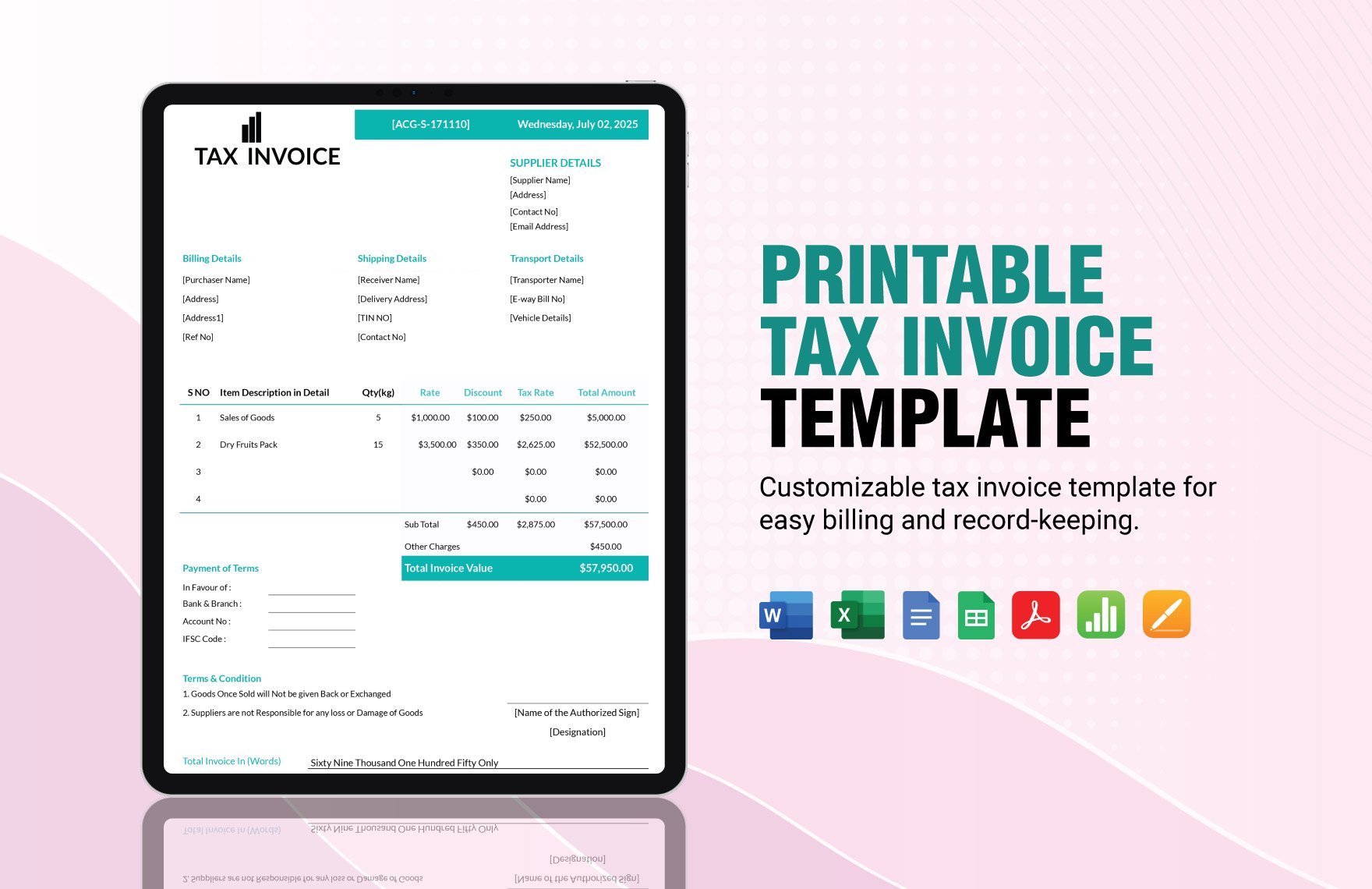

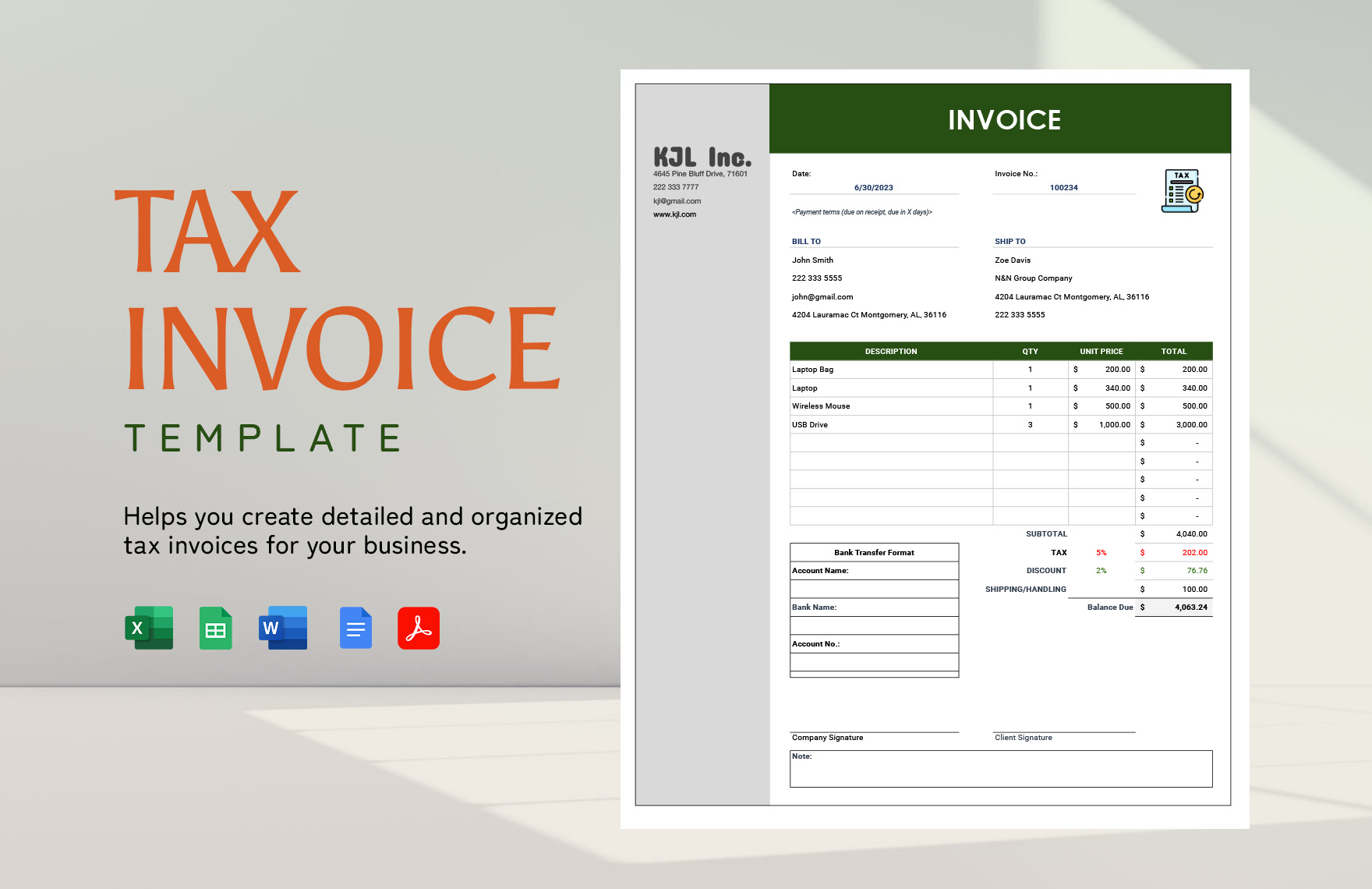

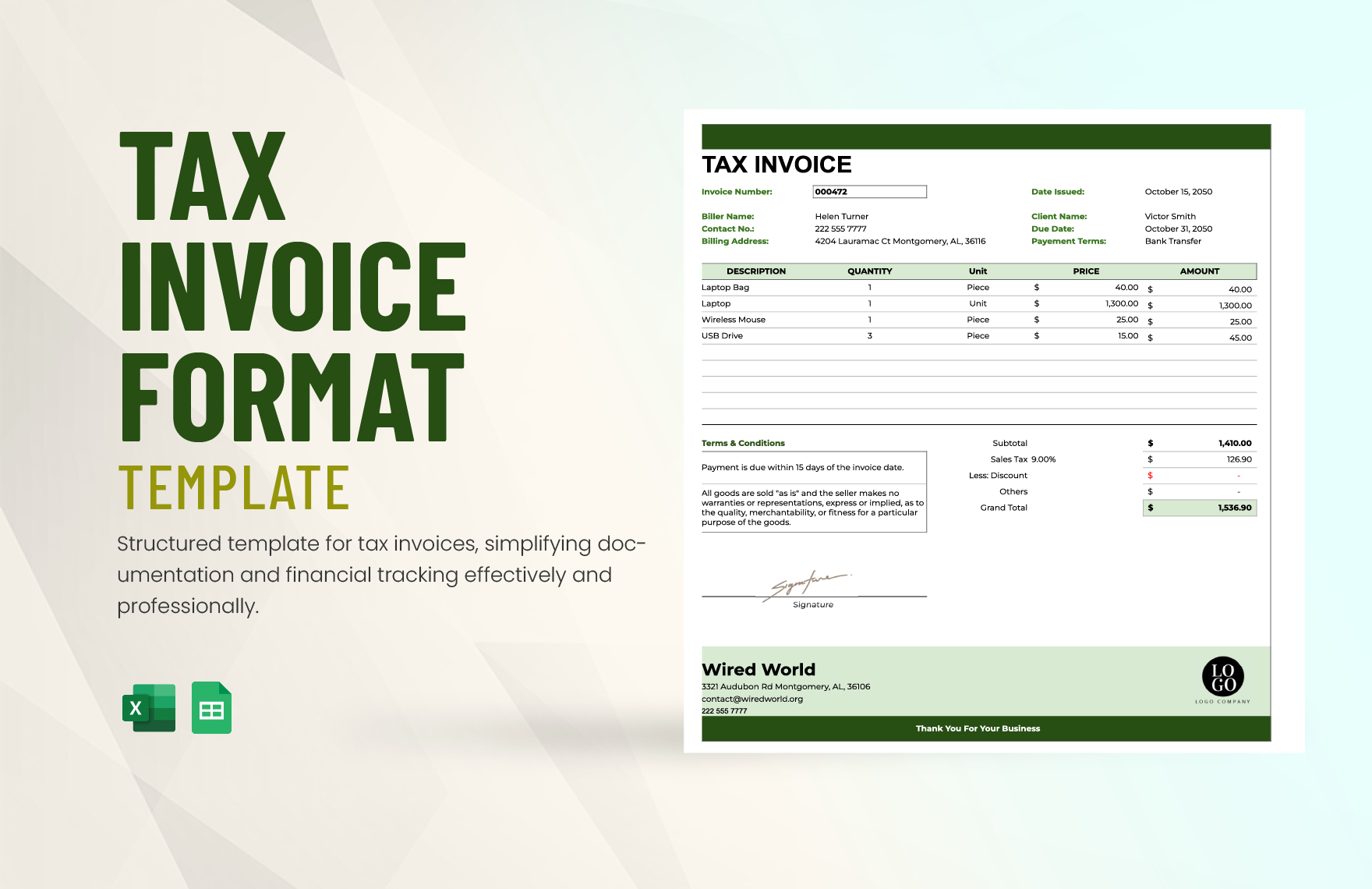

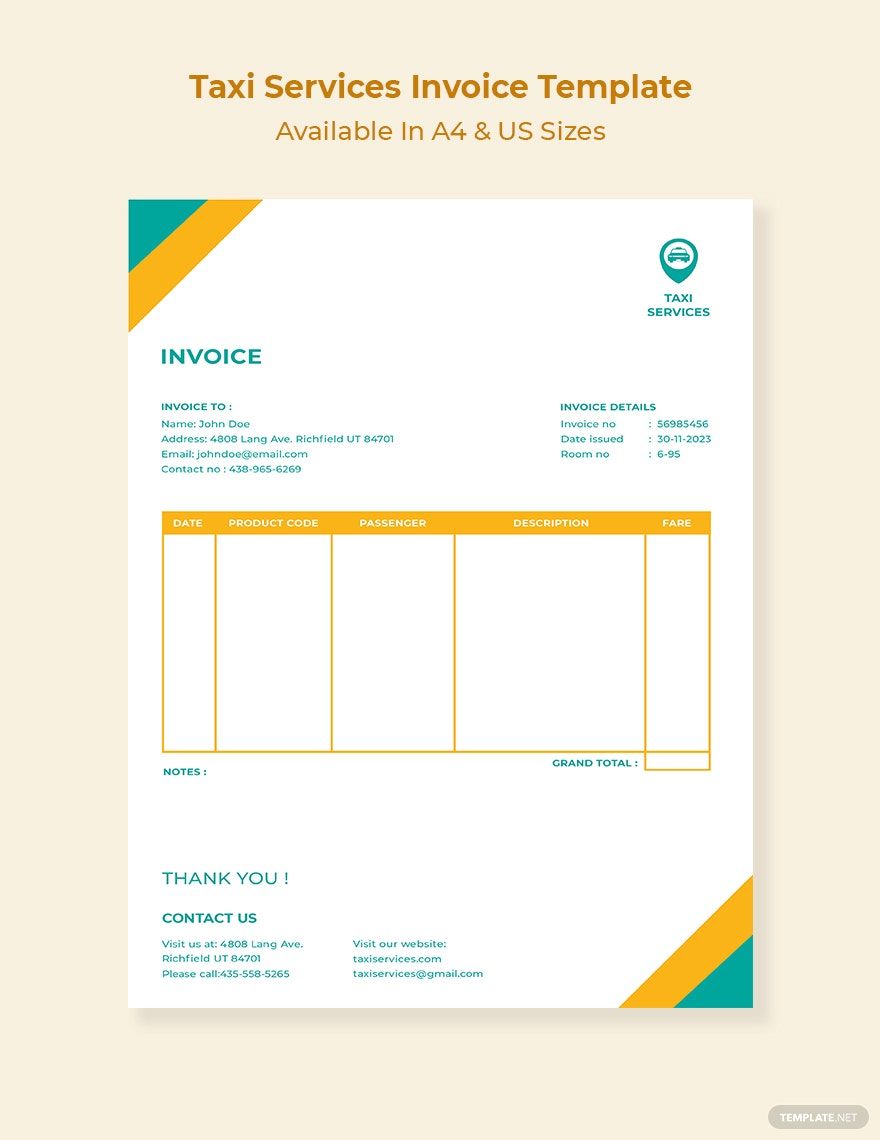

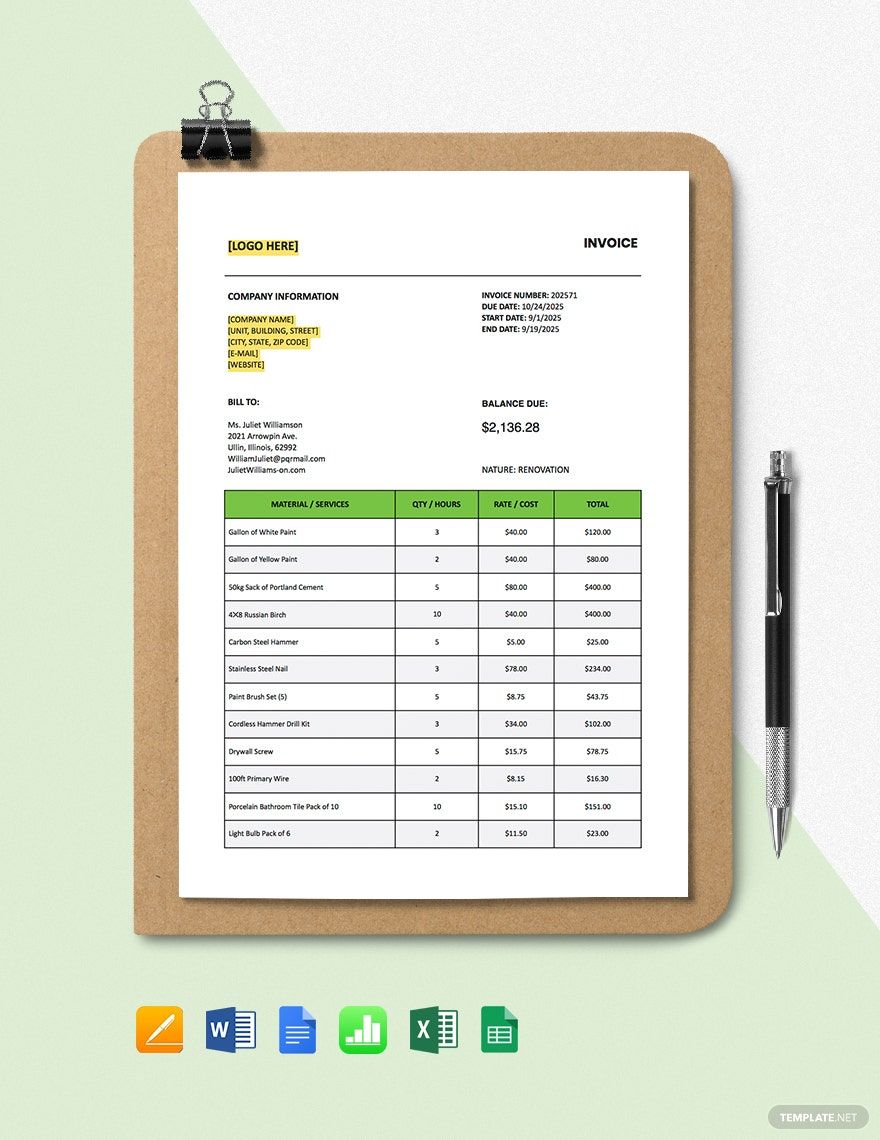

Bring Your Professional Financial Documents to Life with Tax Invoice Templates from Template.net

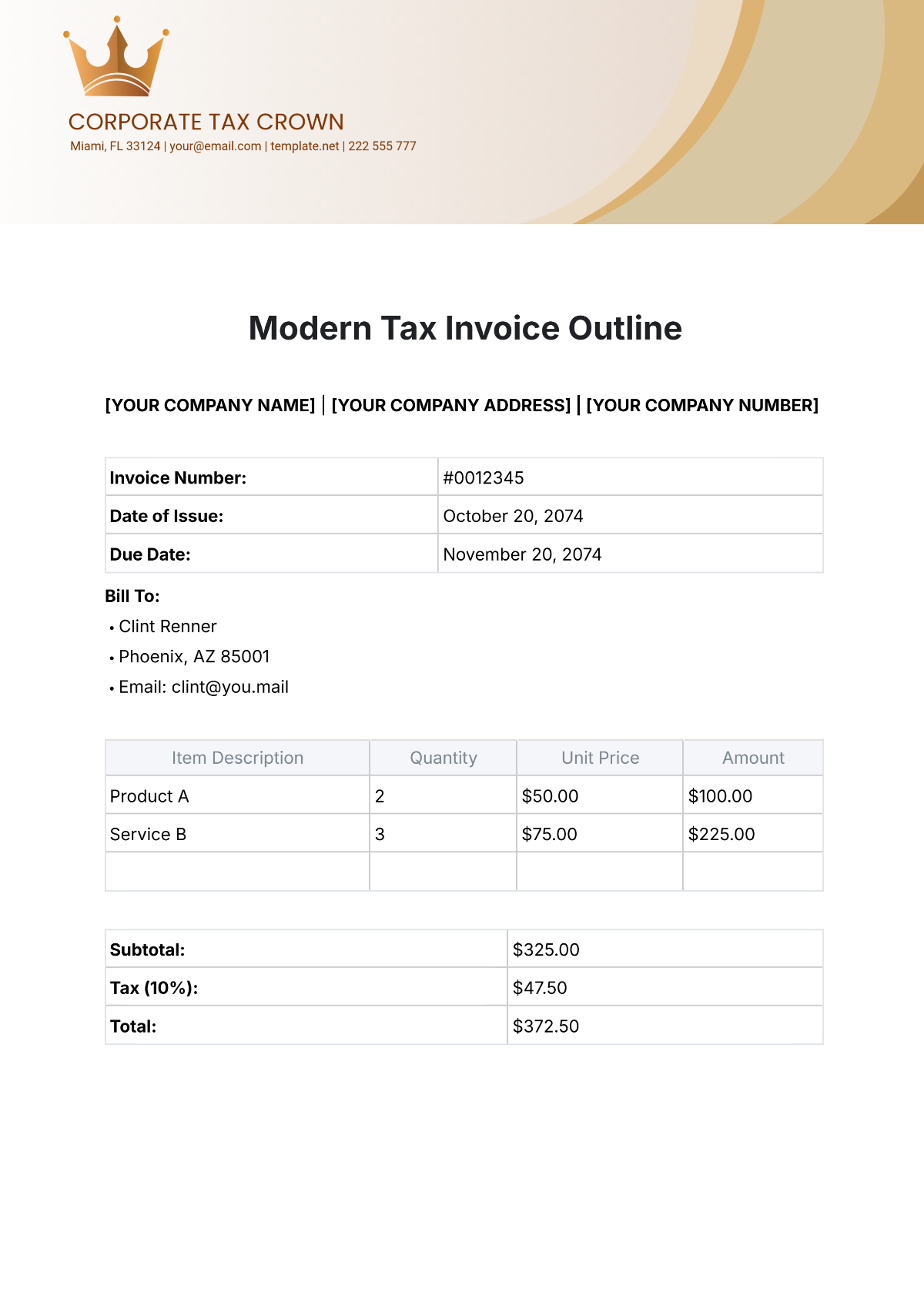

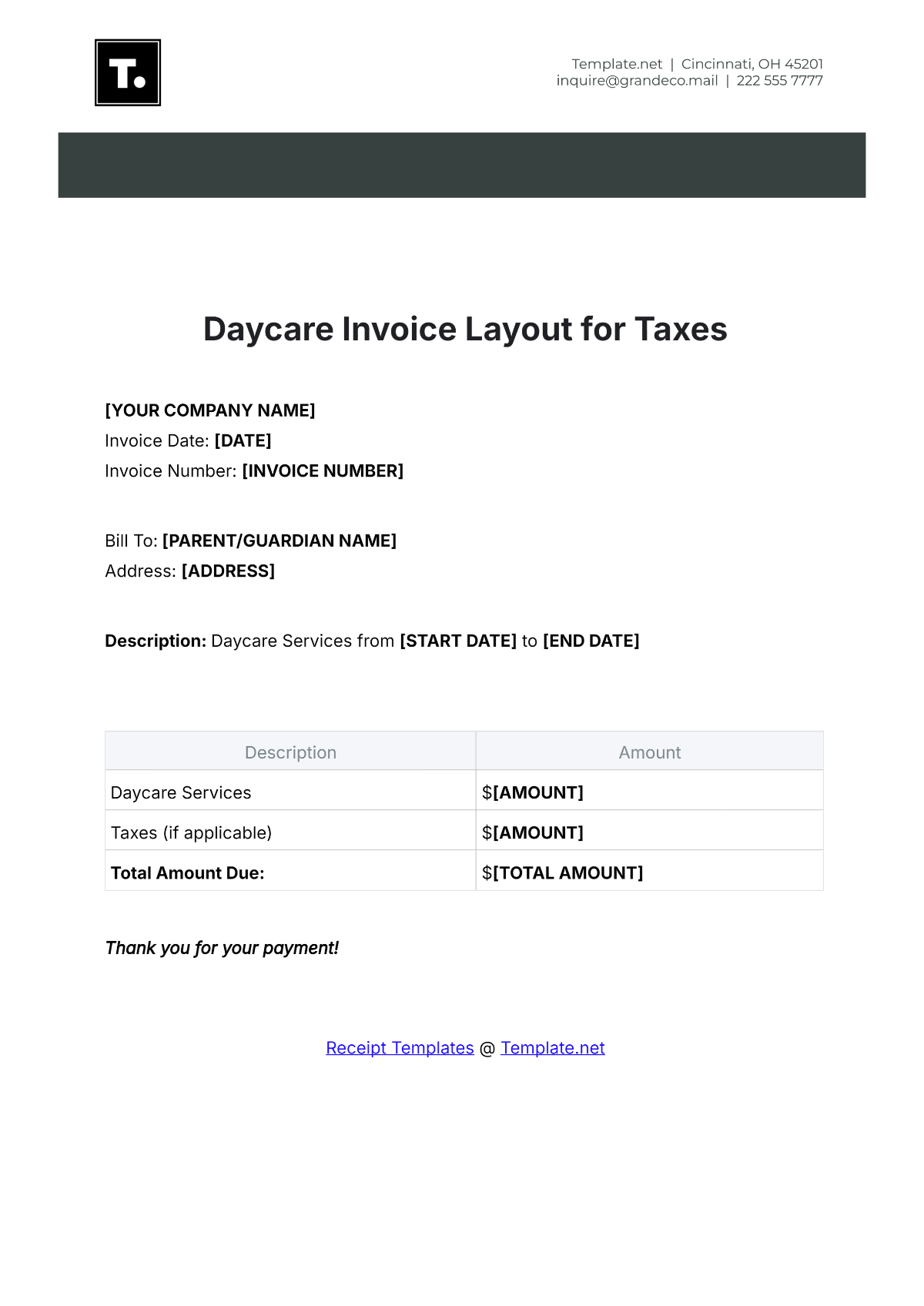

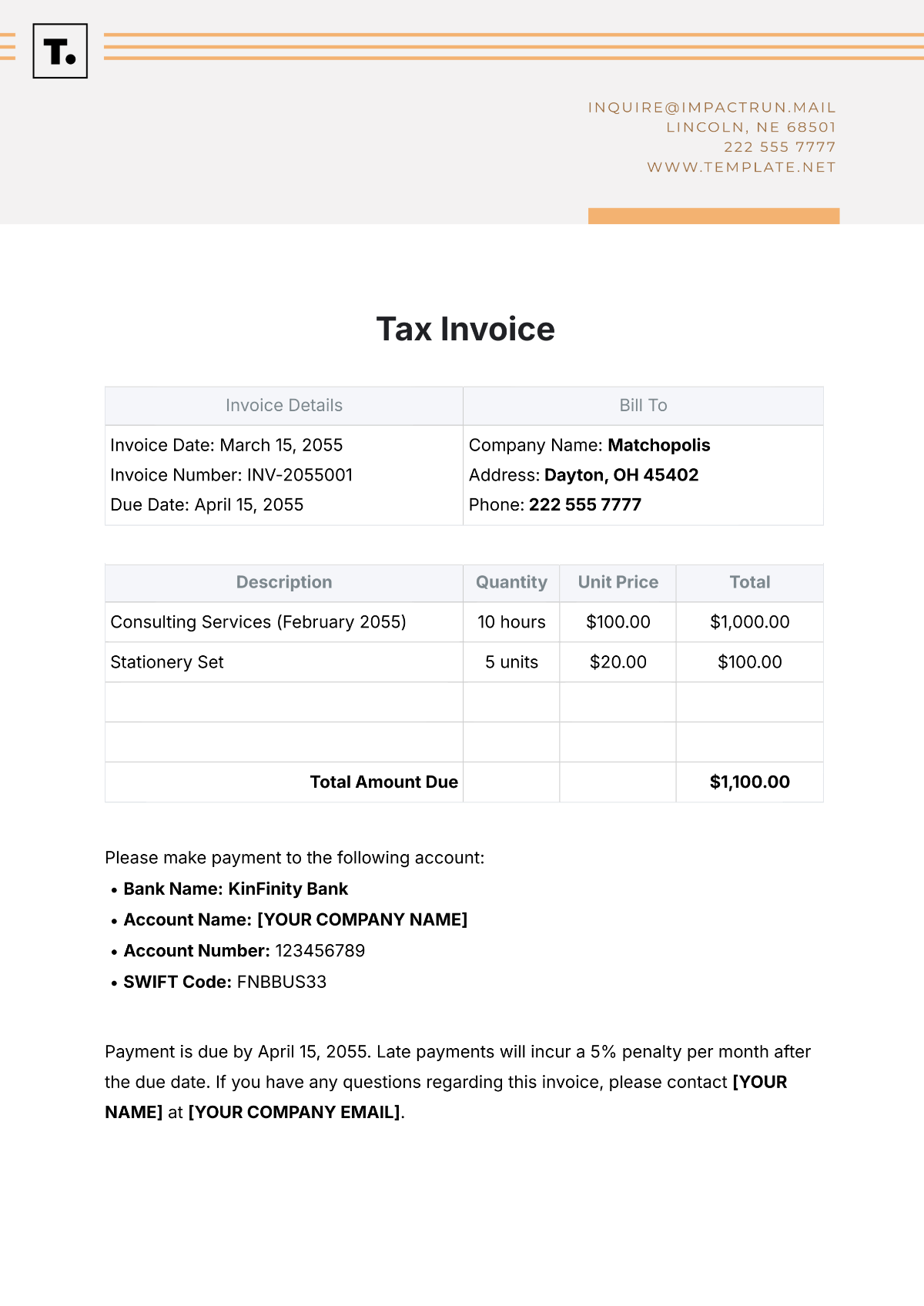

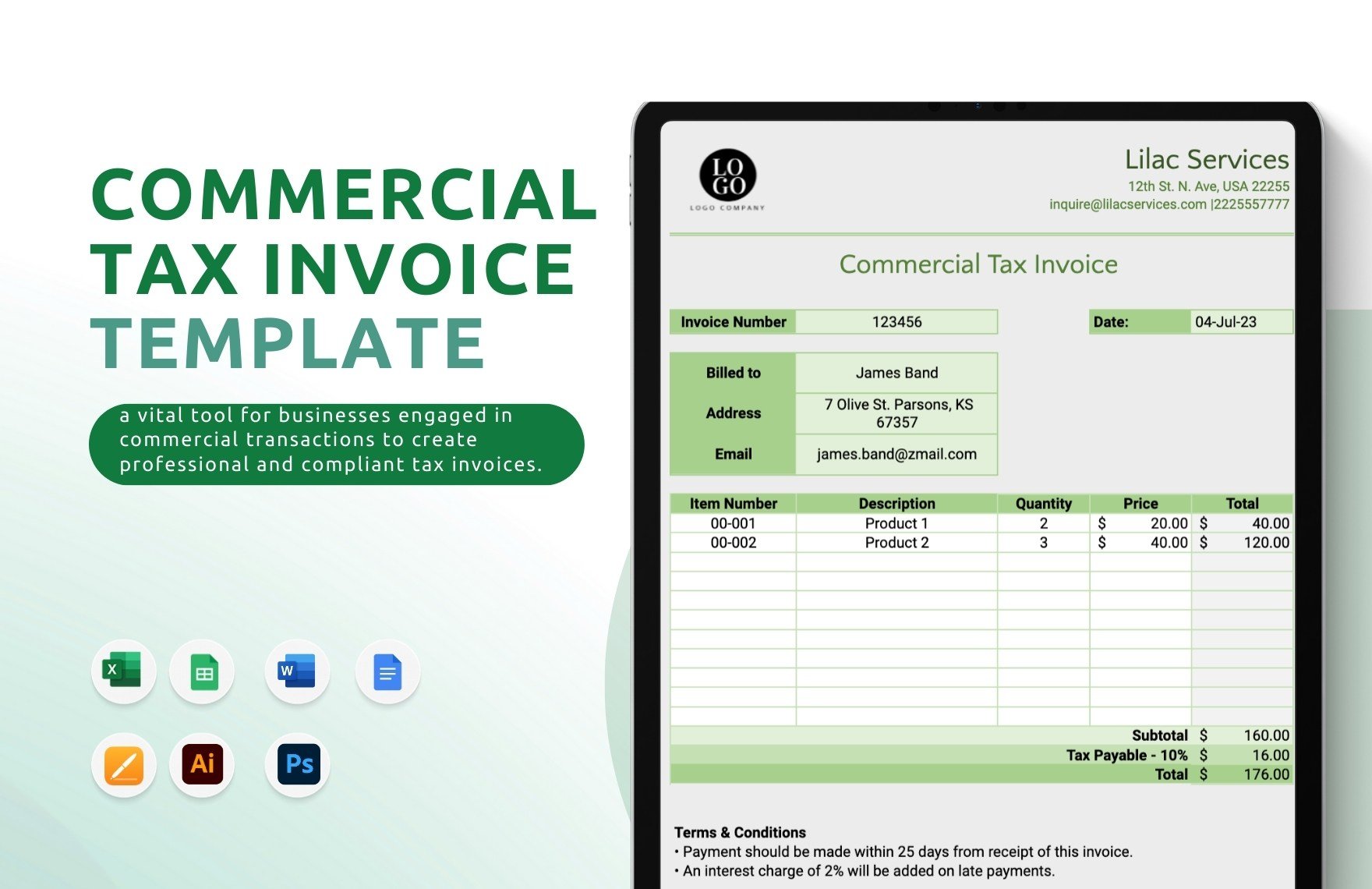

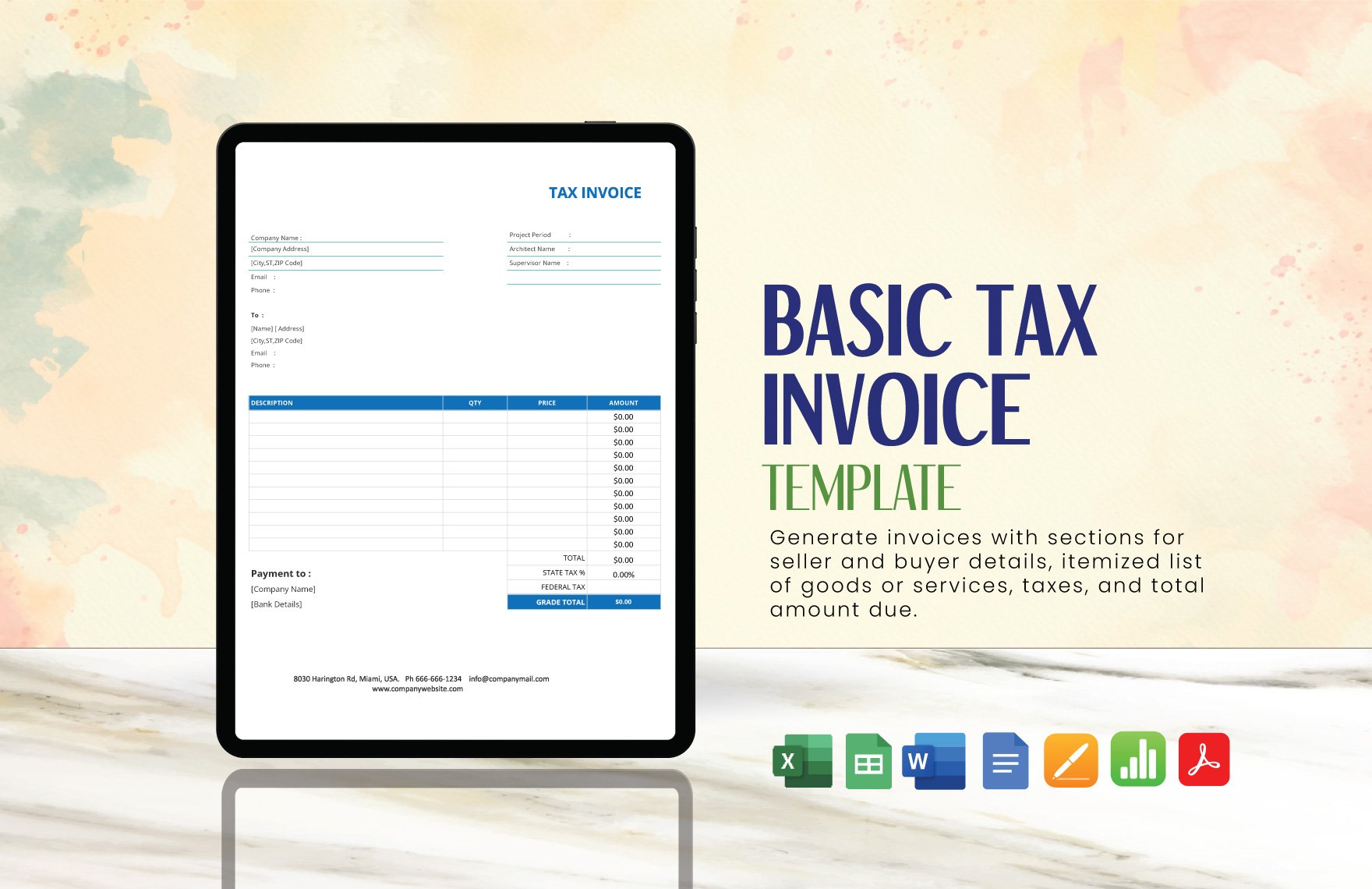

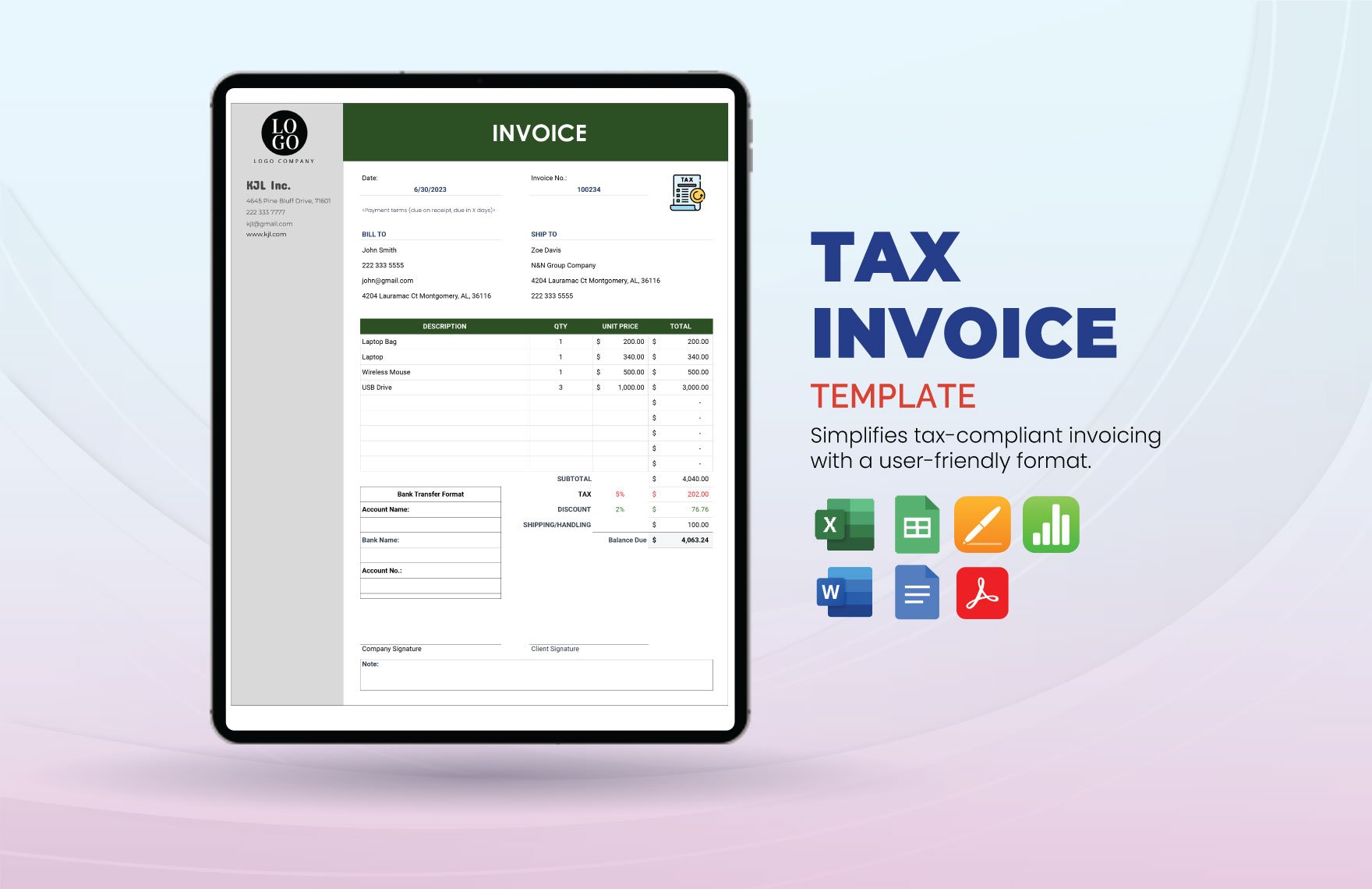

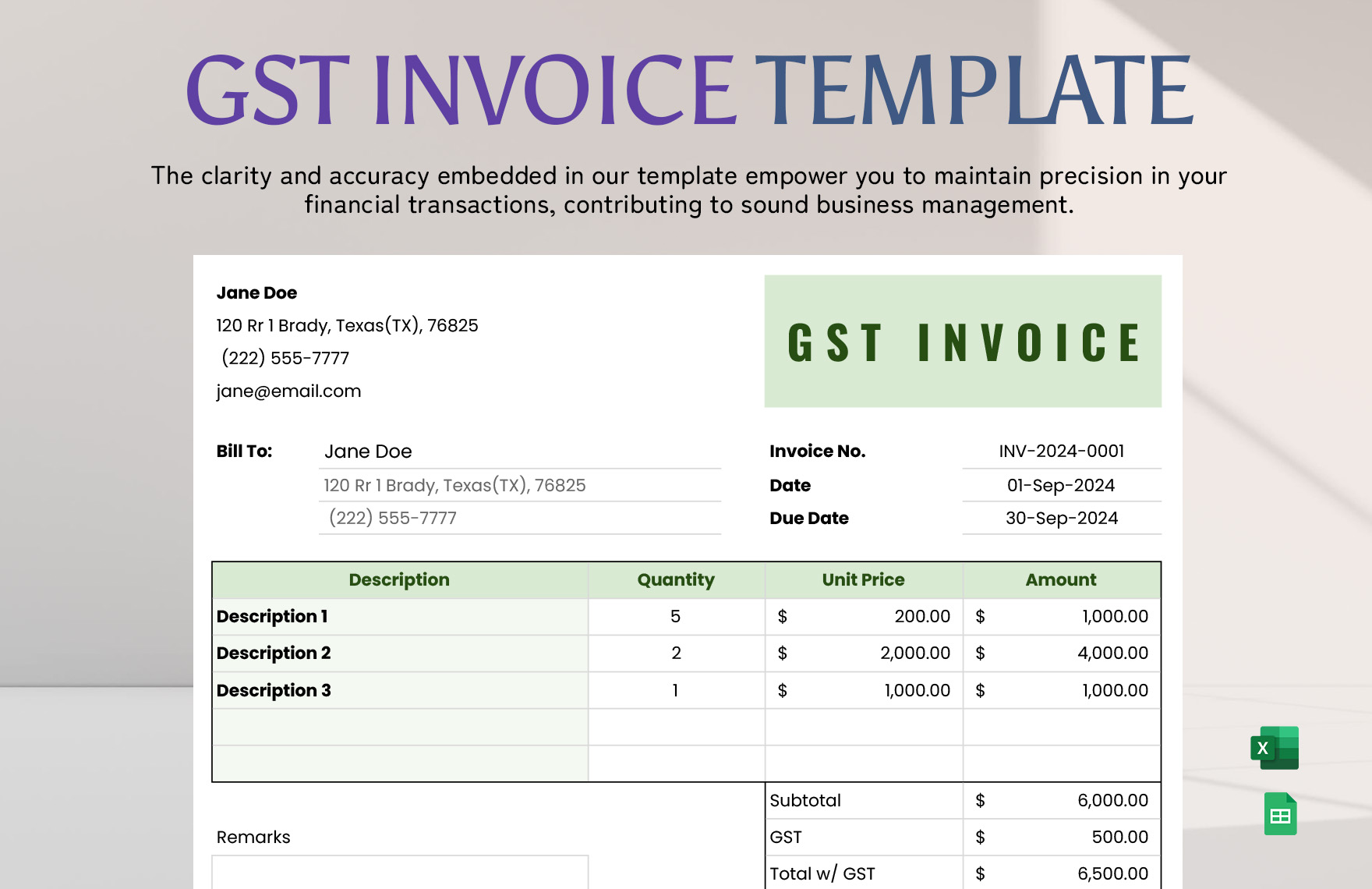

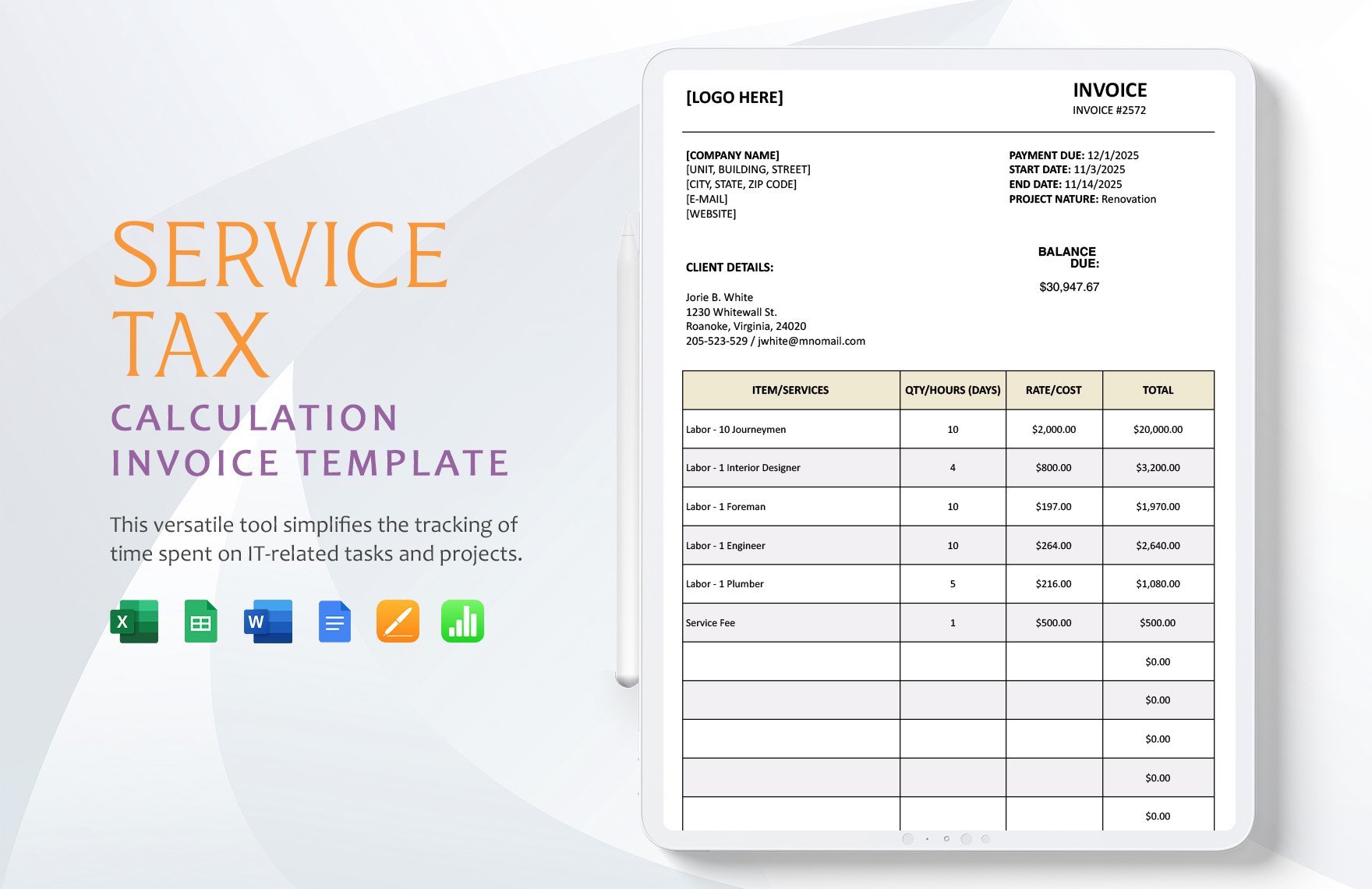

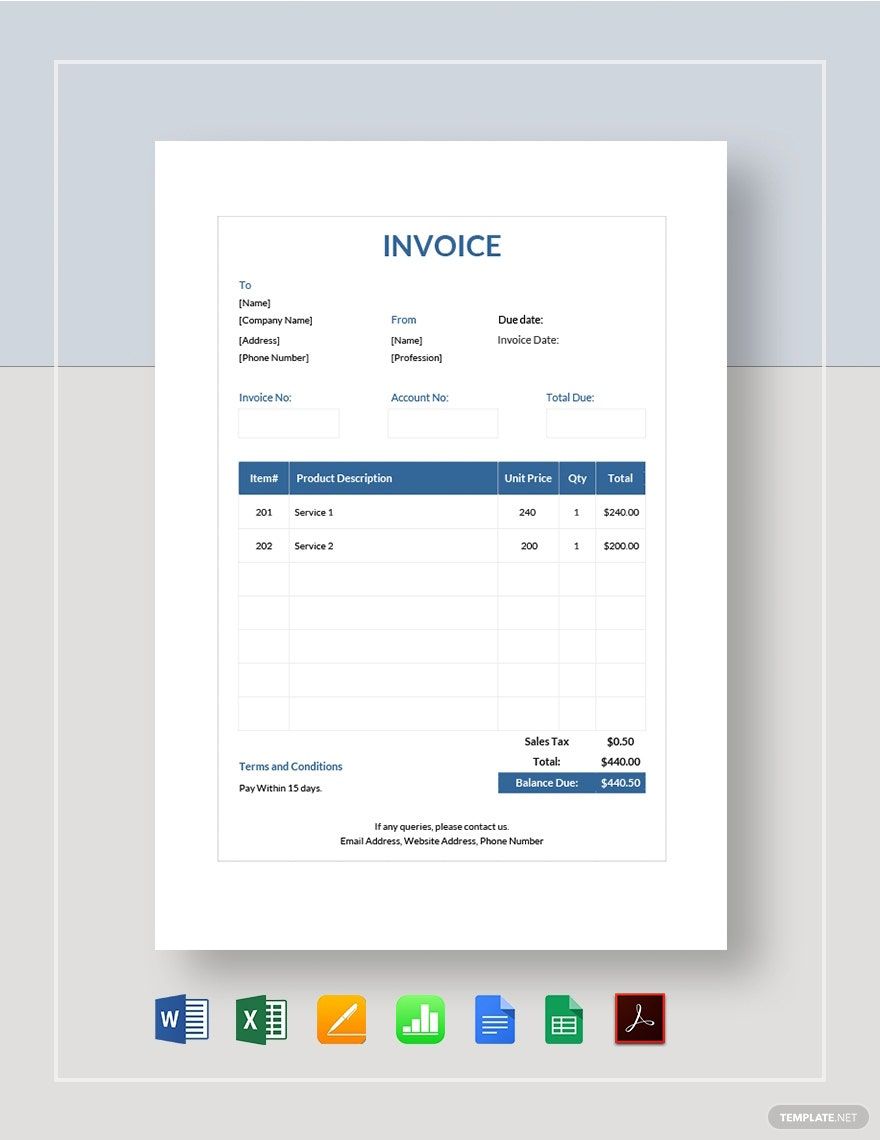

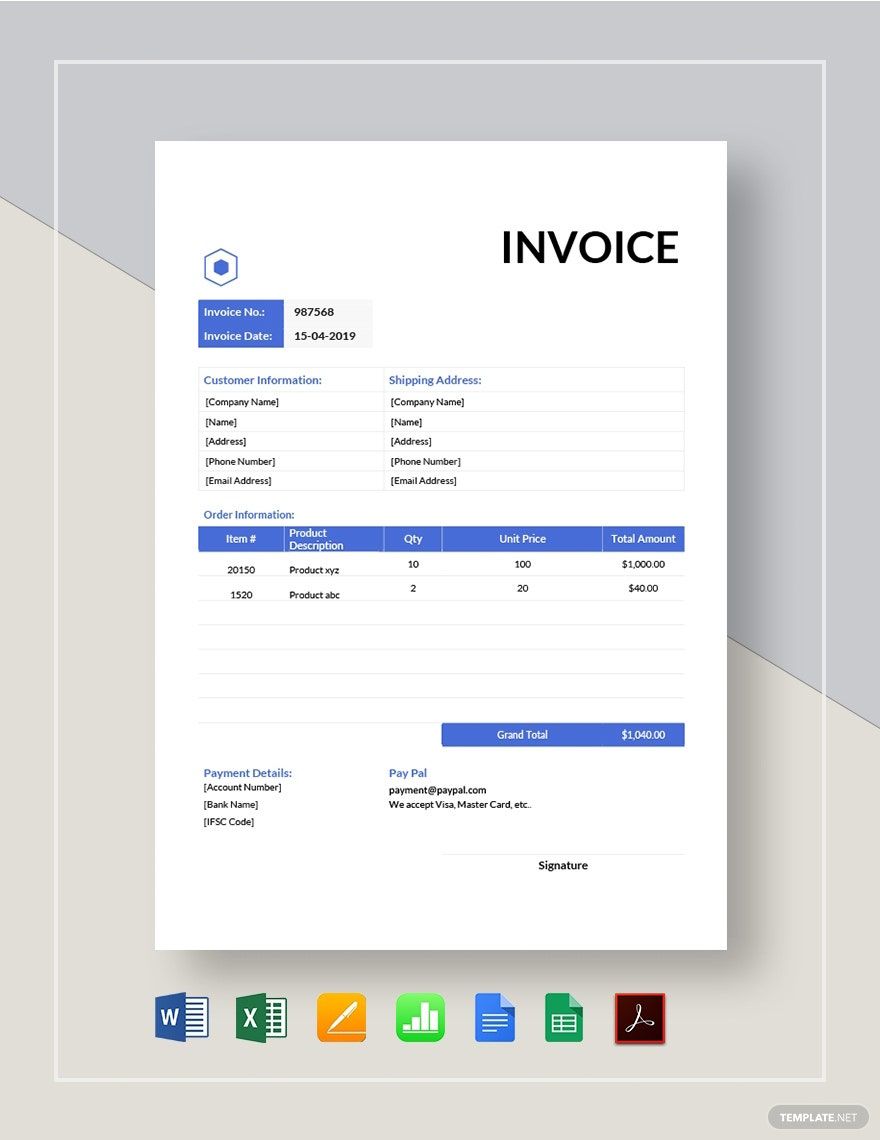

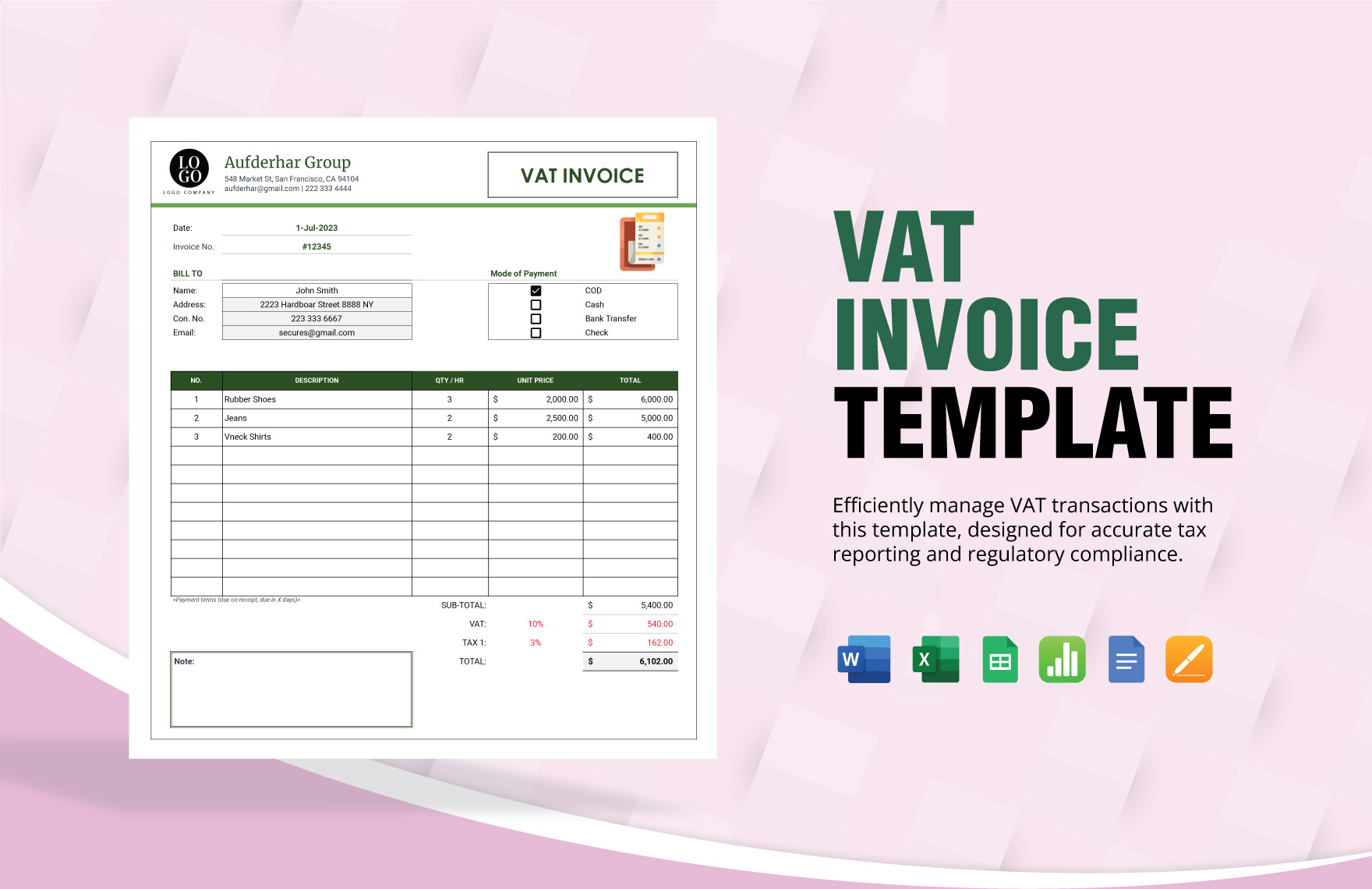

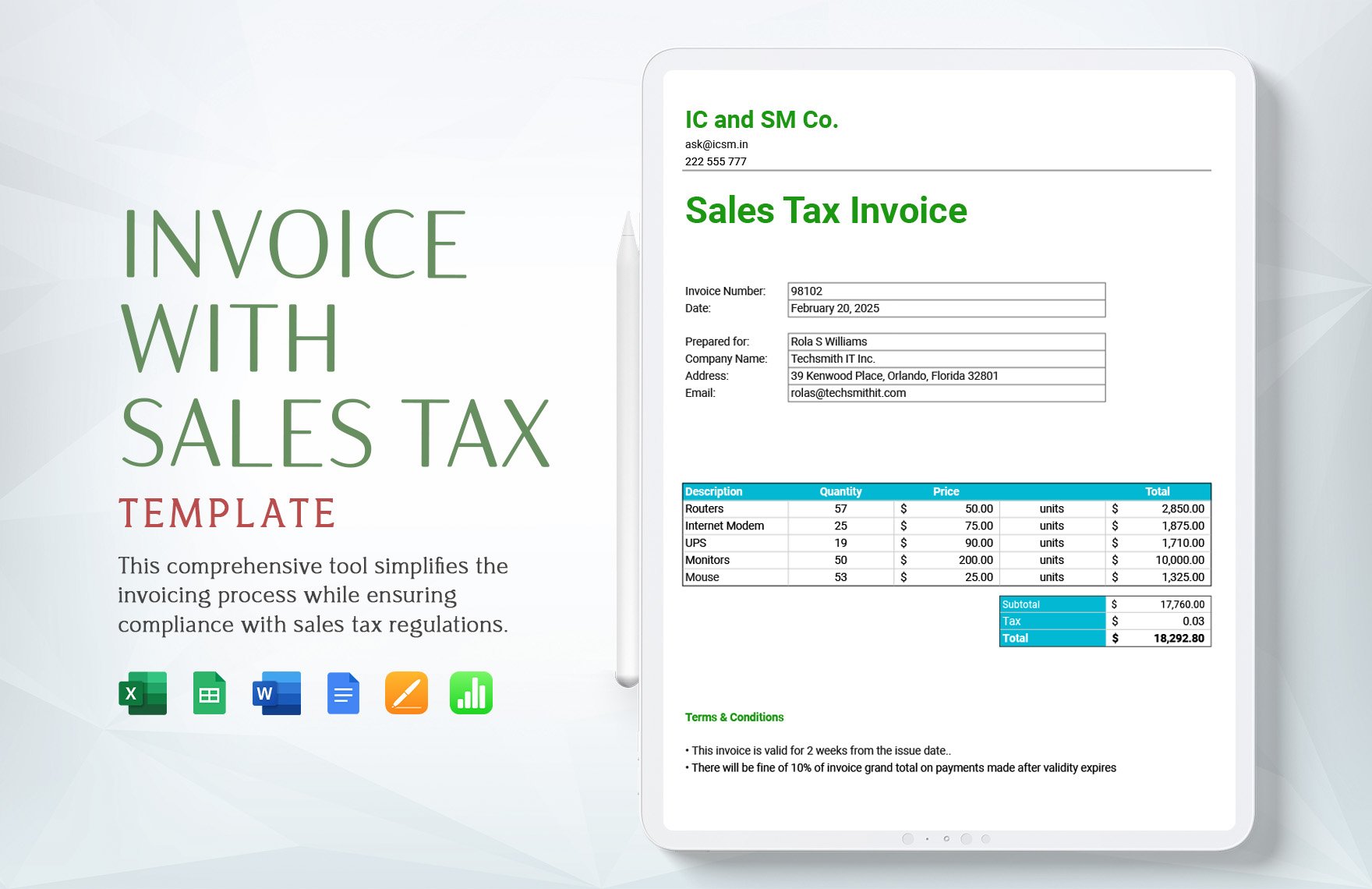

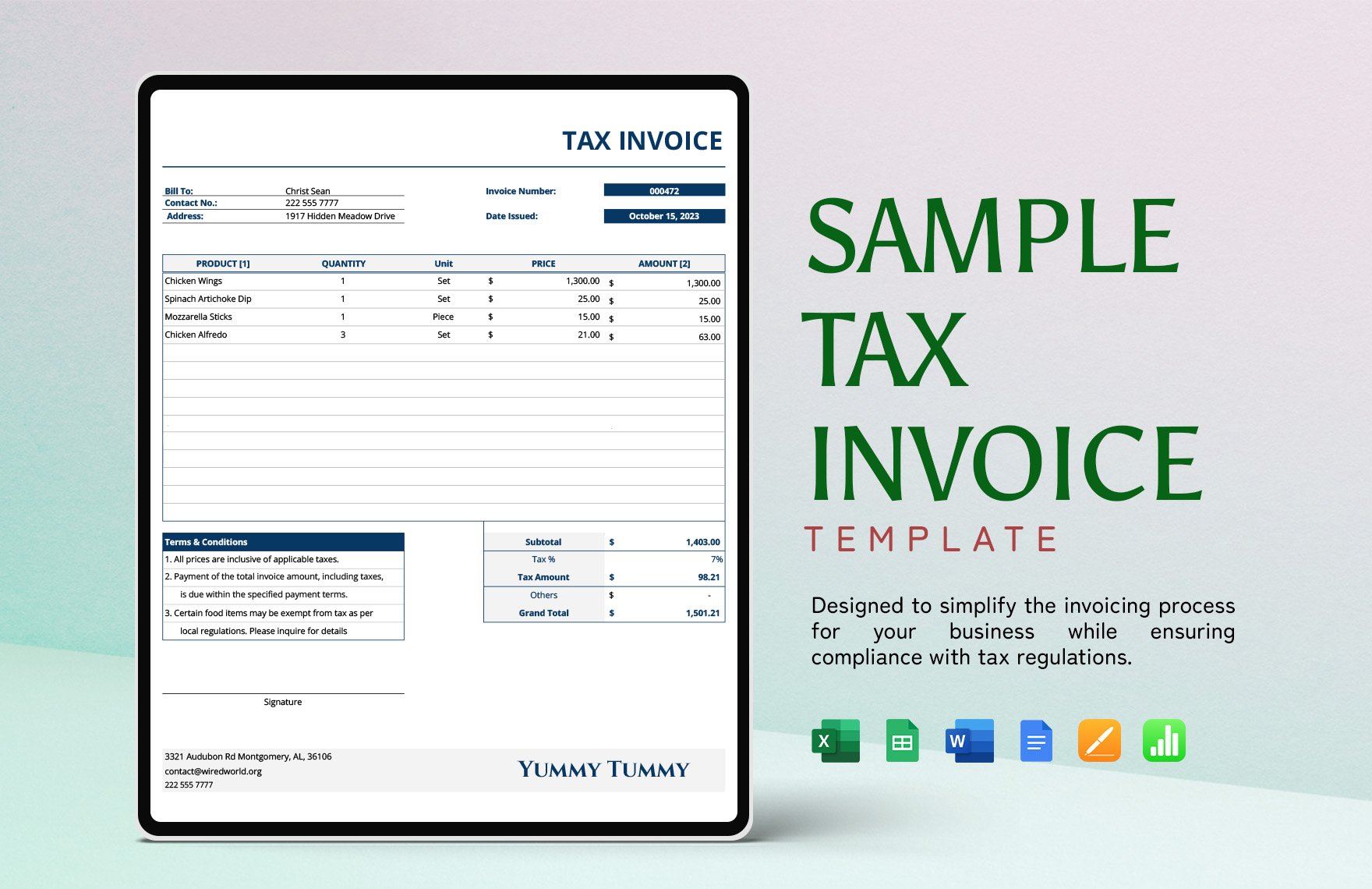

Maintain your business efficiency and streamline your financial paperwork with {Tax Invoice Templates} from {Template.net}. Ideal for small business owners, freelancers, and accountants, these templates enable you to keep your financial records in order, improve accuracy in invoicing, and enhance client communication. Whether you want to promote a sale by detailing a custom offer or need to send a precise invoice for a special event, these templates have you covered. They include all essential fields like time, date, location, and contact information, ensuring everything you need is at your fingertips. No advanced design skills are required, as these templates offer professional-grade design right from the start. Customize them easily to suit your brand and enjoy streamlined print or digital distribution options.

Discover the many Tax Invoice Templates we have on hand designed to suit a wide array of business needs. Choose from a variety of layouts, swap in your business logo, and adjust the colors and fonts to match your brand identity perfectly. Enhance your invoices with advanced touches, such as dragging and dropping icons, incorporating sleek graphics, or integrating your choice of animated effects. With AI-powered text tools, crafting precise and engaging invoices has never been easier. The possibilities are endless, and you don’t need to be a design expert to explore them. Our library is regularly updated with new templates, ensuring you always have fresh designs to choose from. Once your perfect template is ready, download, print, or share it with clients via email or export it for your records.