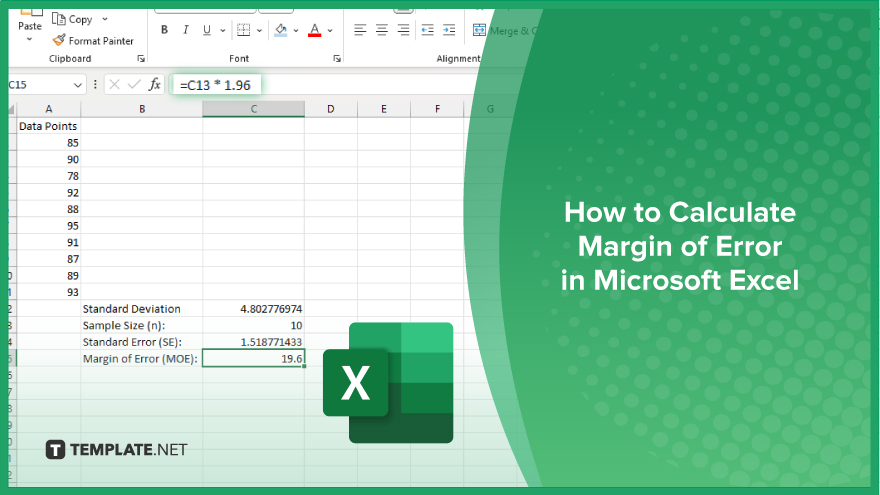

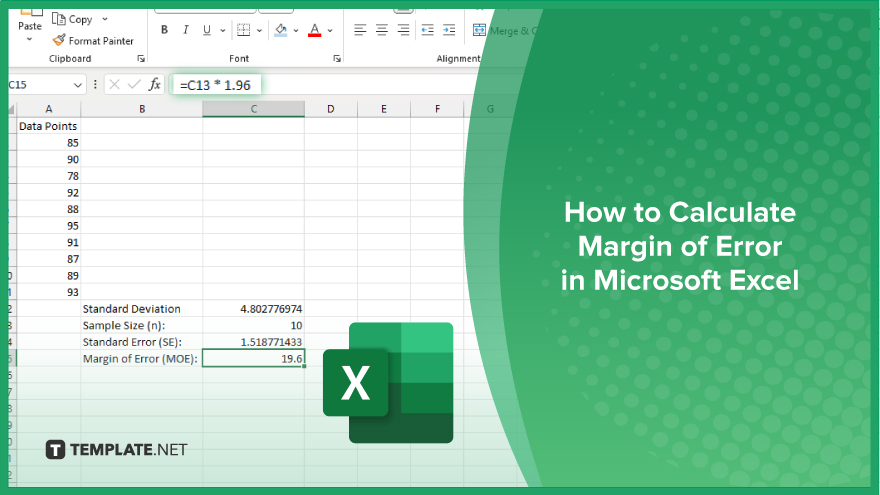

How to Calculate Margin of Error in Microsoft Excel

Microsoft Excel simplifies the process of calculating the margin of error, enabling you to measure the accuracy of your statistical…

Feb 12, 2025

Keeping a record sheet of cash flow is a very important job. It is important to make a proper budget. Another use of keeping a record of cash flow is to determine various taxes that have to be paid. The cash flow must be in a very systematic fashion. Cash flow analysis come in handy to help you keep a record of the cash that comes in and goes out of your organization, for every possible purpose.

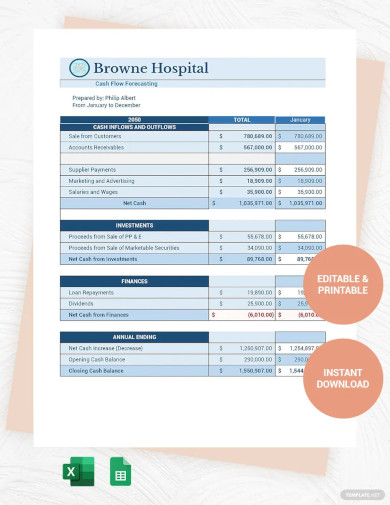

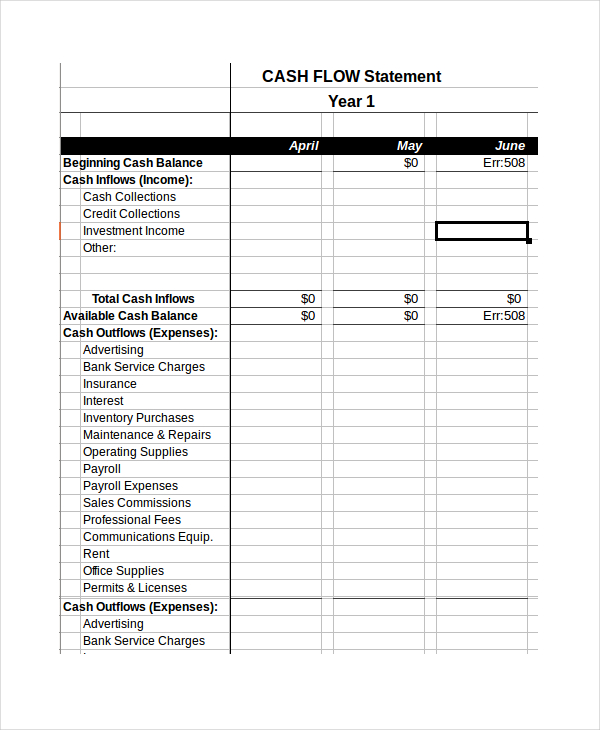

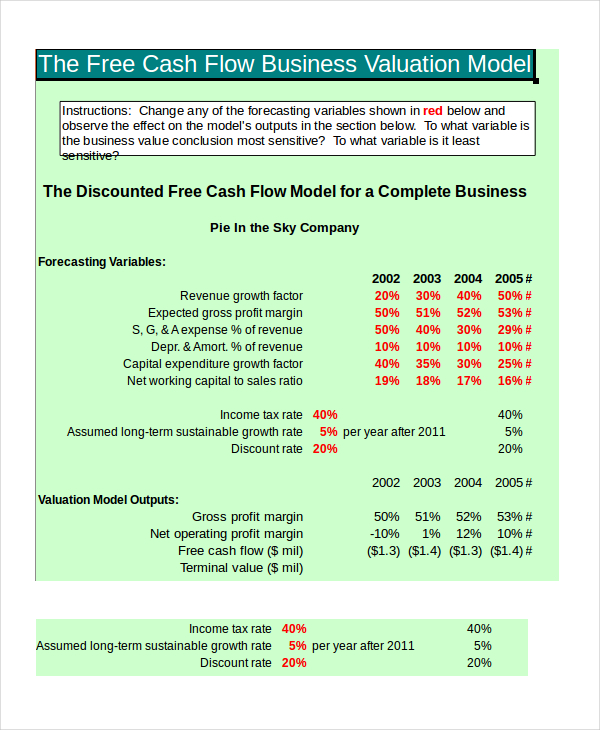

A cash flow statement can be defined as a statement that has in it the details of the flow of money into and out of the organization as income and expenses. Get the above template to craft a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. It helps you keep a check on your income and expenses, making it easier to know where to cut down on expenses and where you can increase the incomes for the growth of your business.

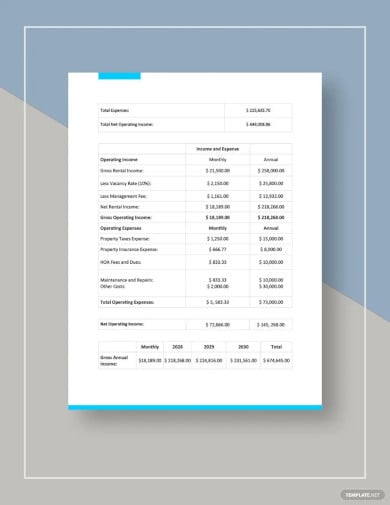

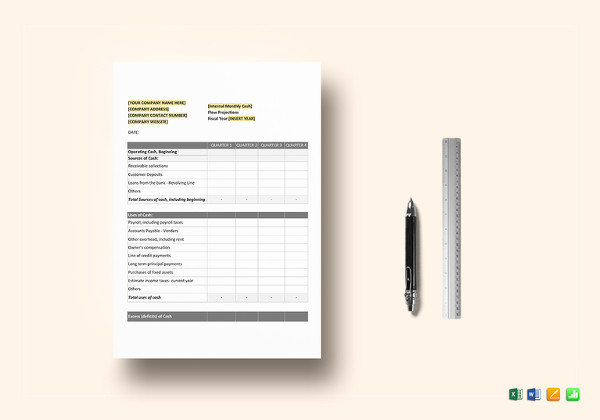

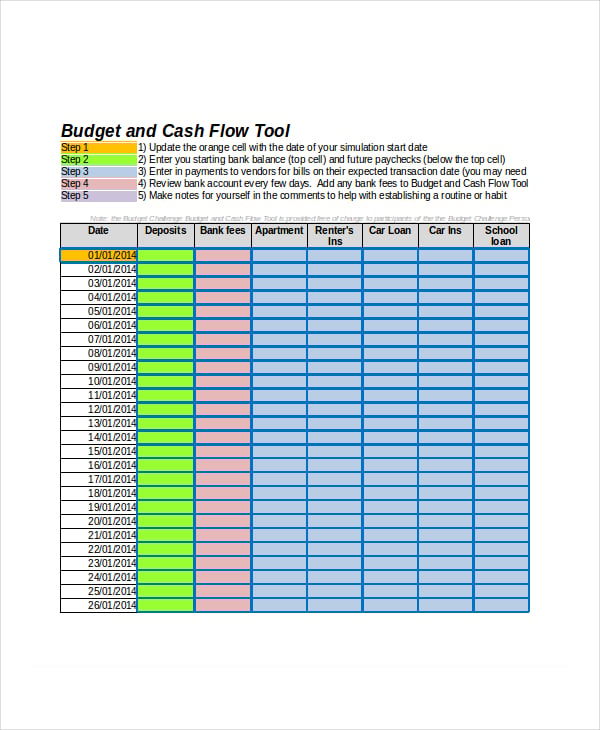

Get to produce a document that would help you show the flow of funds to and from your business weekly with the help of this above-mentioned ready-made weekly cash flow worksheet template. This is perfect for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The file is easy to use, simply make the necessary customization and add the necessary data to the worksheet to proceed with your calculations.

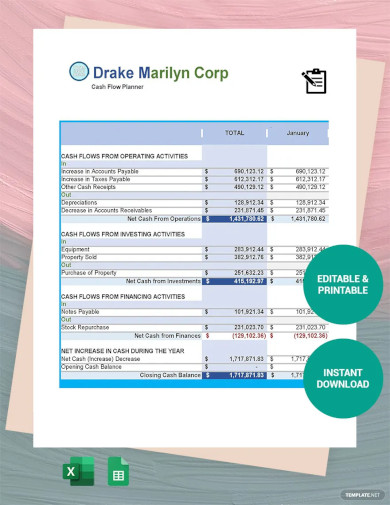

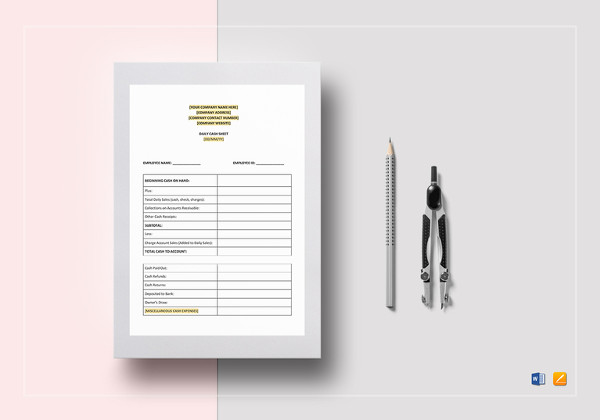

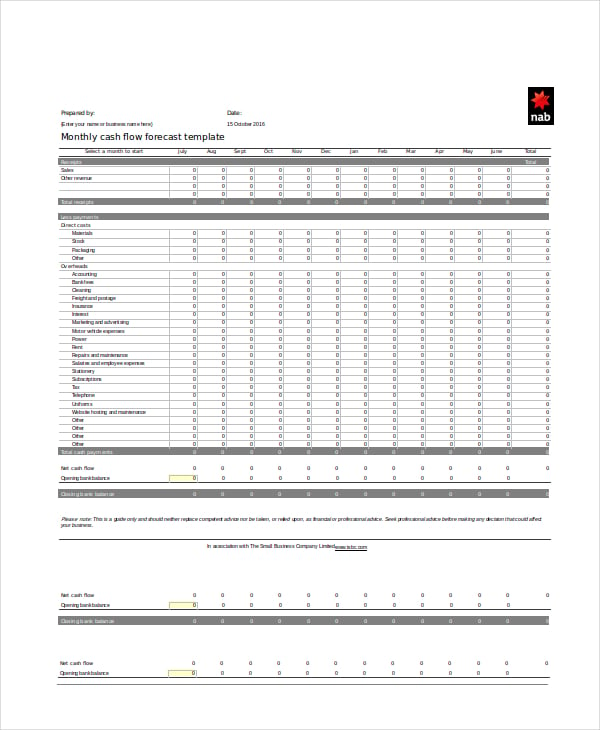

Create a excel document that indicates the amount of available cash in one month once expenditures are subtracted from income using the above template. We help turn your tedious tasks into time-saving ones as these templates help you reduce the stress of creating cash flow sample statements from scratch. Improve your business and make sure your finances are well taken care of. It is professionally designed and helps you with number crunching for your convenience.

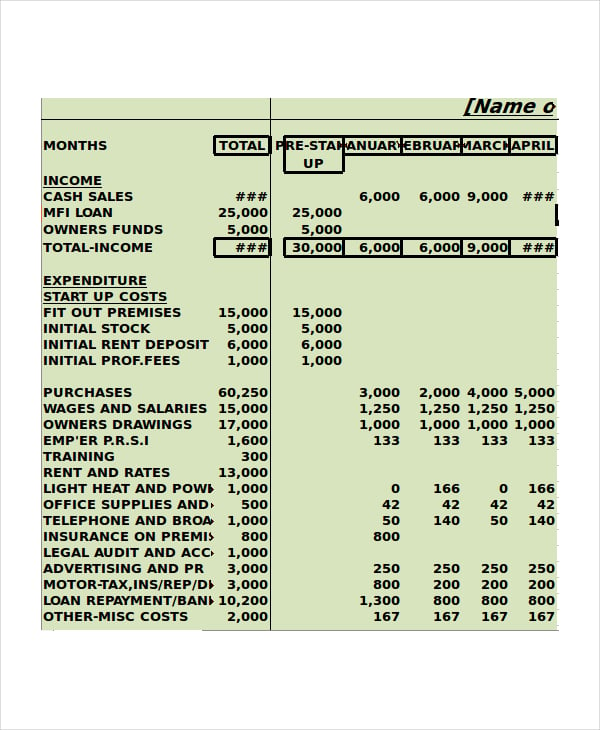

This monthly cash flow forecast template stated above not only sees how the money is being spent, but it also shows if you have enough to keep the business afloat or not. It is easily editable and can be customized to suit your needs perfectly. All you have to do is download the template, edit it and customize it as you wish to do so. Edit the highlighted parts with your information and you’re good to go! You can also see more on Cash Analysis.

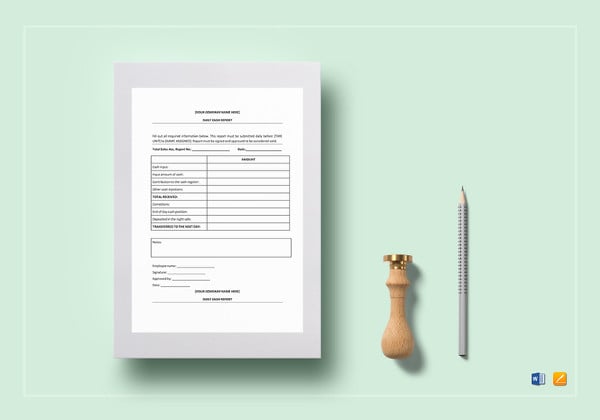

The above simple outline template is a daily cash sheet template, which proves to be a good record-keeping device for the daily cash balance of your business, regardless of which industry you work in. This daily cash sample sheet template is the perfect record keeper for the daily cash balance for your business. It is compatible with Google Docs, so you can edit and share online with your business partners if and when necessary.

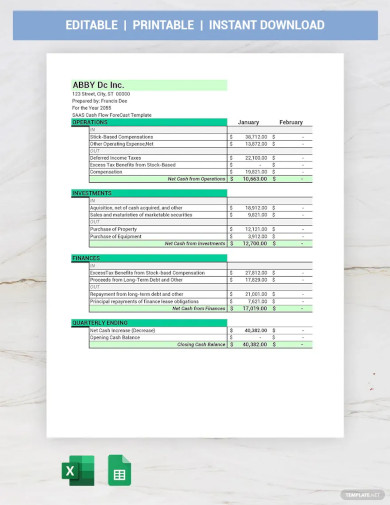

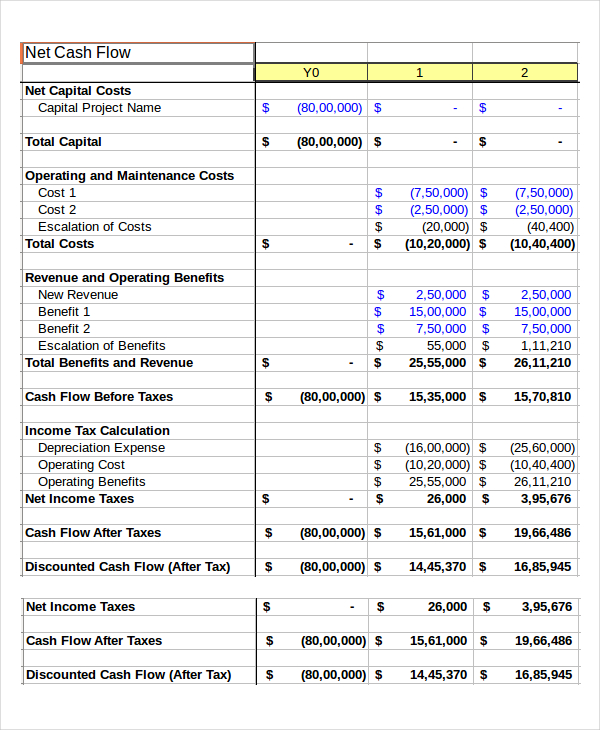

This is a very useful cash flow Excel template which can be used to calculate the inflow and outflow of cash for a company to calculate its net cash balance.

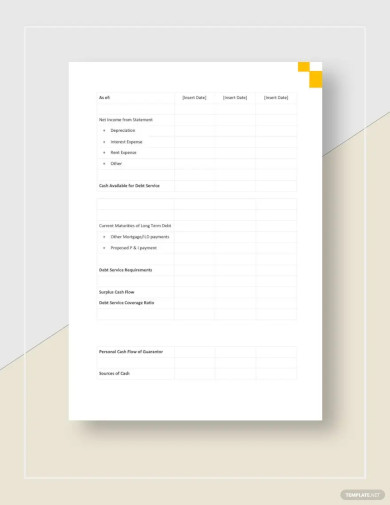

Creating a cash flow can be a tough job since there are two methods you can follow- the direct and the indirect methods. You can follow the steps mentioned below to make it easier for you to create the right kind of a cash flow statement for your organization:

The first thing you need to do is to know what your ending cash balance or the previous year was. This way, you will know if there is any left from the previous year which you can use this year for any extra expenses that might take place. Free cash flow analysis templates will help you get a better idea of how to make the most of the templates that are available online. Then, you would have to establish the cash balance of the present year. Add the value, so you get the right value for your cash flow statement format.

Net income plays an important role in the cash flow statement. Gather basic documents and data that are required to make the perfect cash flow statement for your business. Make adjustments for the accounts you have to pay and receive cash from. Make a list of the cash net income you get from basic operations and deals done in your organization. This way you will know the depreciation (reduction of value of an asset over time) and you can adjust it accordingly.

You must mention the investments in capital. Mention the impact of financing and investing activities. Make adjustments wherever required in the two departments, so you can know where to cut down costs. Tax plays a major role in the cash flow statement, so make sure you mention it without fail. Balance sheets, income statements, and other information should be mentioned in the cash flow statement that needs to be mentioned.

In the ending cash flow balance, you would have to mention whether there was an increase or decrease in the net cash. Calculate the ending cash equals and compare them to the previous year. This way, you will know whether there was an increase or decrease in the expenses. Mention if there are any effects of changes in working capital and what would those be. Simple List all the current assets and liabilities without fail.

The last and final step would be to evaluate where your company stands now. This way, you will know the operating, investing and financing activities of your company. Evaluate your company’s financial place and health with the help of cash flow sample budget statements that are available online for you to use. Add up all of the incomes and expenditures to perform a final check.

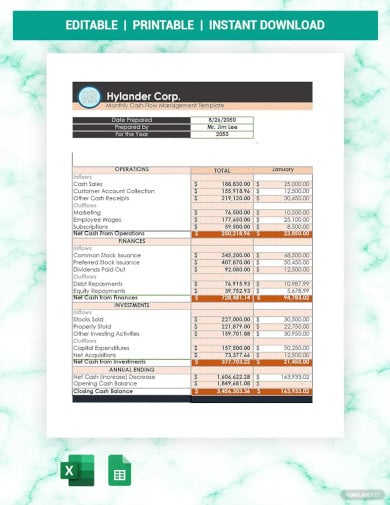

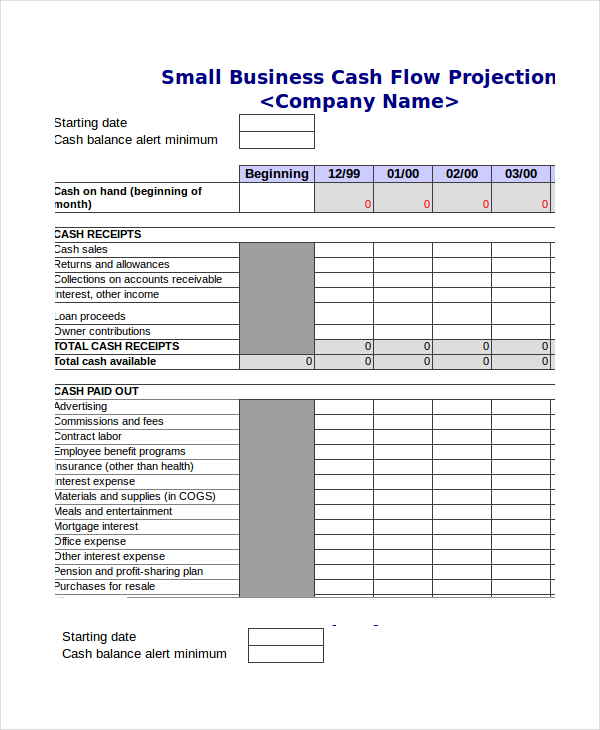

This is a very useful cash flow Excel template that can be used for keeping a record of various transactions of the company to calculate its total revenue, profit, and percentage increase. You can also see more on Small Business Budgets.

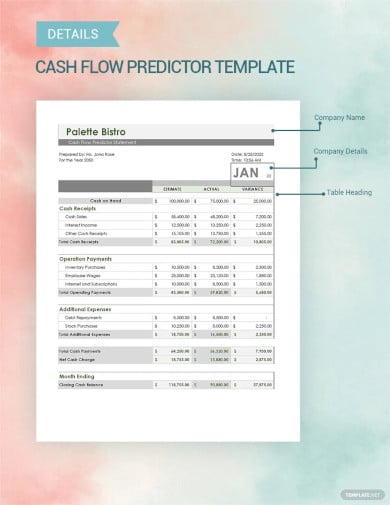

This cash flow template Excel can be of great help as it helps in calculating the expected cash balance you will have by noting the regular expenses and expected income. You can also see more on Small Business Budgets.

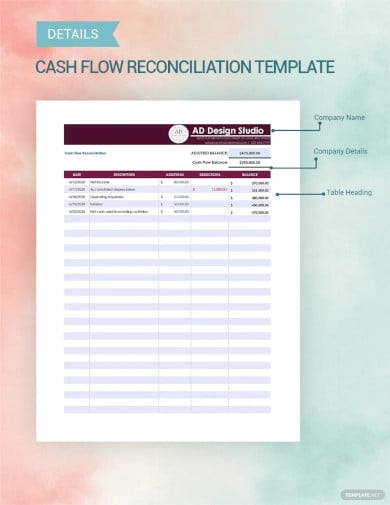

Cash flow templates are pretty similar to excel balance sheets and using them right is very easy. It makes your job way easier. To use the sign-in sheet templates to calculate your net cash flow, you have to make a record of two things, all the assets, and liabilities of your organization. Assets include all the sources from where there are income and gain like investments, collections, sales, funds, etc. These calculate the total amount of money your organization will receive.

Then you have to make a note of liabilities, all sources where you will have to spend money. This includes the salaries of employees, loan payments, advertising, etc. After entering these values, the template automatically gives you the balance and percentage increase. You can also see more on Cash Flow Analysis in Pdf.

Cash flow Excel templates can be used for any type of business. Small businesses ranging from shops and restaurants to large scale industries can make use of these templates to keep a record of their financial status and also project the status of the coming quarters. There are many global cash flow analysis templates available online for you to check and choose the best one that suits your business perfectly.

Accountants are the ones who will benefit the most from the use of these templates as they are the ones who have to keep a record of cash flow and do these complex calculations and make projections regarding the company’s finances. Individuals can also make use of these templates to take care of their finances. You can also see more on Business Expense Budgets in Excel.

This cash flow template Excel will be extremely useful for small businesses as it helps in projecting the total cash flow for an interval by taking into account all the transactions that are expected. You can also see more on Company in excel templates.

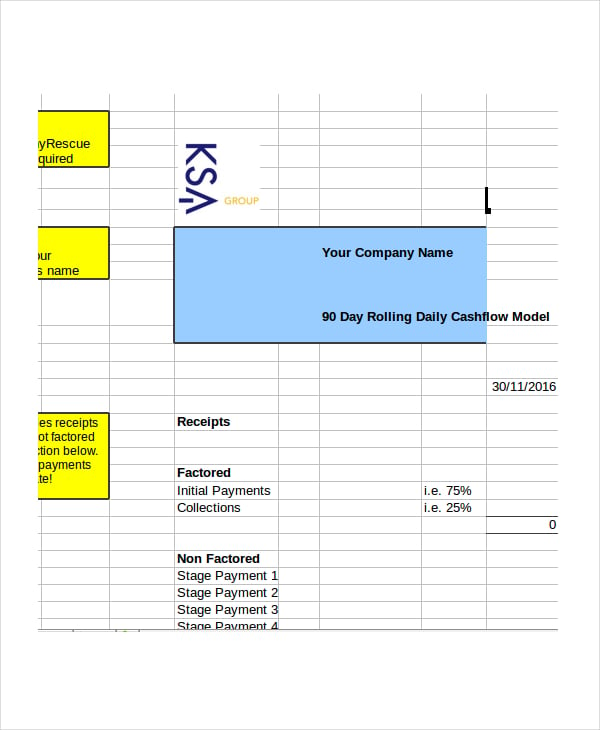

If you want to keep a record of the cash flow in and out of your organization that is done on a day to day basis then you can highly benefit by using this cash flow Excel template. You can also see more on Daily Sheets in Excel.

Cash flow templates have a huge number of benefits. The biggest benefit is that cash flow templates help you in doing complex calculations with ease by making use of the inbuilt functions in Excel. These signup sheet templates also decrease any chances of mistake you might commit while making these calculations as you can easily double-check your entries, which will be difficult to accomplish if you choose to do these calculations manually.

Cash flow templates also help you in listing your finances in order manner, which can be extremely useful for future references. You save a huge amount of time by using these templates. If you are looking to make a budget then you can make use of Excel budget templates.

Cash flow templates can find use in all kinds of businesses. Check out all the templates that we have listed above. You are sure to find a template that will help you with your needs. Best cash flow statements will help you get a better idea of how to make the most perfect and the easiest to understand cash flow personal statements for your business.

Cash flow can be defined as the net amount of cash-to-cash equivalents that are carried in and out of business. It is the company’s ability to create profit for shareholders by creating positive cash flows. Cash flow is the current money that is coming into your business, rather than the expenses going out.

Cash flow is important because it is the payment for things that make your business run. This could be for expenses like stock or raw materials, employee salaries, rent, etc. Positive cash flow is preferred in any business, but many companies also have negative cash flow, where there is more expense than income.

The best things in life are free and that is true for cash flow. Investors prefer companies that produce plenty of cash flow, as that is a huge benefit for them. Good cash flow shows a company’s ability to clear debts, pay dividends and on the whole, promote the growth of the business.

Cash flow is calculated with the help of proper balance simple sheets for each financial year. Using cash flow statements and balance sheets can give you the net income and expenses you have had in that particular year. It helps you understand your income, assets and liabilities, depreciation costs, working capital, etc.

Many factors affect the cash flow of a business organization. Some of them are:

Profit is the overall revenue that remains after subtracting the business costs, while cash flow is the amount of money that flows in and out of business regularly. Profit is more symbolic of the success of your business, whereas cash flow is more important to keep your business running on a daily basis.

Microsoft Excel simplifies the process of calculating the margin of error, enabling you to measure the accuracy of your statistical…

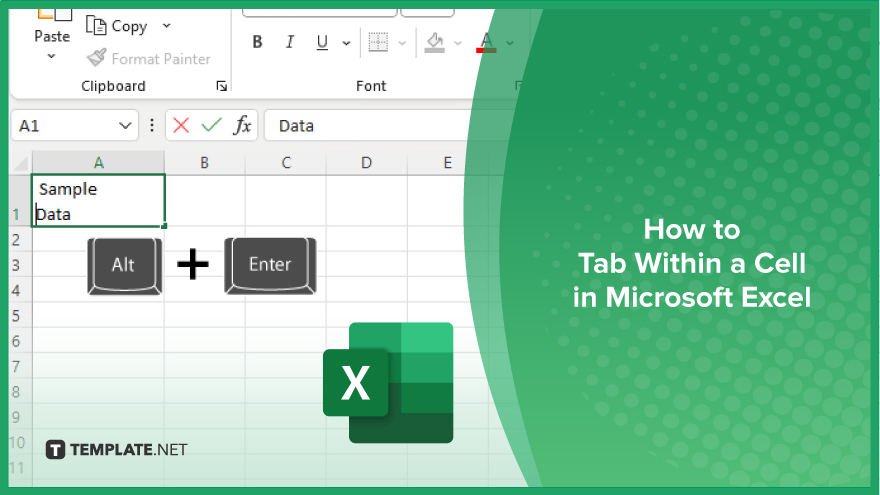

Microsoft Excel users often need to format data within a single cell, and one common requirement is to indent text…

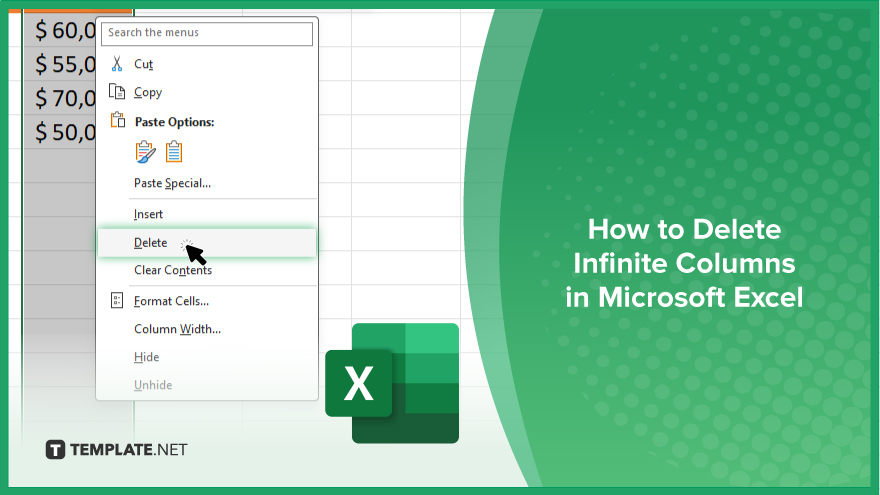

In Microsoft Excel, dealing with infinite columns can be a headache, cluttering your workspace and slowing your workflow.…

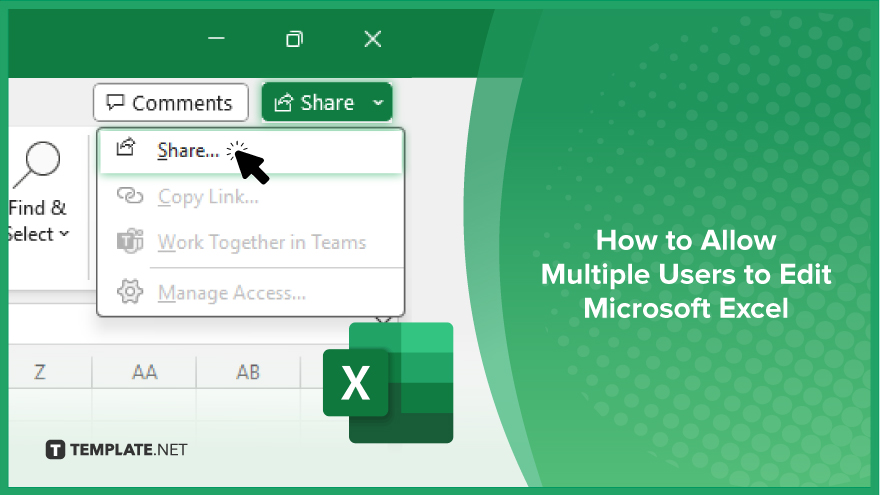

Microsoft Excel revolutionizes teamwork by allowing multiple users to edit spreadsheets simultaneously. This collaborative feature streamlines workflow and boosts productivity…

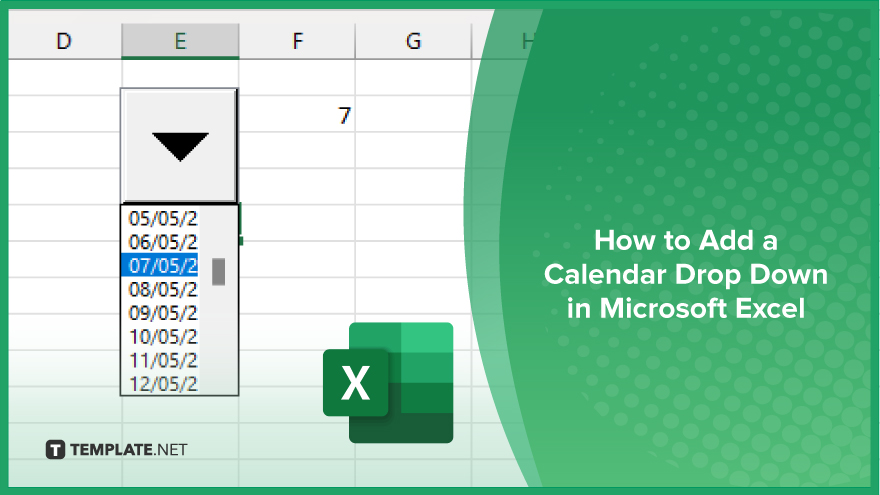

In Microsoft Excel, simplifying data entry just got easier with calendar drop-downs. Learn how to integrate this feature into…

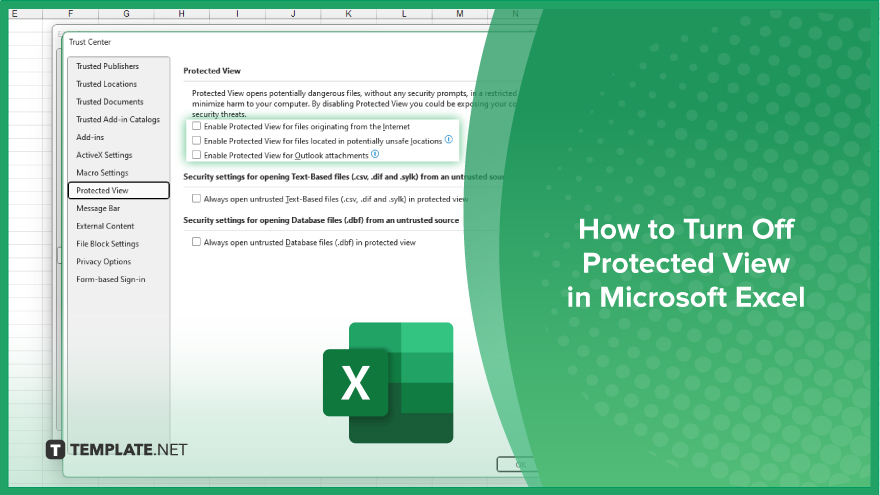

Microsoft Excel users, have you ever encountered the frustration of being unable to edit or interact with a…

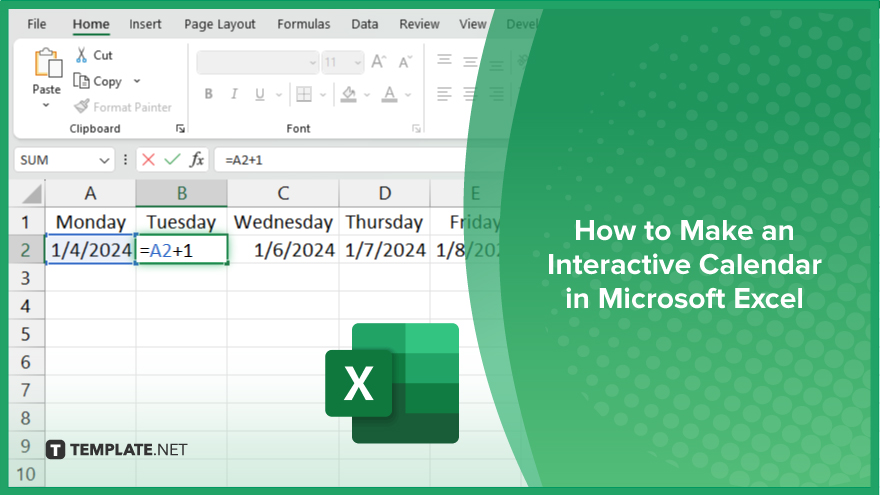

Microsoft Excel is not just for crunching numbers—it can also be transformed into a powerful planning tool by integrating interactive…

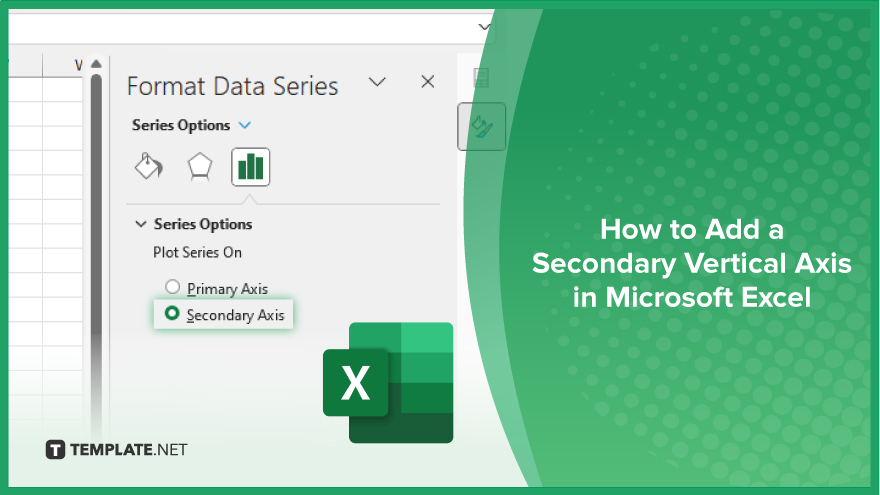

Microsoft Excel users, are you struggling to effectively visualize your data? In this article, we’ll show you how…

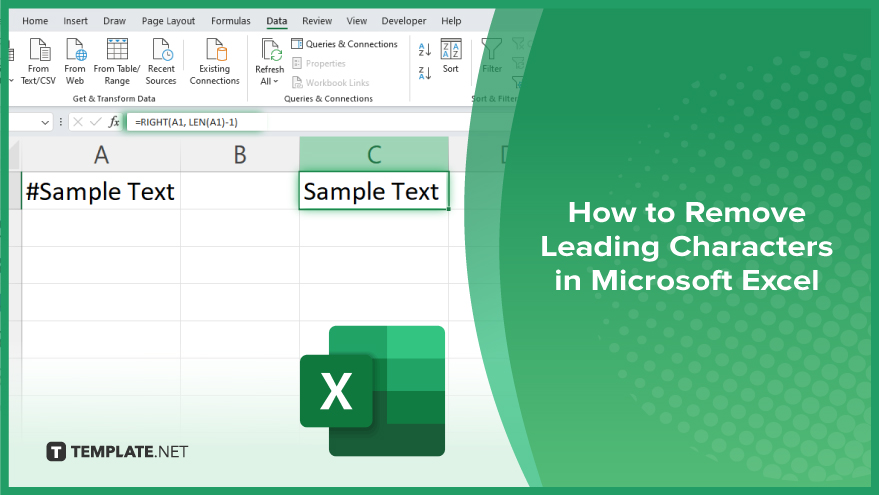

Microsoft Excel provides versatile tools to refine your data, including removing leading characters from cell values. This skill is crucial…