadable, and highly editable in various file formats, especially in Google Sheets, these ready-made-templates will guarantee to save your time and money. Don't pass this opportunity and download our templates today for free!

How to Create a Budget in Google Sheets

The thought and the act of allocating money and time for a reason are acts of budgeting. Pay attention to the little details and expenses you create with your hard-earned money, how much are you spending in a week, a month, and in a year? Can you ensure that your budget works in your favor? How can you possibly avoid the circumstances of running out of cash? Read through the article to maximize your budgeting skills, and learn how to create an adequate budget using Google Sheets.

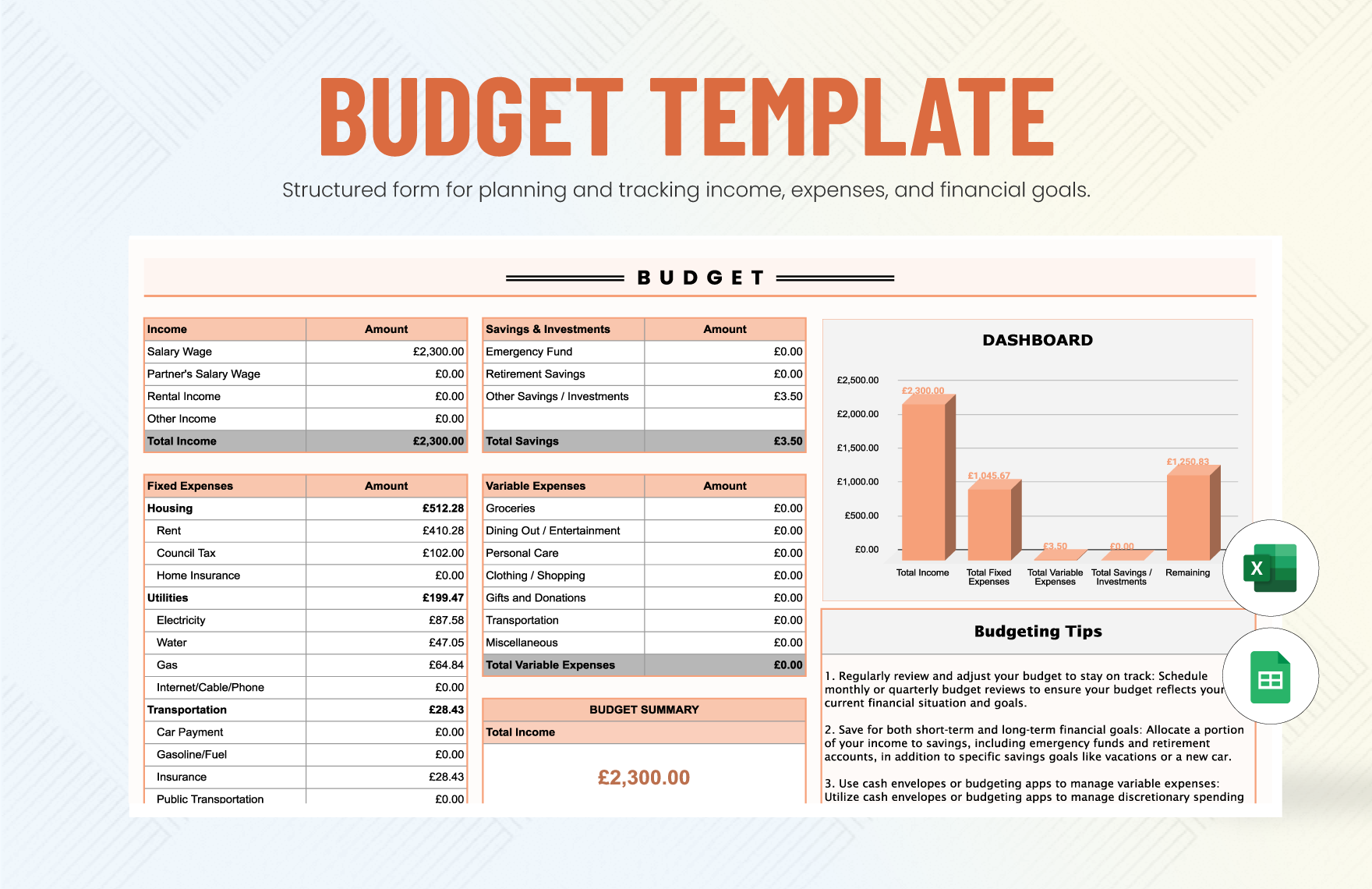

1. Start Calculating Your Expenses

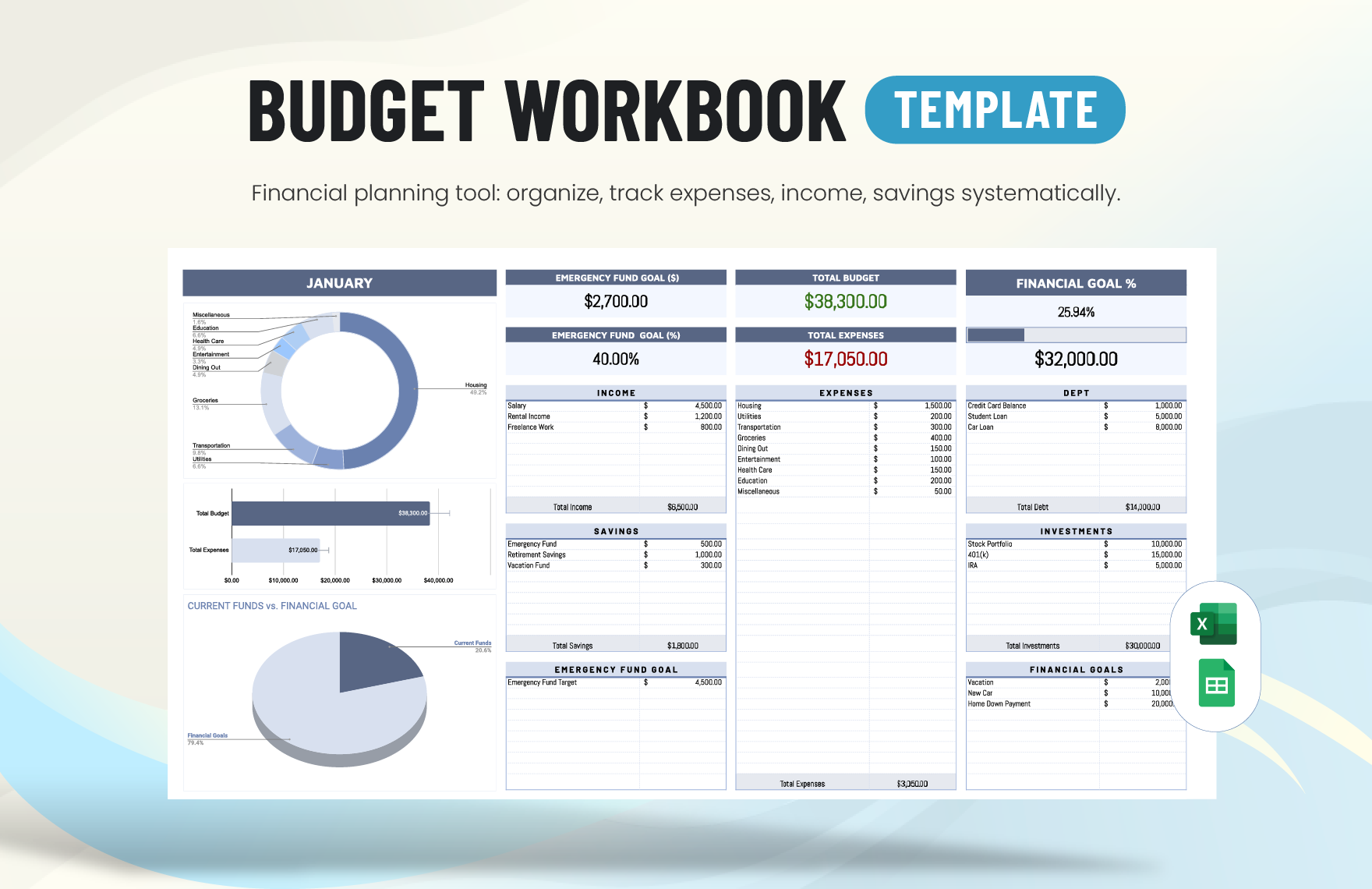

How much are you spending every day? Does your income suffice your total expenses? Before you start complaining about how small your income is, try to check your lifestyle. Are you spending more than what you can afford? Are you drowning in debts? Well, guess like its time to start reviewing and calculating all your previous expenses. Determine where your money is going and create a daily or monthly cash flow analysis.

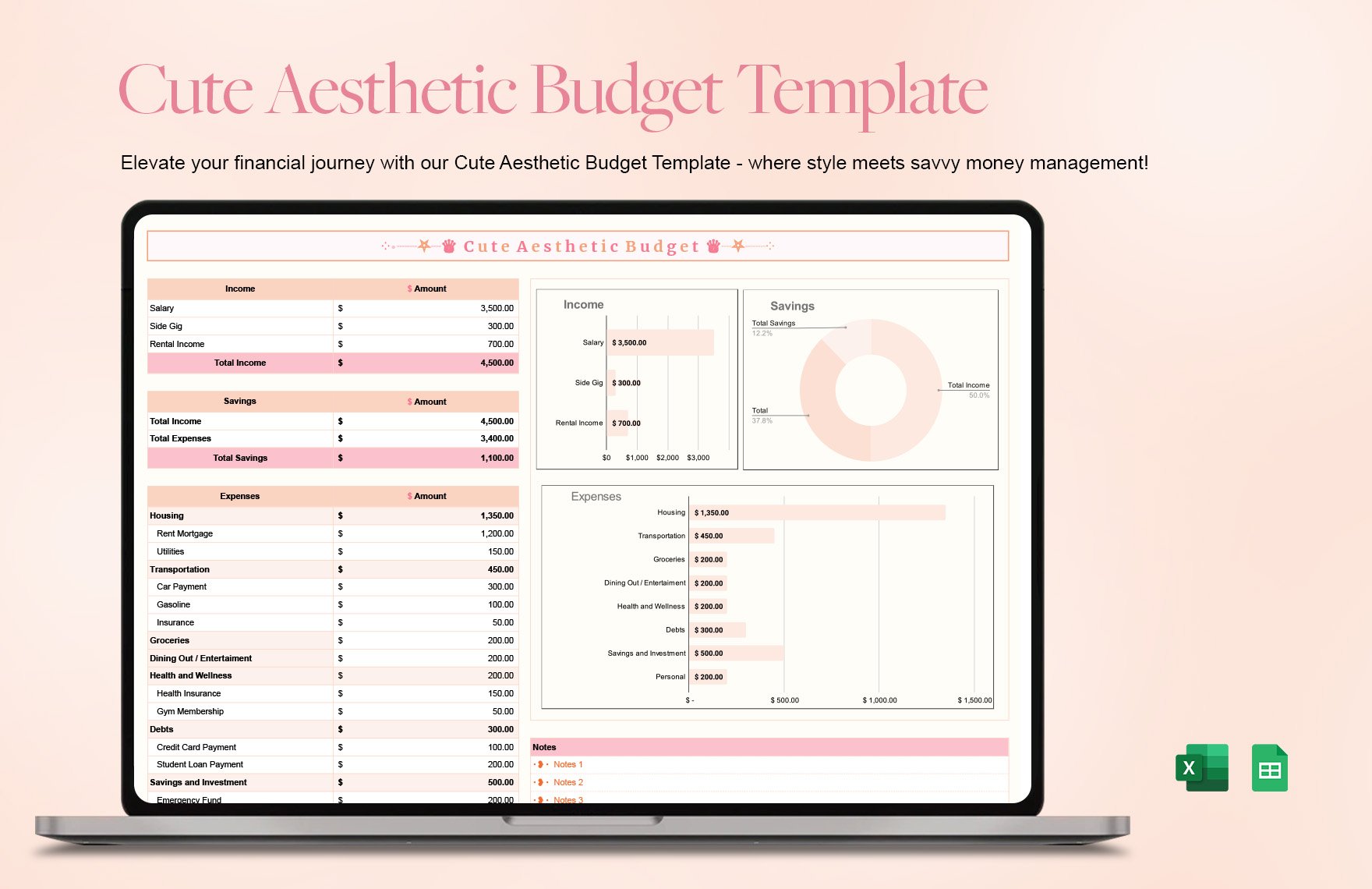

2. Determine Your Income

They say "money can't buy you happiness," but money can buy you things. How can you survive if you're penniless? Everything is getting expensive every year, and apparently, research shows that money can affect a person's emotional state based on their financial status. Do you find yourself in joy not to properly pay any of your household bills and daily commodities? Obviously no. How much are you earning each month? Determine your actual income, create an income statement, and check if you can manage to save while you deal with your financial expenses.

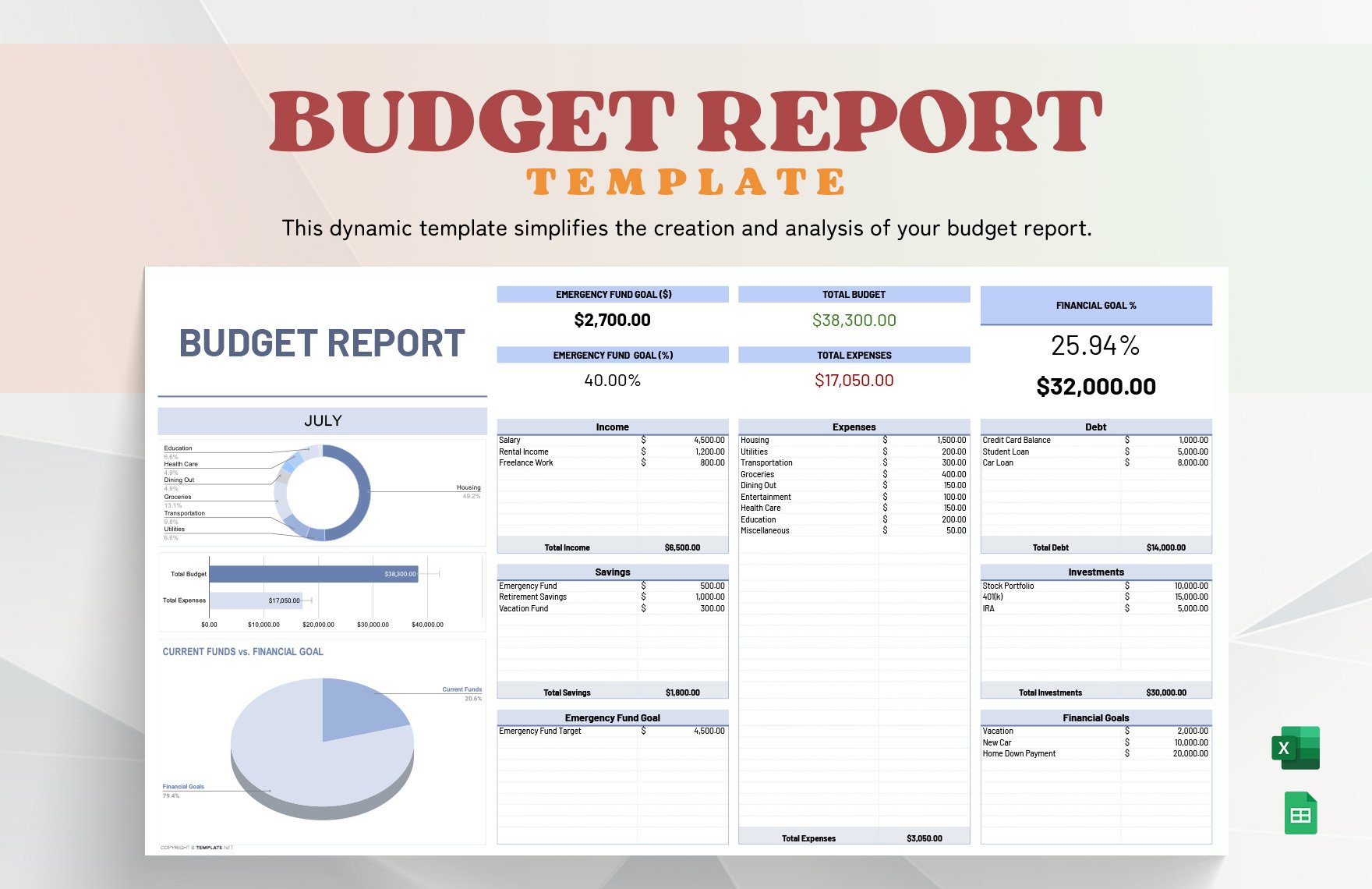

3. Set Goals to Save and Payoff Debts

The main reason why you save is to pay your debts and sustain yourself every day. But aside from that, what are your possible reasons for saving? Surely you must have other plans other than surviving. Are you planning to travel and see the world? Shop and collect shoes and clothes you want? Motivate yourself while you budget your cash. Think of ways on how you can stay positive with your budget plan, and keep your goals realistic to carry out.

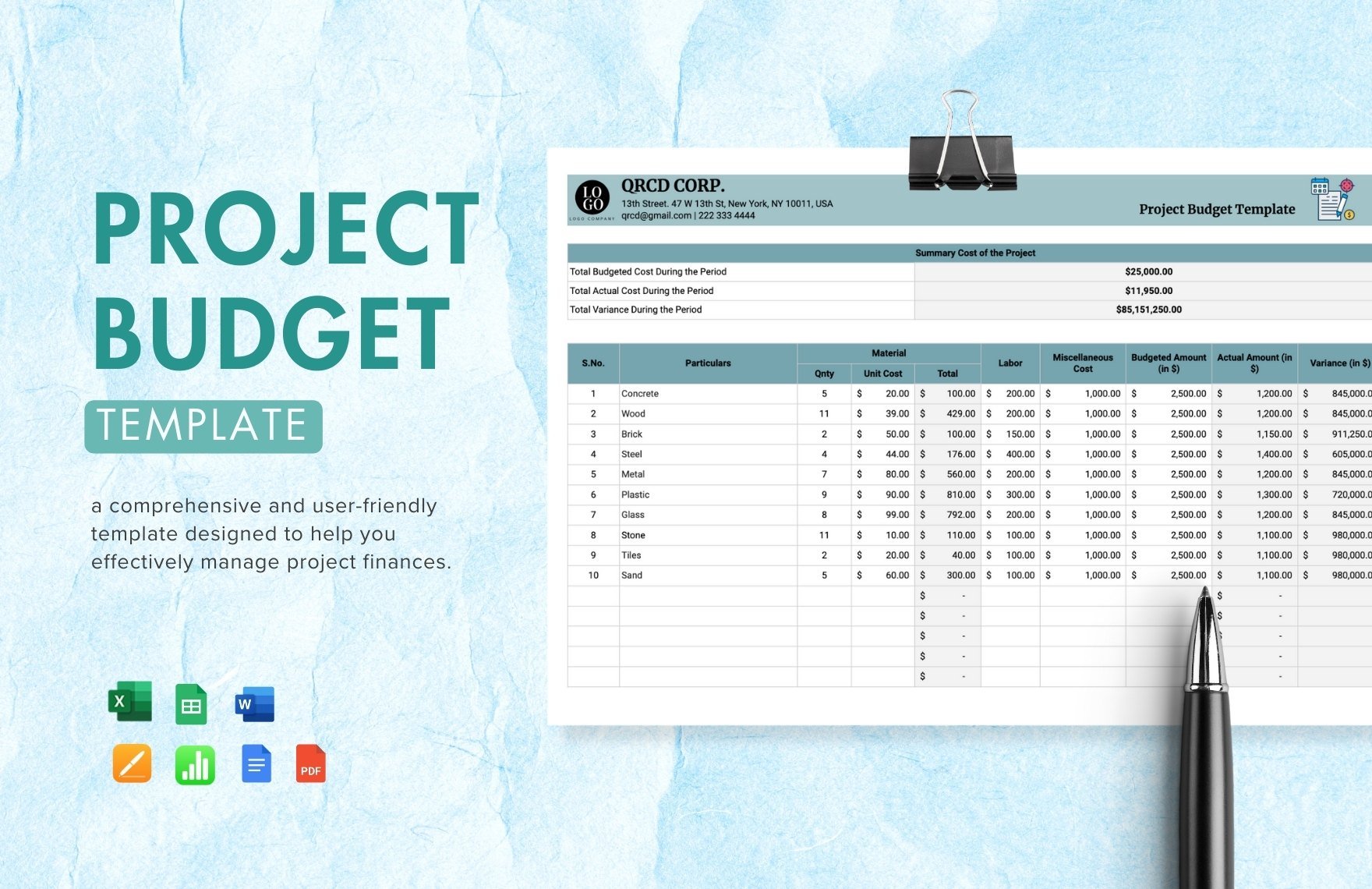

4. Record Your Spending Activities

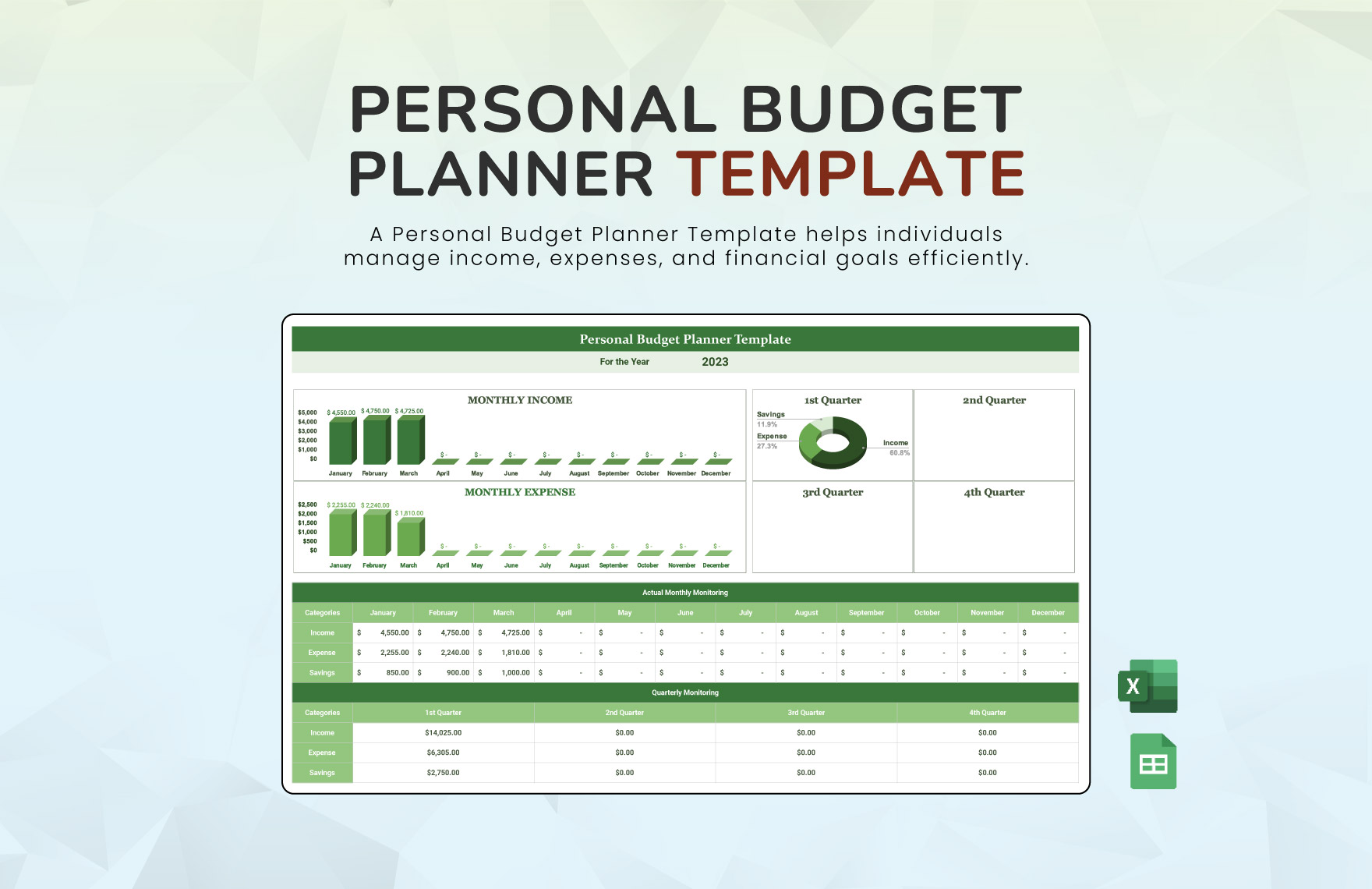

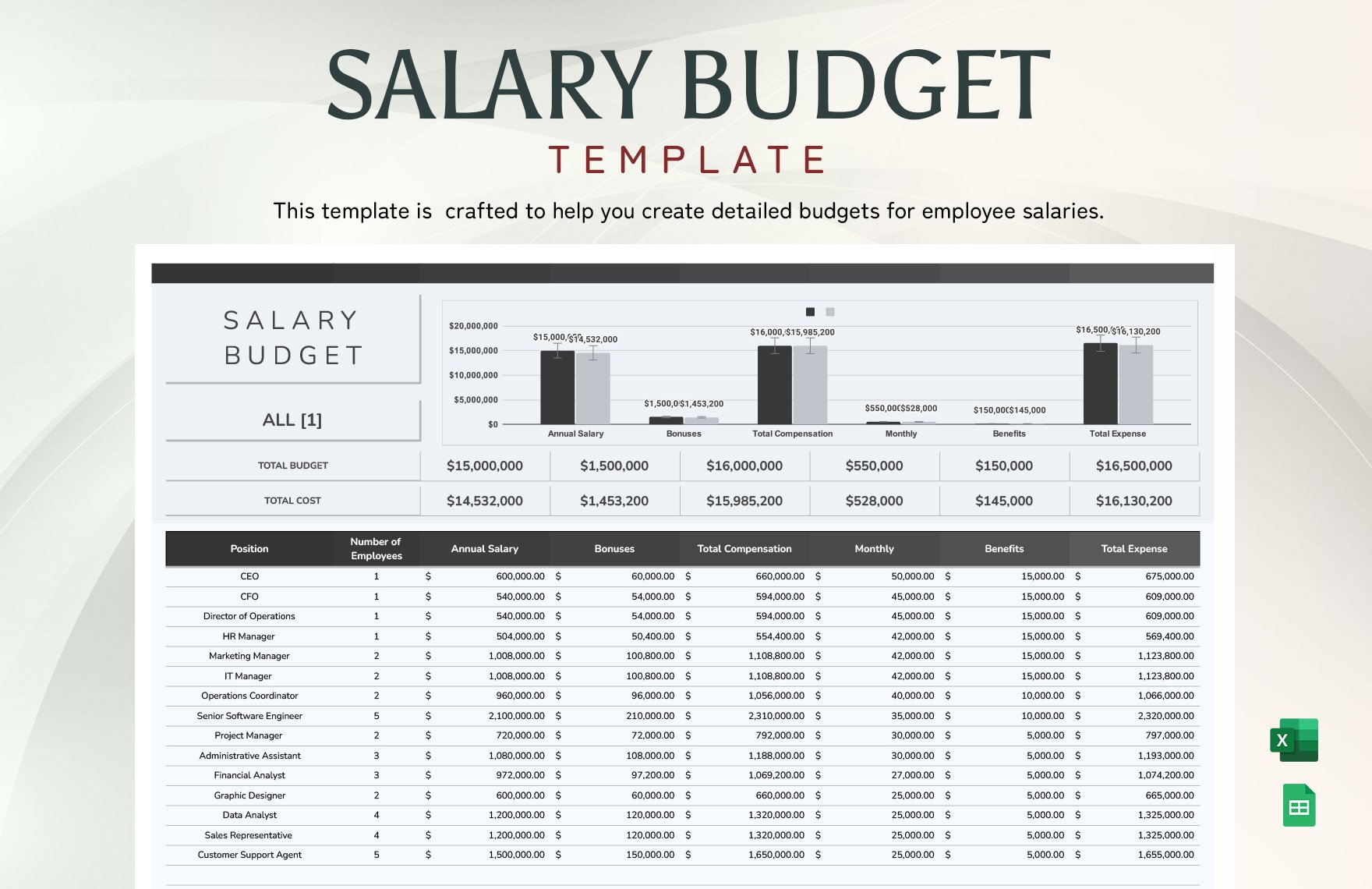

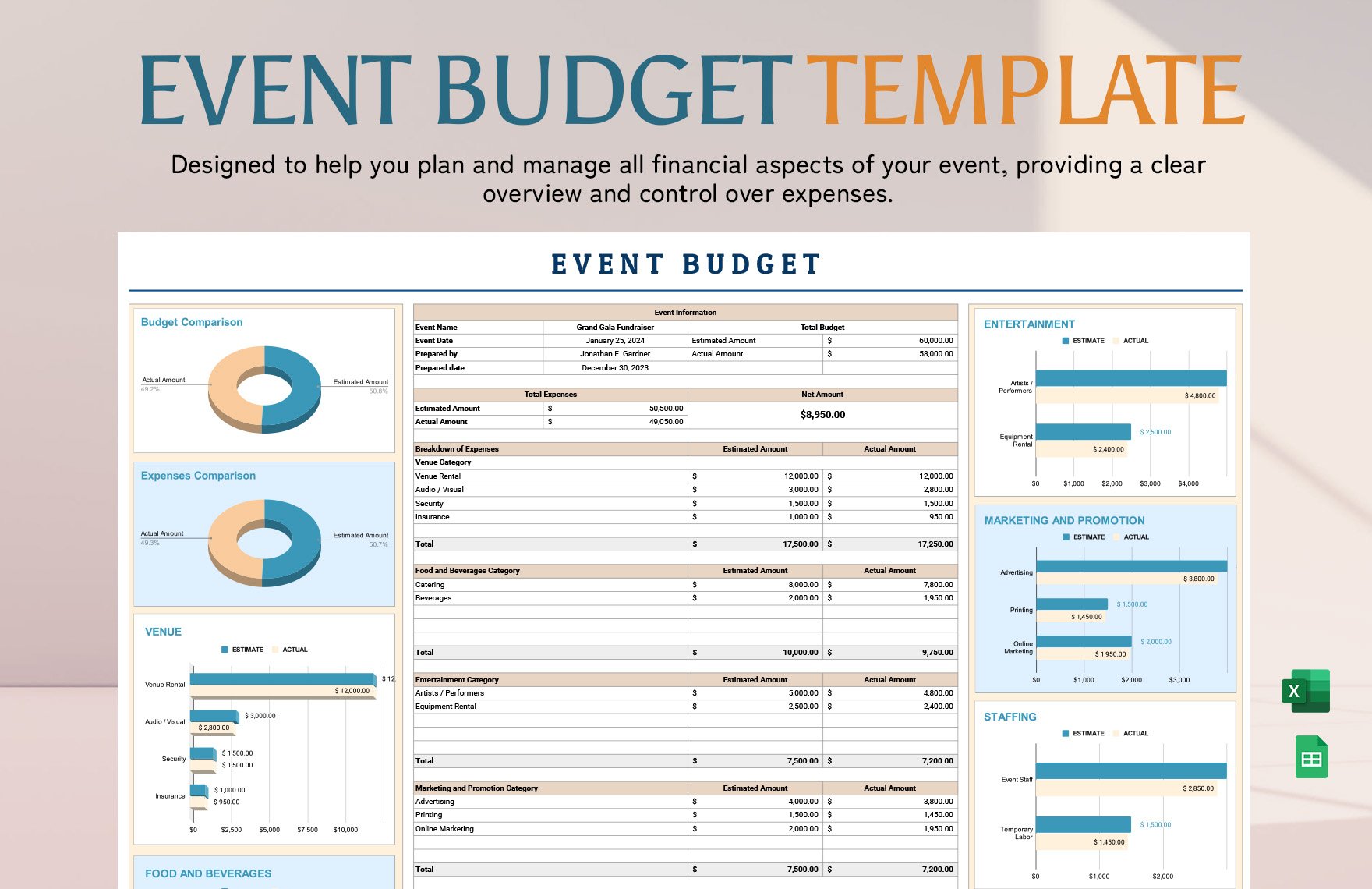

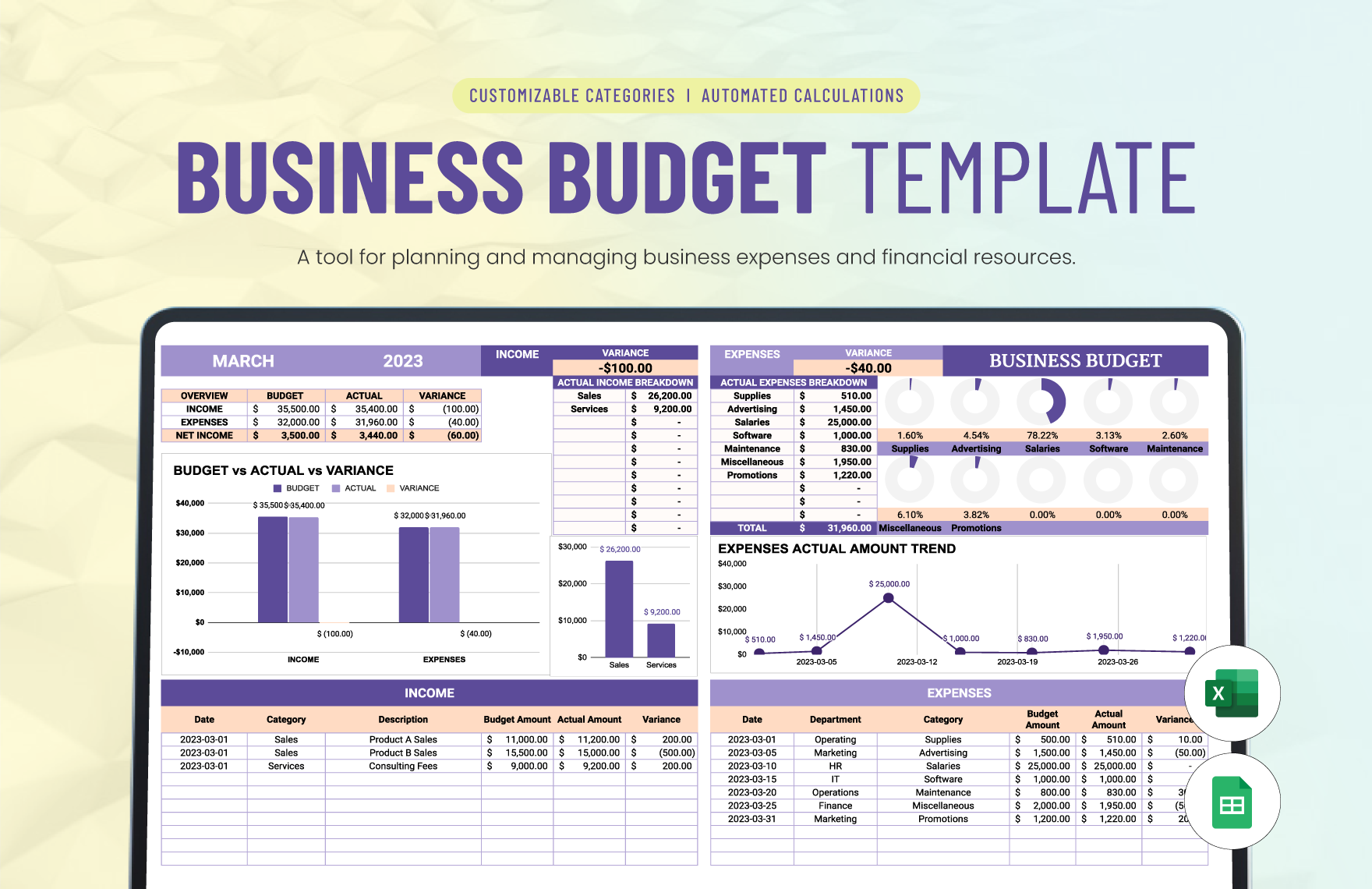

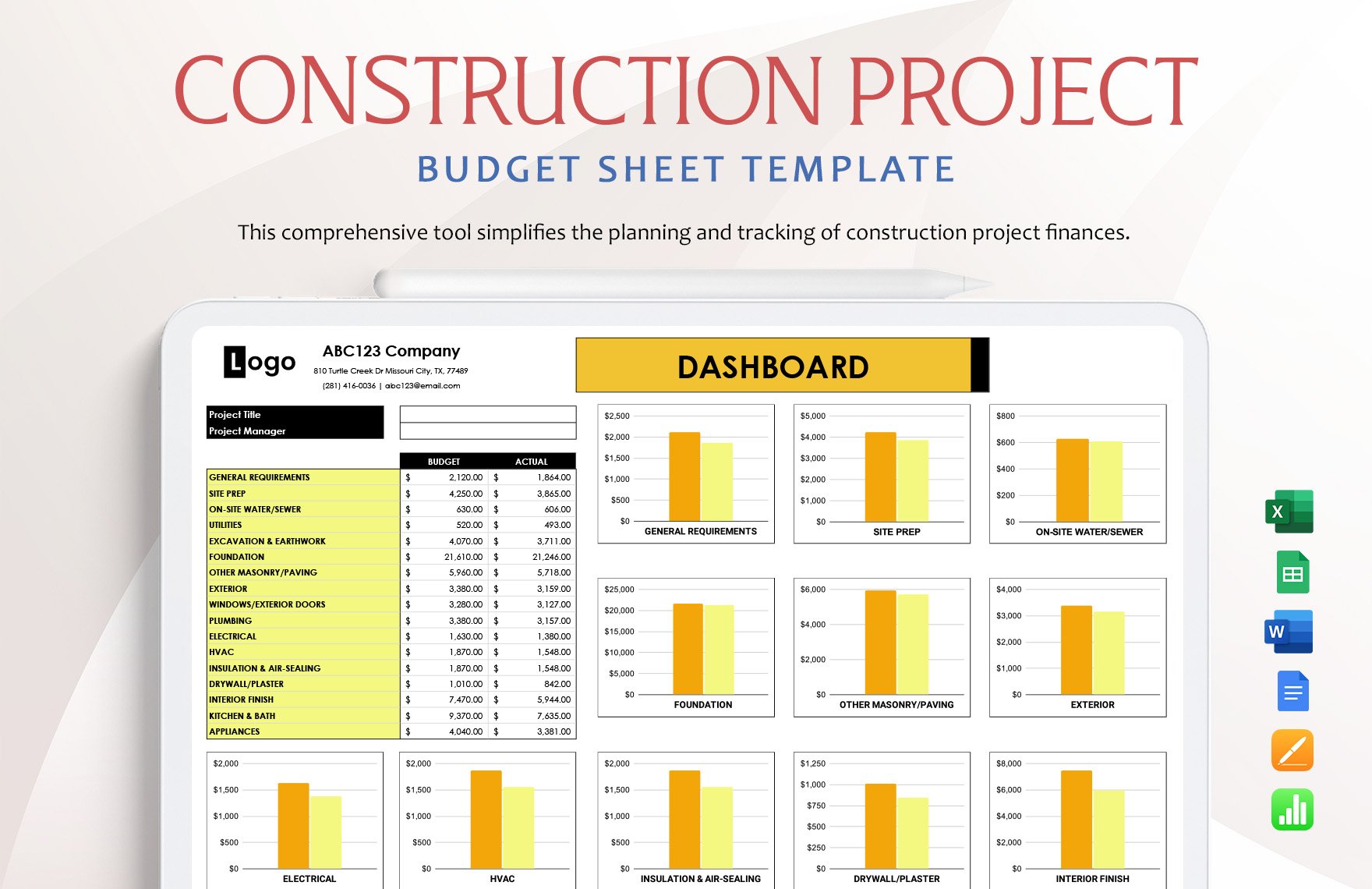

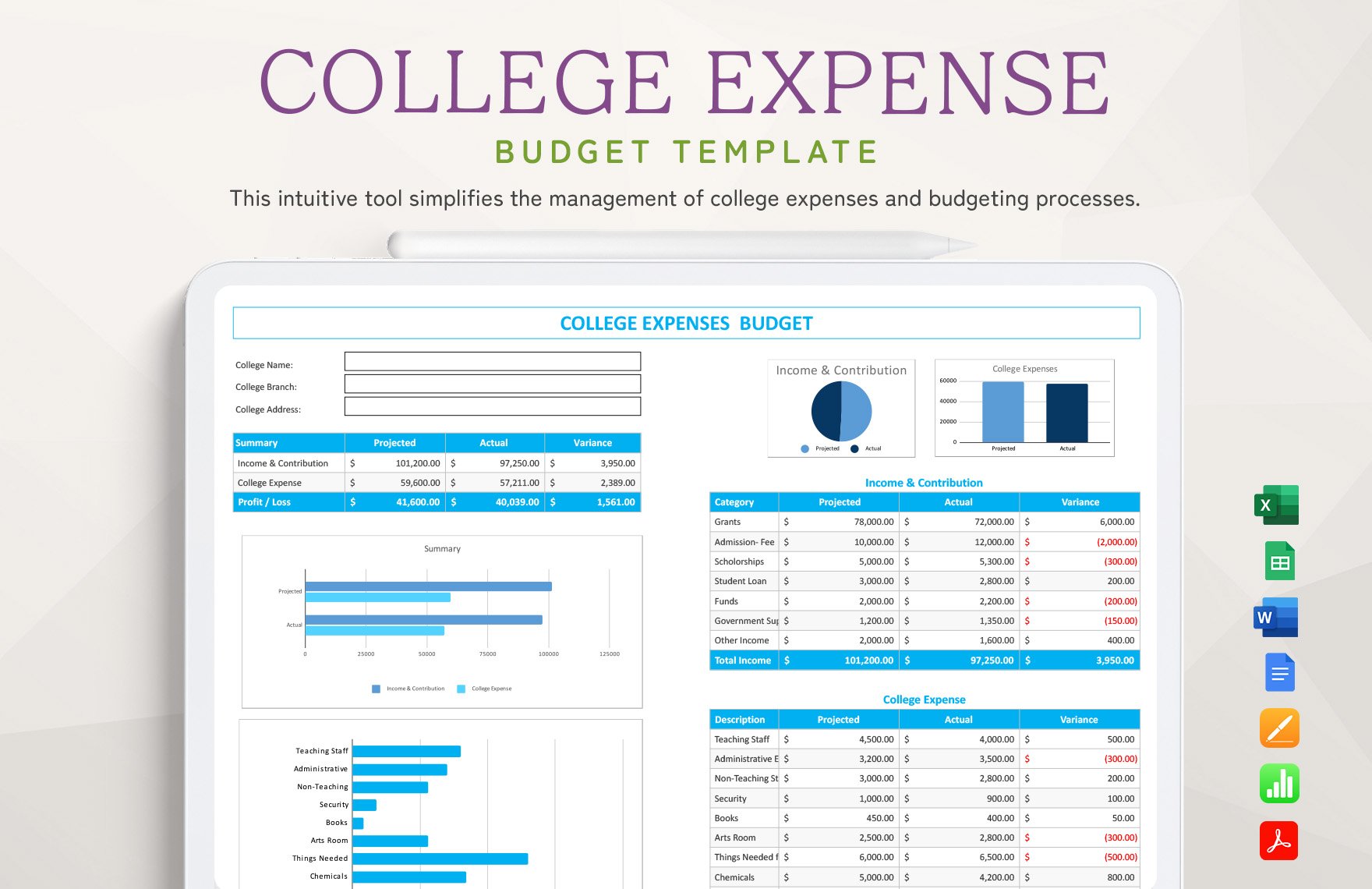

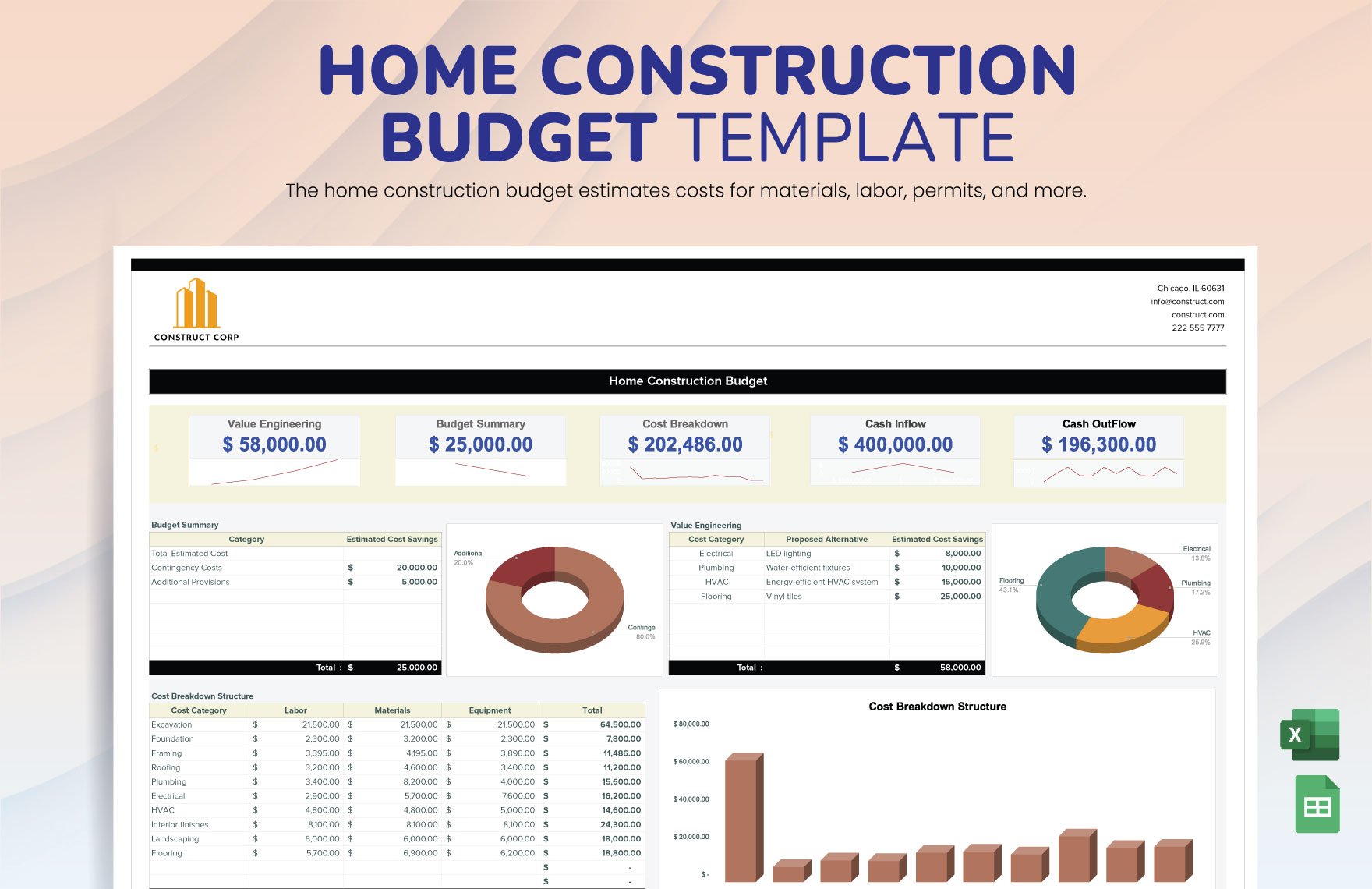

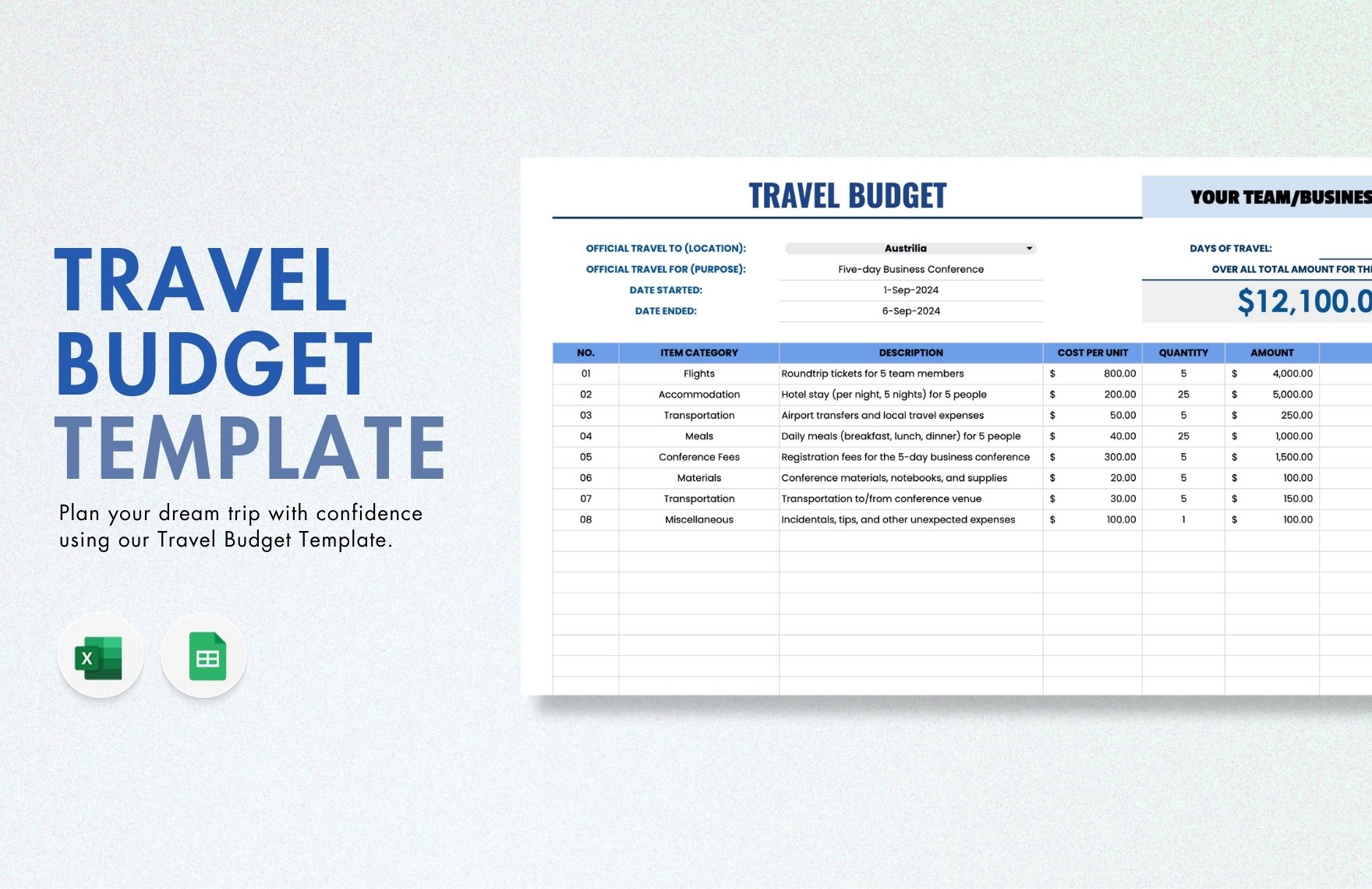

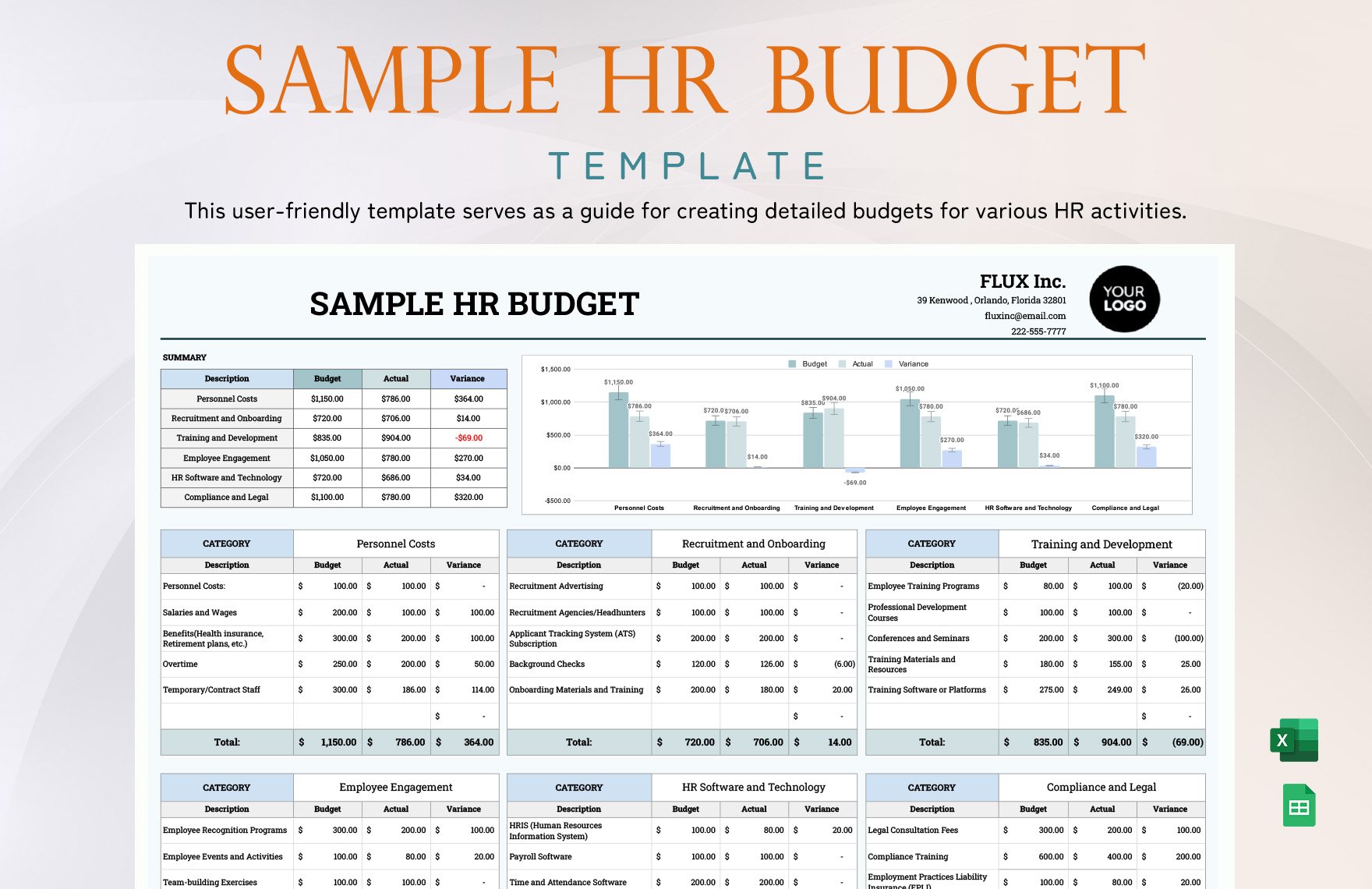

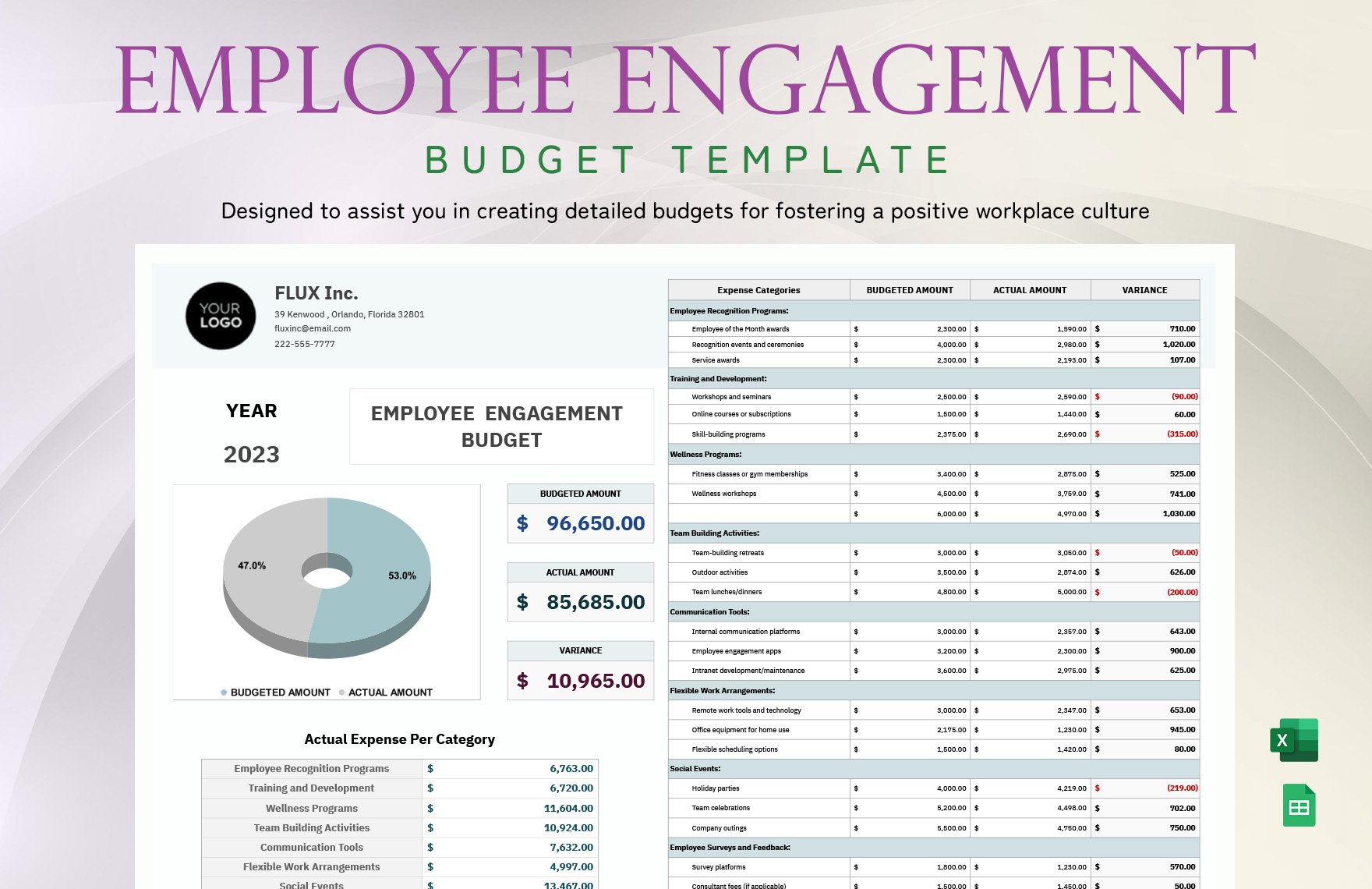

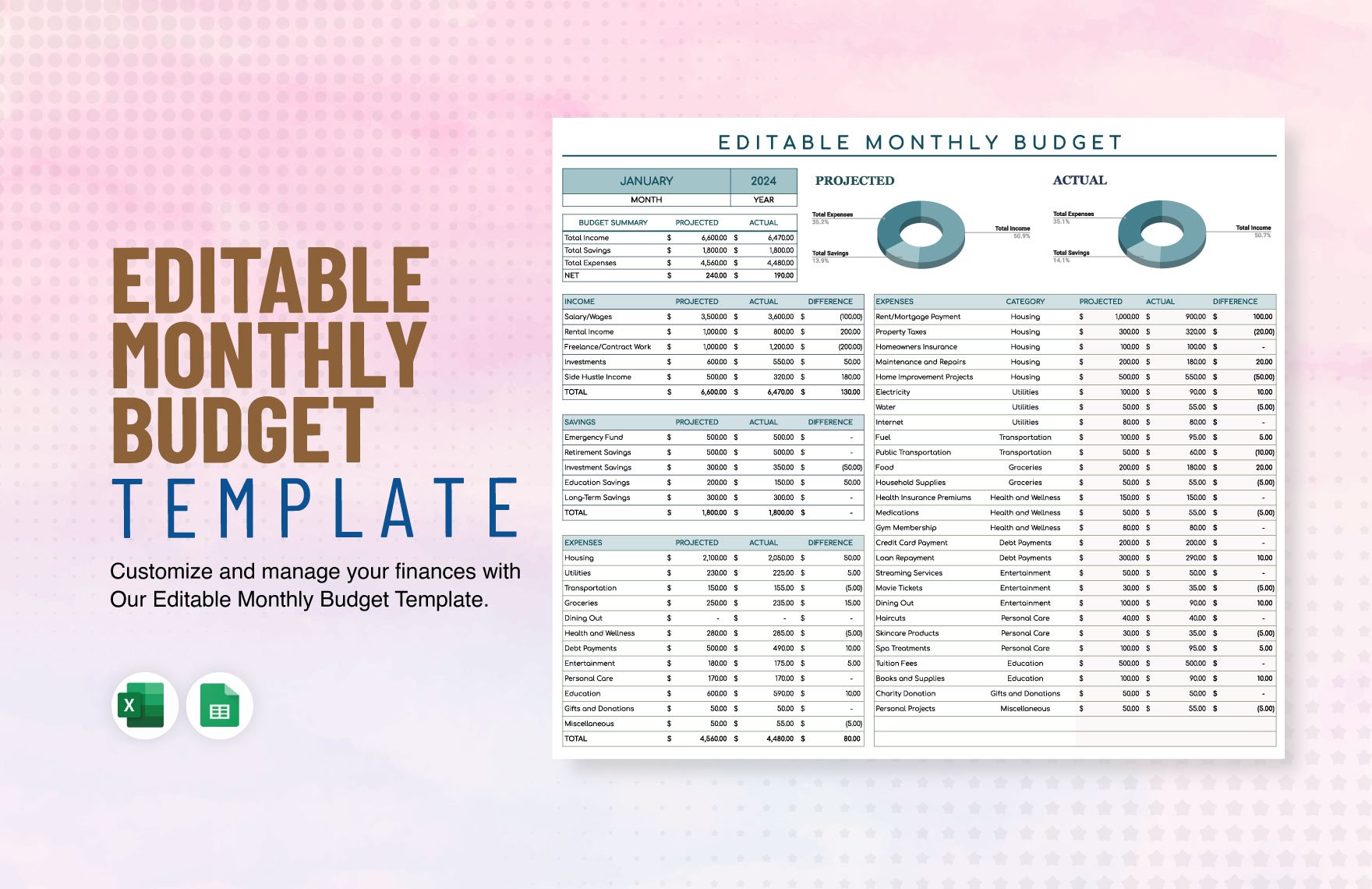

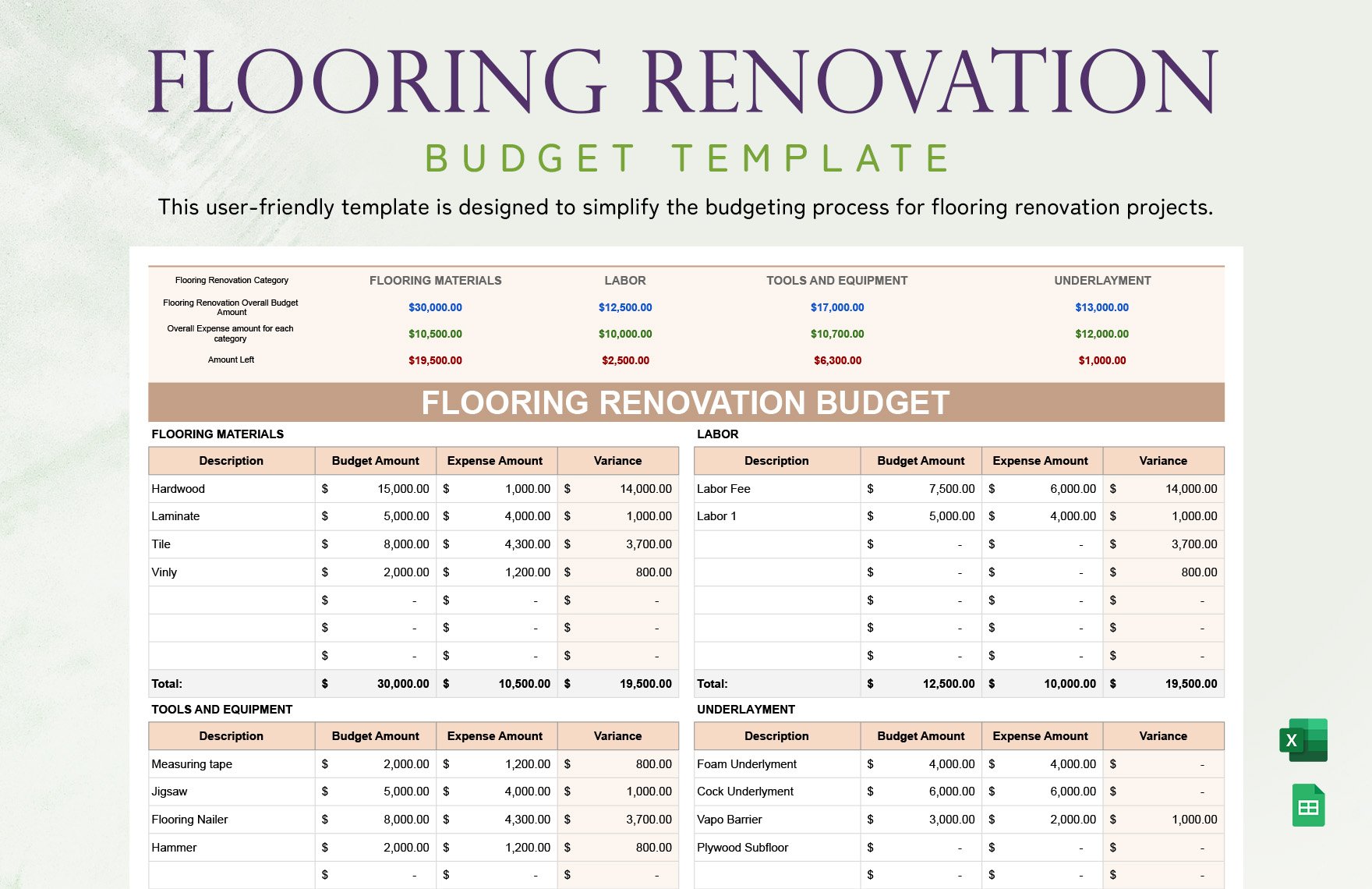

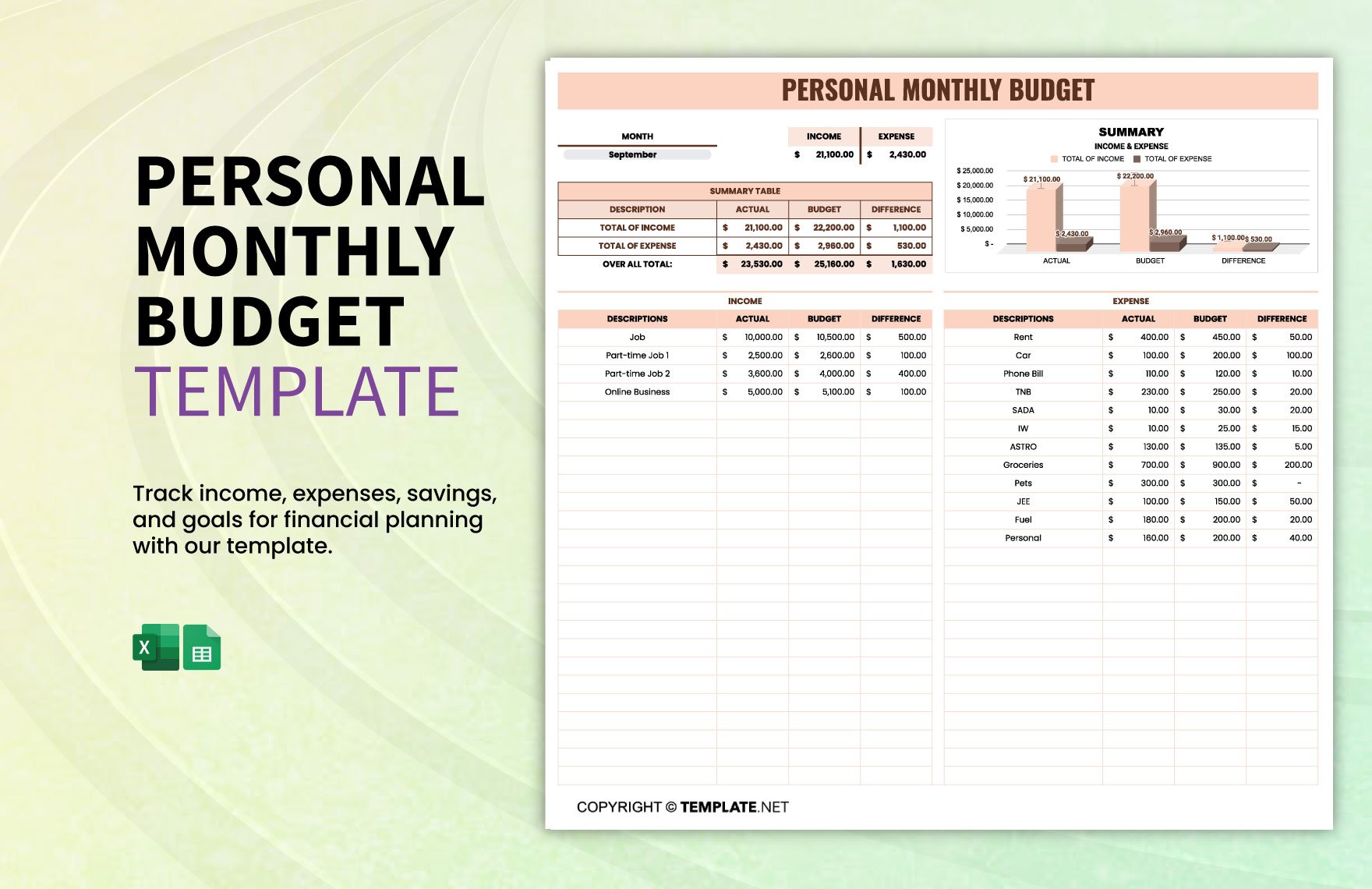

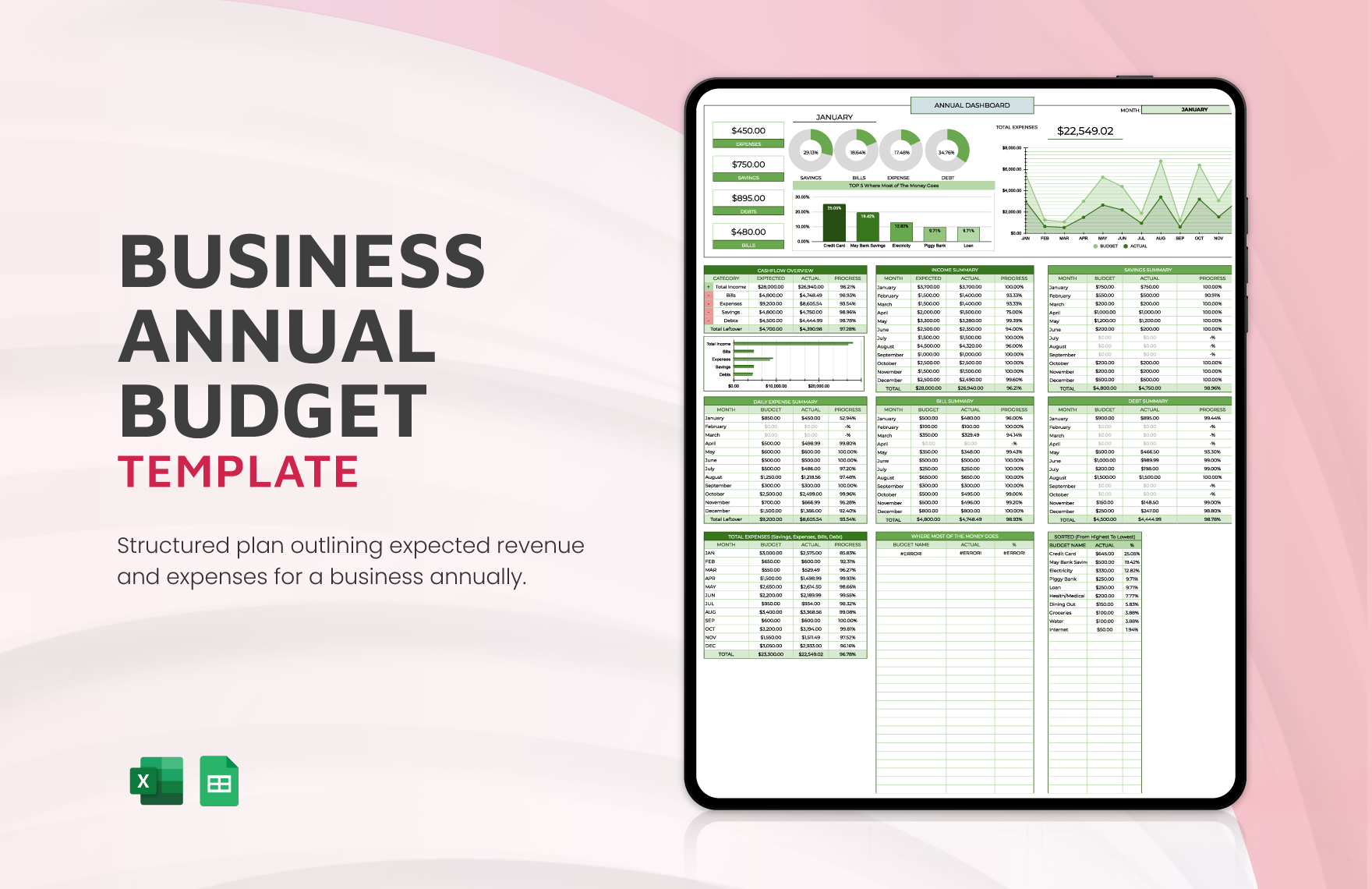

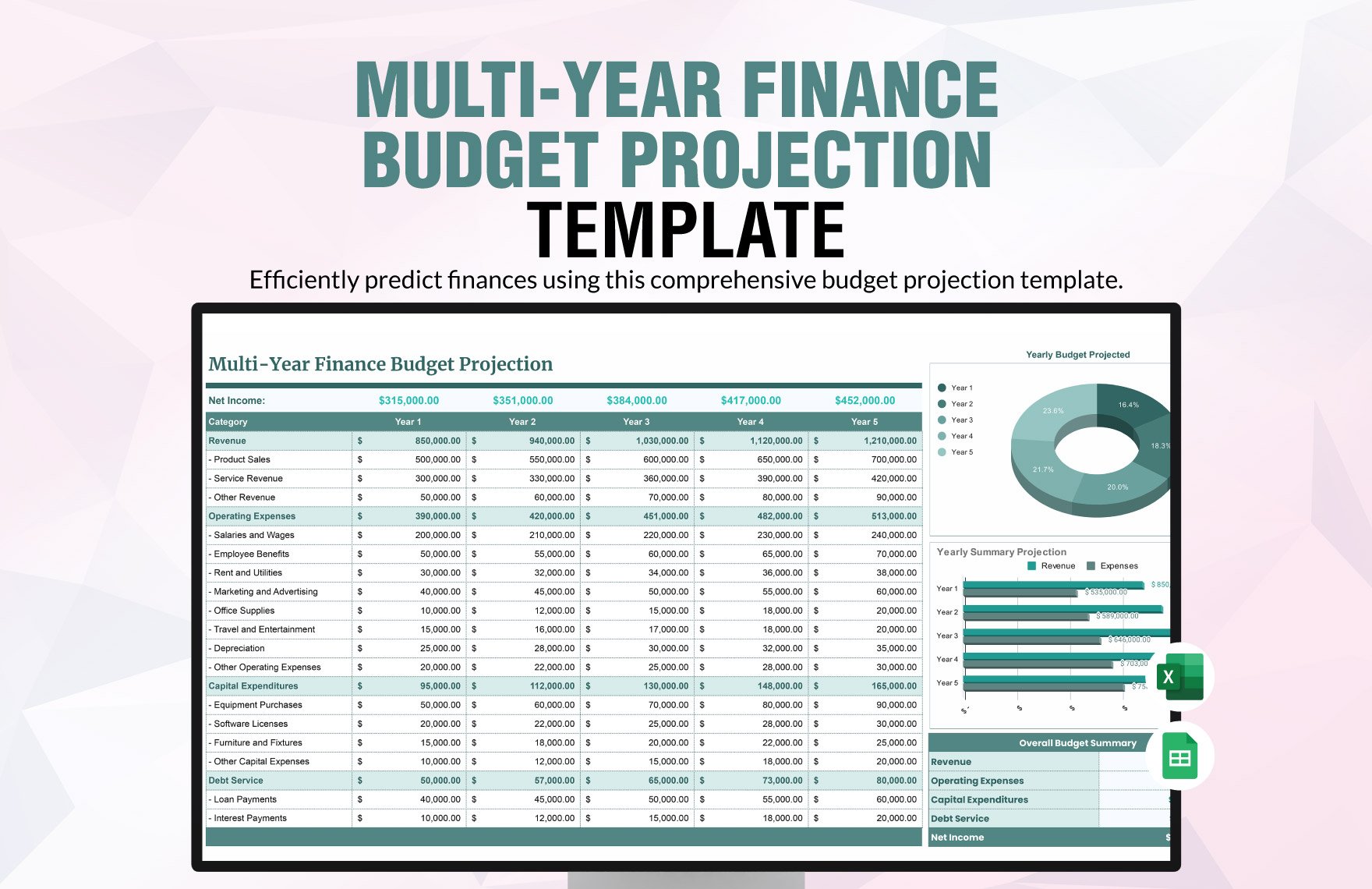

If you are a heavy credit card user who has an impulse to buy unnecessary things, well think twice before you swipe that card. Think about how much money you are throwing outside your doorstep every time you spend. Record and track down what you spend per month, you can use sheets, notebooks, budget planners, budget worksheets, and budgeting apps to help you. To make things easier, you can also download our ready-made budget templates for free to list all your expenses.

5. Alter Things to Maximize Your Budget

Knowing your spending habits, you need to alter a few things on what you spend the most and least. What are your priorities? Focus more on what you currently need and set your wants aside. Though never cut yourself from food and relaxation just to save, though you also need to treat yourself from time to time. Lastly, review your personal or business budget for any changes. Are the changes positive or negative? Did you reach your goal? Apply corrective measures if necessary, and rest assured that your hard work shall pay off in the end.