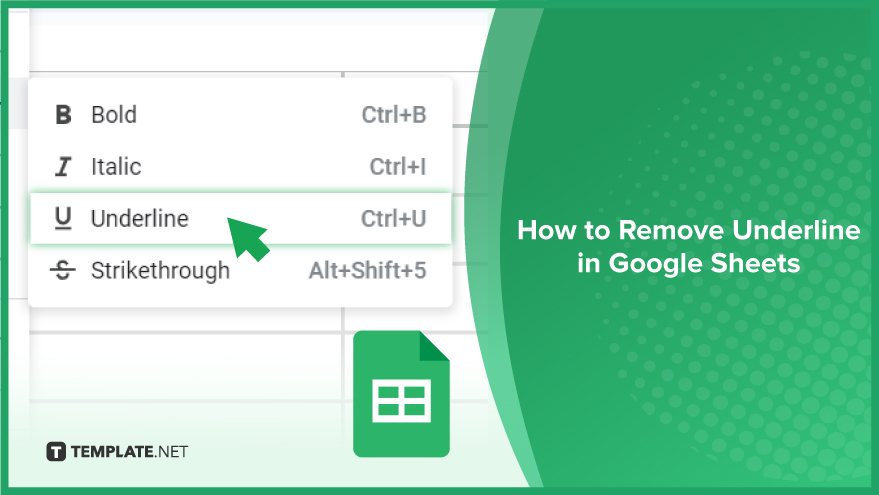

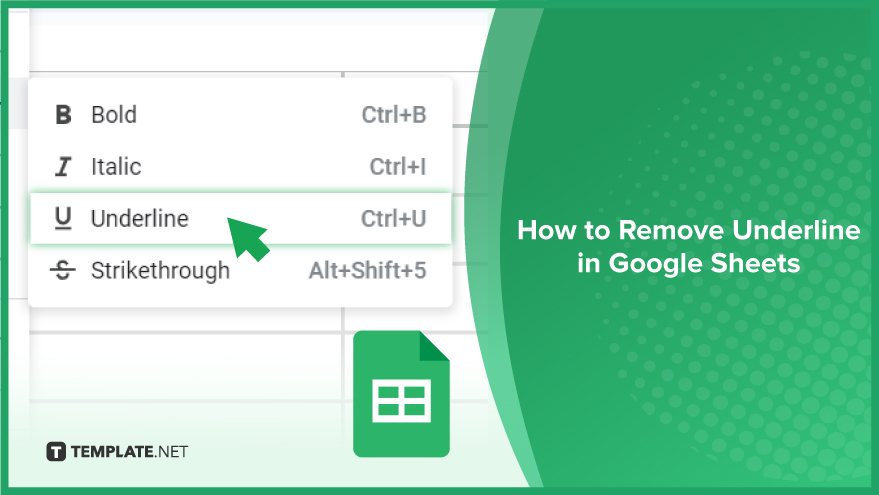

How to Remove Underline in Google Sheets

Google Sheets not only excels in data management but also offers flexible text formatting options, including the removal of underlines. Ideal…

Nov 20, 2023

Personal loan trackers are one of the ways people can manage the finances of their property and gain financial power to obtain something. The challenge right after is paying off their loans which requires a lot of management, which you can do efficiently by using personal loan trackers.

Personal loan trackers are easy to prepare in Google Sheets. If this is your first time preparing one, just refer to this step-by-step guide. You’ll have your tracker in no time.

The Personal Loan Tracker Template will save you from the hassles of creating a tracker from scratch. It can automatically compute balance, interest, and other amounts about your personal loan. You can grab a copy of its Google Sheets version from its product page on this site.

The Personal Loan Tracker Template will save you from the hassles of creating a tracker from scratch. It can automatically compute balance, interest, and other amounts about your personal loan. You can grab a copy of its Google Sheets version from its product page on this site.

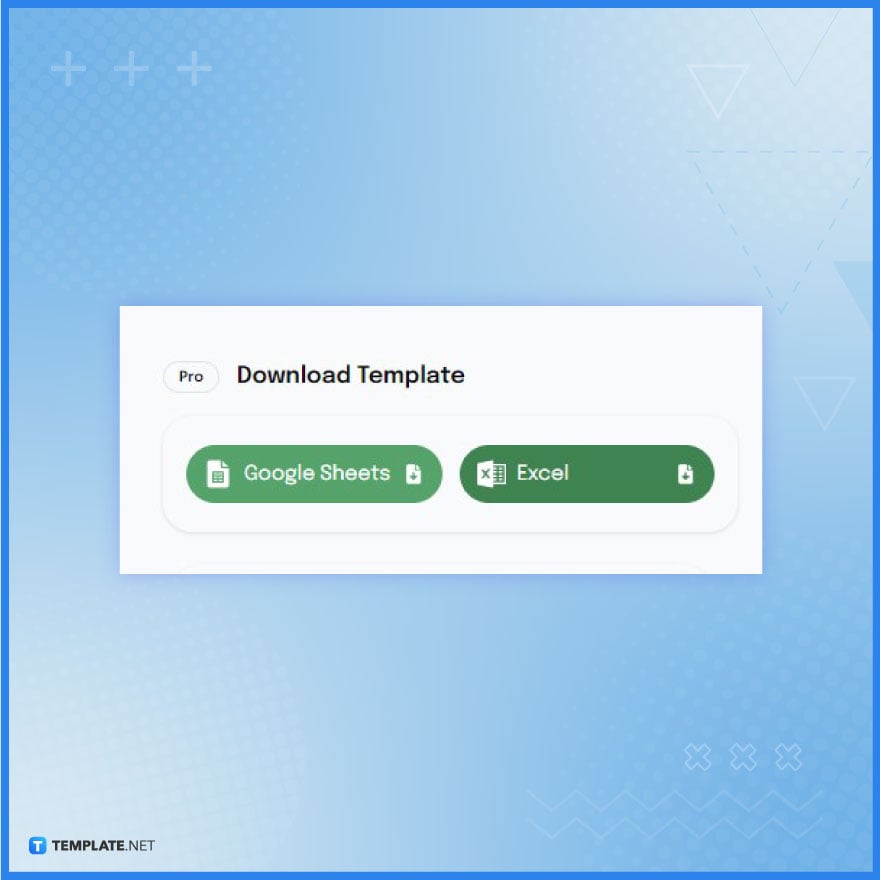

Under the Download Template section, click the ‘Google Sheets’ button to own and open a copy of the template in Google Sheets format.

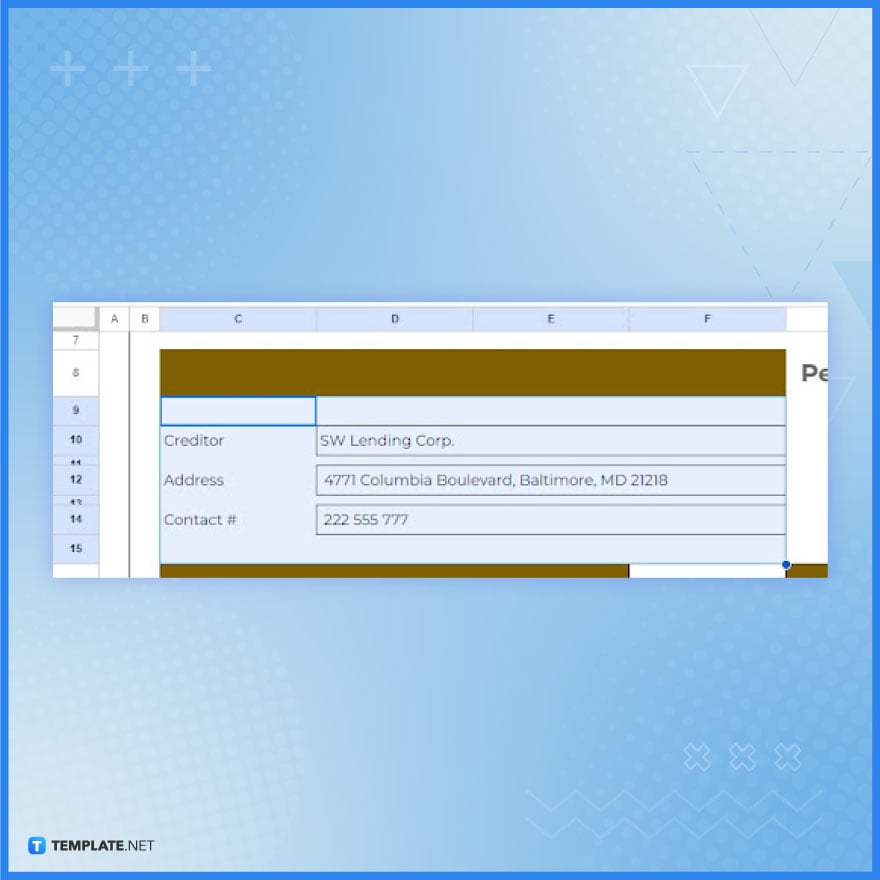

Write the company name of your creditor followed by their address and contact number. This is critical information in case you need to contact your creditor for certain concerns or inquiries.

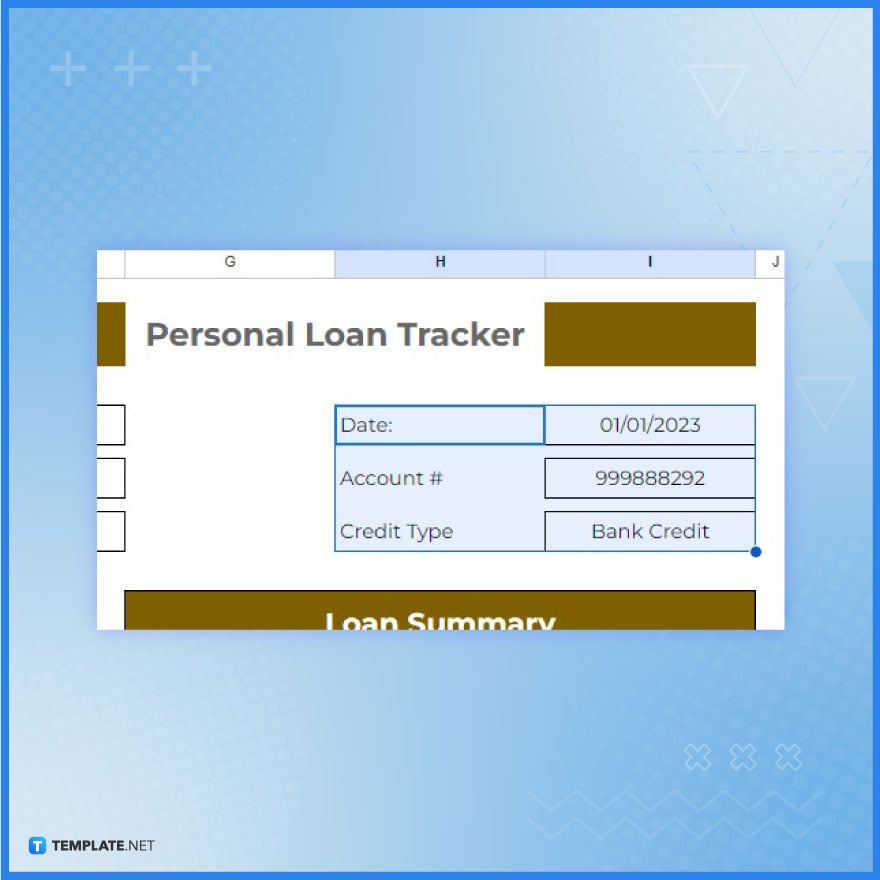

Write the date when you created the tracker, indicate your account number, and specify the credit type of your loan. Insert those pieces of info on the upper right side of the tracker document.

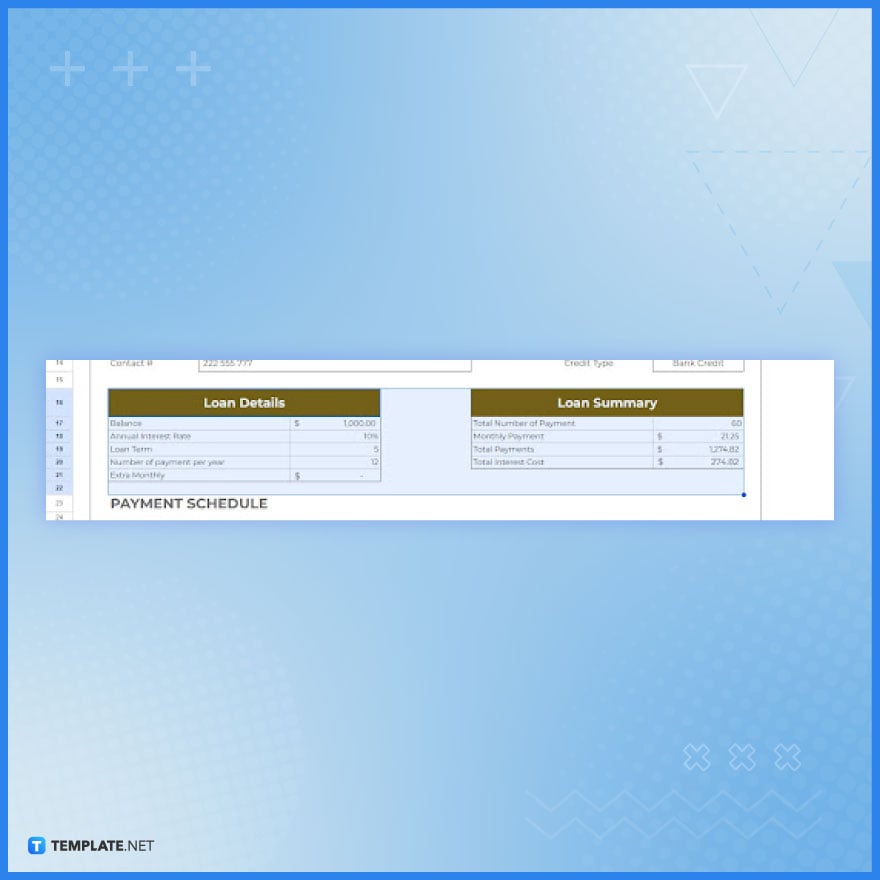

The data you’ll input in the Loan Details and Loan Summar sections directly influences the data that your tracker will present. That said, make sure to input the right data in those sections, most especially the balance, interest rates, and monthly payments.

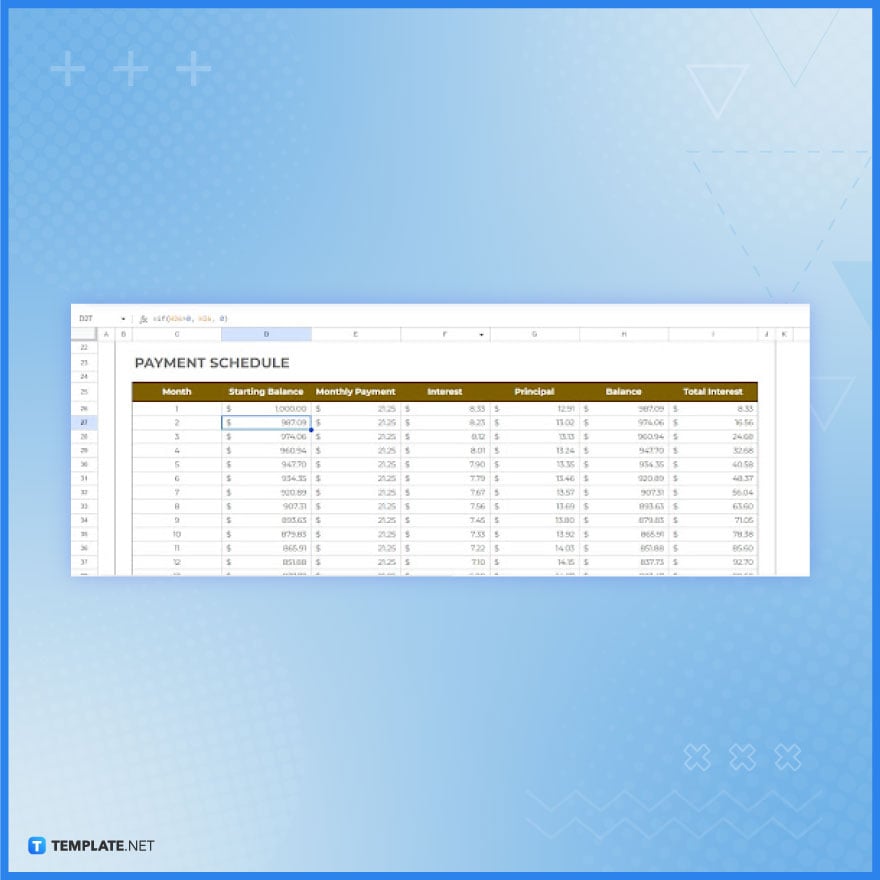

The template’s payment schedule table will automatically present the accurate numbers thanks to its use of the Google Sheets formula. The formula gathers information from the Loan Details and Loan Summar sections and presents the right numbers on the table. So in this step, all you have to do is check the payment schedule table and indicate the month in the Month column.

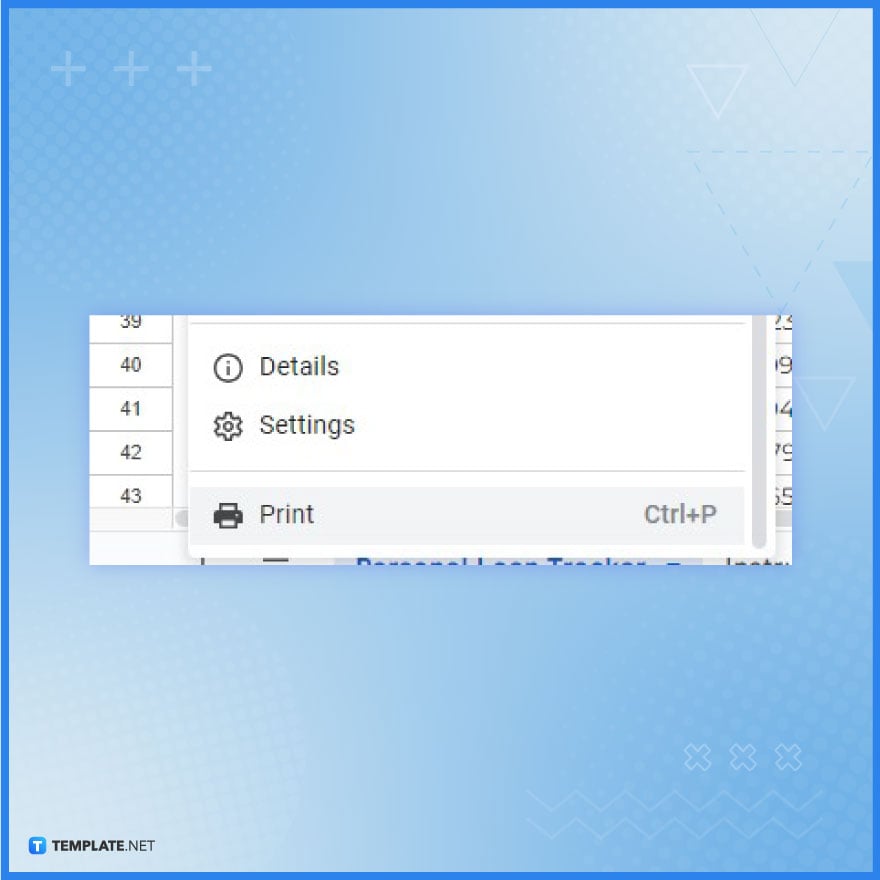

If you want to secure a printed copy of your tracker, simply open the File menu in Google Sheets and click the Print option. This will automatically start the printing process.

Include the loan amount, interest rate, payment schedule, and remaining balance in your template.

Use the =IPMT function in Google Sheets to calculate the interest for each payment.

Yes, you can use Google Calendar integration for automatic payment reminders.

Yes, you can track multiple loans by creating separate sheets or columns for each loan.

Regularly update your payments and cross-check with bank statements for accuracy.

Google Sheets not only excels in data management but also offers flexible text formatting options, including the removal of underlines. Ideal…

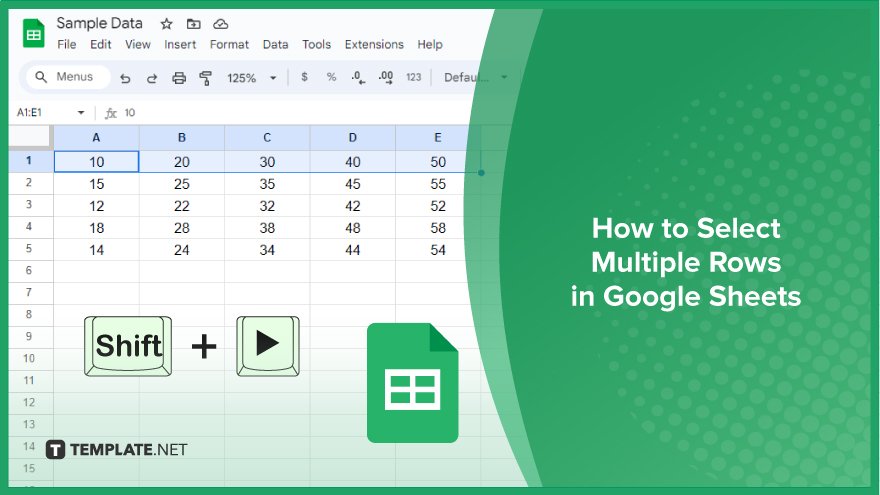

Google Sheets offers a wide range of features that can help you organize, analyze, and manipulate data effectively. One…

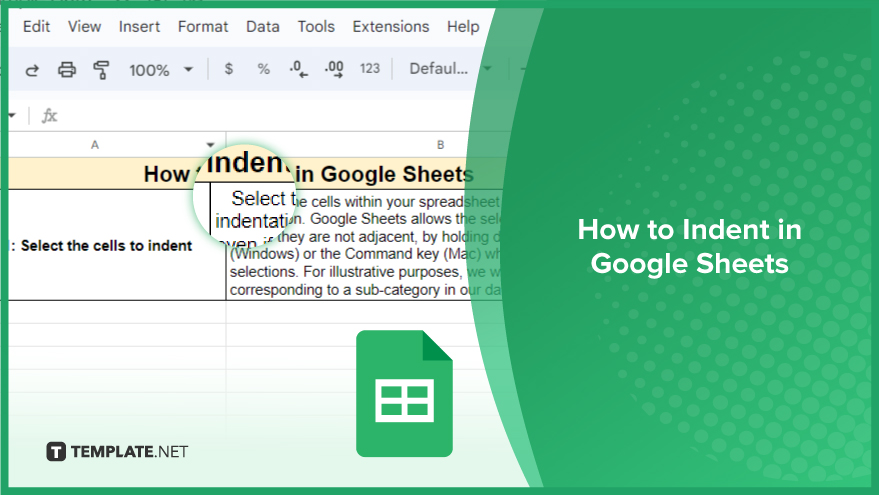

Indentation in Google Sheets is a handy feature that can significantly enhance the readability and organization of your…

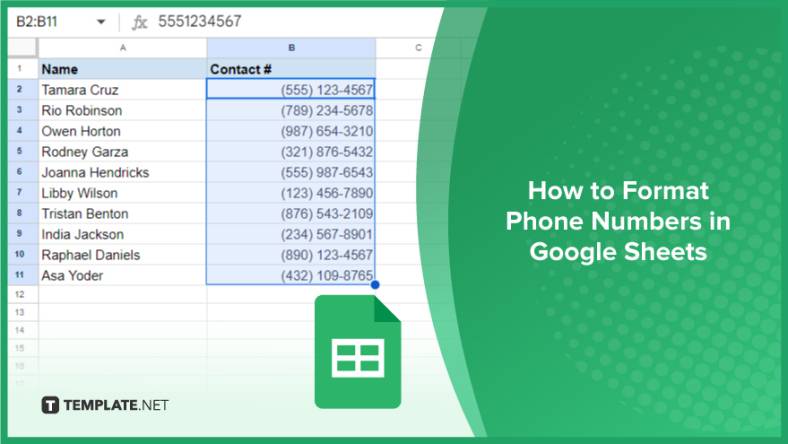

Google Sheets is a vital component of the Google Workspace suite that empowers users with diverse functionalities for efficient data…

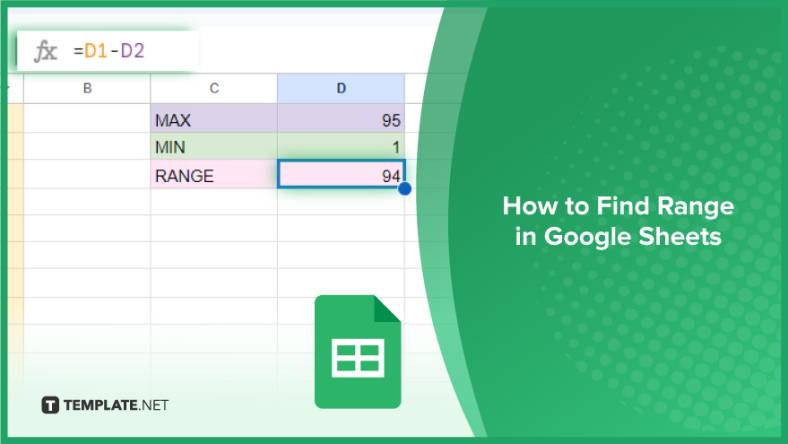

Google Sheets simplifies the process of statistical analysis, particularly in calculating the range of a data set. This guide will walk…

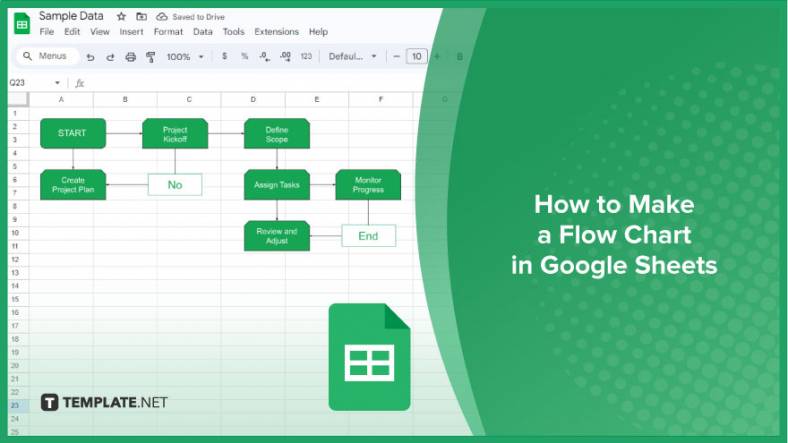

Google Sheets is a popular spreadsheet application that offers a variety of features that can be used to create flow…

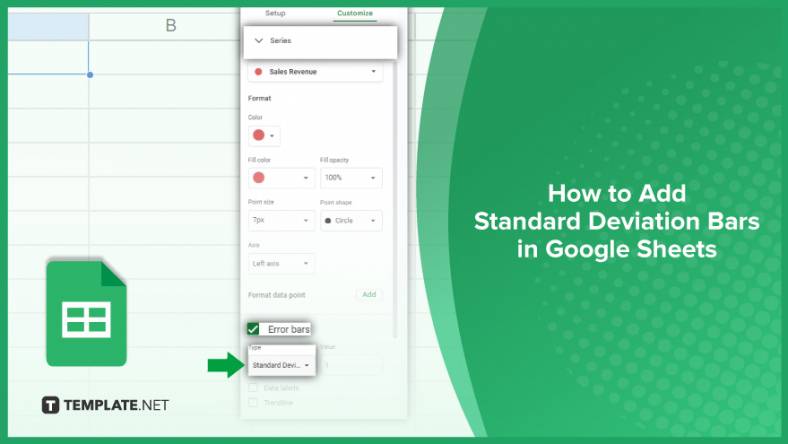

Standard deviation, a key statistical measure for gauging data variability, plays a crucial role in fields like finance, science, and…

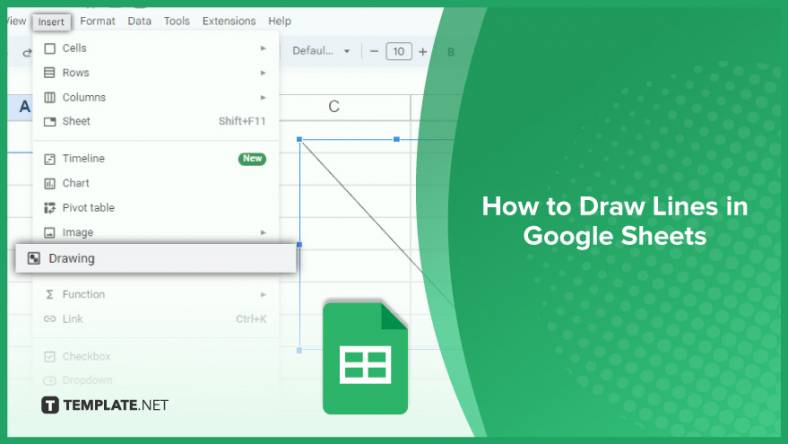

Google Sheets is a versatile spreadsheet application that allows for a variety of formatting options, including the addition of lines. This…

Personal loan trackers are one of the ways people can manage the finances of their property and gain financial power…