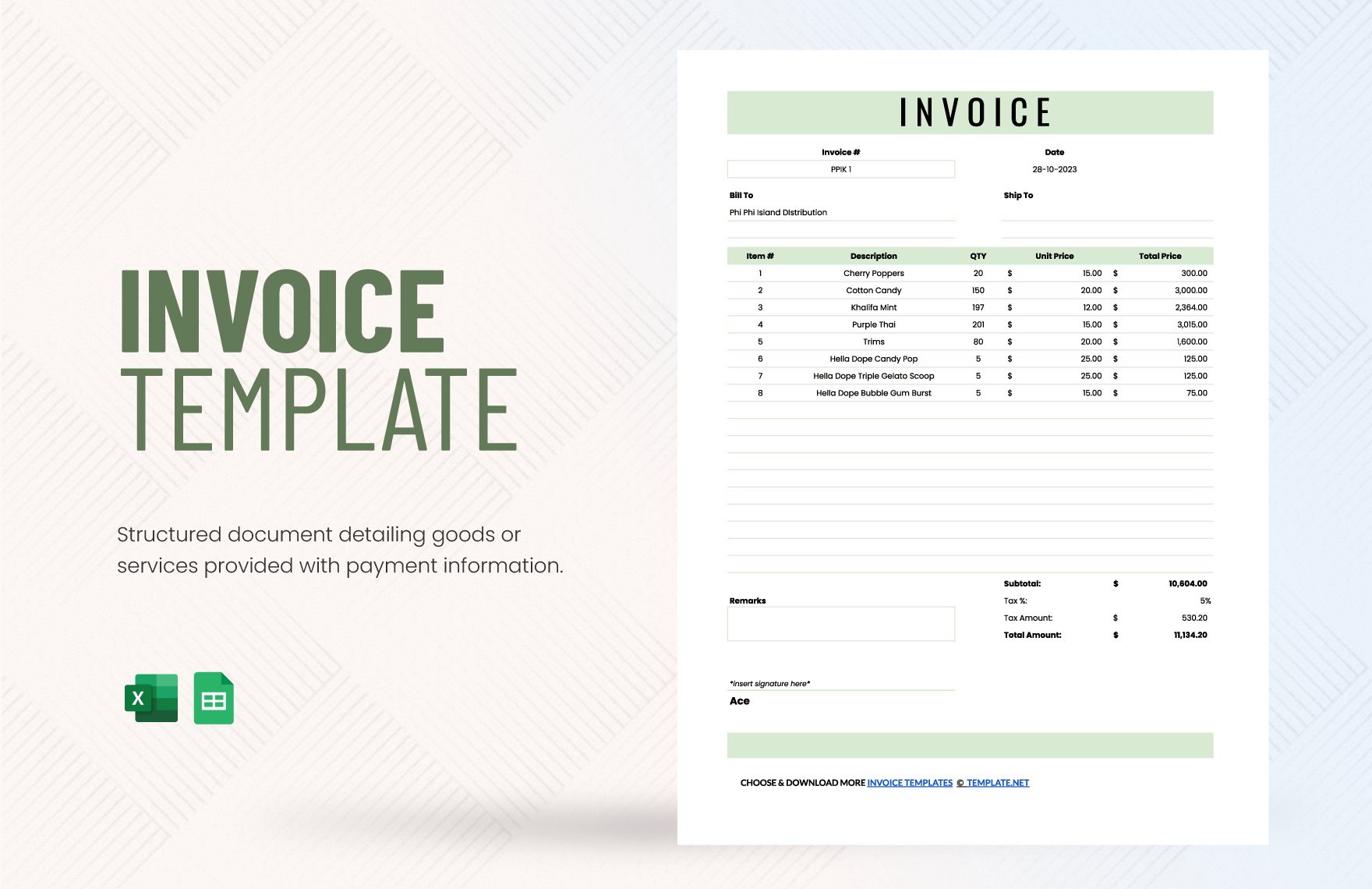

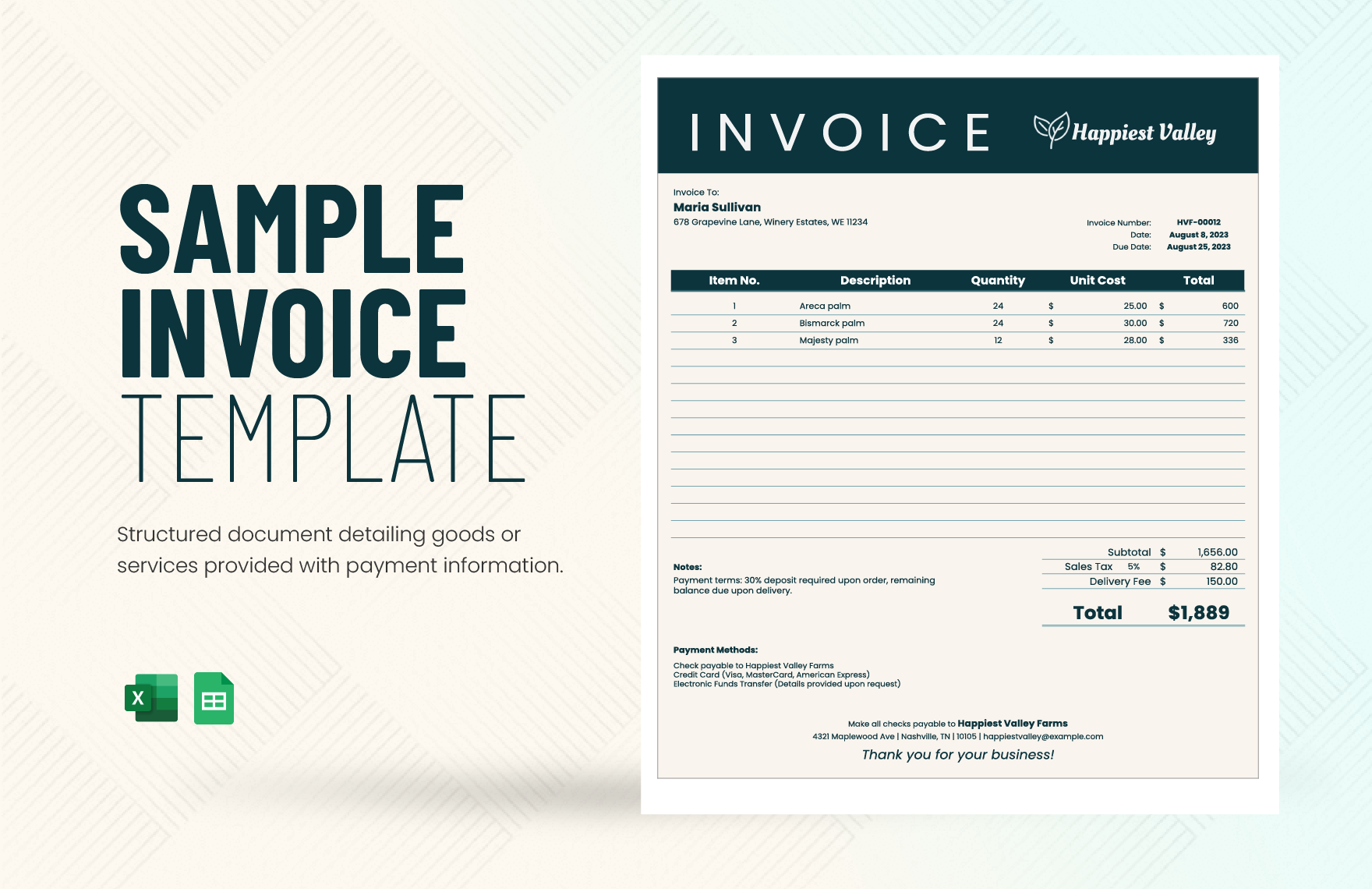

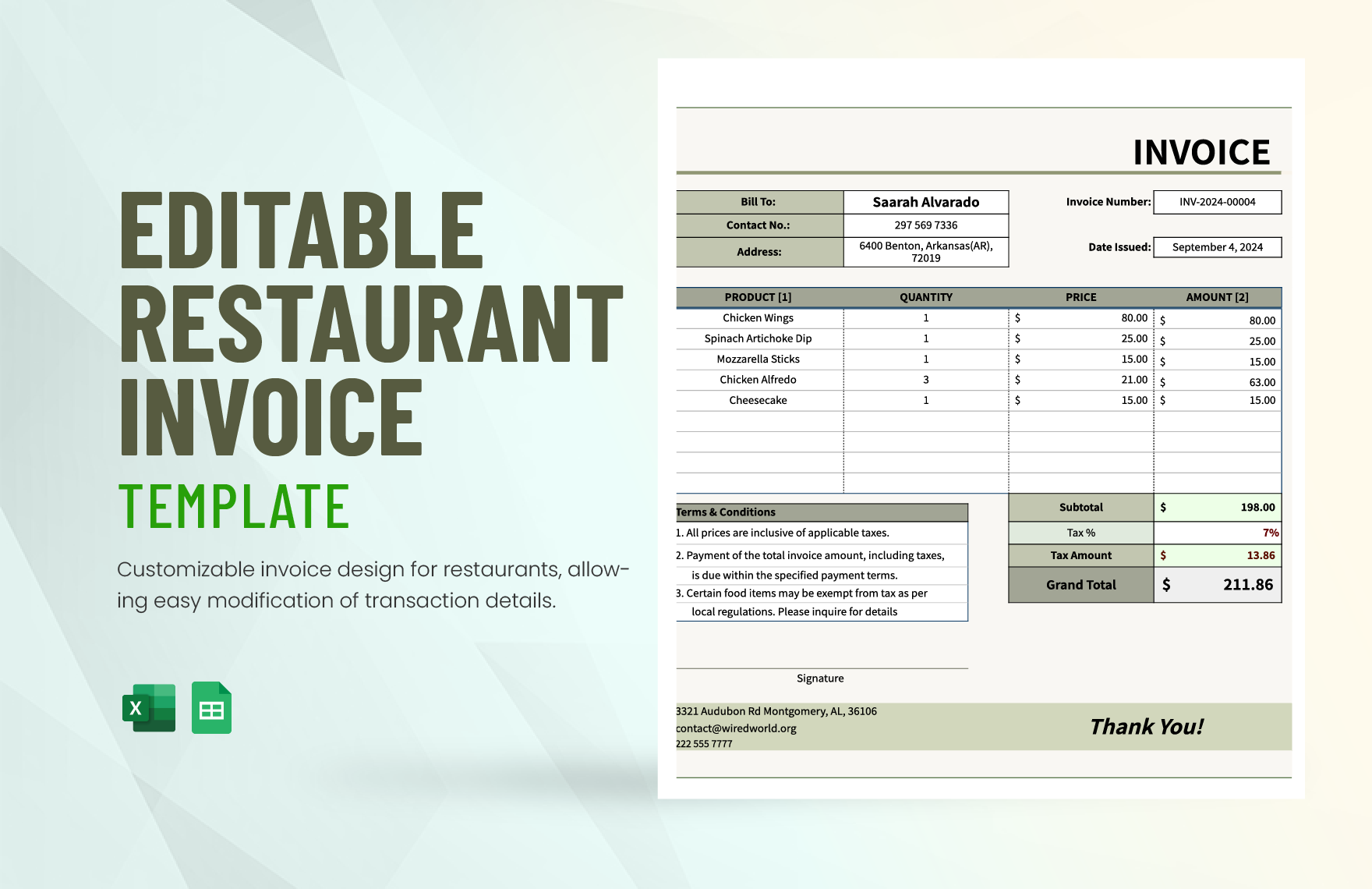

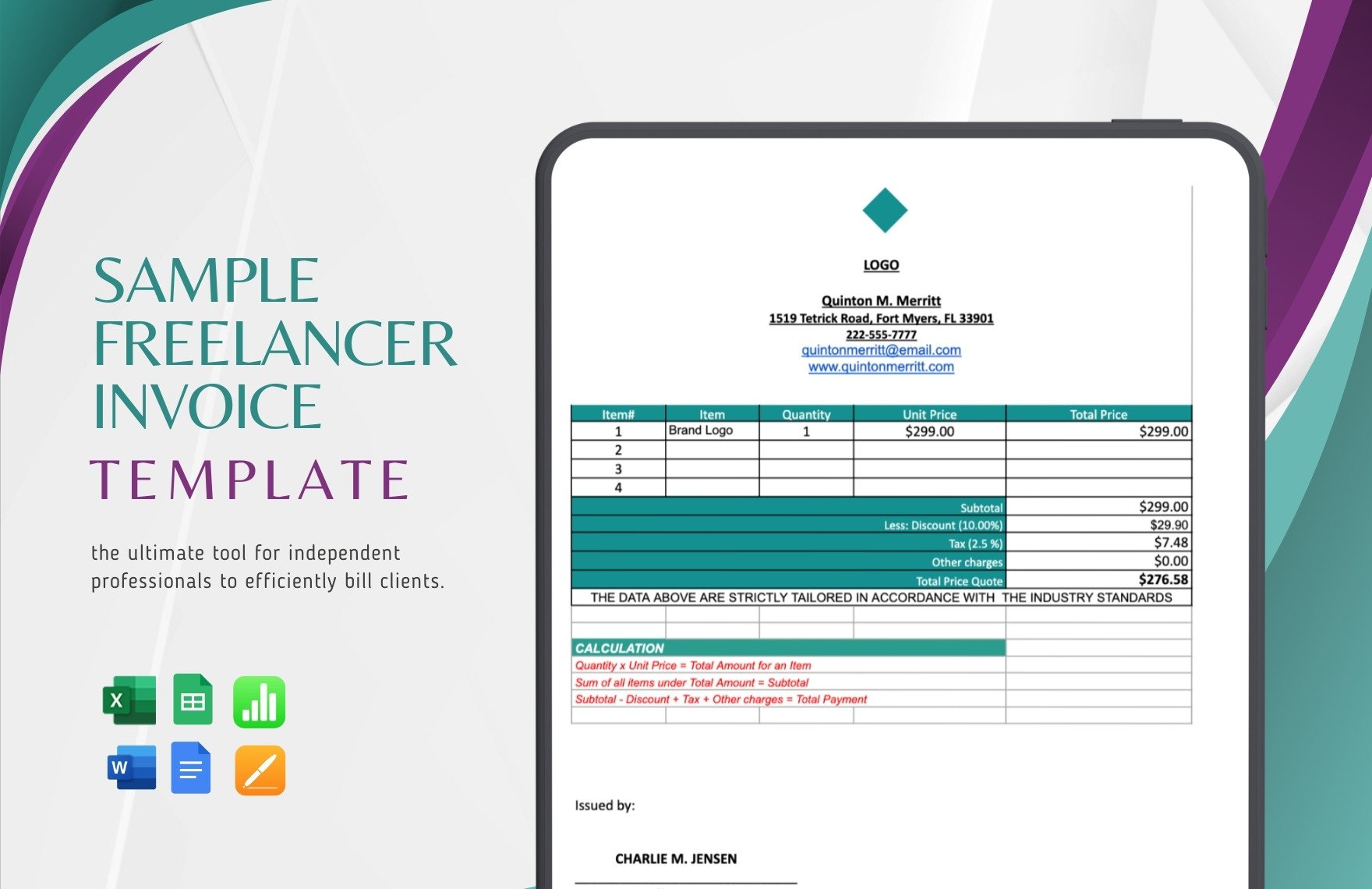

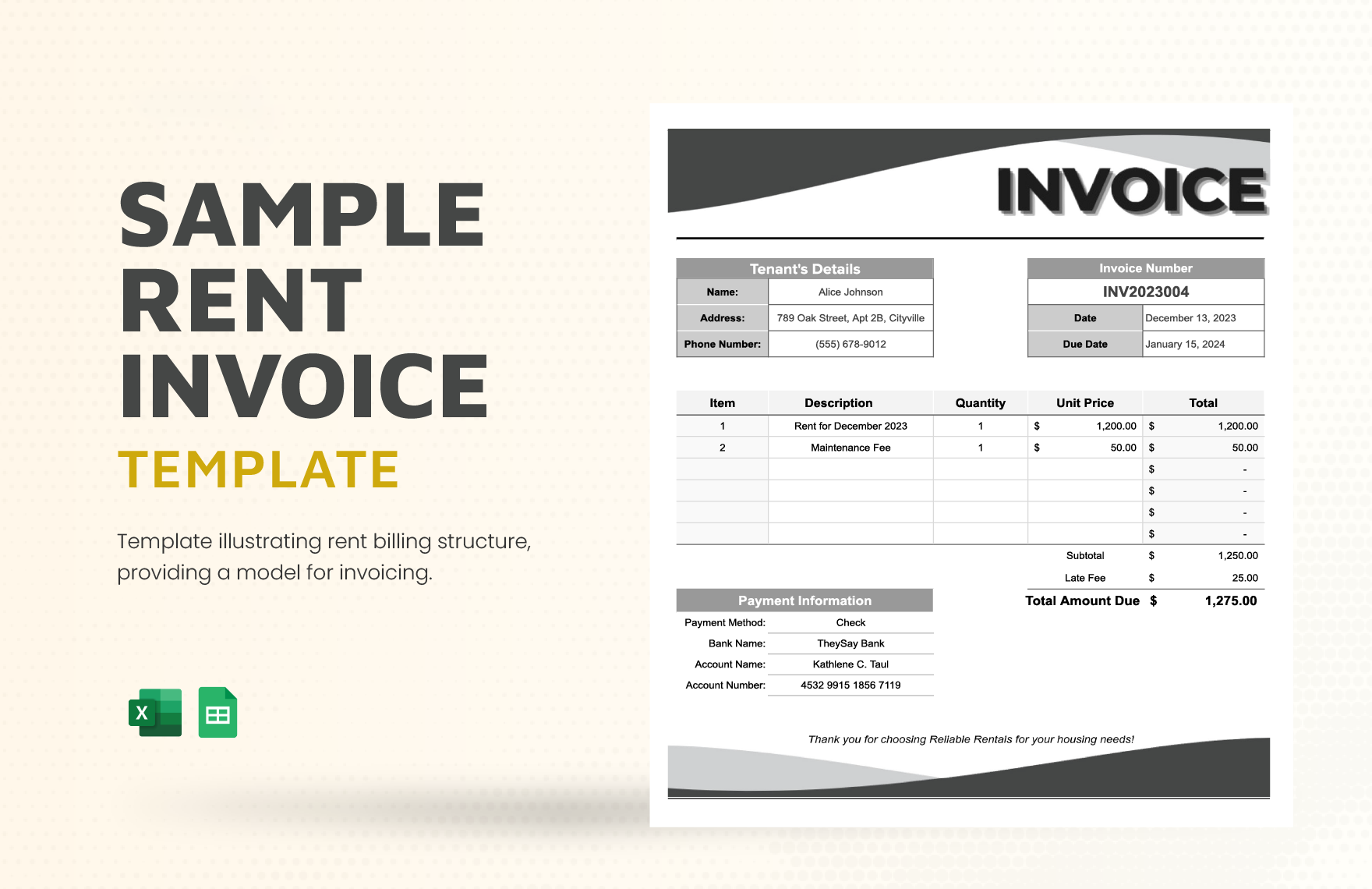

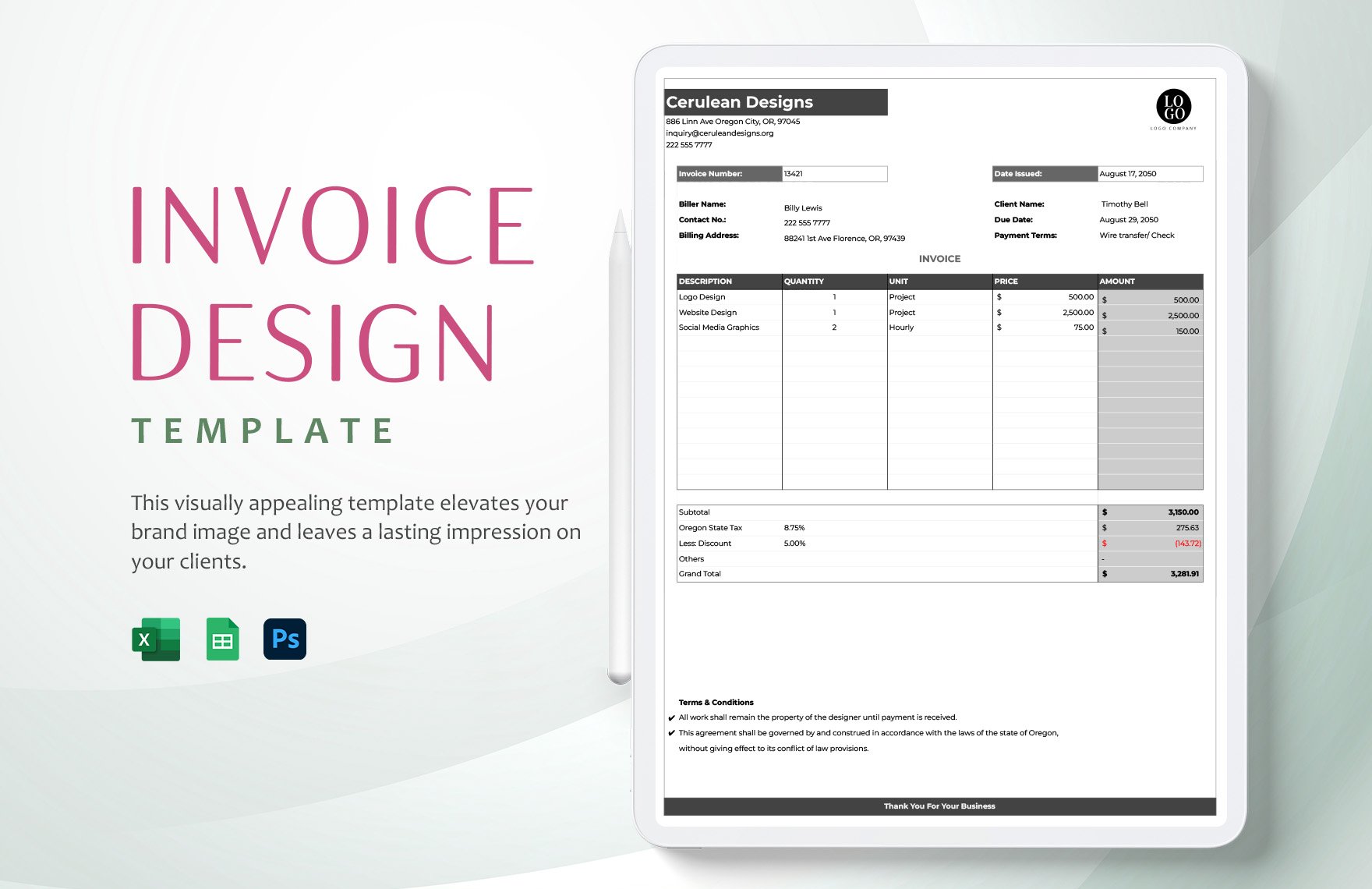

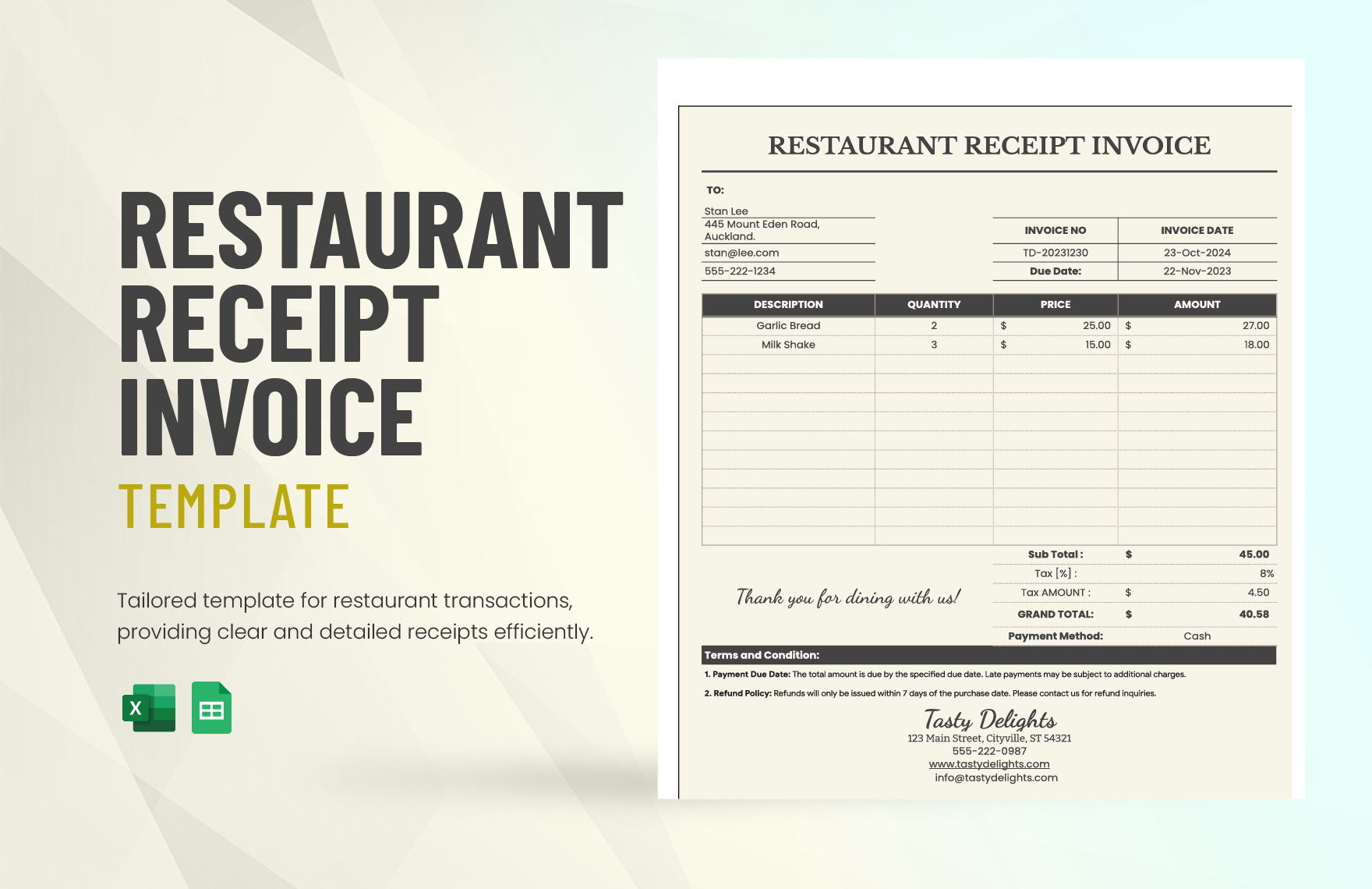

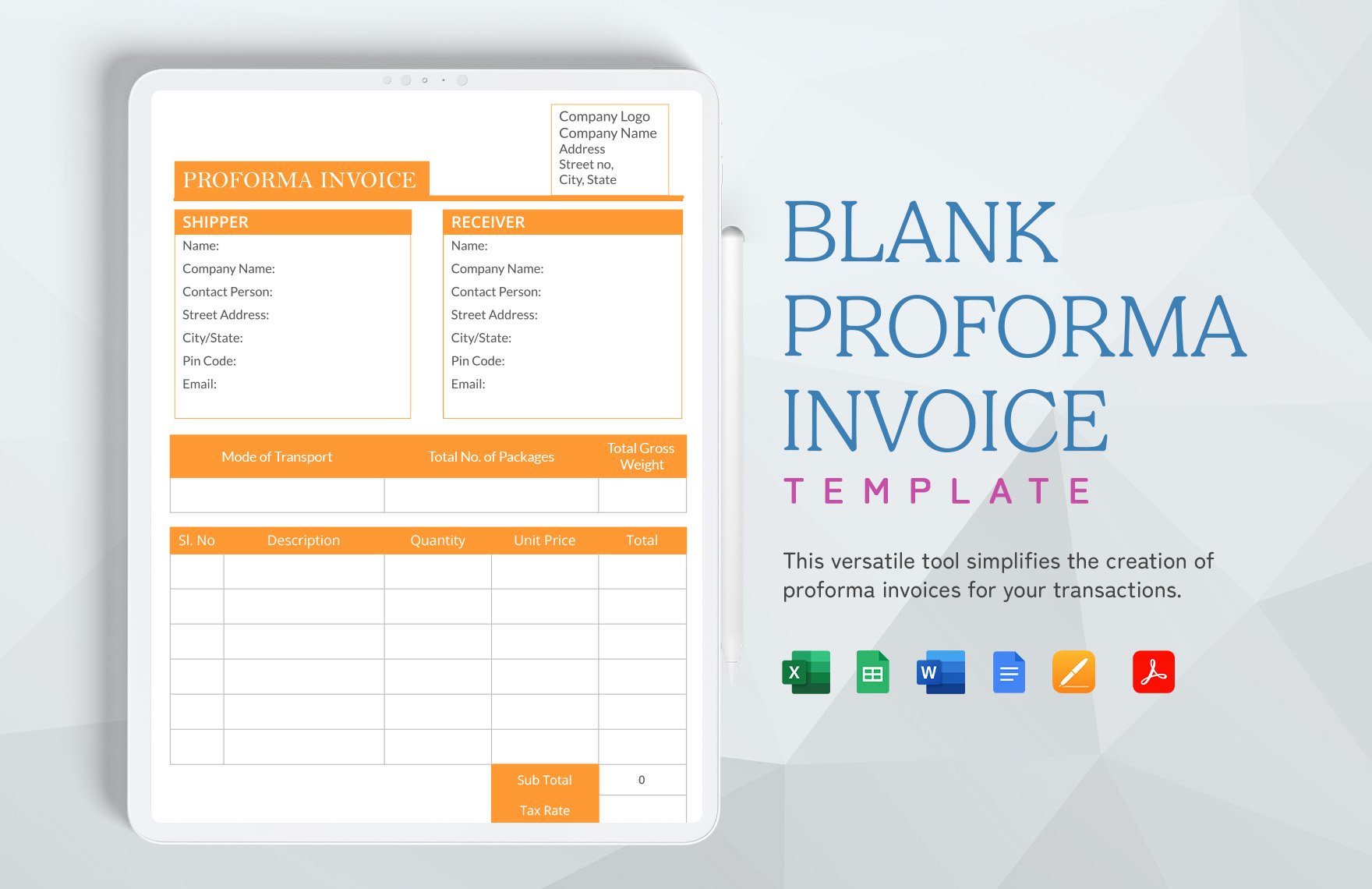

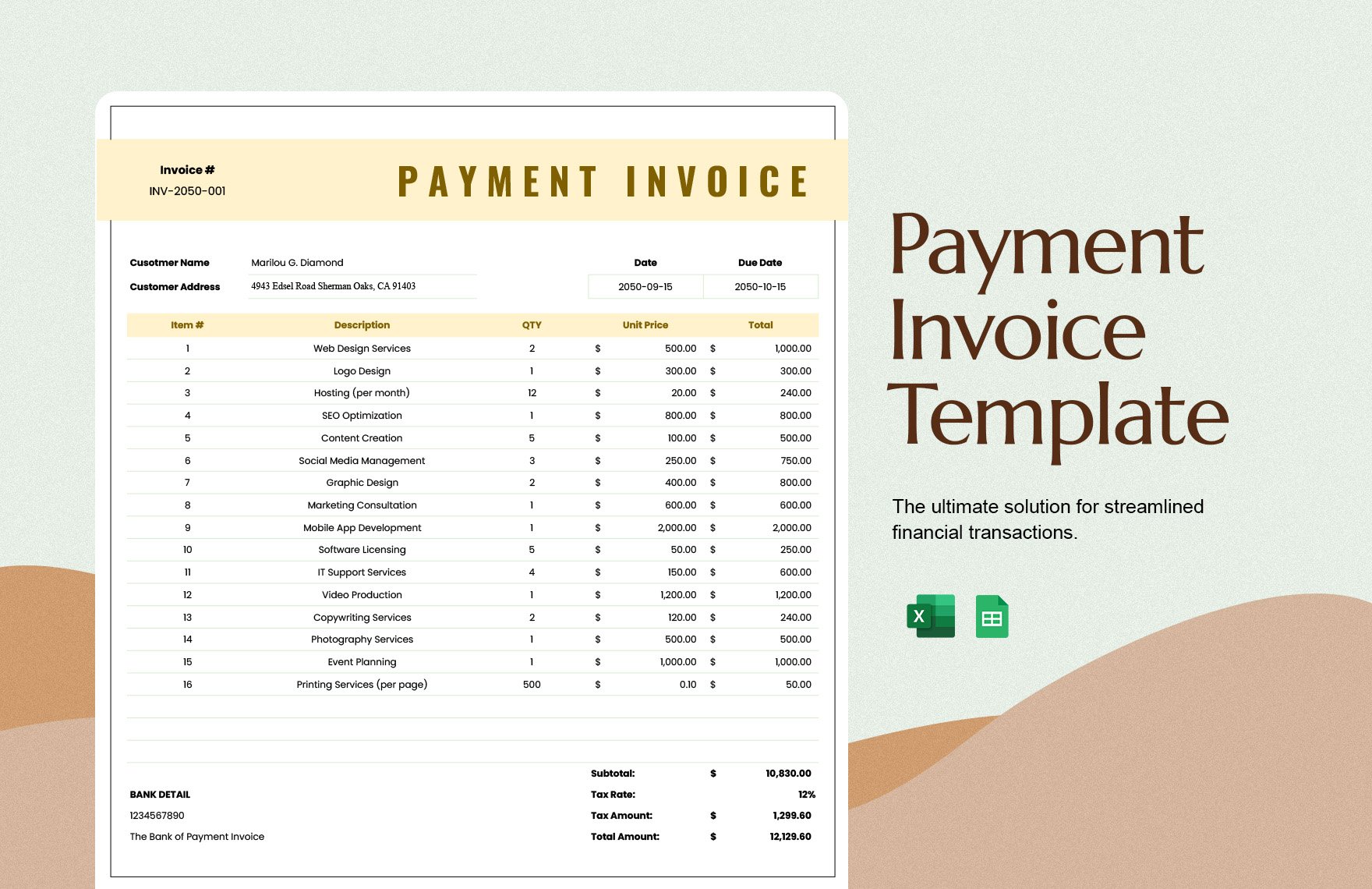

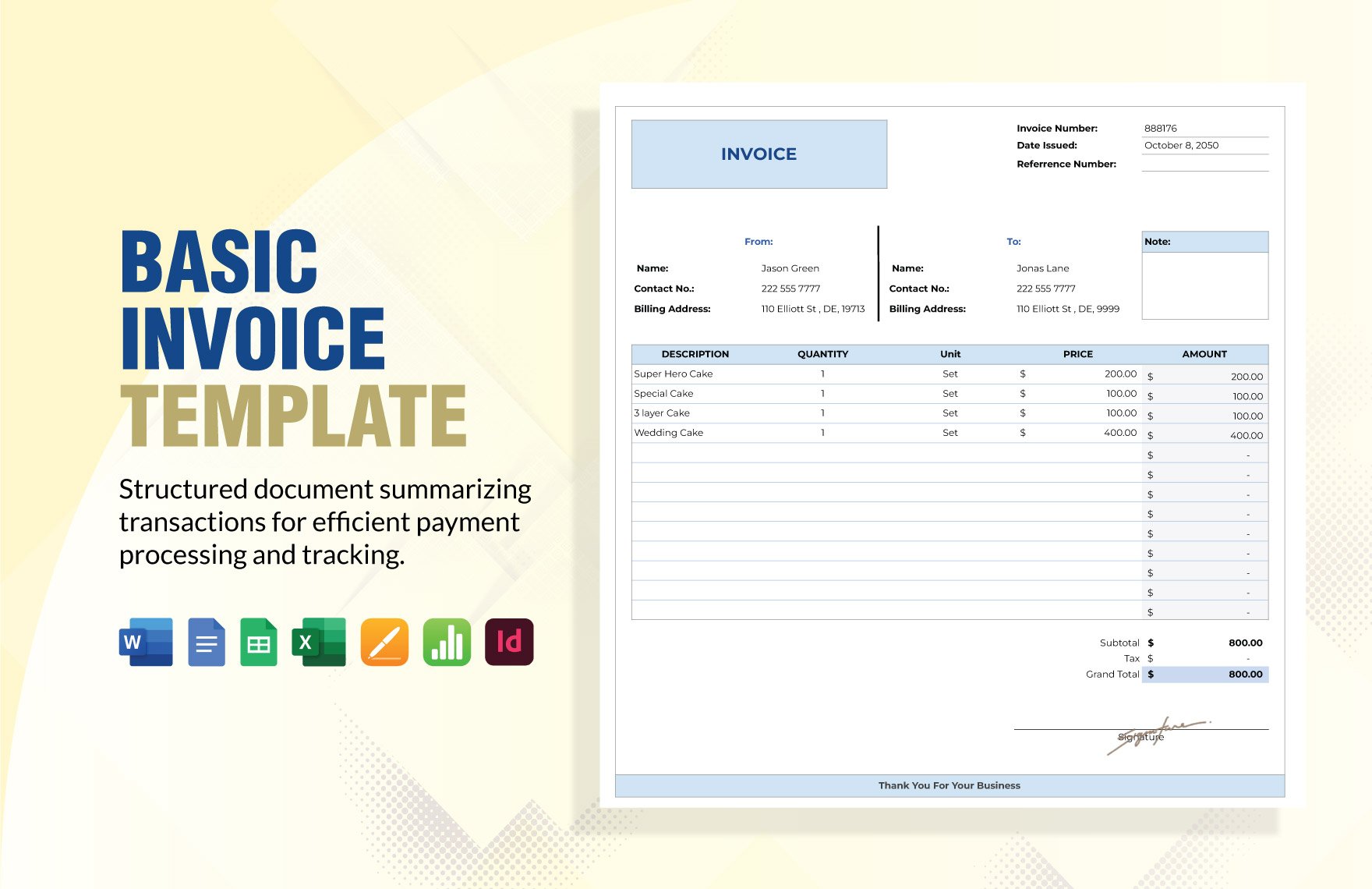

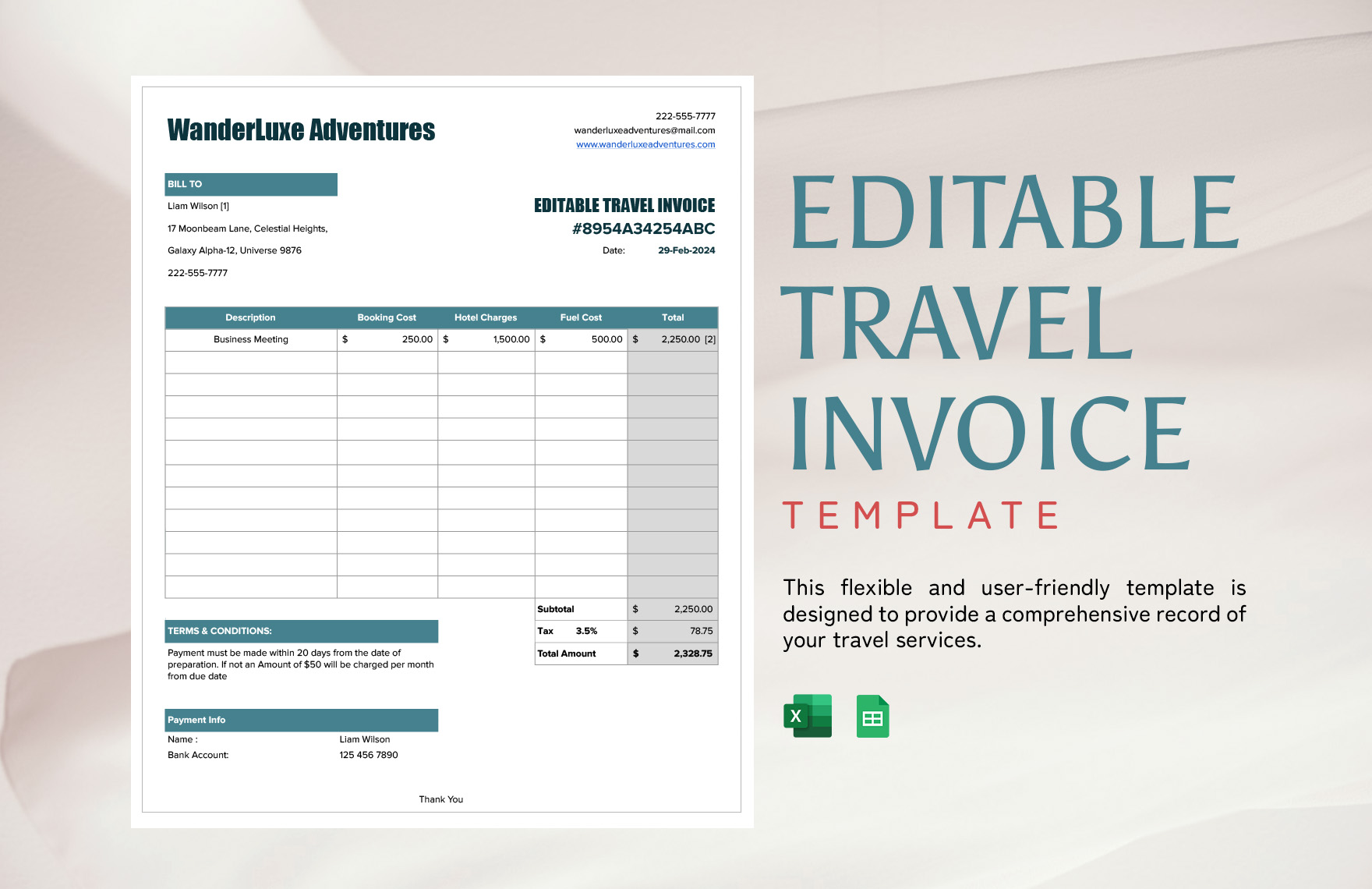

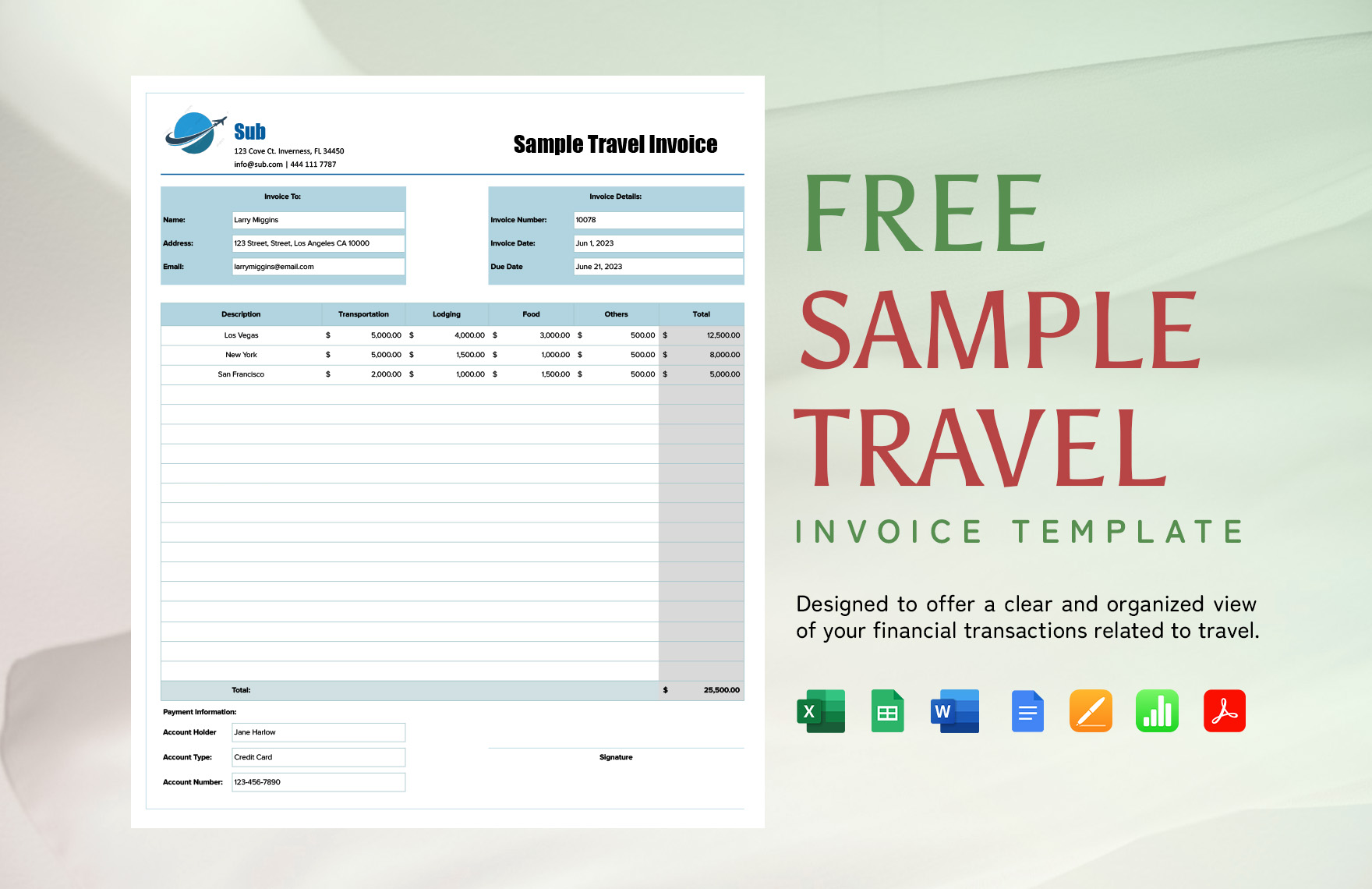

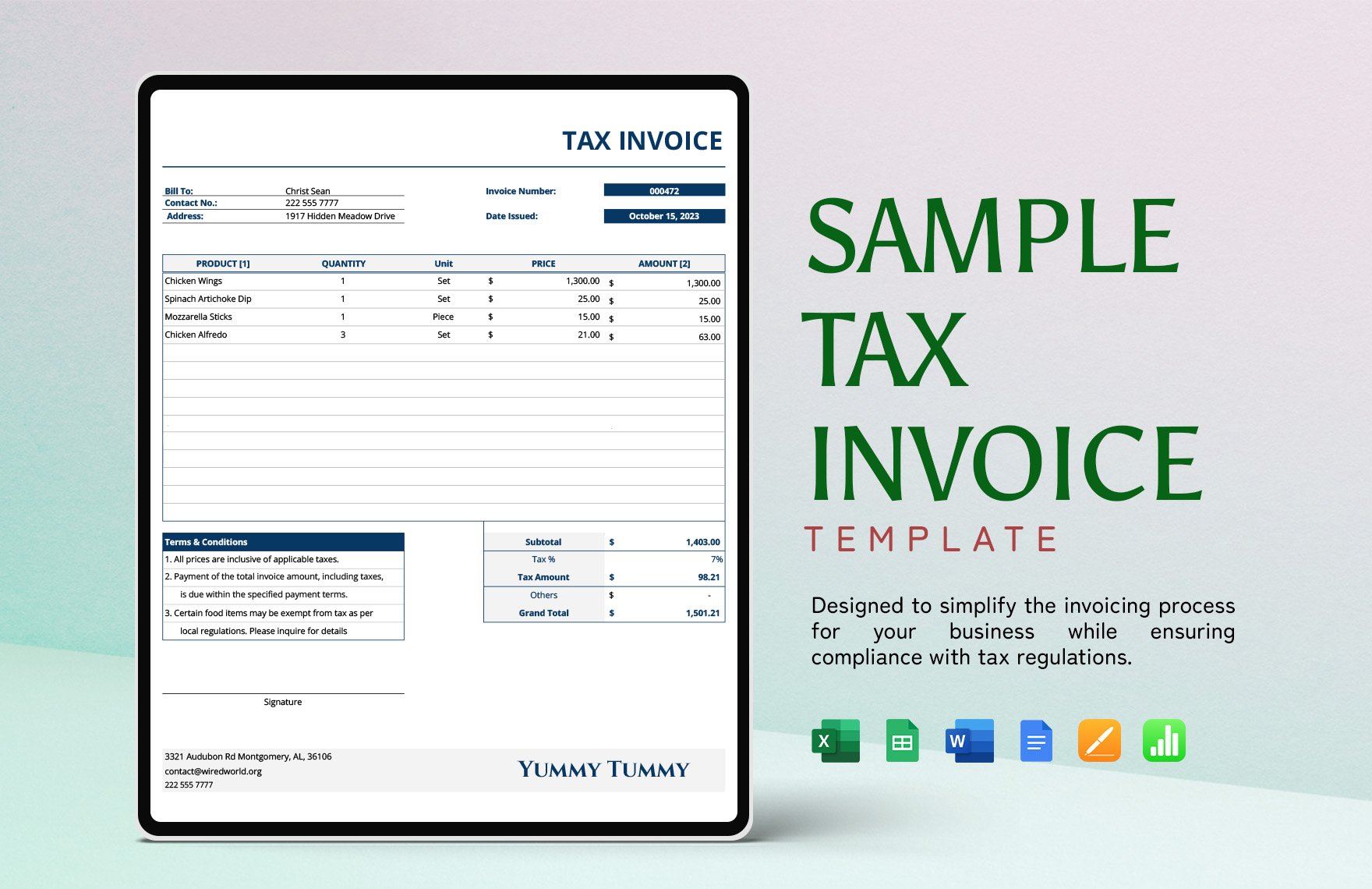

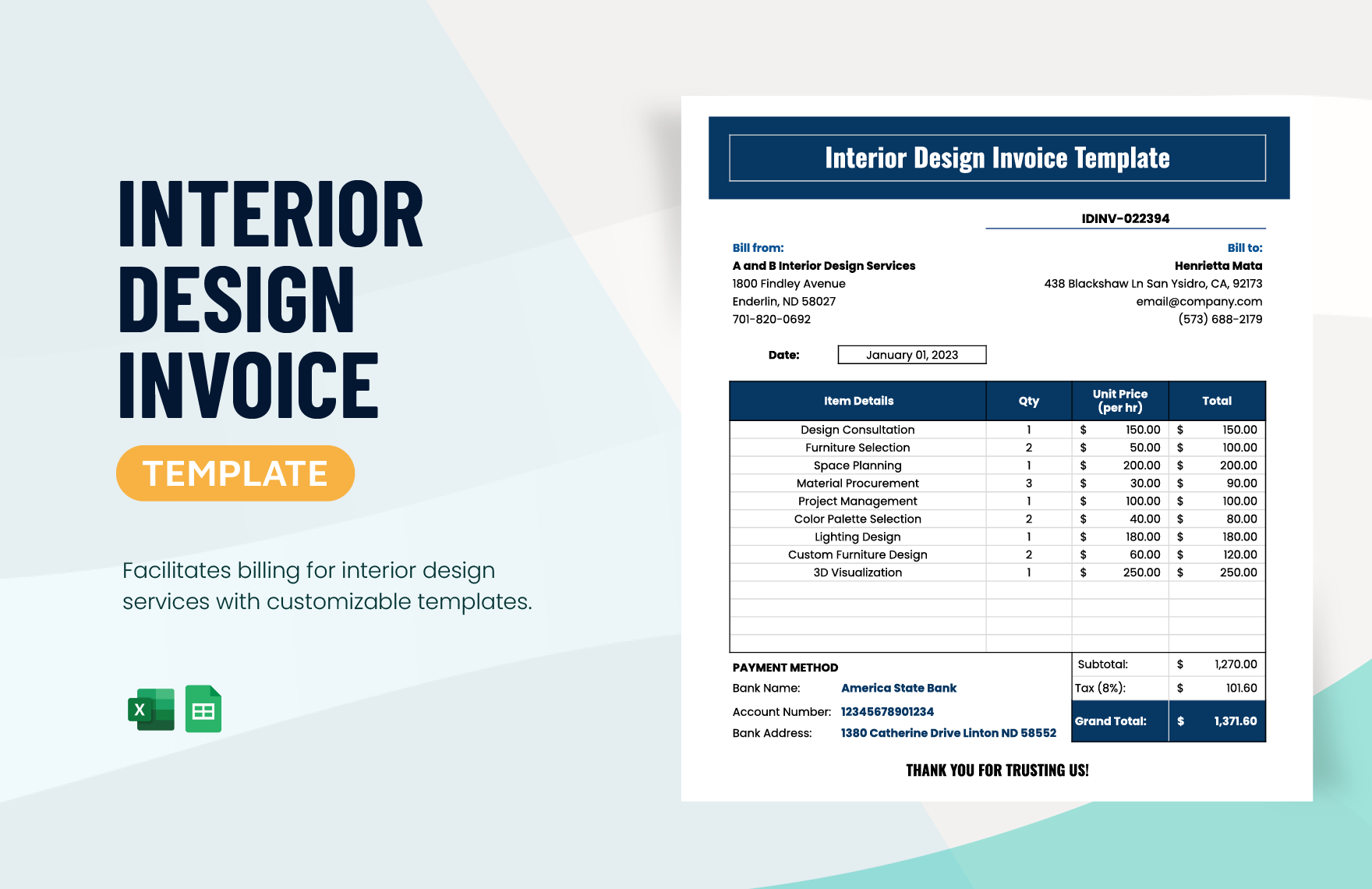

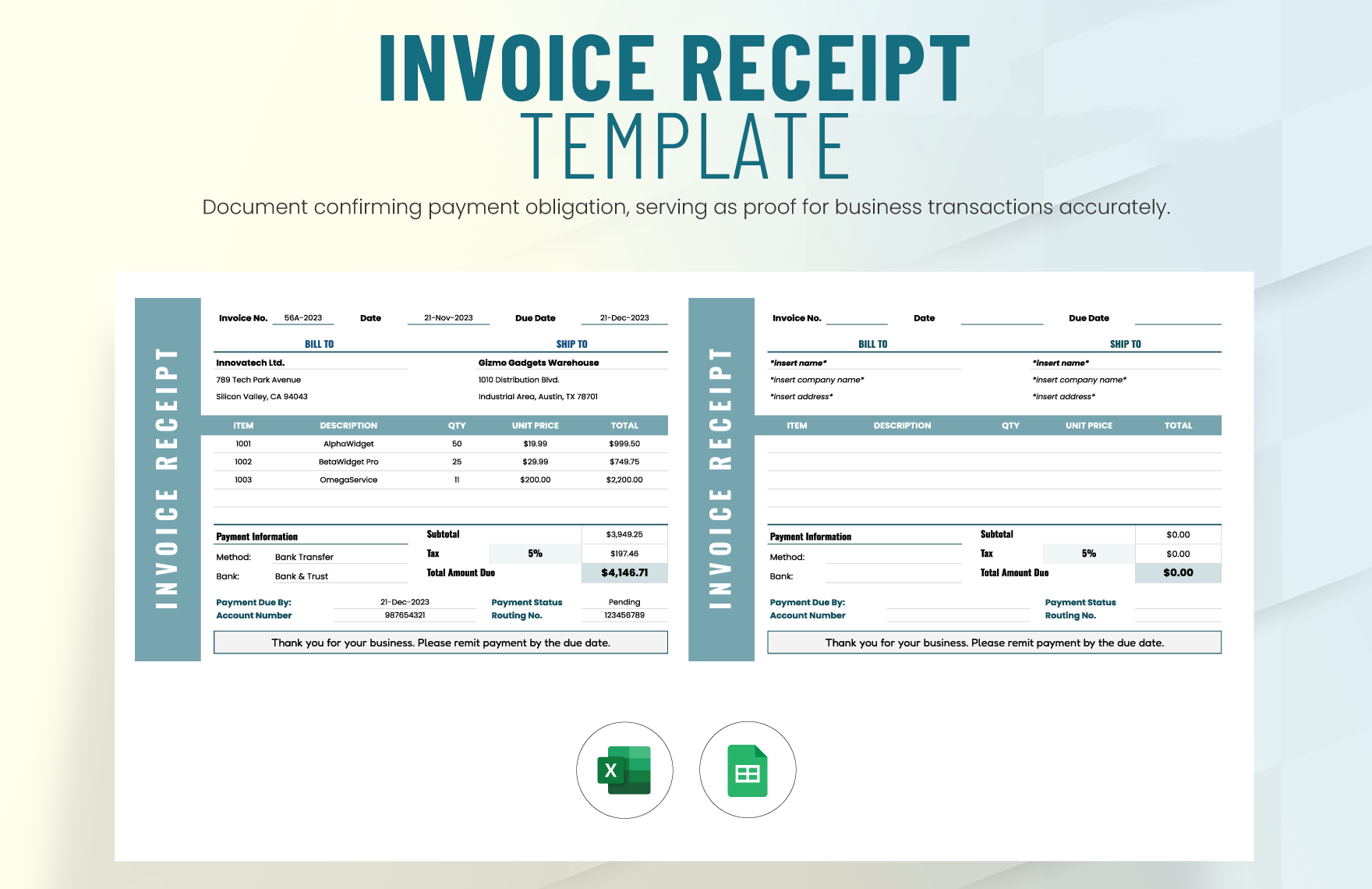

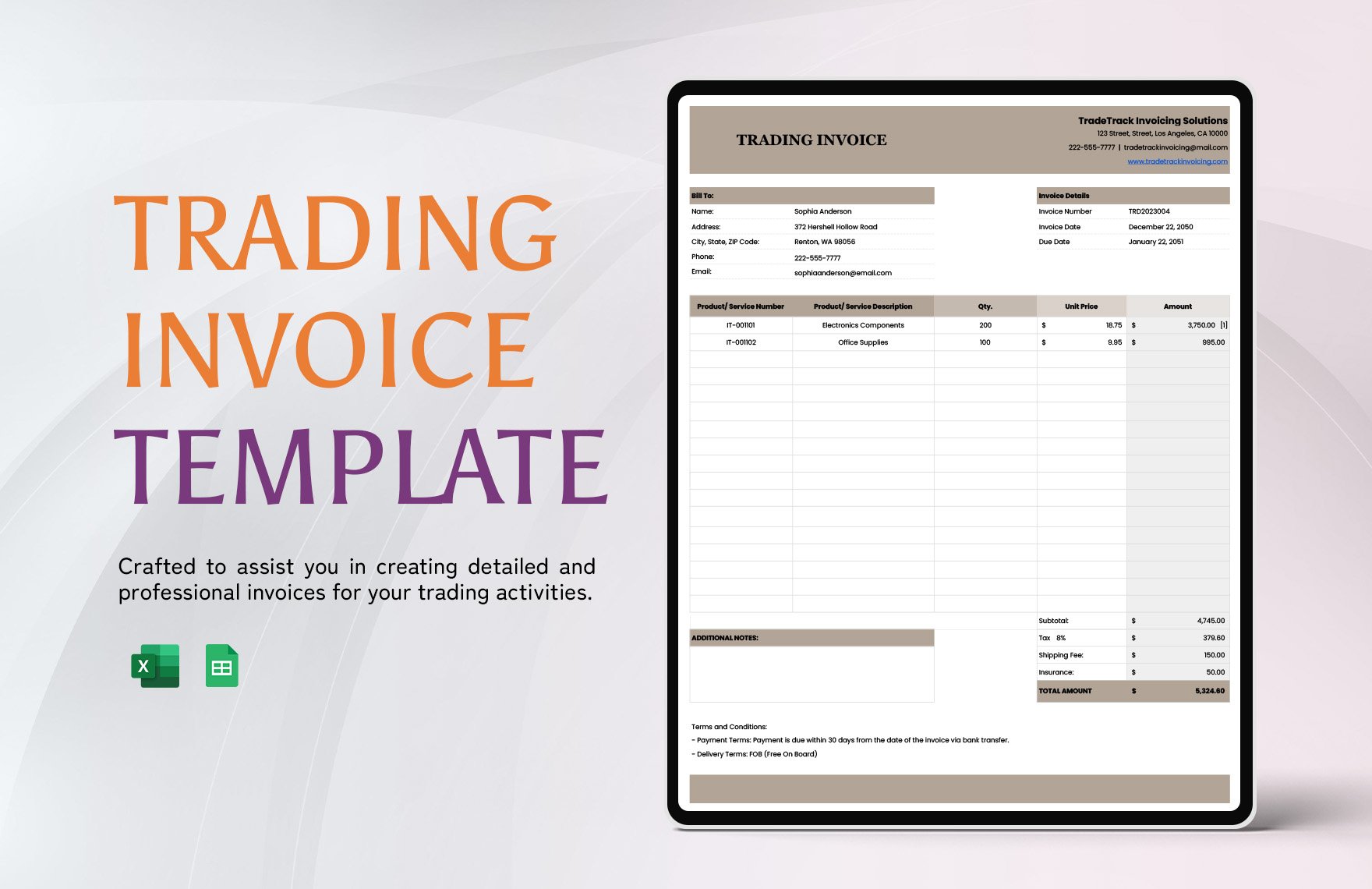

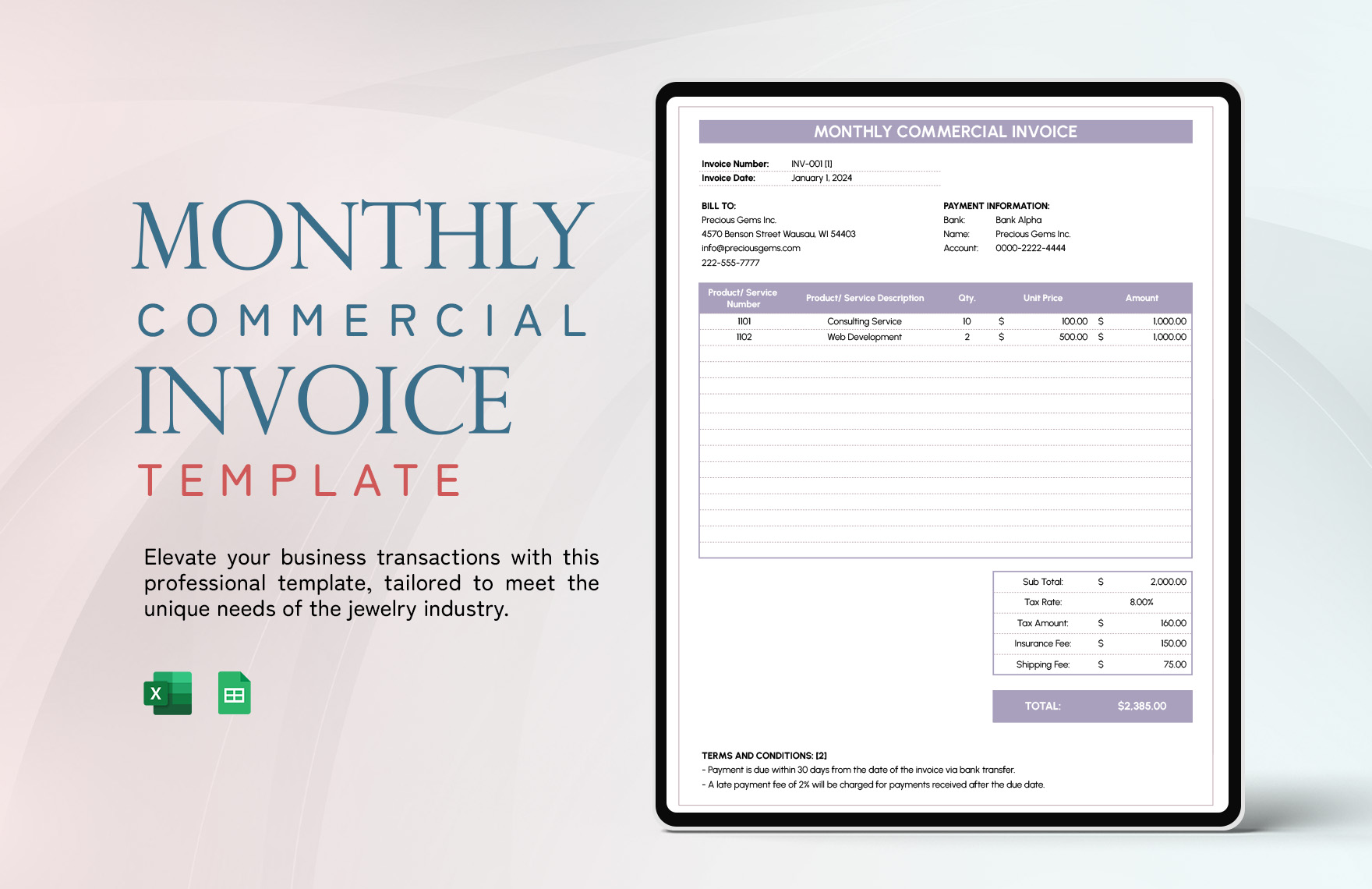

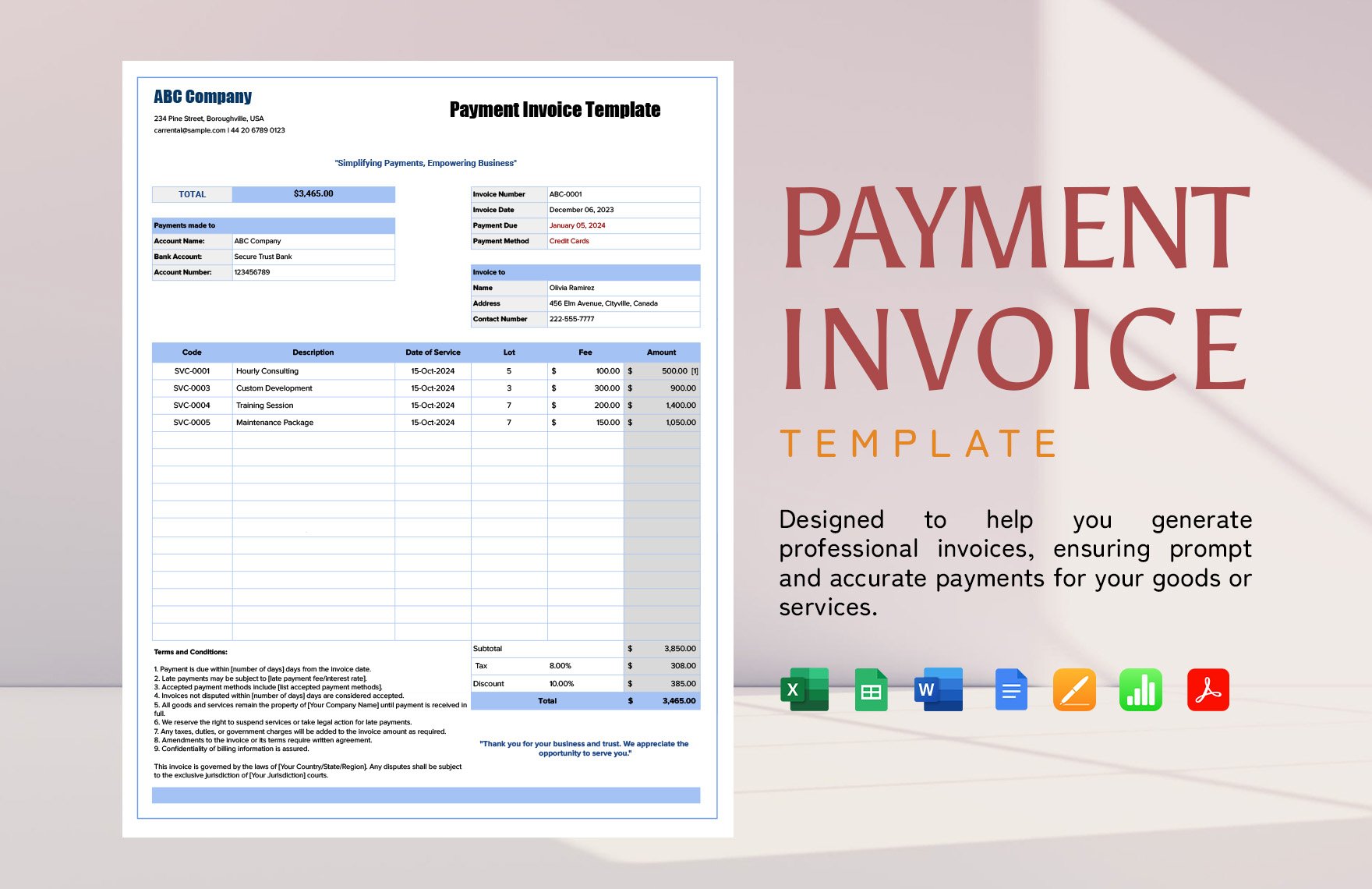

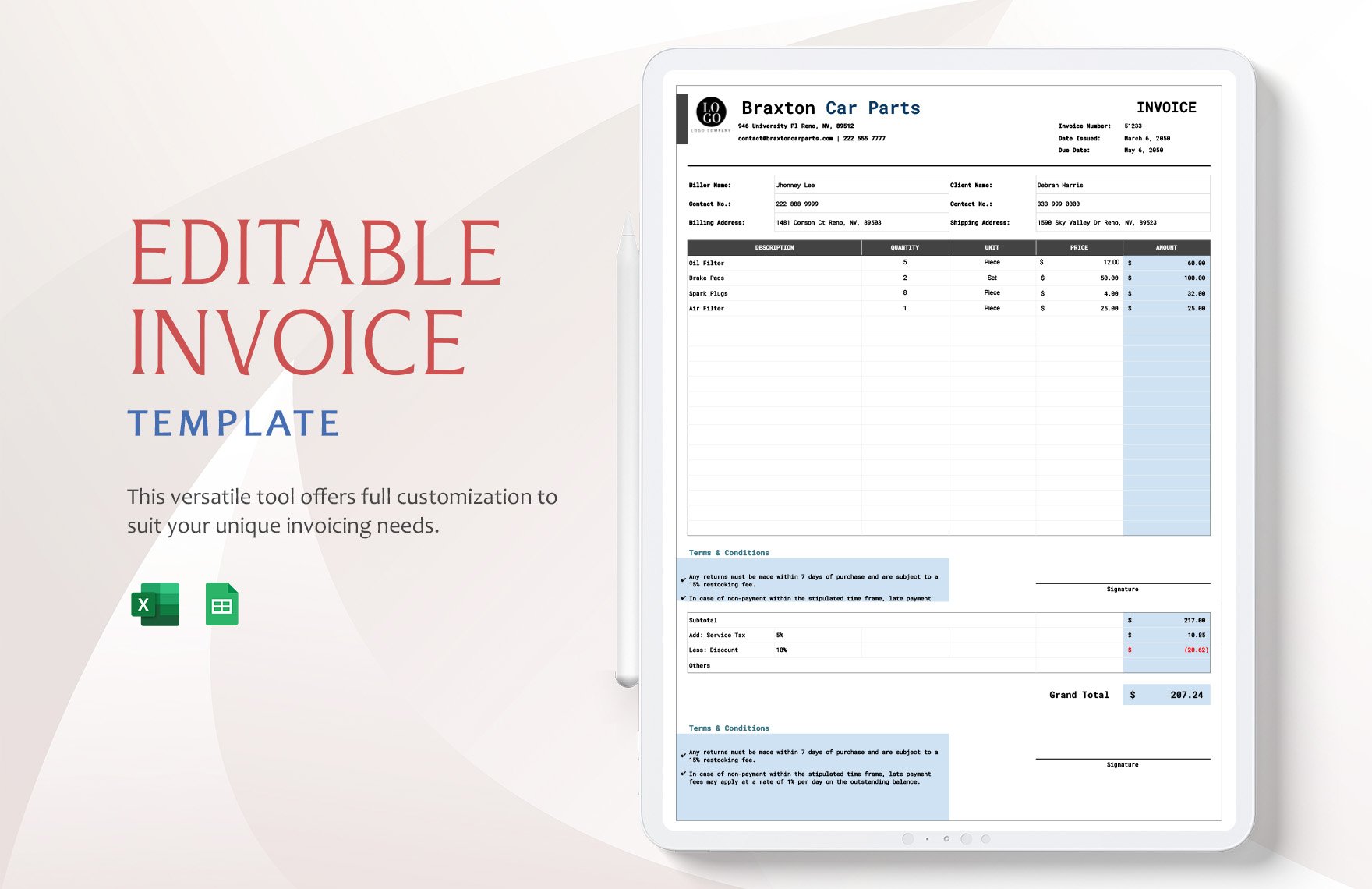

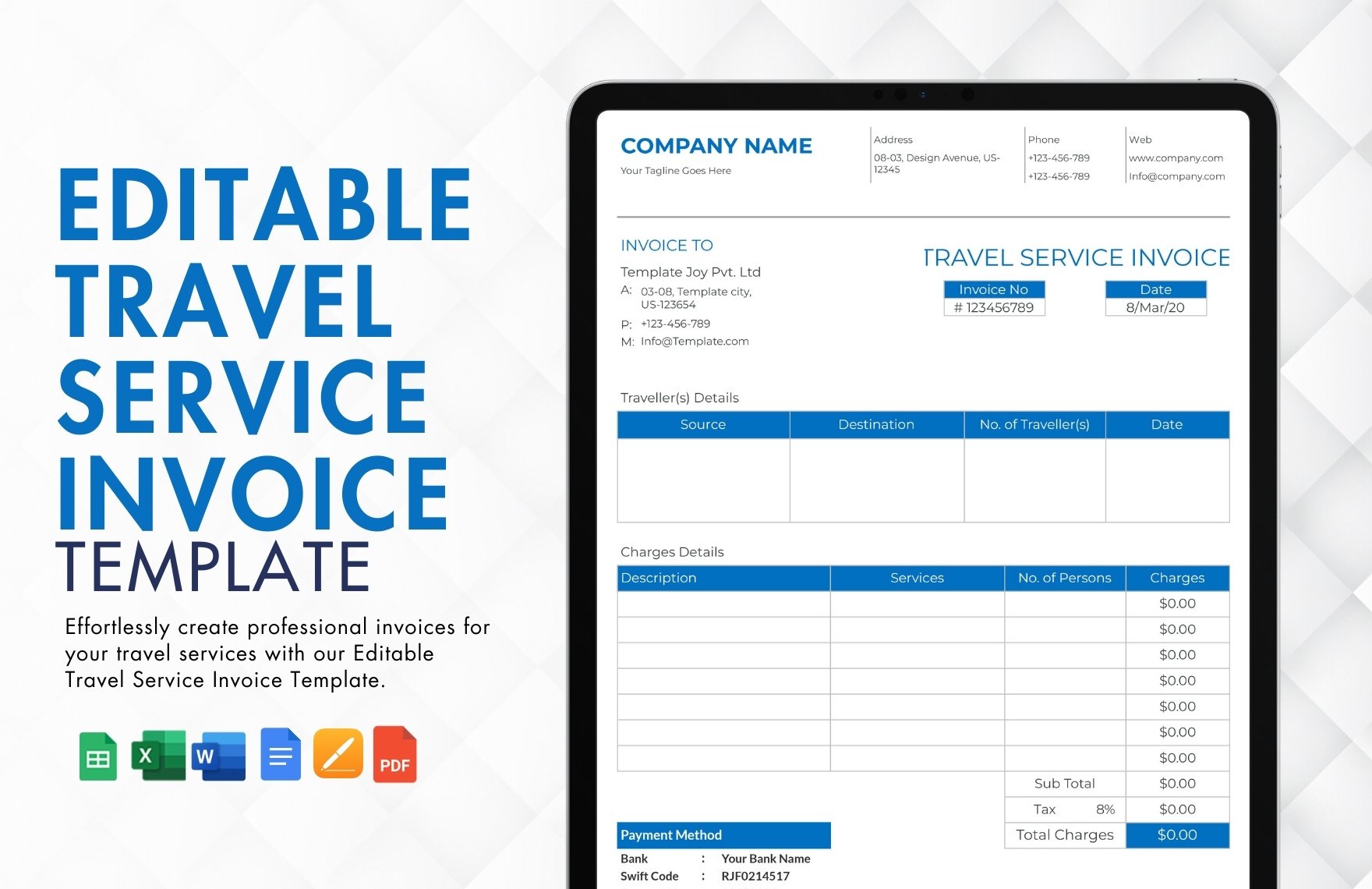

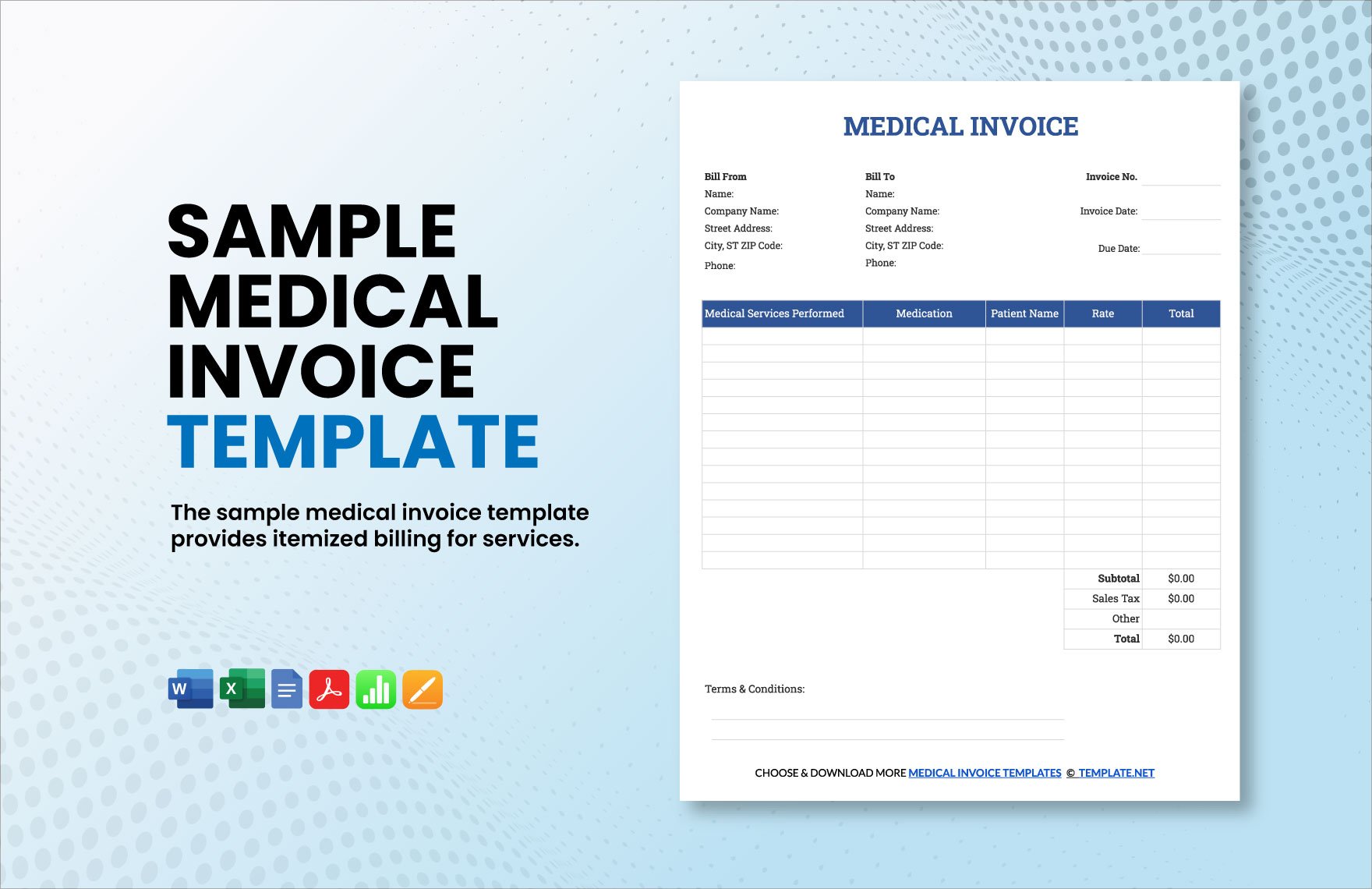

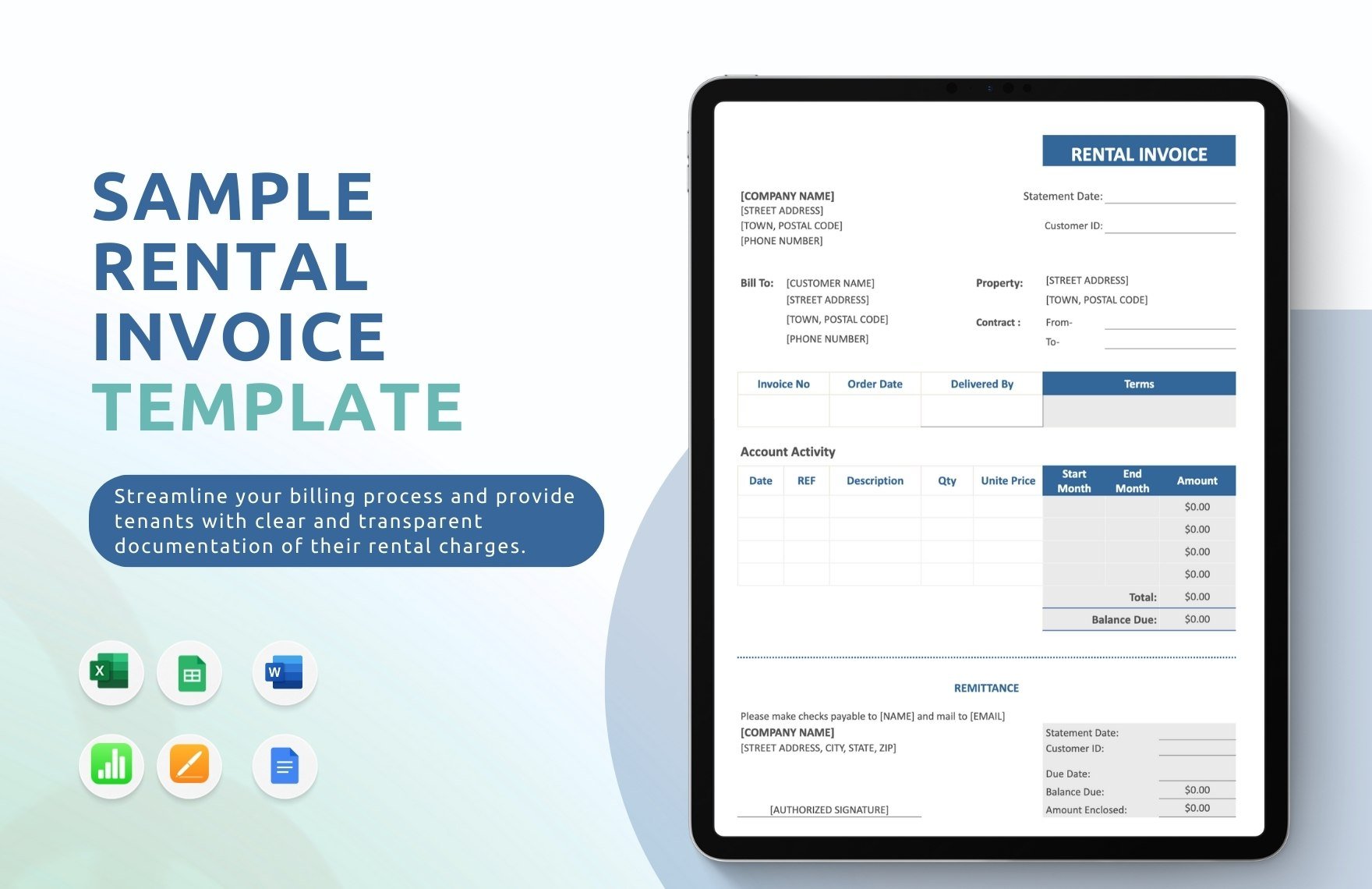

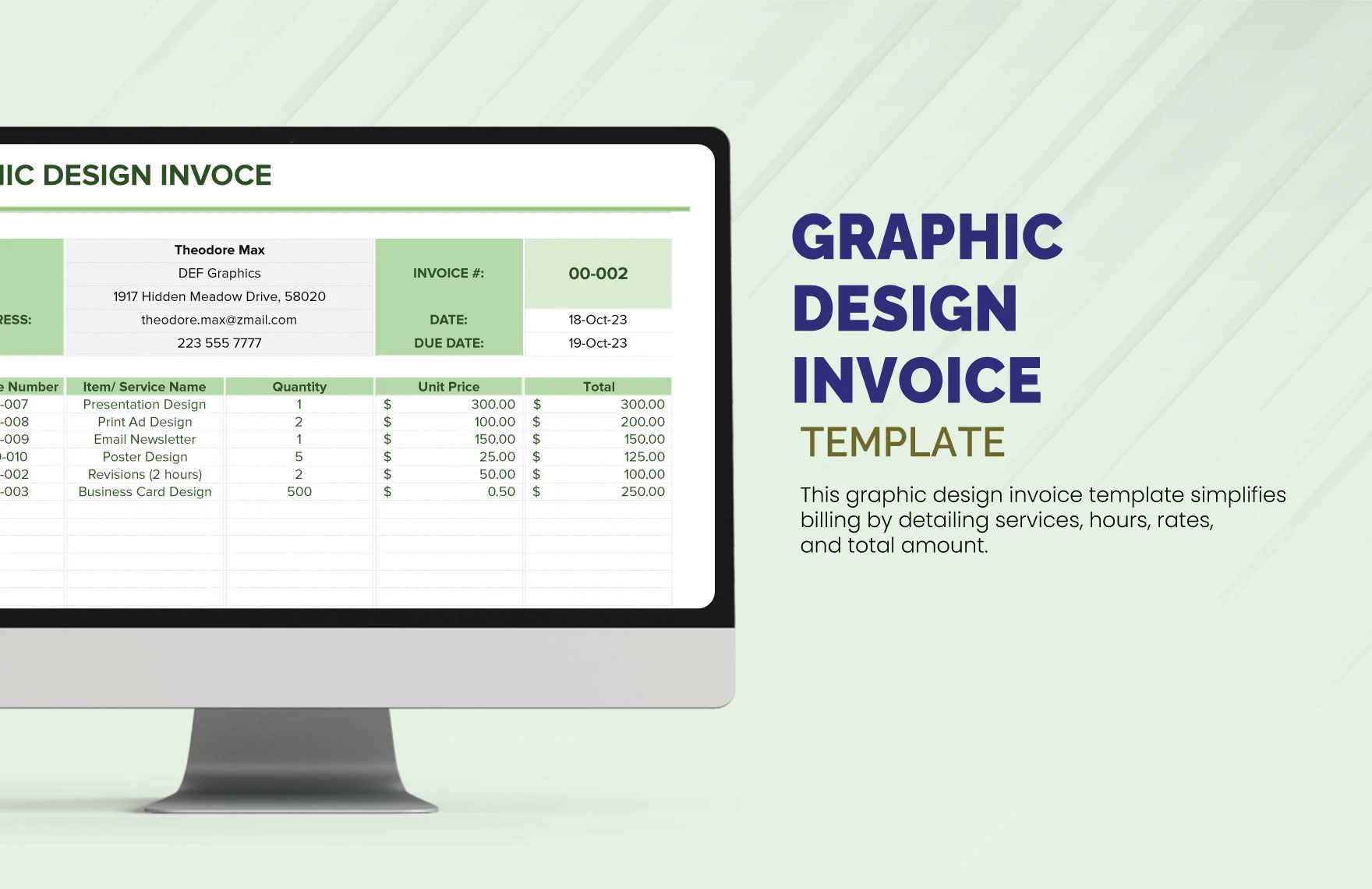

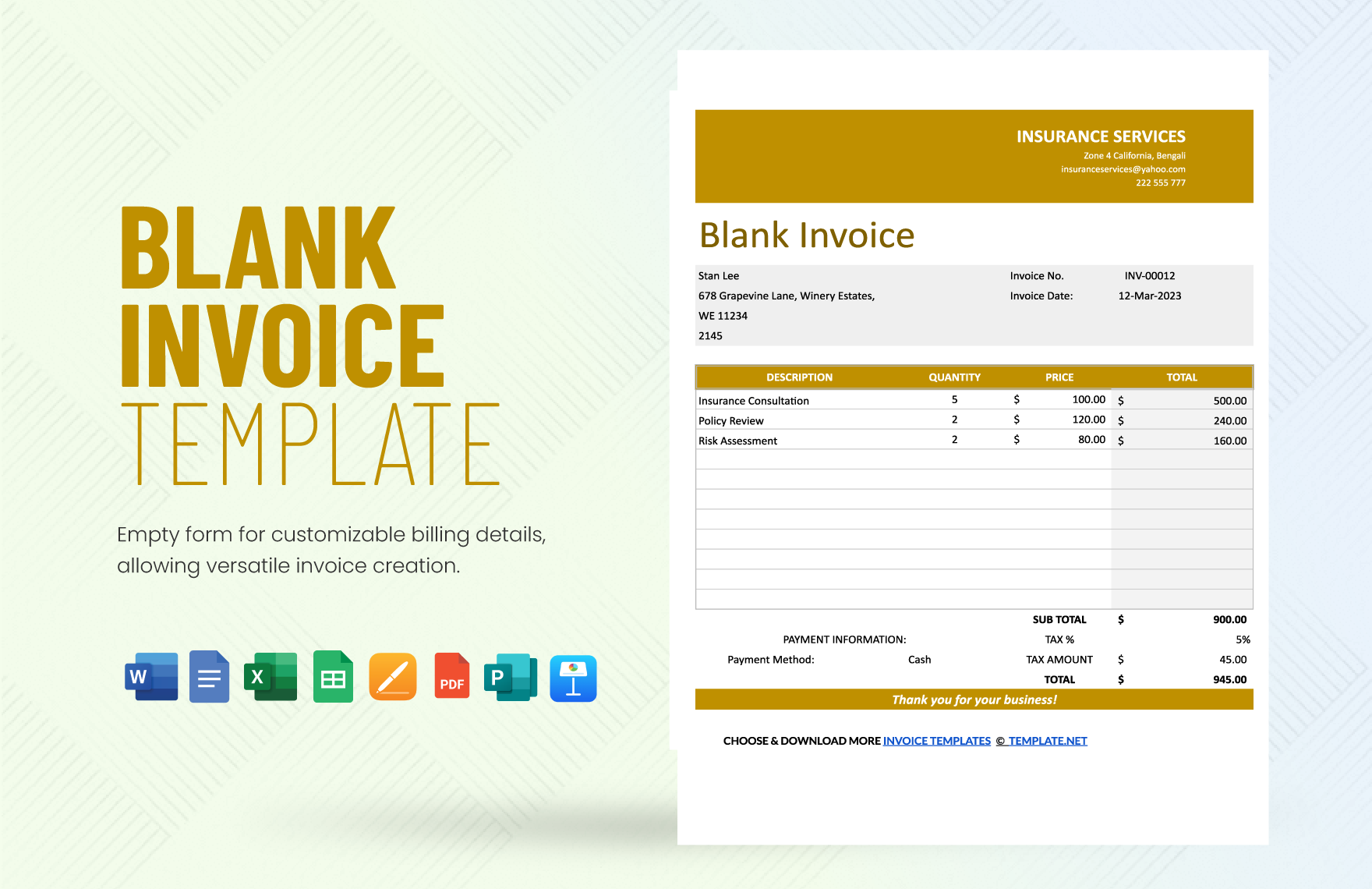

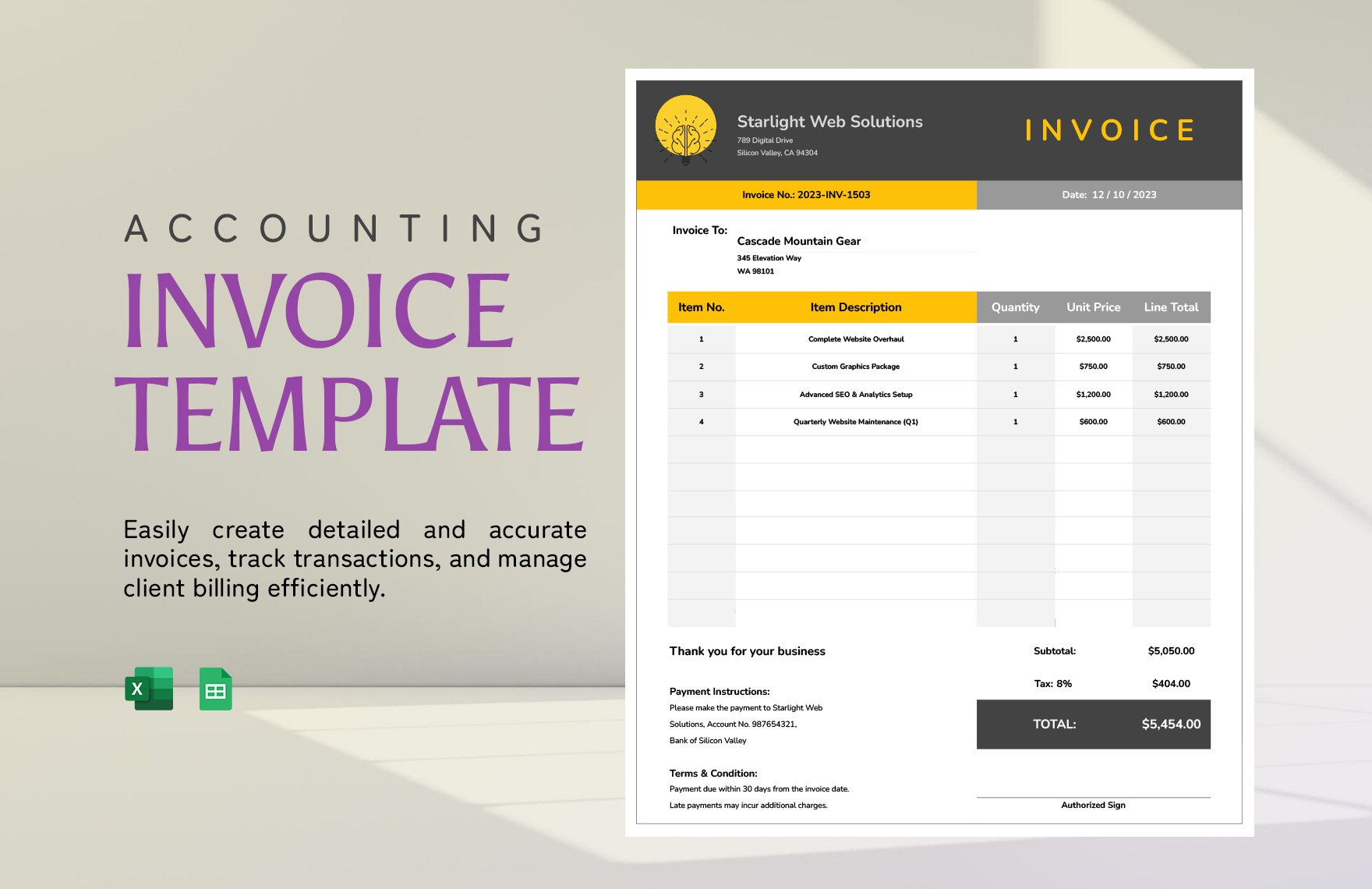

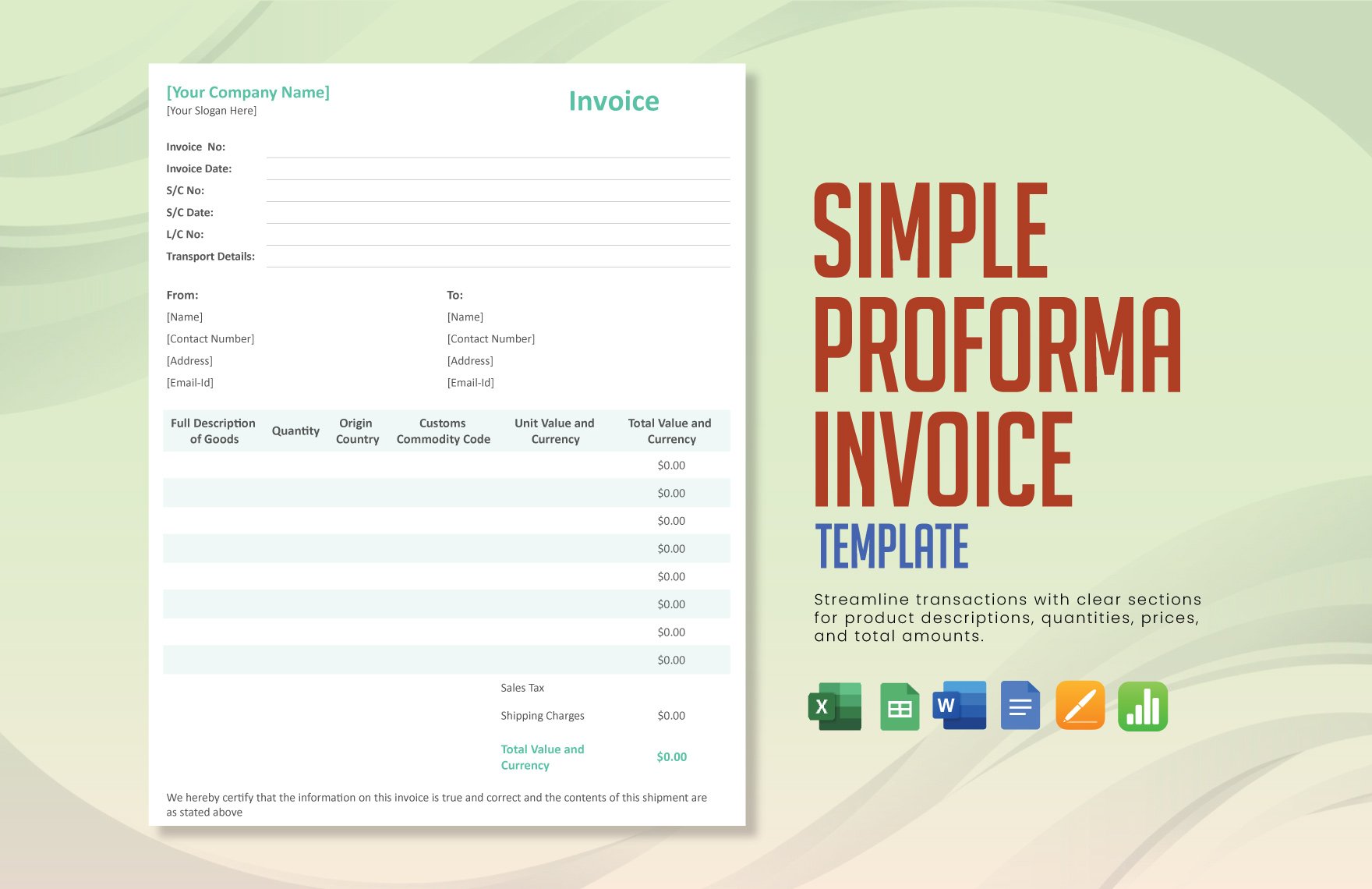

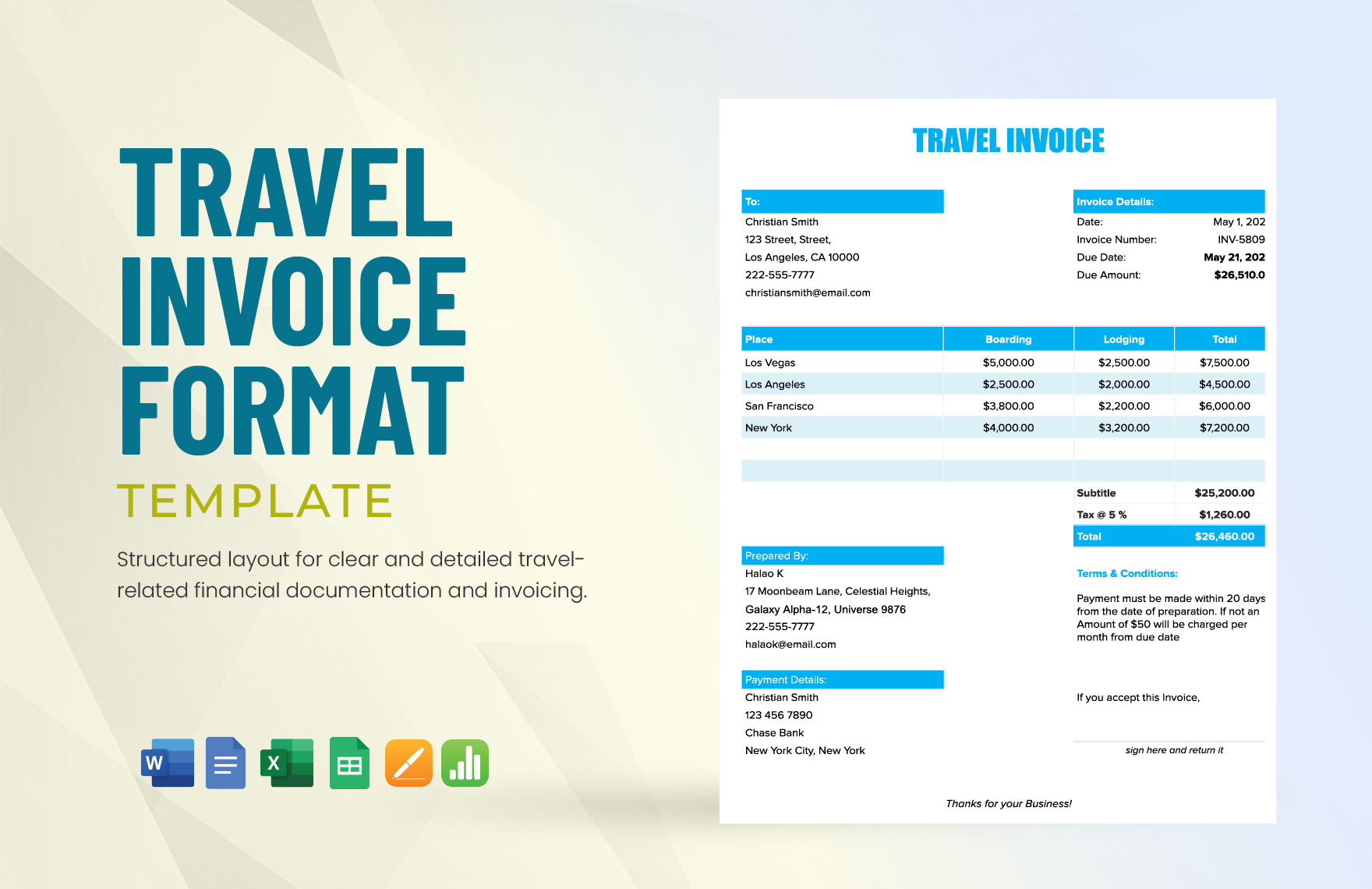

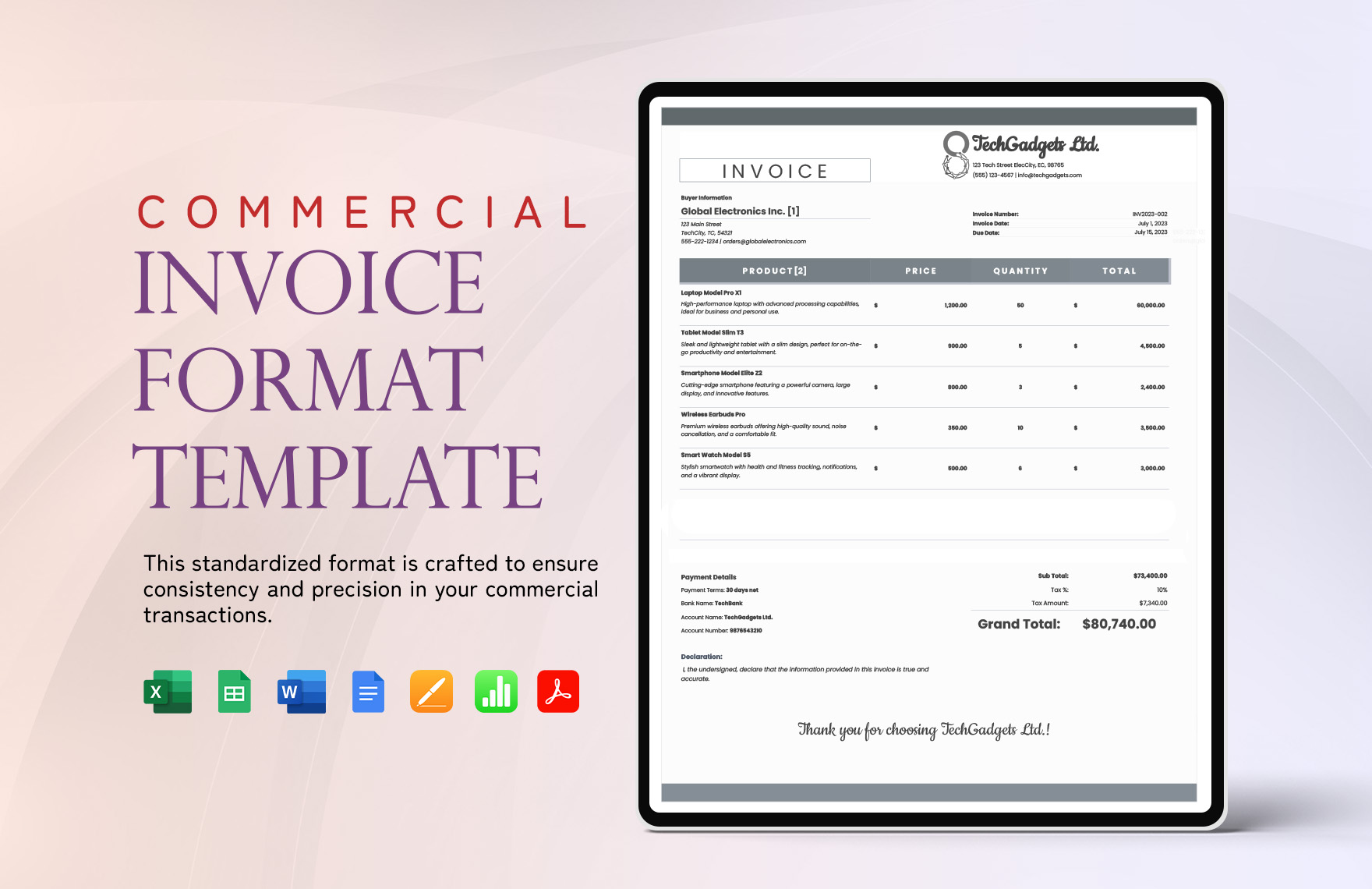

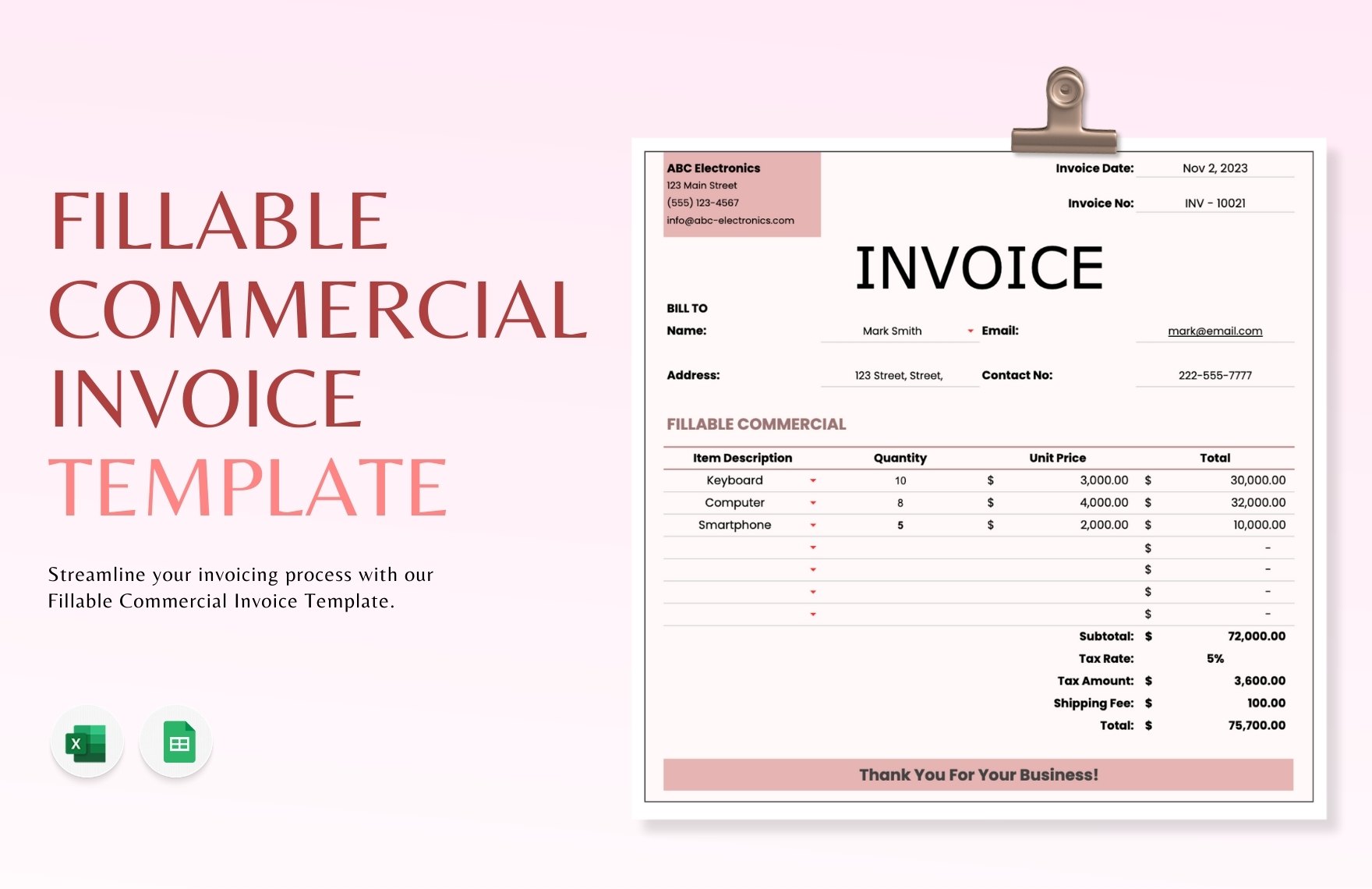

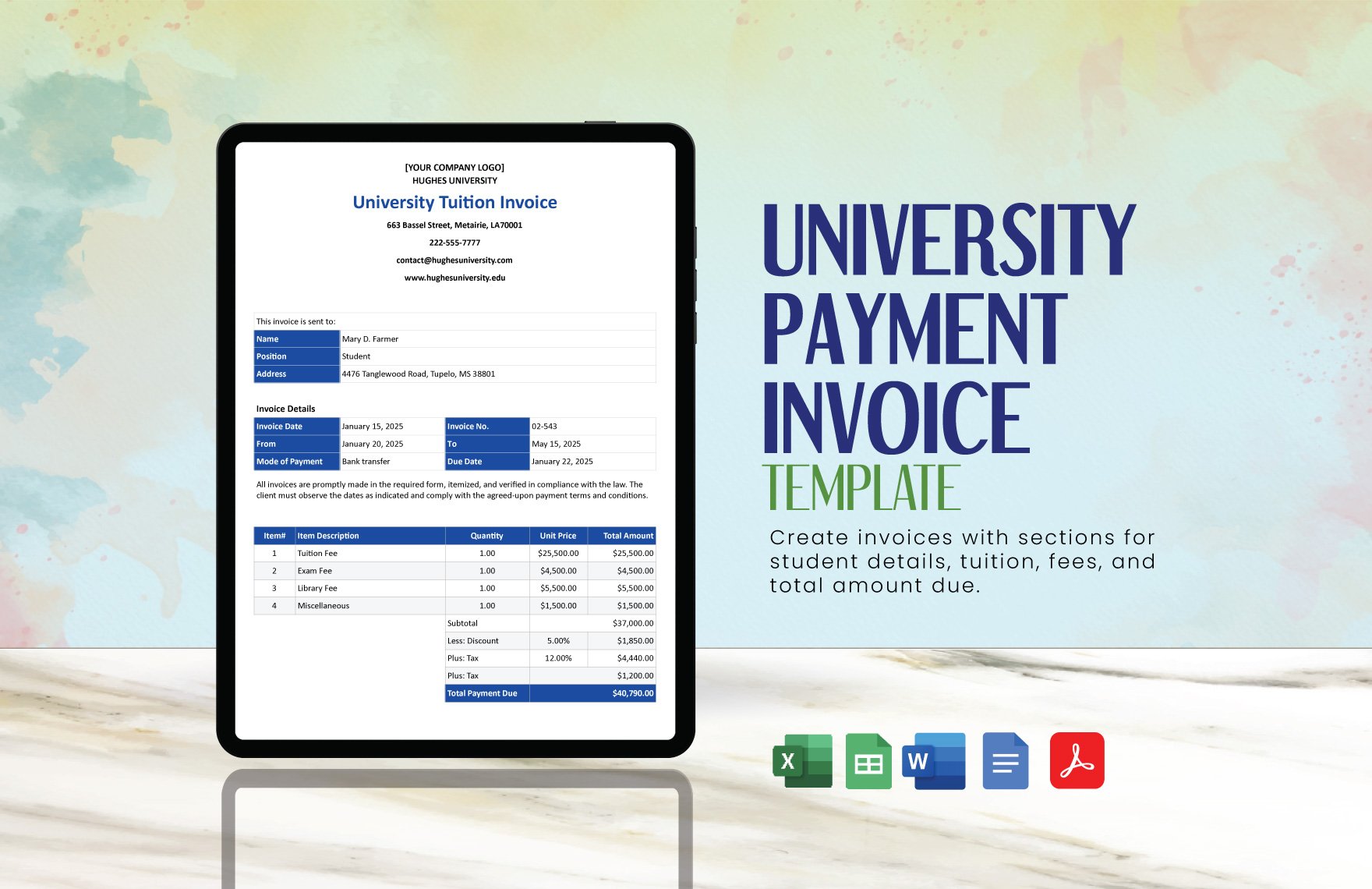

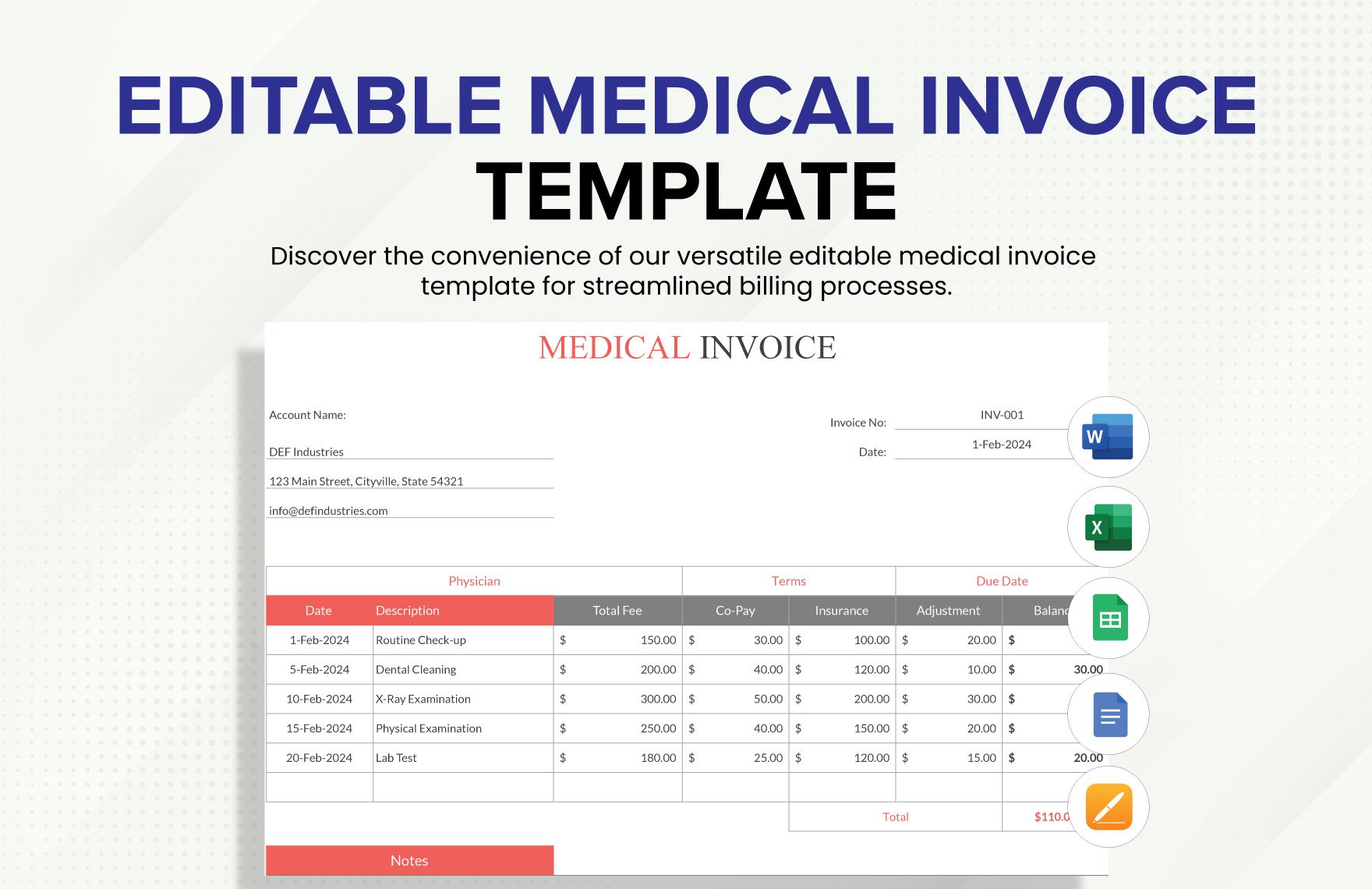

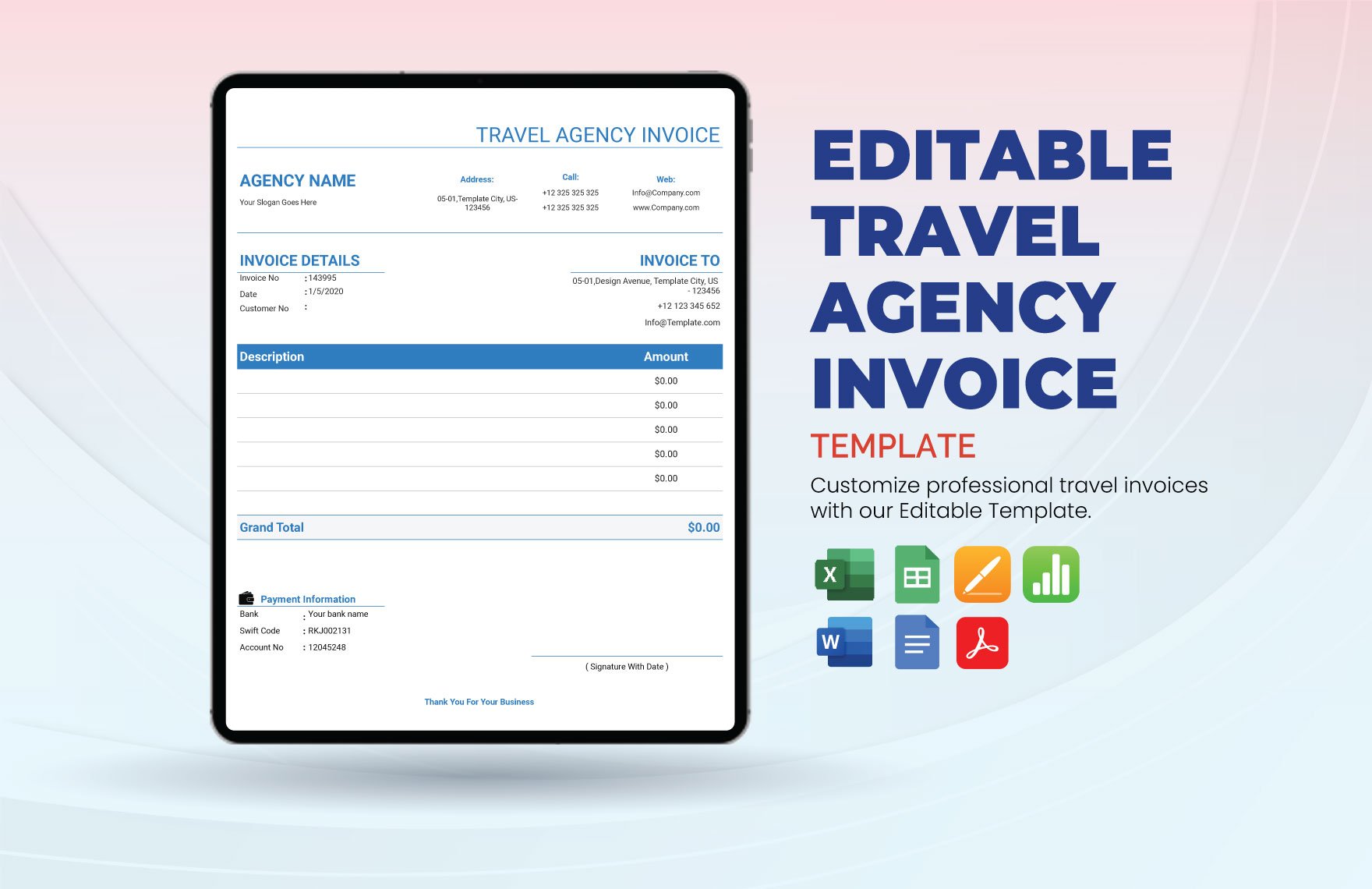

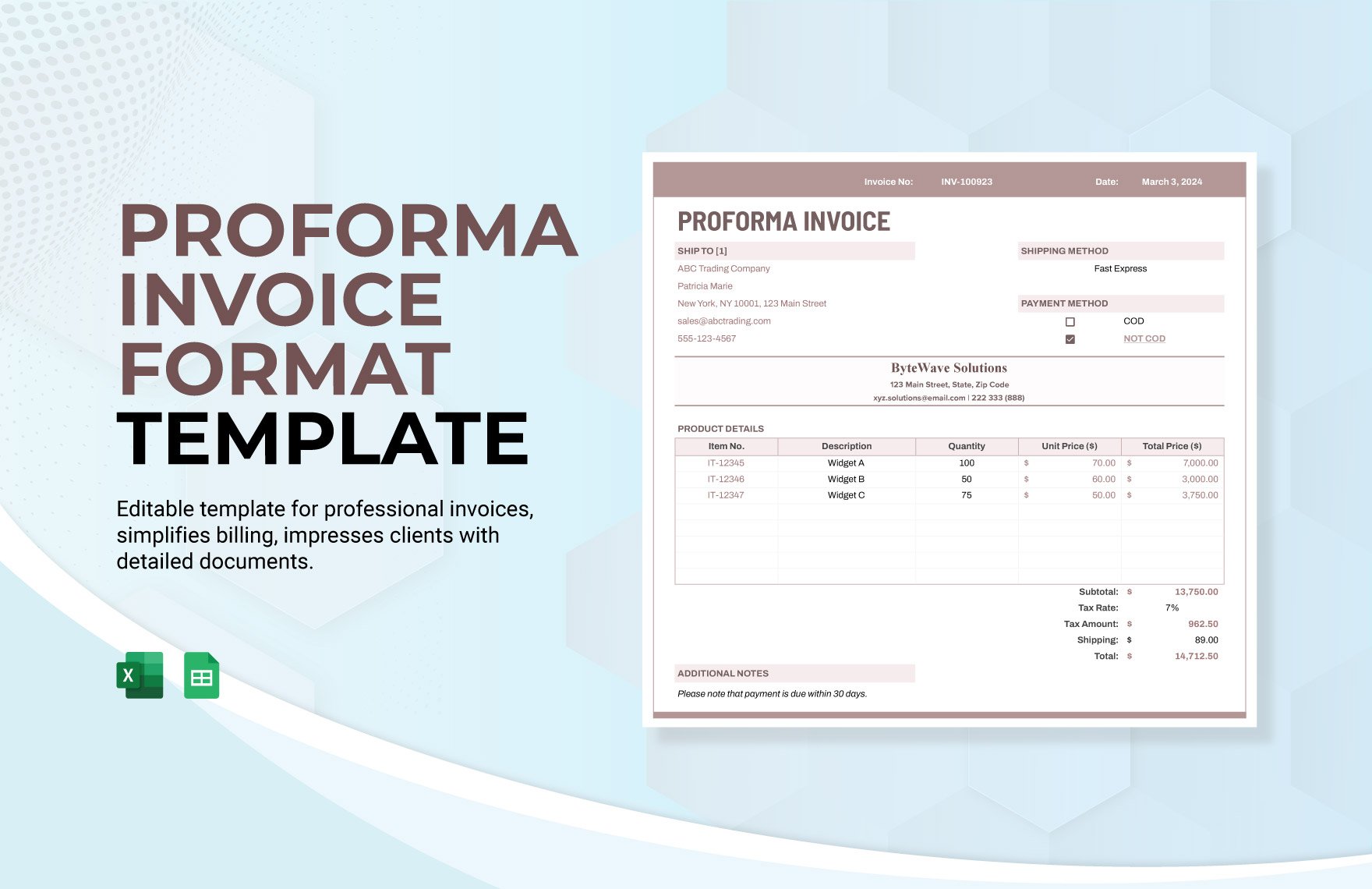

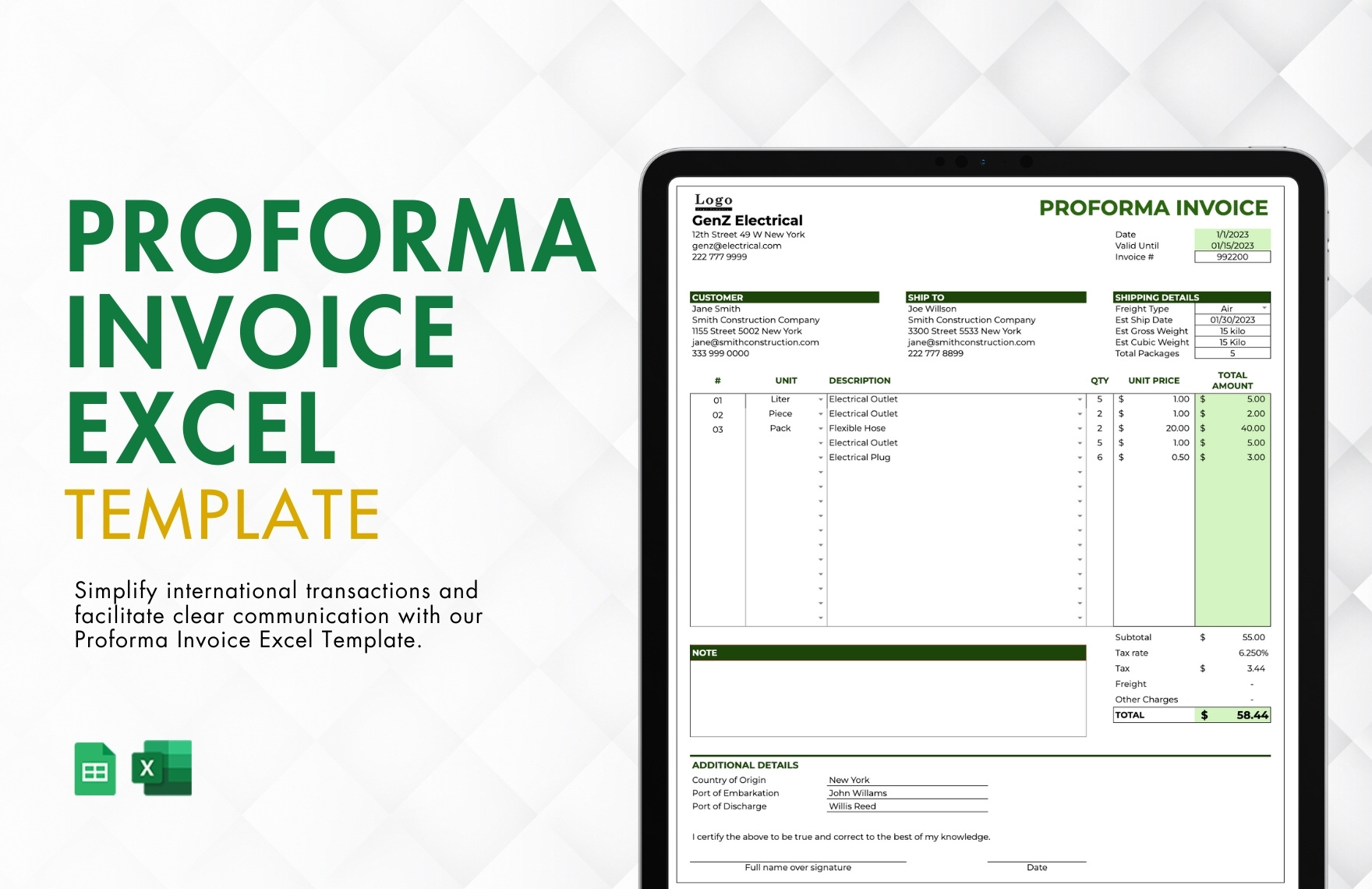

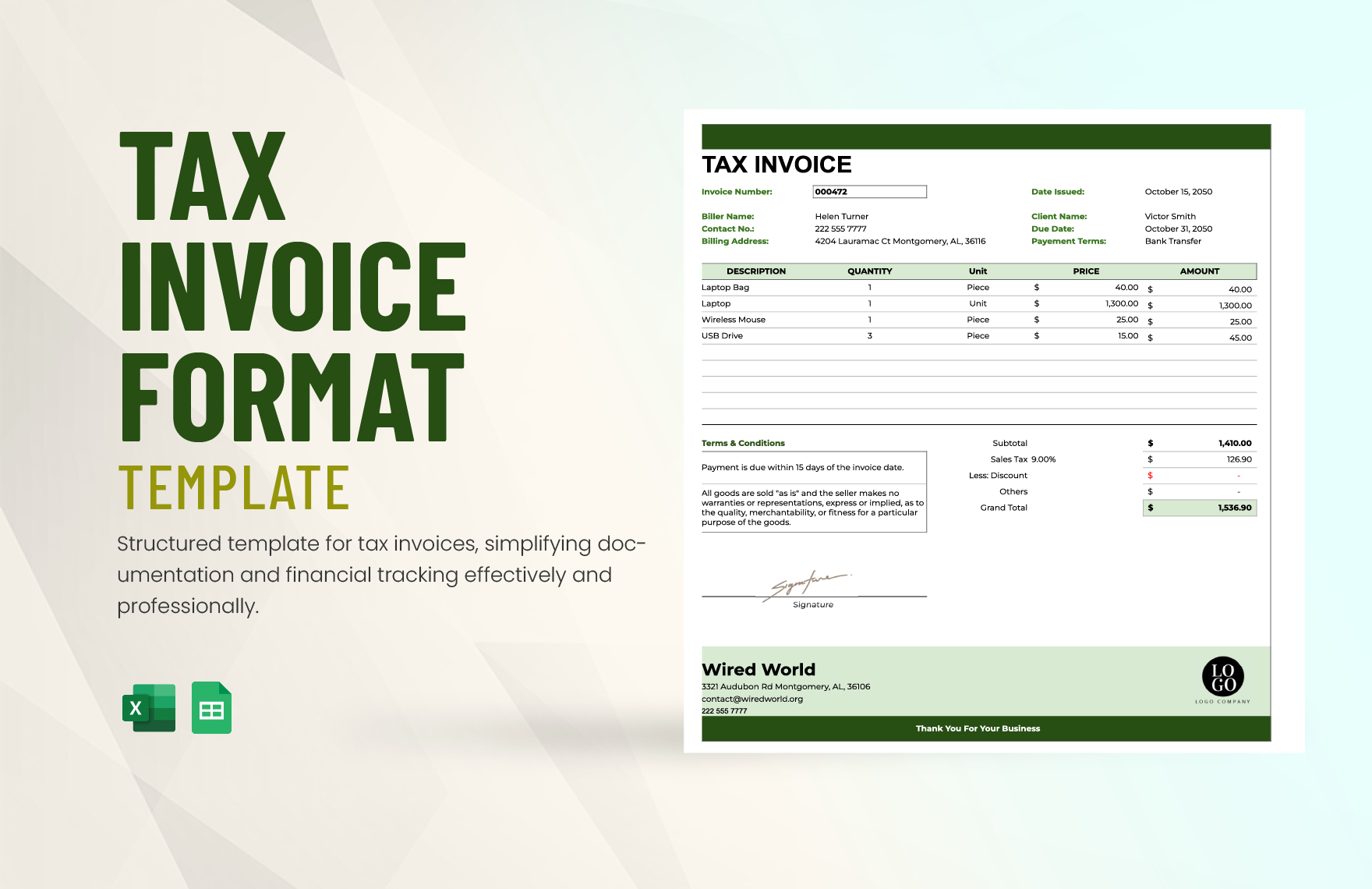

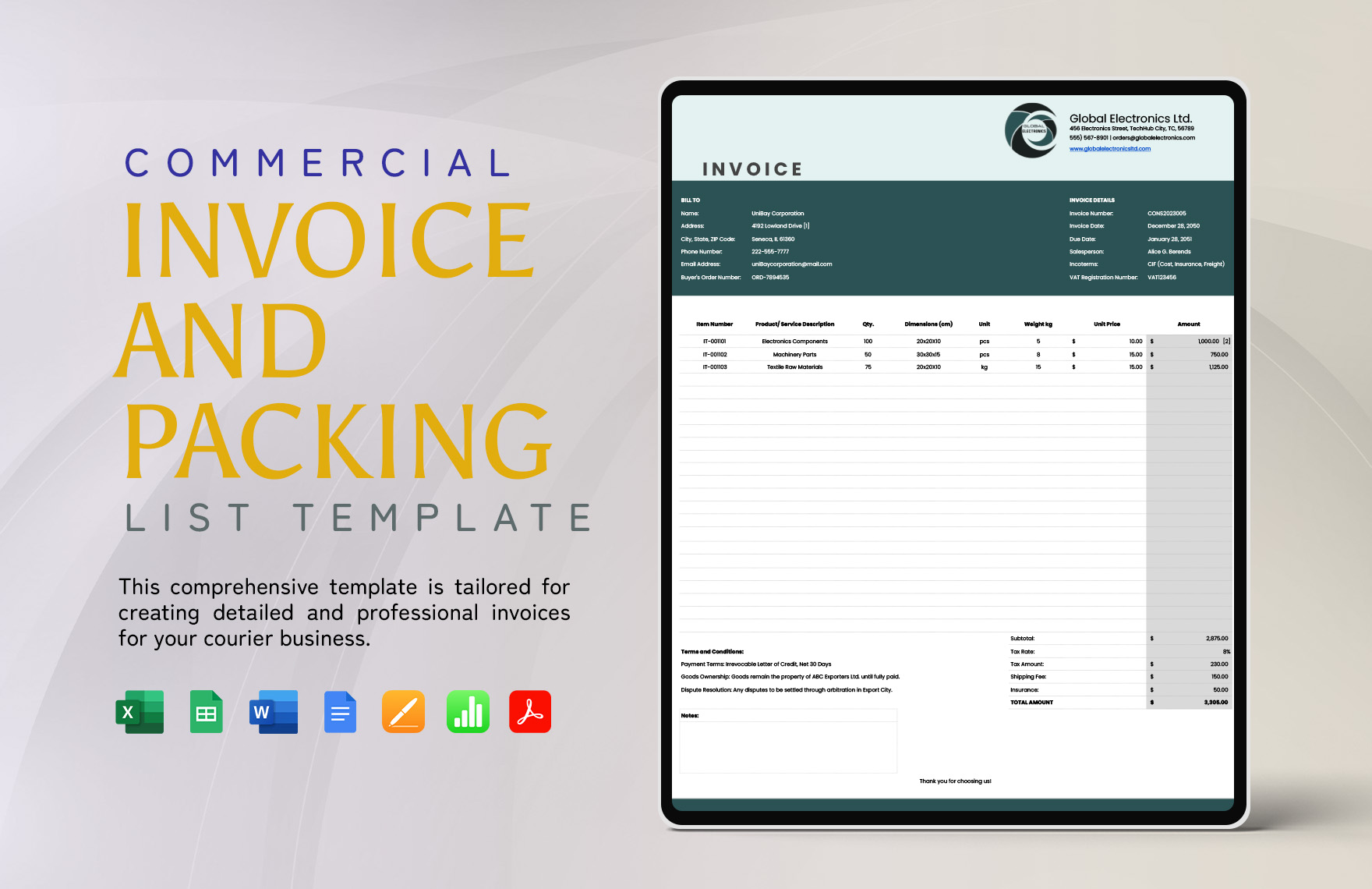

Speed up your business with our professionally designed Invoice Templates in Excel Format. Whether it's a Pro forma or a Commercial Invoice, our Invoice Templates are easy to edit and customize. Our Invoice Templates support Google Docs and Spreadsheets, and, are Mac Os and Windows compatible to give added flexibility in your daily operations. Portable, you can conveniently download our invoice templates anywhere and anytime. Ready to print, our Invoice templates are already oriented in portrait style and are available in A4 and US sizes. Our Invoice Templates are also accessible in Word, Excel, Adobe Photoshop, InDesign file formats. Straightforward, Professional and Exceptional. Download your Invoice Templates now!

How To Make Invoices In Excel.

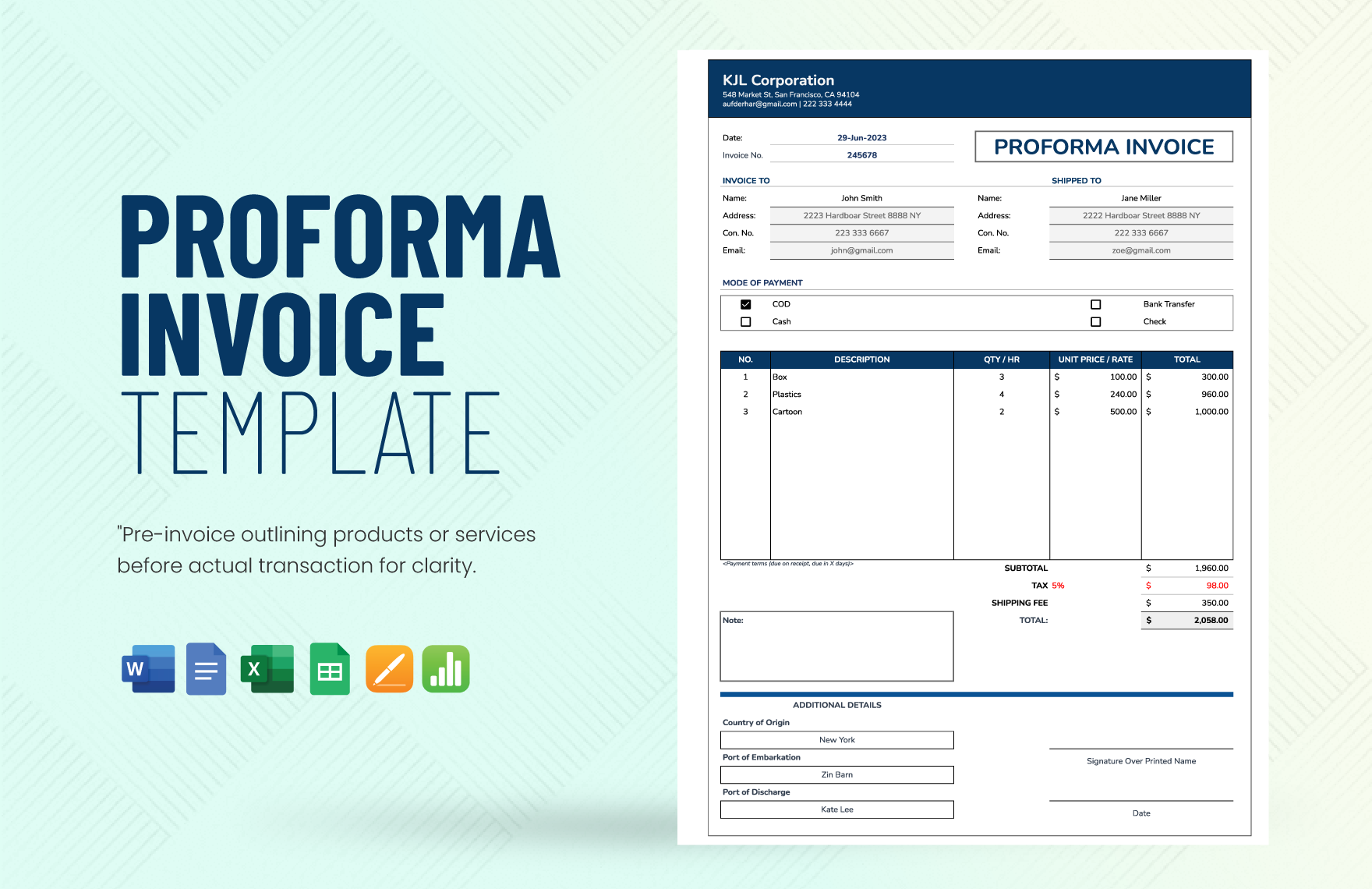

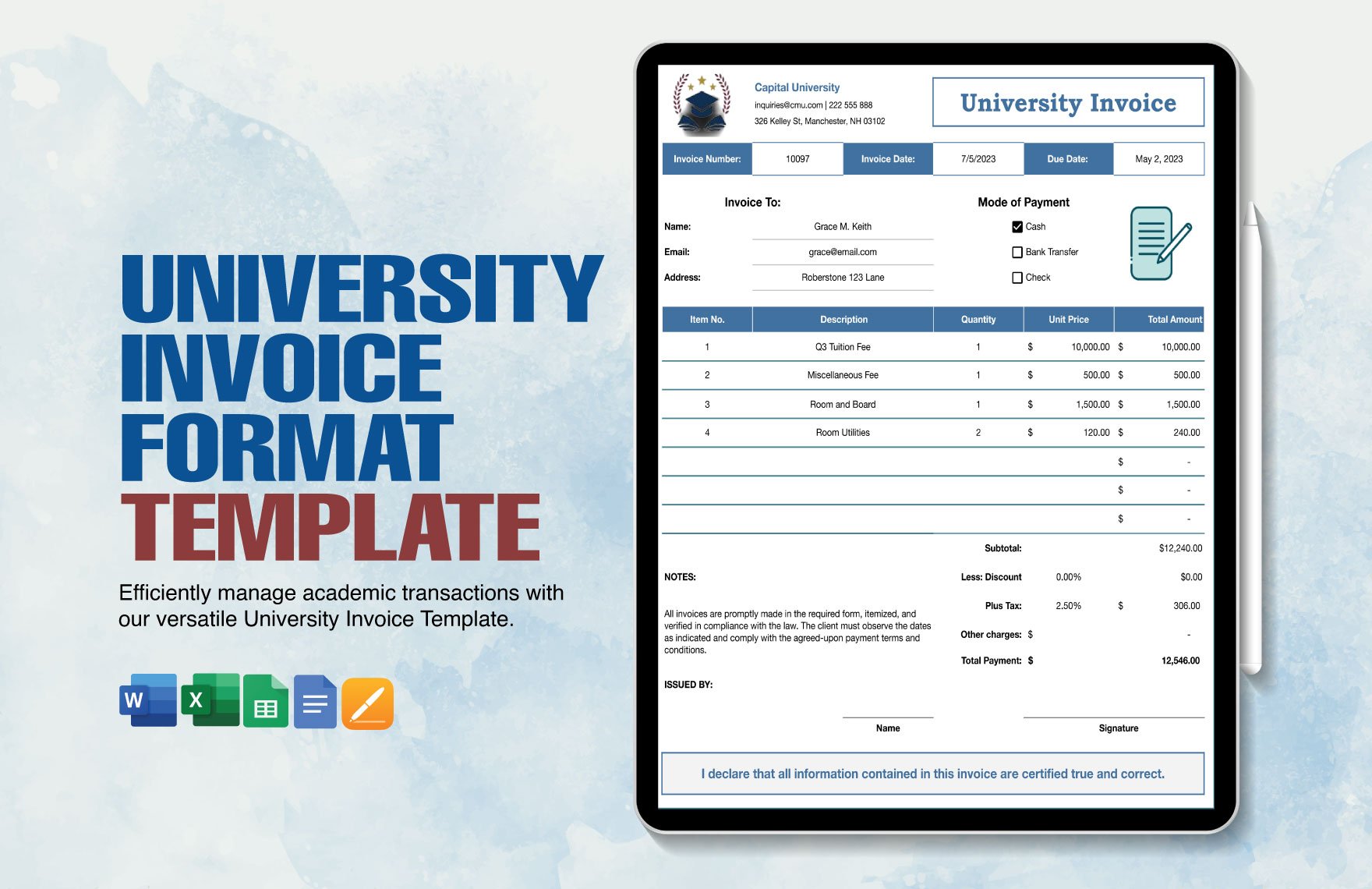

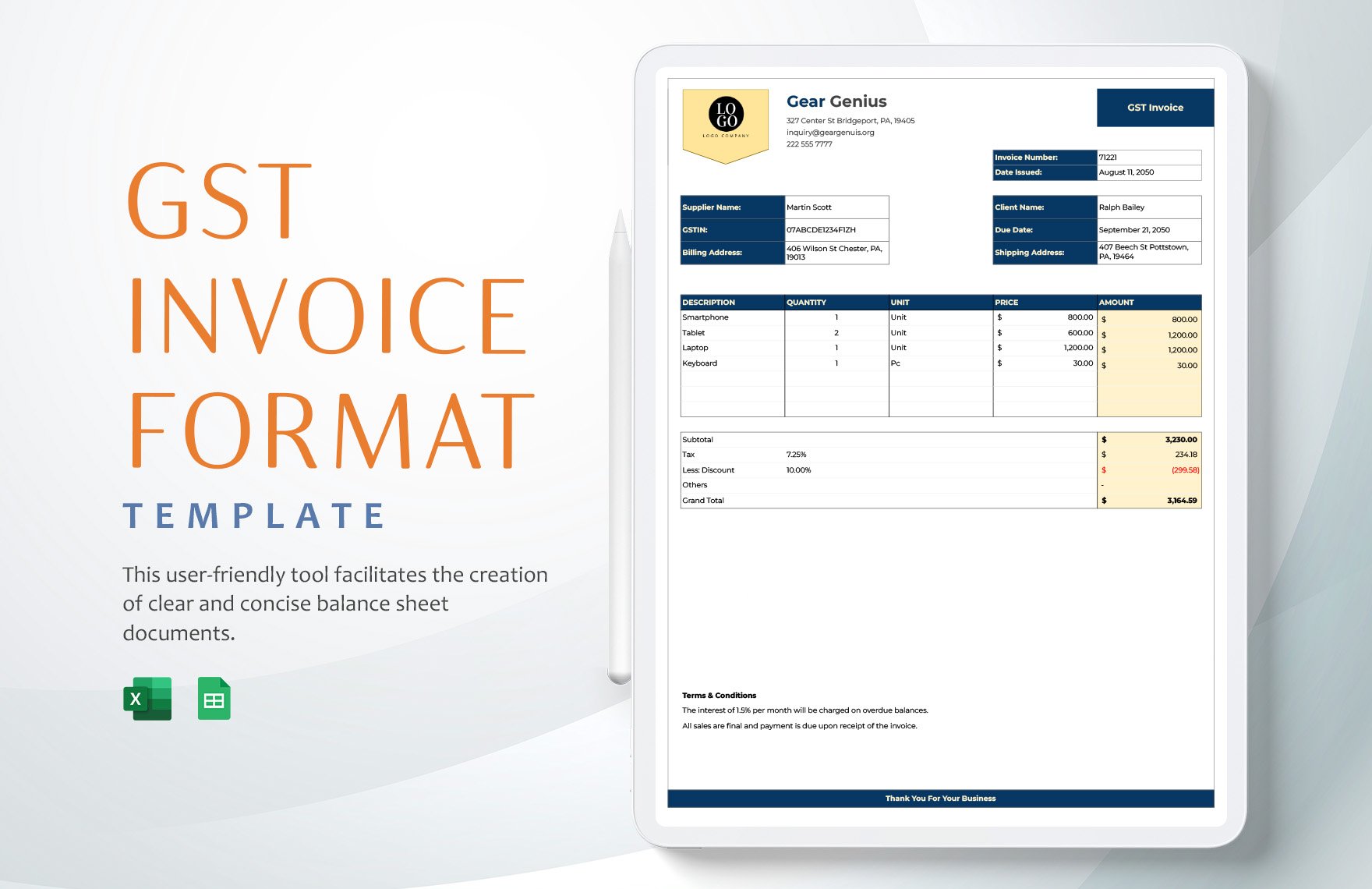

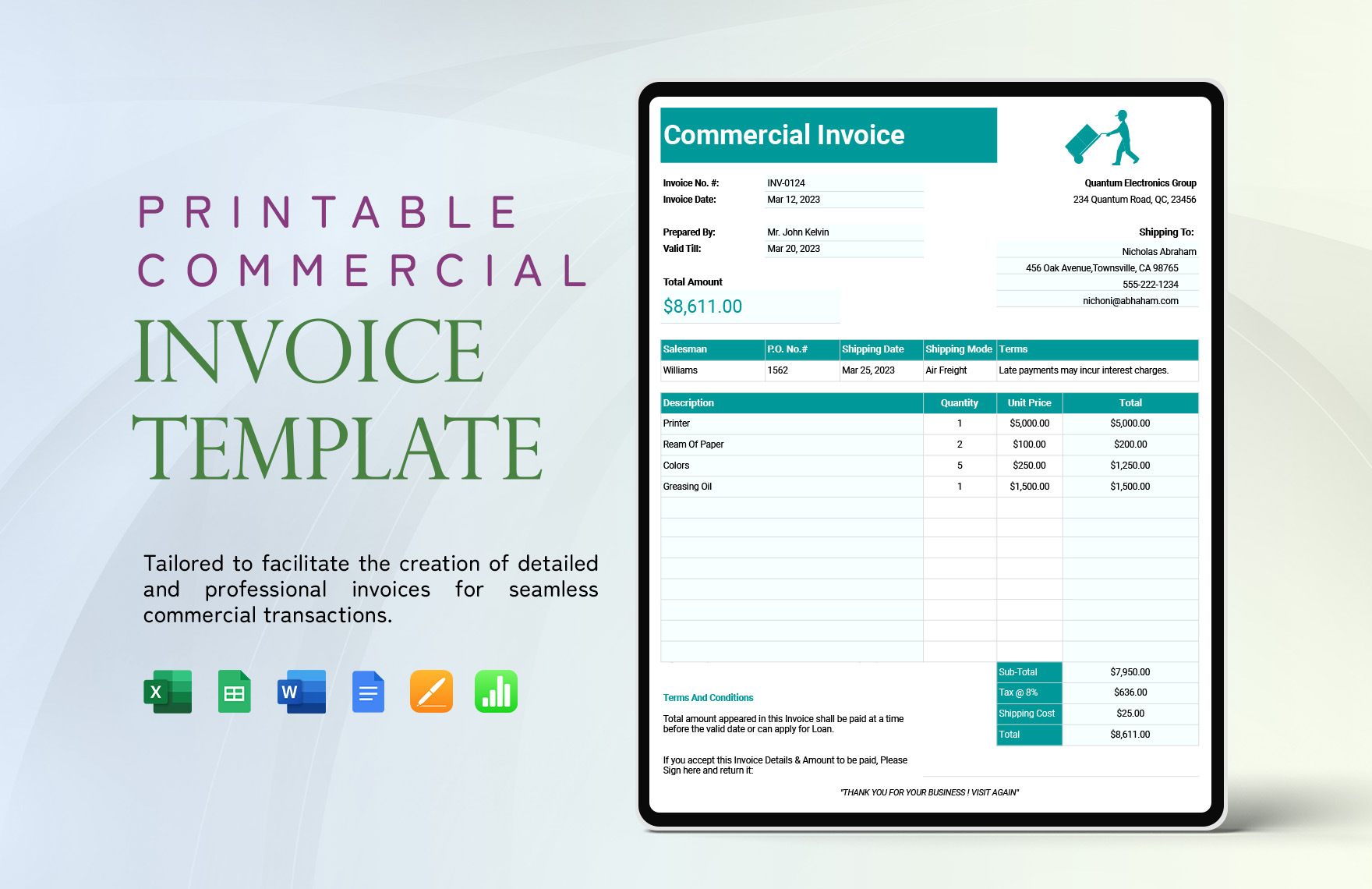

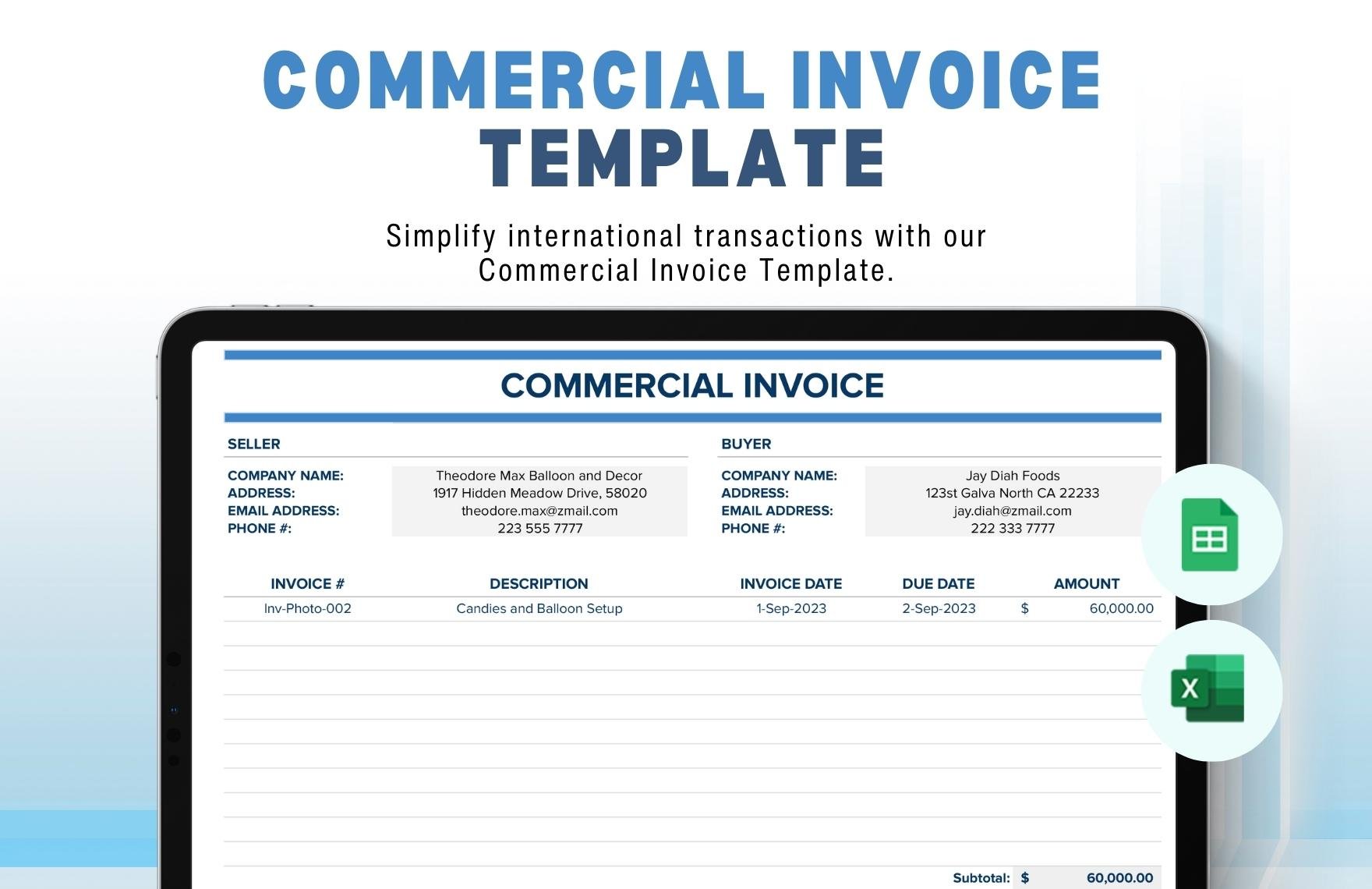

An Invoice, Bill or Tab, is a Commercial Document issued by the Seller to the Customer indicating a purchase. It includes information about the seller and the buyer, the goods purchased and the amount to be paid before delivery. It functions pretty much like a receipt only that a receipt is simple documentation given by the seller to indicate a purchase after delivery is made. Common types of Invoices are Pro Forma Invoices and Commercial Invoices. In India, GST Invoices are also issued along with other supporting documents for compliance.

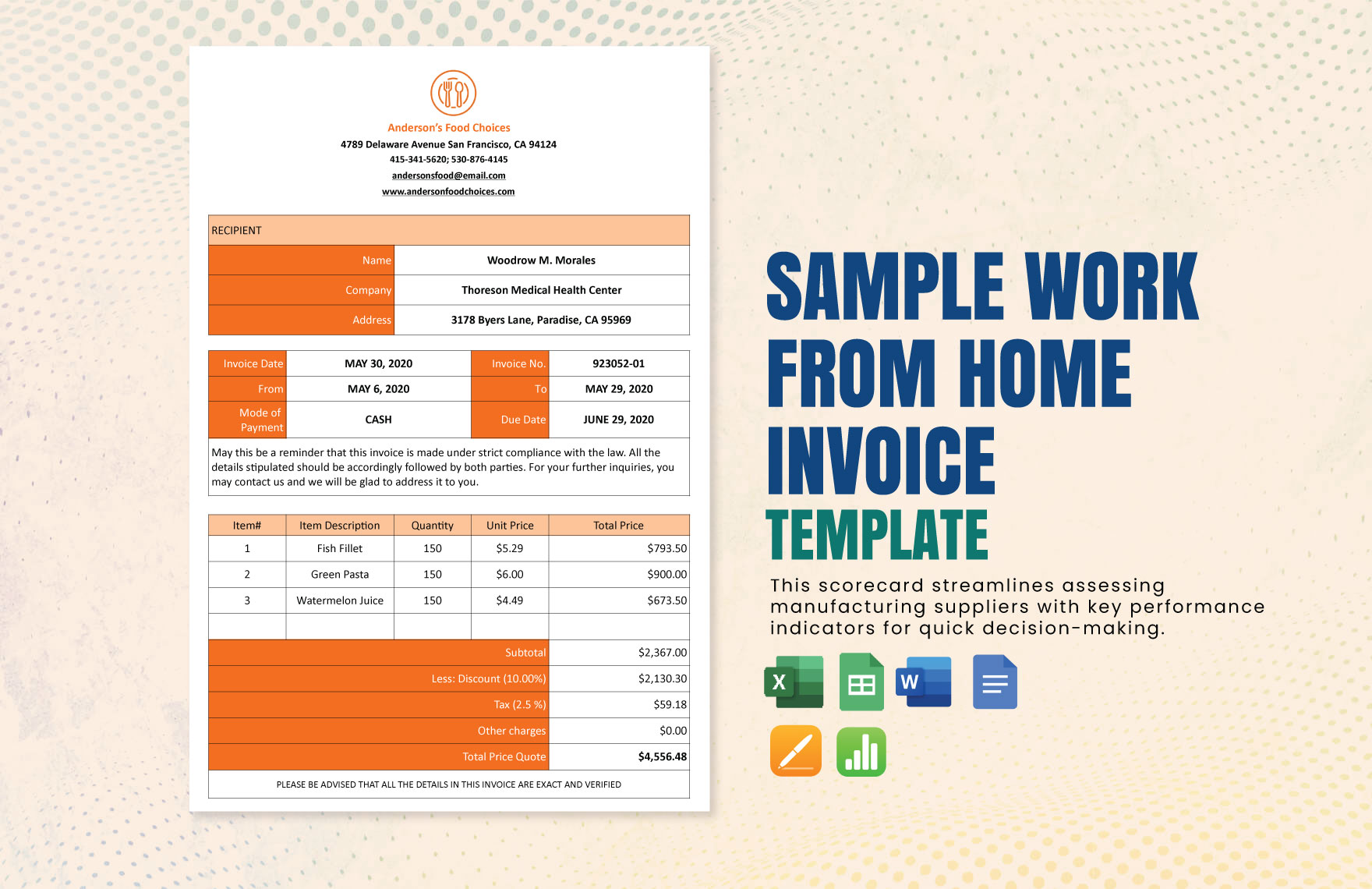

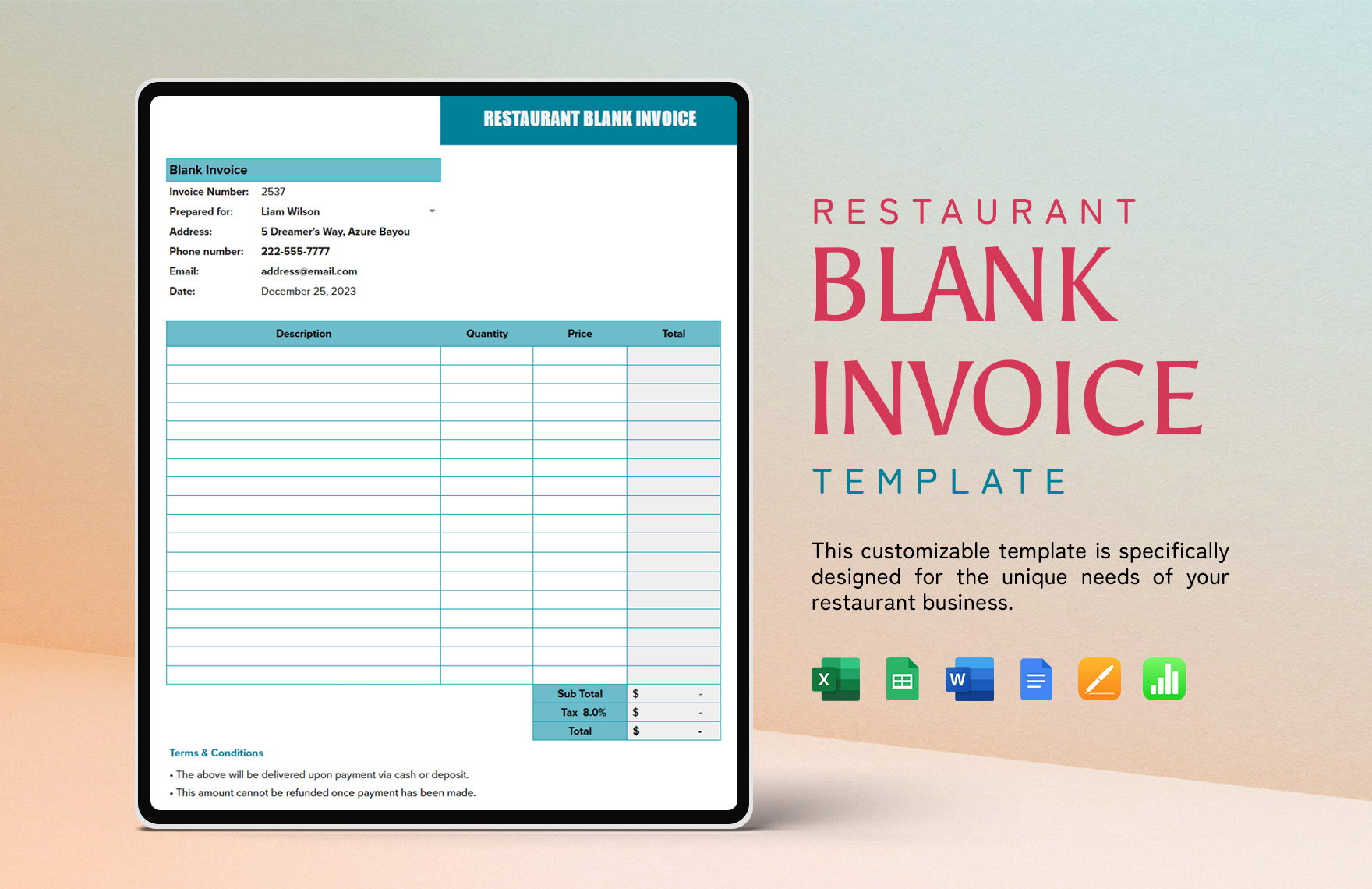

Sample invoices can also be used to give a business its own Personality. A well-designed Invoice is what sets a business apart from one another. Also, it can be used as a marketing and promotion tool for a business and its products. To give Identity to an Invoice, we’ll provide you the procedures to create and own an outstanding Invoice in Spreadsheet Format.

1. Choose The Type Of Invoice According To Purpose

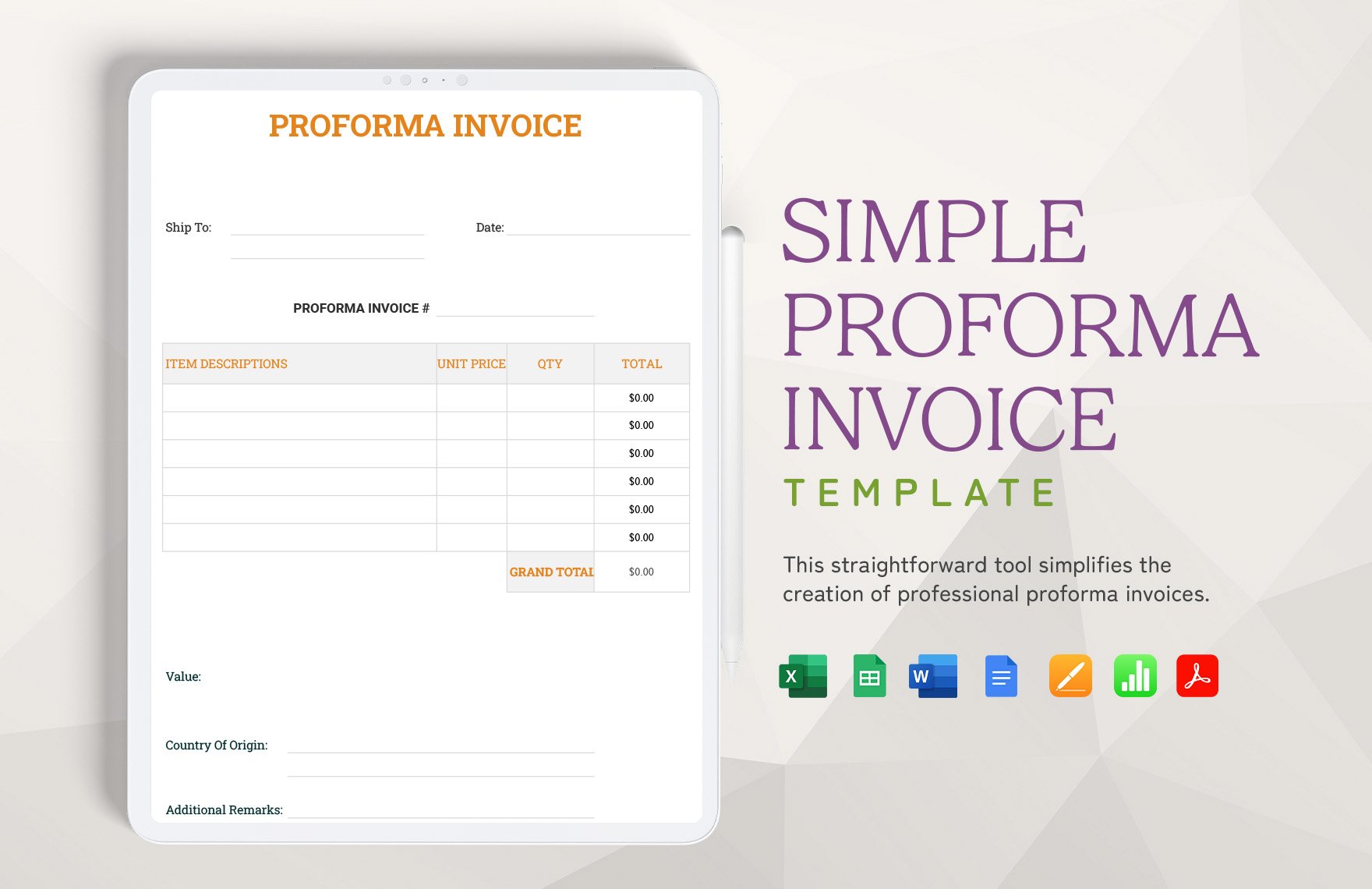

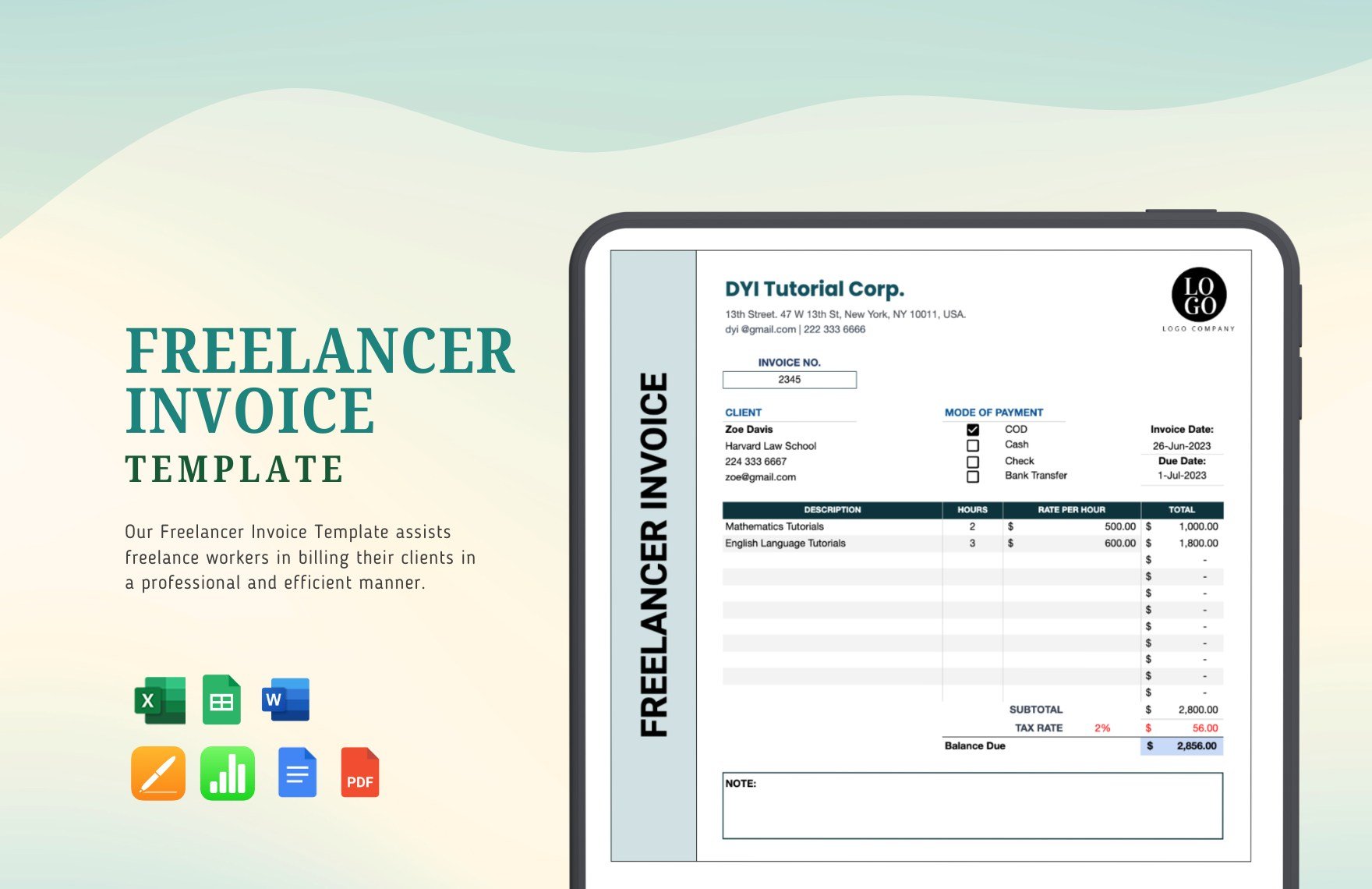

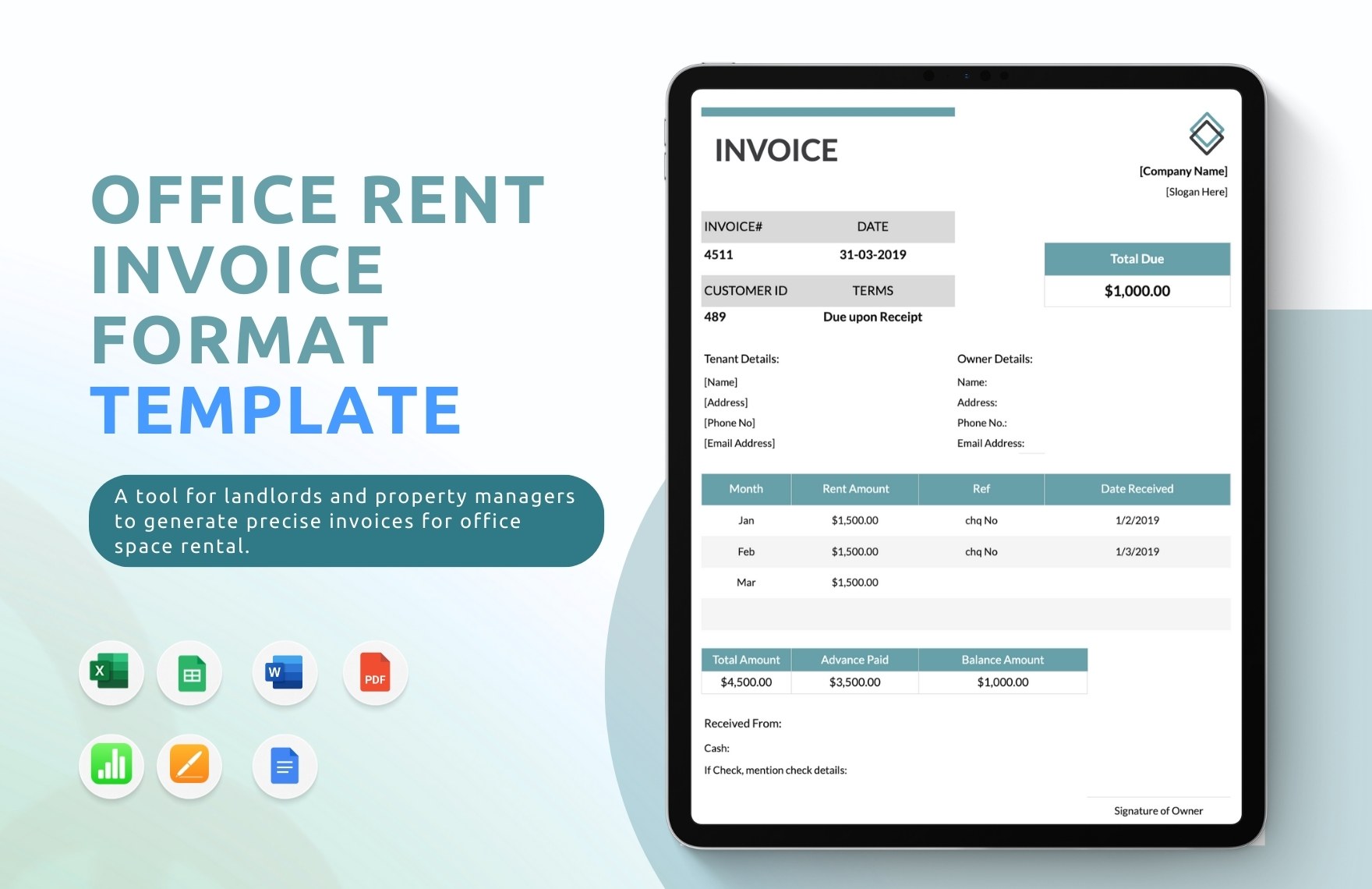

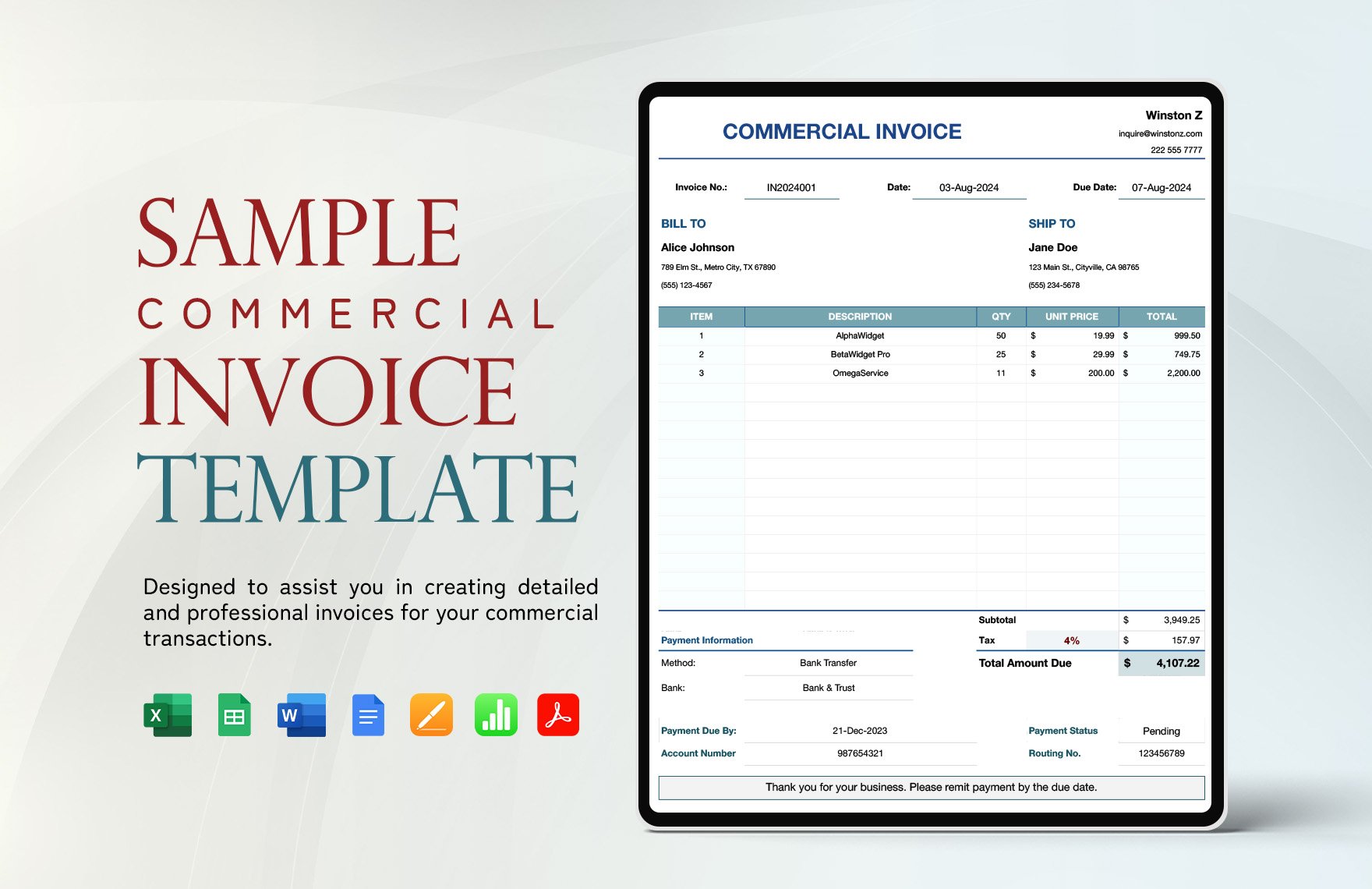

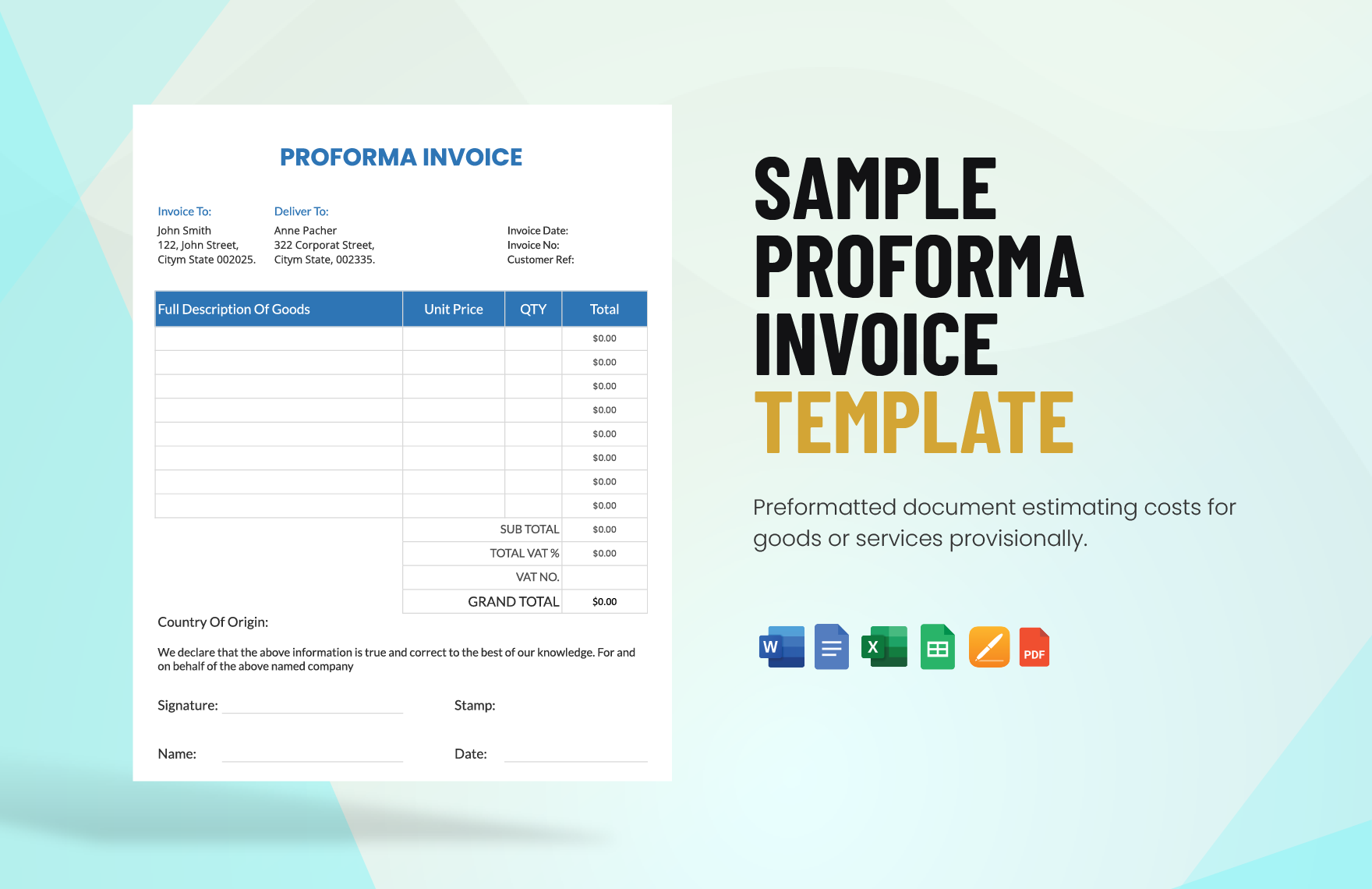

There are different types of Invoices depending on the nature of its purpose. There are Pro Forma Invoices that are not recorded as accounts payable or receivable. Commercial Invoices, on the other hand, are recorded as accounts payable or receivable. Both, however, are commonly used in Import and Export Entries as it is used to show the amount of the goods for Customs Clearance. There are also other types of Invoices although they only apply in particular countries.

2. Elements Of A Valid Invoice

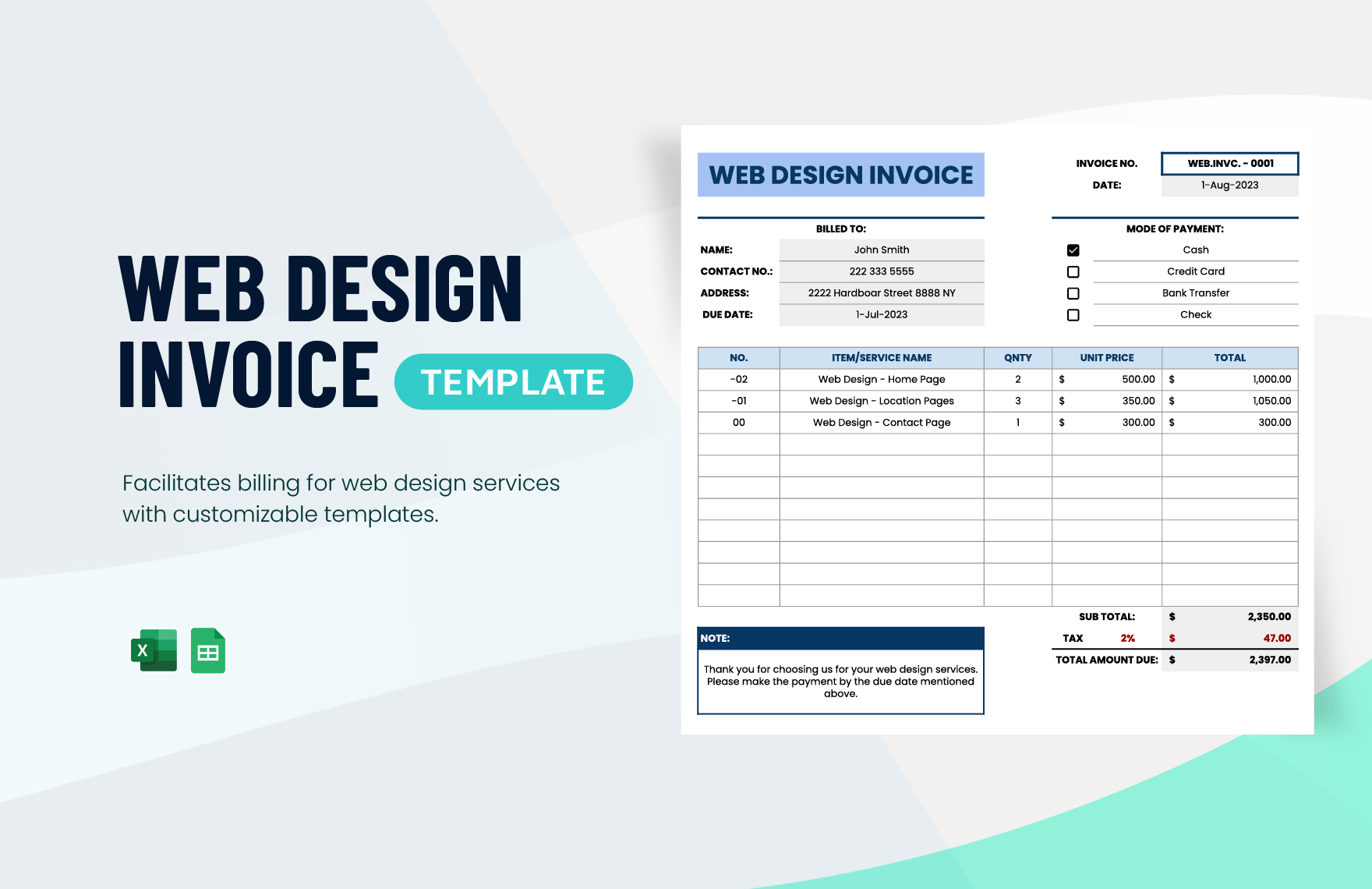

In order to create a valid invoice, the following elements must be present. A valid invoice must state the information of the seller and the buyer, The amount and the name of the goods purchased, the amount paid or to be paid, or the adjusted amount, if there is an indirect tax applied to the price of the goods purchased or services availed. Also, do not forget to put the date of order or purchase and the Invoice number.

3. Use Microsoft Excel

Microsoft Excel is the industry-leading spreadsheet software used by businesses, institutions, and households. Microsoft Excel enables you to accurately and quickly perform computations with its built-in formulas. Aside from performing mathematical and accounting functions, Microsoft Excel also enables you to store and, allows you to view recorded data with its charts.

4. Use Standard Sizes And Format

Using the Right Size and Format makes an invoice up to the standard. Using Standard Sizes and Format in your simple invoice adds credibility and legitimacy to your business. Standard invoice sizes are in A4 and US Letter Sizes. Standard orientation for invoices is in portrait.

5. Use Professional Help

Using Professional help saves you from the hassle of having to think of ideas and design on how to make an Business invoice. Another form of using professional help is by making use of our ready-made templates. Our ready-made templates allow you to save time and money. Our ready-made templates are highly customizable which allows you to give your invoice your business's own personal touch.