Table of Contents

Payslip

A payslip is an important document in human resource management that provides the necessary information regarding an employee’s earnings. The issuance of a payslip is a function and responsibility of the human resources department, specifically the compensation and benefits officer or specialist.

Payslip Definition & Meaning

A payslip is a document that details the total earnings, deductions, and net pay of an employee for a service or job rendered.

Ideally, payslips are given every payday or every pay period; and they can either be printed the traditional way or sent as an electronic payslip.

What Is a Payslip?

A payslip is a formal document that is issued whenever an employee receives their salary. It is sometimes referred to as a paycheck or a pay stub. Issuing a payslip is common practice and in most states and cities, companies and businesses are required by law to provide payslips to all their employees.

10 Types of Payslip

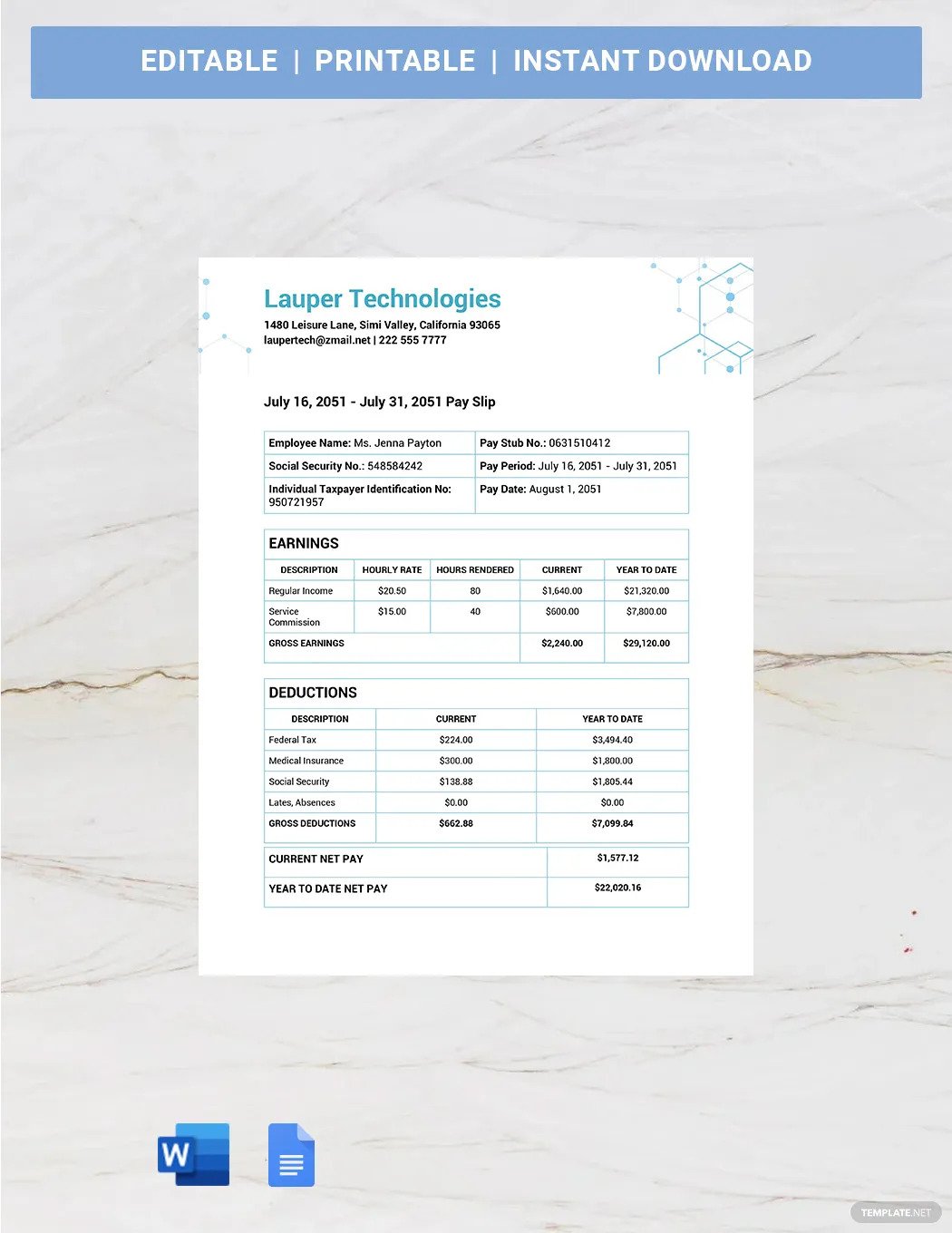

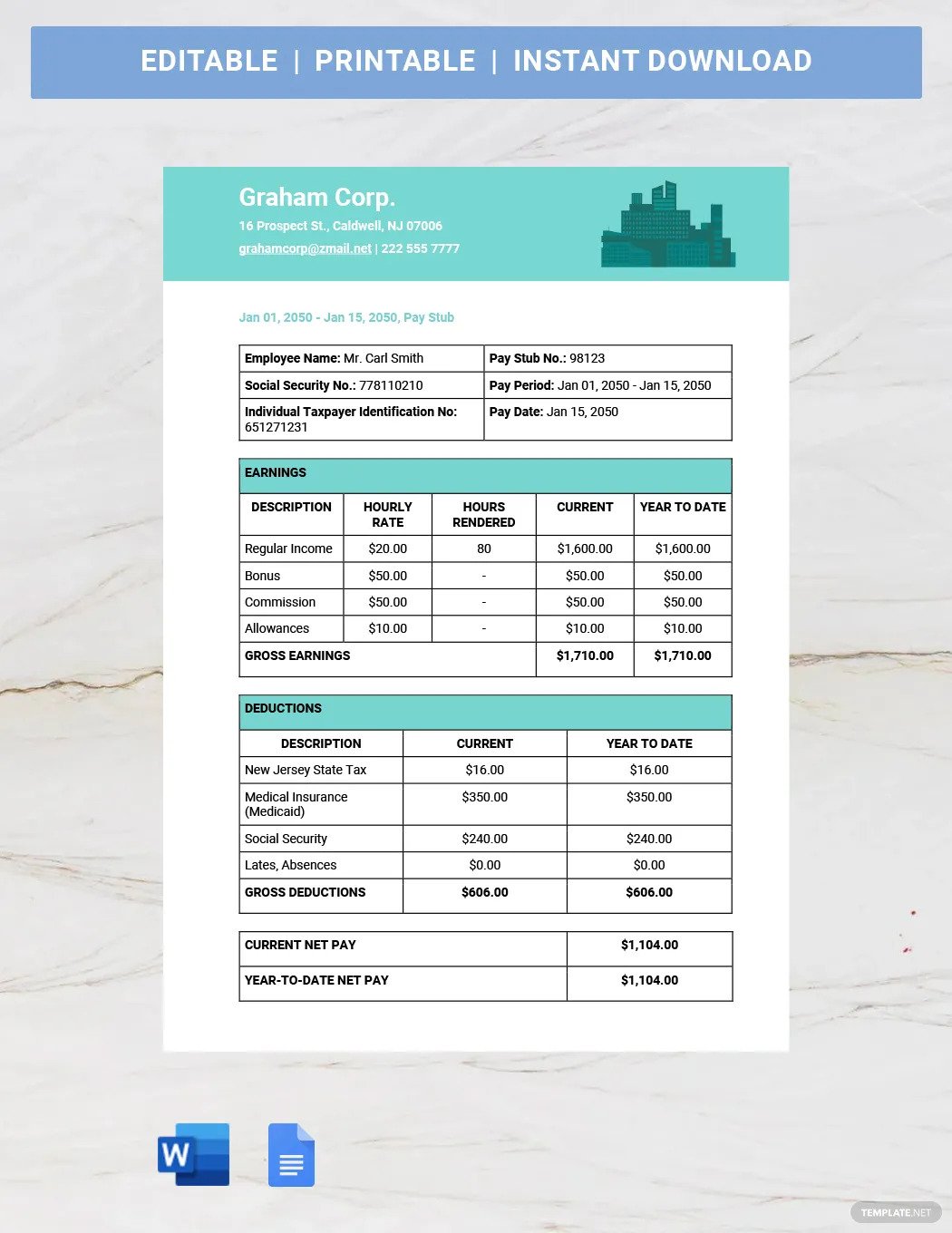

Bi-Weekly Payslip

Payslips are a basic human resource management document and they are important for payroll, compensation, and benefits. In most companies, a month’s salary is split into two and given every two weeks. A bi-weekly payslip covers one pay period- typically the first half of the month and the last two weeks of a month.

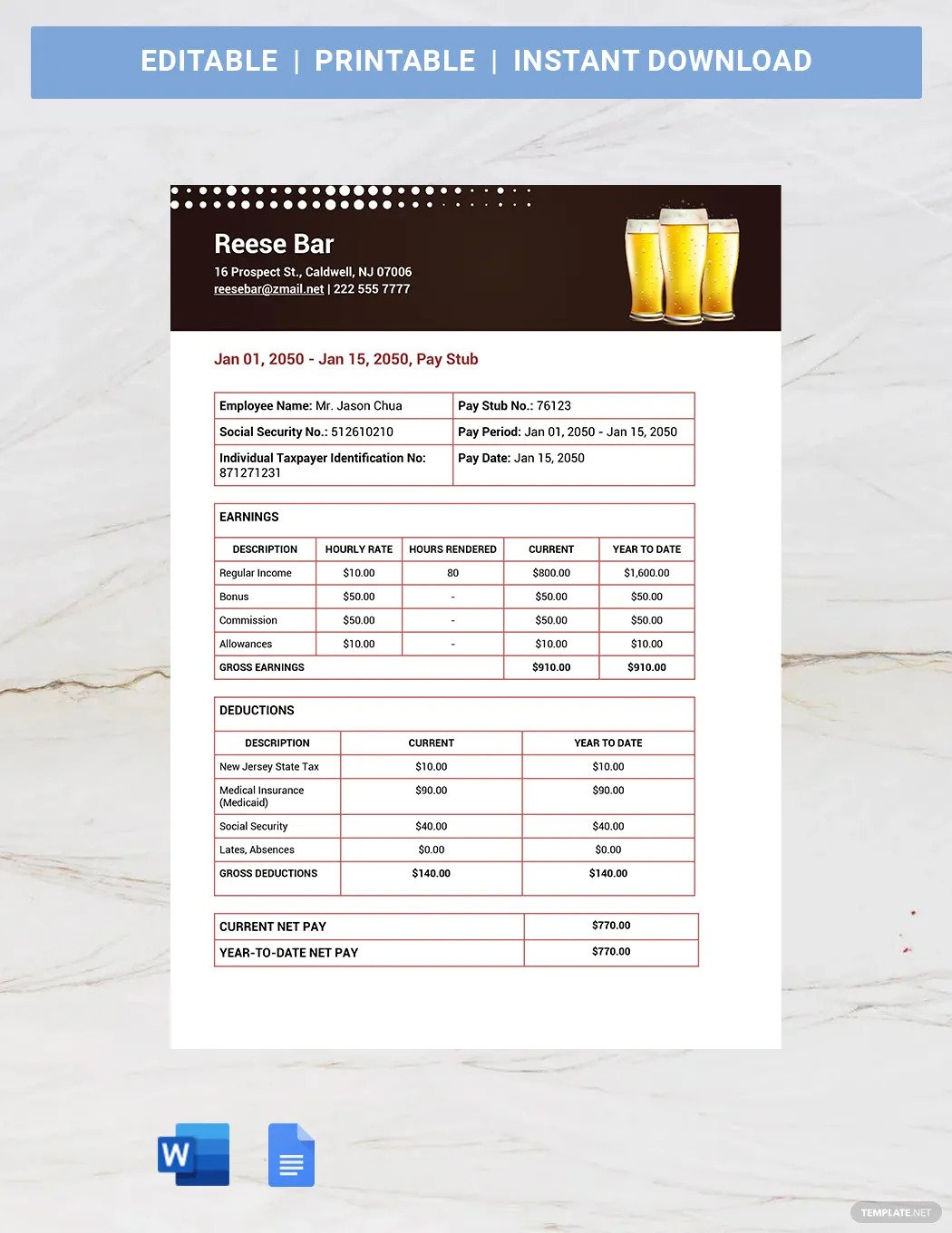

Restaurant Payslip

The food business and restaurant industry are just like any structured organization. Employees are hired and paid to do various types of jobs ranging from food preparation to customer service to packaging and distribution. For people who work in dining establishments and the food service industry, it is the management’s responsibility to issue a restaurant payslip to all their employees every pay period.

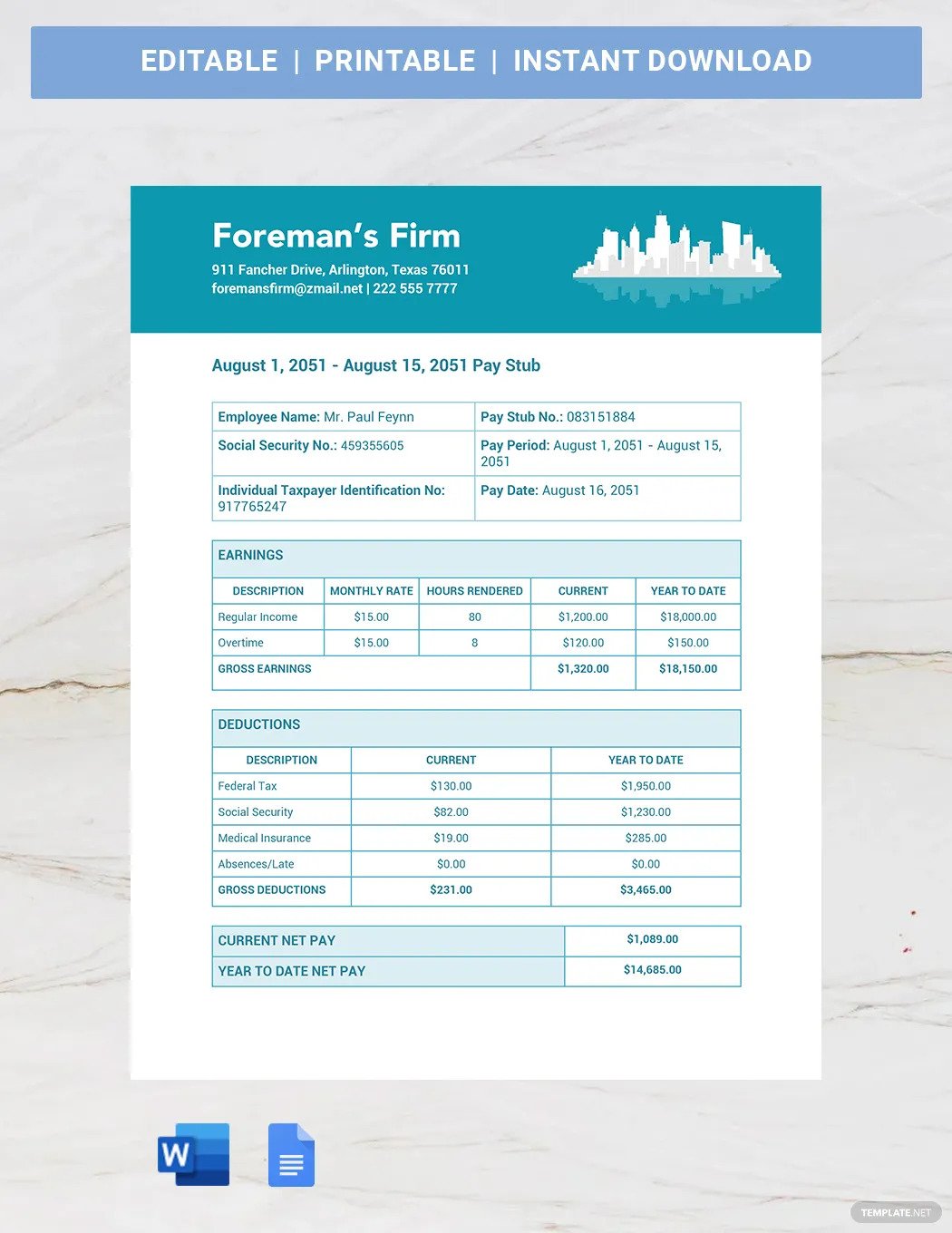

Contractor Payslip

If you work as an independent contractor, you are not exempt from following standard protocol when it comes to compensation practices. Whether the employee is a full-time and tenured worker or is a project-based hire, it is important to provide a contractor payslip whenever a salary is given. When creating a payslip, do not forget to include key information such as the employee’s taxpayer identification number and social security number.

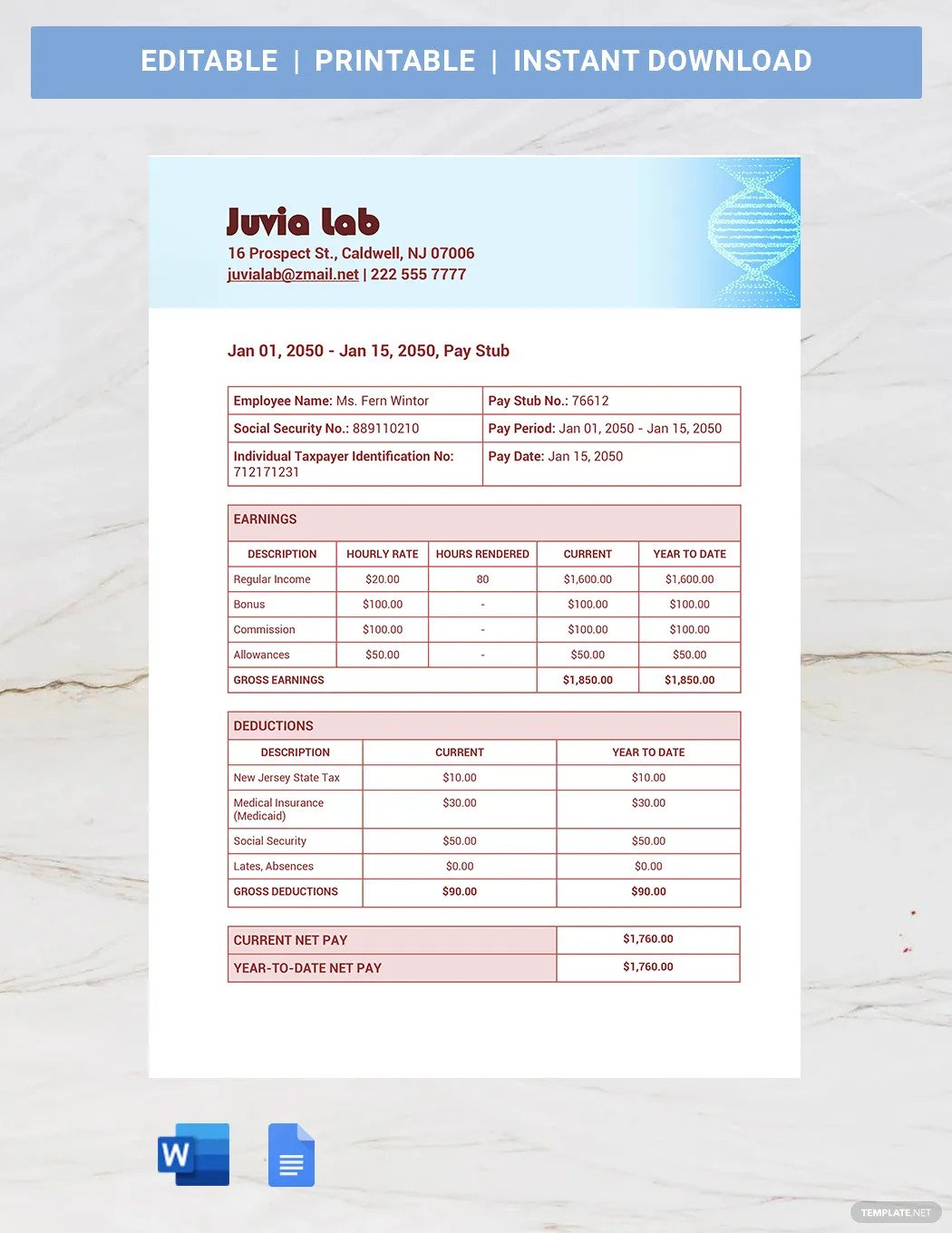

Salary Payslip

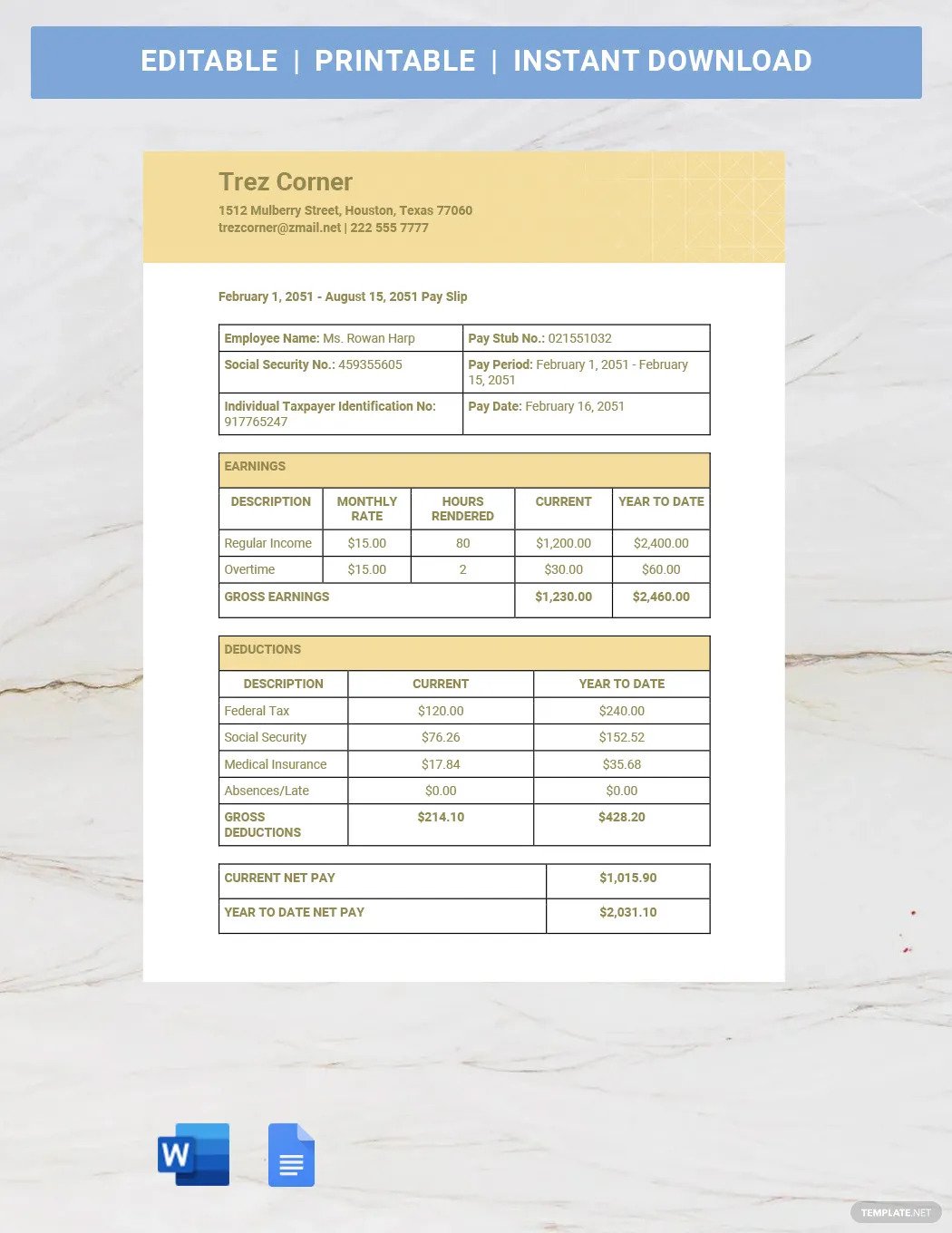

Payslips help the employee gain a better understanding of their compensation on a regular basis. With a salary payslip, the worker is able to see not just how much their take-home pay is, but also how much is deducted from their salary for a given payroll period. Thus, a payslip should always include a detailed breakdown of both the employee’s earnings and deductions.

Worker Payslip

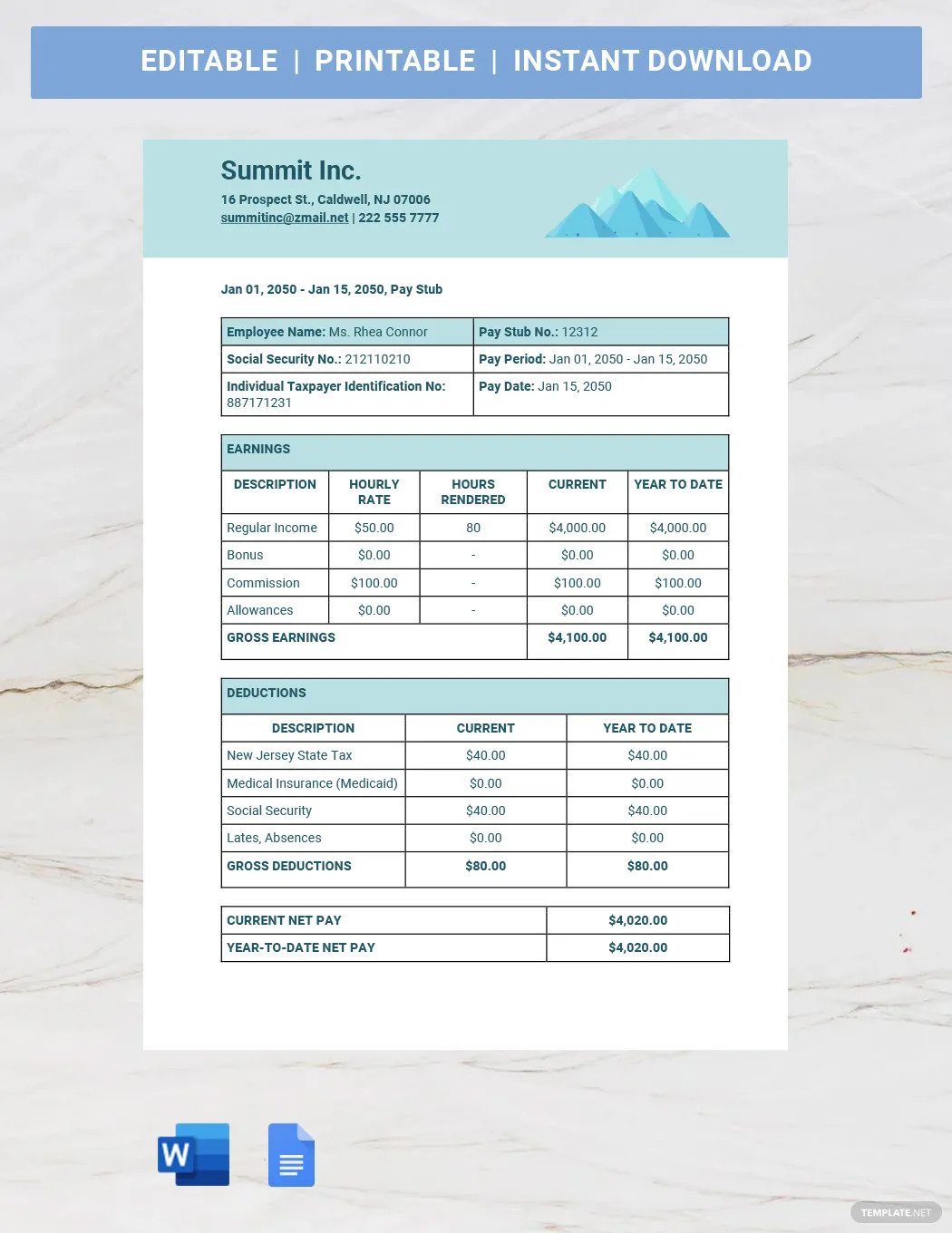

Regardless of industry or sector, a worker is entitled to a payslip each time their salary is released. A worker payslip ought to contain a number of basic components. These components include the employee’s information, company information, total earnings, total deductions, current net pay, and year-to-date net pay.

Consultant Payslip

In some cases, consultants are part of a company’s regular payroll. They are often regarded for their expert opinions and professional advice and are paid just like any other employee or worker. A consultant payslip has a similar format to a regular payslip but it can vary in content, depending on the consultant’s specific role in the company.

Generic Payslip

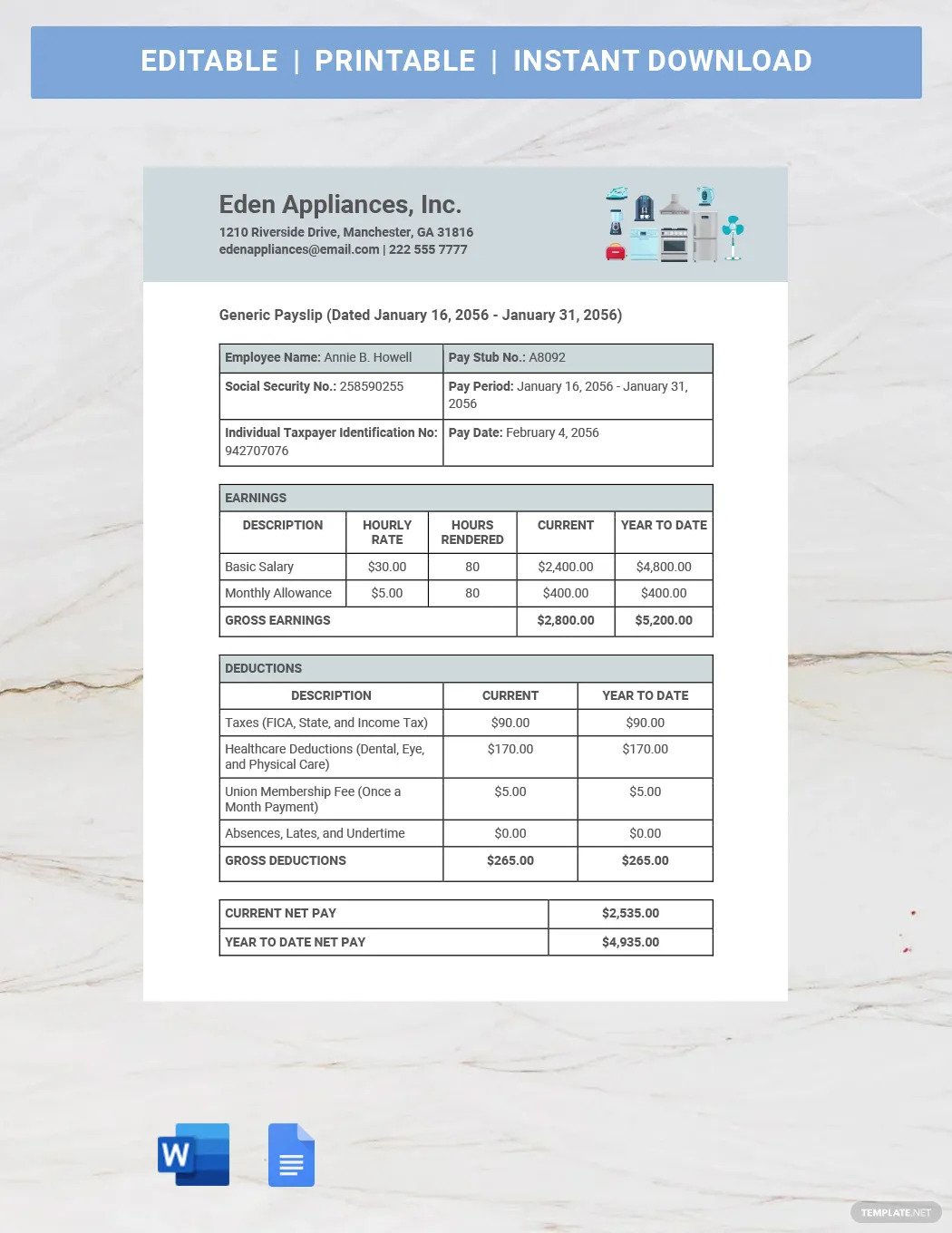

A generic payslip can be given to all workers, regardless of employment status. It contains a standard format and can easily be edited to suit one’s needs and objectives. For example, the payslip template below already has a predesigned table for earnings and deductions, all you need to do is input the specific values or amounts.

Rental Payslip

Leasing out spaces or equipment can be a very lucrative and profitable business. In the case of rentals, it does not even require that much manpower or labor compared to other business ventures. Still, a rental payslip must be issued to any employee hired- whether full-time or part-time.

Self-Employed Payslip

If you are an entrepreneur or you operate your own small business, you owe it to your employees to be transparent and fair in disclosing their compensation and benefits. Issuing a payslip on a regular basis is just one way of promoting transparency. A self-employed payslip should contain a specific breakdown of the source of earnings as well as a detailed description of each deduction.

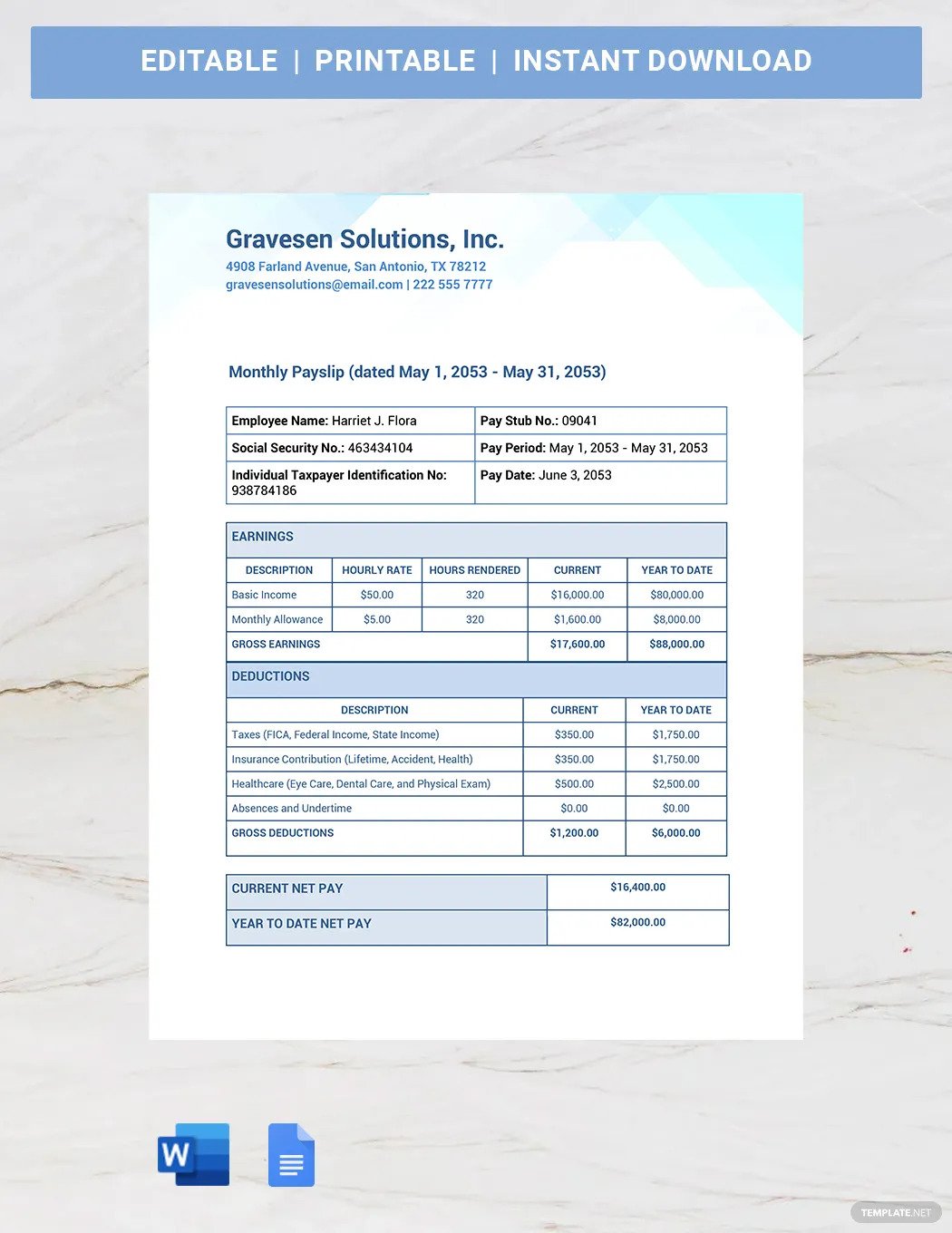

Monthly Payslip

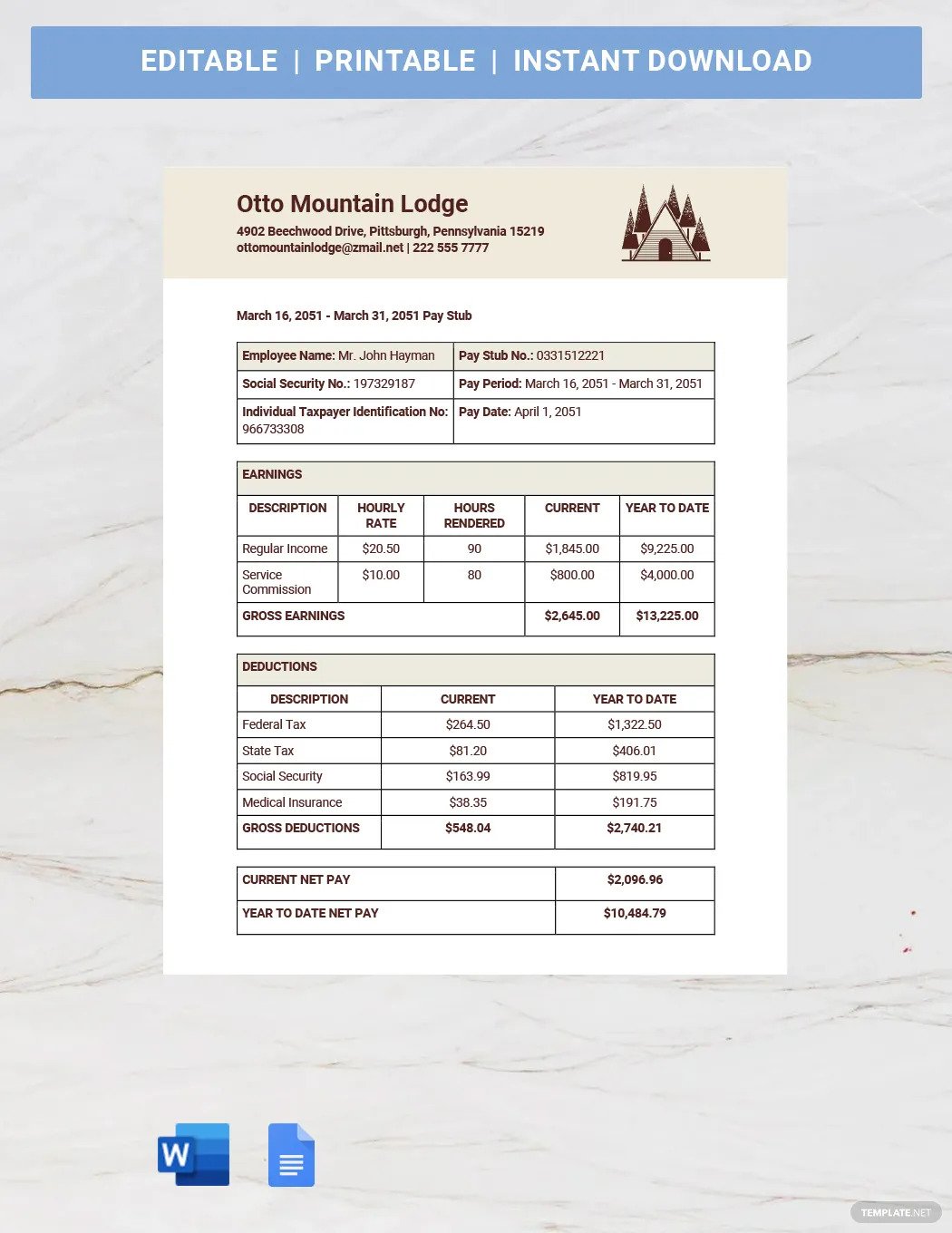

There are cases wherein an employer may give a worker a whole month’s wages instead of a bi-weekly payout arrangement. Even if the payslip is only issued once a month, the format of the payslip should remain constant. Aside from the detailed breakdown of earnings and deductions, the current net pay and the year-to-date net pay are also vital components that should be stated in a monthly payslip.

Payslip Uses, Purpose, and Importance

A payslip is a payroll document that serves various purposes and caters to multiple parties. It is useful not just for the employee, but for the employer as well.

Proof of Compensation

The primary purpose of a payslip or paycheck is that it serves as formal proof of compensation. When you are given salaries or wages for any kind of work, a payslip should come with it. In the payslip, you can check and review your total earnings or salary based on your contract of employment.

Bank Requirement

A payslip is also very useful when it comes to bank transactions and applications. If you plan on opening a bank account, there are certain requirements that you must comply with in order to open one. A copy of a recent payslip is just one of the many supporting documents that banks typically ask applicants and clients to submit.

Keep Track of Deductions and Contributions

In addition to earnings, deductions are also a key component of a payslip. As much as possible, you want to know where these deductions go and how much is subtracted from your total income. Be it absences, undertime, taxes, or government contributions, these are important details that you should not overlook.

Manage One’s Income

If you have a steady job, you obviously want to know how much your take-home pay is after working hard on the job. A payslip provides important information such as your net pay, which is your total pay minus all the deductions for a certain payroll period. You can use this information to better monitor or manage your income and finances.

Employment Confirmation

A payslip can also be a mode of confirming or verifying employment. If for any reason, a certificate of employment cannot be issued, a payslip document can be a substitute to confirm employment. Some agencies and establishments require employment verification and by providing a copy of a payslip, there is hard evidence of one’s earnings.

What’s in a Payslip?

Employee Information

In addition to the pay date and pay period, a payslip must always contain basic information about the employee. This includes the employee’s complete name, tax identification number, social security number, and other relevant details.

Company Information

In a payslip, the company information is normally located at the top of the page. Make sure to include the complete company name, business address, and contact details.

Earnings

A payslip is essentially a summary or breakdown of an employee’s earnings. It is not enough to simply state the income for the current pay period; you also need to identify and specify the hourly rate and calculate the employee’s gross earnings.

Deductions

Another main element of a payslip is the deductions. Absences and tardiness can contribute to deductions but most employees are also subject to other types of deductions such as government taxes, mandatory contributions, and medical insurance.

Net Pay

It is important to state the net pay in each and every payslip. The net pay, or take-home pay, is the total earnings after all the subtractions and deductions have been made.

How to Design a Payslip

1. Choose a Payslip Size.

2. Specify the objective of the payslip.

3. Select a Payslip Template.

4. Input the complete employee and company information.

5. Itemize each of the earnings and deductions.

6. Calculate the net pay and the year-to-date net pay.

Payslip vs. Paycheck

A payslip is a document that accompanies an employee’s salary or paycheck.

A paycheck is a form of payment that an employer hands to an employee in exchange for the latter’s labor or services; the check can be cashed in or deposited in a bank account.

What’s the Difference Between a Payslip, Payroll, and Payment?

A payslip is sometimes called a pay stub and it is basically a document that serves as proof of compensation or salary.

Payroll refers to a list of workers entitled to wages or the process of compensating employees within an organization or company.

A payment is an act or process of transferring money or services in exchange for labor, goods, etc.

Payslip Sizes

A payslip is a formal document that usually requires a certain format. Although the right size would depend on the employer’s preferences and needs, there are a few standard payslip sizes to choose from.

- US Letter Size (8.5 Inches × 11 Inches)

- Legal Size (8.5 Inches × 14Inches)

- A4 Size (8.3 Inches × 11.7 Inches)

Payslip Ideas & Examples

Payslips are pretty standard across all industries and sectors. Whether it is the hospitality sector or the information technology industry, a payslip is a universal HR document. However, there are a few variations when it comes to content and format, as illustrated in some payslip ideas and examples that you can find online.

- Basic Payslip Ideas and Examples

- Weekly Payslip Ideas and Examples

- Simple Payslip Ideas and Examples

- Blank Payslip Ideas and Examples

- Worker Payslip Ideas and Examples

- Bi-Weekly Payslip Ideas and Examples

- Monthly Payslip Ideas and Examples

- Salary Payslip Ideas and Examples

- Self-Employed Payslip Ideas and Examples

- Generic Payslip Ideas and Examples

FAQs

What should be included in a payslip?

The main components that should be included in any payslip are employee and company information, a breakdown of total earnings, deductions, and the employee’s net pay.

Can you create your own payslip?

Yes, you can easily and conveniently create your own payslip with the use of a ready-made template.

What does a blank payslip mean?

A blank payslip is a payslip that is either incomplete or lacks any relevant information, but it can also refer to a payslip template that has yet to be filled out.

How can payslips be verified?

Payslips can be verified in a number of ways such as company payroll verification and bank validation.

Are payslips mandatory?

In most cases, payslips are a legal requirement but it is also a widely common practice to issue a payslip or pay stub to all employees every payday.

What is a payslip portal?

A payslip portal is an online platform that employees use to view or access their electronic payslips and other related documents.

What to do if your employer does not give you a payslip?

If your employer fails to issue a payslip, you need to explicitly request it from them and if they still do not give it to you, then the next step would be to explore legal options or avenues.

What font is used for payslips?

Most payslips use classic fonts such as Times New Roman, Arial, Calibri, or Verdana.

What are e-payslips?

An e-payslip simply means electronic payslip; it is basically a digital version of a traditional physical payslip which means it can be accessed online.

What is the password to open a payslip?

It depends on company protocol but payslip passwords often involve the employee’s company ID number, surname, or date of birth.

How can I get my payslip?

Your company’s compensation or payroll officer should give you the payslip but if they are unable to do so, you can directly request your payslip from HR.

Is a payslip a paycheck?

Not necessarily, a payslip or a pay stub is a document that normally goes hand-in-hand with a paycheck.

Is a salary statement the same as a payslip?

Yes, a payslip can be considered a formal salary statement.

When should I get my payslip?

You can get your payslip during every pay period, depending on your employer’s salary release schedule.

Why is a payslip important?

It is important because payslips are considered supporting documents for various pursuits such as applying for loans and opening bank accounts.