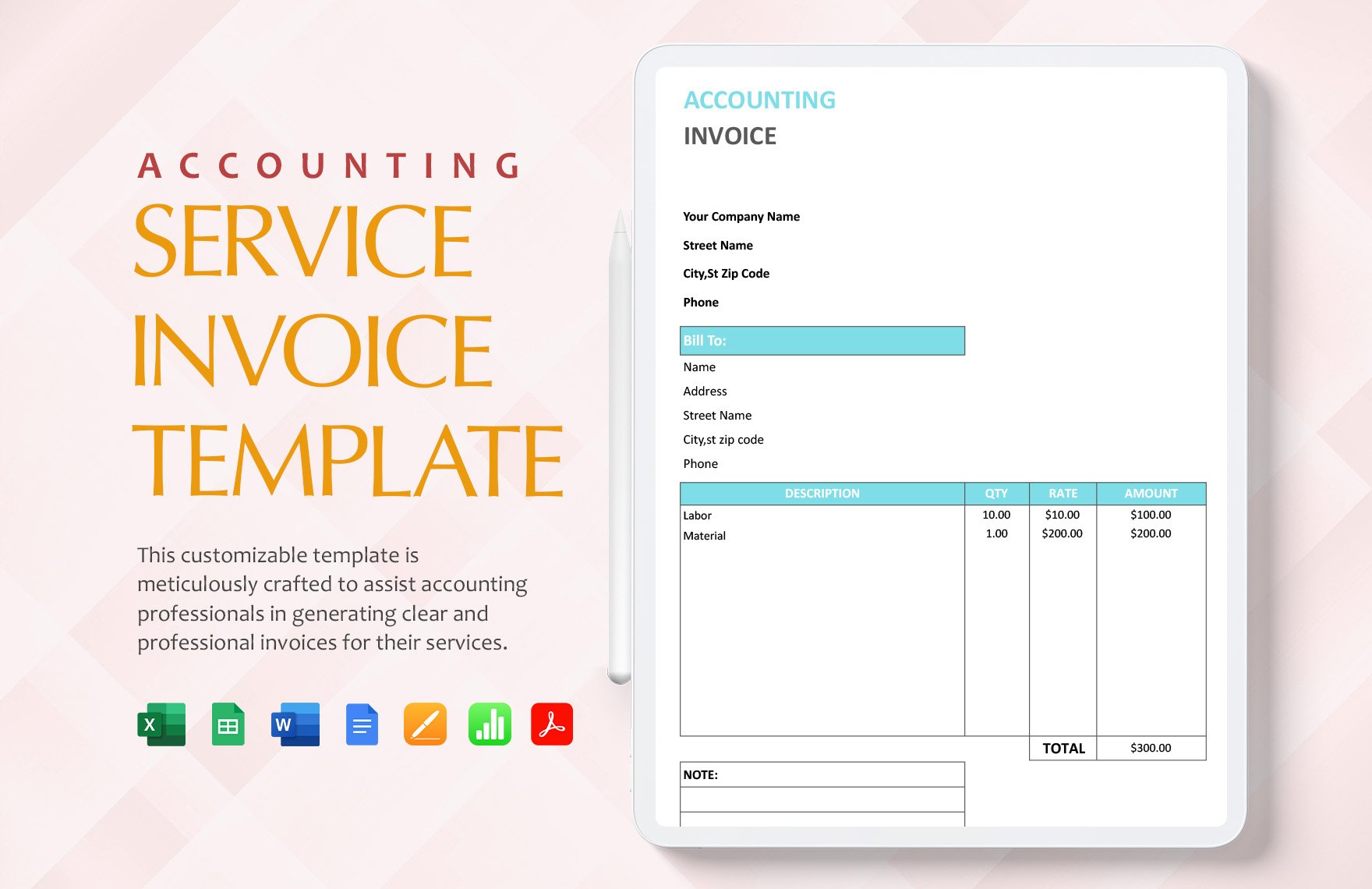

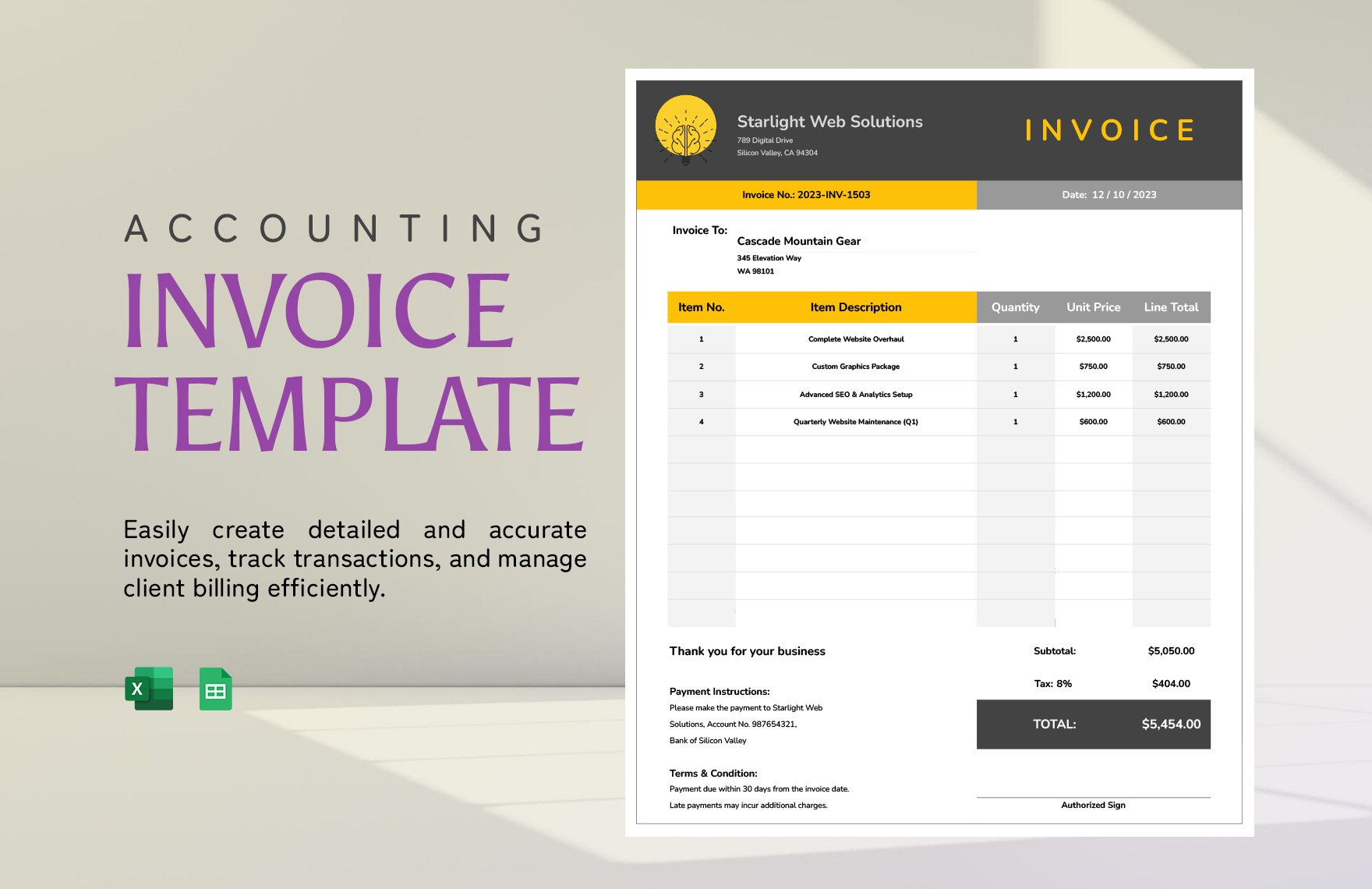

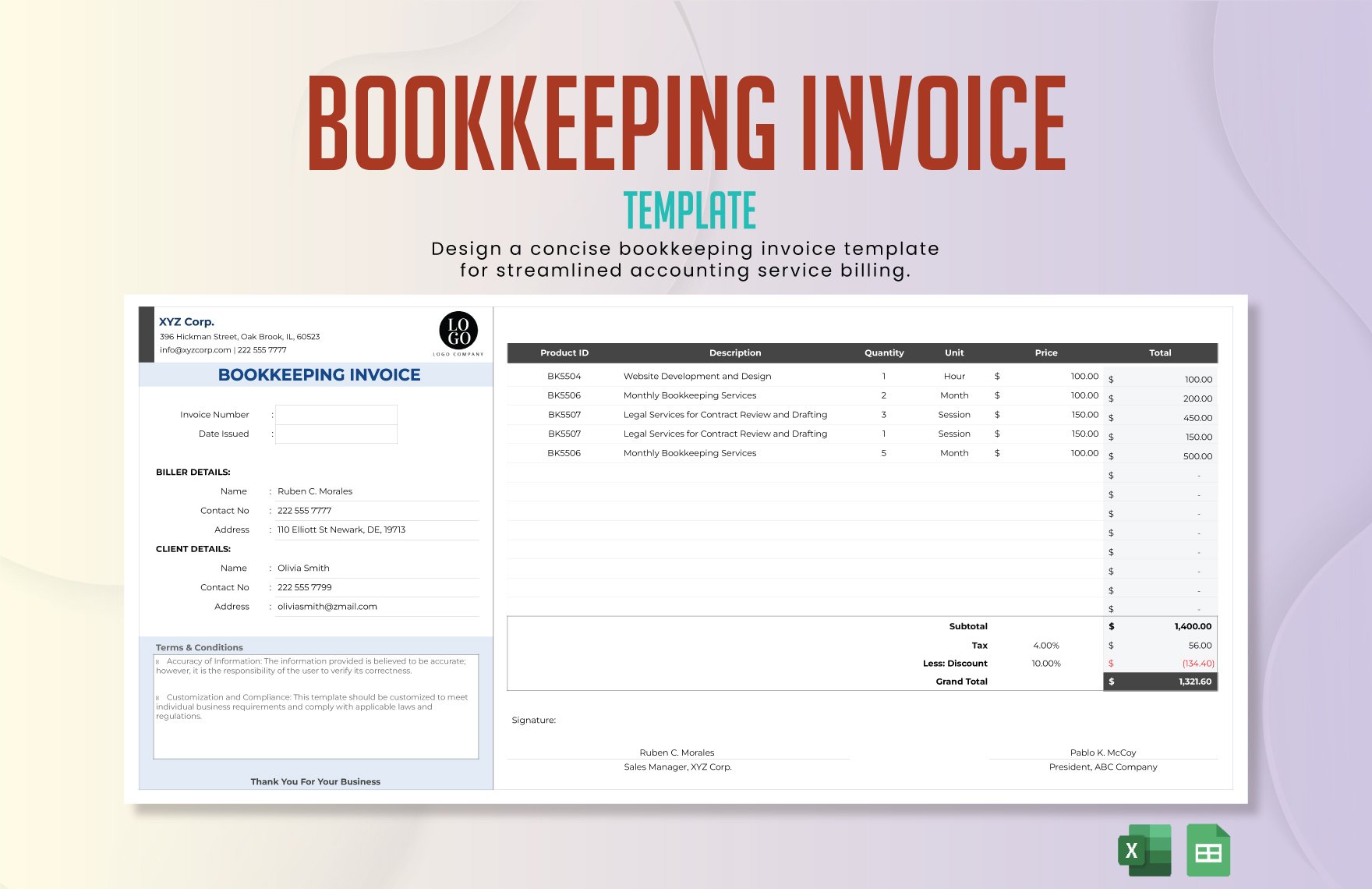

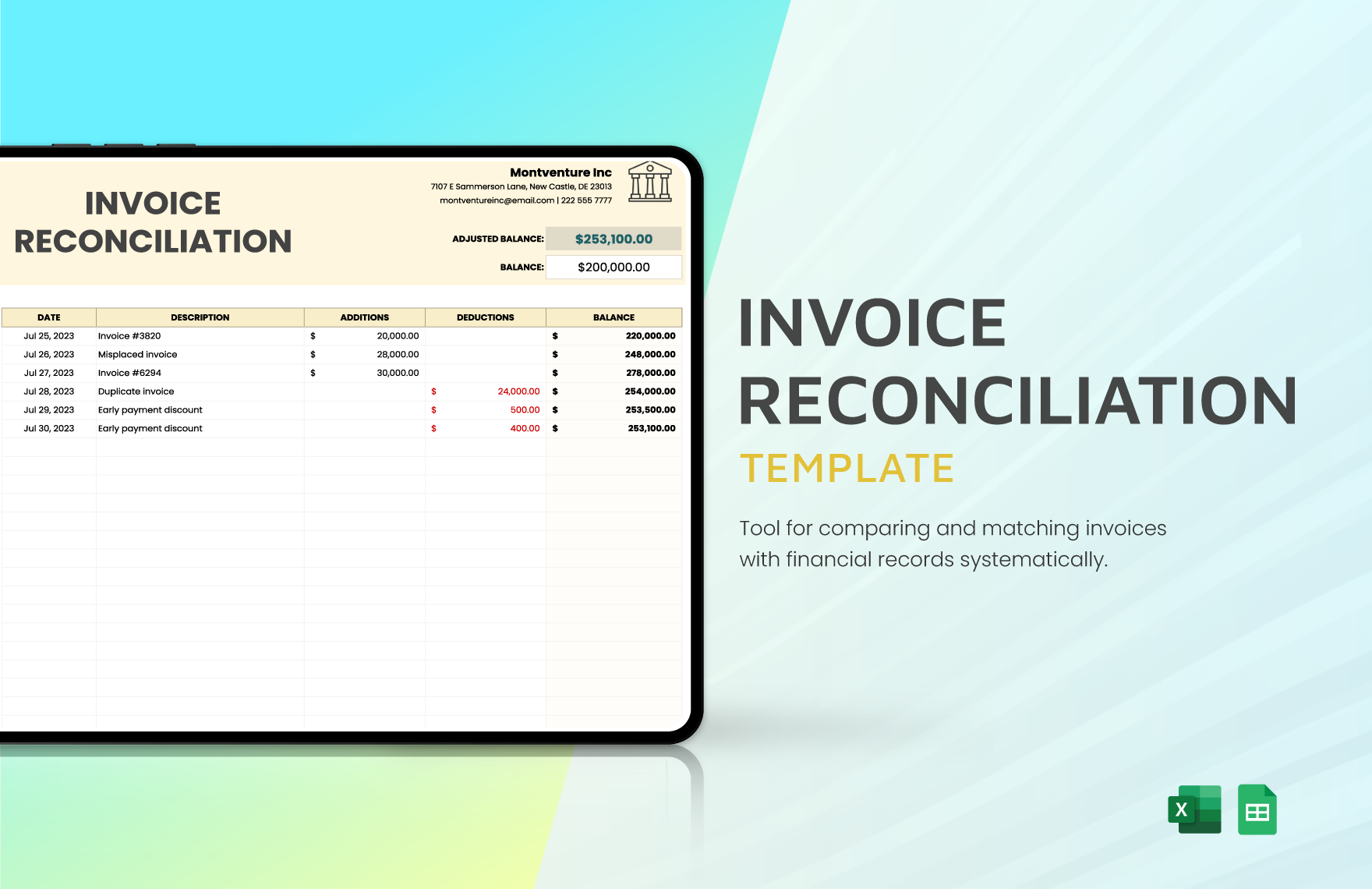

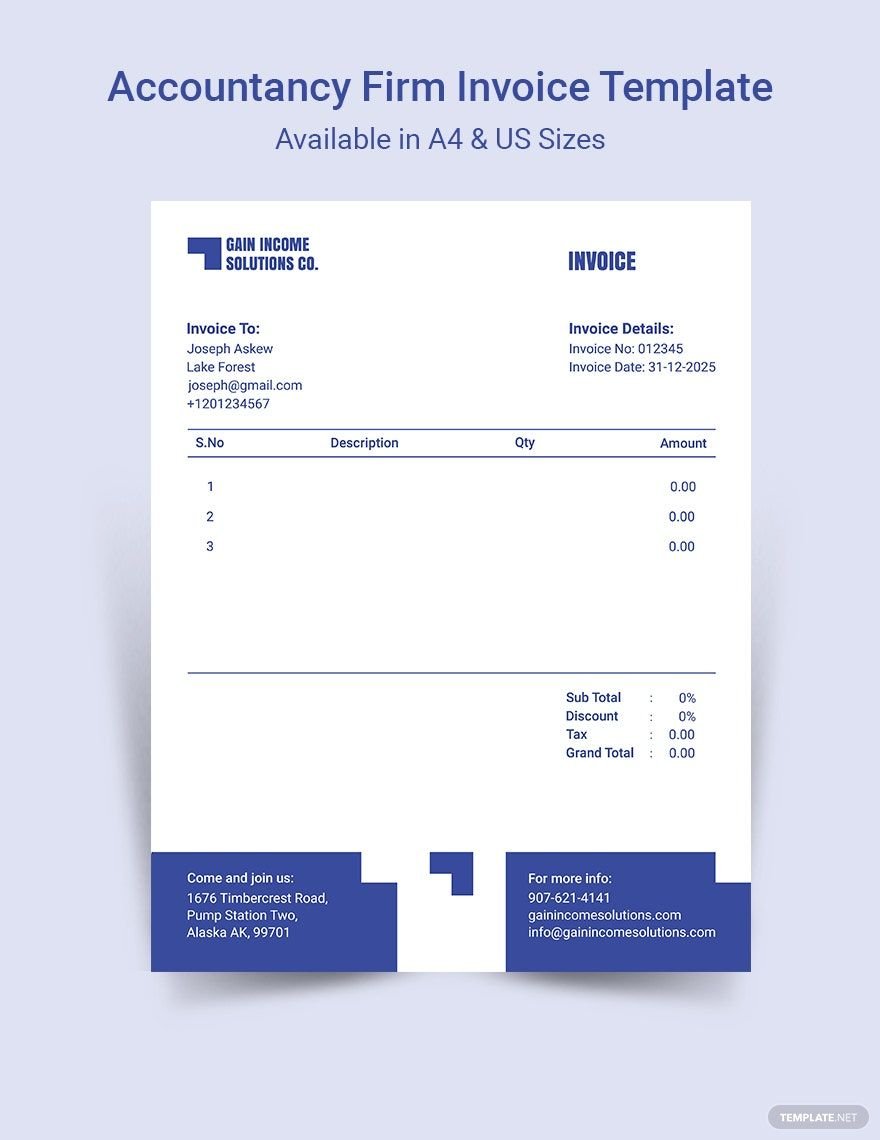

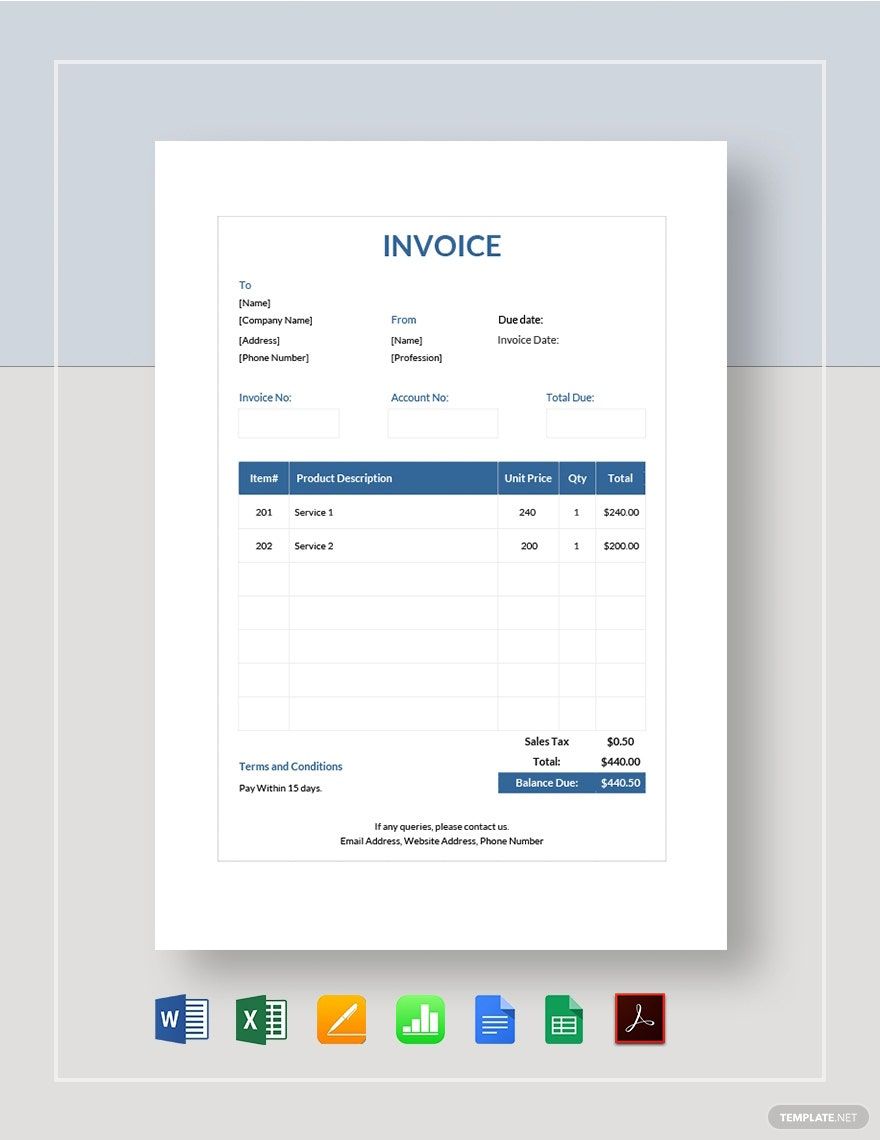

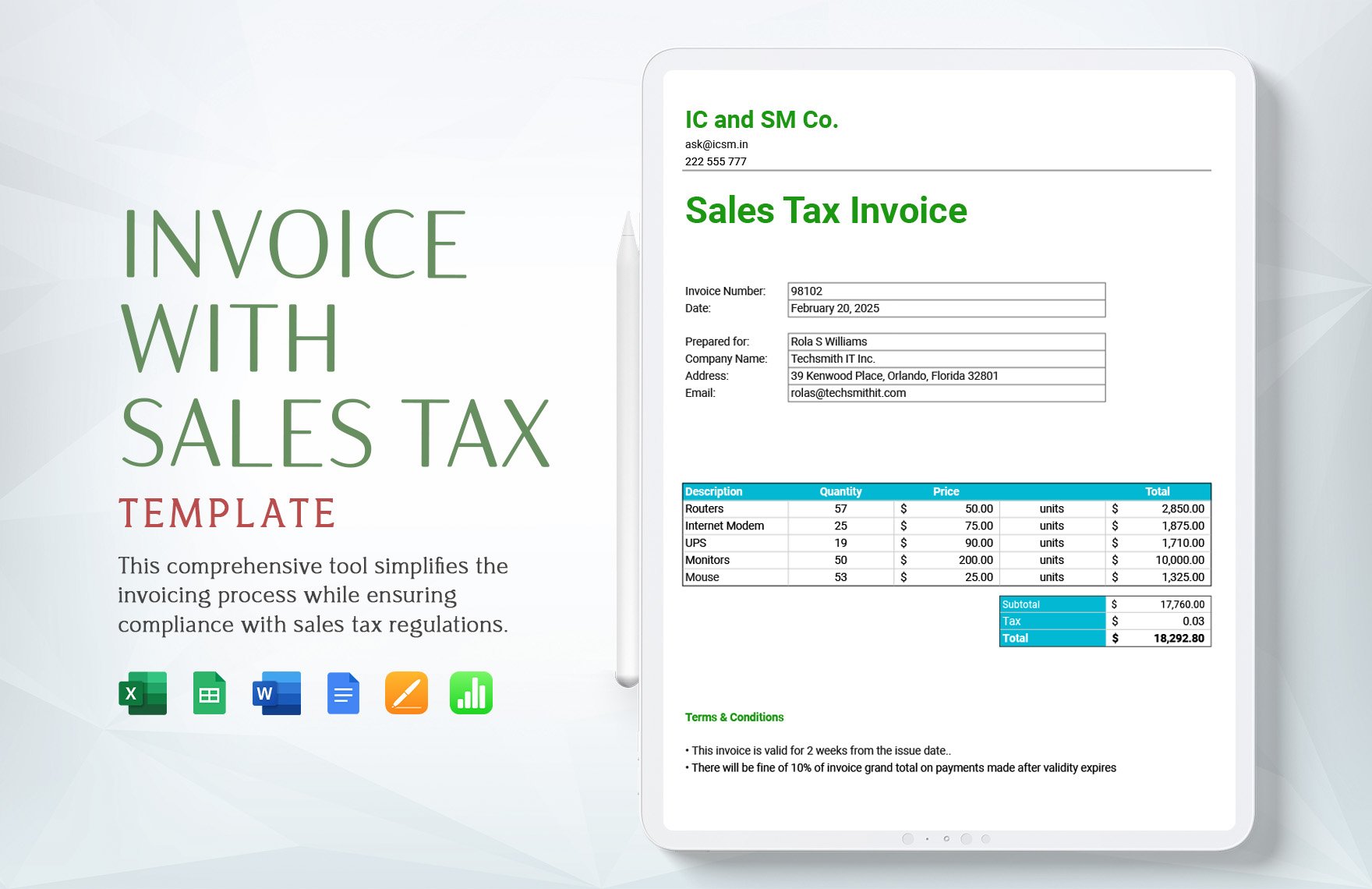

Bring Your Financial Management to Life with Accounting Invoice Templates from Template.net

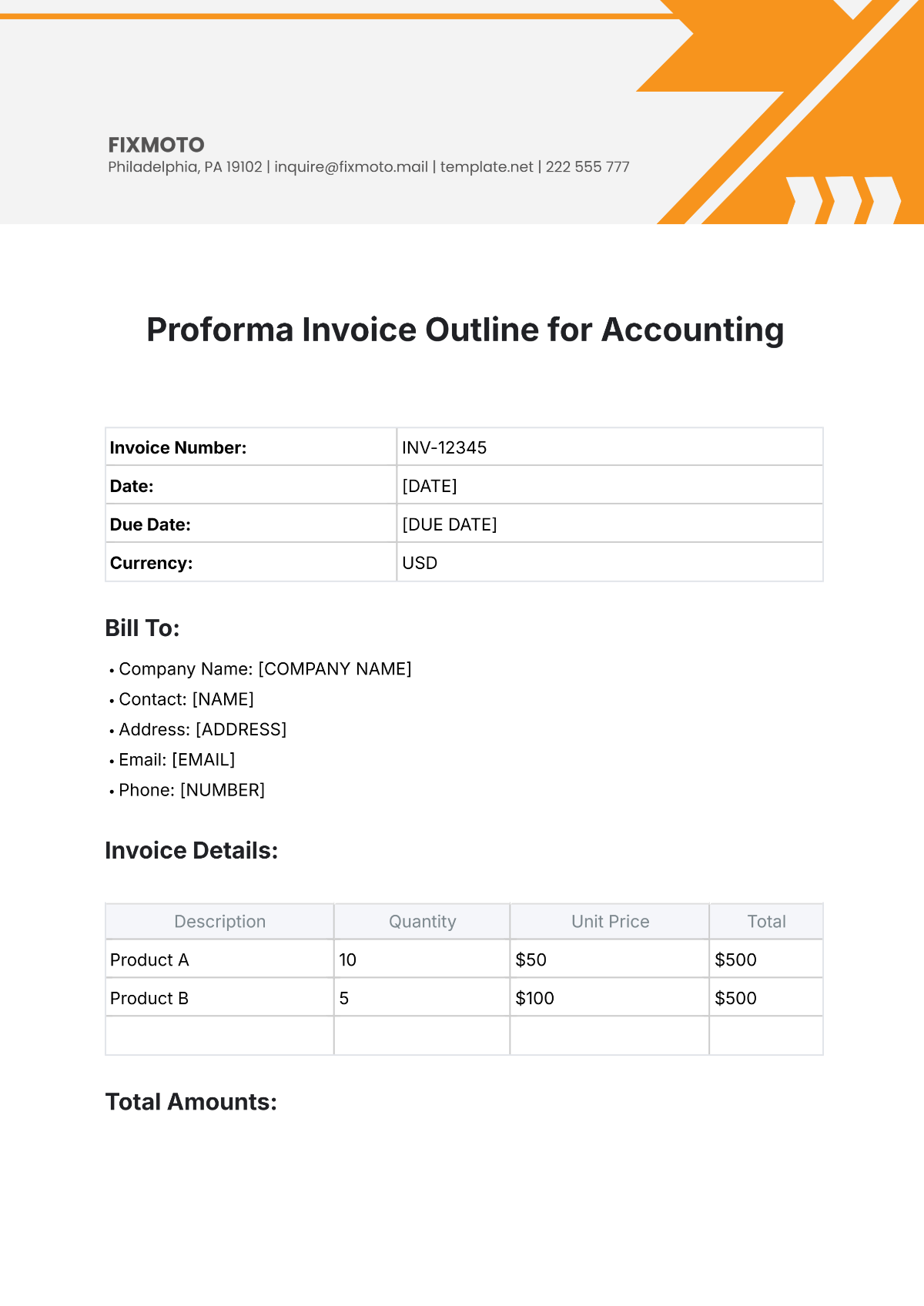

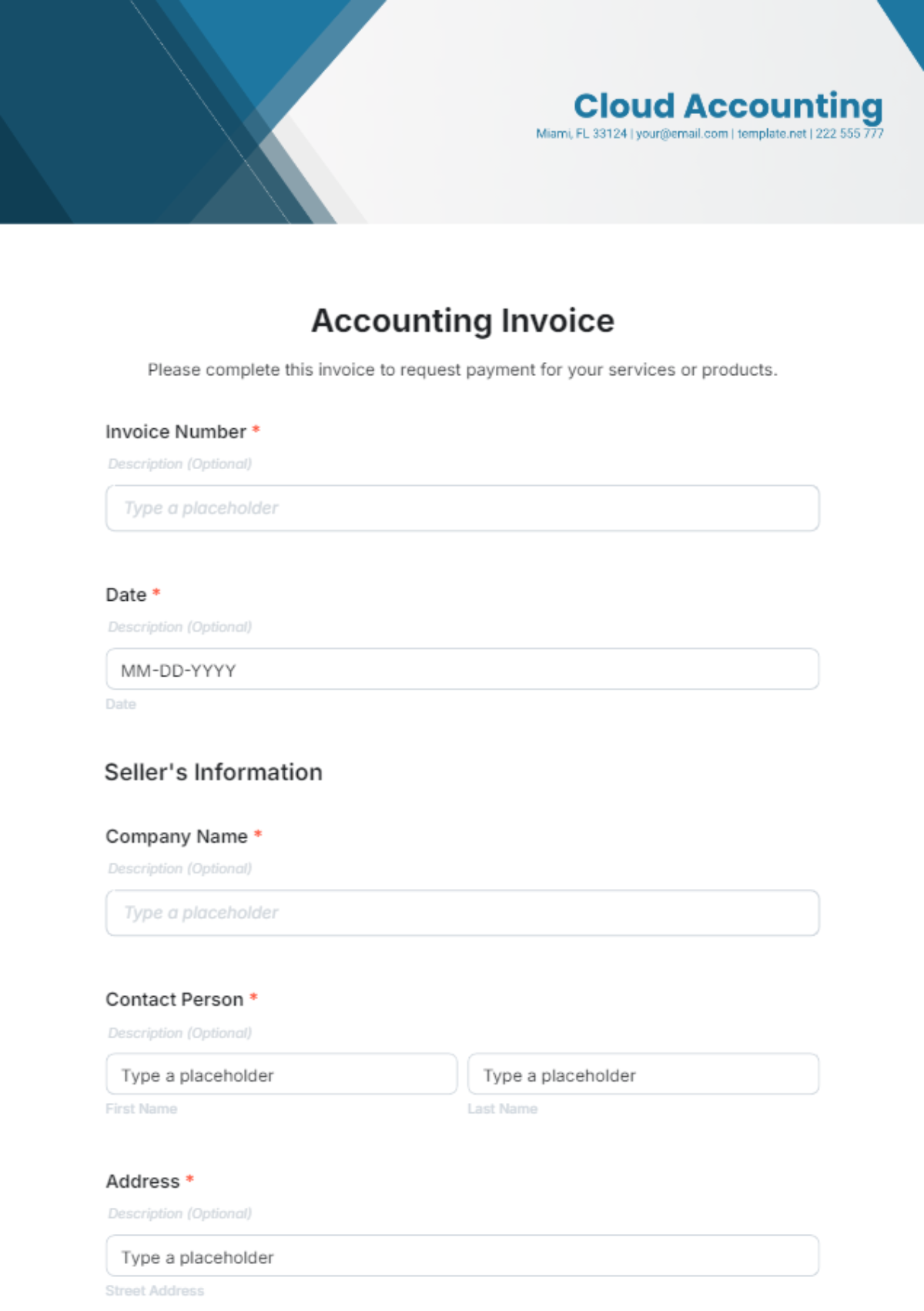

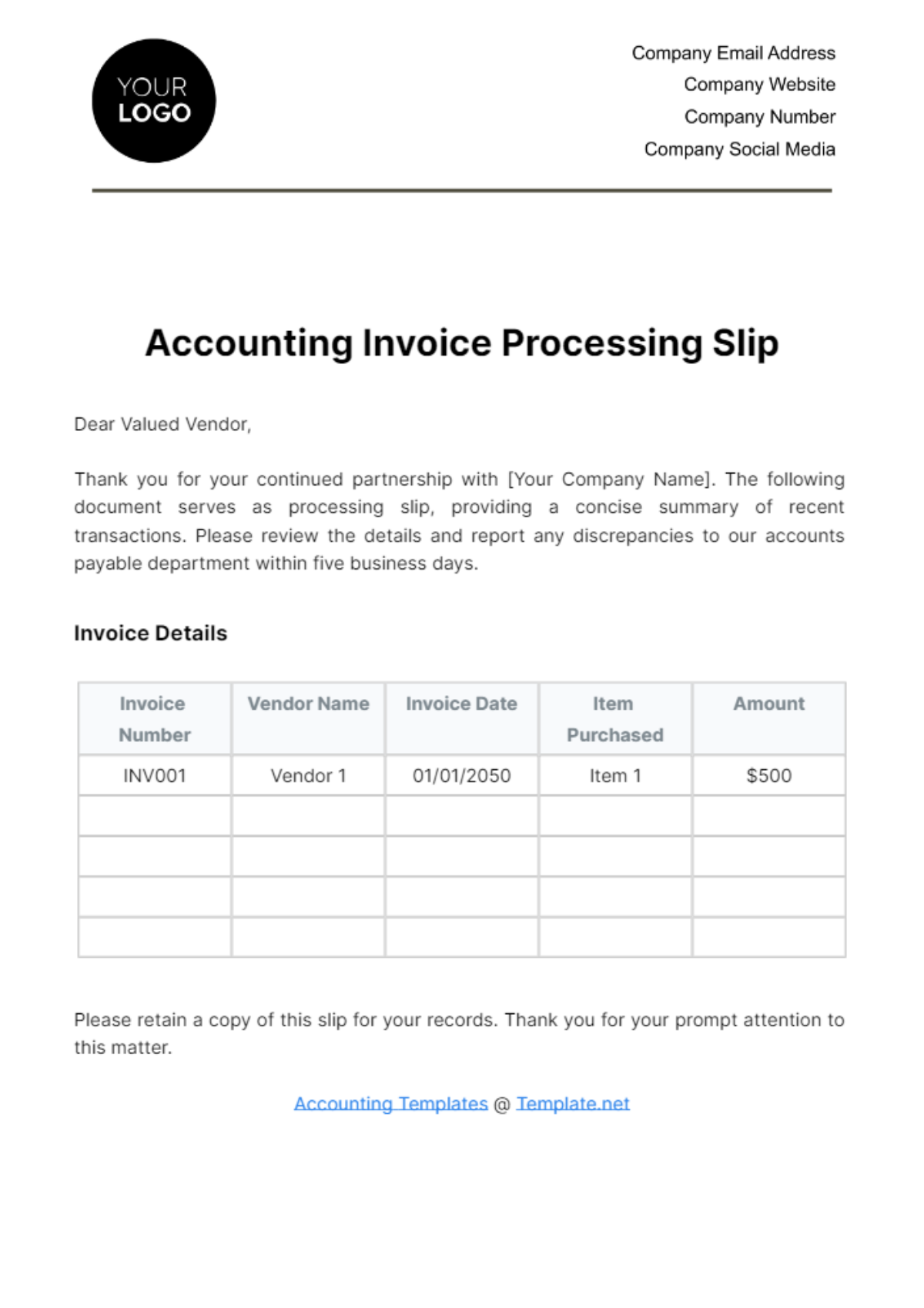

Keep your business operations running smoothly and professionally with Accounting Invoice Templates from Template.net. Designed for entrepreneurs, freelancers, and small business owners, these templates help you create polished, detailed, and accurate invoices, ensuring prompt payments and enhancing brand credibility. Easily convert new clients or promote existing services by sending out detailed invoices that reflect professionalism and attention to detail. Each template includes crucial details like time, date, location, and client contact information, streamlining your invoicing process. With no design skills required, you'll enjoy professional-grade layout options, perfect for both digital and print distribution—ideal for those looking to save time and resources while maintaining top-tier professionalism.

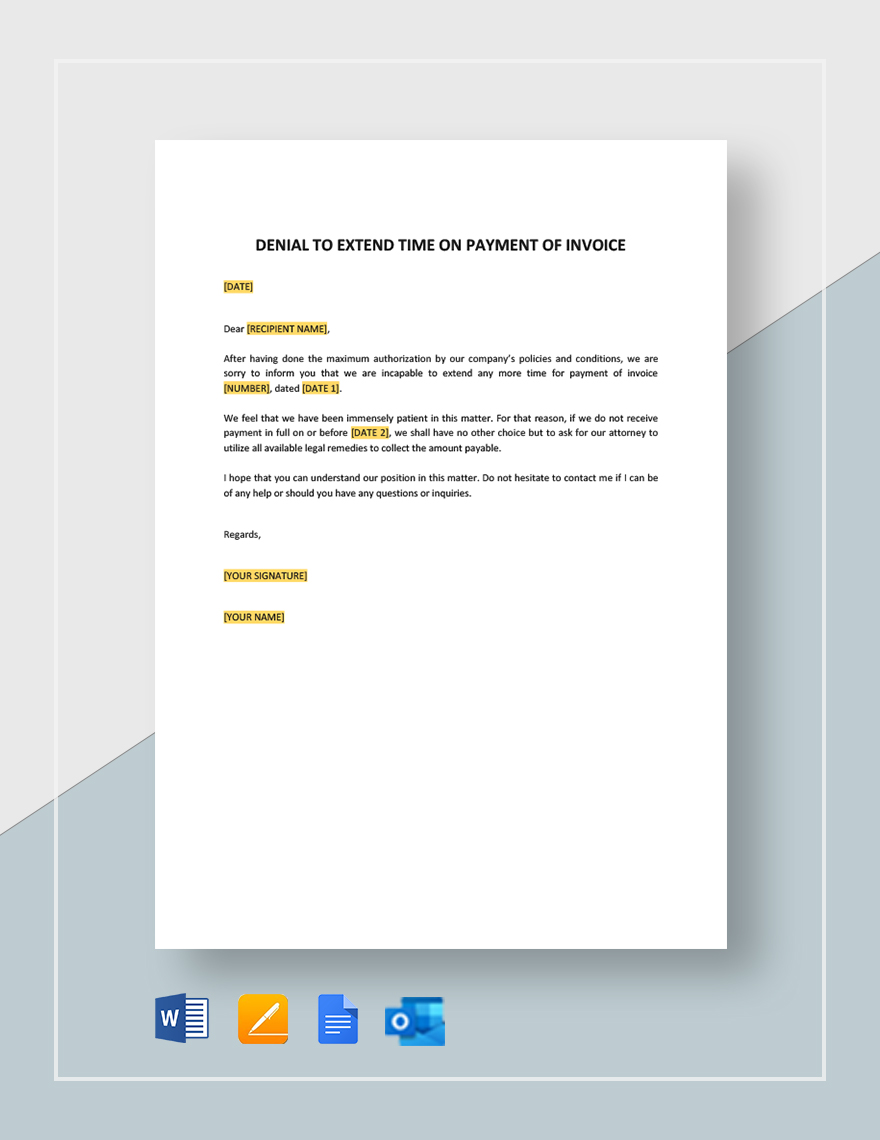

Discover the many invoice templates we have on hand at Template.net, offering a variety of styles suited to different business needs. Start by selecting a template that fits your brand, swapping in your assets, and tailoring colors and fonts to match your corporate identity. Add advanced touches by dragging and dropping icons or graphics, or utilize AI-powered text tools for effortlessly clear communication. With endless possibilities and no skill barriers, crafting your ideal invoice becomes a fun and hassle-free experience. Our library is regularly updated with new designs, keeping your business documents fresh and relevant. Once you're satisfied with your creation, download or share your invoice via link, print, email, or any export method of your choice—perfect for integration across multiple channels and collaborative environments.