Transform Your Financial Planning with Pre-Designed Budget Templates in Apple Pages by Template.net

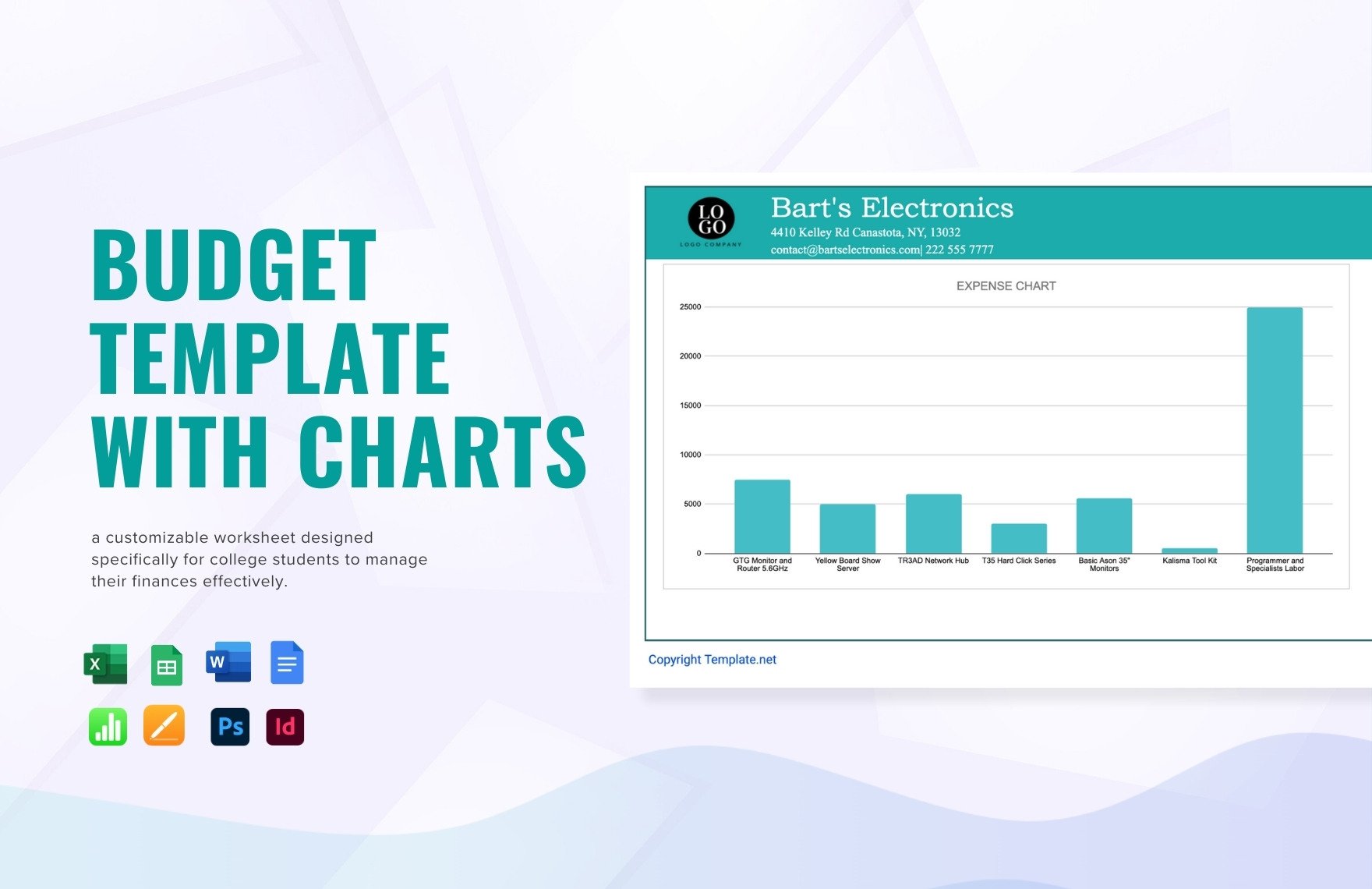

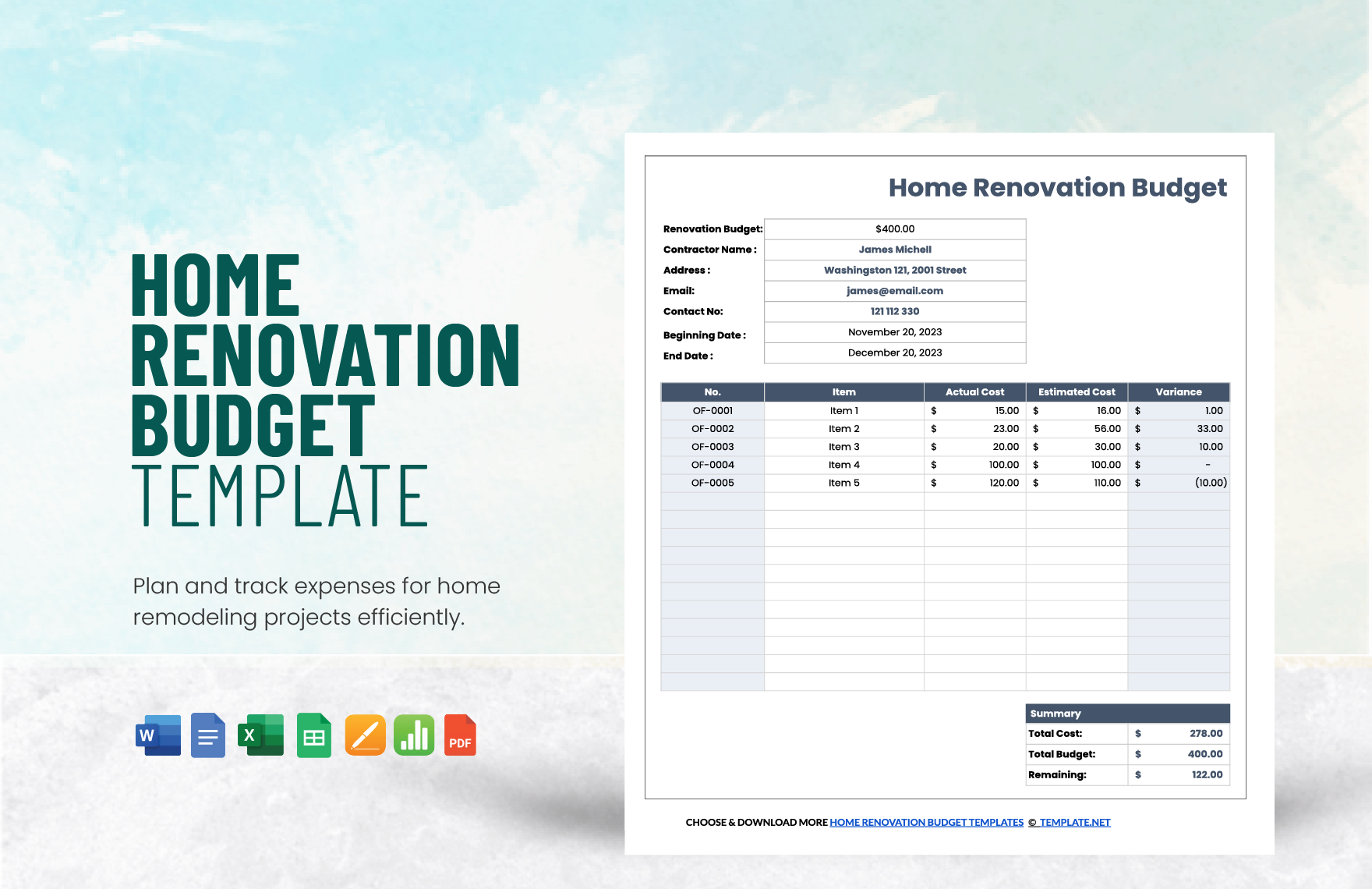

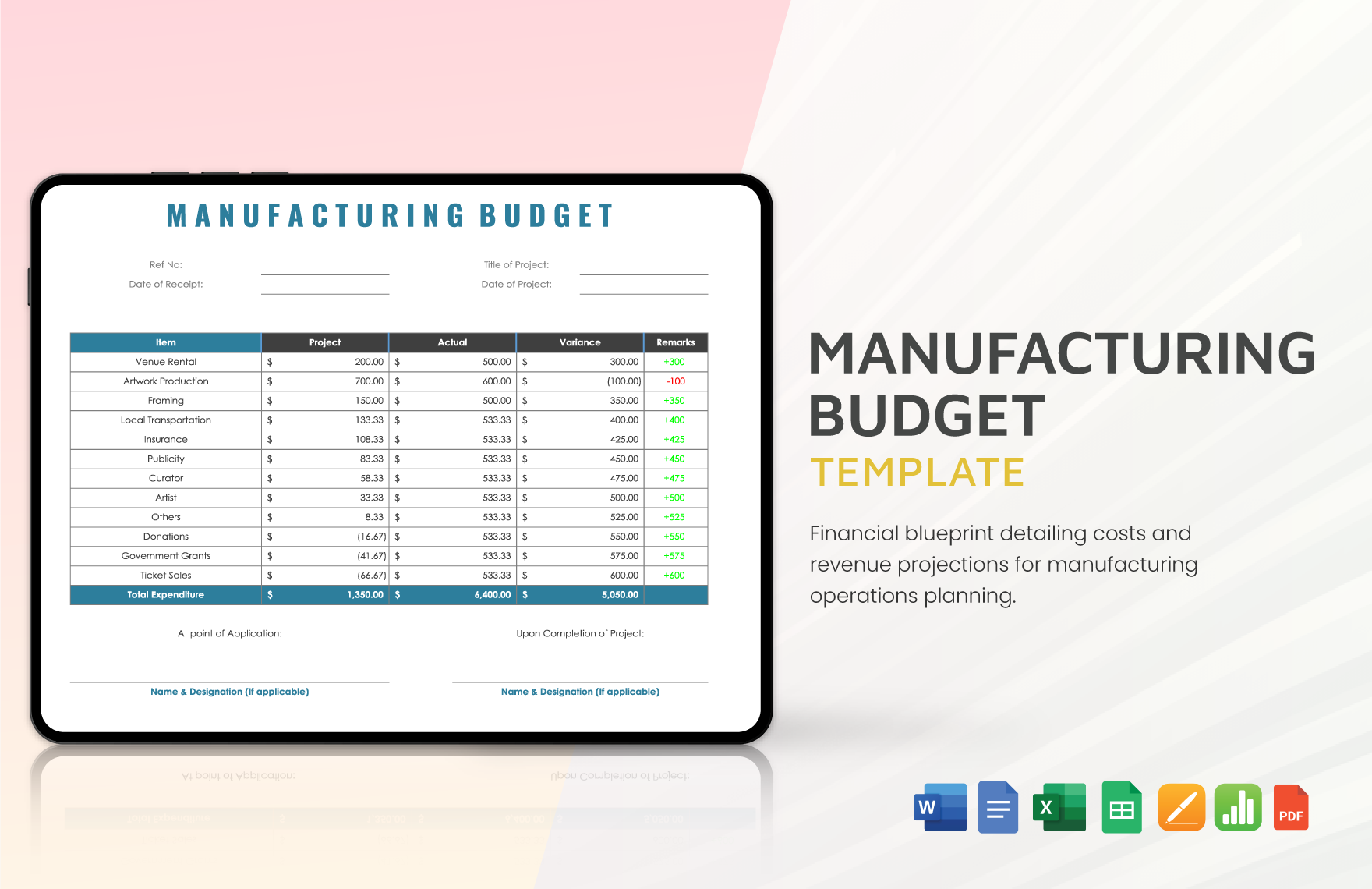

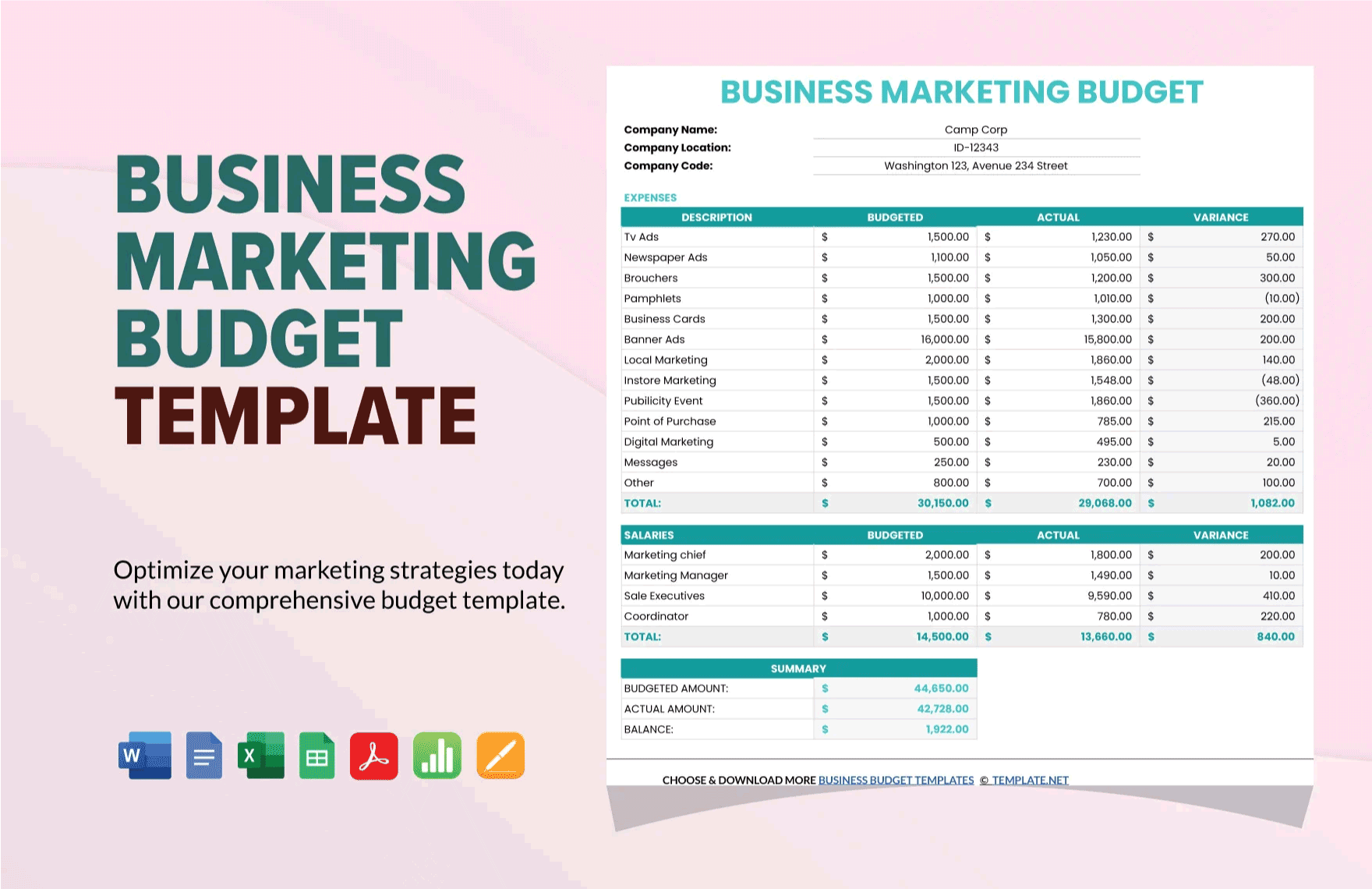

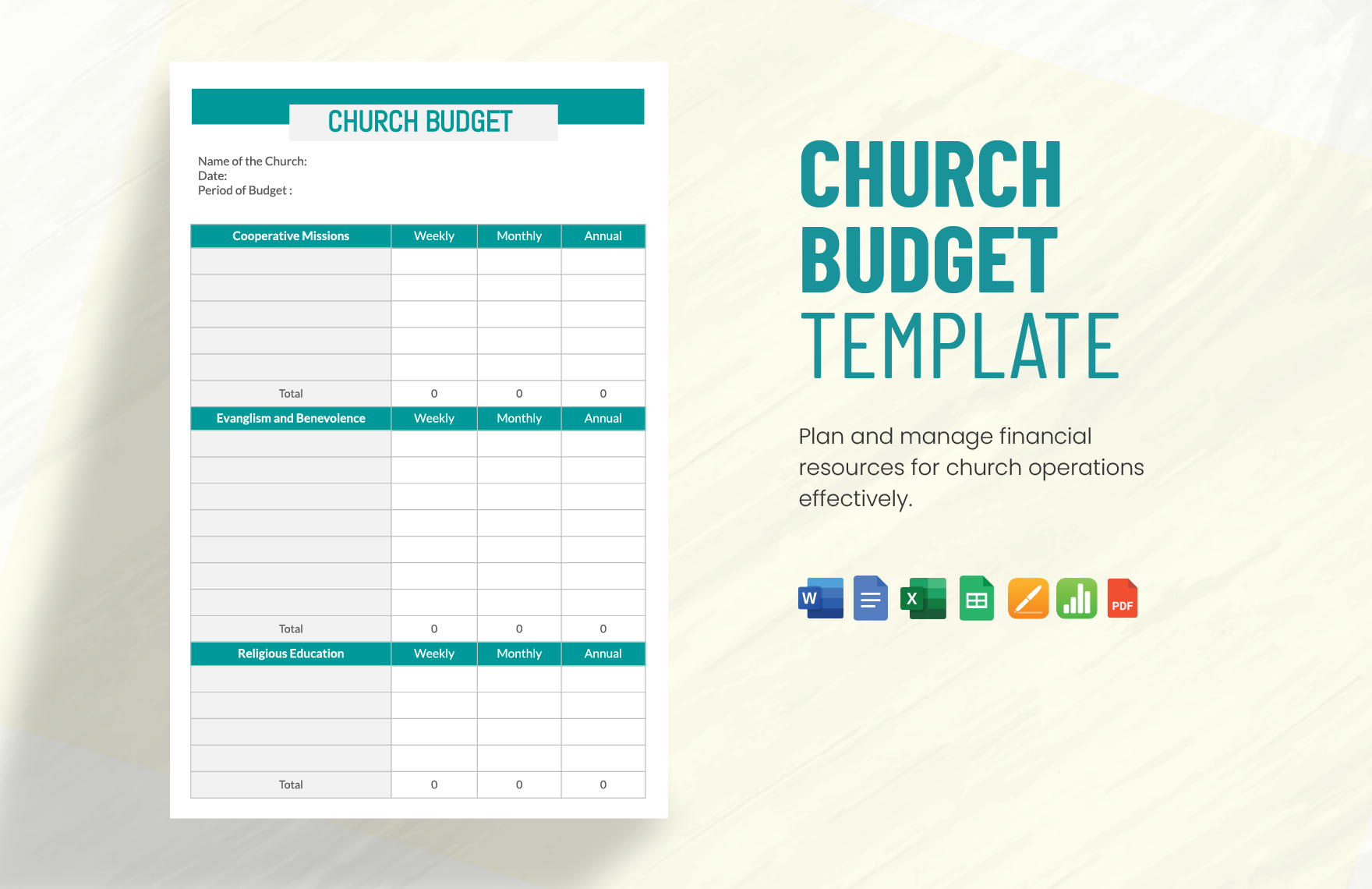

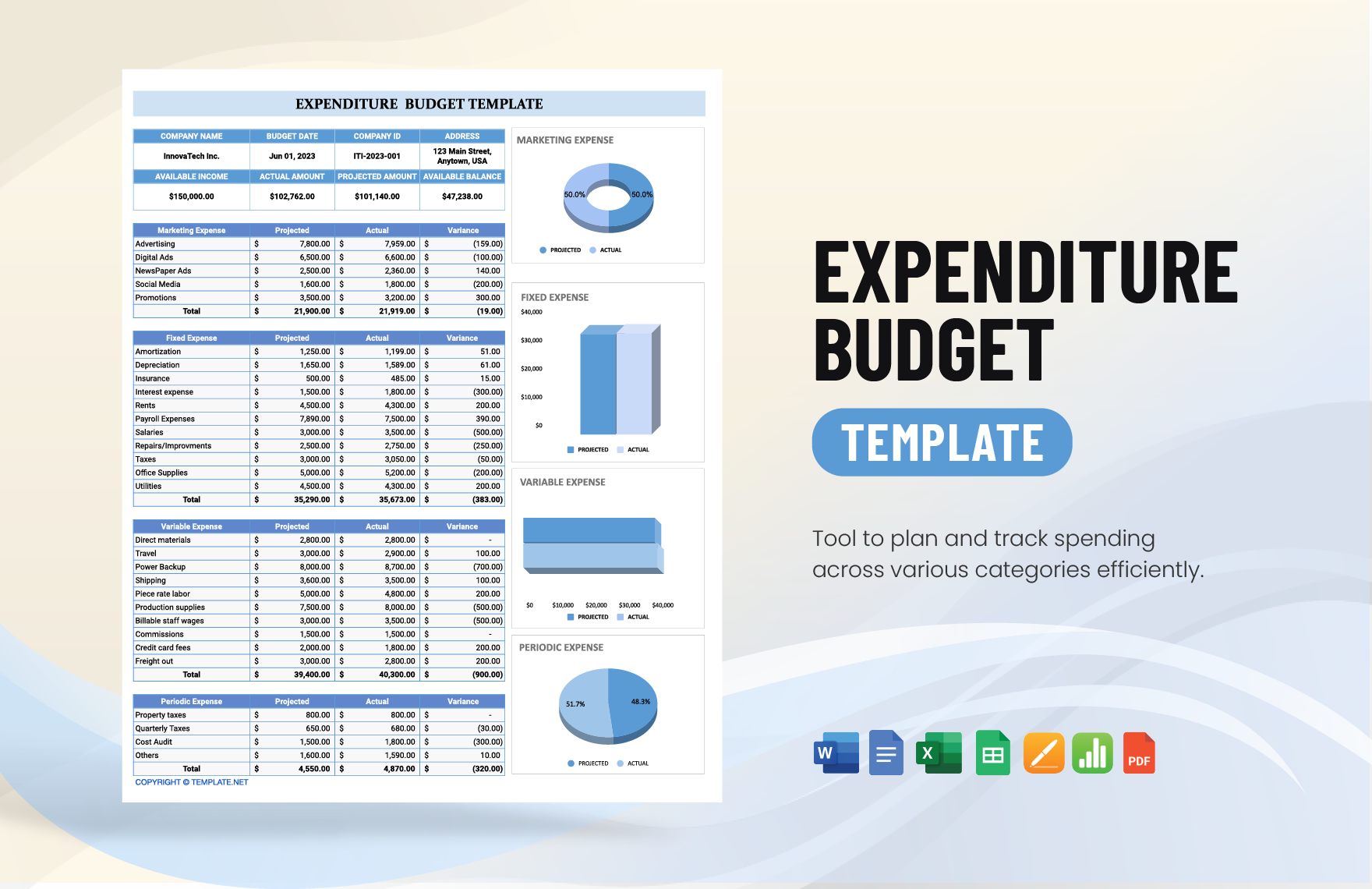

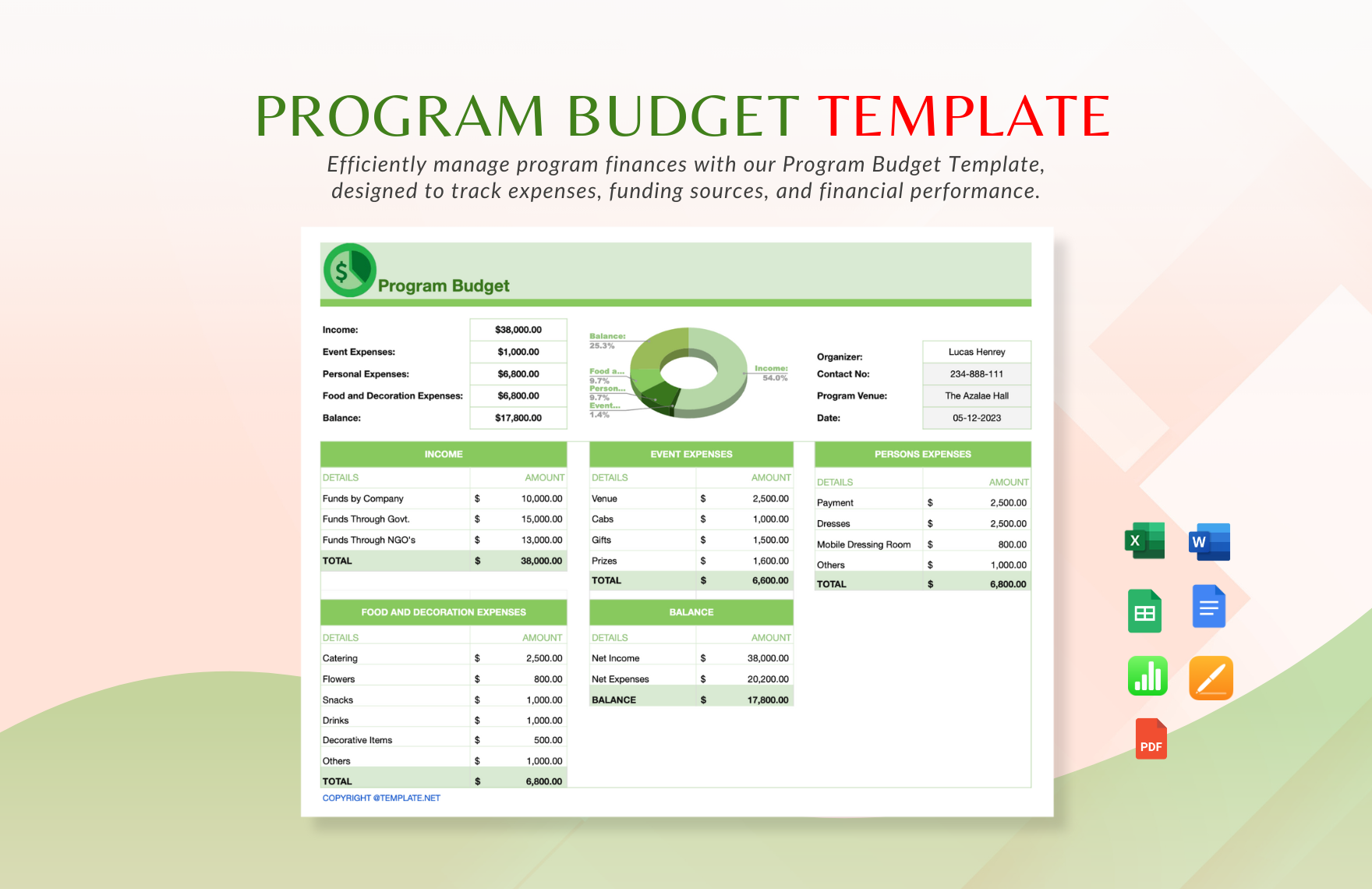

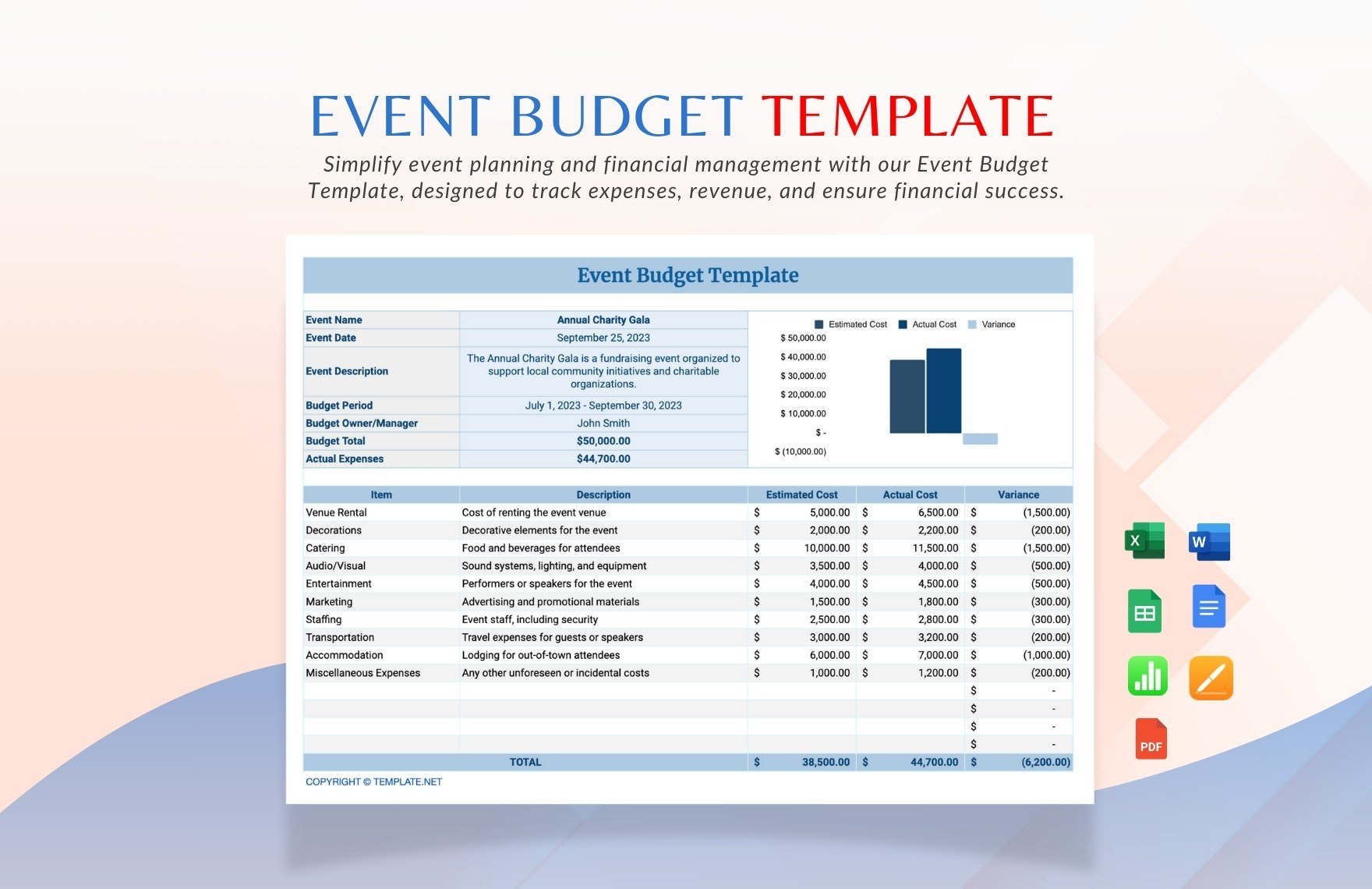

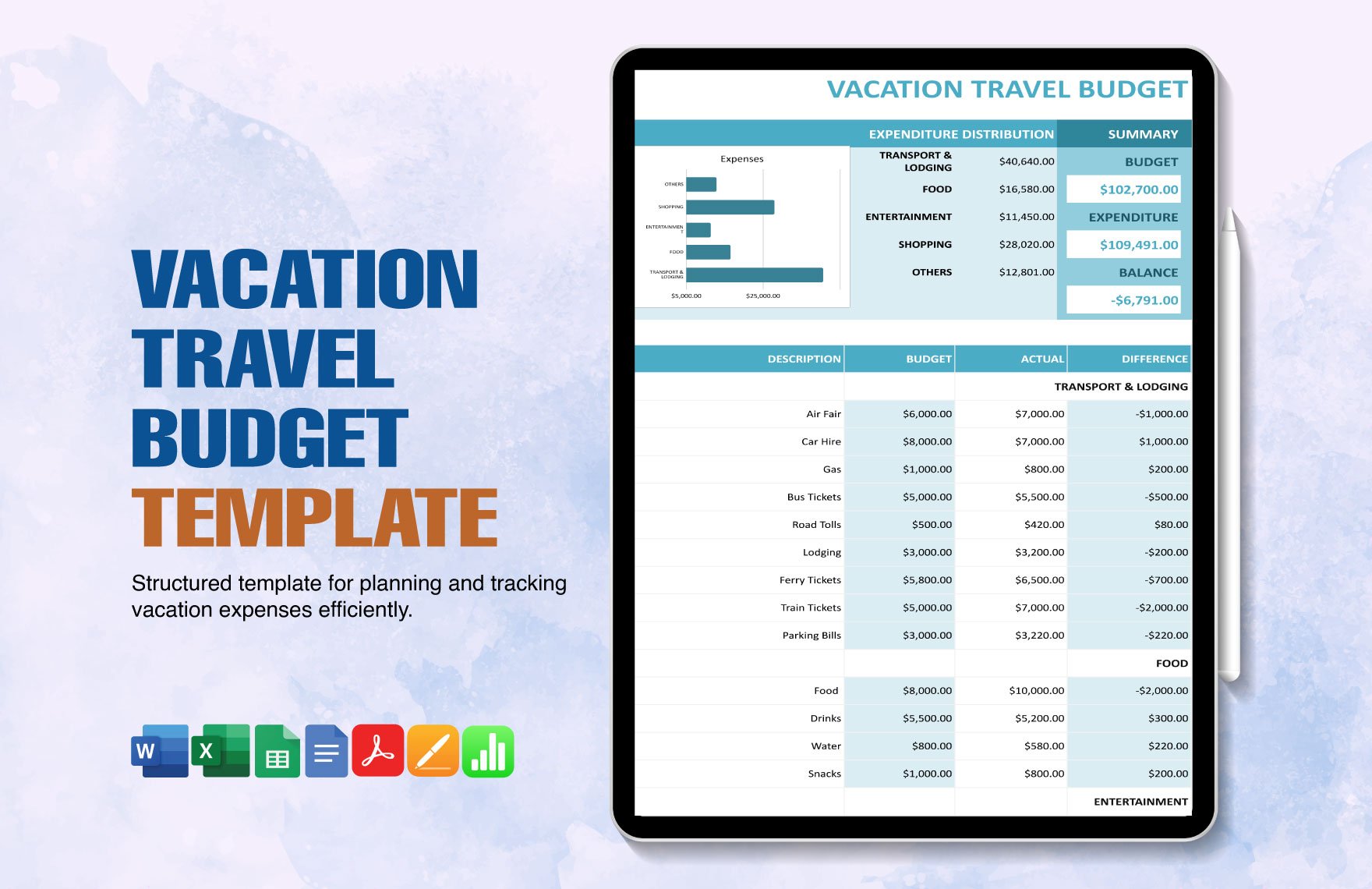

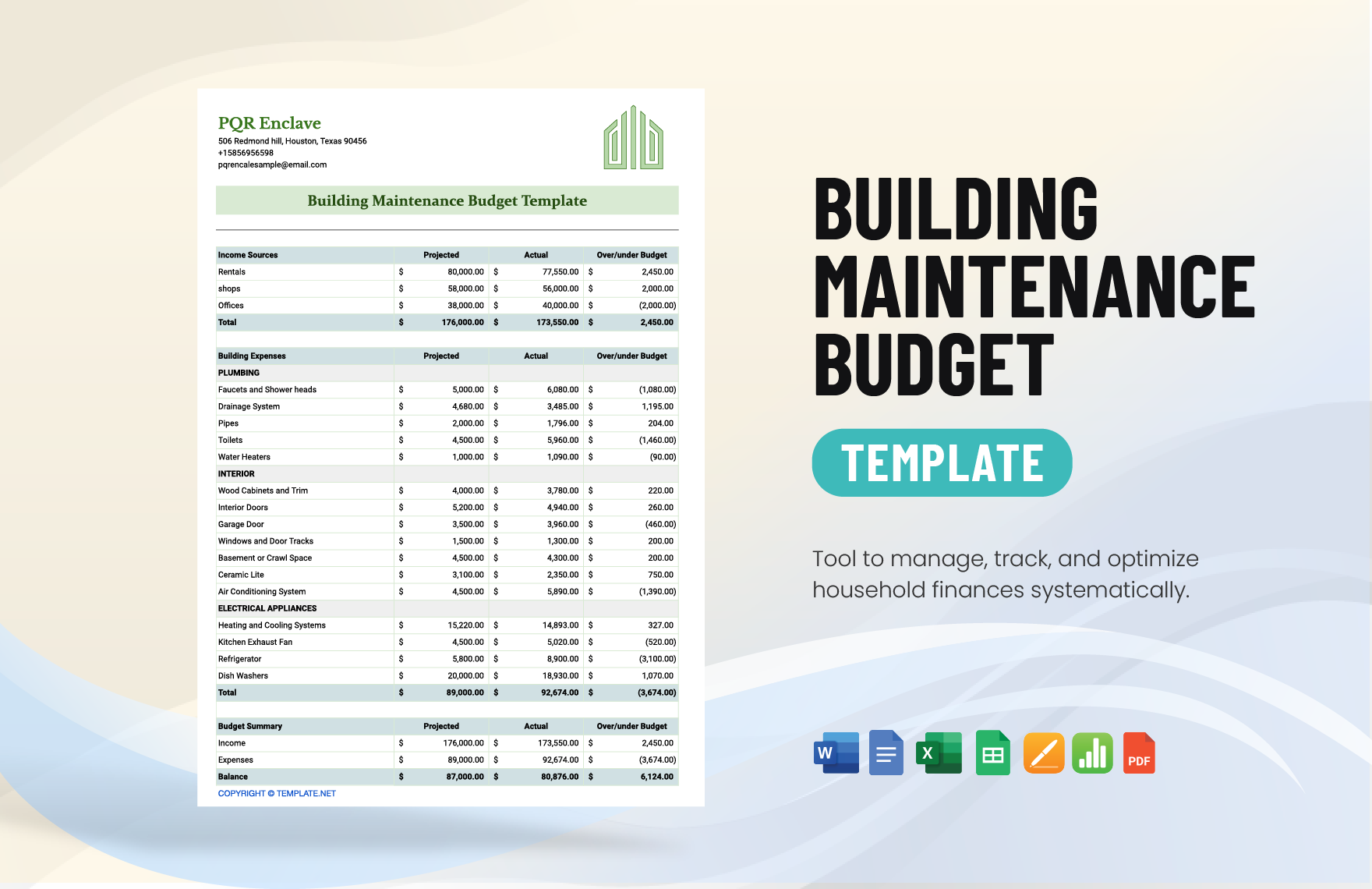

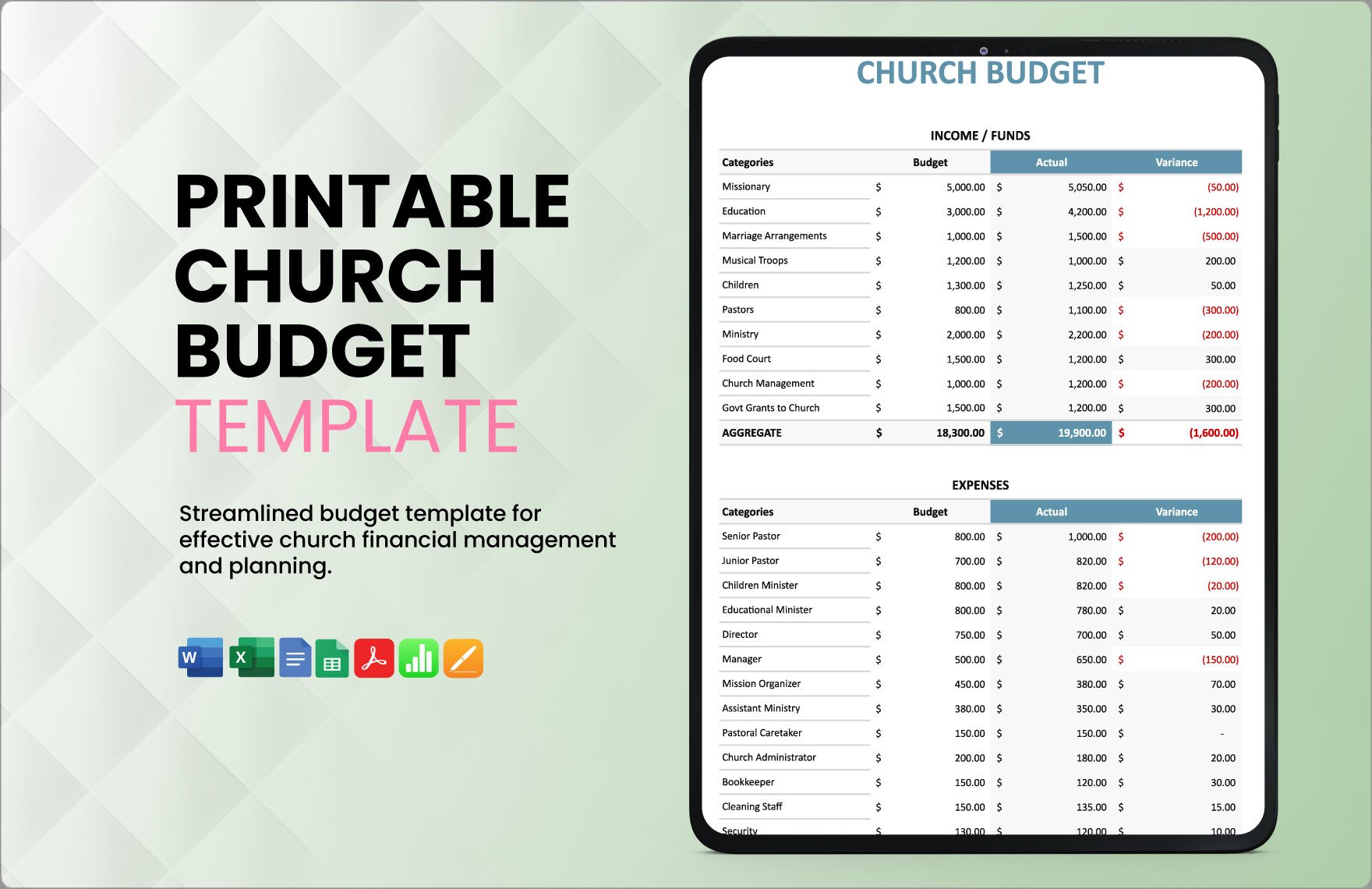

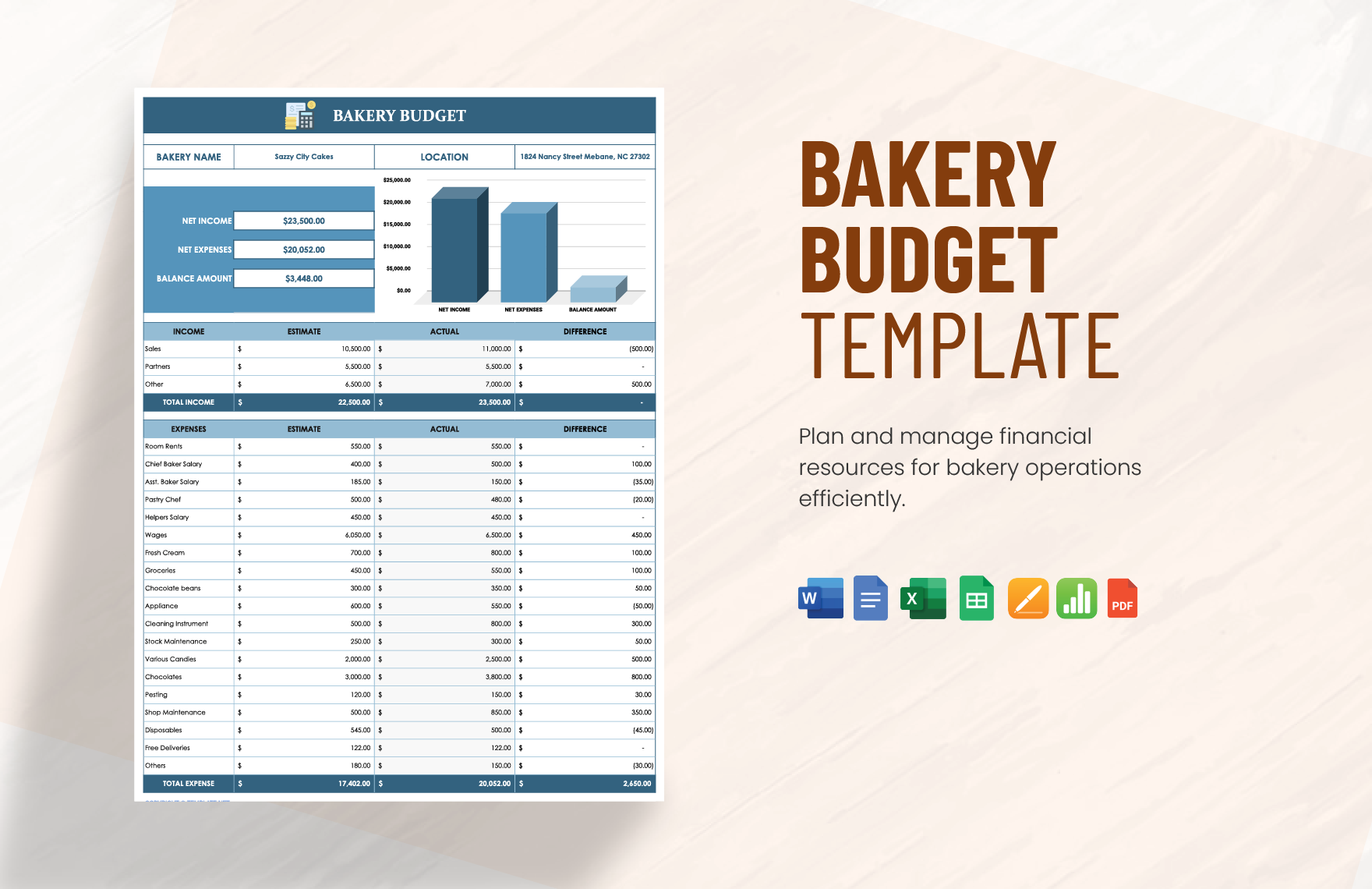

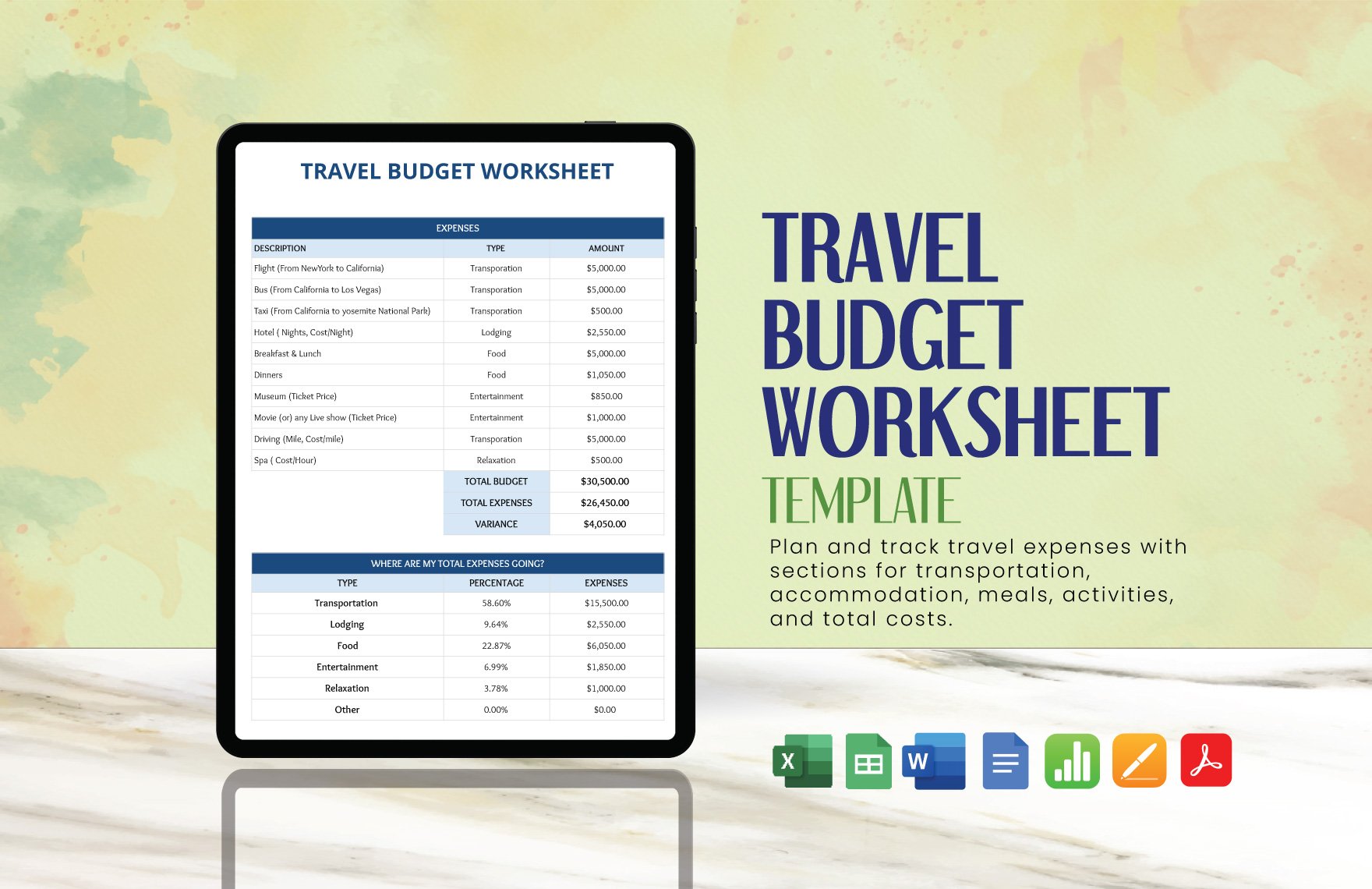

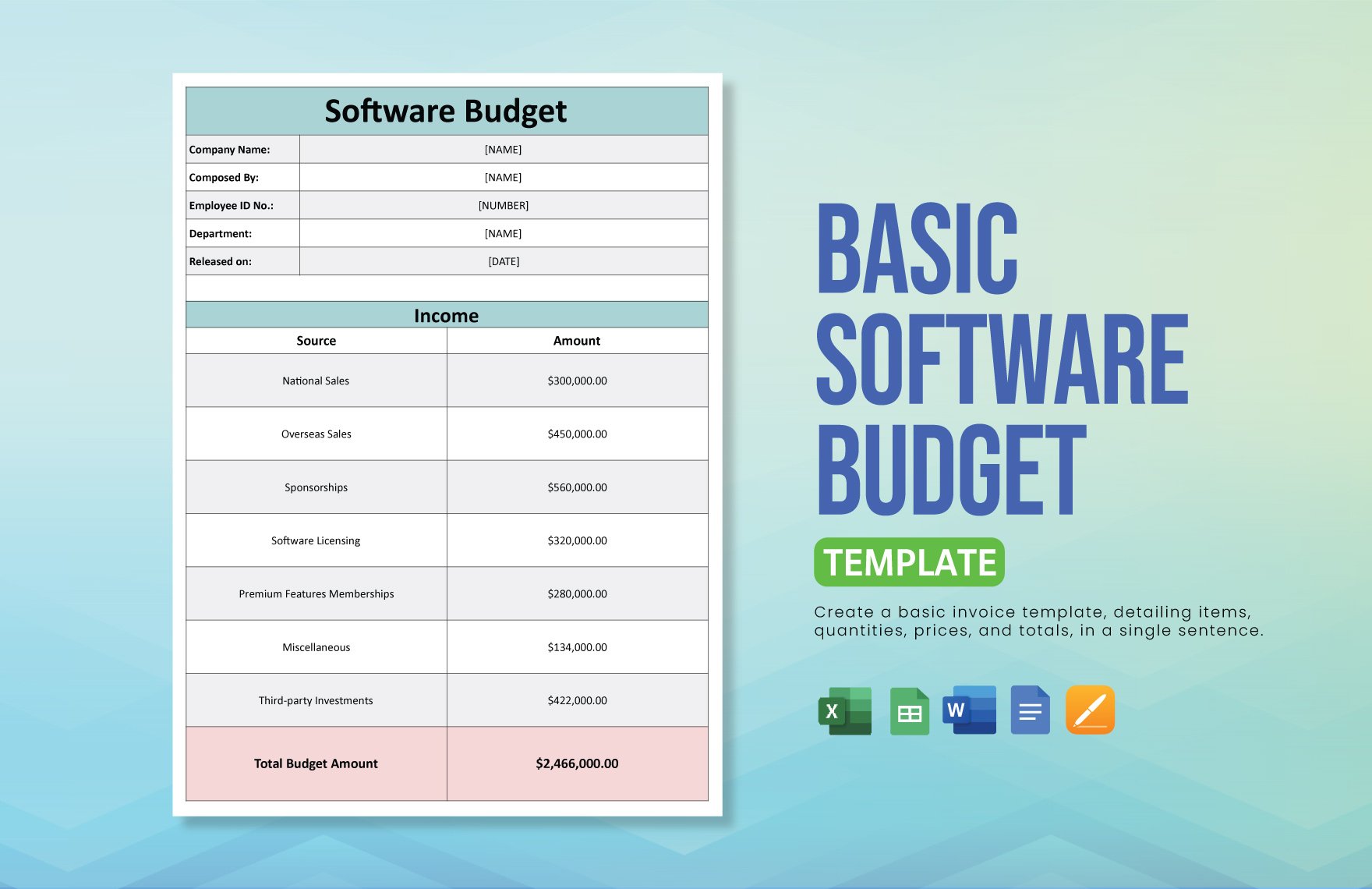

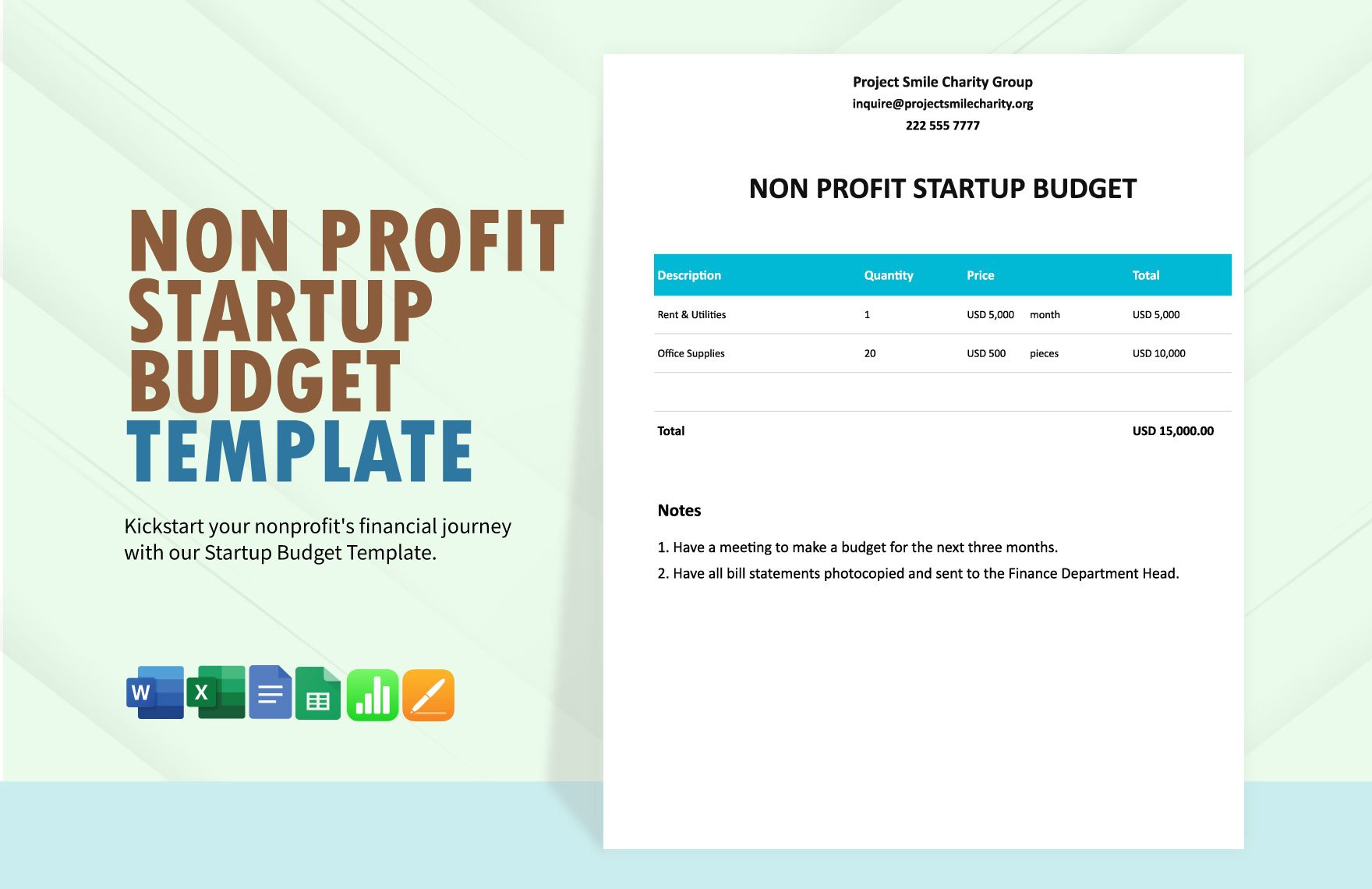

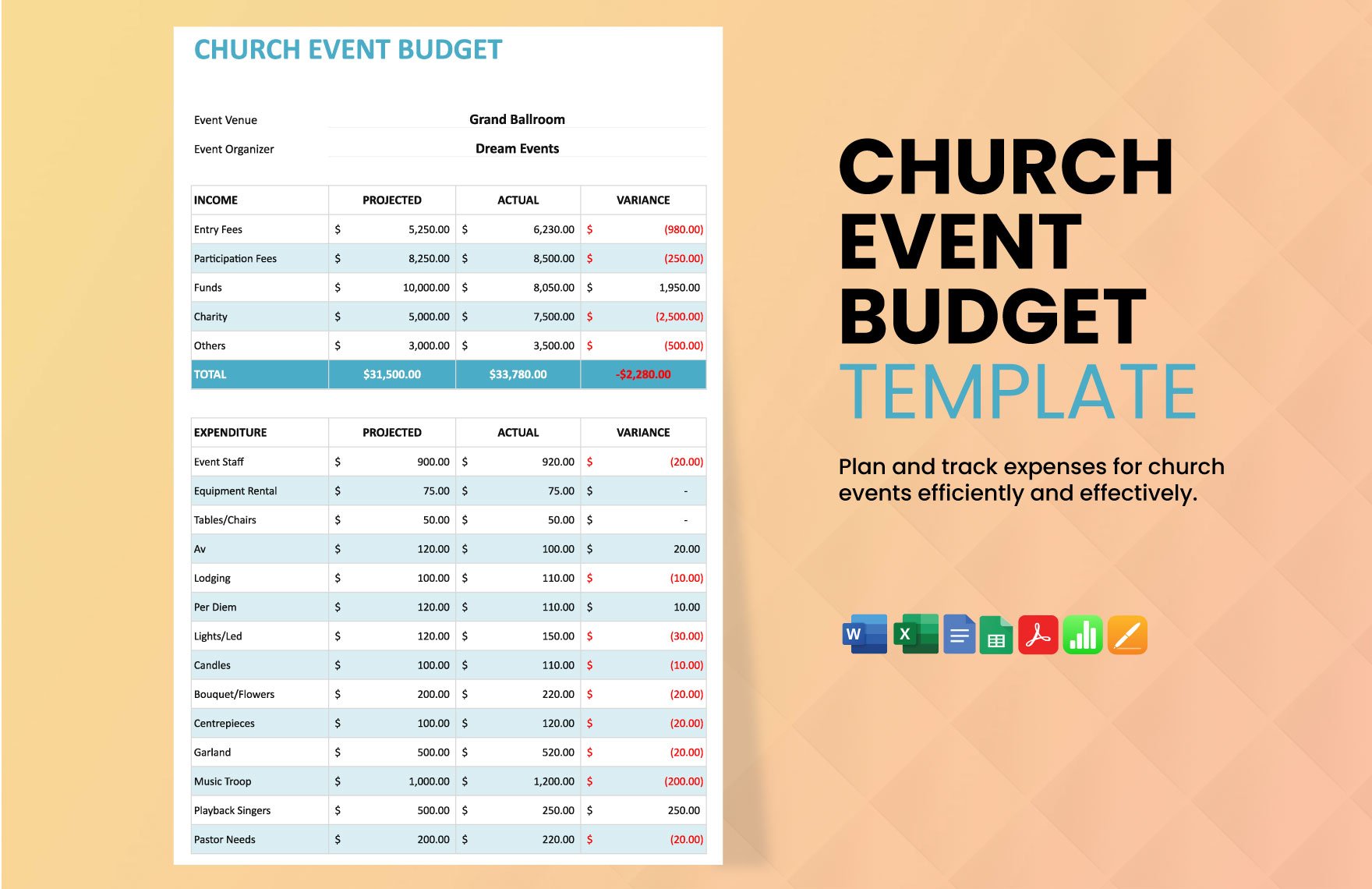

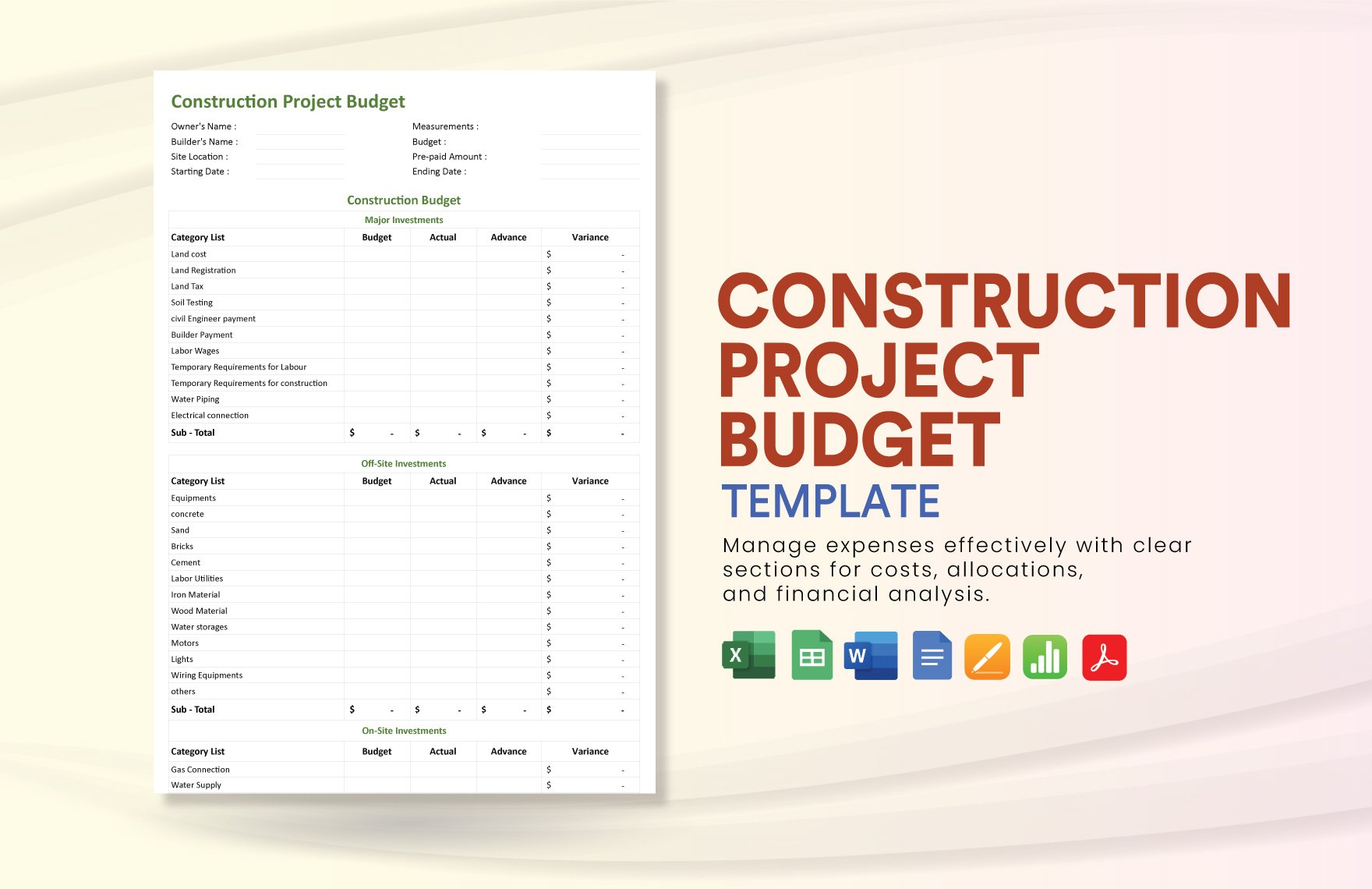

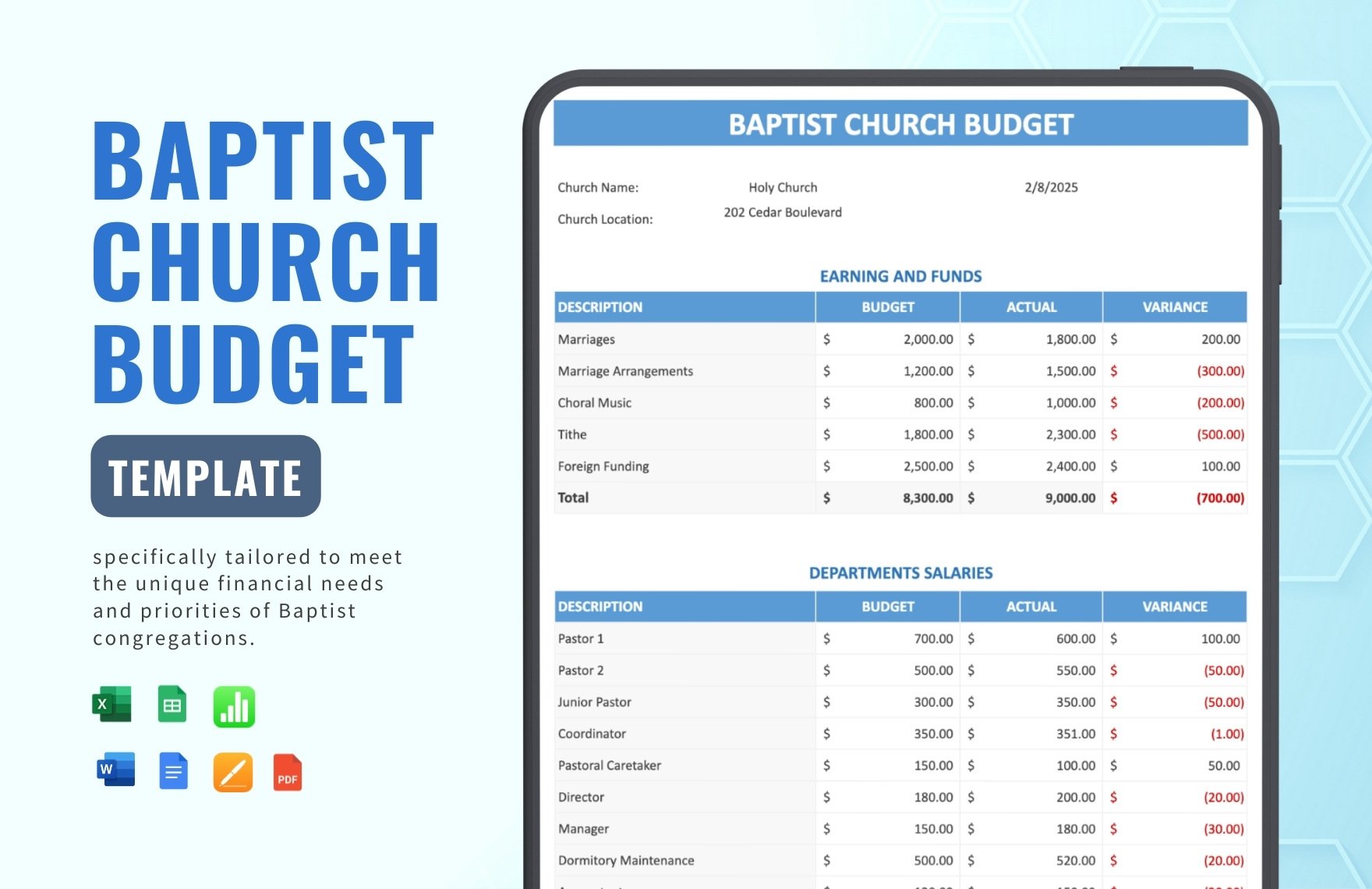

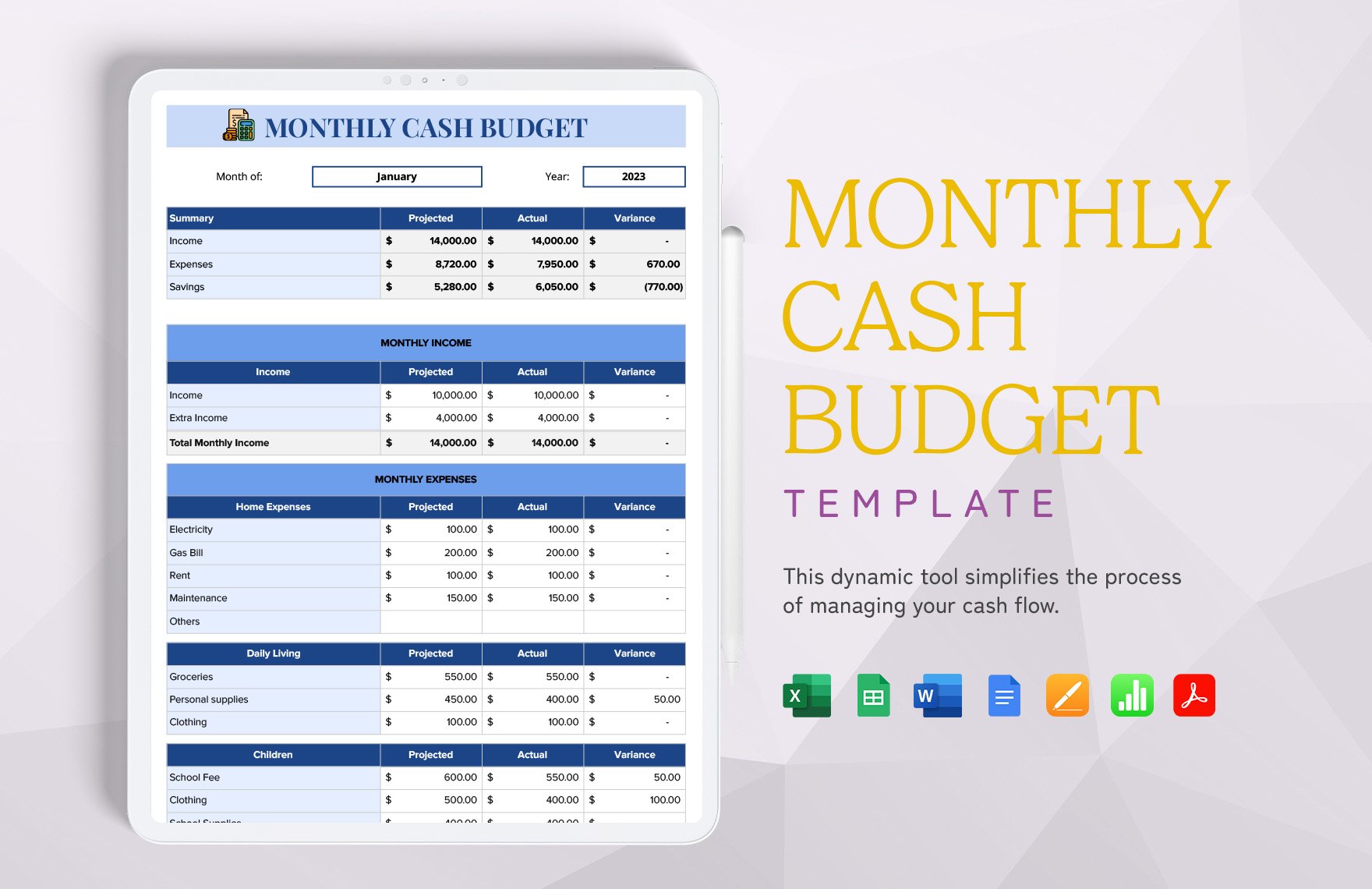

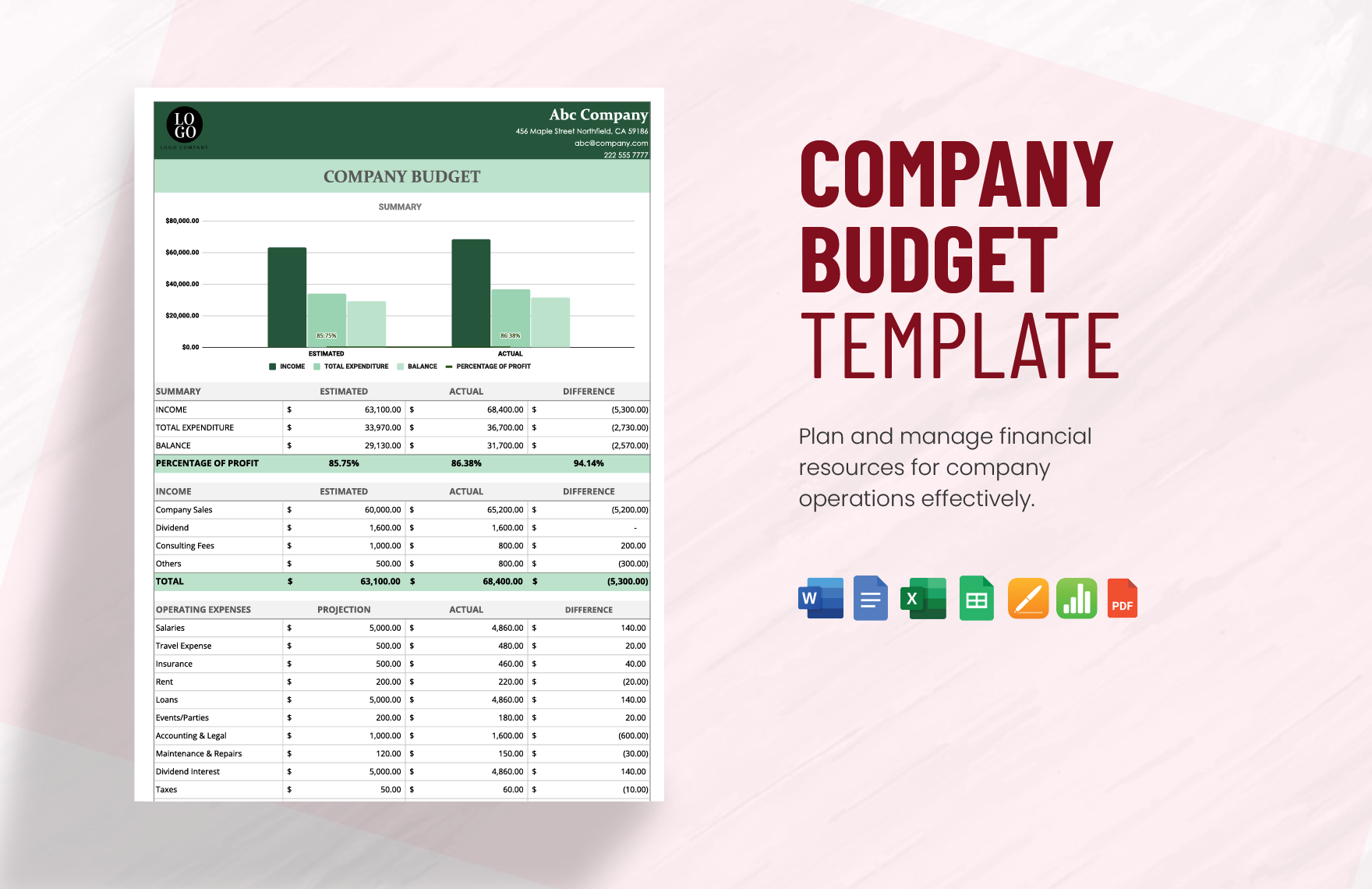

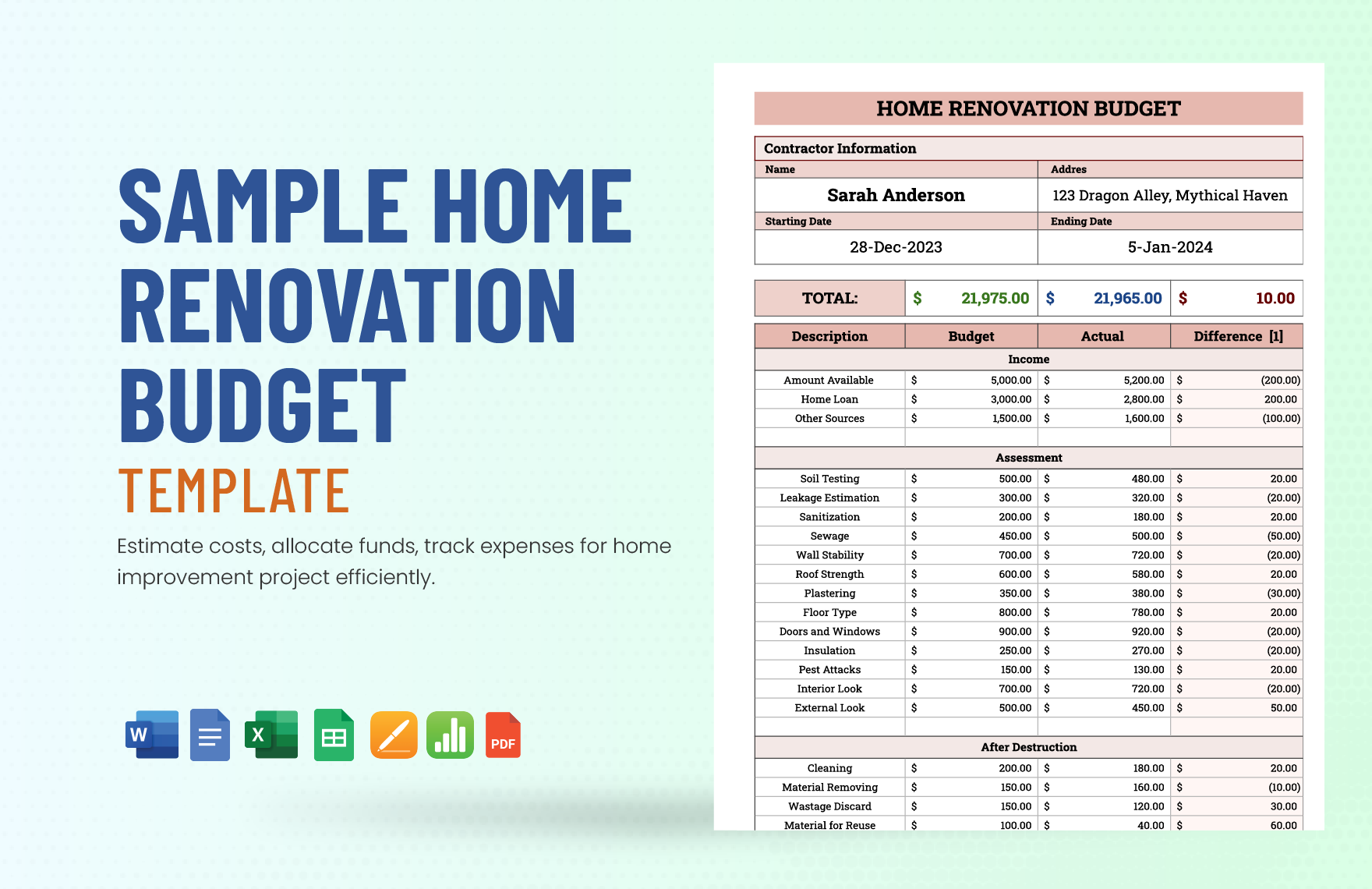

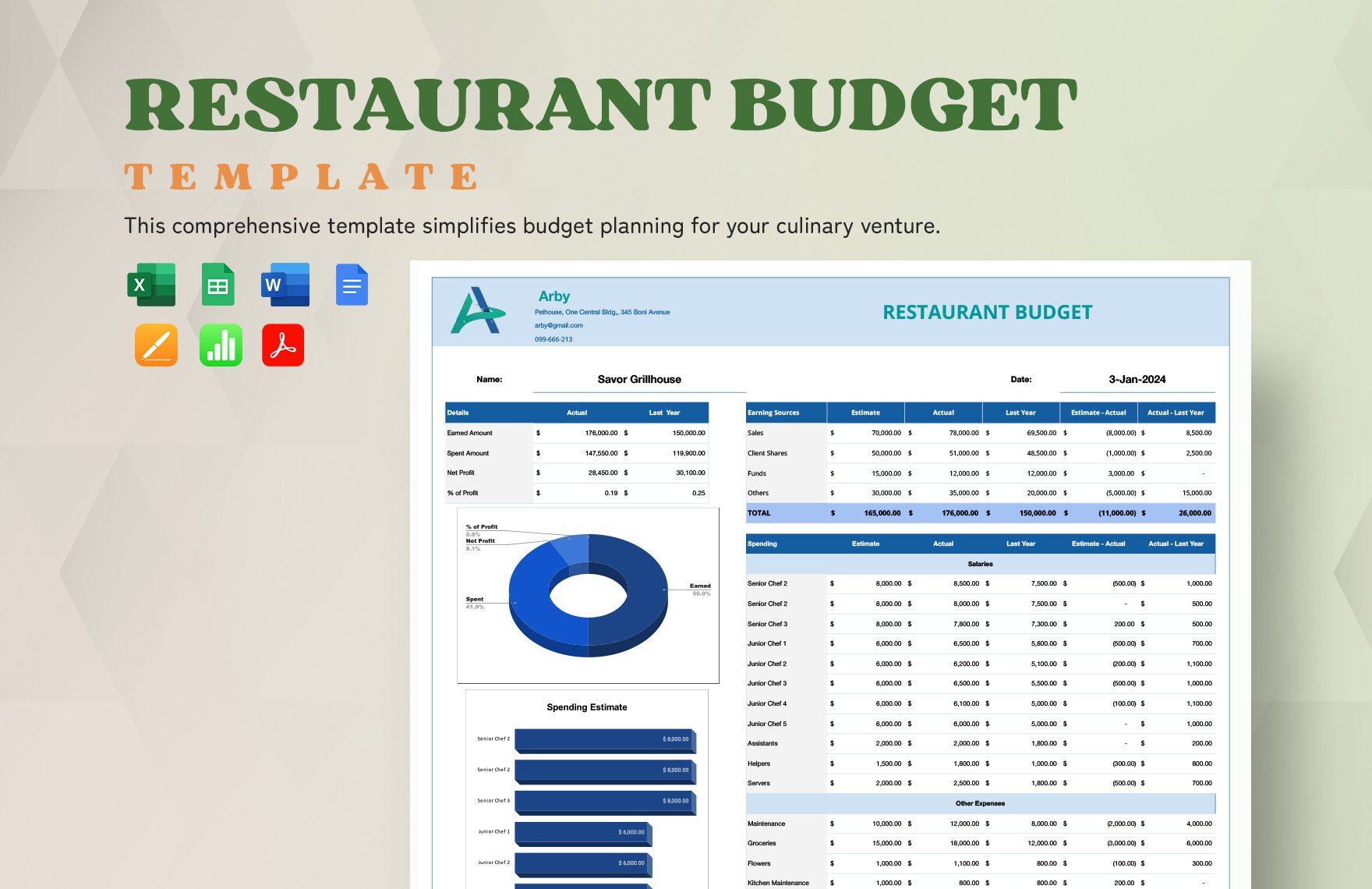

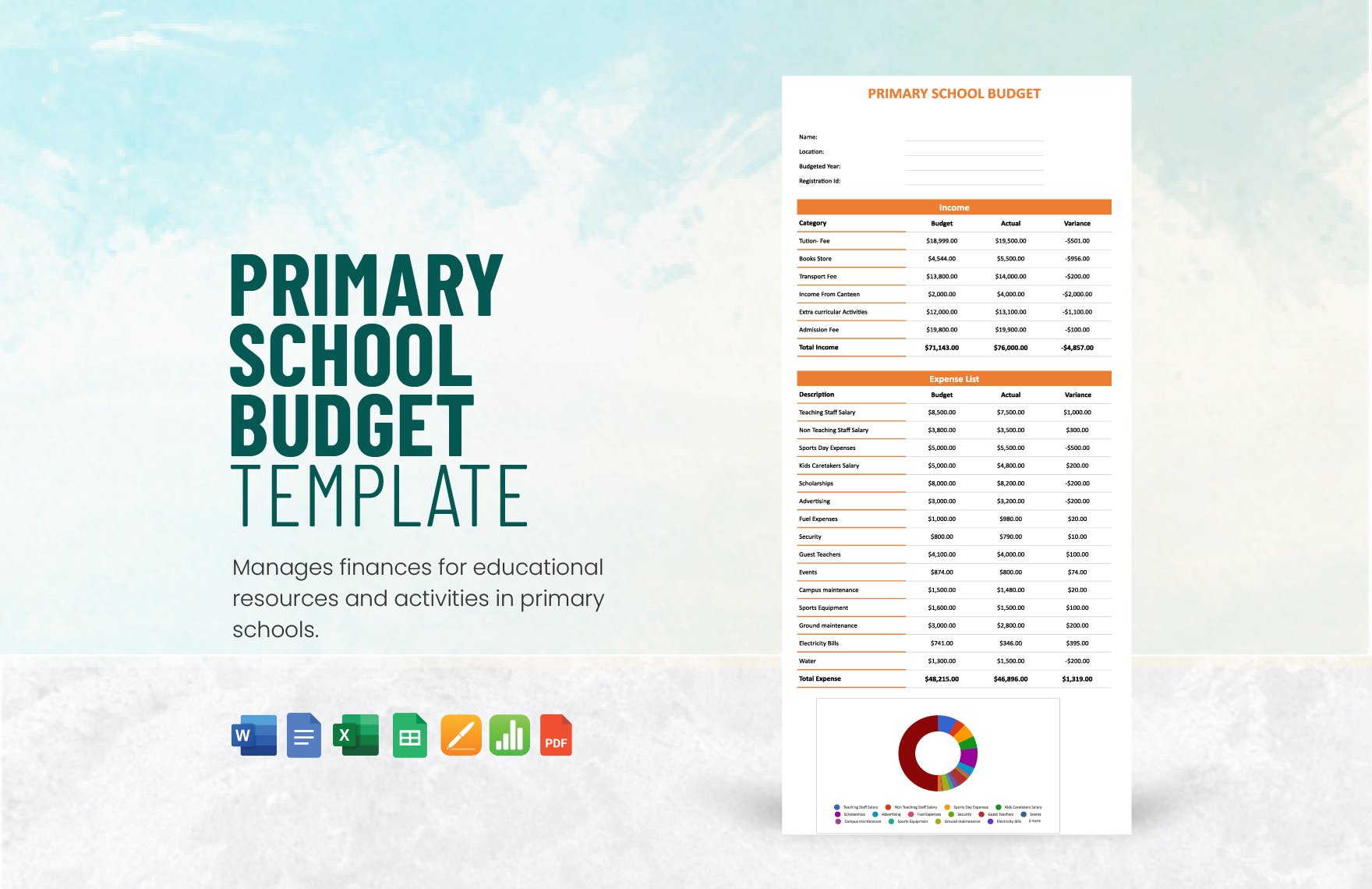

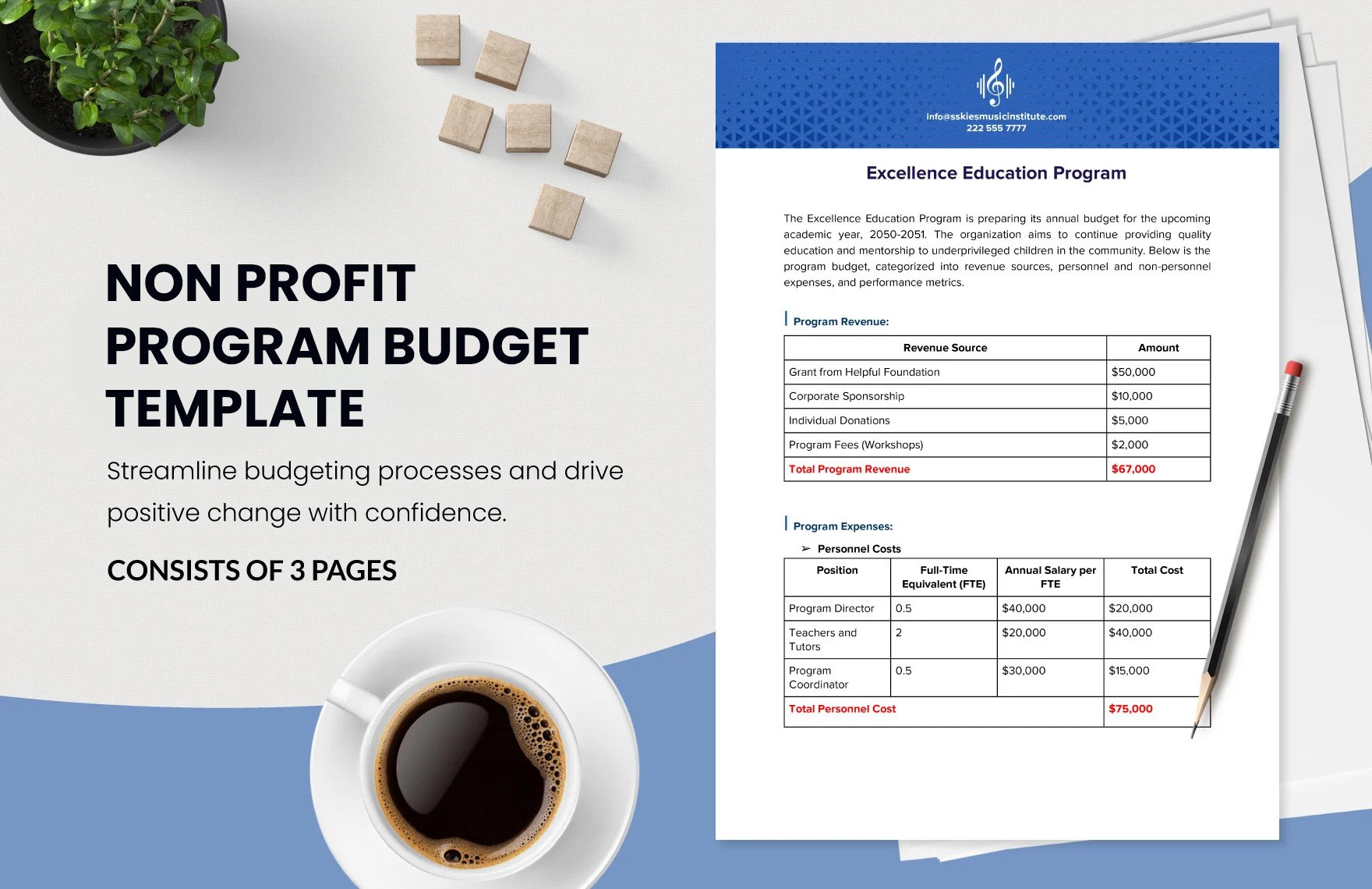

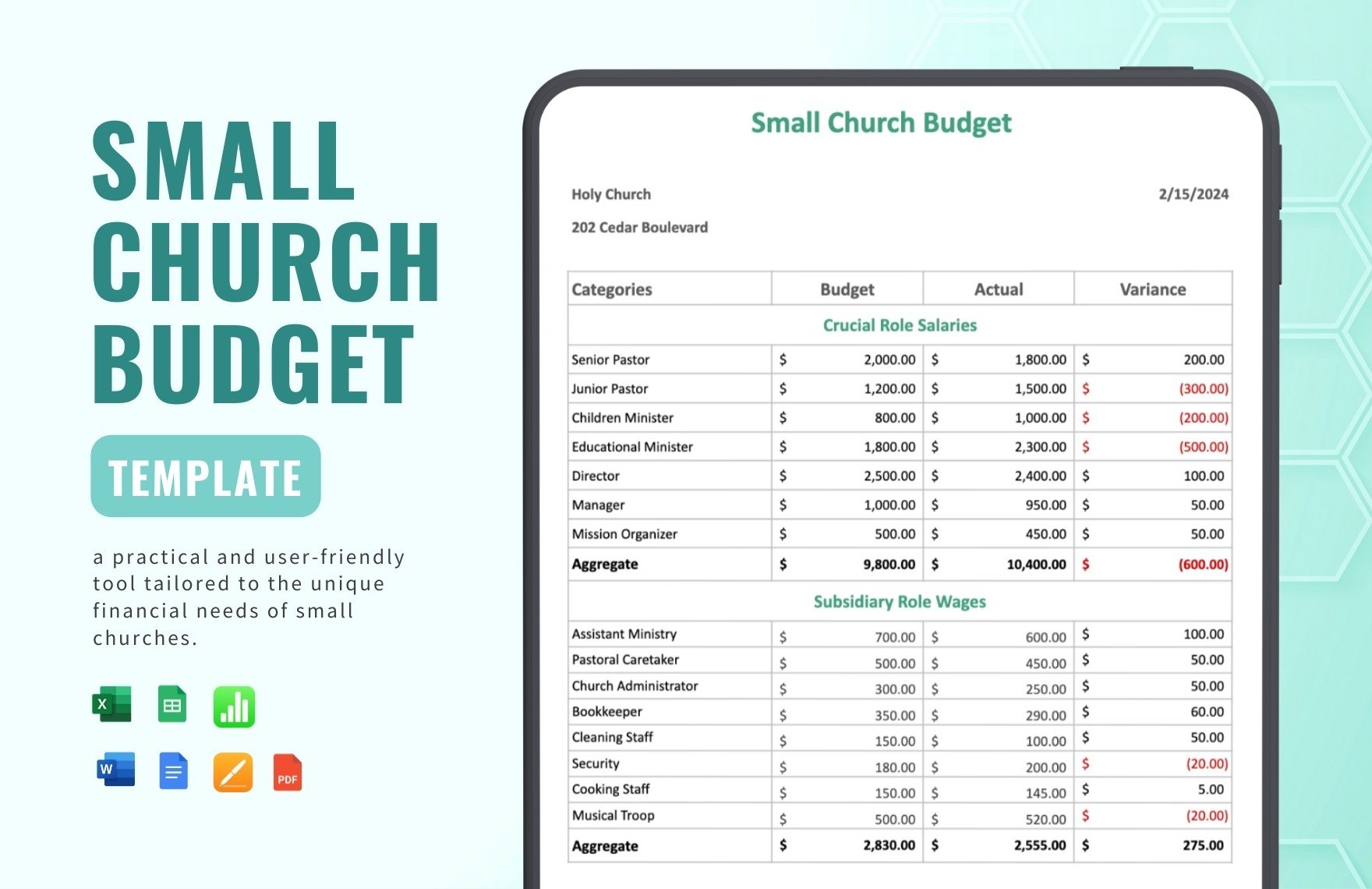

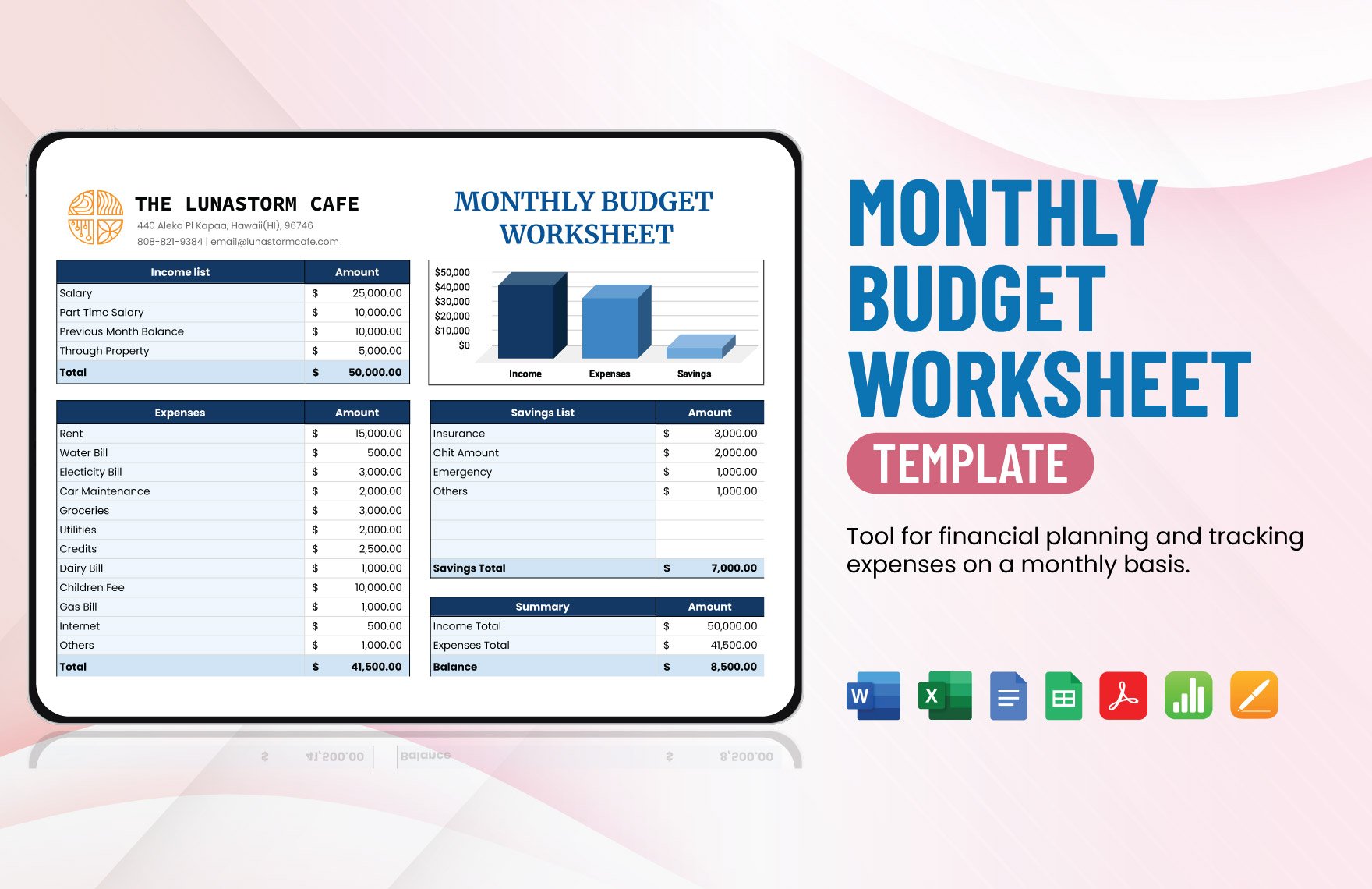

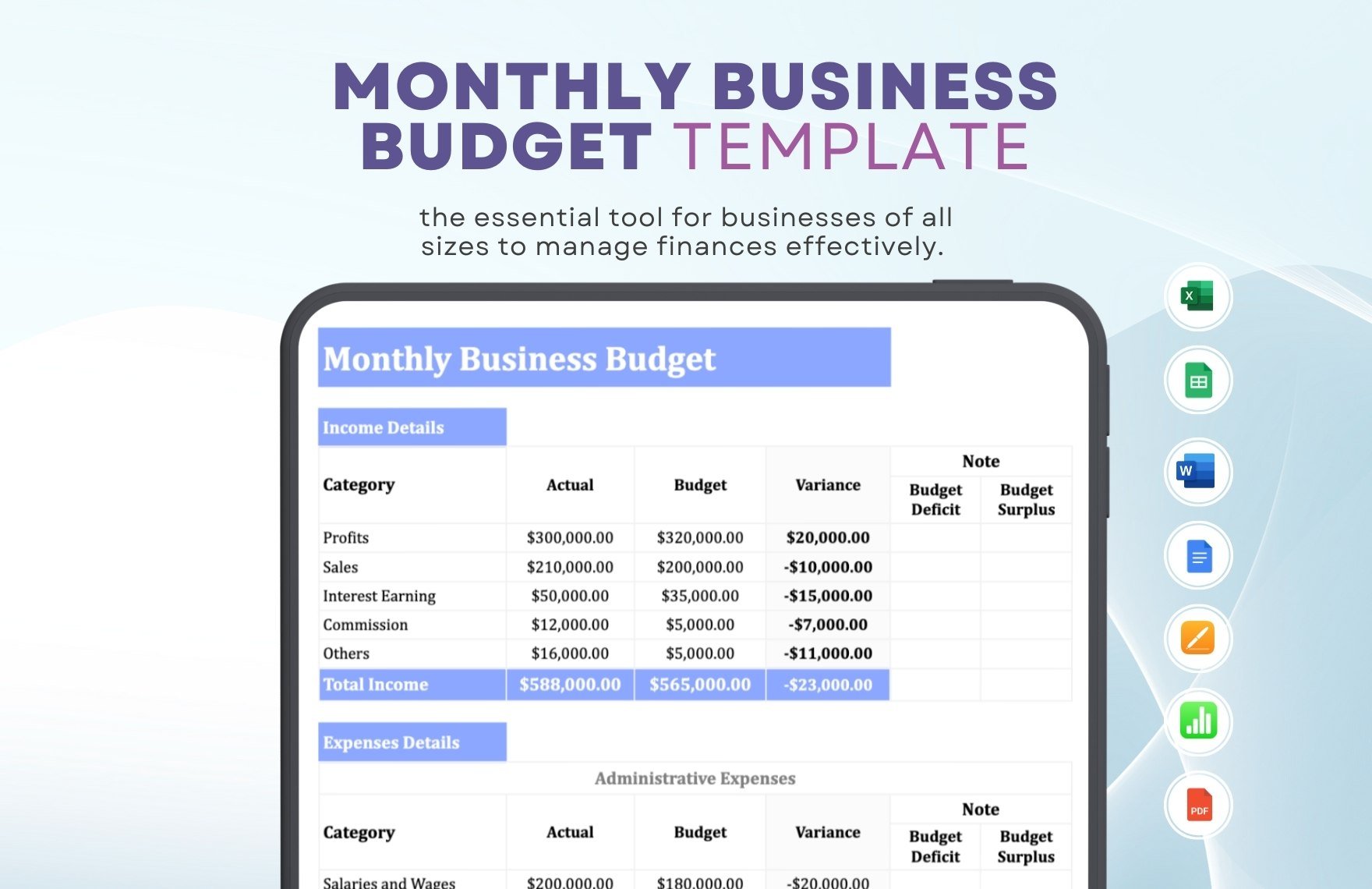

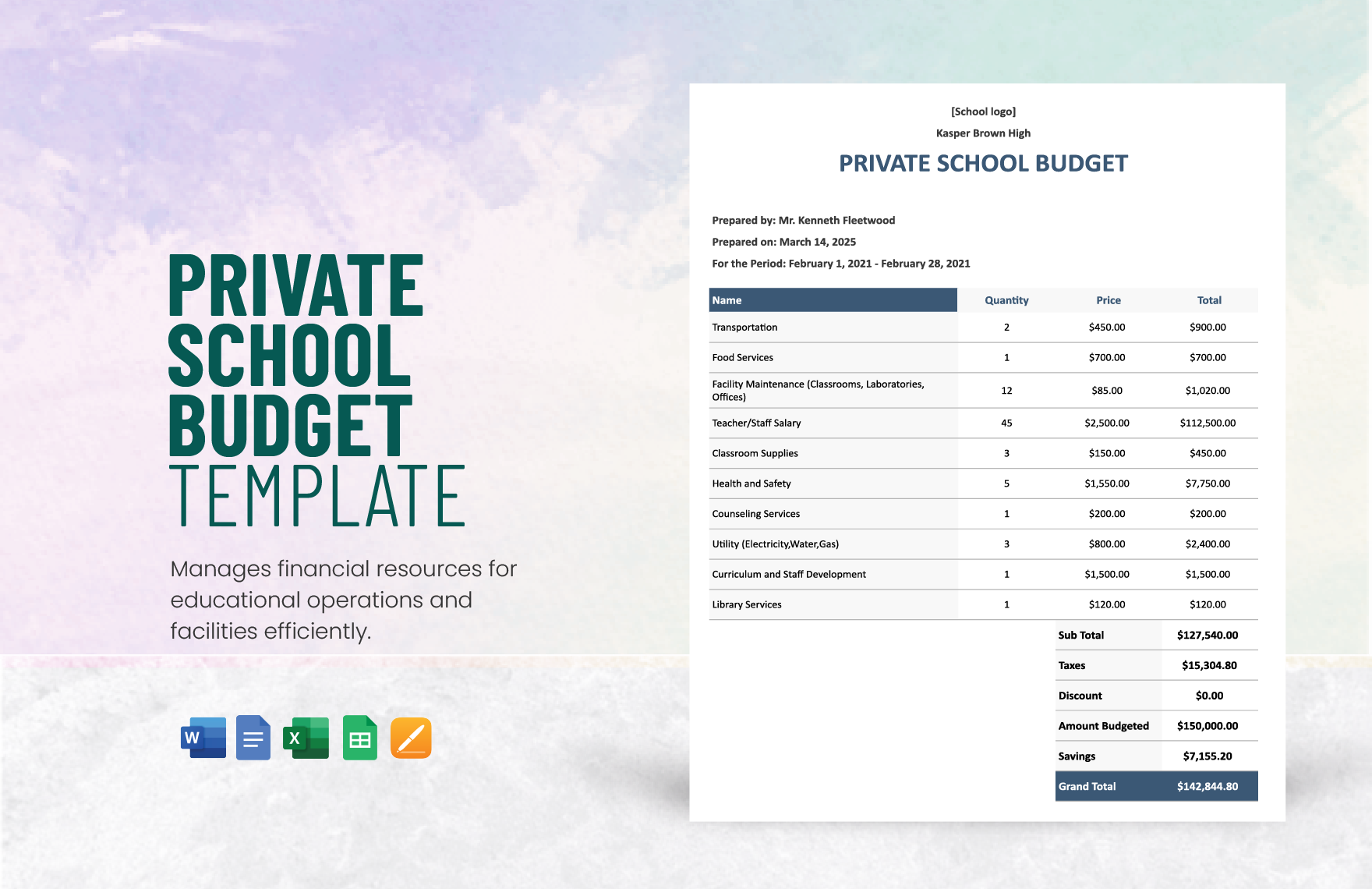

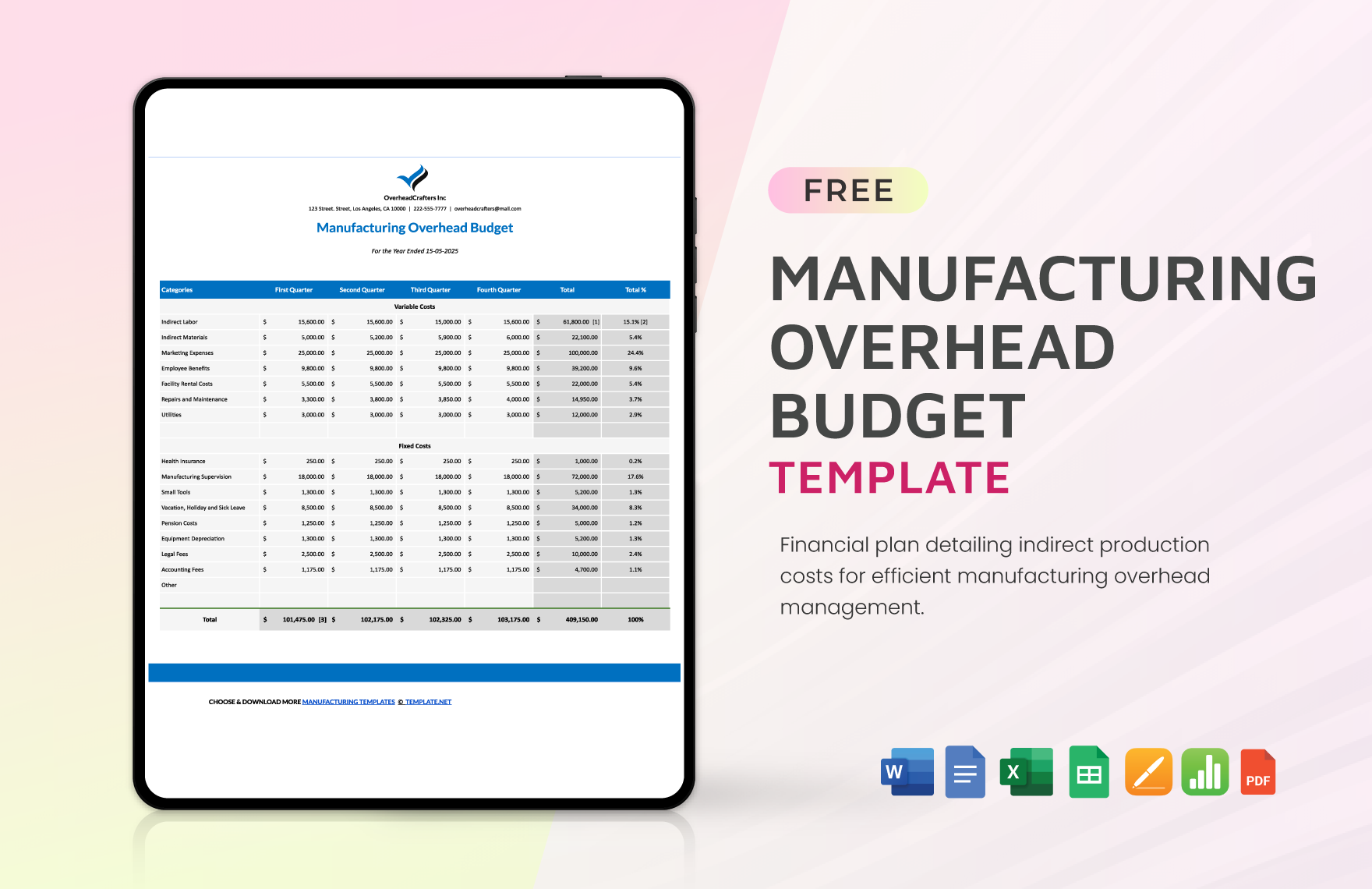

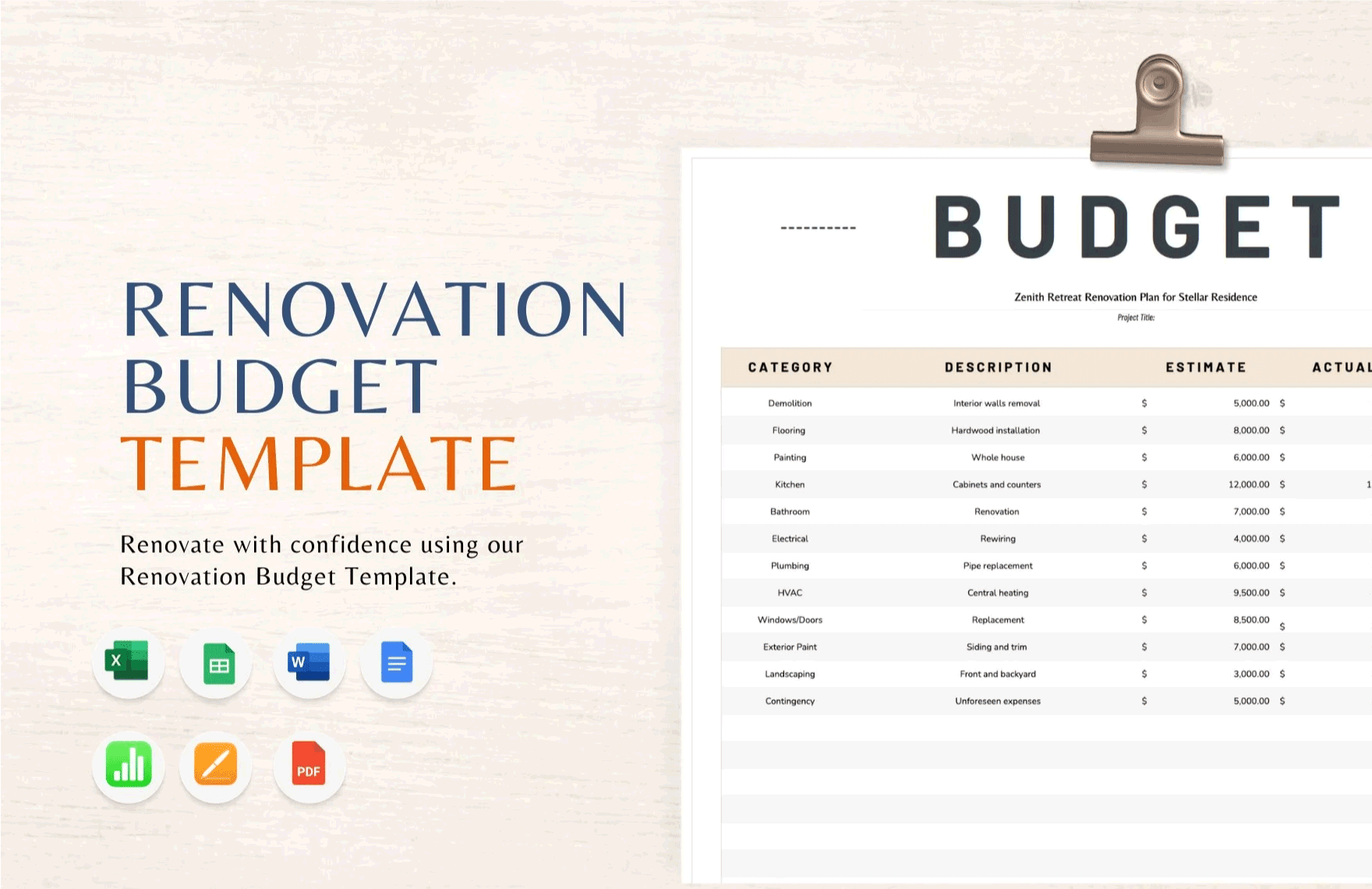

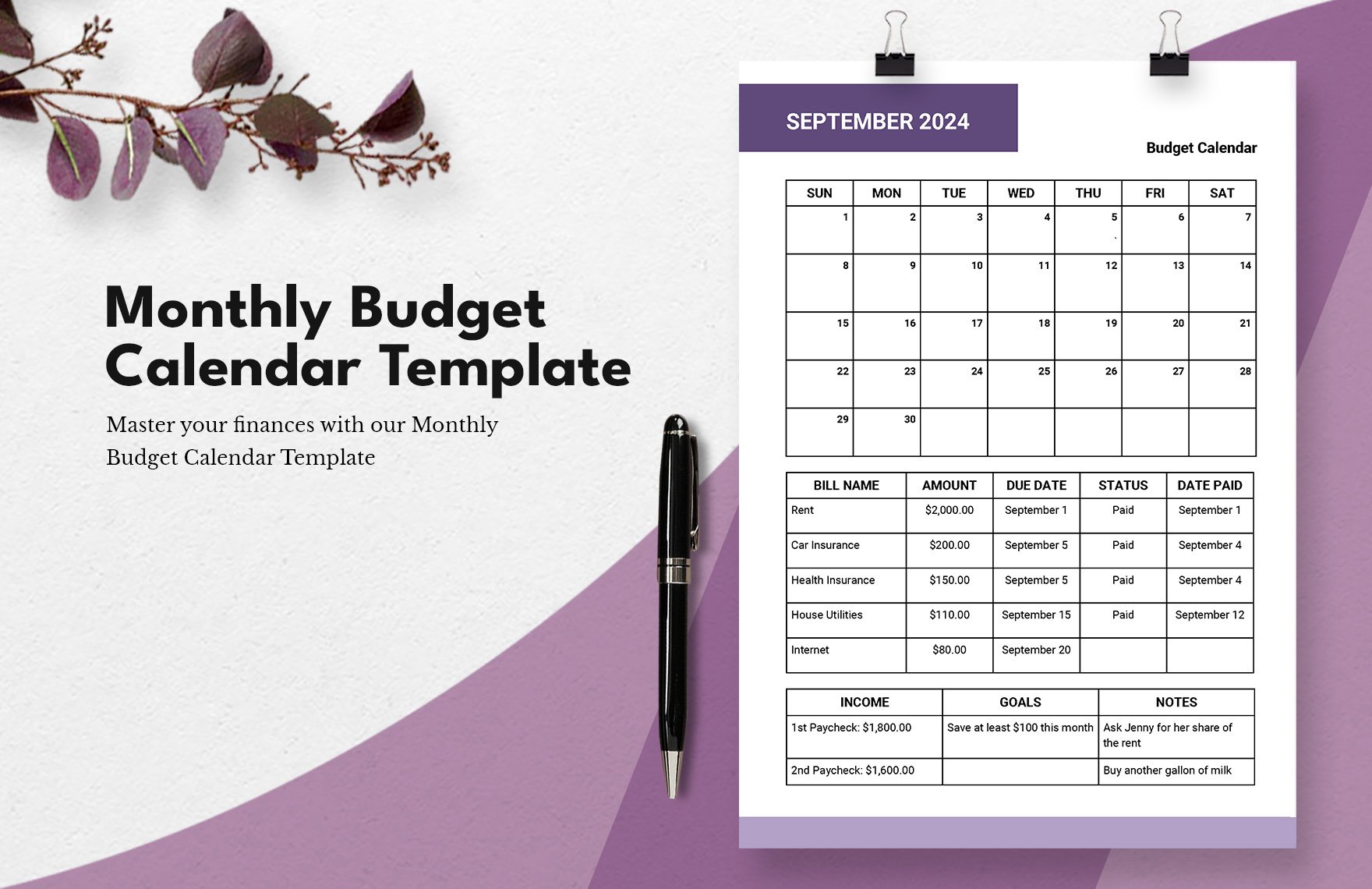

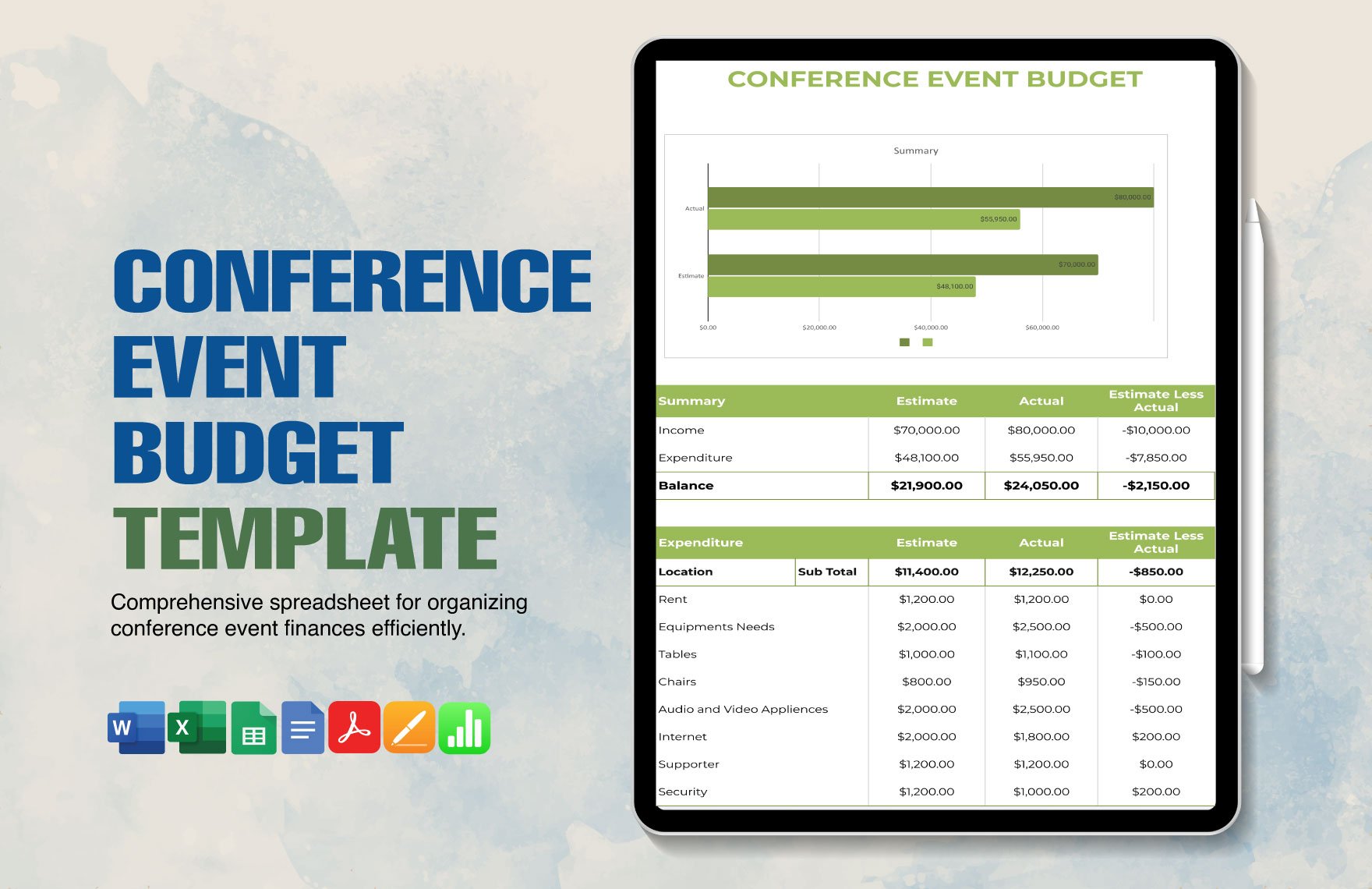

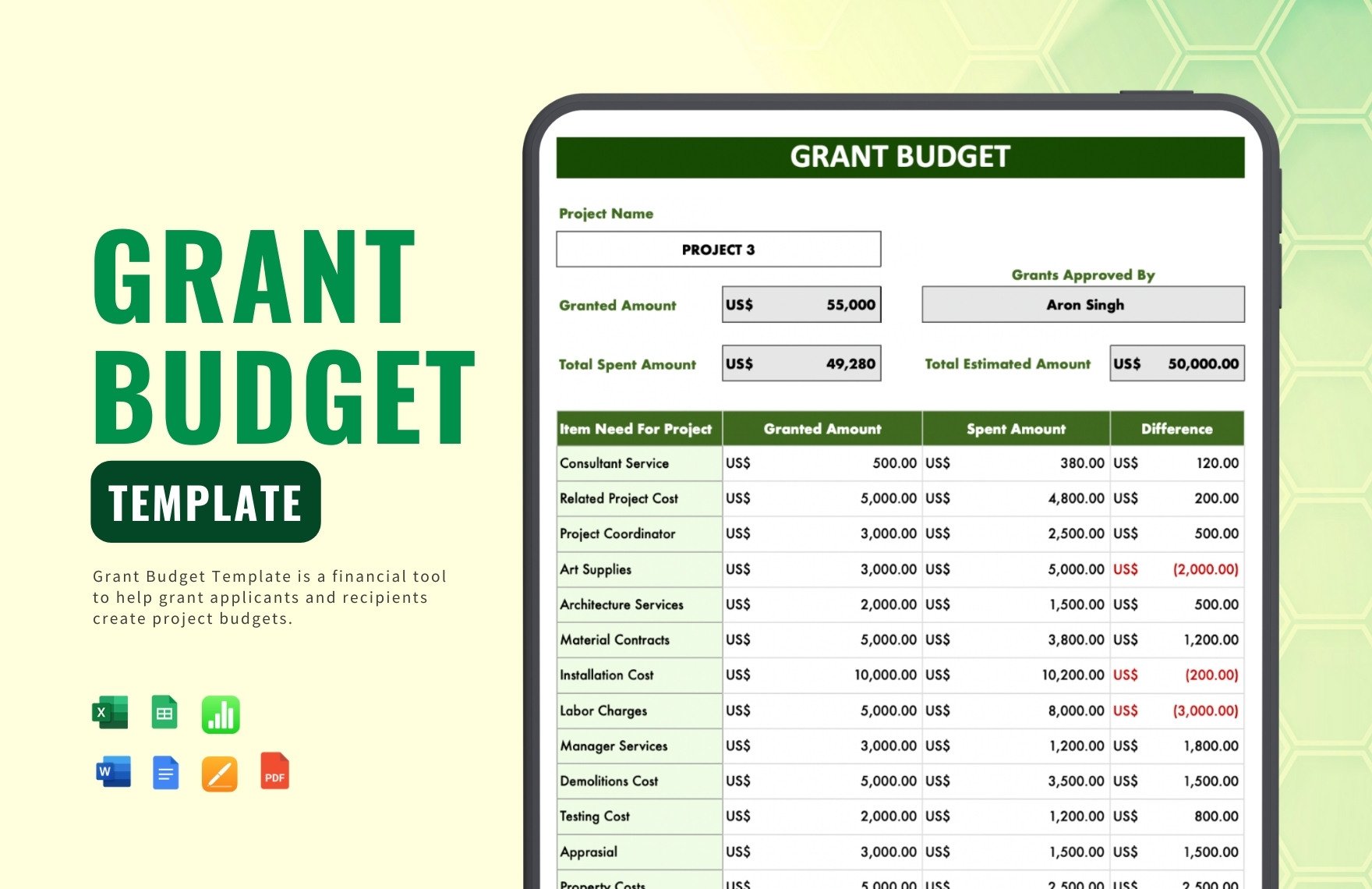

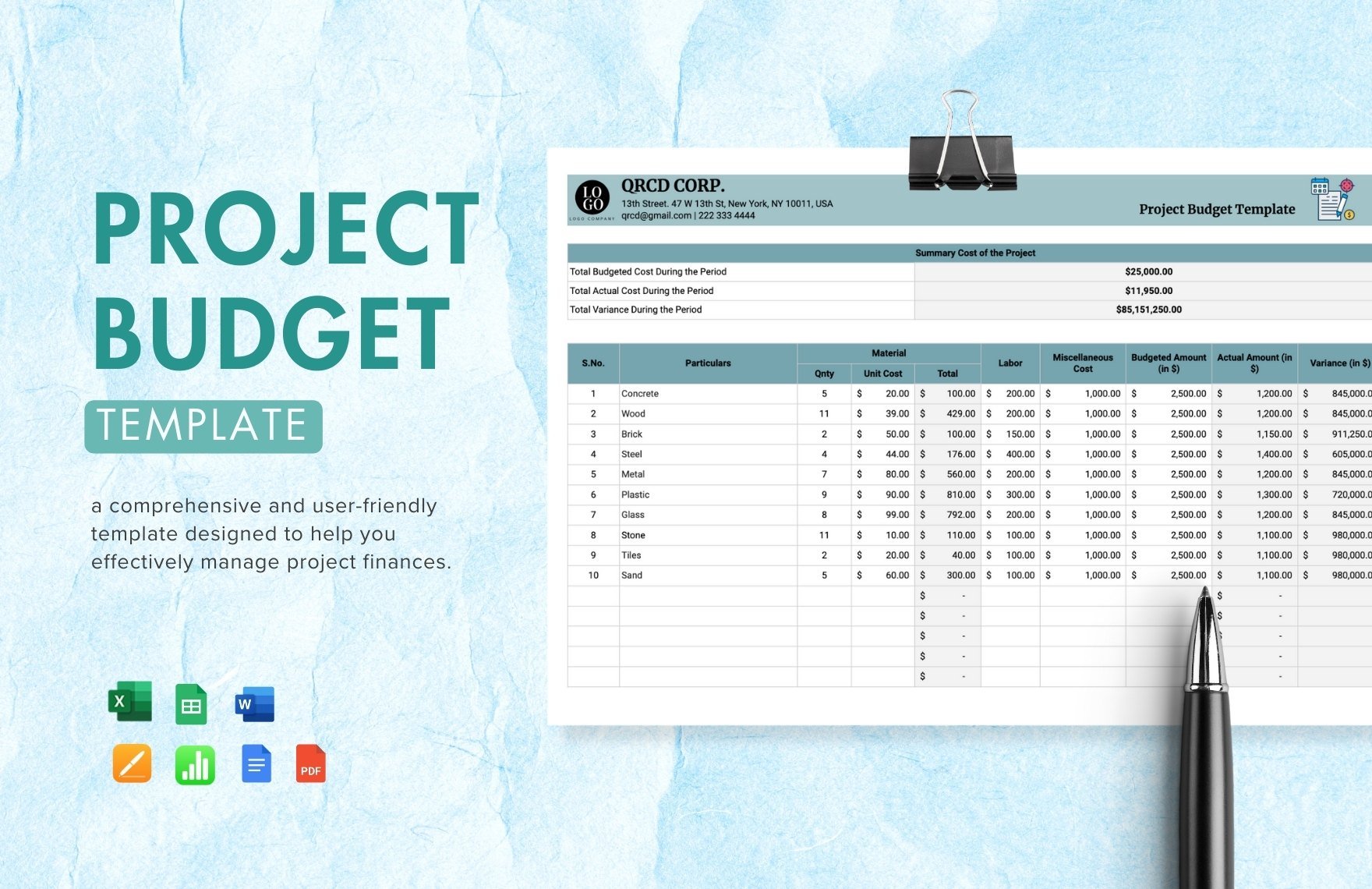

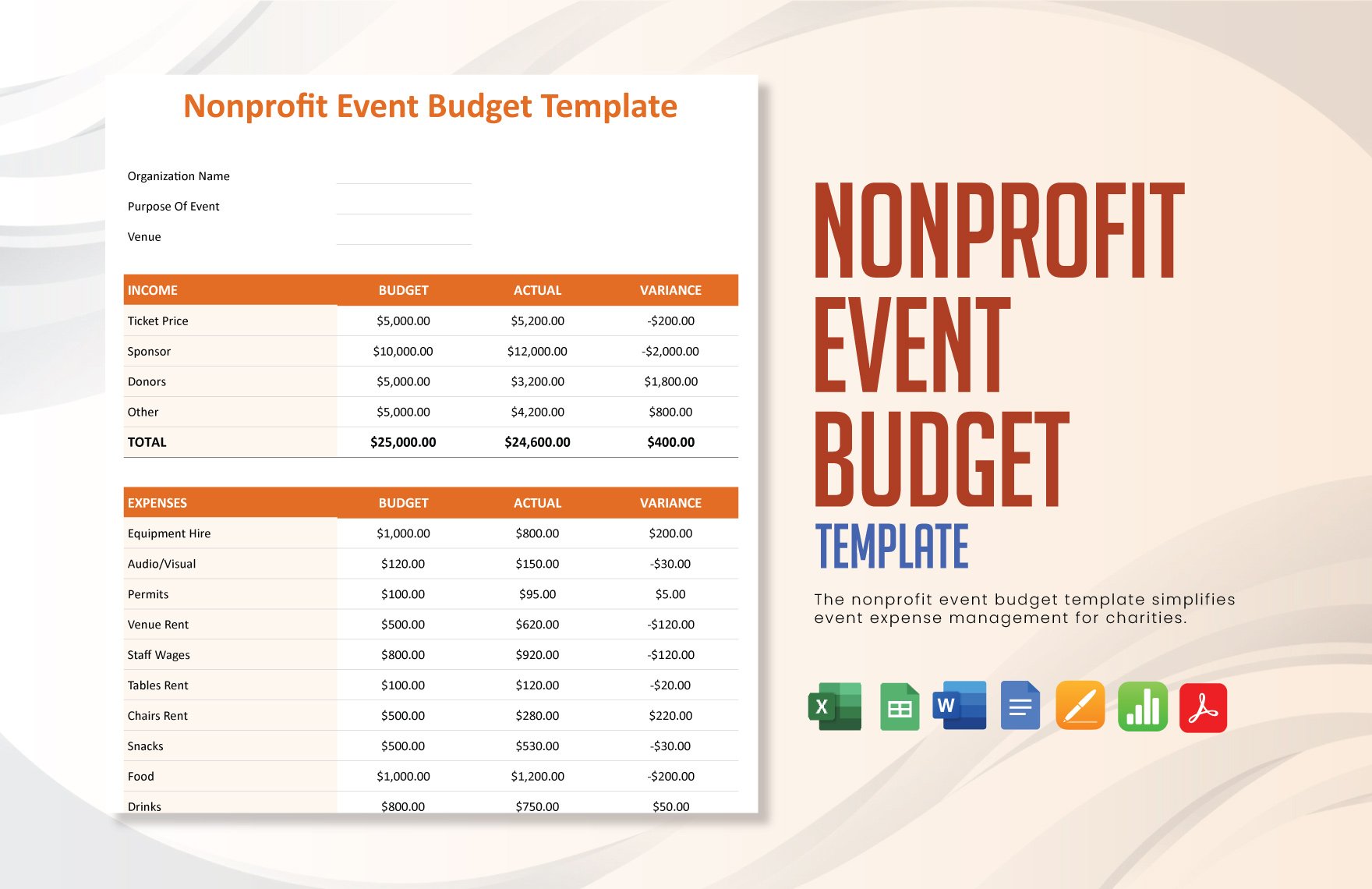

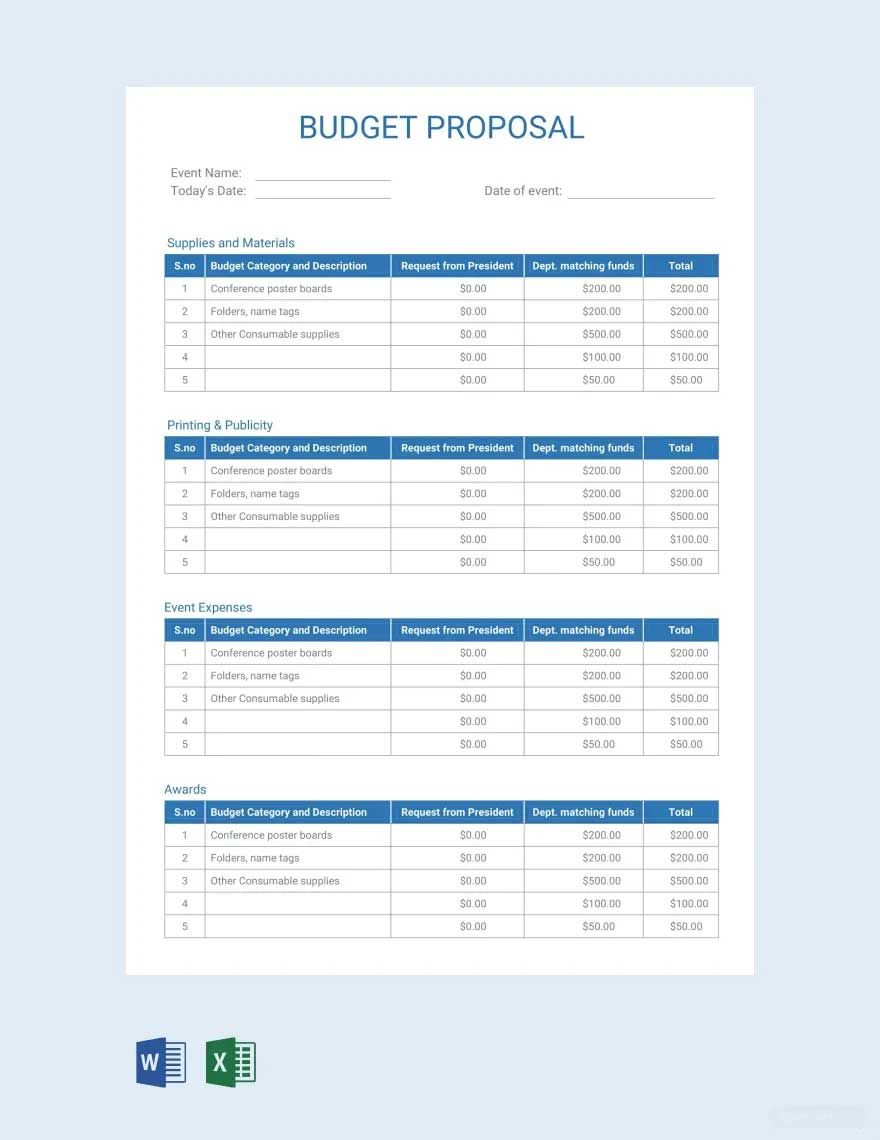

Bring your financial planning to life with free pre-designed “Budget Templates” available in Apple Pages by Template.net. Ideal for individuals, small businesses, and finance teams, these templates allow you to create professional-grade budgets quickly, no design skills needed. Whether you're planning a household budget or preparing a comprehensive business financial overview, these templates provide elegant, easy-to-customize layouts for both print and digital distribution. Enjoy the dual benefit of being able to download and print Apple Pages files effortlessly while saving valuable time and resources. Stand out with beautiful, free templates that give you the flexibility to adjust your budget plans as needed.

Discover the extensive array of Budget Templates available, featuring more stunning premium pre-designed options in Apple Pages. Template.net frequently updates its library, offering innovative designs that meet the evolving needs of users. With the choice of free and premium templates, you can work within your budget while expanding your creative expression. Easily download or share via email to enhance communication and collaboration with stakeholders or print for comprehensive presentations. Maximize the benefits of both free pre-designed and premium templates to ensure elegance meets functionality in your fiscal planning.