According to Tax Foundation, last 2016, around 140.9 million were paying taxes in the United States. As everyone knows, it's every business' responsibility to pay tax to the government. Additionally, your clients must also pay taxes. And to professionally tell them their payment, you need a tax invoice. This invoice will show all the information a client has to know for the tax payable. For that, check out our stock of ready-made Tax Invoice Templates in Microsoft Excel (XLS). This template has a formal and professional layout for any business. It's 100% editable, too. Download a template now!

Tax Invoice Templates in Excel

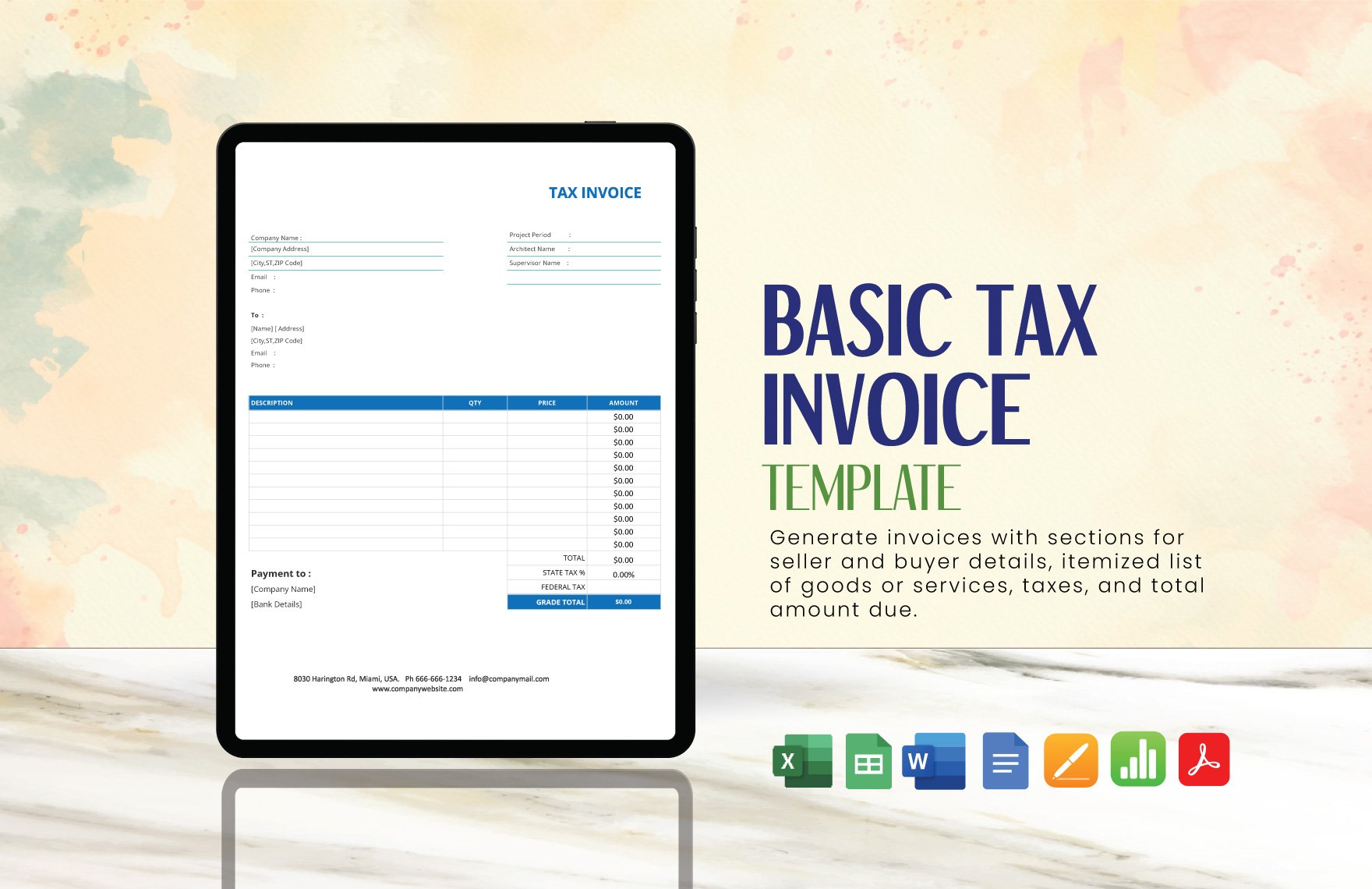

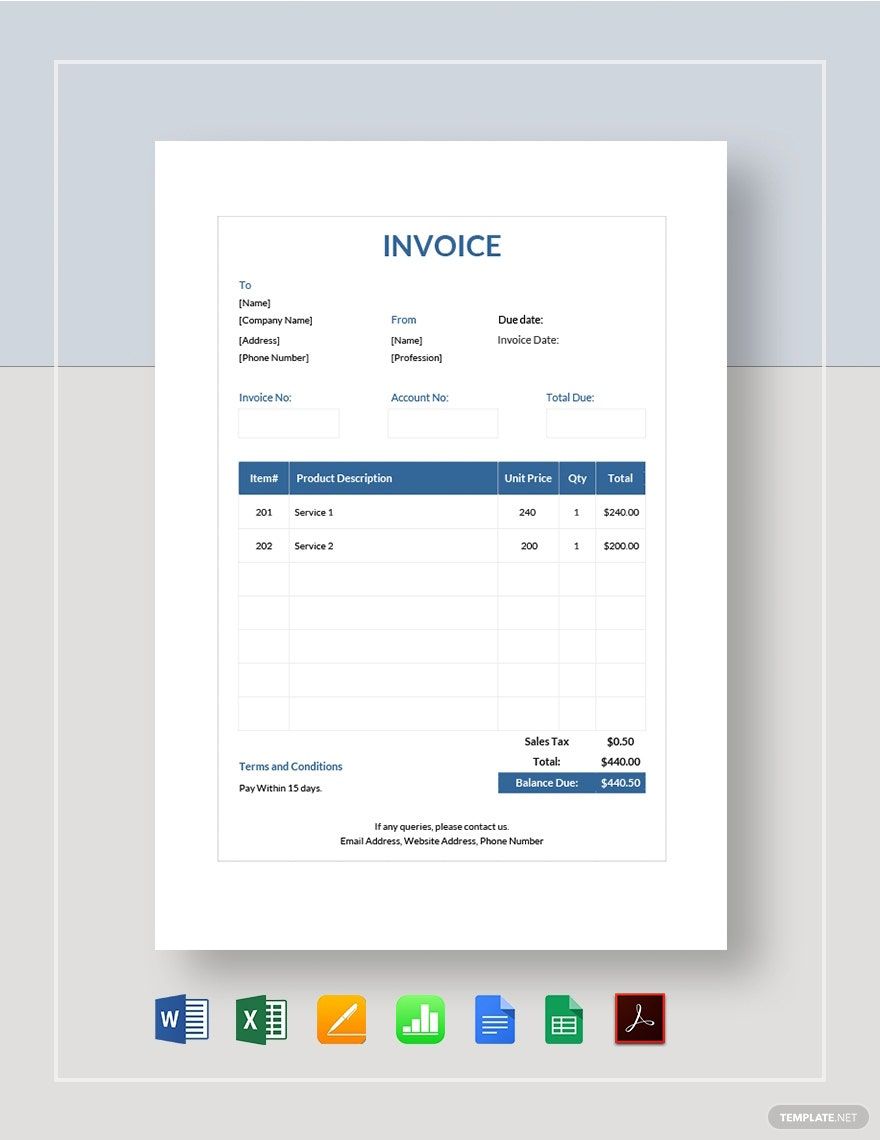

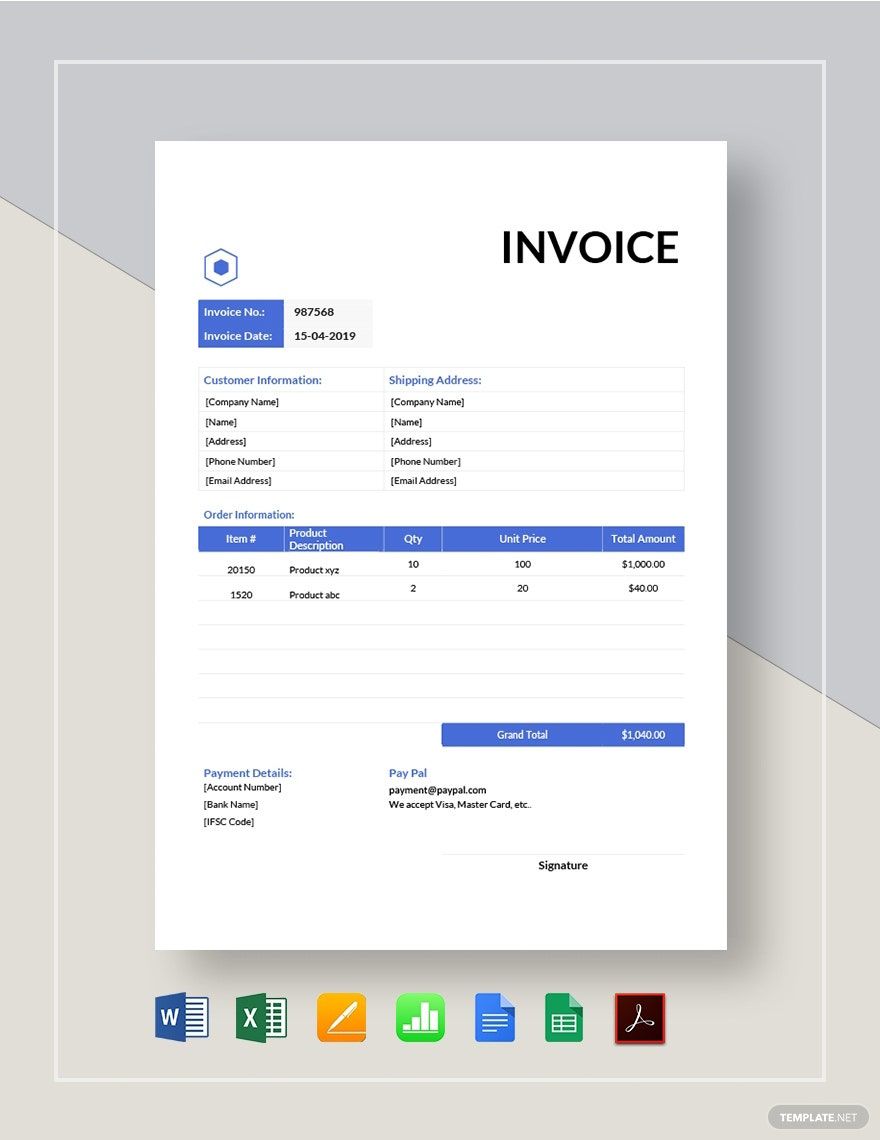

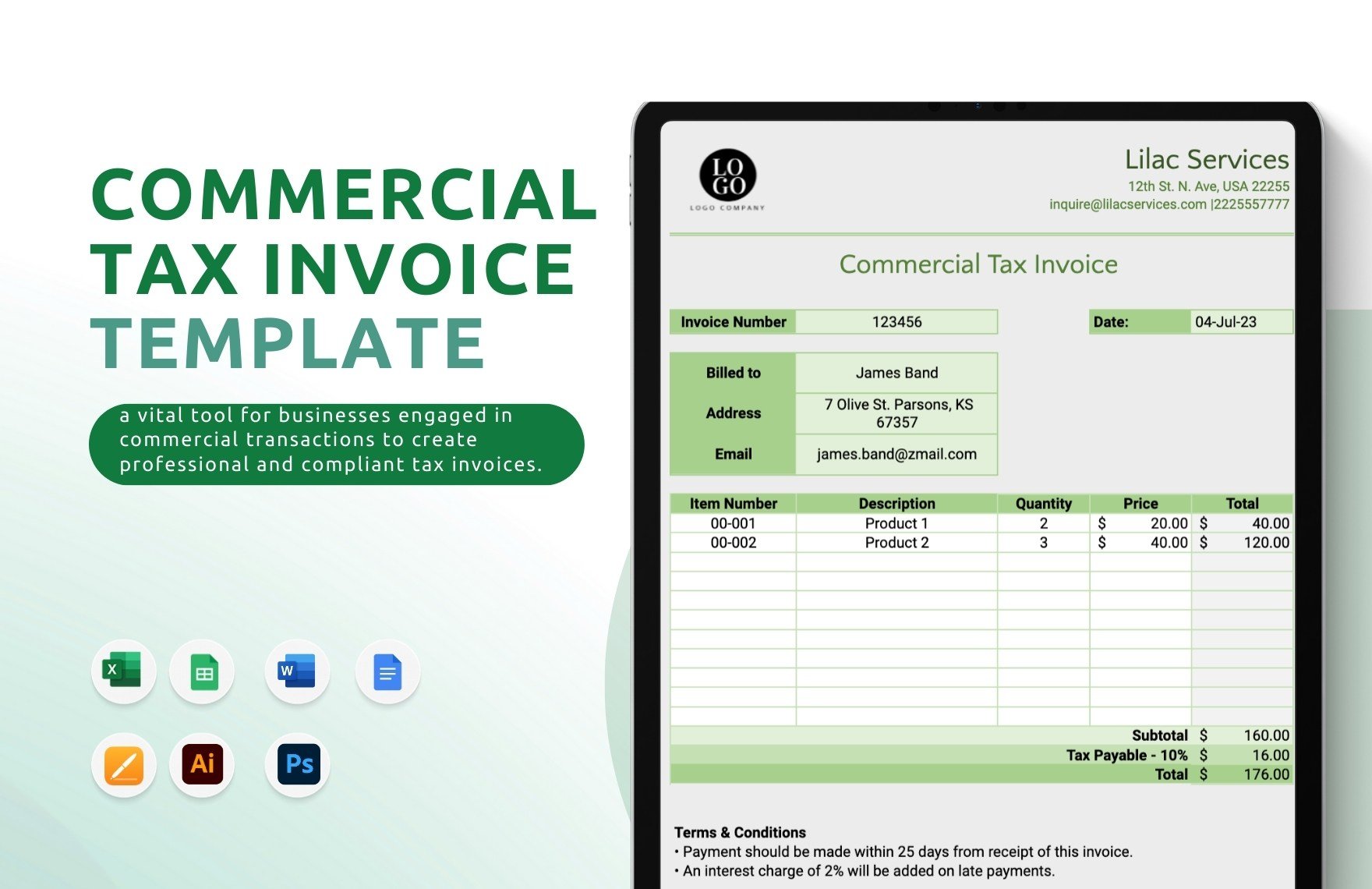

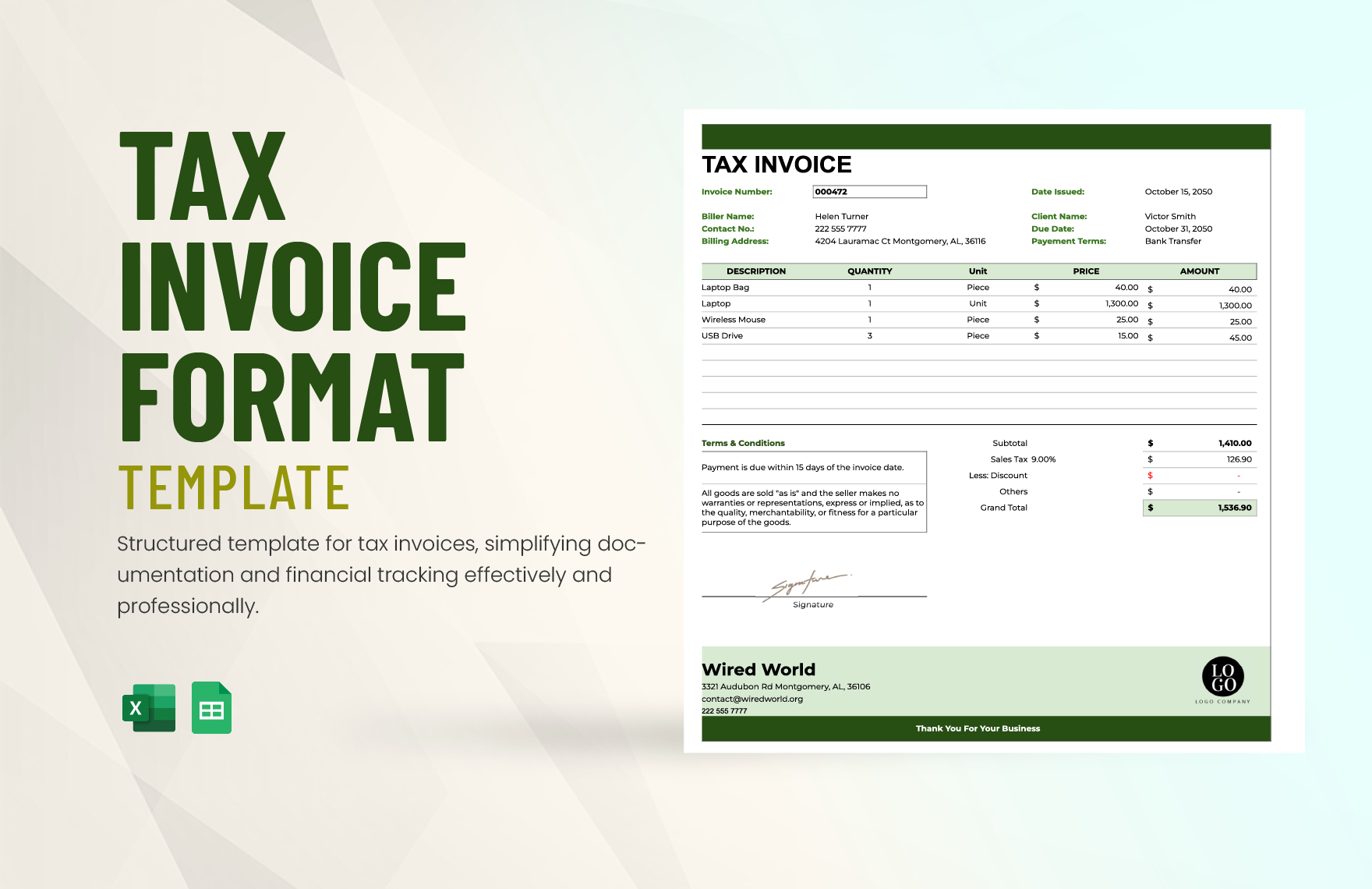

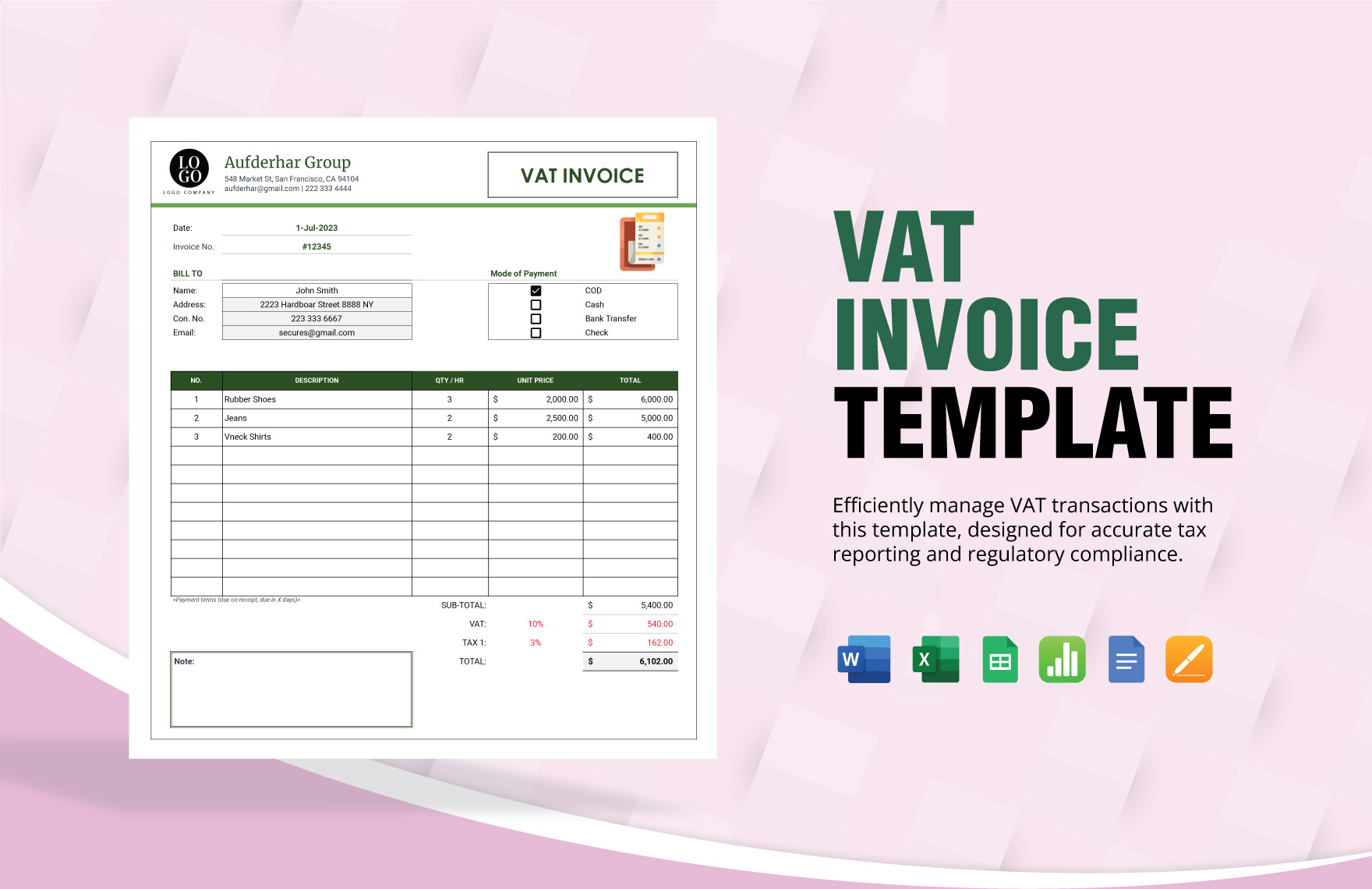

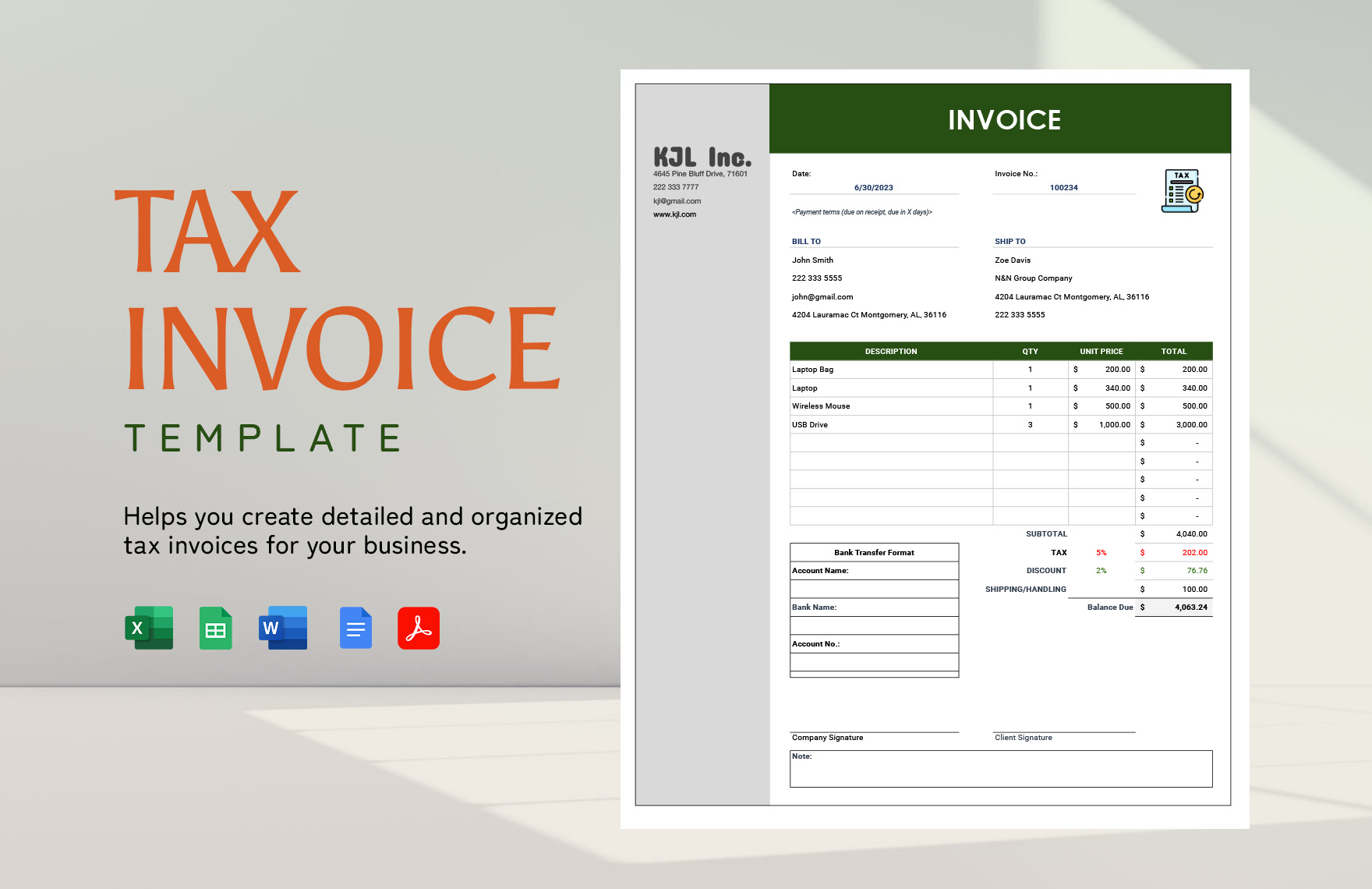

Enhance Your Business Efficiency with Seamless Tax Invoice Management Using Tax Invoice Templates in Microsoft Excel by Template.net

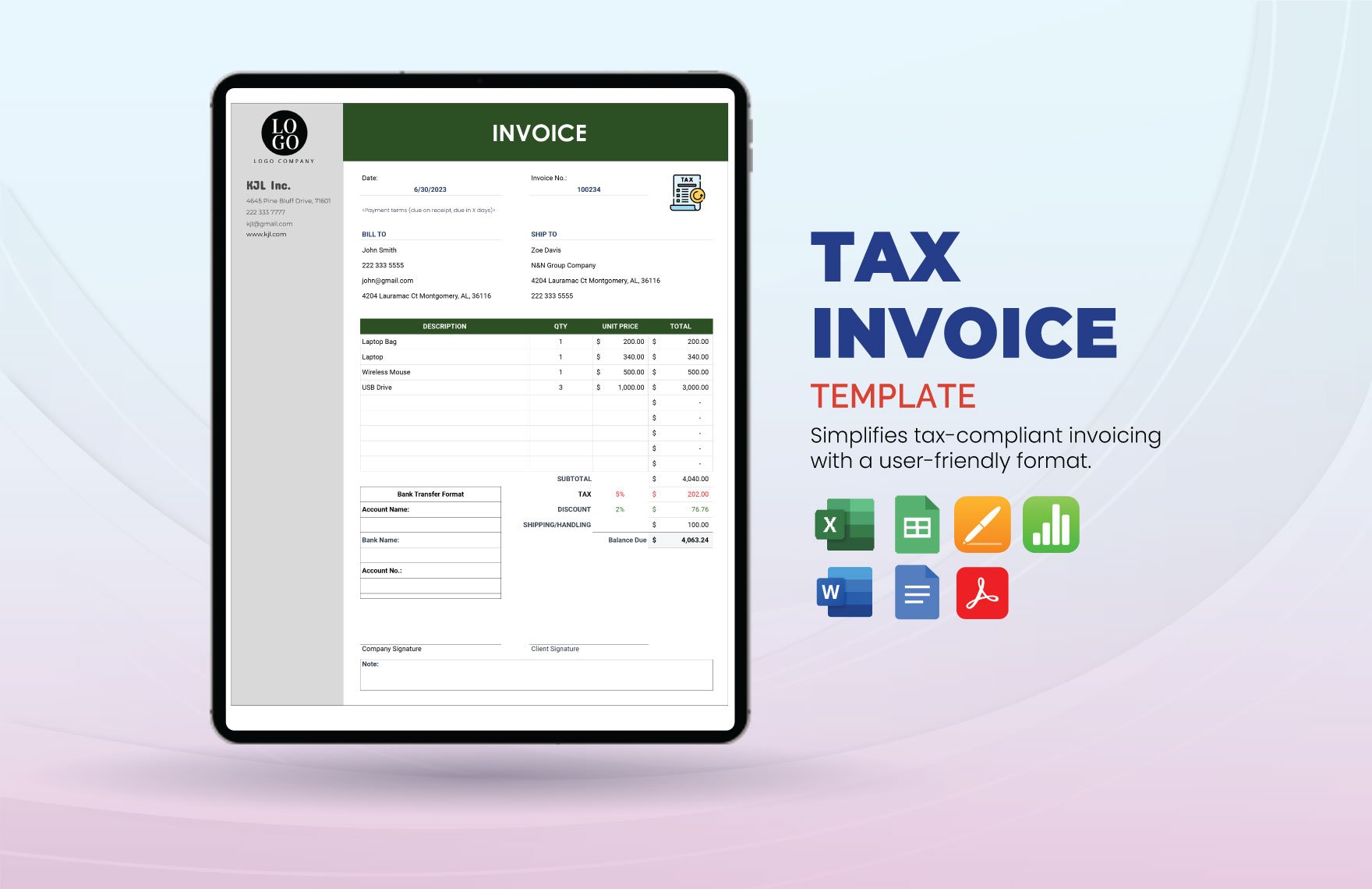

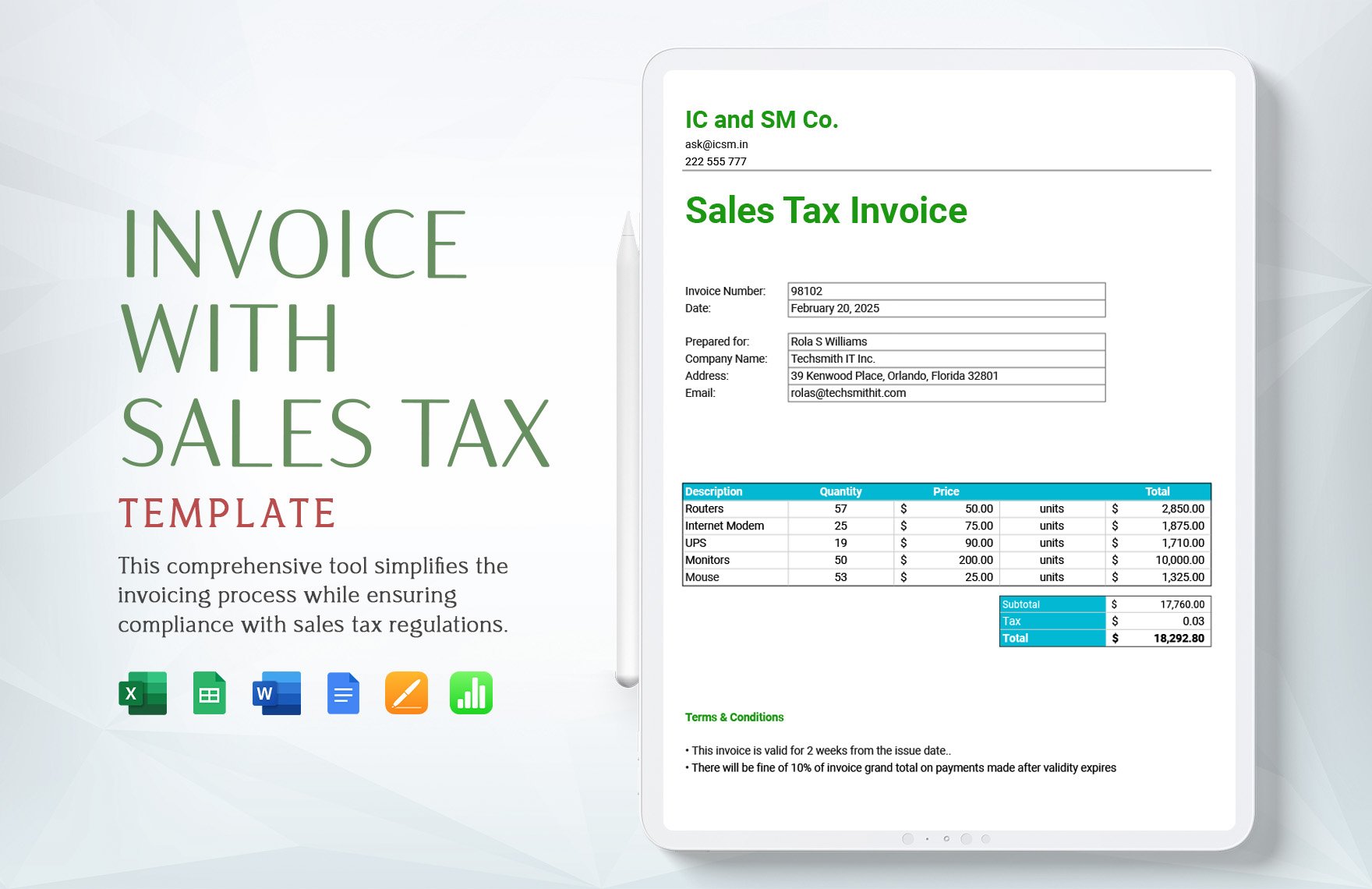

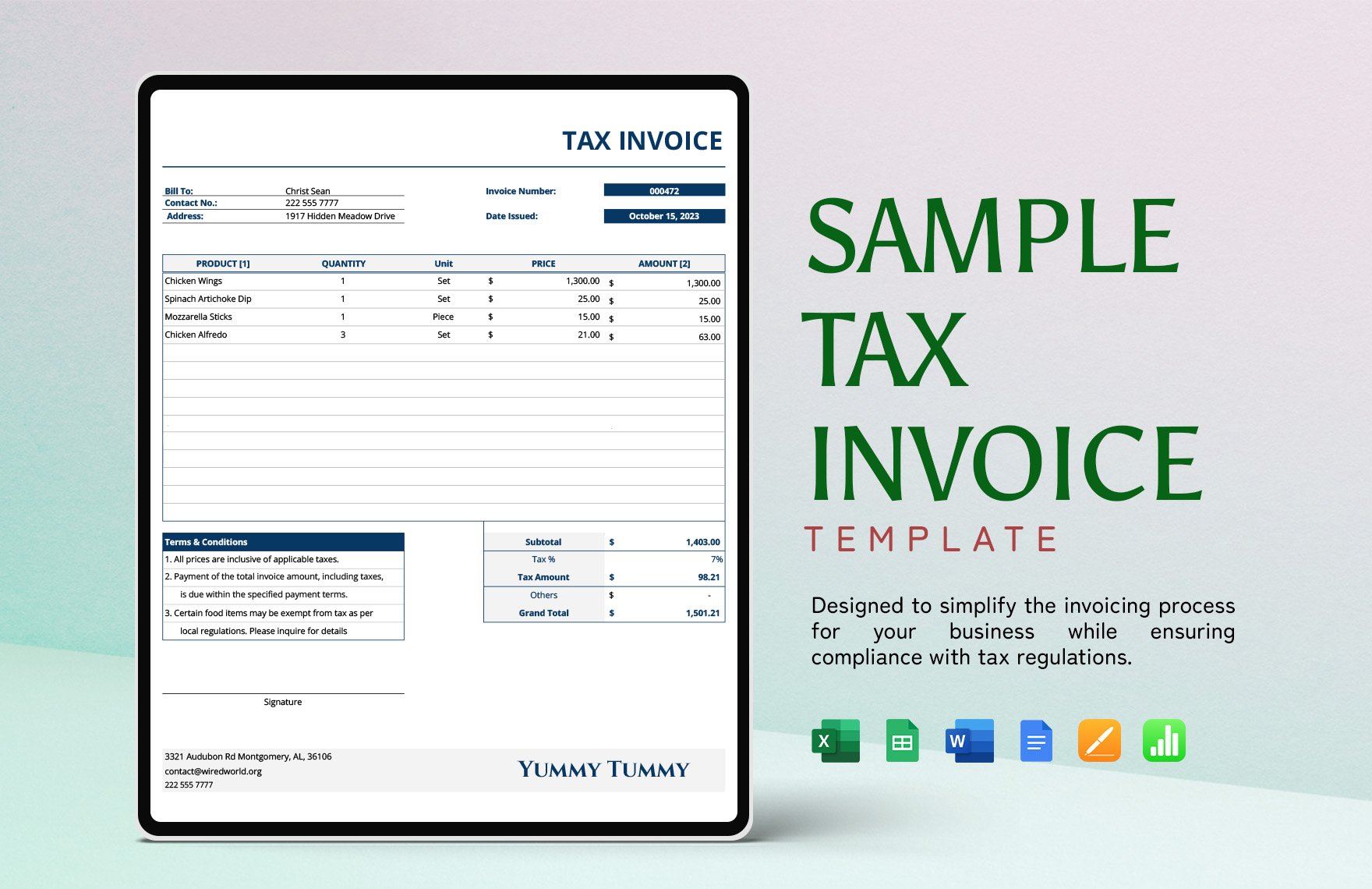

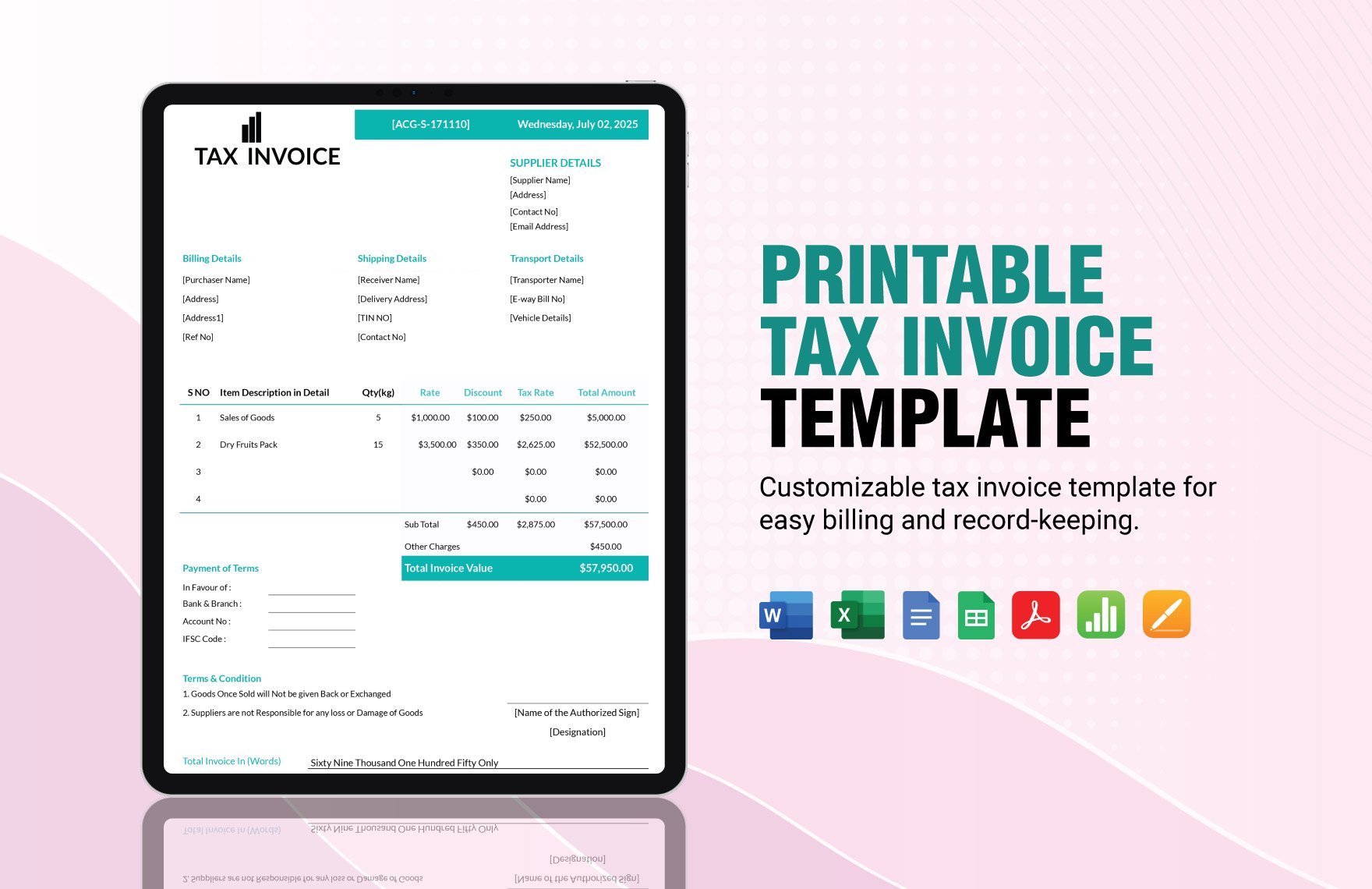

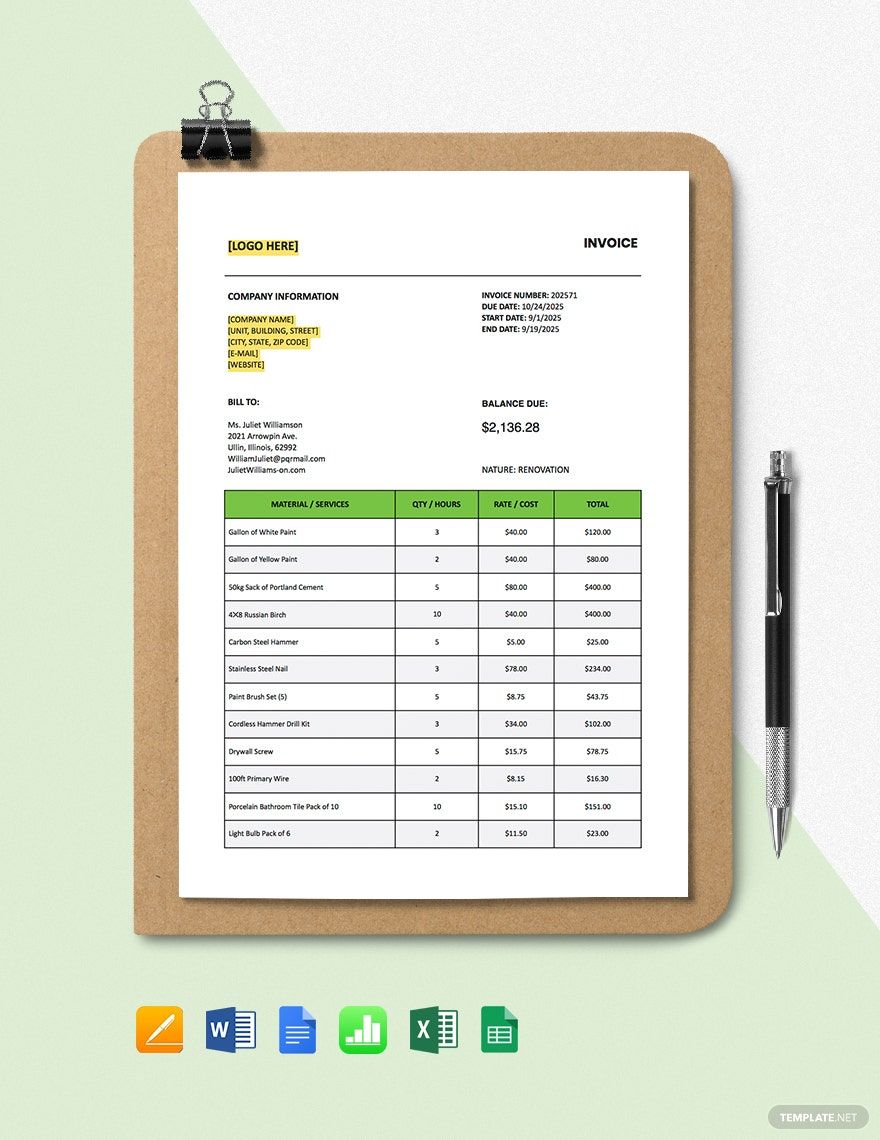

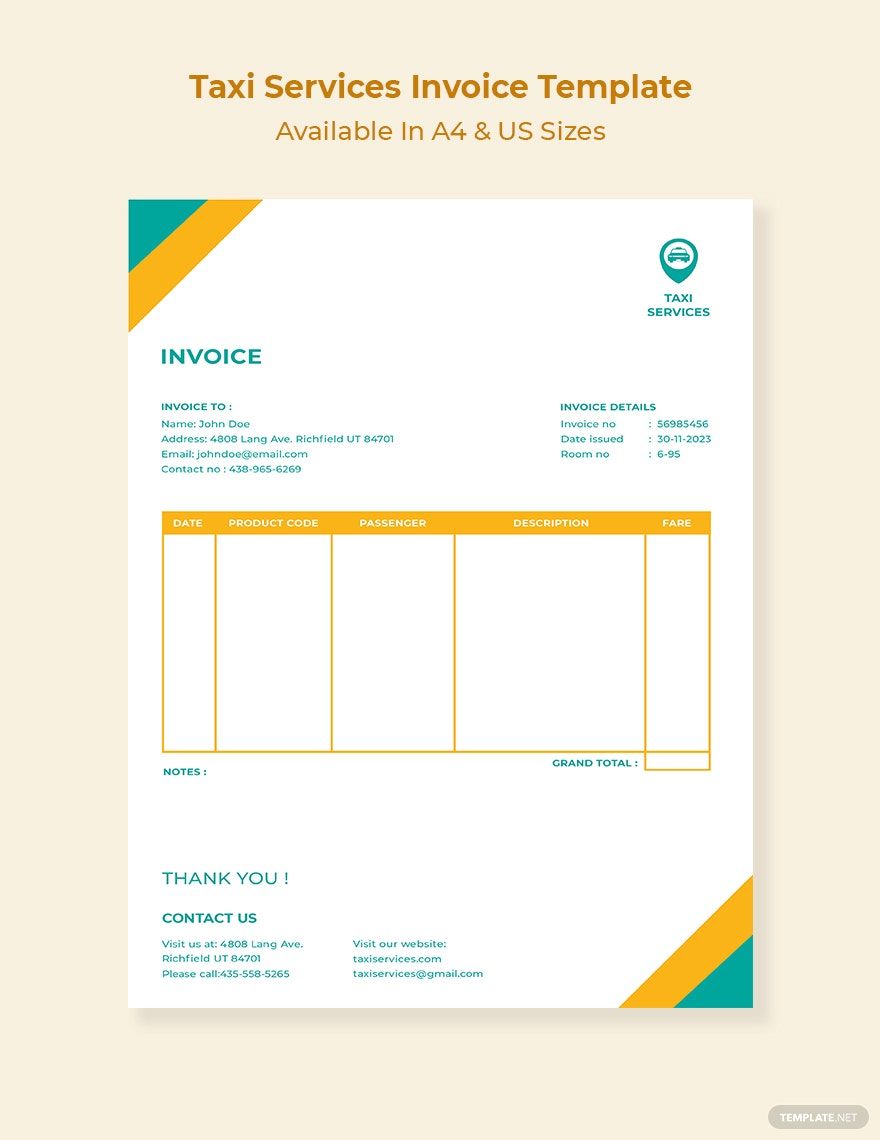

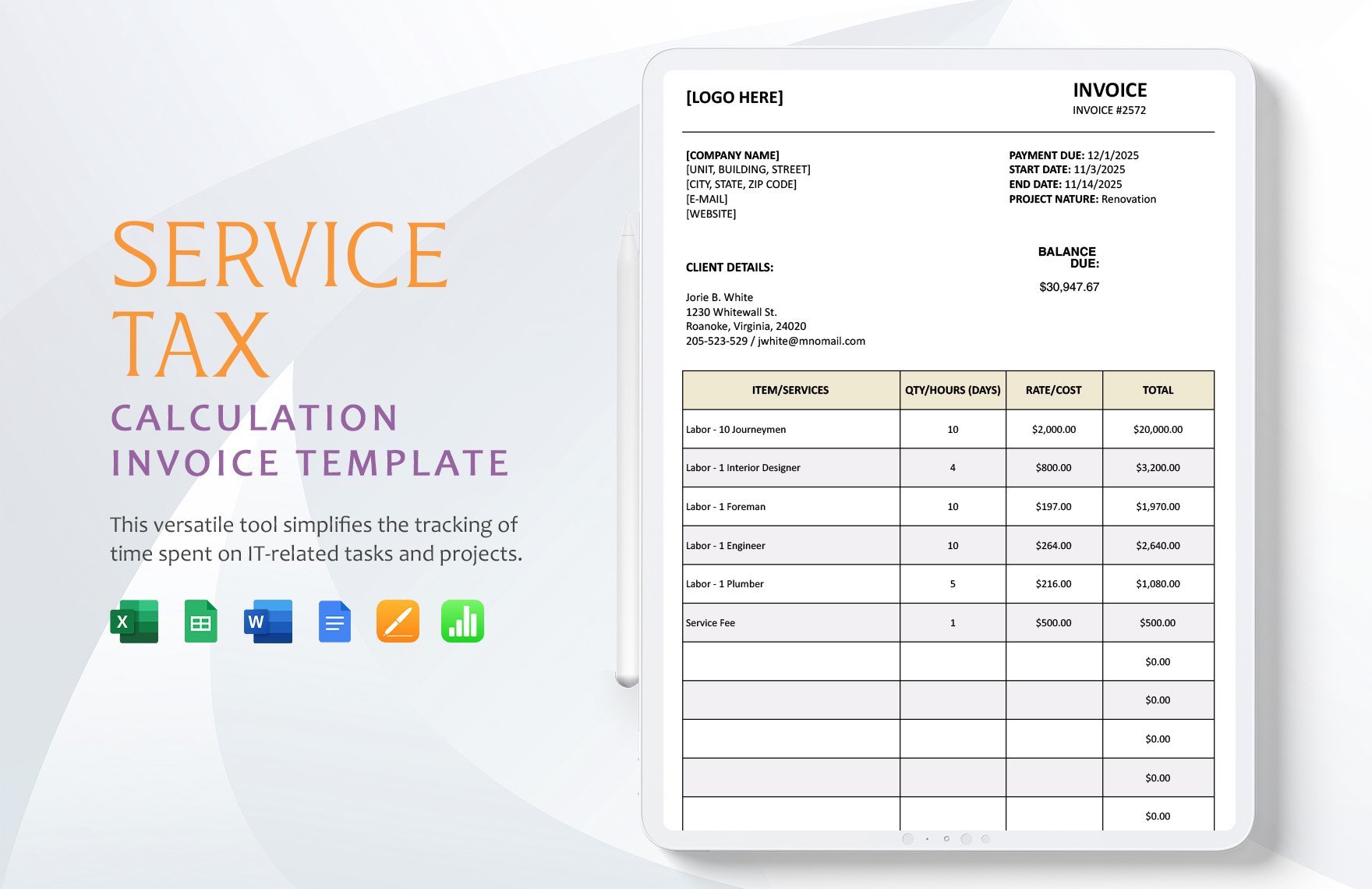

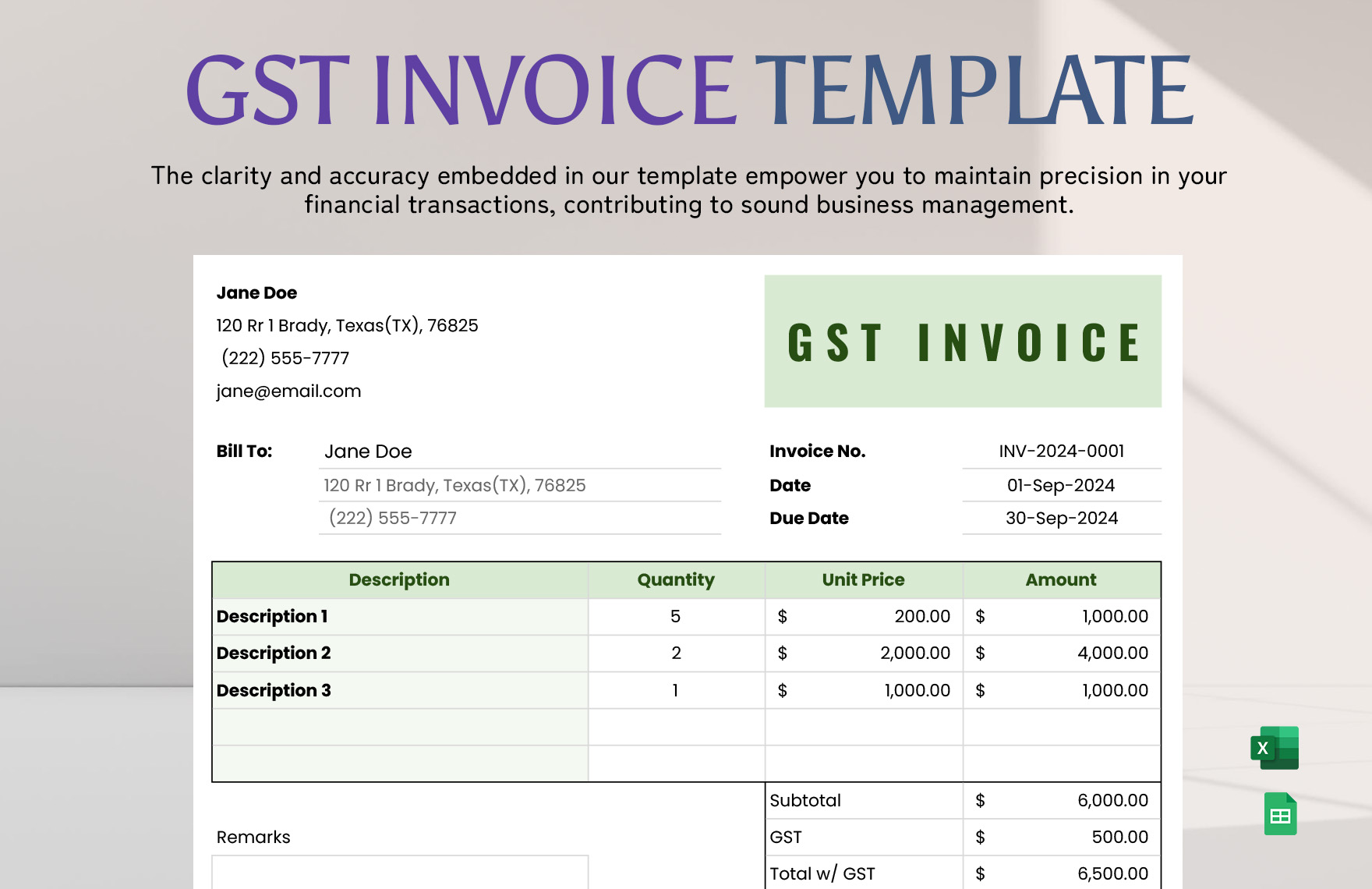

Streamline your invoicing process and keep your business finances organized effortlessly with pre-designed Tax Invoice Templates in Microsoft Excel by Template.net. Perfect for small businesses, freelancers, and accountants, these templates enable you to create professional-grade invoices quickly and easily with no prior design experience. Whether you're looking to send out consistent and attractive invoices to clients or need to keep track of billable hours, these templates are your perfect solution. With beautiful pre-designed templates that are free to download and print, users can choose from a variety of customizable layouts suitable for both digital and print distribution. The Microsoft Excel format ensures easy data management and automation, saving you both time and effort.

Discover an expansive collection of Tax Invoice Templates that cater to diverse business needs and are updated regularly with new designs. Enjoy the flexibility of free and premium options, allowing you to find the perfect fit for your unique business requirements. With easy sharing options, you can download, print, or share invoices via email or export them as needed for seamless client communication. Explore the potential of combining various free and premium templates to enhance your invoicing strategy and maximize the reach and efficiency of your billing system.

Frequently Asked Questions

What is invoice format?

An invoice format pertains to the arrangement of the content of an invoice.

Is an invoice a bill?

An invoice and bill are documents that clients or customers receive from a seller or a service provider to request payment. Both bills and invoices may have the same function, but they have a slight difference. You use the term bill for paying ahead or immediately while you may use the word invoice for requesting payment later.

What are the types of invoices?

Invoices have different types, and you can use a particular type of invoice based on your needs. We've prepared a list of some of the types of invoices you can use for your business below.

- Standard Invoice

- Commercial Invoice

- Proforma Invoice

- Final Invoice

- Credit Invoice

- Debit Invoice

Is an invoice the same as a receipt?

A lot of people may find invoices and receipts are the same, but they're not. Firstly, you use the invoice to ask for payment from your clients or customers after completing your services. Oppositely, you send a receipt to your clients after they pay for your services.

What comes the first purchase order or invoice?

The document that comes first is the purchase order. A purchase order is a document that clients prepare for the seller to request products or services. After delivering the services or products, the company will send invoices to their clients for payment purposes.