Streamline Your Financial Planning with Ready-to-Use Business Budget Templates by Template.net

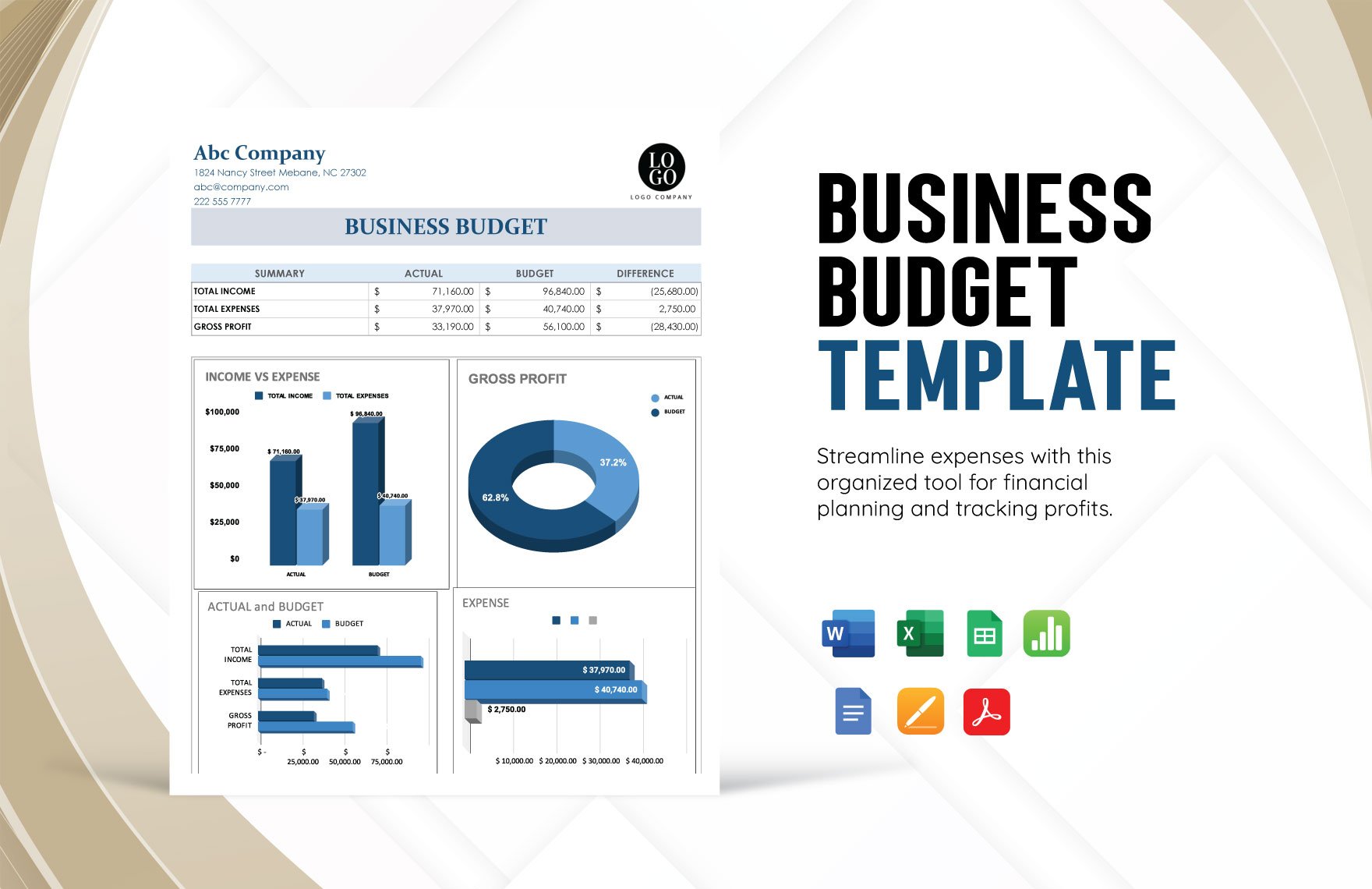

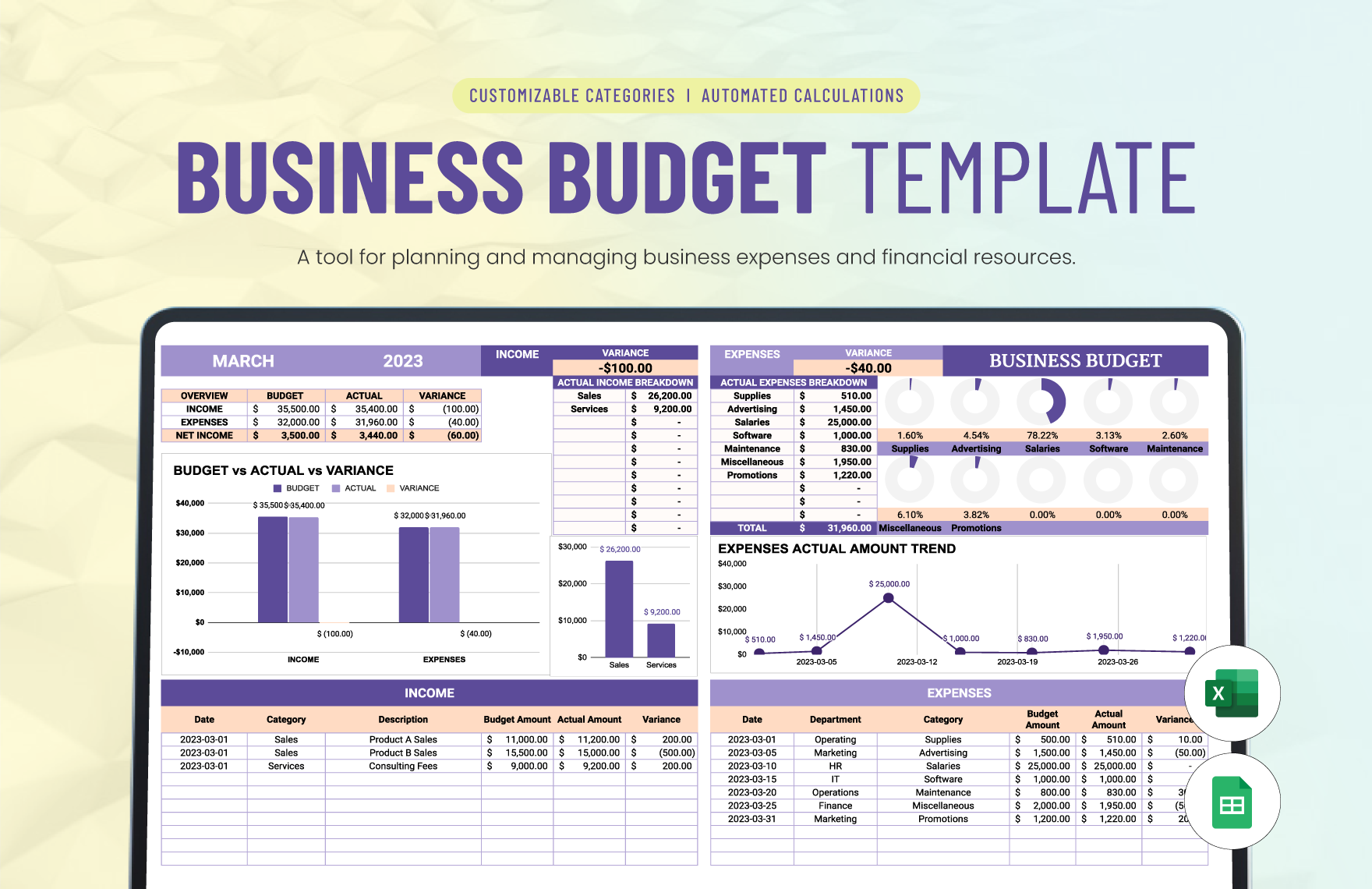

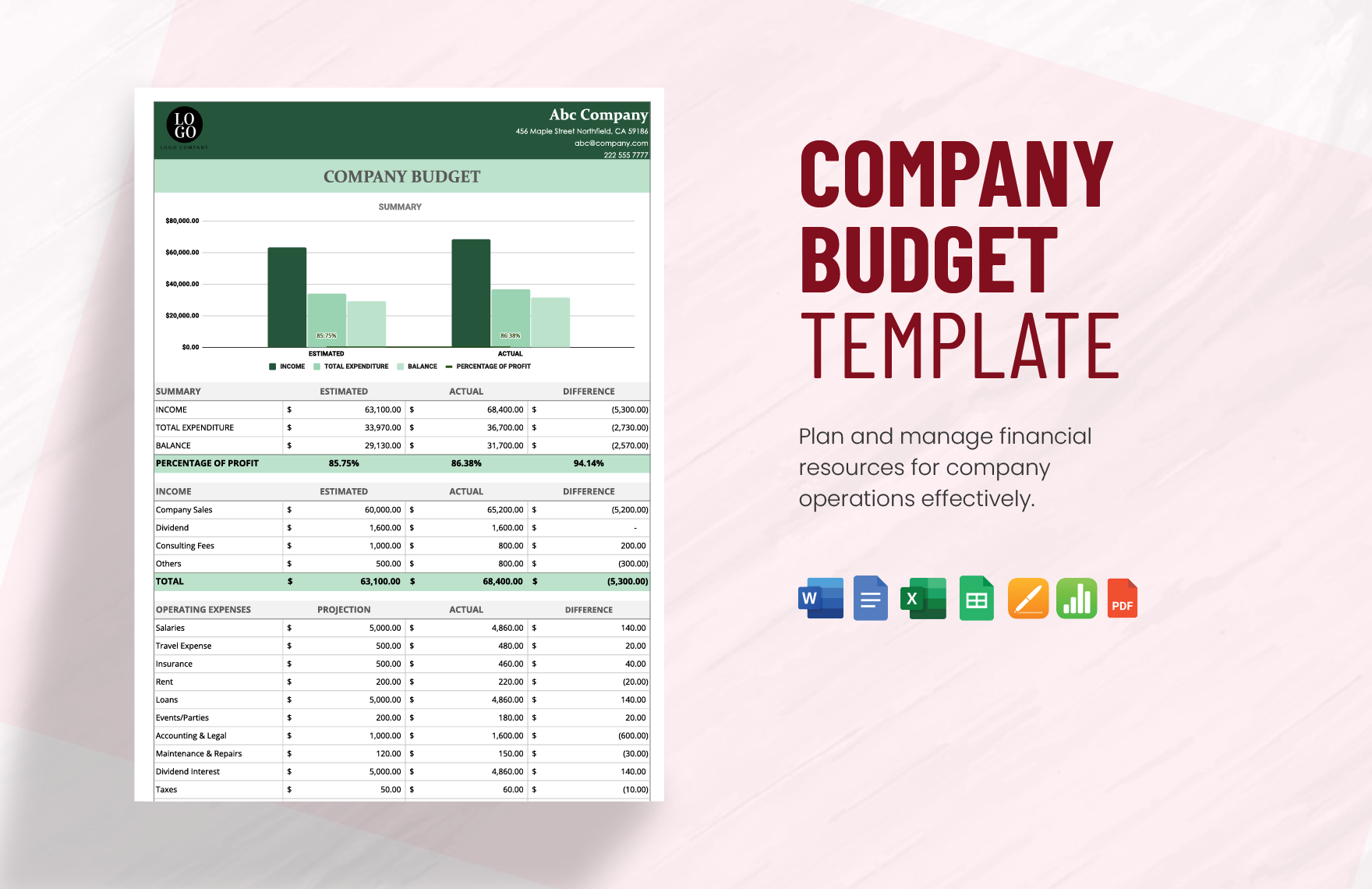

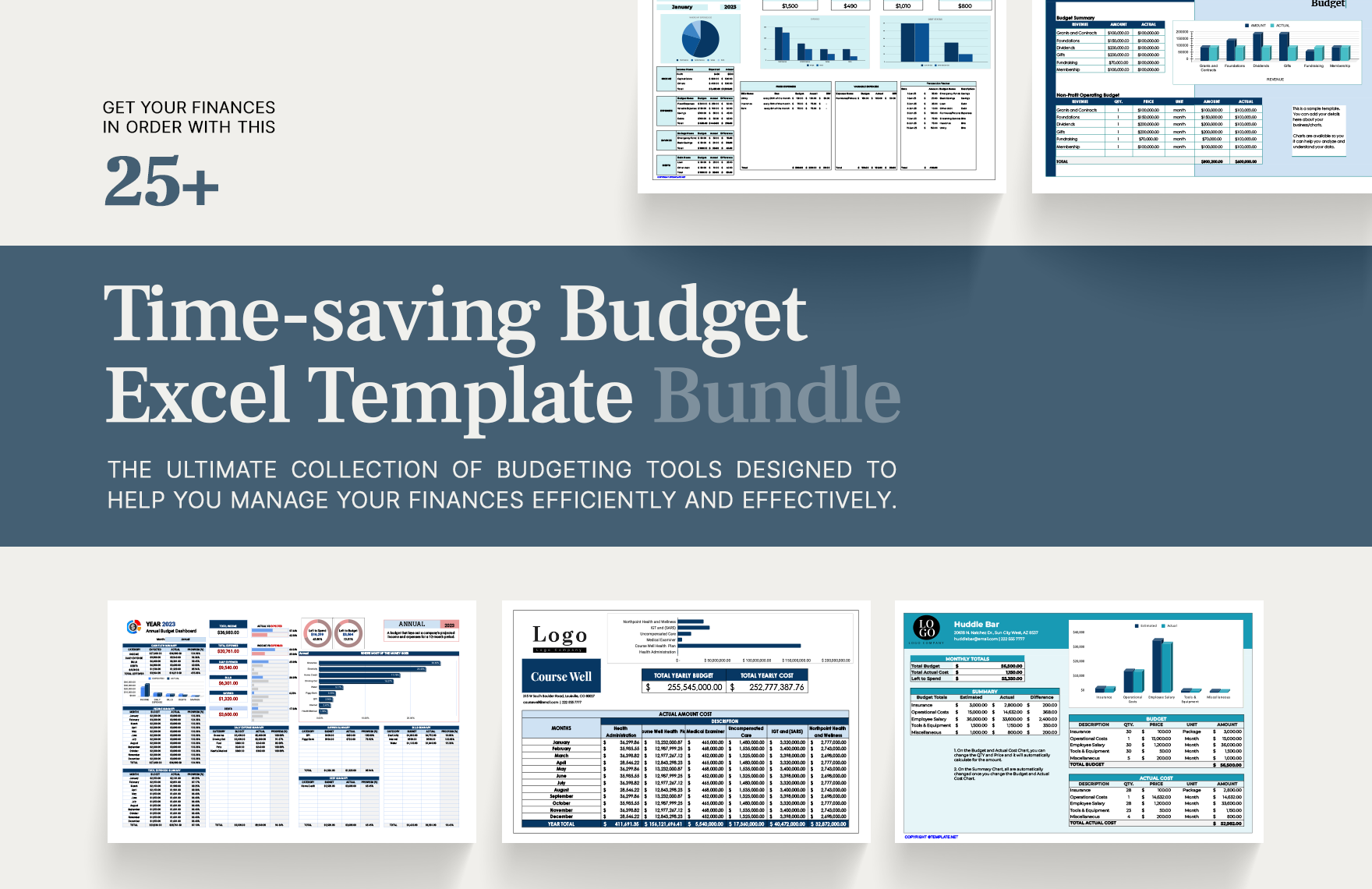

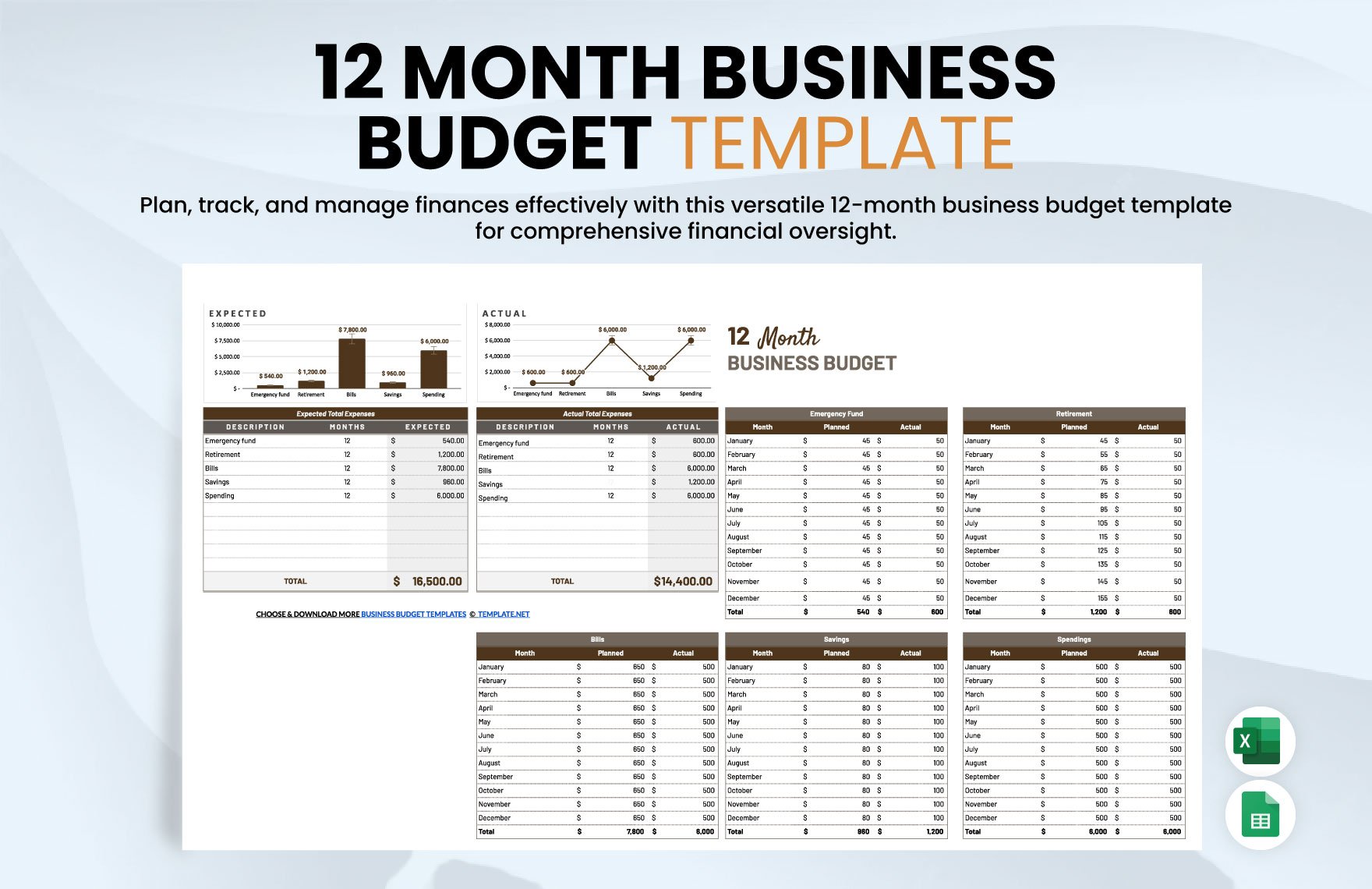

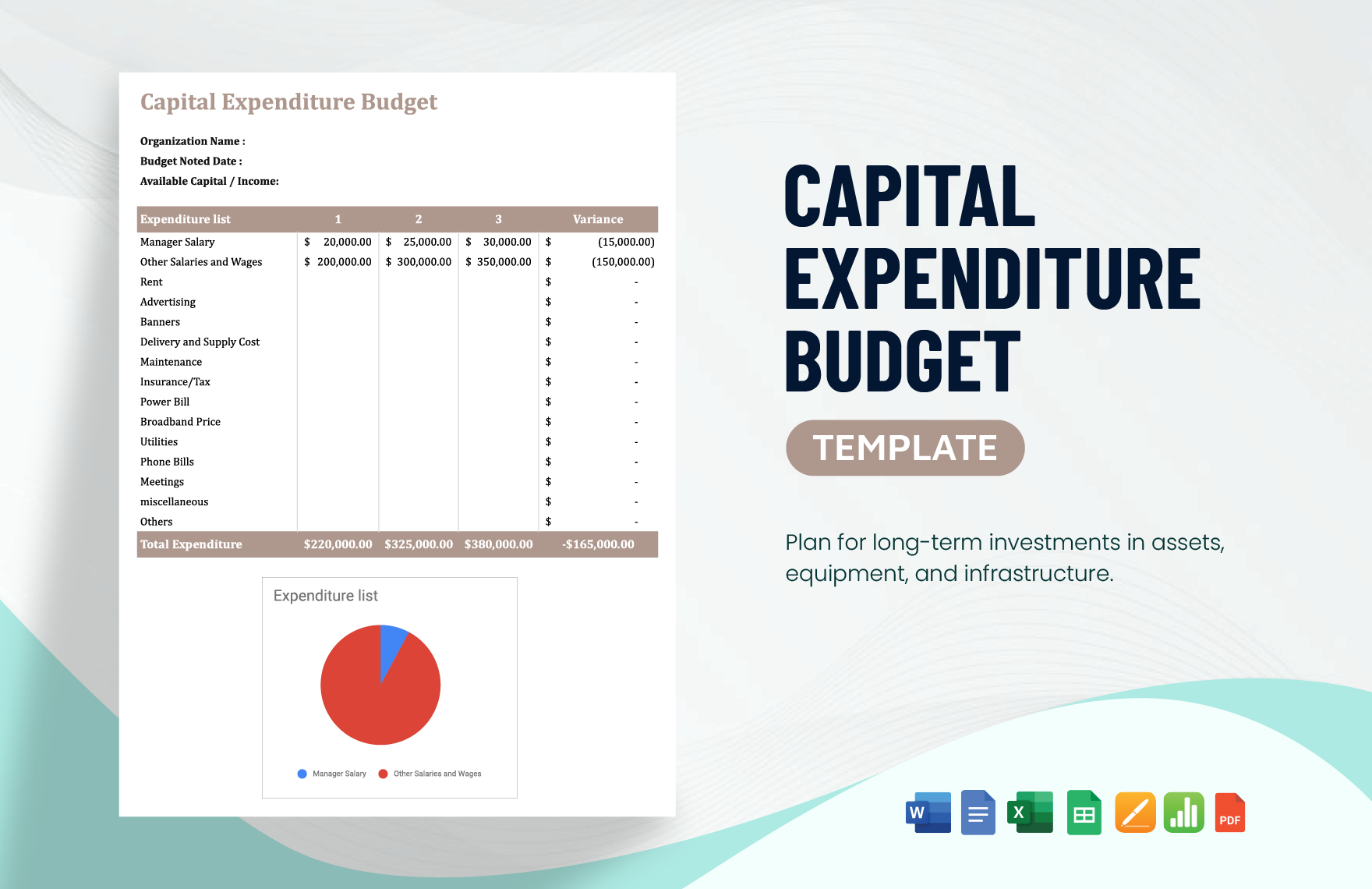

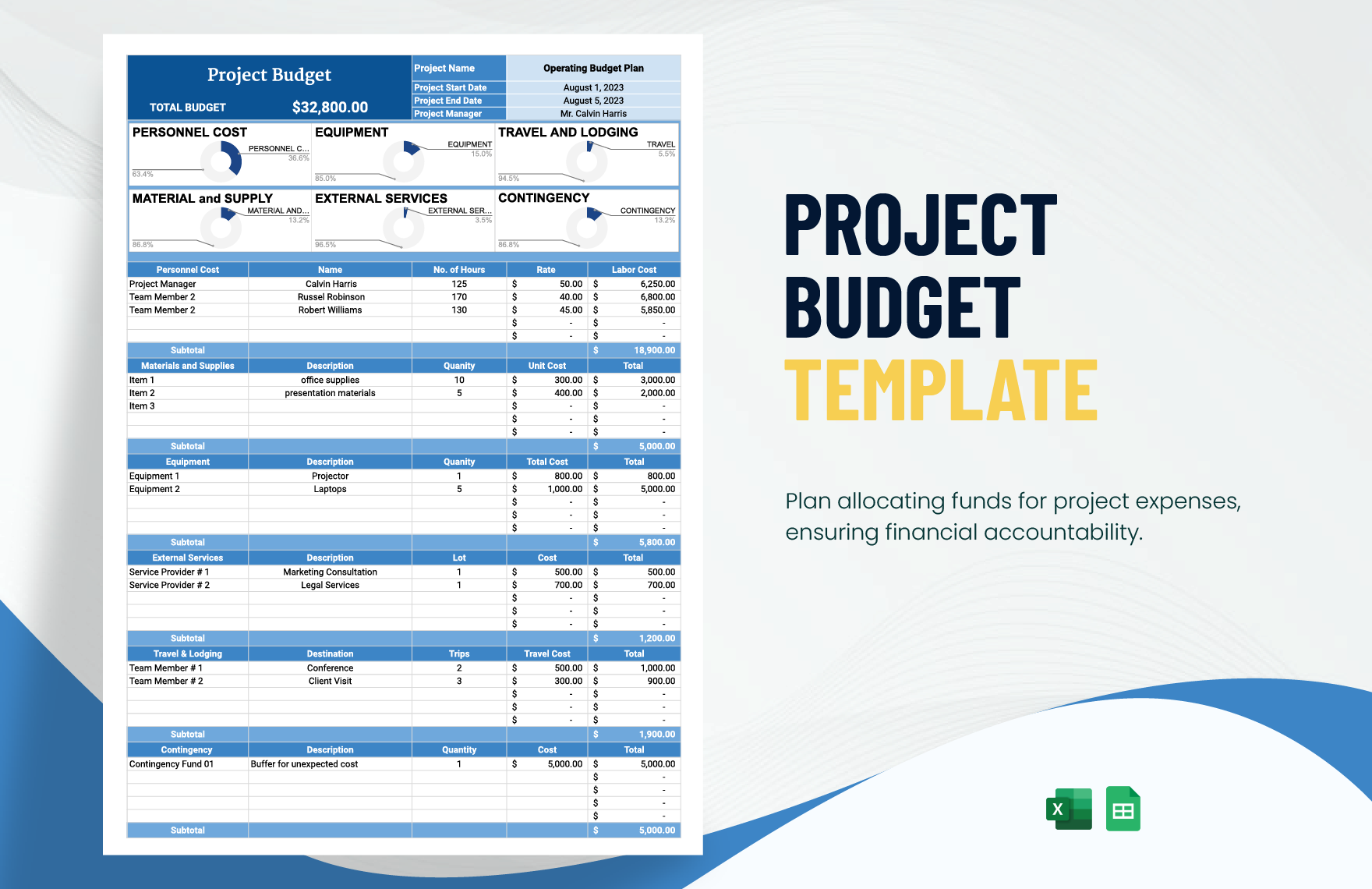

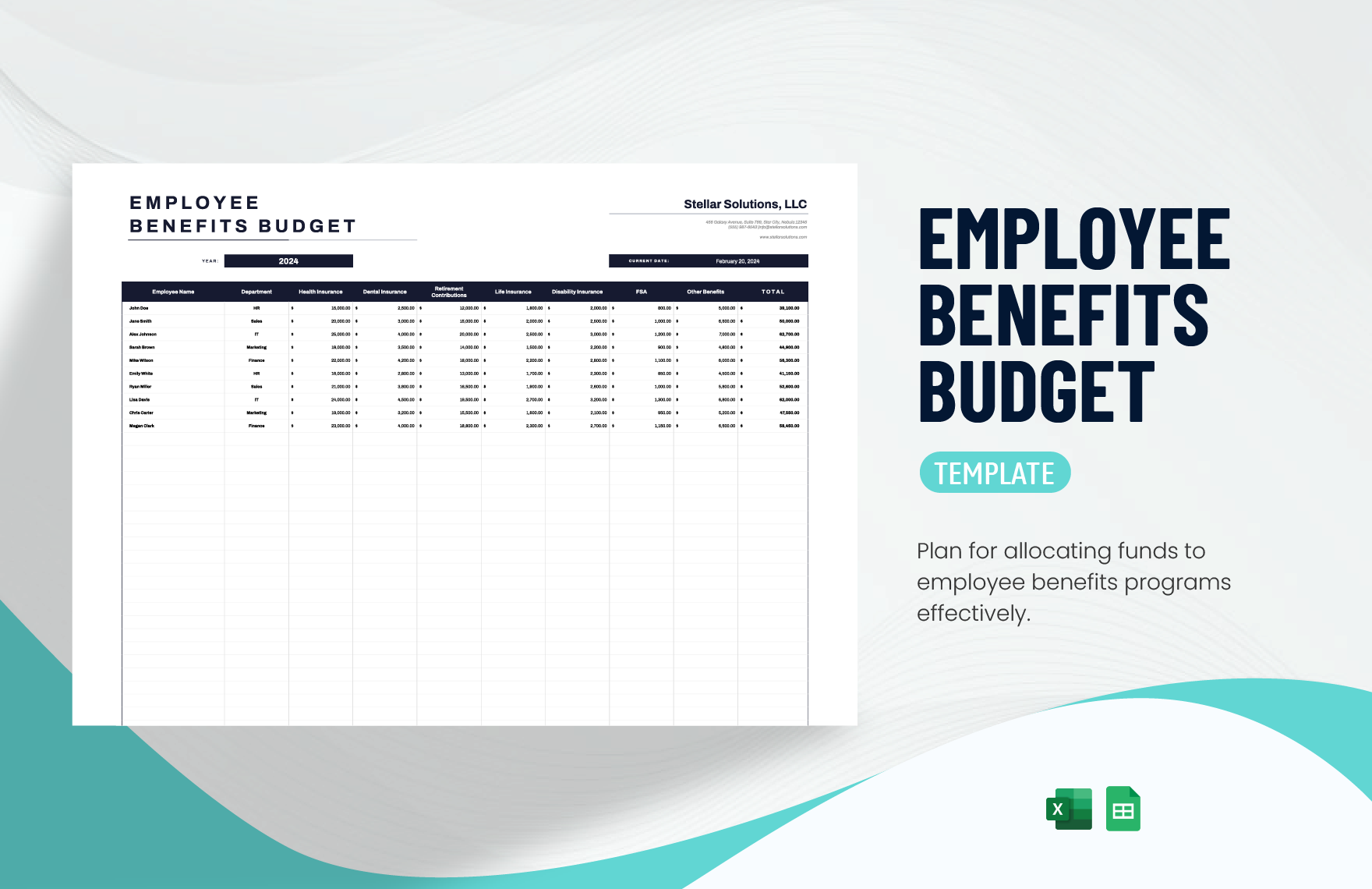

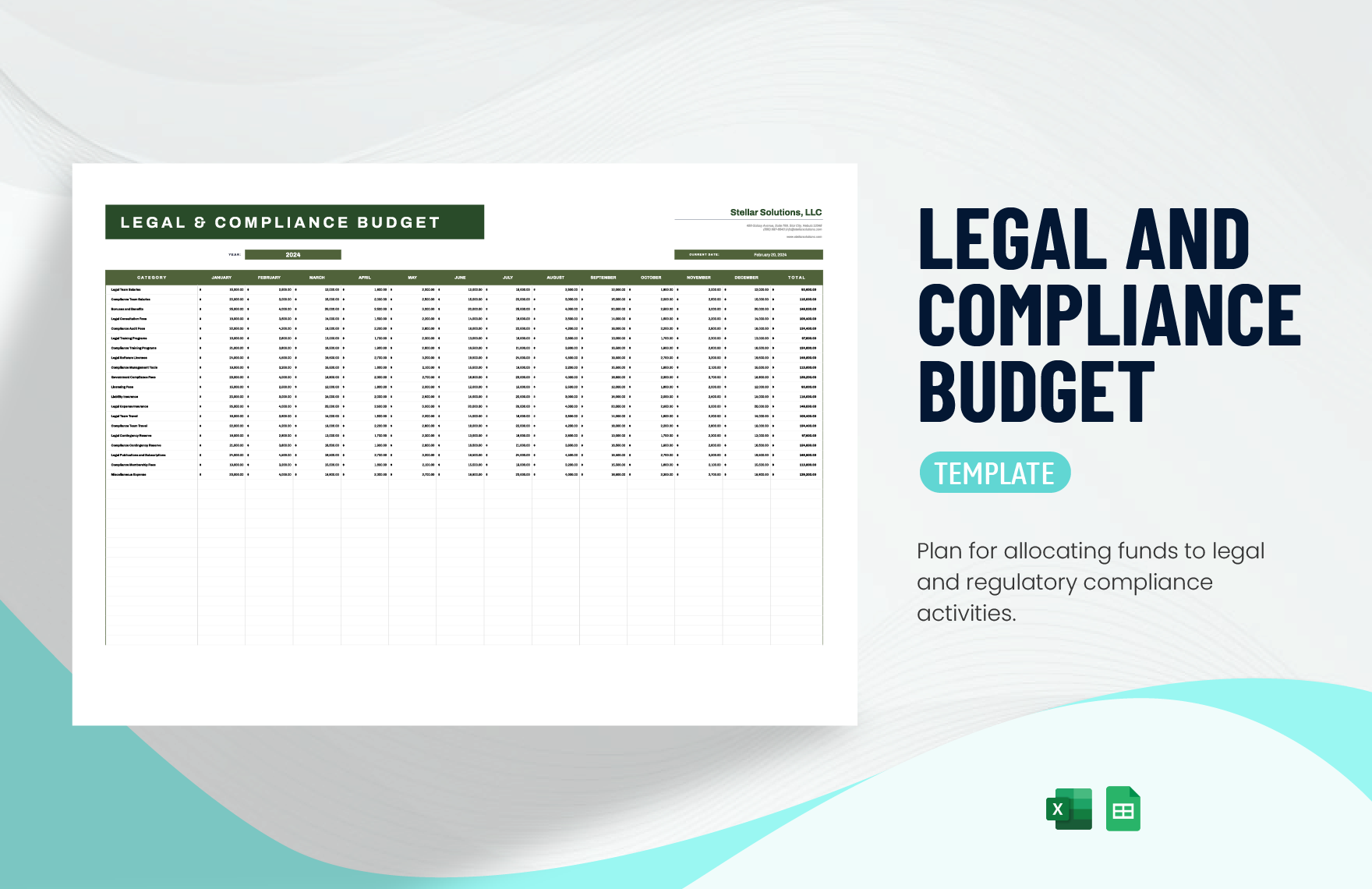

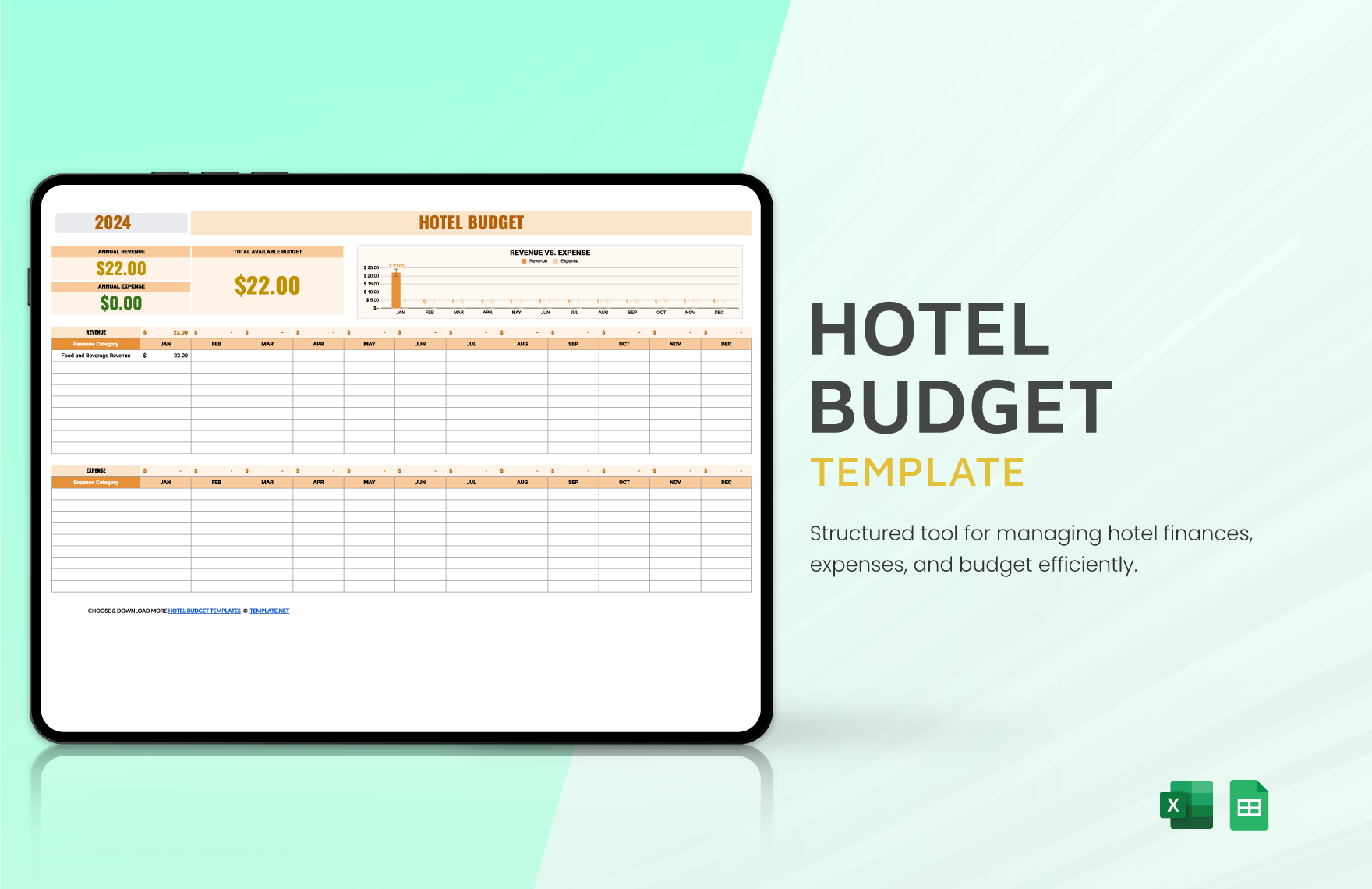

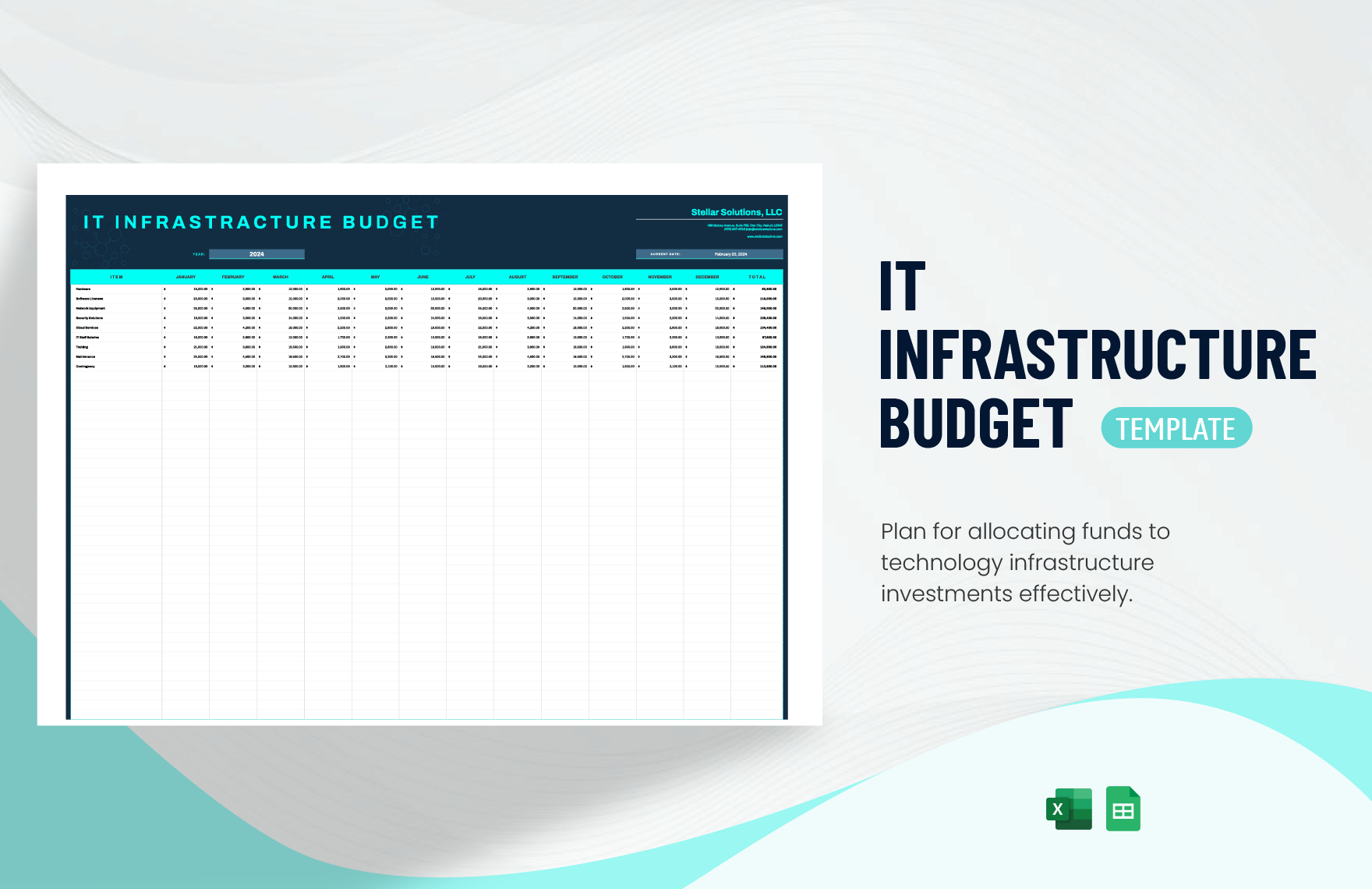

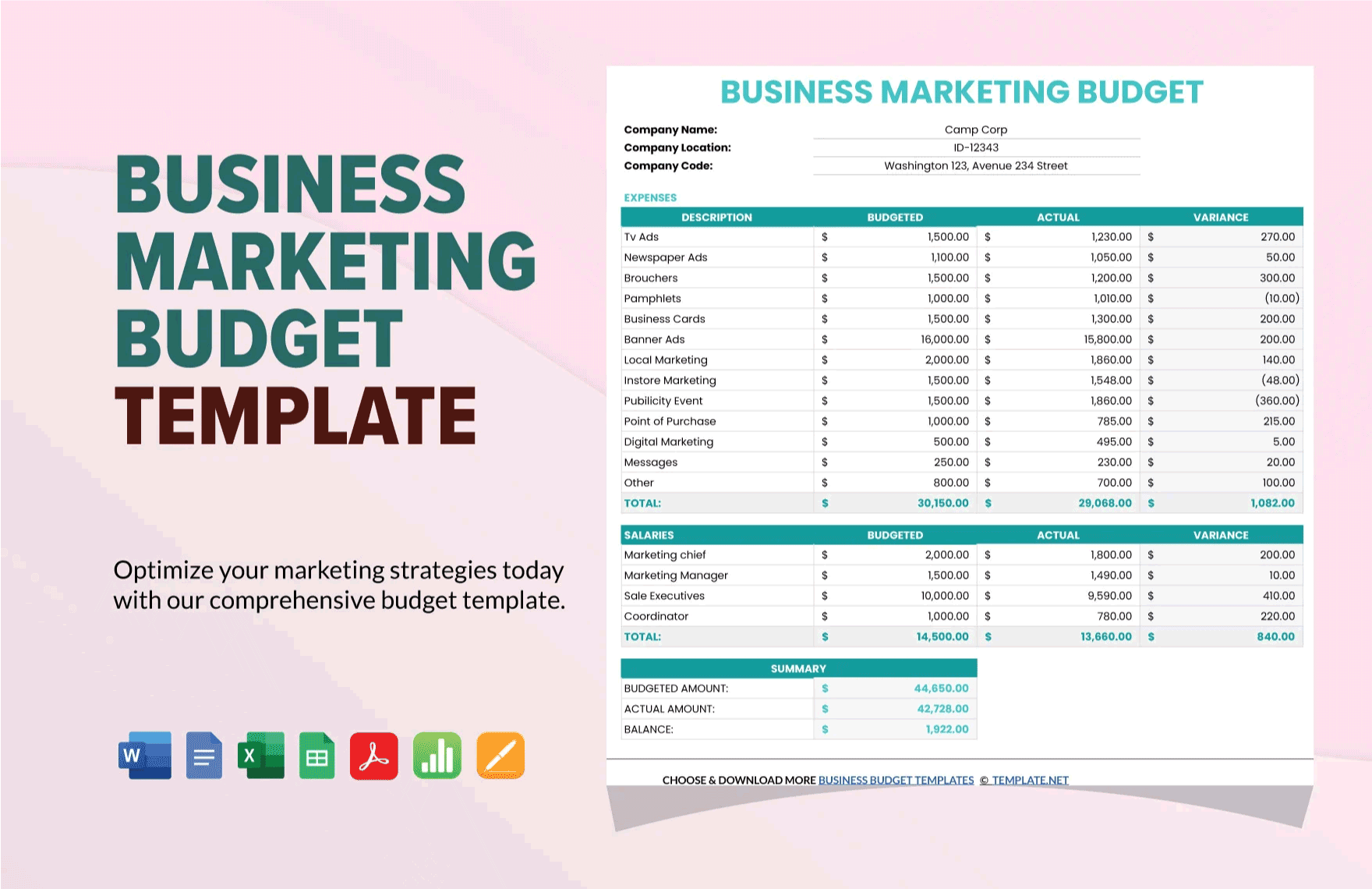

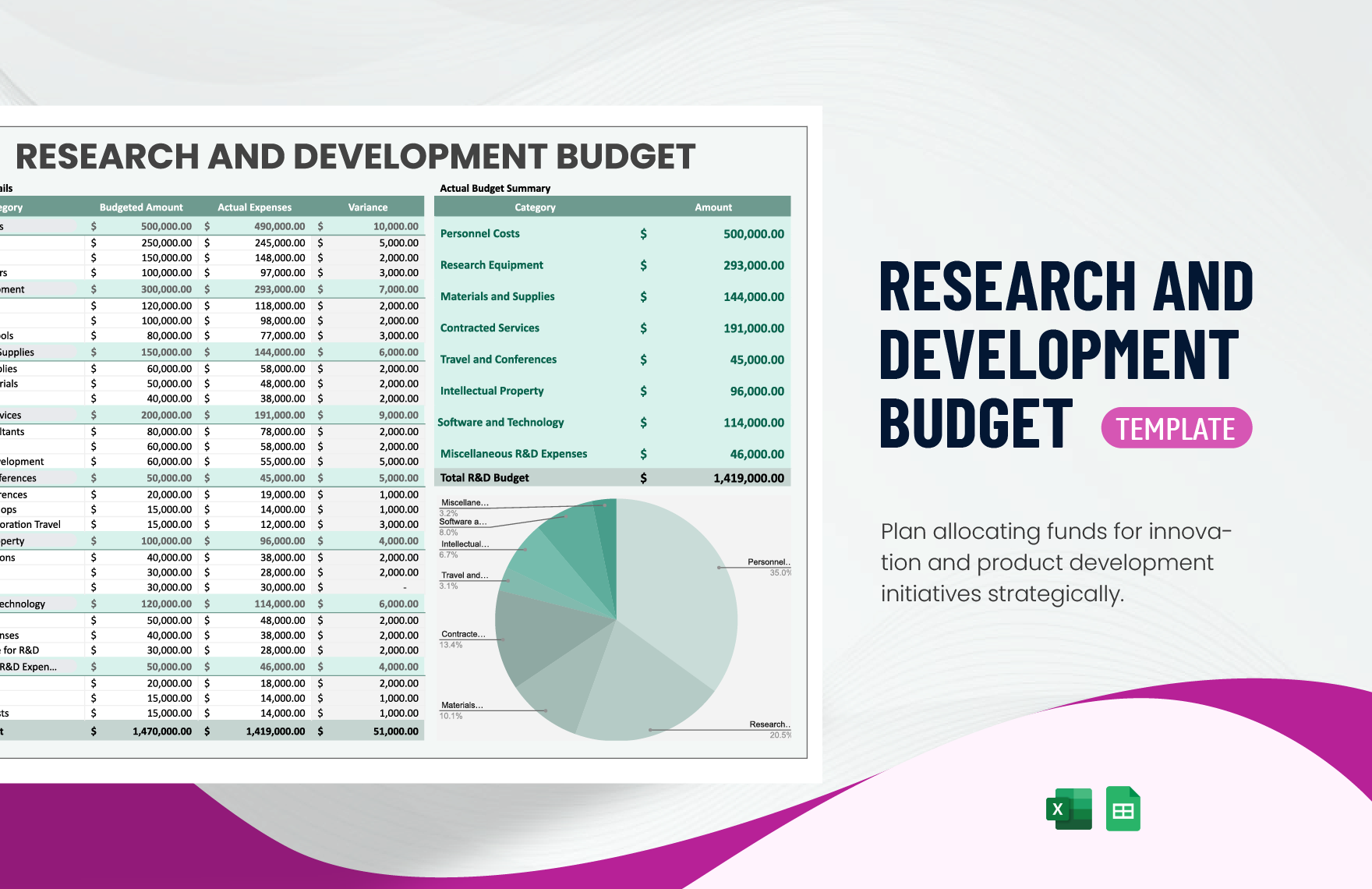

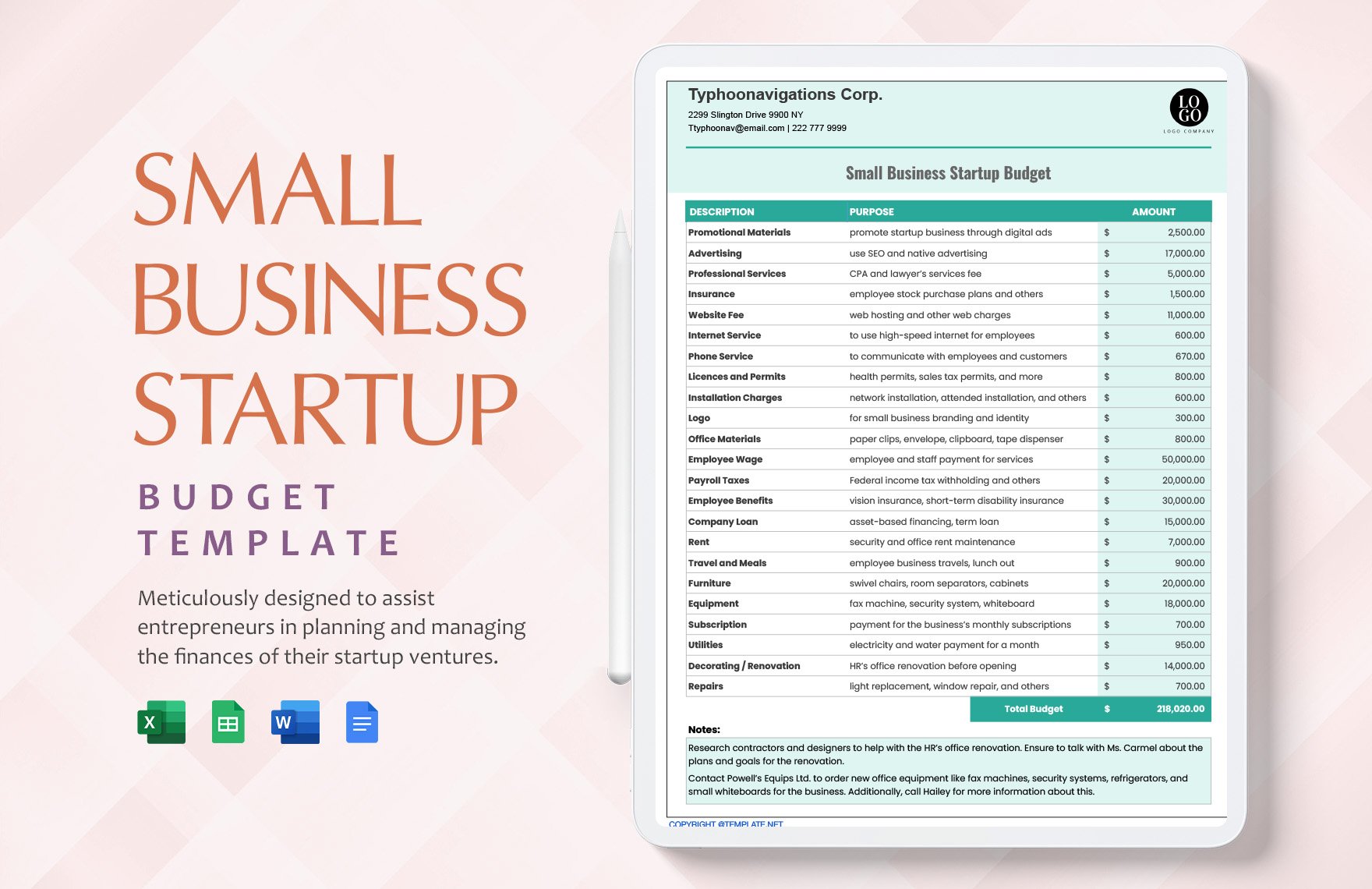

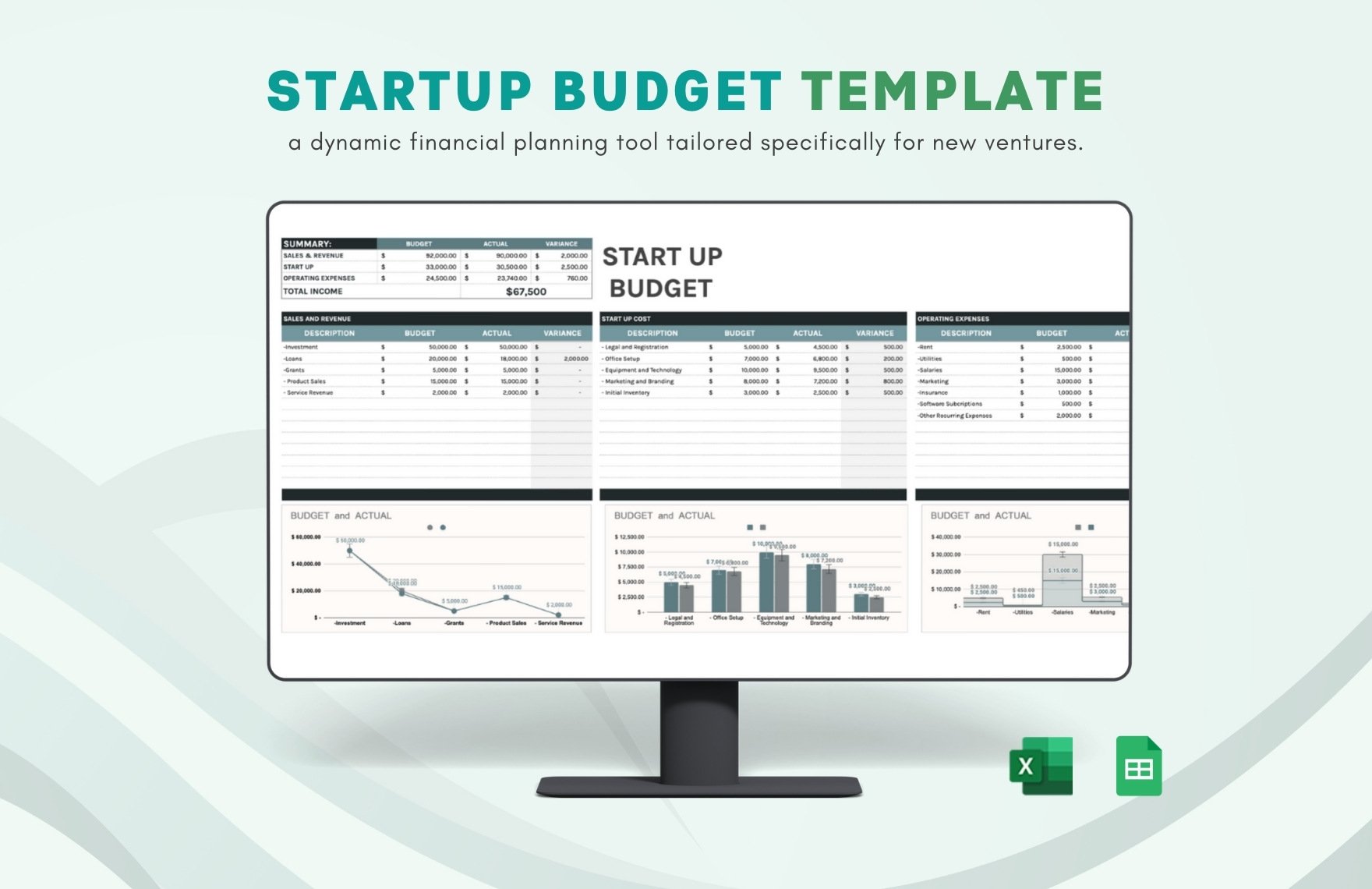

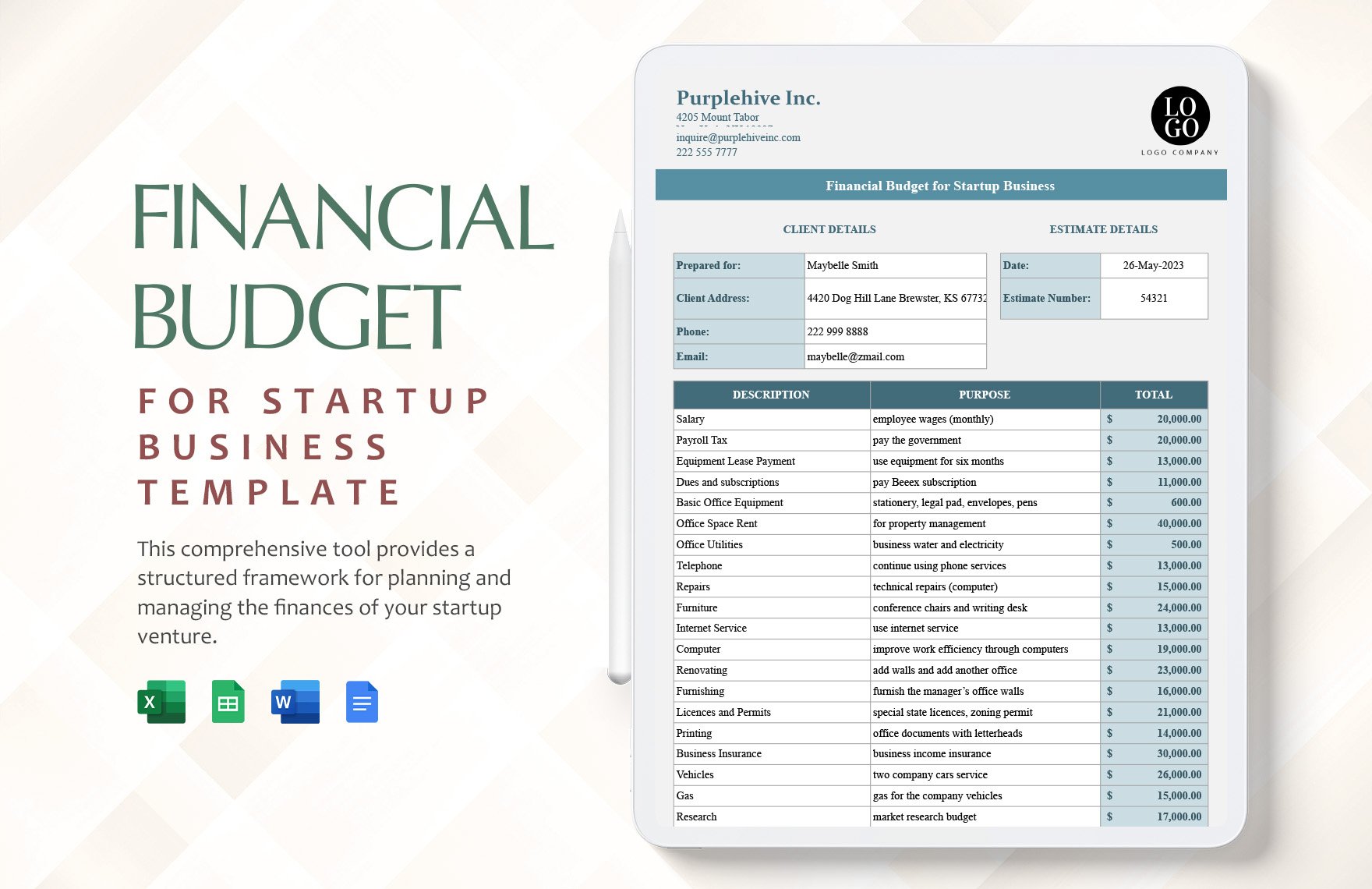

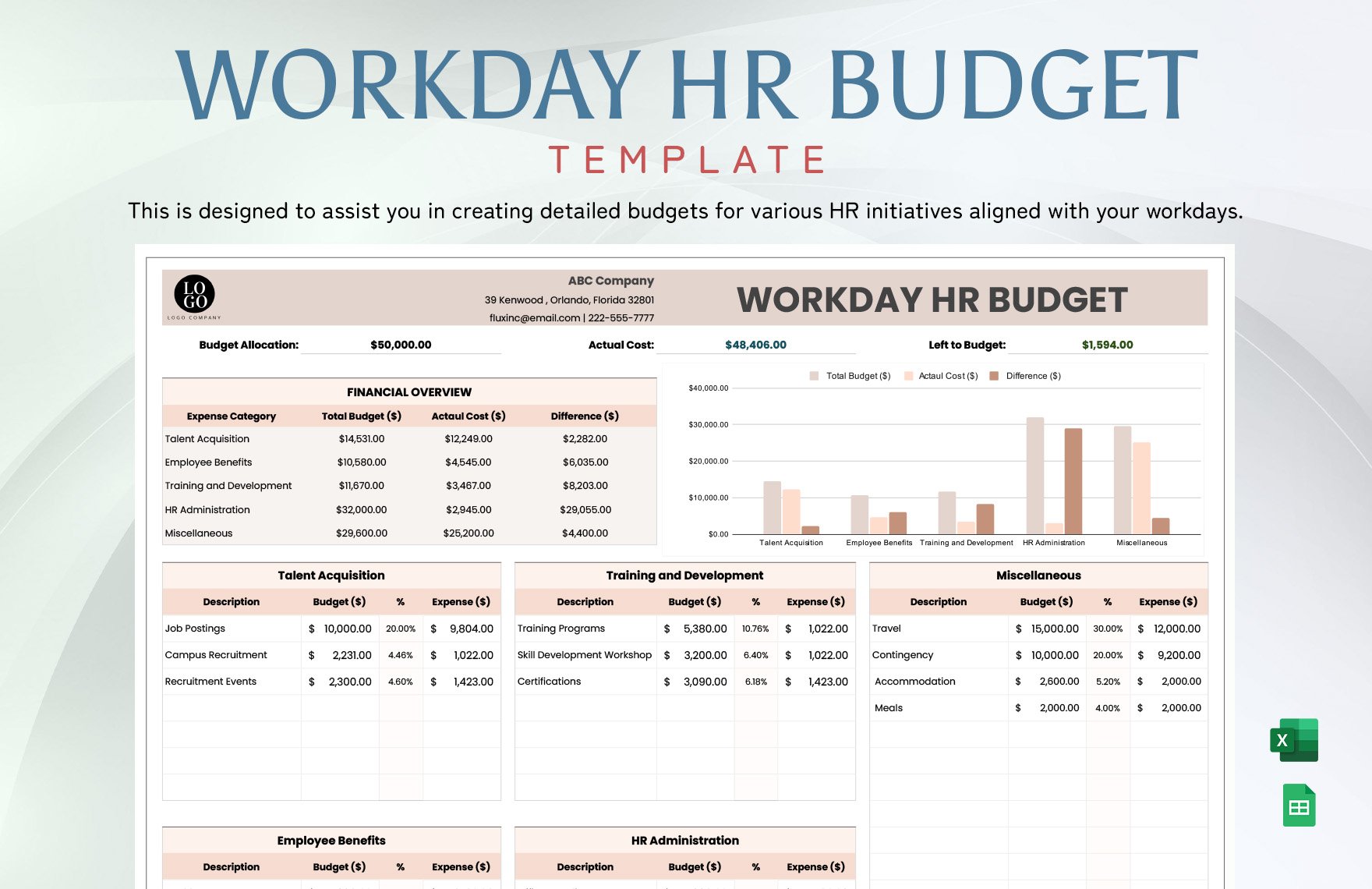

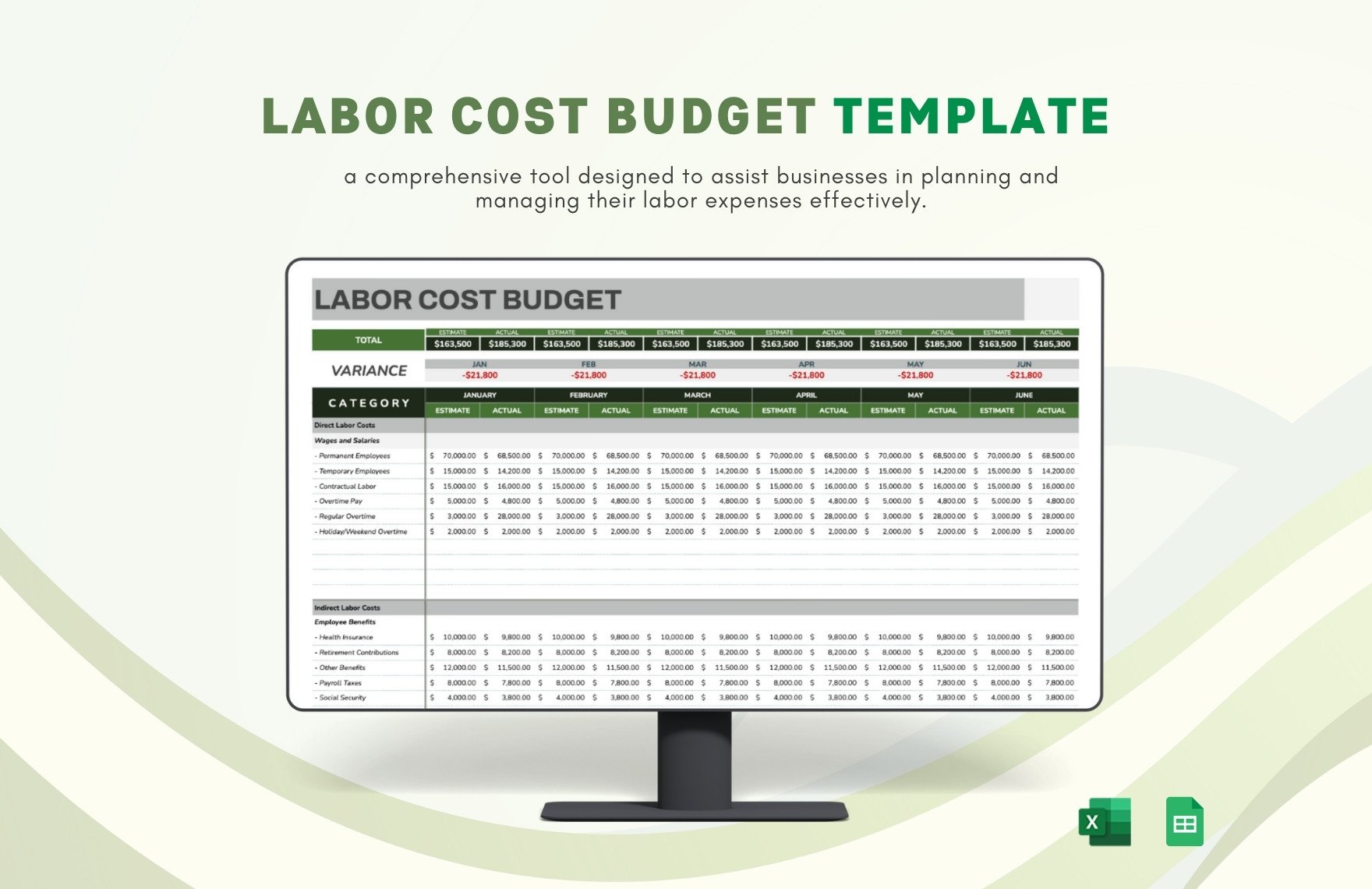

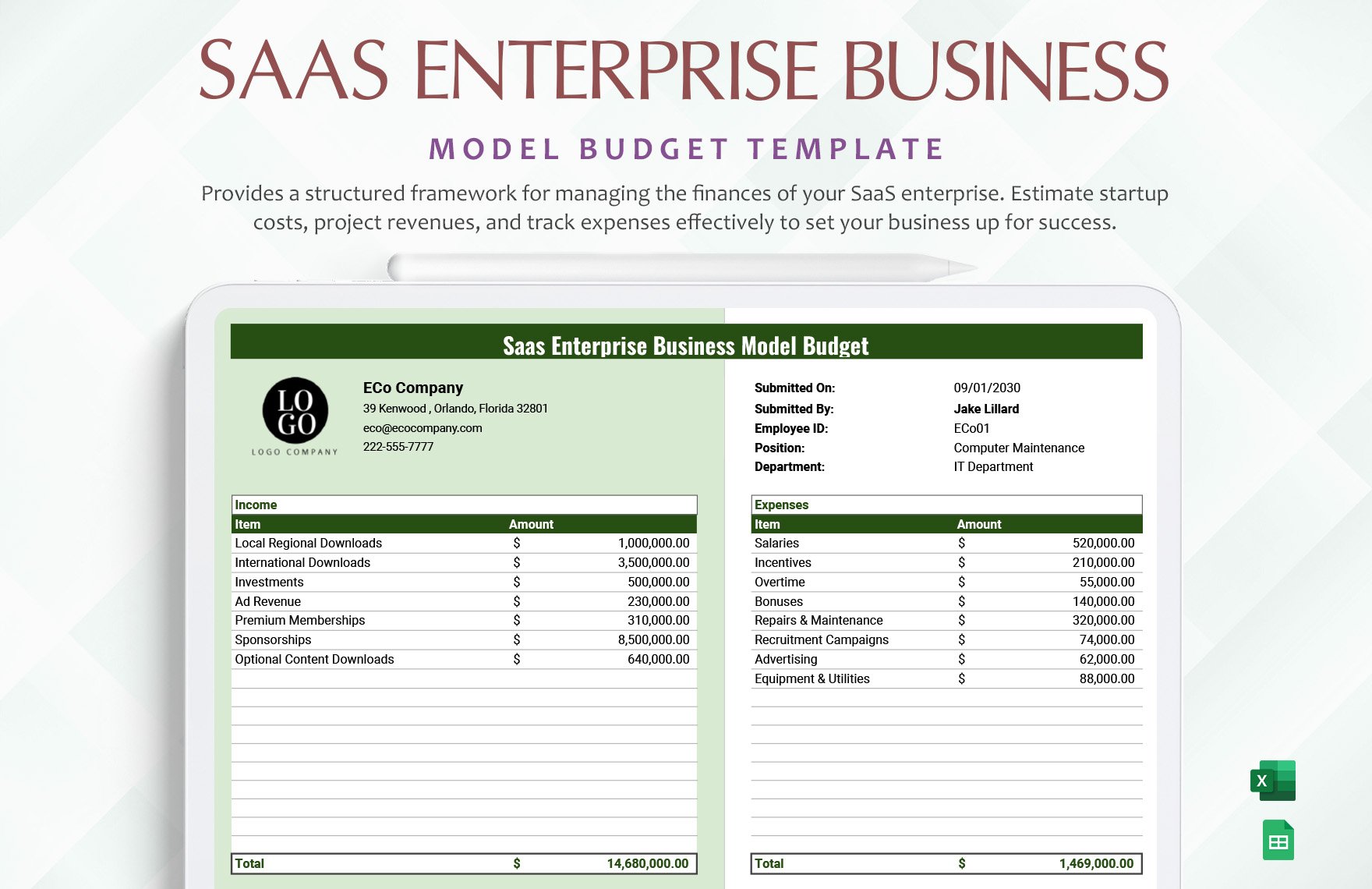

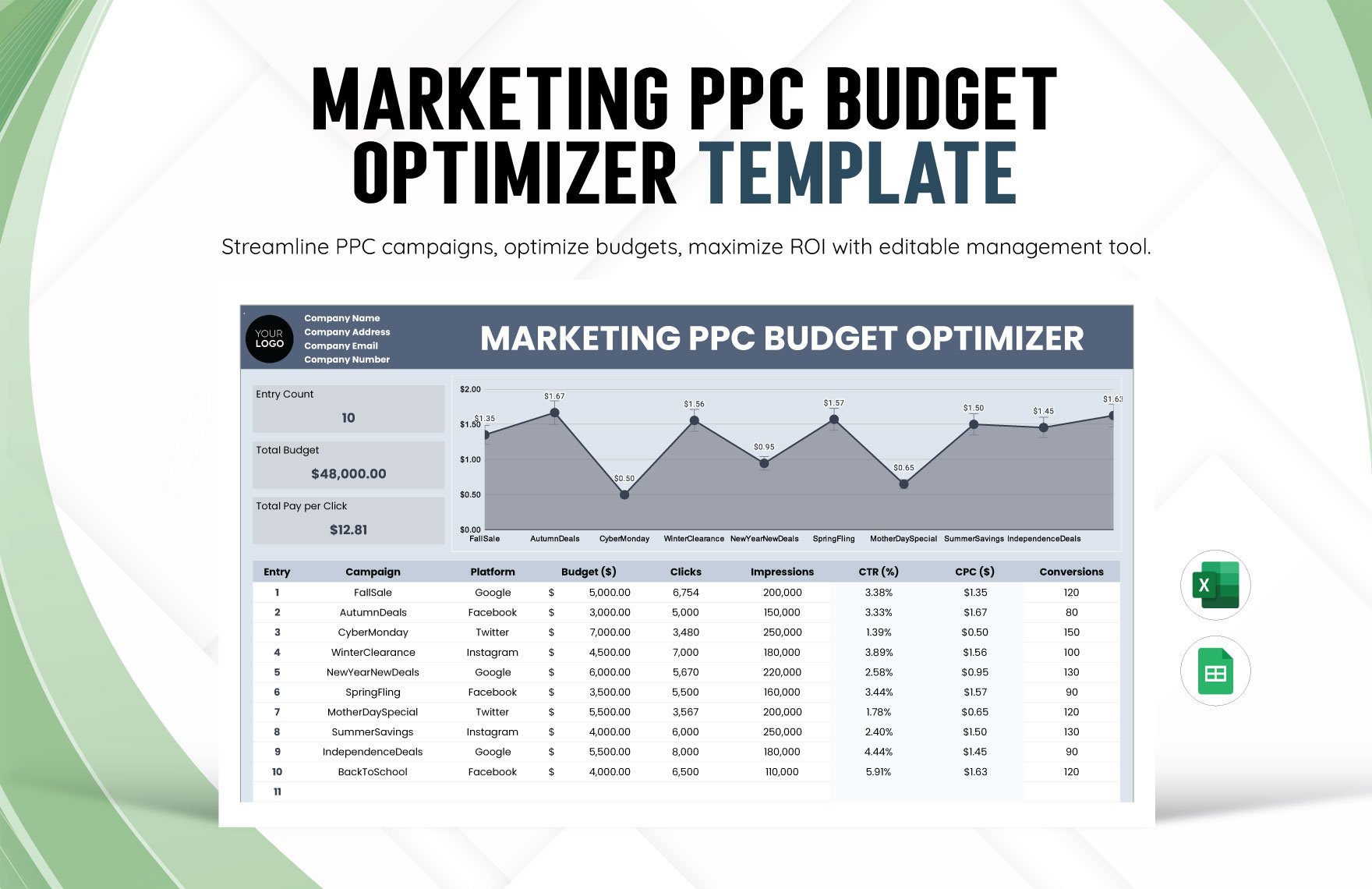

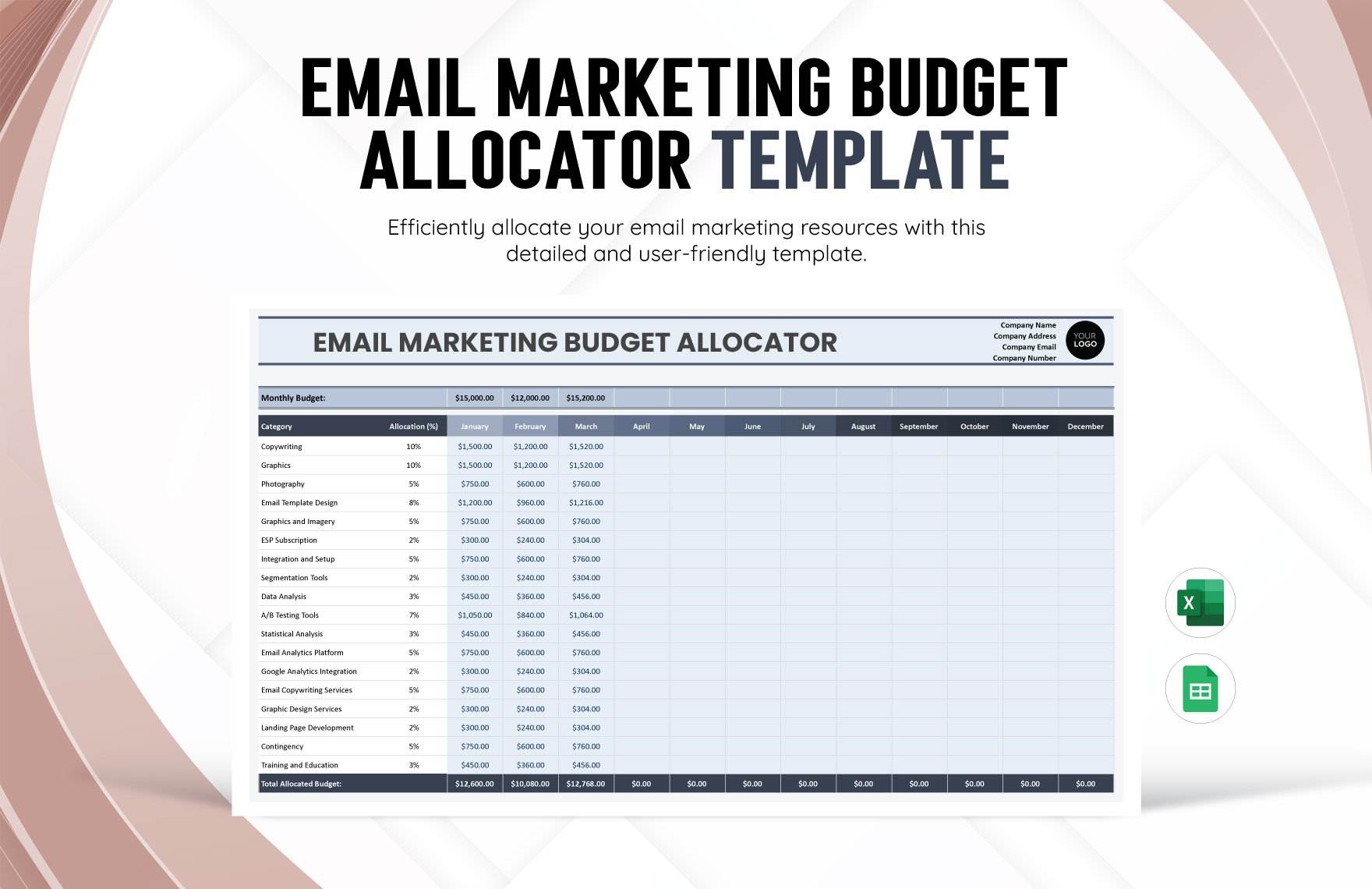

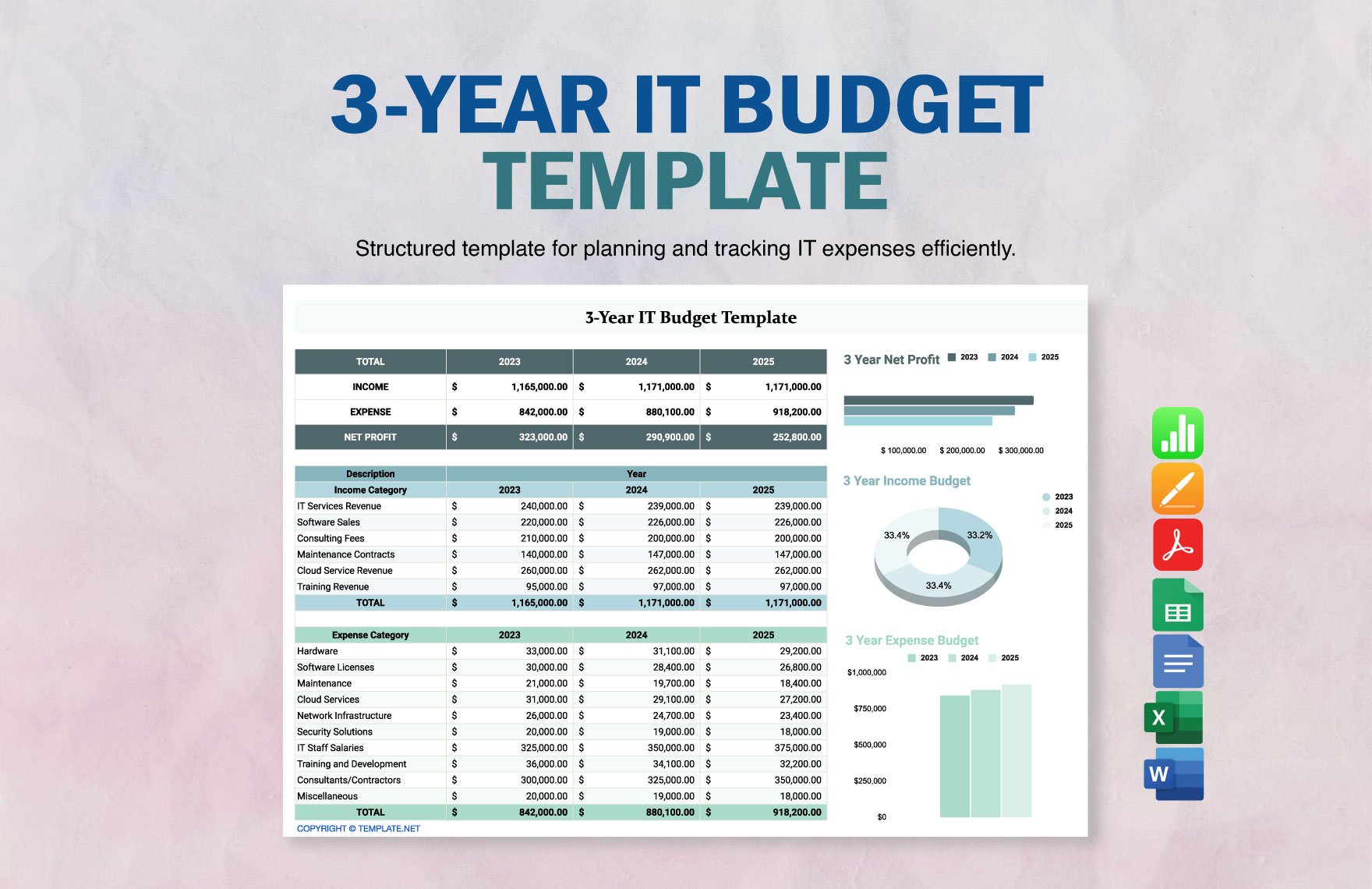

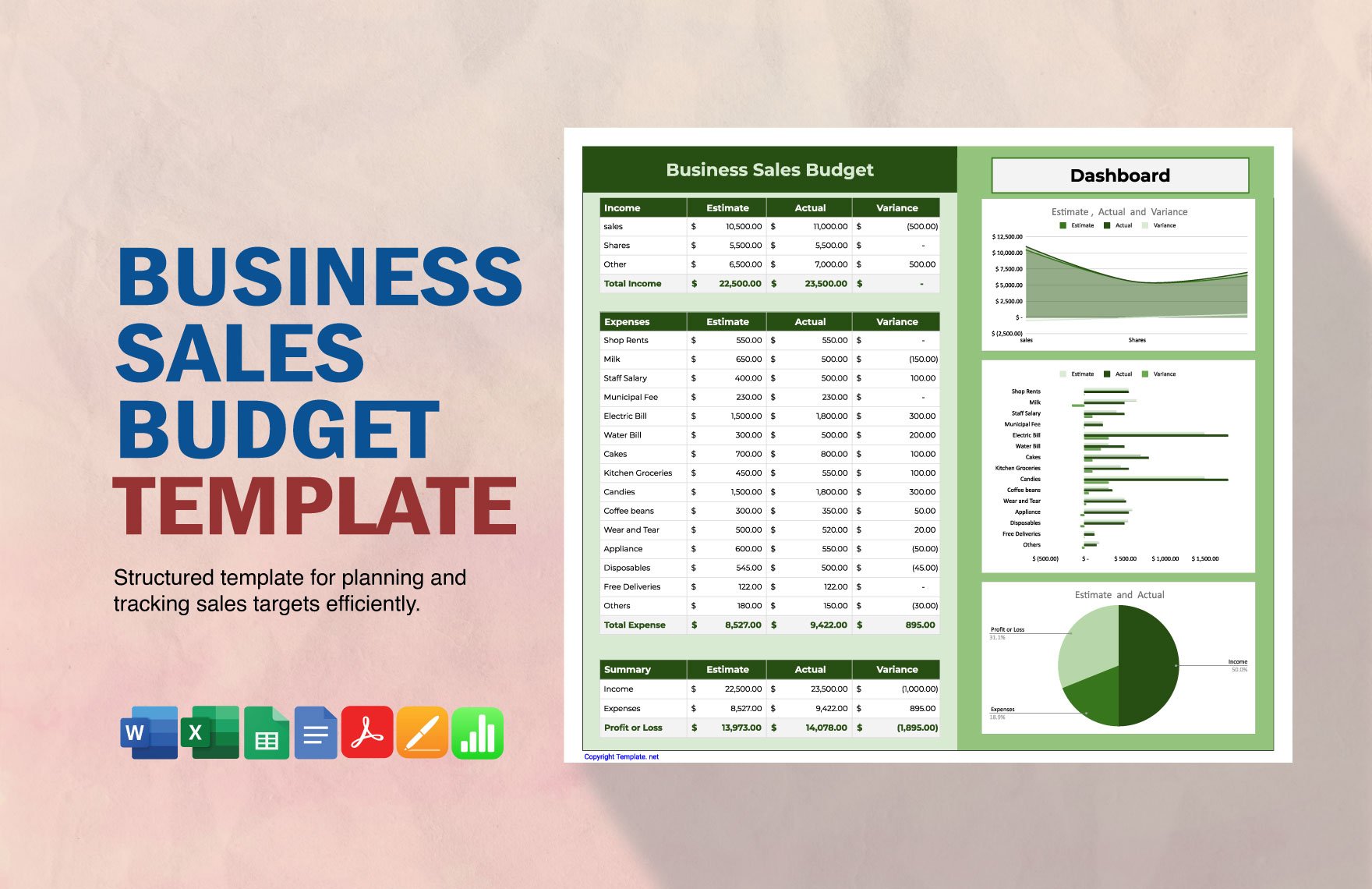

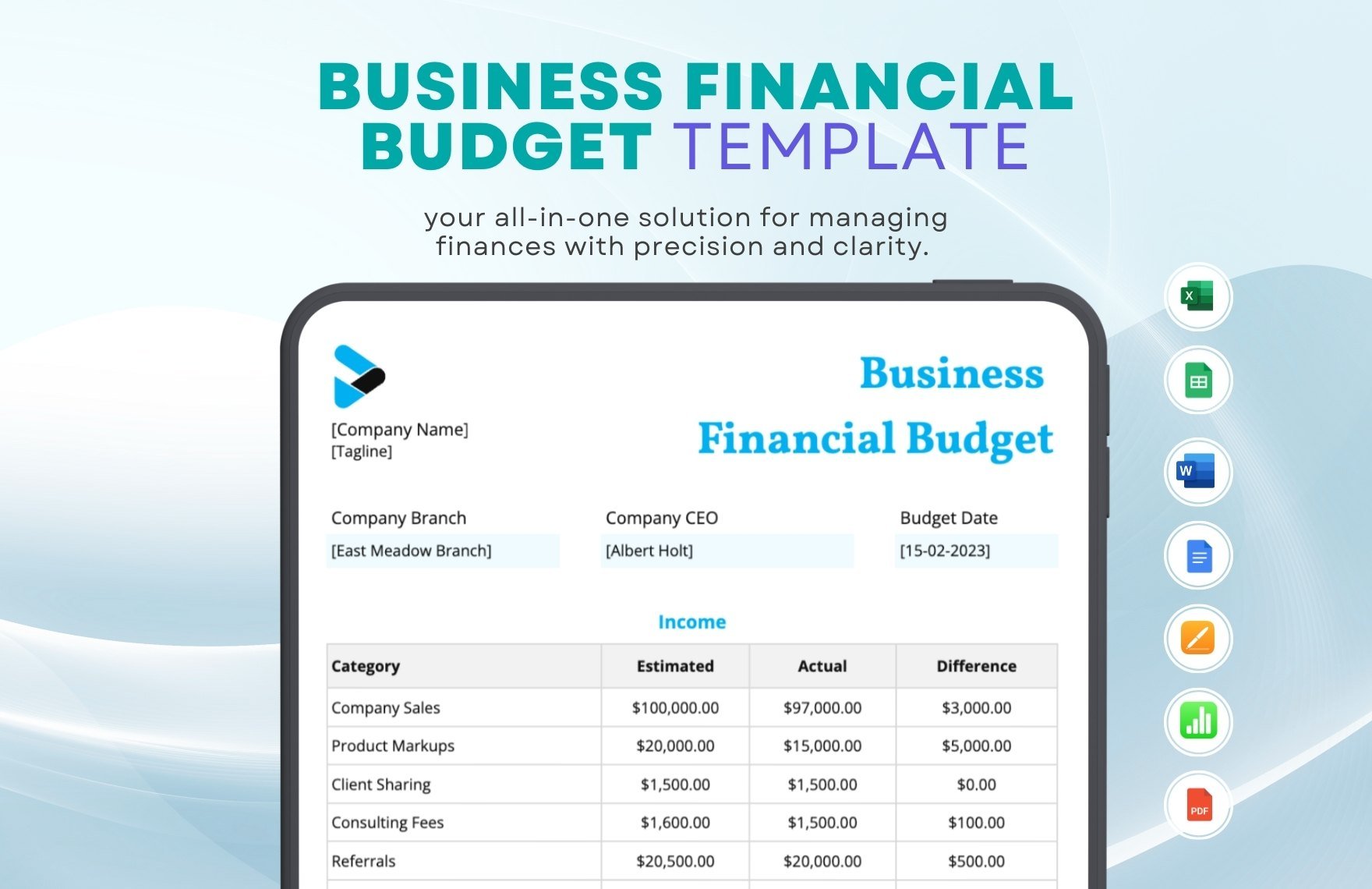

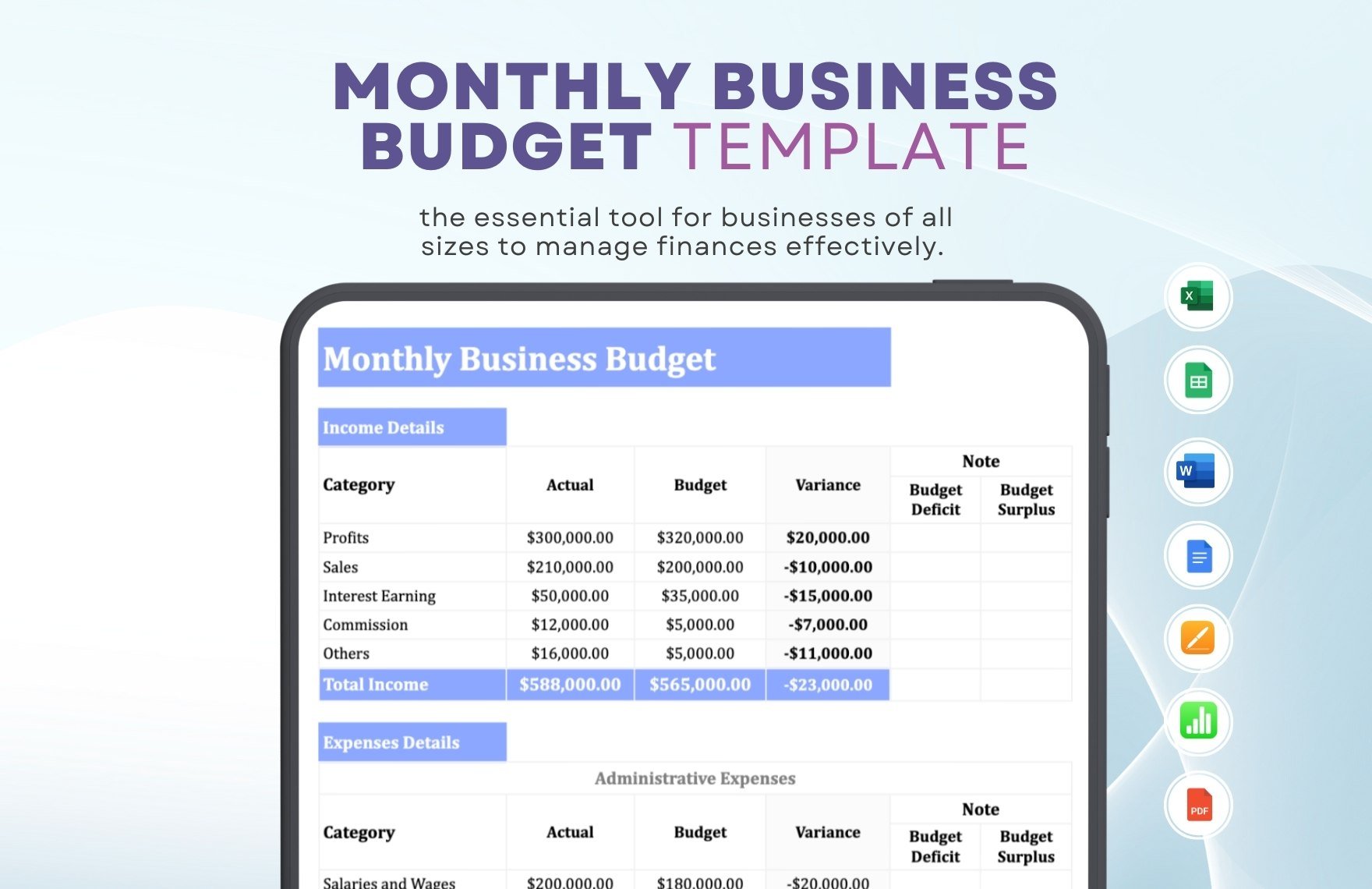

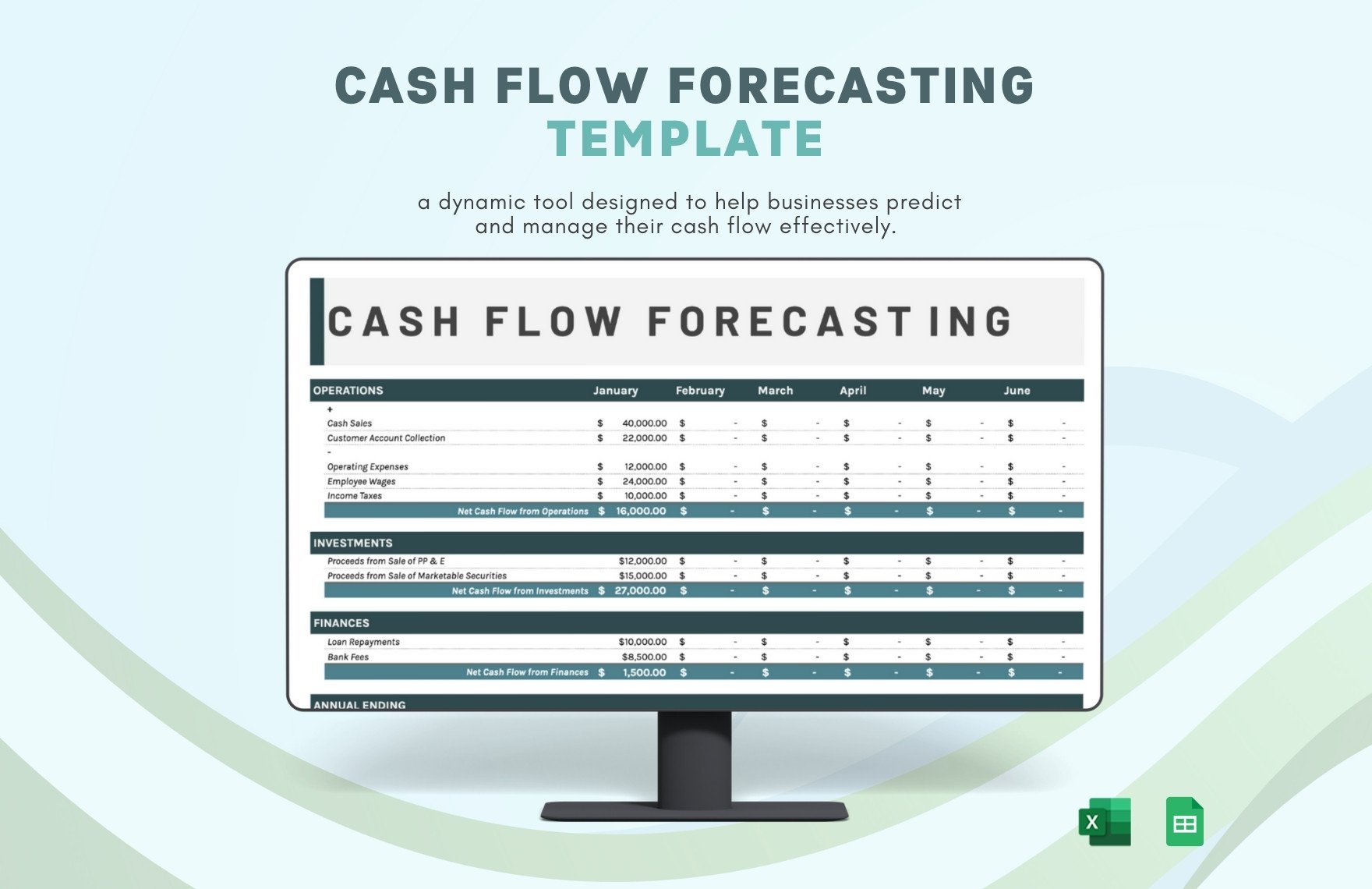

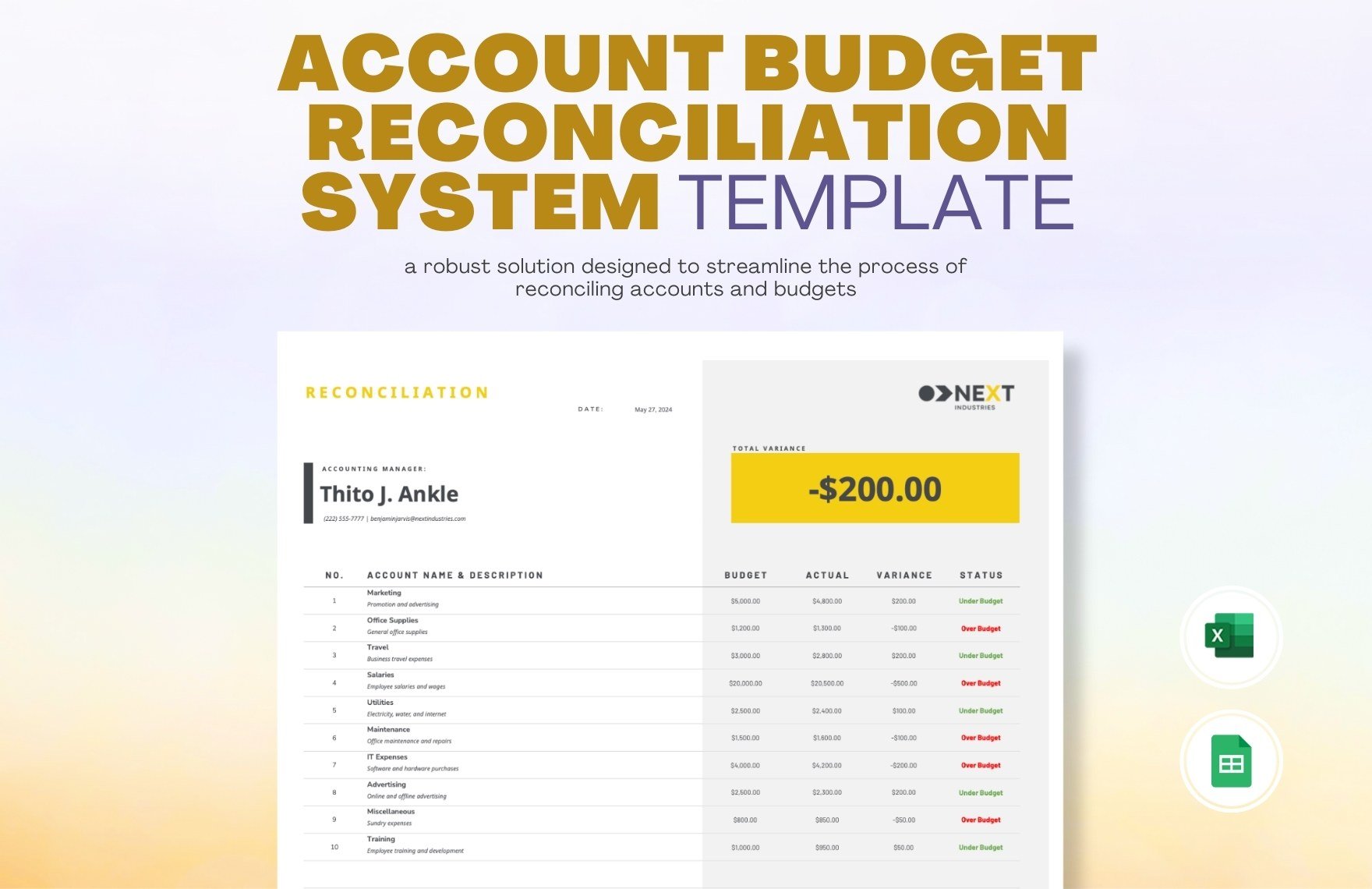

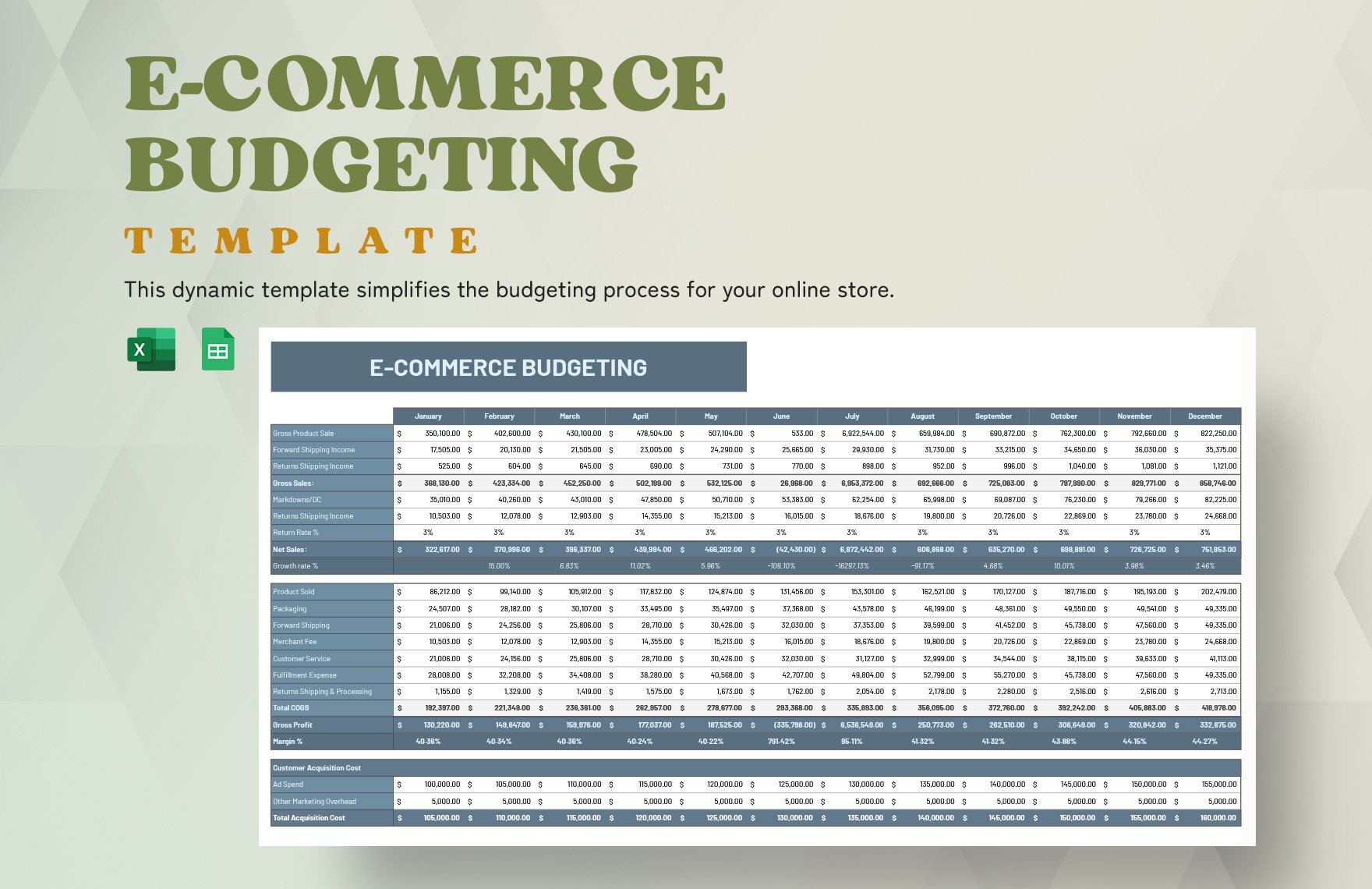

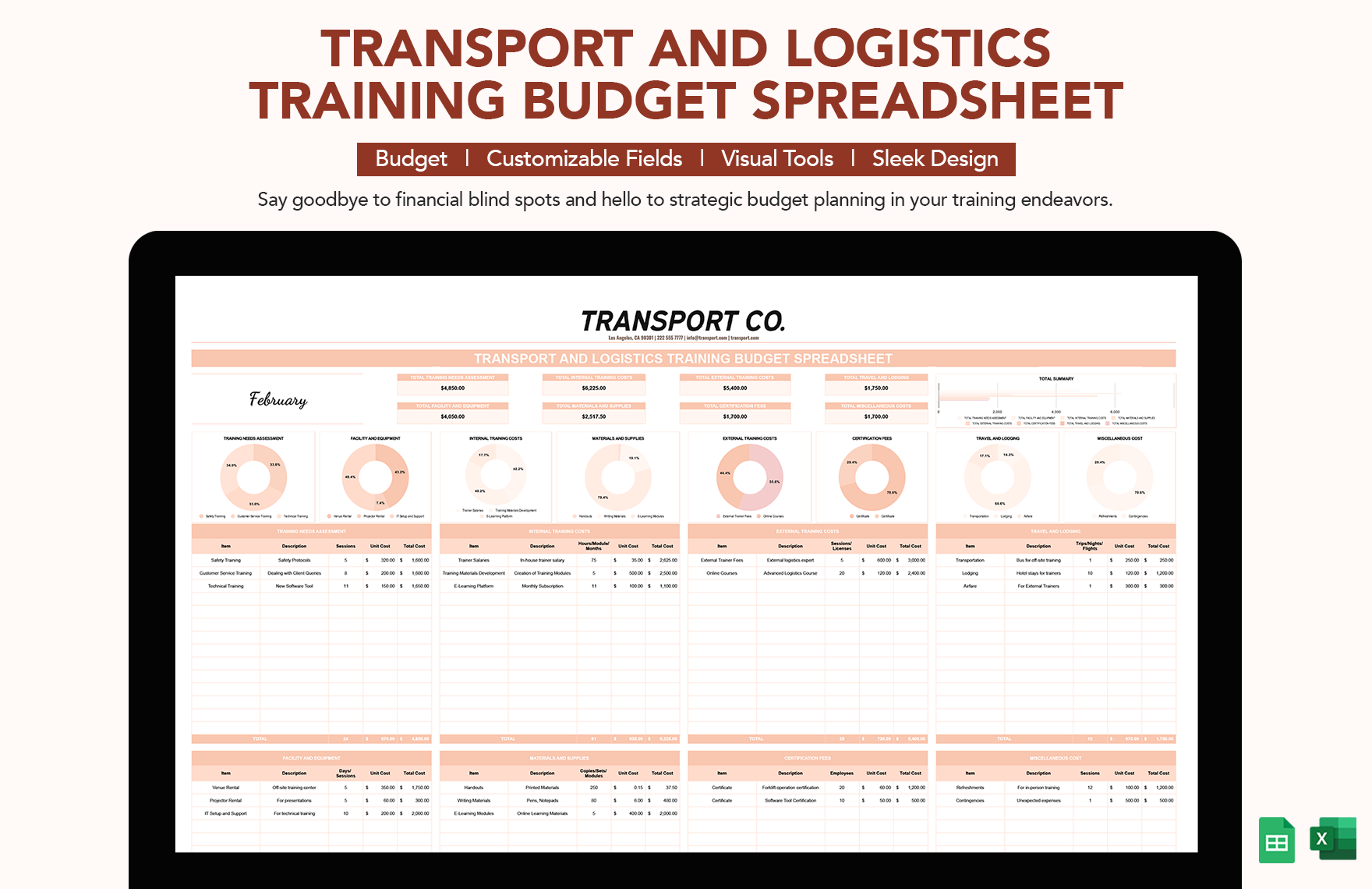

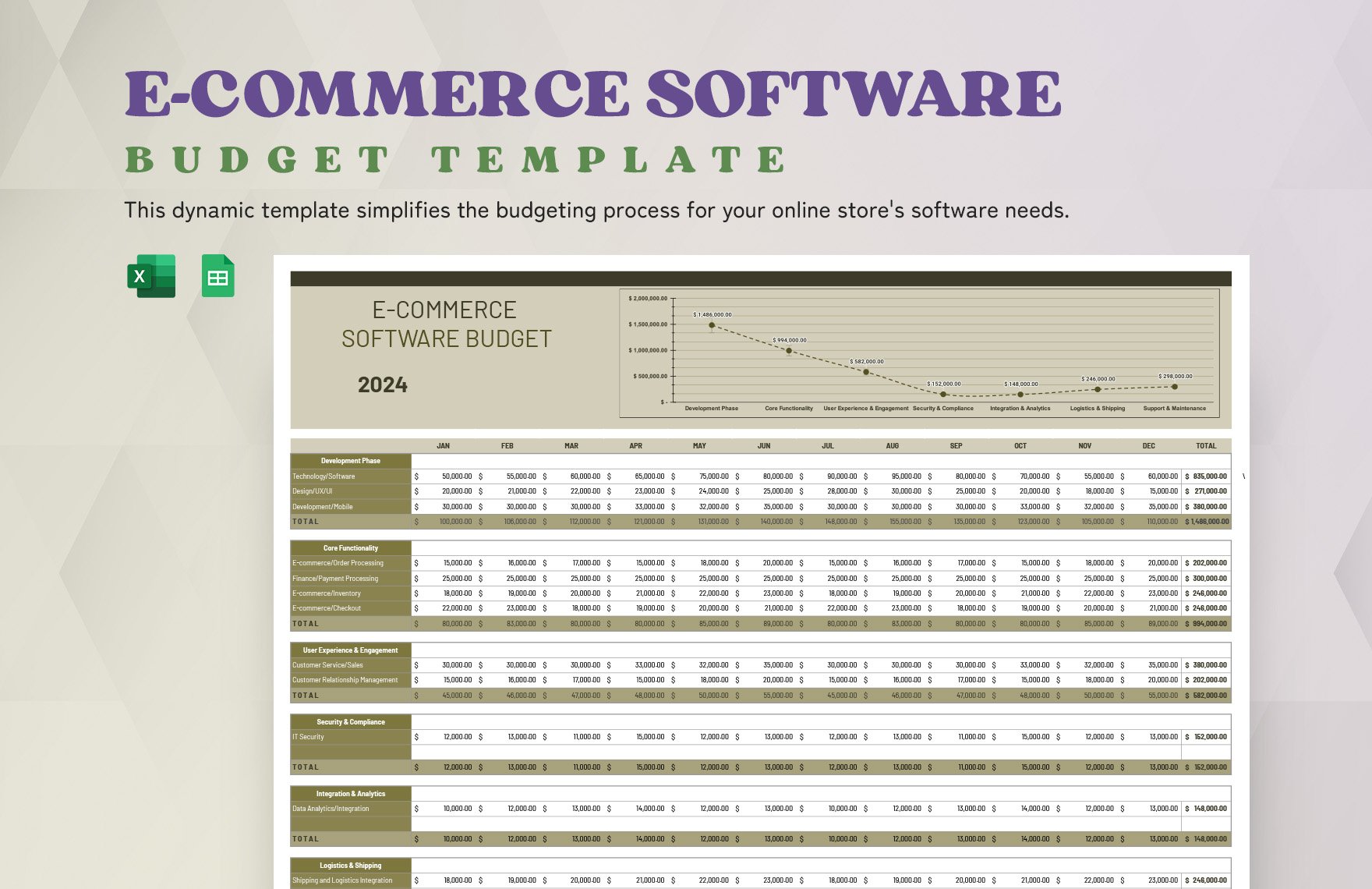

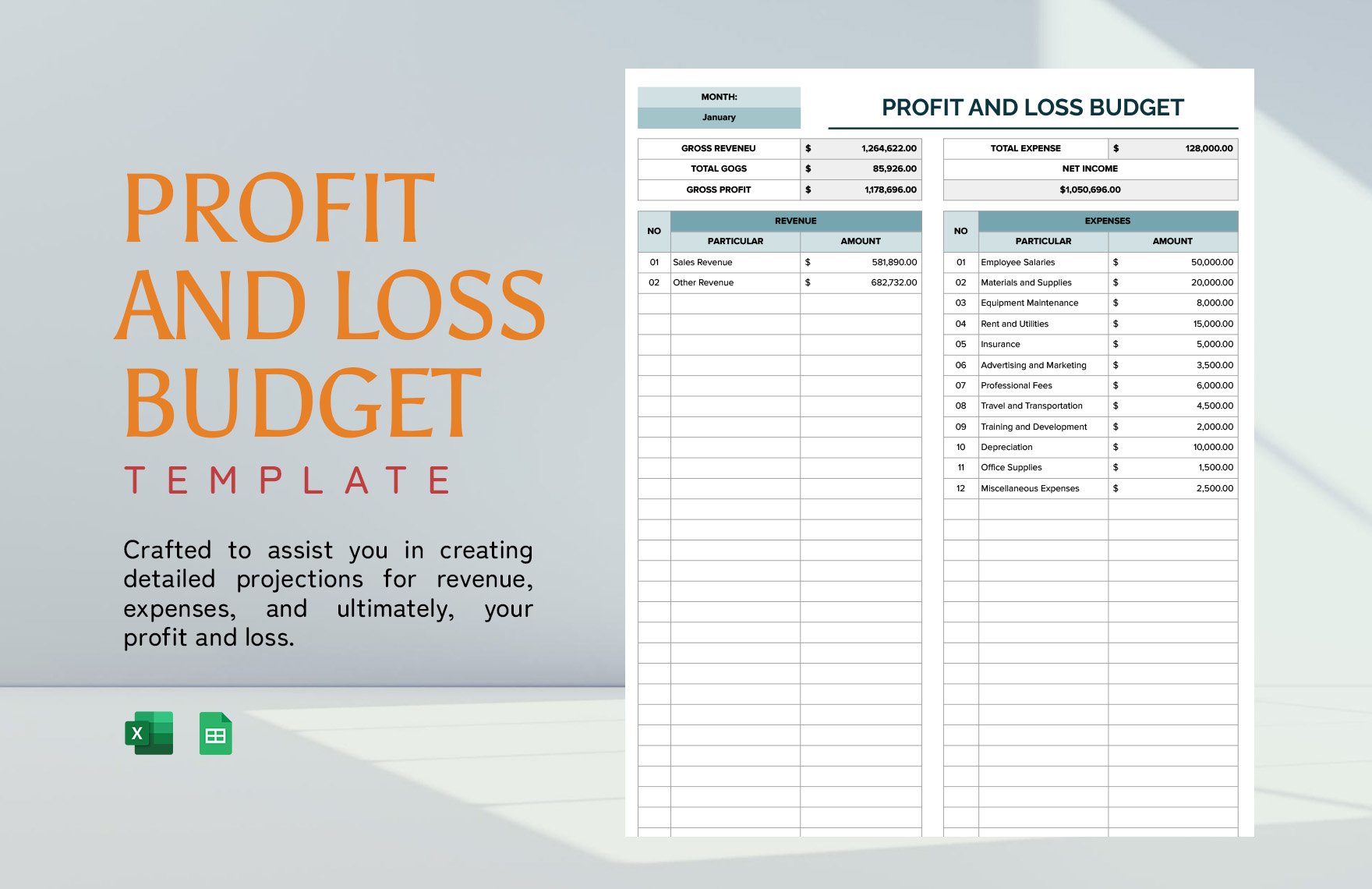

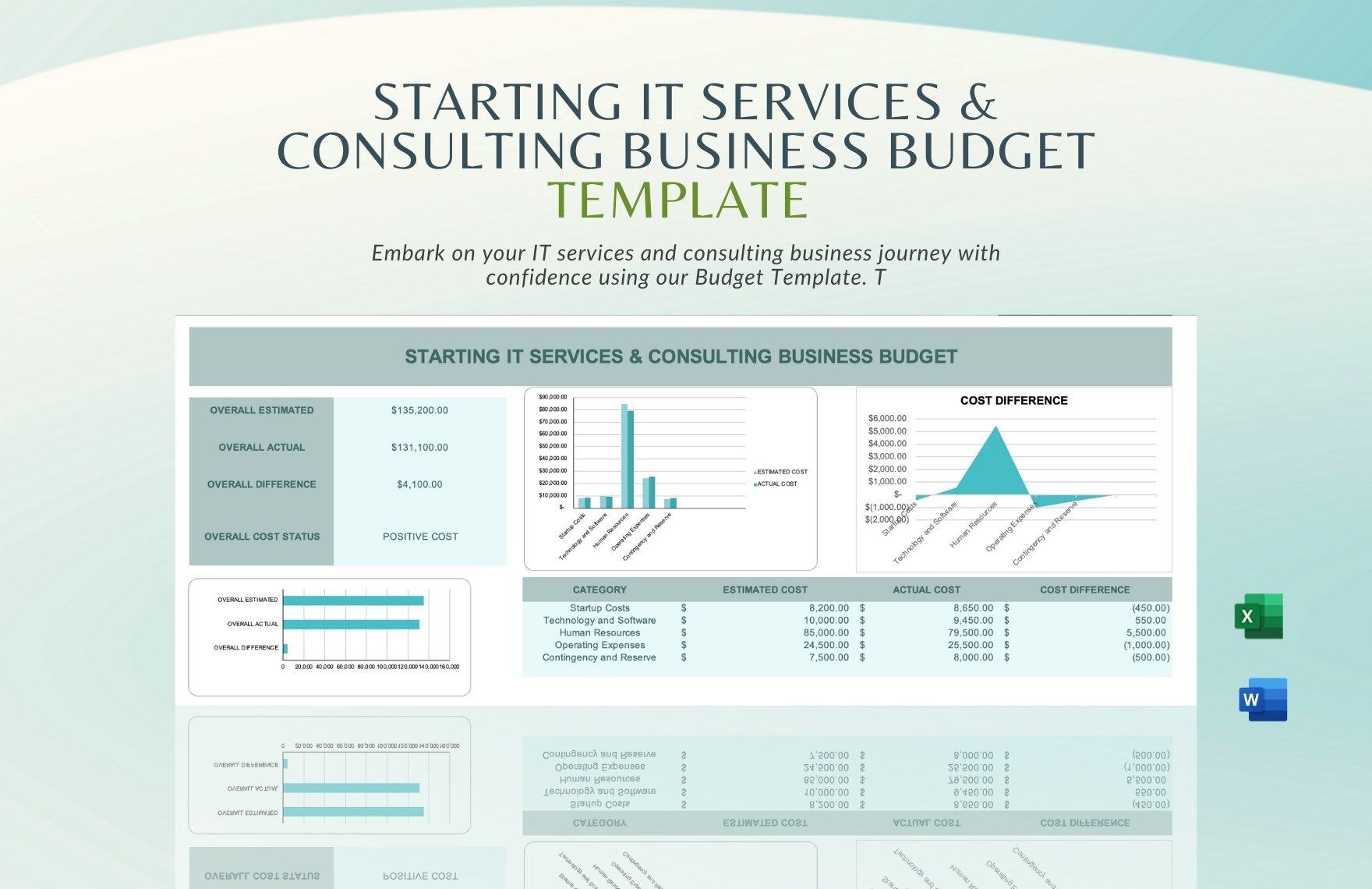

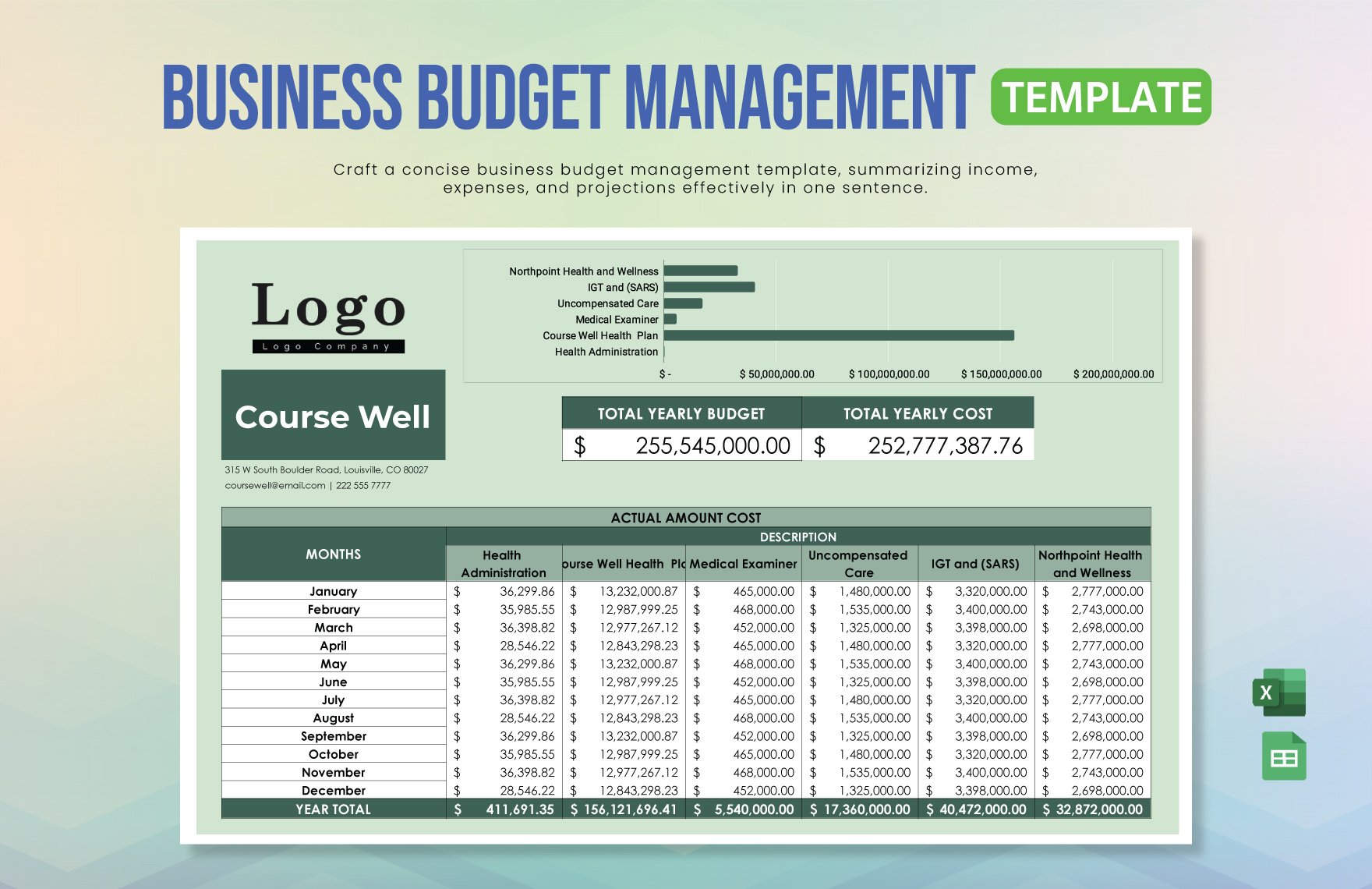

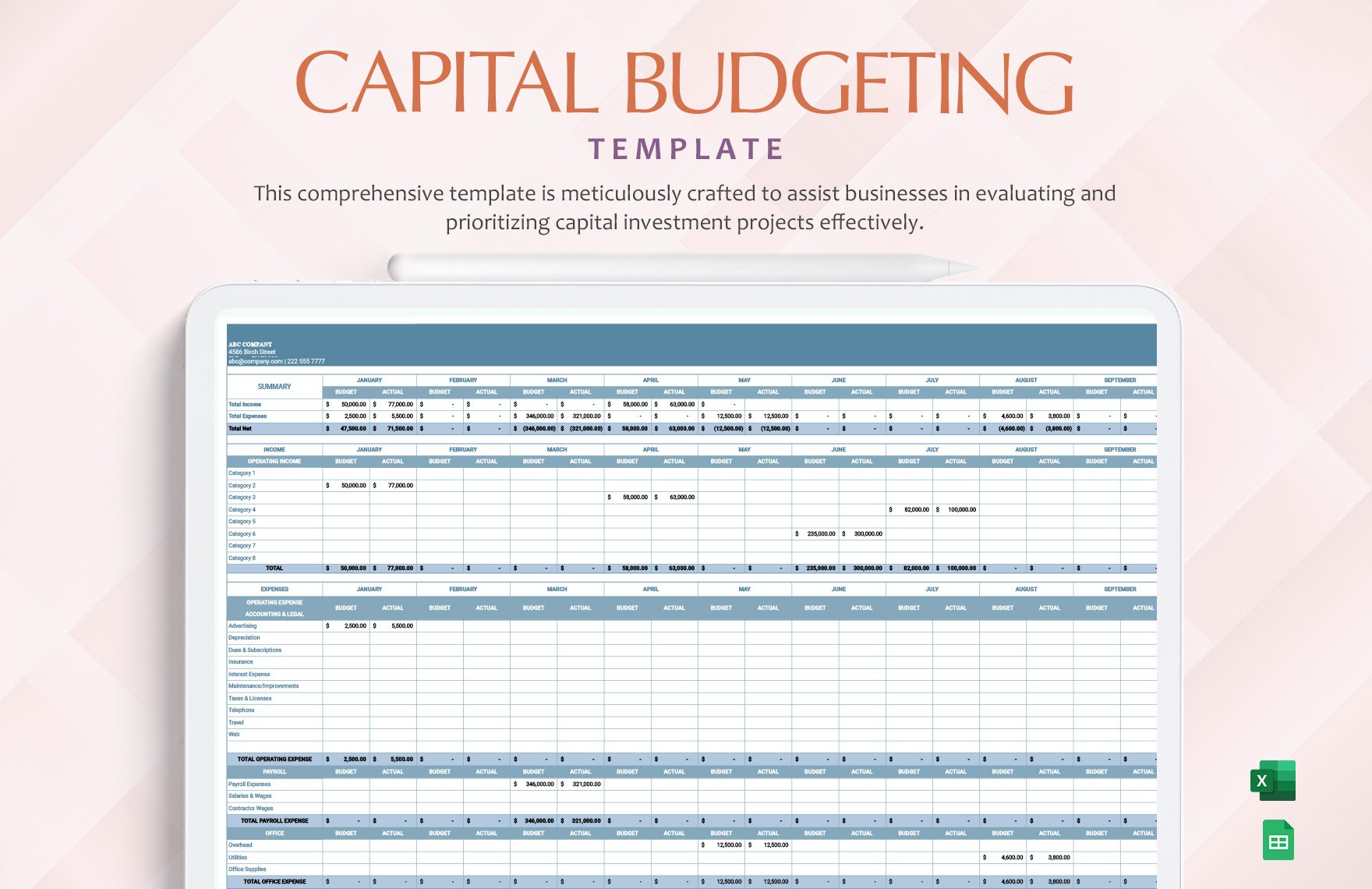

Bring your financial strategies into sharp focus with our free pre-designed Business Budget Templates in Microsoft Excel by Template.net. Designed for entrepreneurs and professionals seeking to manage their finances effectively, these templates allow you to create a comprehensive budget even without accounting expertise. Whether you're looking to forecast yearly expenses for a startup initiative or manage department spending for a large corporation, our templates are tailored to meet your needs. With a wealth of free pre-designed templates available, along with printable and downloadable files in Microsoft Excel format, experience the ease of crafting detailed financial plans without the need for complex spreadsheet skills. These beautiful pre-designed templates also offer customizable layouts suitable for both digital presentations and physical reports.

Explore a diverse collection of premium pre-designed Business Budget Templates in Microsoft Excel that cater to various financial scenarios, from personal budgeting to intricate corporate financial planning. Our library of templates is regularly updated to include new designs, ensuring that you always have access to the latest tools. Maximize the potential of your budget planning with the option to download or share your completed templates through links, print, or email for wider distribution and collaboration. Use the free templates for immediate needs and upgrade to premium versions for more advanced features, giving you the flexibility to cover all your budgeting requirements effectively.