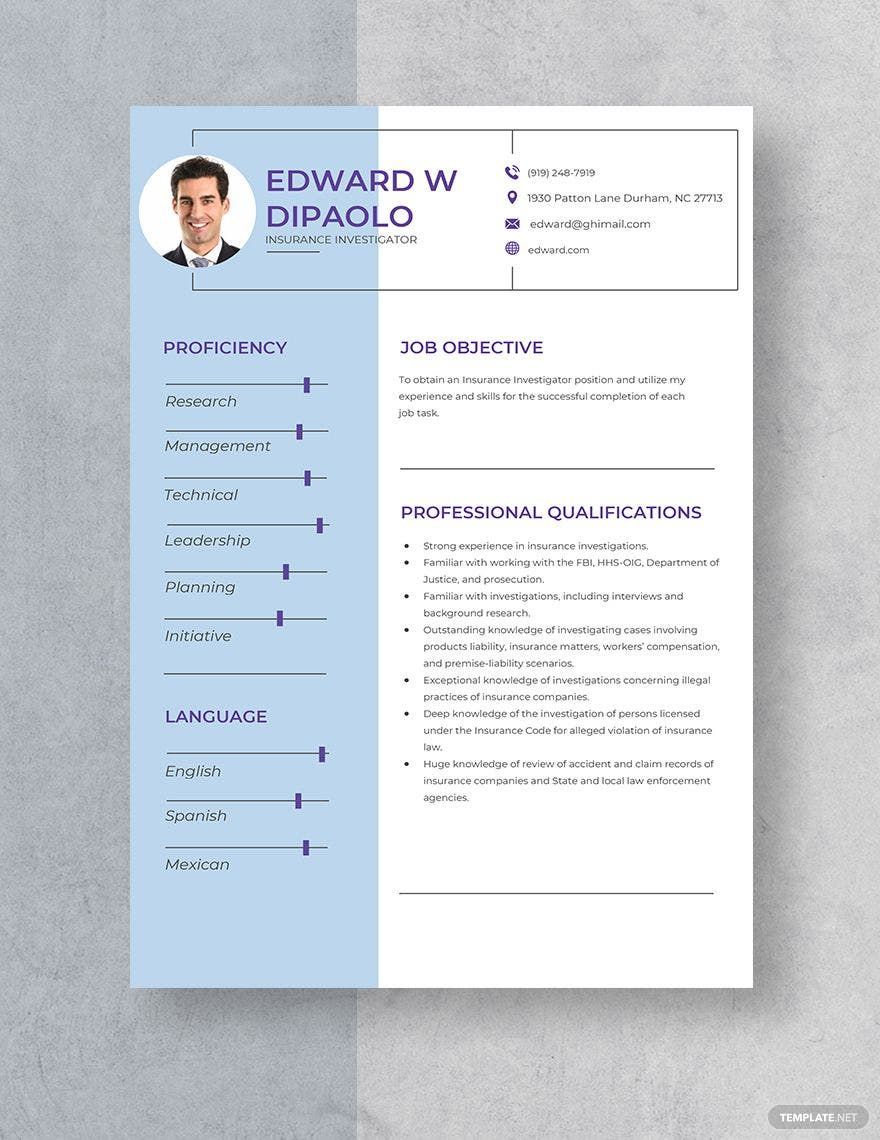

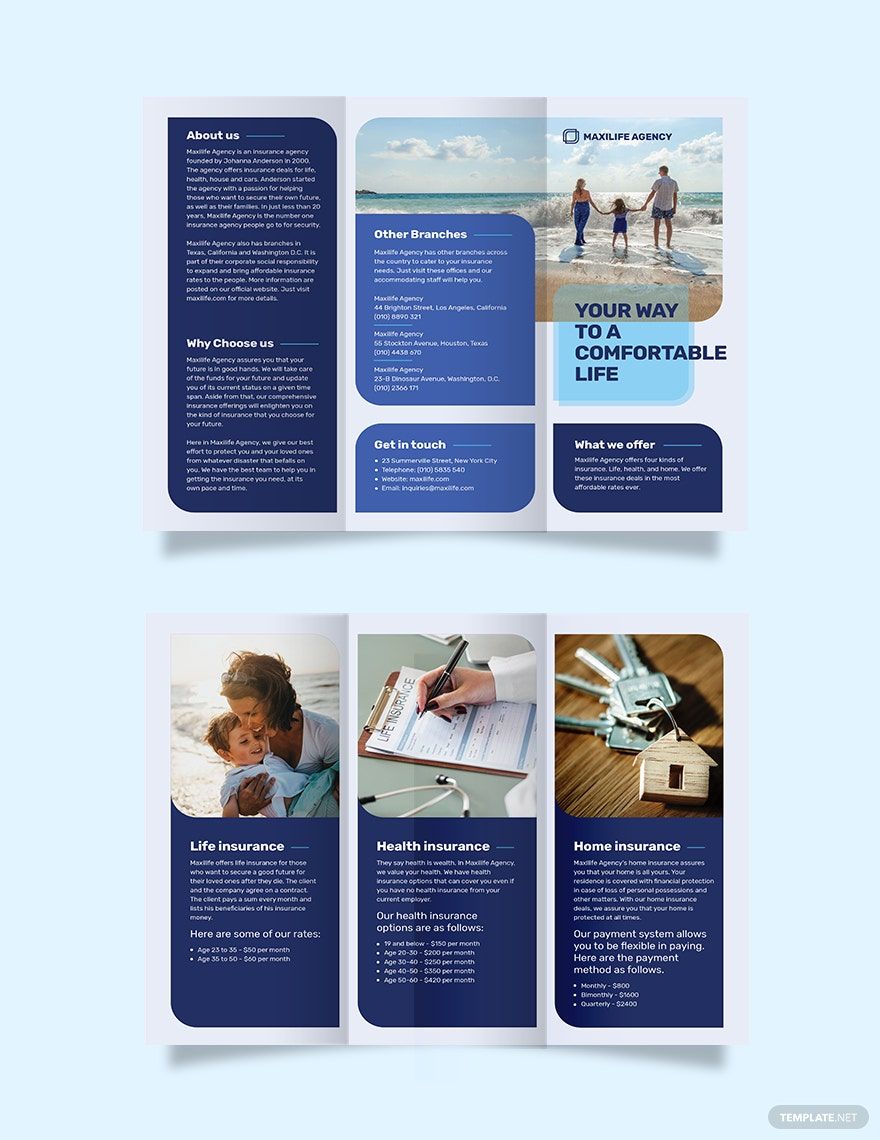

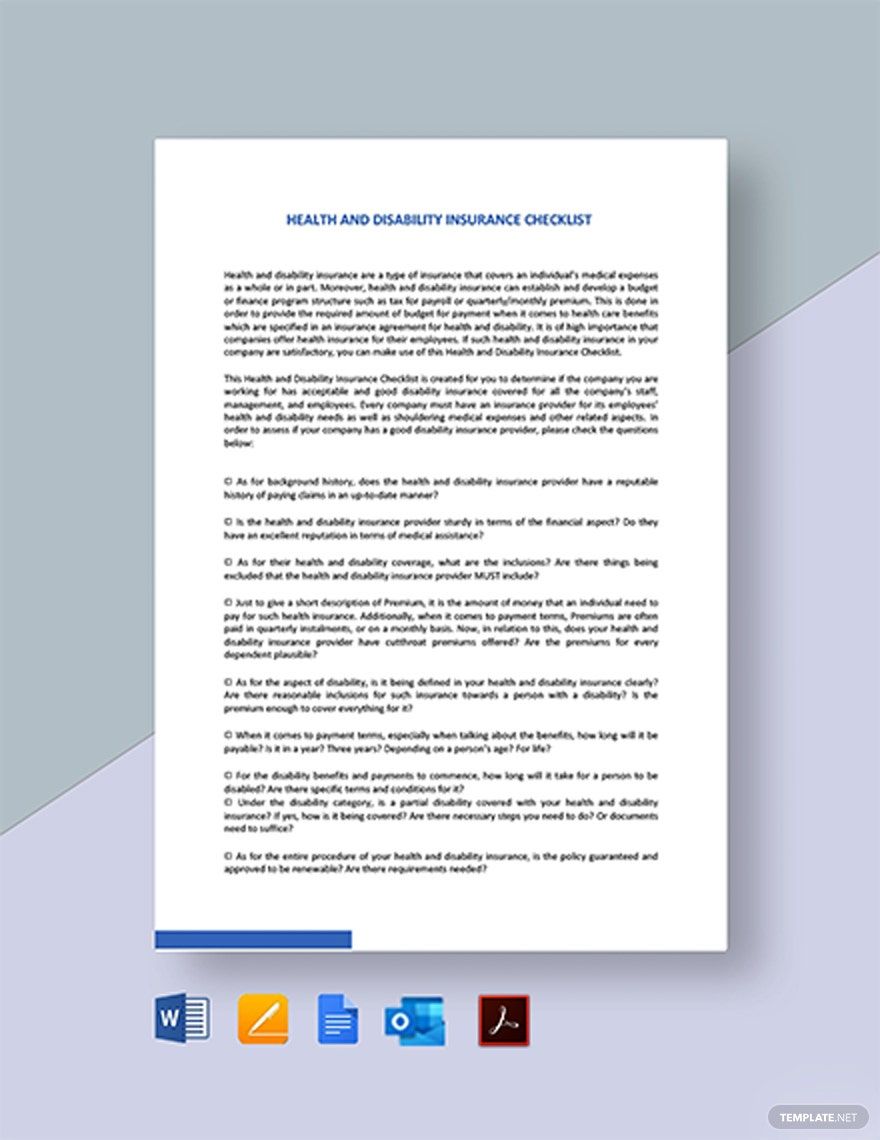

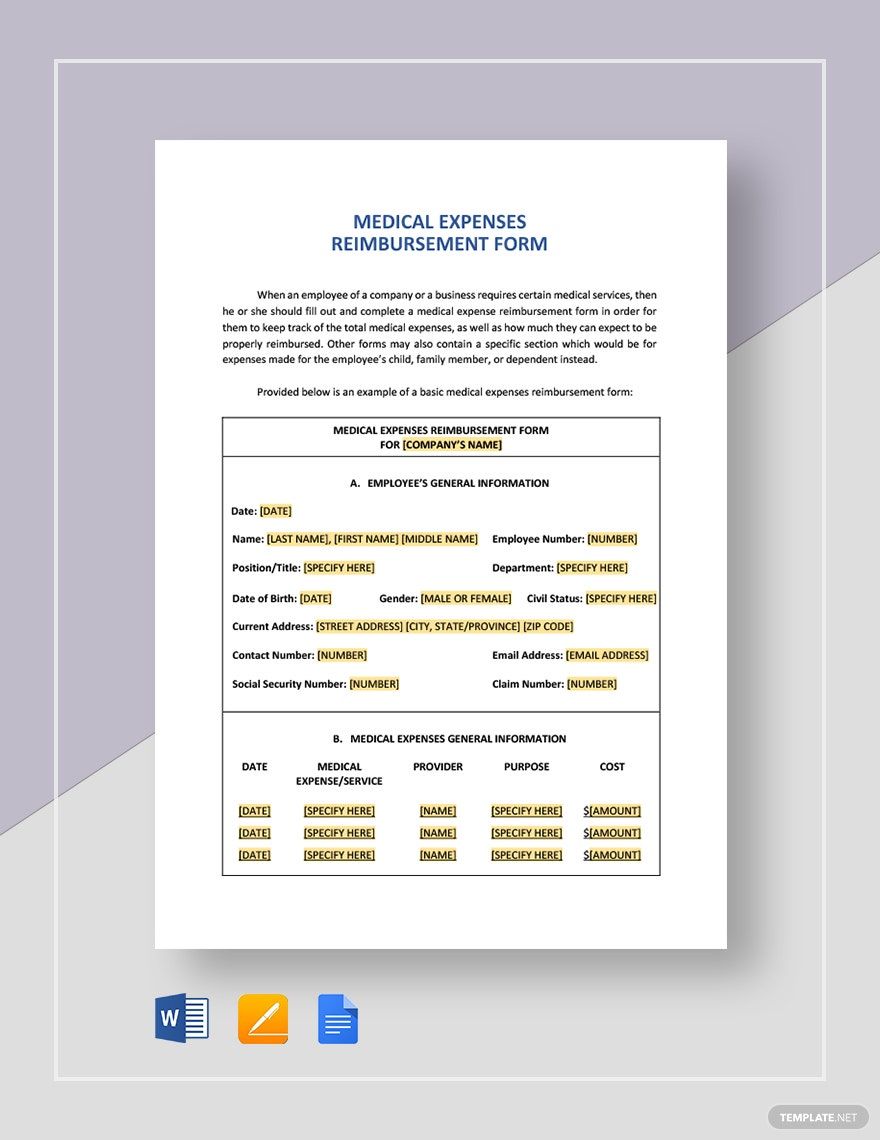

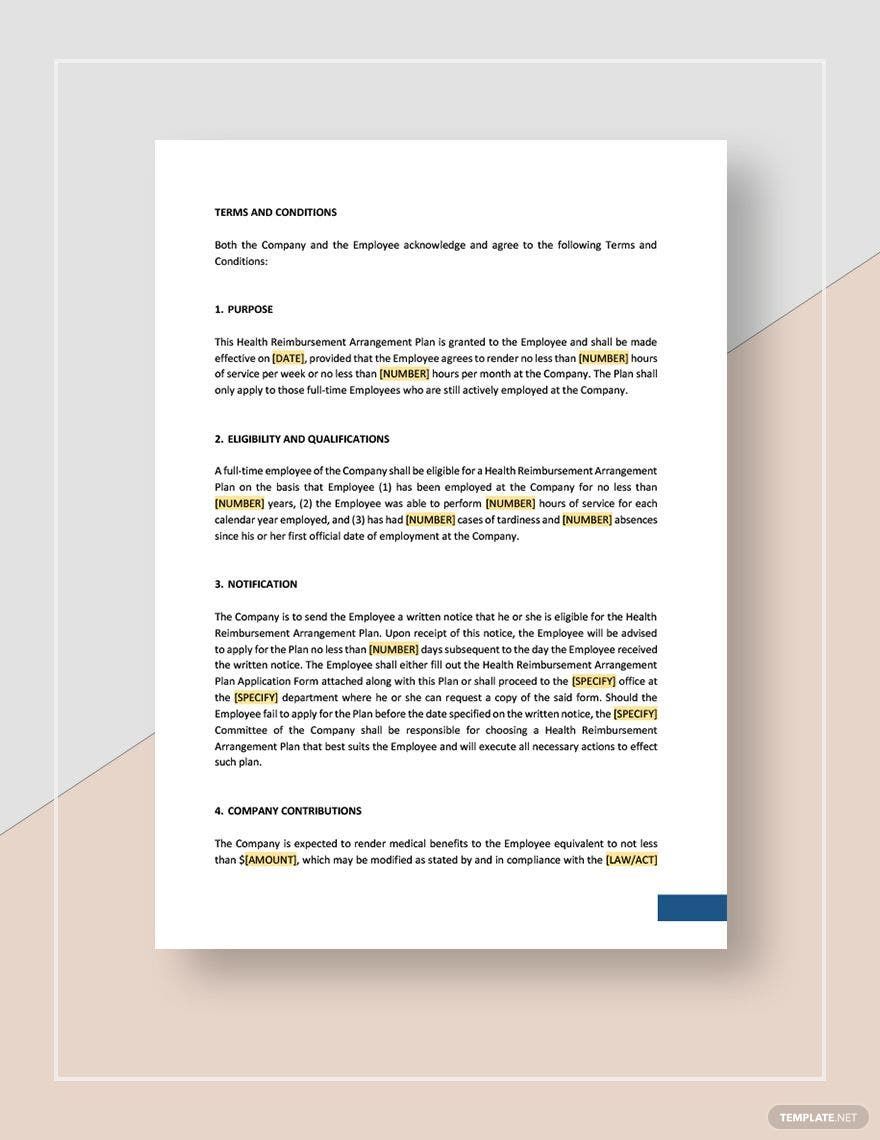

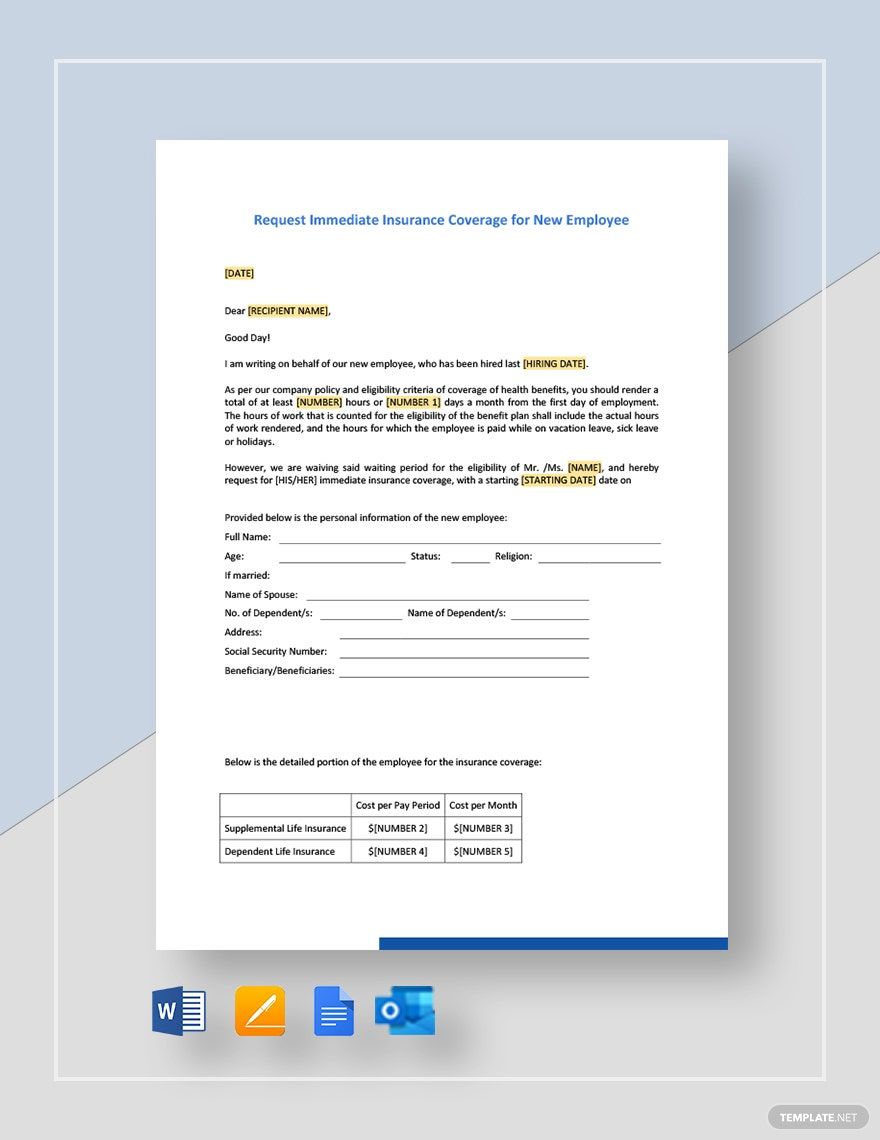

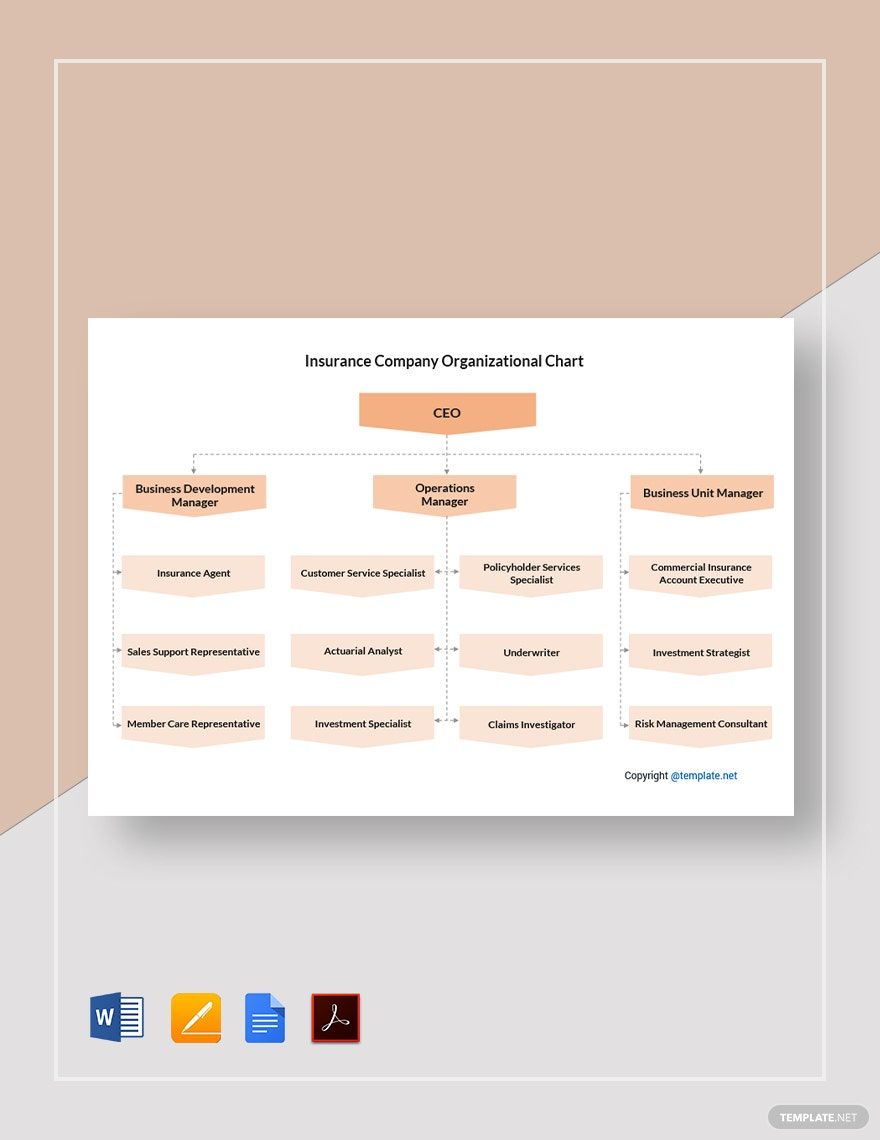

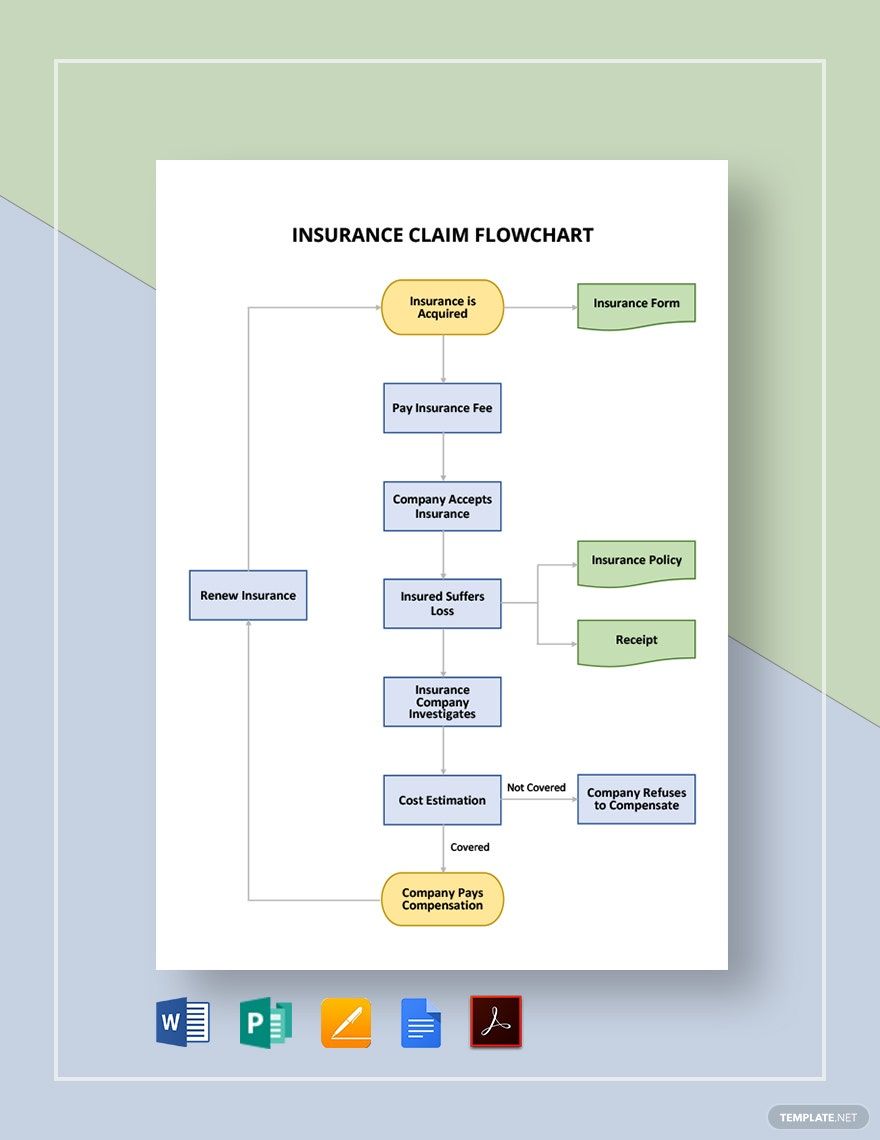

Properly address the requirements of insurance companies regarding the nature of your insurance claims with the help of our ready-made insurance templates. Forget the hassle of having to make an insurance document from scratch and simply click on the download button to purchase our subscription plan. We got it all for you, from health insurance, homeowner insurance, travel insurance, farmers insurance, medical insurance, or any insurance documents. These high-quality files are professionally-written by our legal and financial experts to help users create all kinds of important documents. They are easy to use, 100% customizable, and can be opened in any version of Apple Pages for Mac users. Convenience, versatility, and user-friendliness all rolled into one template. Act now by downloading any of our printable insurance templates!