Are you tasked to present your financial statement with Apple Numbers file format, but don't know where to start? Worry no more, for we offer you a variety of our ready-made Finance Templates in Apple Numbers! Constructing your financial statements can be tedious and time-consuming especially if you have compatibility issues with your format. Say goodbye to your problems and say hello to a hassle-free work for your day to day operations with these professionally-written templates. 100% customizable, printable, and highly editable in various formats especially in Apple Numbers. File reports and creates amazingly accurate presentations for meetings and other client presentations. Finances need not be a burden. Make meetings on sales and budget issues exciting and download our best templates today.

How to Make a Financial Statement in Apple Numbers?

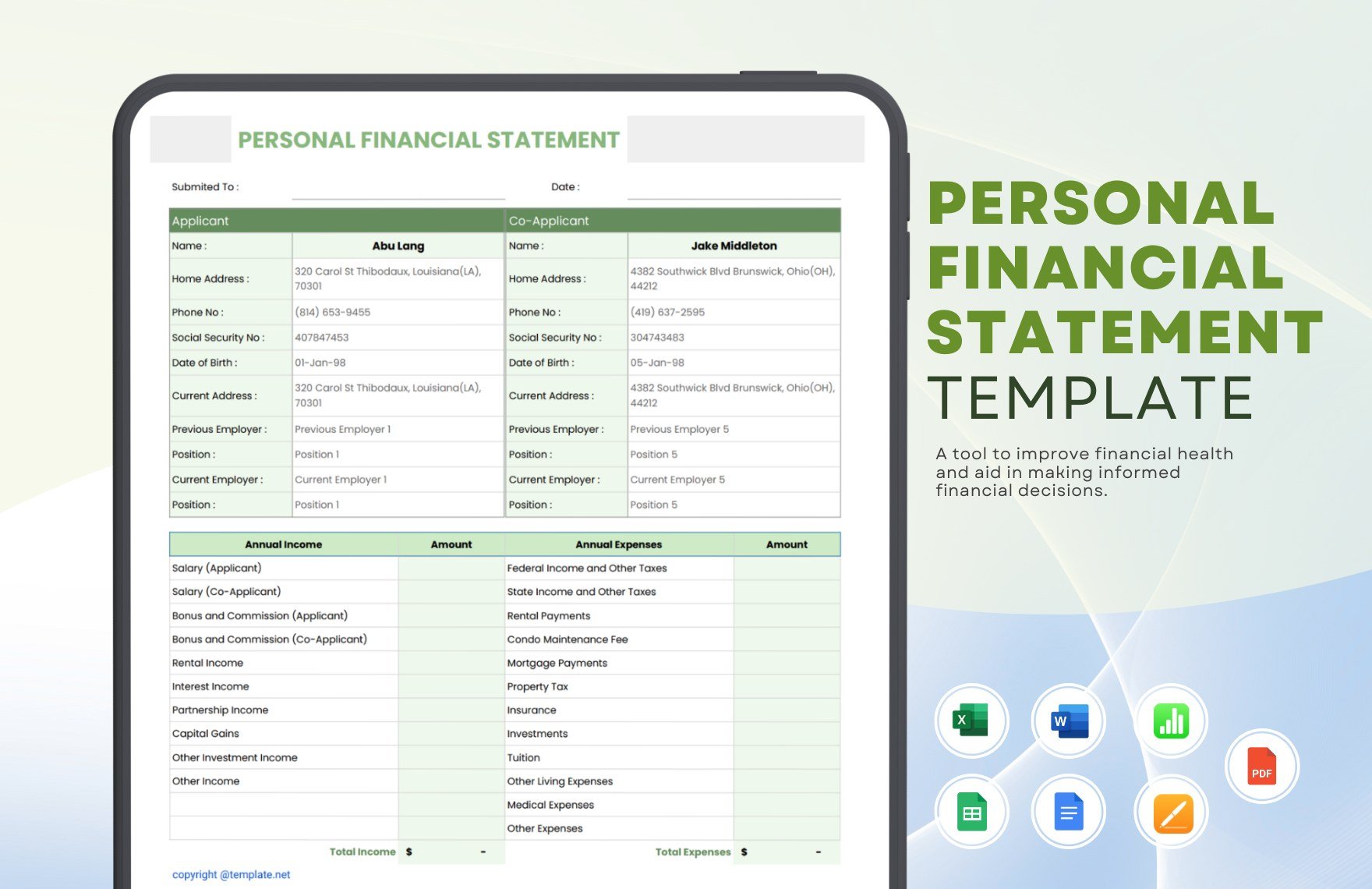

Financial statements are written records that provide your business with a list of your financial activities, as well as the financial performance of your company. This is commonly used to evaluate your company's standing and earning potential.

Constructing financial statements is geared towards communicating information clearly and accurately to achieve a specific result. Aside from giving you an overview of your business' health, financial statements are powerful management tools to provide positive changes to your company.

1. Gather Data About Your Finances

You'll need data to create your financial statements. To make things easier, gather information on your finances on a monthly basis and audit every department and team in your company. Create an analysis of where your money comes from, where it goes, and where it currently is. Prepare your balance sheet, income statement, as well as your cash flow report to support your financial statement.

2. Create Your Balance Sheet

Creating your balance sheet shall describe your company's performance at a certain period. This shall serve as a directional guide to your finances, as this will indicate the exact amount your business owns and owes to others. List your assets and liabilities, as well as your shareholder's equity (capital). To figure out your capital, subtract your liabilities from your assets. Some examples that fall under the category of a shareholder's equity are common stocks, preferred stocks, capital in excess of par, and retained earnings.

3. Write Your Income Statement

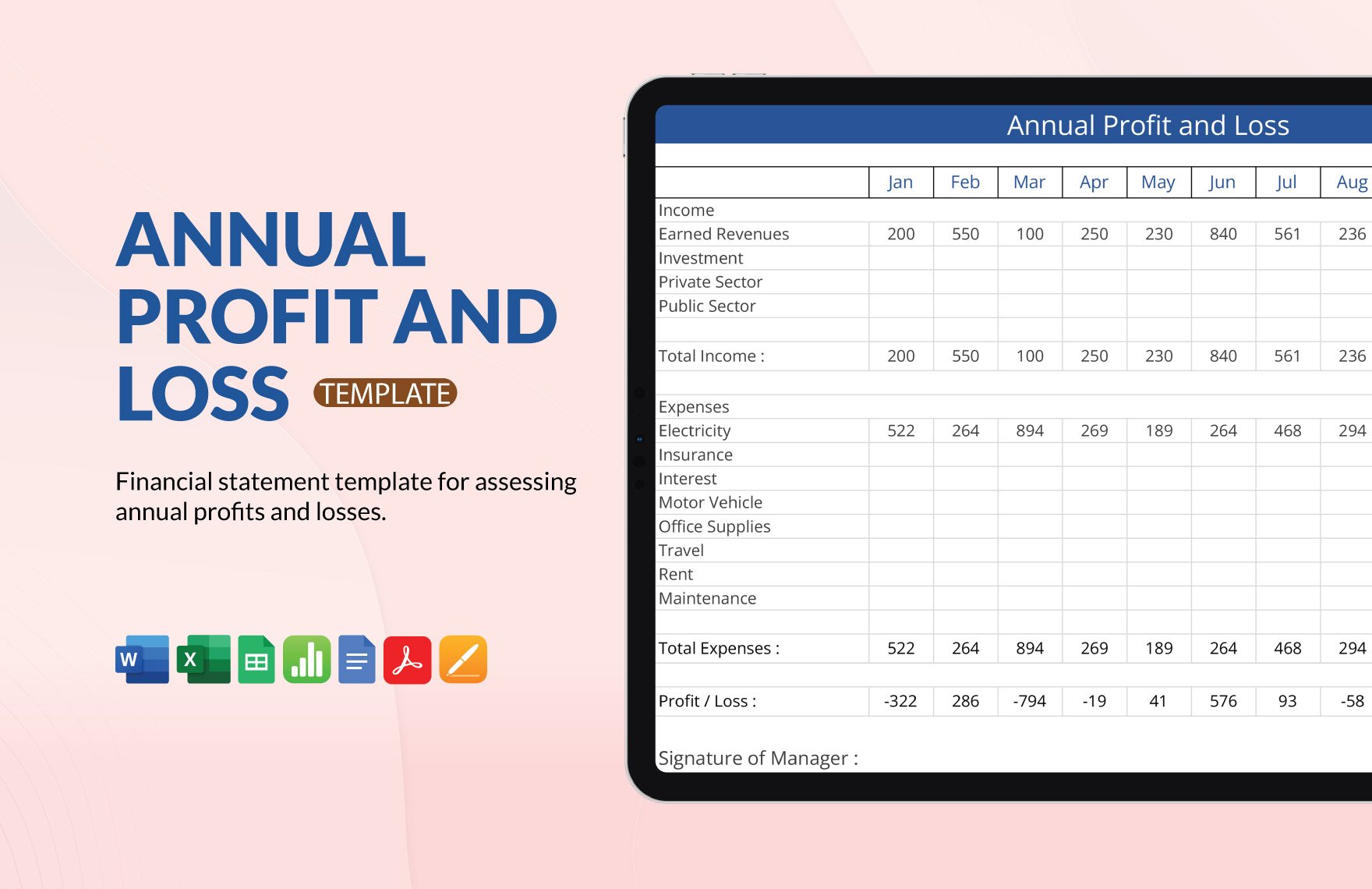

Your income statement will summarize your company's revenue and expenses for a specific period. Your net sales represent your gross sales which are your total sales for the period, not counting the additional charges or discounts in your profit. Calculate your gross profit and list your company's operating expenses and non-operating expenses, then layout your income statement.

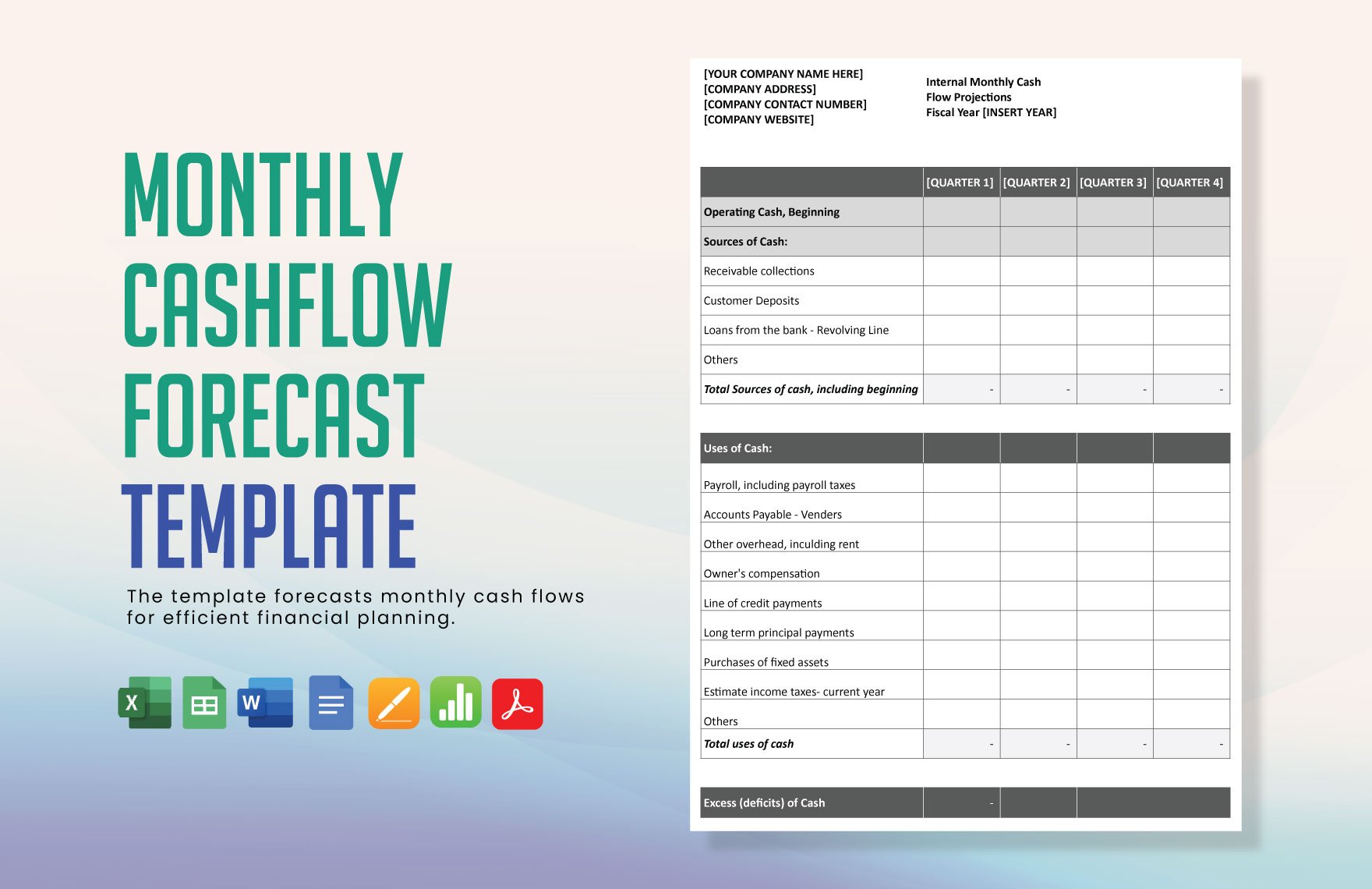

4. State Your Cash Flow

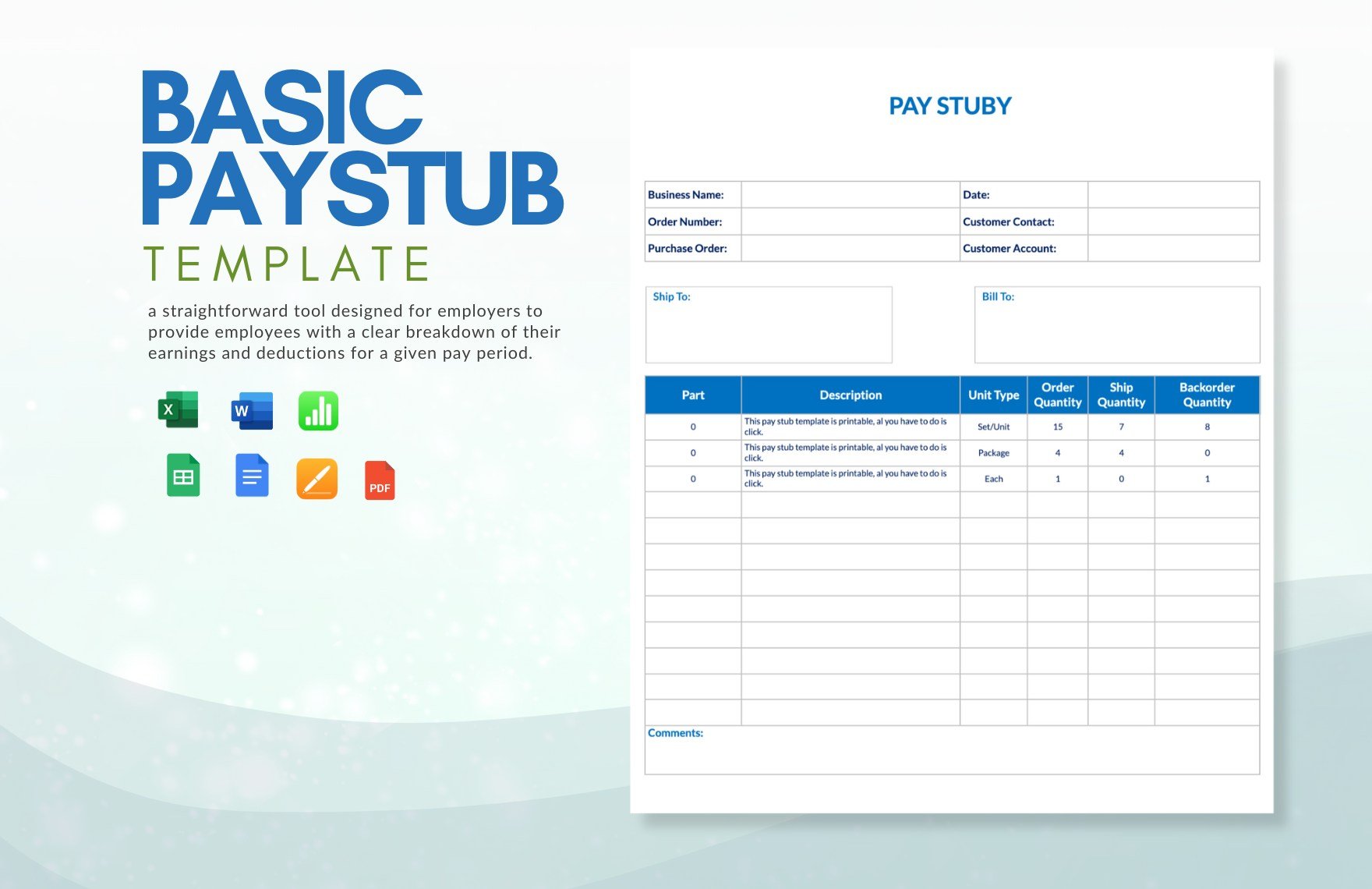

Your cashflow records the in and out of your money for a given period. This allows you to pay your suppliers and employees while meeting your short term obligations. Begin with your net income and calculate the cash flow of your operating activities. Then, figure out the cash flow of the rest of your operations and other investing activities. Next is to look for any cash available from financing, then layout your cash flow statement.

5. Review and Present Your Financial Statement

Before you show your financial statements to the board, don't forget to review your work for any errors and discrepancies. In presenting your statement, start by displaying either your balance sheet or your income statement to your audiences. Your cash flow follows after your balance sheet and income statement since it supports your discussion about them. Give an in-depth look at your stockholder's equity, then close your presentation with your notes about your financial statement. If you are wondering, these notes give detailed information about your company policies and procedures.