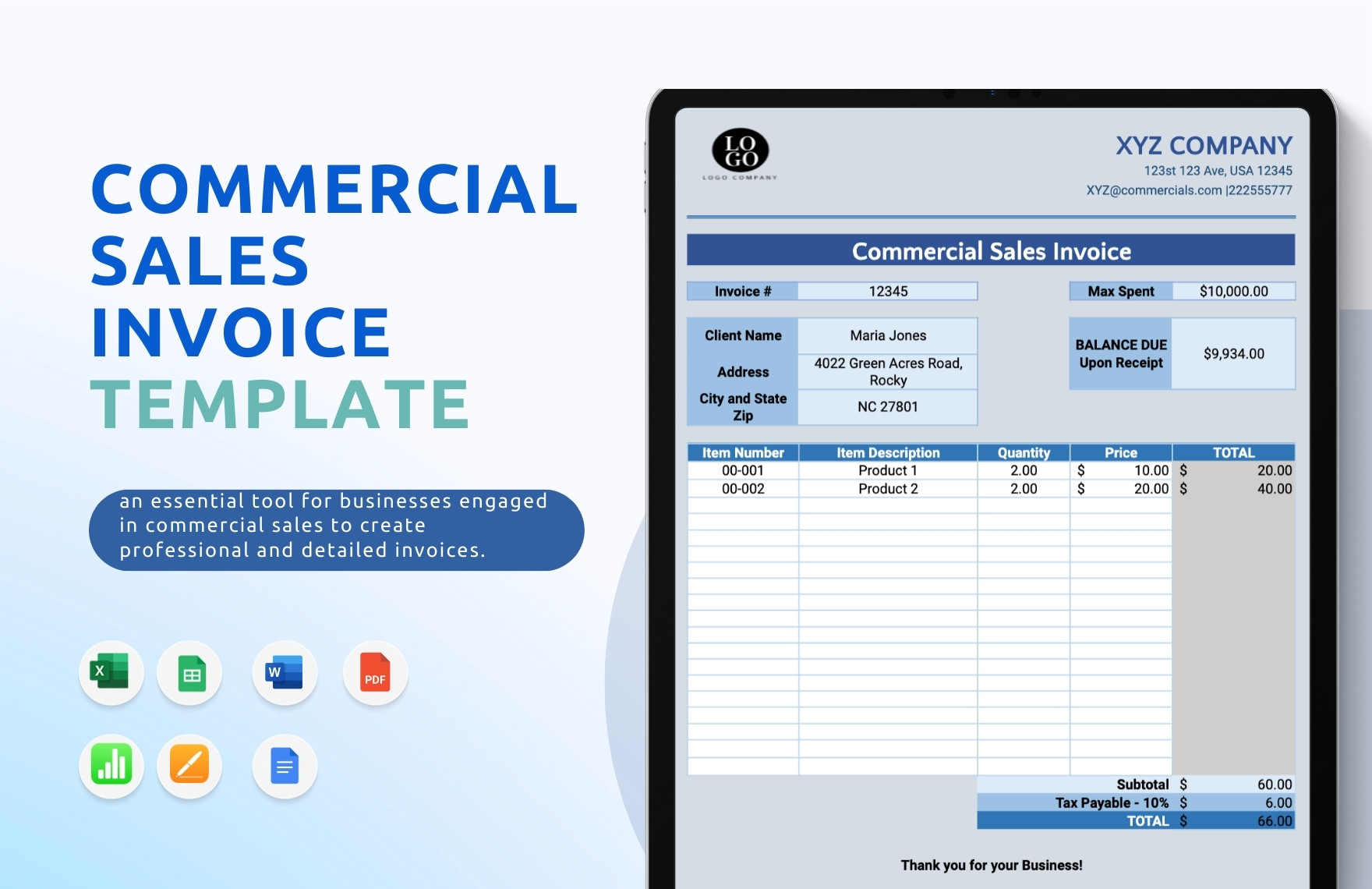

Bring Your Professional Billing to Life with Sales Invoice Templates from Template.net

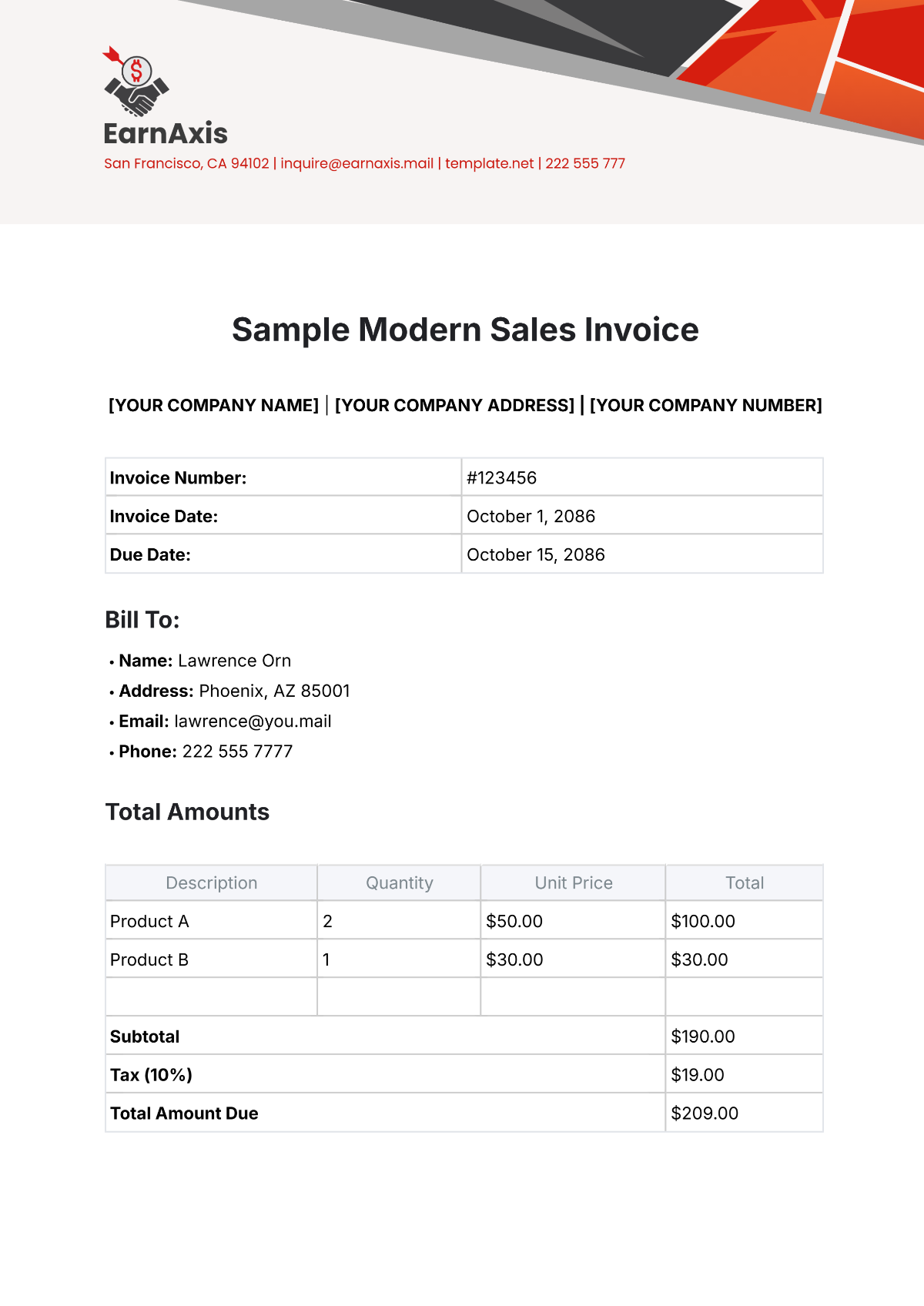

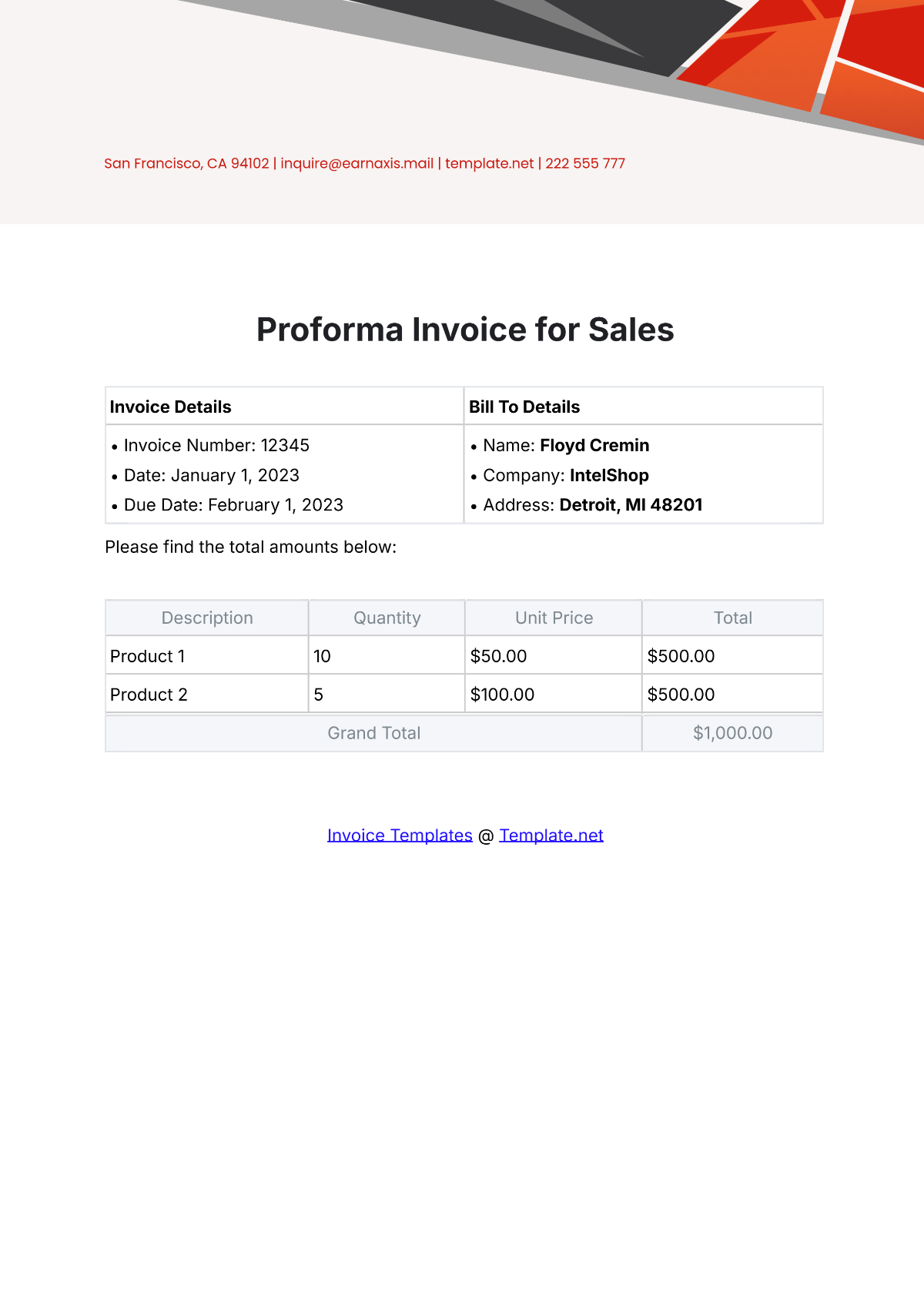

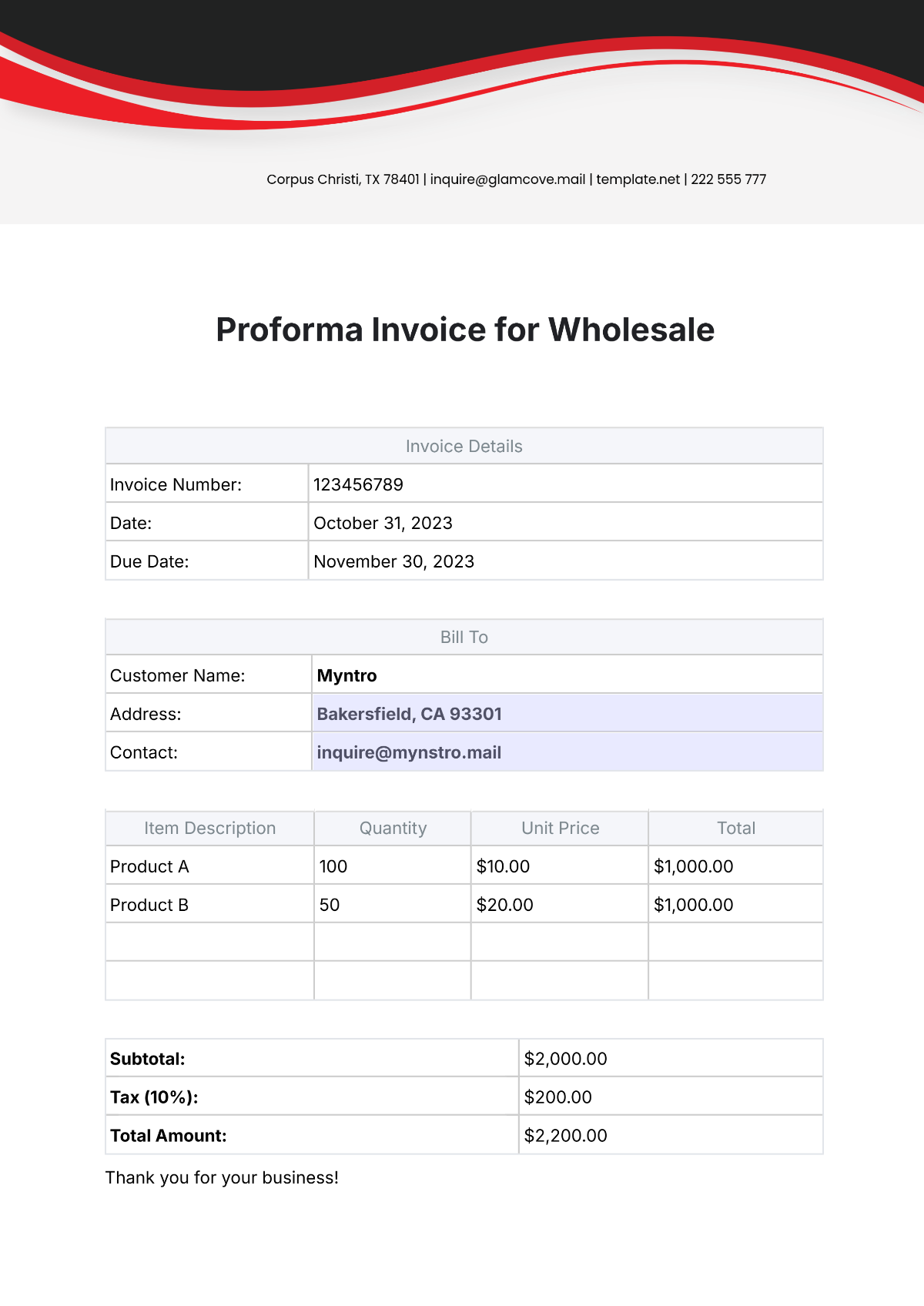

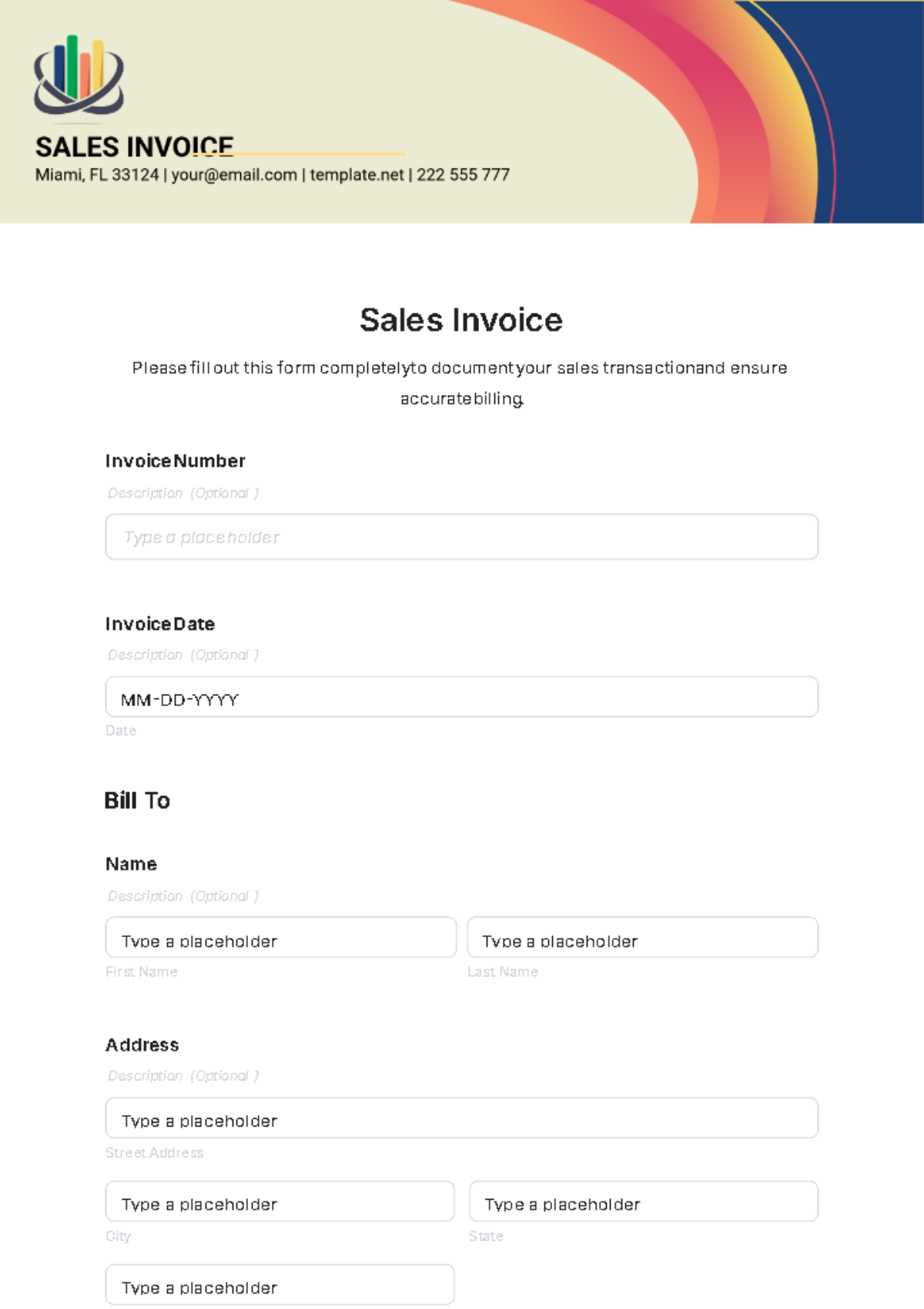

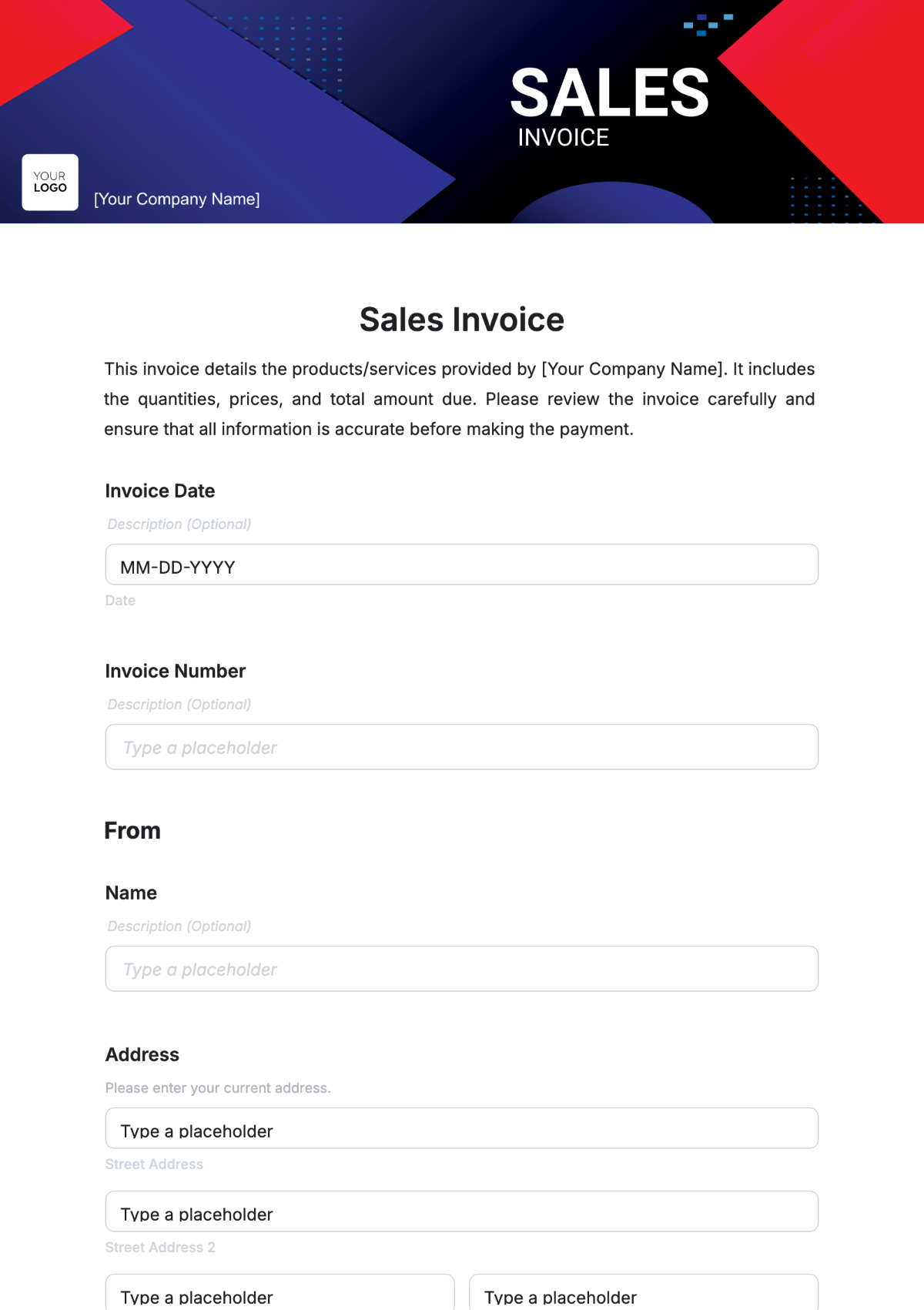

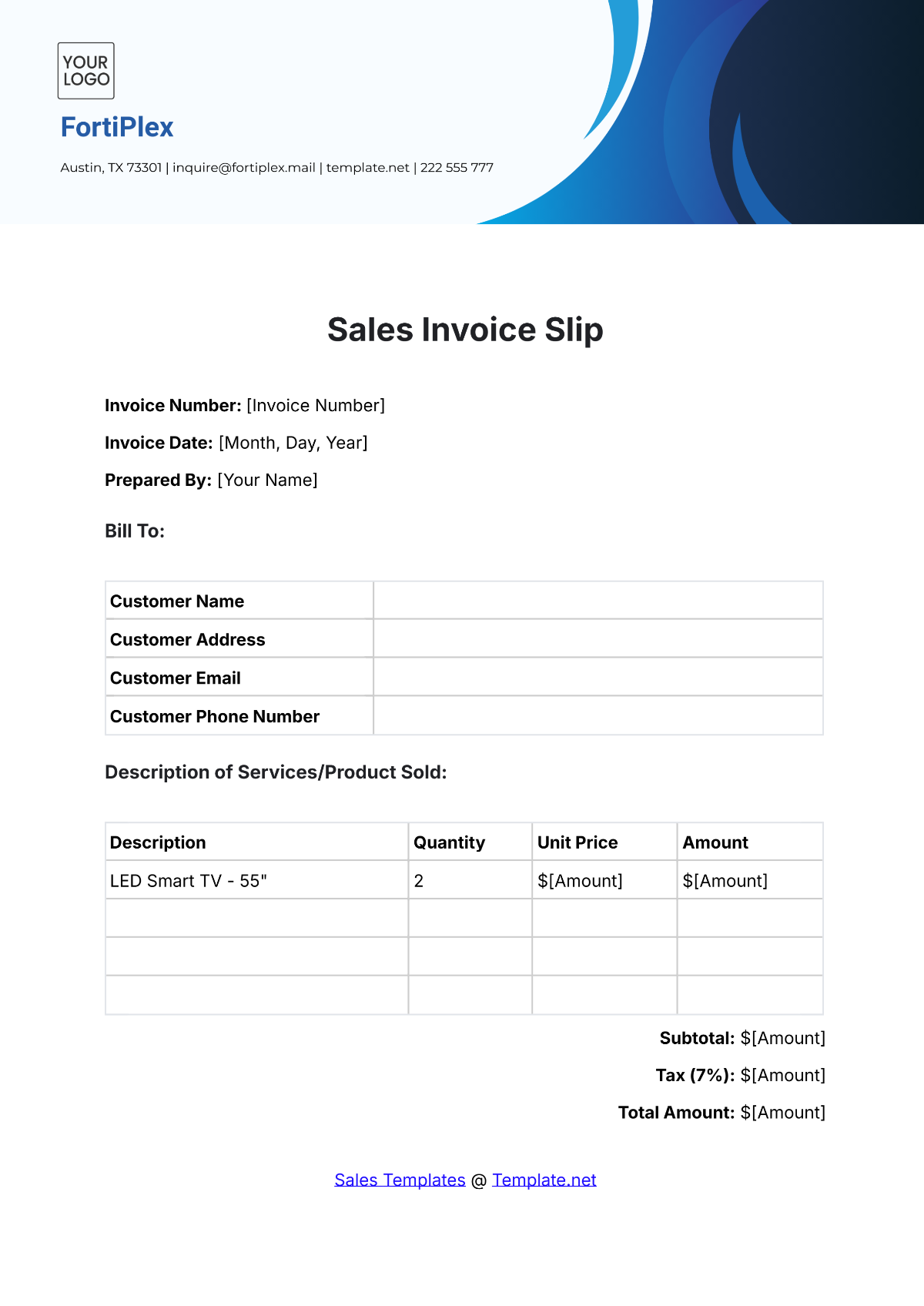

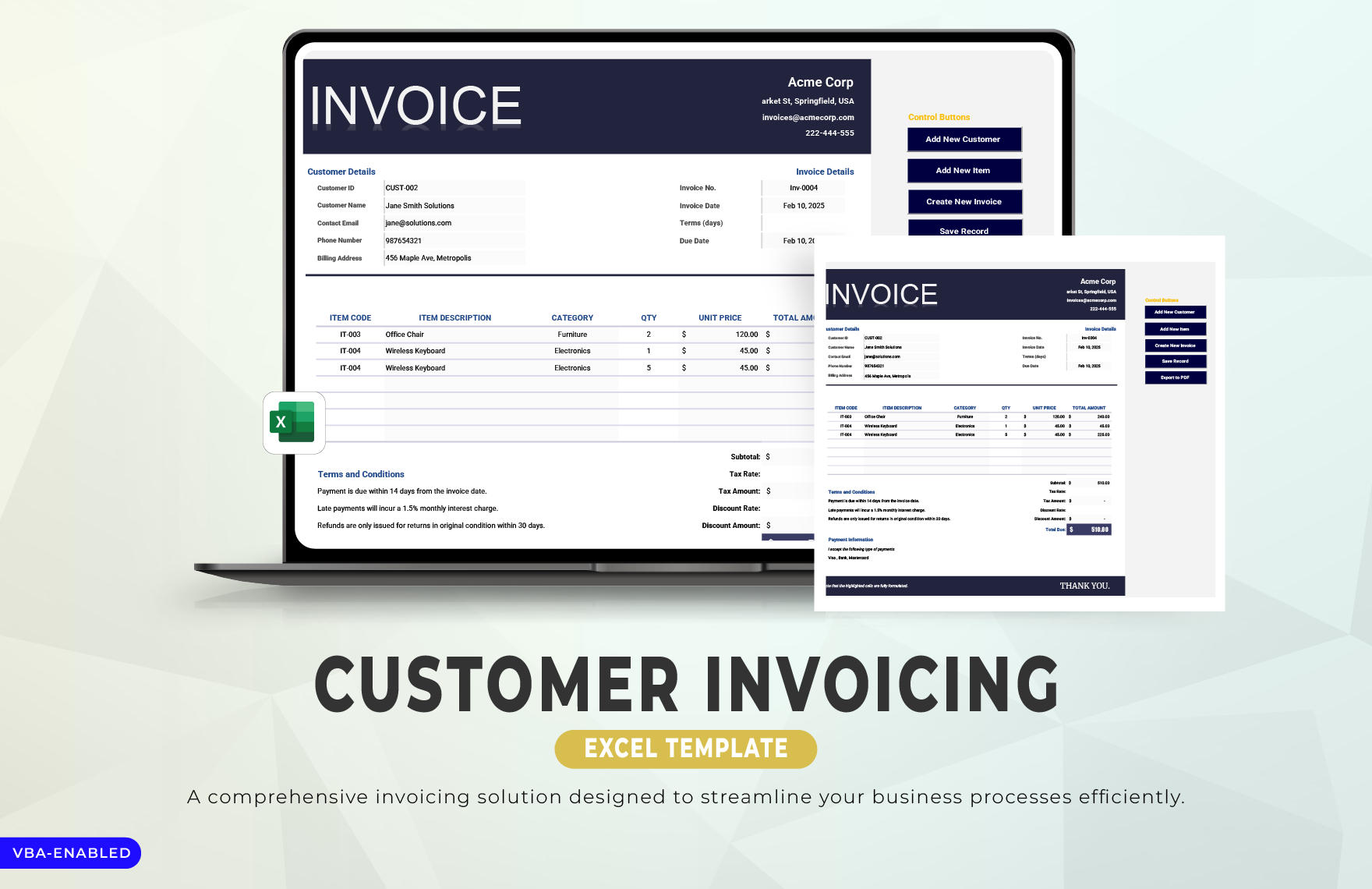

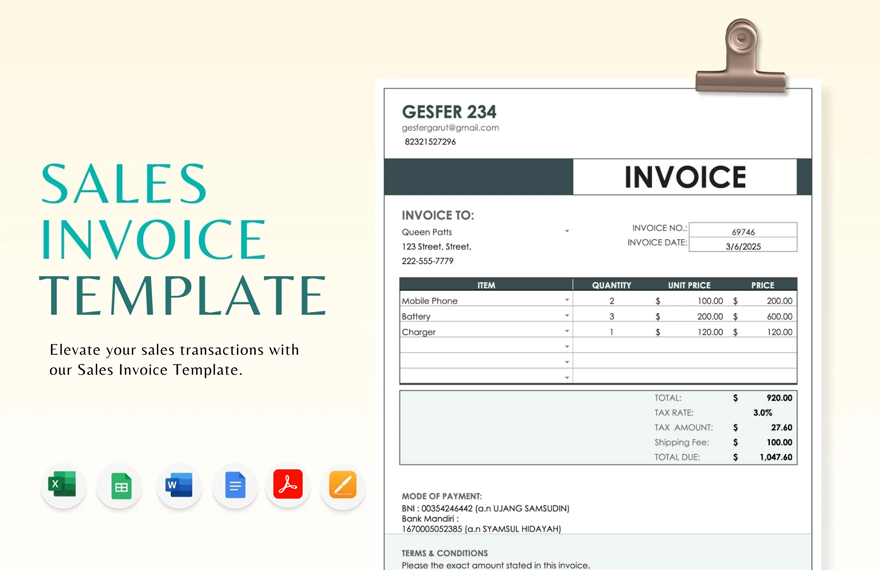

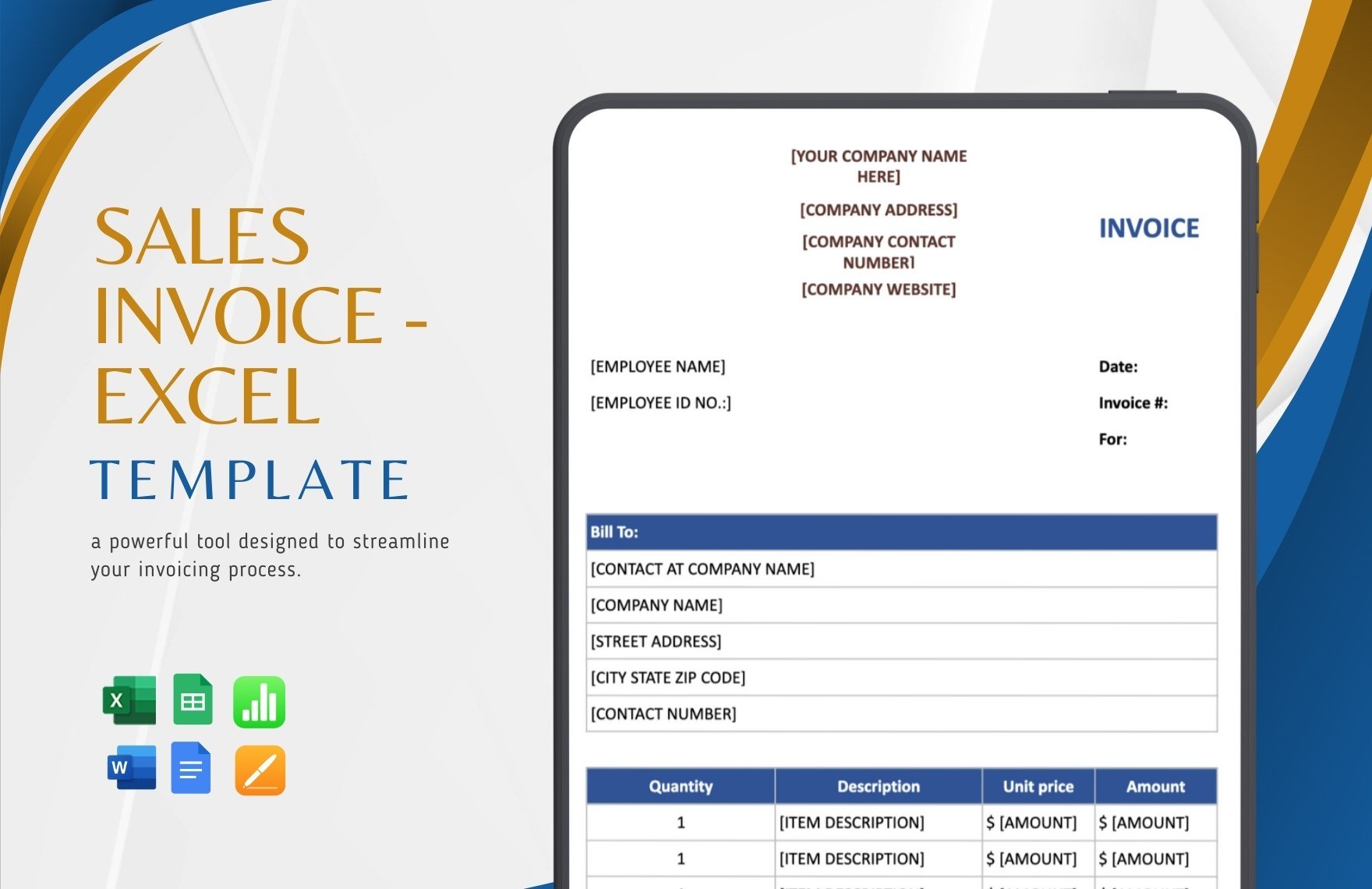

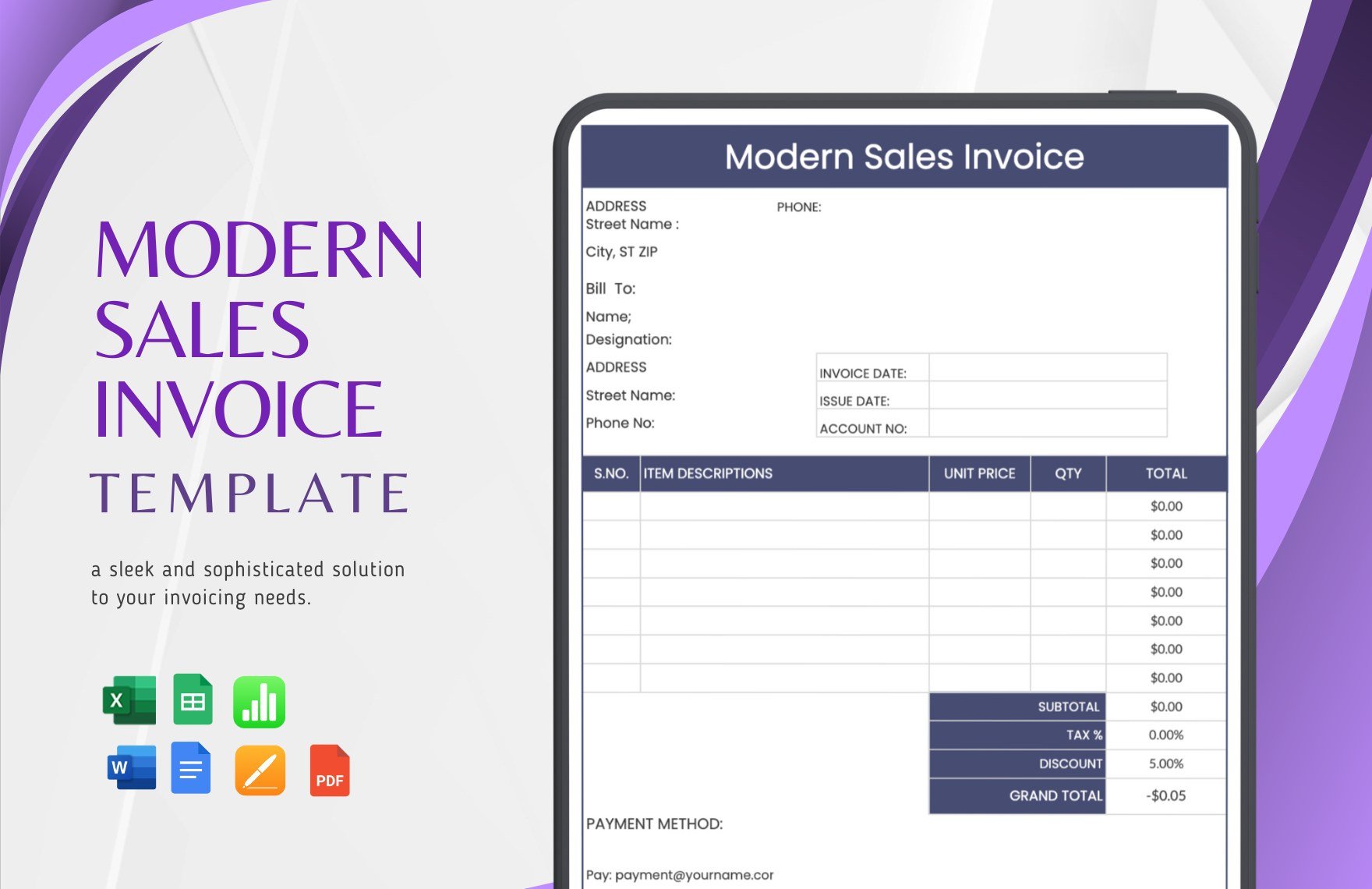

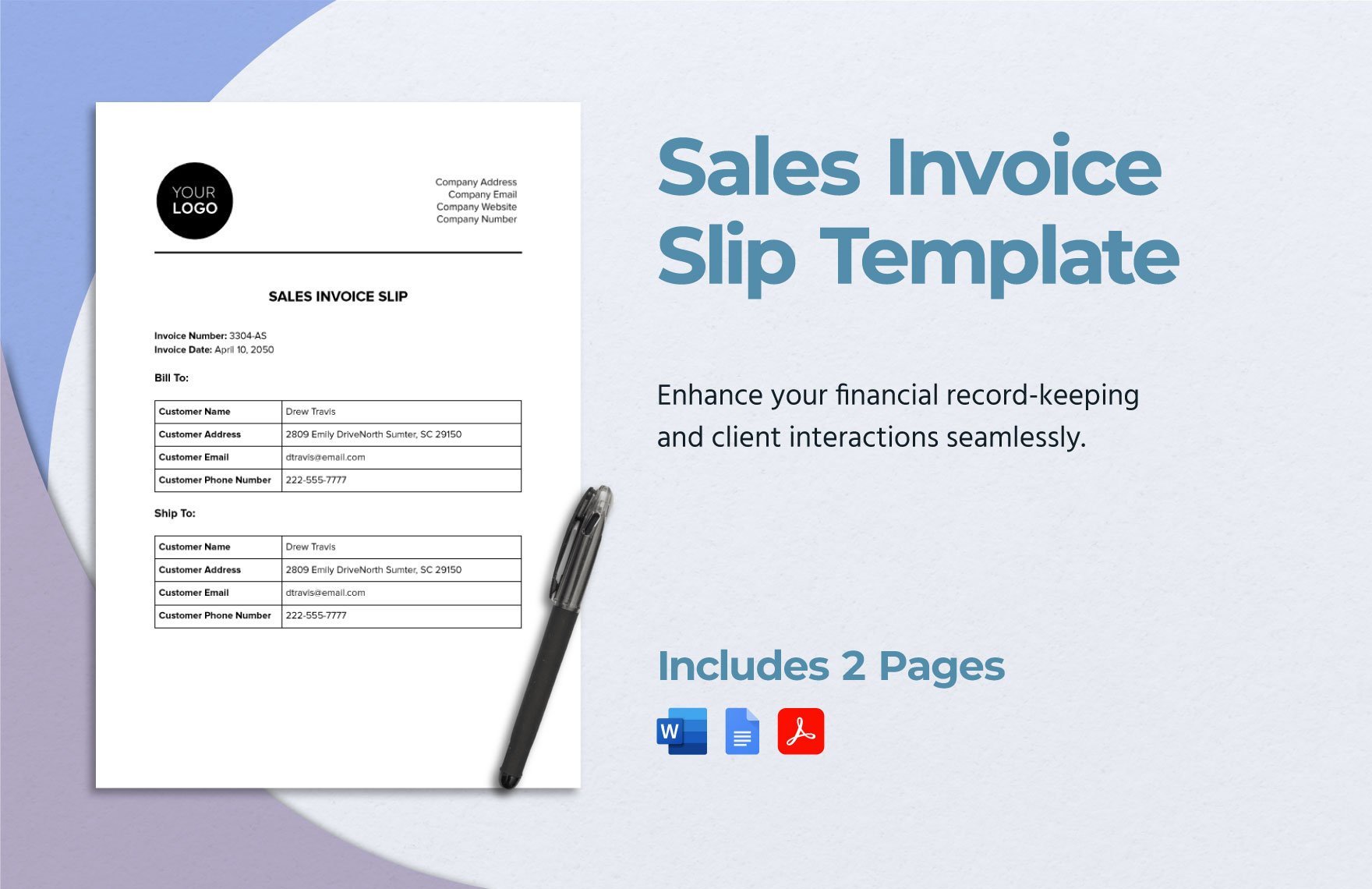

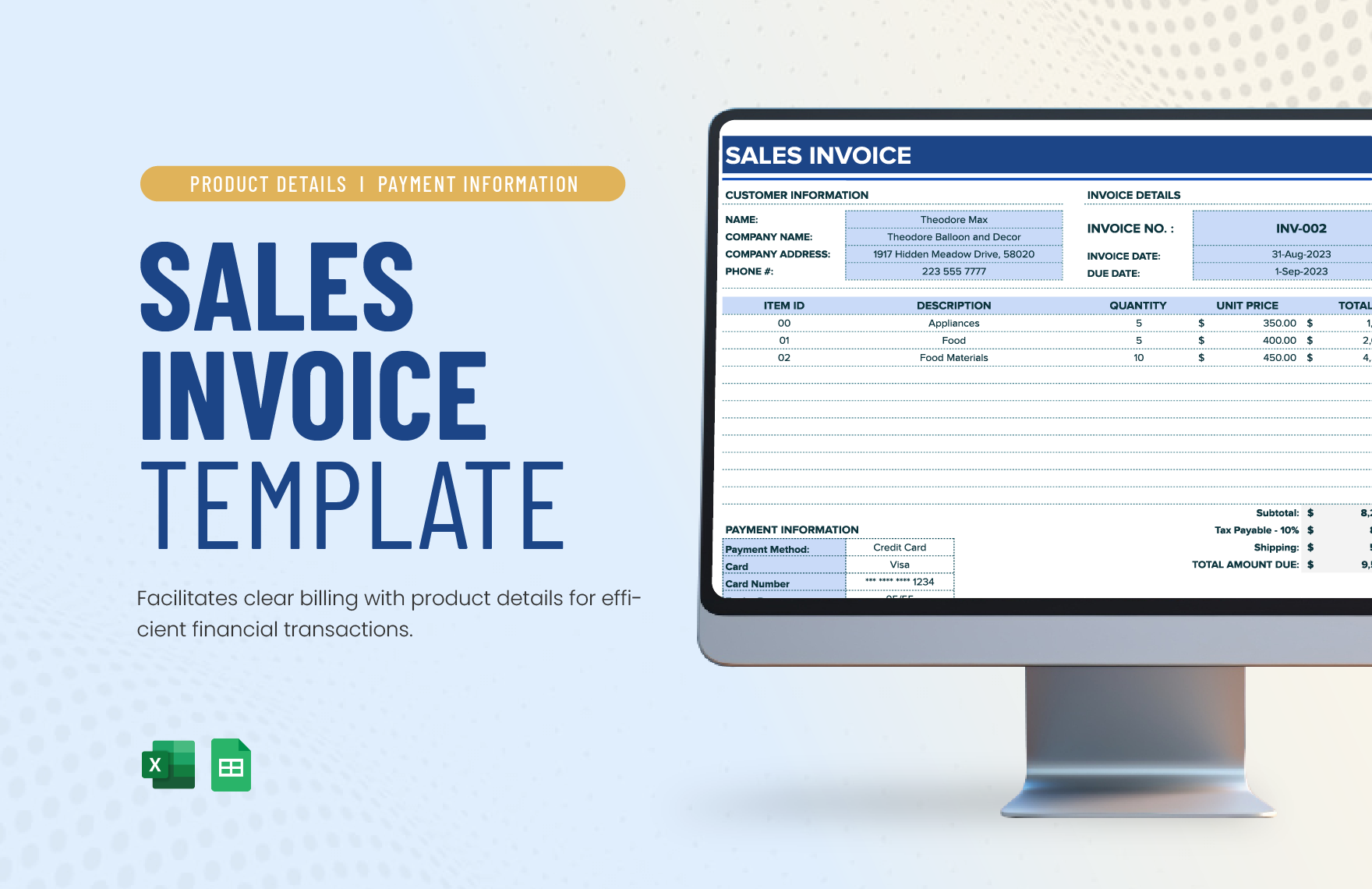

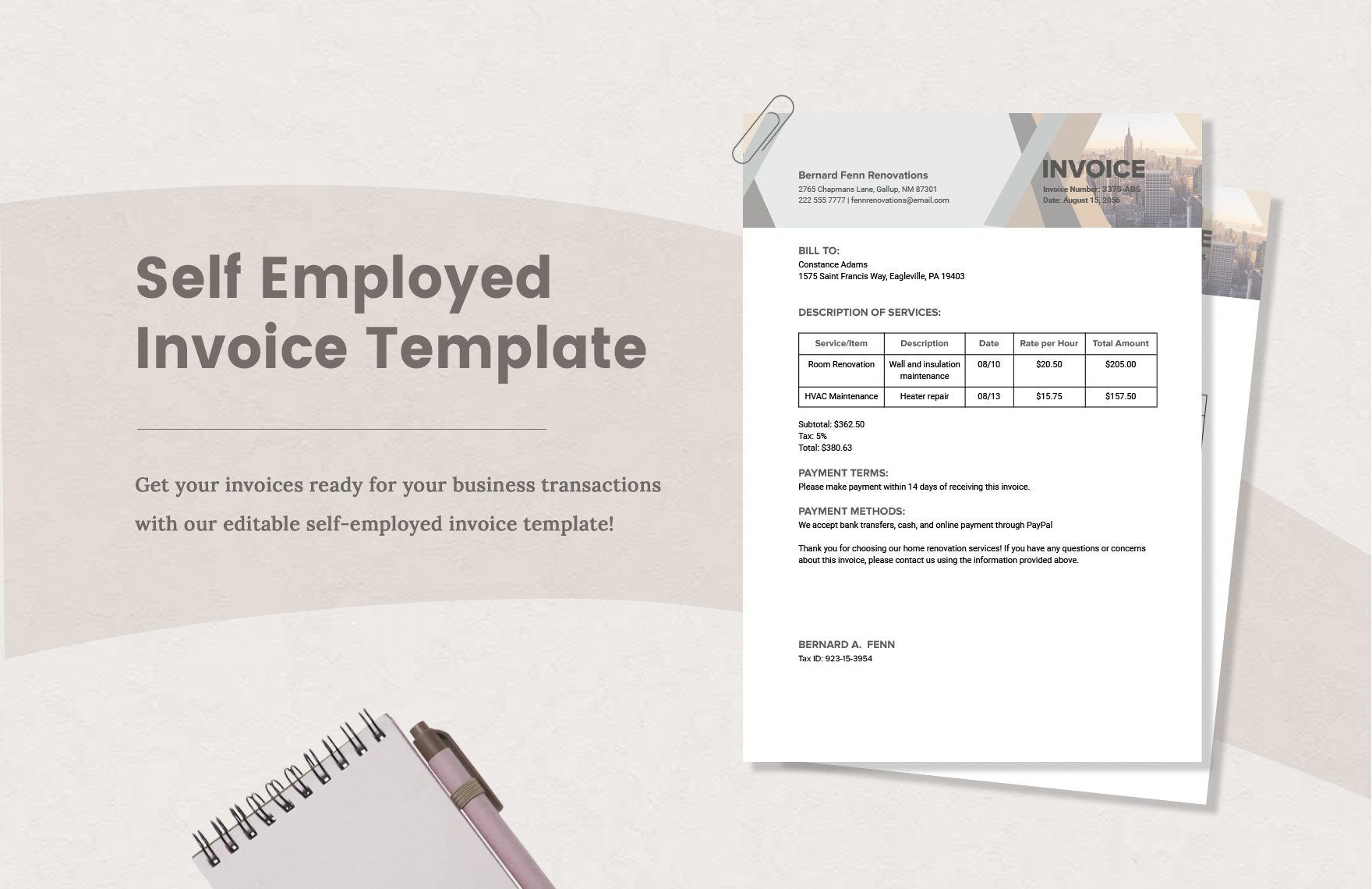

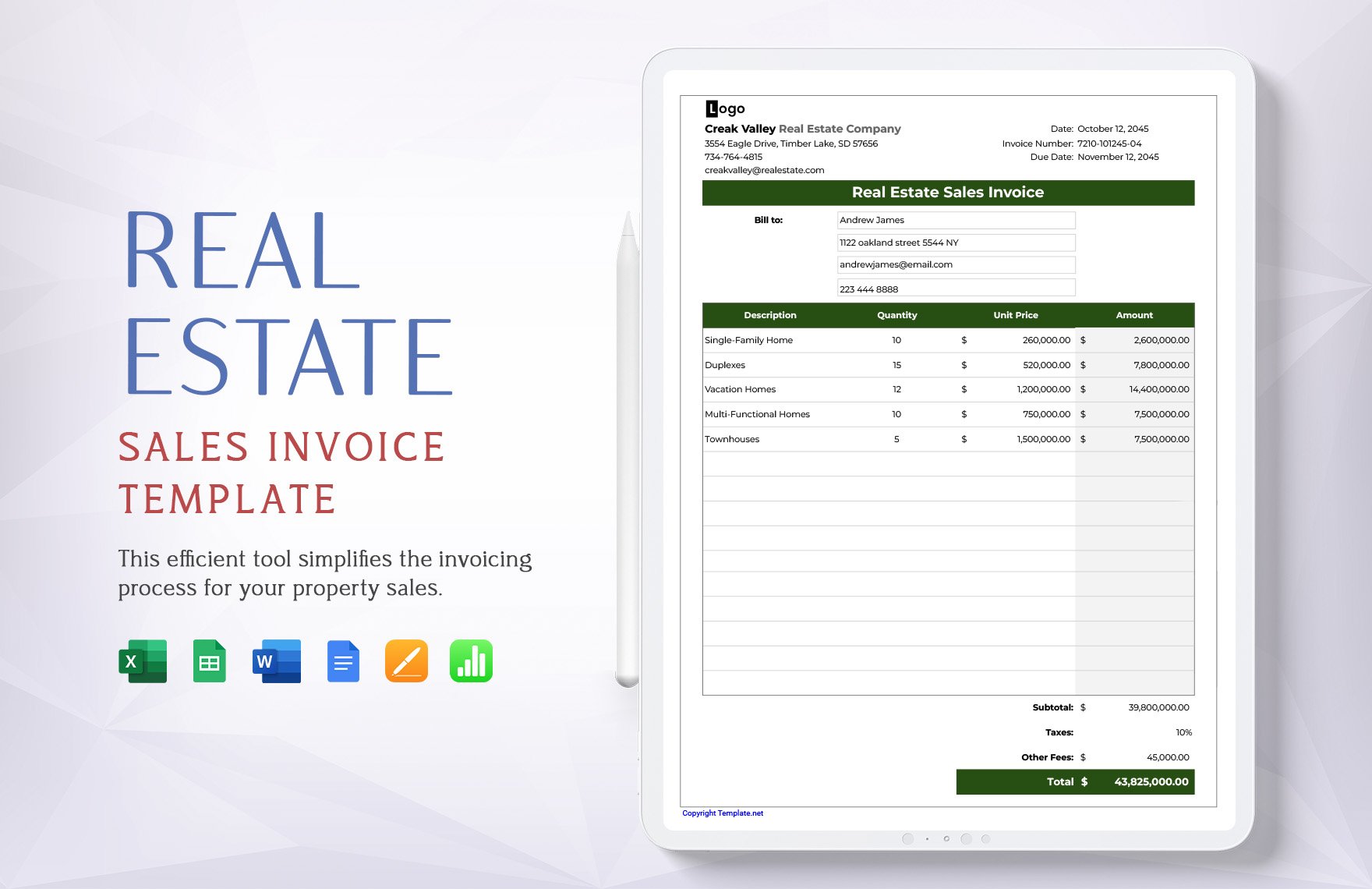

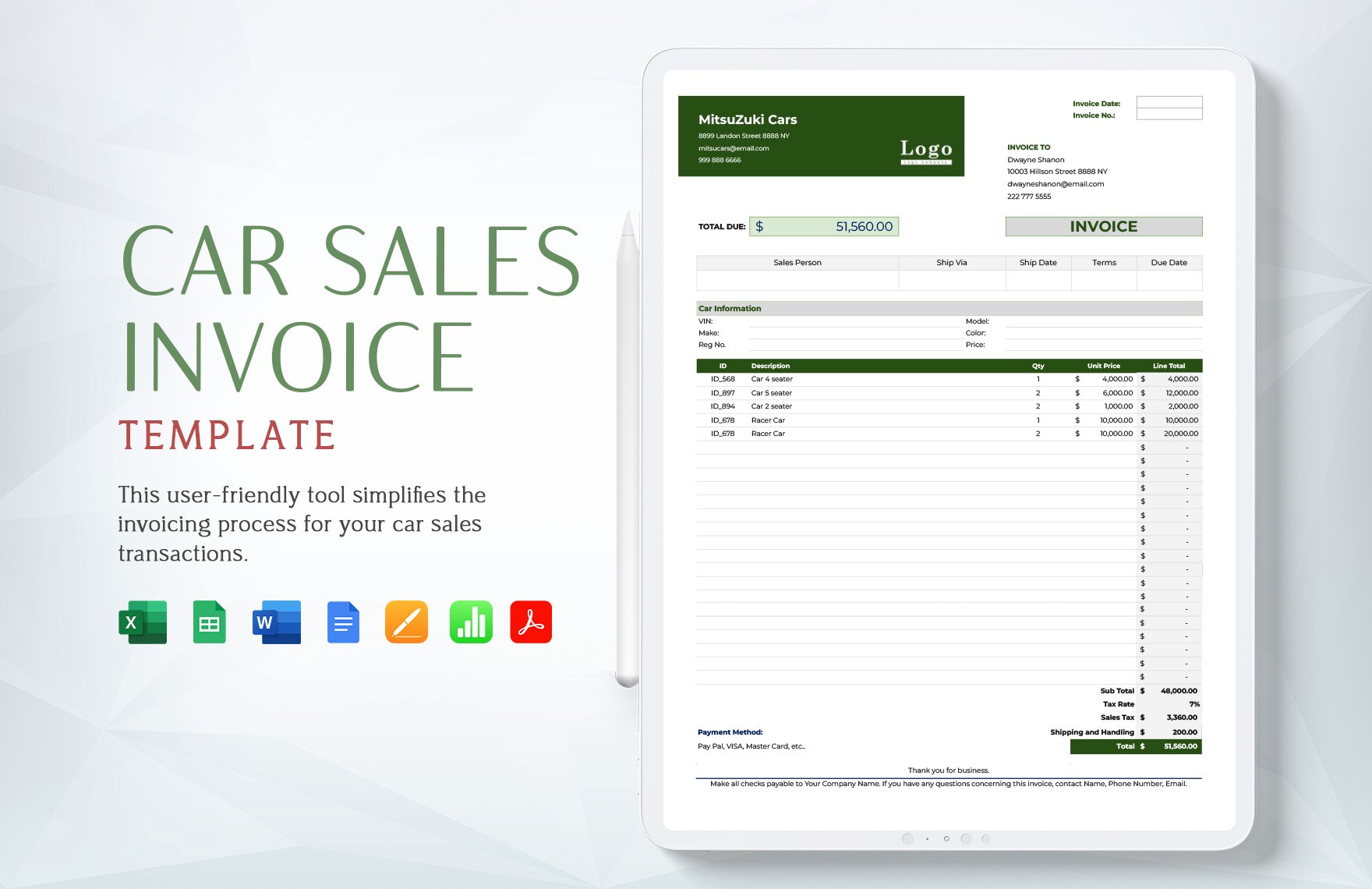

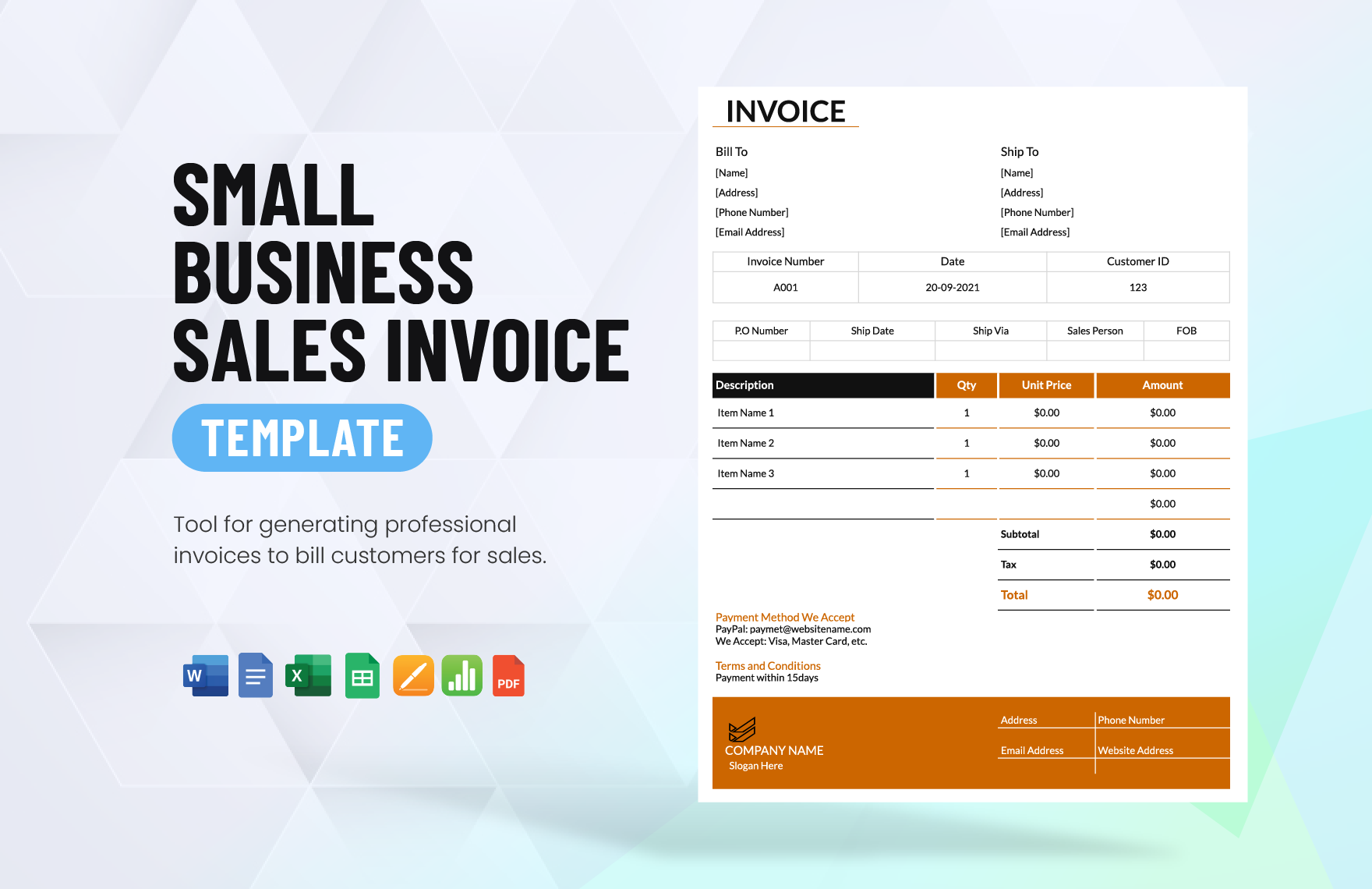

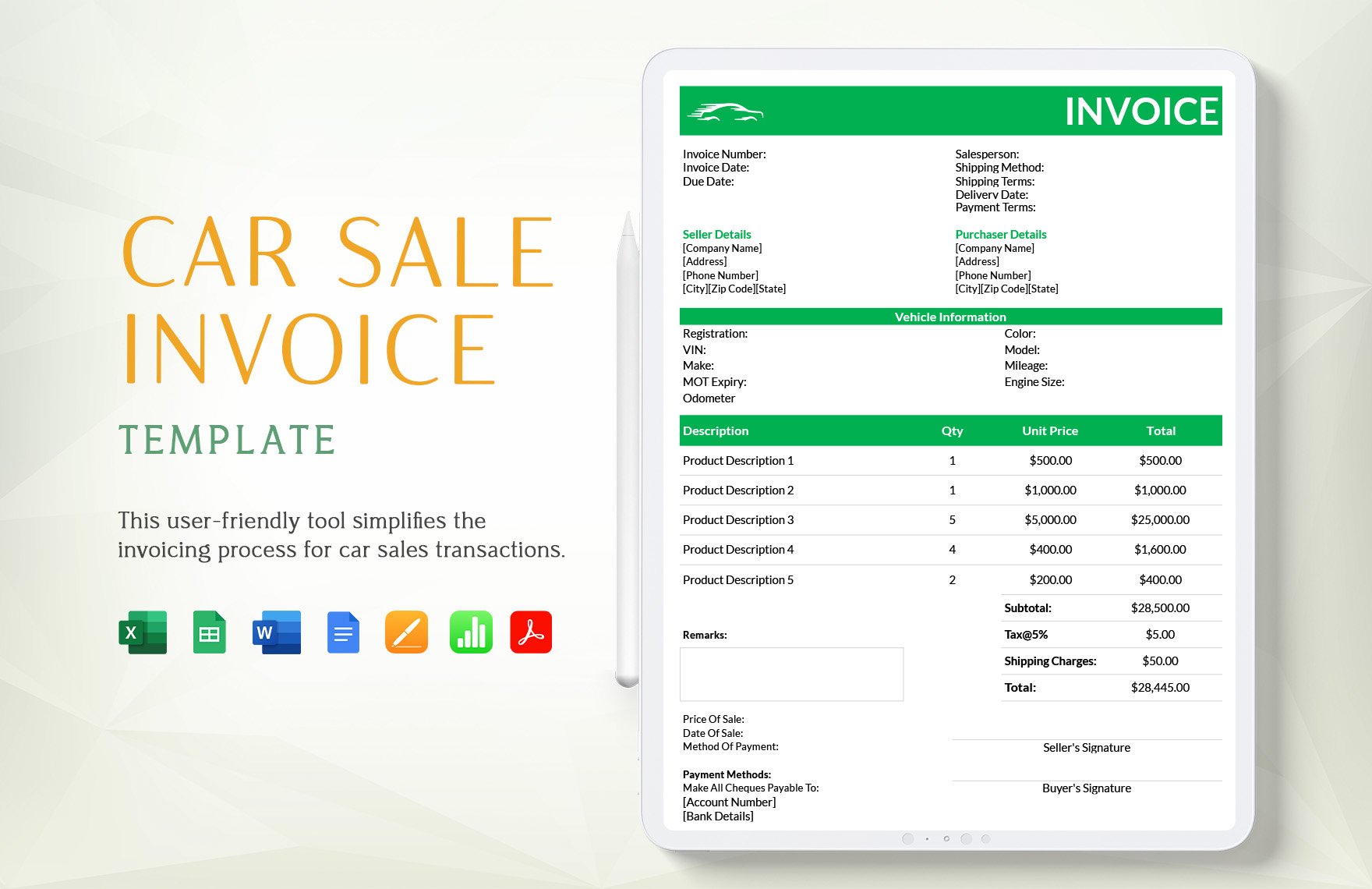

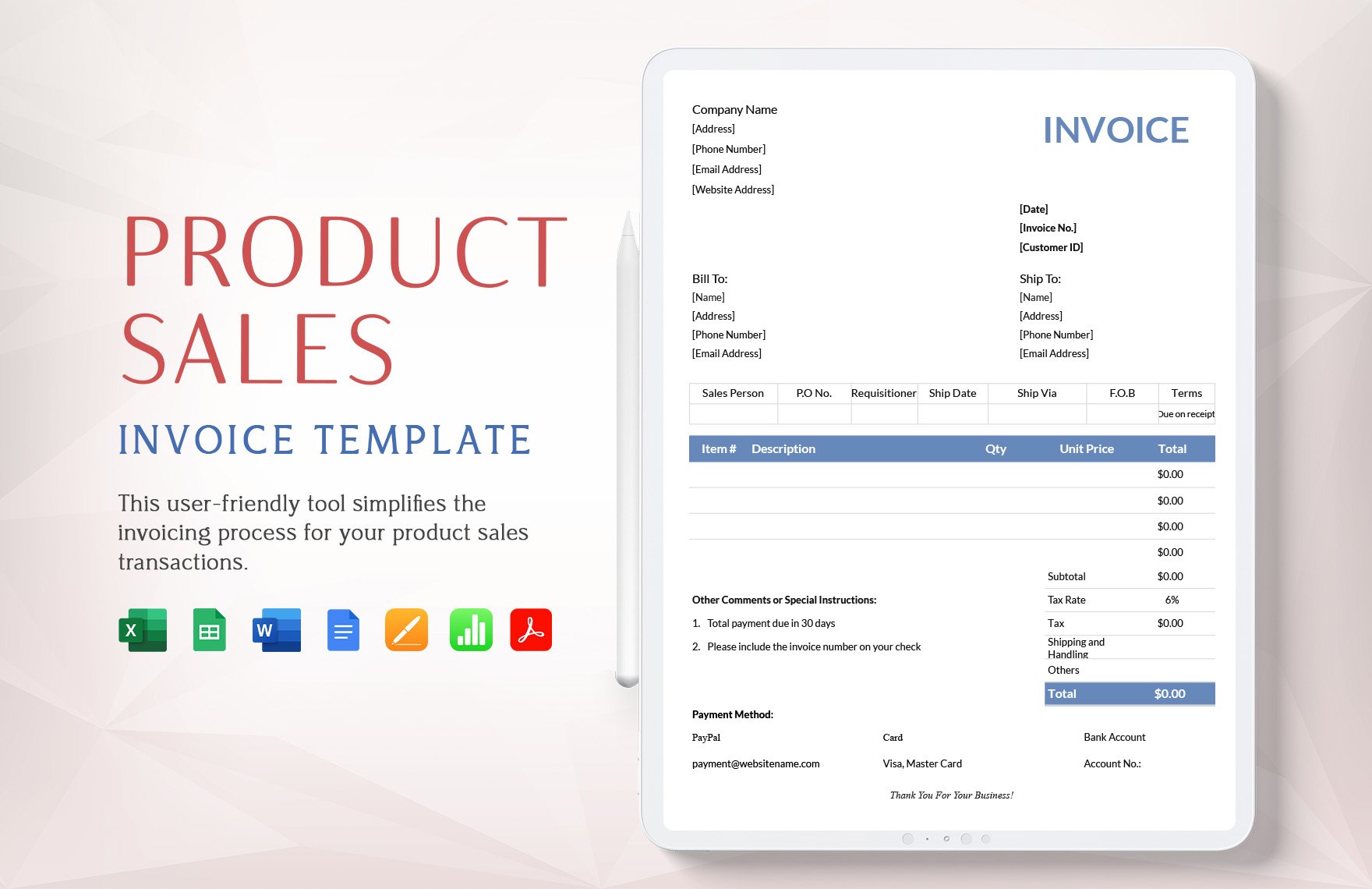

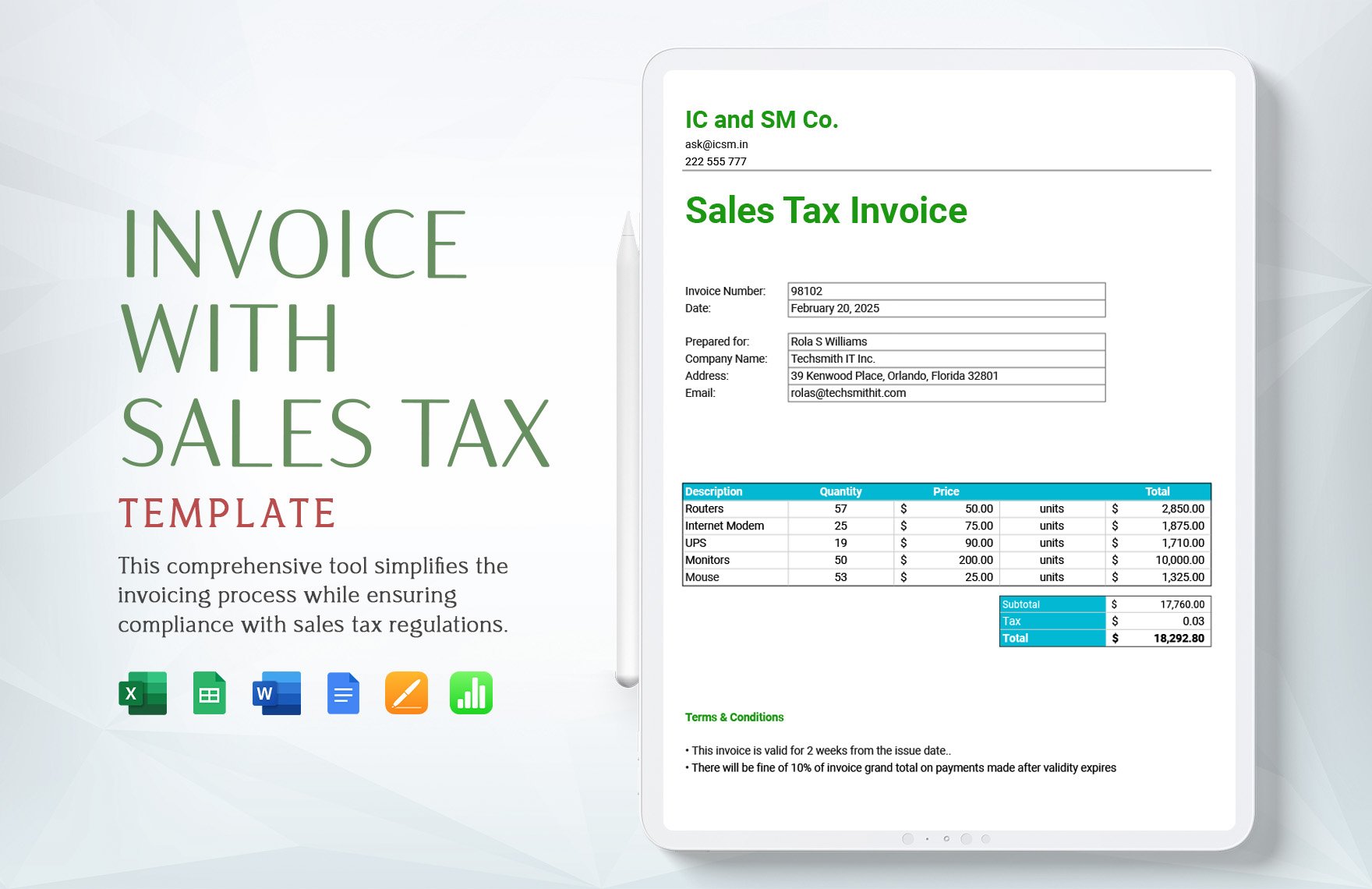

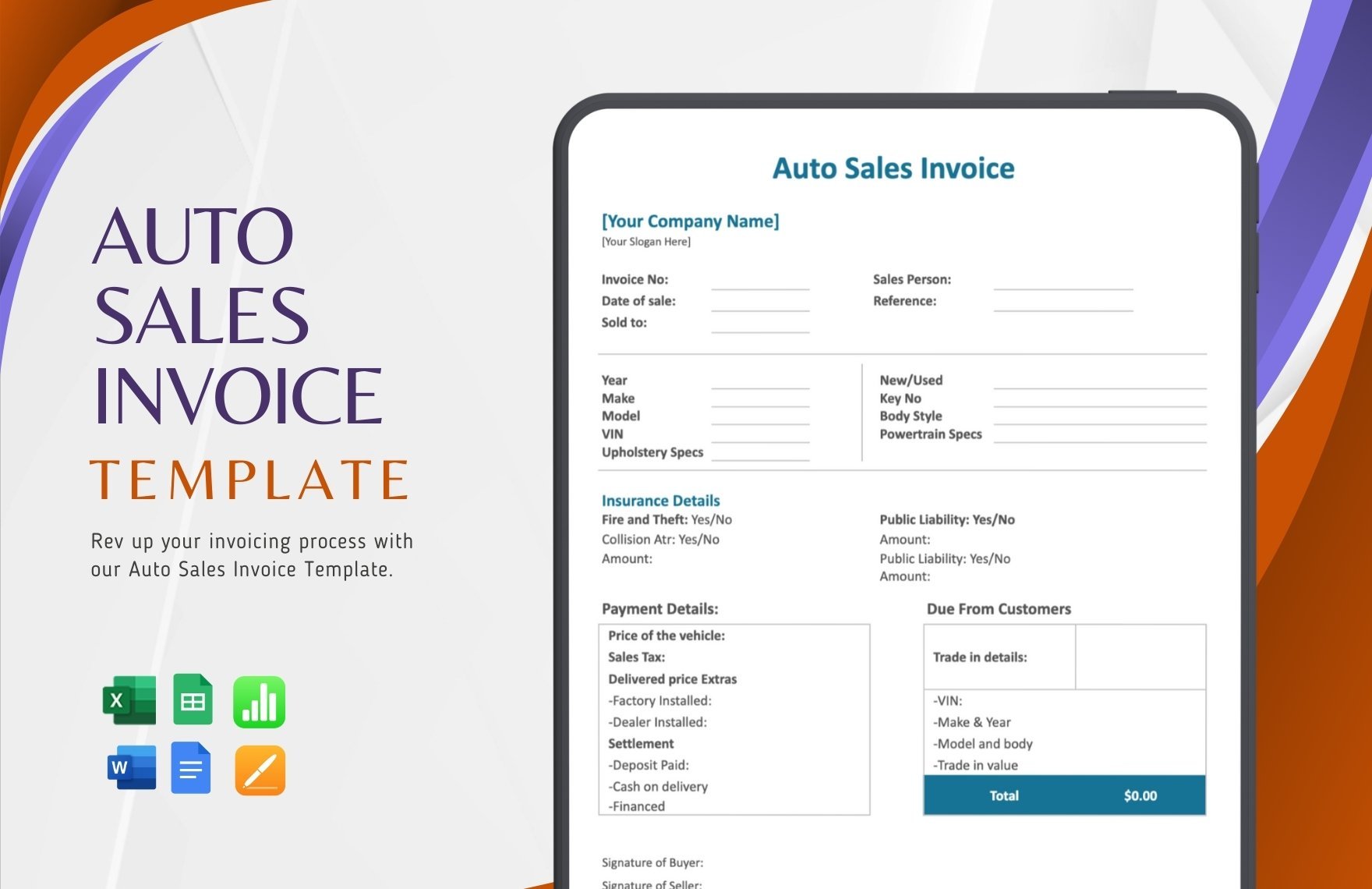

Keep your business operations smooth and your financial management effortless with the Sales Invoice Templates from Template.net. These templates are perfect for small business owners, freelancers, and corporate teams looking to create professional invoices with ease. Highlight critical details such as time/date, client contact information, and itemized billing items. Whether you want to promote transparency with clients by providing detailed cost breakdowns or invite them to discuss invoices further, these templates have got you covered. With no advanced design skills required, enjoy professional-grade layouts that can be utilized both in print or digitally, ensuring every recipient perceives you as organized and efficient.

Discover the many Sales Invoice Templates we have on hand, ready for you to customize to suit your brand style perfectly. Simply select a template that resonates with your business, switch in your company assets, and easily adjust colors and fonts to maintain brand consistency. Add your special touch with drag-and-drop icons or graphics, or incorporate animated effects for digital invoices. With AI-powered text tools, constructing the perfect invoice has never been this exciting or skill-free. Benefit from regularly updated templates, ensuring access to the latest in design trends. When you’re finished, download or share directly via link, print, email, and other export options, assuring that your invoices reach your clients through multiple channels without a hitch.