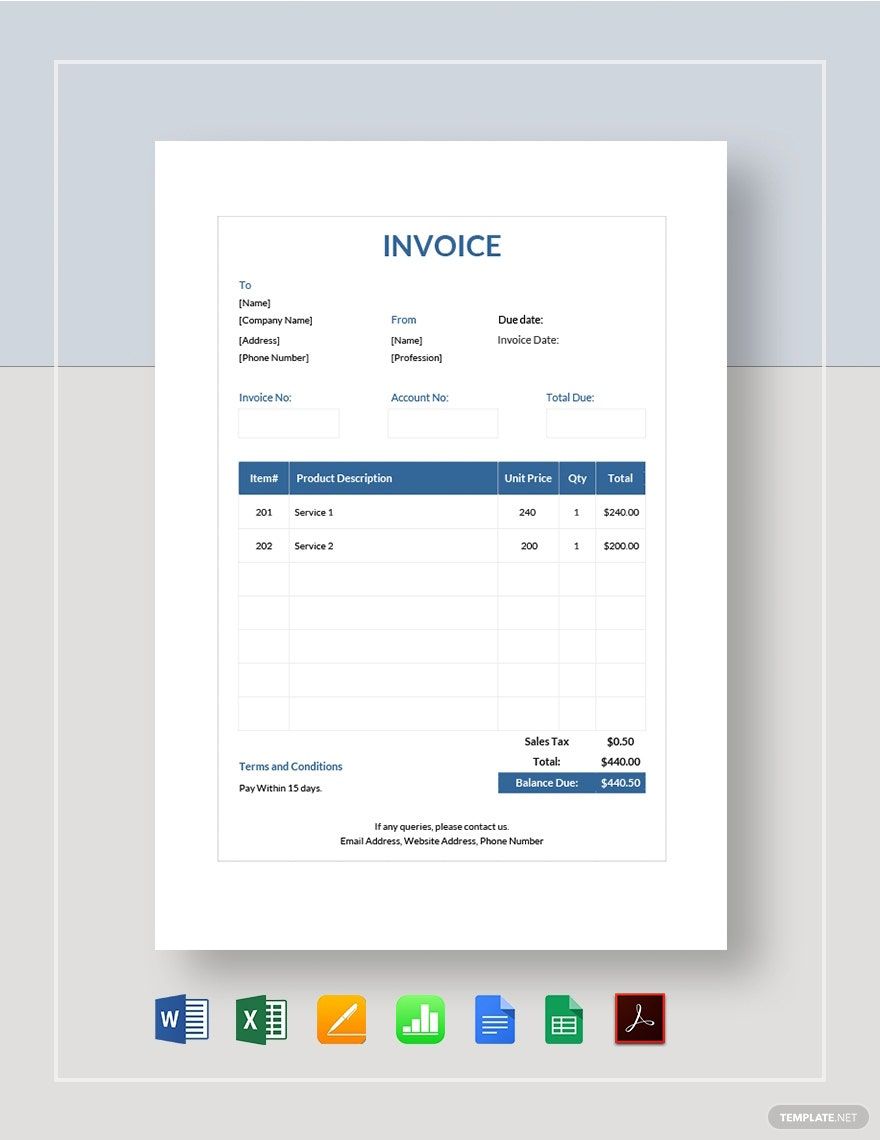

Elevate Your Business Efficiency with Streamlined Tax Invoice Templates in Adobe PDF by Template.net

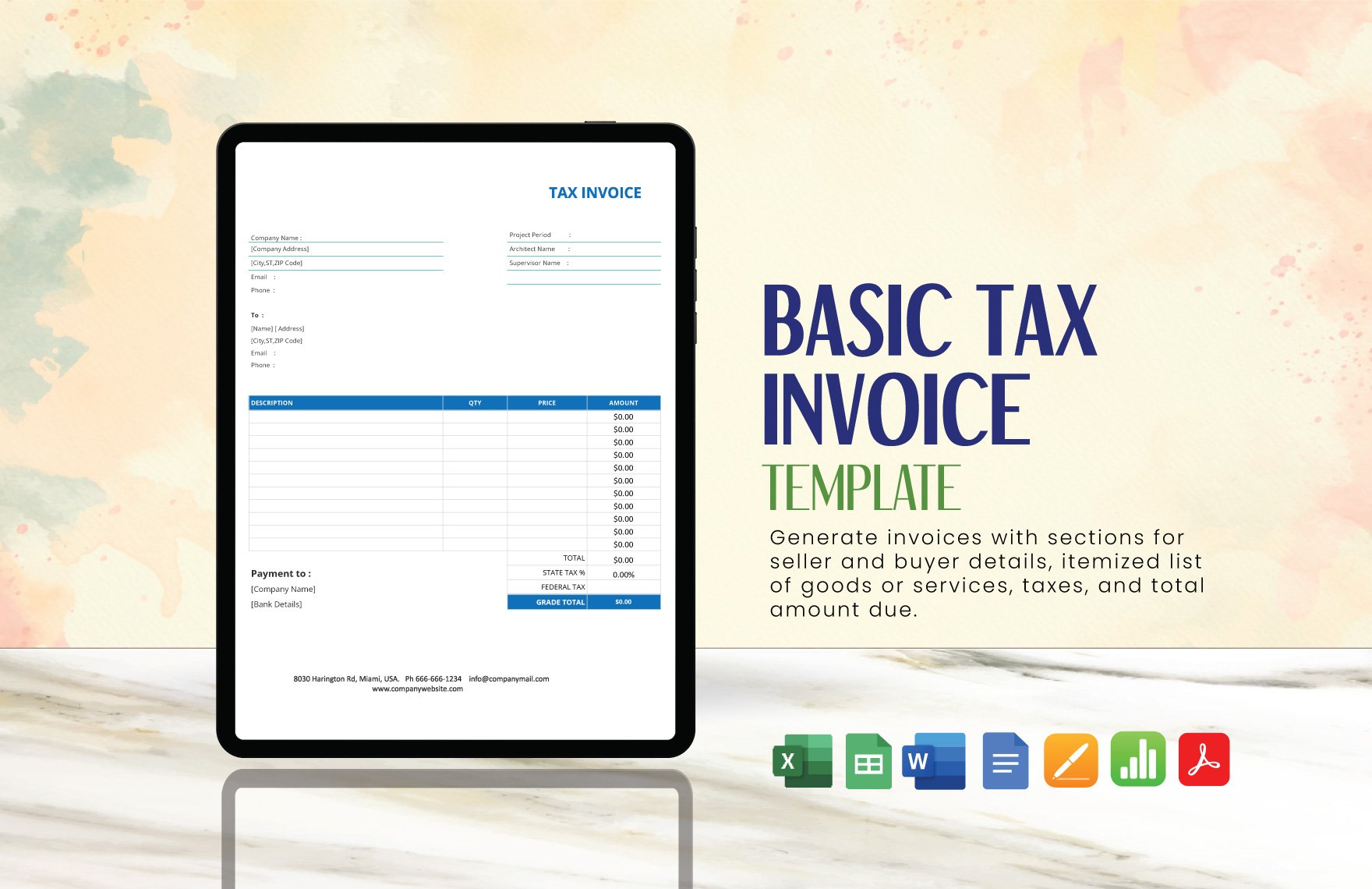

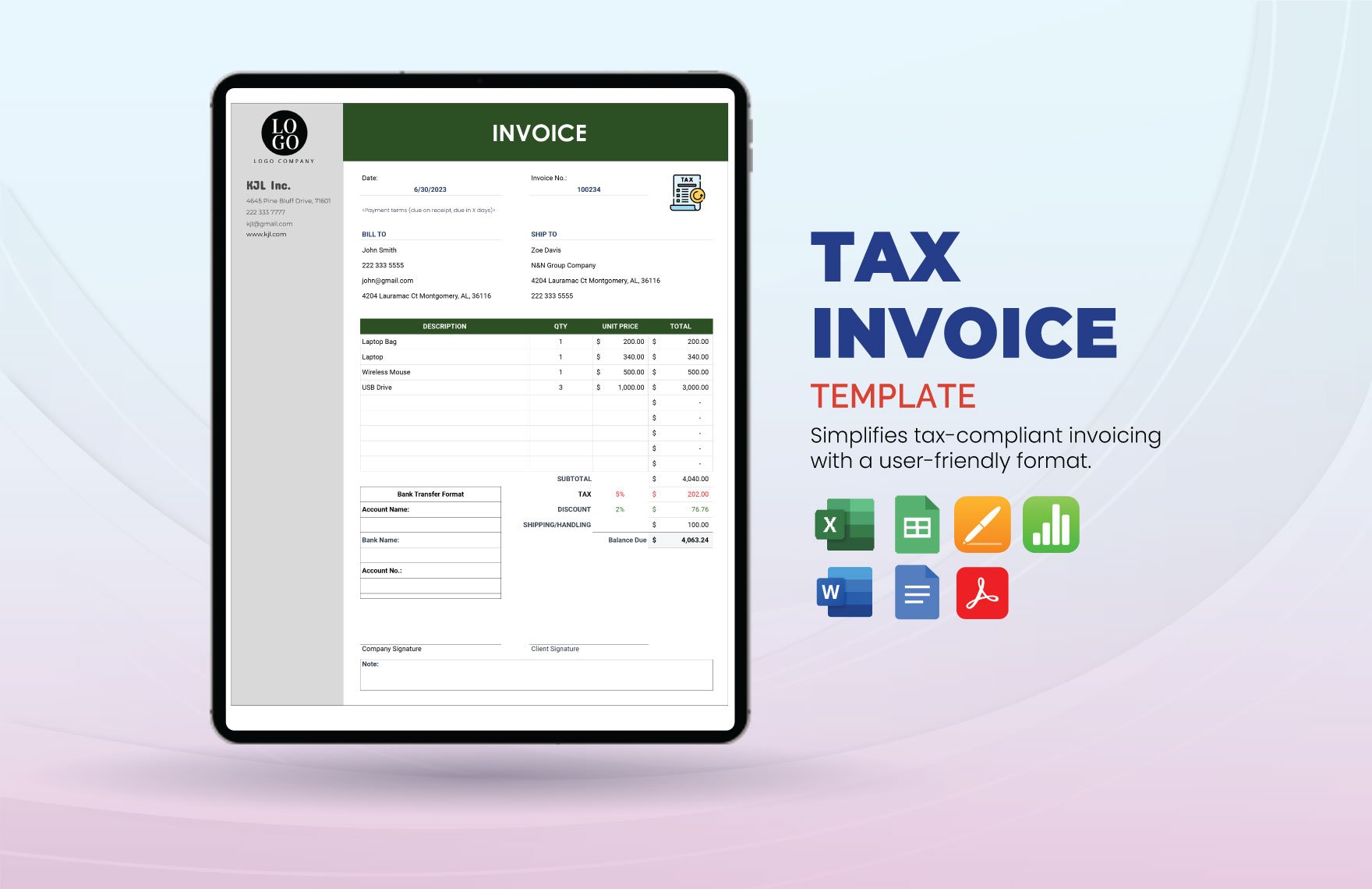

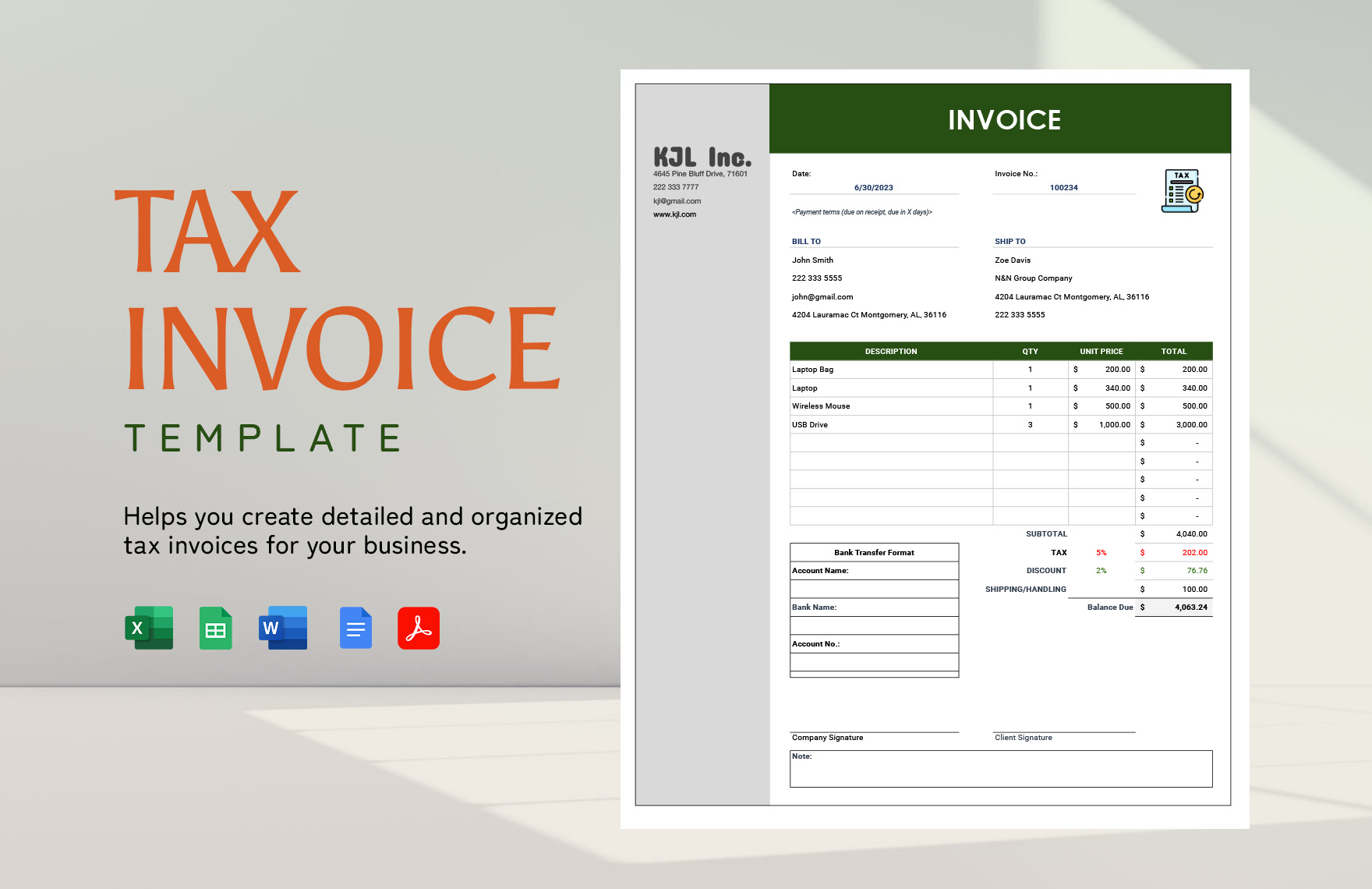

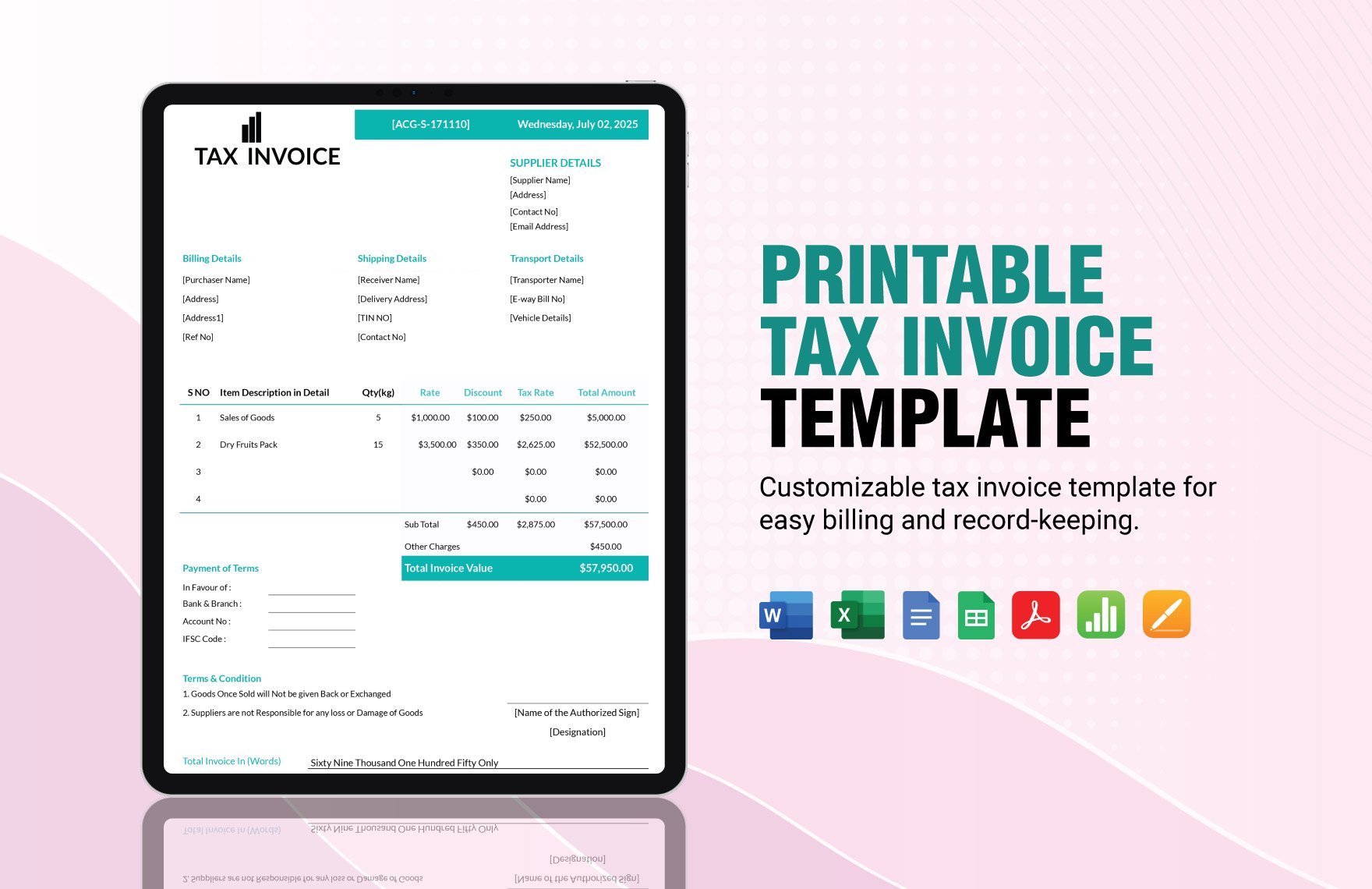

Bring your financial transactions to a new level of professionalism with Template.net's expertly crafted Tax Invoice Templates in Adobe PDF. Designed for businesses of all sizes, these templates offer a seamless solution for creating professional-grade invoices swiftly and with minimal effort. Whether you are looking to promote your services or showcase detailed financial records, our templates provide the perfect starting point. With a vast collection of pre-designed templates that are both free and effortlessly customizable, anyone can achieve polished results without needing specialized skills. Our downloadable and printable files in Adobe PDF format ensure that your invoices are ready for both digital dispatch and physical mailing. Harness the power of these beautiful templates for both social media branding and traditional distribution, and experience significant time and cost savings compared to starting from scratch.

Discover a broader array of visually pleasing premium pre-designed templates in Adobe PDF and take your business capabilities to the next level. Our library is regularly updated to feature the latest designs and enhancements, ensuring that you always have access to cutting-edge resources. Download or share your completed documents via link, print, email, or export options for increased reach and impact. We encourage you to explore both free and premium templates to harness full flexibility and tailor your invoicing to any occasion. With Template.net, achieving professional invoicing is now simpler, quicker, and more efficient than ever before.