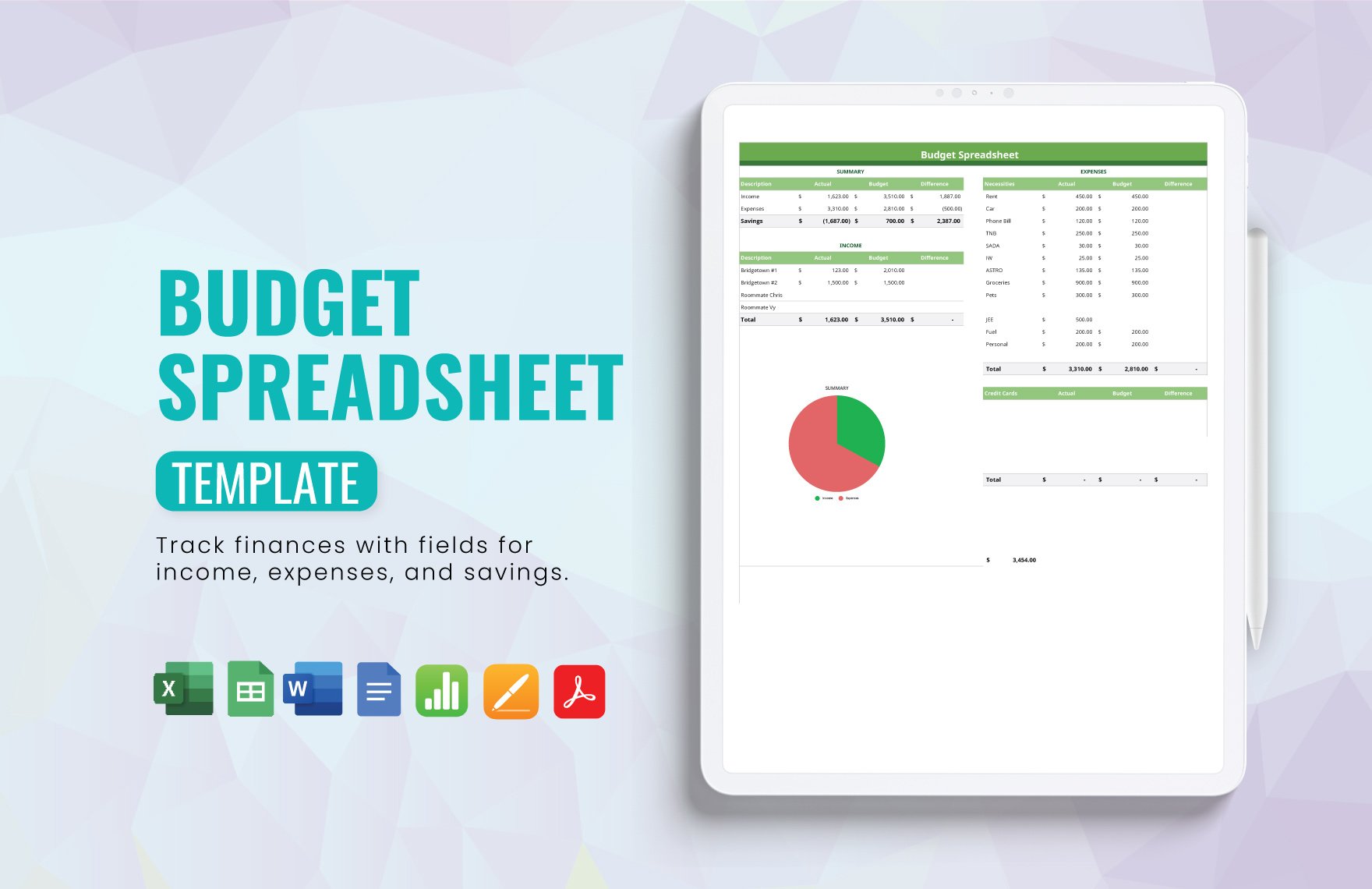

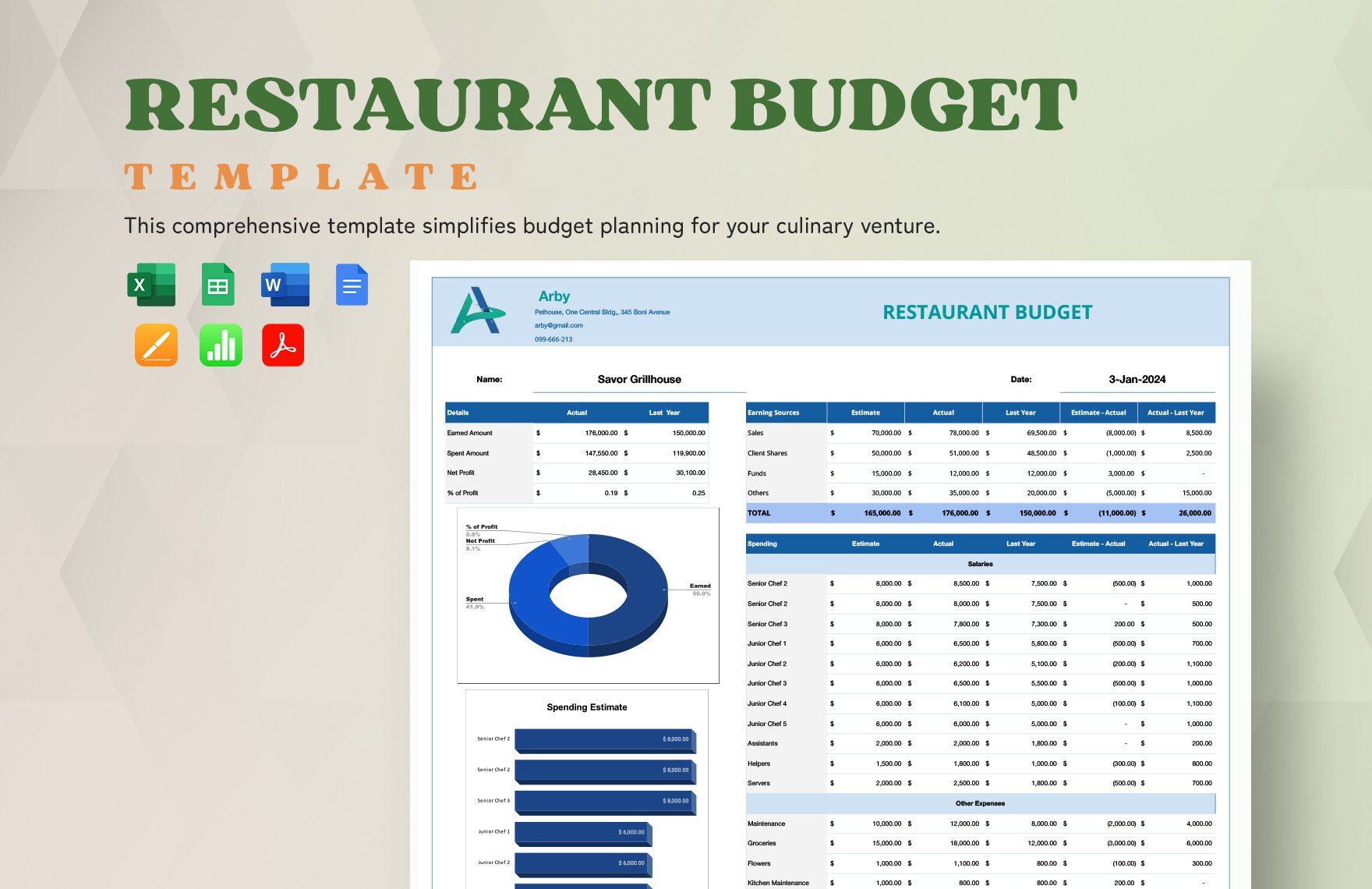

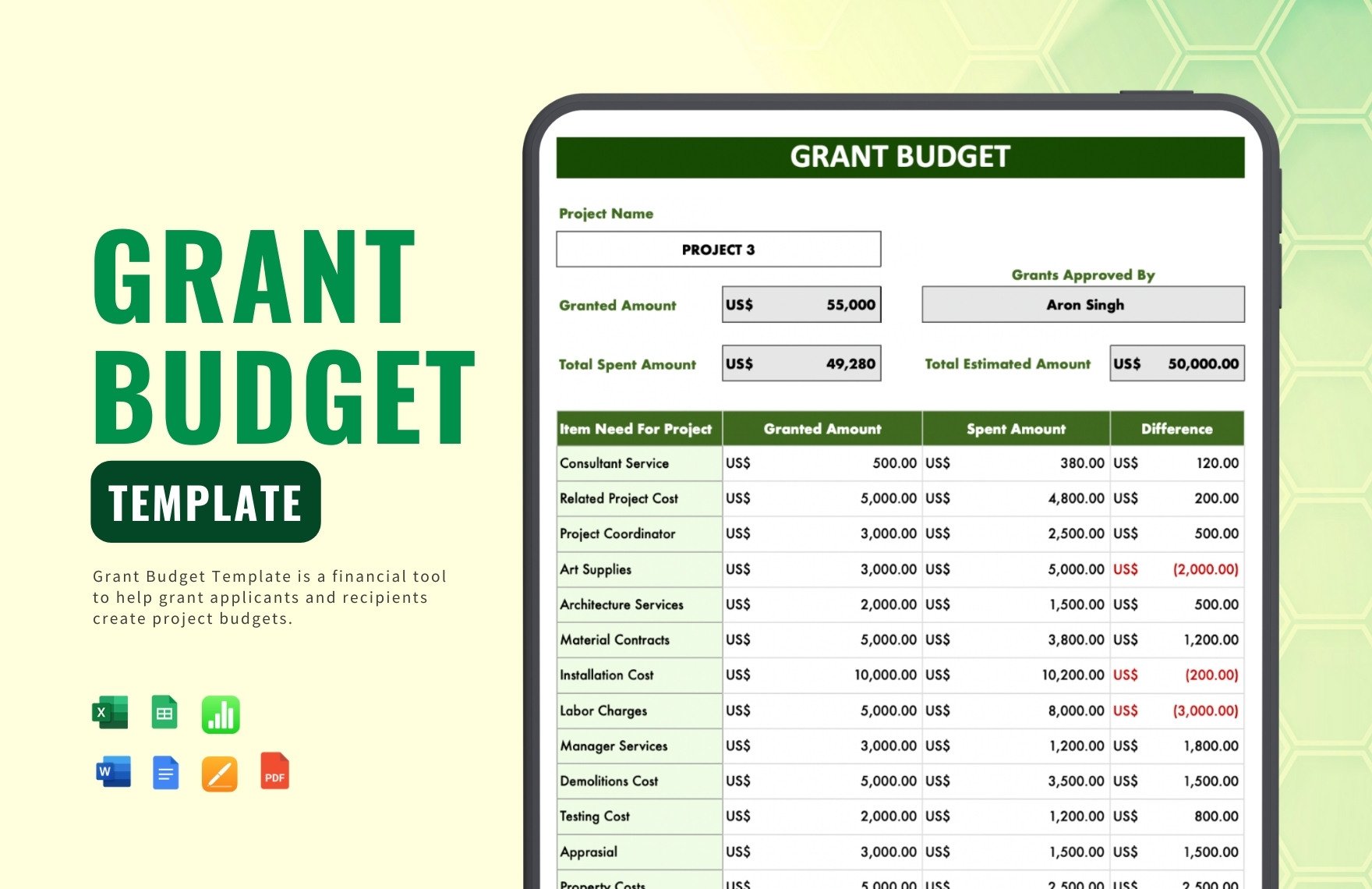

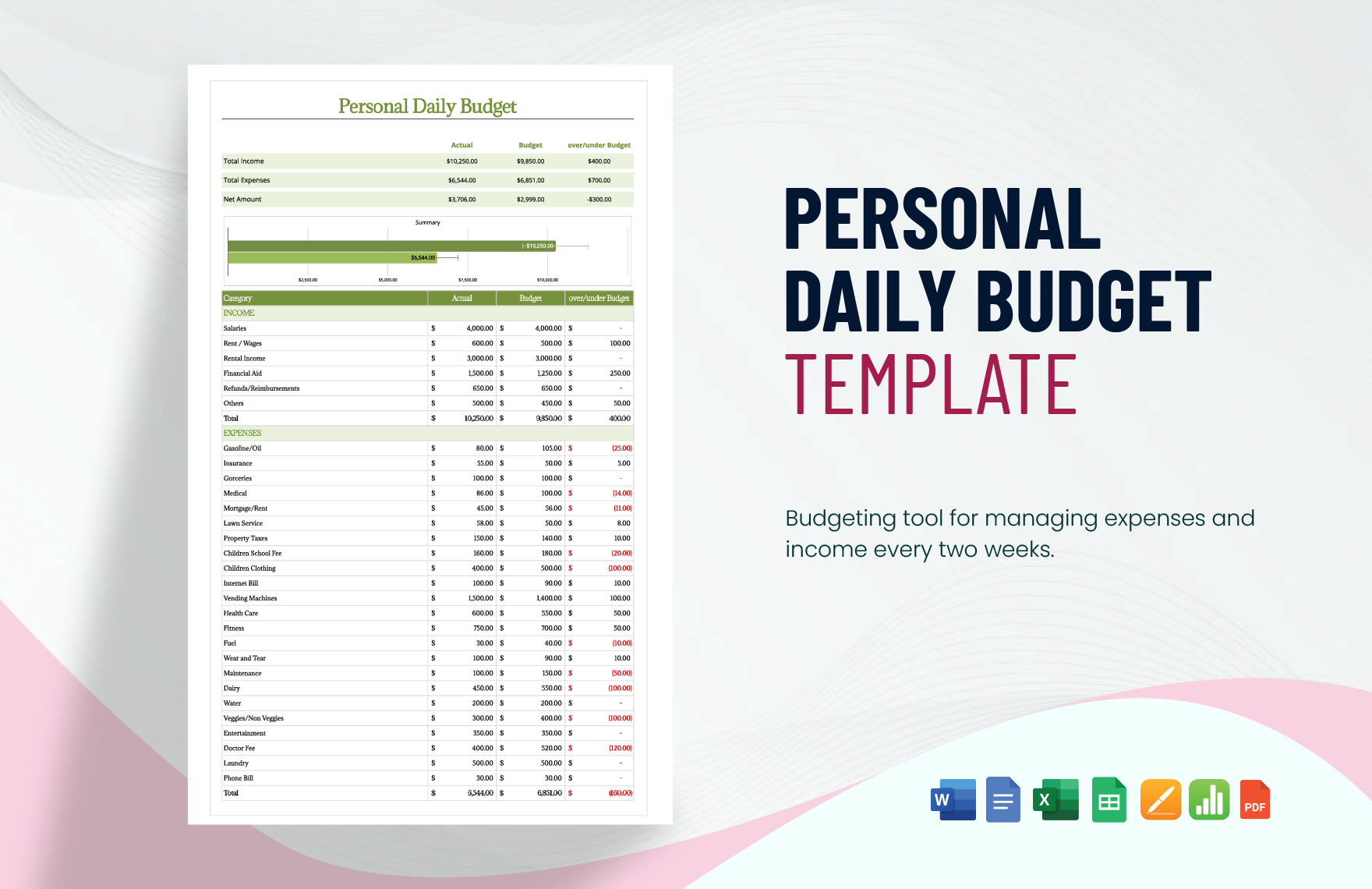

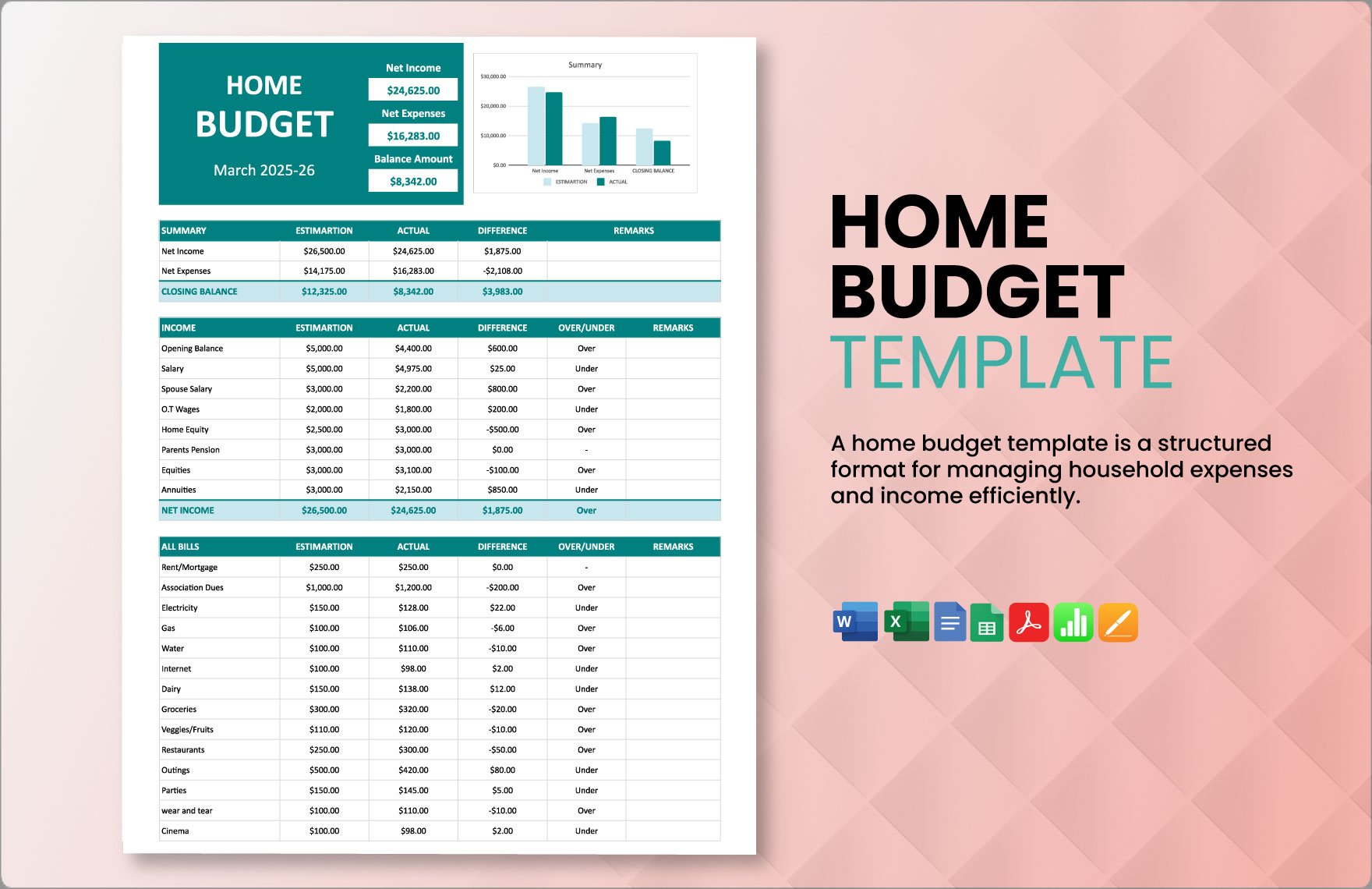

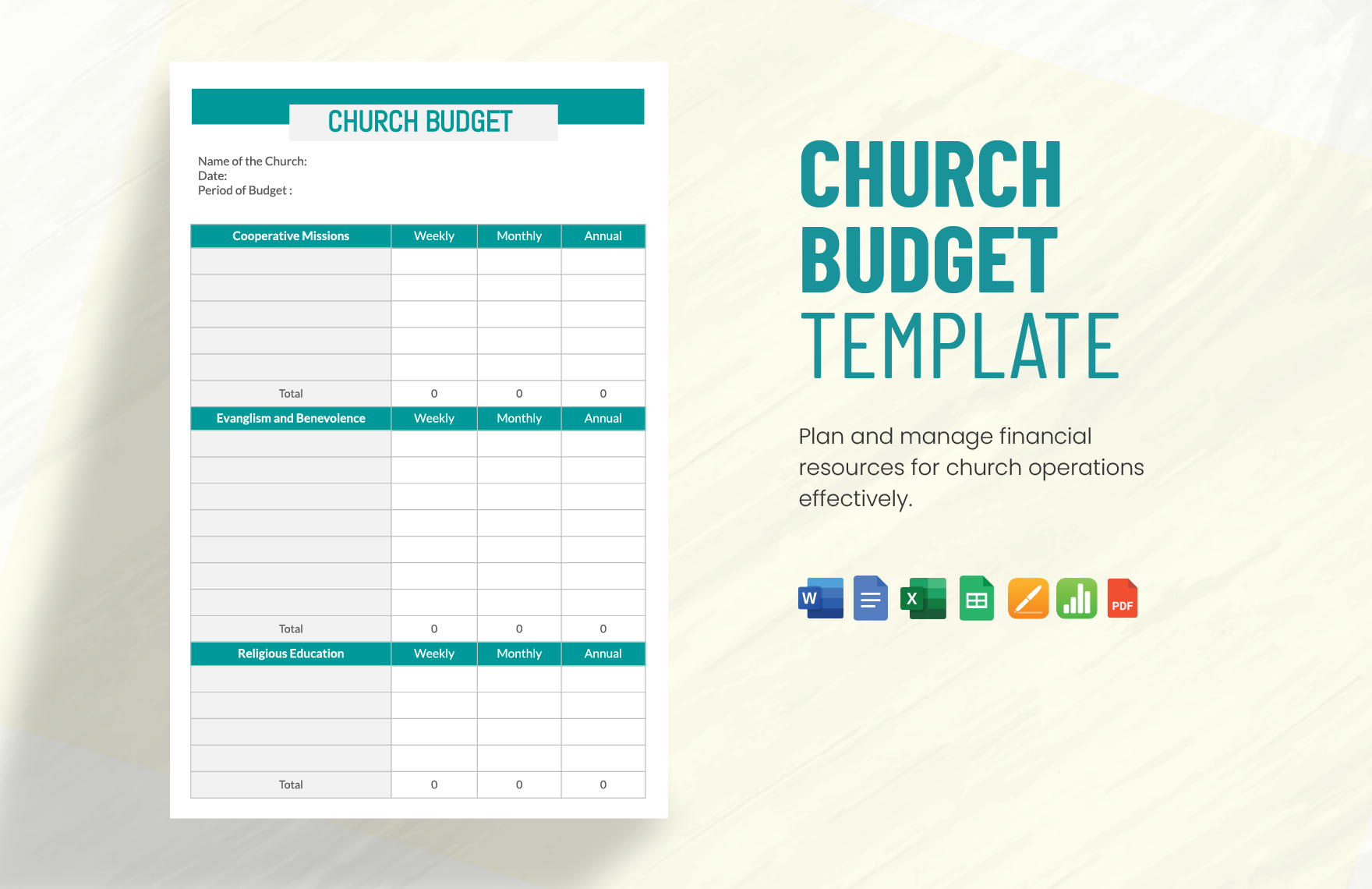

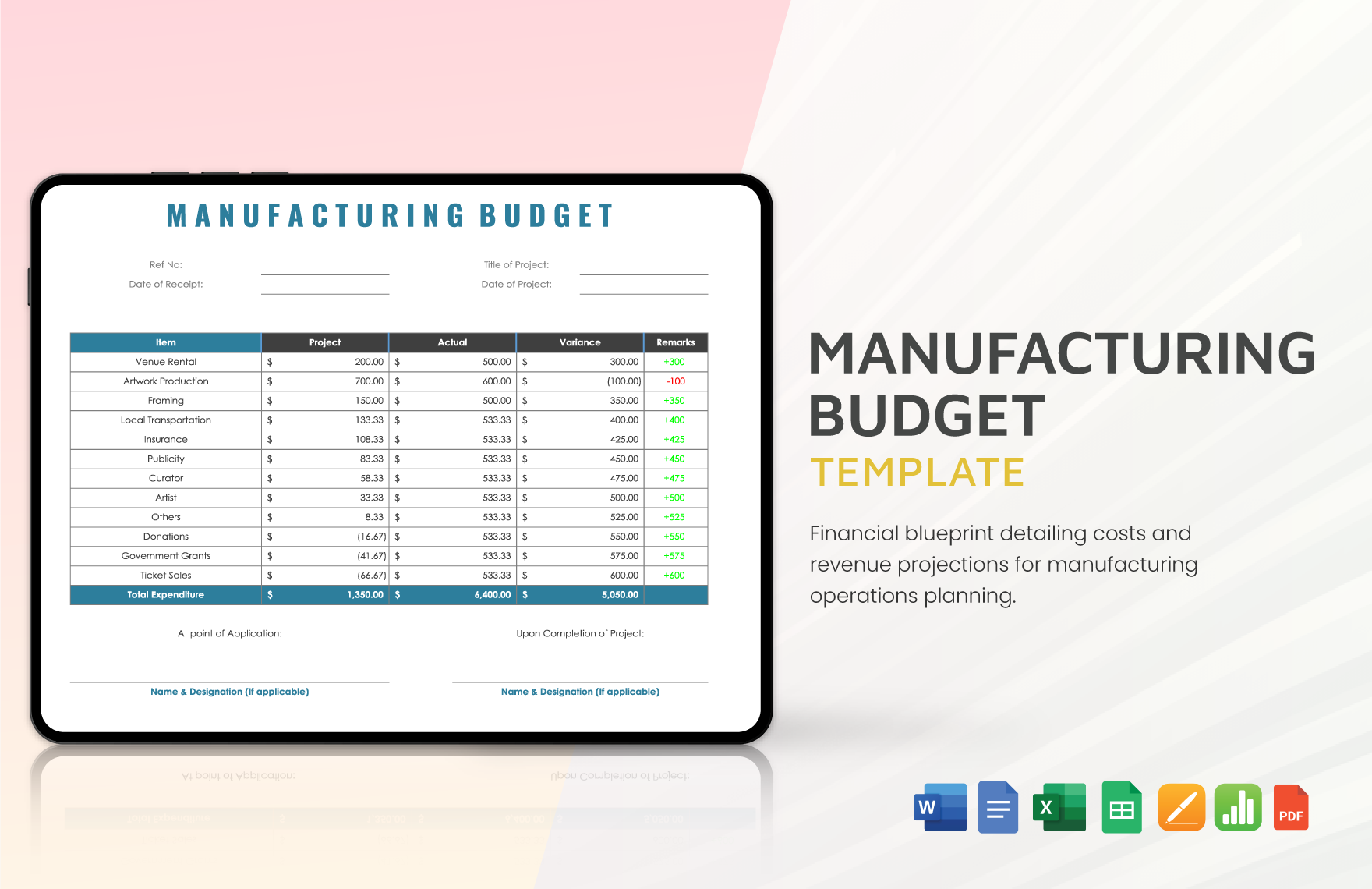

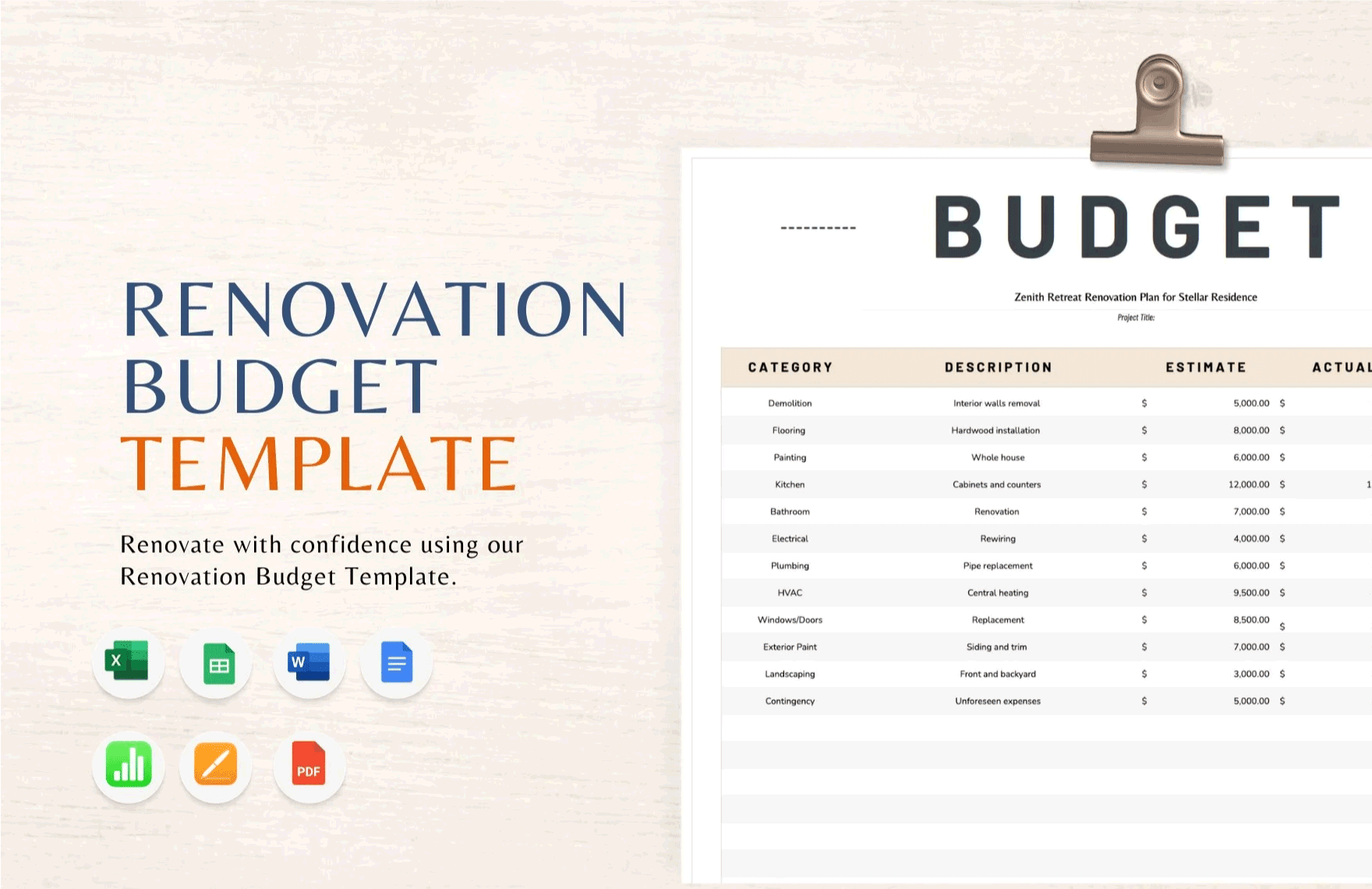

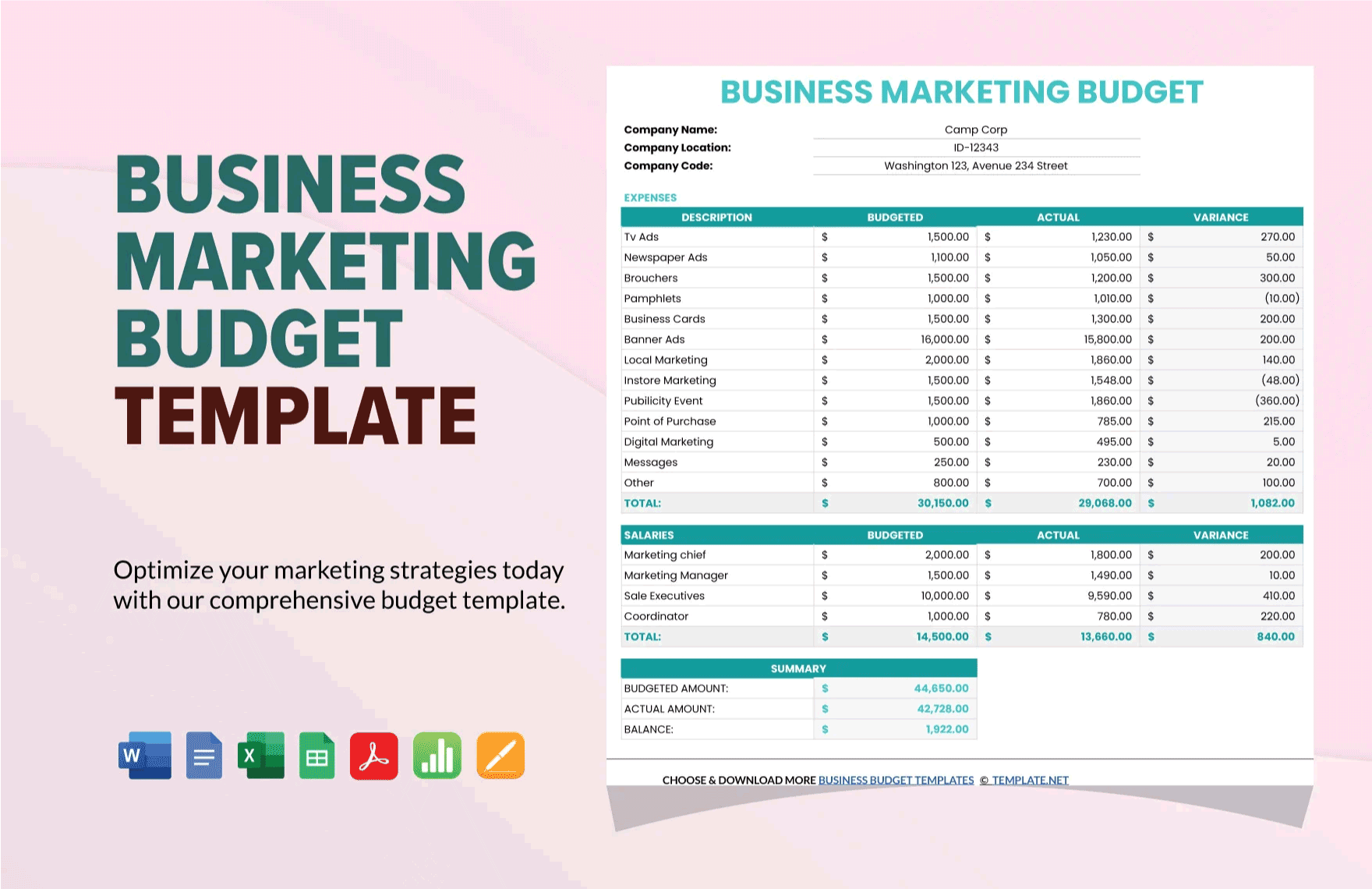

Being able to review and keep track of your financial records will surely help you make better and wiser financial decisions. Thus, having a budget that records your earnings, spendings, and savings will help guide you on your decision-making process. Our ready-made Budget Templates that you can download in Apple Numbers have a well-formatted content that you can easily customize to suit your purpose and goals. If you need a premium template for a budget summary, budget plan, budget tracking, budget proposal, etc., you can easily choose the perfect one from the wide selection that we offer. Get our free Budget Templates in Apple Numbers today to achieve the best quality finish in the most convenient way.

How To Create A Budget Spreadsheet In Apple Numbers

Budgeting is a discipline that makes you wise in handling your money. Before you make any financial decisions, you need to check on your weekly, monthly, or yearly financial records. Thus, a simple and comprehensive personal budget sheet should always be on your side. For you to create a comprehensive financial record, here are a few steps and inclusions that you will need to take into consideration.

1. Determine Your Goal

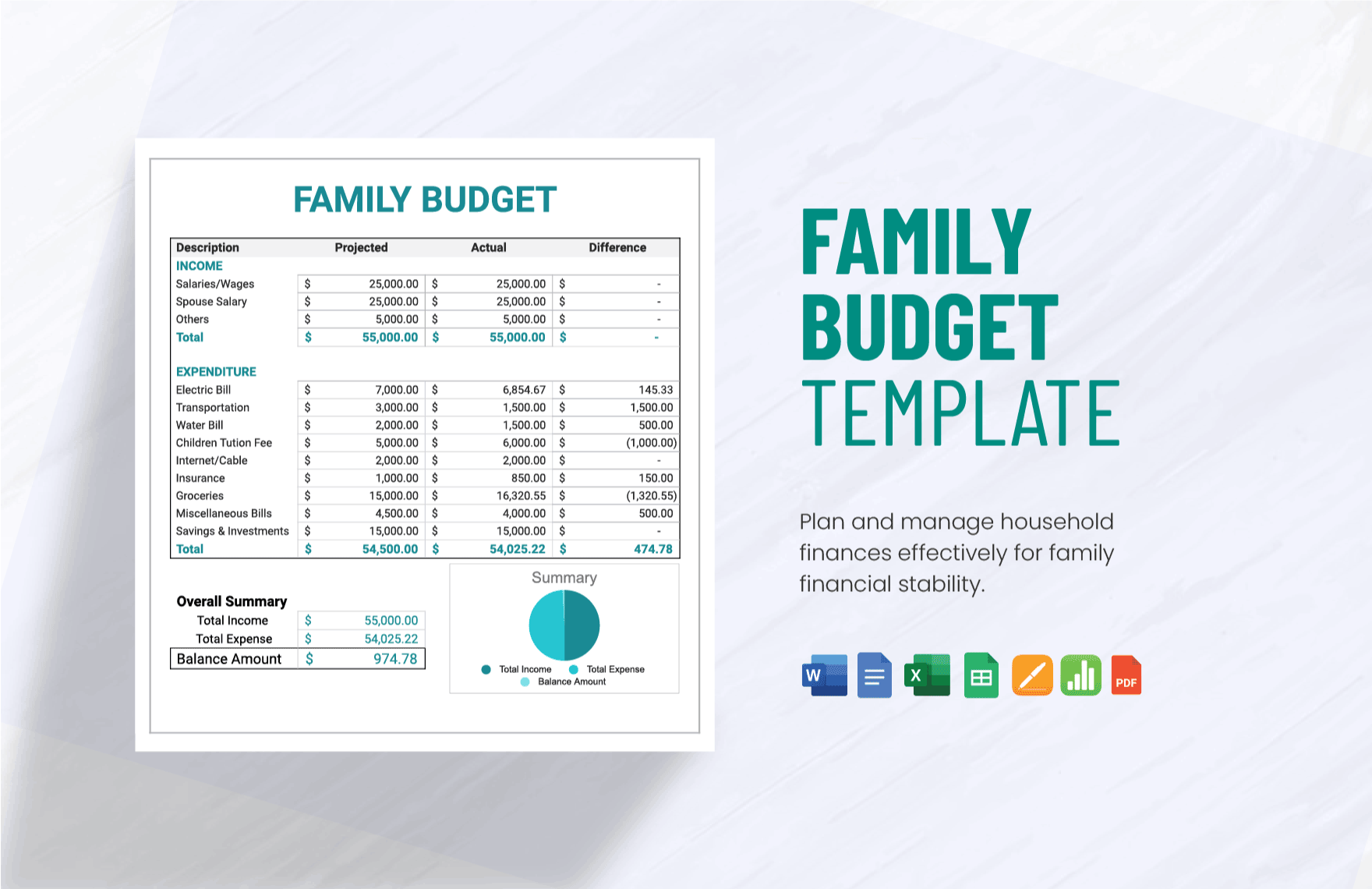

Before you create your budget spreadsheet, it's important to know your financial goals first. Decide whether you want to simply keep track of the ways you have collected your money, how they were used, or how will you spend your remaining financial resources for your next plan. Upon doing so, you must first determine what you want or what you need so that you can use your money appropriately. You may use it if you pan to purchase house supplies, then you might think of creating a household budget, family budget, or If you want to rent a car, then create a budget plan for car rental; preferably choose those cheap car rentals.

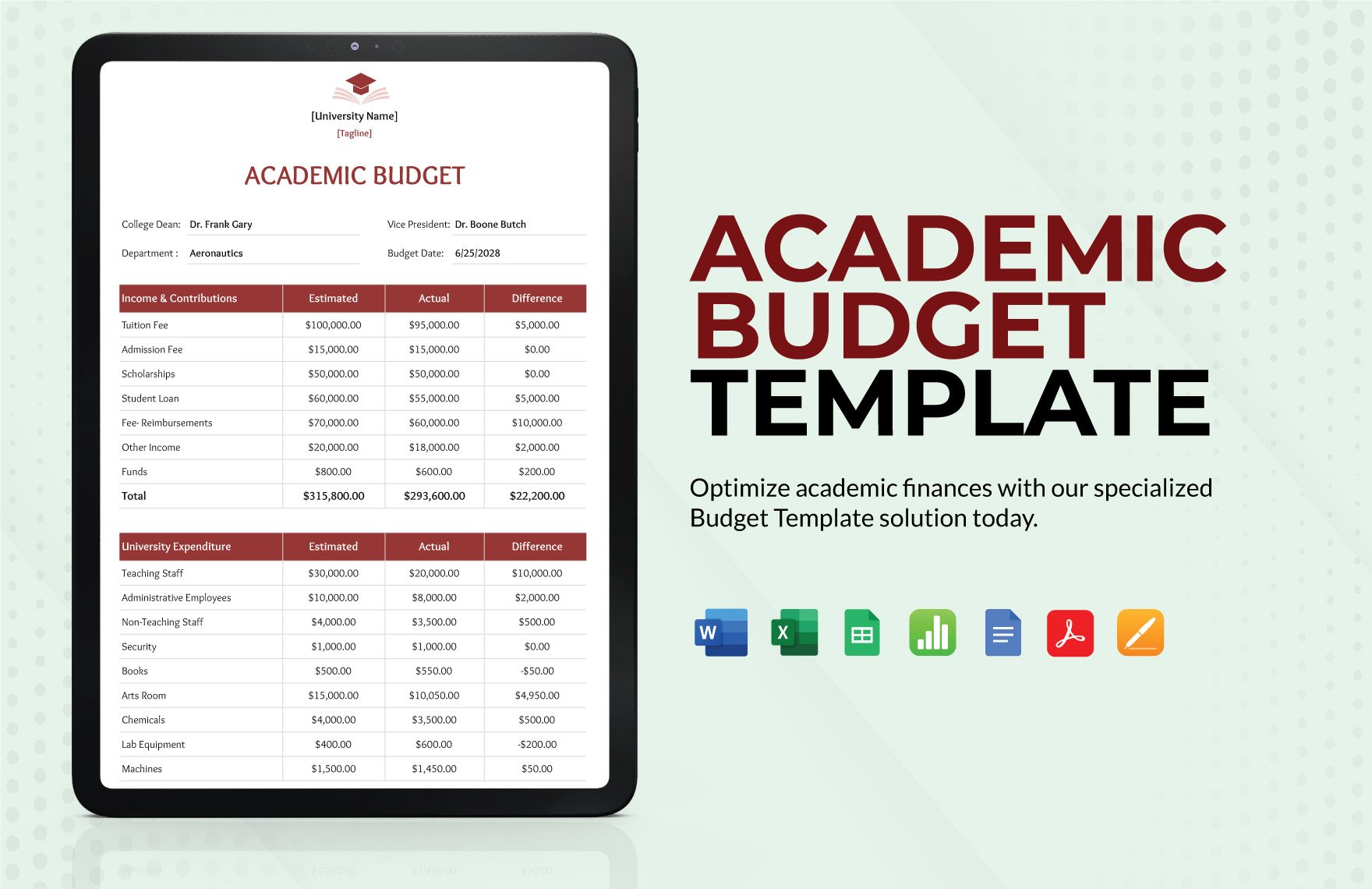

2. List Your Monthly Income

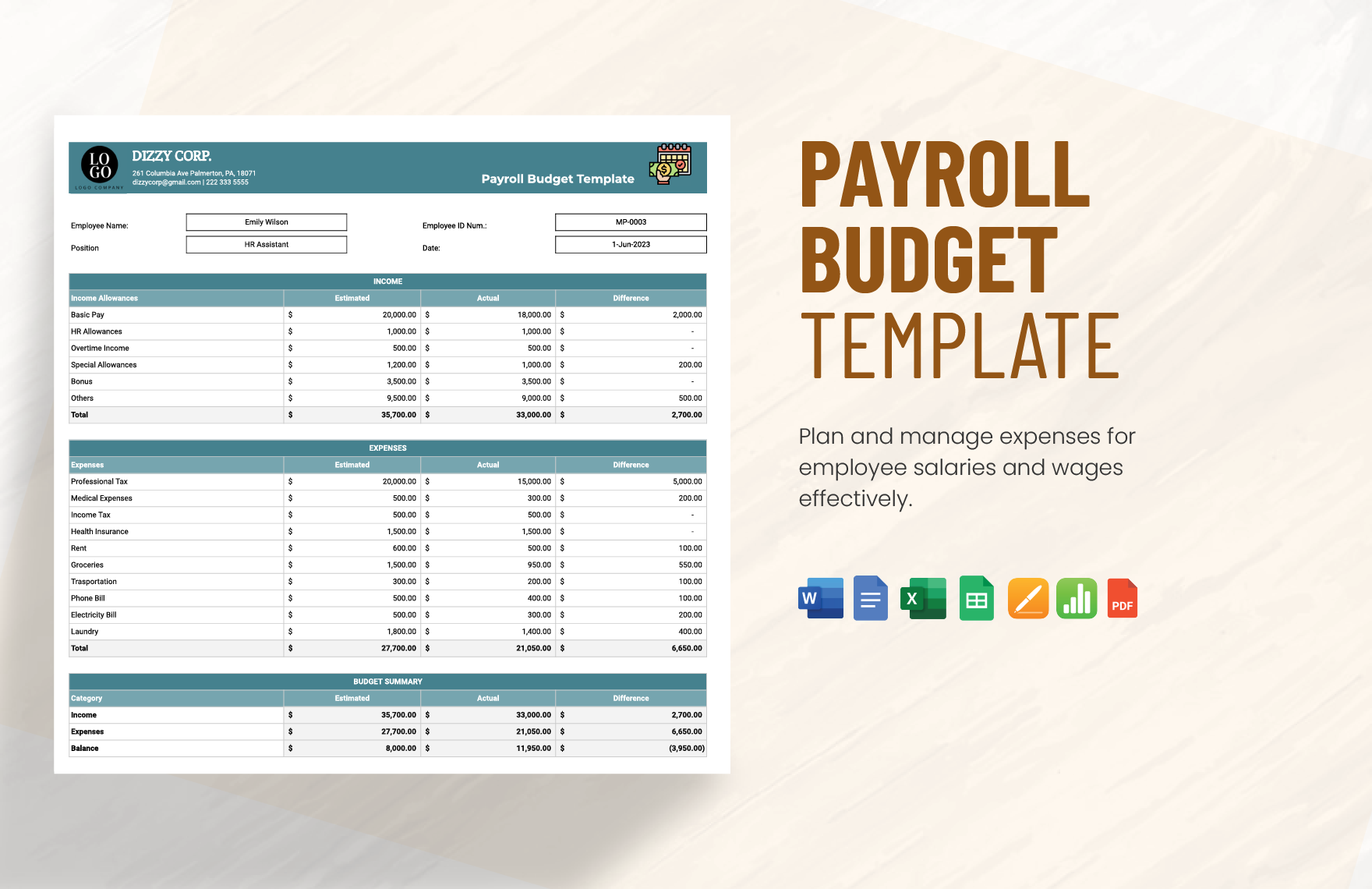

The source of your monthly income may come from your school allowance if you're a student, or from your "legit" salary if you have a regular job. If you receive your paycheck biweekly, then you would simply multiply the number by 2 and if it's given to you weekly, then divide it by four, since the standard number of weeks in a month is four. This way, you will have a good extra amount throughout the year to help cover your annual expenses and record it accordingly in your expense statement.

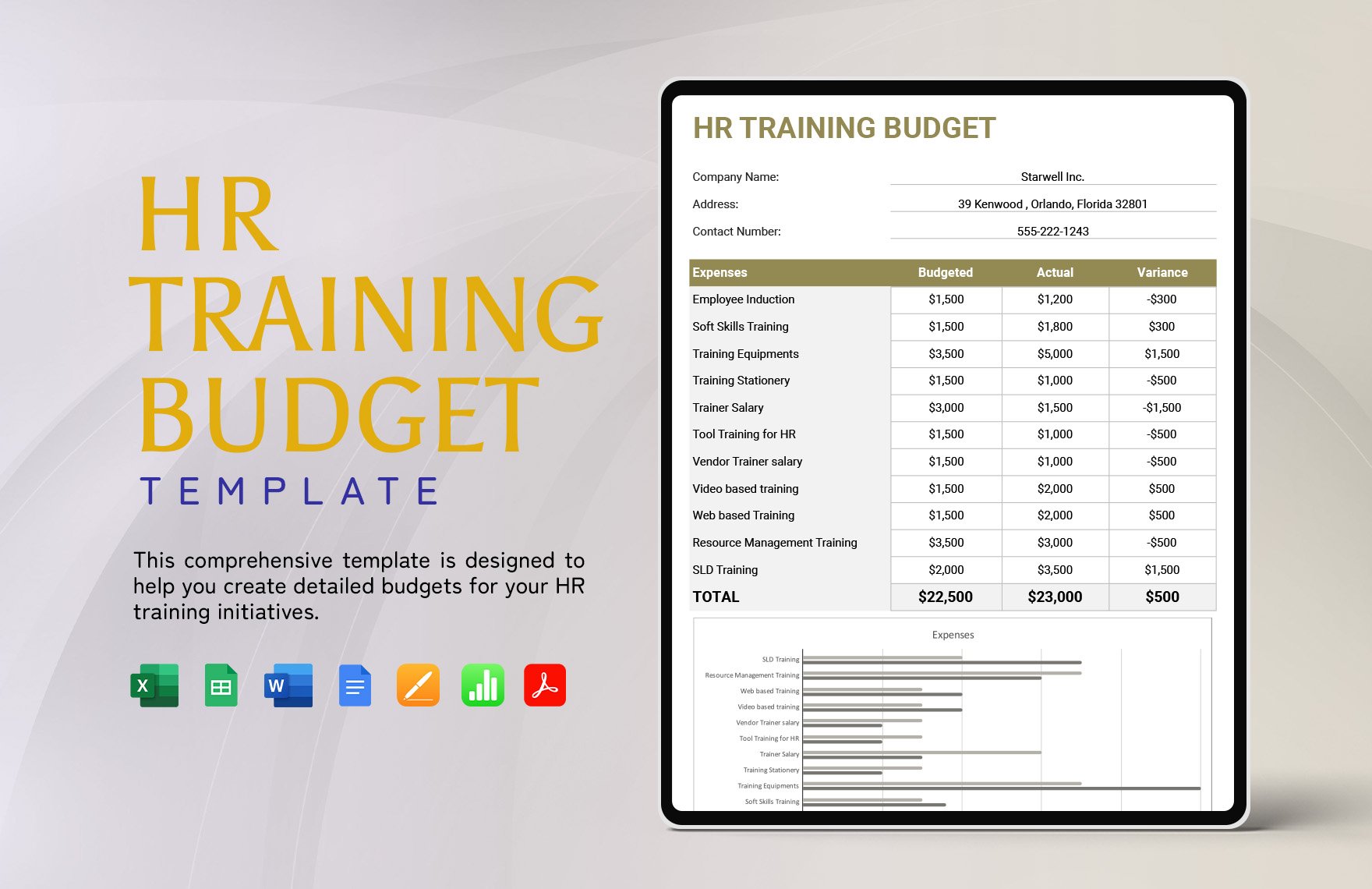

3. Line Up Your Monthly Expense

Your monthly expenses could be the bills that you receive on a regular basis. These bills include gas, insurance, loan payment, electricity, water, etc. For you to effectively estimate your monthly expenses, create an expense sheet and list down the expected amount of money for these monthly expenses. Then, prioritize items by sorting out the things you absolutely needed the most and the ones you are committed to paying.

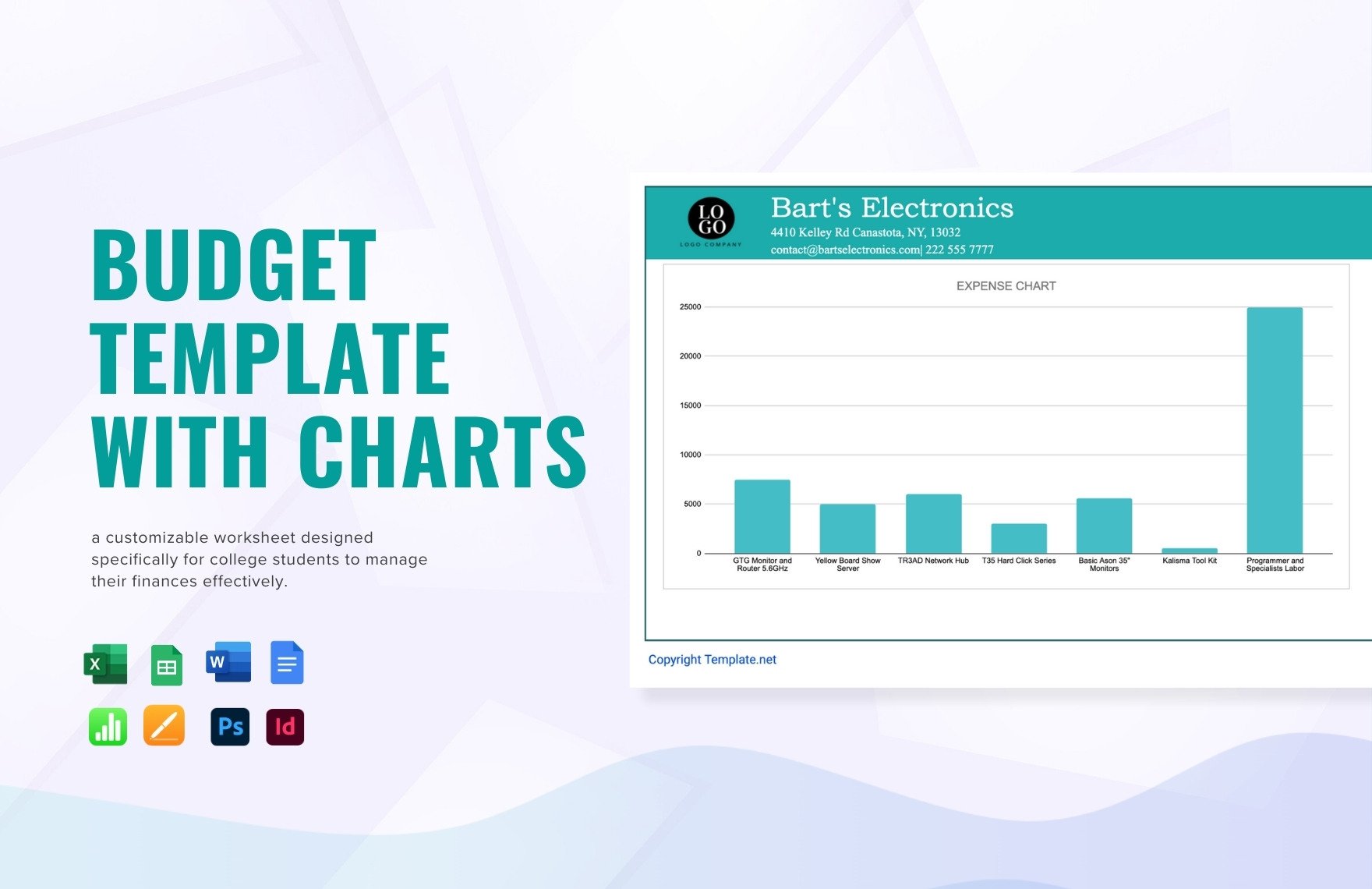

4. Look For A Sheet-Processing Software

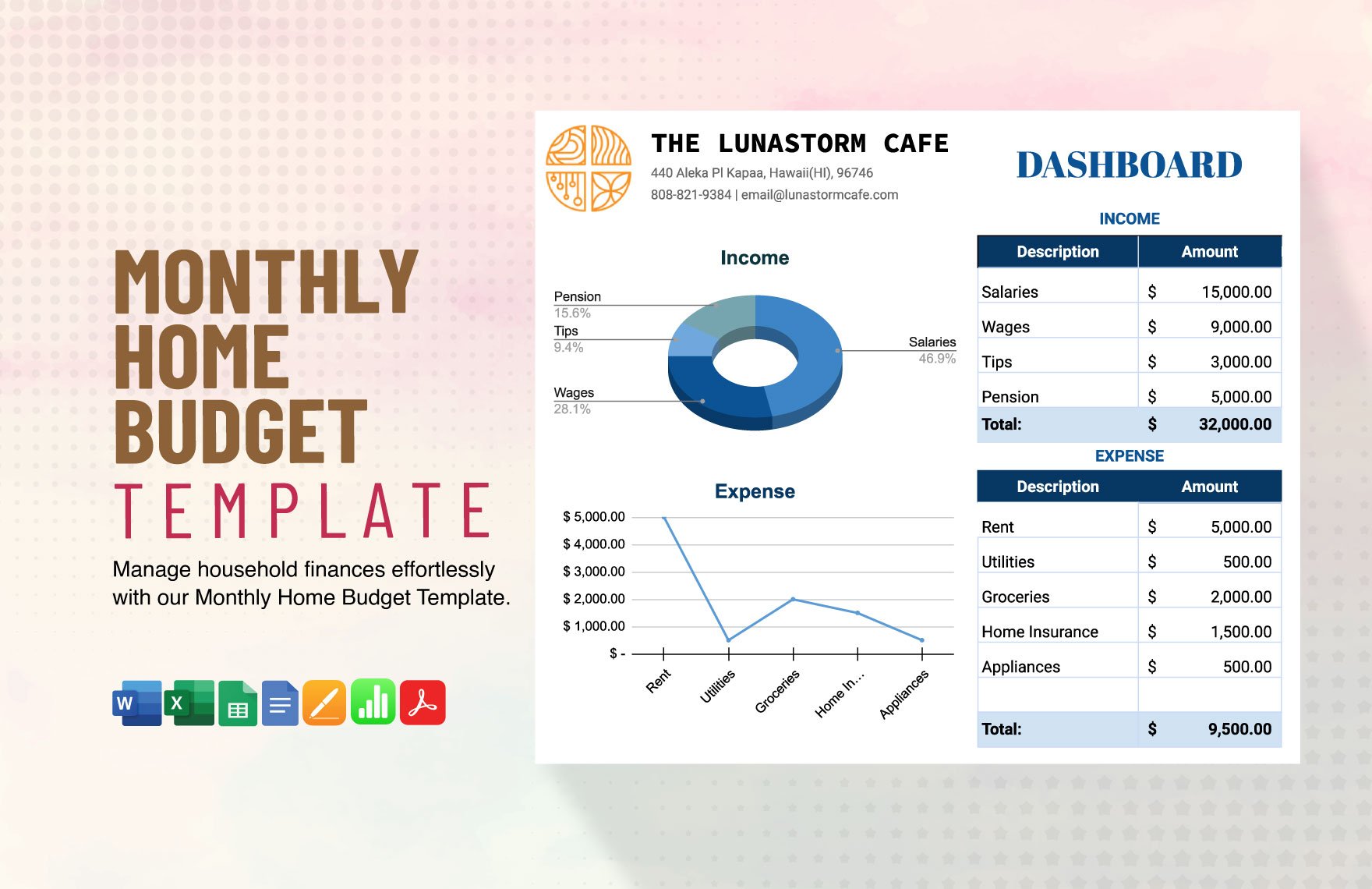

You may choose MS Excel, Google Sheets, MS Word, or Apple Pages. As soon as you do, make sure you specify the thing you will need to include in your budget. For instance, provide two columns where you can list down all the things you'd include in your expenses then put the (expected) monetary value beside each. Then, you may shop for any built-in printable sample budget templates which are readily available in whichever software you choose.

5. Open Apple Numbers In Your MAC or PC

Now, it's time to pull up Apple Numbers or any other budget apps on your MAC or PC and create a new file. To make your task a little easy, choose some of the ready-made budget planner or budget templates that are available Apple Pages. Then, once you feel that you are done, hit the "save" button. If you want to browse on your budget plan, while you go pay your expenses but forgot your phone, then common sense will tell you to print it out immediately.