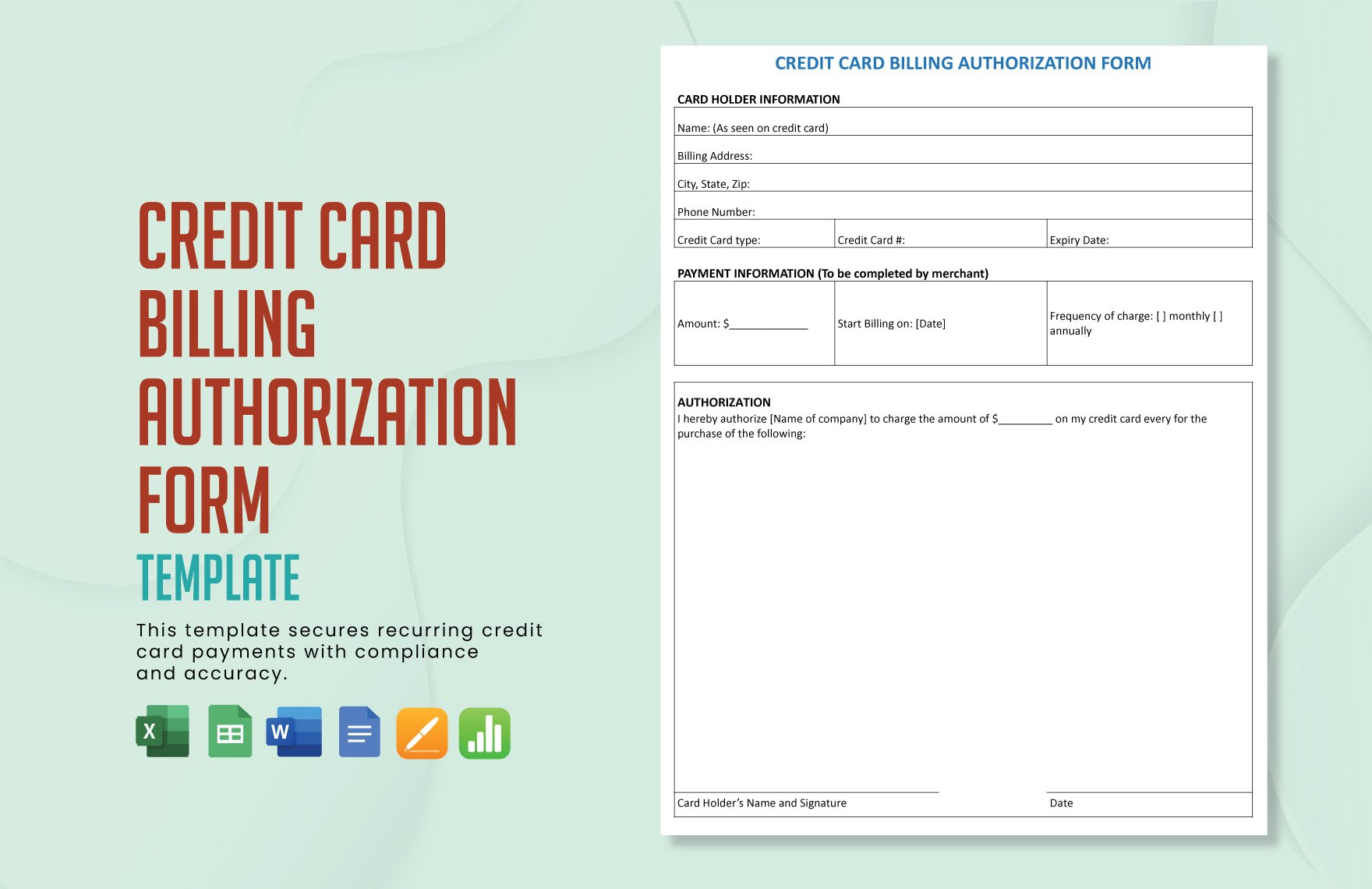

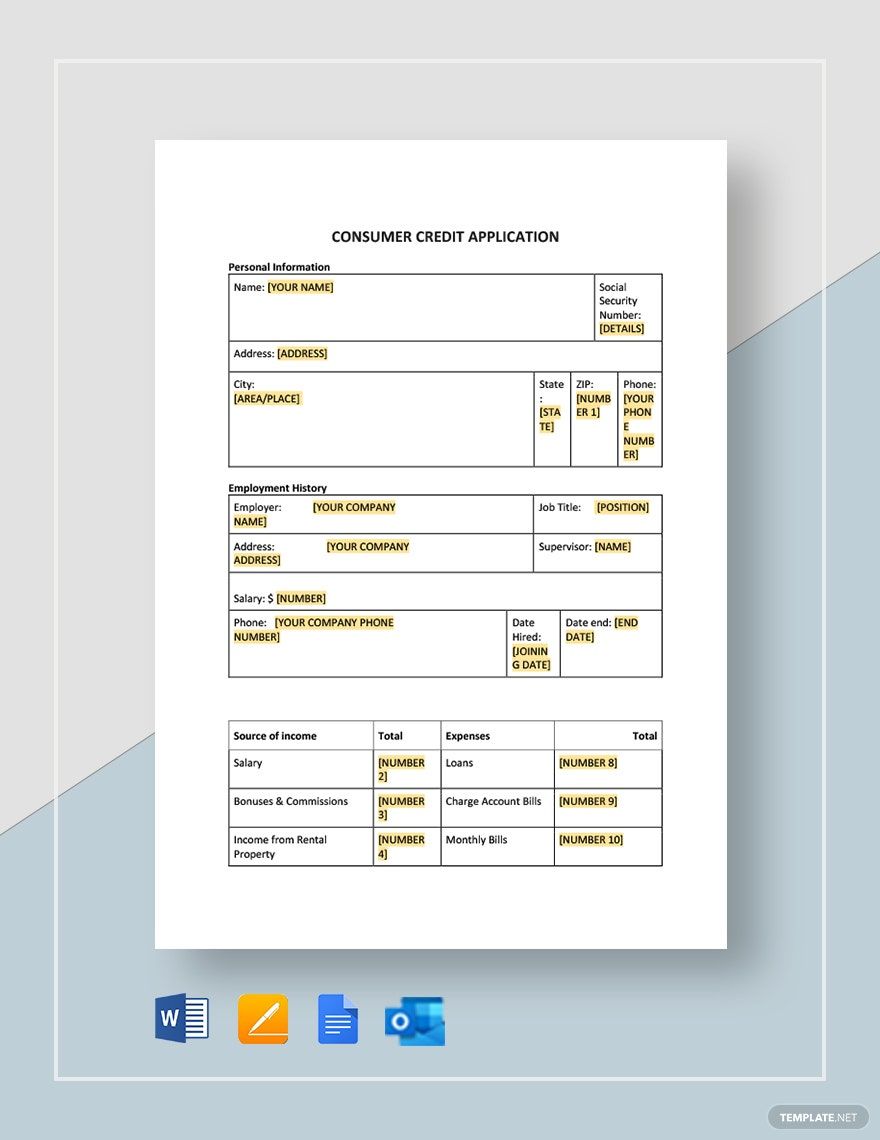

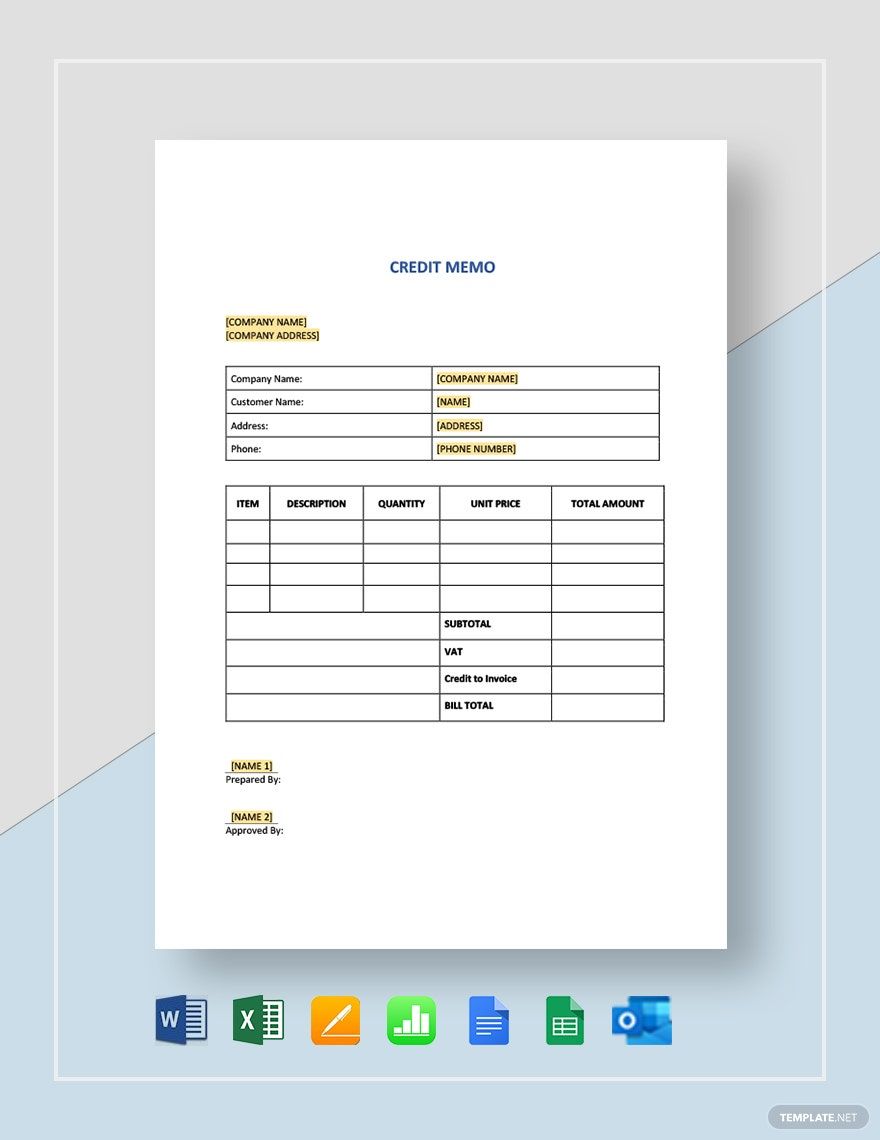

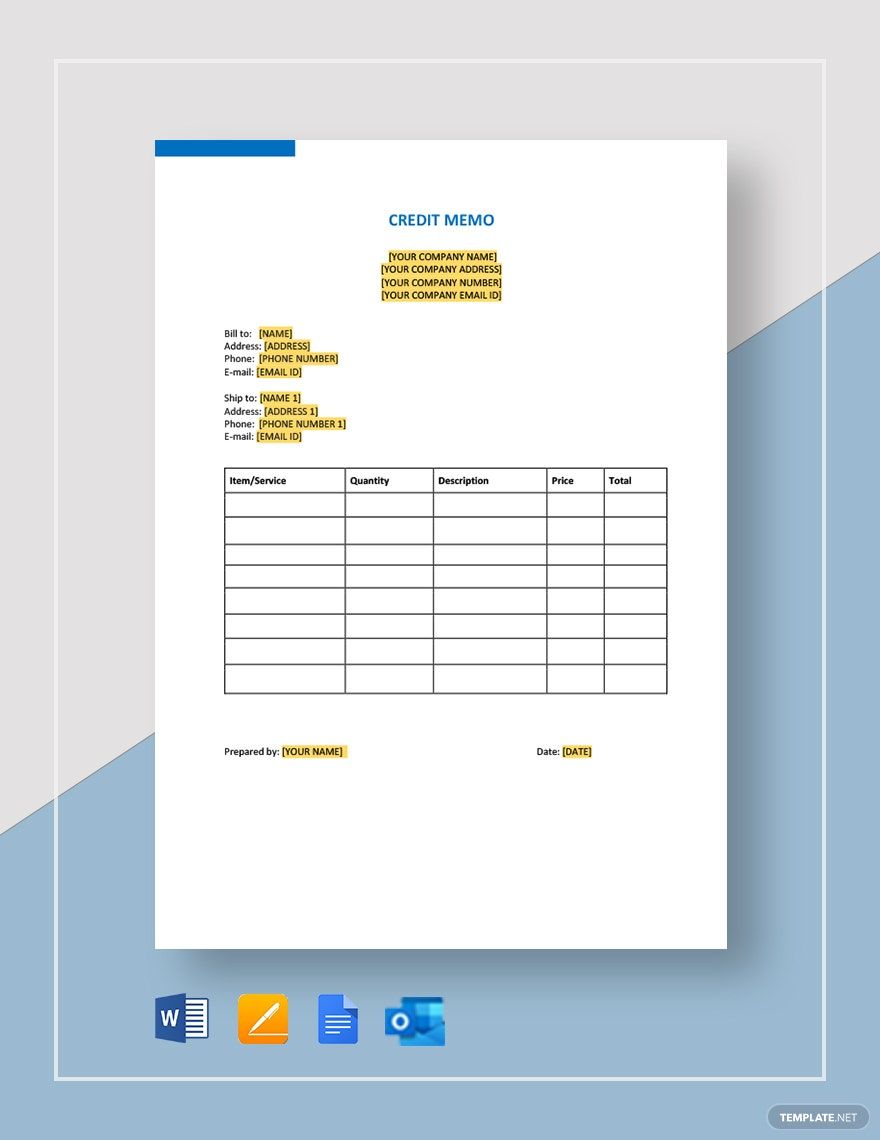

If you’re in need of a consumer credit application, credit card billing authorization form, credit memo, and other credit documents for a more convenient business process, have the freedom to choose from any of our ready-made Credit Templates in Google Sheets. Each template is written with suggestive content that’s 100% customizable, easily editable, and printable in Google Sheets format. Also, these high-quality templates are tailored for all your business needs. Don’t forget to replace highlighted texts with your own business details before making use of them. Save yourself the hassle and get more than with these well-crafted ready-made Credit Templates in Google Sheets!

How to Create a Credit in Google Sheets

In the world of finance, the term credit has a lot of meaning. It is usually described as a financial agreement in which a borrower gets something of value and decides to repay the lender at a subsequent date- commonly with interest.

Problems arise when a certain borrower does not pay. By having a credit application form, you can lessen the issue of non-paying clients. A credit application form will help you report and gather data from your clients to assist you in evaluating their suitability for a credit contract.

Here, we present some useful tips on how to start creating credit in Google Sheets. It is vital for a company to keep a record of cash coming in and moving out. Google Sheets can be used to manage calculations while working with numerical data. It is a user-friendly application since it has a very convenient interface.

1. Know about How Credit Works

First off, it is a must for you to know how credit functions in your transactions. Credit report and credit score represent how well you have handled your financial accountability over a certain span of time. An article reveals that having a good credit report and credit score enables you to gain credit cards and loans, obtain resources to pay for unavoidable situations, have accessible services when you have a credit card like car renting and the like.

Credit or payment guidelines are simple and easy. A lender expands a credit range to you. You propose to repay the percentage you spend plus interest charges and maybe extra business payments to the lender. A payment schedule is fixed, and according to that timeframe you are needed to create payments. Paying your fees at a given time is the most noteworthy suggestion.

2. Know the Basics of your Credit Report

It is very important to know what credit reports are for. Credit reports record a person's credit history over a span of time. If you ask what is a good credit score, it is a statistical amount based on credit history that examines the financial health of a consumer. According to an article, the credit score of an individual varies from 300 to 850, and the greater the rating, the more an individual is classified as financially competent.

3. Include Necessary Details

Along with your credit report, you need to include the necessary details. Basically, these are personal information, trade account information, public record information, and credit queries.

4. Be Detailed and Sure

Inputting all your information must be done in a detailed manner. An article suggests that it is necessary for a credit bureau to check a lender’s credit background via a credit report as it is their basis whether the applicant is illegible or not. In the United States, there are three major credit bureaus, and these are Equifax, Experian, and TransUnion. These credit agencies collate data about consumer’s personal information and their methods of paying their bills to make a distinct credit report. Although almost all of the details are similar, there is generally very little difference between the three reports.

5. Set Out Payment Terms

To avoid writing a dispute letter, it is best that your credit application form should set clear and concise payment terms especially the exact date when you require the said payment. Commonly, this is within 7, 14, 21 or 28 days of providing goods or services. State what types of payment are allowed and which are not. Standard options usually include cash, cheque, credit or debit cards, and online payments.