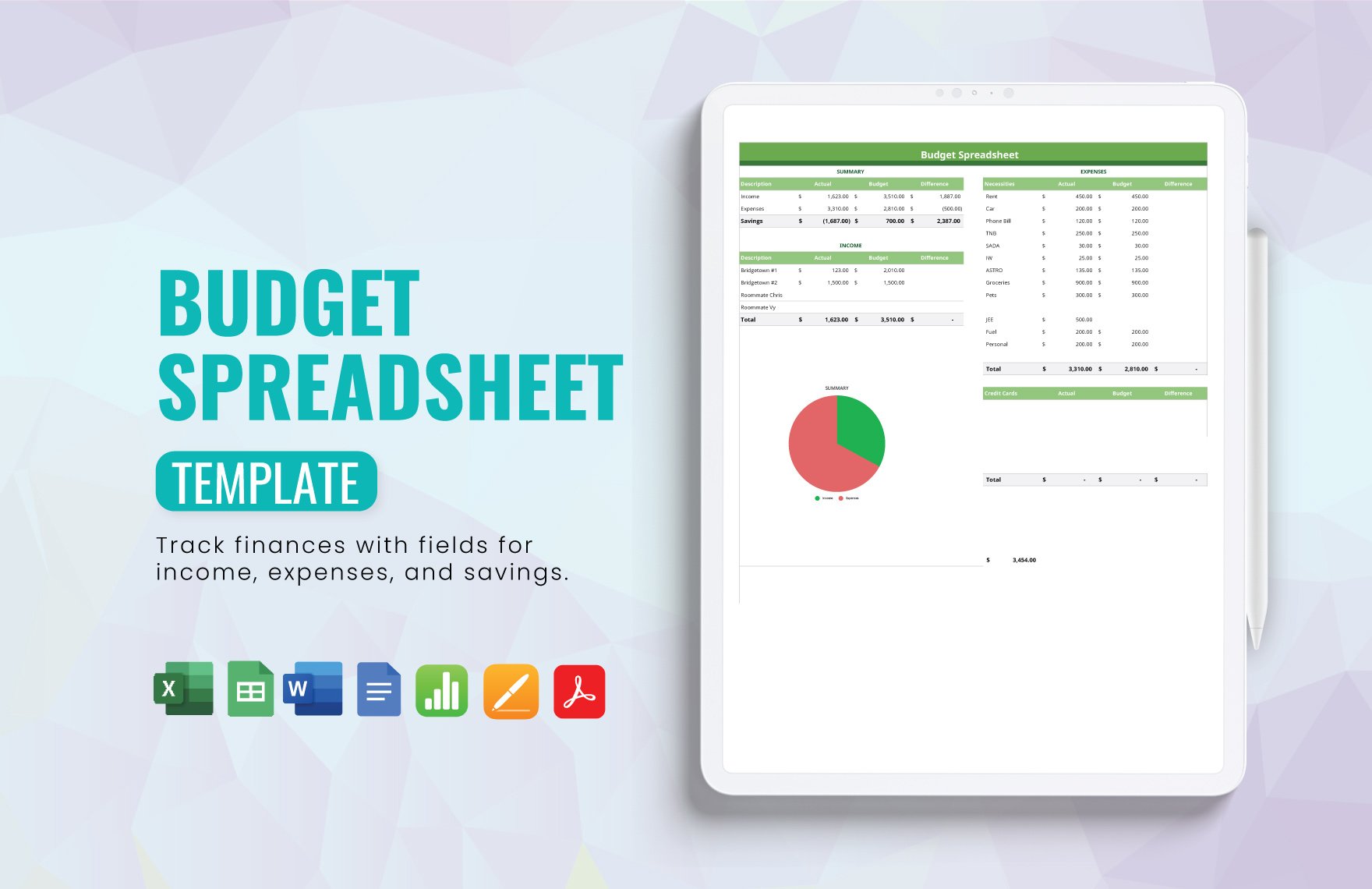

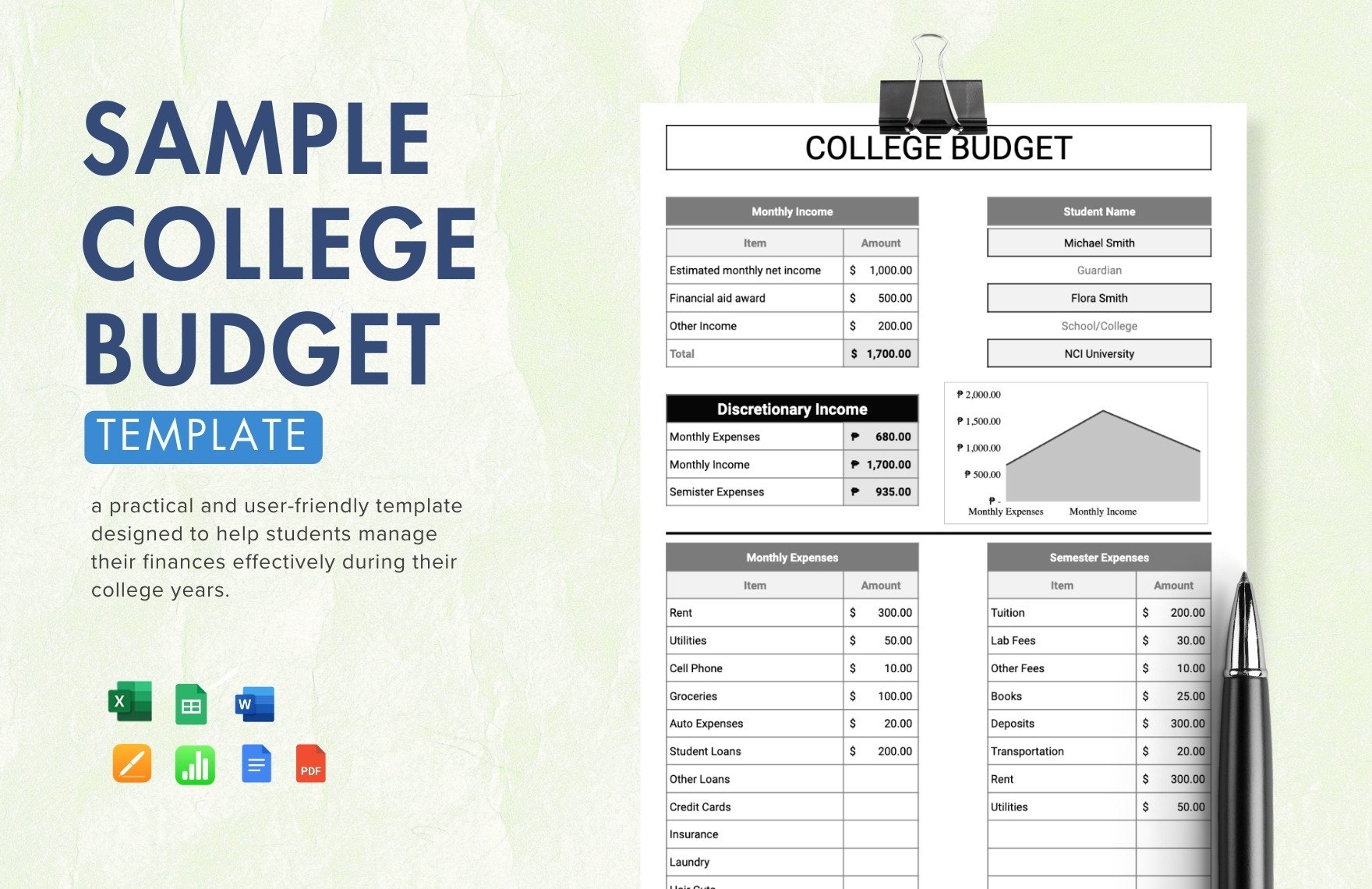

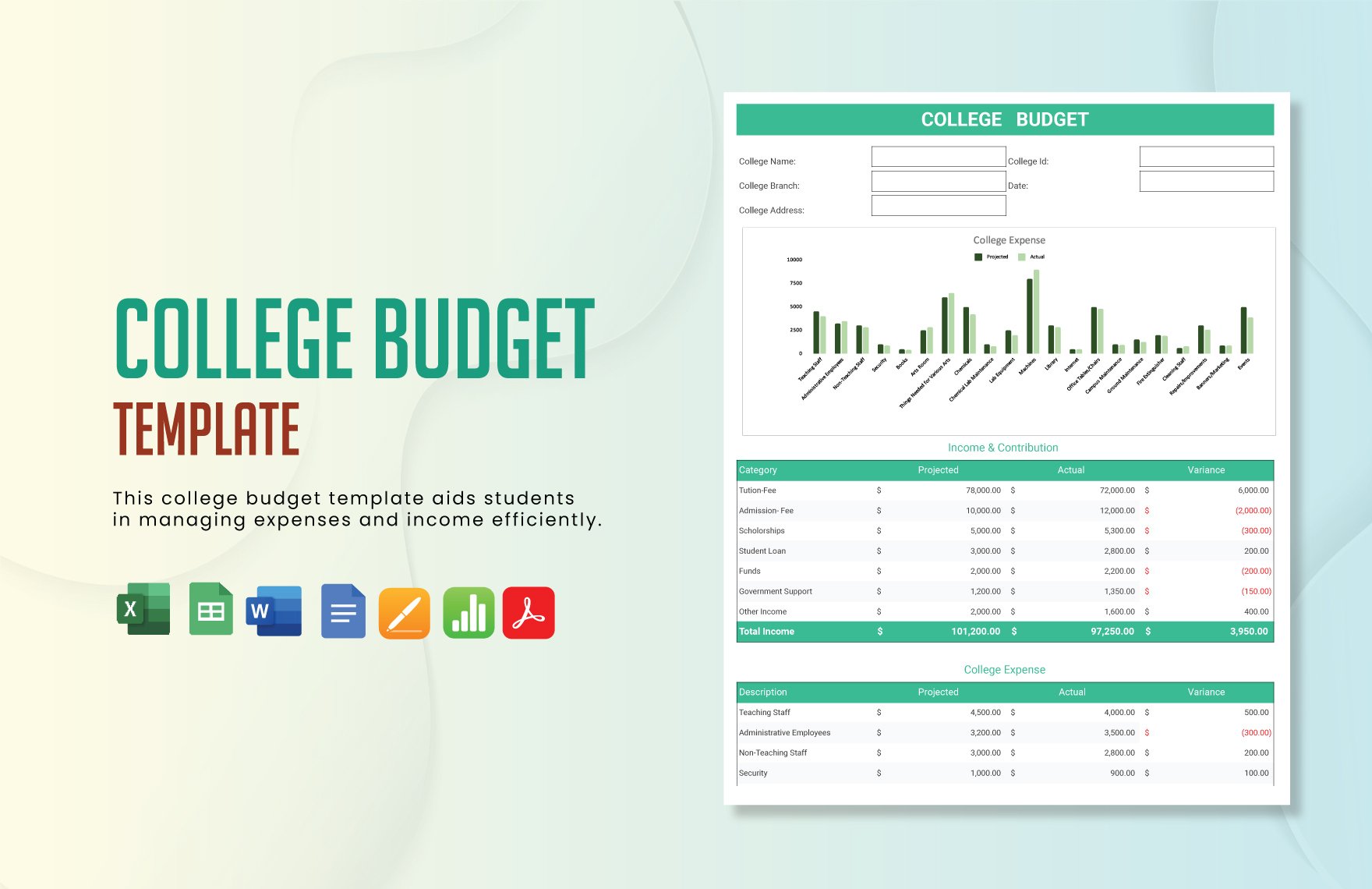

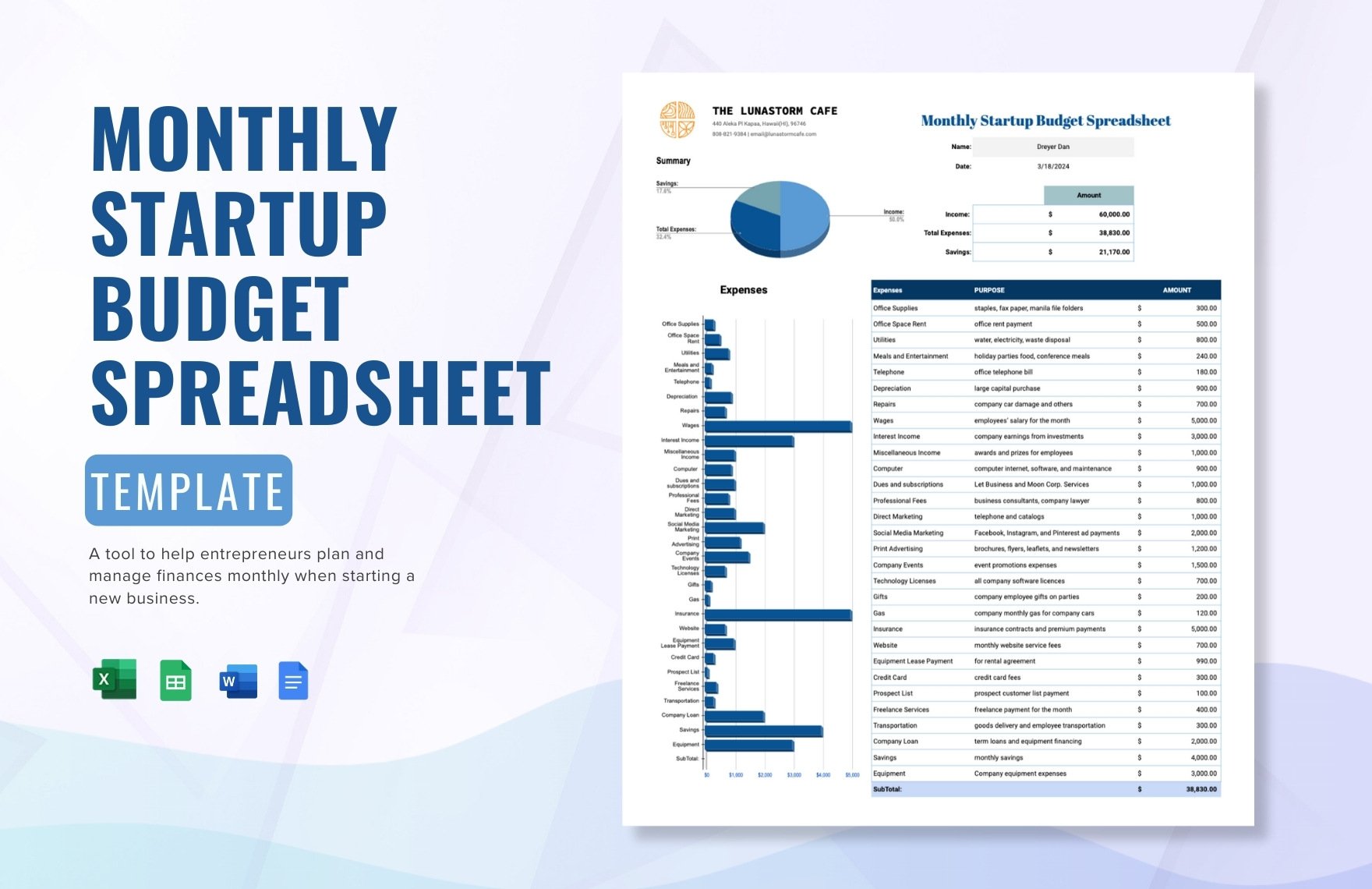

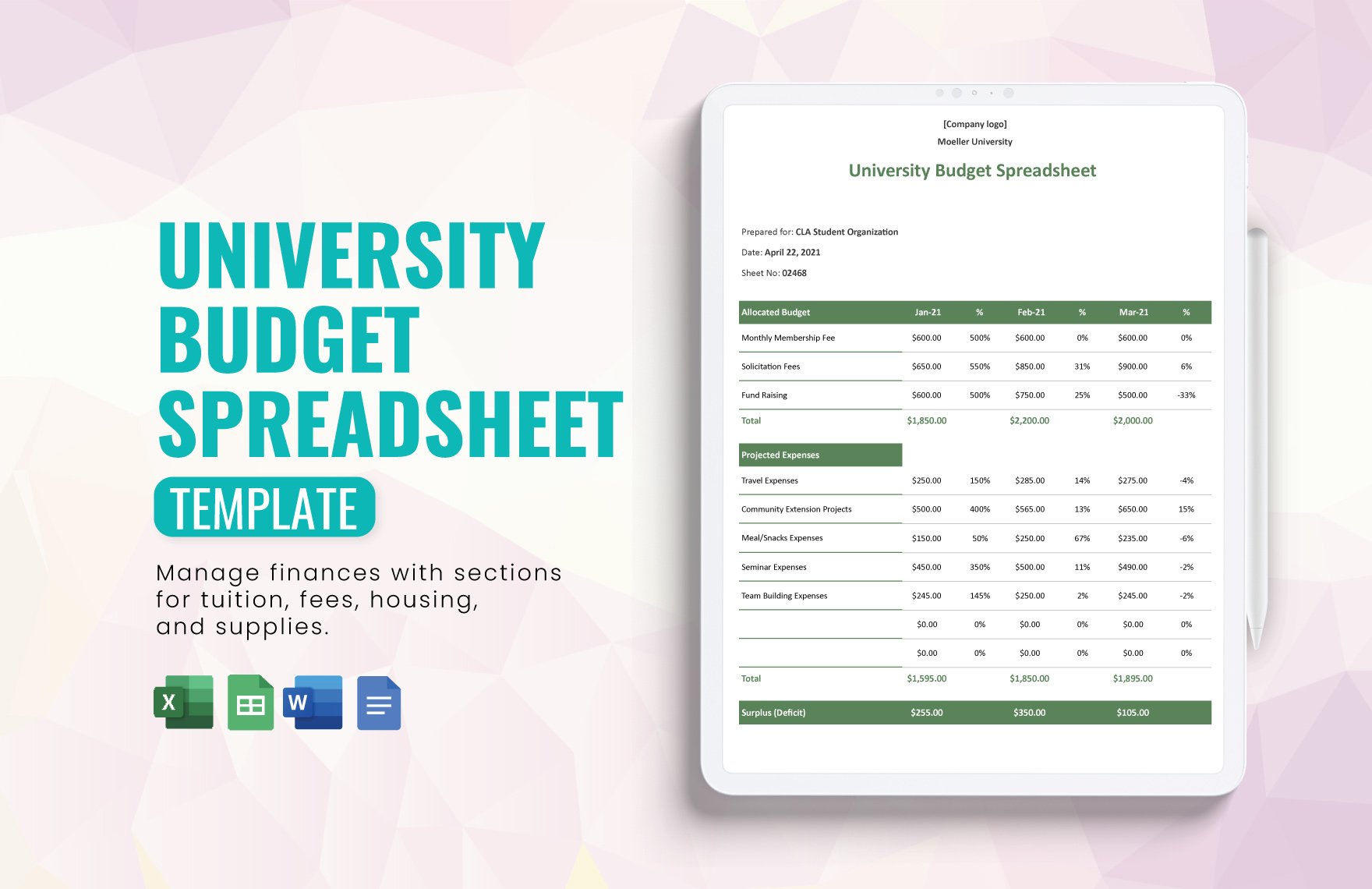

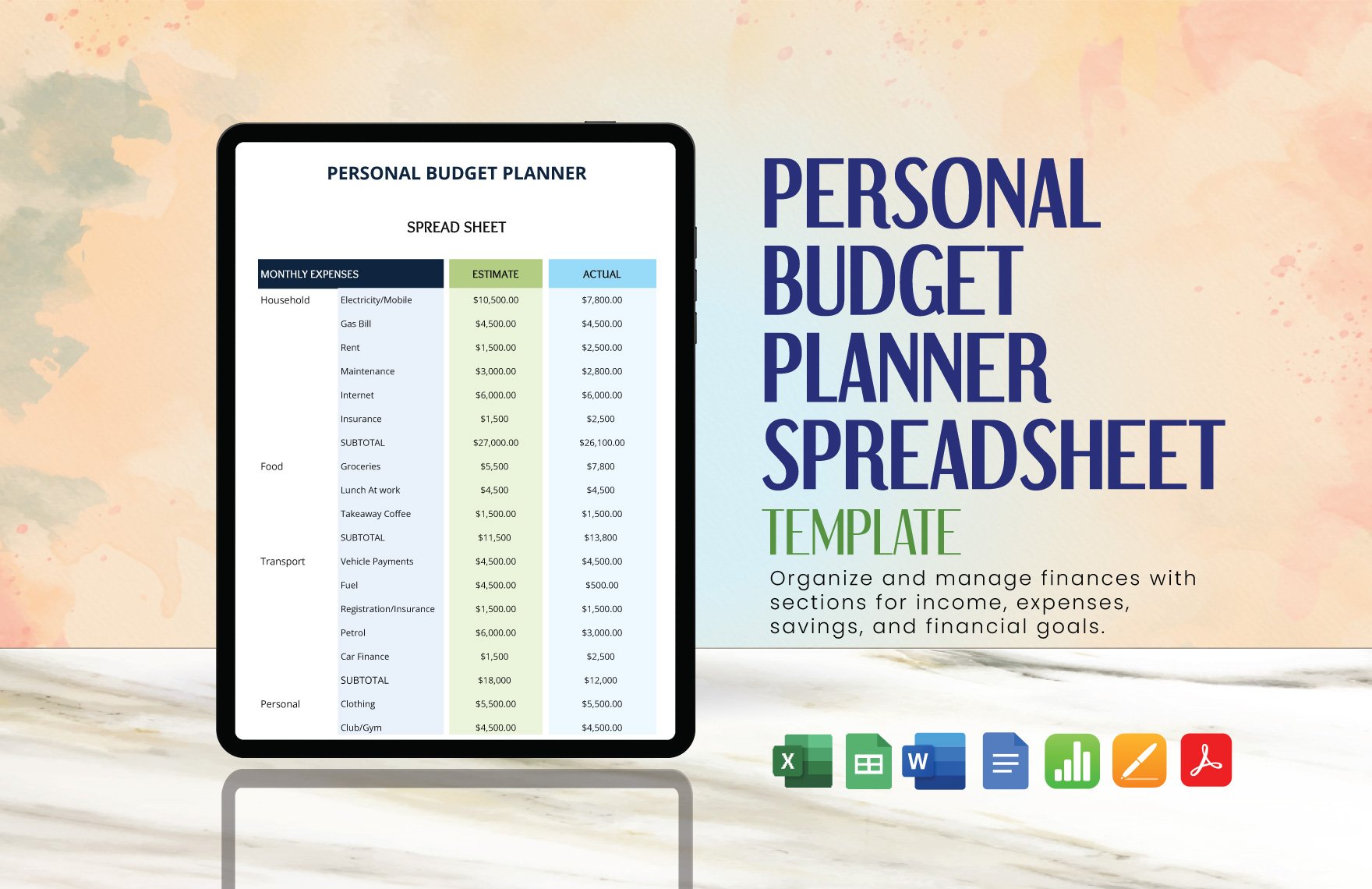

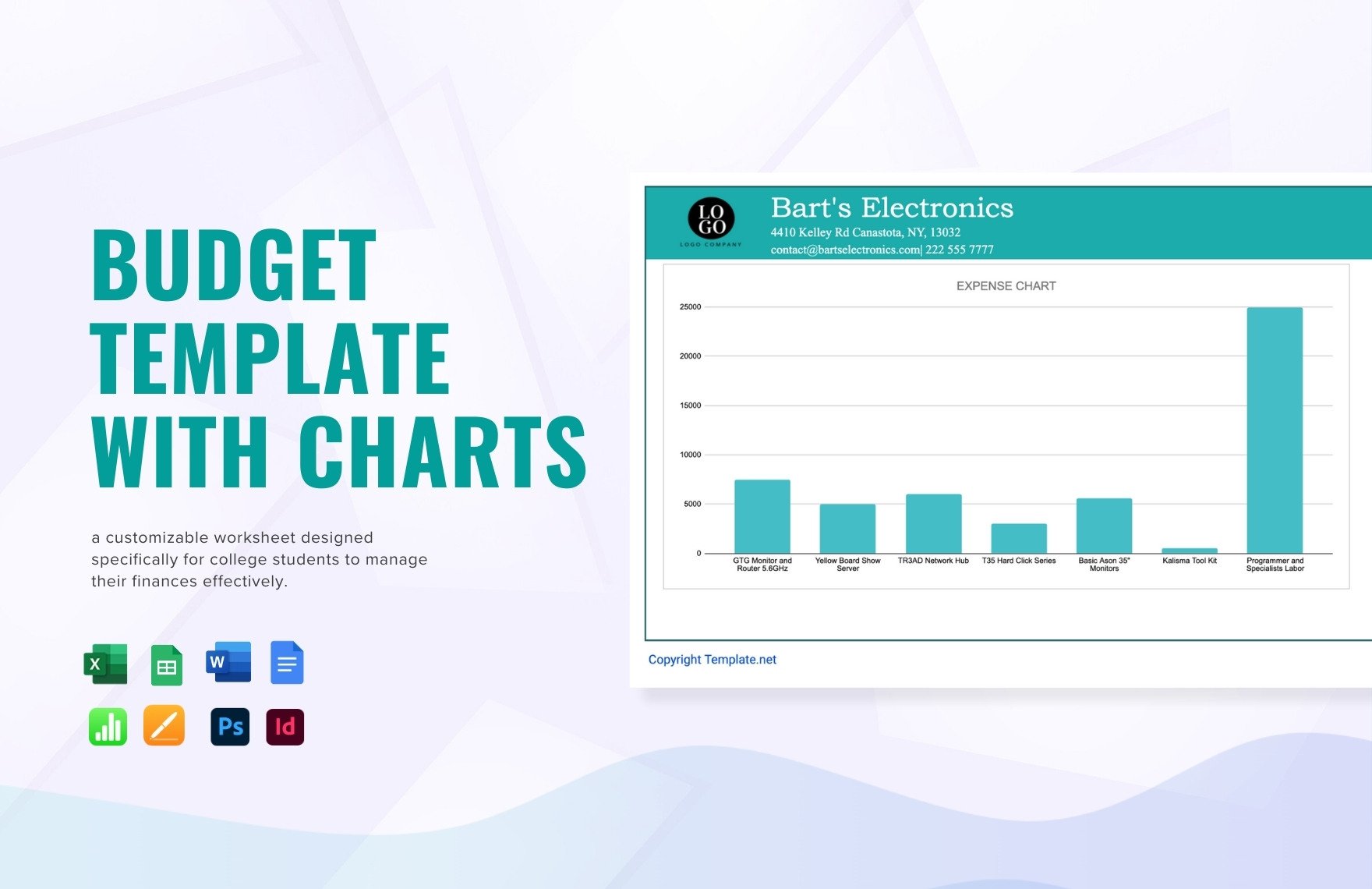

In any business or household, one of the essential factors that keep them going is the budget. Since the budget allows you to plan your finances strategically, you are ensured that you have enough money for your expenses. So, if you wish to have one now, why not download this amazing, premium, and beautifully designed Budget Spreadsheet Template. Guaranteed that you can use this template for your daily, weekly, monthly, or yearly budget as it is 100% customizable, easily editable, and printable in Microsoft Word format. Moreover, our professionals ensure that this template has original suggestive content. So, why pass up this once in a lifetime opportunity to have a personal or business budget? Download now!

How to Make a Budget Spreadsheet in Microsoft Word

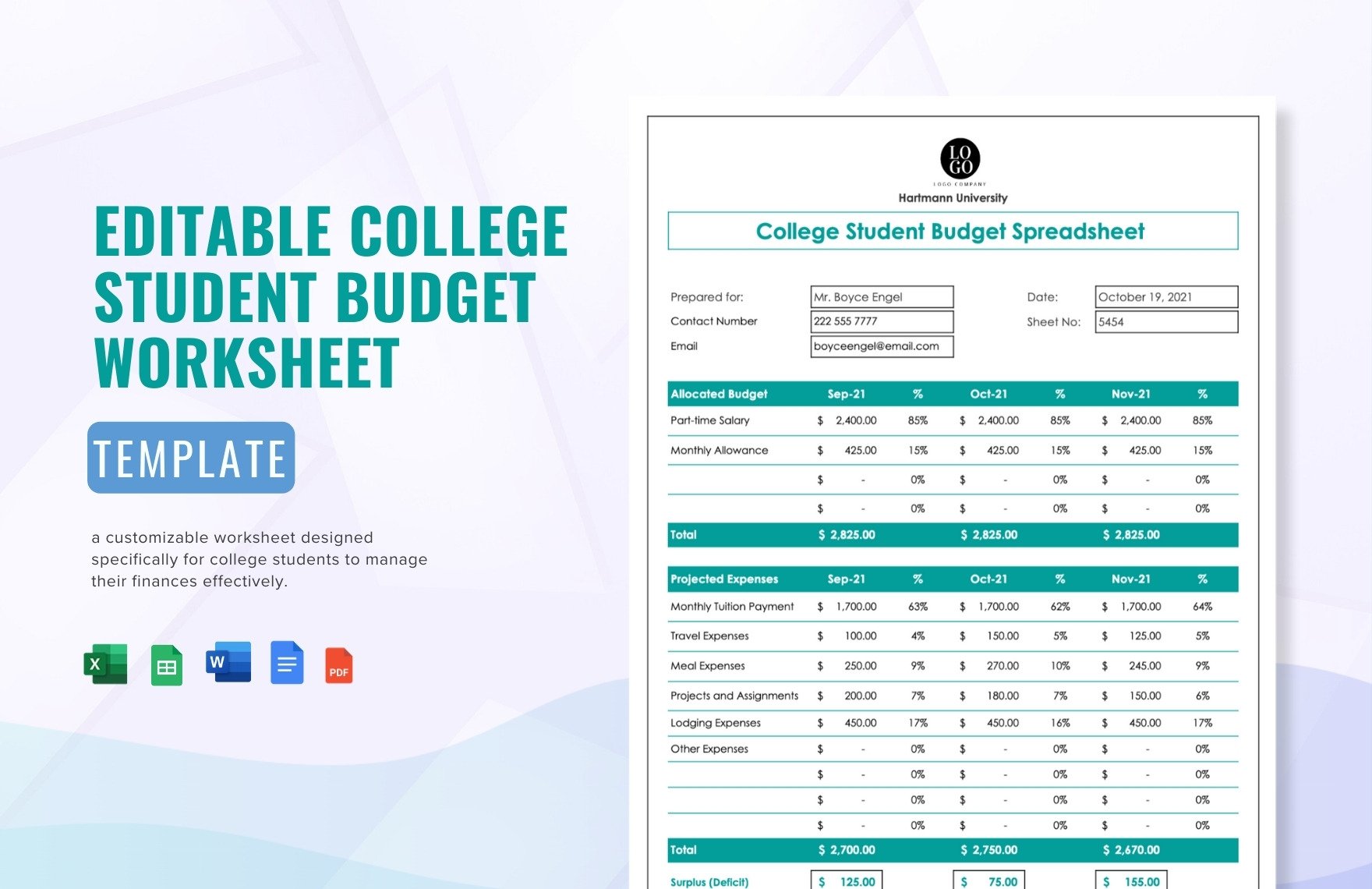

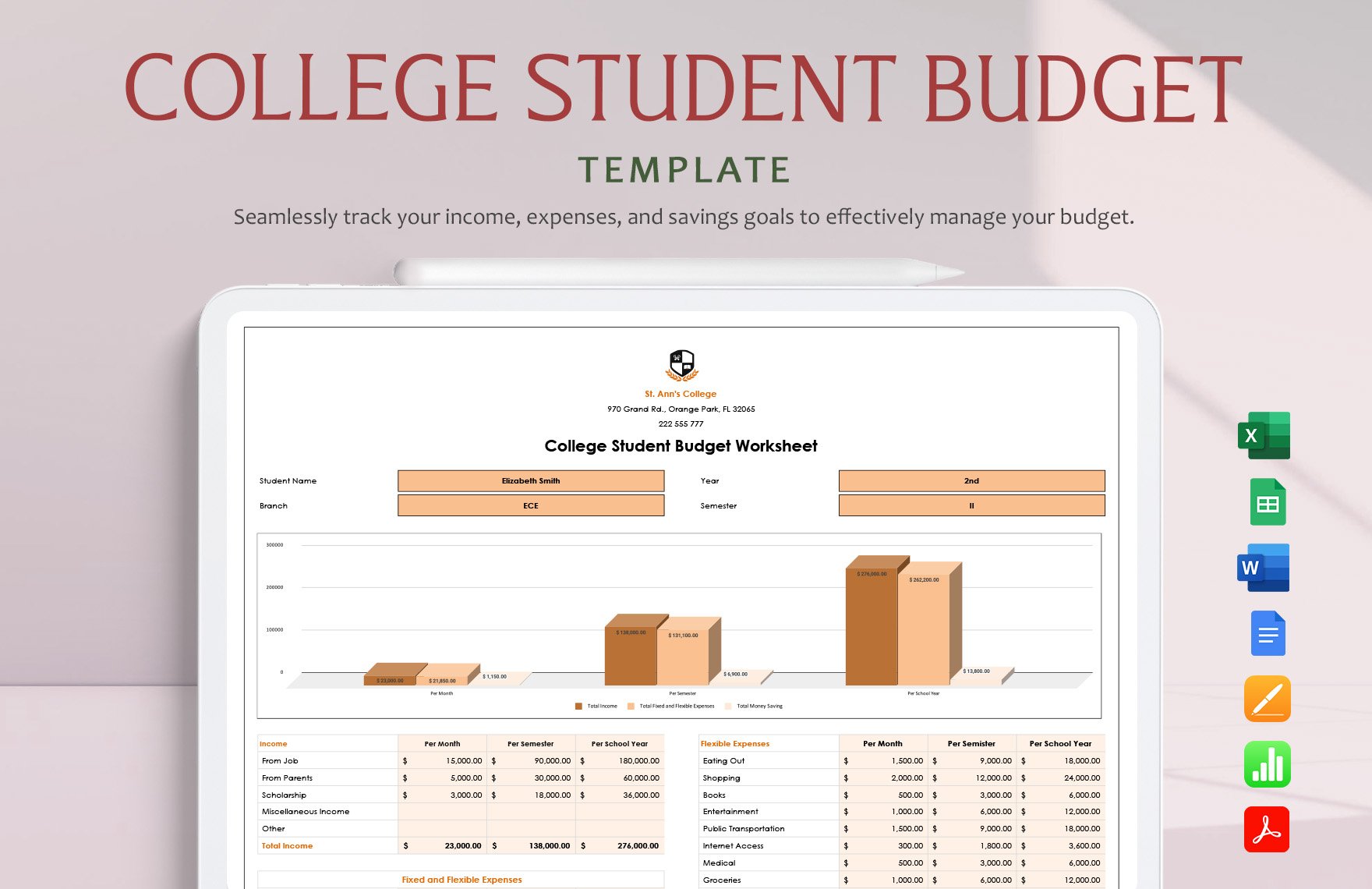

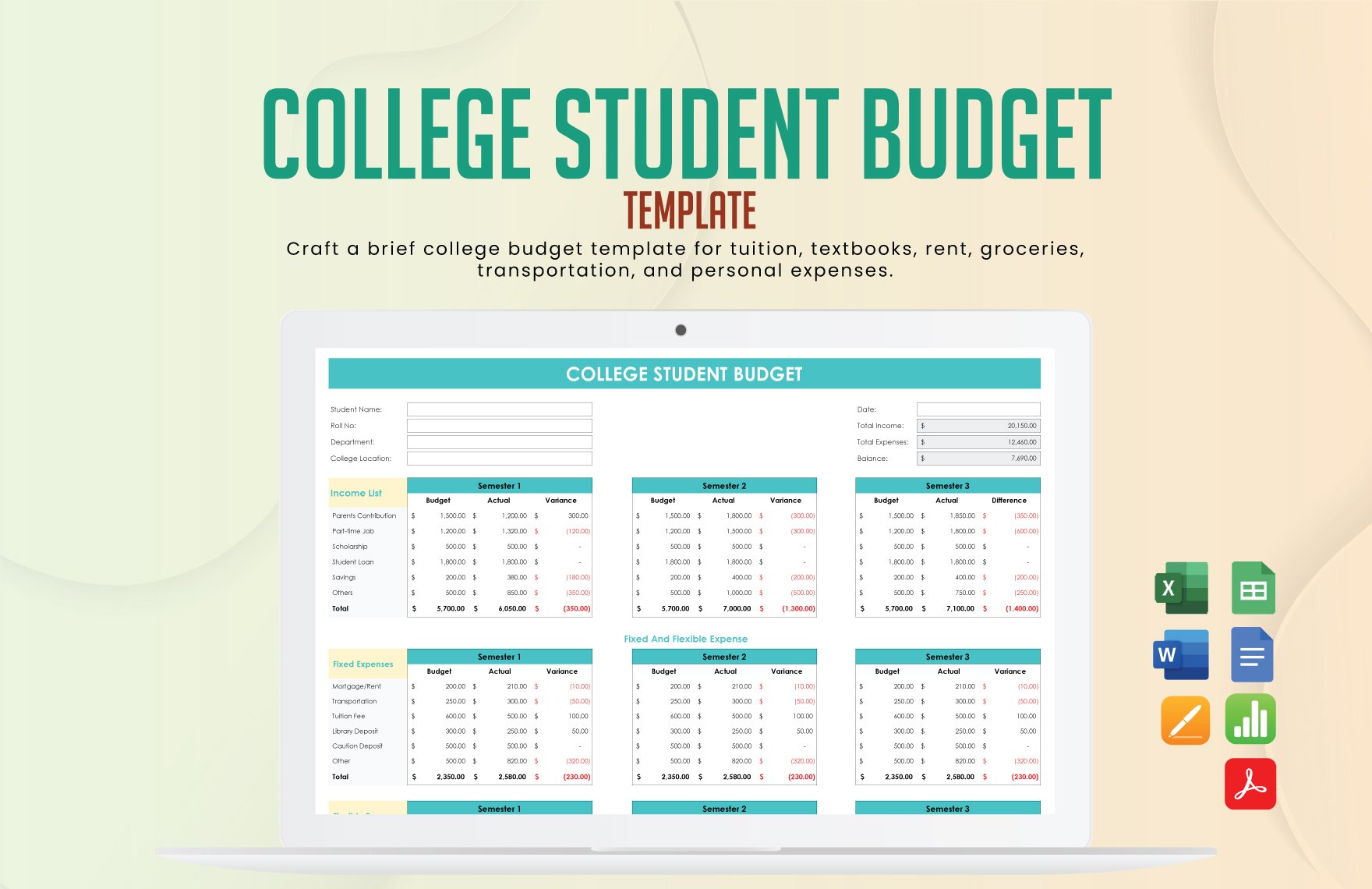

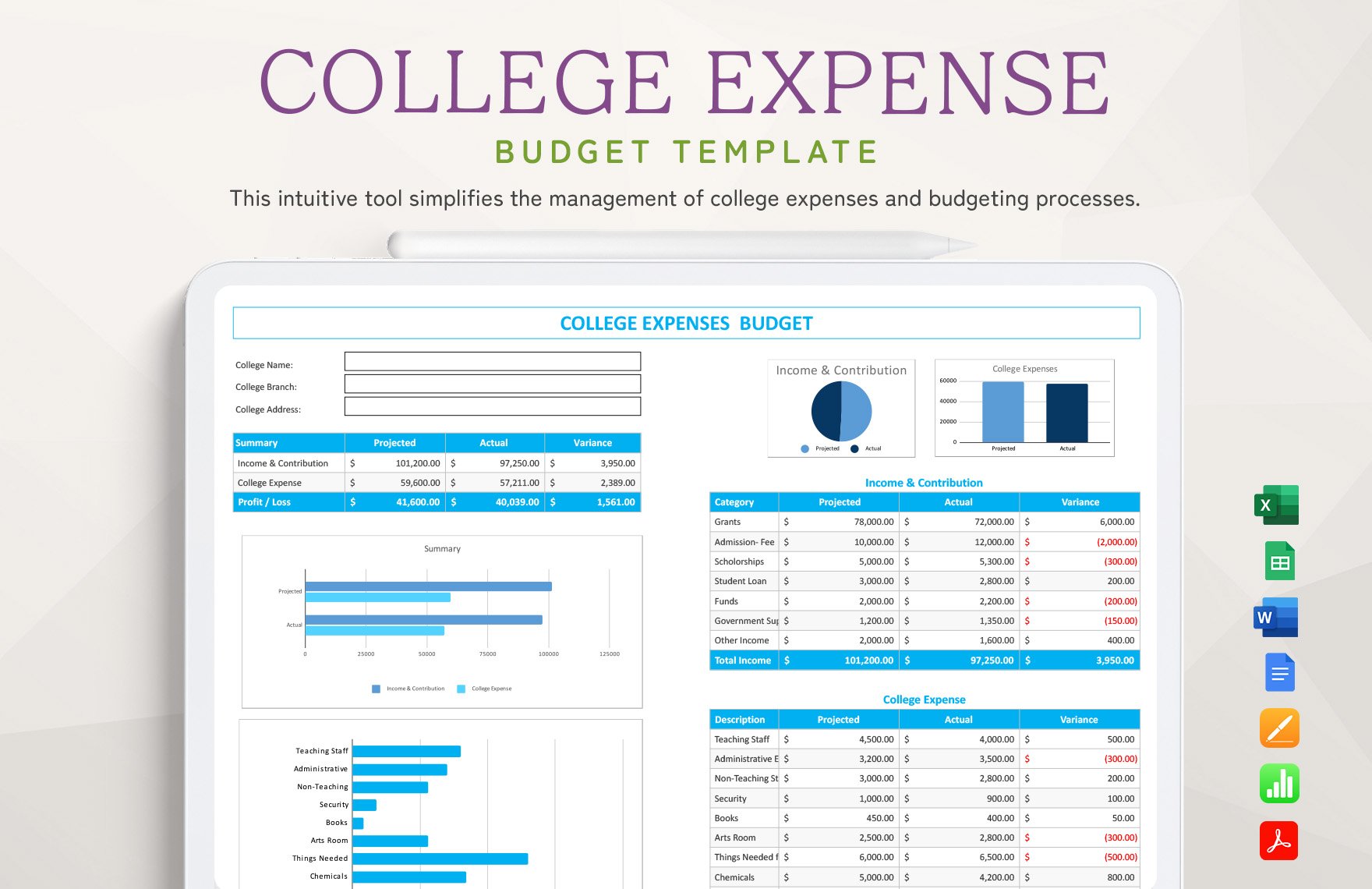

As your personal or business budget planner, it is your responsibility to come up with a document that lets you effectively plan your finances. Any type of budget would do, but do you know what is the most effective of them all? A budget spreadsheet. As a budget spreadsheet lets you lay out every expenditure that you need to budget, you also feel the control into it. So, if you wanted to make one now, here are some simple tips in making a budget spreadsheet.

1. Note your Numbers

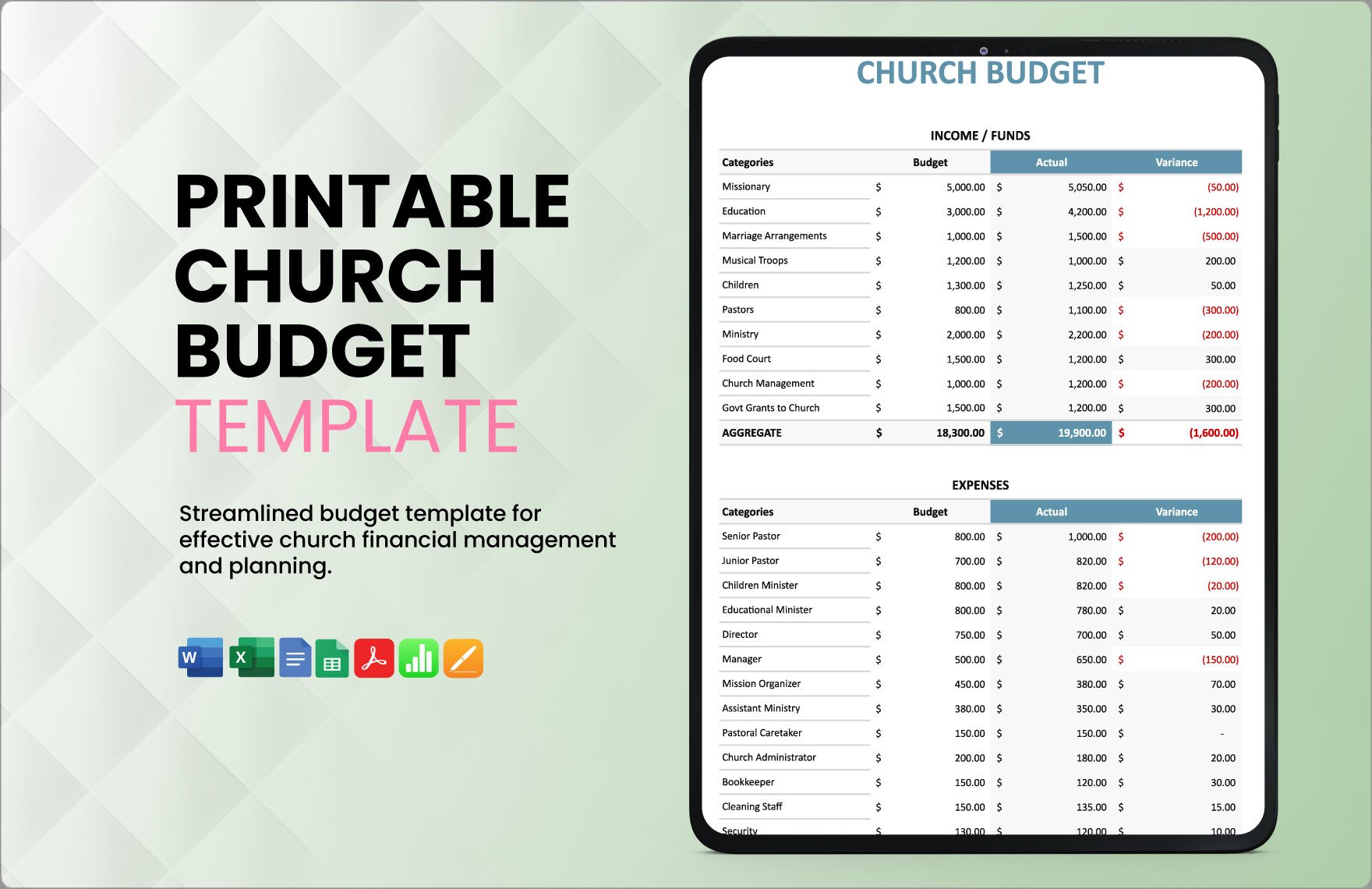

With numbers, you need to take note of your net income. But, remember, you can easily overestimate everything exceeding your budget, so you need to make sure that you have a definite number. To do this, you need to subtract taxes, insurances, and account allocations. With that, you have your take-home pay that would serve as your net income. Depending on the regularity and irregularity of your income, adjust your budget.

2. Track your Expenditures

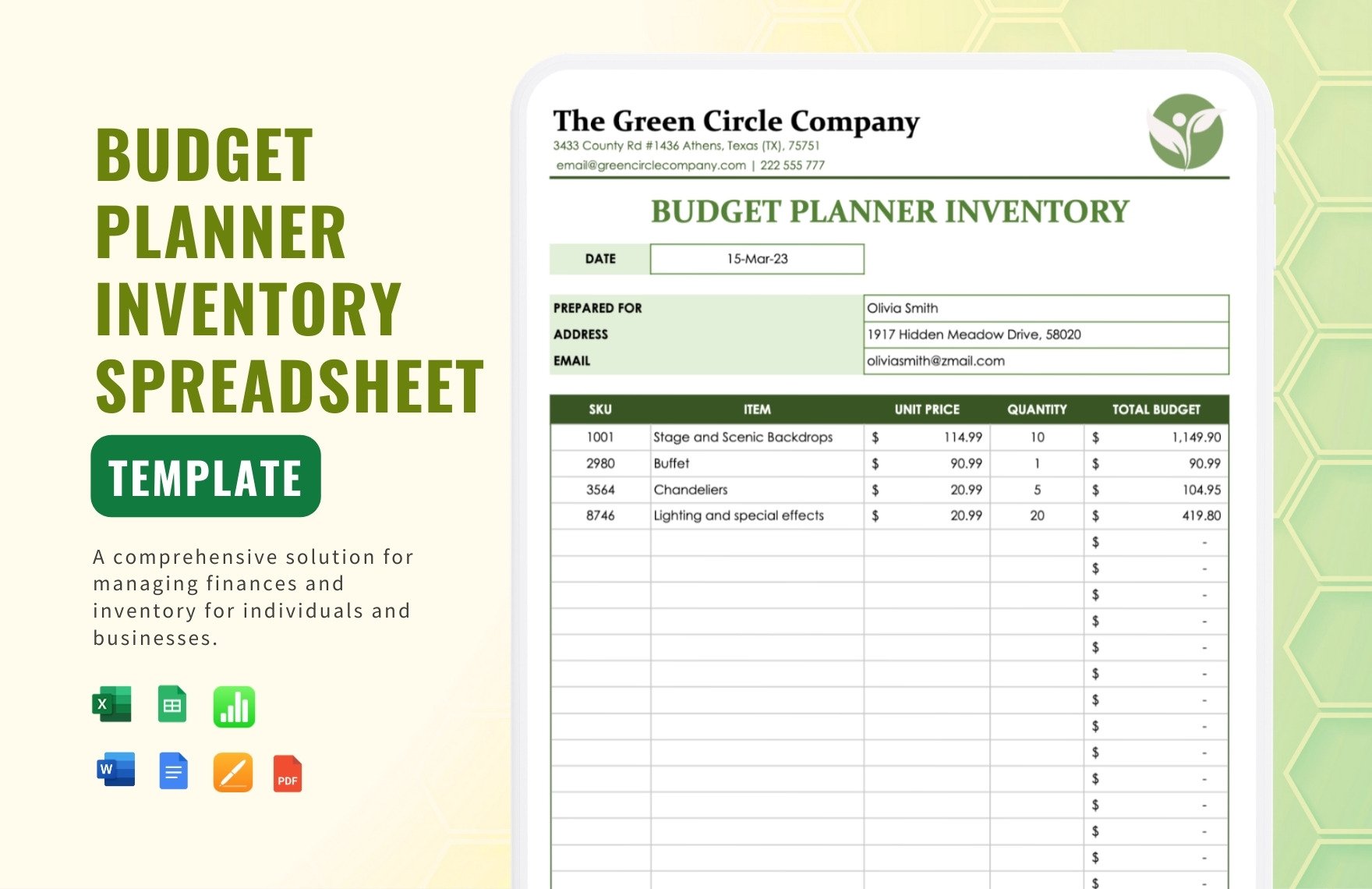

If you wish to make a monthly budget spreadsheet for your family or business, you might as well track every expense that you make. Come up with an expenditure list that would narrate every financial transaction that took place. In this way, you can identify as to where you overspend or underspend. As a result, this would greatly help you in adjusting your budget.

3. Know your Goals

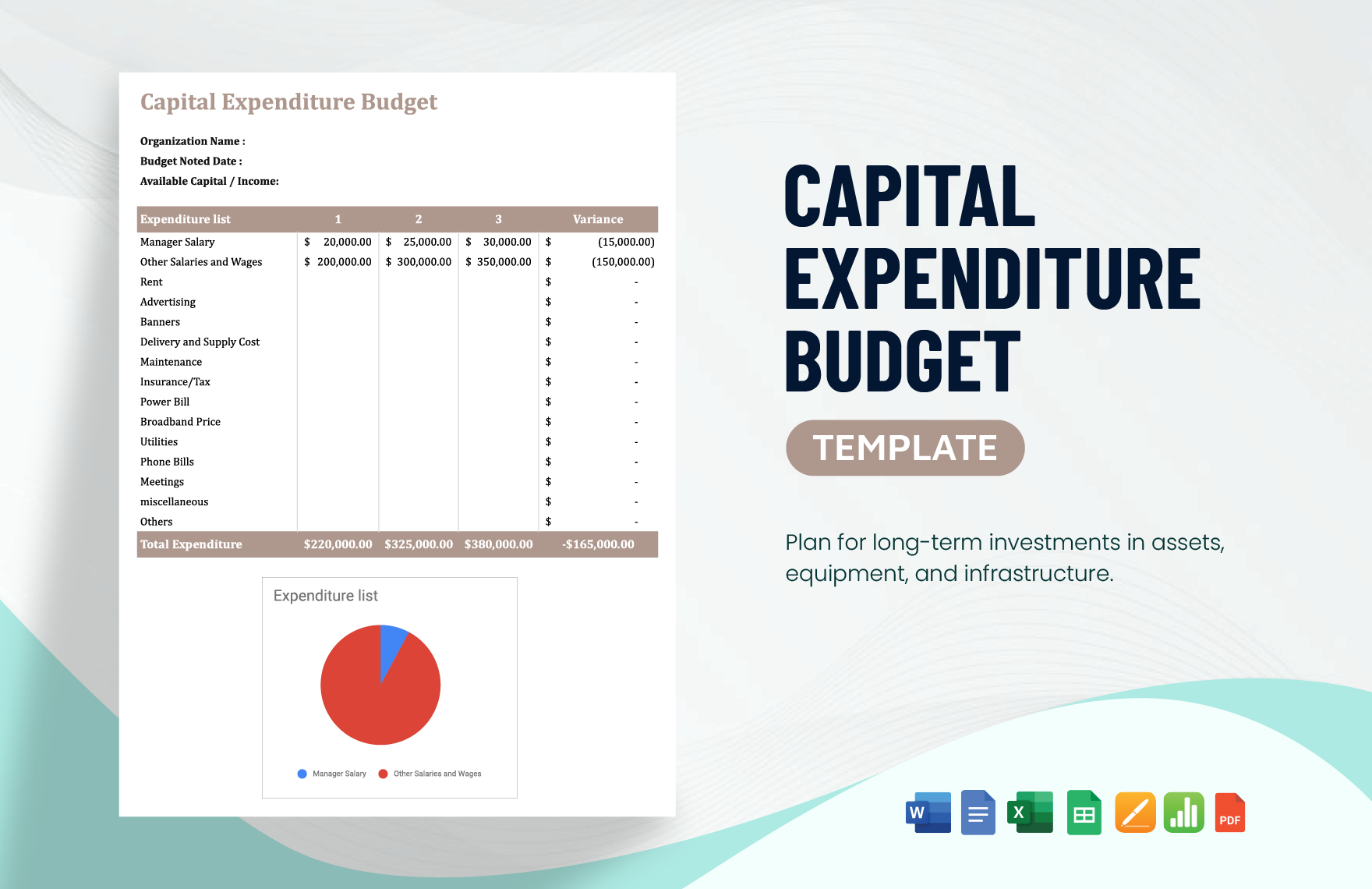

After the two tips, you can now start deciding on your goals. Do you want to save this month? Or do you want to have less expense this week? Asking this would generate you the goals that you wanted to achieve. Then, sort the goals out— short or long term. Short-term goals are usually achieved a year or two. Long-term goals may take a couple of years to achieve. Some examples of long term goals are education, retirement, and more.

4. Plan your Expenses

Now that you have decided with your goals, you can now start planning your expenses. Together with a budget calculator and budget spreadsheet, you can fairly predict how much you will budget for. Make your past budget experience as a reference.

5. Test it Out

If you have come up with a sample budget spreadsheet, you can test it out by applying it to the real scenario. Observe the application of the budget spreadsheet and take note as to what element did it succeed or fail. Make it as your editing reference.