Bring your financial management to life with pre-designed Budget Templates in Adobe PDF by Template.net

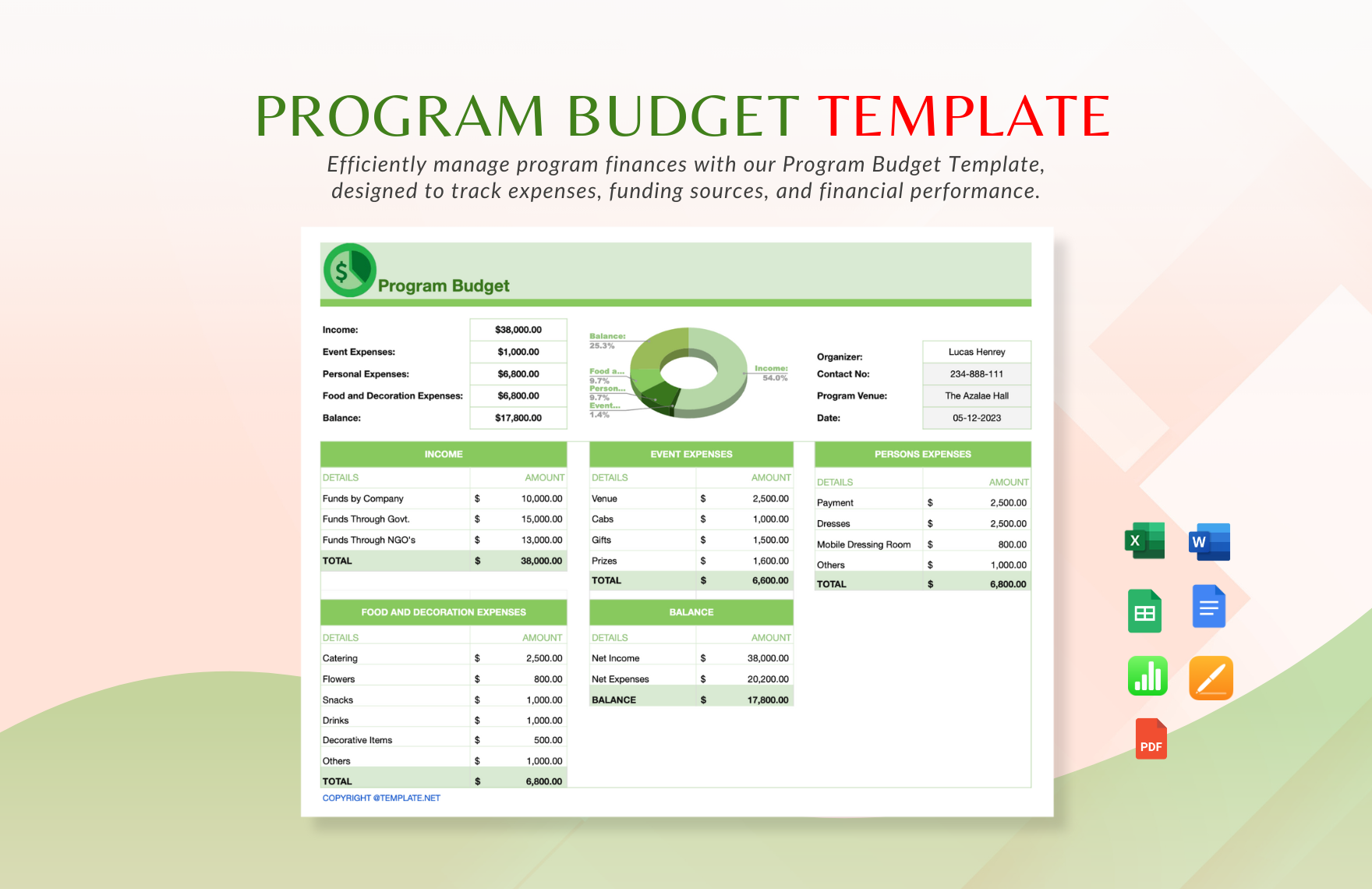

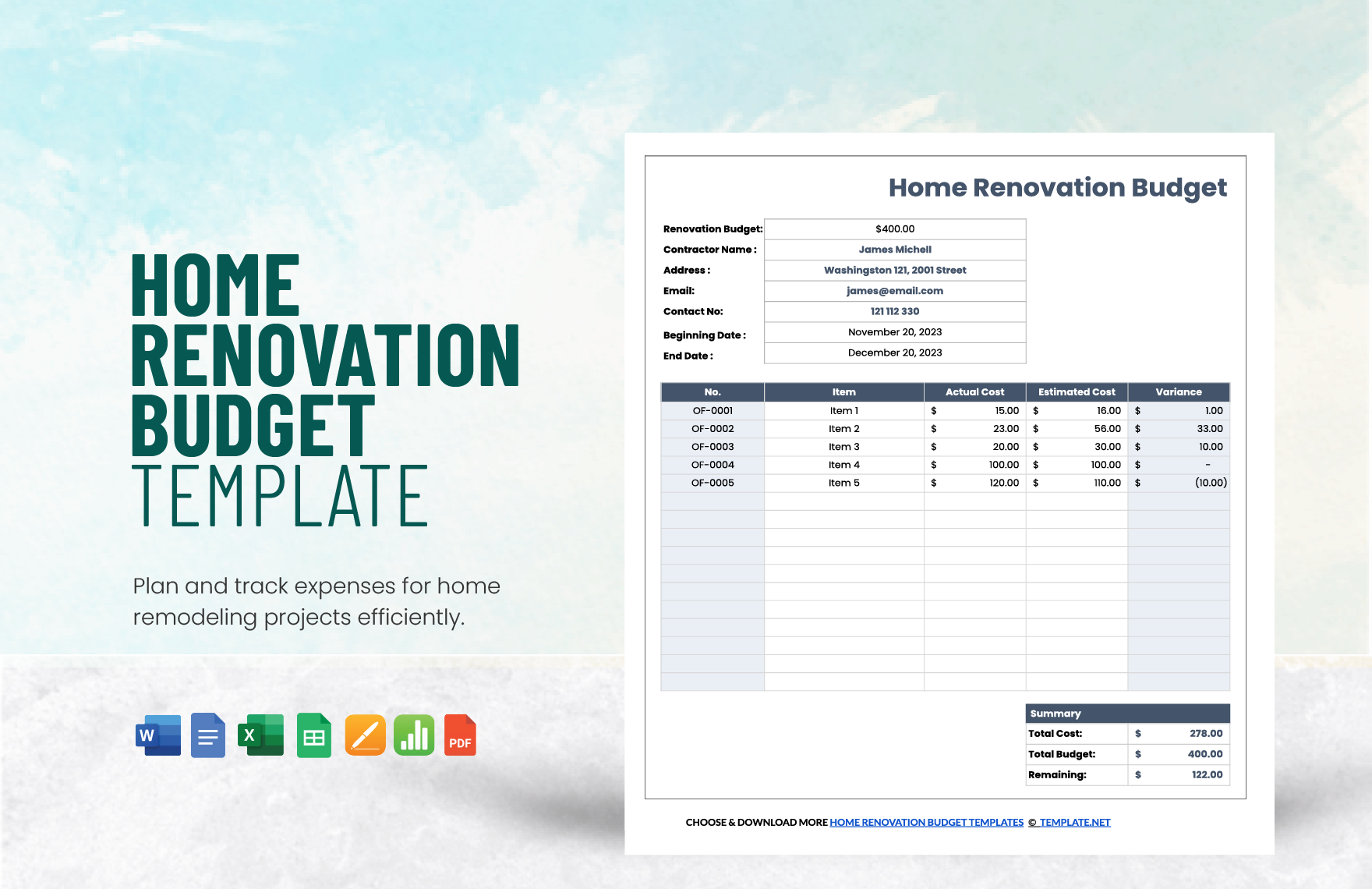

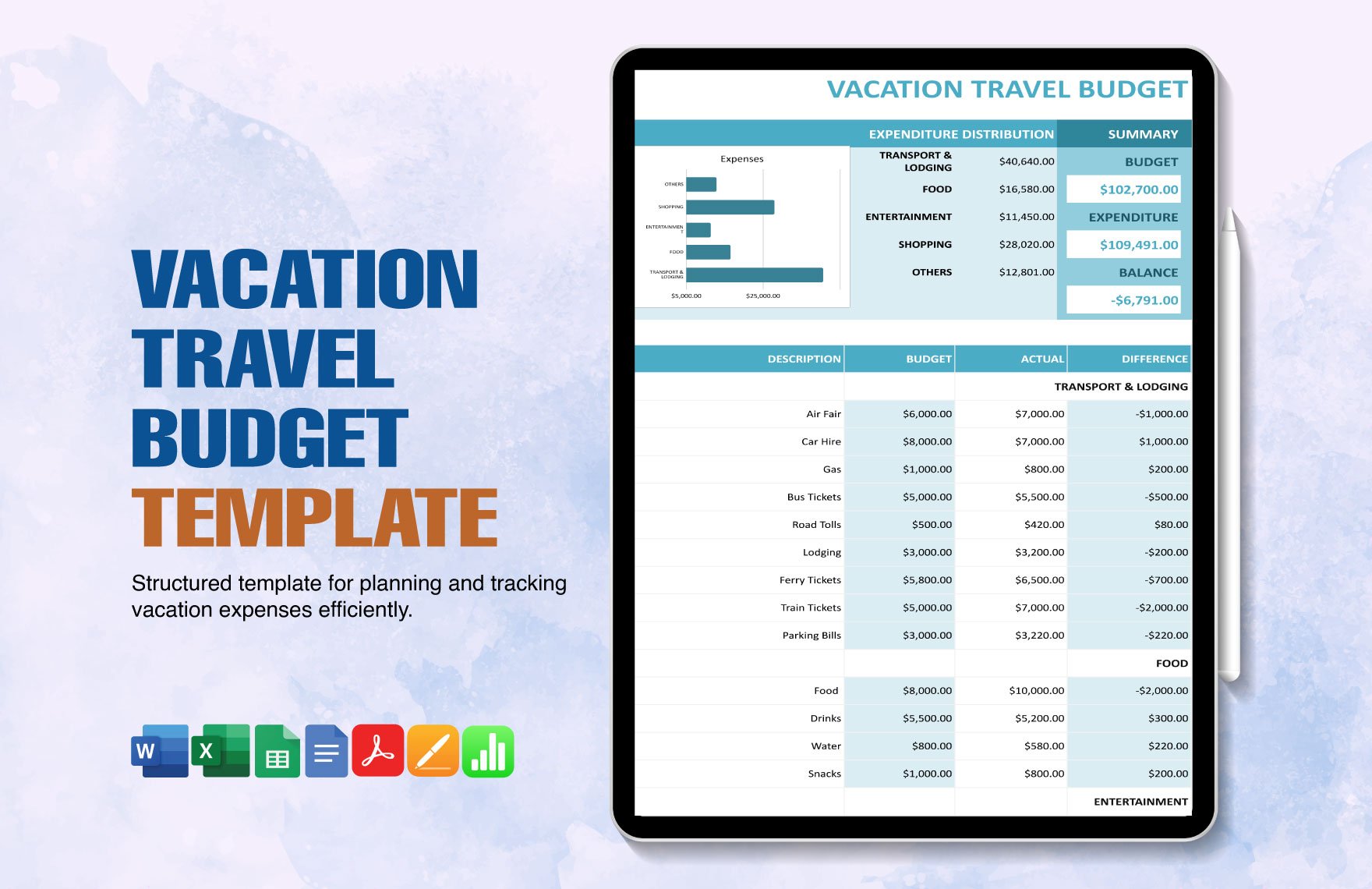

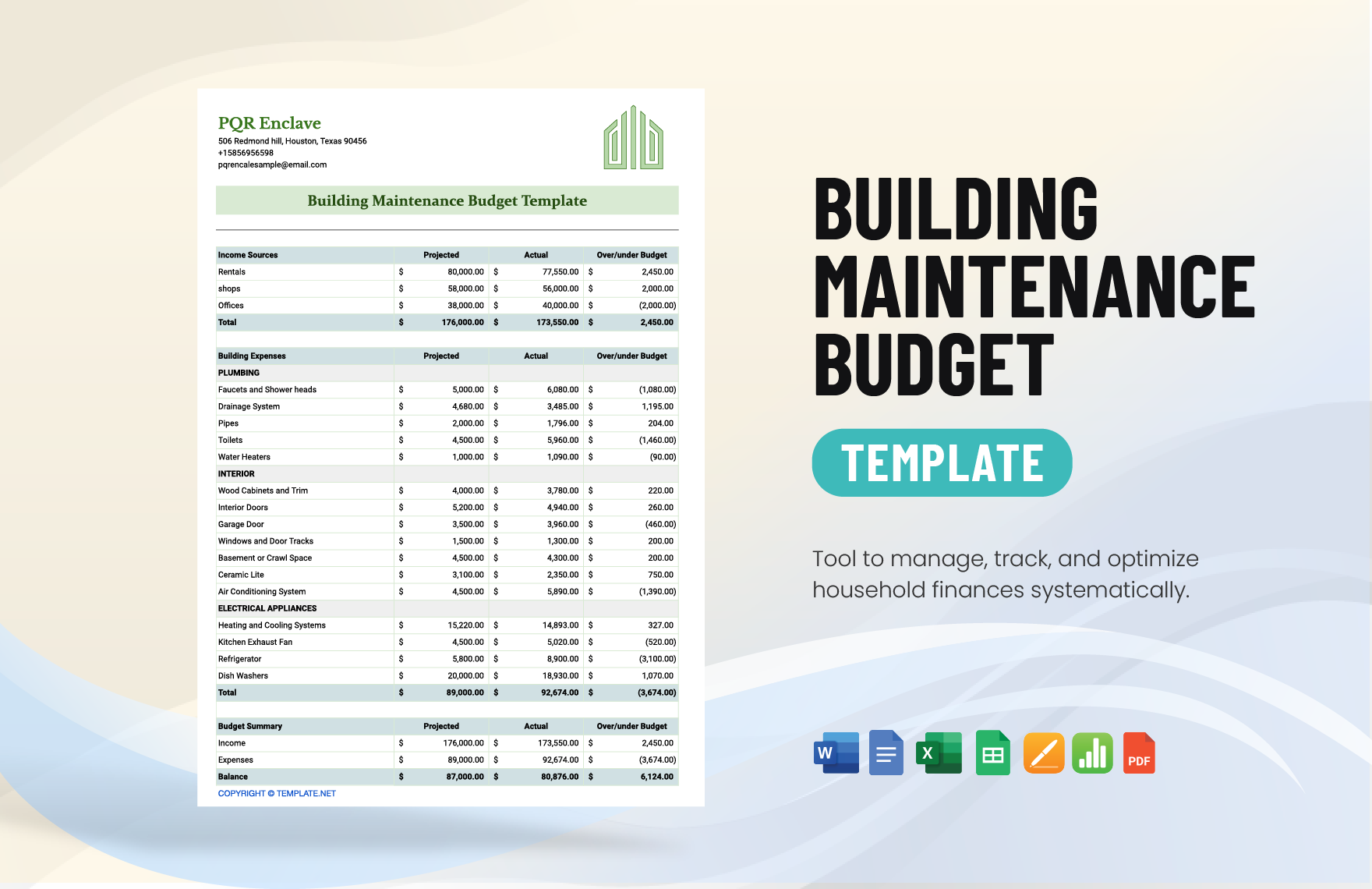

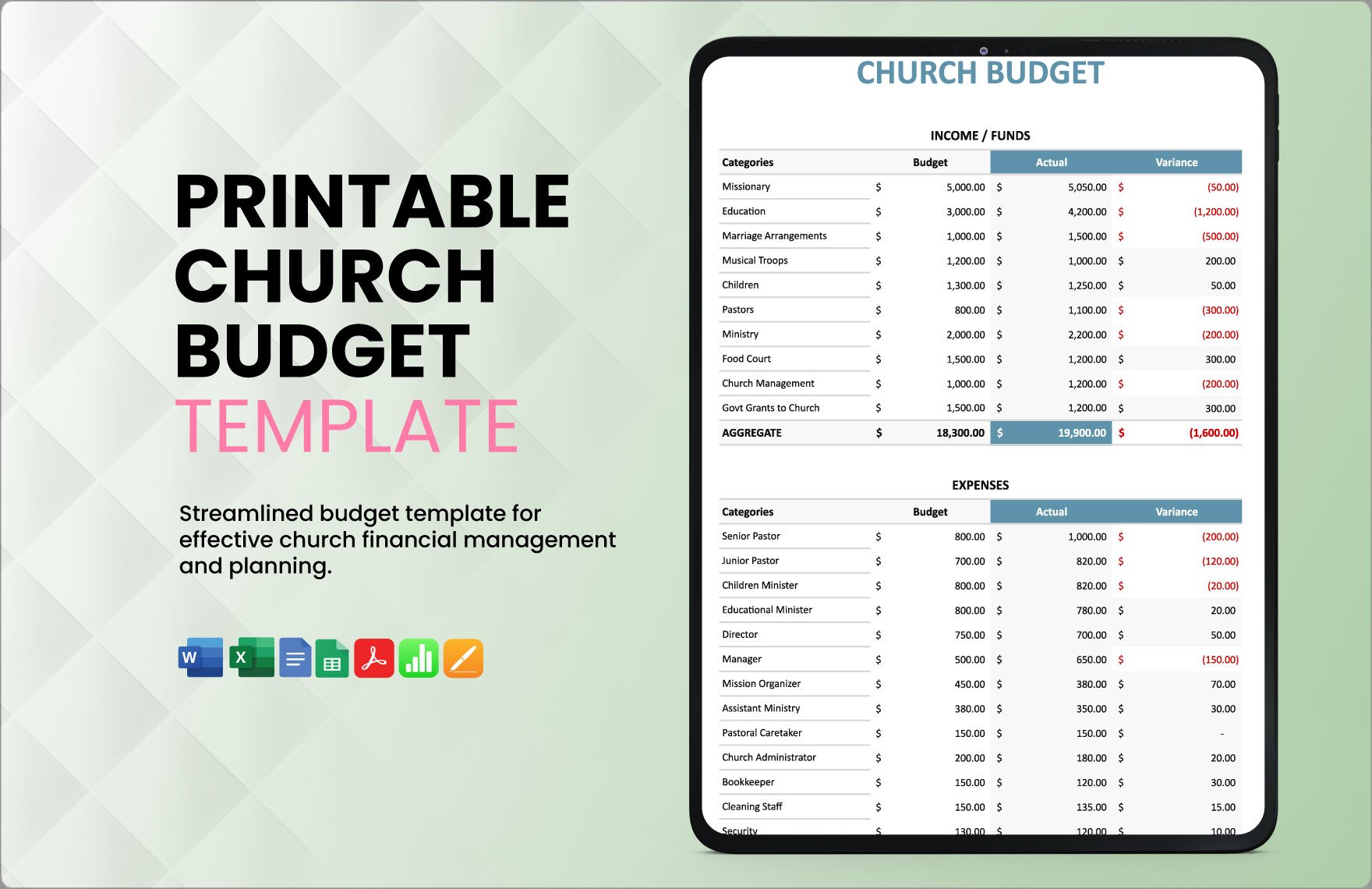

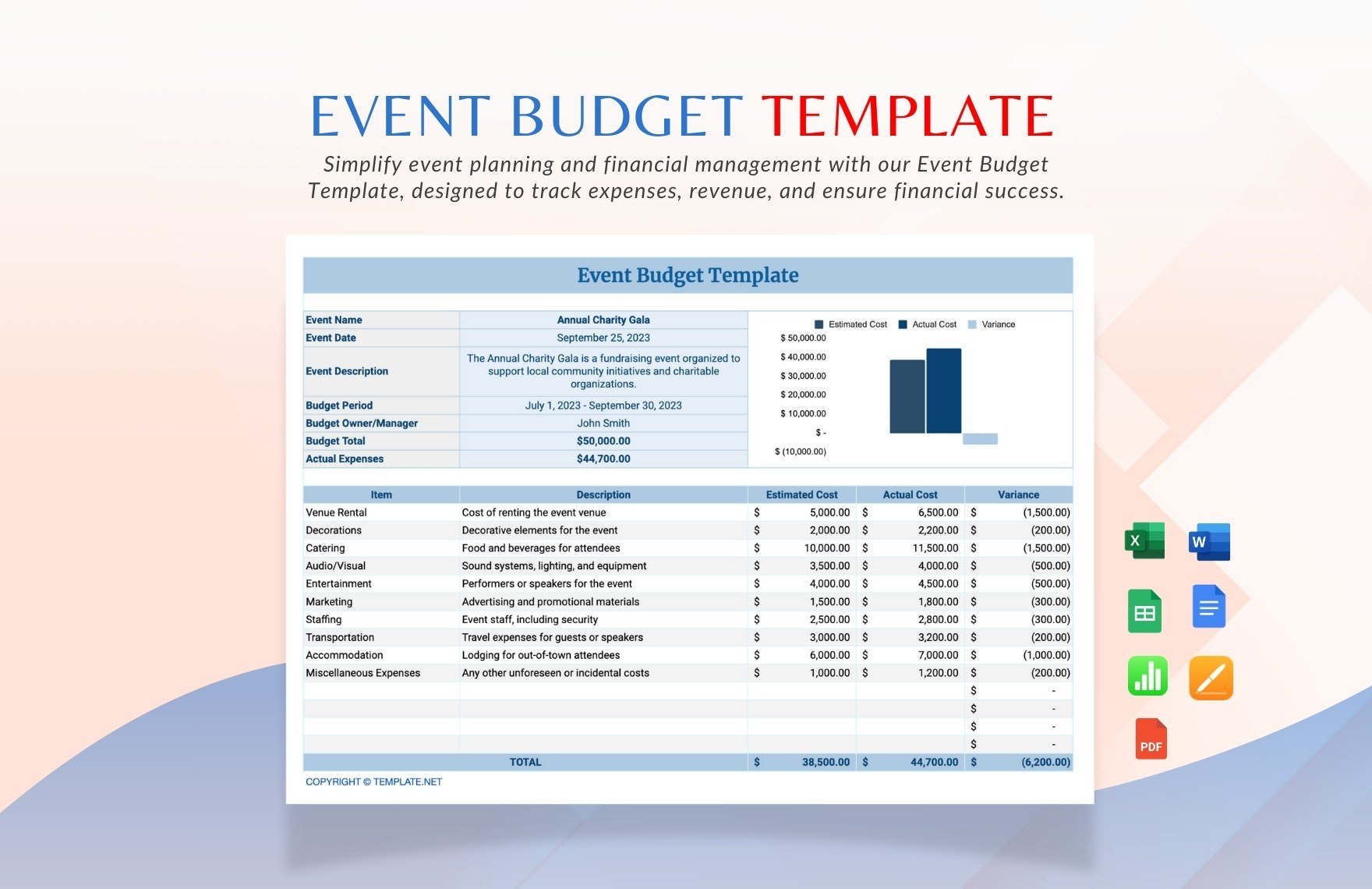

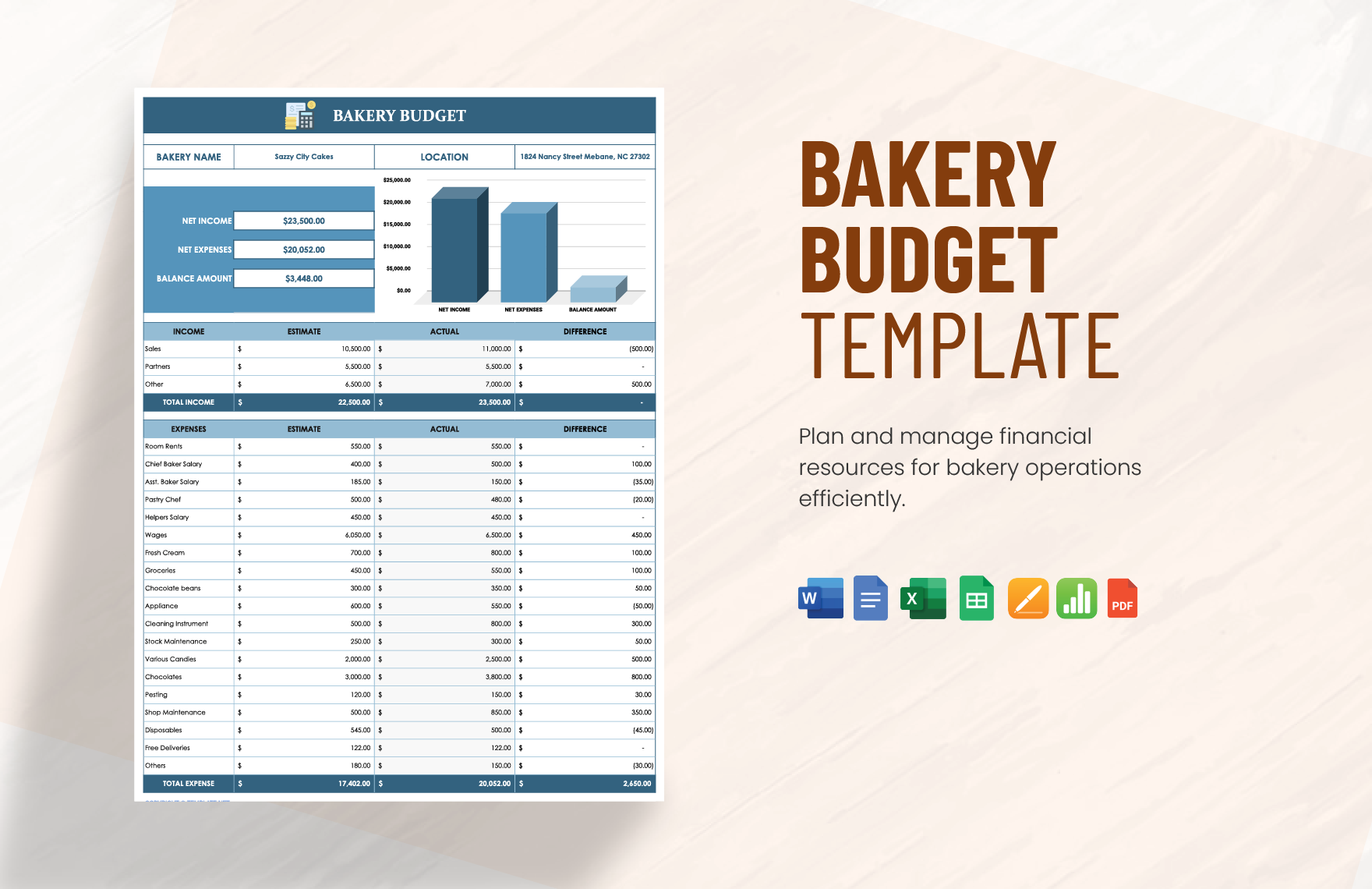

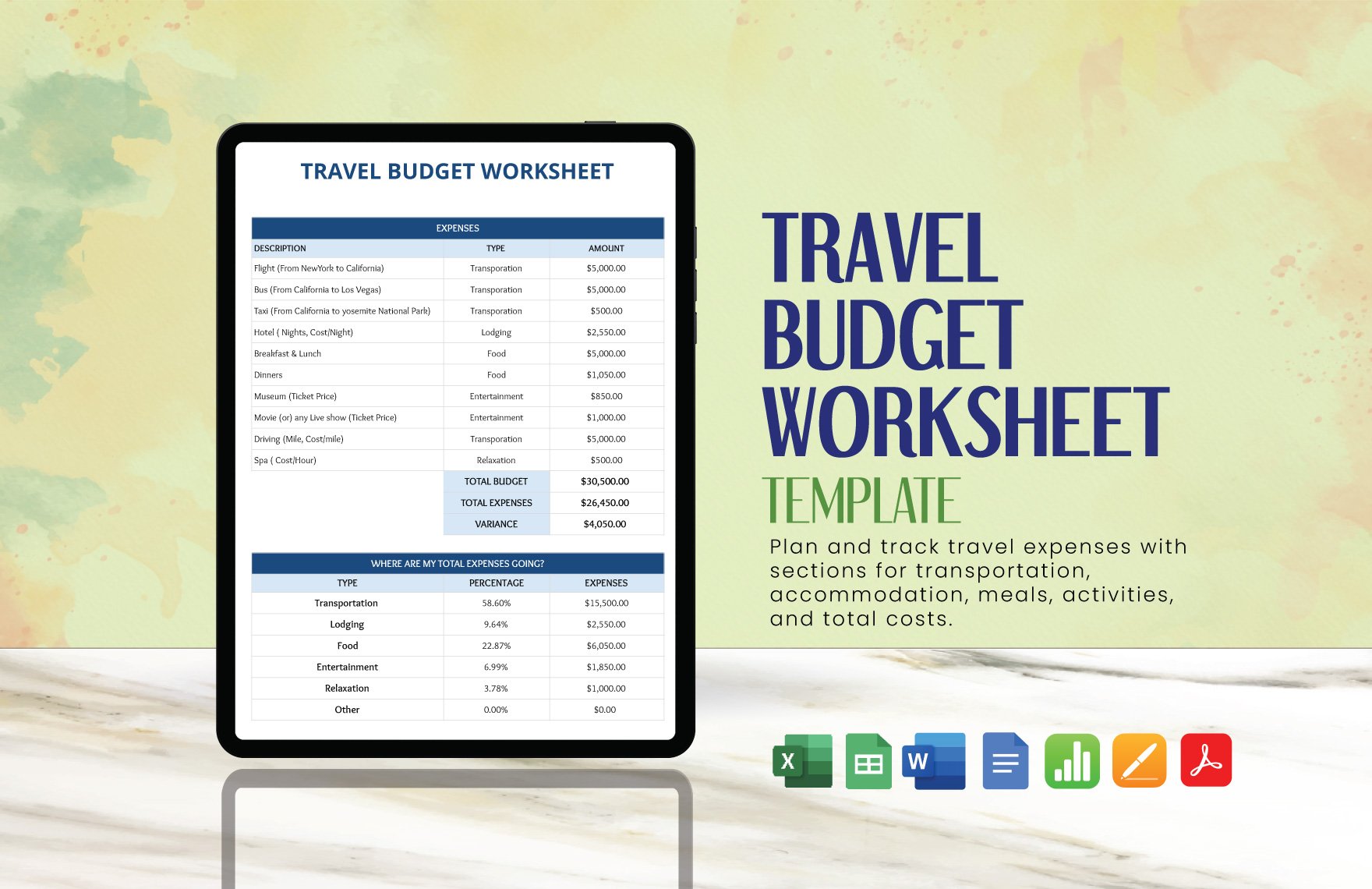

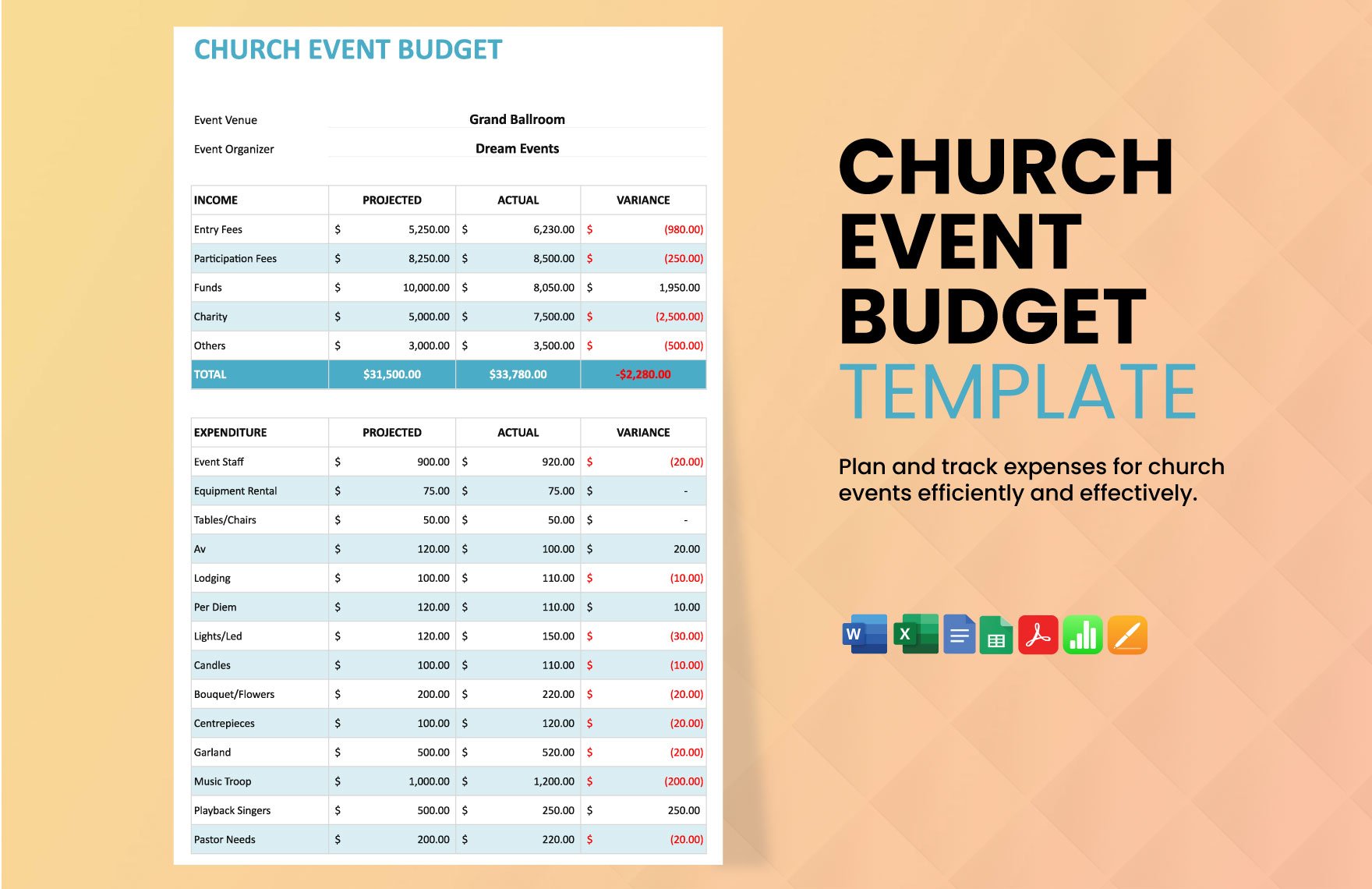

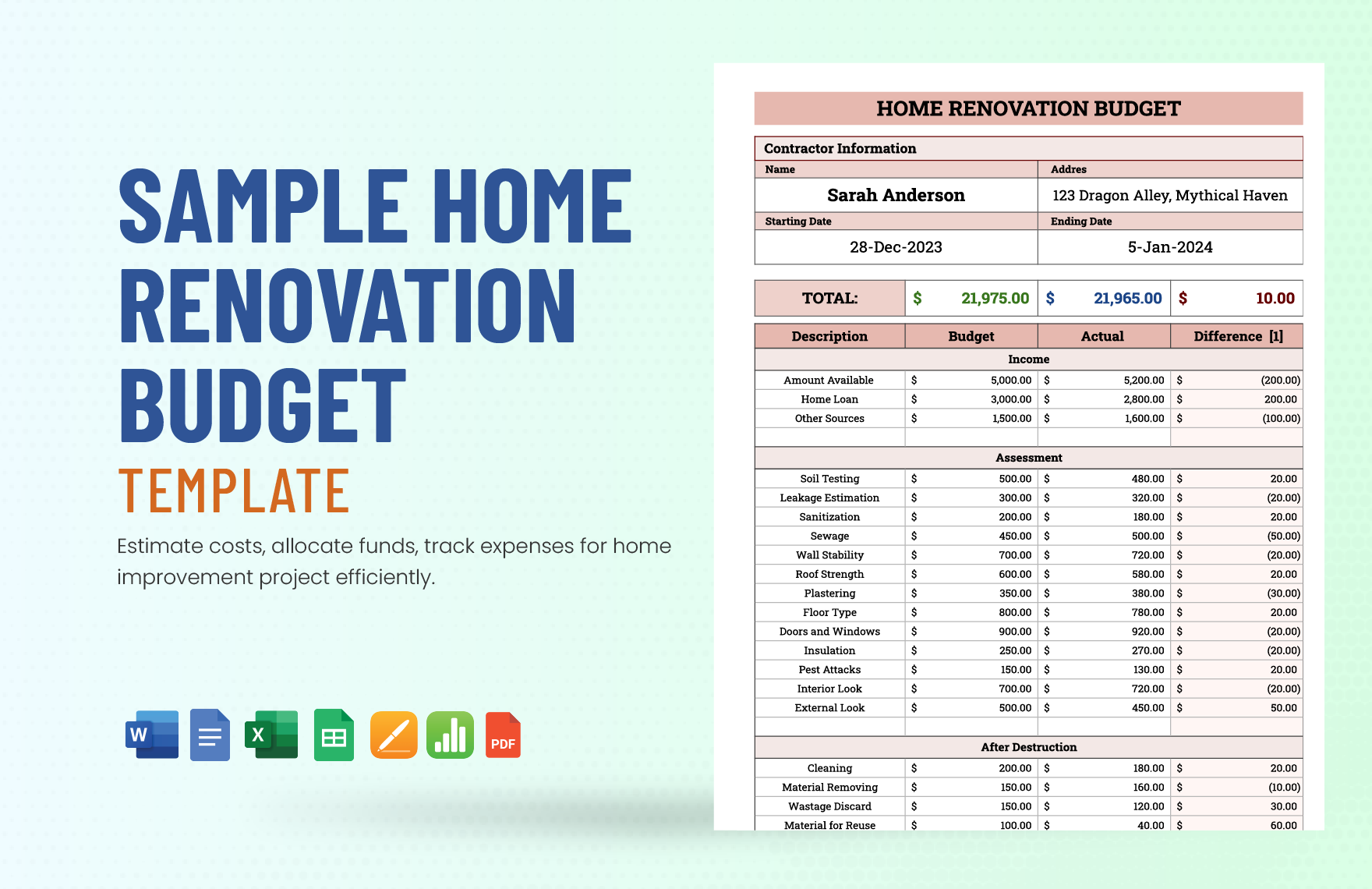

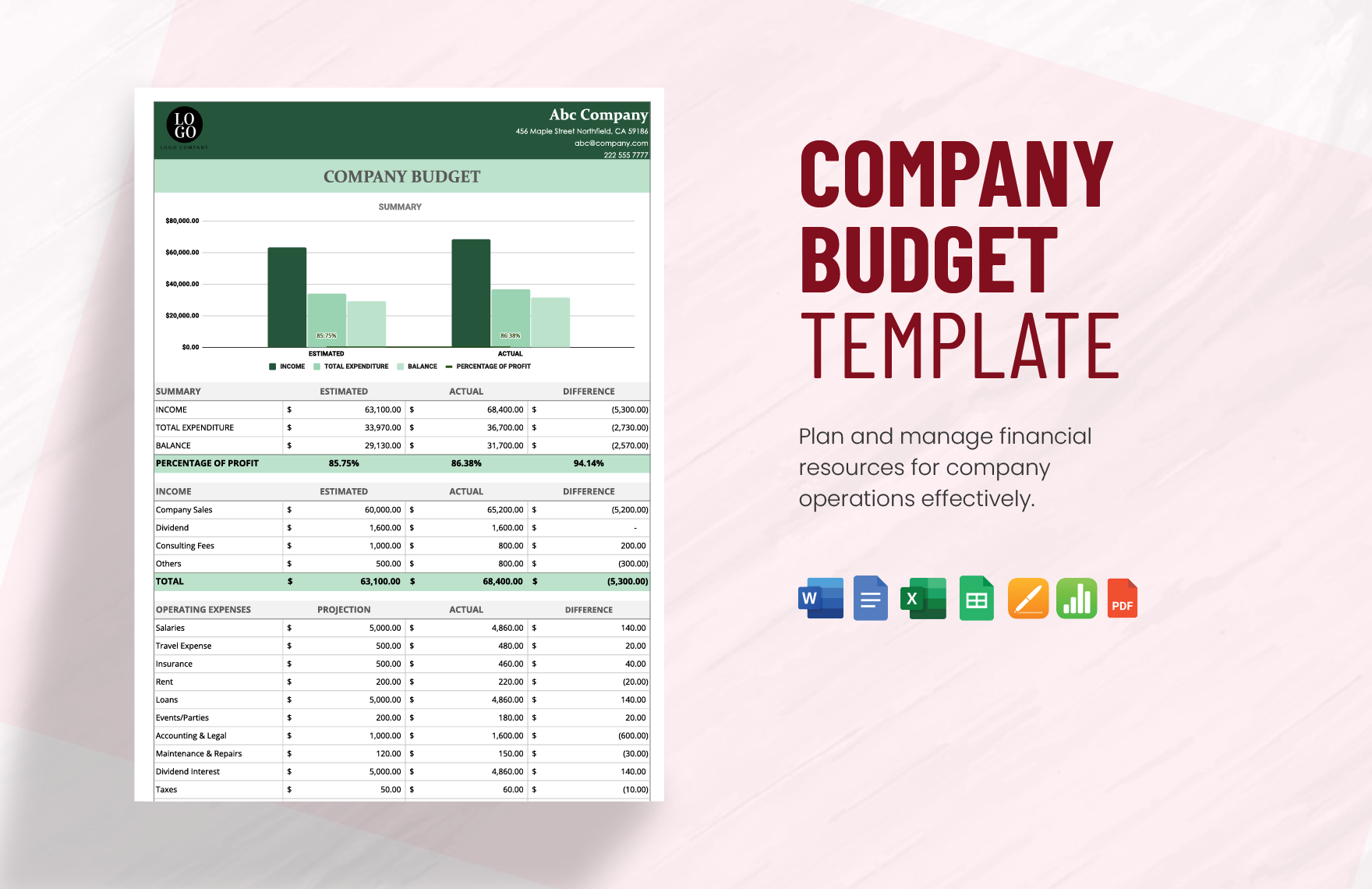

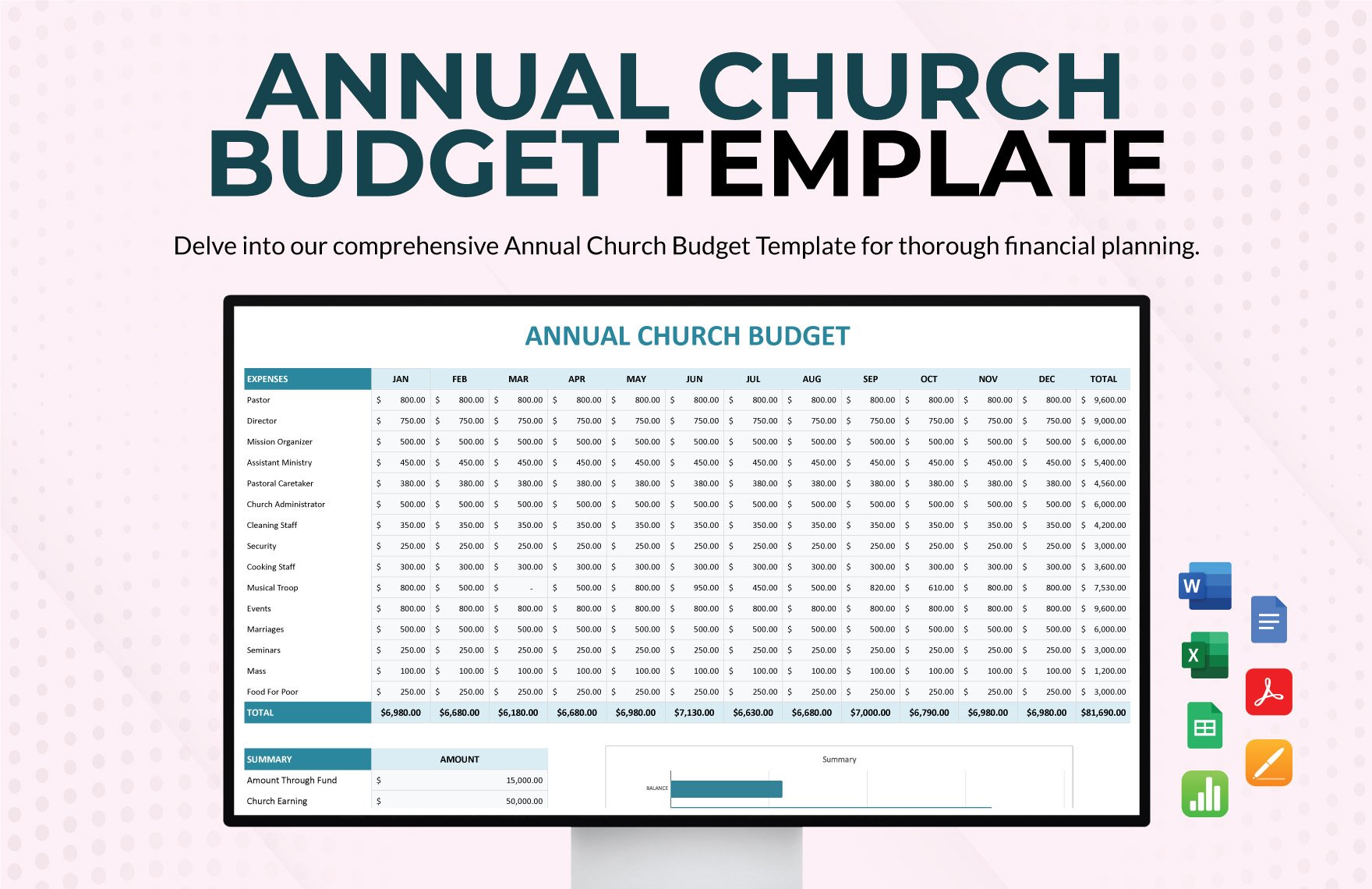

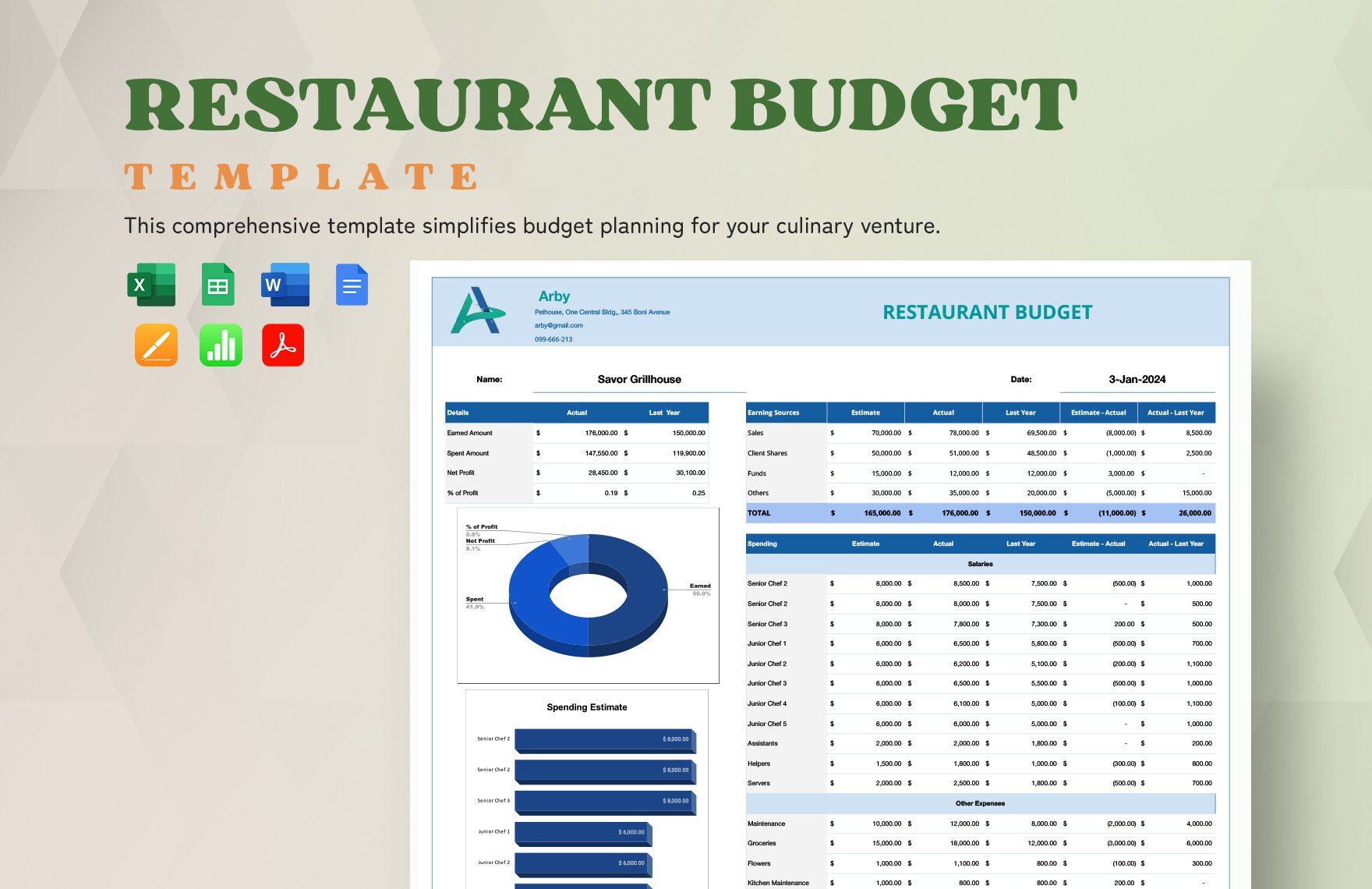

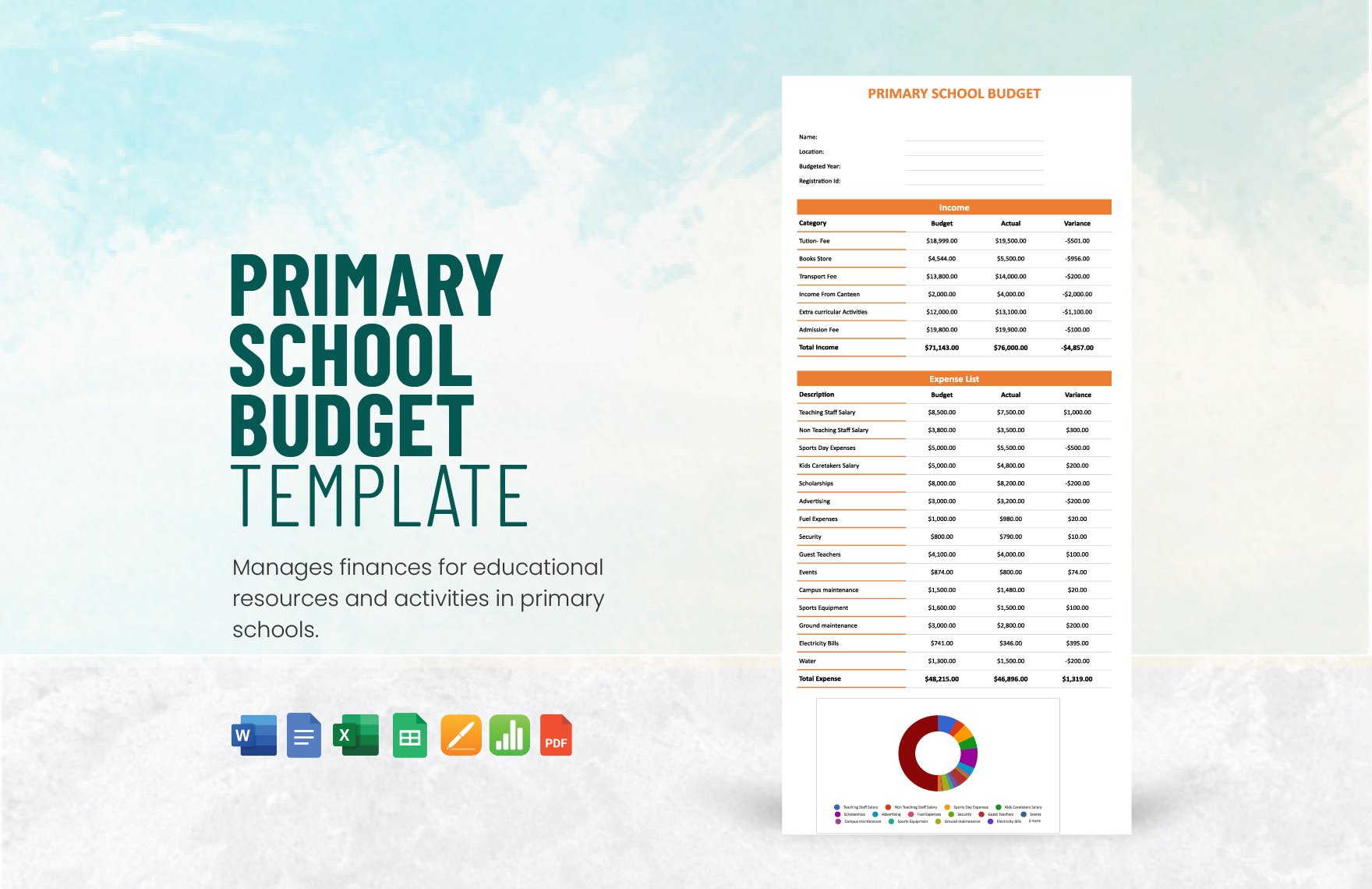

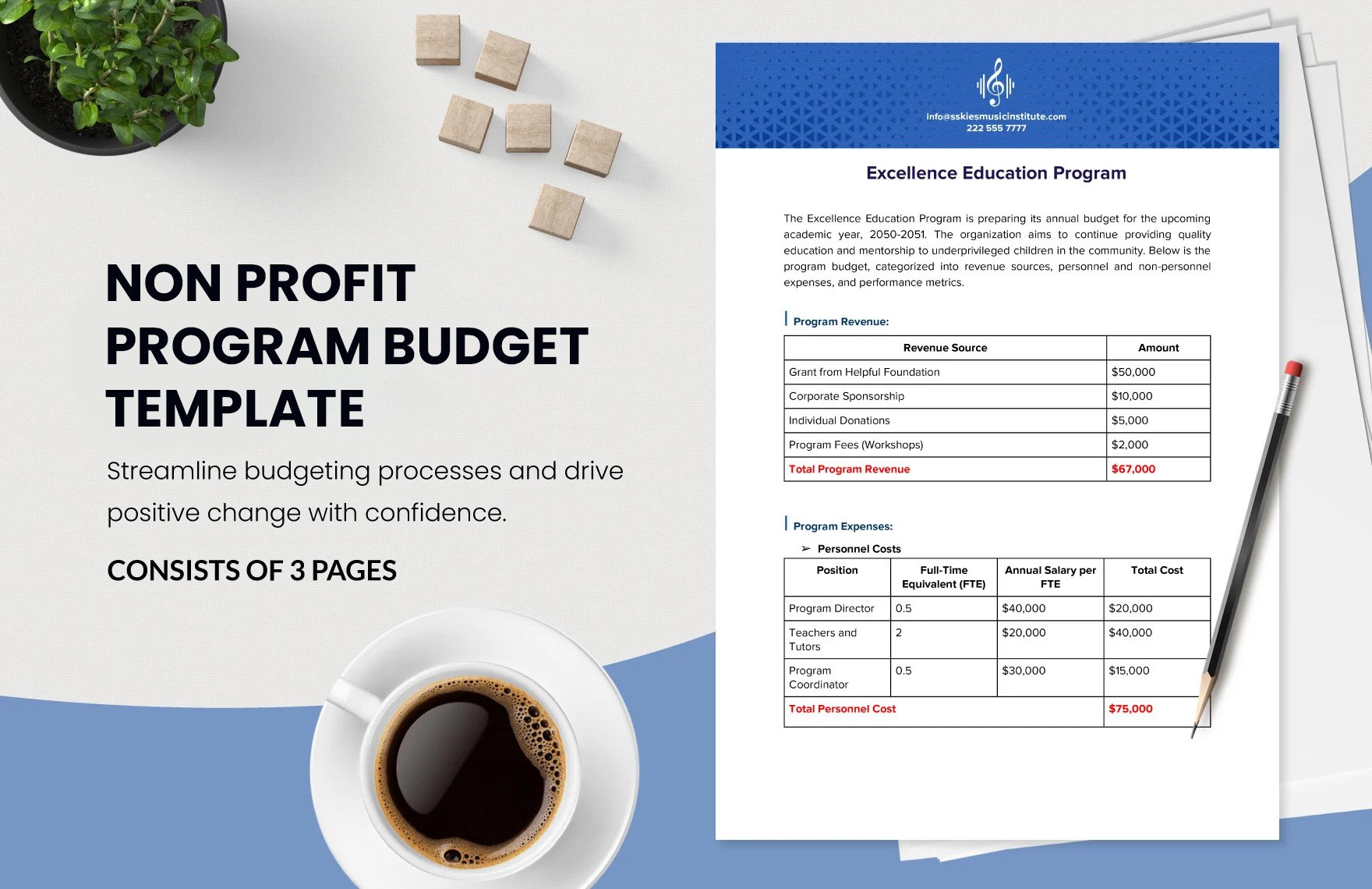

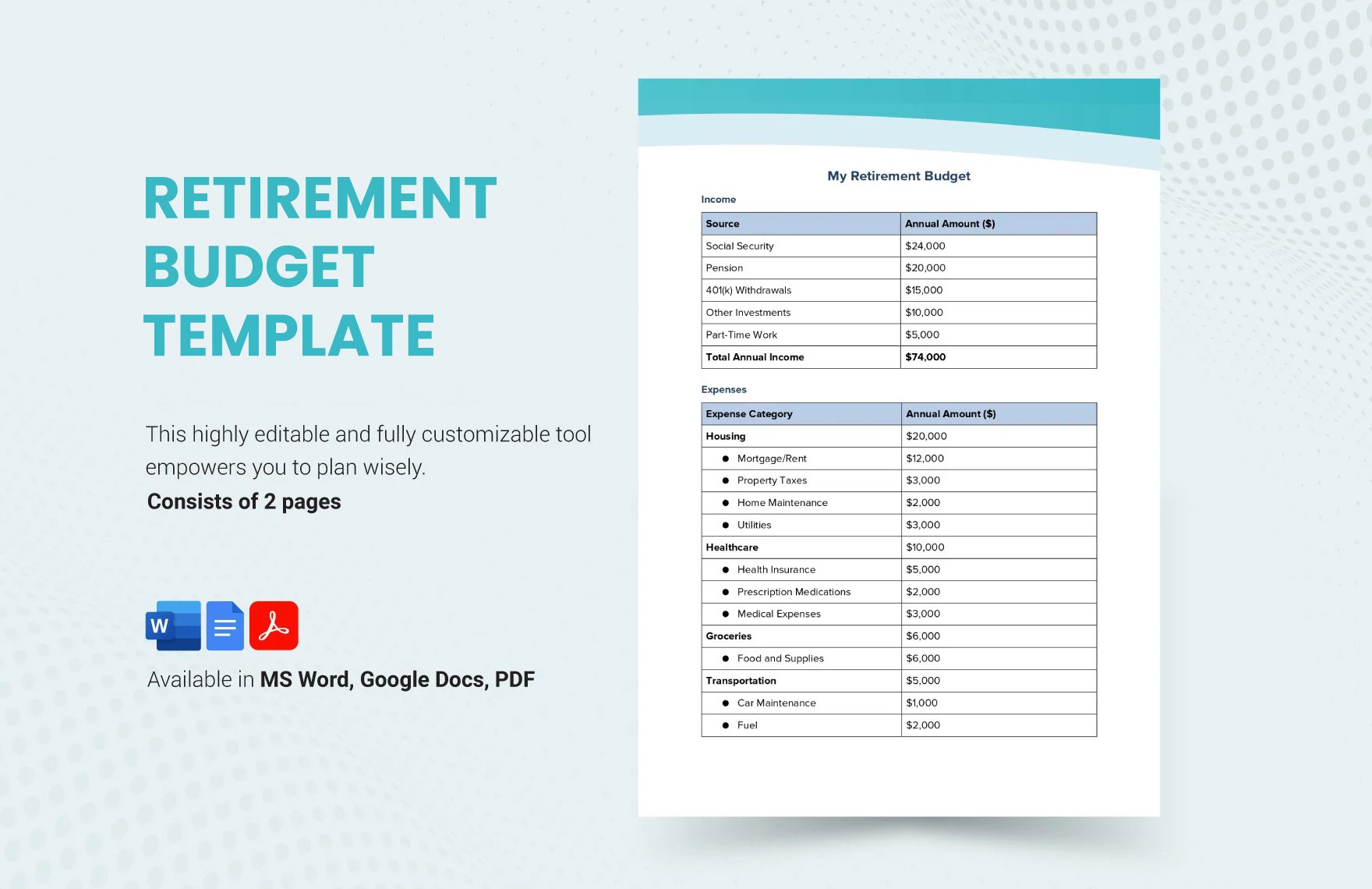

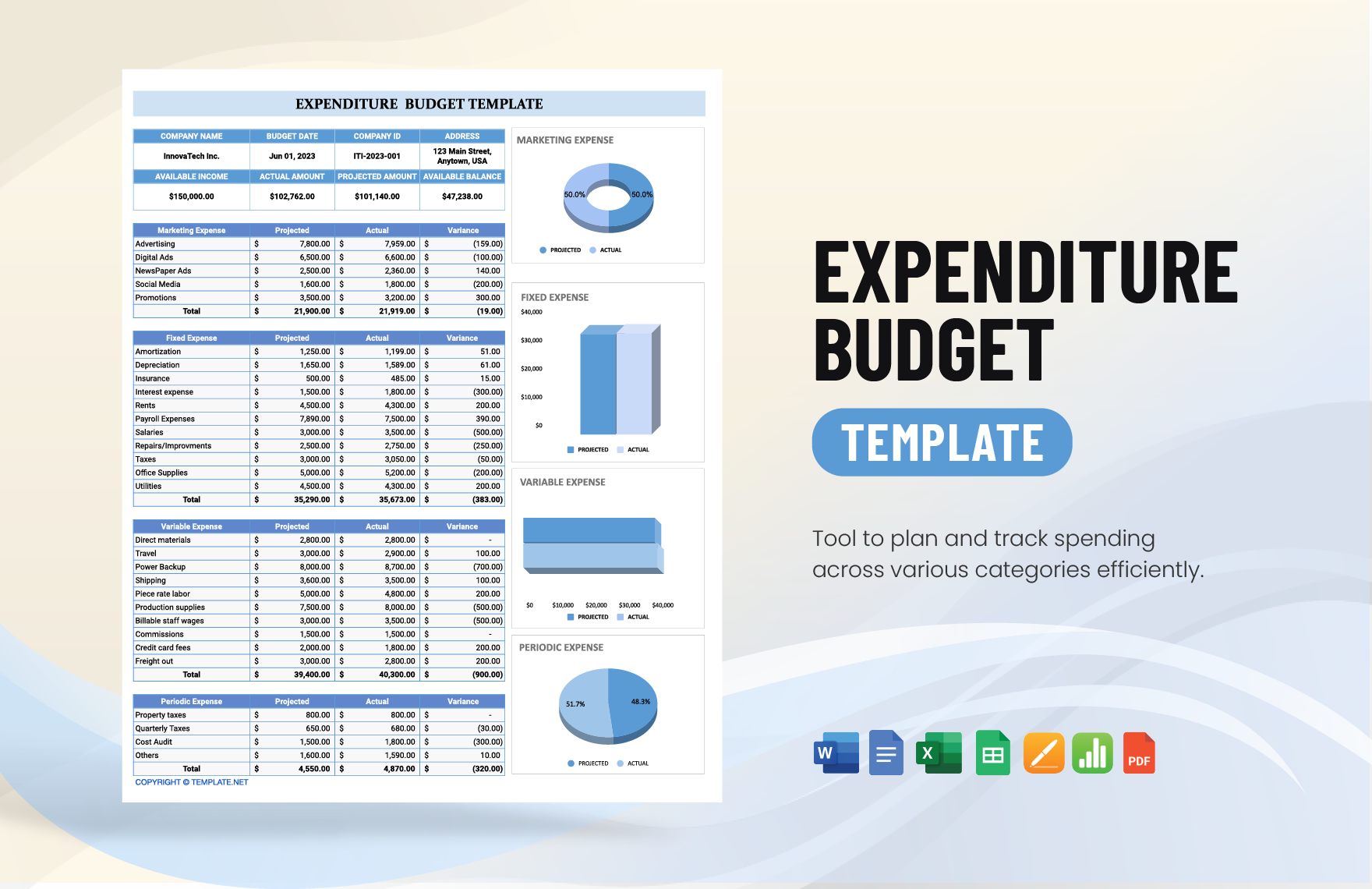

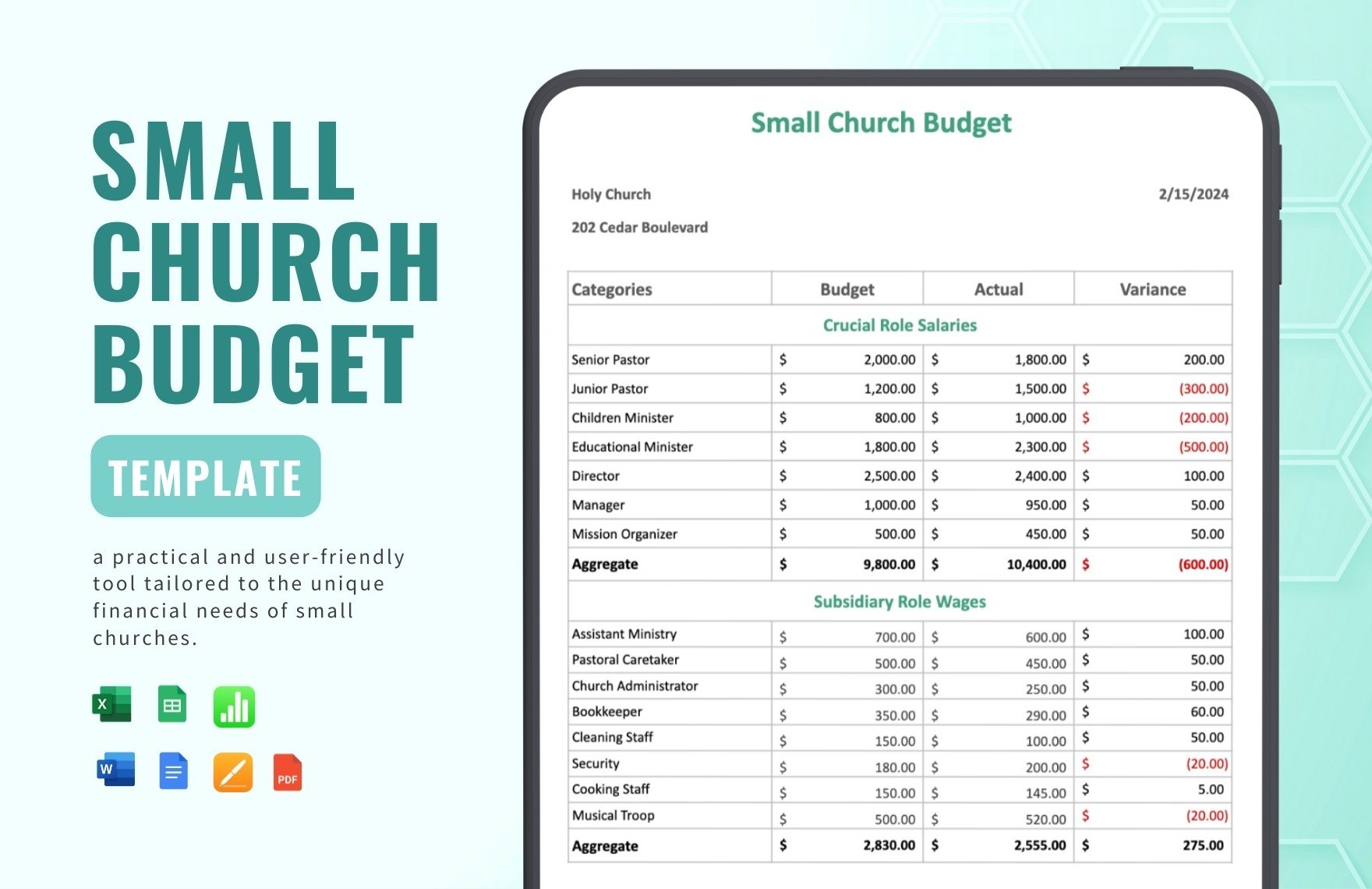

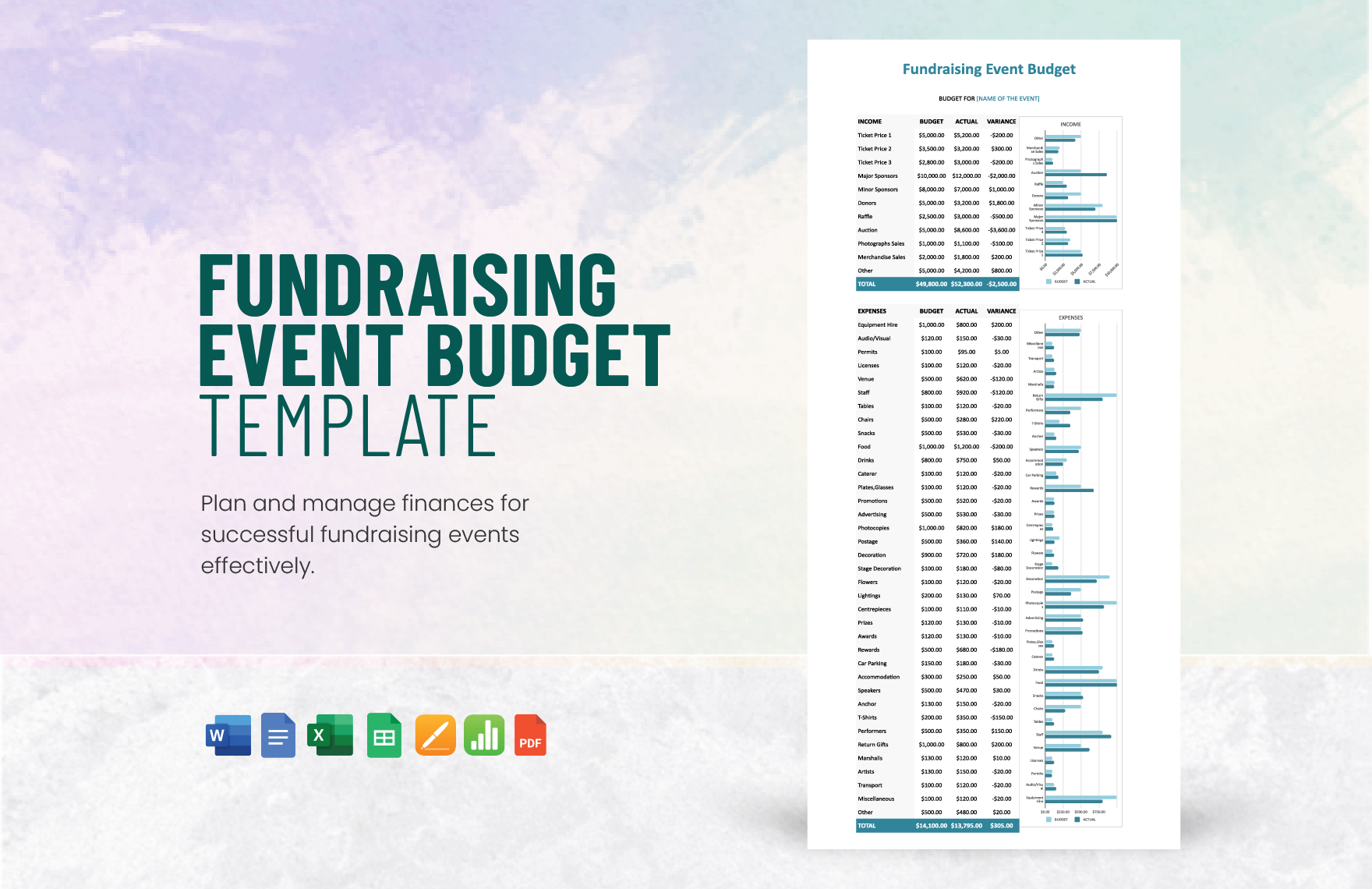

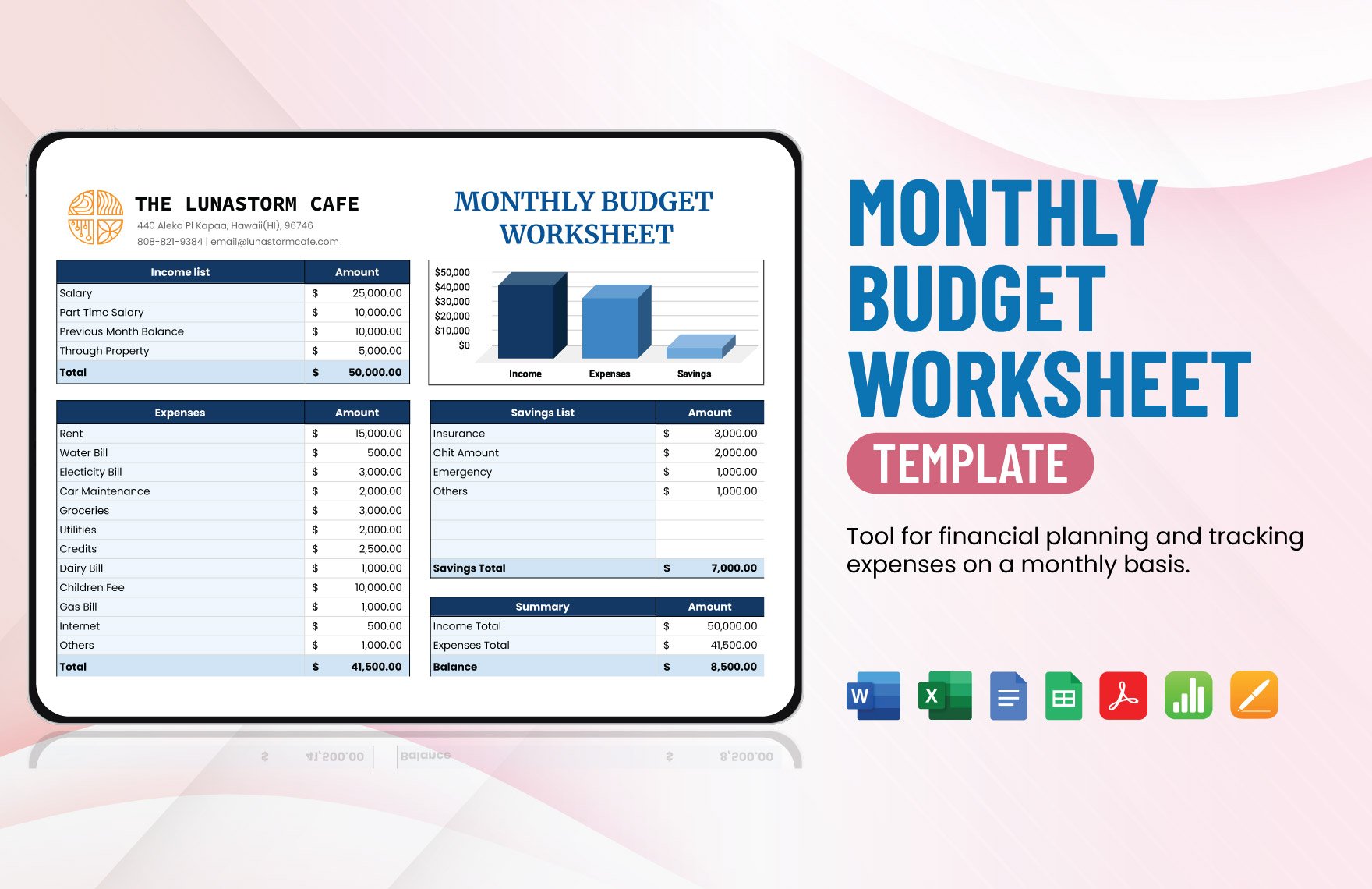

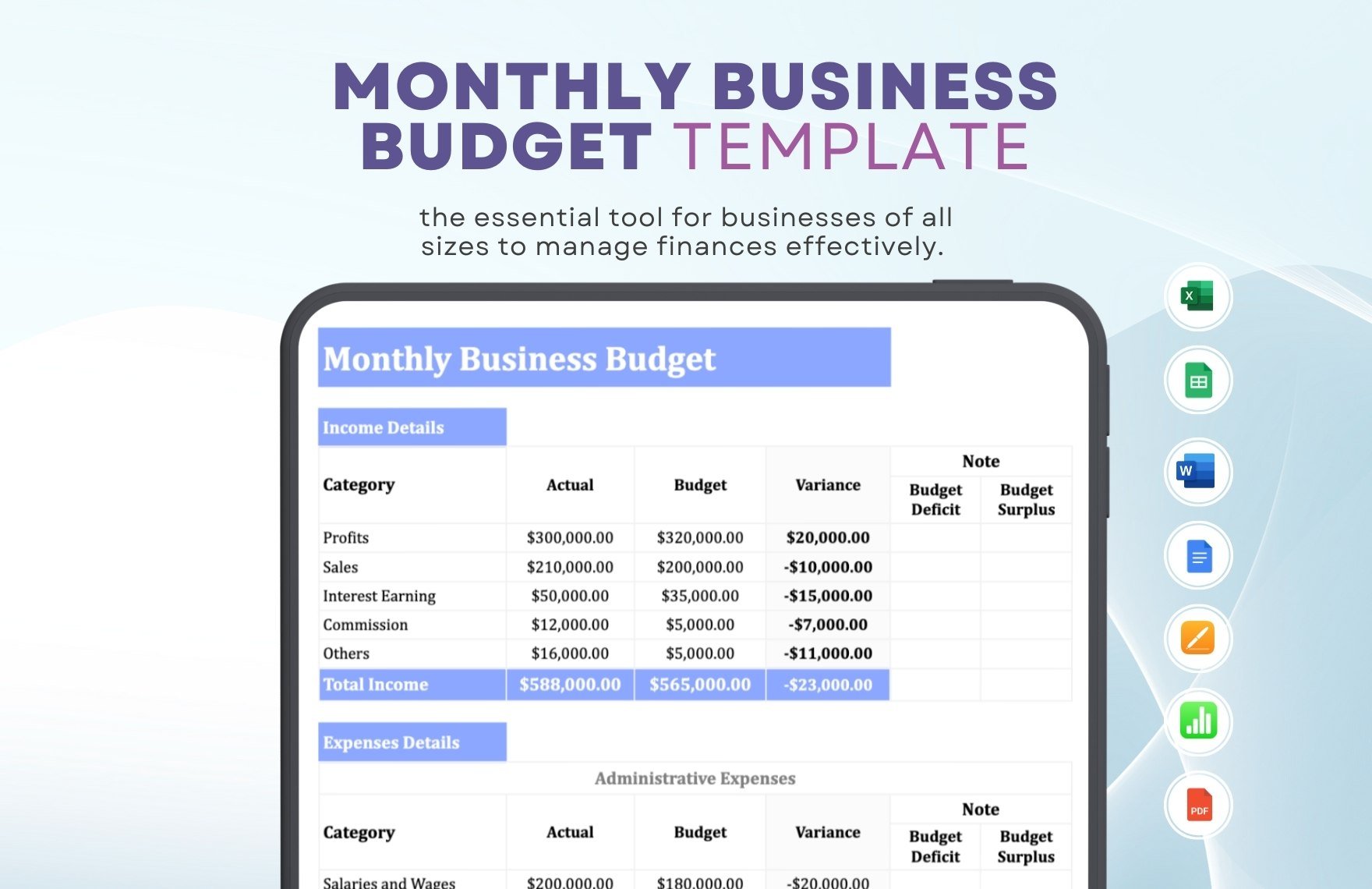

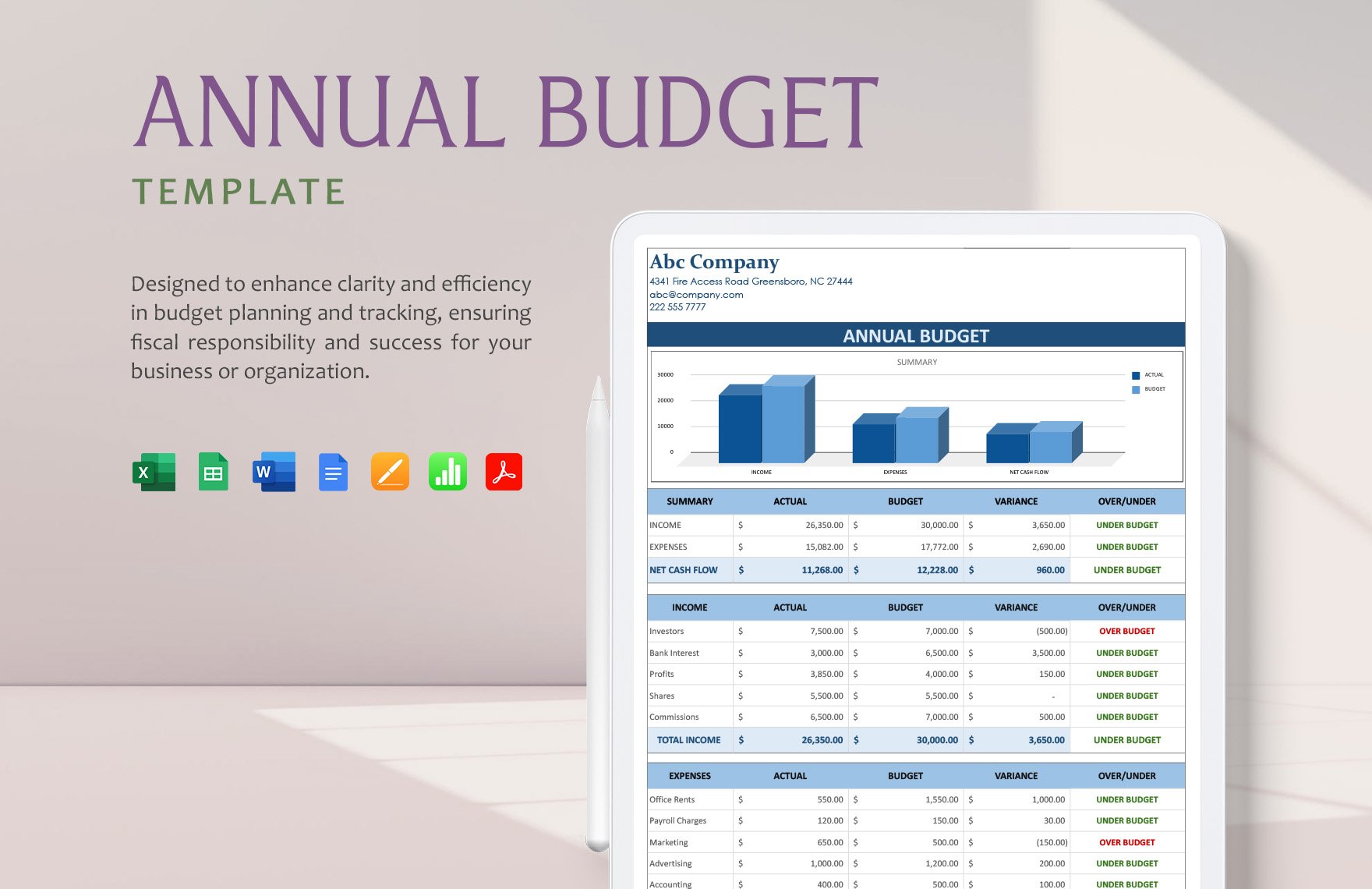

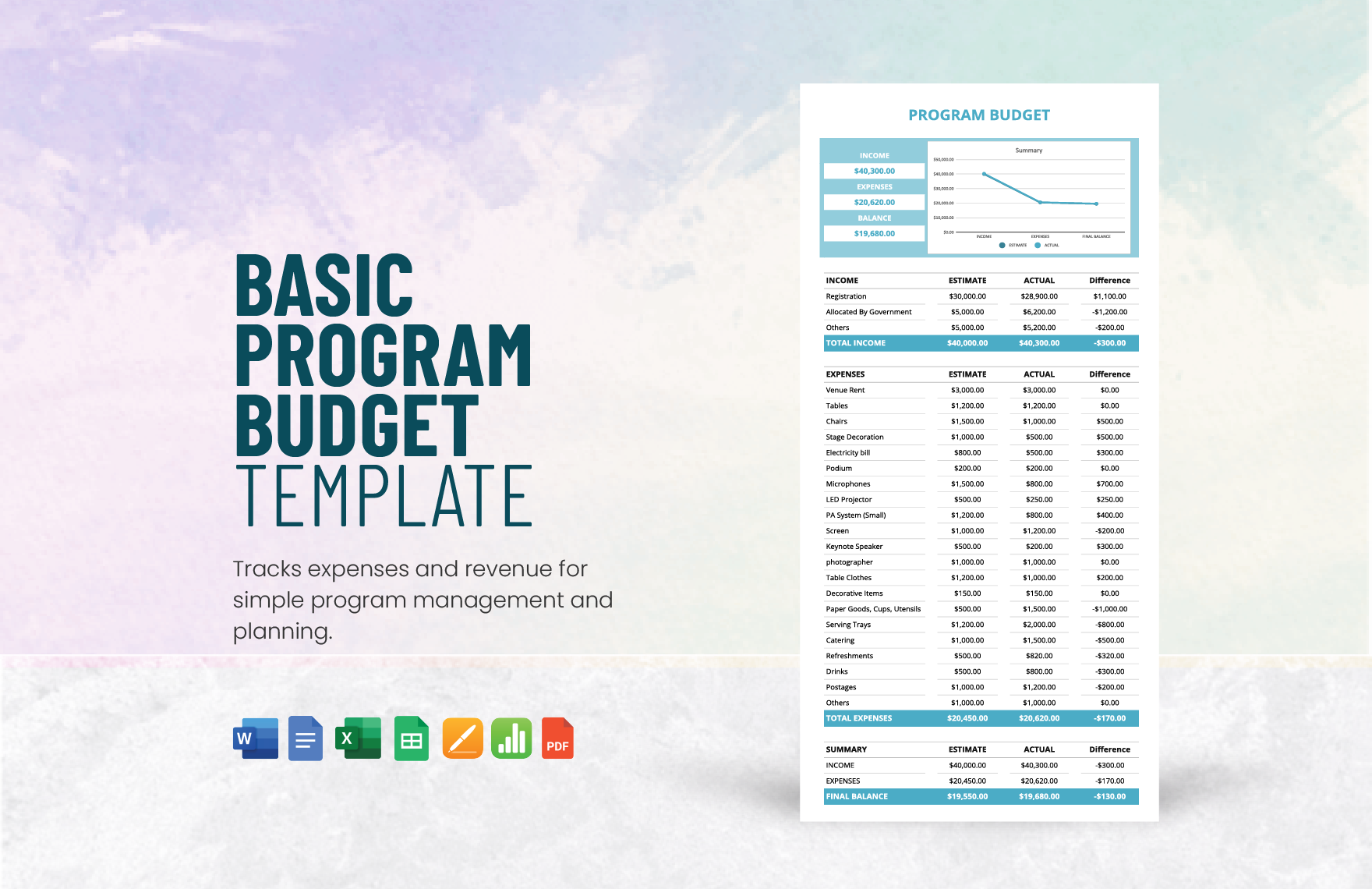

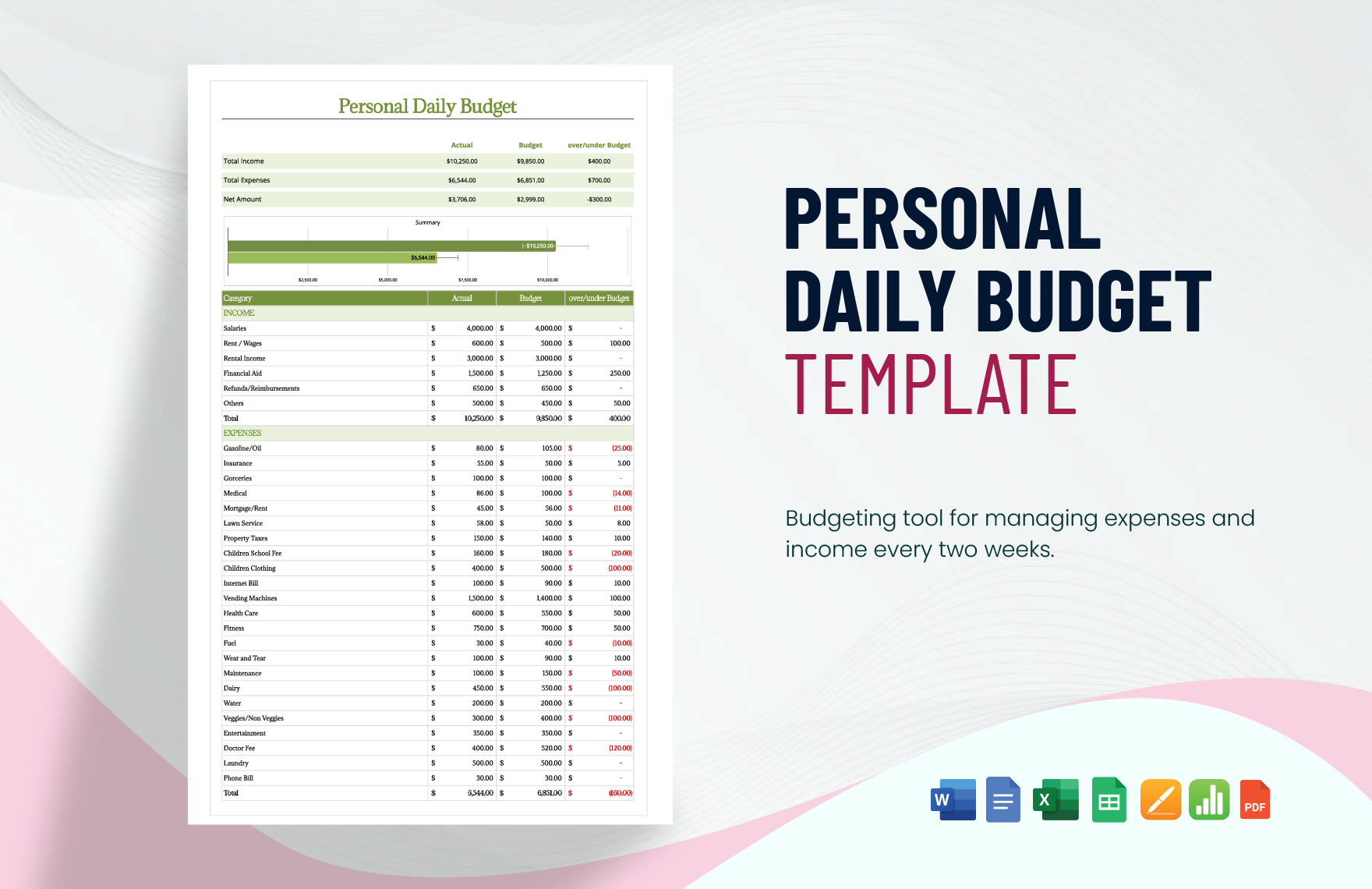

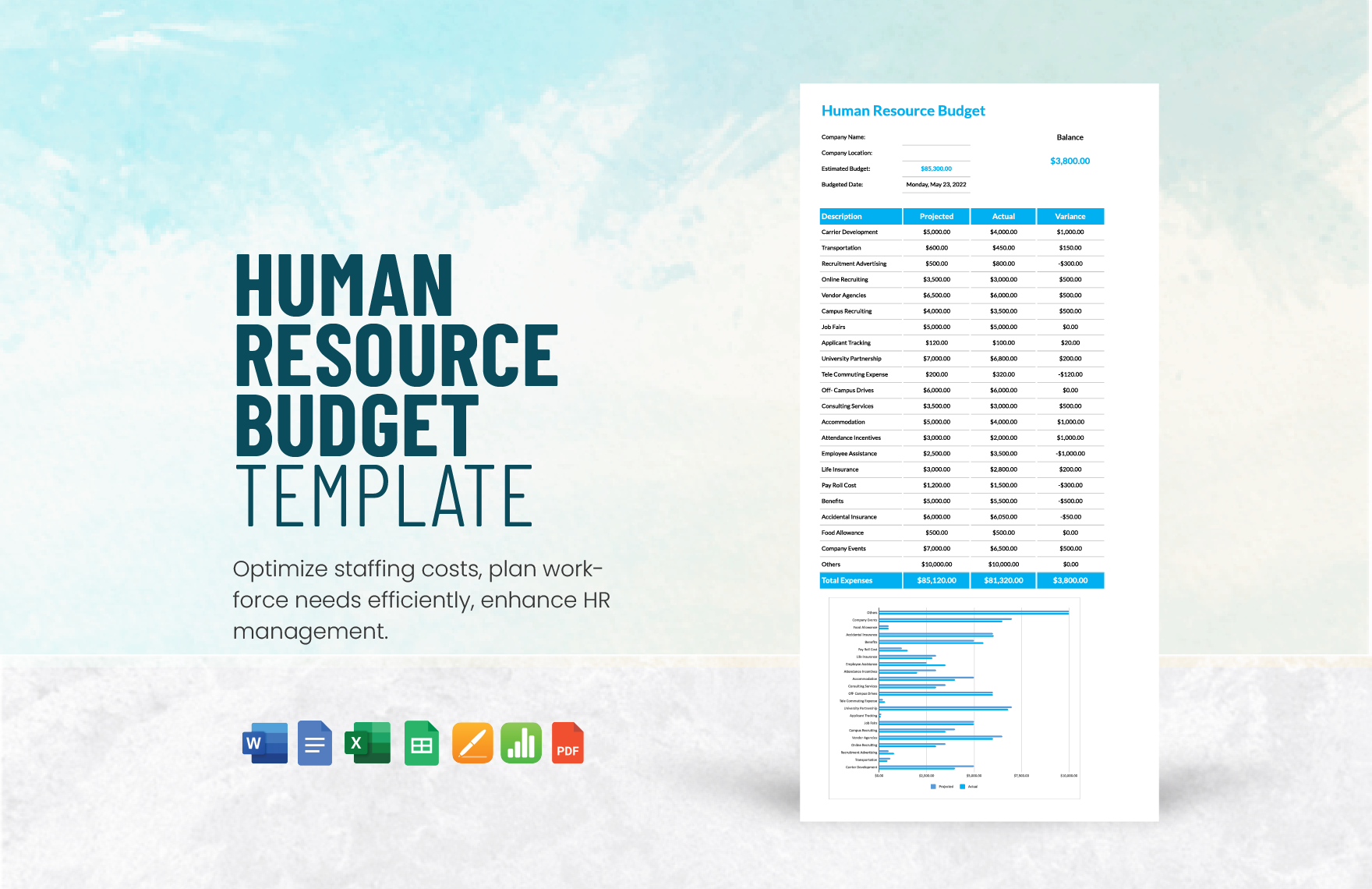

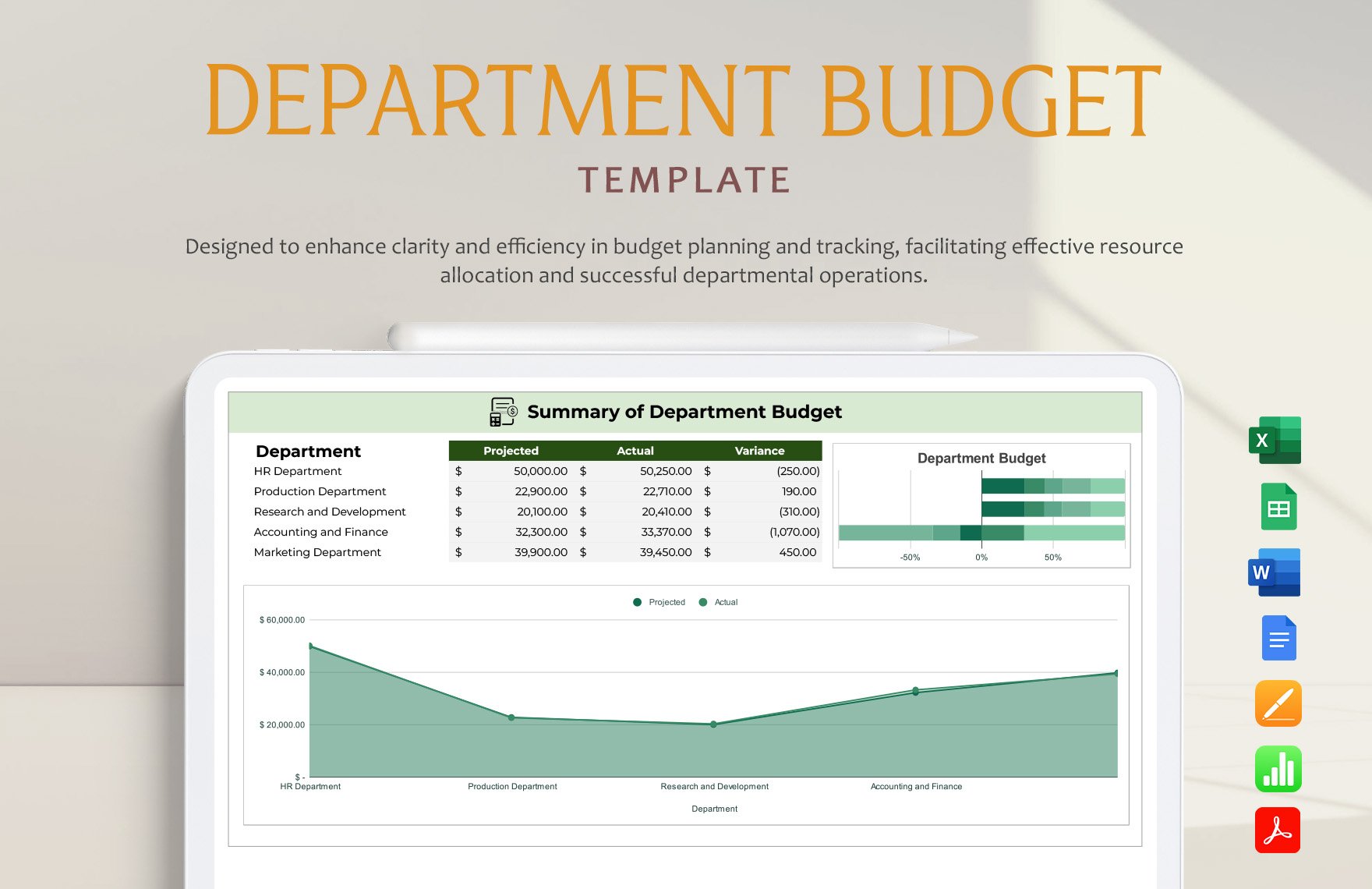

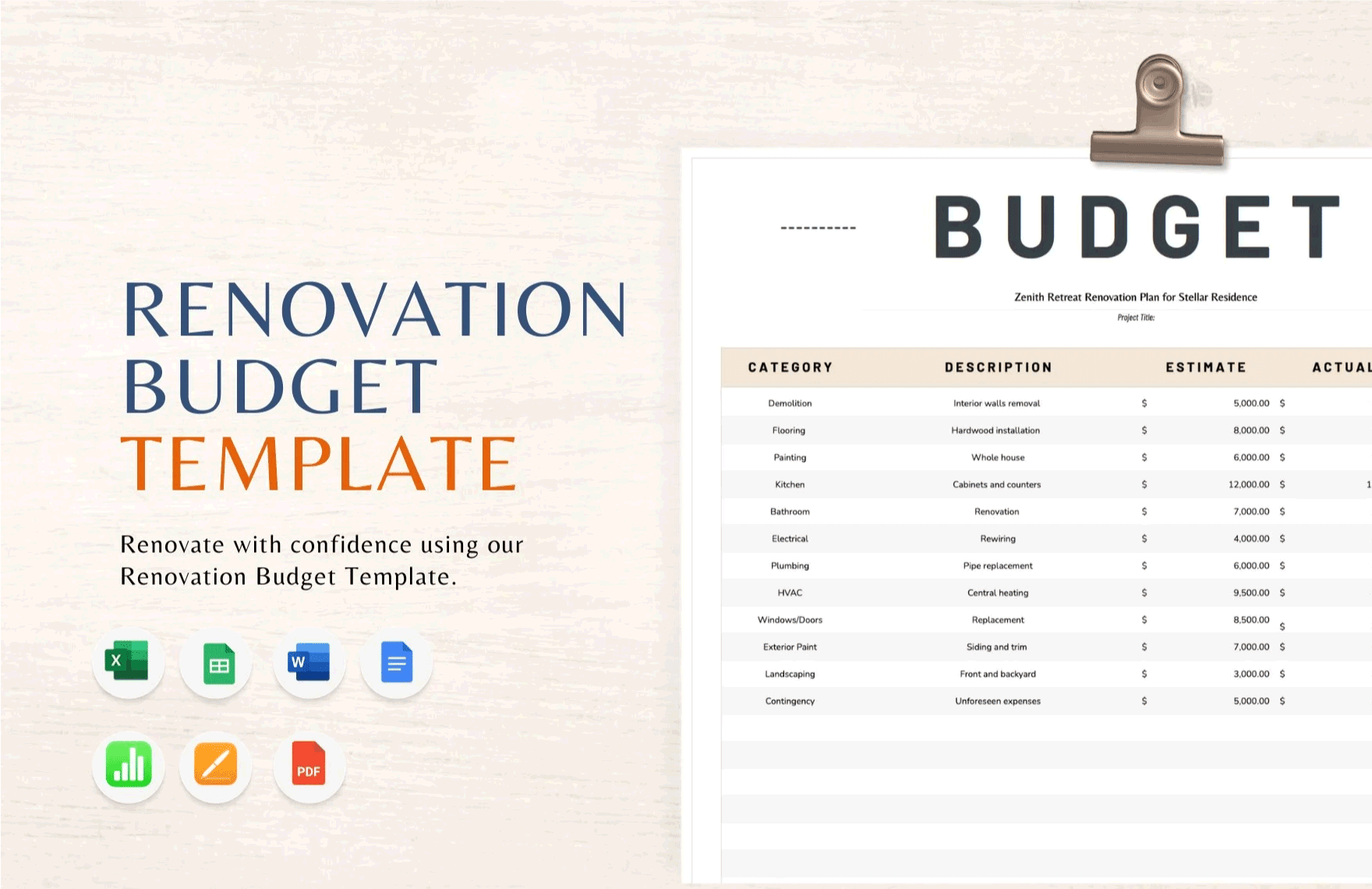

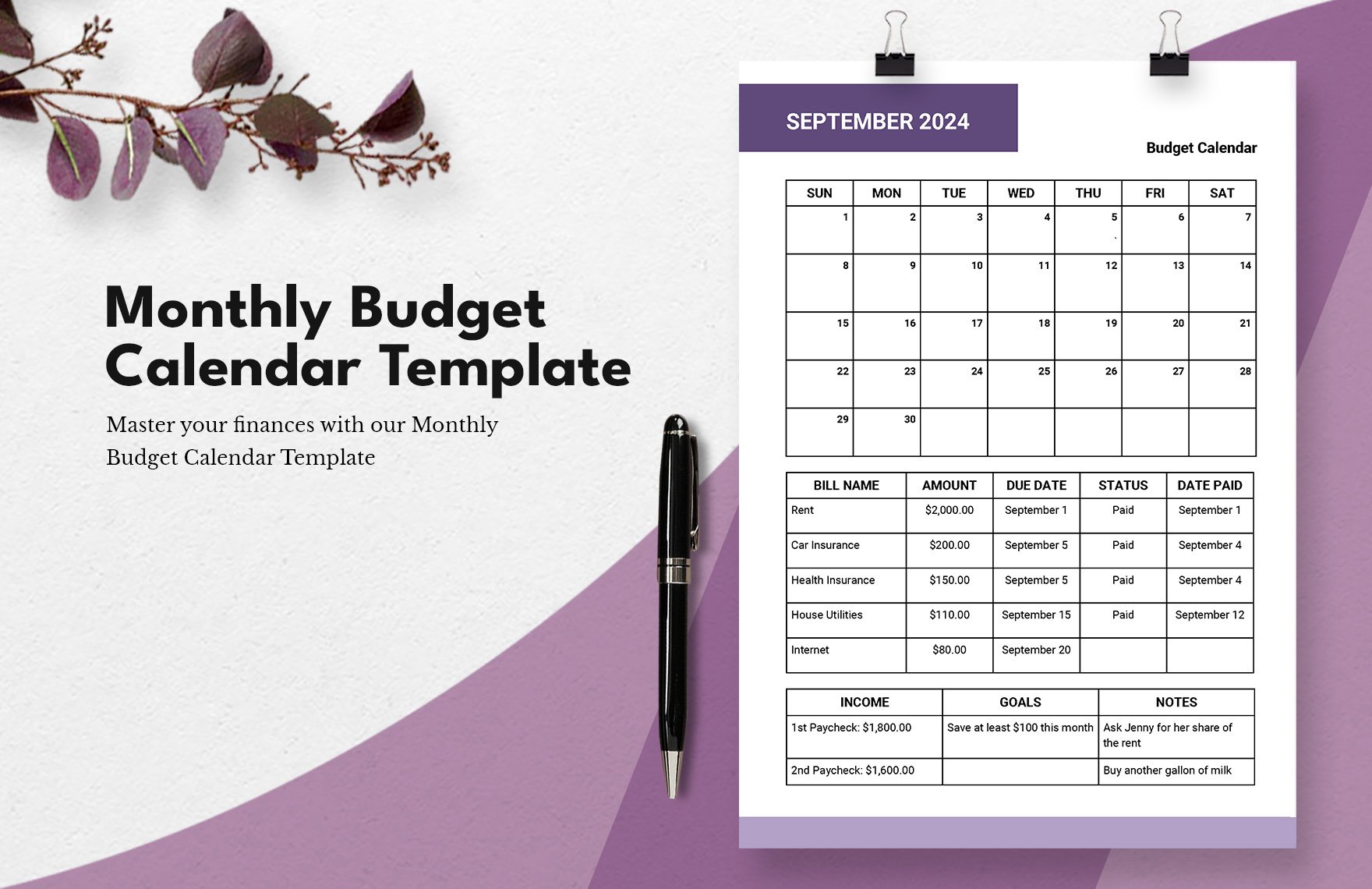

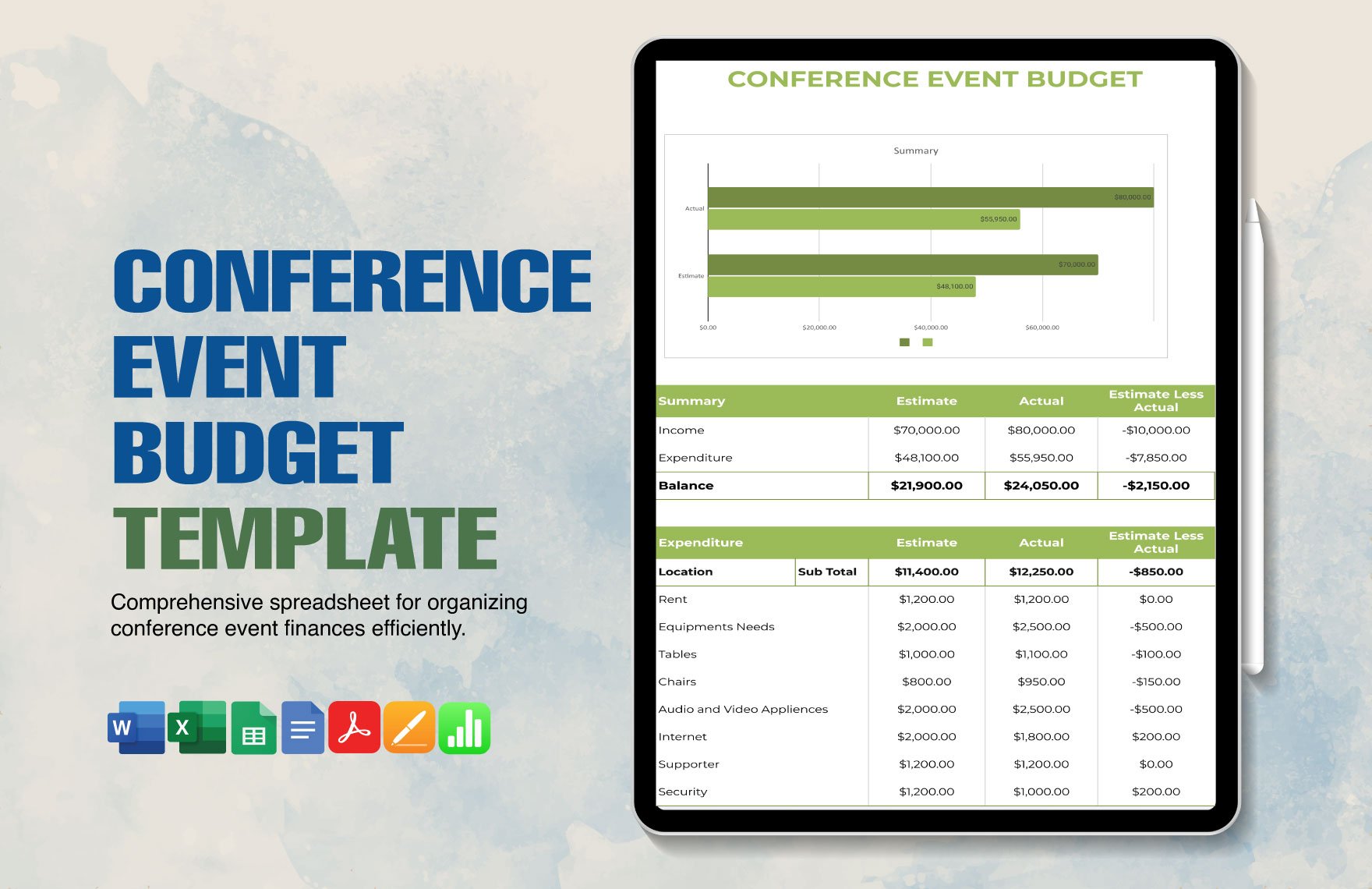

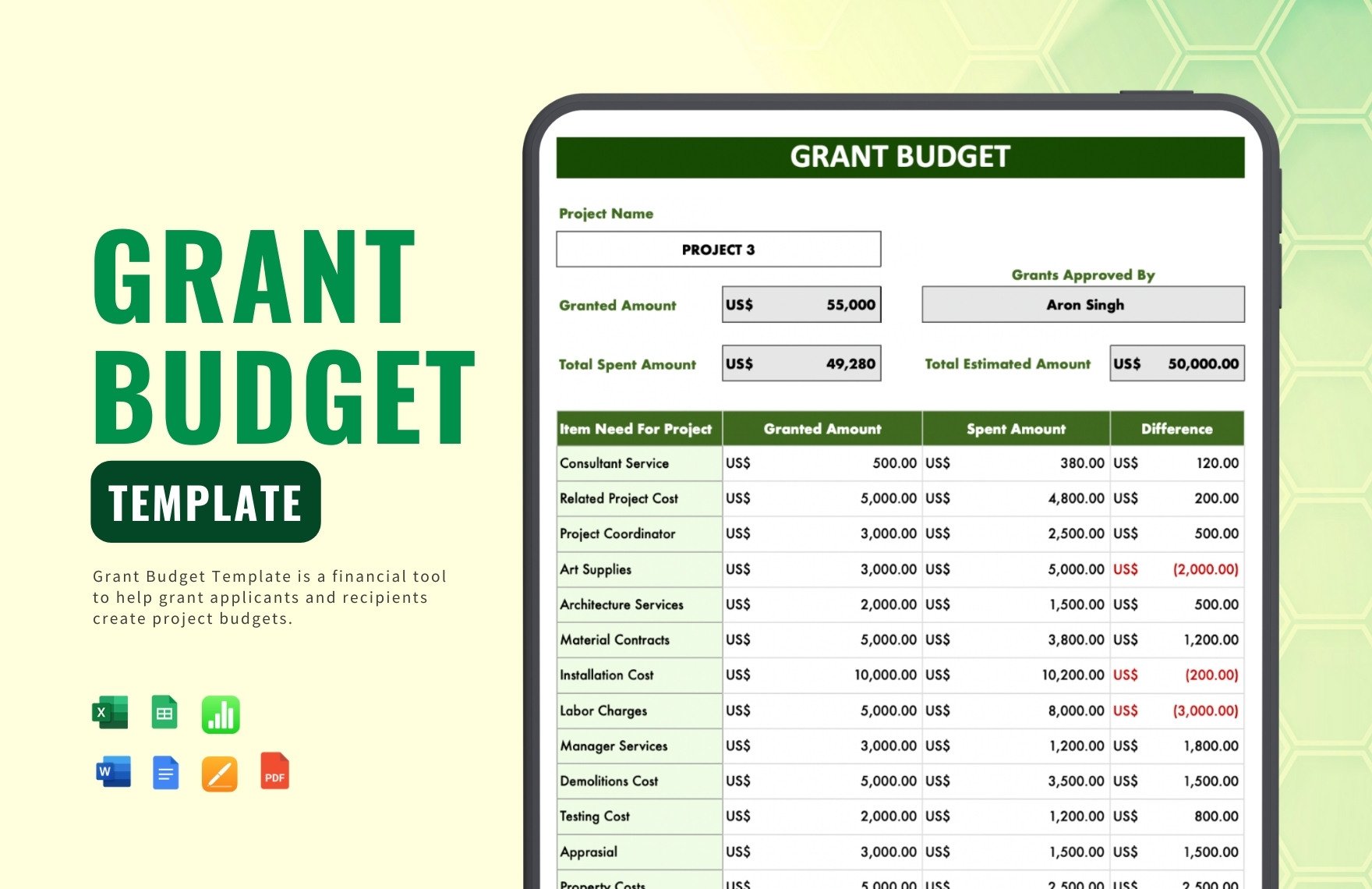

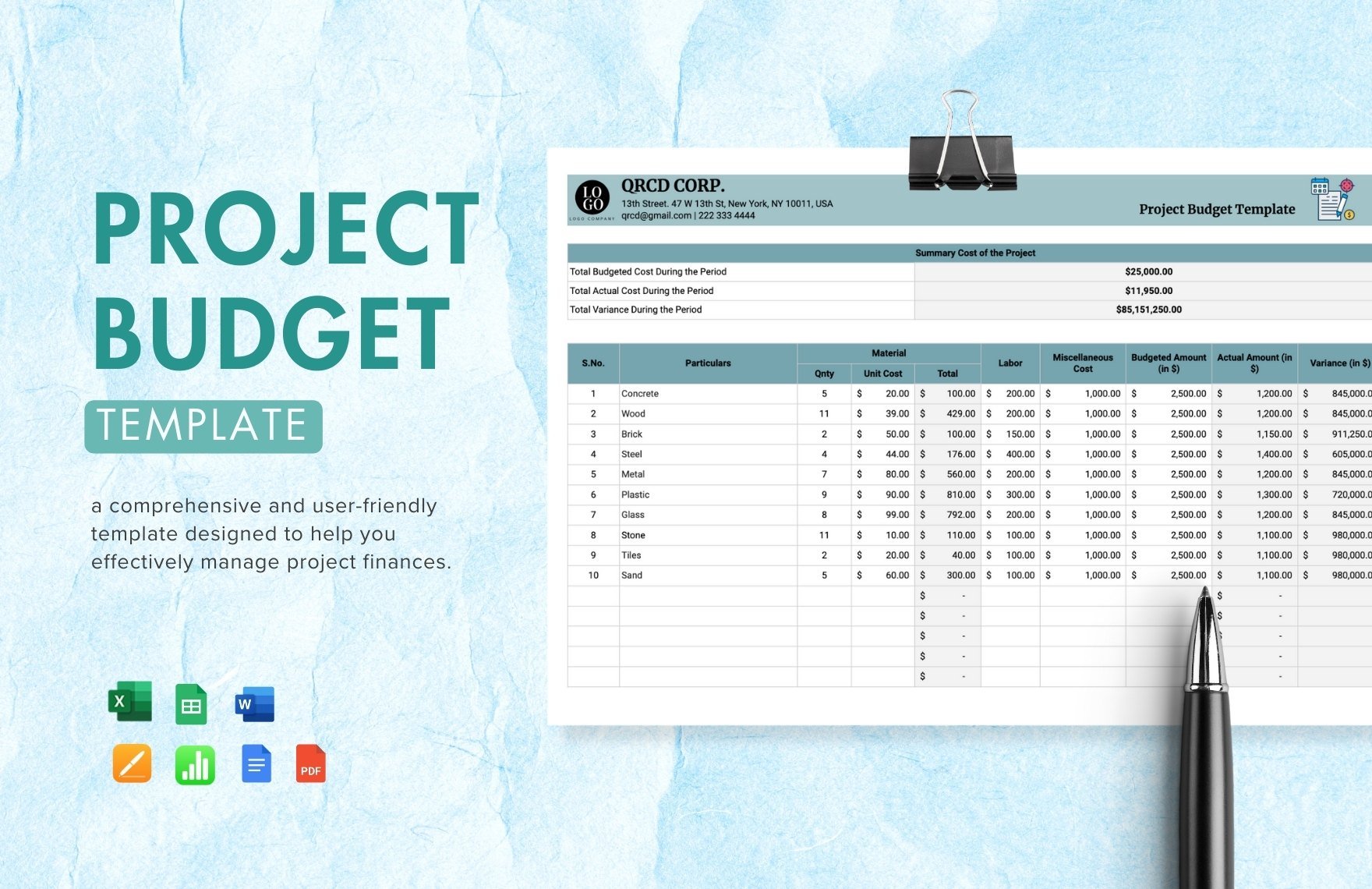

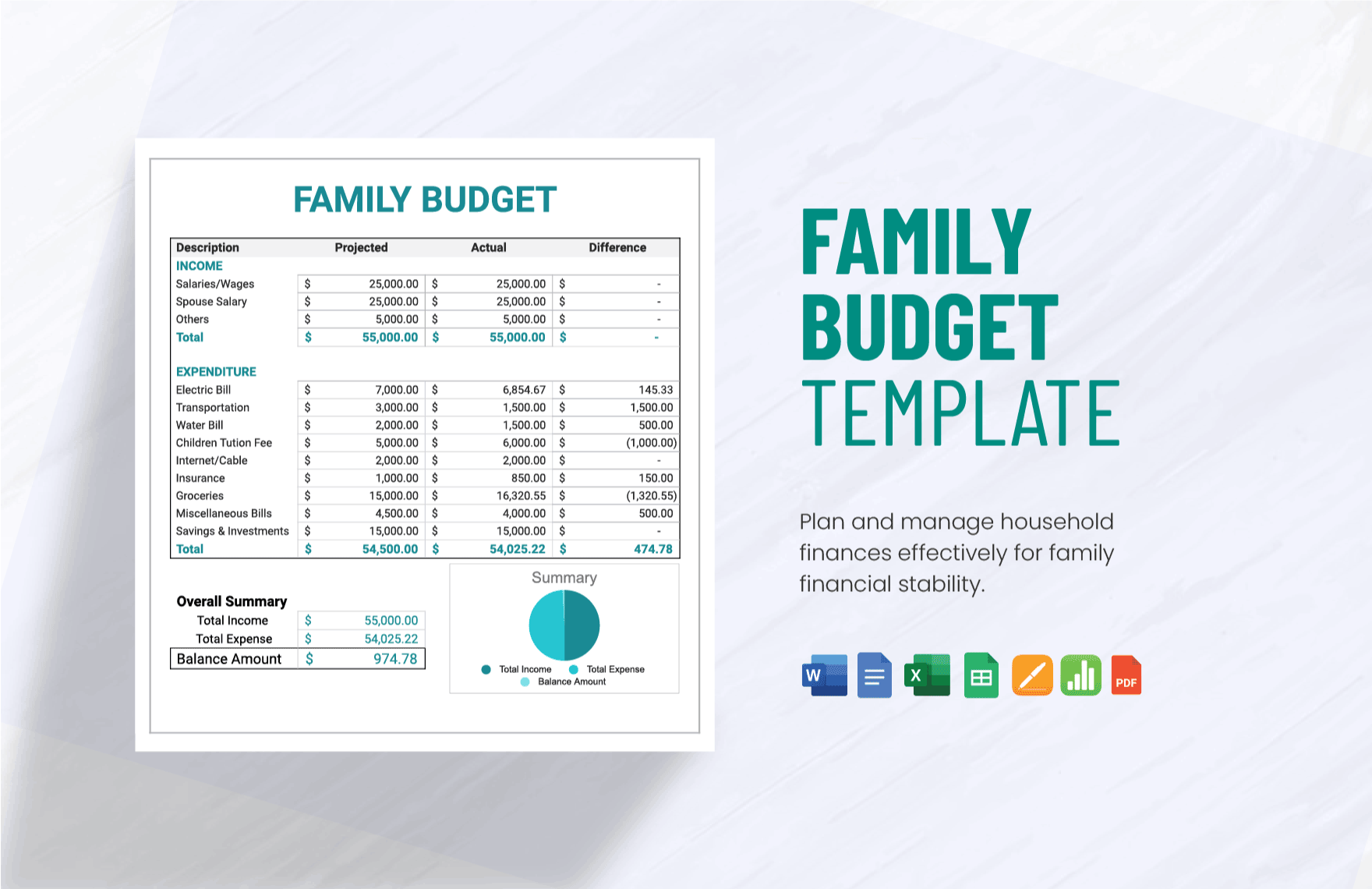

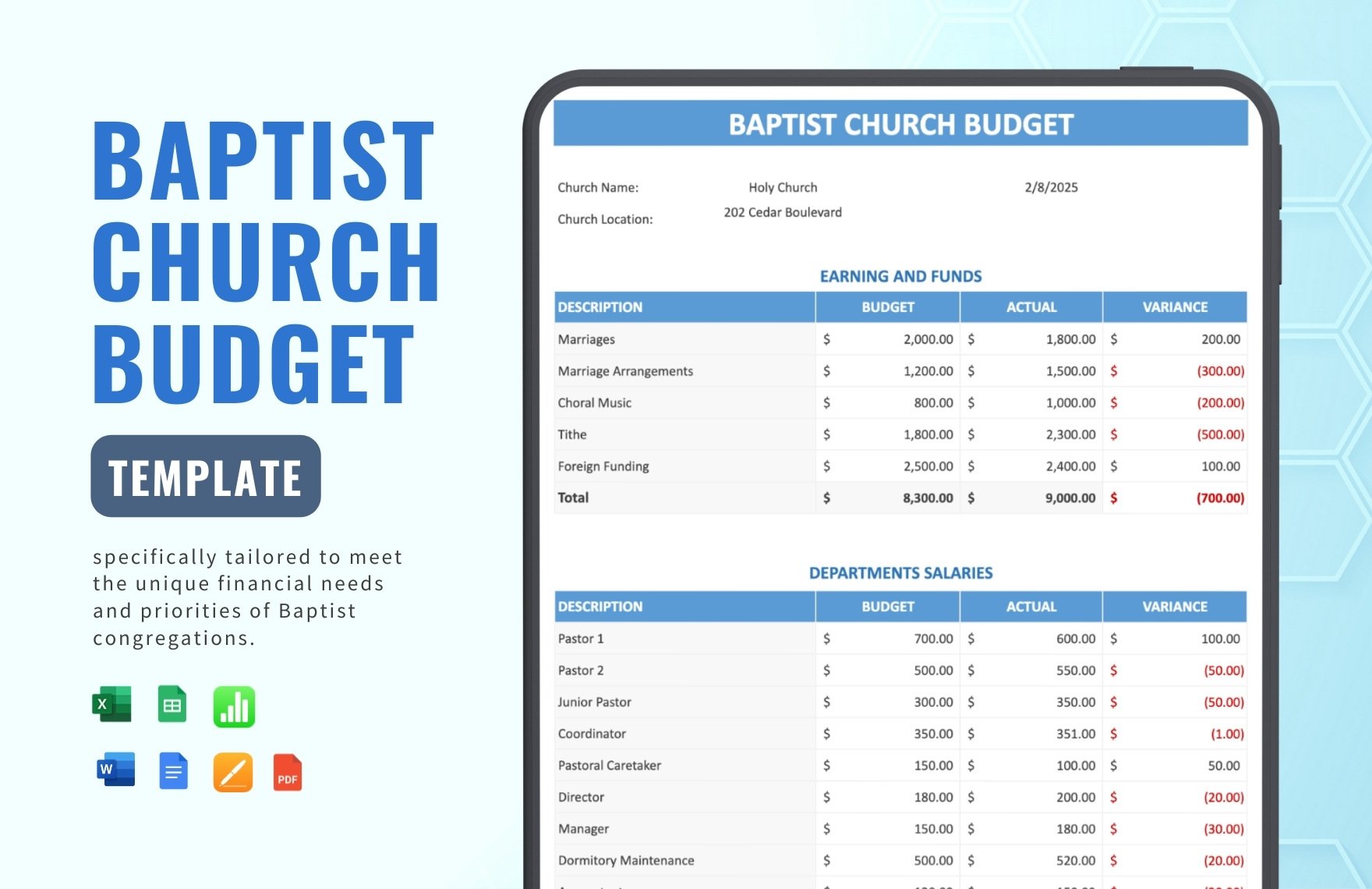

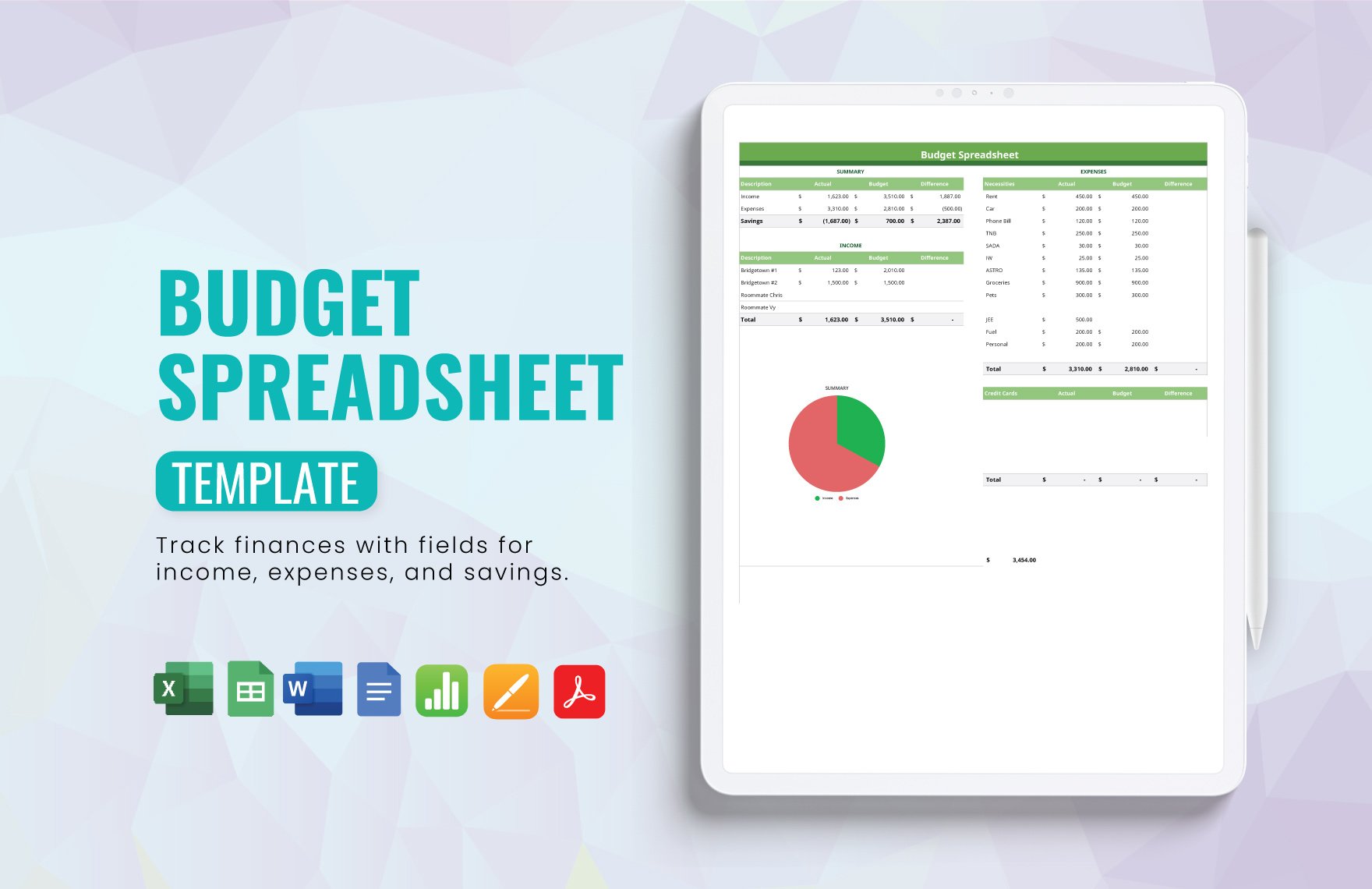

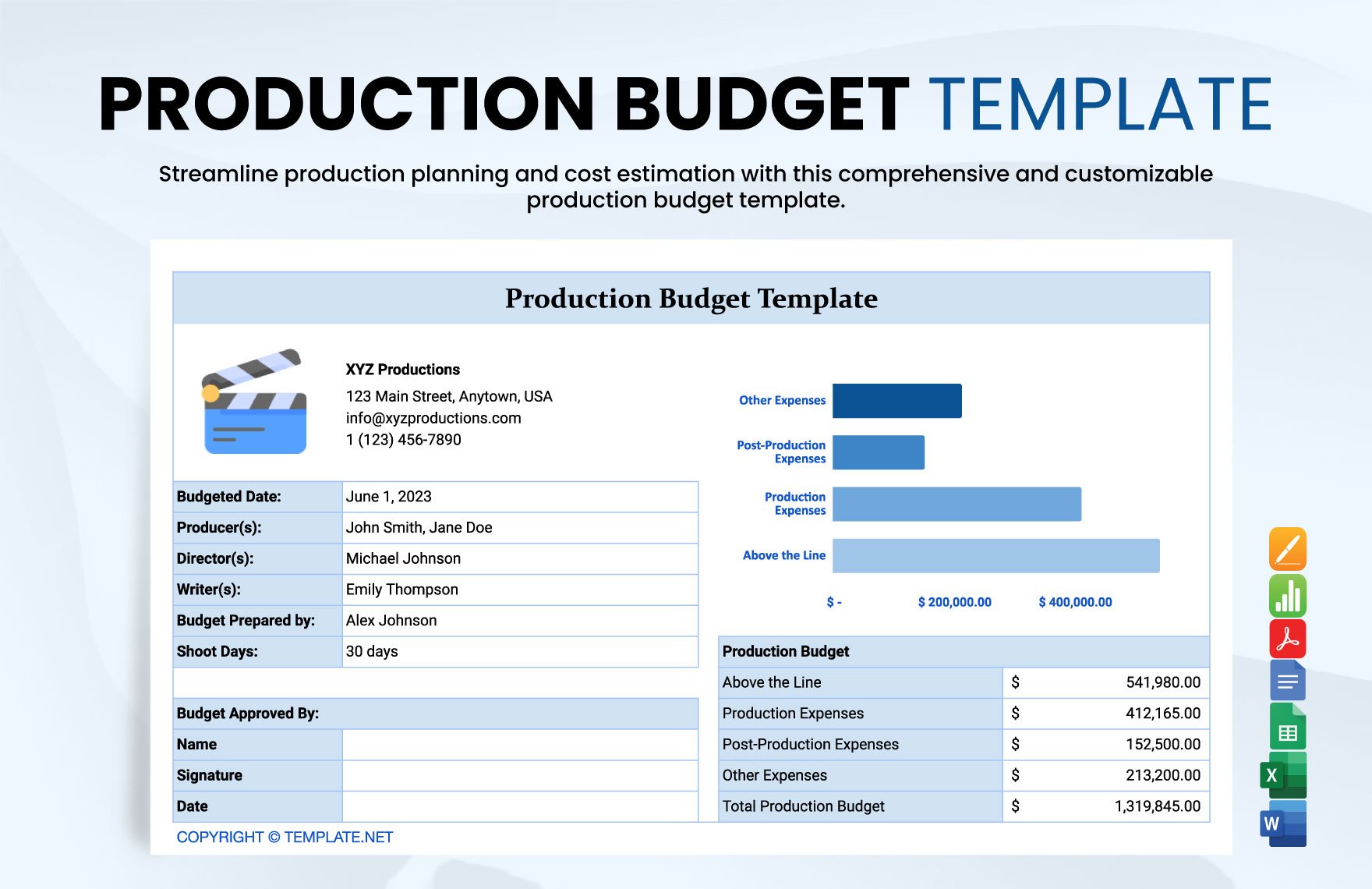

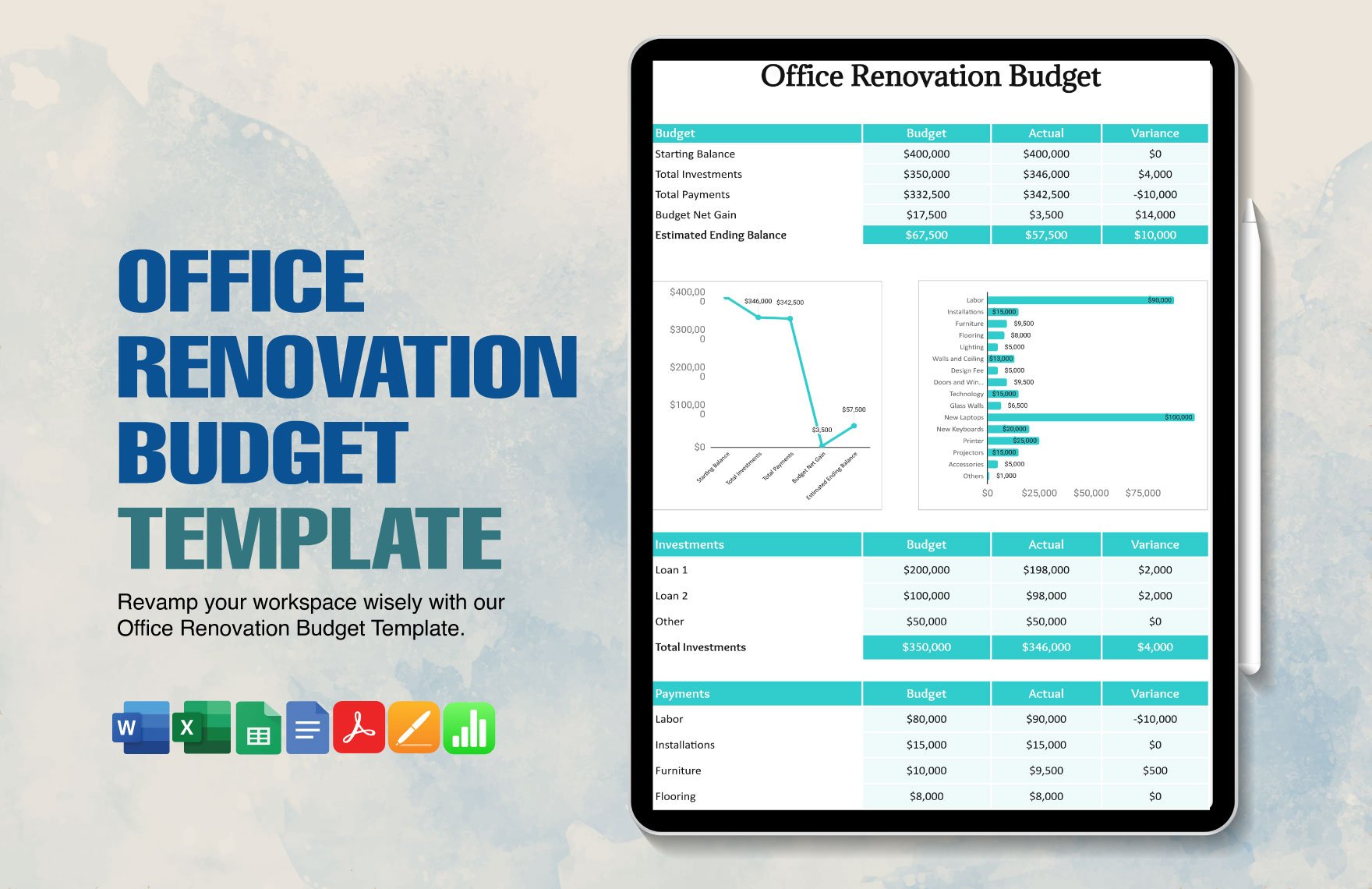

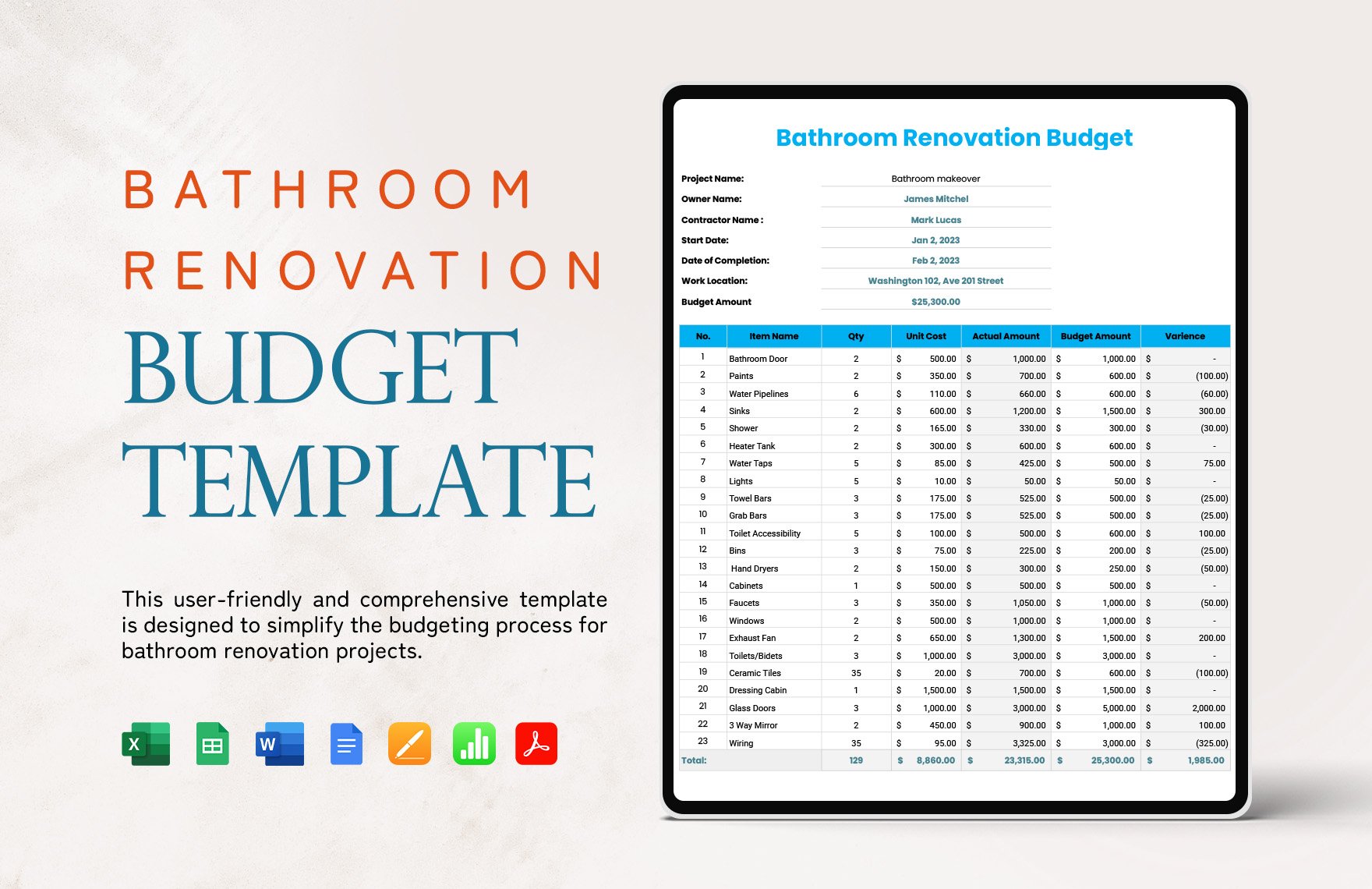

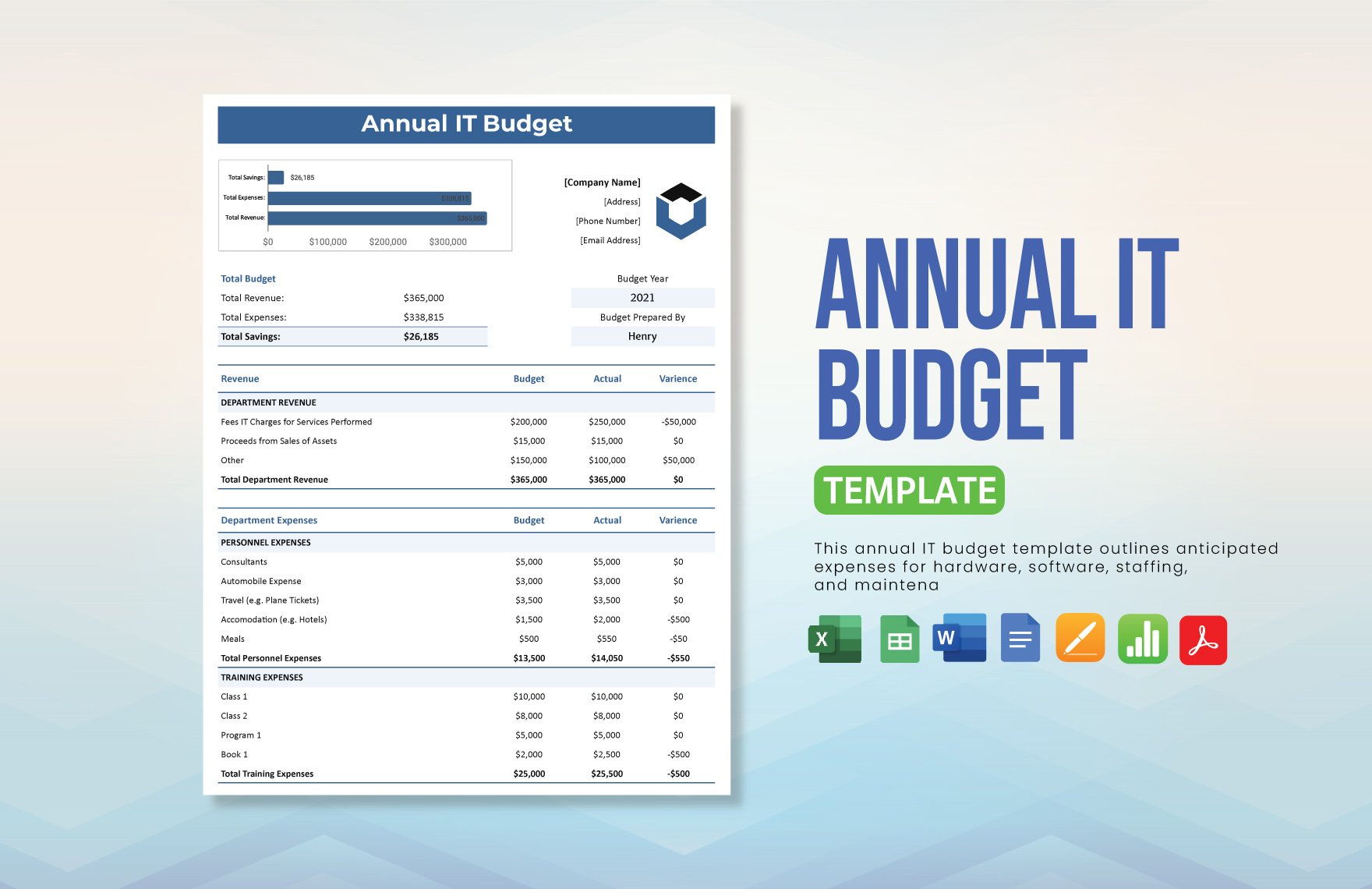

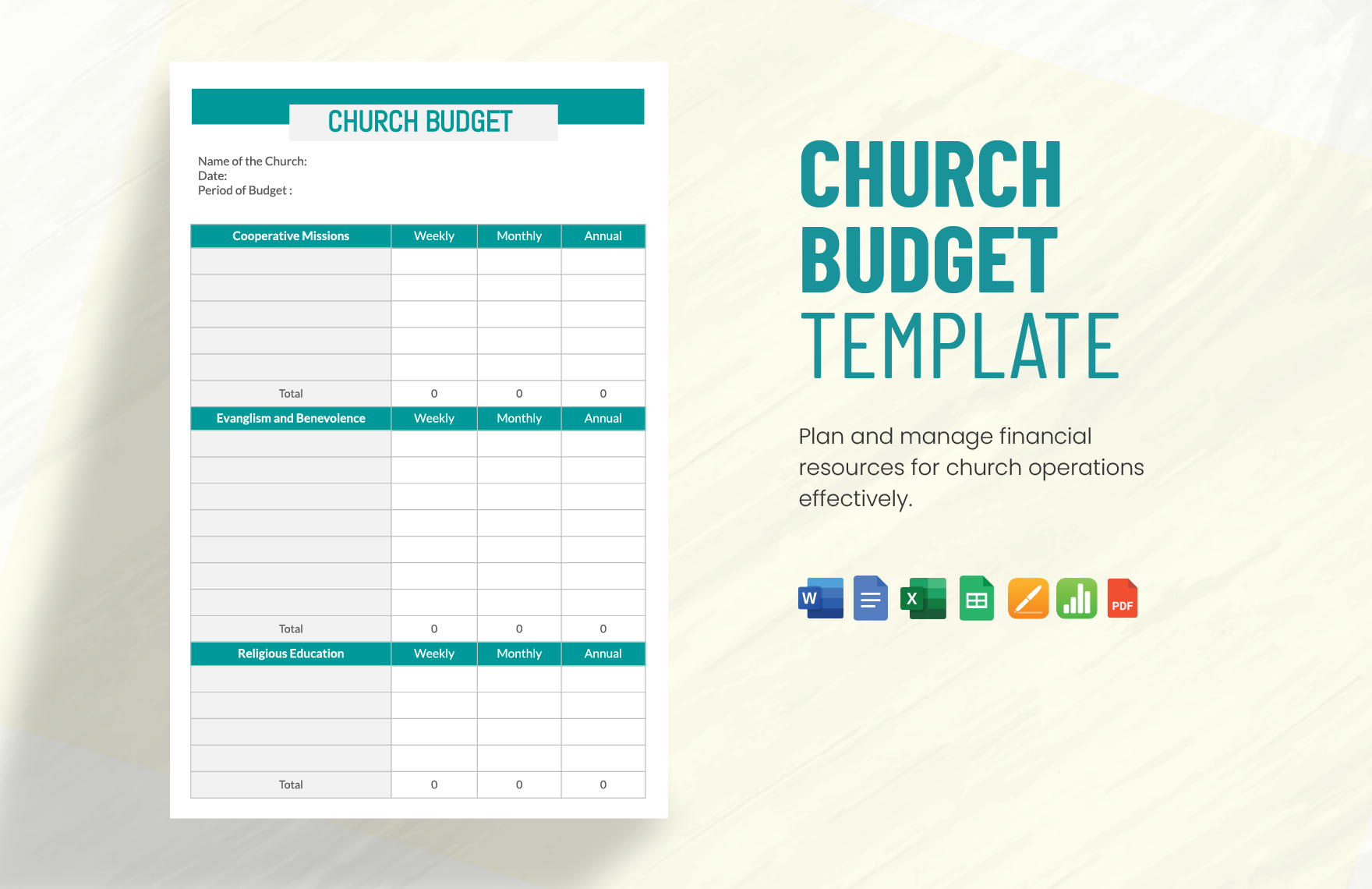

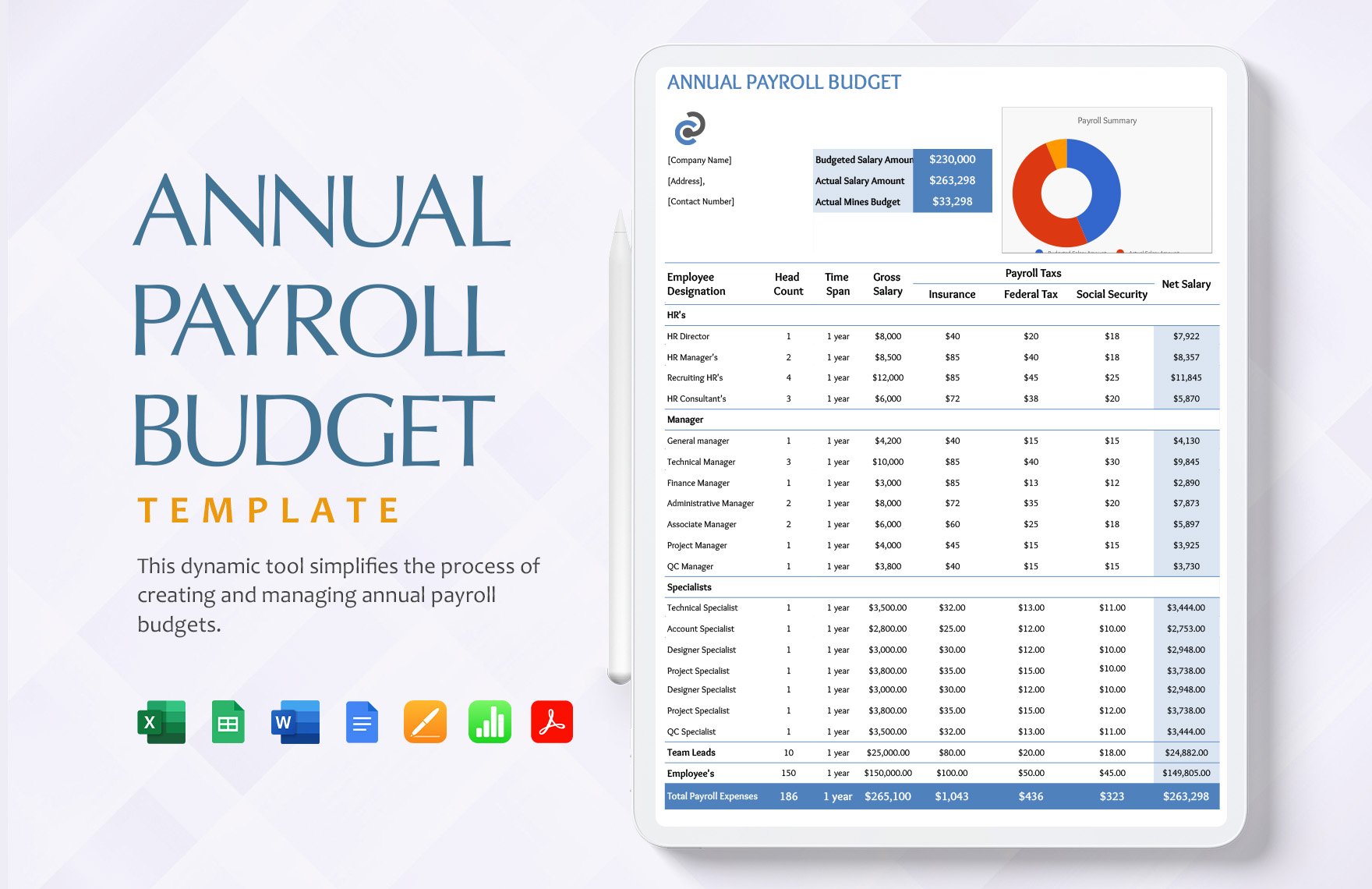

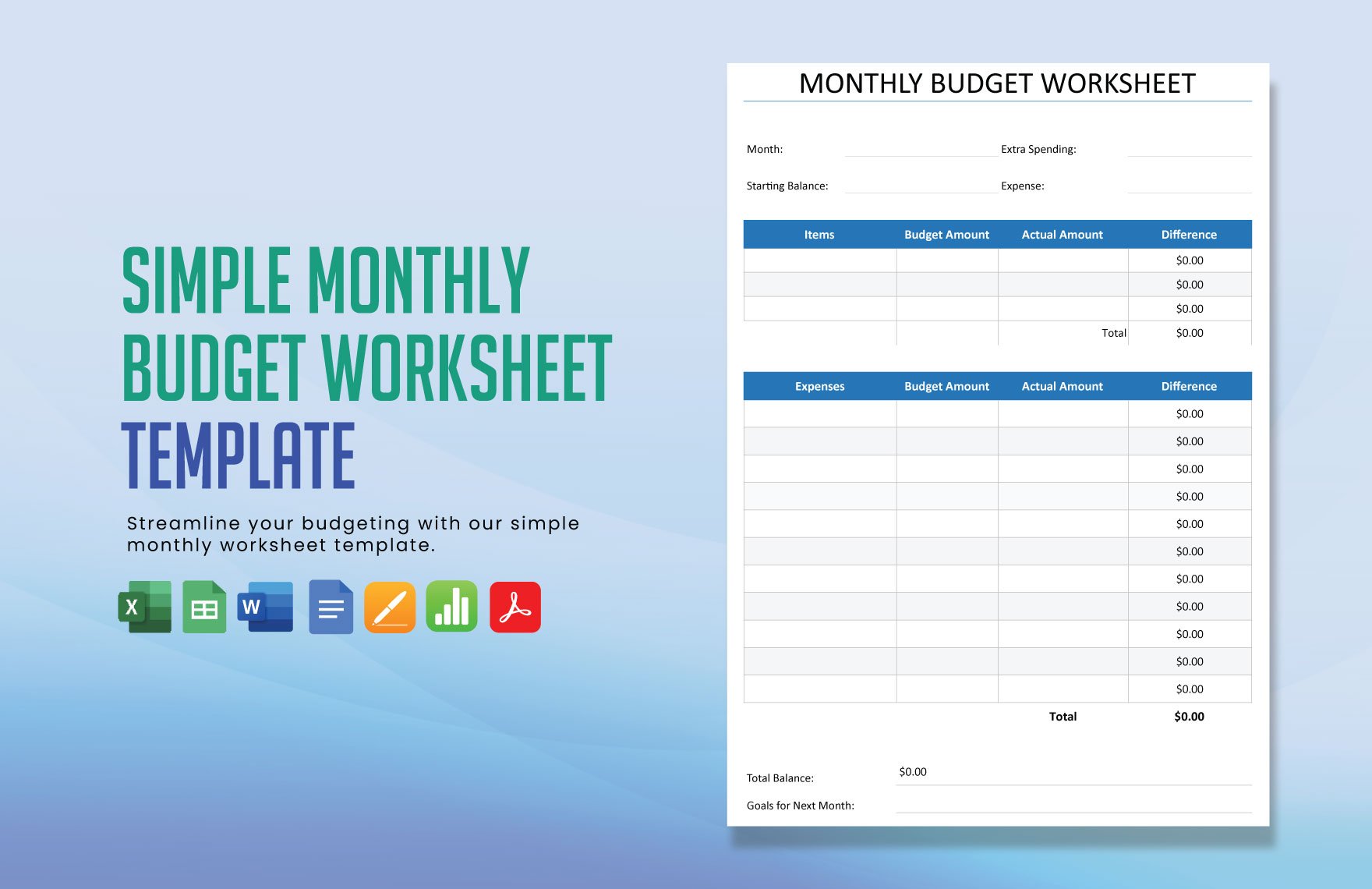

Create professional-grade budgets quickly and easily with no financial experience using Budget Templates by Template.net. Designed for business owners, finance teams, and individuals alike, these templates empower you to streamline your financial planning effortlessly. Whether you're managing company finances or personal budgets, our templates provide beautifully pre-designed layouts ready for your use. Enjoy the convenience of free templates that can be immediately downloaded and printed in Adobe PDF format. With customizable sections for income, expenses, and savings goals, managing your finances has never been easier. Experience the savings in time and effort with these user-friendly tools, perfect for both digital and print formats.

Explore more beautiful premium pre-designed templates in Adobe PDF format to enhance your budgeting strategy. Our library is frequently updated with new designs, ensuring fresh choices to meet all your budgeting needs. Easily download or share via link, print, or email for increased collaboration and reach. By combining our free and premium templates, you can achieve maximum flexibility and effectiveness in your financial management efforts. Take advantage of this comprehensive toolkit to stay ahead of your financial goals, leveraging the ease of use and professional touch only Template.net provides.