Looking for a promissory note templates that you can use? Well, look no more. Here in Template.Net , we give you a wide range of high-quality printable promissory note templates that you can use in schools and businesses. It is professionally written for legal documents like this one. We guarantee you 100% customizable templates that are easily editable through file formats like Google Docs, MS Word, and Pages. Available in A4 and US sizes. What are you waiting for? Hit the download button now!

What Is a Promissory Note

A promissory note is a financial statement and instrument containing a written commitment by one party (the issuer or the maker of the note) to pay a definite amount of cash to another party (the payee of the note), either on request or at a defined future date. Your promissory note may be between you and another individual or company as a standalone document. It may also be part of a series of loan papers that you obtain from a school or other businesses.

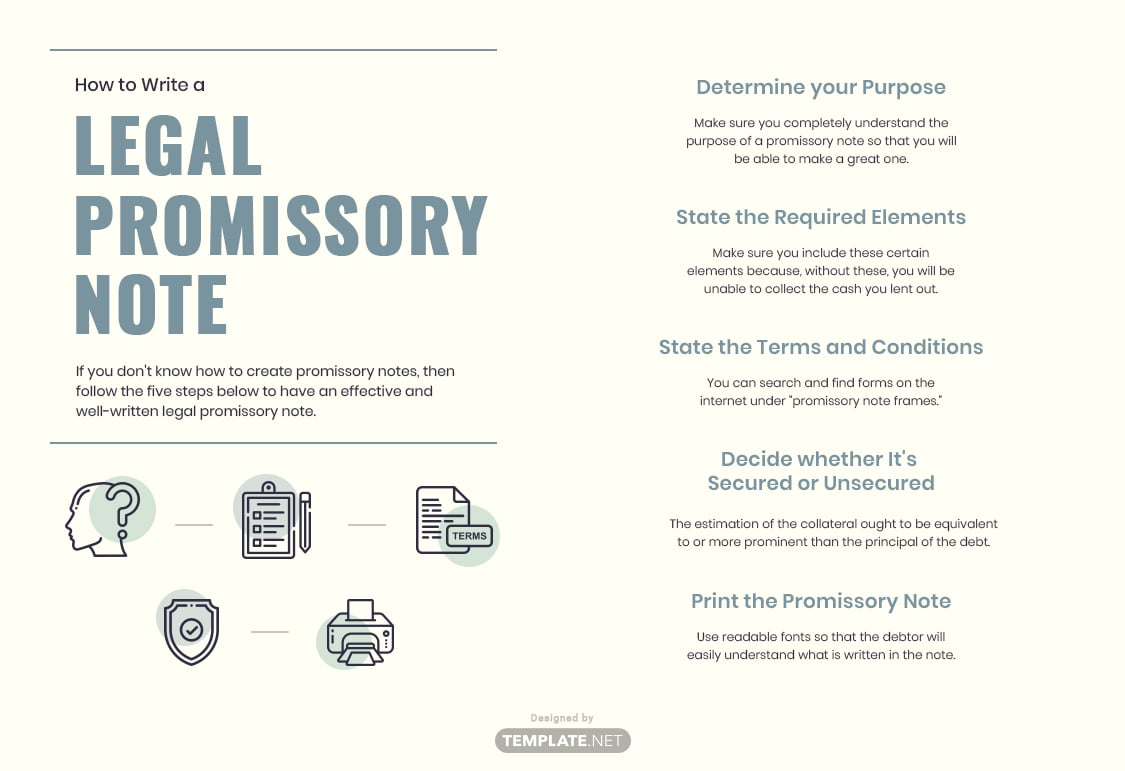

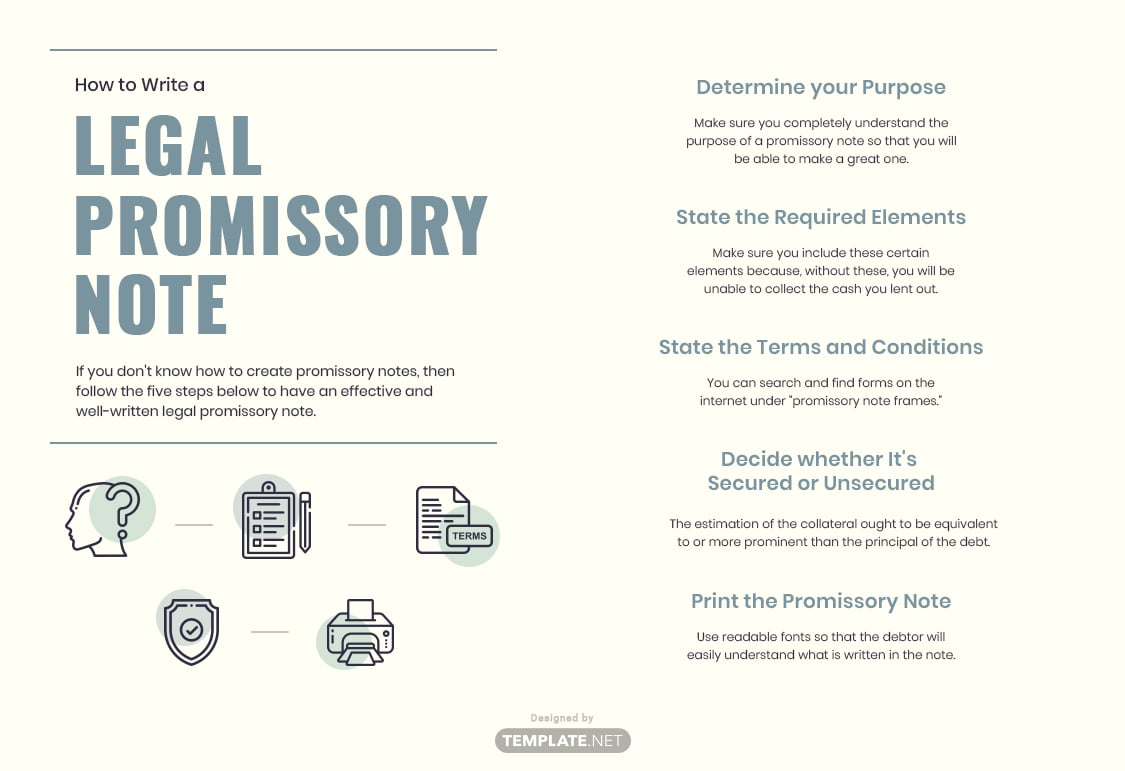

How to Write a Legal Promissory Note

If you don't know how to create promissory notes, then follow the five steps below to have an effective and well-written legal promissory note.

1. Determine your Purpose

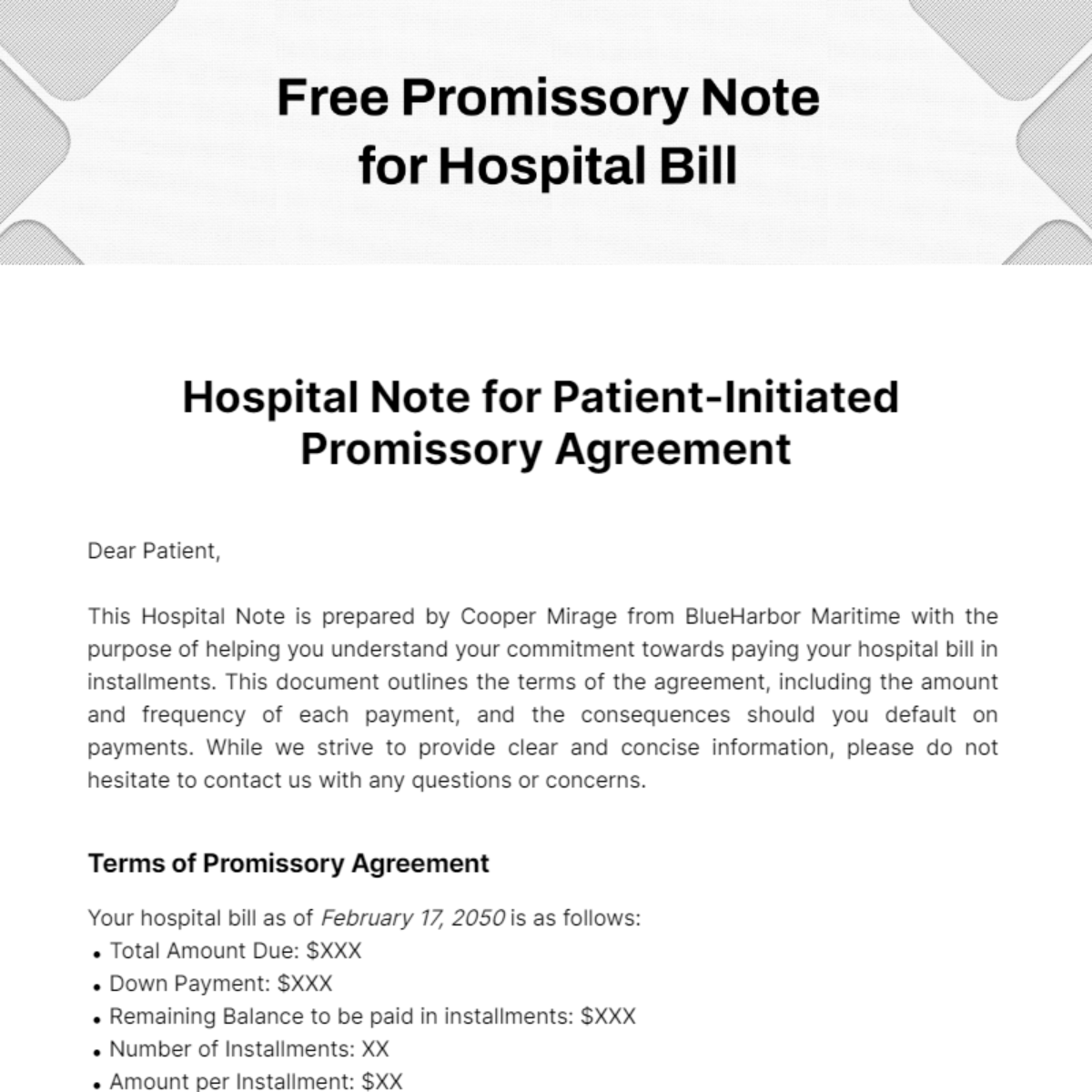

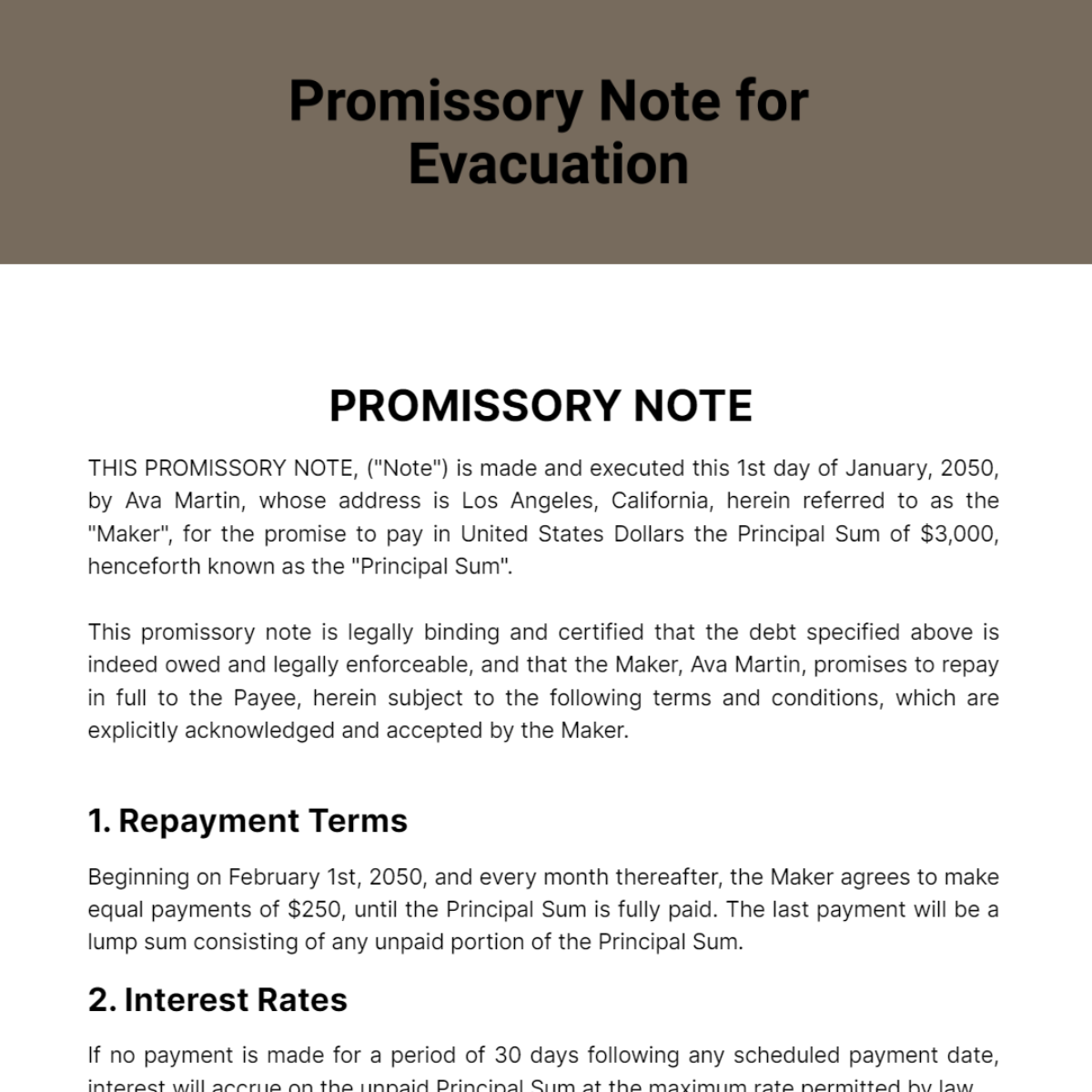

Promissory notes have a lot of usages. It can be used whether in school for school payment purposes such as tuition fees for exams and enrollment. It can also be used for businesses, real estate, hospitals, loan agreements, family loans, and personal loans. Make sure you completely understand the purpose of a promissory note so that you will be able to make a great one.

2. State the Required Elements

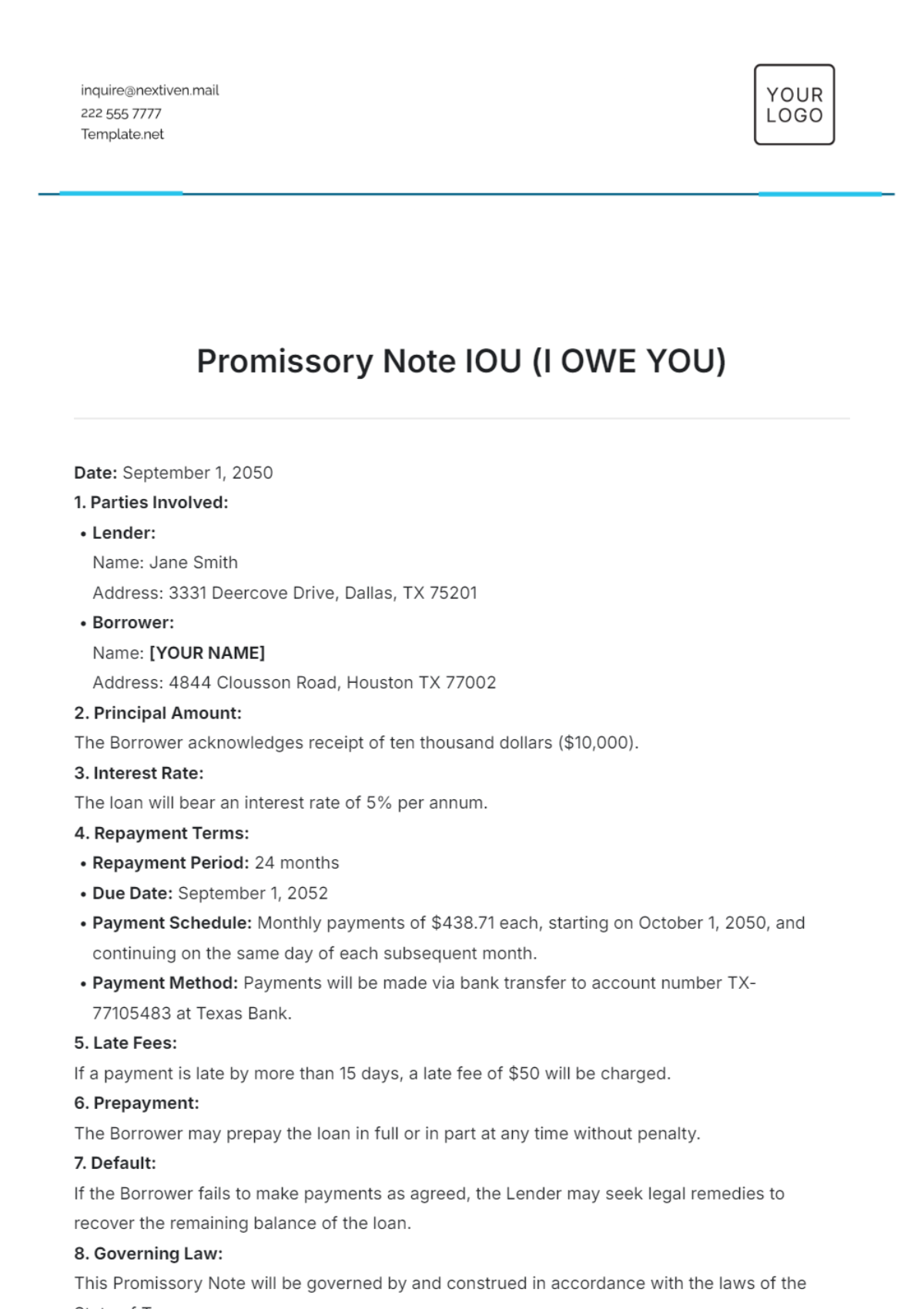

In order for your promissory note to be legal, make sure you include these certain elements because, without these, you will be unable to collect the cash you lent out. These are the following elements that must be included: the amount that is borrowed and owed, the payment schedule, the rate charged or paid on the borrowed cash (Interest rates are determined regarding yearly rate or APR), the amount after interest has been applied, the pledge of security agreement or collateral hold, the terms for late or missed payments, the terms if ever the borrower fails to repay the money in the due date, and lastly the signature for both parties.

3. State the Terms and Conditions

These are the terms and conditions that the borrower and the lender have settled after covering each of the required components mentioned above. You can search and find forms on the internet under "promissory note frames." You might want to incorporate a repayment schedule explicit due dates if there will be month to month or week by week installments. Aside from that, you may download promissory note templates here on our site.

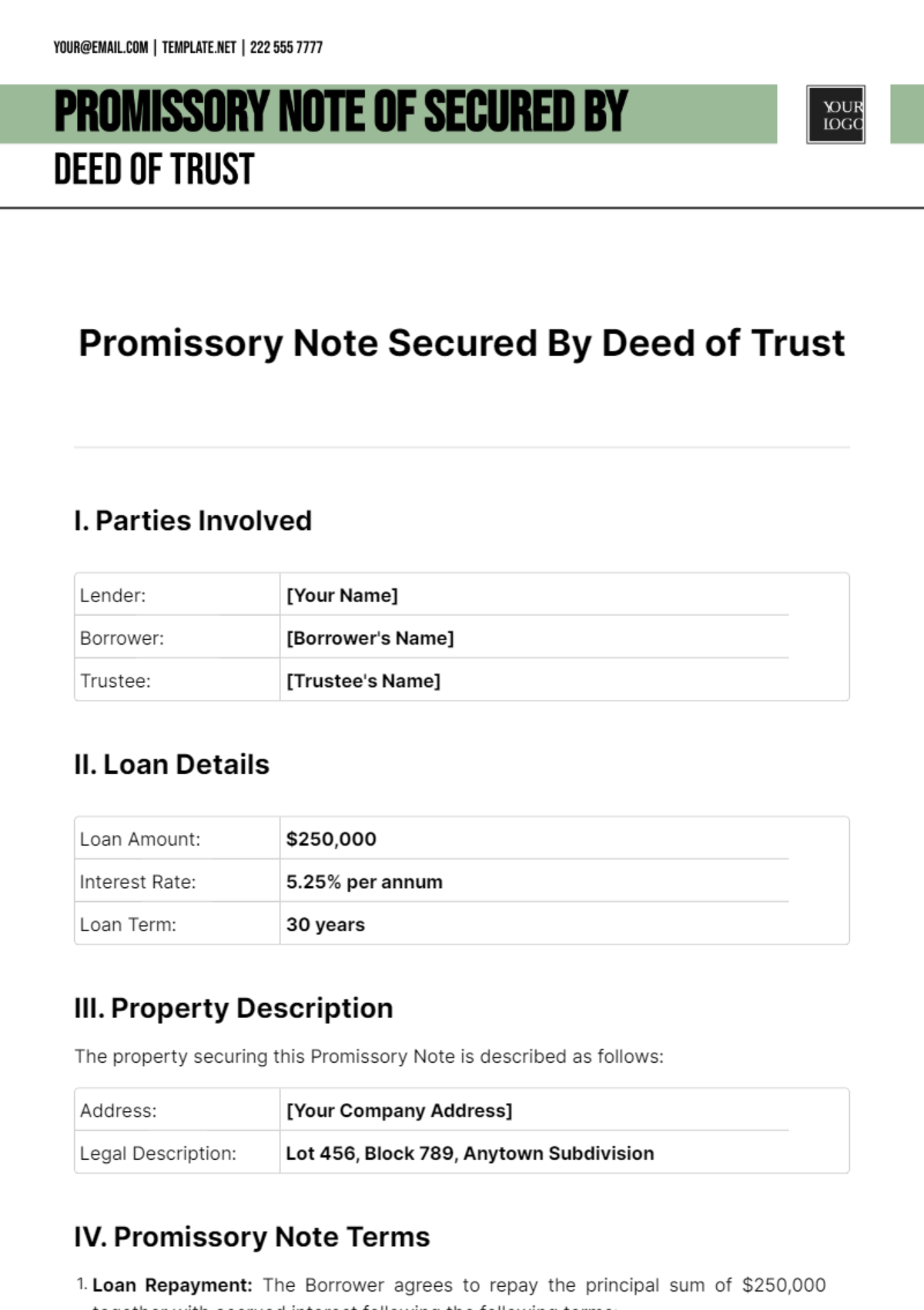

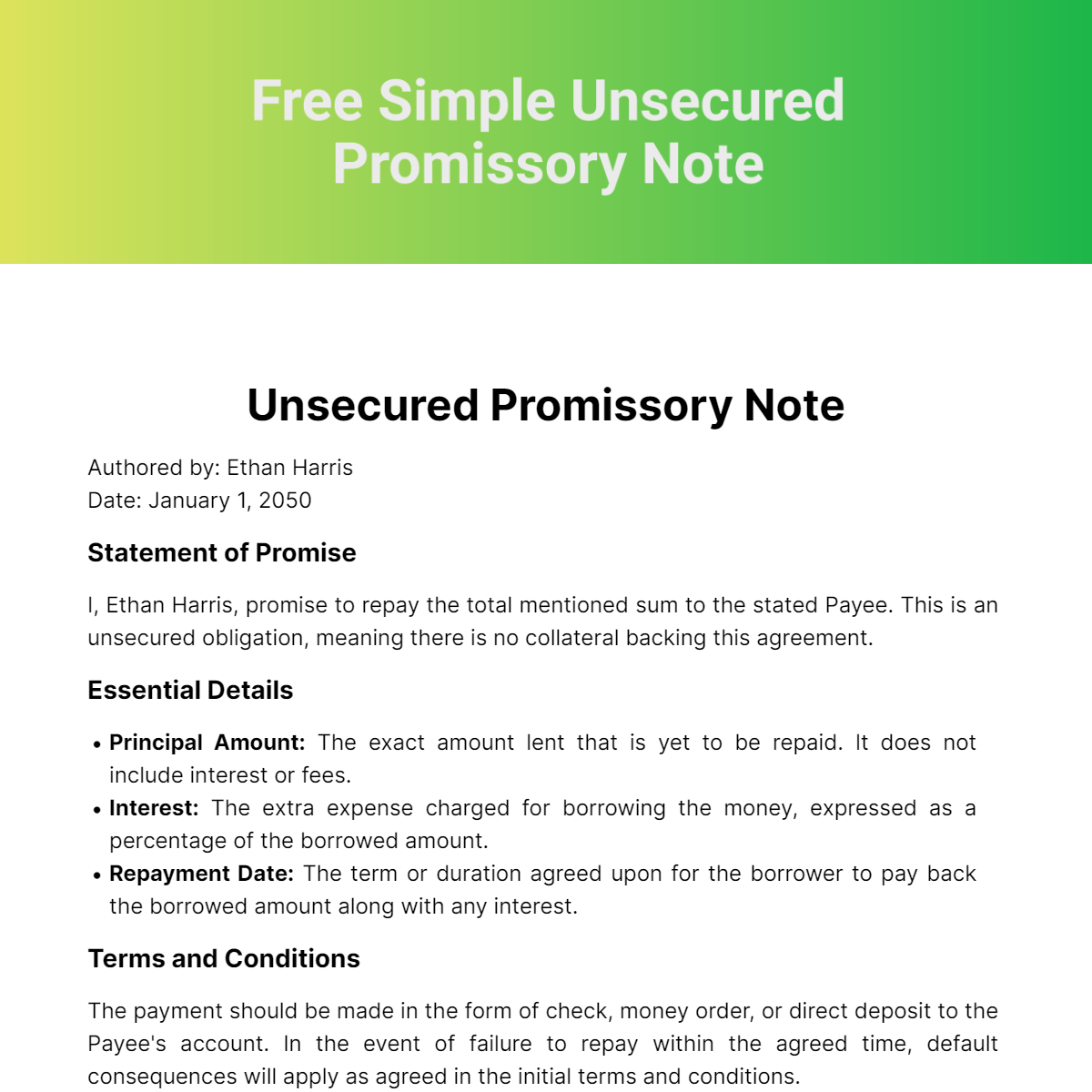

4. Decide whether It's a Secured or Unsecured Promissory Note

A secured promissory note requires the borrower to give merchandise, property, or administrations as insurance, in the event the borrower defaults on the debt. The estimation of the collateral ought to be equivalent to or more prominent than the principal of the debt. Meanwhile, an unsecured promissory note is the total opposite of the secured one. It requires no insurance to obtain.

5. Print the Promissory Note

It's very important to print out the promissory notes you have created because you will distribute it to the borrower of your money for them to be reminded about their debt. But before you print out the notes, make sure you proofread every word so that there will be no missing detail. Use readable fonts so that the debtor will easily understand what is written in the note.