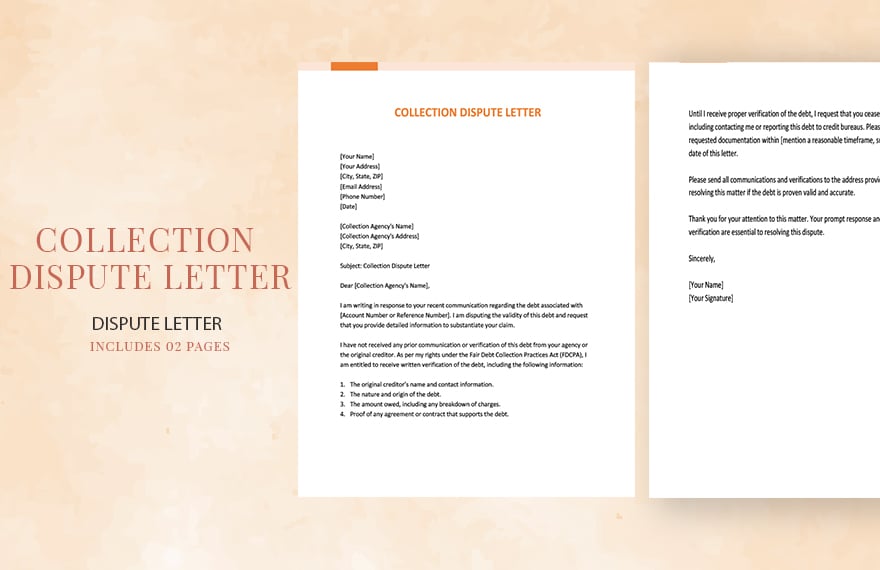

Clients tend to overlook or intentionally ignore pending payment that they need to settle. According to statistics, only 21% of Americans pay their bills on time. So, as a responsible business owner, you must remind your clients to pay their past-due debt. How? Through this comprehensive, professionally written, and industry-compliant Collection Letter Template. We guarantee you that this template has everything you need for a collection letter. Moreover, you can download it in any of your access devices anytime and anywhere. Collect payments now with our template!

How to Write a Collection Letter?

A collection letter is a type of letter written by entrepreneurs to remind their clients about a particular overdue payment that they need to settle. This is proven to be an effective reminder to clients as it is cost-effective and would encourage clients to pay.

Many business owners hated the thought of collecting payments as it may be tedious and tiresome. But, there are ways that they can collect payments without exerting much effort and money in it, and writing a collection letter is one of the ways. Serves as a final notice of payment, a collection letter is an innovative way to inform clients about their pending payments. So, if you are bound to collect payments, here are some tips that you can follow in writing one.

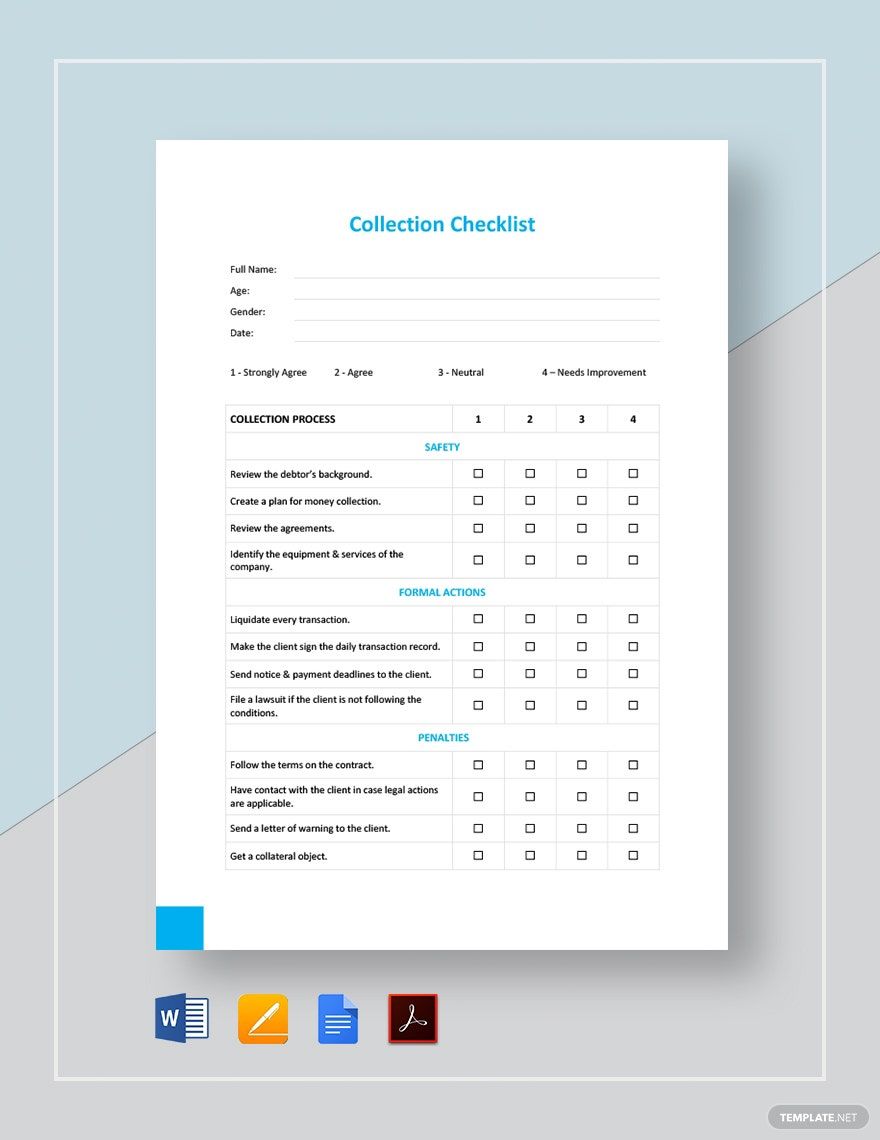

1. Know Customer Payment Information

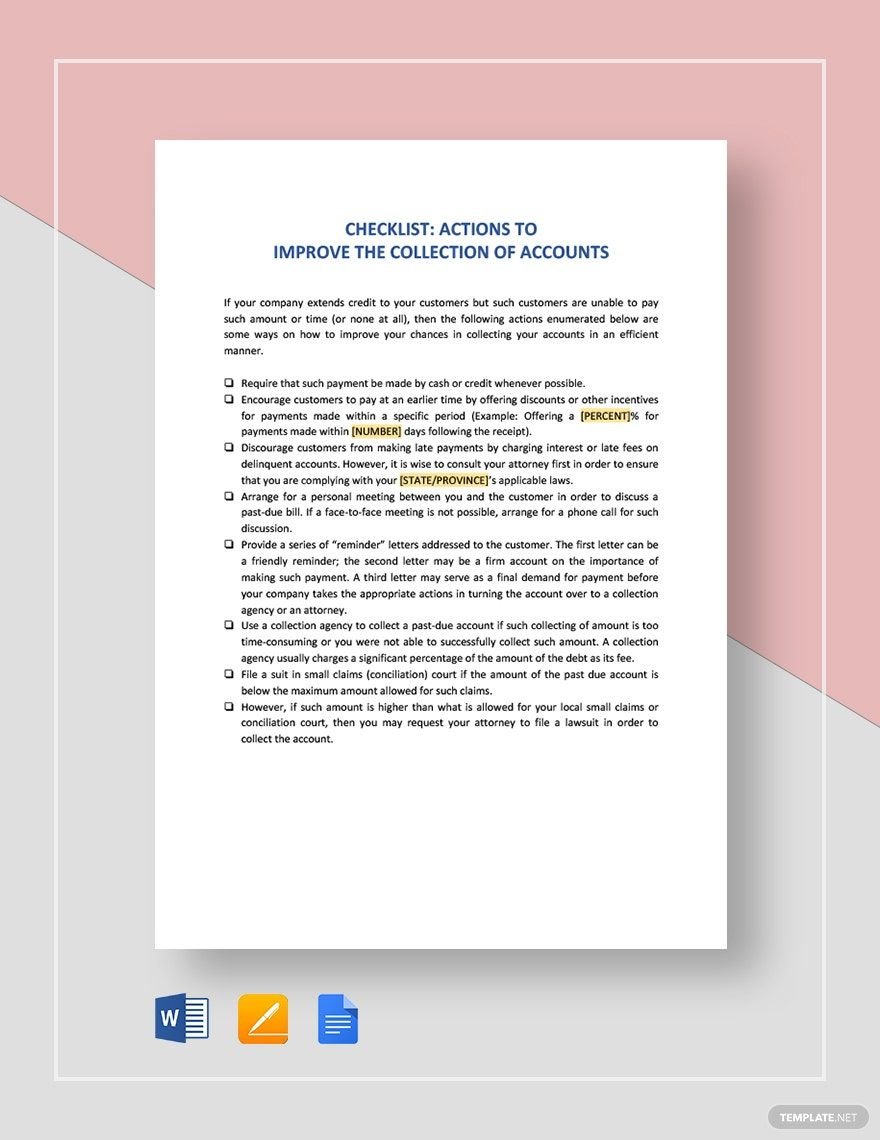

The first thing that you need to do is to familiarize your clients with due to pay. Make a checklist of clients together with their payment account information. Then, take note as to how much they owe you. Remember to be genuine and specific with numbers to avoid discrepancies.

2. Include Payment Incentives

Encouraging your clients to pay within the given ultimatum is hard, especially those delinquent clients who would not easily settle their payments. So, to make it easier for you, including payment incentives into your notice letter, is preferred. Include a statement wherein you would give your clients payment discounts if the payment is settled within the given period.

3. Offer Assistance

Assume that not all of your clients have the easiest access on payment. With that, you need to be friendly enough to offer them assistance in paying. Use a sincere tone in conveying your message of assistance into your document, talk out with your client, and ensure that any payment arrangement is accepted.

4. Penalize Unresponsive Customers

It is given that not all of your clients would easily settle their payments, so include penalties for unresponsive customers. For example, if you have given a 30-day extension to settle your client’s payment, include a clause stating that failure to comply with the requirement within the given period will be handled with legal actions.

5. Format your Letter

Now that you have included these essential tips, you can now format your formal letter. Follow the basic format of business letters, such as the heading, body, and conclusion. Also, make sure to include your name and signature as the seller/producer.