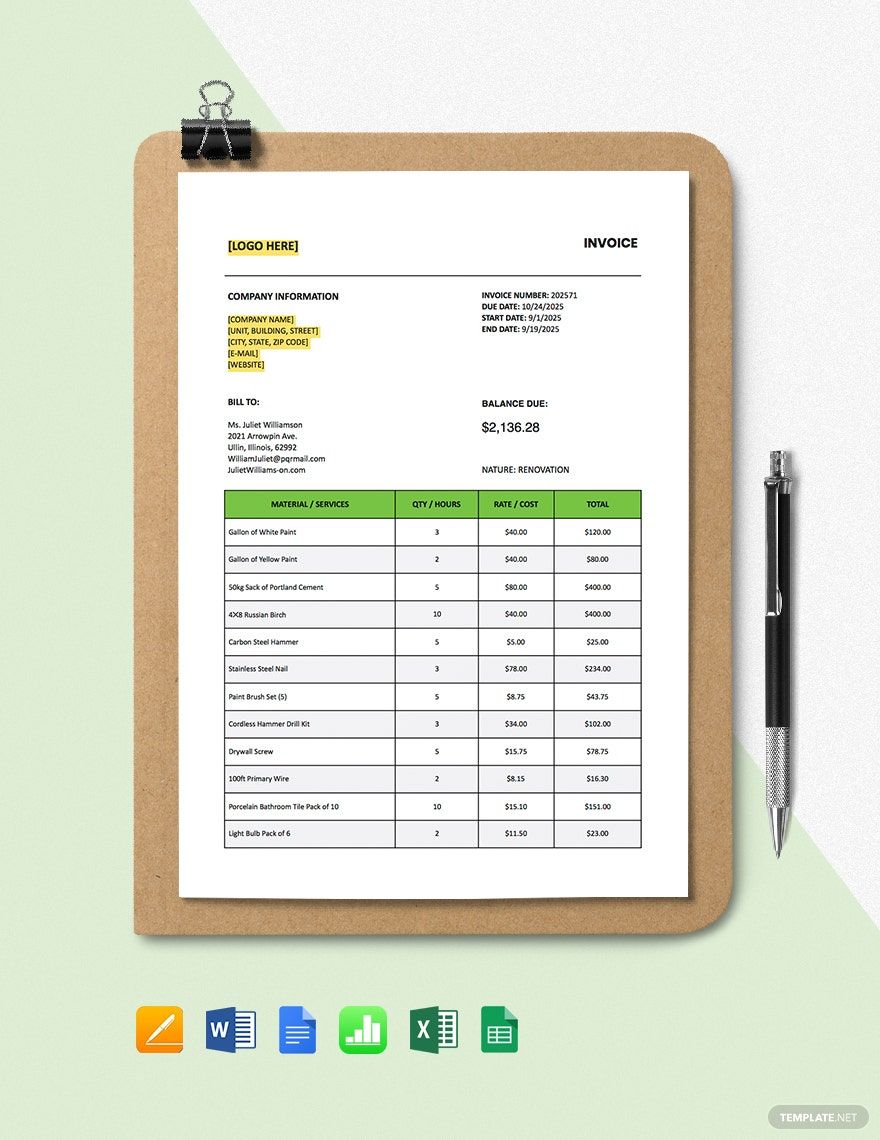

Statistics shows that an American consumer pays on average seven days late. This is not a surprising numbers as businesses tend to overlook invoices, which would lead to delayed payments. So, if you wanted your clients to pay the taxable goods or services that your business offers on time, you need to issue a tax invoice immediately. Make one now by having this comprehensive, high-quality, and professionally written Tax Invoice. This template is proven to be industry compliant as it has original suggestive heading and content. Besides, this file is downloadable, editable, and printable in Apple Pages format. Download now!

Tax Invoice Templates in Apple Pages

Streamline Your Billing Process with Easy-to-Use Tax Invoice Templates by Template.net

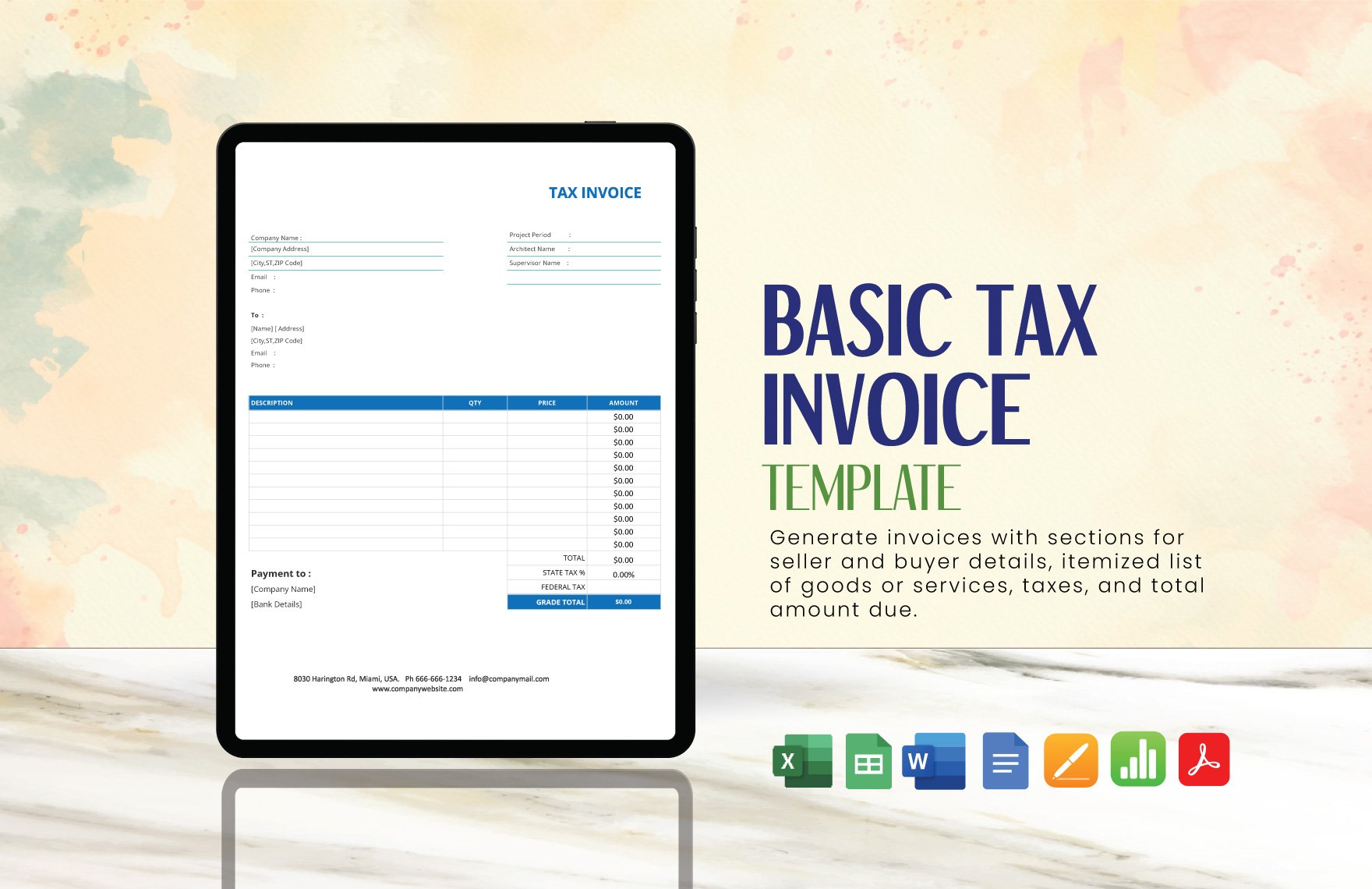

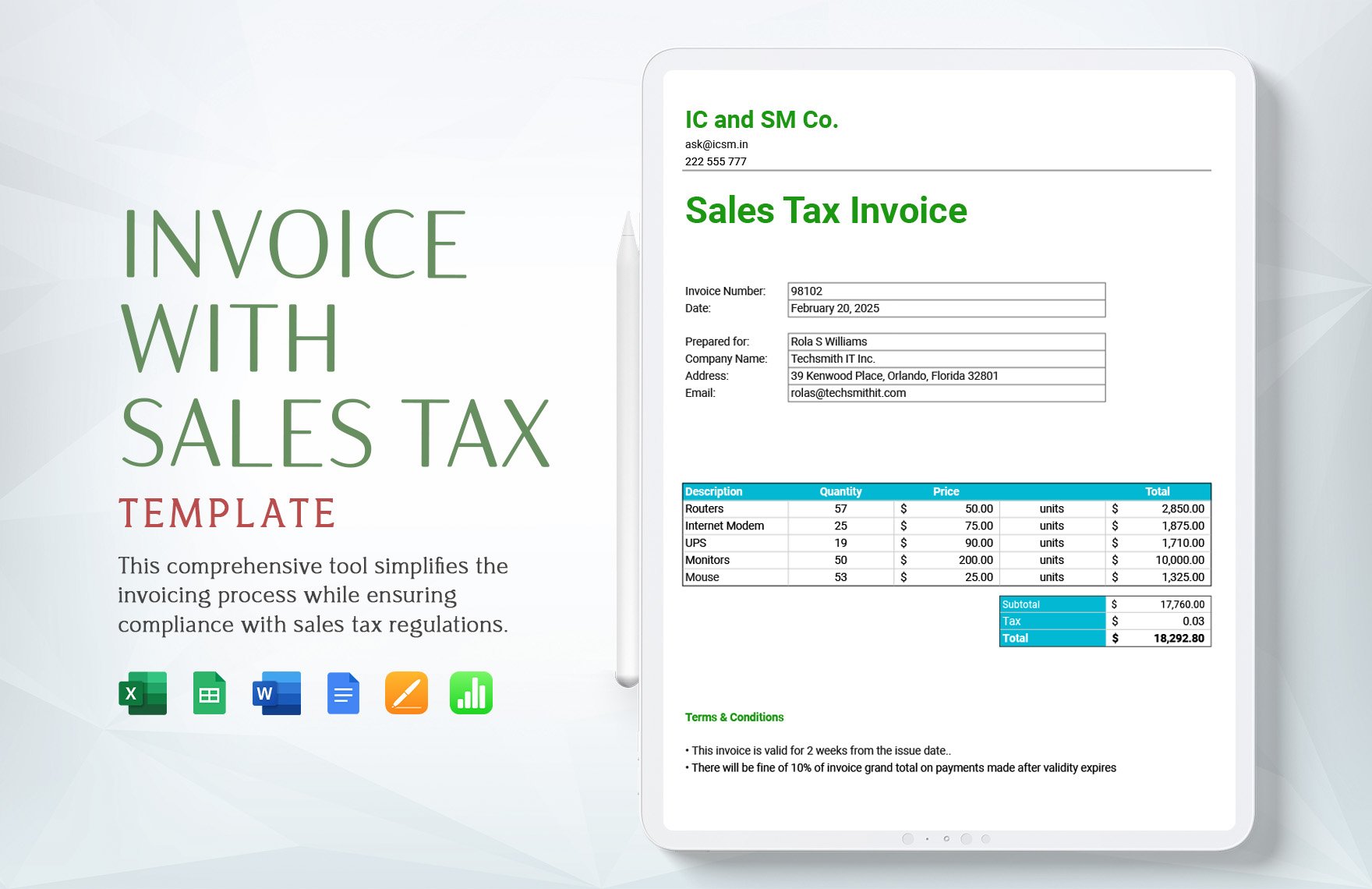

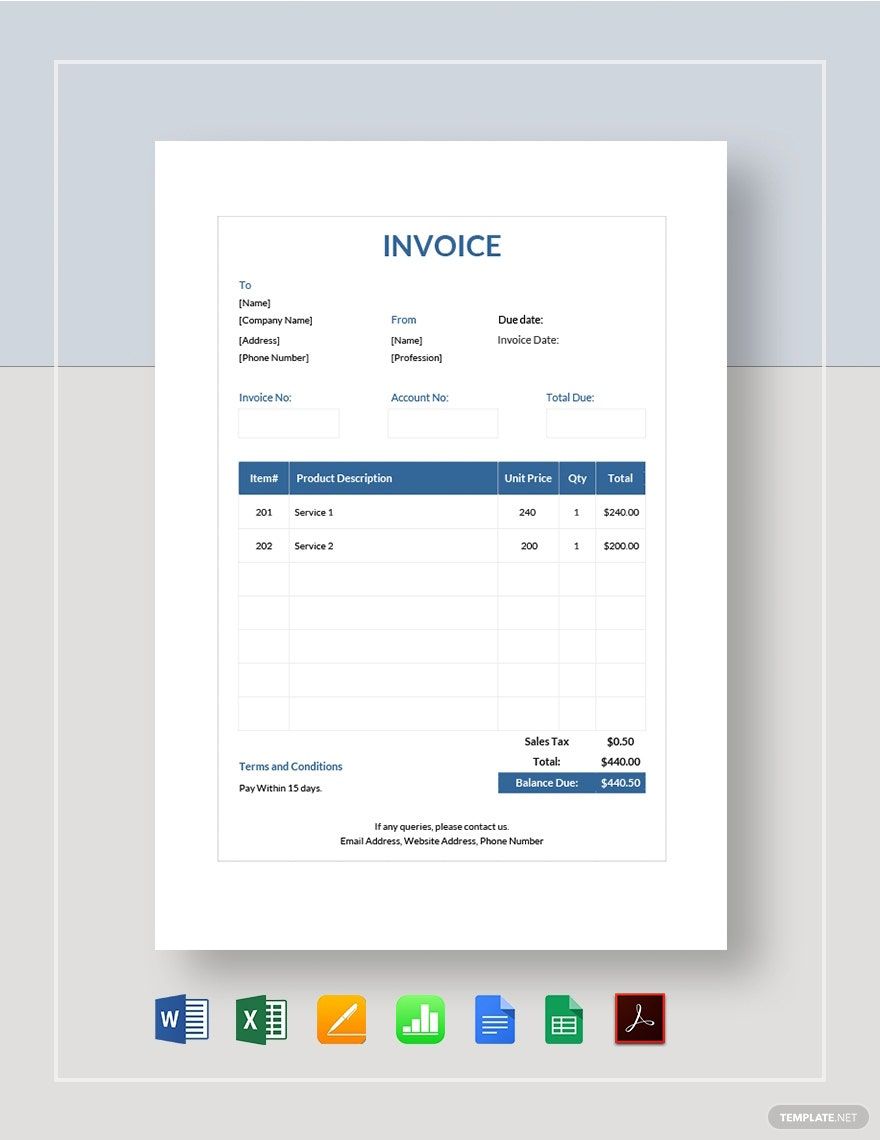

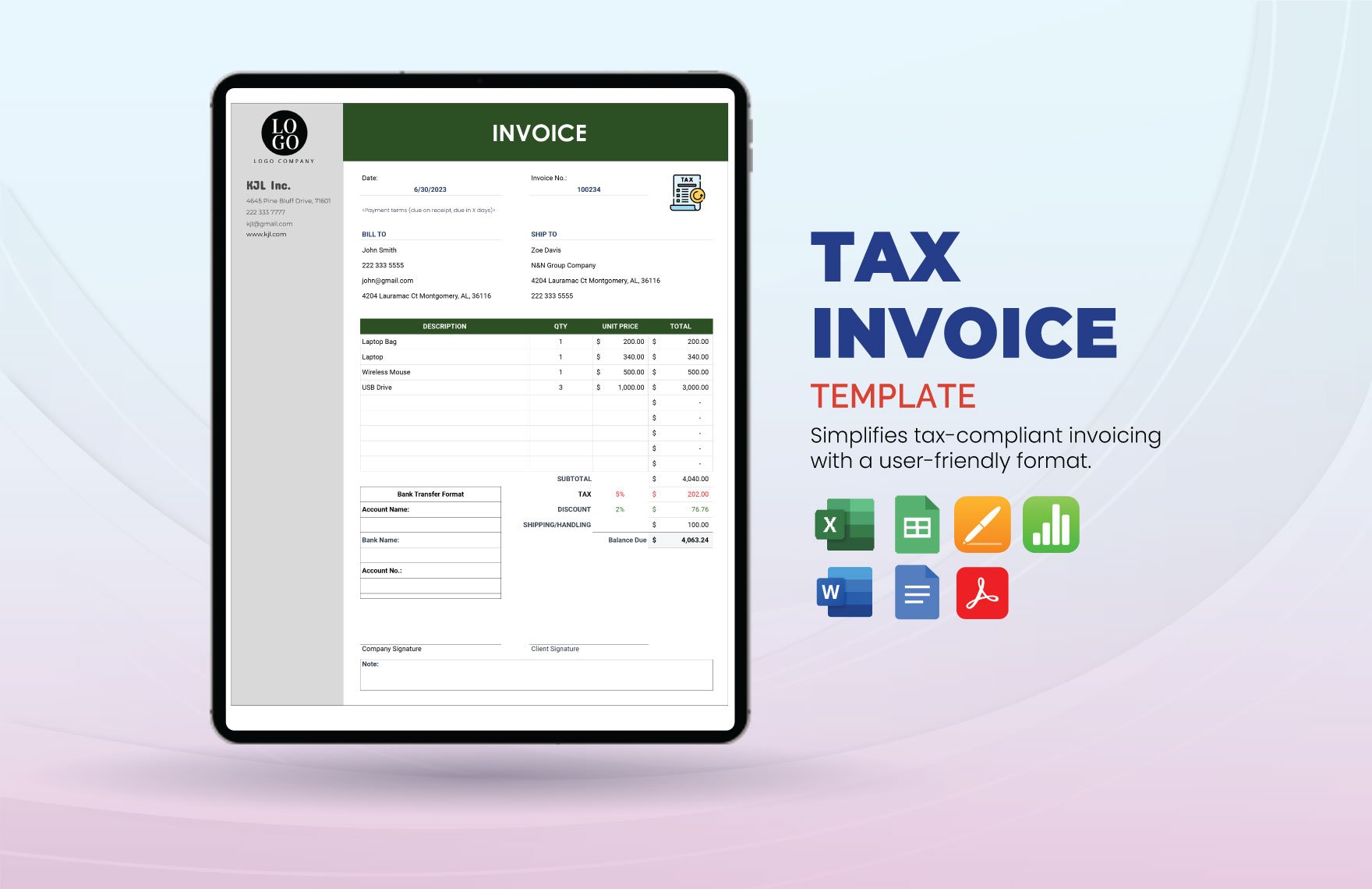

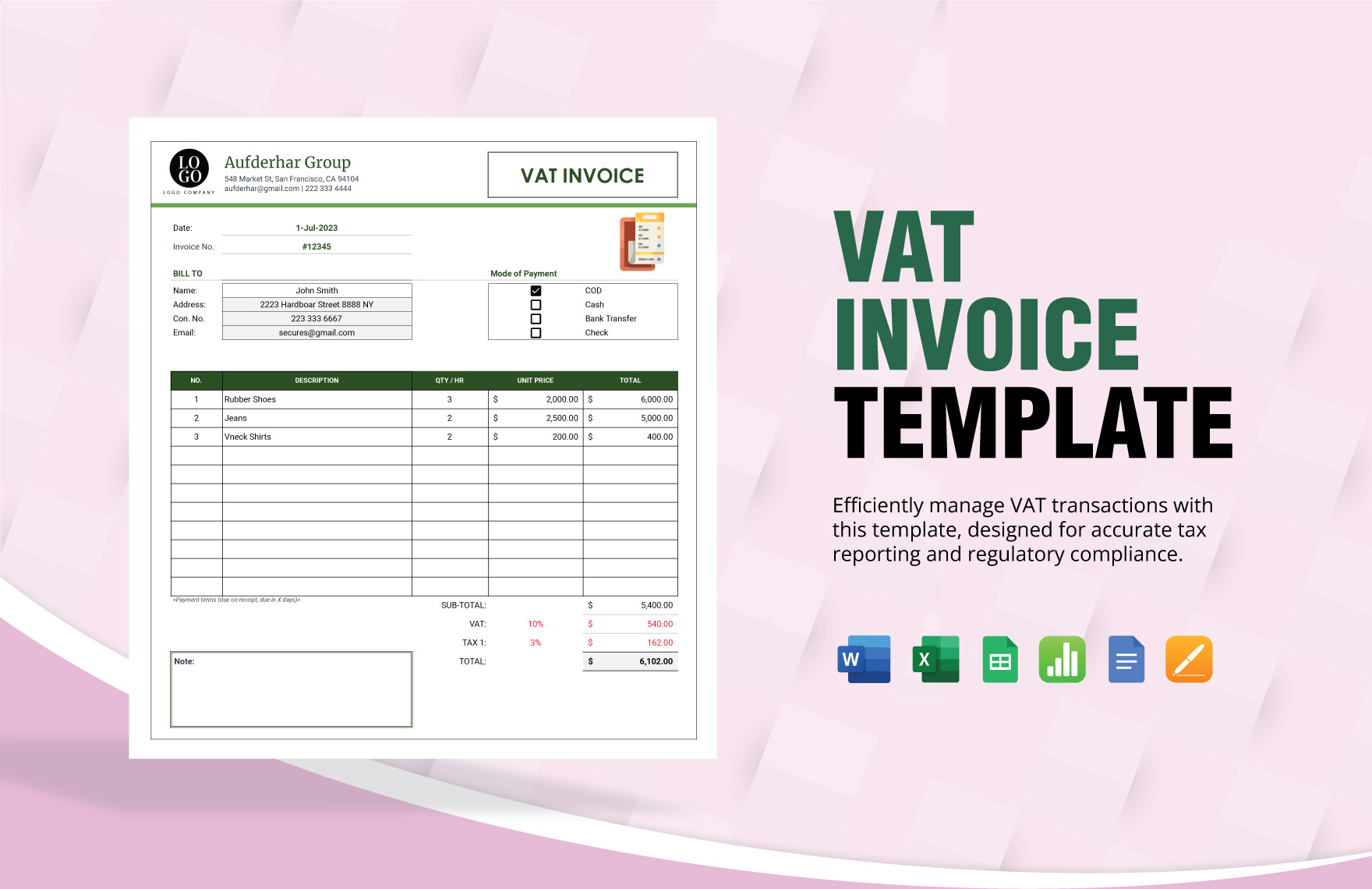

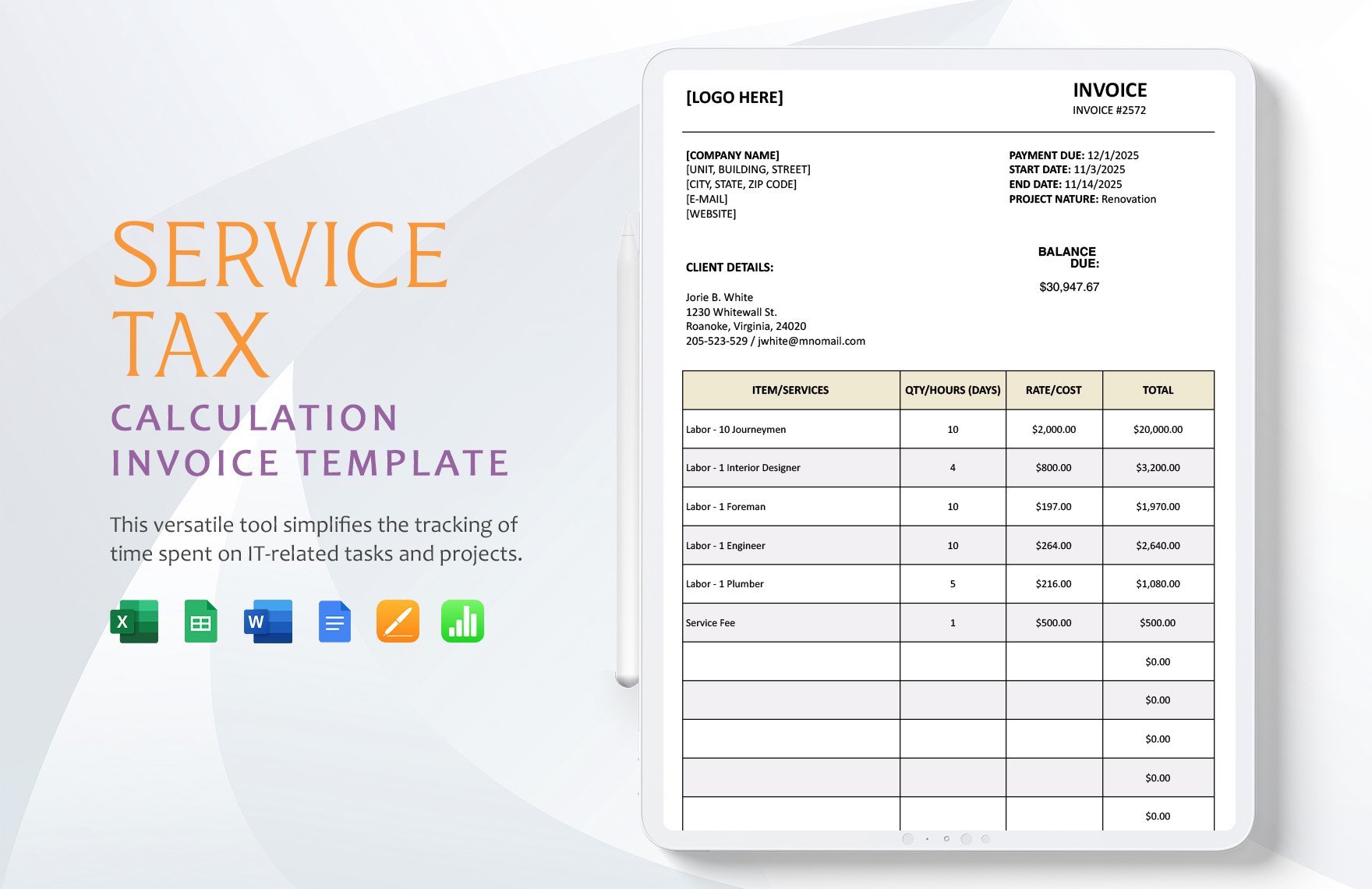

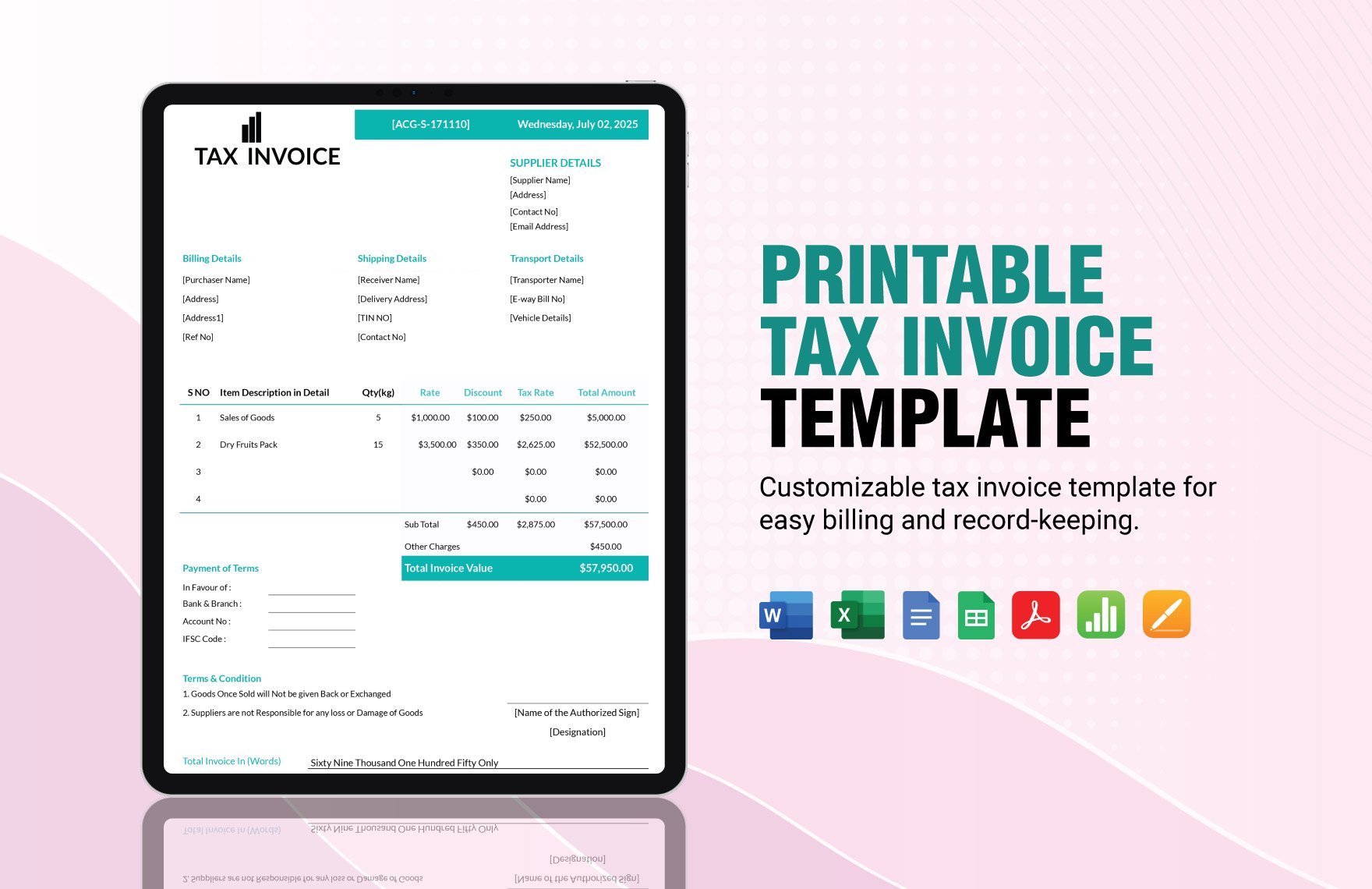

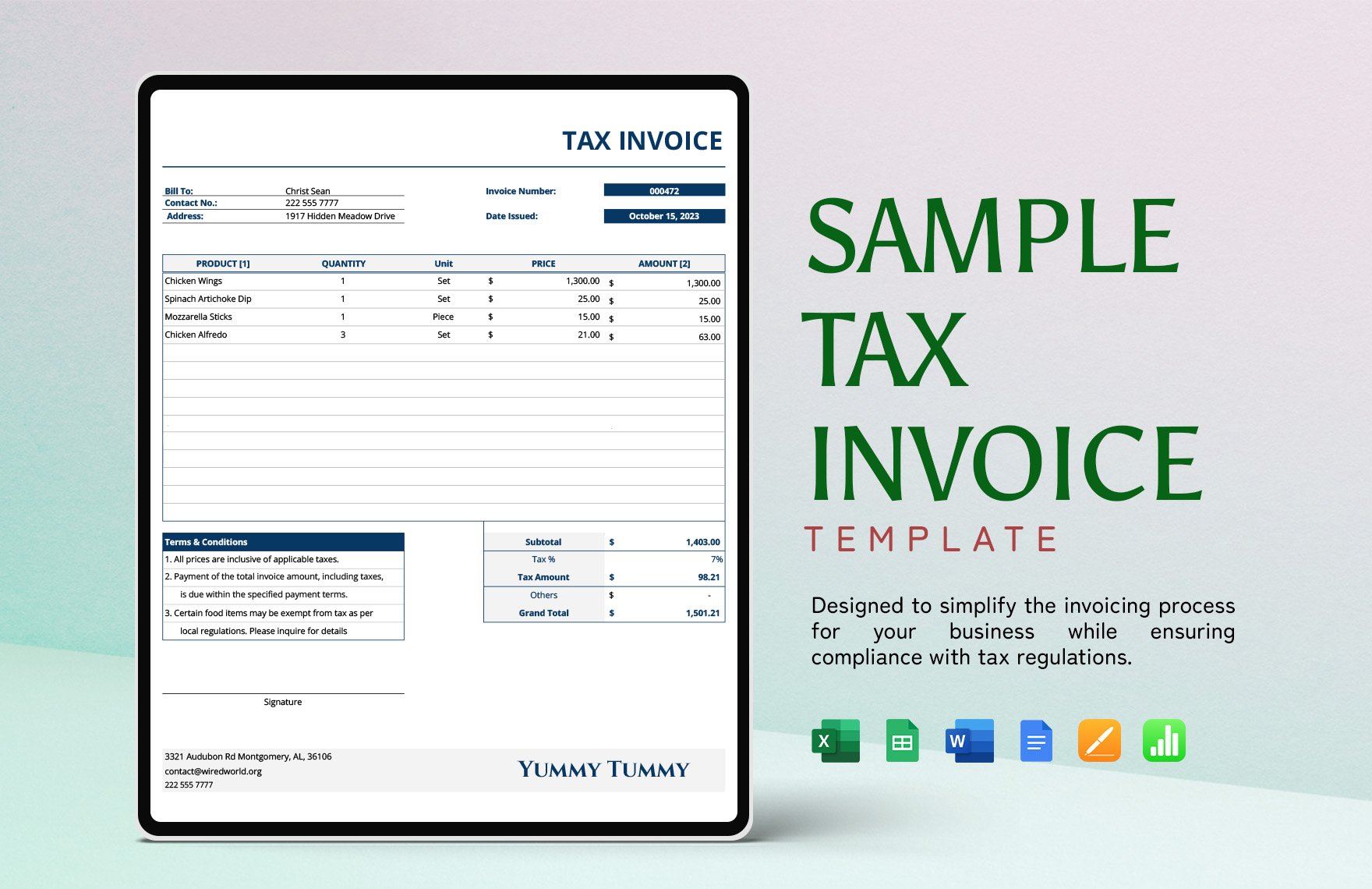

Effortlessly manage your finances with pre-designed Tax Invoice Templates specially crafted for Apple Pages by Template.net. Designed for business owners and financial professionals, these templates allow you to create professional and detailed invoices without any complex design experience. Use these templates to streamline your billing processes or manage client invoicing with ease. With our library of free pre-designed templates, you can download and print files directly in Apple Pages. Enjoy the convenience of beautifully structured templates that require no design skills needed, and take advantage of our collection of free templates for both print and digital distribution, ensuring that your invoicing is as straightforward as possible.

Explore our extensive array of Tax Invoice Templates available in Apple Pages, featuring not only our free options but also stunning premium pre-designed templates. We regularly update our library with fresh designs, so there's always something new to discover. Enhance your financial management by easily downloading or sharing your invoices via email or print for a broader reach and increased efficiency. For the ultimate in flexibility, mix and match both free and premium templates to cater to all your business needs. As a tip, leverage pre-designed layouts to save time and ensure a professional appearance, transforming your invoicing process into a smooth, stress-free experience.

Frequently Asked Questions

What are other types of invoices?

Aside from tax invoices, you can issue the following for your business:

1. Standard invoice

2. Commercial invoice

3. Progress invoice

4. Timesheet

5. Utility invoice

6. Recurring invoice

7. Pro-Forma invoice

8. Debit memo

9. Pending invoice

10. Value-Based billing

11. Fixed-bid billing

12. Time-based billing

What are common payment terms for tax invoices?

1. Terms of Sales

2. Payment in Advance

3. Immediate Payment

4. Net 30, 60, 90

5. 2/10 Net 30

6. Line of Credit Pay

7. Quotes and Estimates

Is invoice a receipt?

There is a big difference between an invoice and a receipt. An invoice is a document released by a seller containing the list of goods and services that a consumer must pay. A receipt is a document released after the payment has been settled.

How long is an invoice valid?

An unpaid invoice can be valid up to 6 years from the time released.