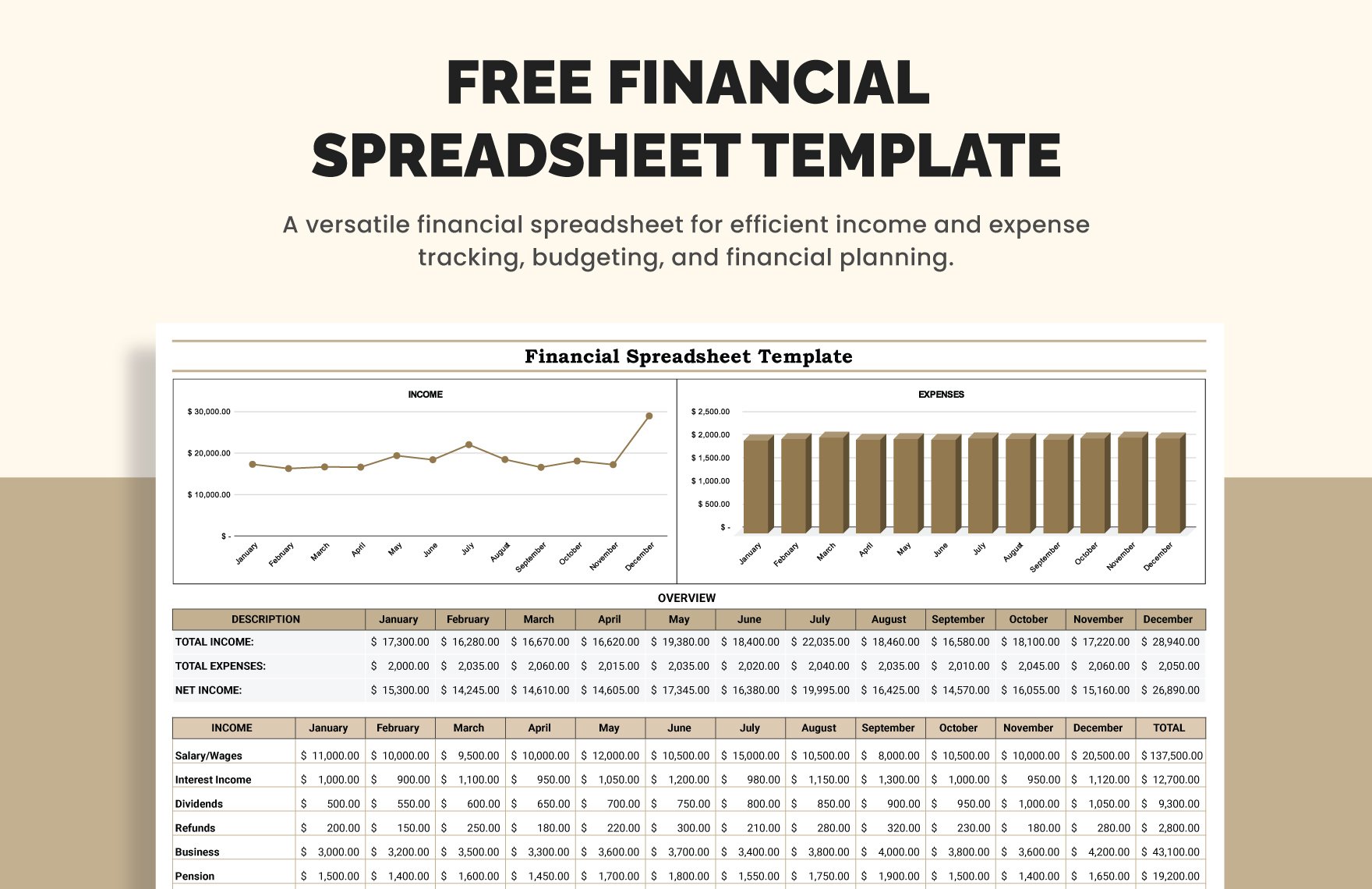

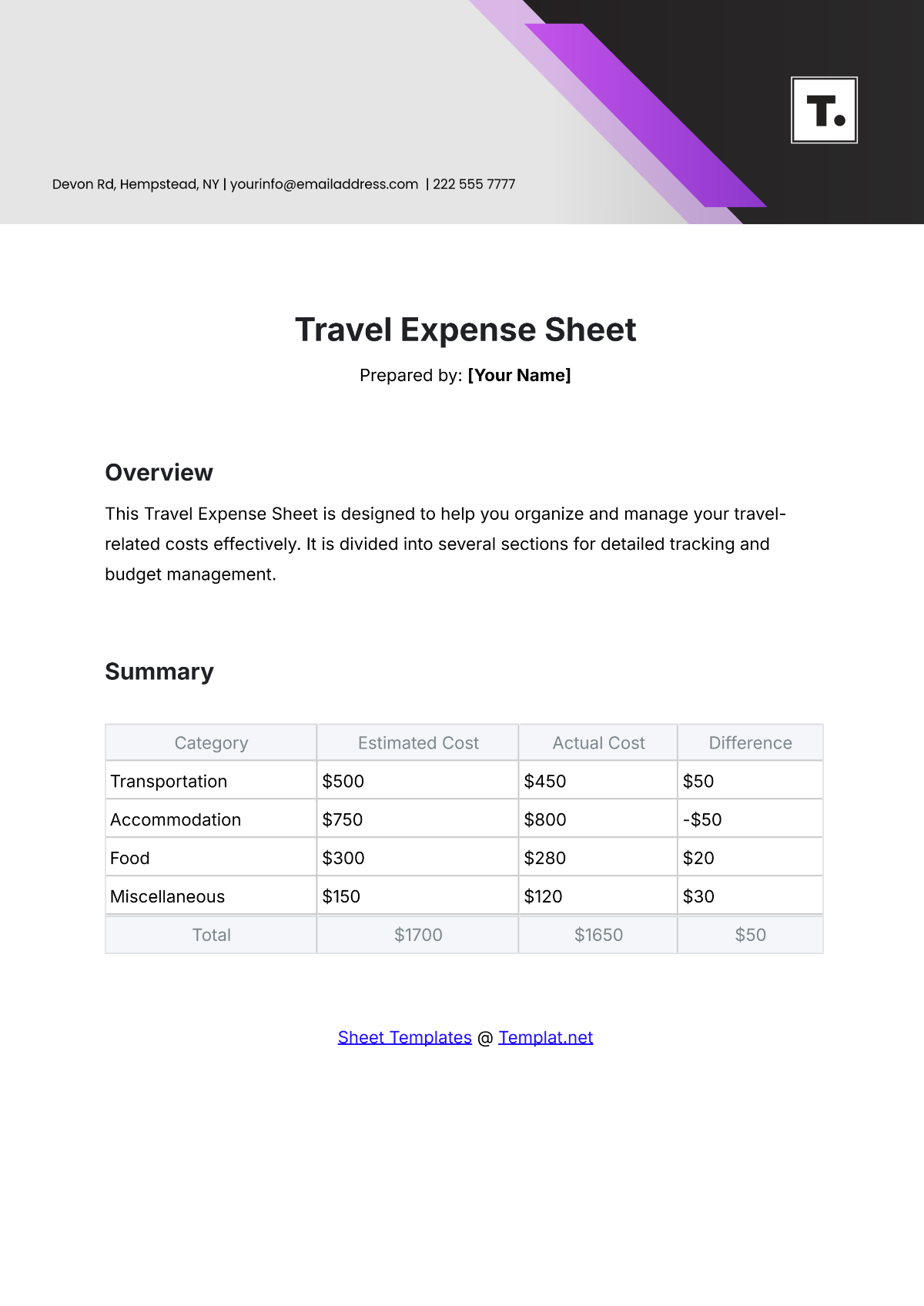

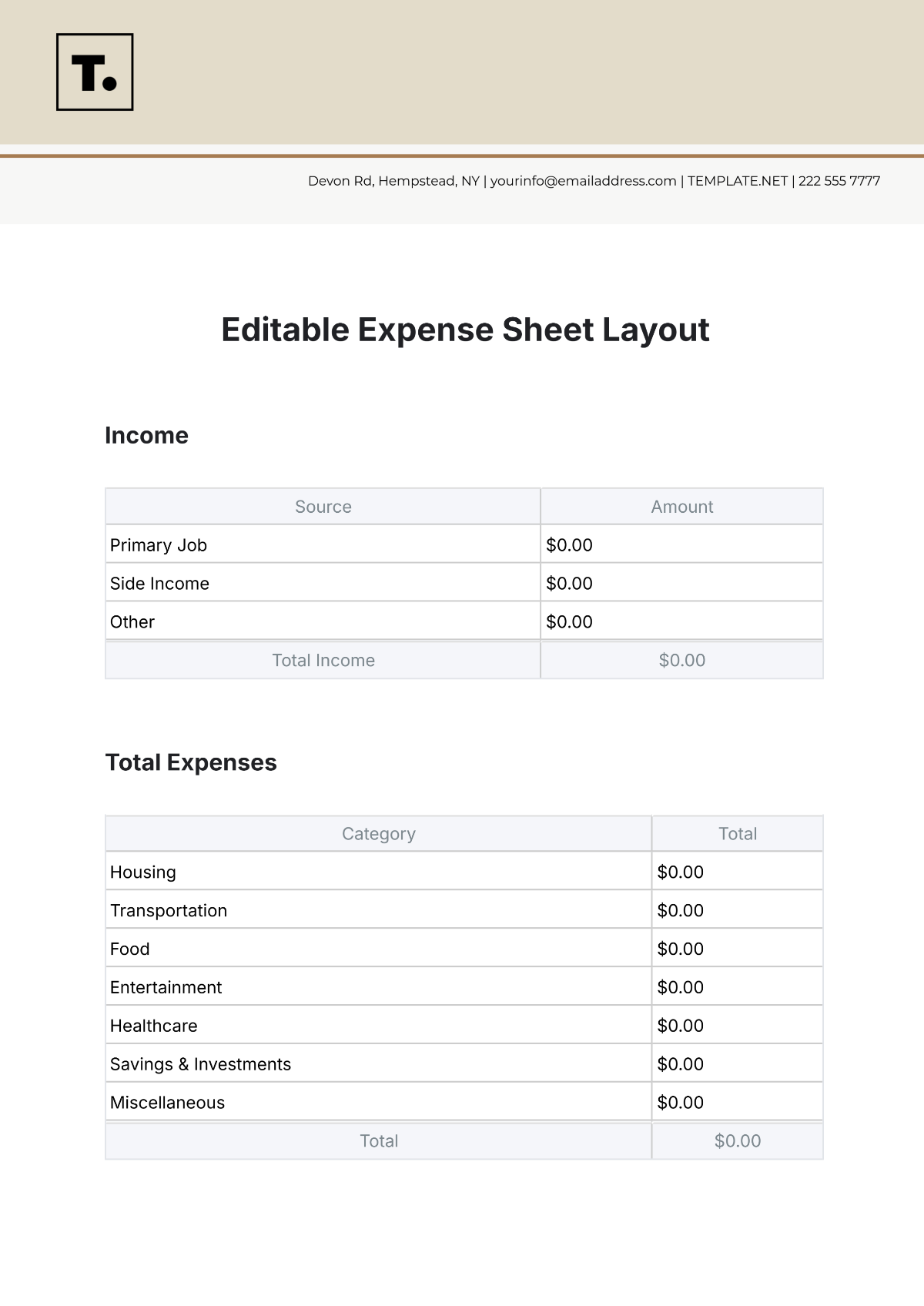

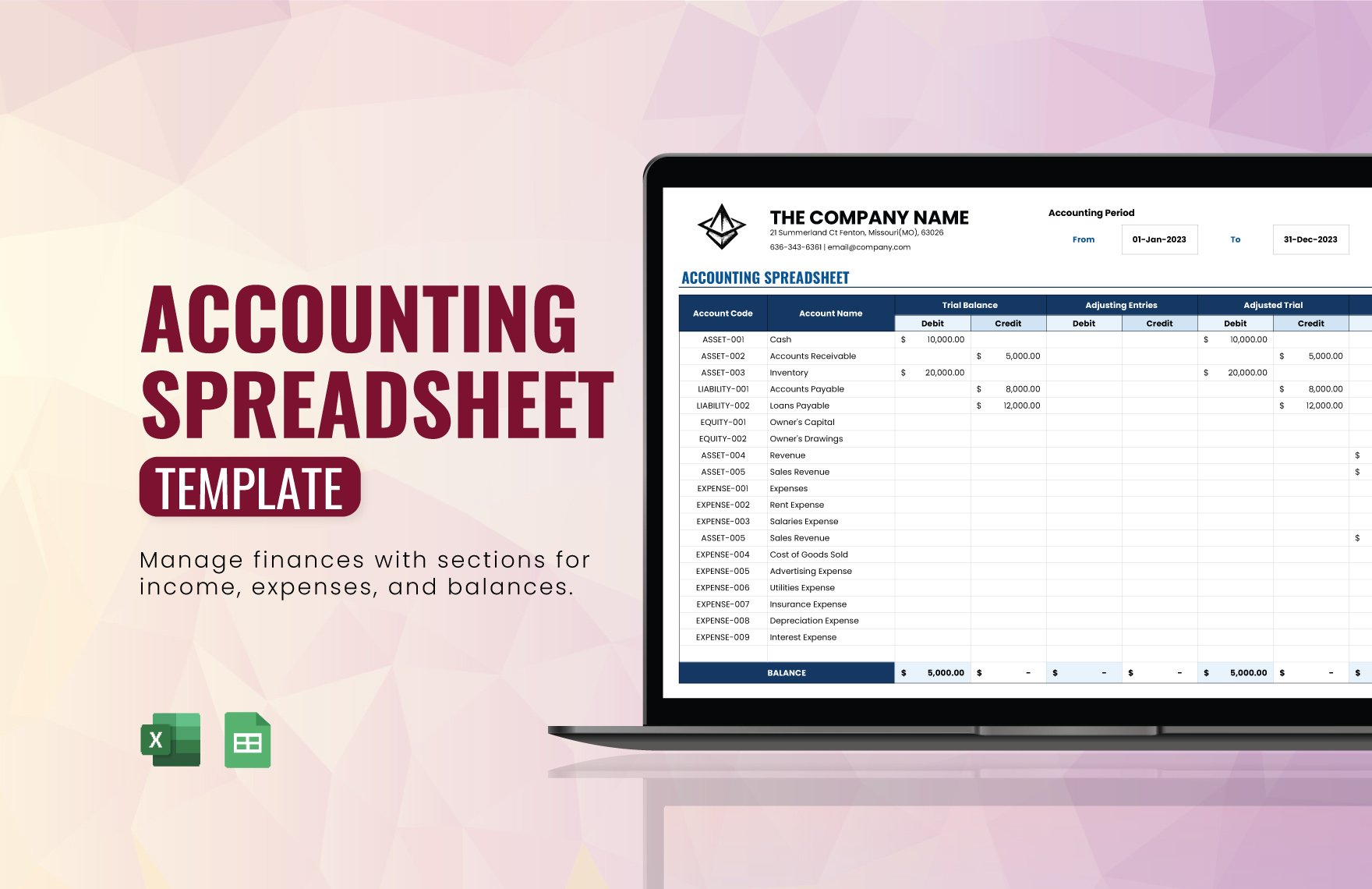

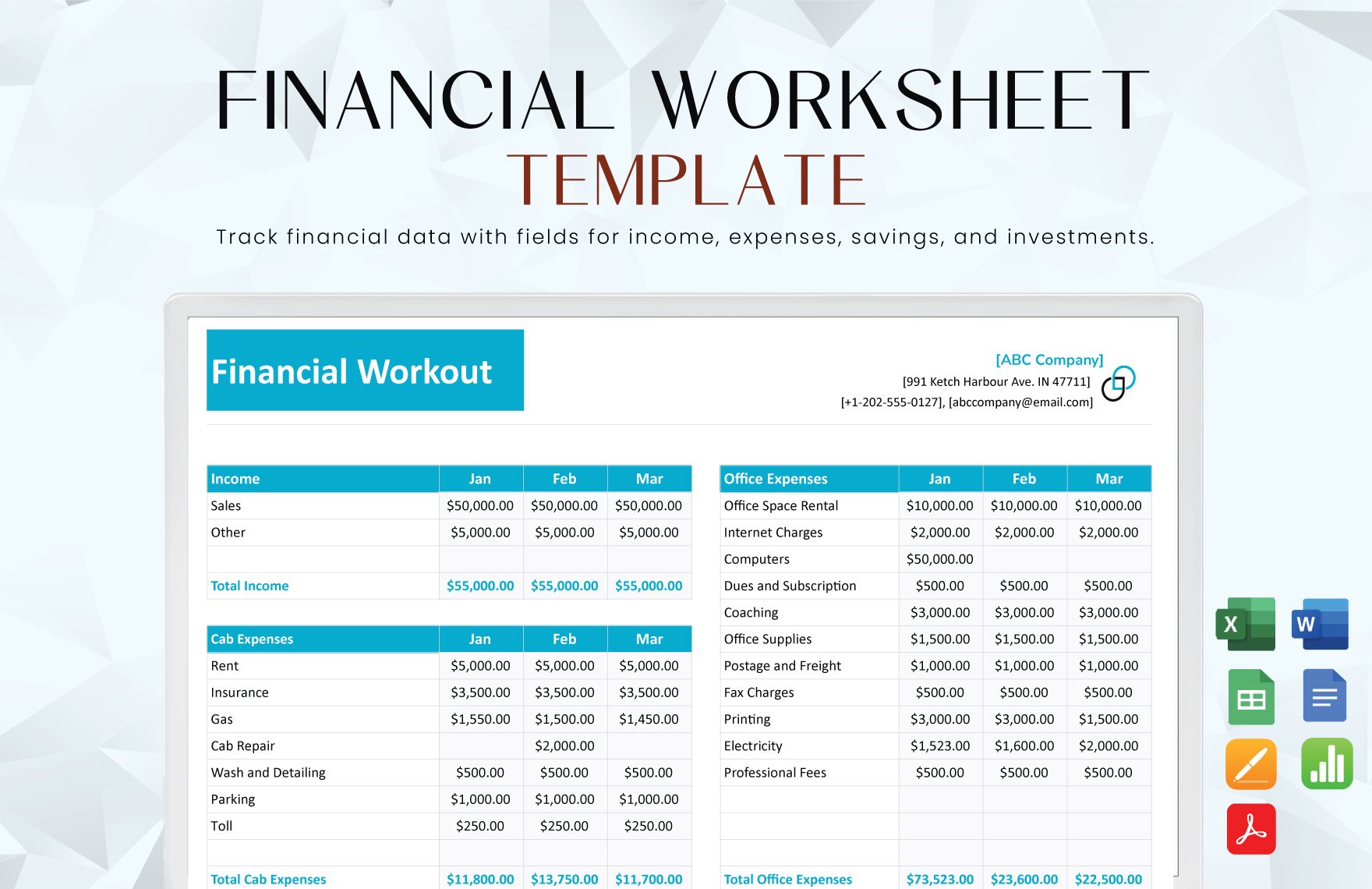

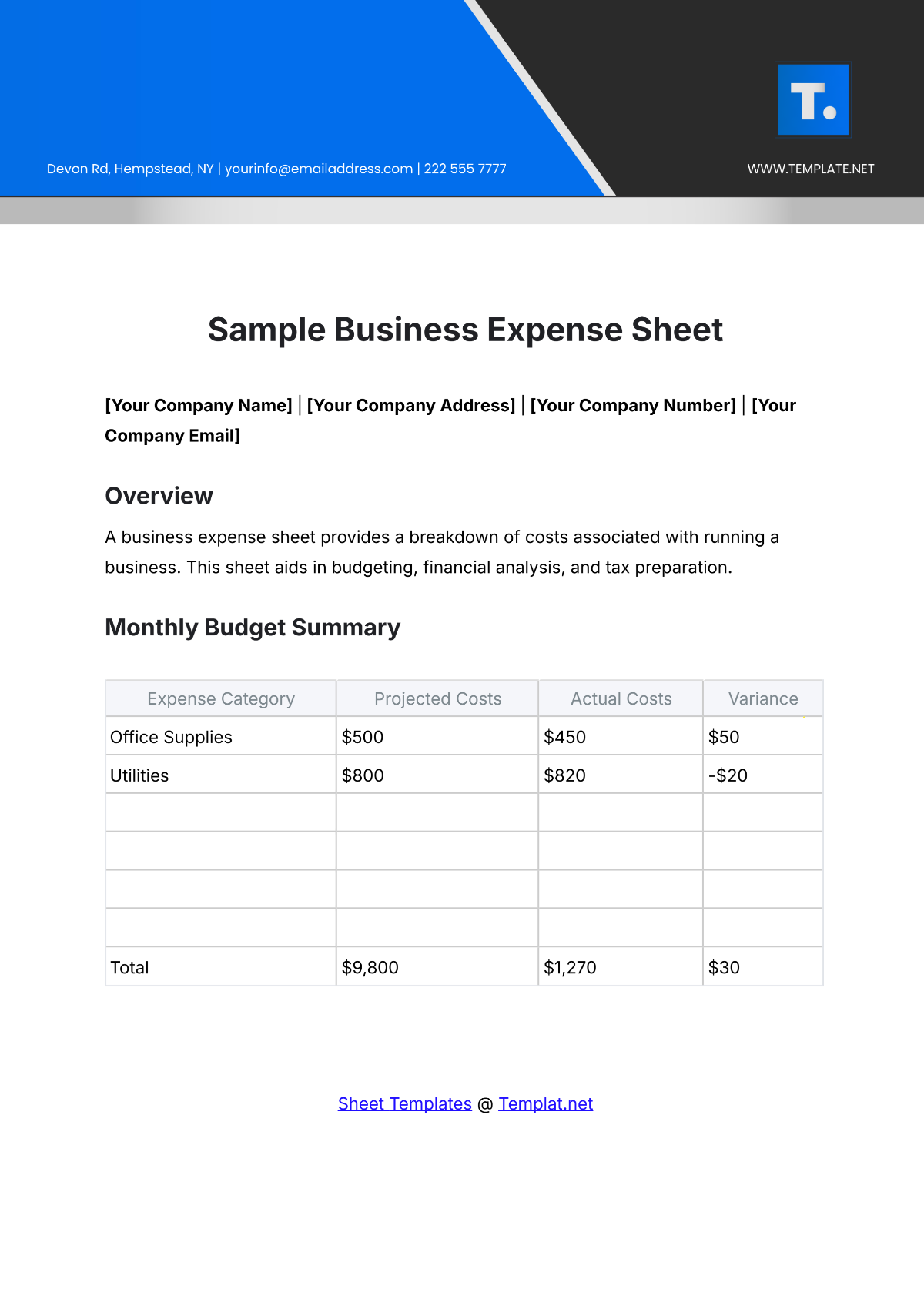

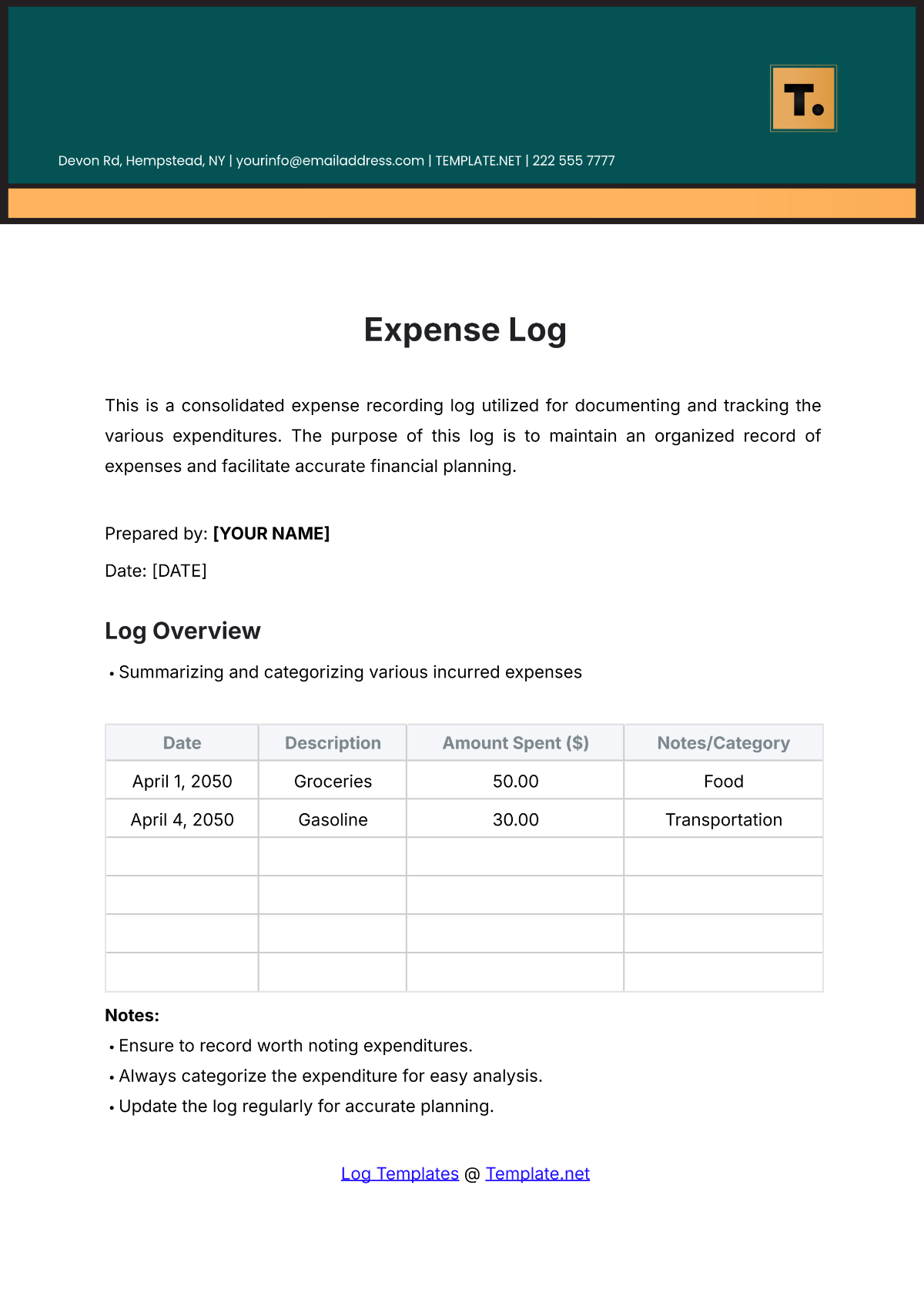

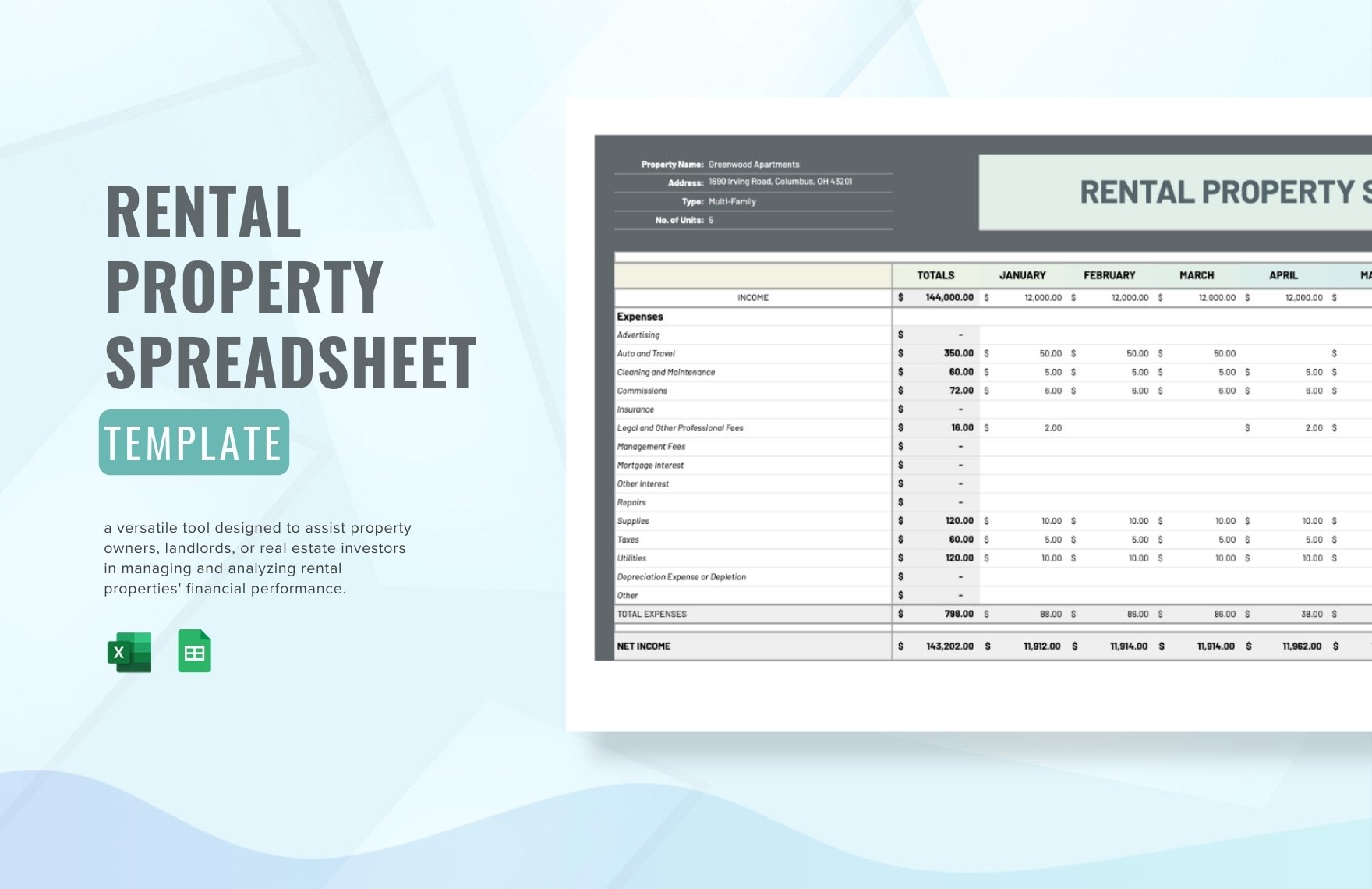

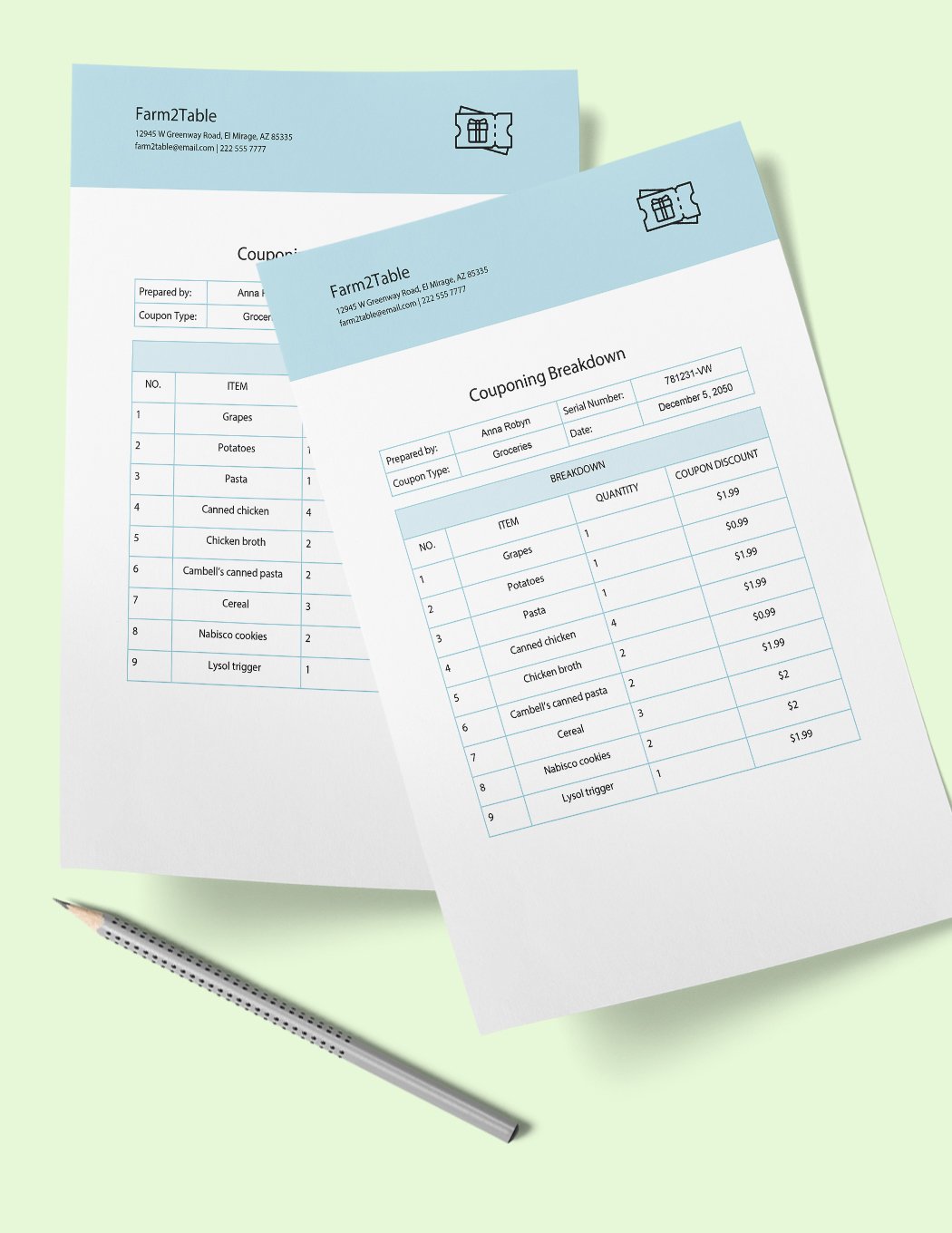

Seeking ways to keep track of your expenses for your business? Looking for the best method to monitor your personal or household expenses? Consider your search successful for you've landed on our selection of customizable and printable expense sheets that can serve both your business and personal needs. With the use of our highly functional templates, you can effectively itemize your expenses accordingly, especially that it already comes with useful visual elements and suggestive written contents that are layered into scalable vectors which enables you to further modify it using programs like Google Docs, Google Sheets, MS Word, Excel, Numbers, and Pages. Download our premium Expense Sheet Templates today when you avail of any of our subscription plans!

What Is an Expense Sheet?

In order to record your expenses within a certain period of time, it is highly recommended that you make use of an expense sheet that will get the job done for you. No matter how well you simplify your budget for your finances, it will be pointless if you do not track your expenses. Through expense sheets, you can easily keep track where your income, or your money in general, is going. Managing expenses can be tough for some people, but if you want to get disciplined, an expense sheet is a great tool that can help you get started.

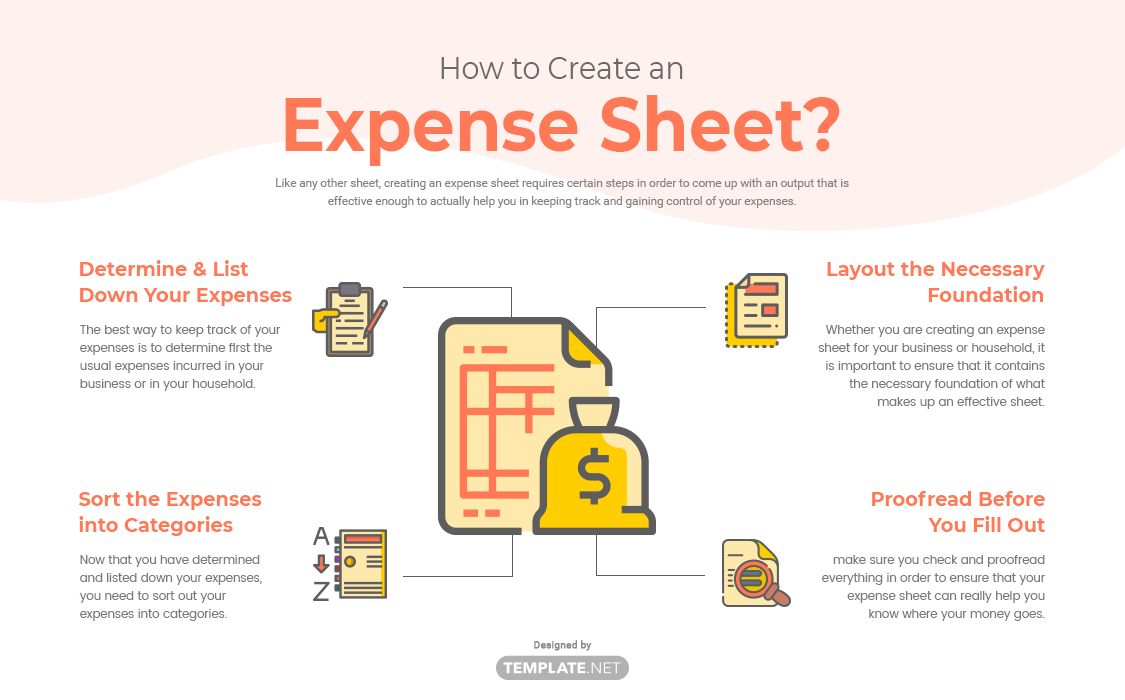

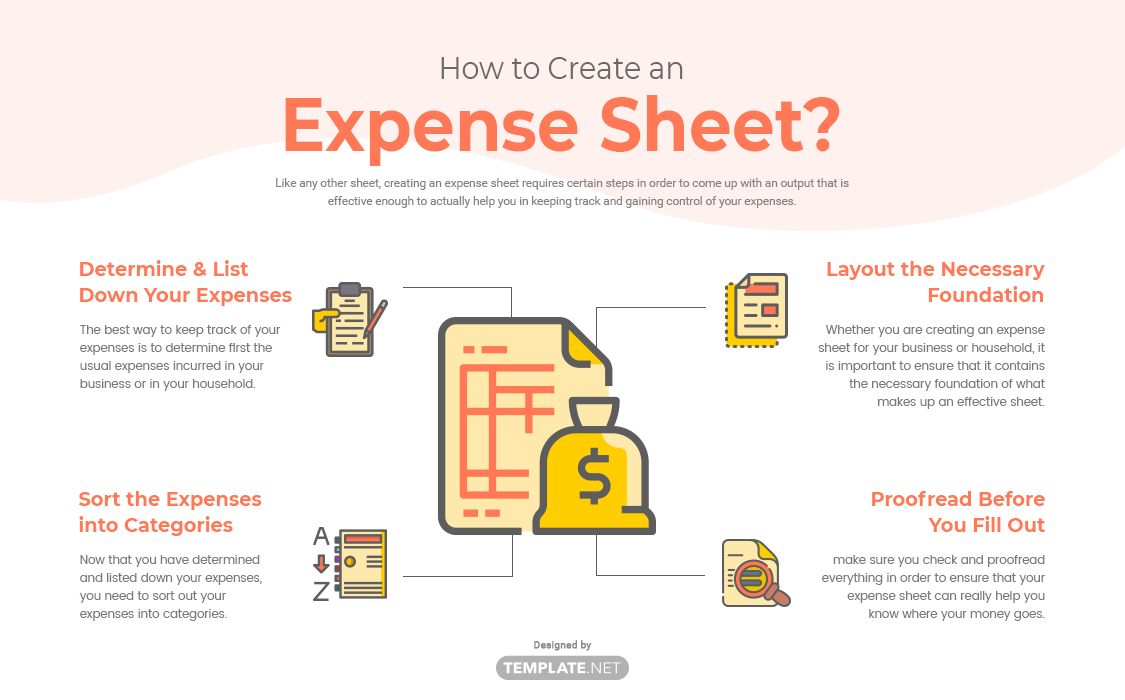

How to Create an Expense Sheet

Like any other sheet, creating an expense sheet requires certain steps in order to come up with an output that is effective enough to actually help you in keeping track and gaining control of your expenses. To help you out with that, here are the guidelines you can follow to come up with an expense sheet that works well for you.

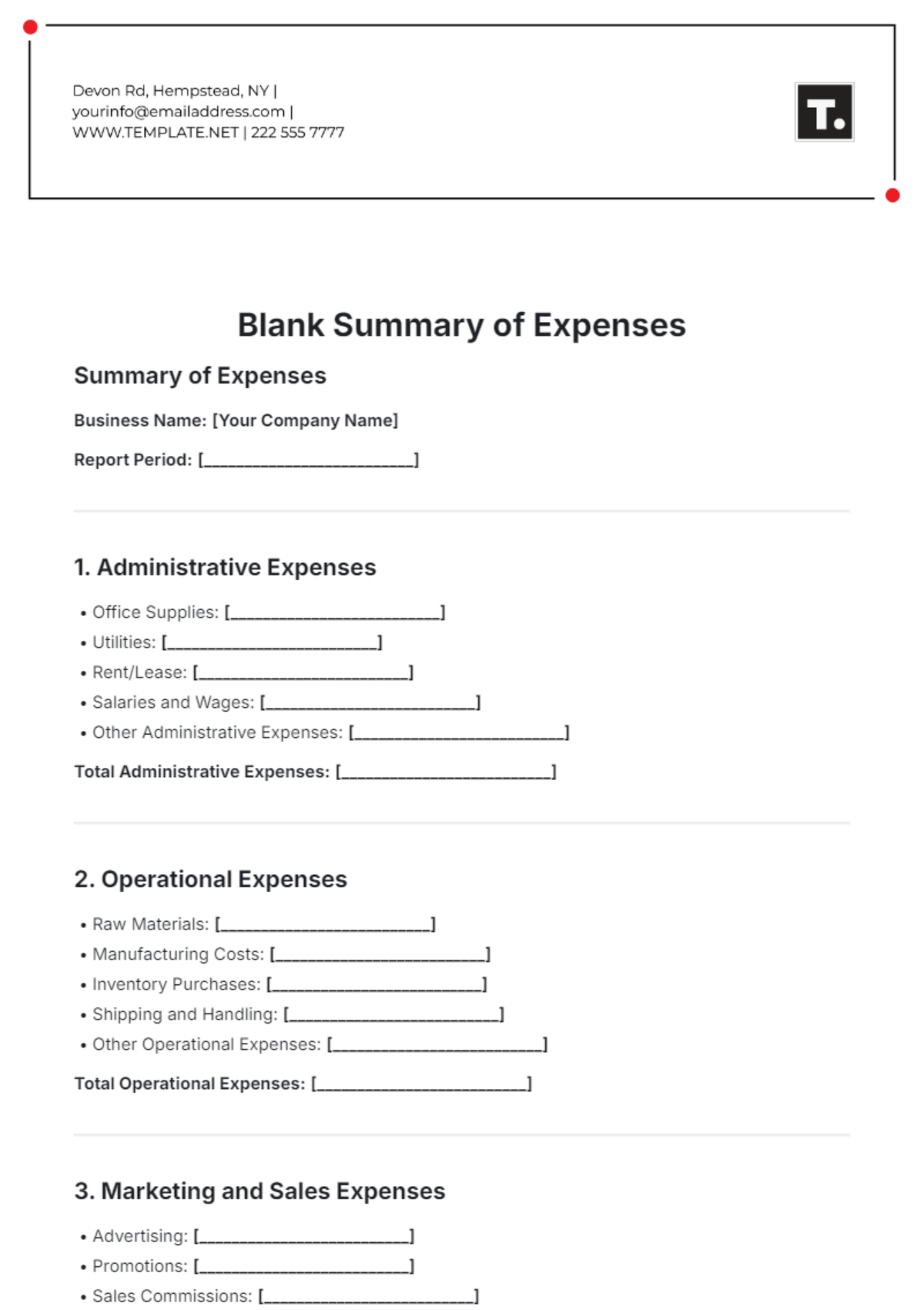

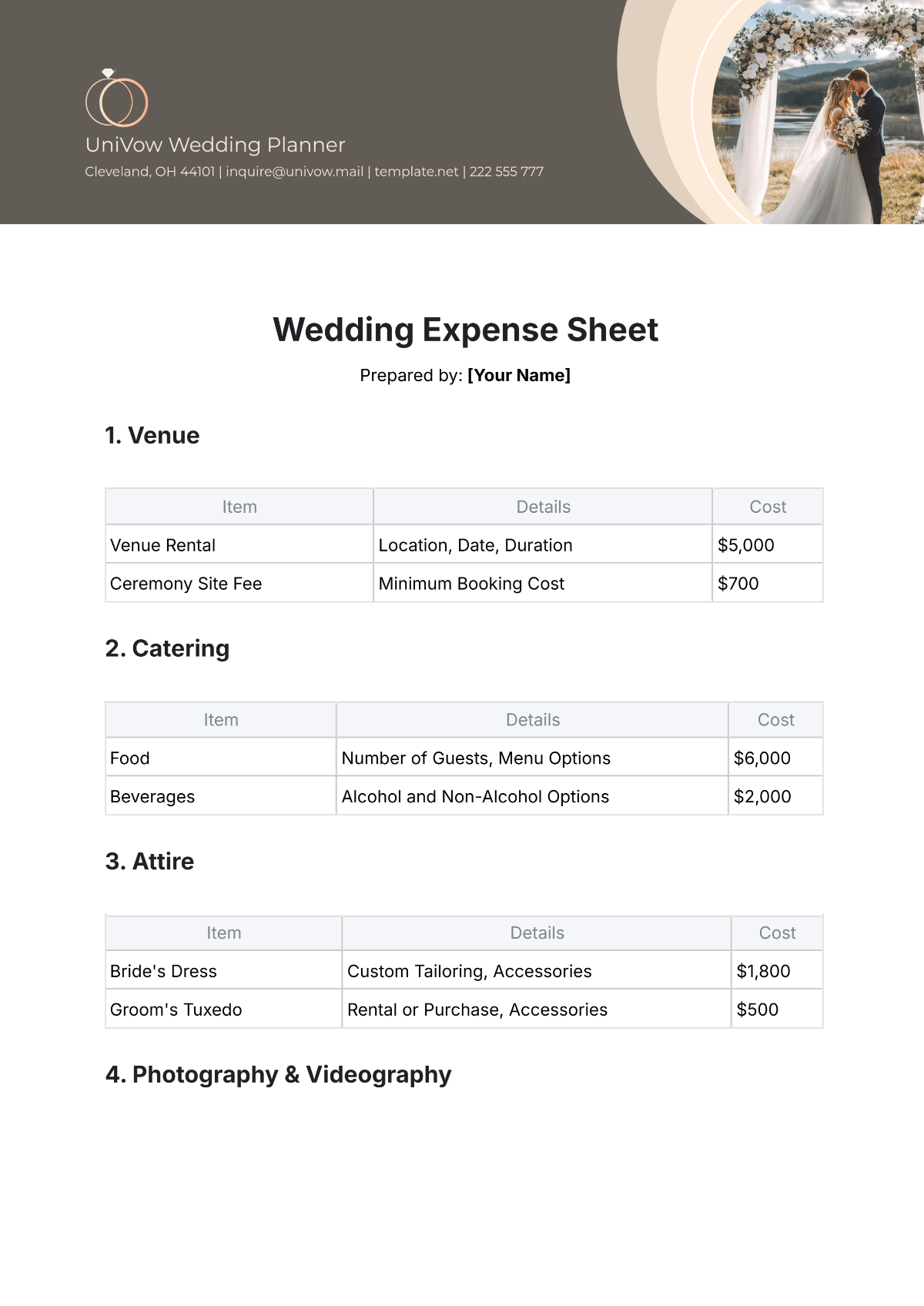

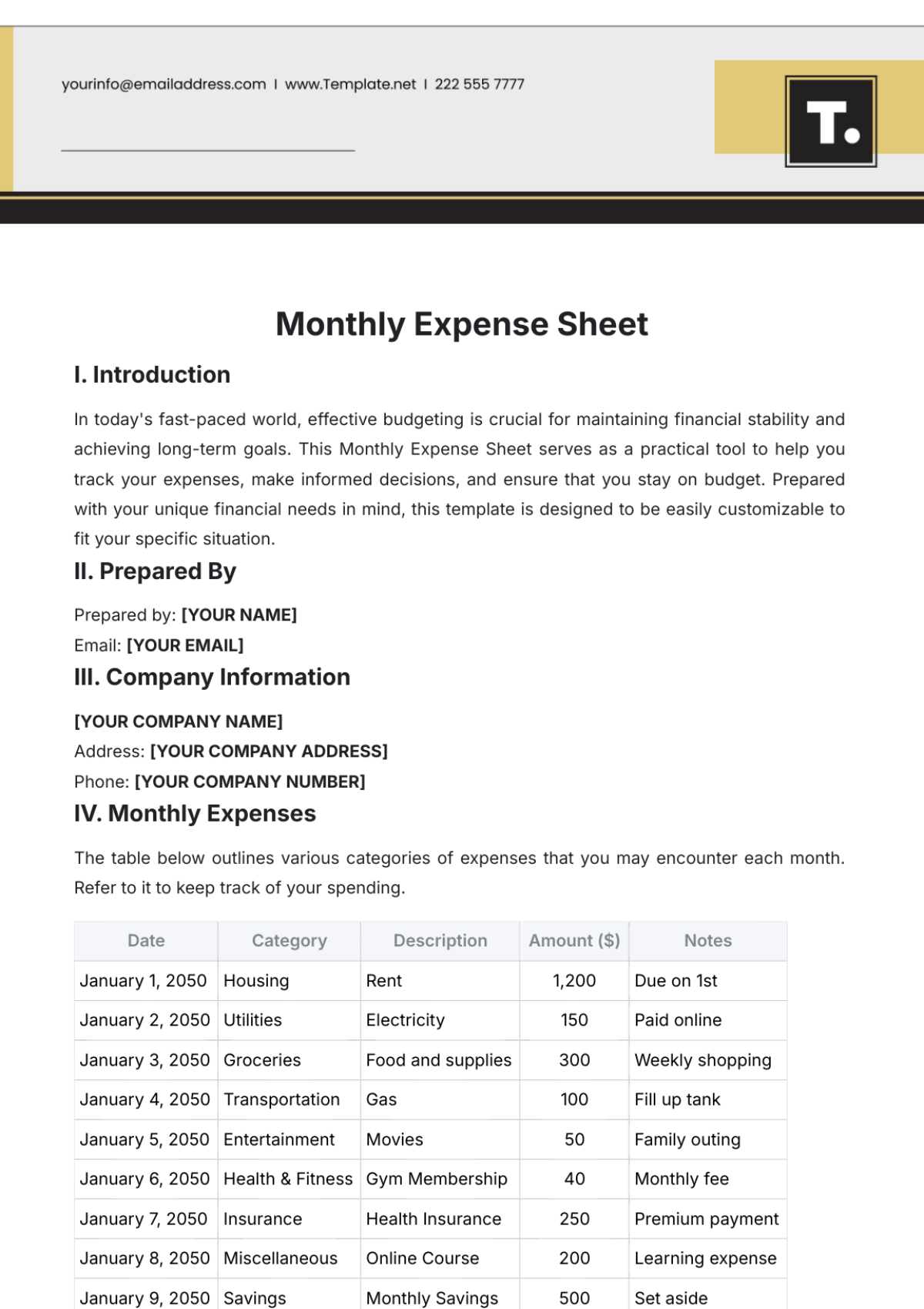

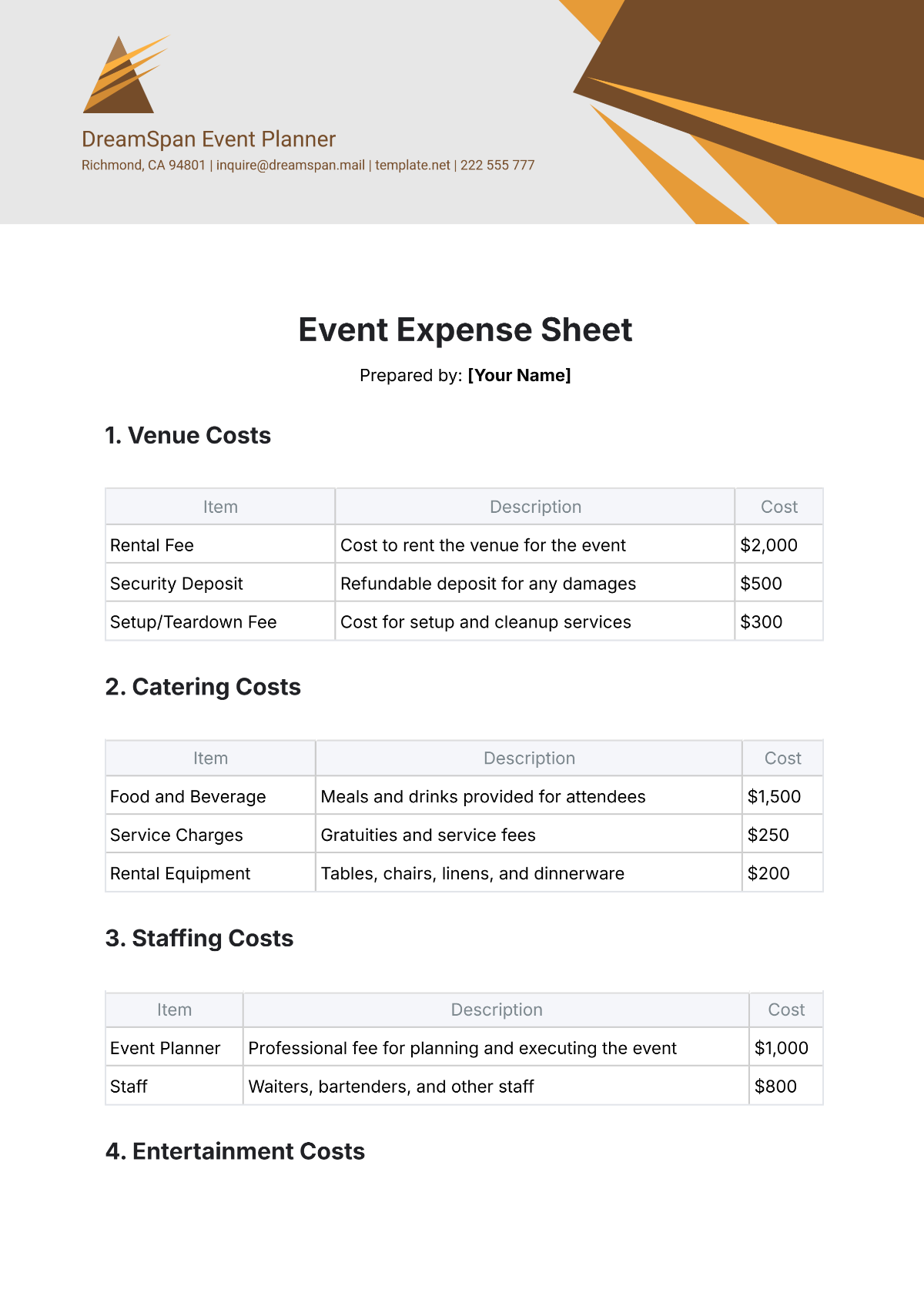

1. Determine and List Down Your Expenses

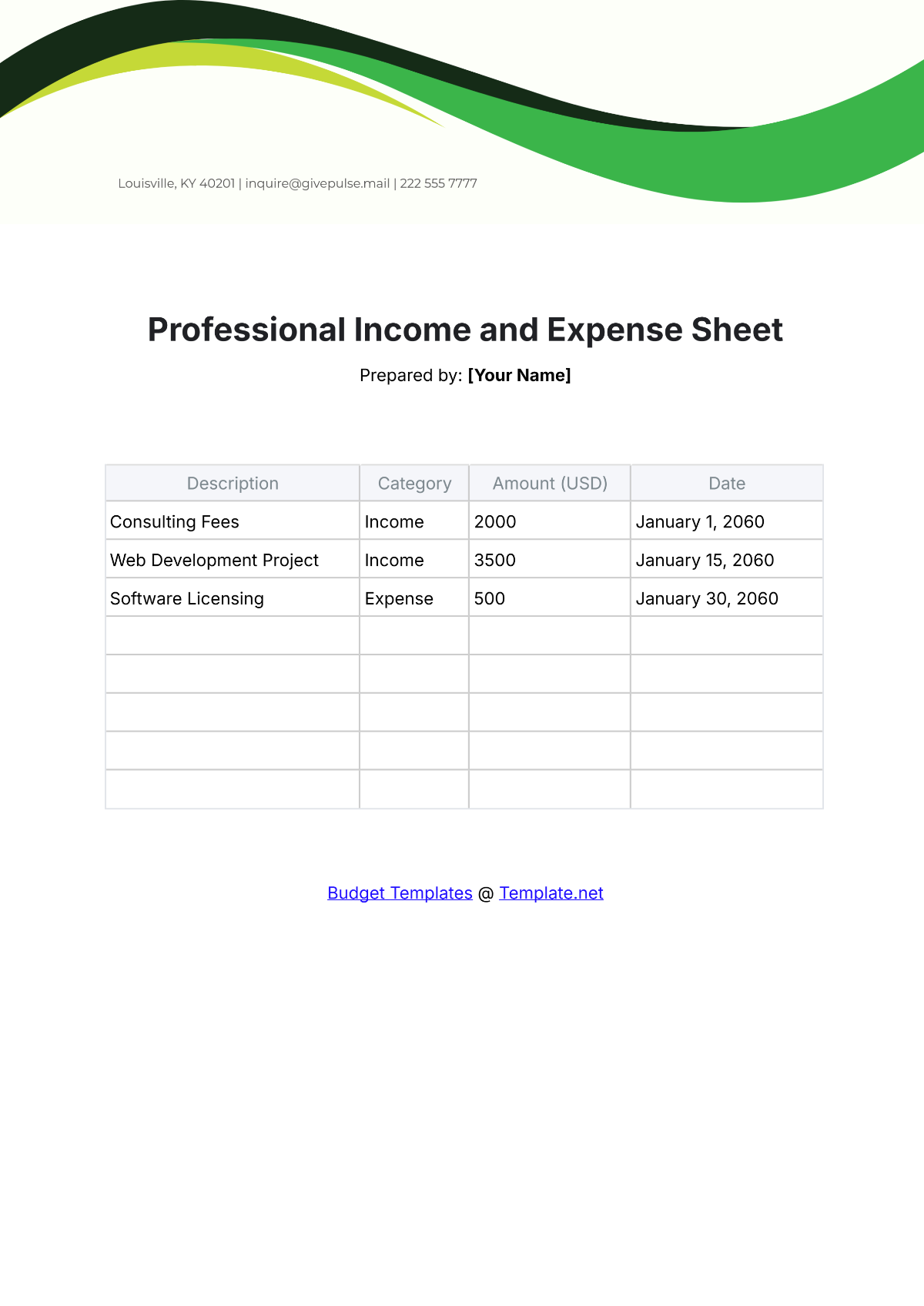

The best way to keep track of your expenses is to determine first the usual expenses incurred in your business or in your household. It is in listing down your daily, weekly, monthly, and even yearly expenses that you can conveniently determine the specific categories for your expense sheet. You may refer to your old receipts, ATM receipts, credit card statements, and bills and take note of its dates but if you want to gain accurate details of your expenses, you need to be diligent enough to keep track and record even that single piece of candy you've bought.

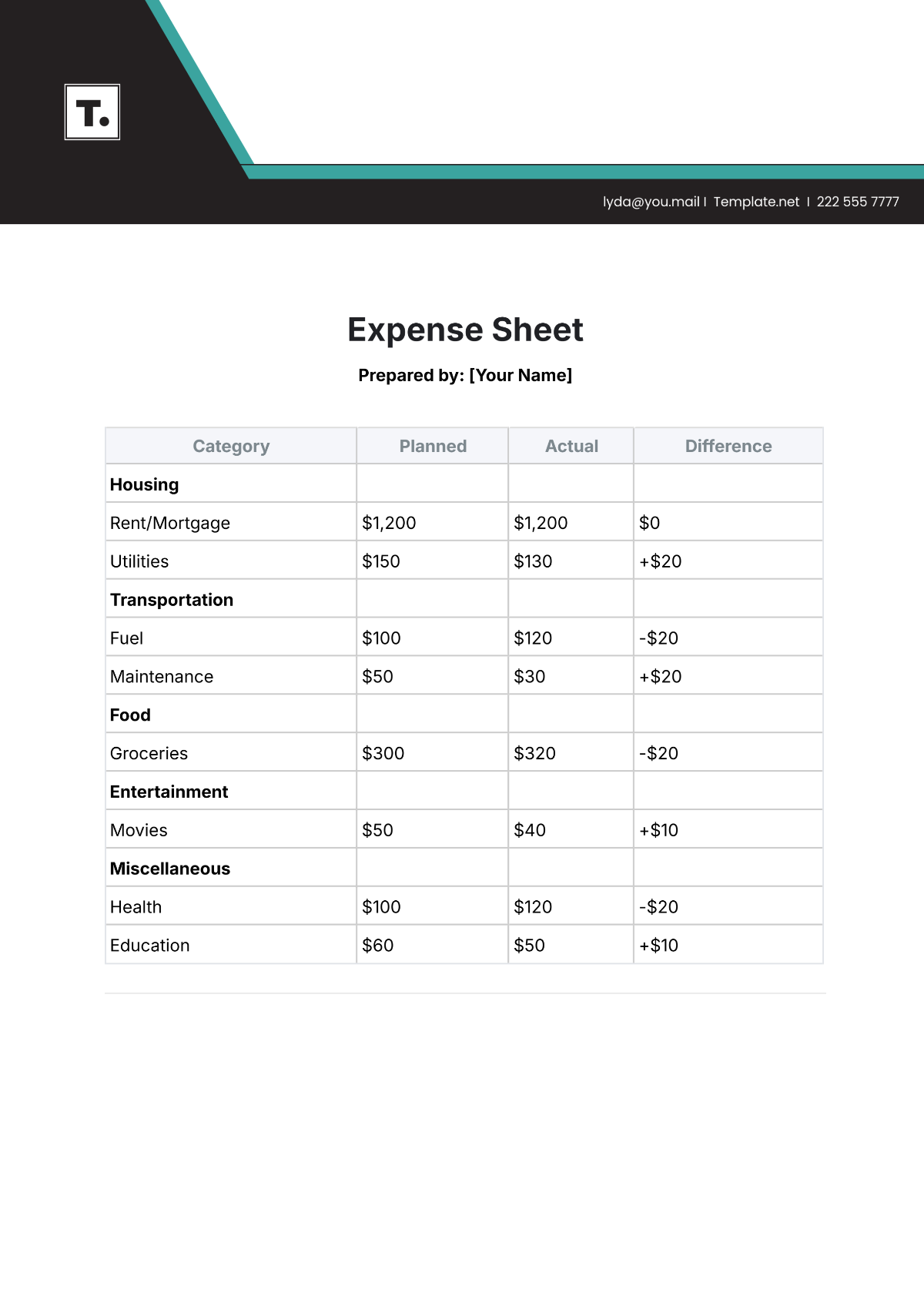

2. Sort the Expenses into Categories

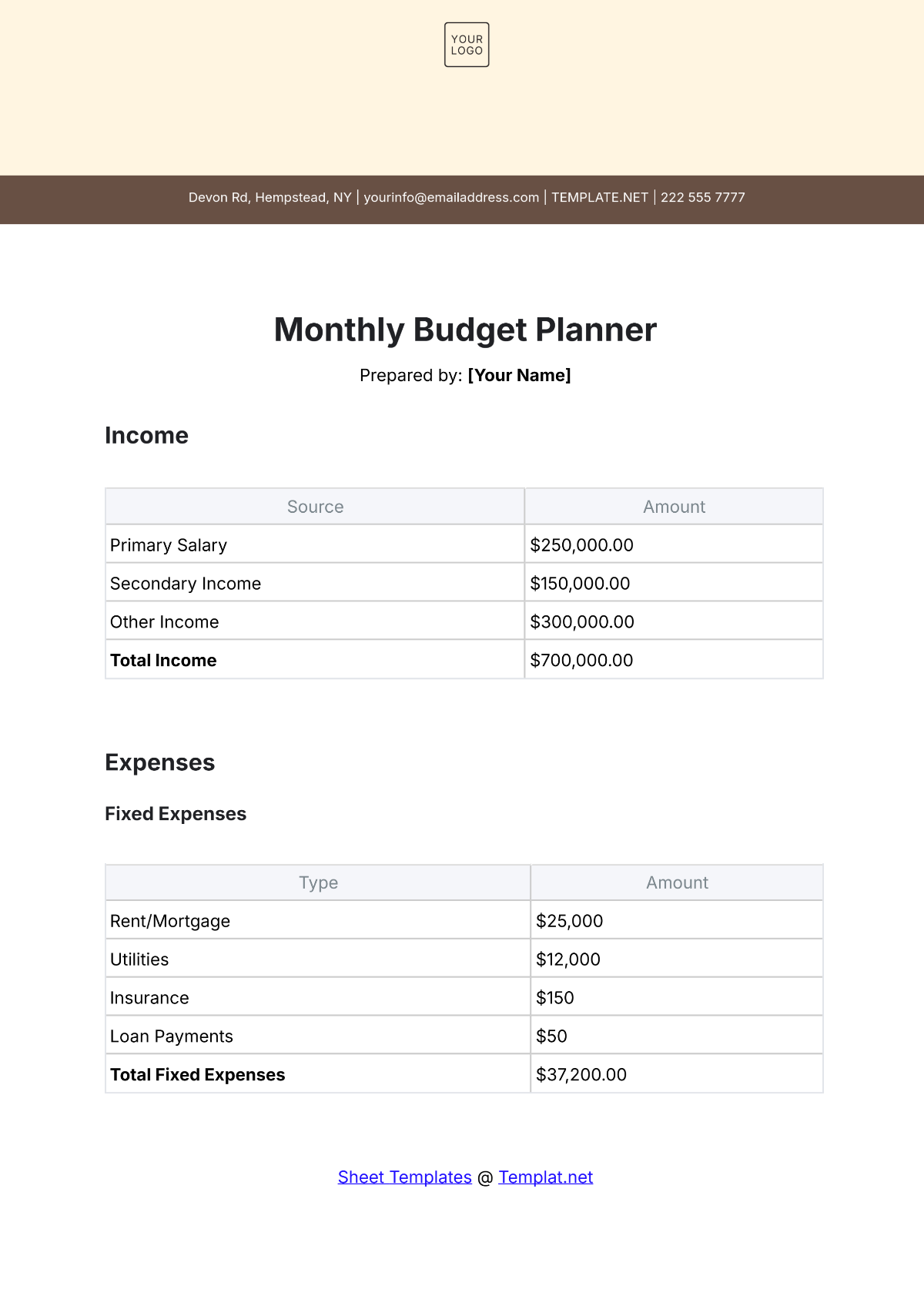

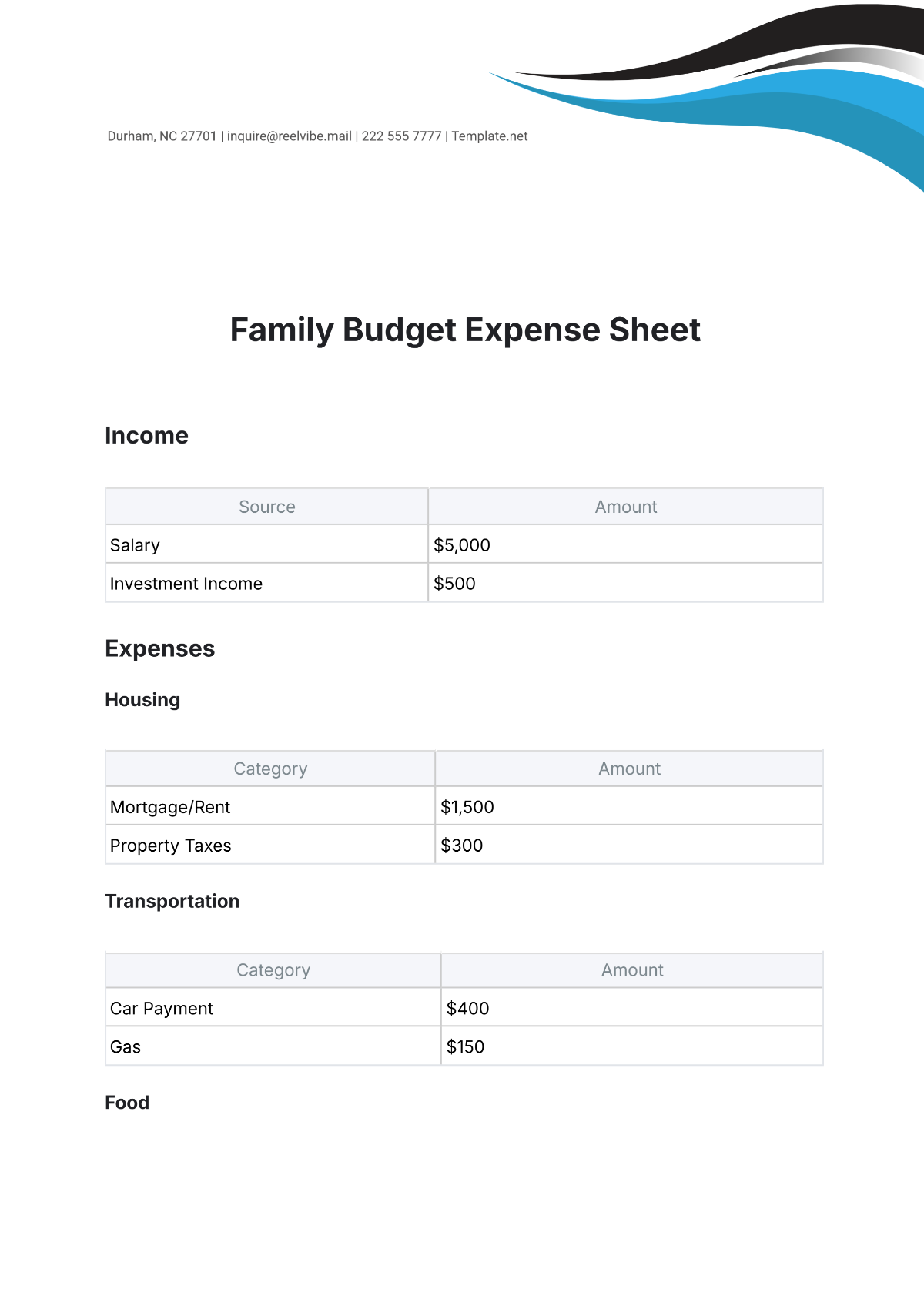

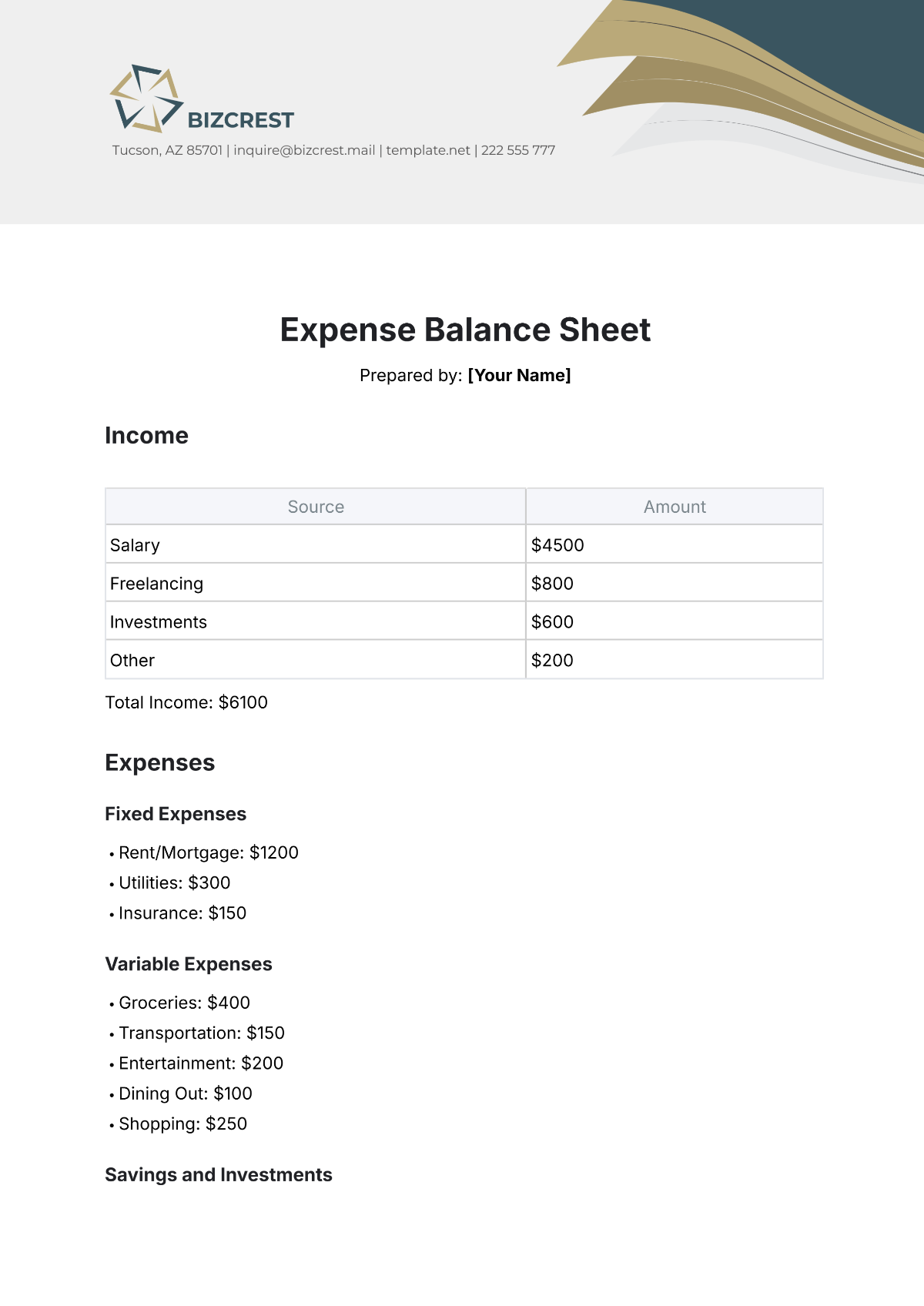

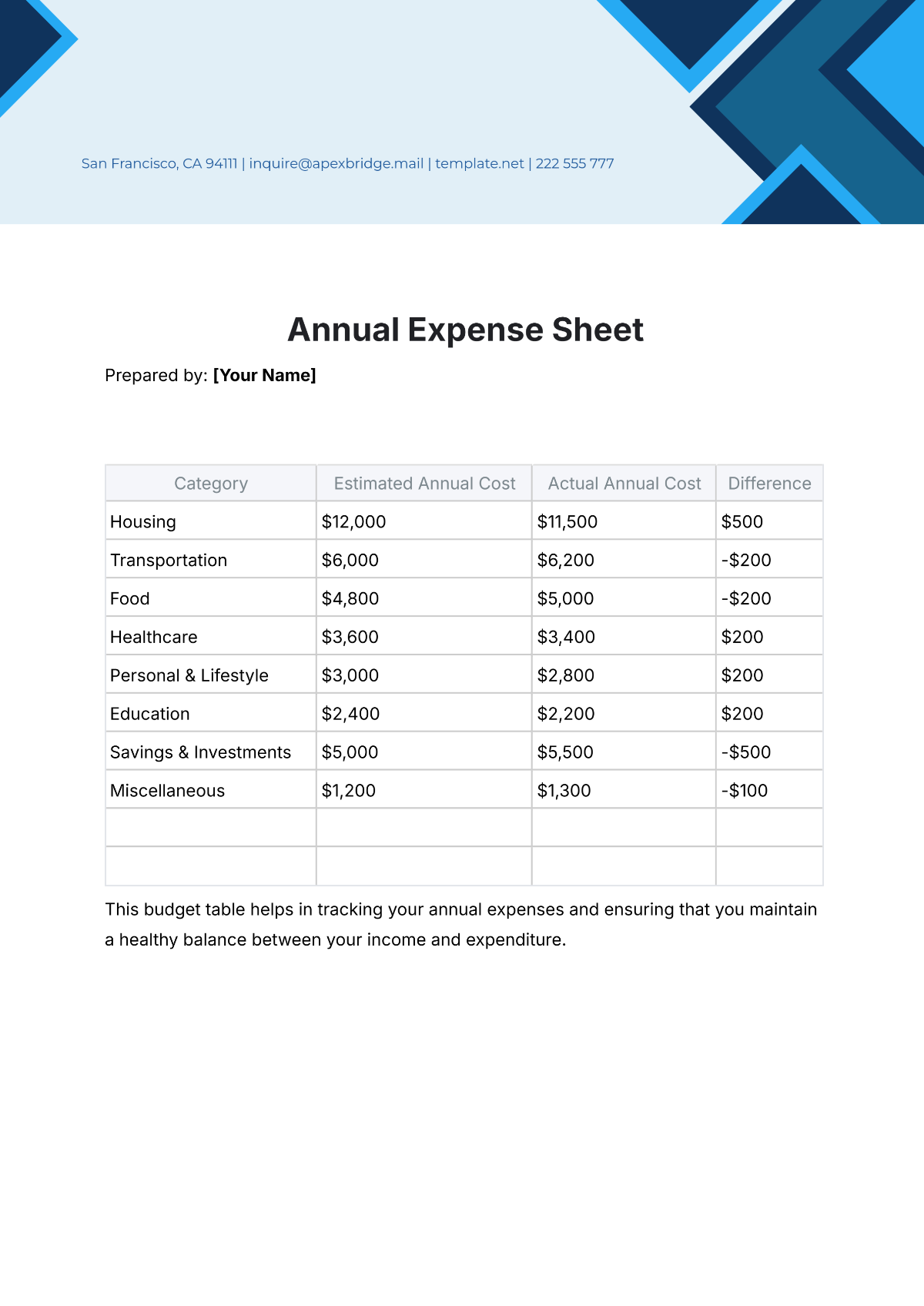

Now that you have determined and listed down your expenses, you need to sort out your expenses into categories. The three categories we recommend you to use are fixed expenses, variable expenses, and periodic expenses. Fixed expenses are the things you are ought to pay within a certain time period such as monthly bills and the like, variable expenses are expenses that are not set such as your grocery bills and utility bills, and your periodic expenses are the things you buy on an impulse, clothing, gifts, and the like.

3. Layout the Necessary Foundation

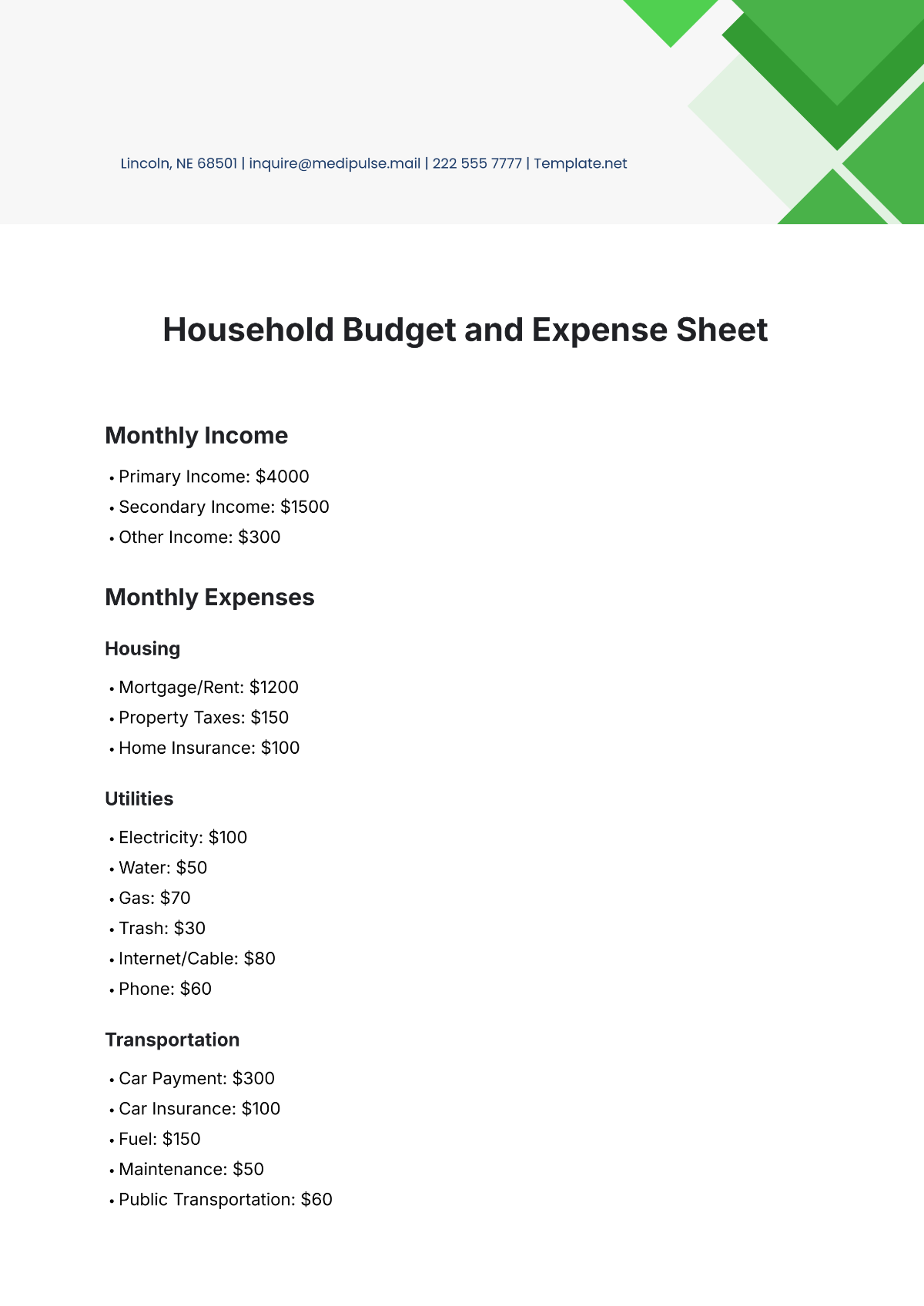

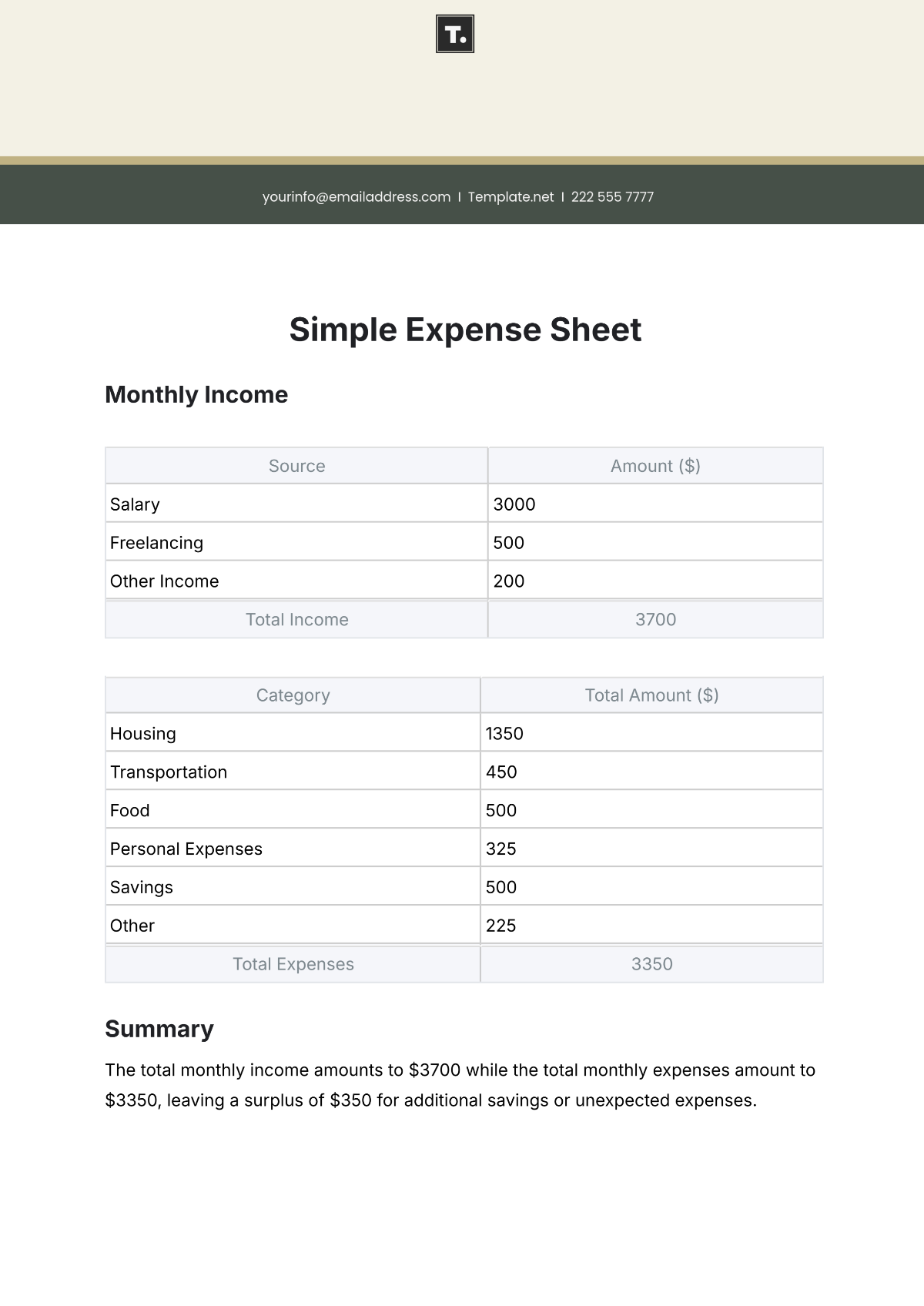

Whether you are creating an expense sheet for your business or for your household, it is important to ensure that it contains the necessary foundation of what makes up an effective budget sheet. The components of your expense sheet's foundation should include both an income and expenses section, the categories you have determined from the previous step, specific dates, and ample spaces where you can write down additional information such as your total income and total expenses according to a time period.

4. Proofread Before You Fill Out

Before you get too excited to fill out the expense sheet you just created, make sure you check and proofread everything in order to ensure that your expense sheet can really help you know where your money goes, encourage you to spend wisely, control your financial statements, and eventually reach your financial goals.