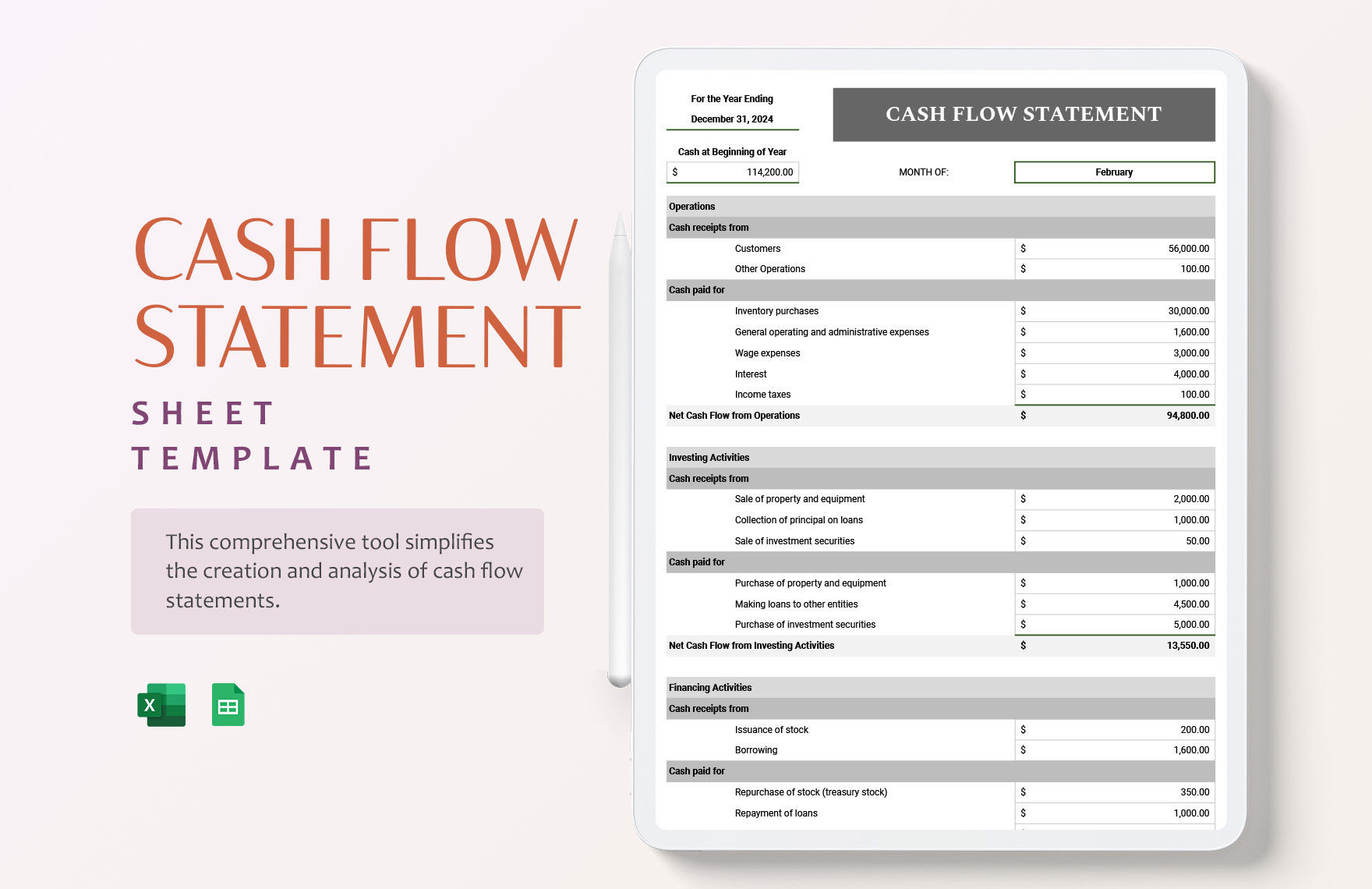

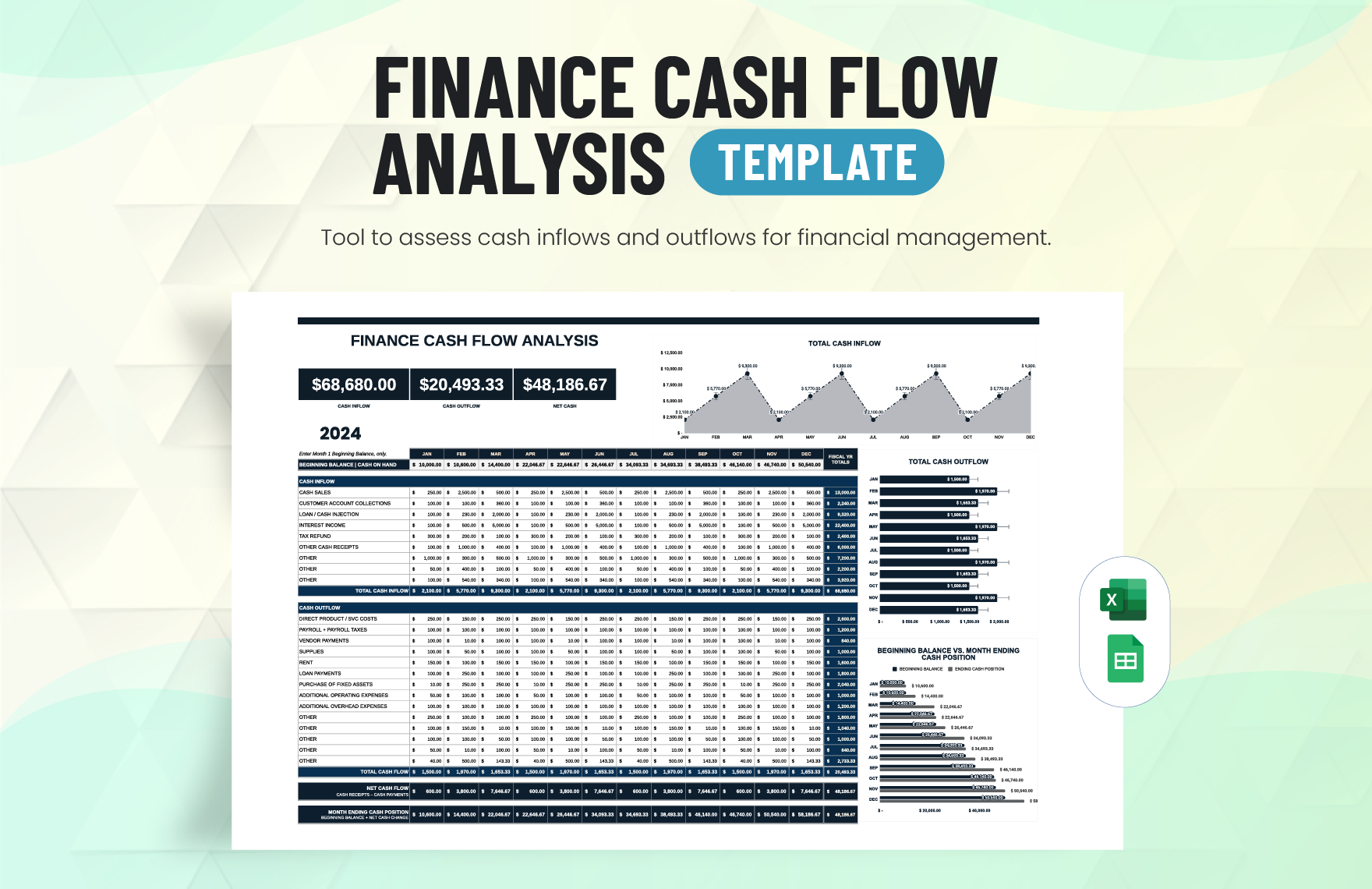

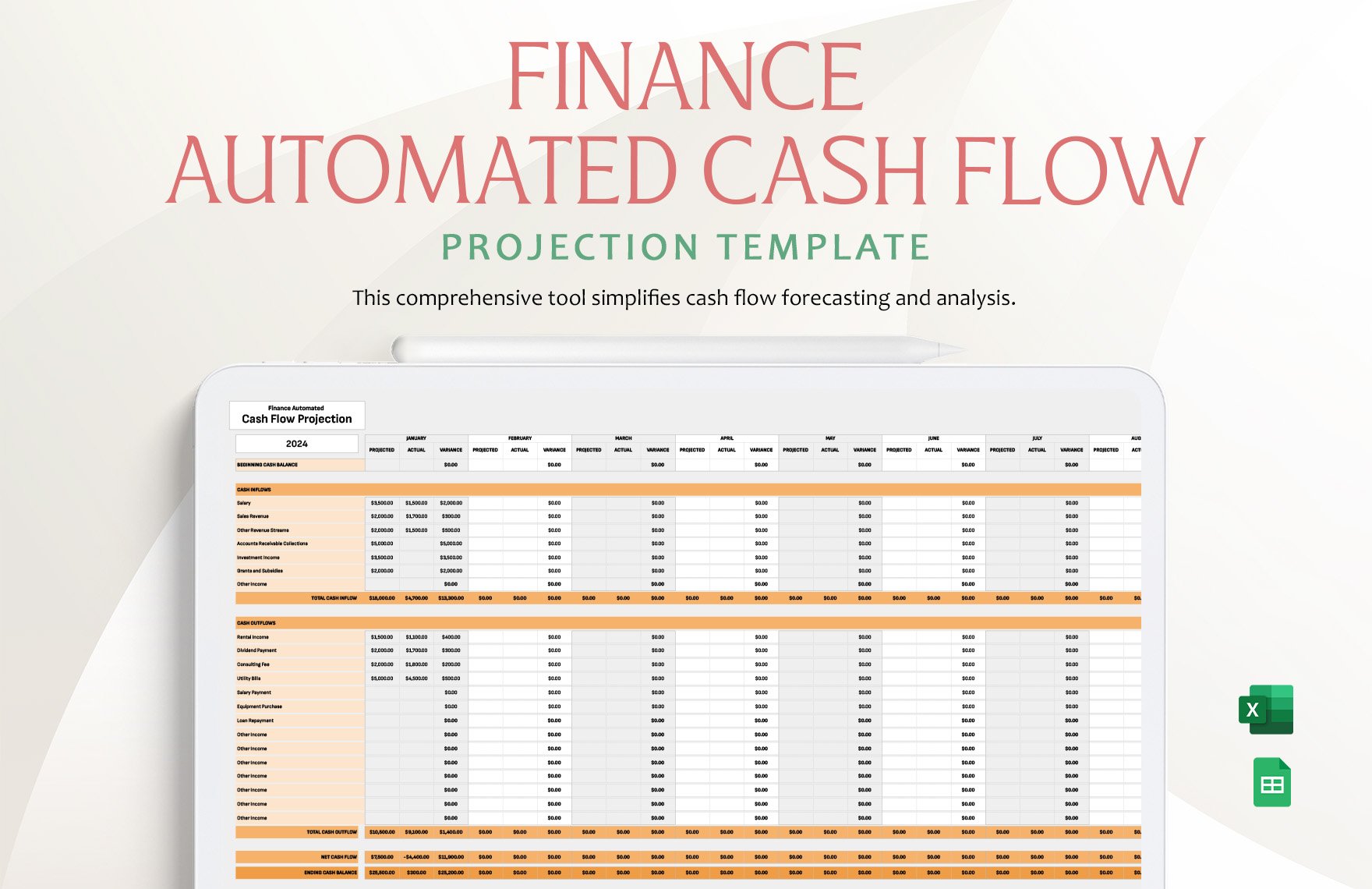

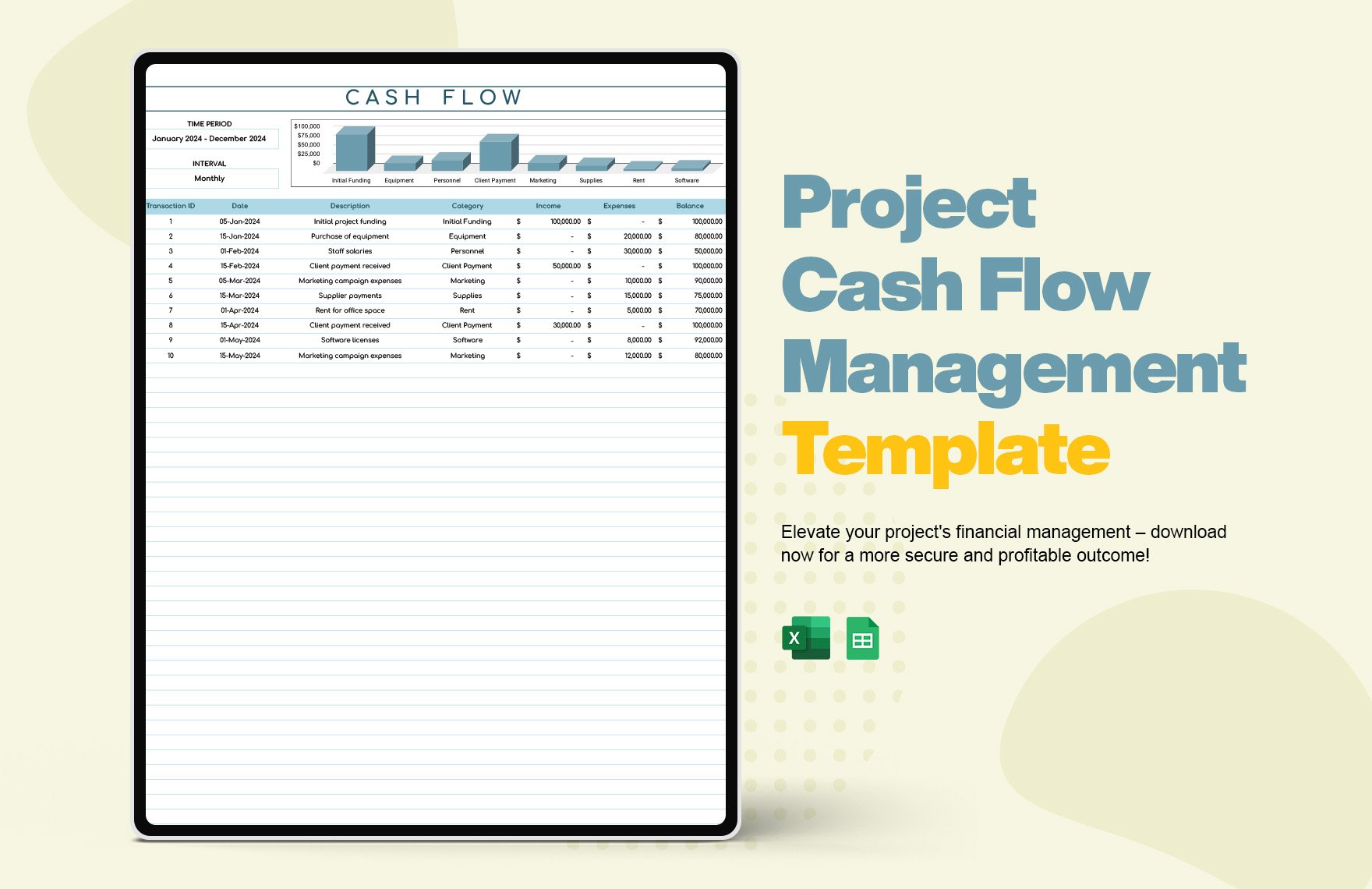

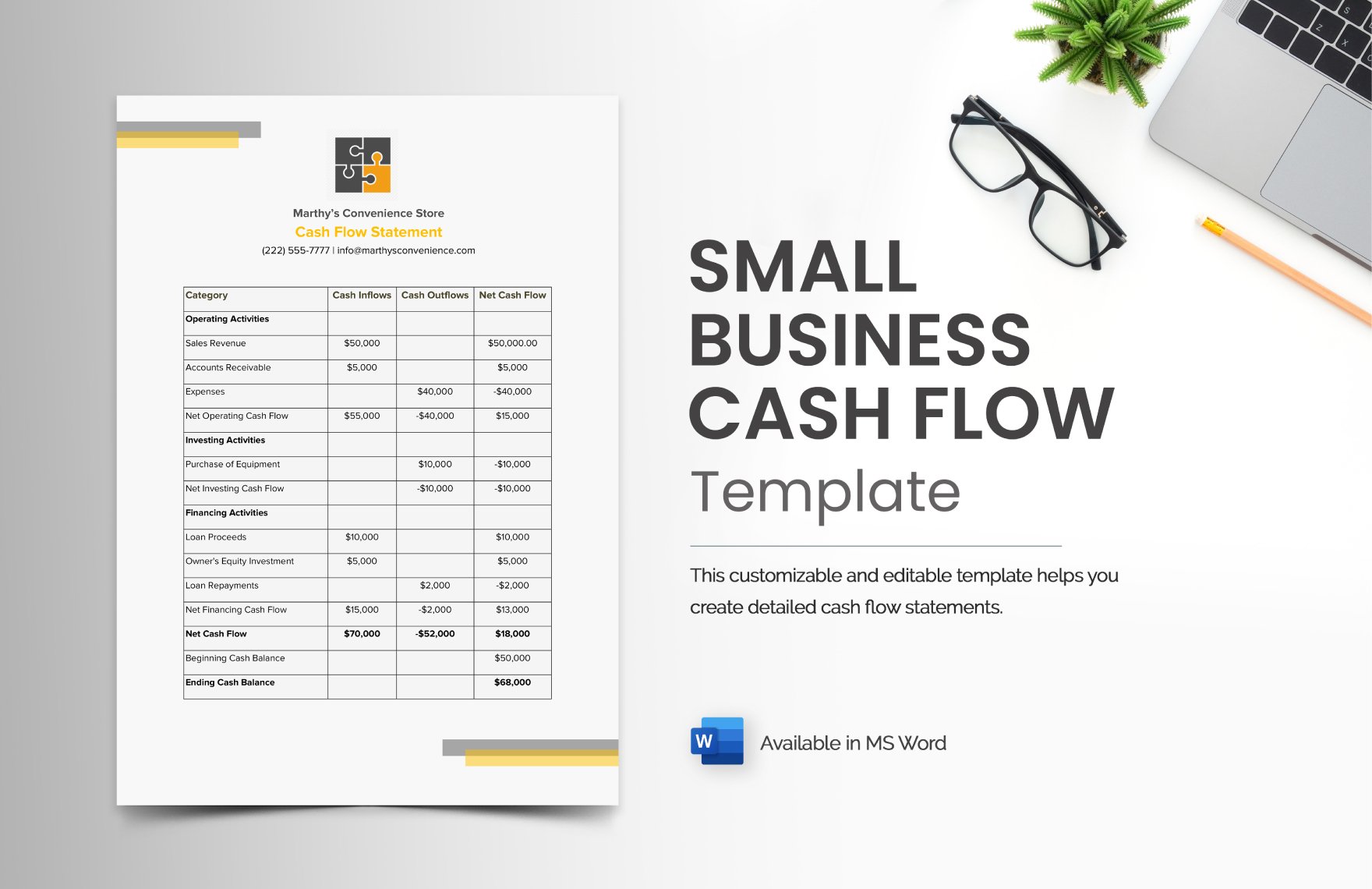

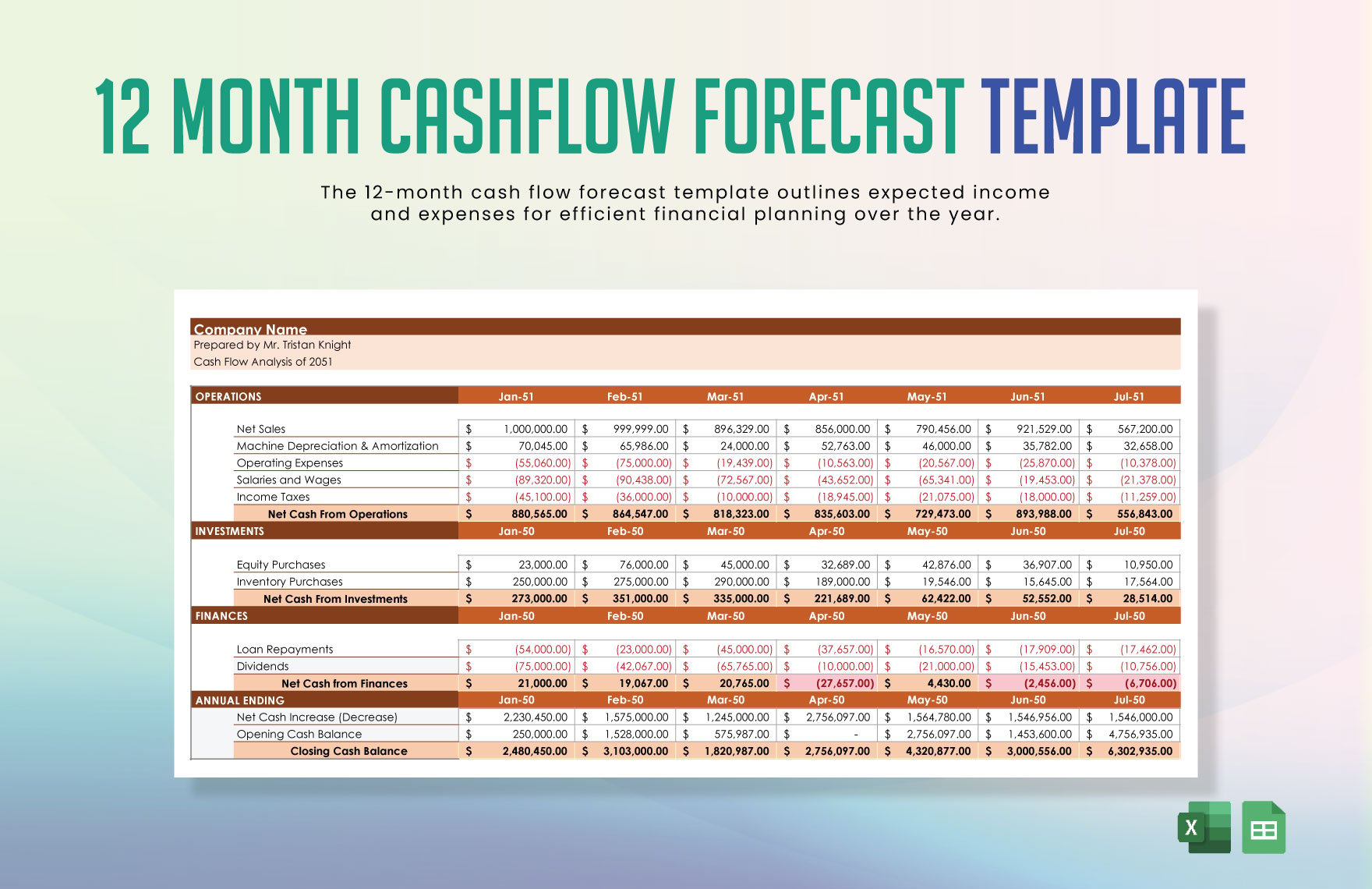

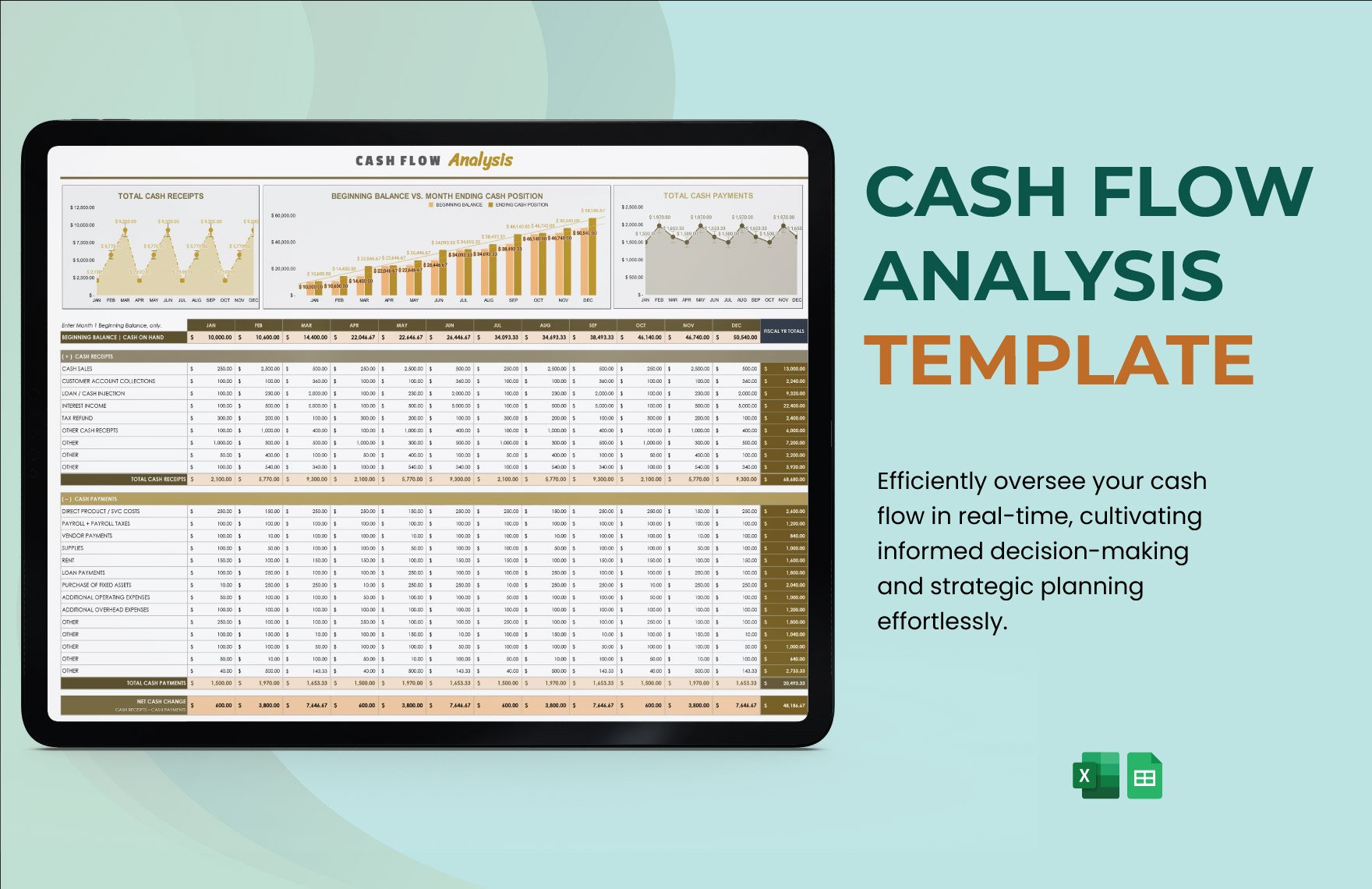

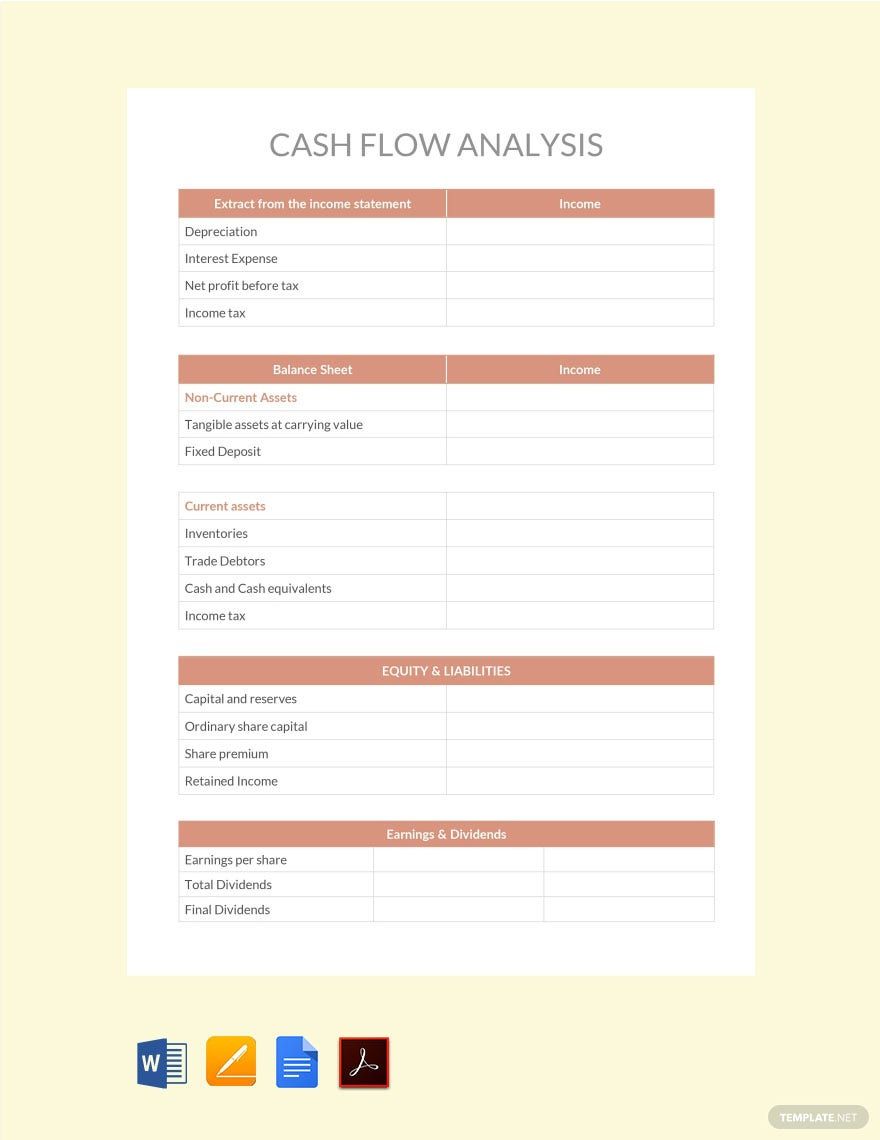

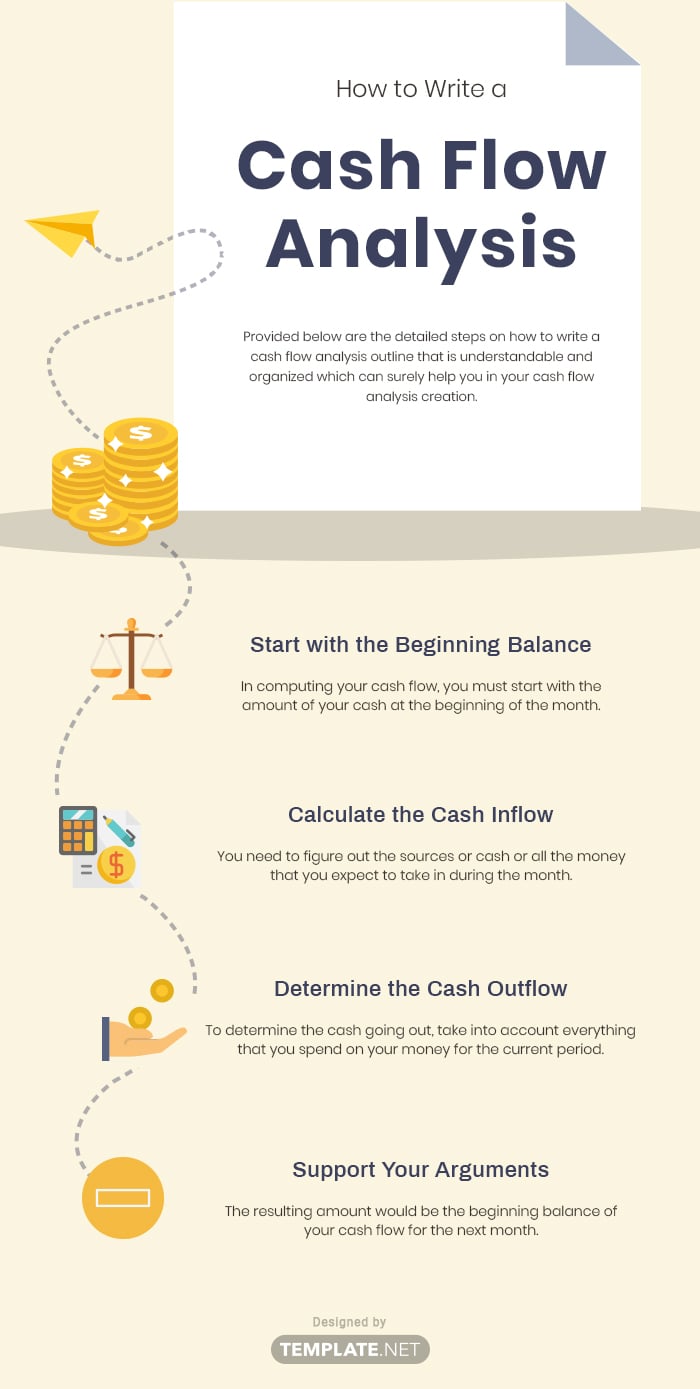

Cash flow analysis is a deep dive into your business’s financial health, examining and assessing the entity's cash inflow and outflow within a certain period, usually monthly, quarterly, or annually, which is useful in analyzing the company's liquidity and long-term solvency. Basically, it shows where the cash is being generated and where the cash is being spent. It has three components, namely cash flow from operations, investing, and financing. Provided below are the detailed steps on how to write a cash flow analysis outline that is understandable and organized which can surely help you in your cash flow analysis creation.

1. Start with the Beginning Balance

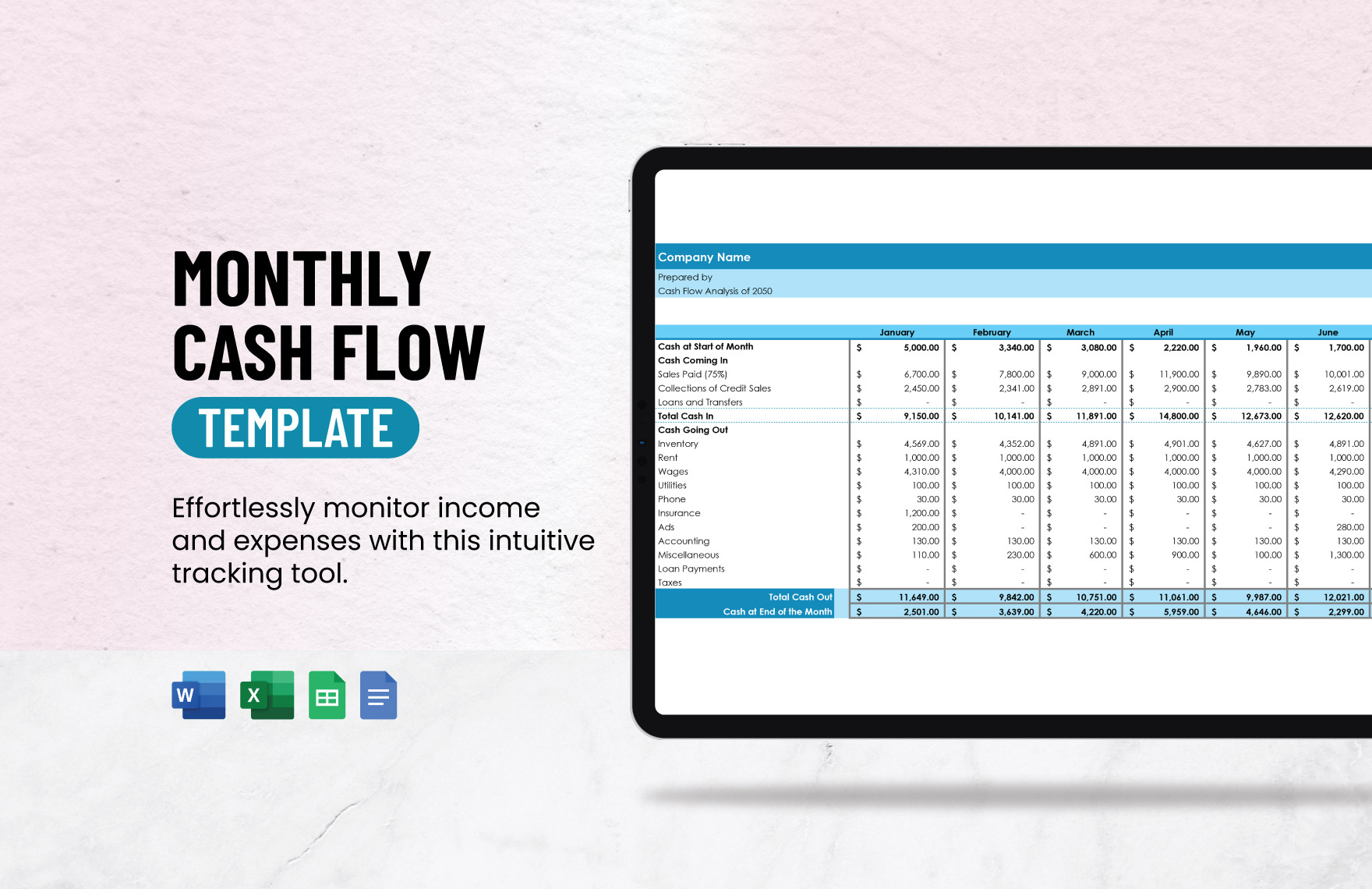

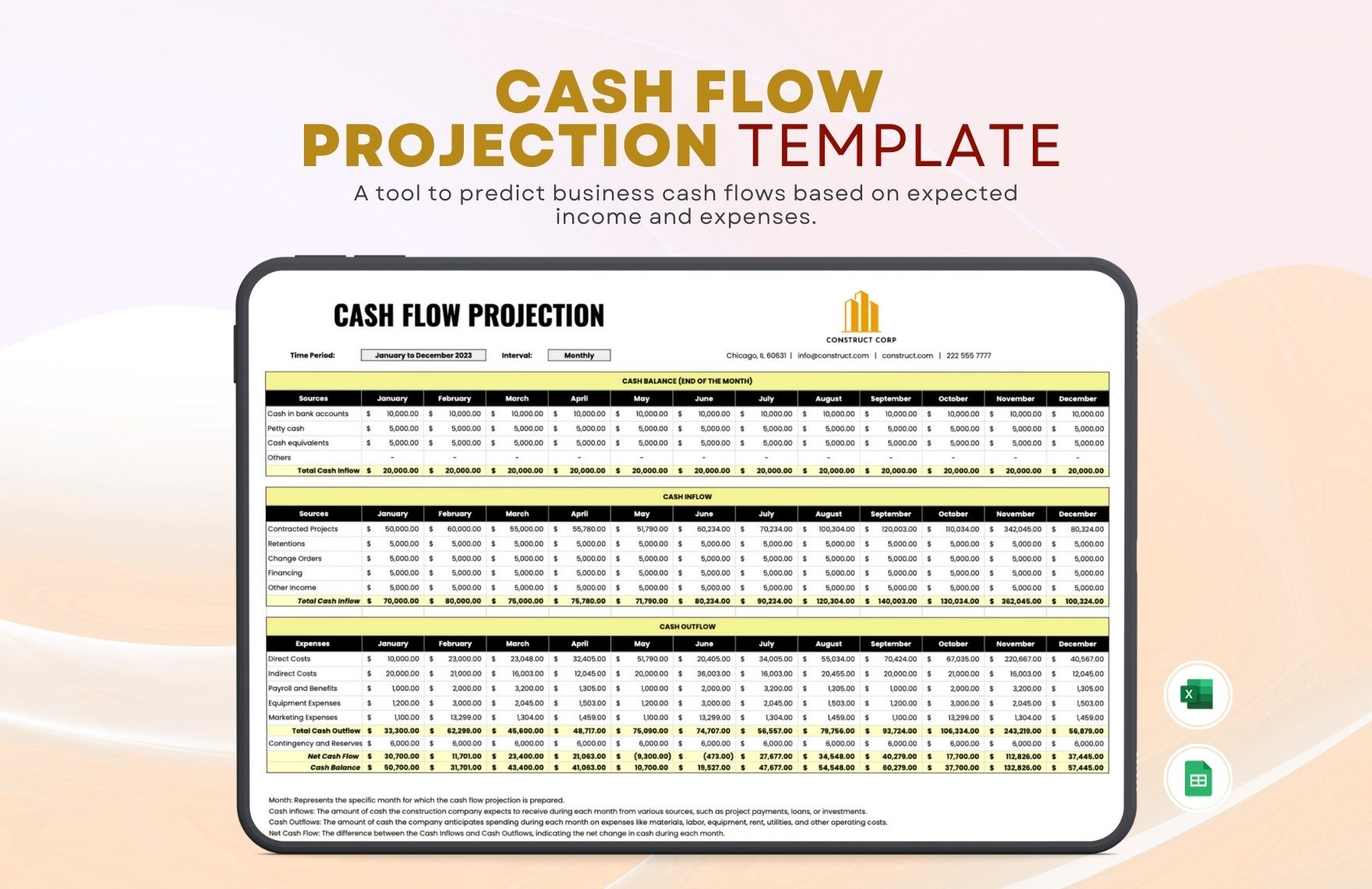

In computing your cash flow, you must start with the amount of your cash at the beginning of the month. Check your total cash in your bank account and your cash on hand. Record this as your first line item. This refers to the beginning balance of your cash flow for the current period.

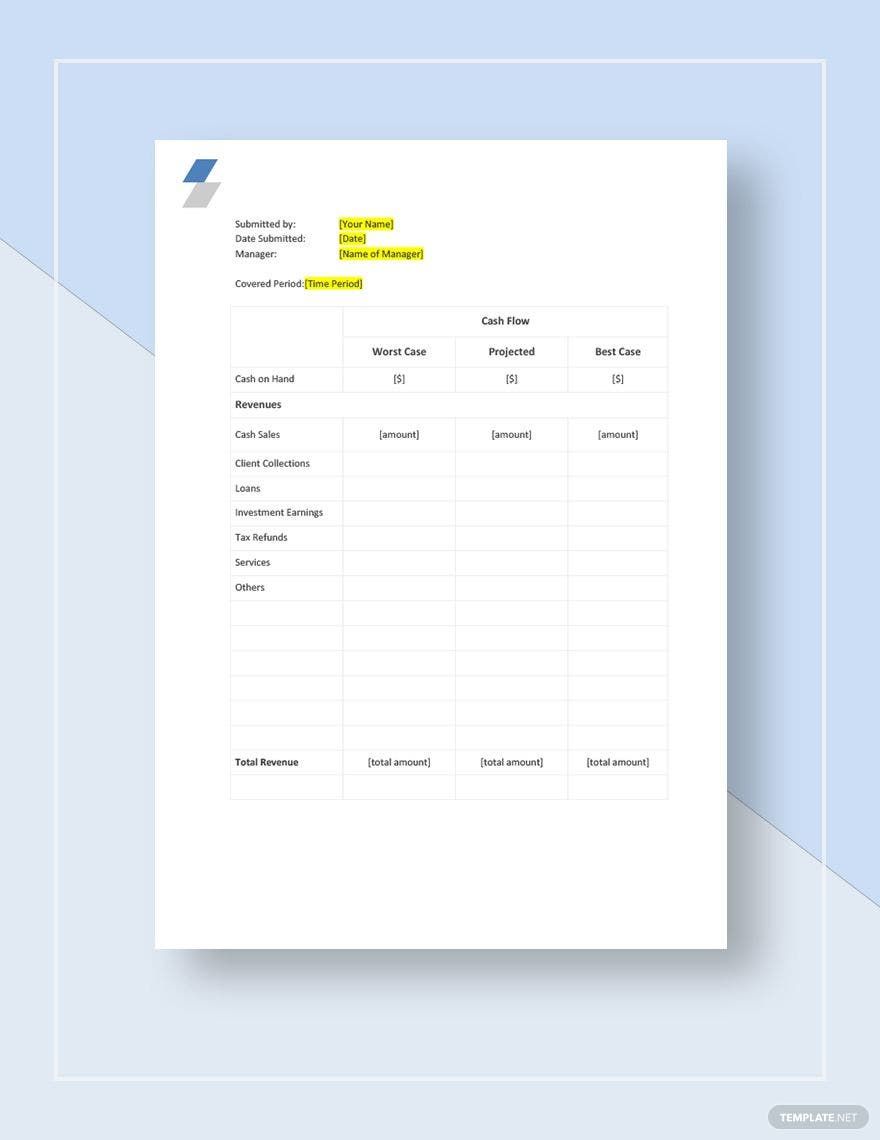

2. Calculate the Cash Inflow

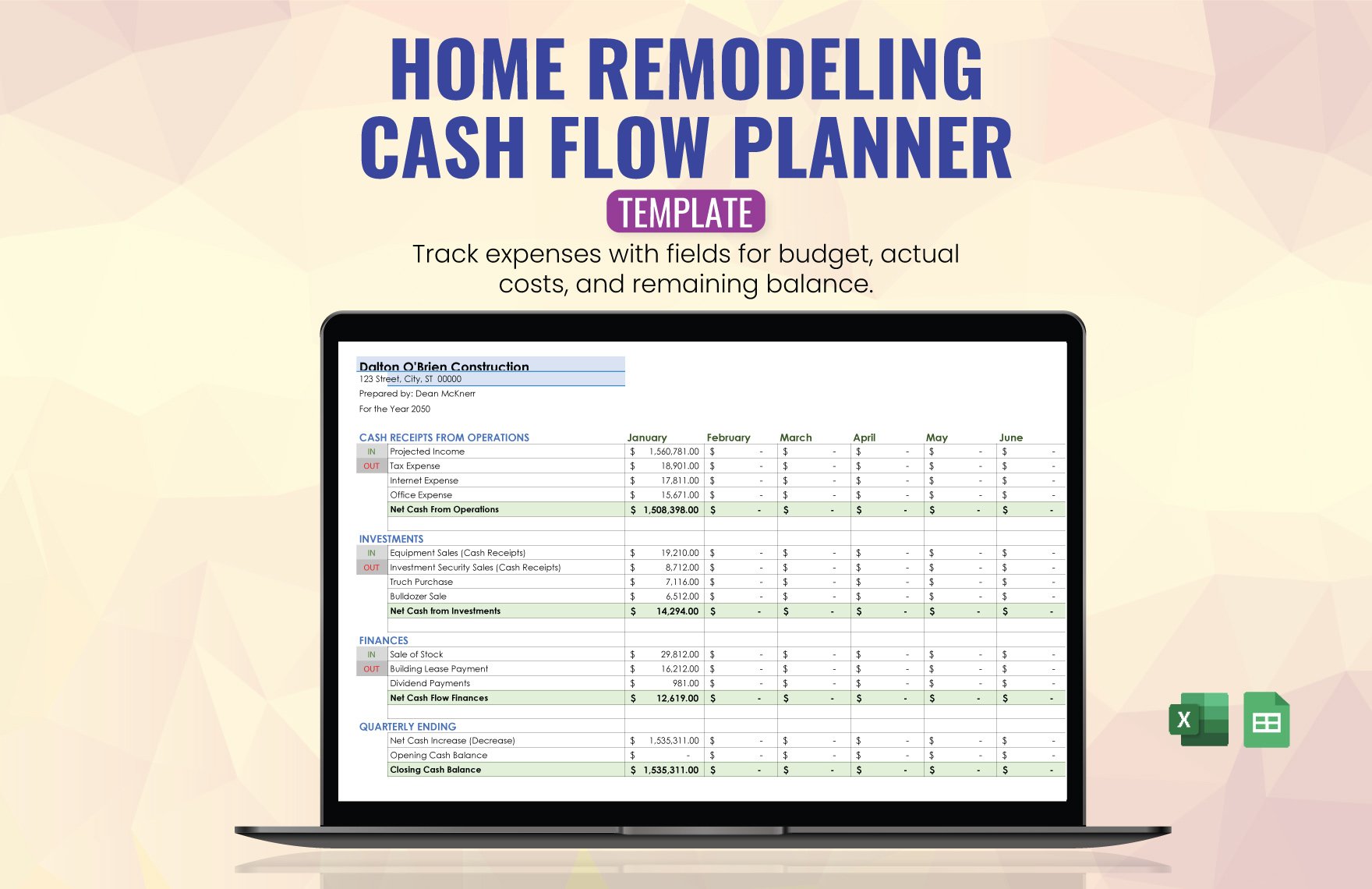

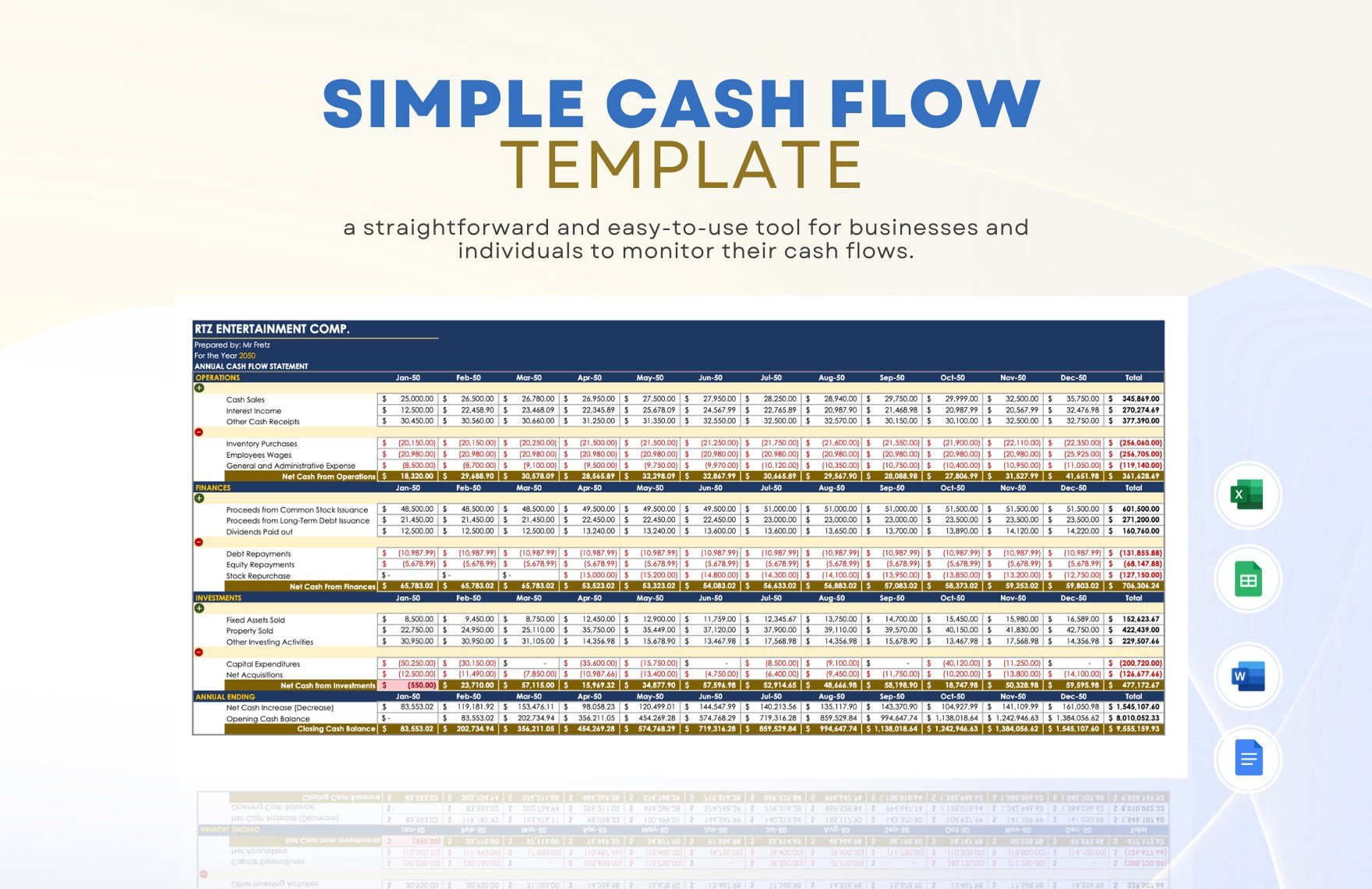

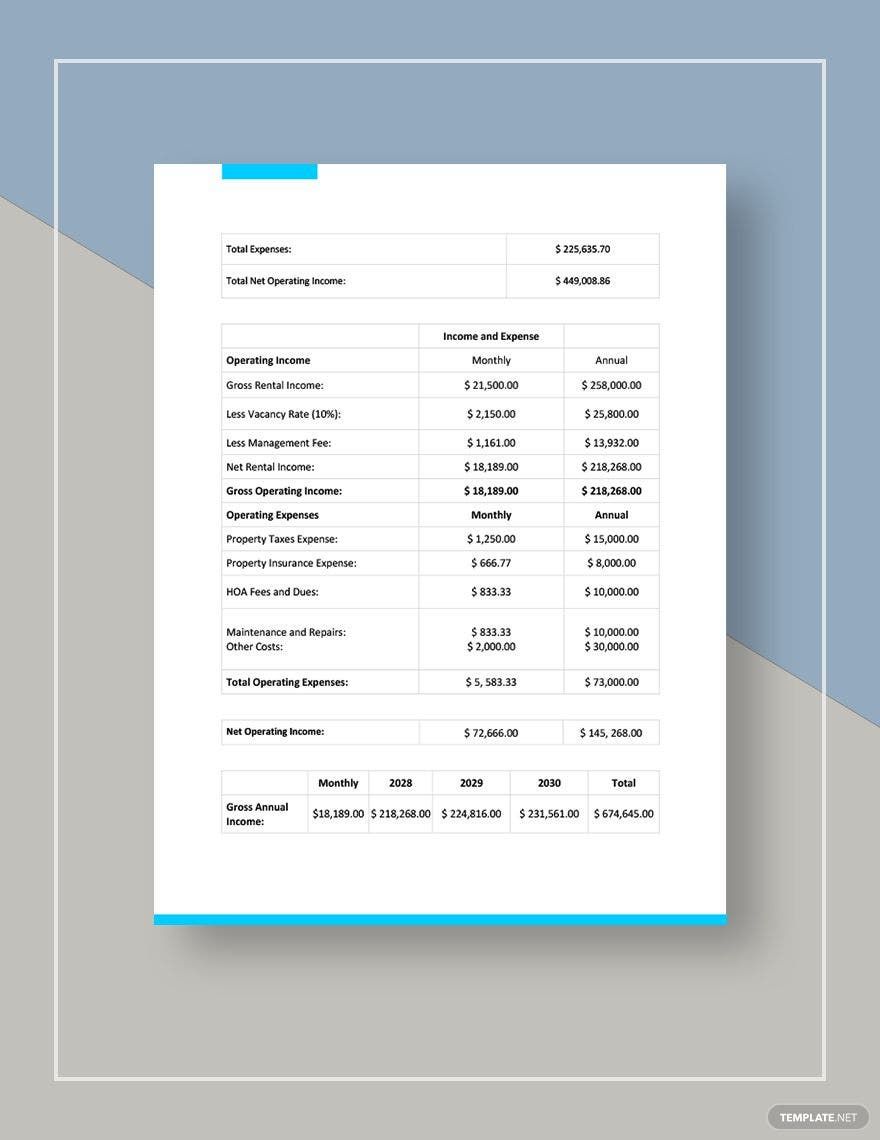

After presenting the beginning financial sheet, you need to figure out the sources of cash or all the money that you expect to take in during the month. Note that you only need to include the actual money that you will be receiving and use the cash basis of accounting instead of the accrual basis of accounting. As stated above, you need to include the cash inflow from operations, such as the sale of your goods or services; from your investment, such as the sale of assets other than your inventory needed for your operations; and financing activities, such as loans and the equity you and your shareholders are providing.

3. Determine the Cash Outflow

To determine the cash going out, take into account everything that you spend on your money for the current period. Just like the cash inflow, cash outflow includes three components: operating, investing, and financing. Examples of operating cash outflow are payments to employees and suppliers, examples of investing cash outflow are loans to other entities or expenses to acquire fixed assets, and examples of financing cash outflow are payments to buy back shares or payment to cash dividends.

4. Subtract Your Cash Outflow From Your Cash Inflow

After you have determined the total cash inflow and cash outflow, you have to subtract the outflow from the inflow plus the beginning balance to determine the net cash you have. The resulting amount would be the beginning balance of your cash flow for the next month. If the amount is positive, this means that you have enough cash to cover your expense sheet and that you are not incurring a loss in your operating, investing, and financing activities. On the other hand, if the amount is negative, this means that you have a negative cash flow and that your expenses are higher than the cash that you have generated for the period.