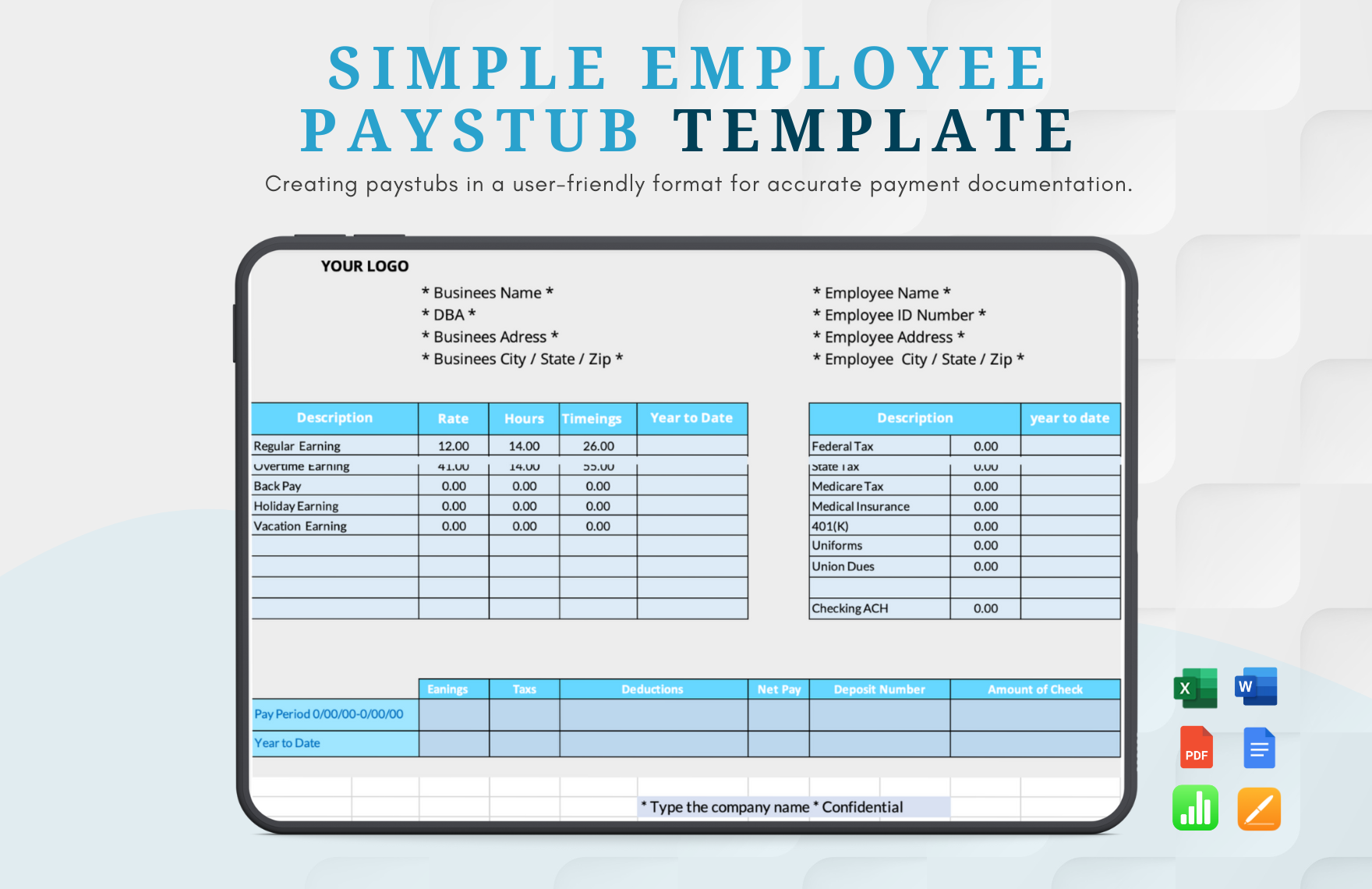

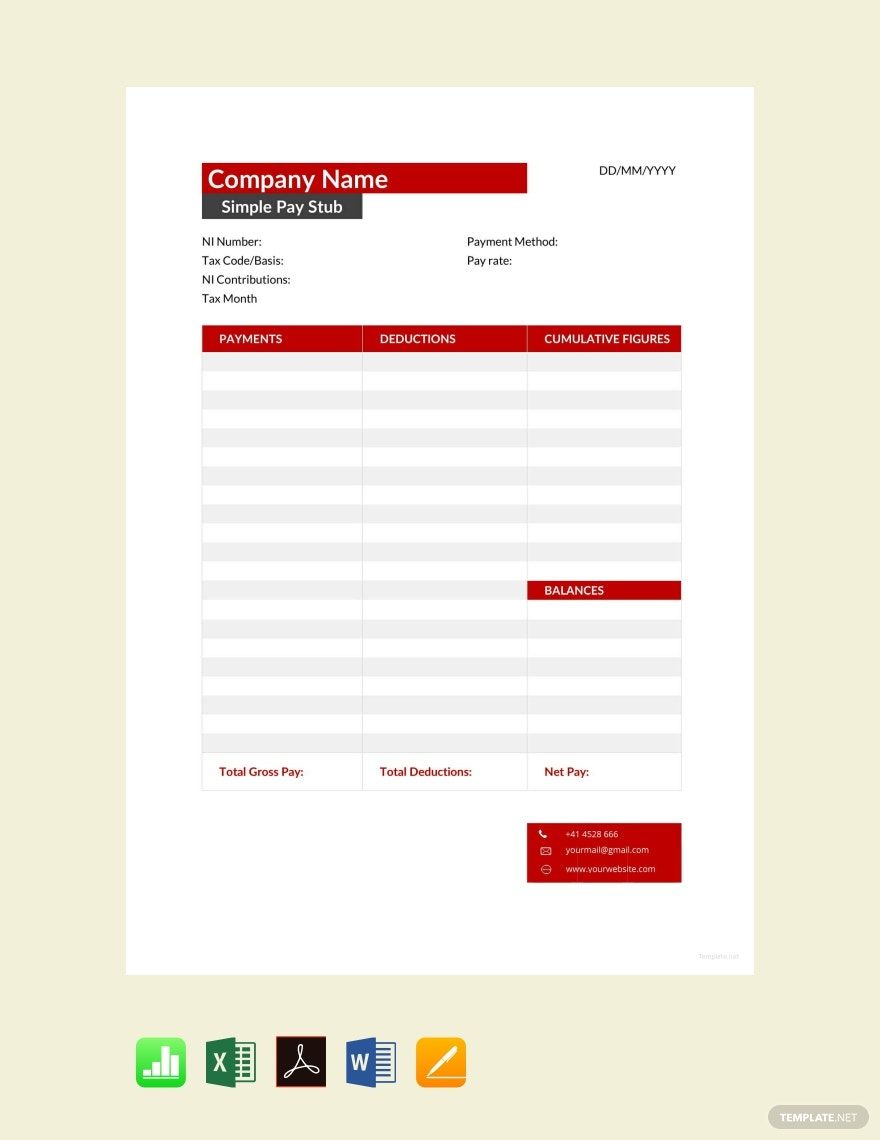

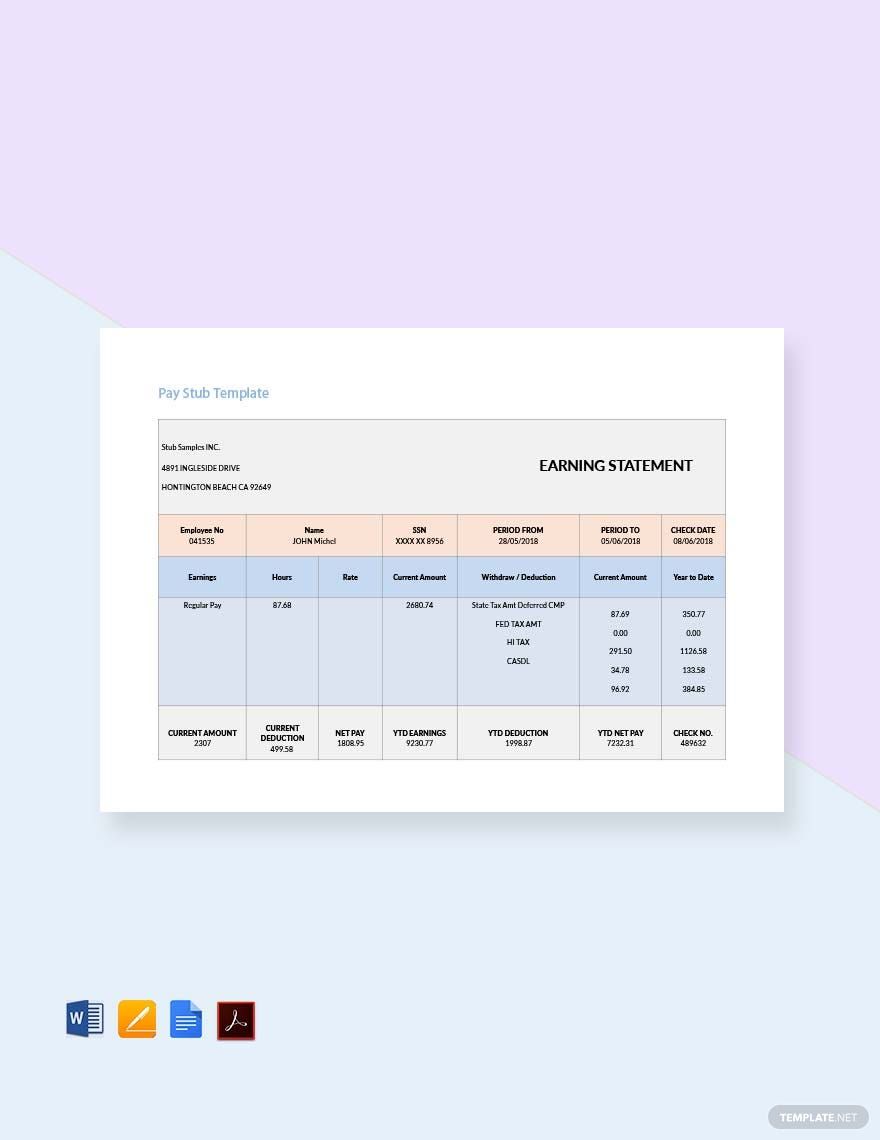

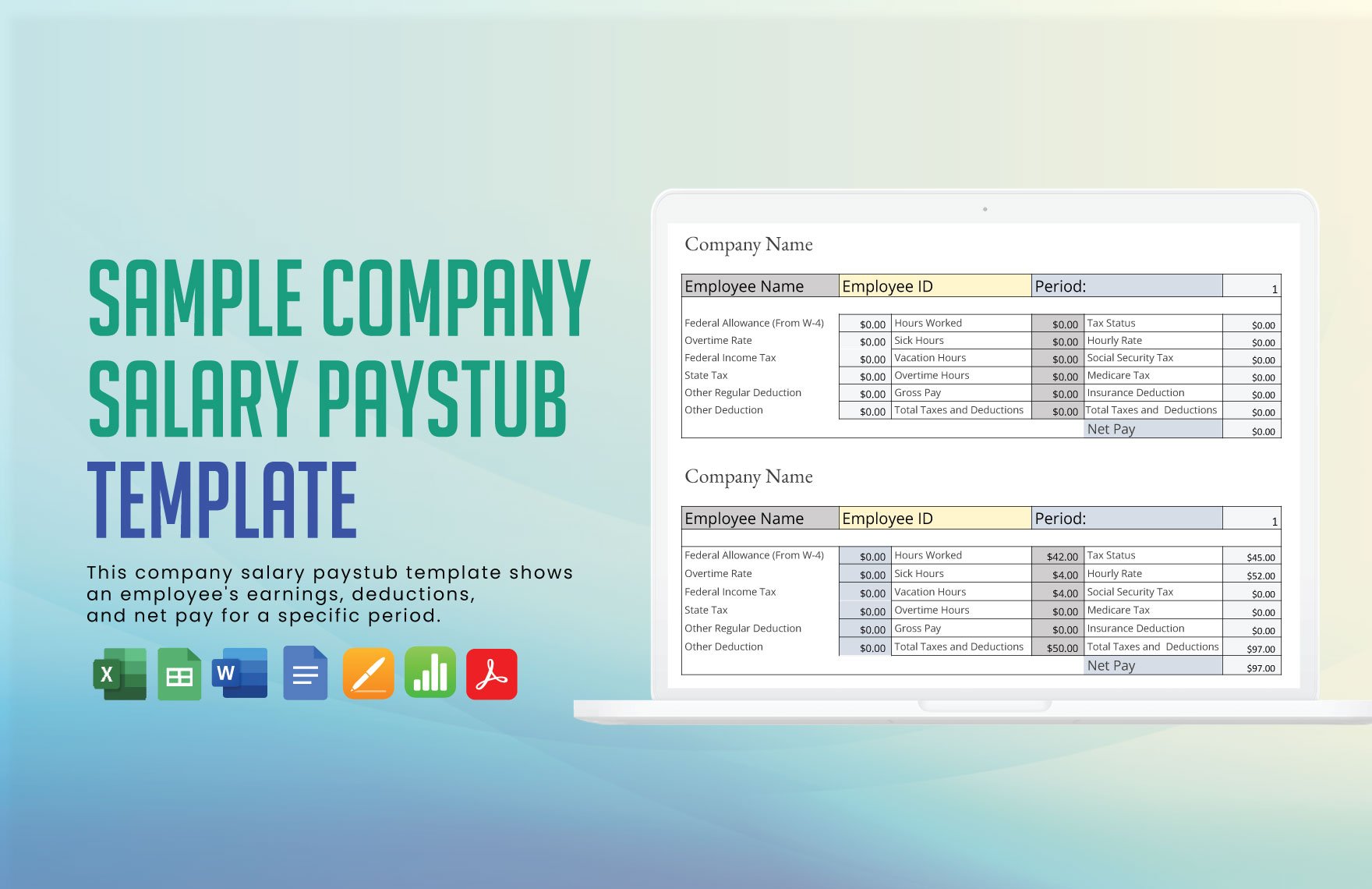

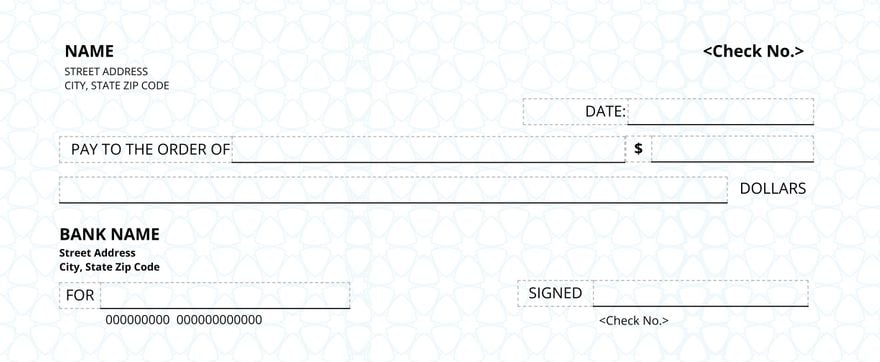

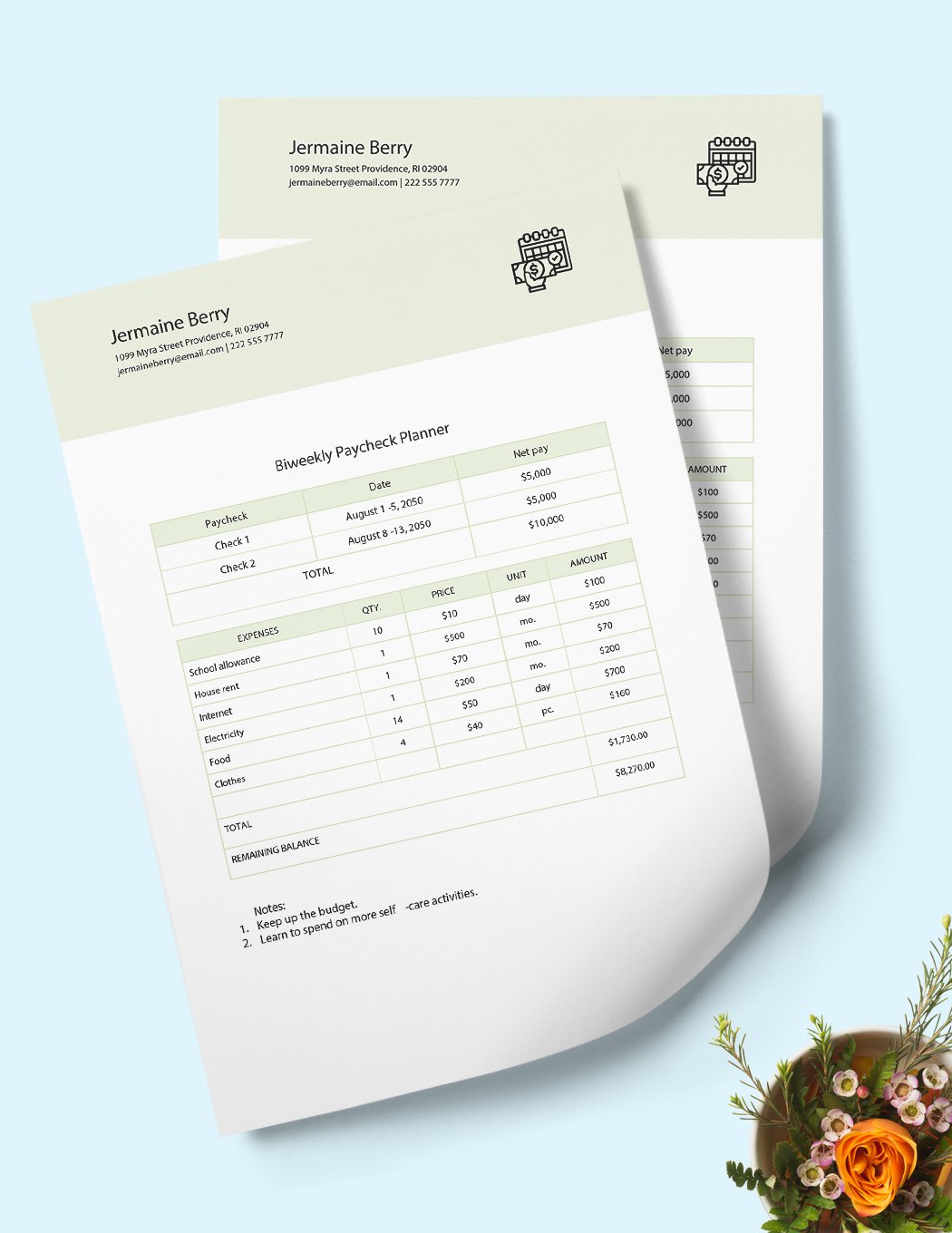

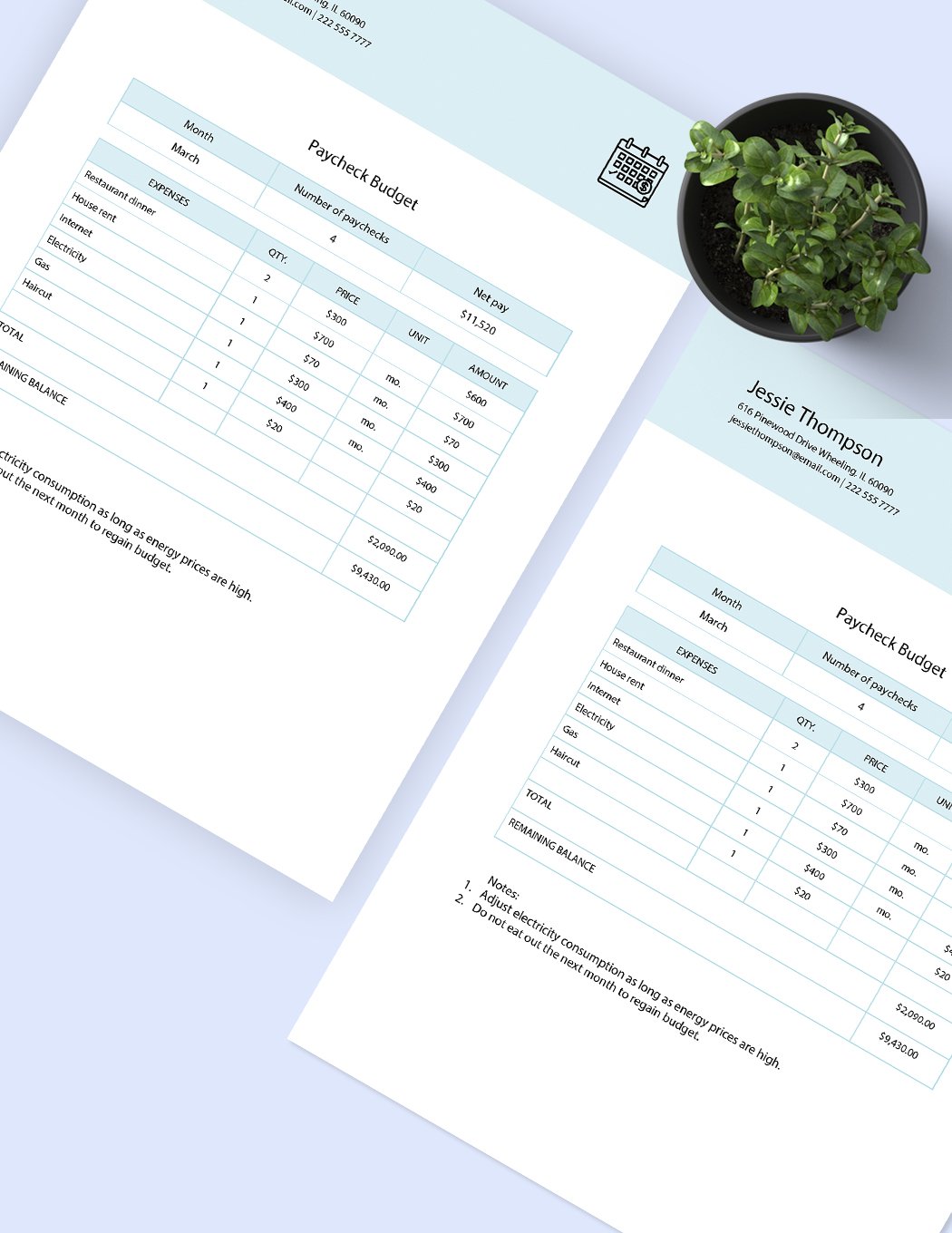

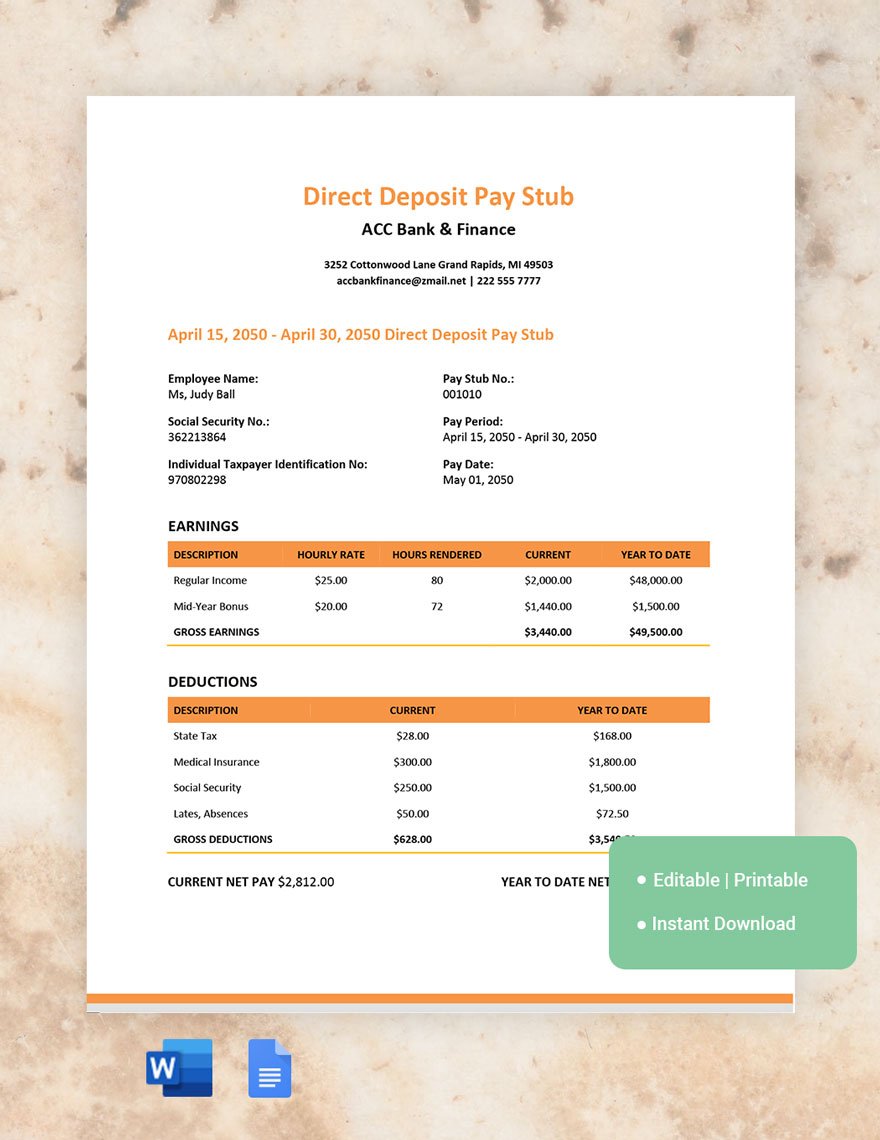

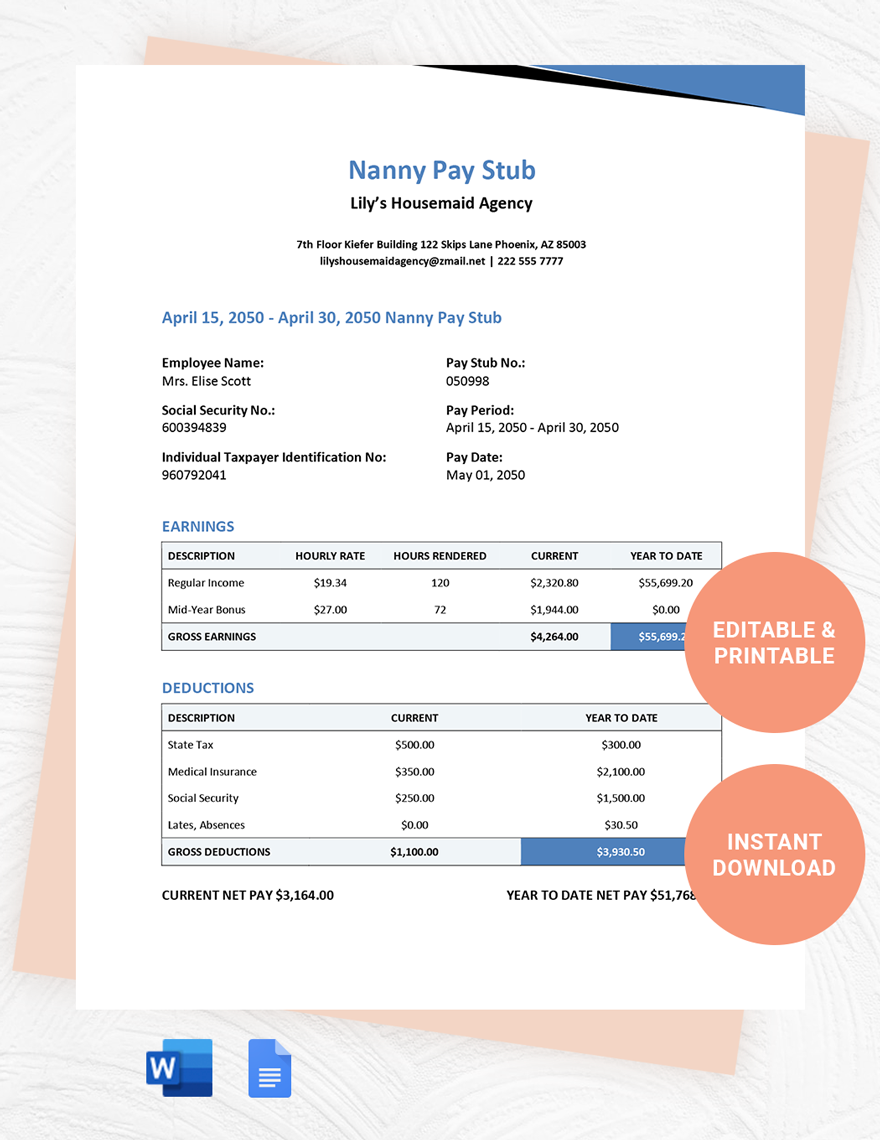

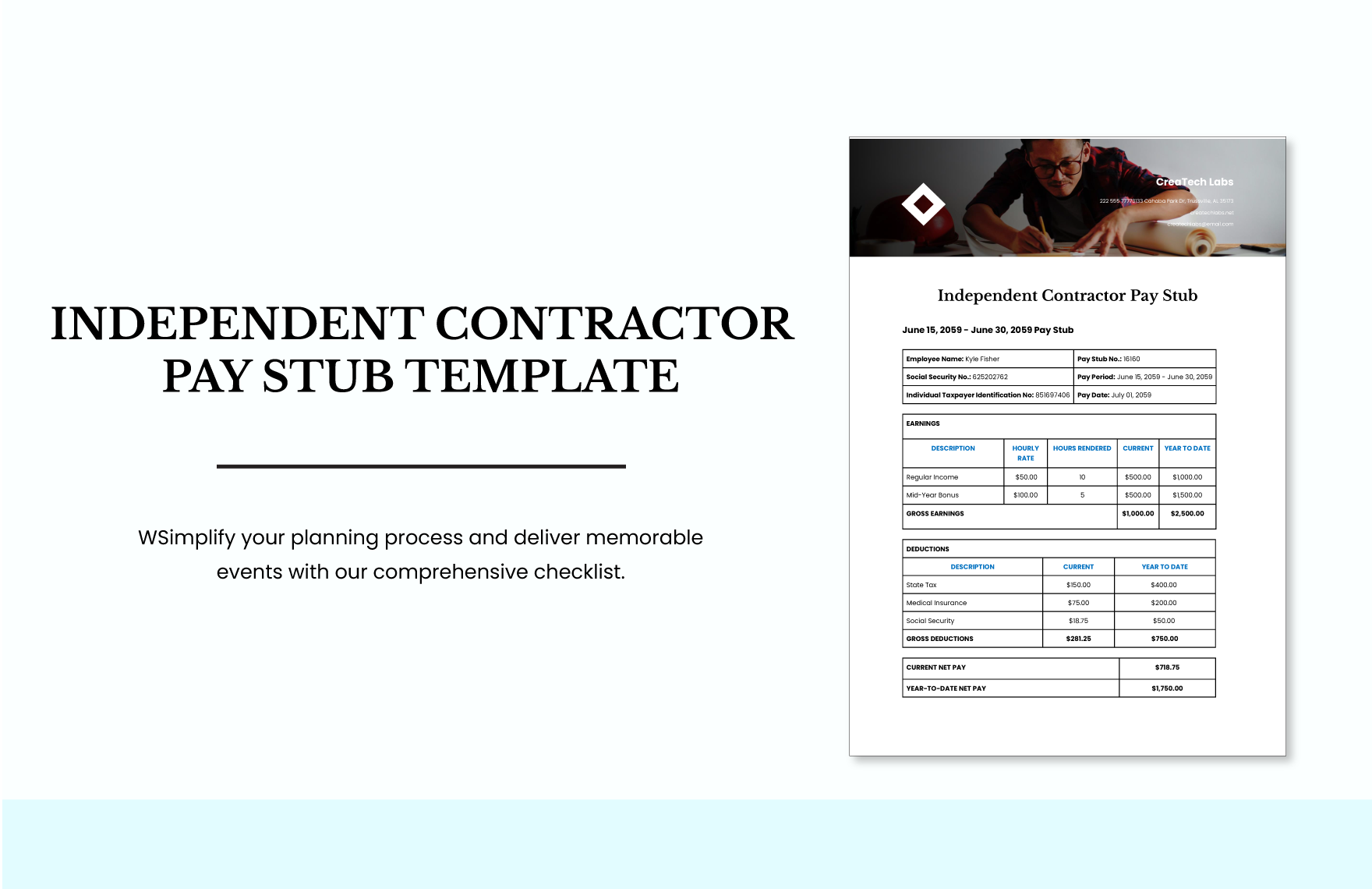

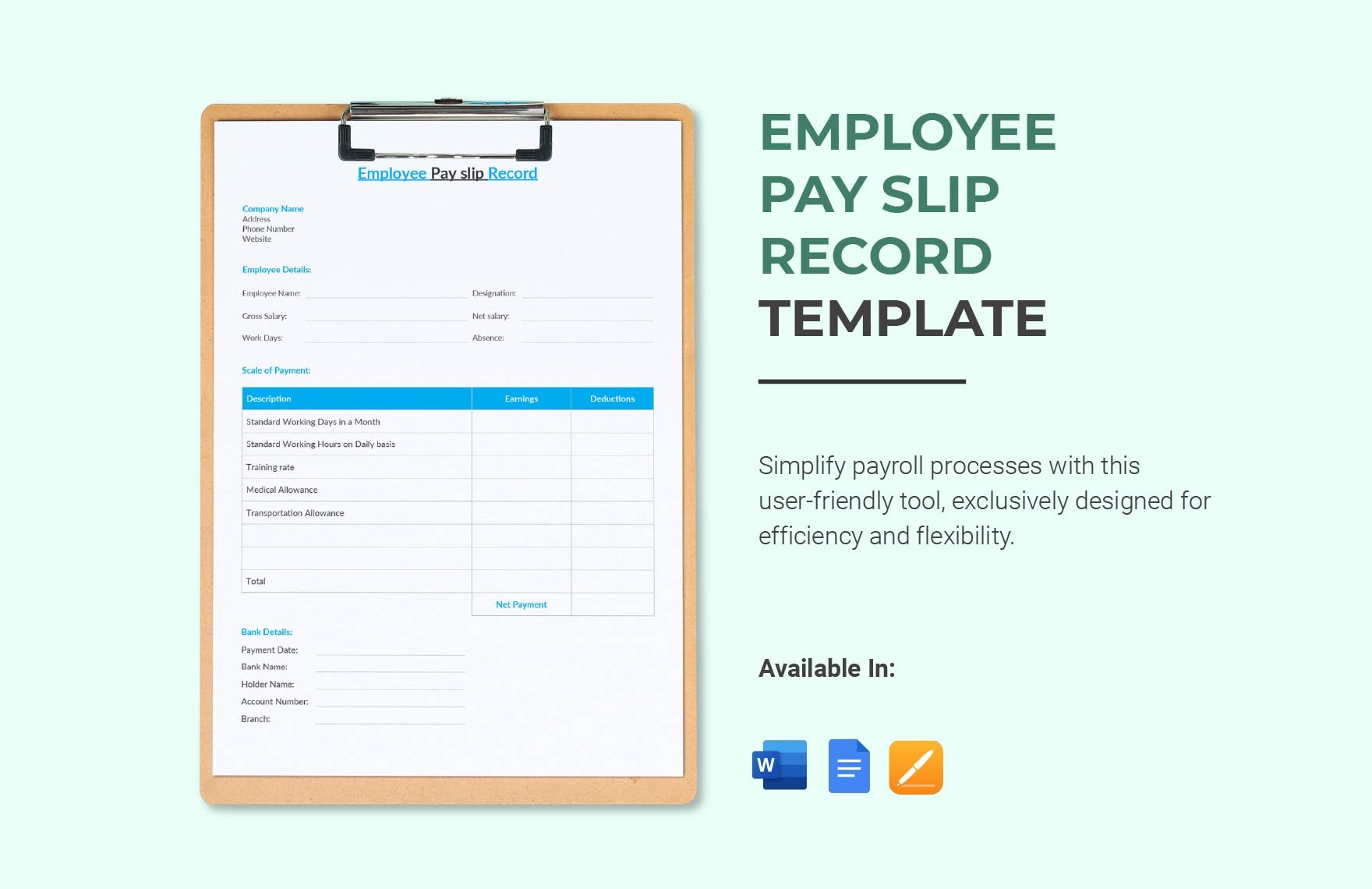

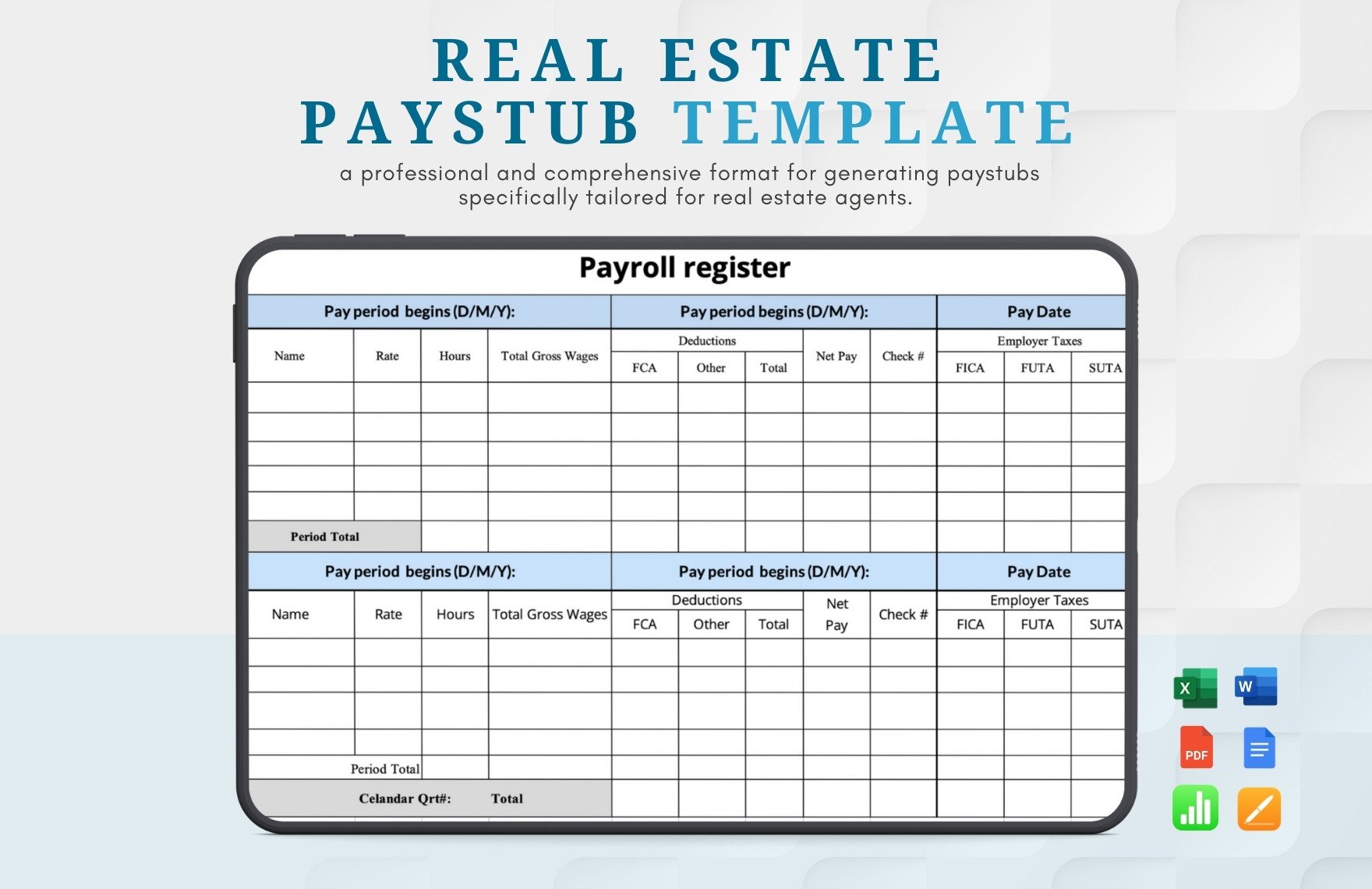

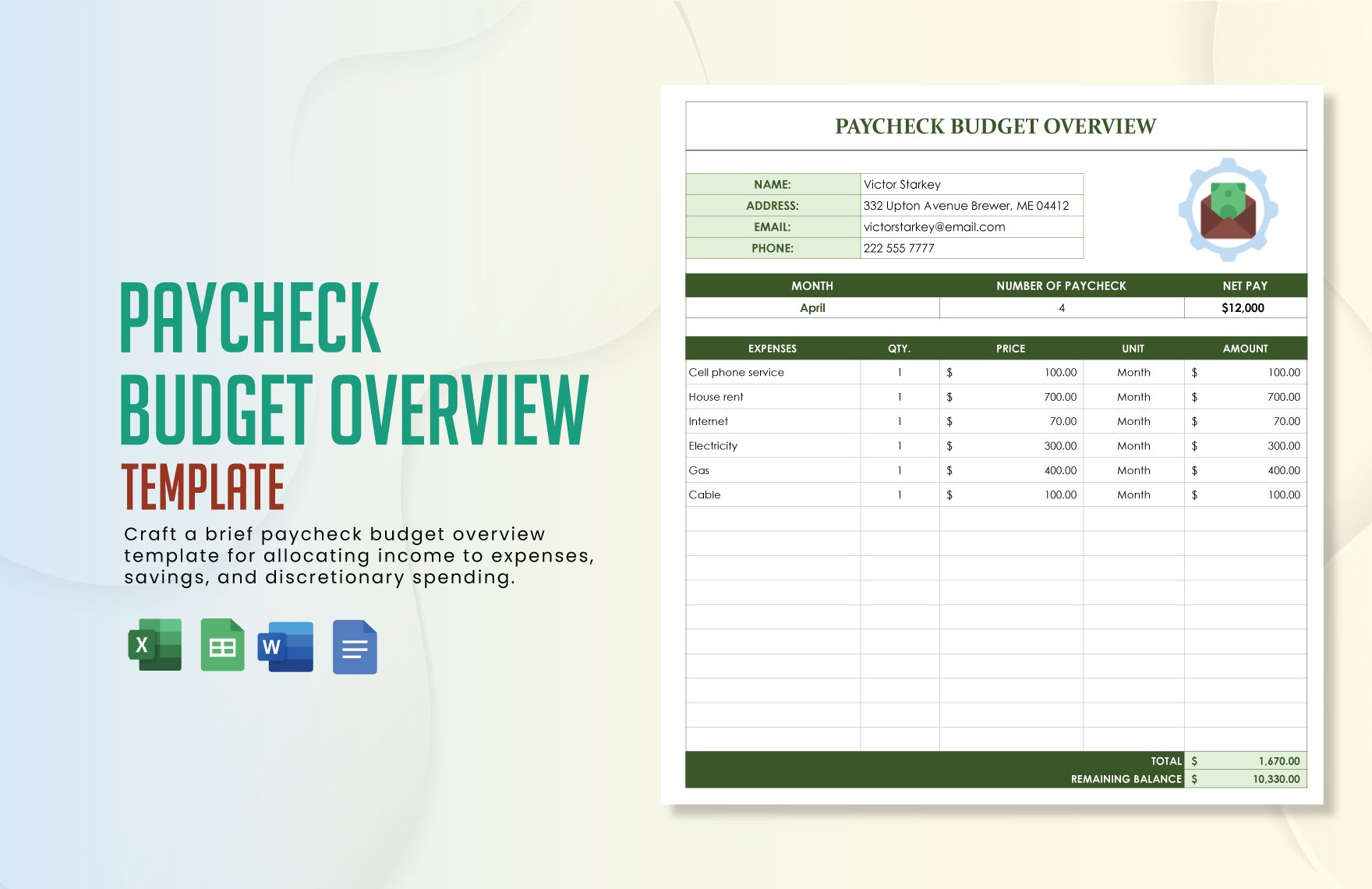

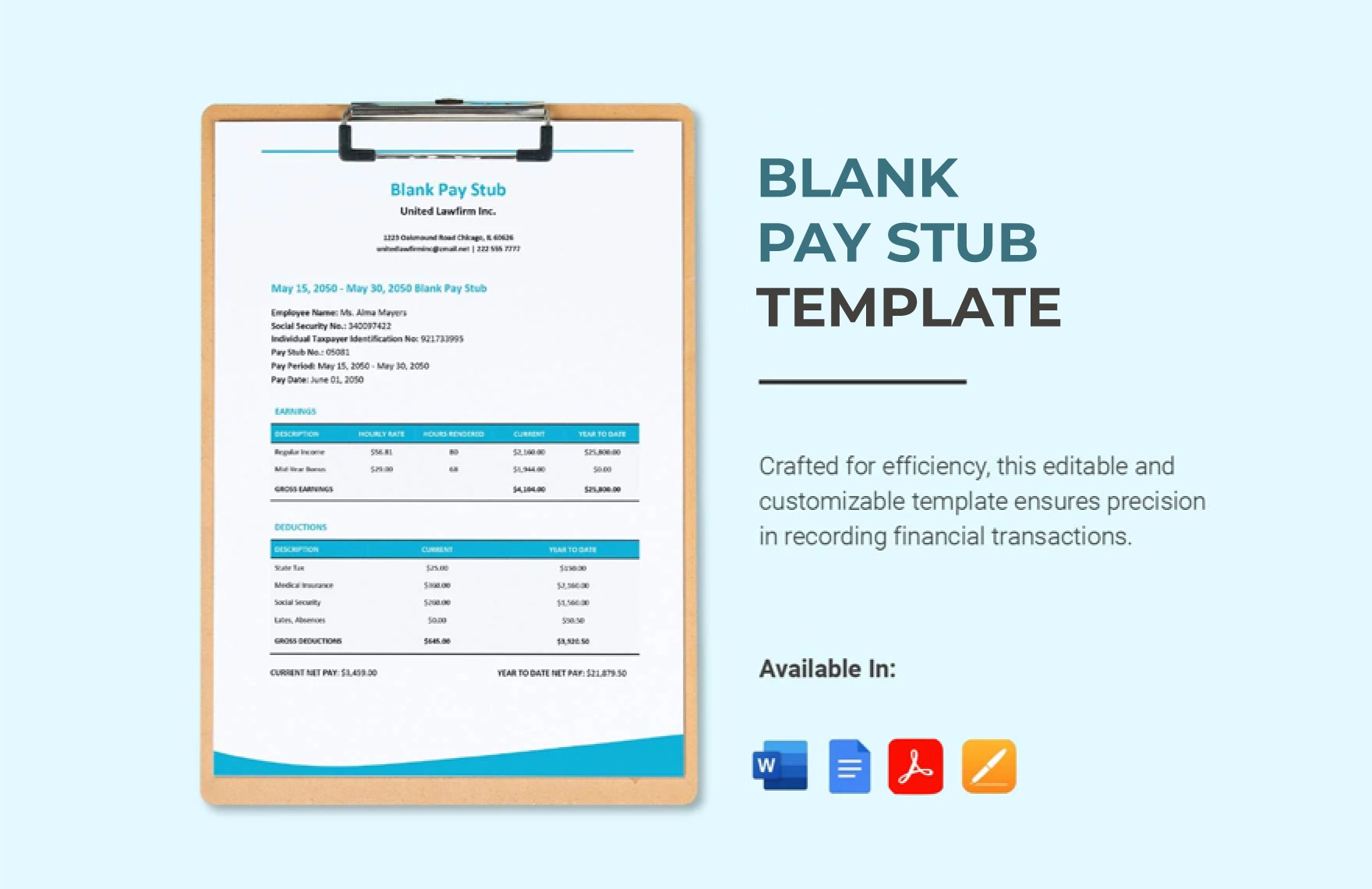

Get to produce a business document an employee receives either as a notice that the direct deposit transaction has gone through, or is attached to the paycheck. To help you craft the perfect direct or ePay stub, download one of our premium Pay Stub Templates. You can easily edit our templates in all versions of Microsoft Word. Our files are ready-made and 100% customizable to suit your preferences. This professionally-written template isn’t just limited to a computer. It can be viewed and editable on your tablet and phone as well. Available in A4 and US print sizes. Don’t wait for tomorrow and start issuing earning statement with our templates today!

How To Create A Pay Stub In Microsoft Word?

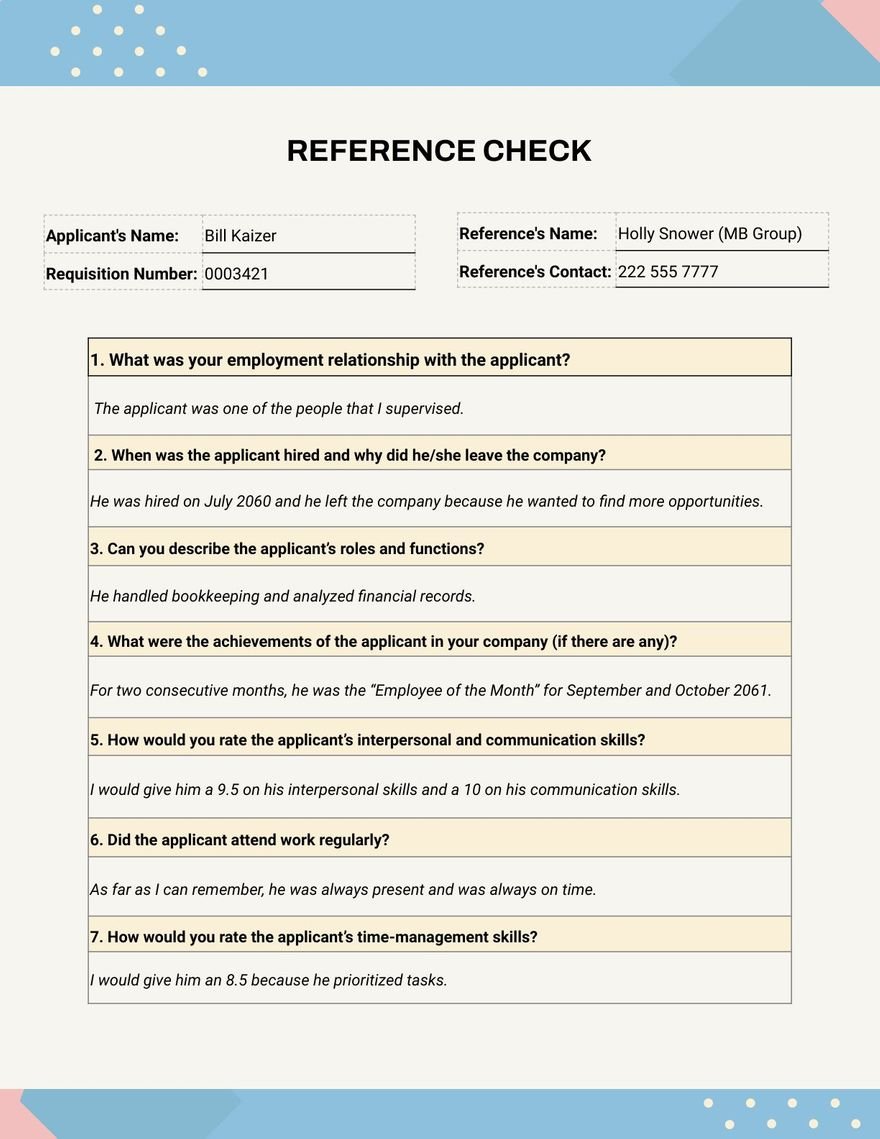

Whether you are applying for a real estate loan or issuing a proof of transaction for your small business, a pay stub is a preferred document that you need. It will benefit both employers and employees. Pay stubs, together with the payroll, are a record of the monthly or hourly wage of an employee. According to the Federal Law, it isn't mandatory to provide pay stubs. However, it will put you, and your company in the state wherein your credibility will be questioned. To avoid so, make one now and find out how with these tips.

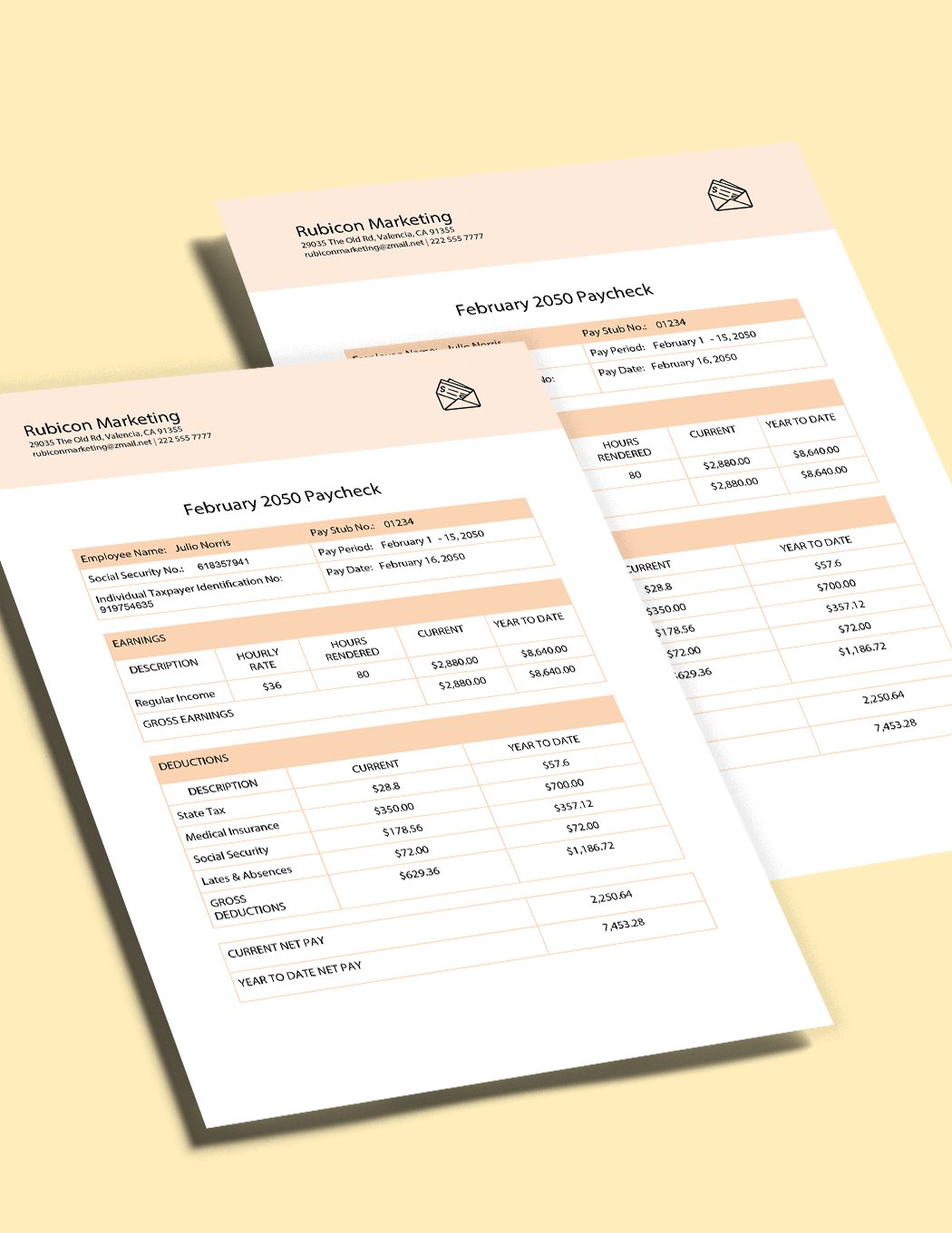

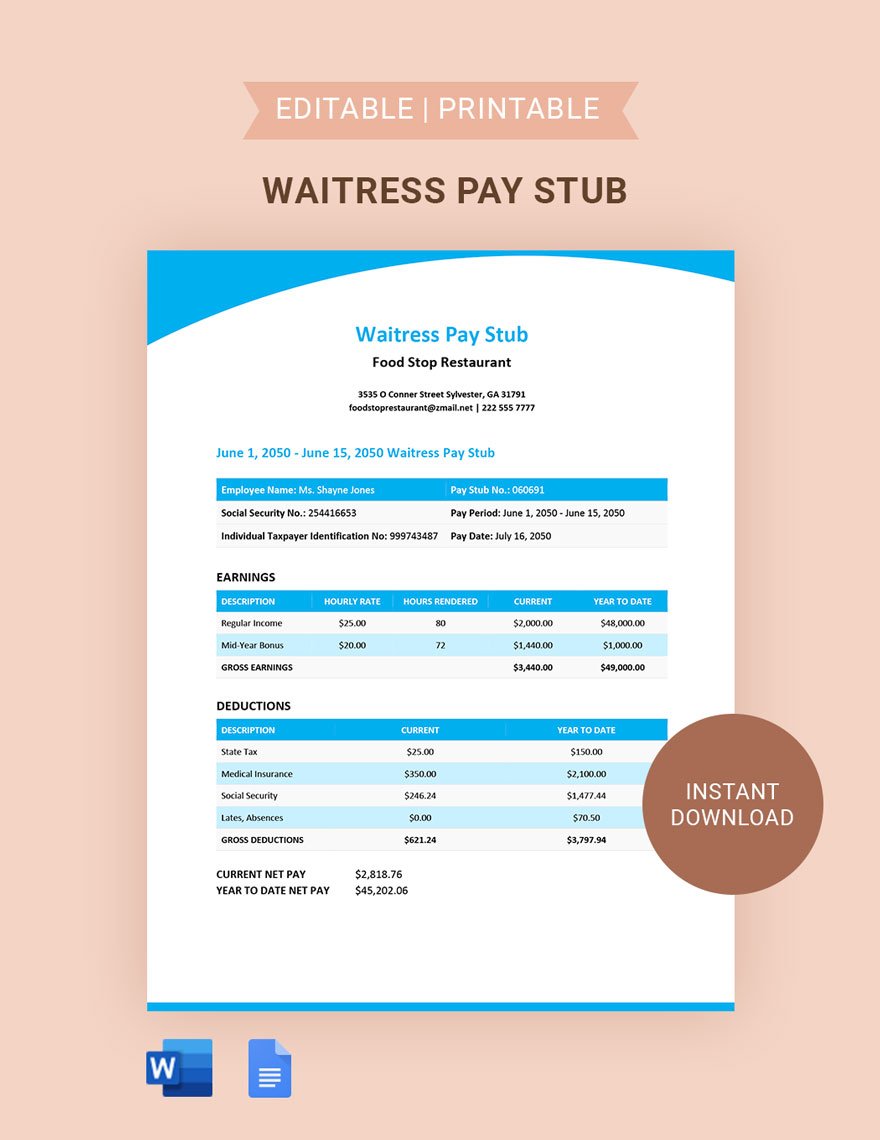

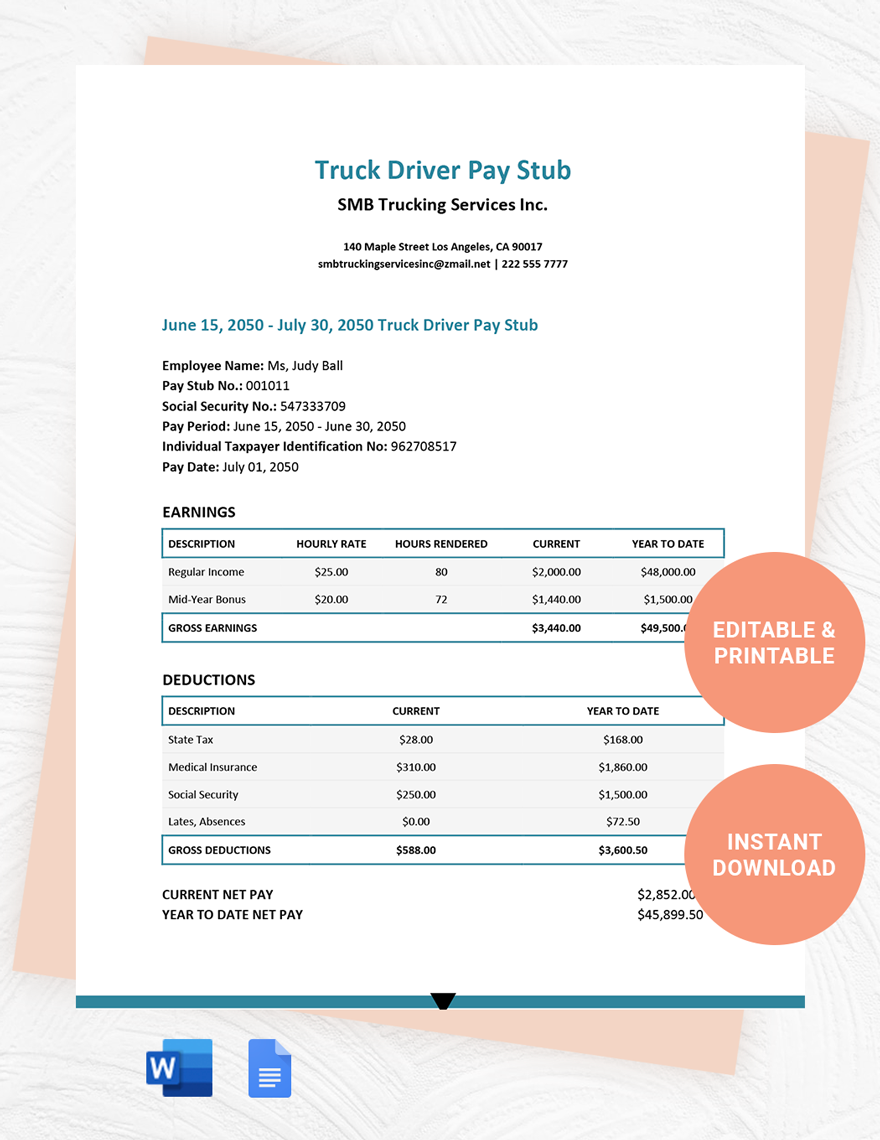

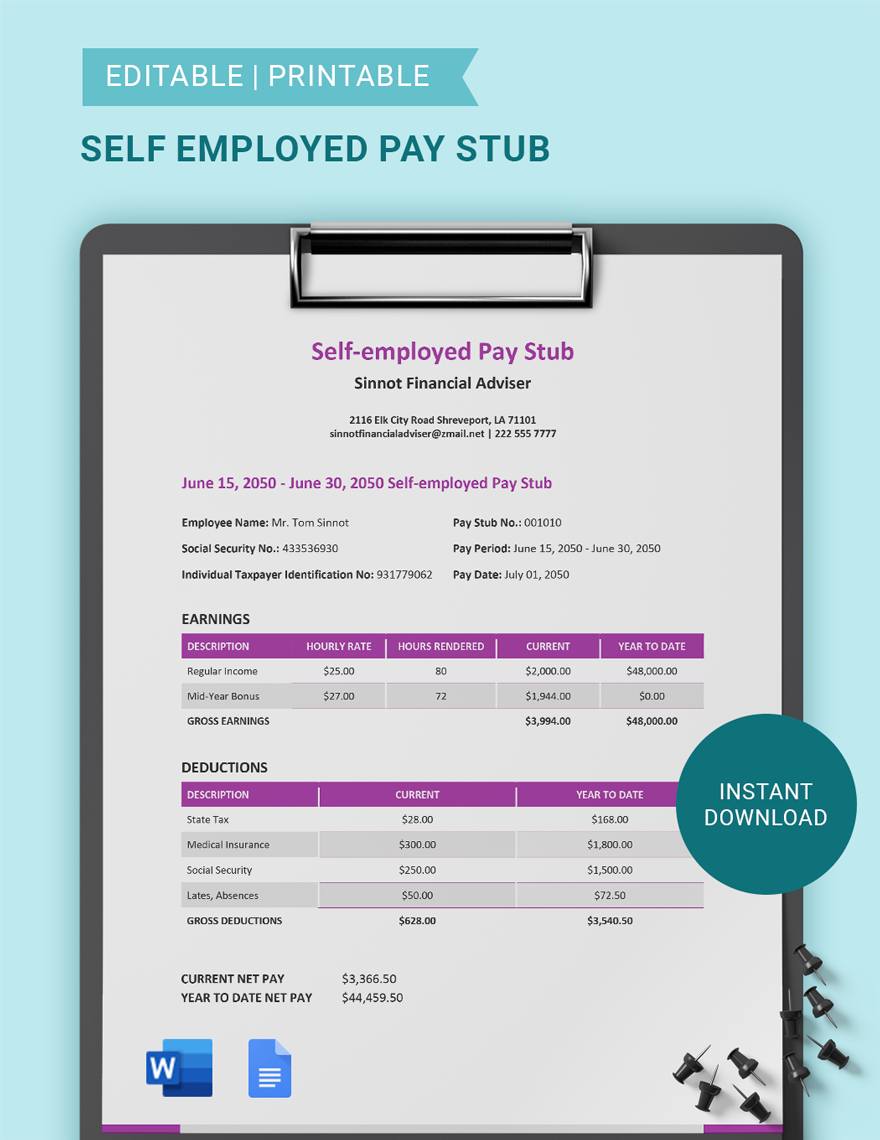

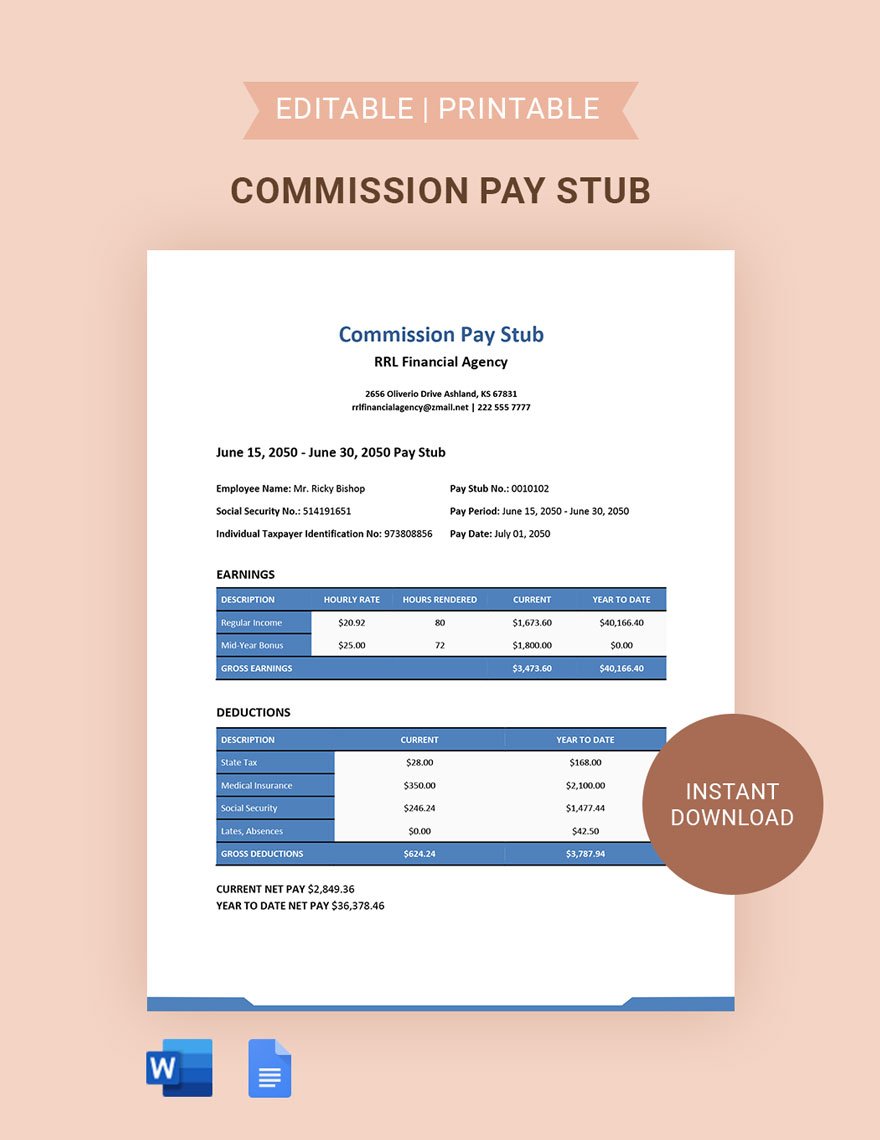

1. Calculate Your Gross Wage

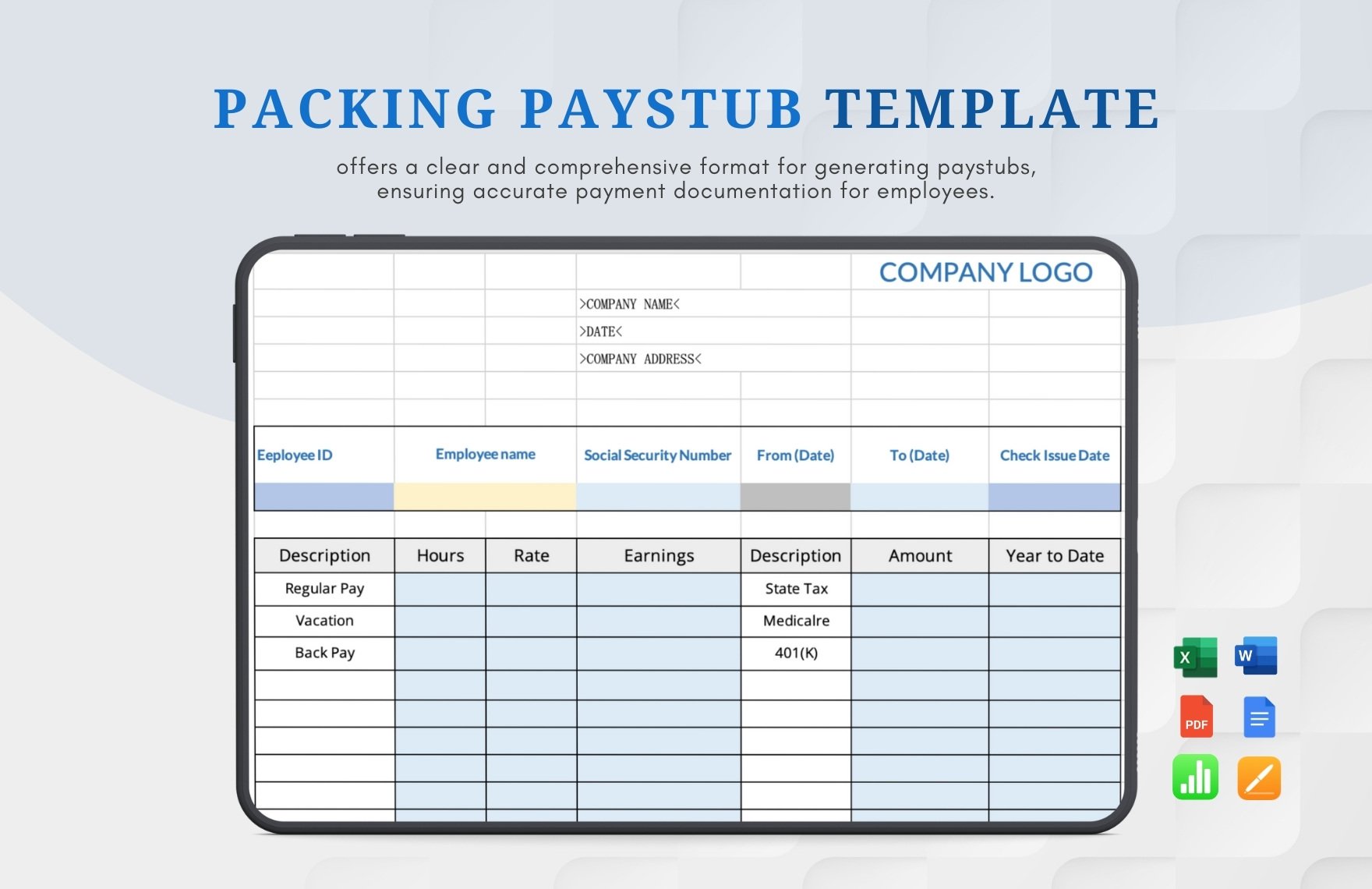

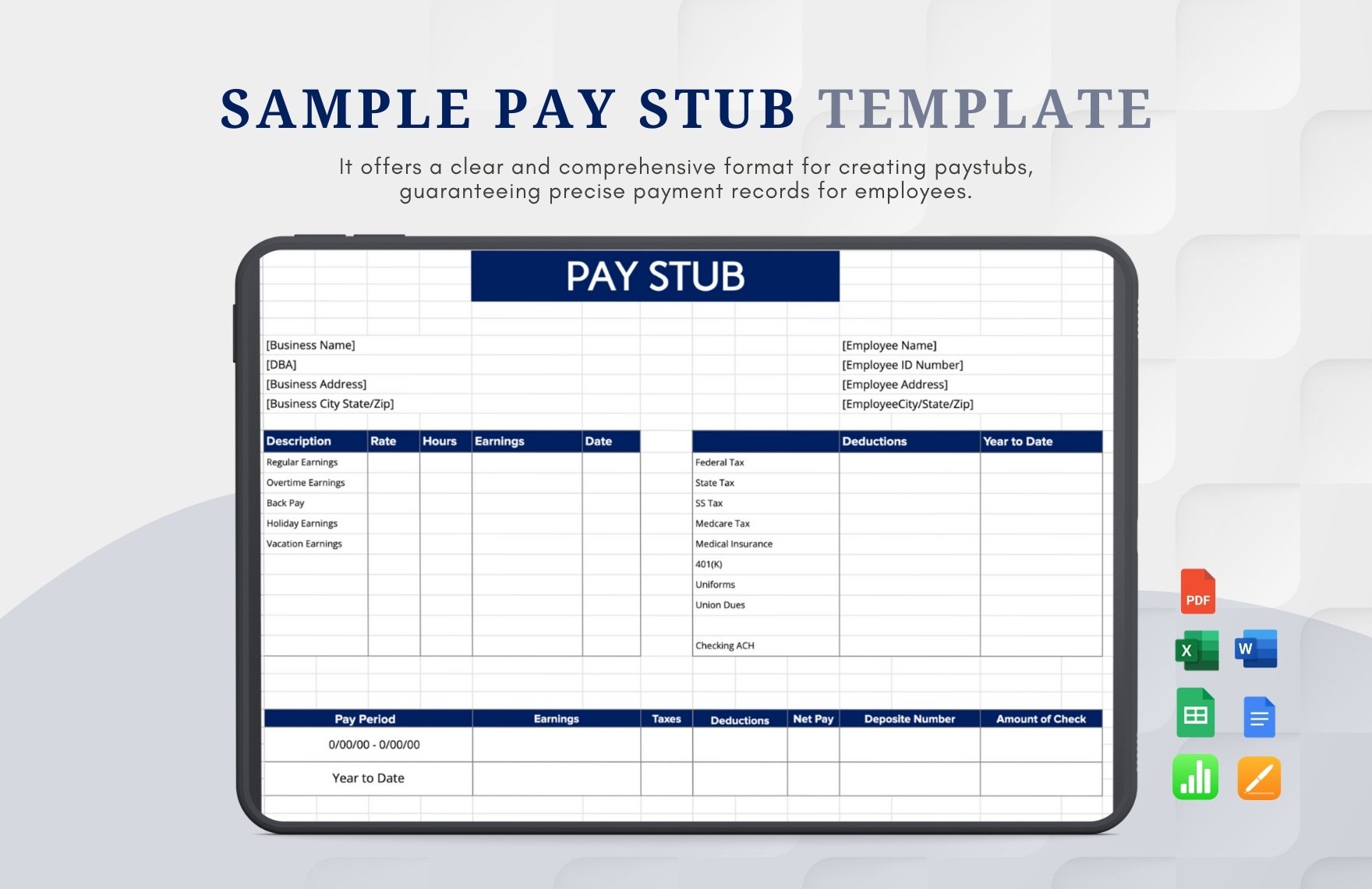

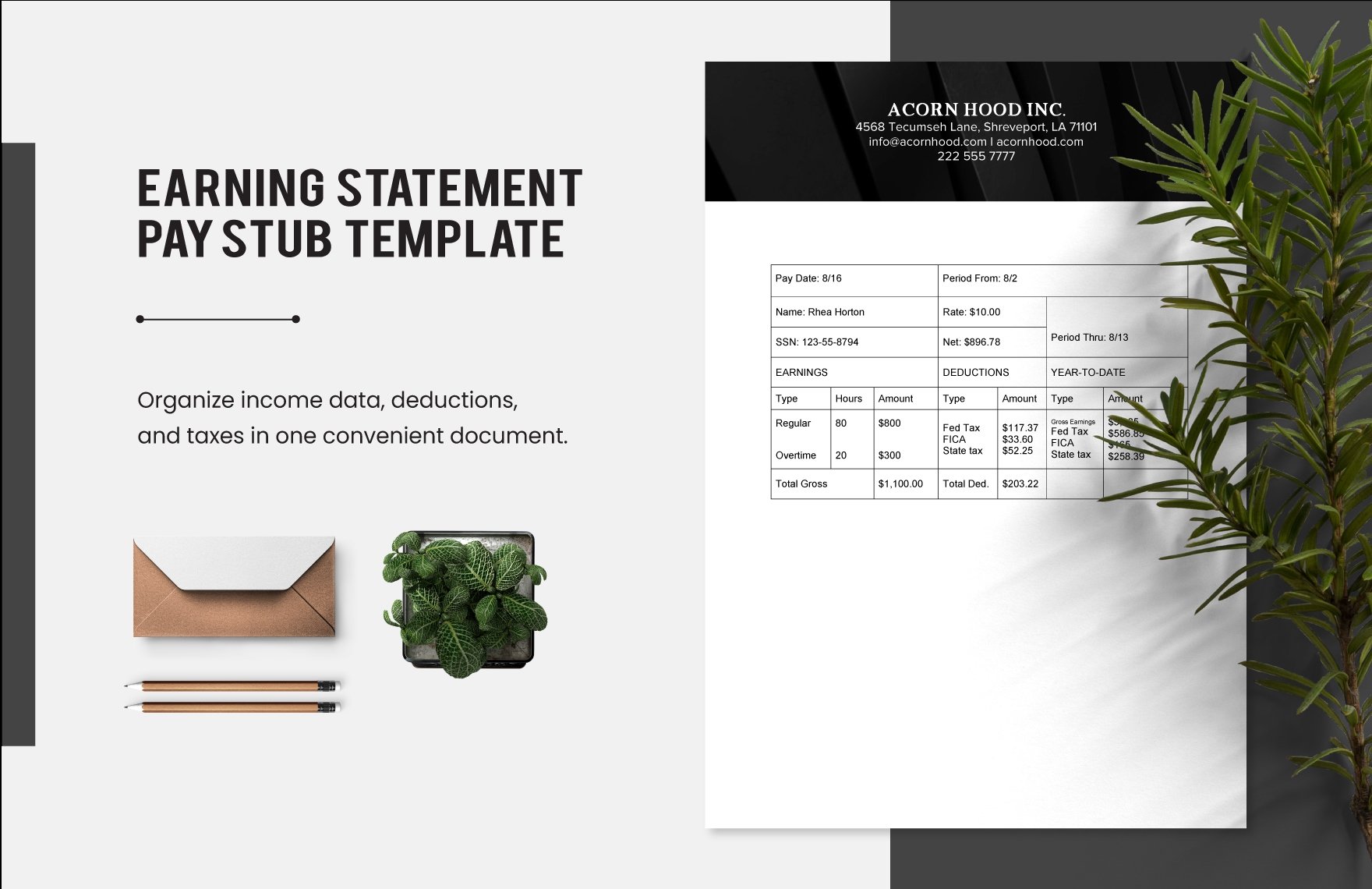

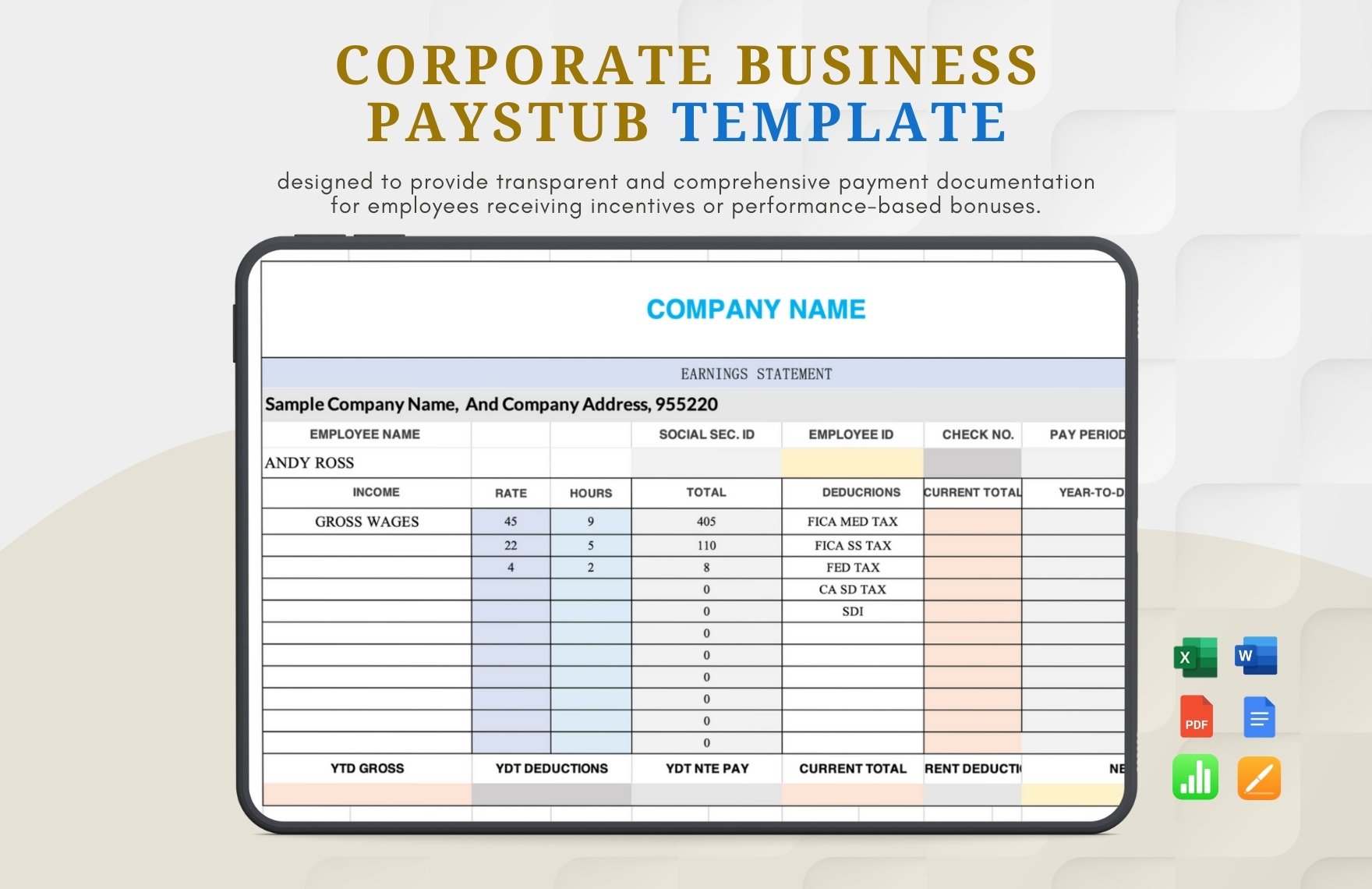

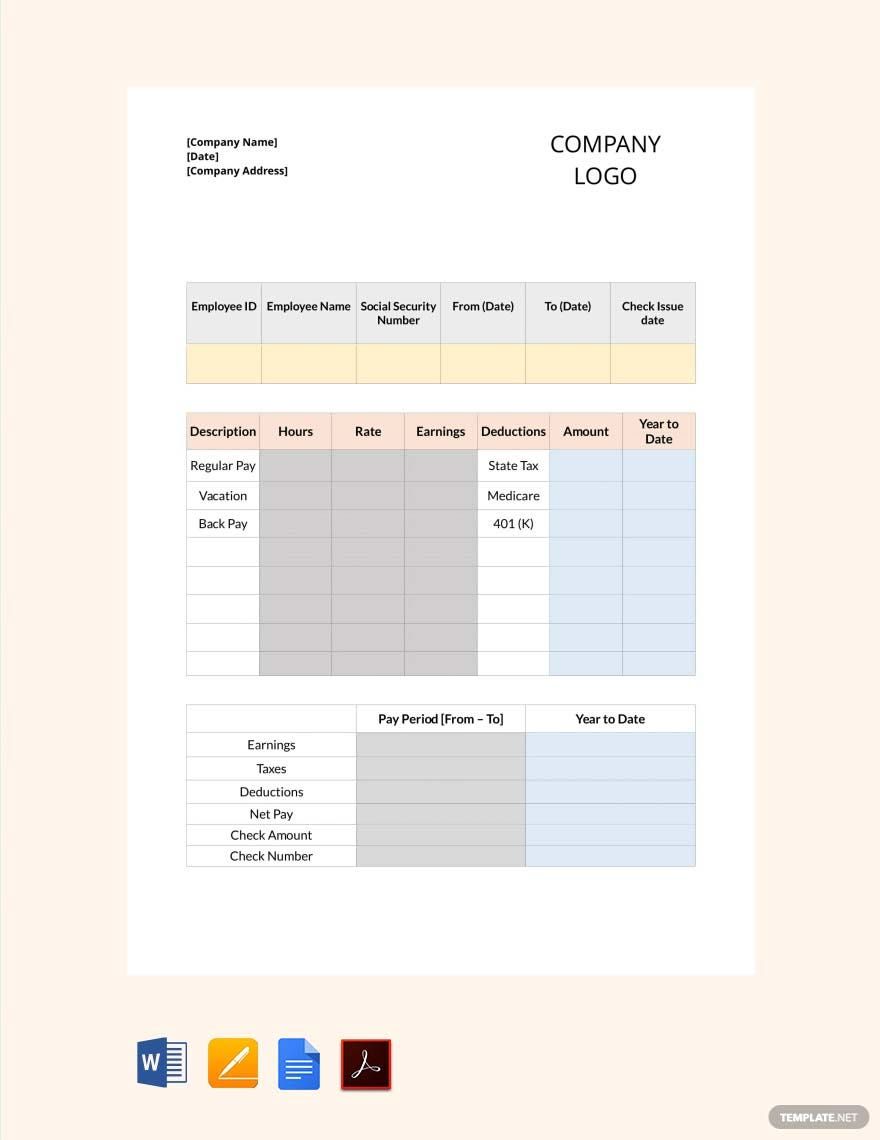

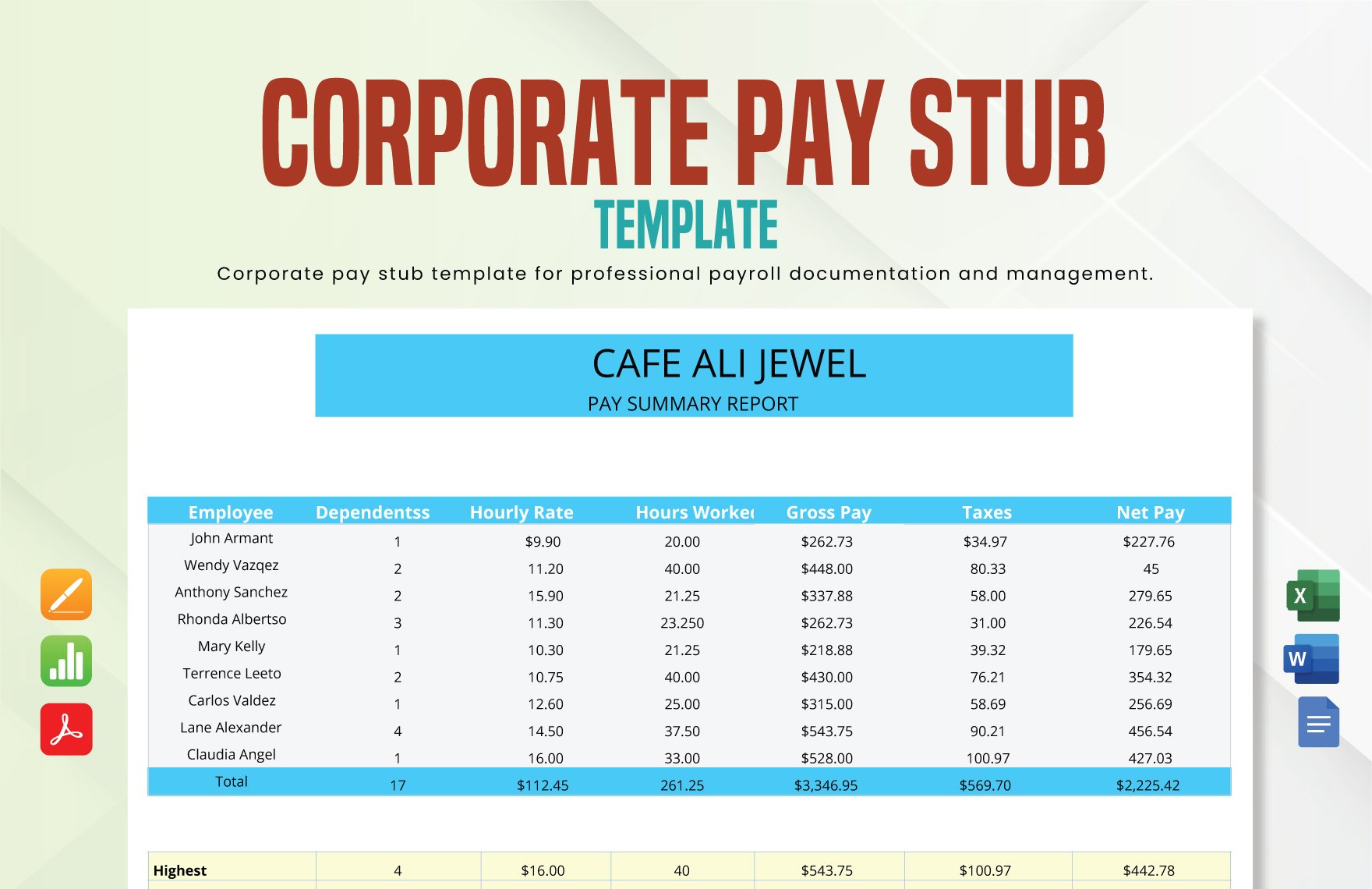

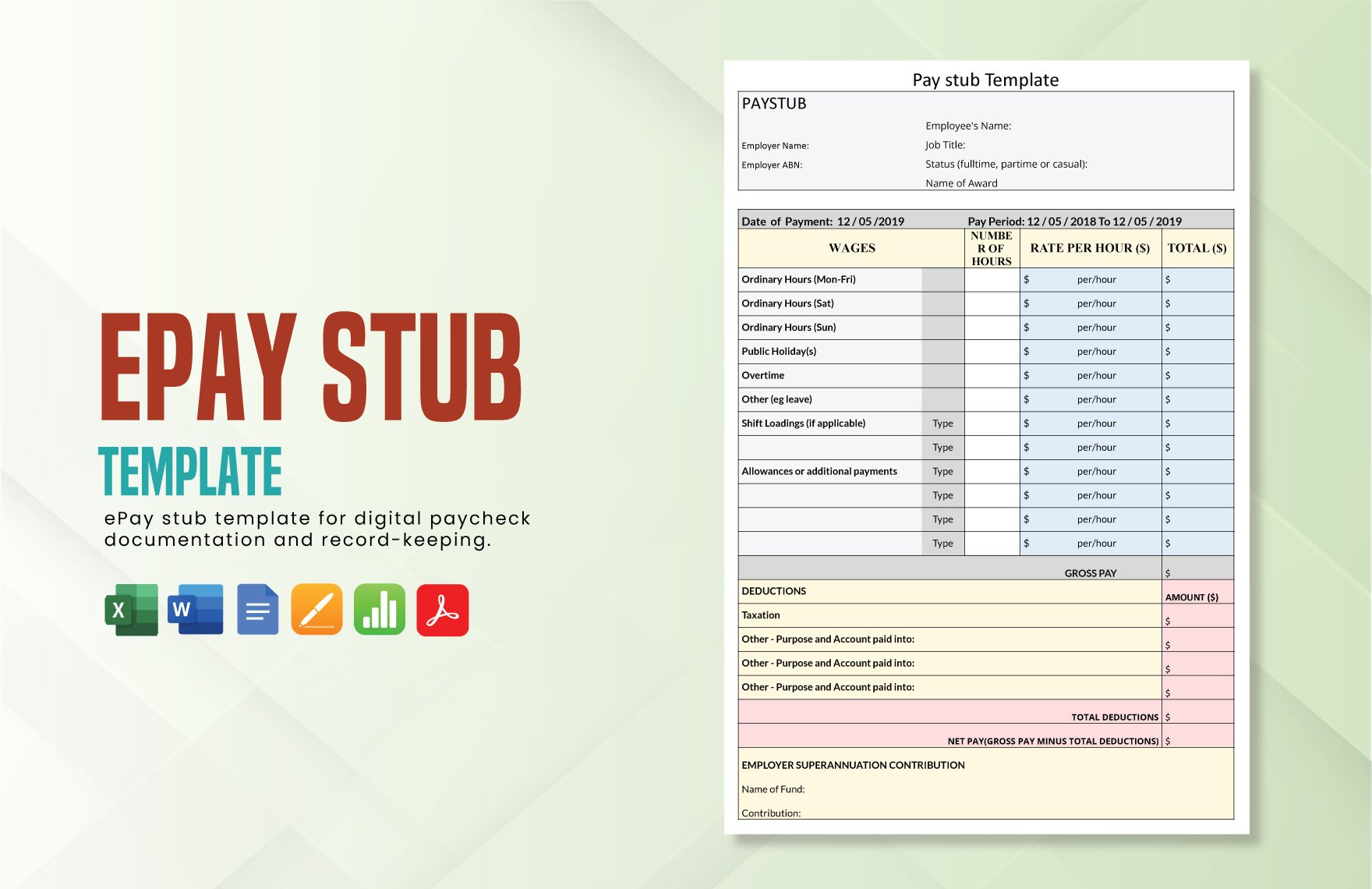

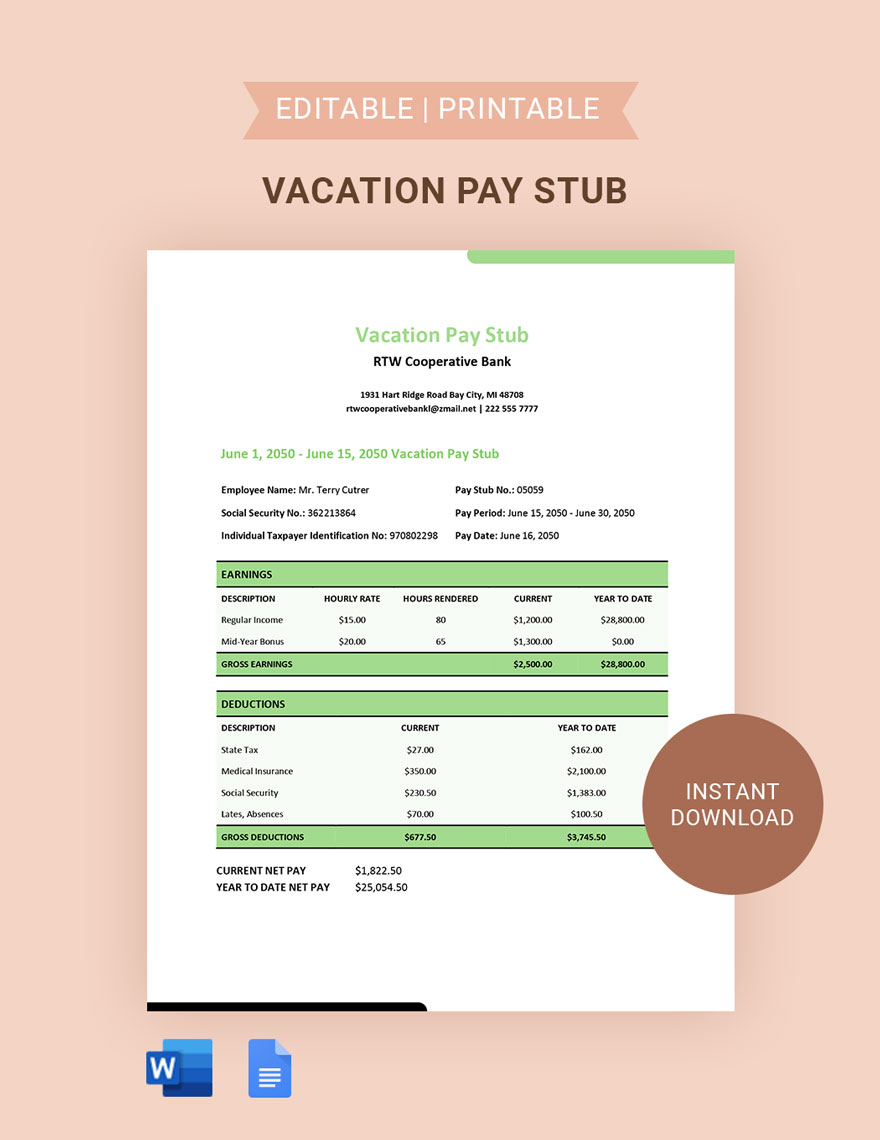

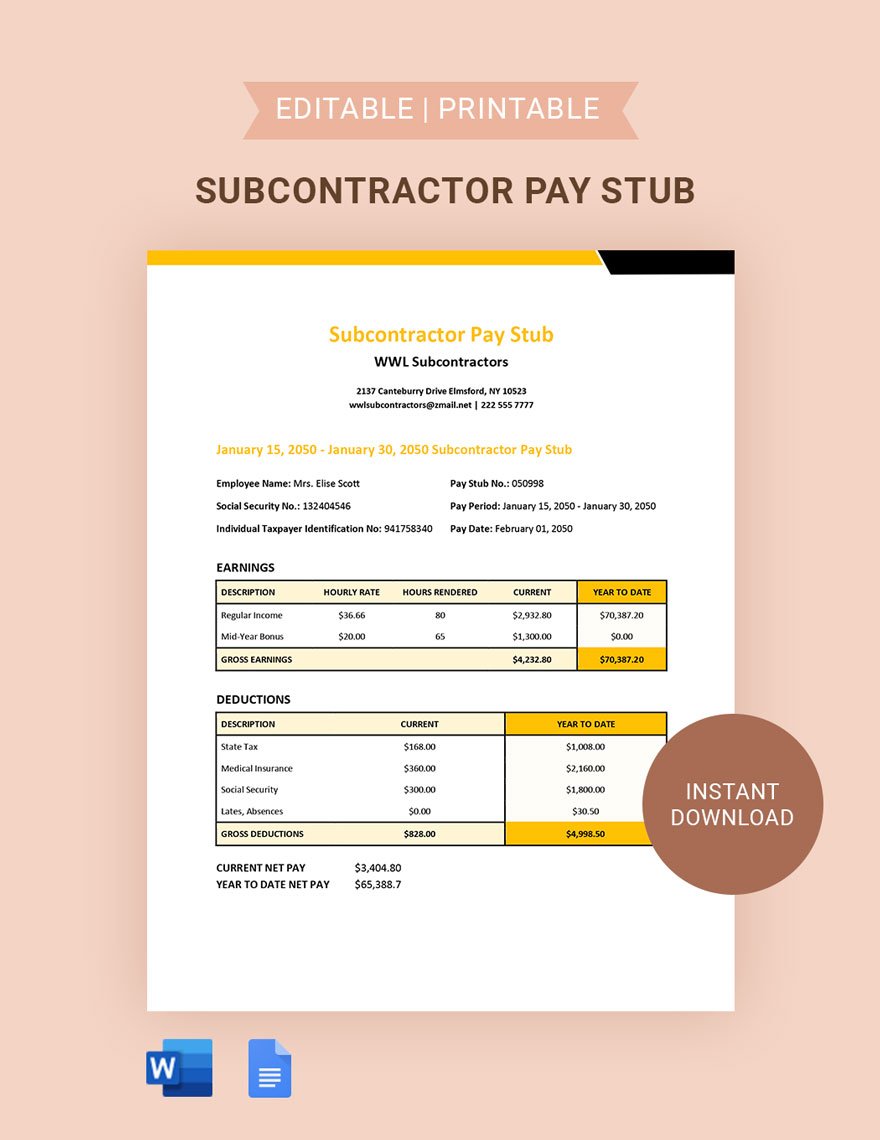

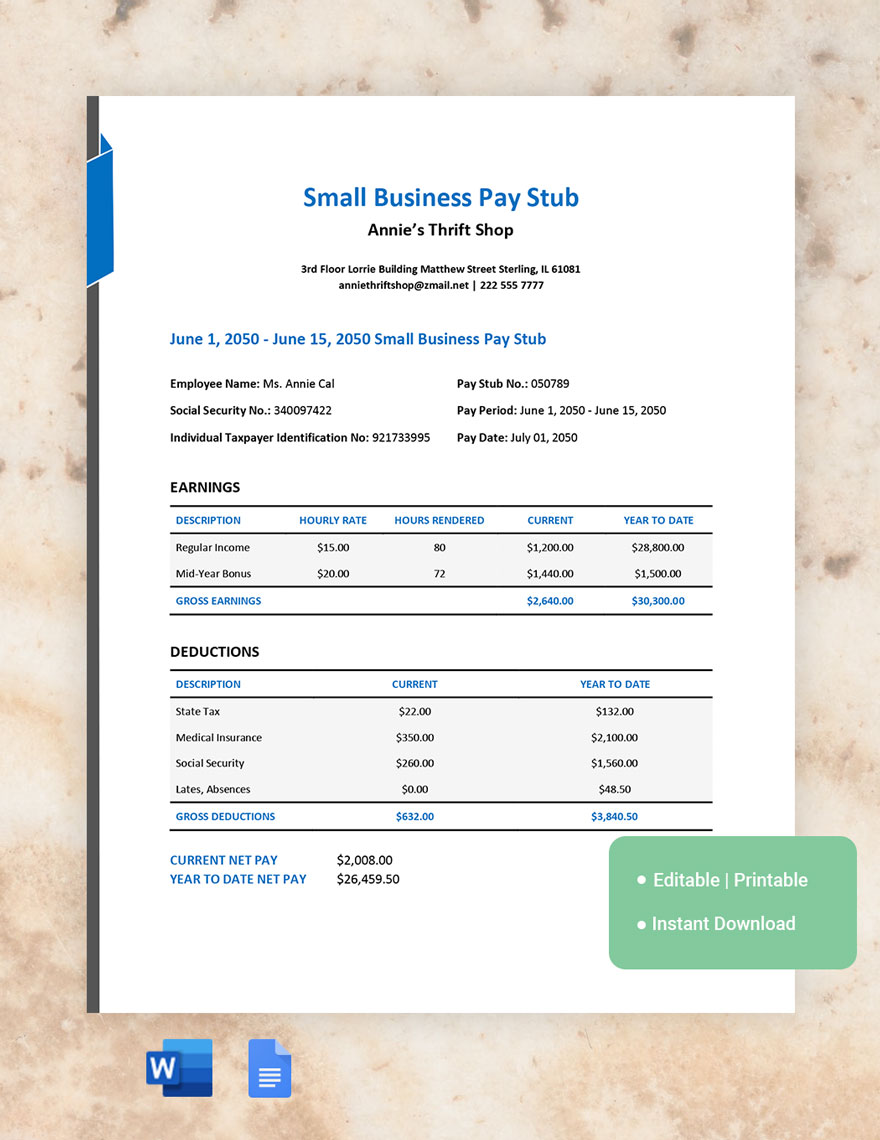

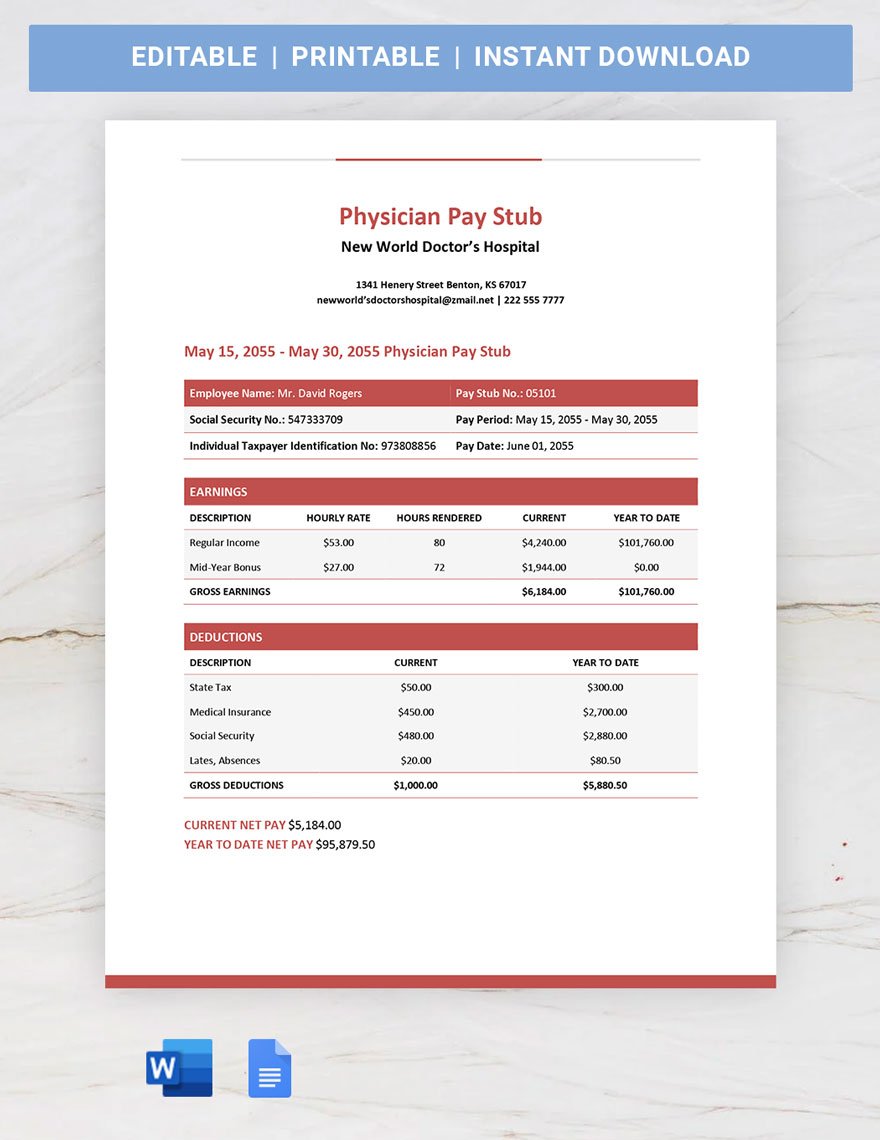

Gross wages are where the employee's pay starts. It includes the employee earned without the deductions. As the gross calculator, you can calculate it depending on the type of payment a corporate practice—salary or hourly. To calculate hourly gross wage, multiply the hourly rate and the working hours of the employee. If it is salary, divide the annual salary with the number of pays in a year. The information of the gross wage of an employee is broken down into two columns—the current gross pay and the year-to-date totals.

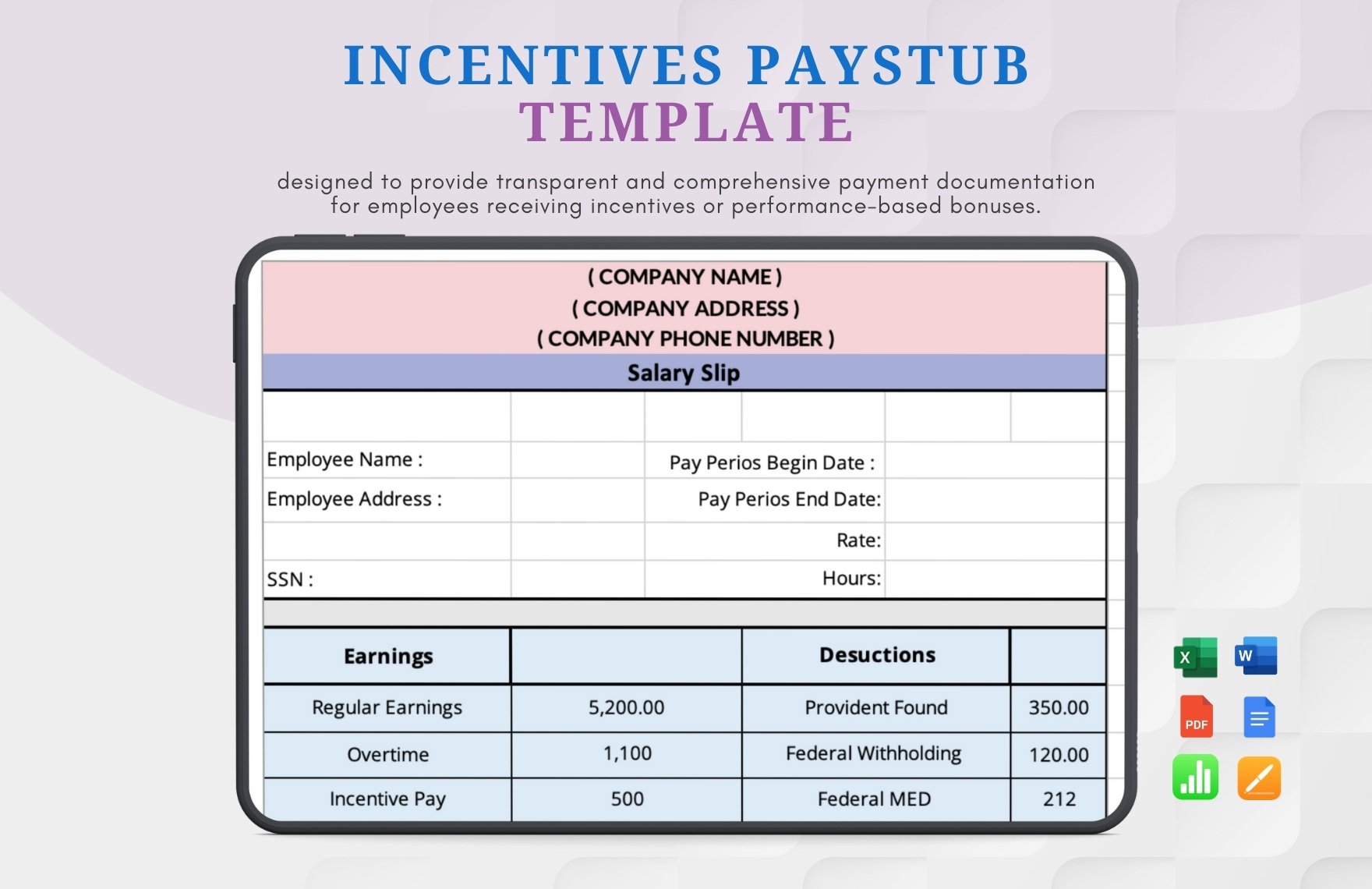

2. Lay Out Tax, Deductions, And Contributions

In your employee pay stub, itemize the deductions so the employees will know the amount taken from their wages. It is categorized into current deductions wherein it includes the tax that the government mandated and contributions of an employee. It is usually composed of federal income tax, state and local taxes, and more. For the contribution, your payment will be deduced and transferred to any insurance plans, retirement plans, life plans, charitable donations, loan payments, and other voluntary deductions.

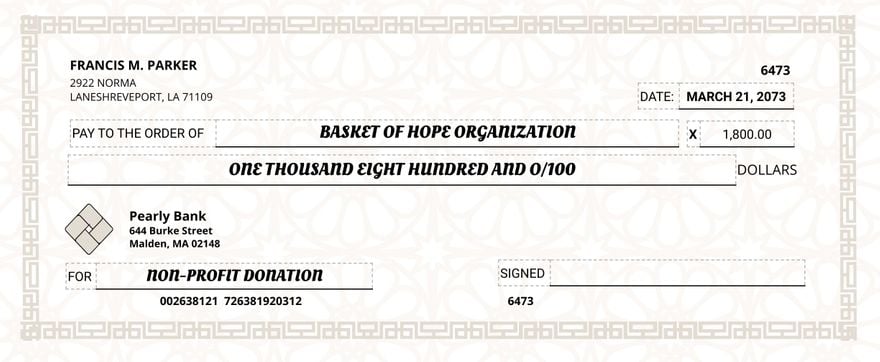

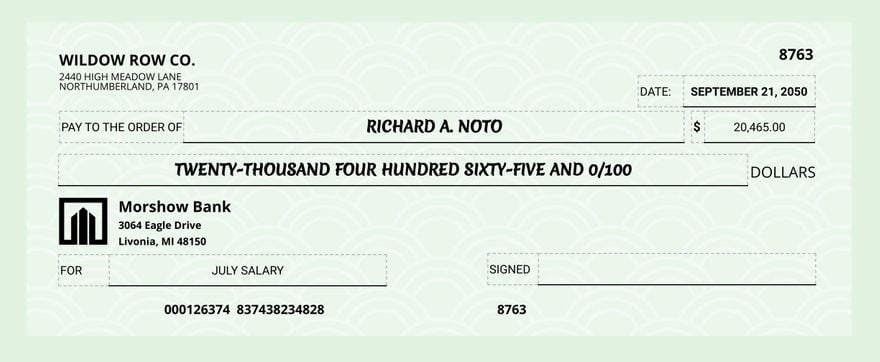

3. State The Net Pay

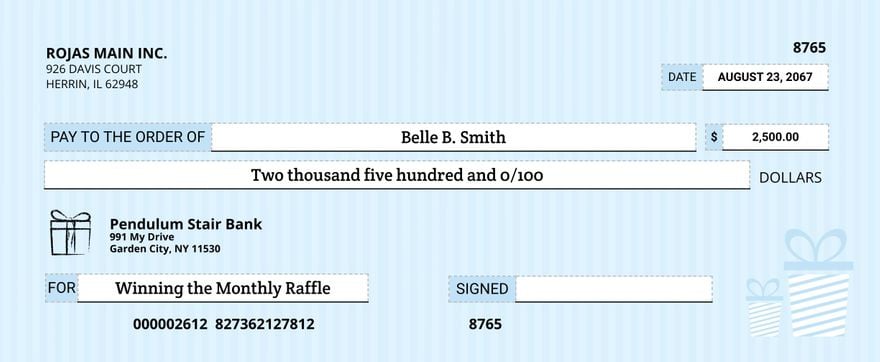

Net pay is the amount left from subtracting the gross wage to the deductions. It will be the employee's take-home pay. It will be the amount that you will write in the employee's paycheck. You need to establish a flow chart of items about the employee's pay for the sake of your employee. In that way, they can easily understand your pay stub and would not ask for clarifications.

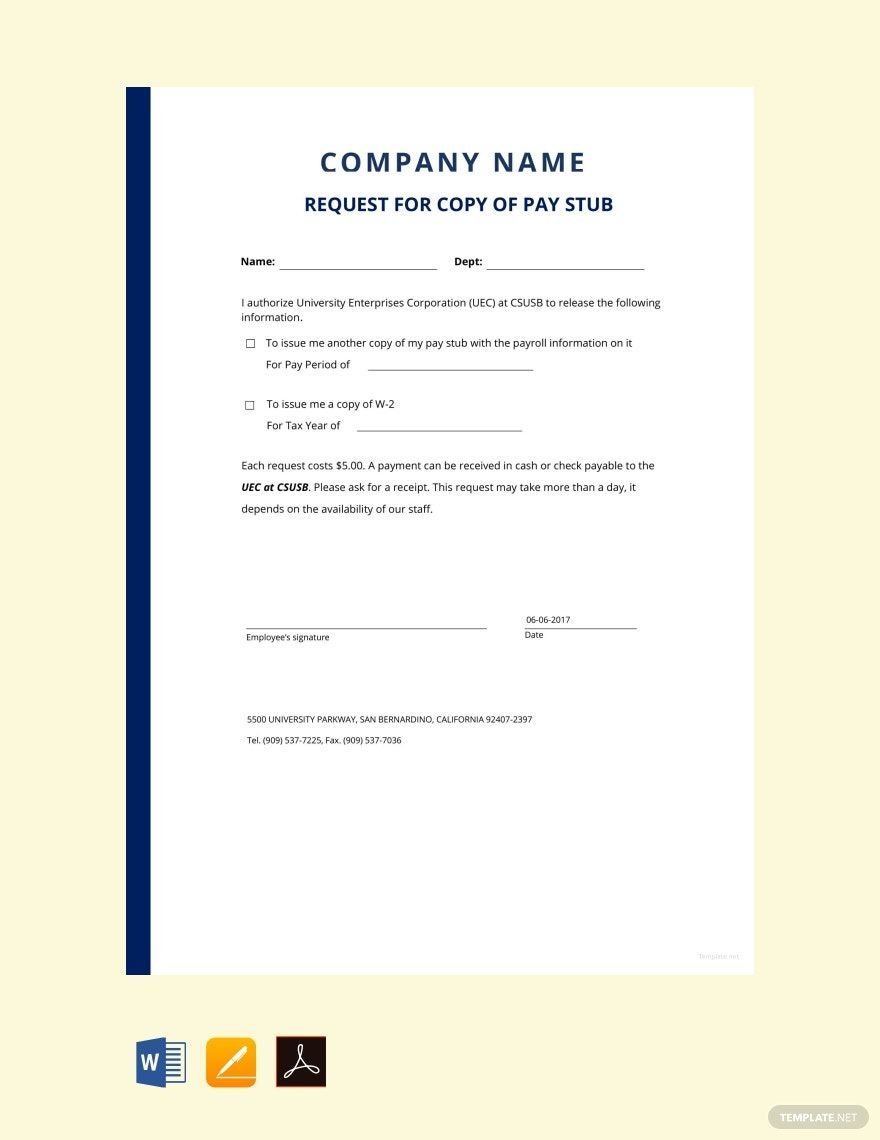

4. Download Pay Stub Templates

If you want to quickly formulate a pay stub or ticket for your employee's upcoming payday, you can download pay stub templates here at template.net. What sets us apart from our competitors? Our templates are 100% customizable, high-quality, and professionally-written by our line of professionals. What is more interesting? Our templates are downloadable for free! You can download business-related templates such as an invoice, payroll, paysheet, and more.

5. Issue Employee's Pay Stub

After formatting your pay stub, you can now make some finishing touches with it. Recalculate your work in a manual or digital calculator. You would not want to miss even a single penny in your employee's payroll as it would mess the whole pay stub that you will issue. Be a responsible human resource officer.