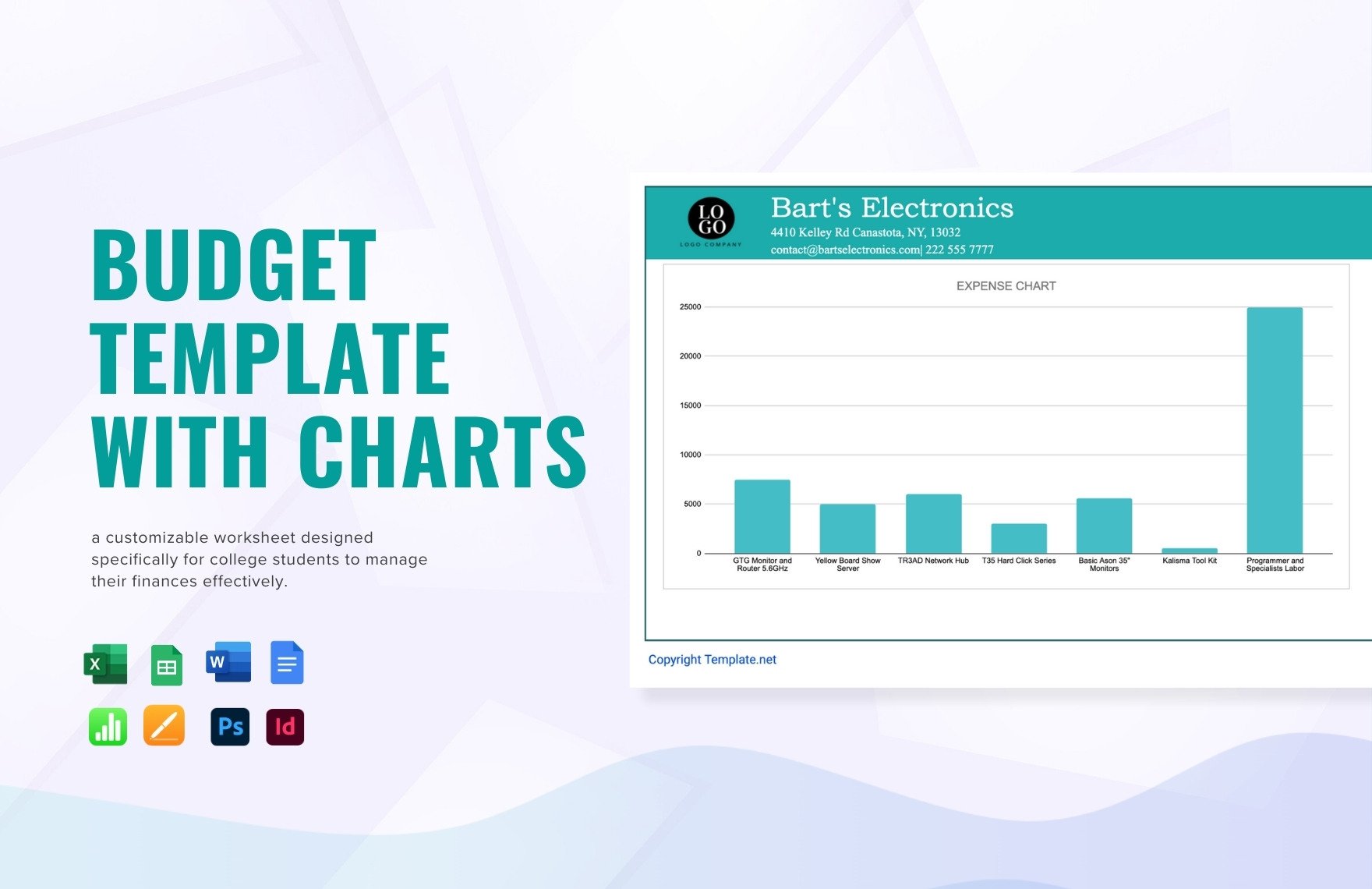

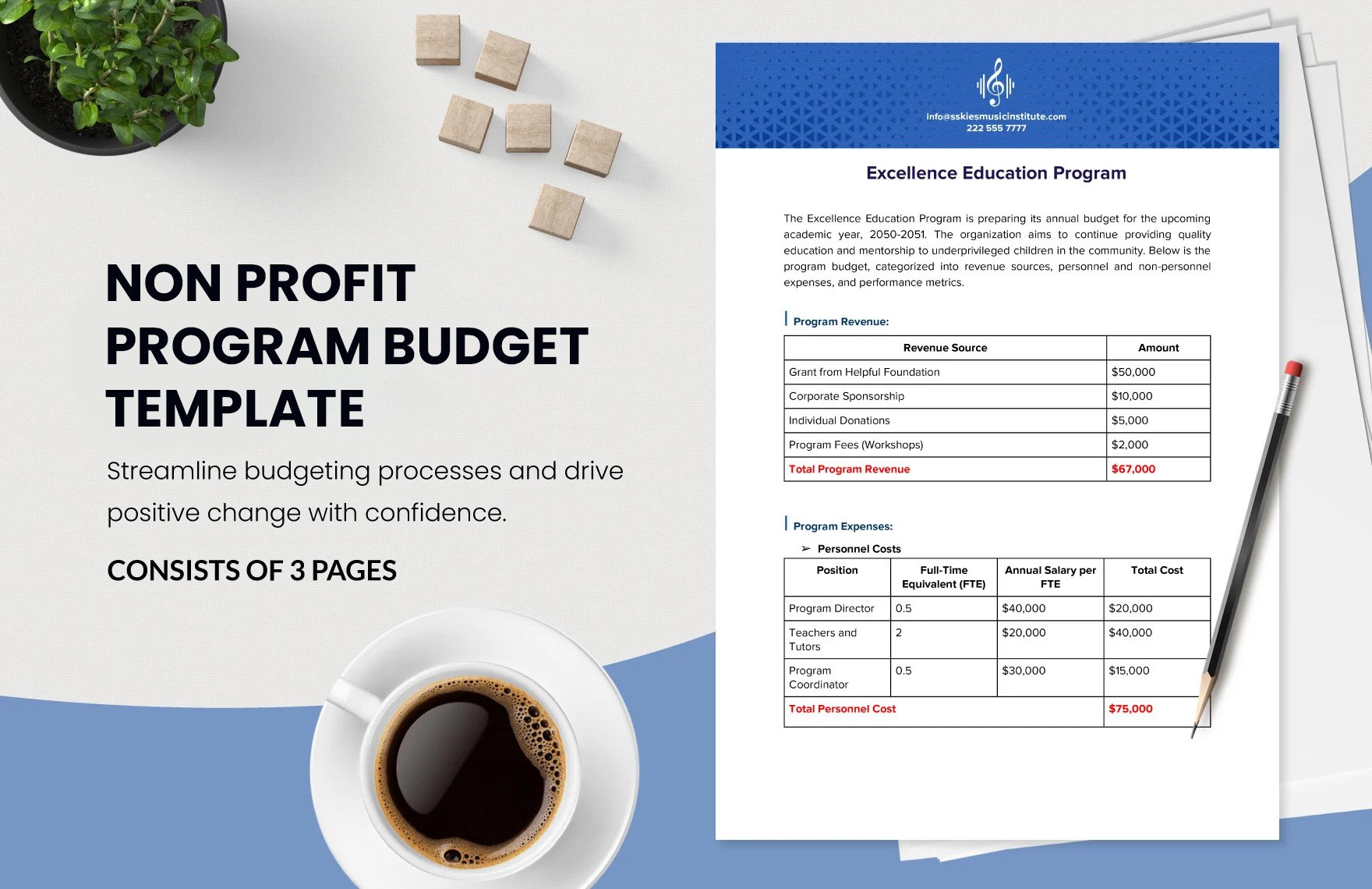

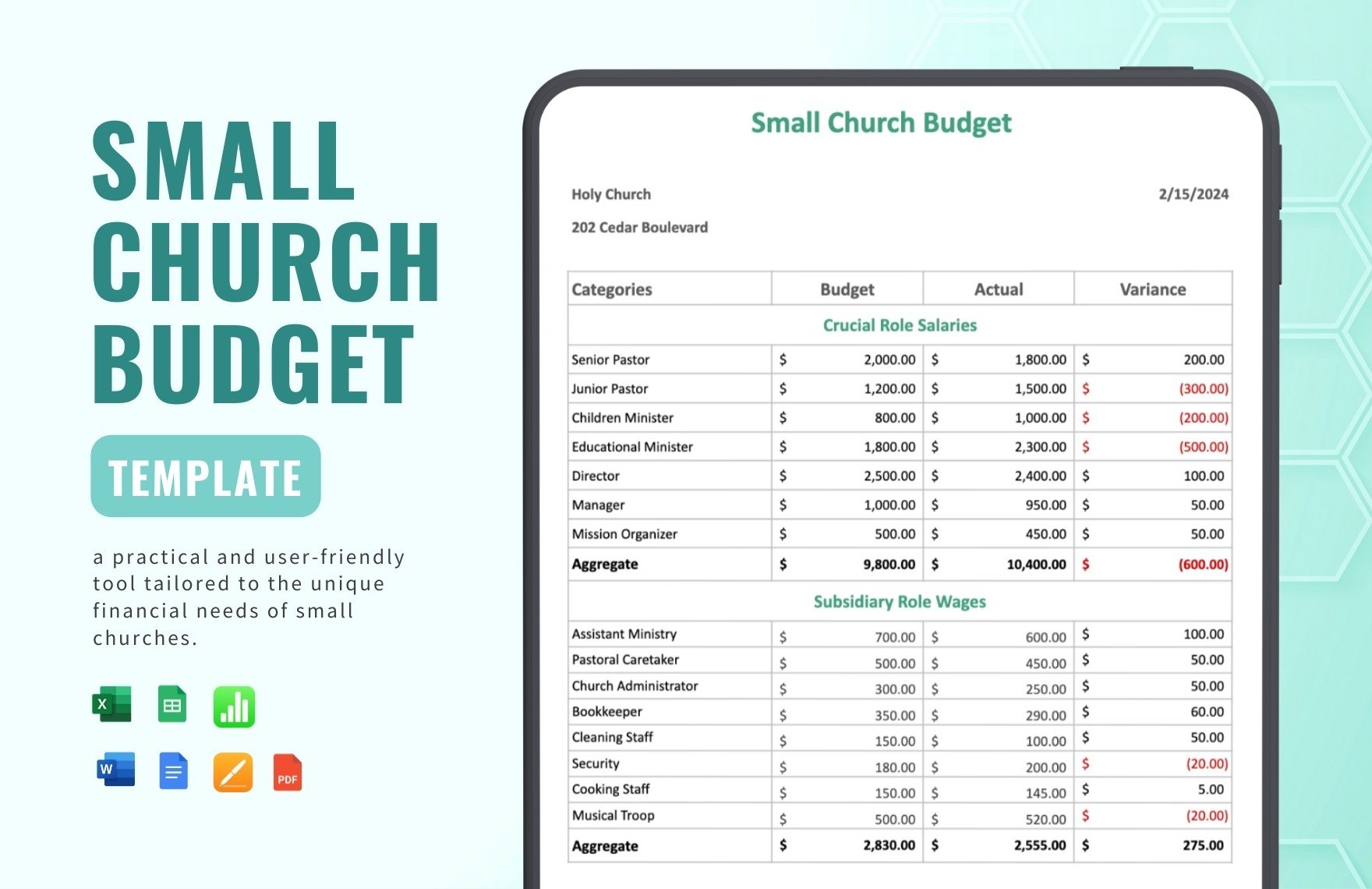

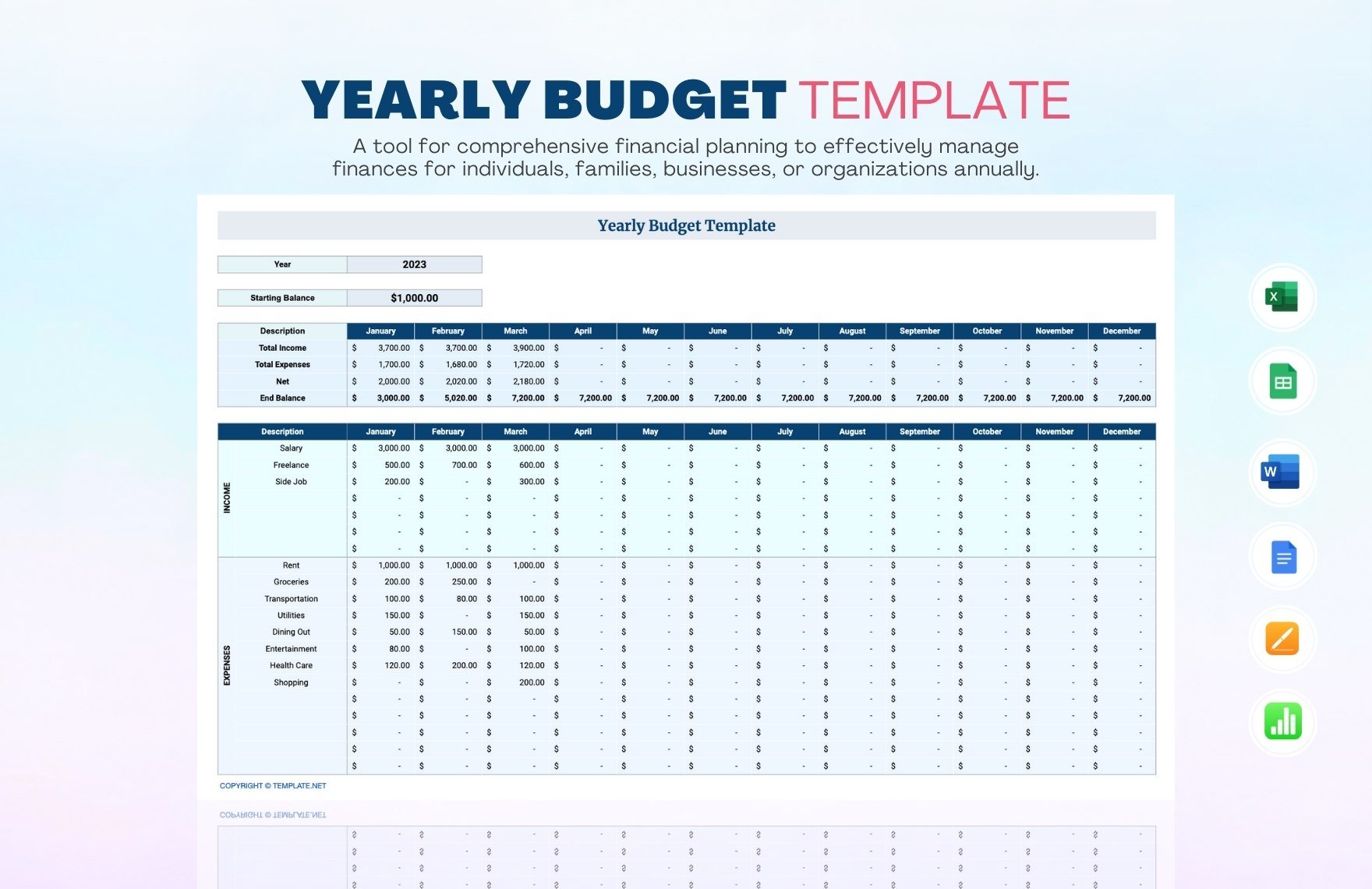

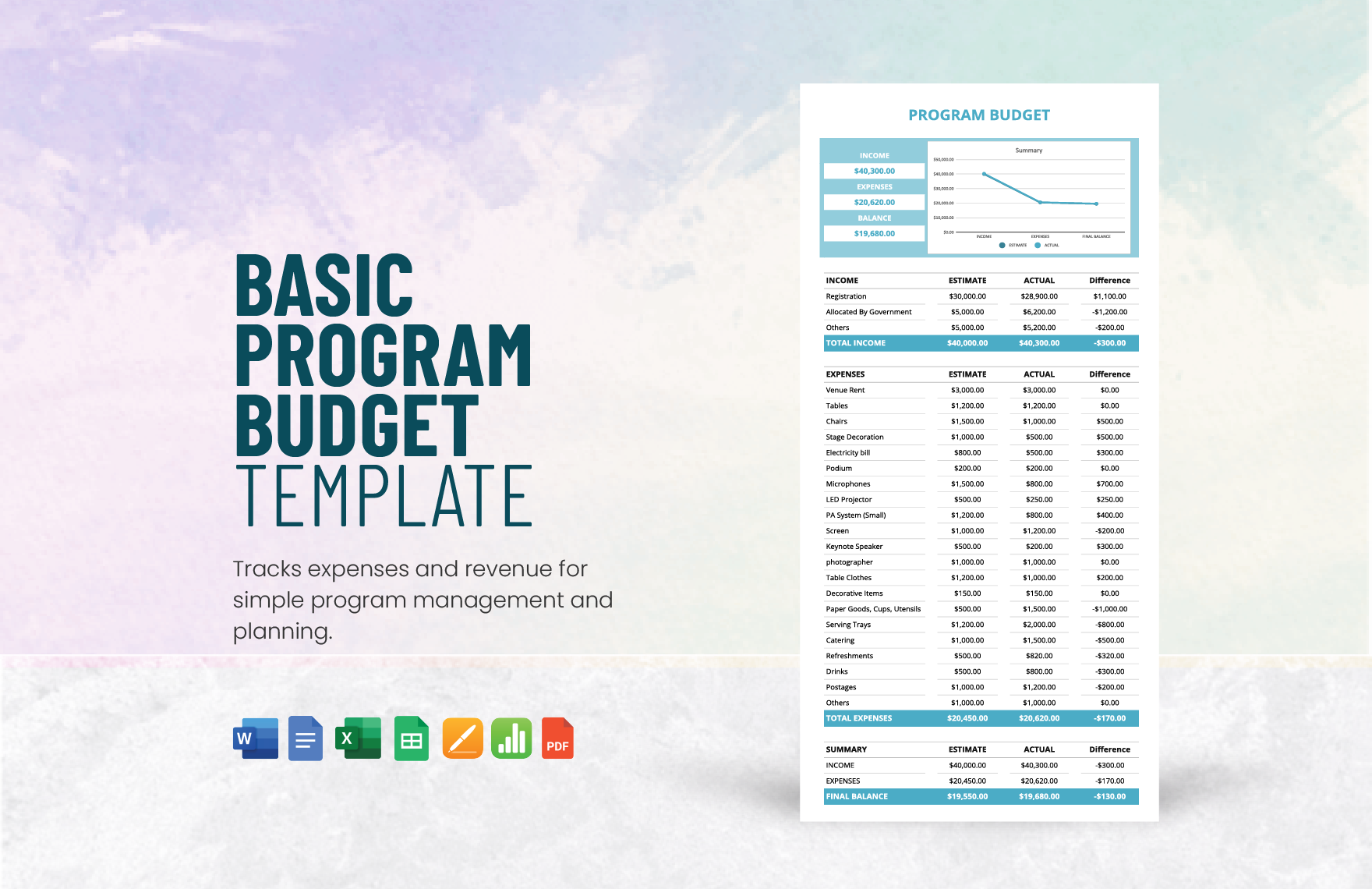

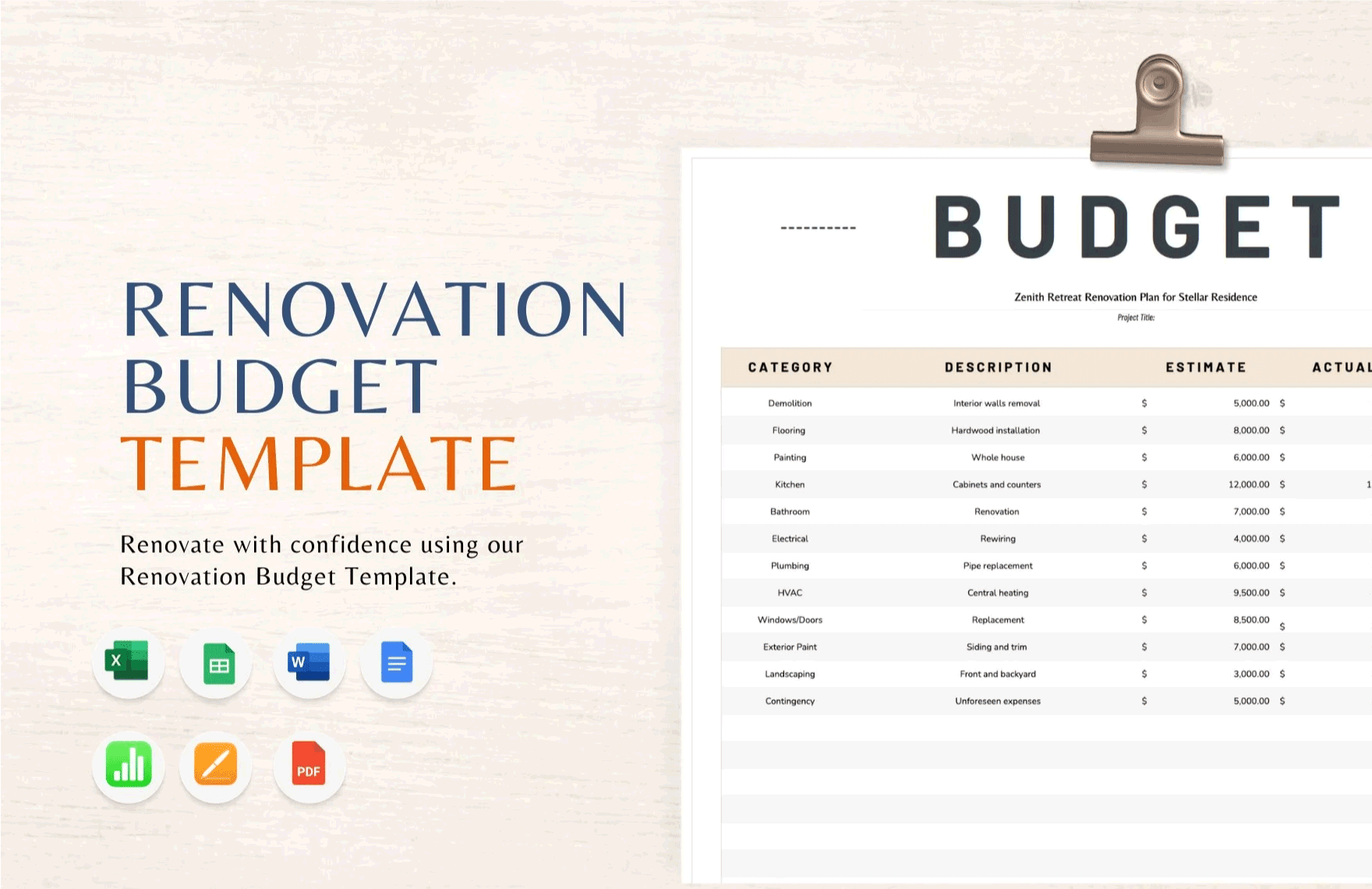

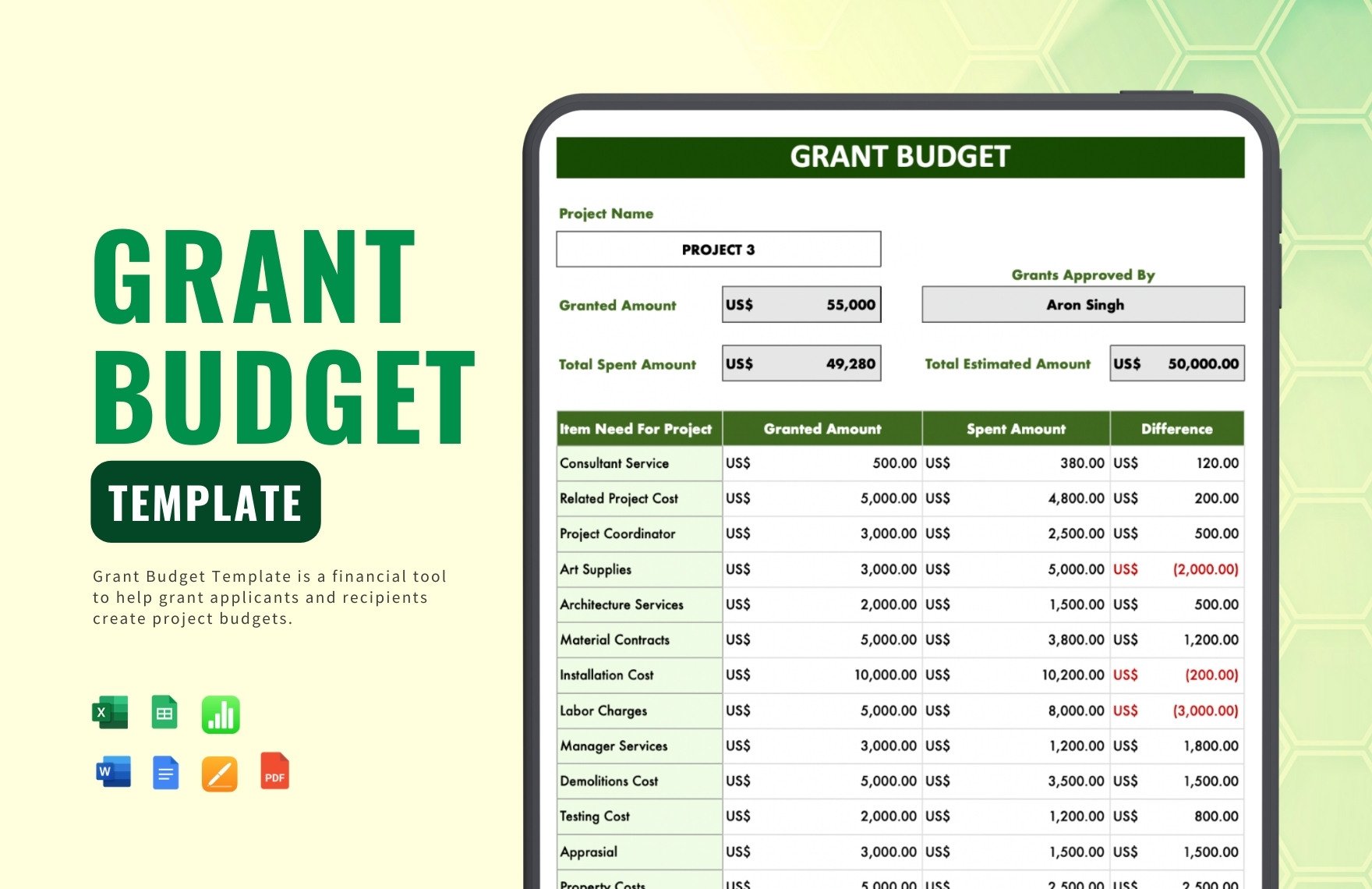

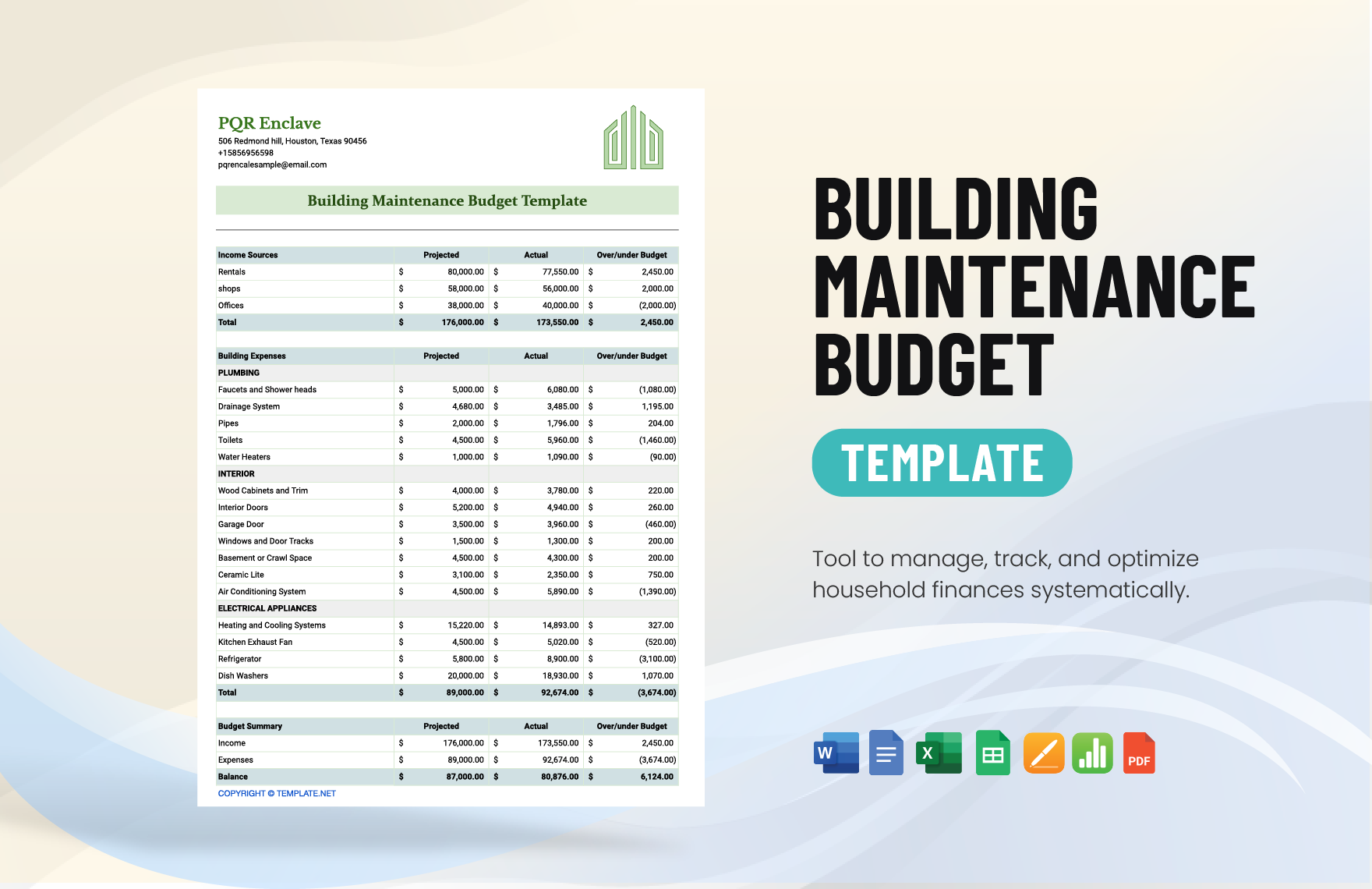

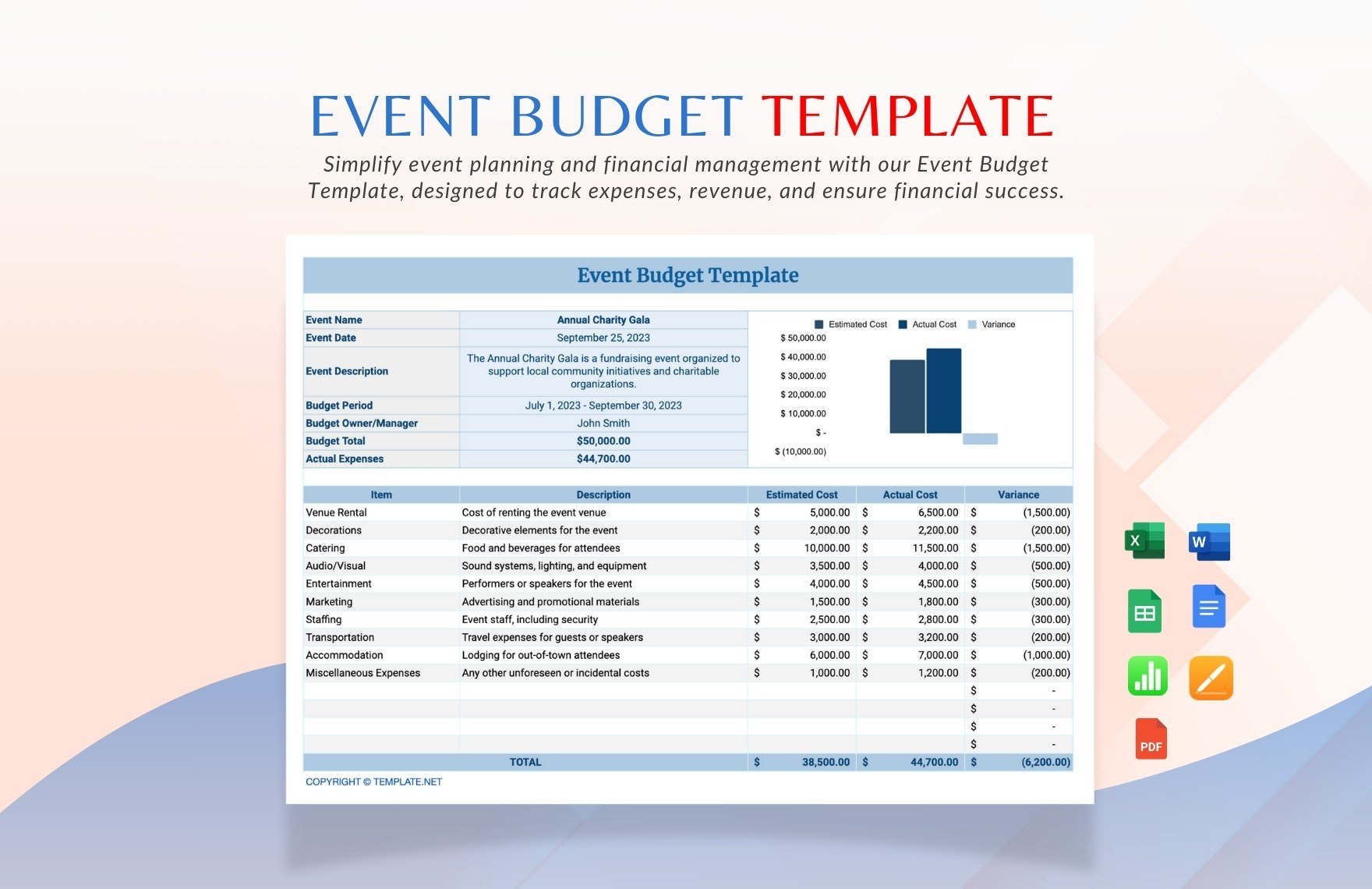

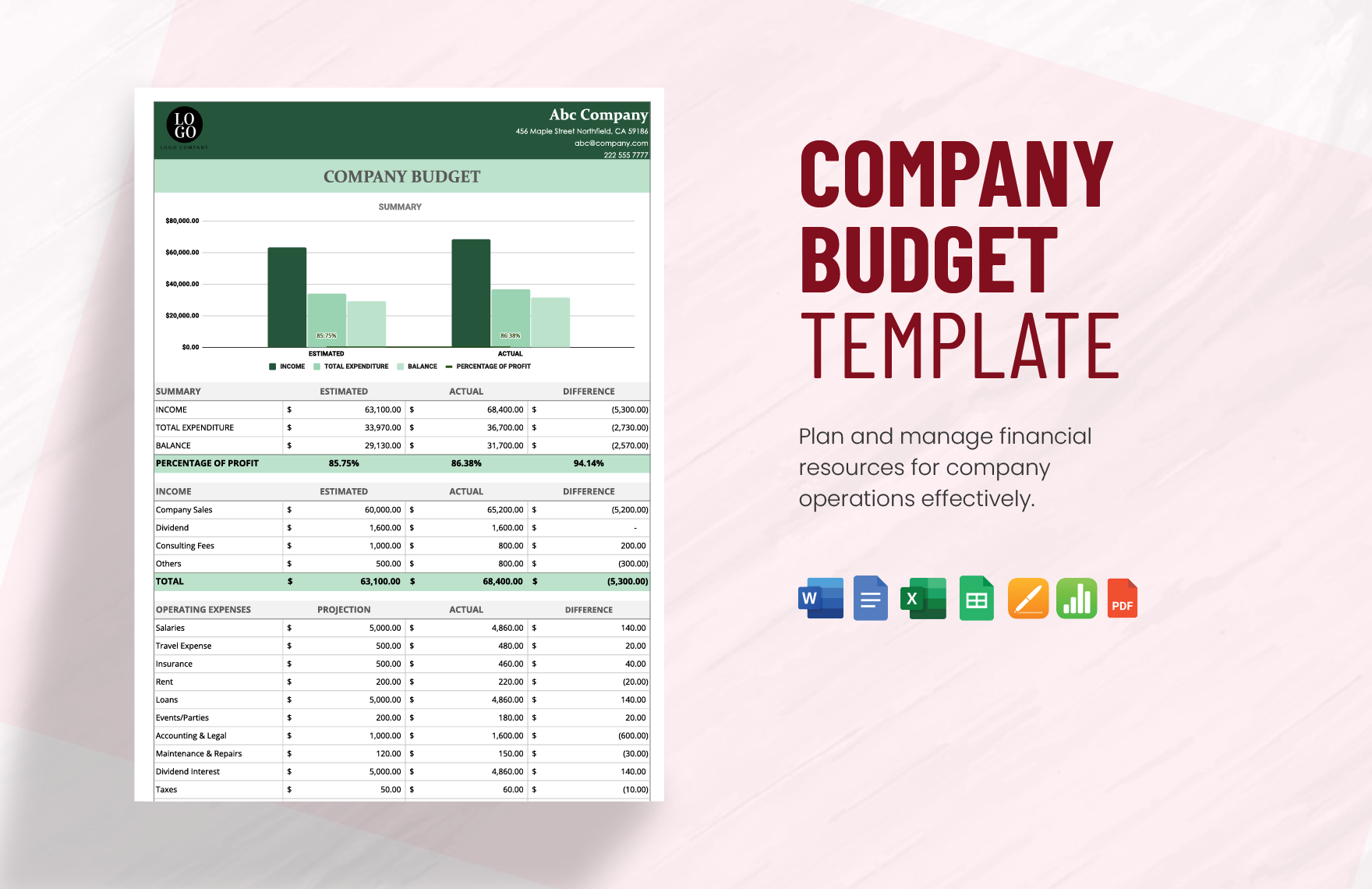

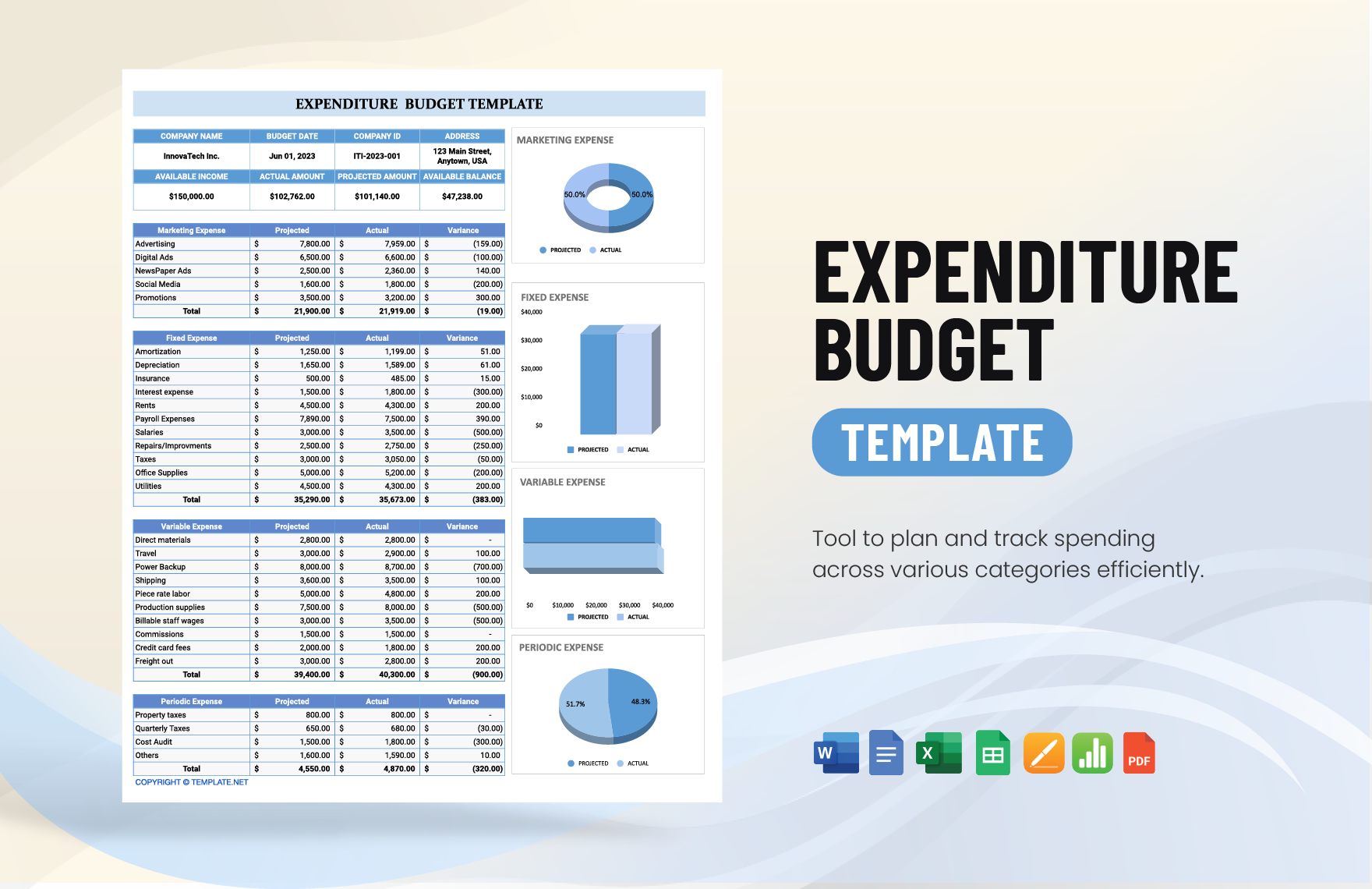

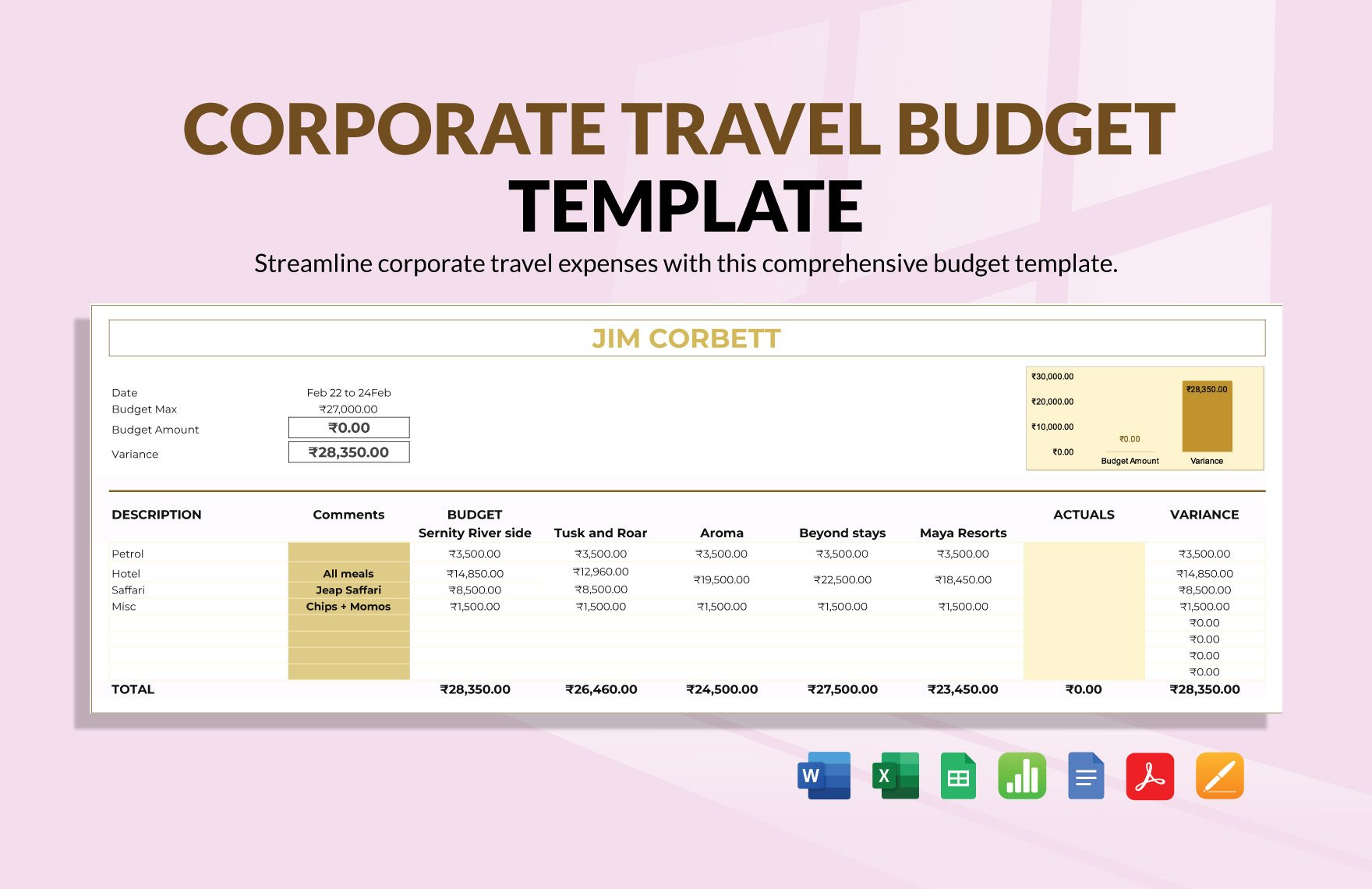

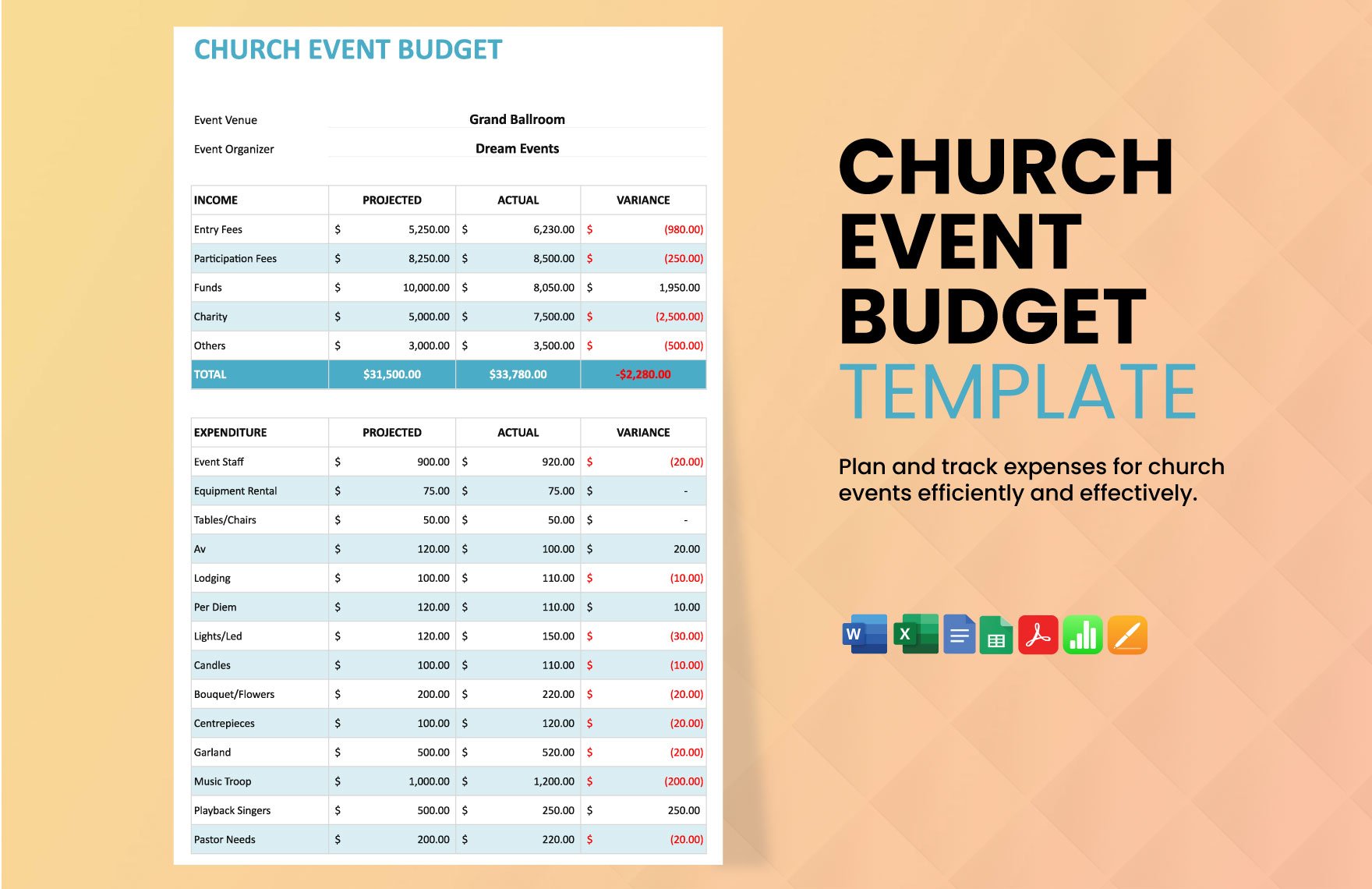

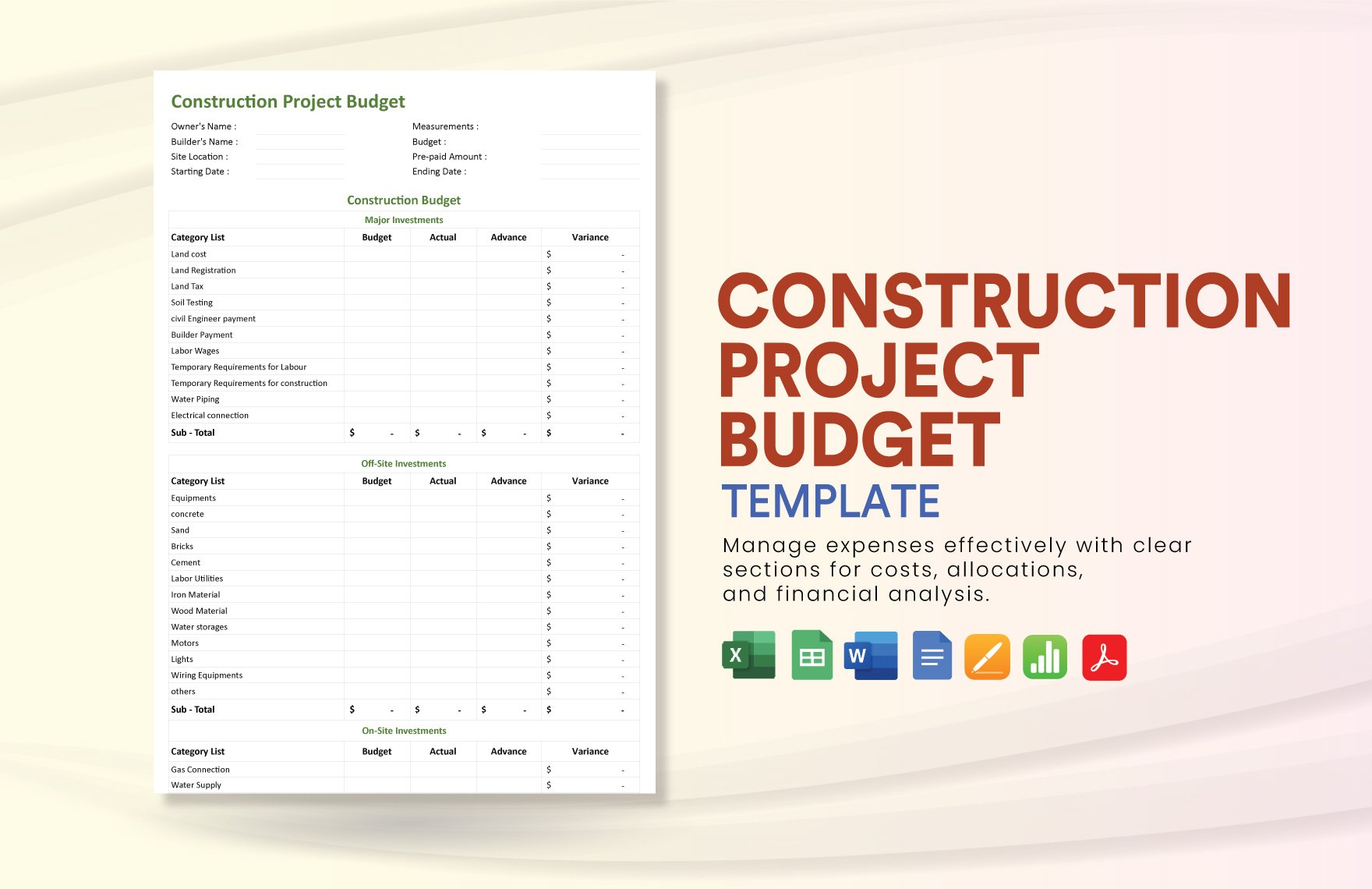

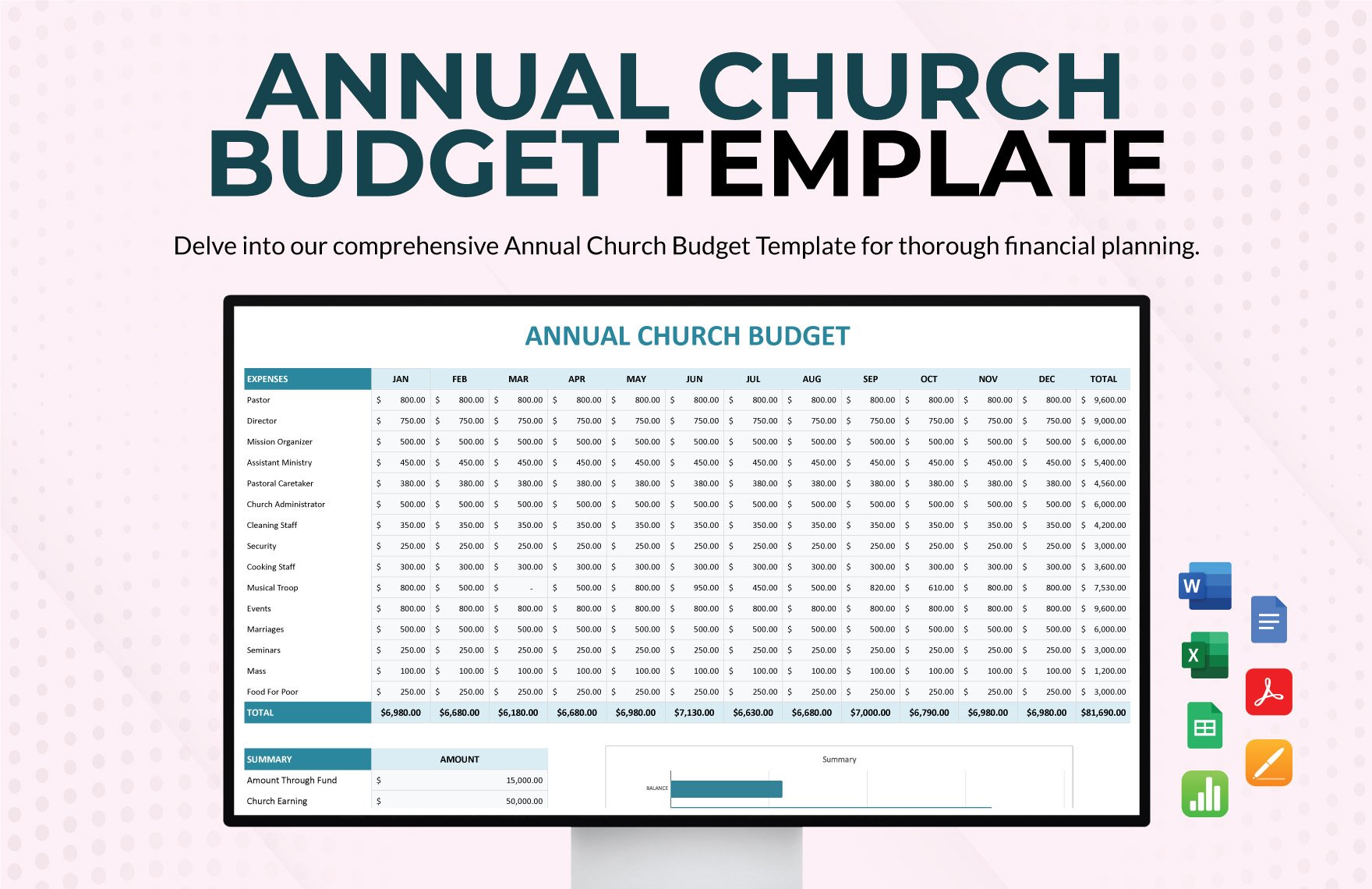

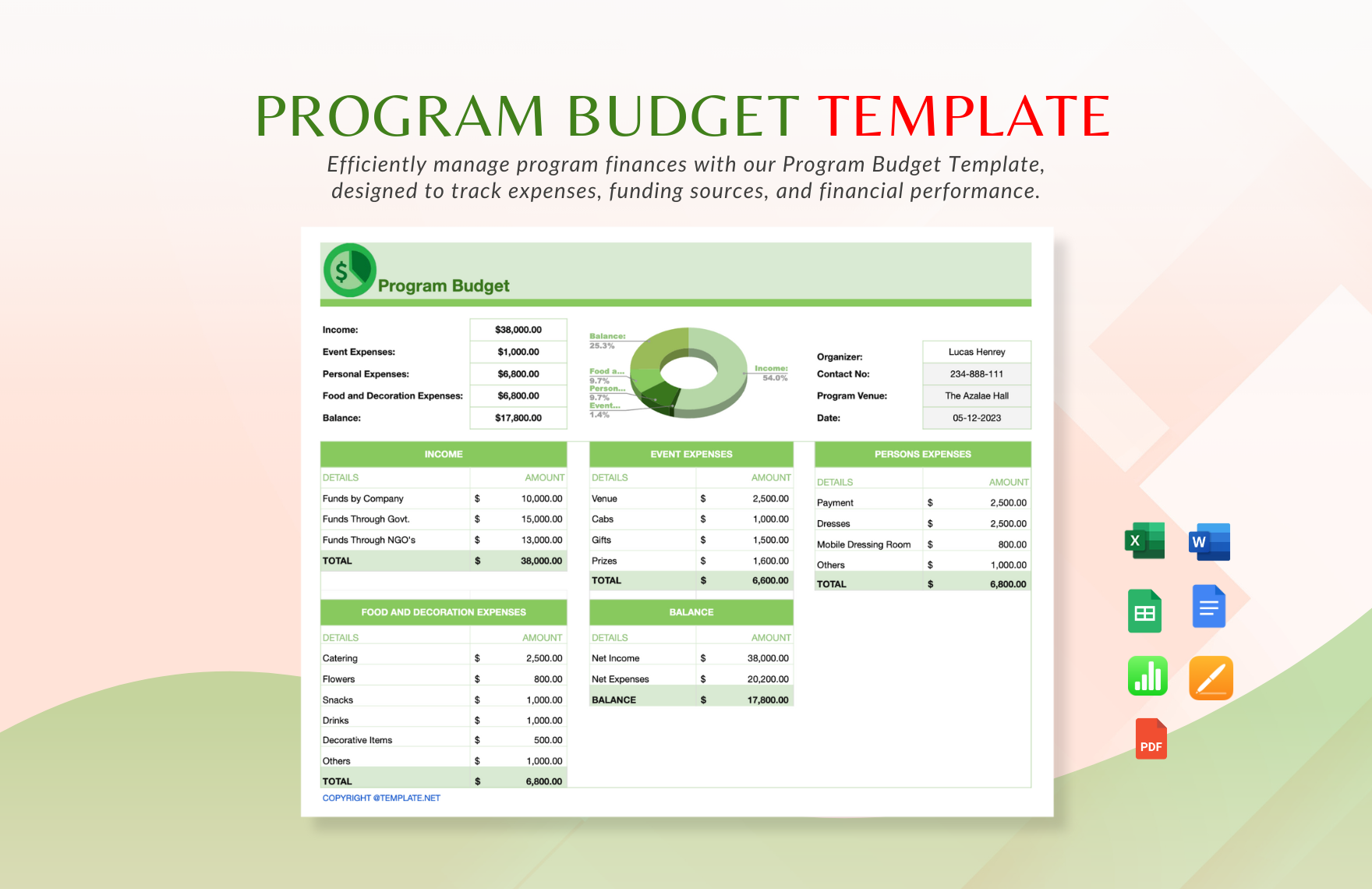

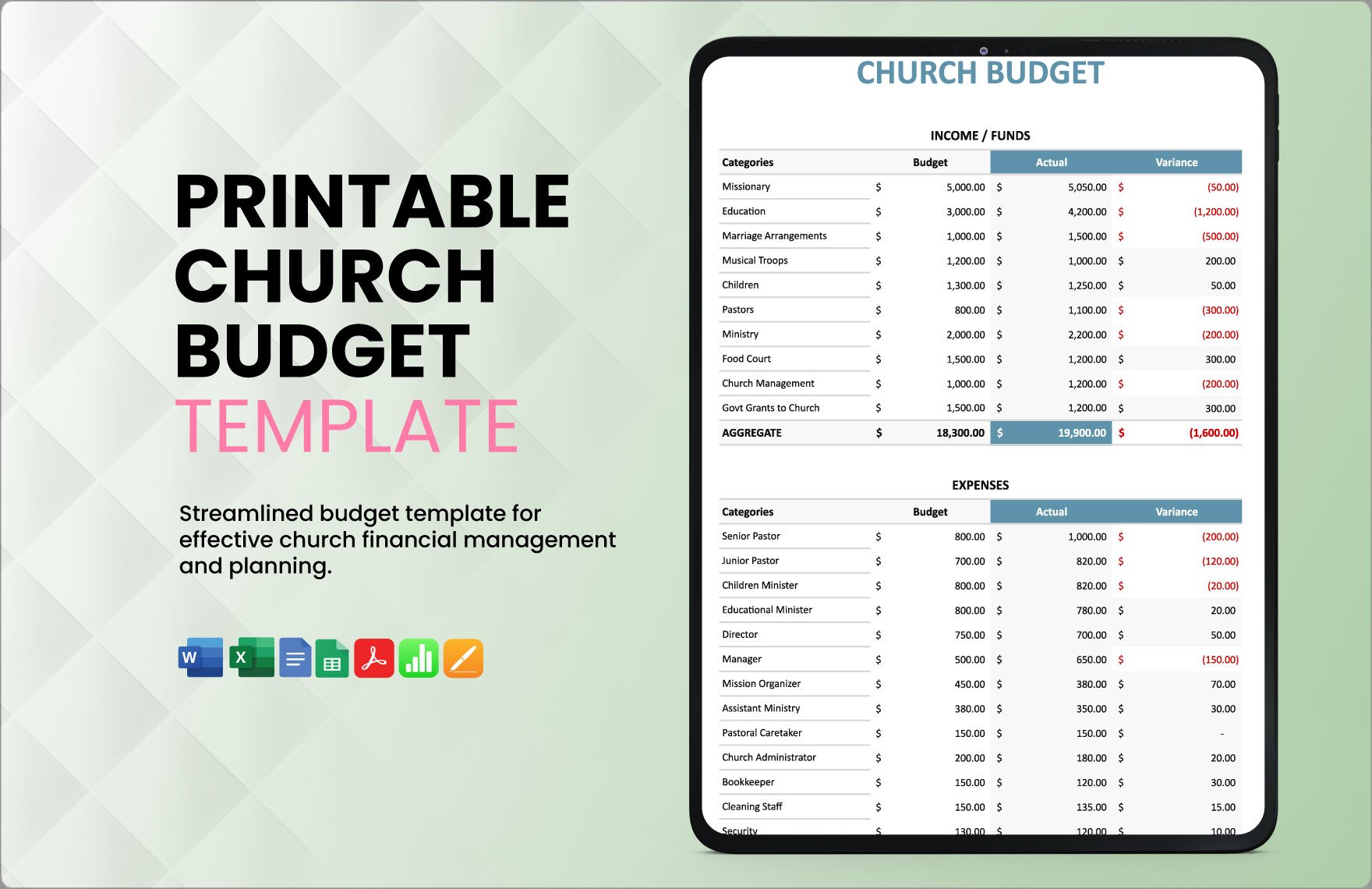

If you're looking for comprehensive templates to help make the process of creating personal or business budgets more efficient, Template.net has the best solution. Our collection of budget templates in Google Docs are 100% customizable and have been professionally made to give you an outline where you can easily fill out the pertinent information relevant to the purpose of the budget. We also ensured that these ready-made templates are user-friendly and easily editable to guarantee that you achieve excellent quality output with just a few clicks of a button. Avail of a subscription plan now and start managing your money better with the help of our downloadable and editable budget templates in Google Docs.

What is a Budget?

A budget, also known as a spending plan, is an estimation of how much an entity will earn or spend over a specific time period. Corporate budgets, which are usually prepared by public accountants, are one of the internal tools that are used by the management in conveying the financial health of the company. Anyone can have a budget, with most people opting to have their budget written, but there are also some who prefer to use budgeting apps, spreadsheets, or any computer program designed for this kind of task.

How to Make a Budget on Google Docs?

According to one article, only 40% of Americans spend less than their income while 38% and 22% spend around equal of what they earn and more than their income, respectively. It is undeniably true that the first time you engage in budgeting may get you overwhelmed, but it is worth the time and effort when you will start reaping what you have sown. To help you get started, here are some guidelines that you can use in making a budget.

1. Take Note of Your Income

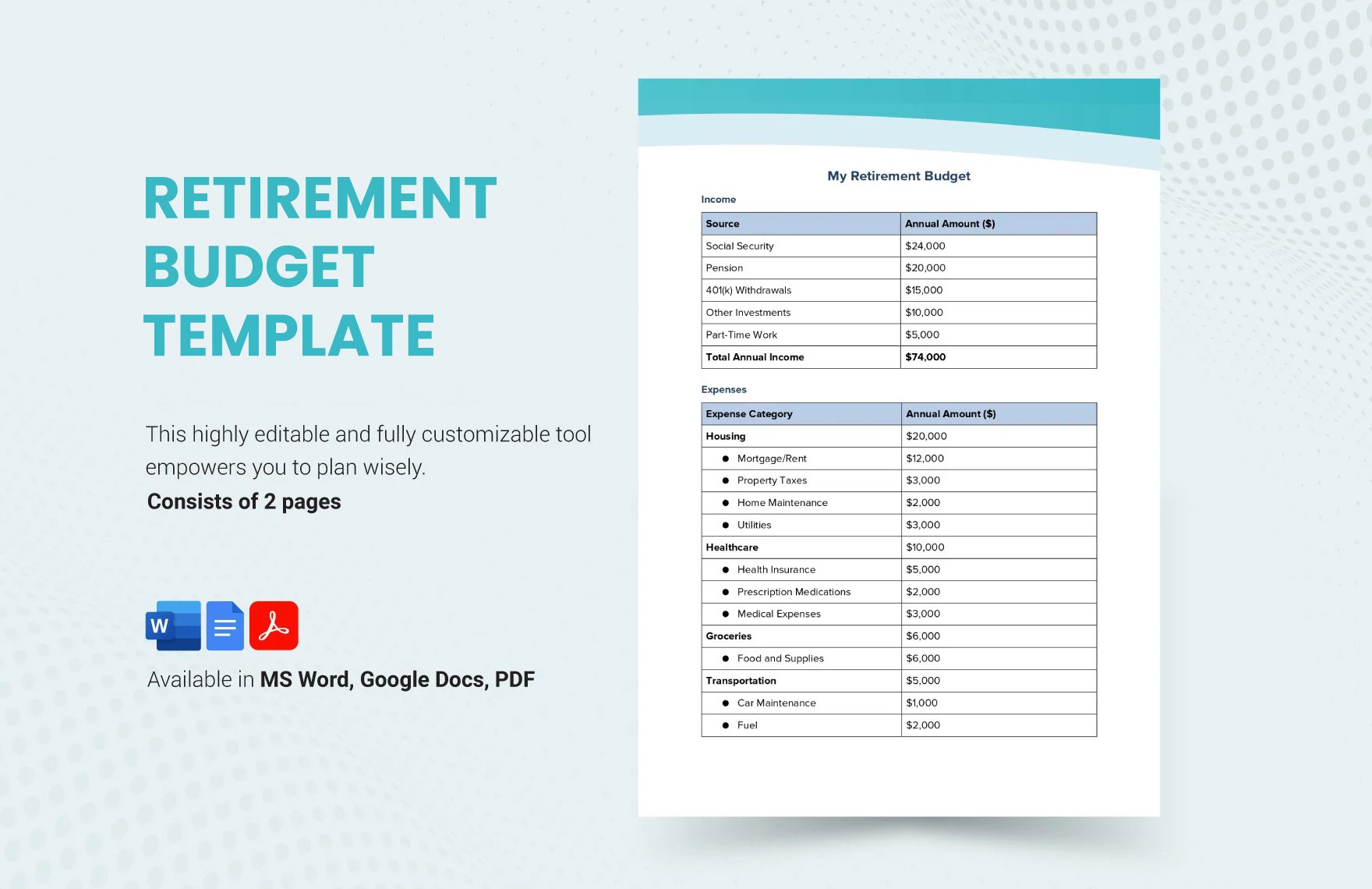

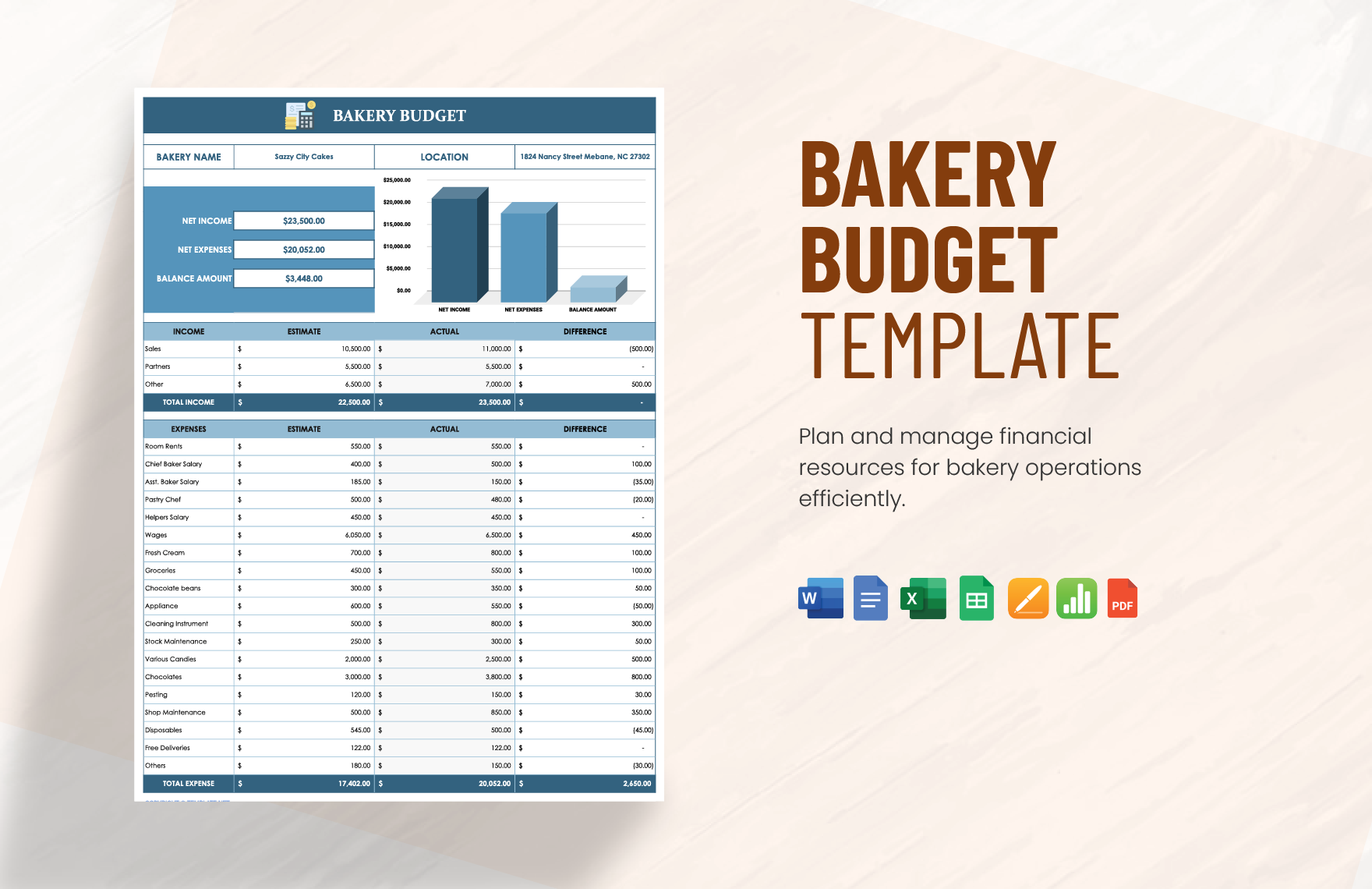

The key to successful budgeting is knowing or familiarizing much money you usually earn over a period of time. Take note, your budget plan should start with laying out your income as well as where these funds came from, and this is to help you keep track of how your resources are circulating. In addition, knowing your income will help you in managing your expenditures, thereby allowing your budgeting strategy to be more efficient.

2. Record Your Expenses

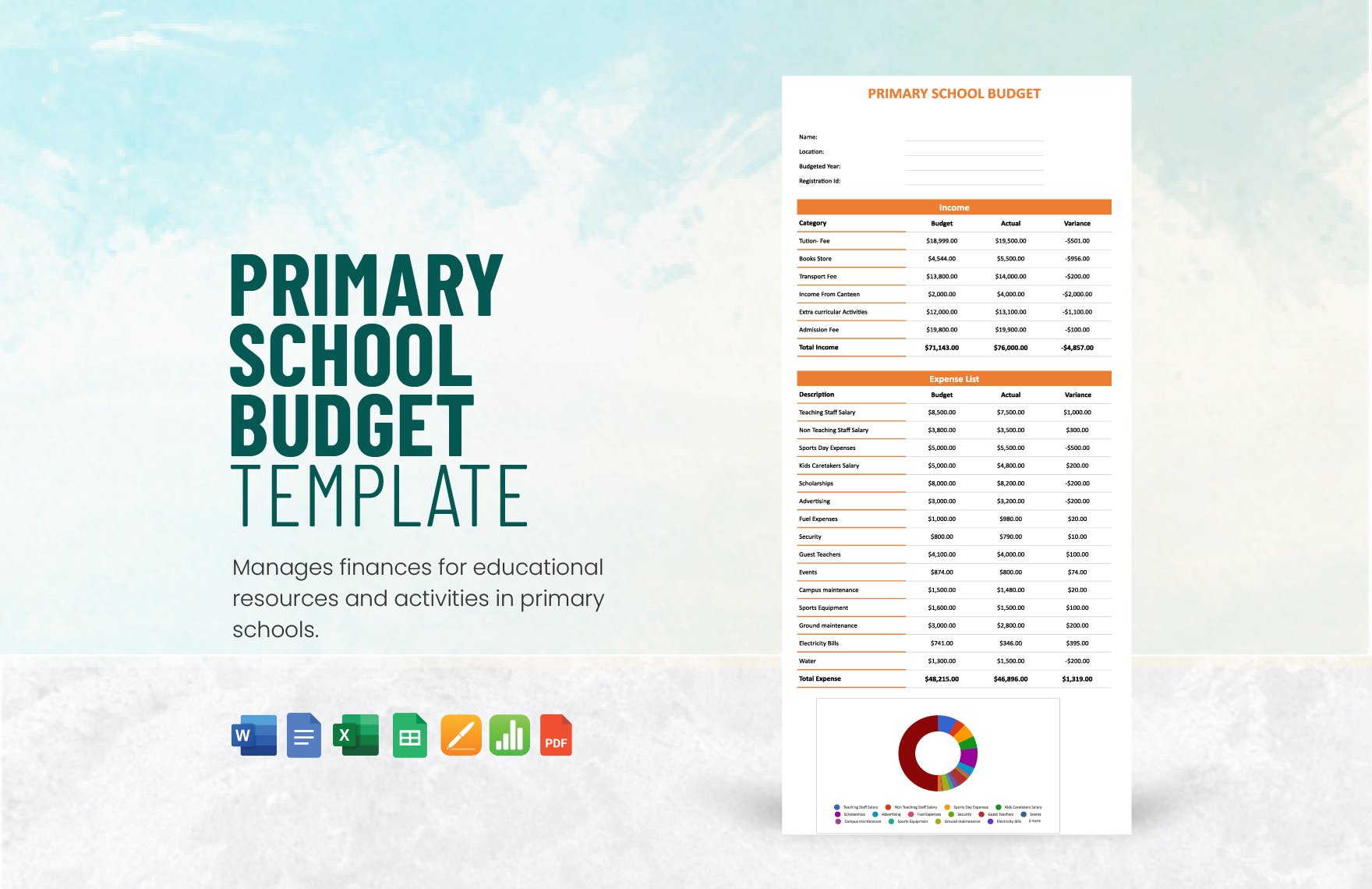

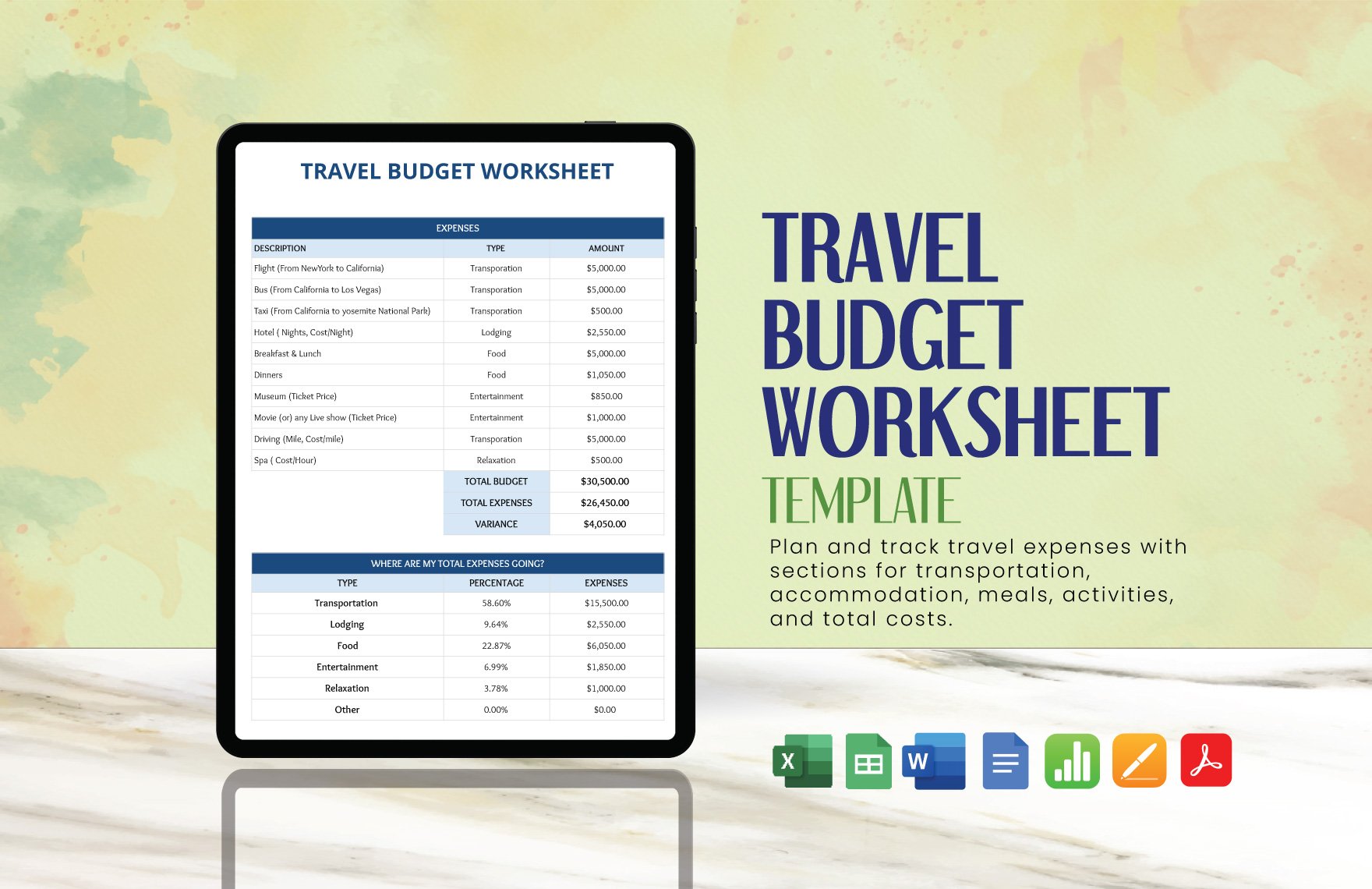

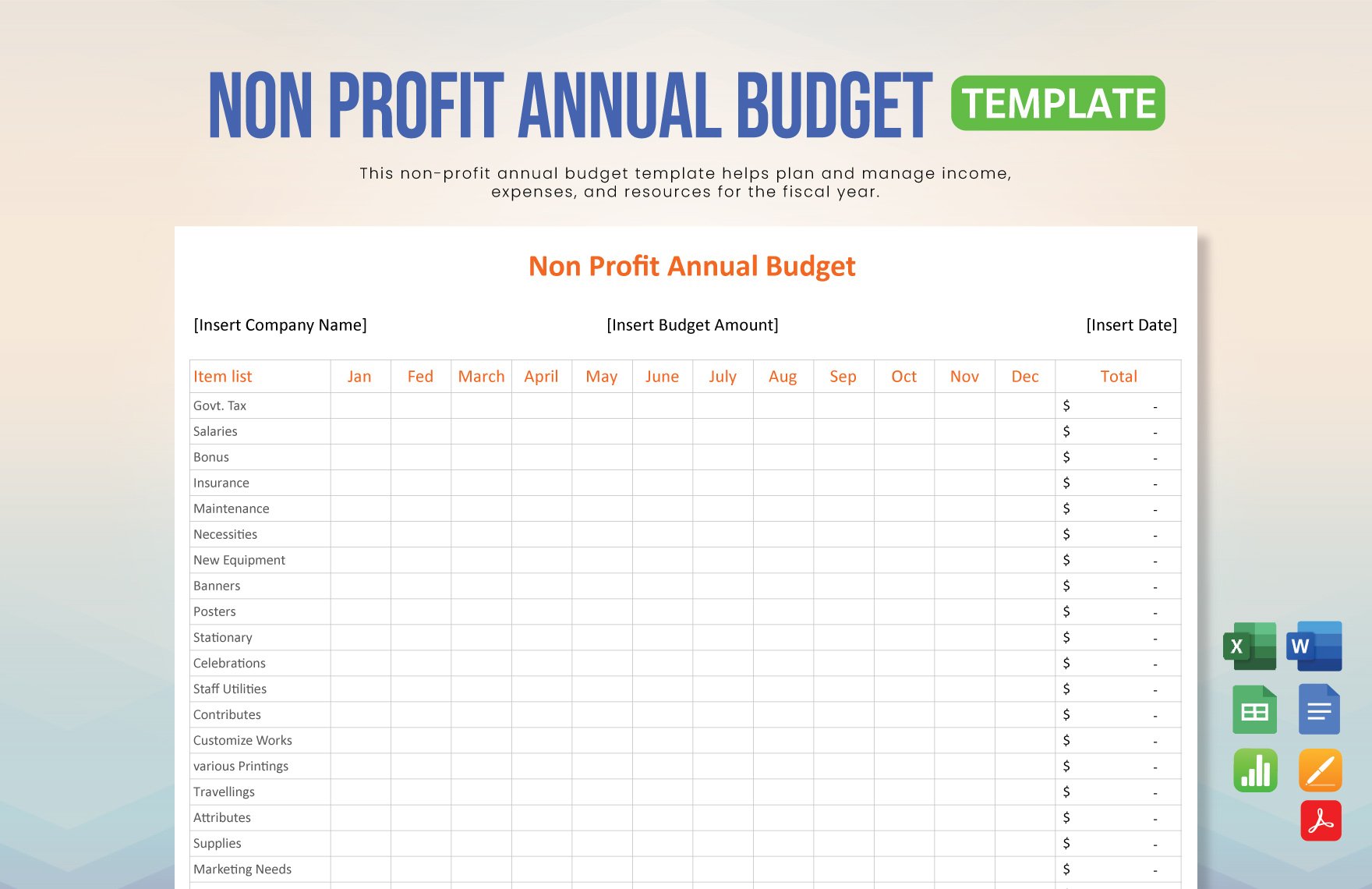

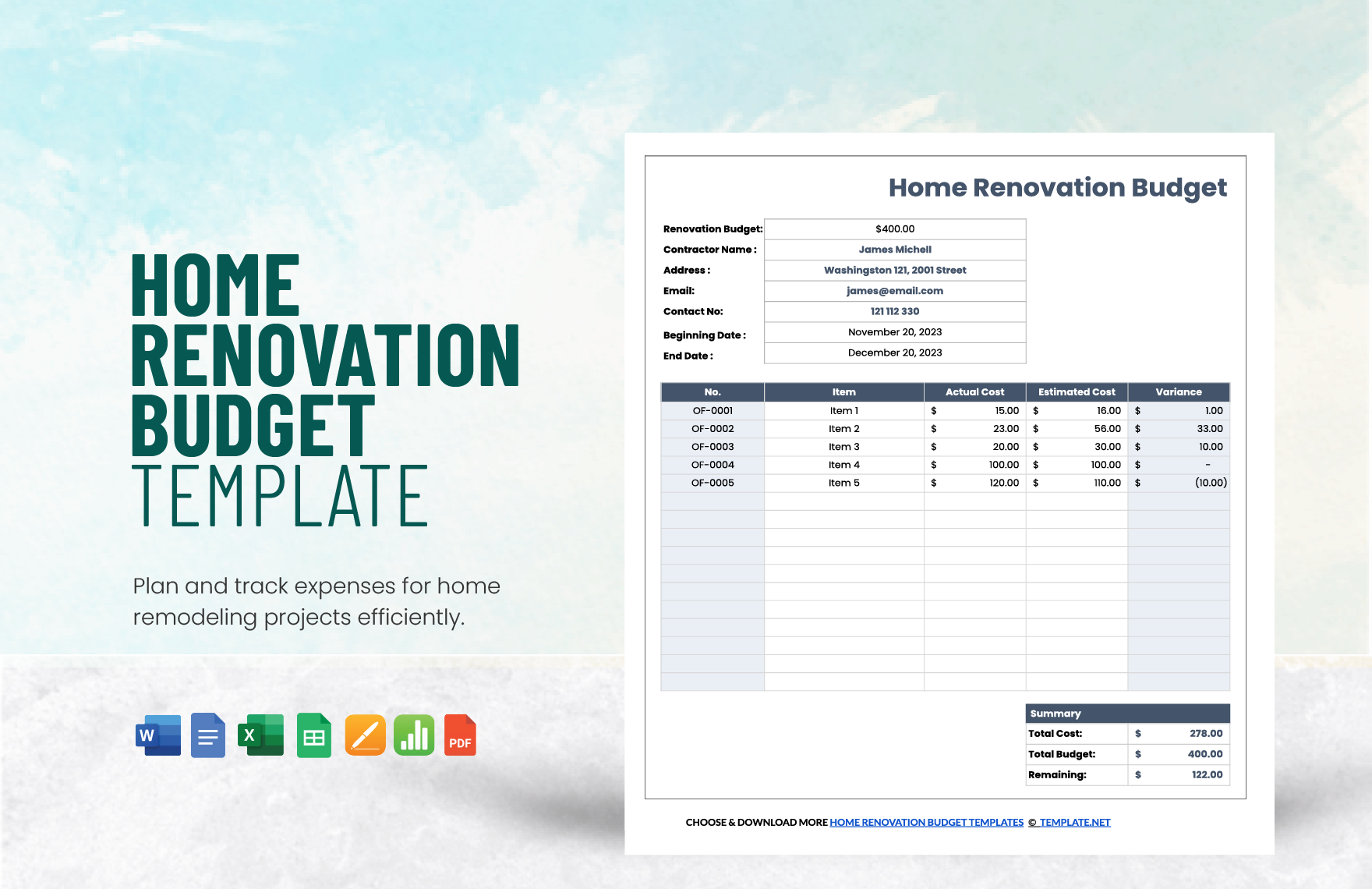

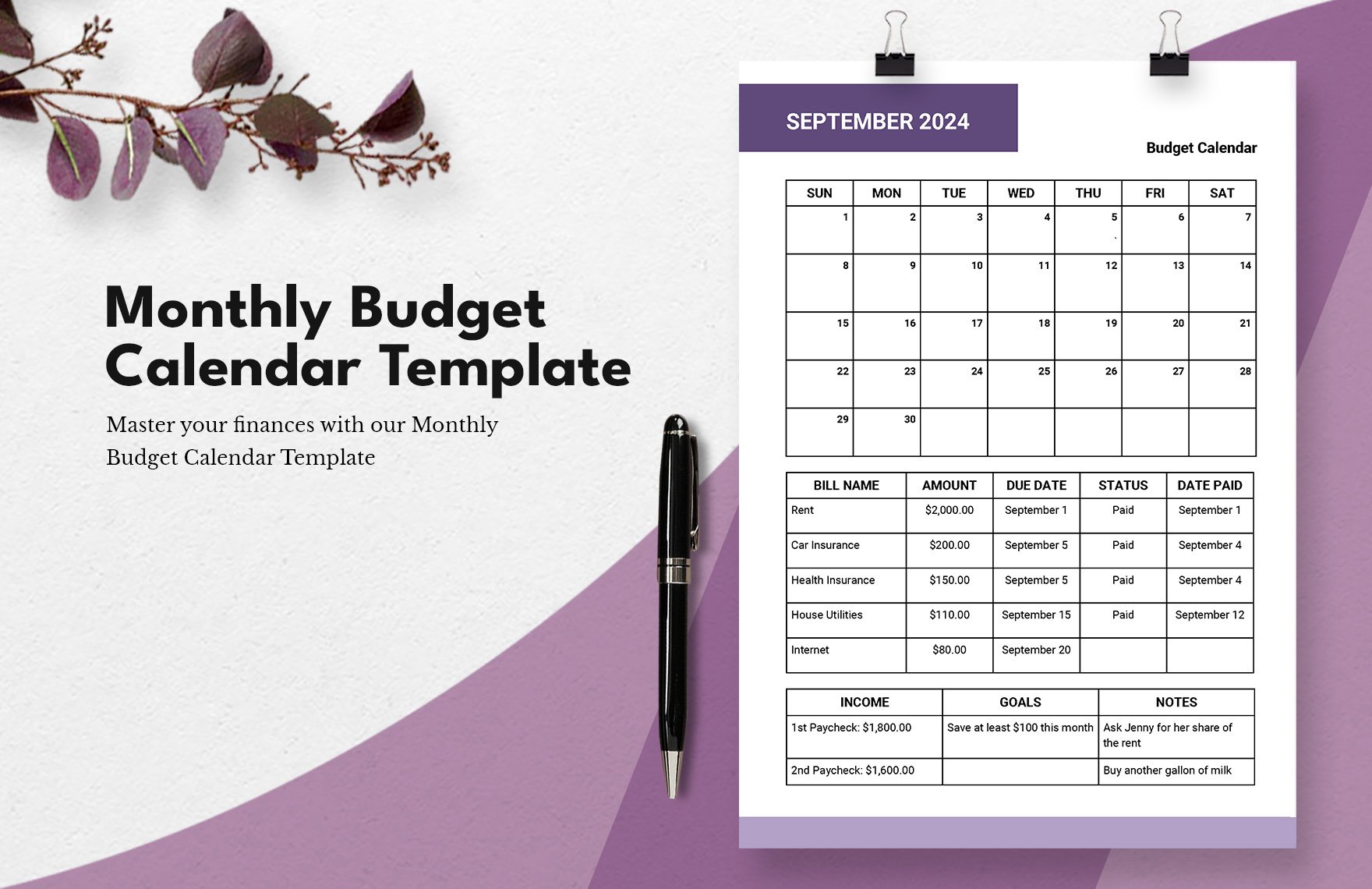

Whether you are making a weekly, monthly, yearly, or a travel budget, you have to make sure that you will record your fixed and variable expenses. Fixed expenses are those that are prevalent at all times and should be paid on a monthly basis such as rent, electricity, water bill, etc. On the other hand, variable expenses refer to those that can be changed from time to time such as groceries and cost of utilities, to name a few.

3. Set Goals

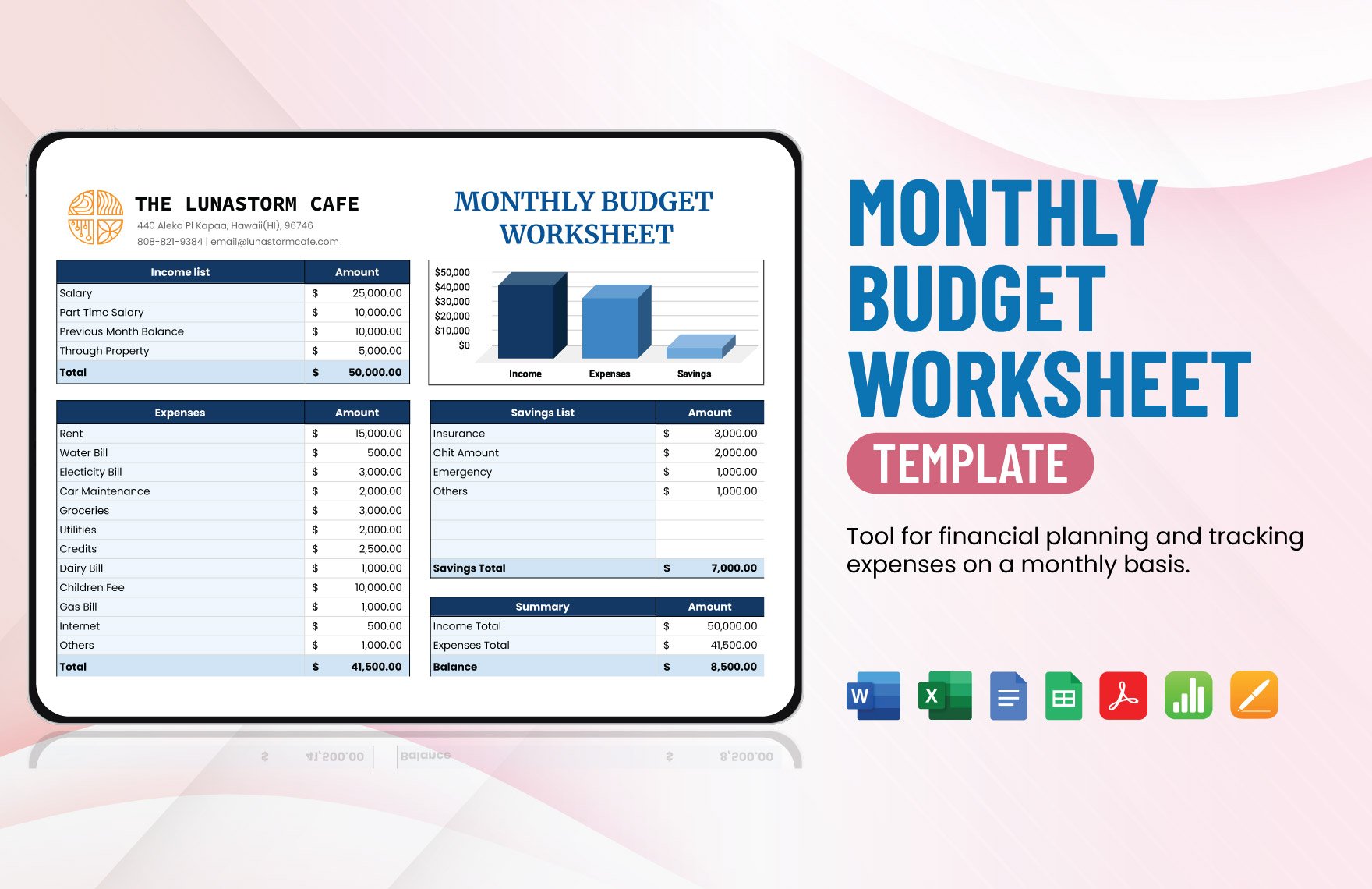

Now that you have taken a look at your overall income and expenses, it is vital that you make adjustments to your expenses. At the bottom part of your budget worksheet, you can write goals for the following week, month, or year. The advantage of having a realistic and attainable goal is that it helps to motivate you in sticking to your budget.

4. Track and Monitor Your Budget

Evaluate your budget regularly, check whether or not you've achieved your goals and try thinking of solutions that you can use in the next budget plans. Creating even a simple budget can get difficult especially if it's your first time, but you will eventually get the hang of it if you just keep on trying.

5. Make Use of our Budget Templates

It is indeed convenient to have a copy of your budget worksheet within reach especially when you need to refer to it. Thankfully, we've got a wide array of printable budget templates that you can download and use anytime, just make sure to use high-quality paper when printing copies of your budget plan or worksheet.