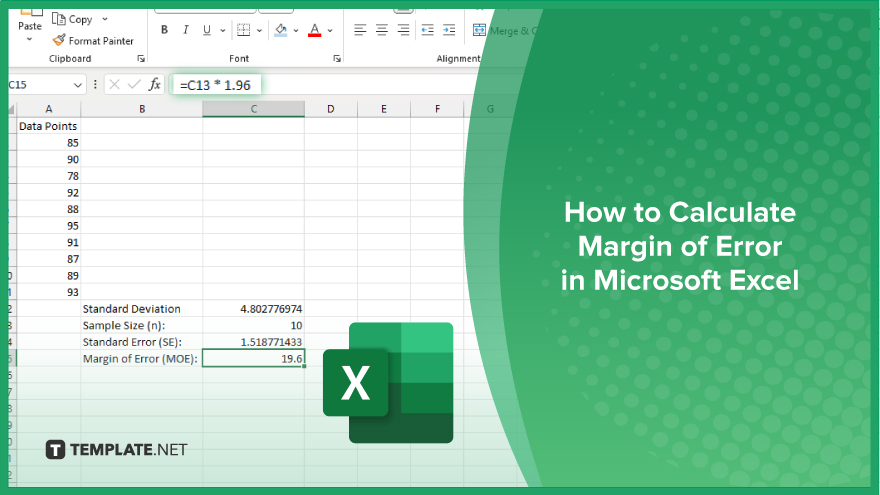

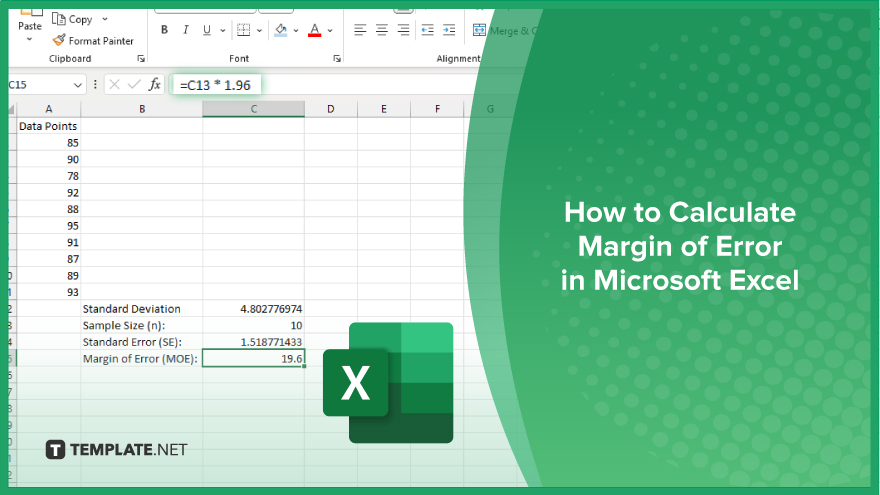

How to Calculate Margin of Error in Microsoft Excel

Microsoft Excel simplifies the process of calculating the margin of error, enabling you to measure the accuracy of your statistical…

Jun 22, 2022

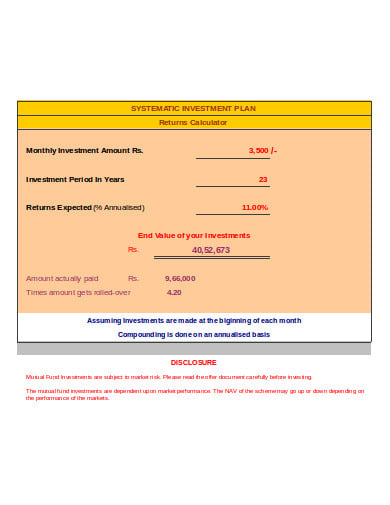

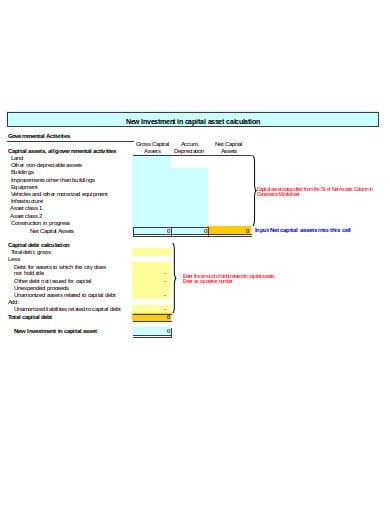

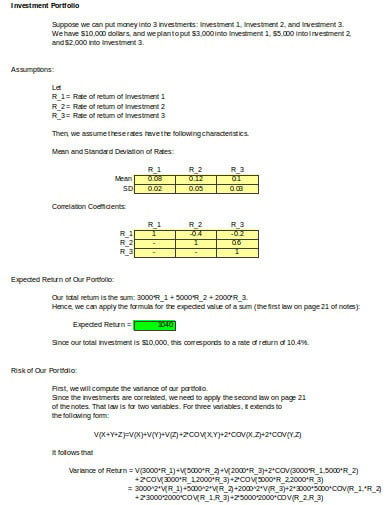

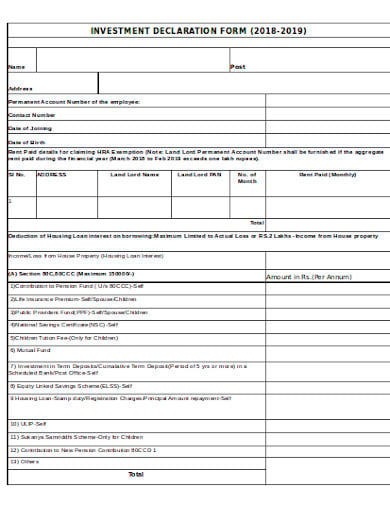

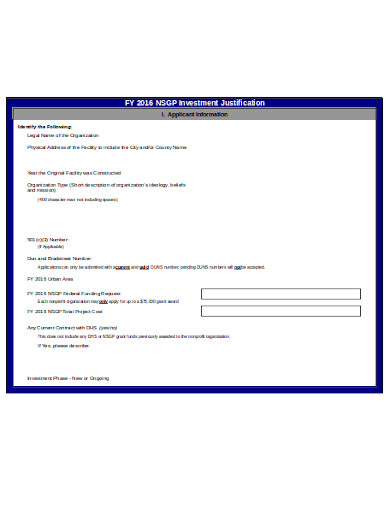

The term venture or making an investment is usually used while forming a new business and developing or molding your hands in the business. In any event, this understanding will begin by recognizing the terms and conditions that are to be changed. It will express the idea between the associations as trading regard or monies from the money related master for stock in the association.

rrfinance.com

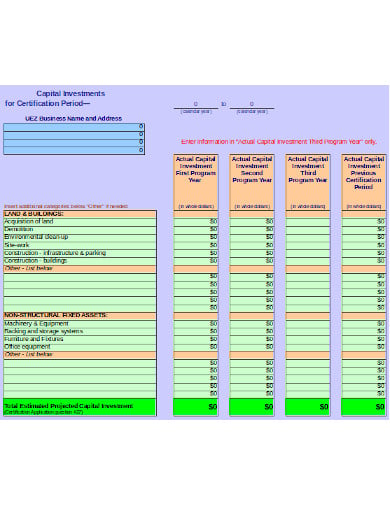

rrfinance.com qlutch.com

qlutch.com nctreasurer.com

nctreasurer.com personal.utdallas.edu

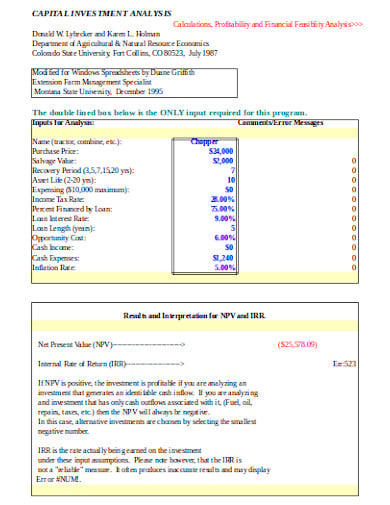

personal.utdallas.edu montana.edu

montana.edu nj.gov

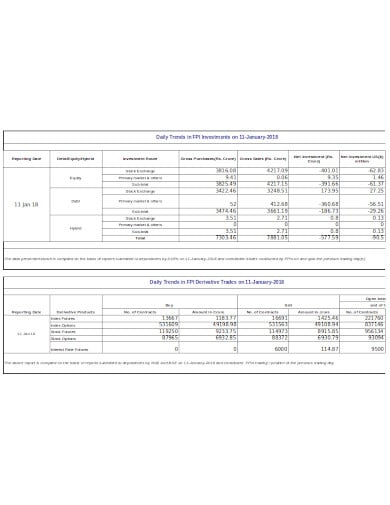

nj.gov cdslindia.com

cdslindia.com nitrr.ac.in

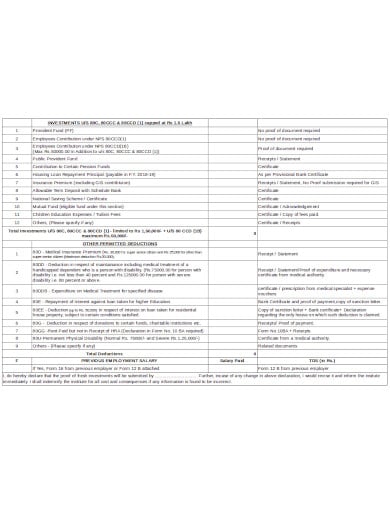

nitrr.ac.in stratishealth.org

stratishealth.org aiimsjodhpur.edu

aiimsjodhpur.edu global.oup.com

global.oup.com jcrcny.org

jcrcny.orgCommitting any later transferees of the stock to be needy upon the arrangements of the hypothesis understanding.

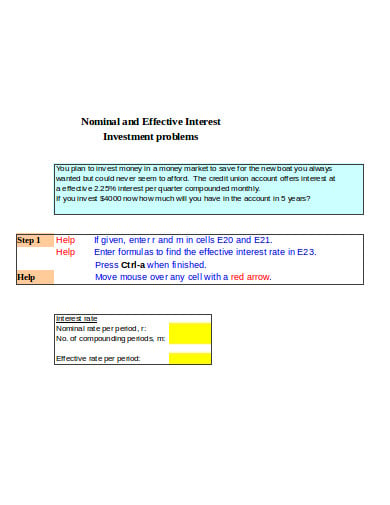

If the budgetary expert won’t make the entire enthusiasm for the association on the double, the endeavor resources may be paid in showed entireties at decided periods. These portions are known as tranches. It is ordinary in new organizations for money related masters to concentrate on capital hypothesis at various authoritative accomplishments. The tranches are normally joined to thing improvement, pay targets, or other operational estimations.

Portrayals are affirmations made by each social event that a particular truth is legitimate. Assurance is a declaration by the association that particular truth will remain substantial until some communicated point later on. The depictions and certifications all things considered once-over out association conditions that will be investigated through due productivity. These may concern the cash related position (accounting and cost depictions), association assets (ownership and valuation), the ownership structure, the operational qualities, and the authentic condition of the association. As a part of these depictions, the association may be focused on making unequivocal reports identified with therewith.

The comprehension may join any number of money related to pro-rights (particularly throwing voting form rights) including:

This stresses the ability to sell or move shares. It may in like manner restrict how many financial specialists can take certain exercises, for instance, going toward the association or serving a contender.

These are all around assertions that the association will keep the association or course of action information mystery. This is ordinary with hypothesis concurrences with exclusive organizations. There may be uncommon cases for disclosure to existing association accomplices.

A shareholder agreement is used to guarantee the benefits of existing financial specialists. Right when monetary pros hope to place assets into the association, the present financial specialists will require the theorist to go into the speculator understanding. The arrangements of the speculator understanding will move contingent upon the premiums of existing financial specialists.

These game plans are affirmations that a financial specialist will cast a polling form her ideas according to specific confinements. The facts may confirm that the financial specialist agrees to cast a polling form in a square with various speculators.

These stress the benefits of the financial specialists to pick or empty unequivocal speculators. The benefit to oust boss.

This may consolidate the limit with regards to financial specialists to make the association suggestion. It may similarly consolidate intrigue rights in eagerly held associations.

These courses of action concern if and how a speculator can move her offers. These courses of action will often permit the benefits of the main refusal to the association to repurchase the offers. It may moreover surrender co-bargain rights to the speculator on the event various financial specialists offer their ideas to the association or untouchables.

These courses of action concern how financial specialists can voice protests or resolve banters between speculators.

A financial specialist’s objectives will follow a fundamental association. It will exhibit who is ruling for financial specialist action. It will show the number of financial specialists present, with the objective that the move is made ward upon most of those certified for the vote. By then, it will spread out the movement that the speculators confirm. This may fuse selling noteworthy assets of the association, changing the association reports, supporting examiner financing, or dissolving the association.

Microsoft Excel simplifies the process of calculating the margin of error, enabling you to measure the accuracy of your statistical…

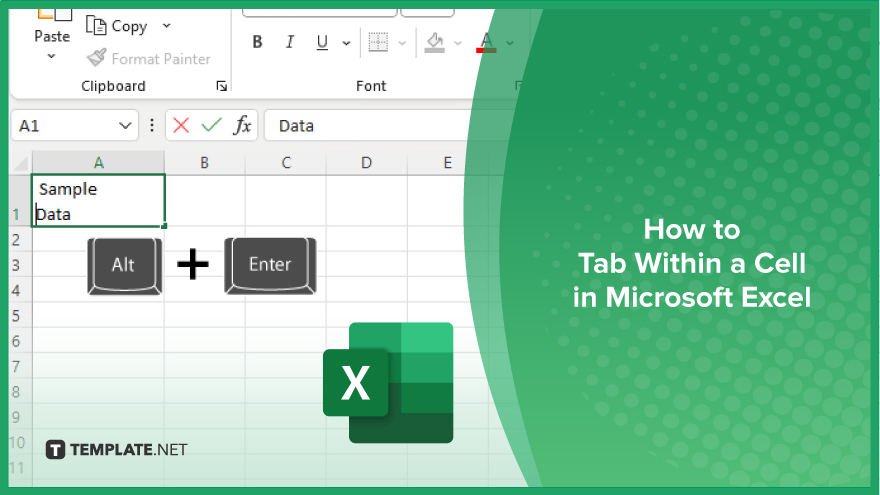

Microsoft Excel users often need to format data within a single cell, and one common requirement is to indent text…

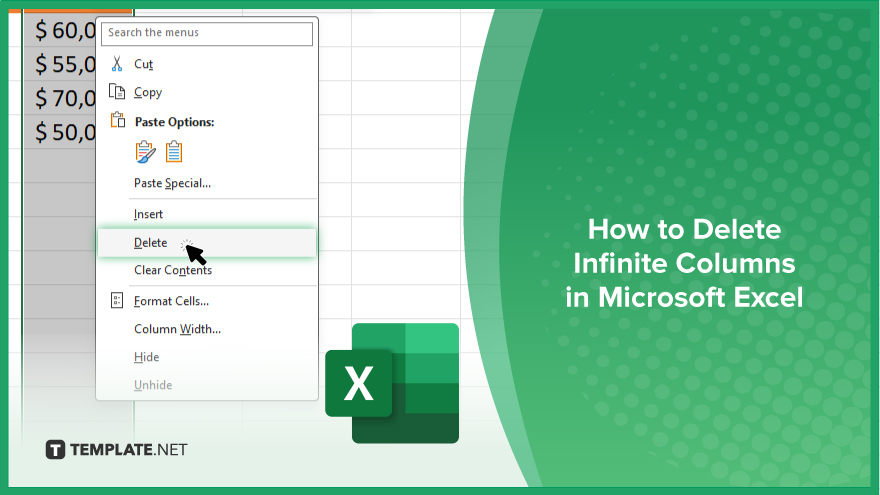

In Microsoft Excel, dealing with infinite columns can be a headache, cluttering your workspace and slowing your workflow.…

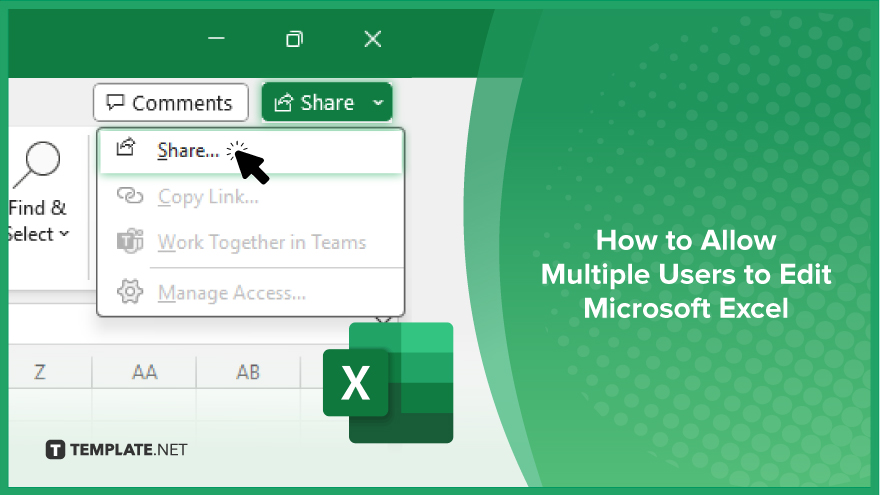

Microsoft Excel revolutionizes teamwork by allowing multiple users to edit spreadsheets simultaneously. This collaborative feature streamlines workflow and boosts productivity…

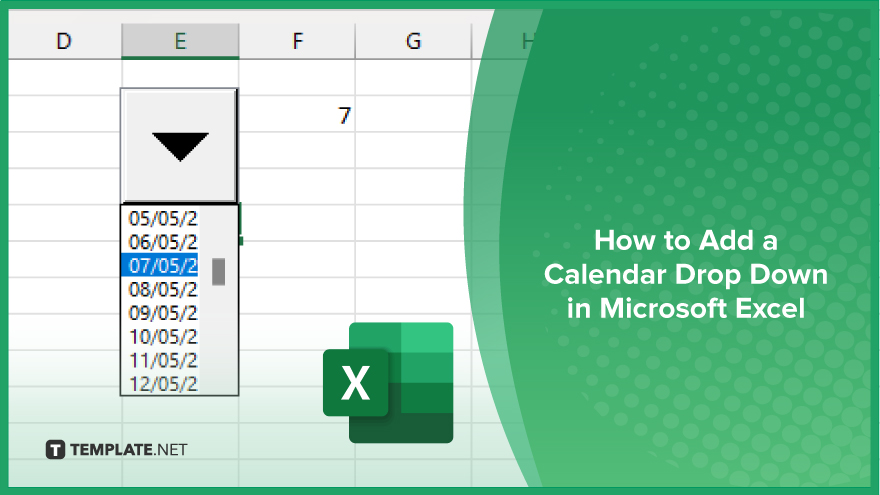

In Microsoft Excel, simplifying data entry just got easier with calendar drop-downs. Learn how to integrate this feature into…

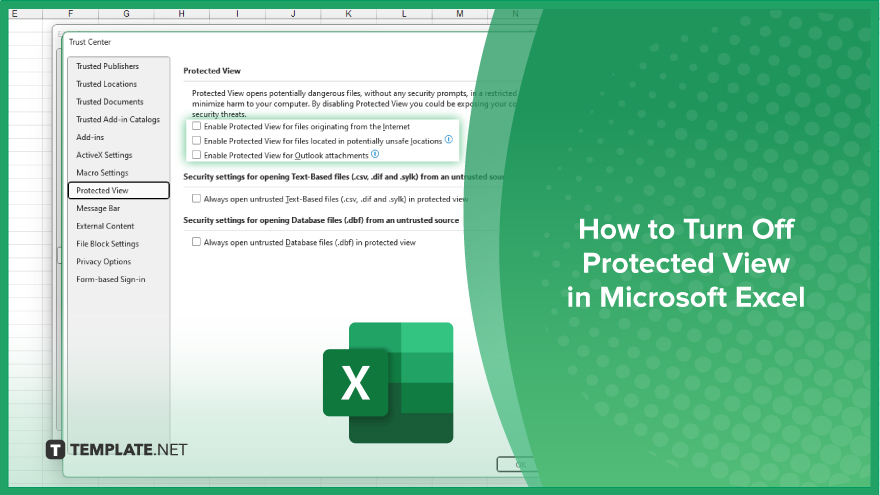

Microsoft Excel users, have you ever encountered the frustration of being unable to edit or interact with a…

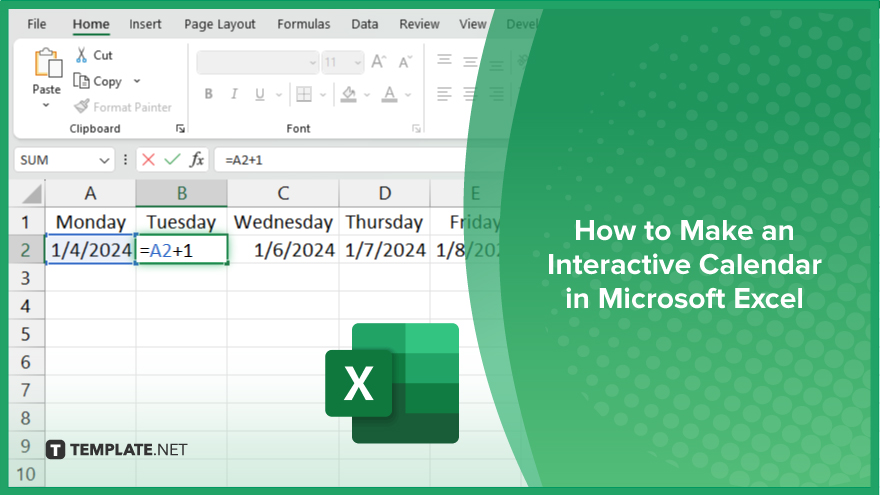

Microsoft Excel is not just for crunching numbers—it can also be transformed into a powerful planning tool by integrating interactive…

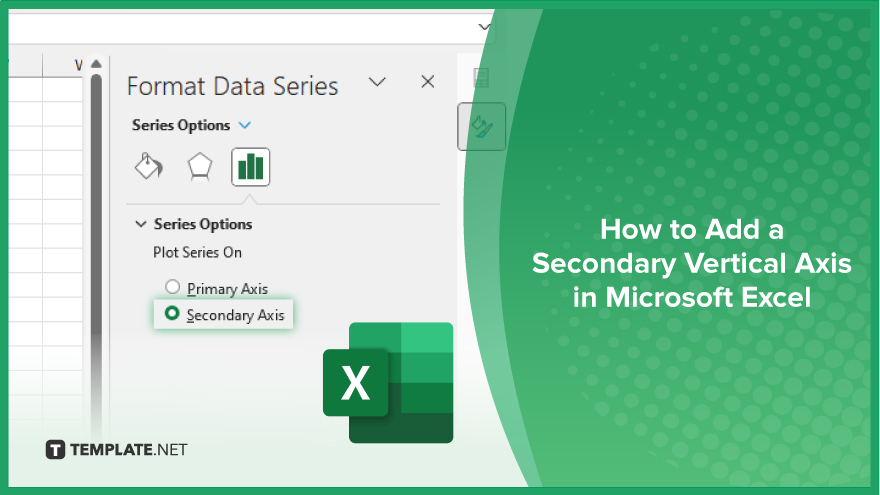

Microsoft Excel users, are you struggling to effectively visualize your data? In this article, we’ll show you how…

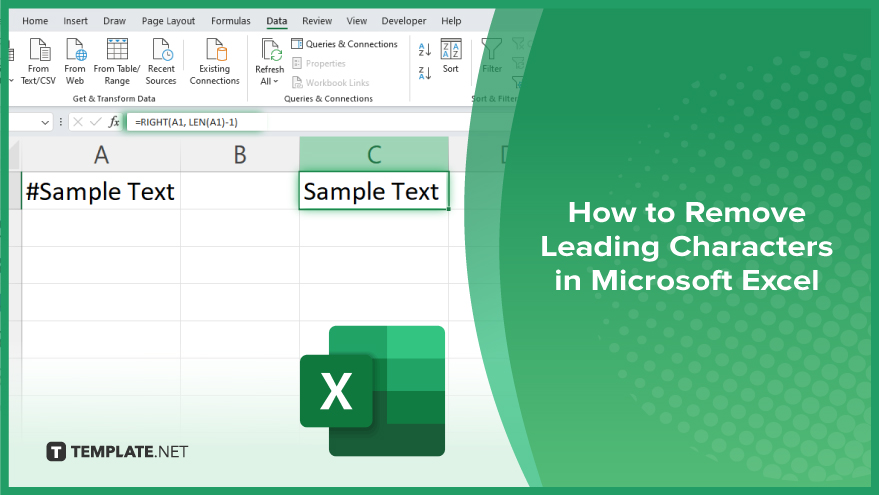

Microsoft Excel provides versatile tools to refine your data, including removing leading characters from cell values. This skill is crucial…