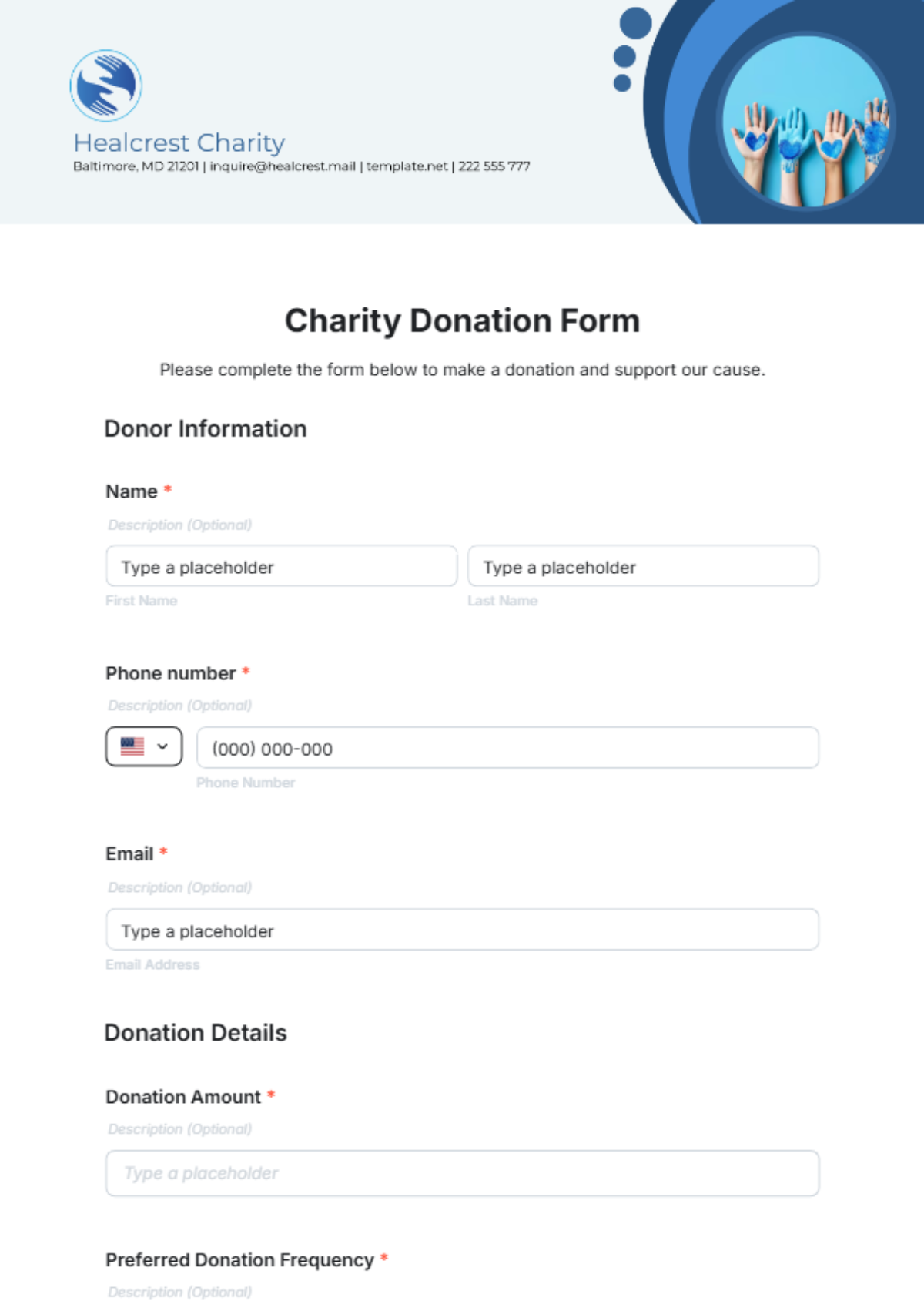

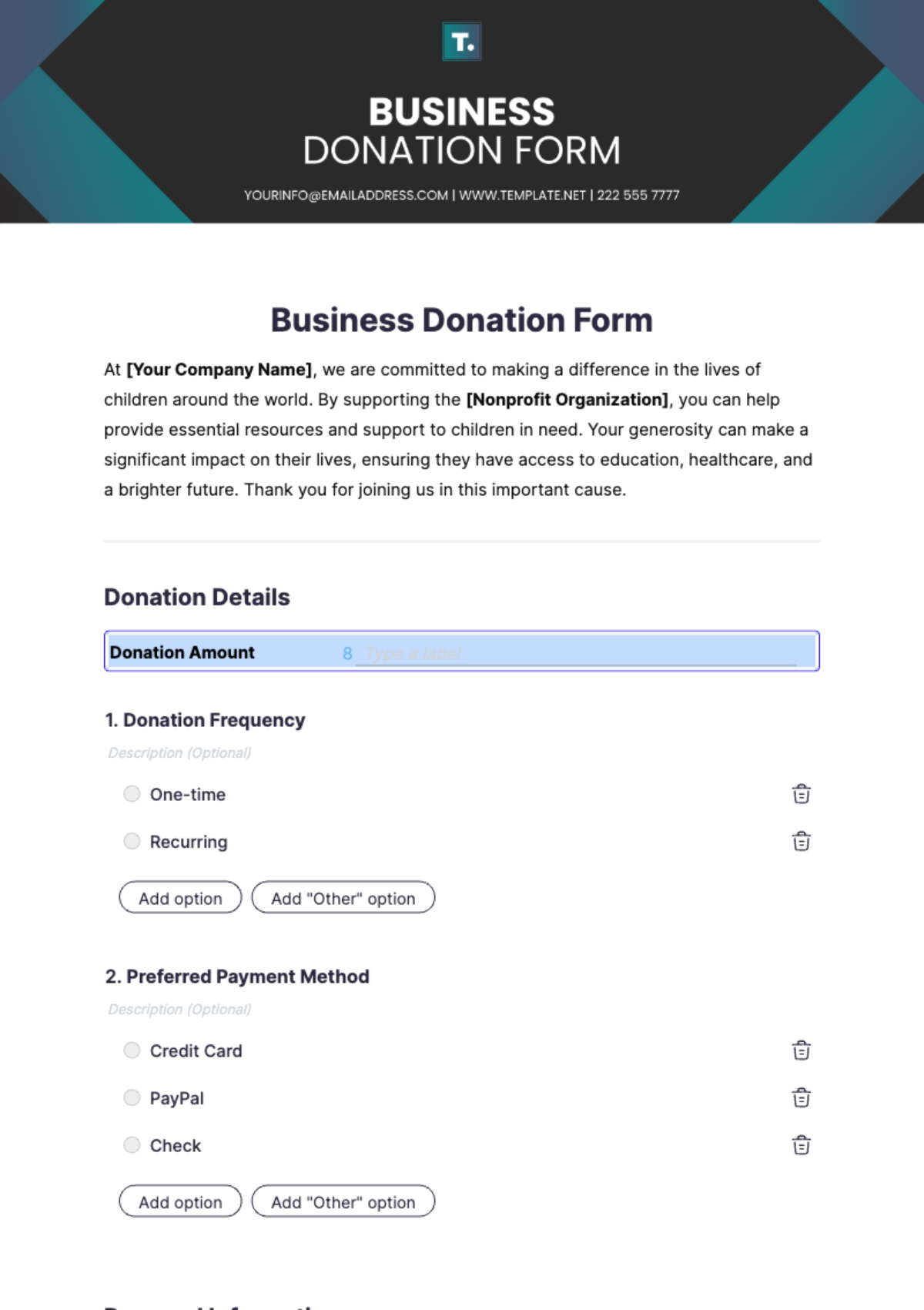

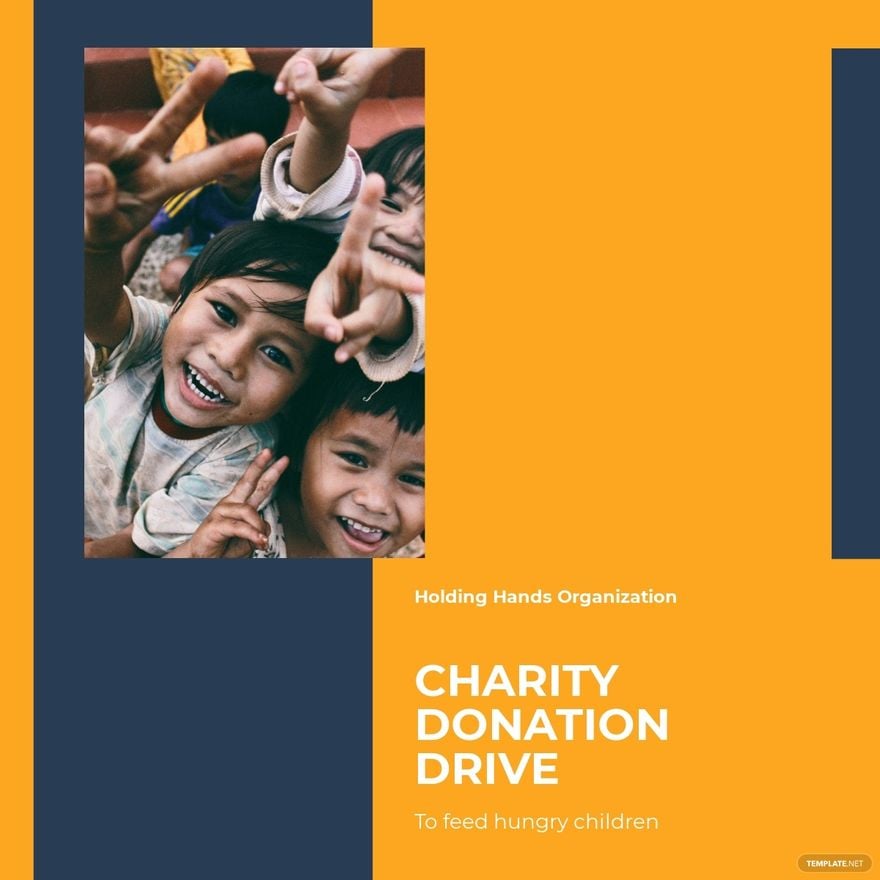

Bring Your Fundraising Vision to Life with Donation Templates from Template.net

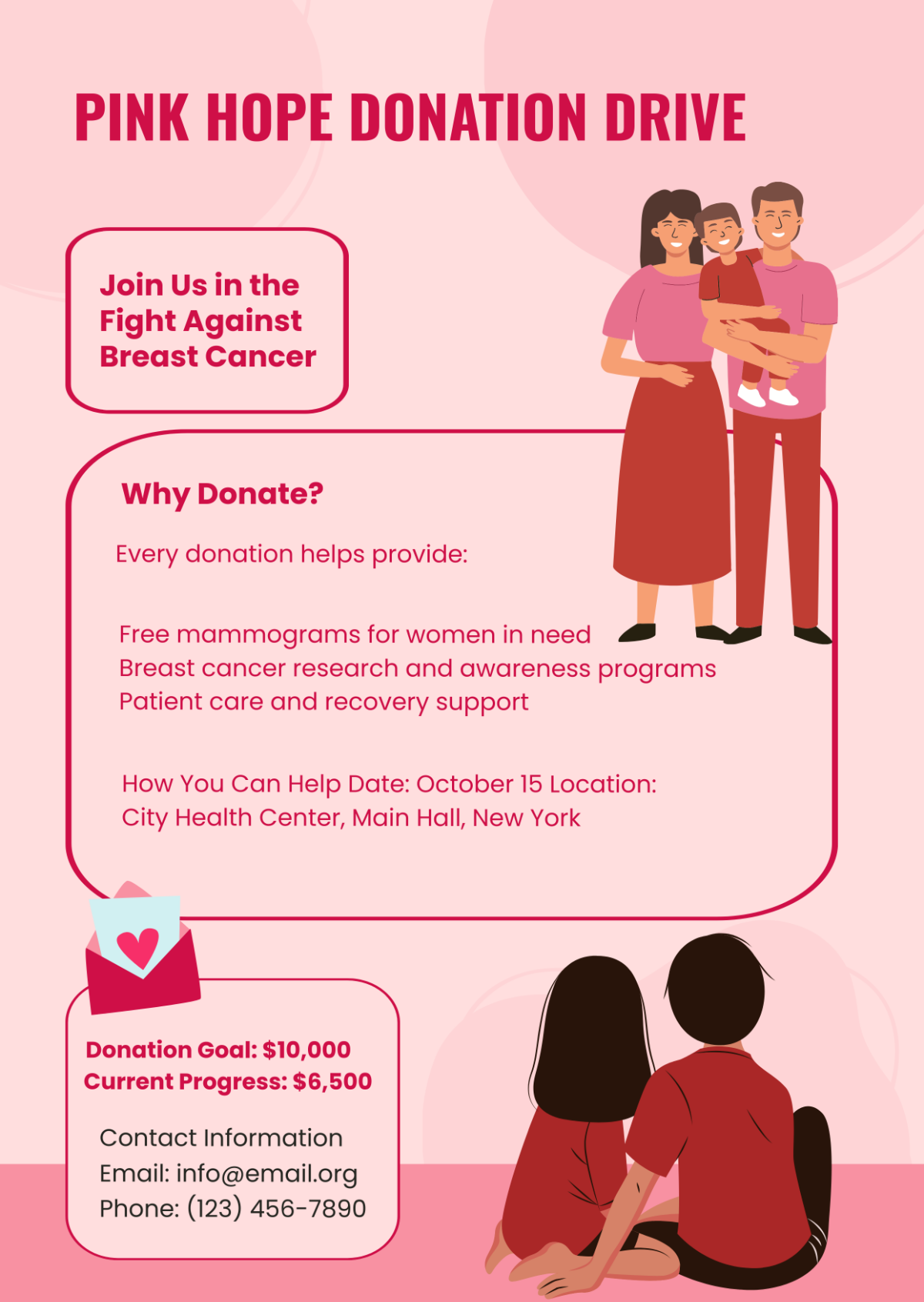

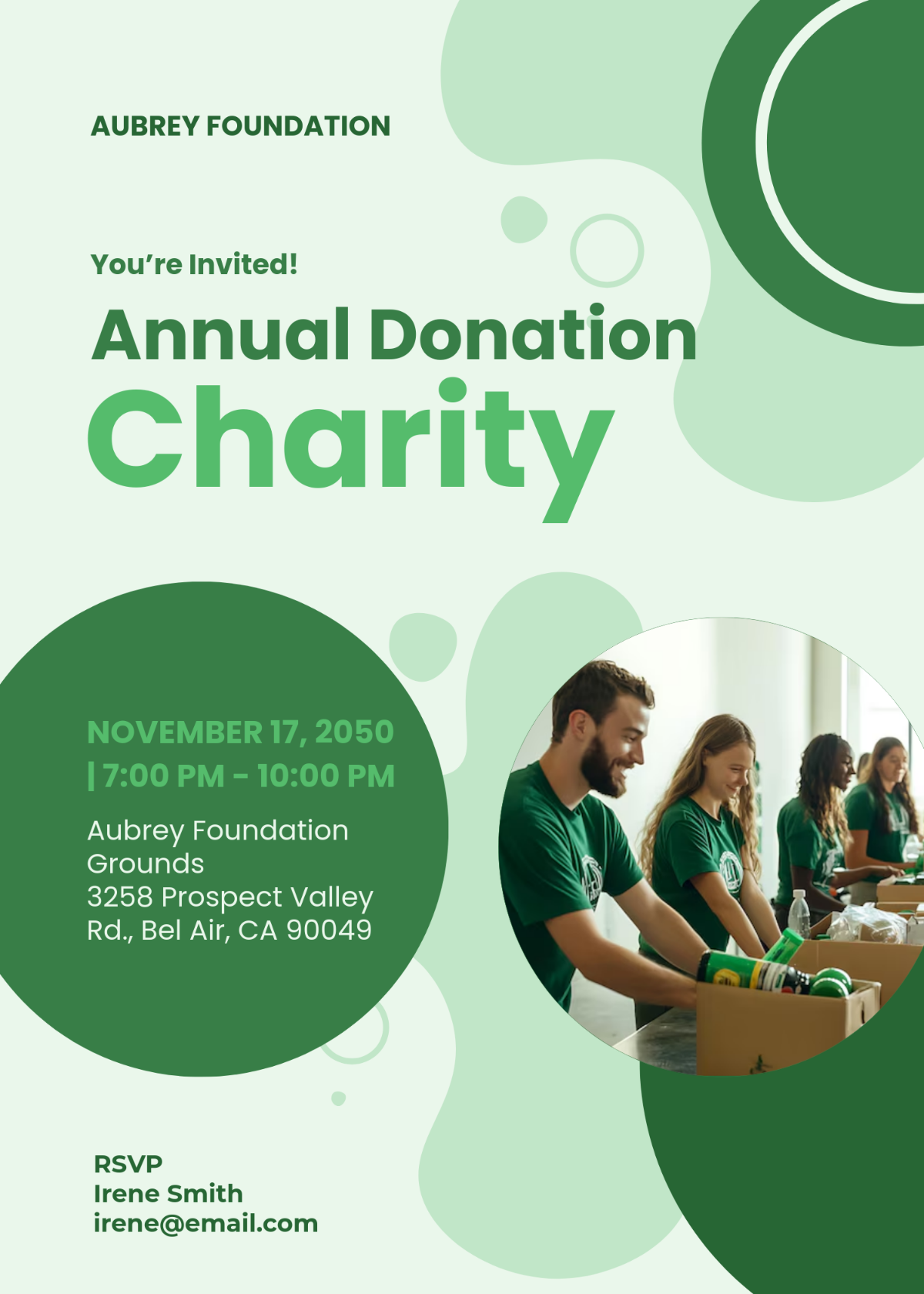

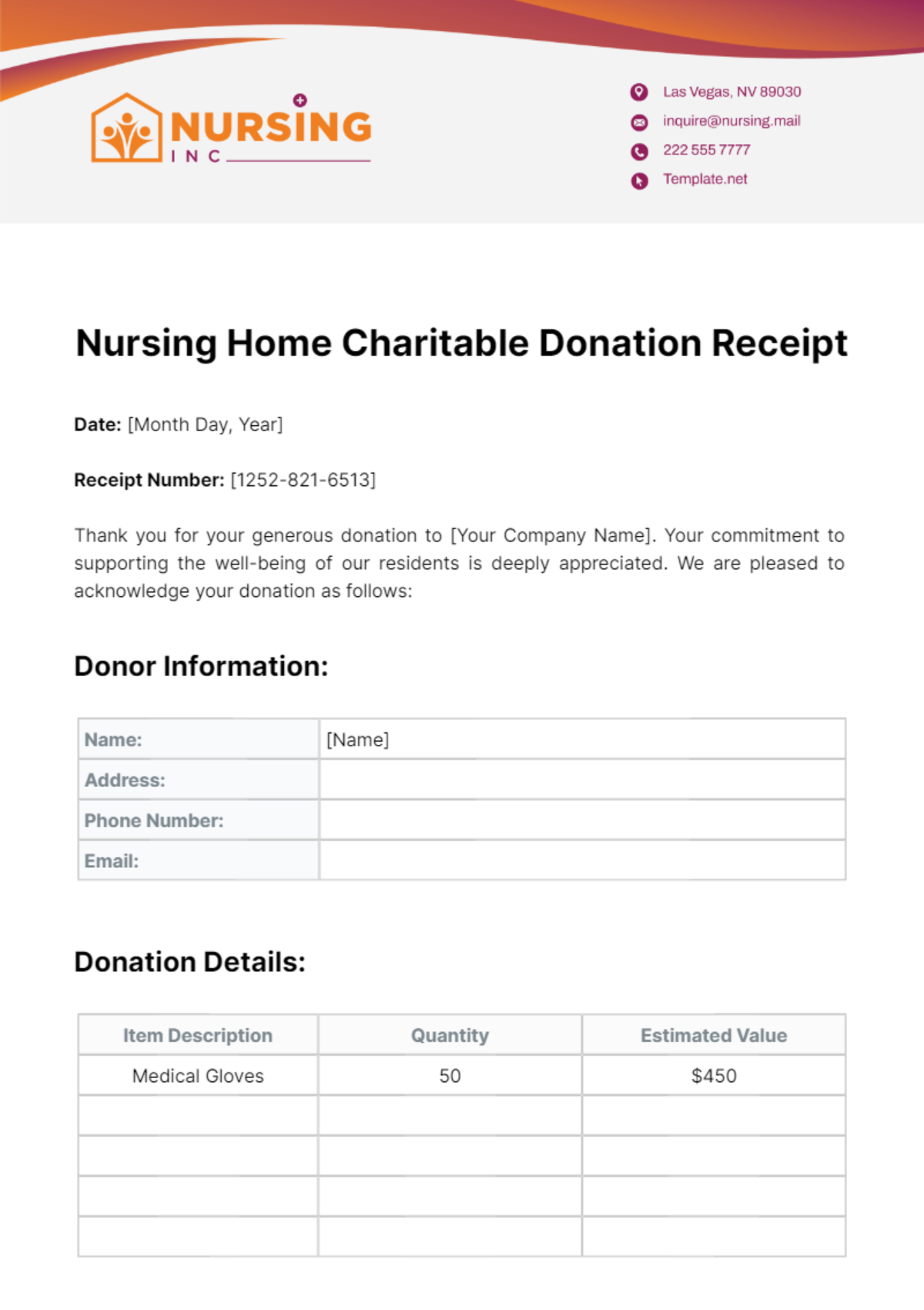

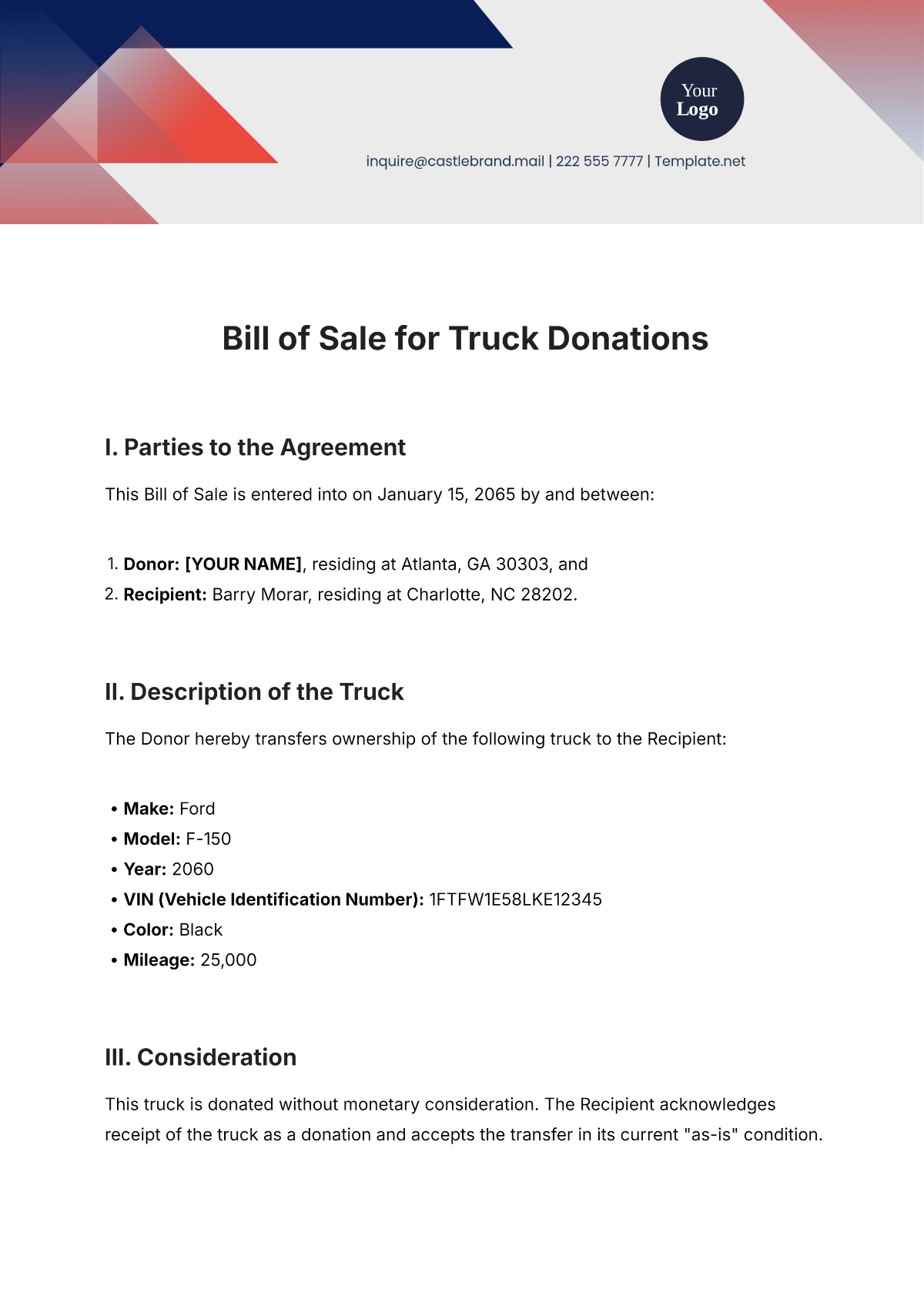

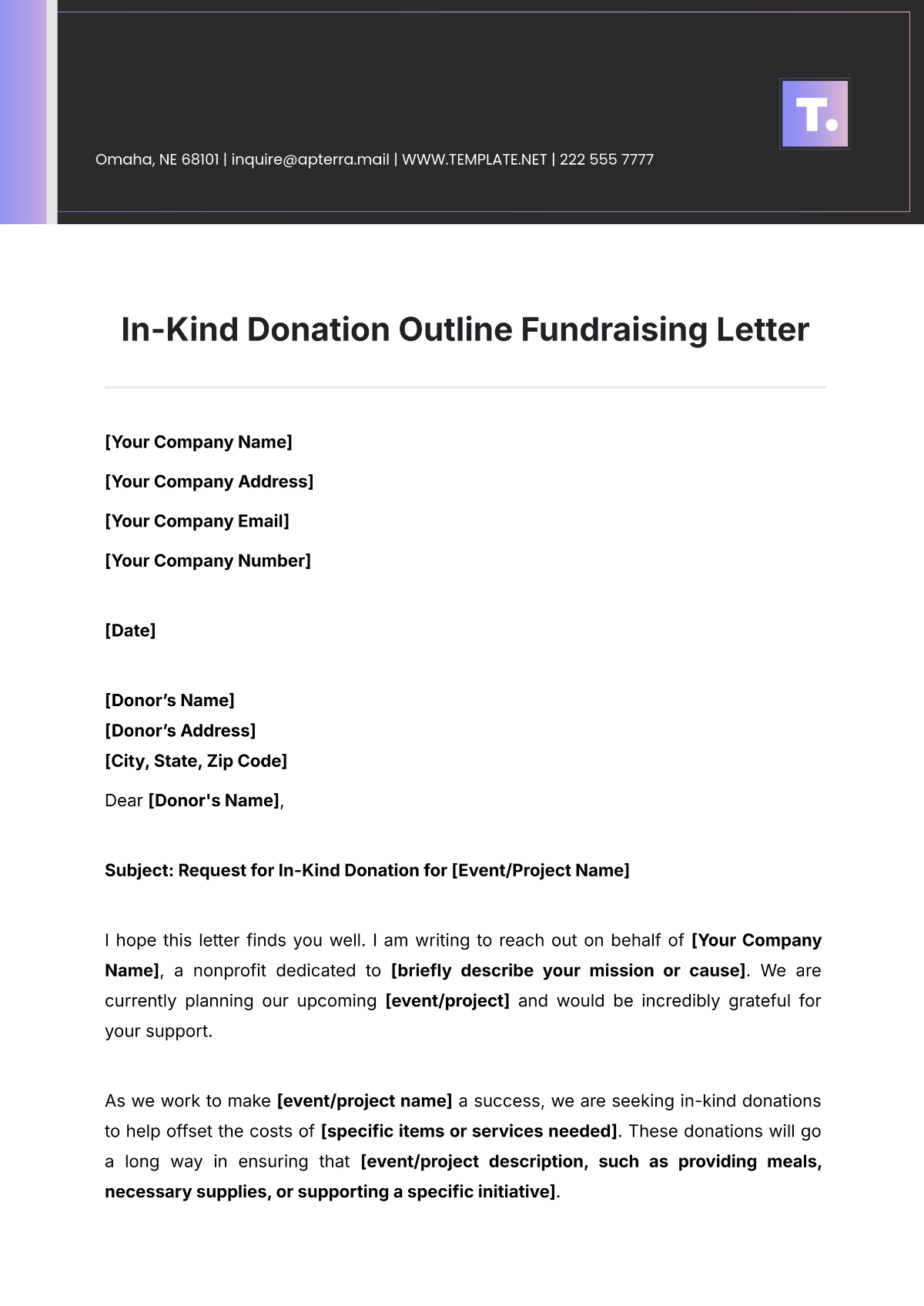

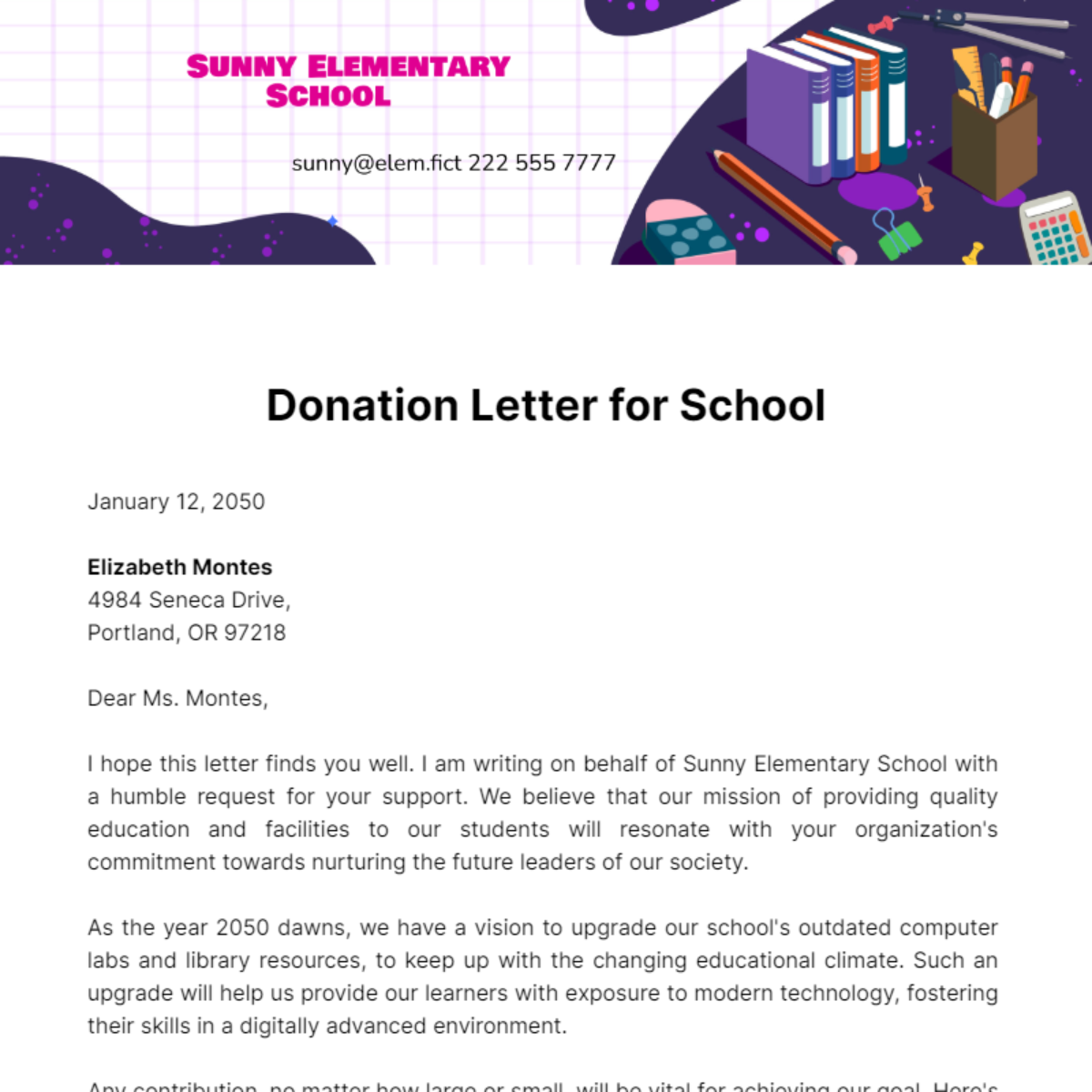

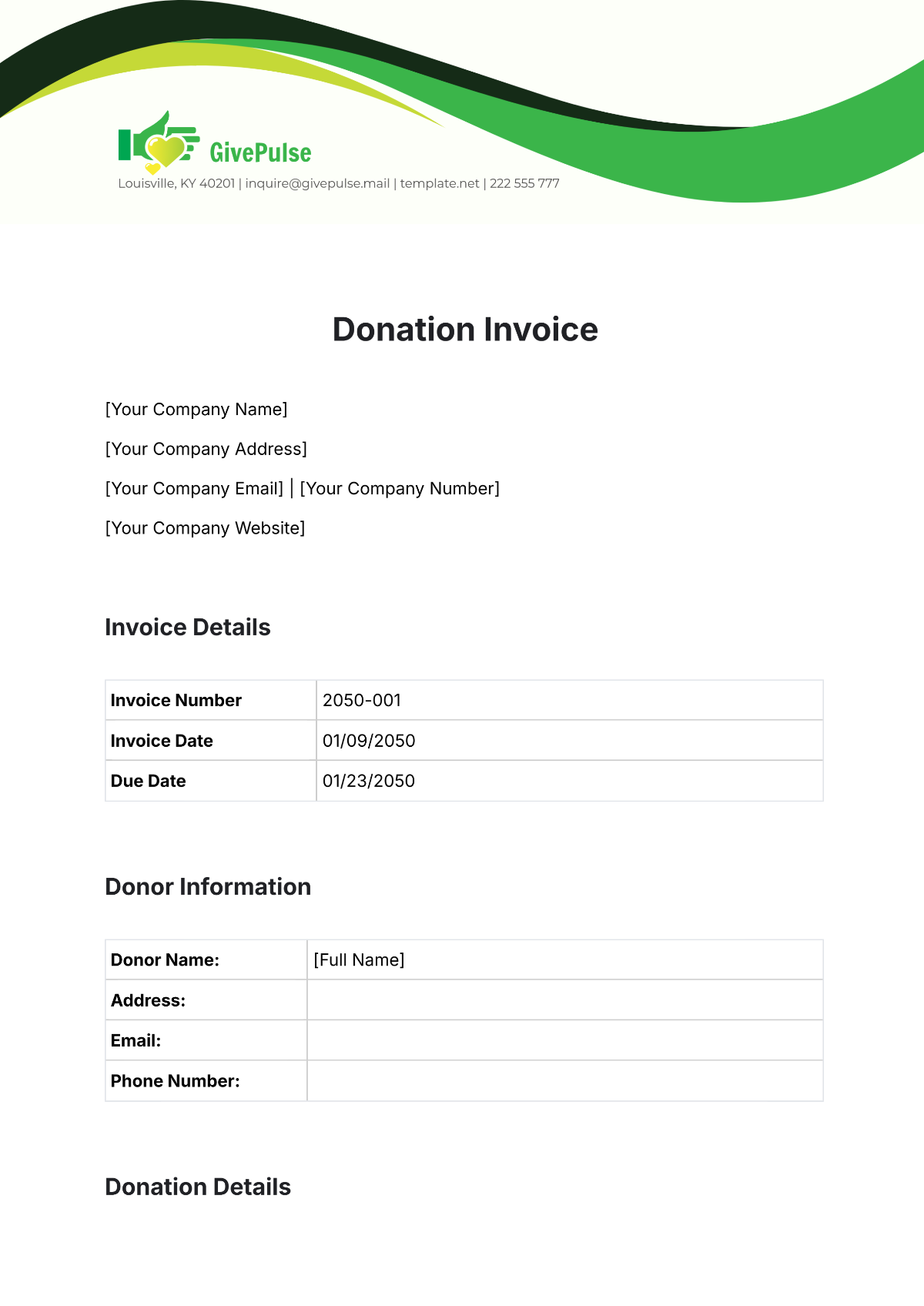

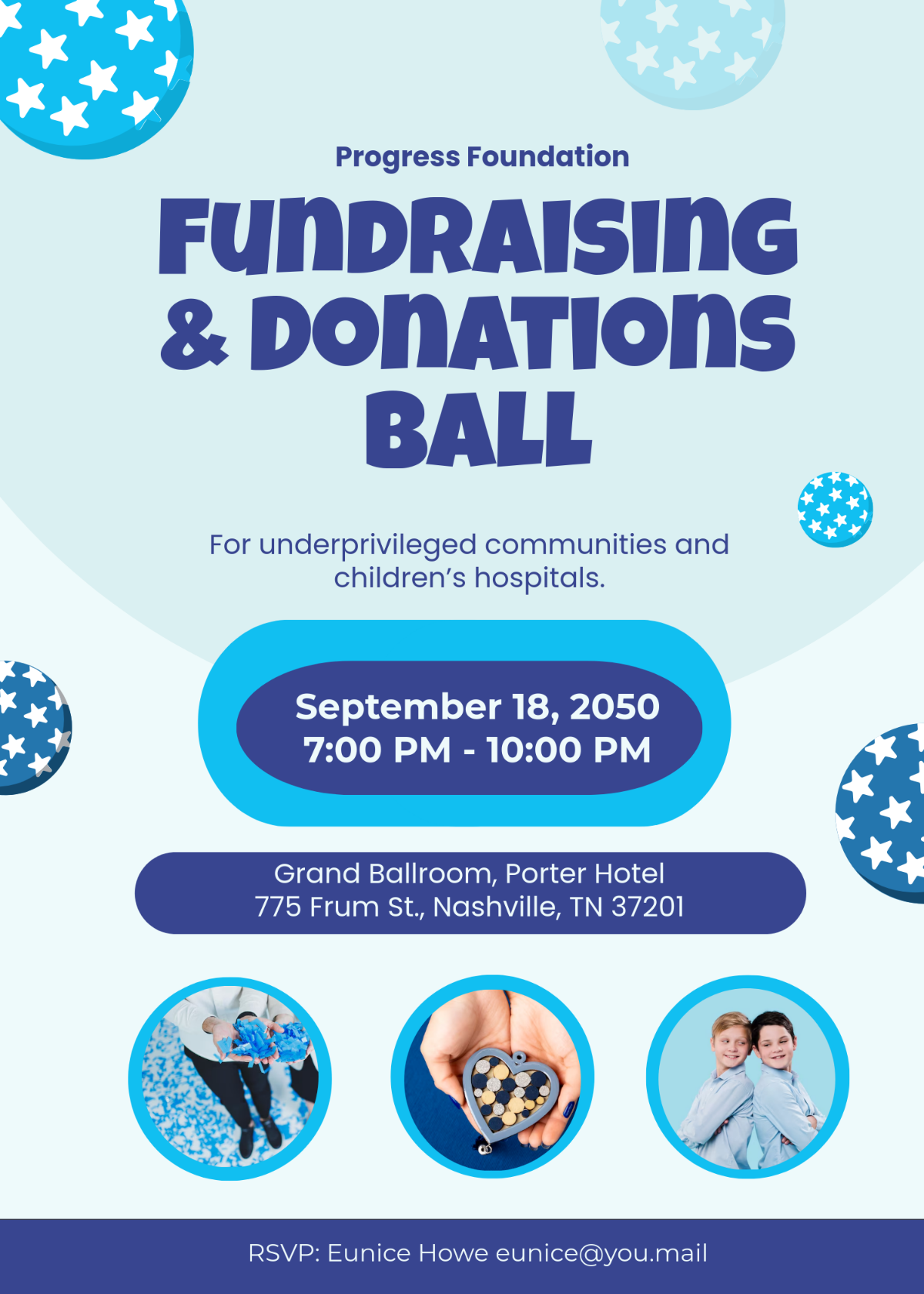

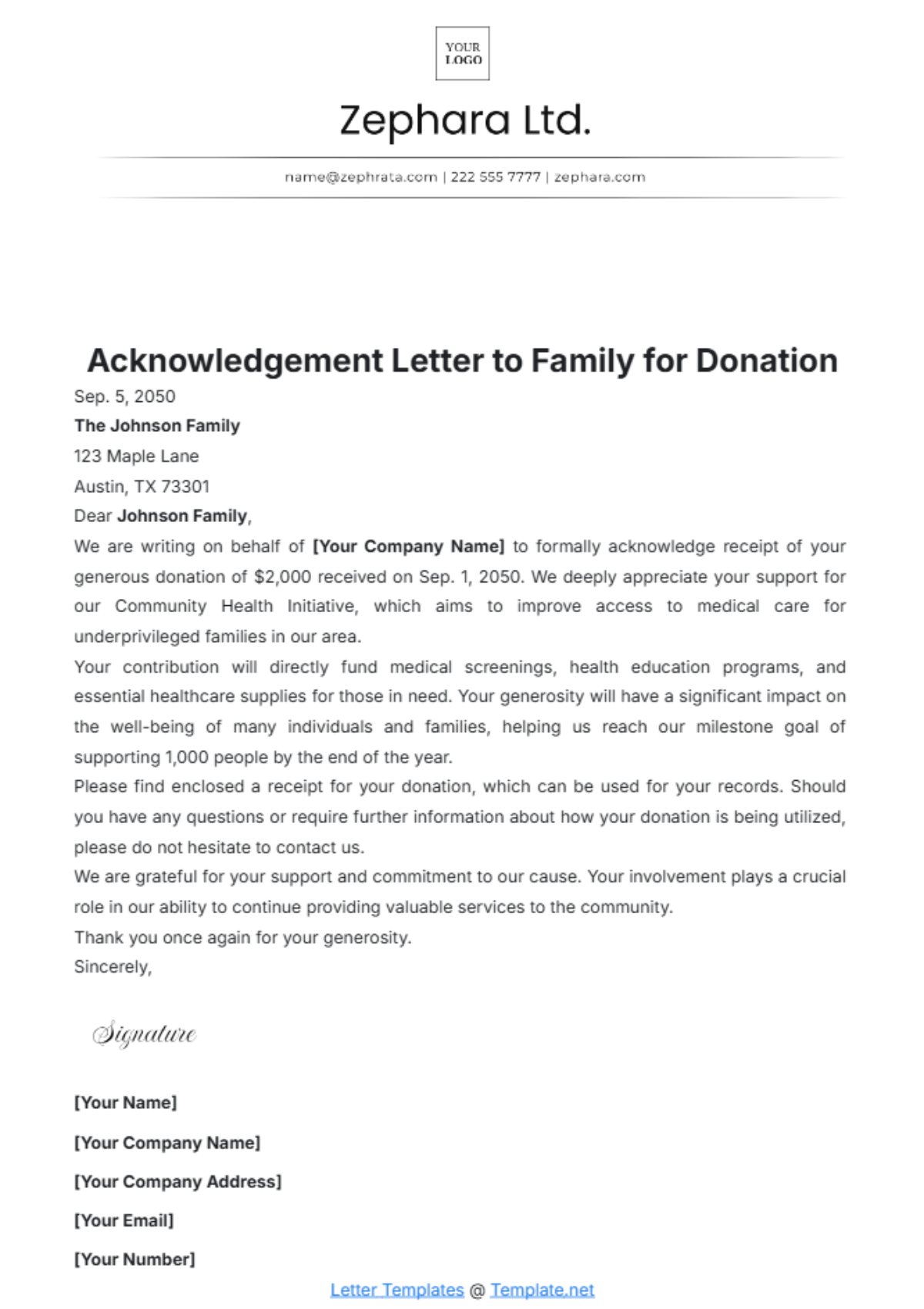

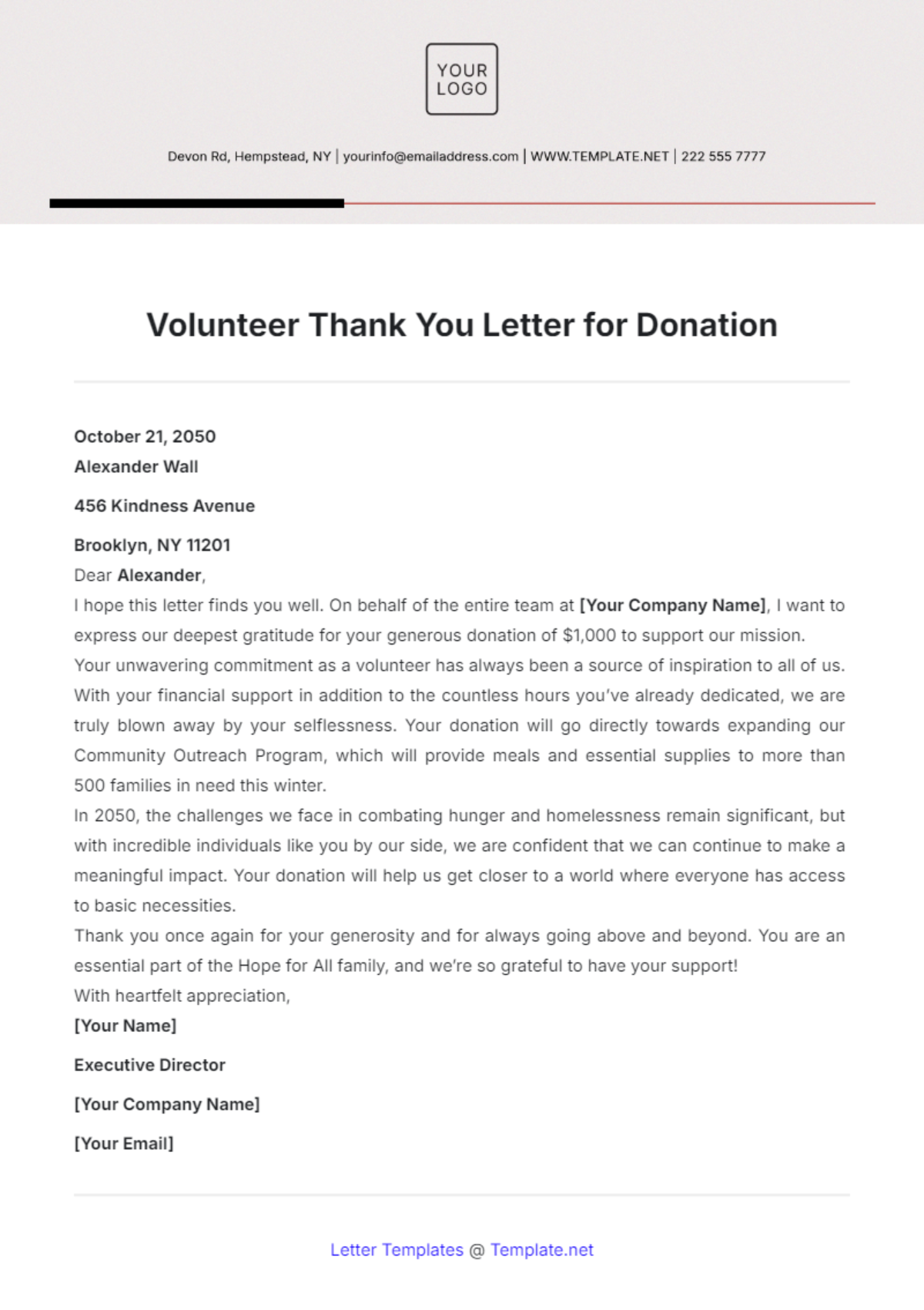

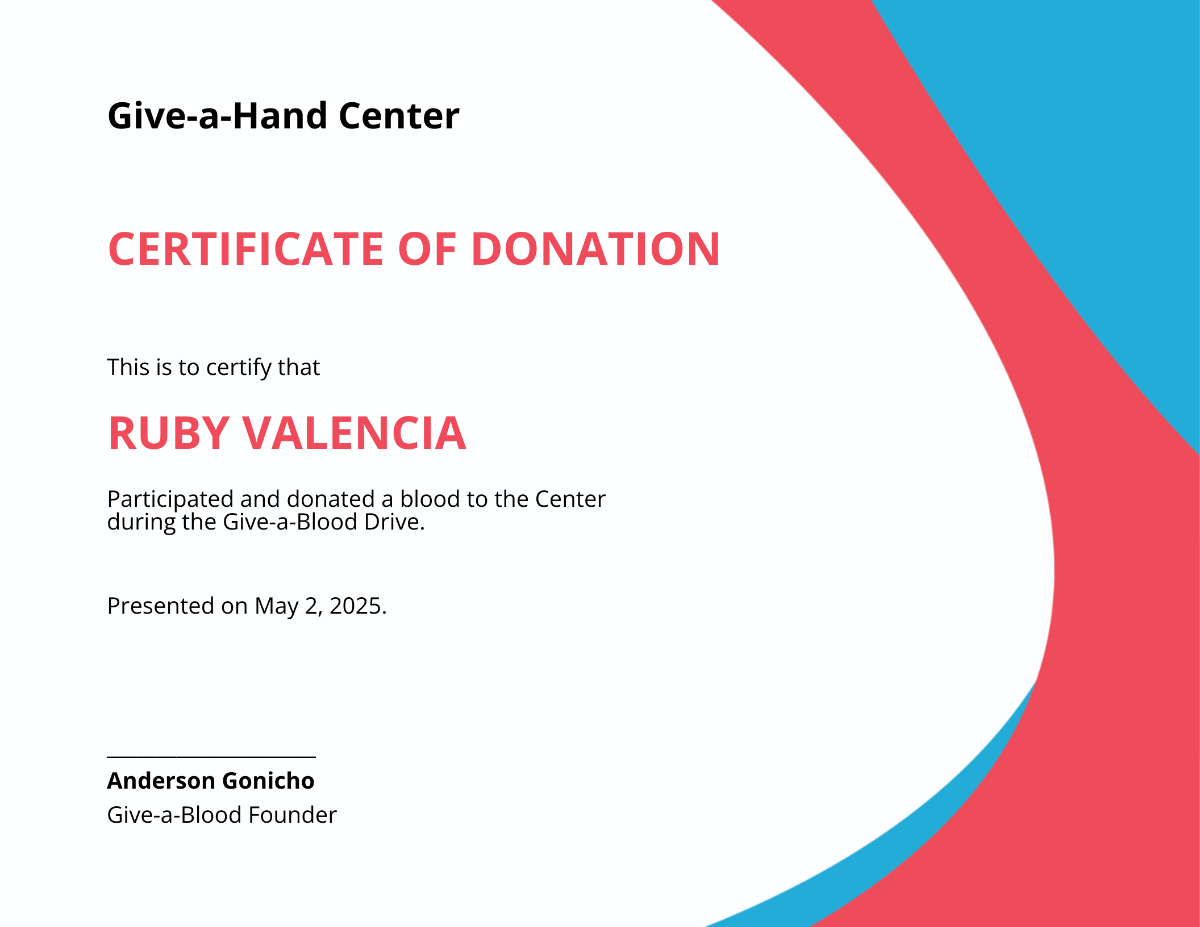

Keep your nonprofit organization engaged, increase donor participation, and streamline your fundraising efforts with Donation Templates from Template.net. Whether you're organizing a charity auction or hosting a community fundraising event, these templates offer professional-quality designs that capture attention and convey your mission effectively. Include vital information such as event dates, donation goals, or QR codes to facilitate easy donations and ensure your potential donors are well-informed. Best of all, no advanced design skills are required! With customizable layouts tailored for both print and digital platforms, you can quickly create compelling content that promotes your cause and maximizes your impact.

Discover the many Donation Templates we have on hand to suit every fundraising initiative. Select a template that resonates with your campaign, then effortlessly swap in your organization's assets, and tweak colors and fonts to align with your branding. Enhance your templates by dragging-and-dropping graphics or adding animated effects to make your message stand out. The possibilities are endless and completely skill-free, allowing anyone to create stunning designs that leave a lasting impression. With regularly updated templates and new designs added weekly, you'll always have fresh content at your fingertips. When you’re finished, download or share your templates via email, social media, or print, making them ideal for multiple channels and reaching your audience wherever they are.