Taxes are vital for a government or a similar body of authority. A tax allows funding for all kinds of government-run services and operations, such as law enforcement and healthcare organizations. When requesting tax payments, invoices are useful tools for such matters. Do you need easily editable content to help with your paperwork? Then consider one of our professional Tax Invoice Templates! Our content is suitable for taxing restaurants, sponsorships, hotels, and more. All of these samples are 100% customizable in Microsoft Word, which means quick and optimal editing on a Windows computer. So, download today—create a formal tax bill by incorporating our versatile invoice templates!

Tax Invoice Templates in Word

Explore professionally designed editable tax invoice templates in Word to download. Free and customizable for professional quality. Download now.

- Ticket

- Quotation

- Receipt

- Recipe Card

- Proposal

- Contract

- Statement

- Newsletter

- Coupon

- Bill of Sale

- Agreement

- Affidavit

- Memo

- White Paper

- Itinerary

- Email Signature

- Postcard

- Plan

- Planner

- Program

- Note

- Cover Page

- ID Card

- Banner

- Form

- Envelope

- CV

- Ebook

- Manual

- Notice

- Magazine

- Thesis

- Bookmark

- Lesson Plan

- APA

- Job Description

- Cover Letter

- Sign In Sign Out

- Poster

- Chart

- List

- Time Sheet

- To-Do List

- Log

- Assessment

- Teacher

- Business

- HR

- Marketing

- Sale

- Advertising

- Finance

- Accounting

- Legal

- Administration

- Operations

- Health Safety

- Bookkeeping

Elevate Your Business Transactions with Professional Tax Invoice Templates in Microsoft Word by Template.net

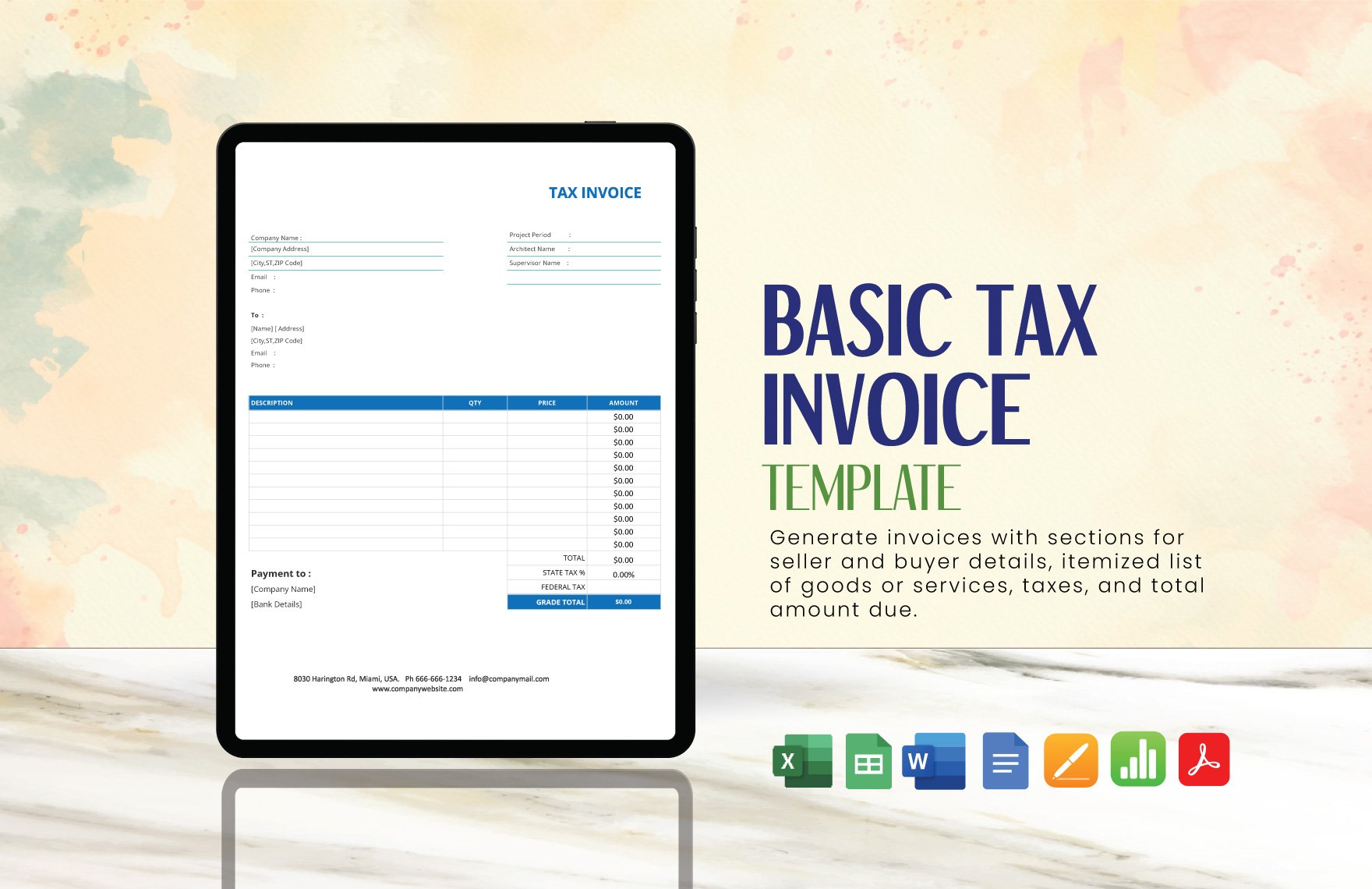

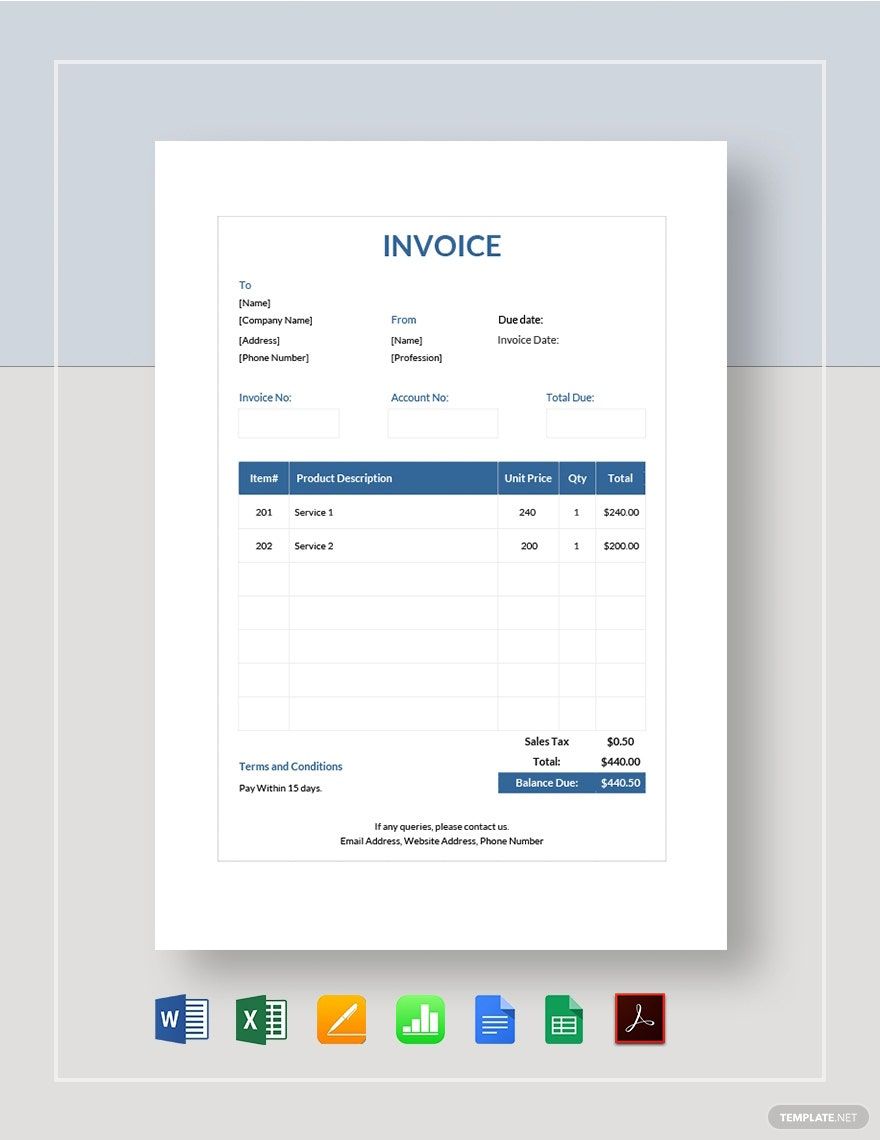

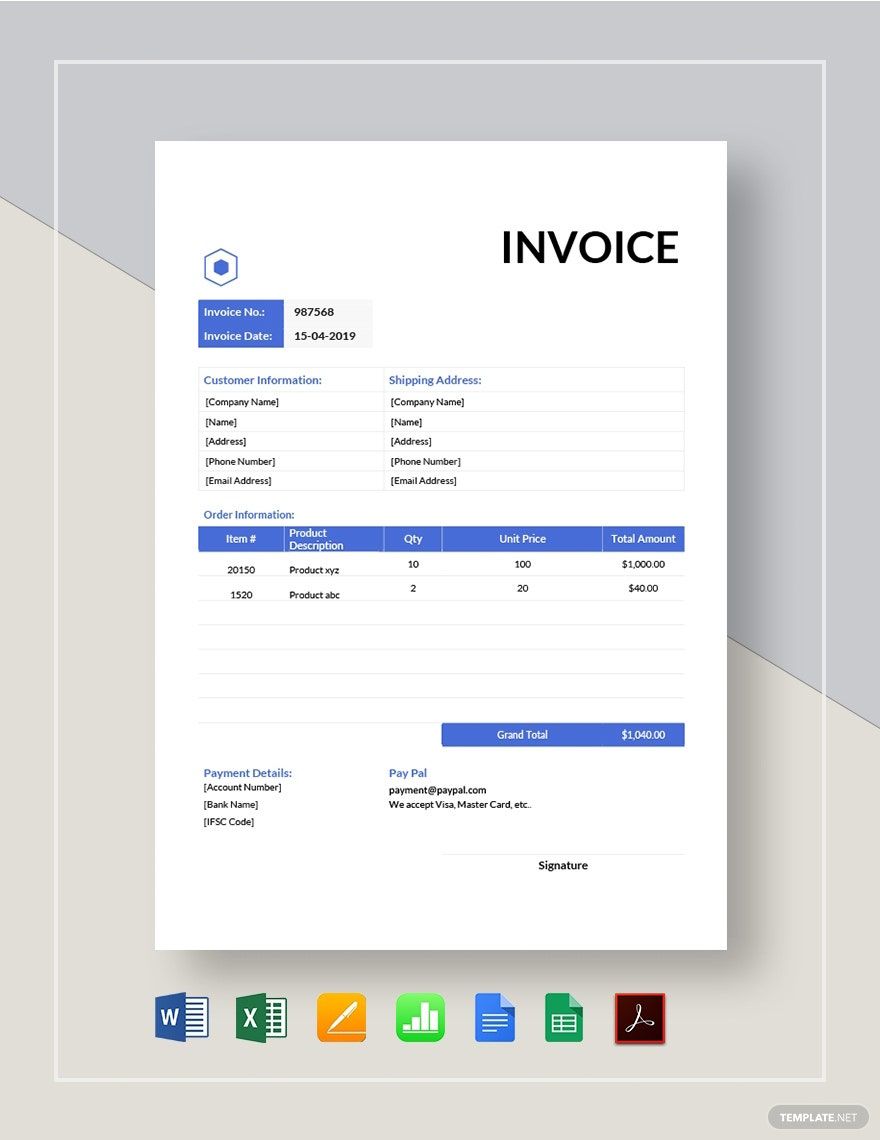

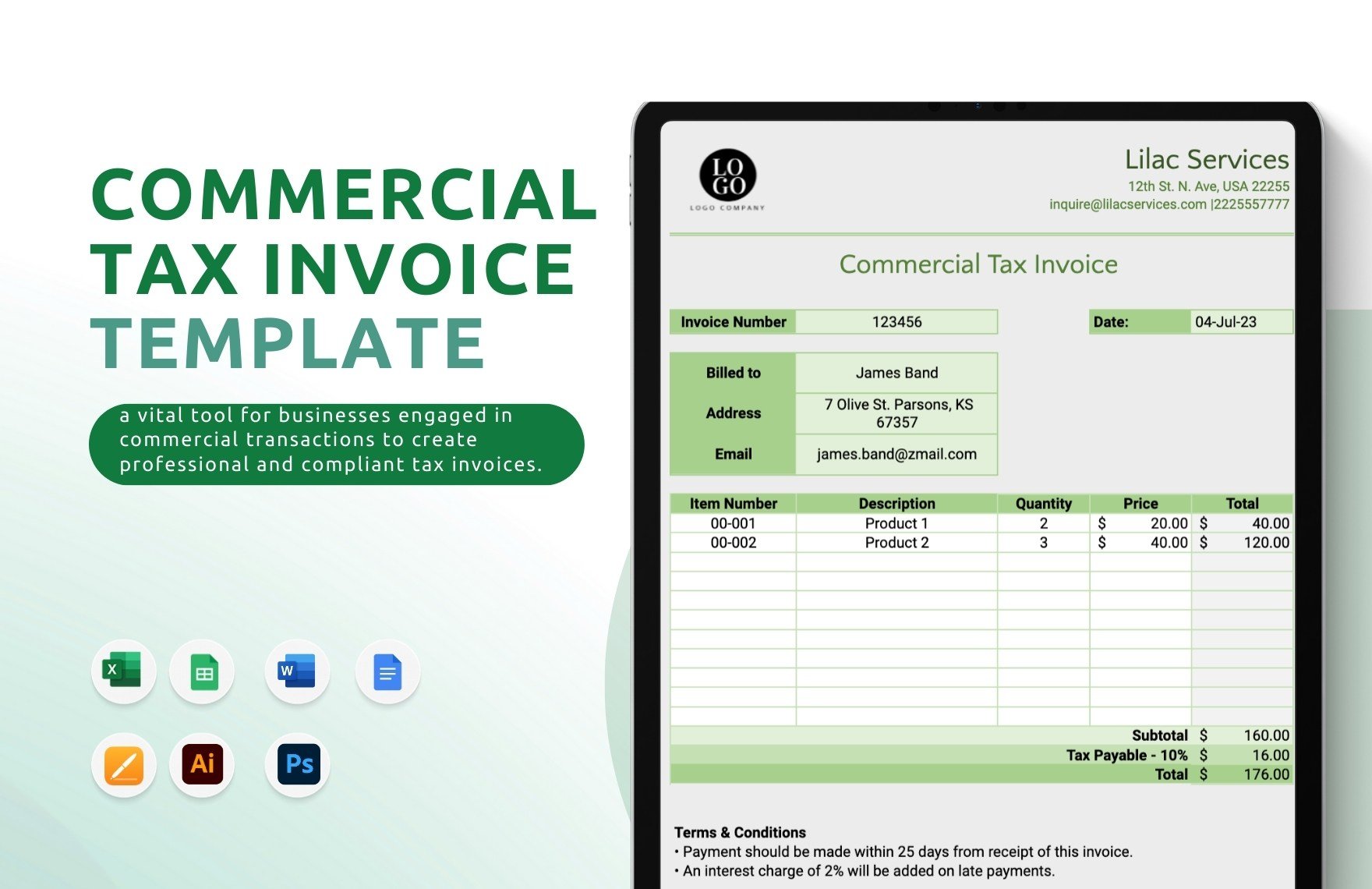

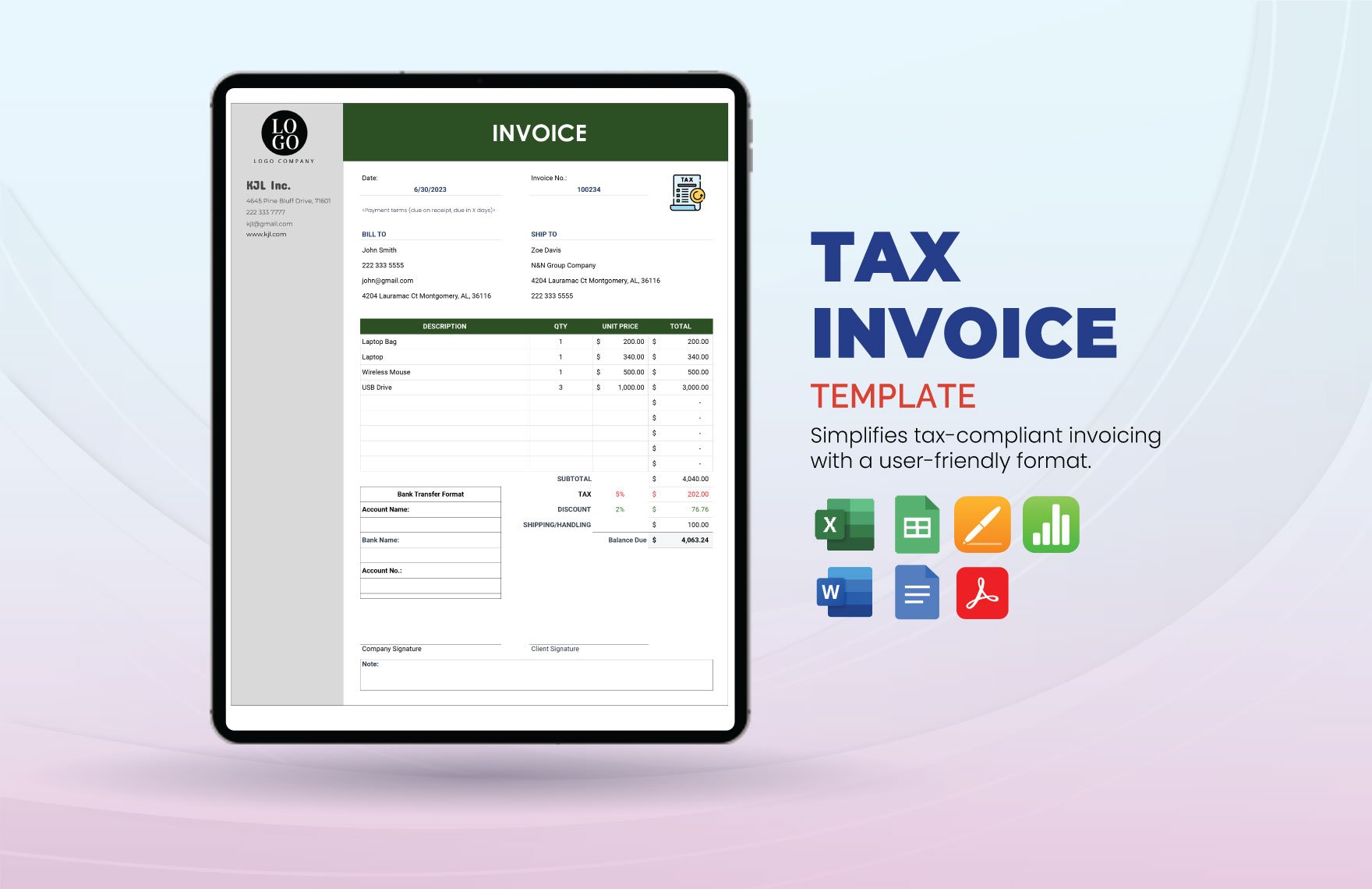

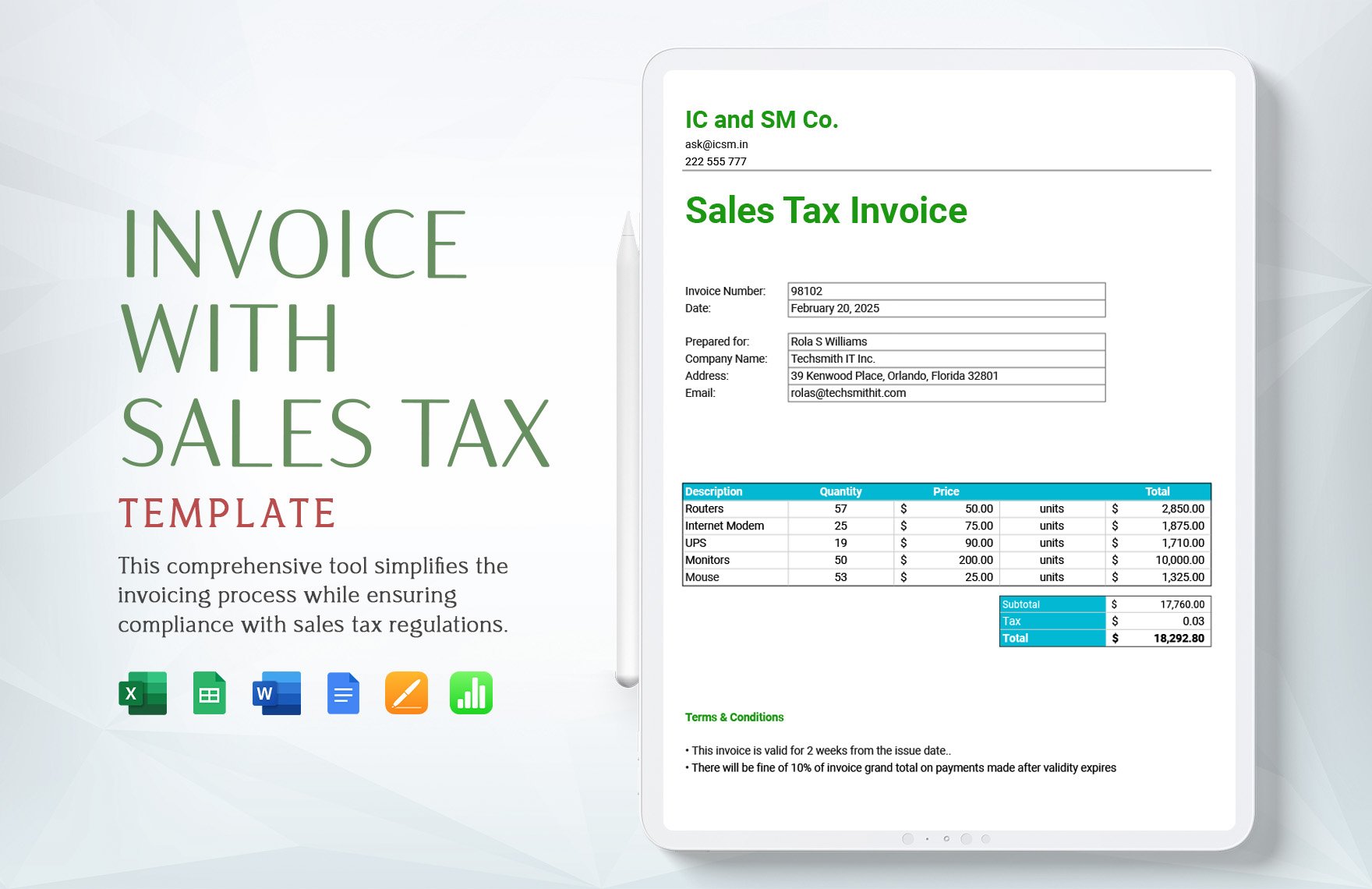

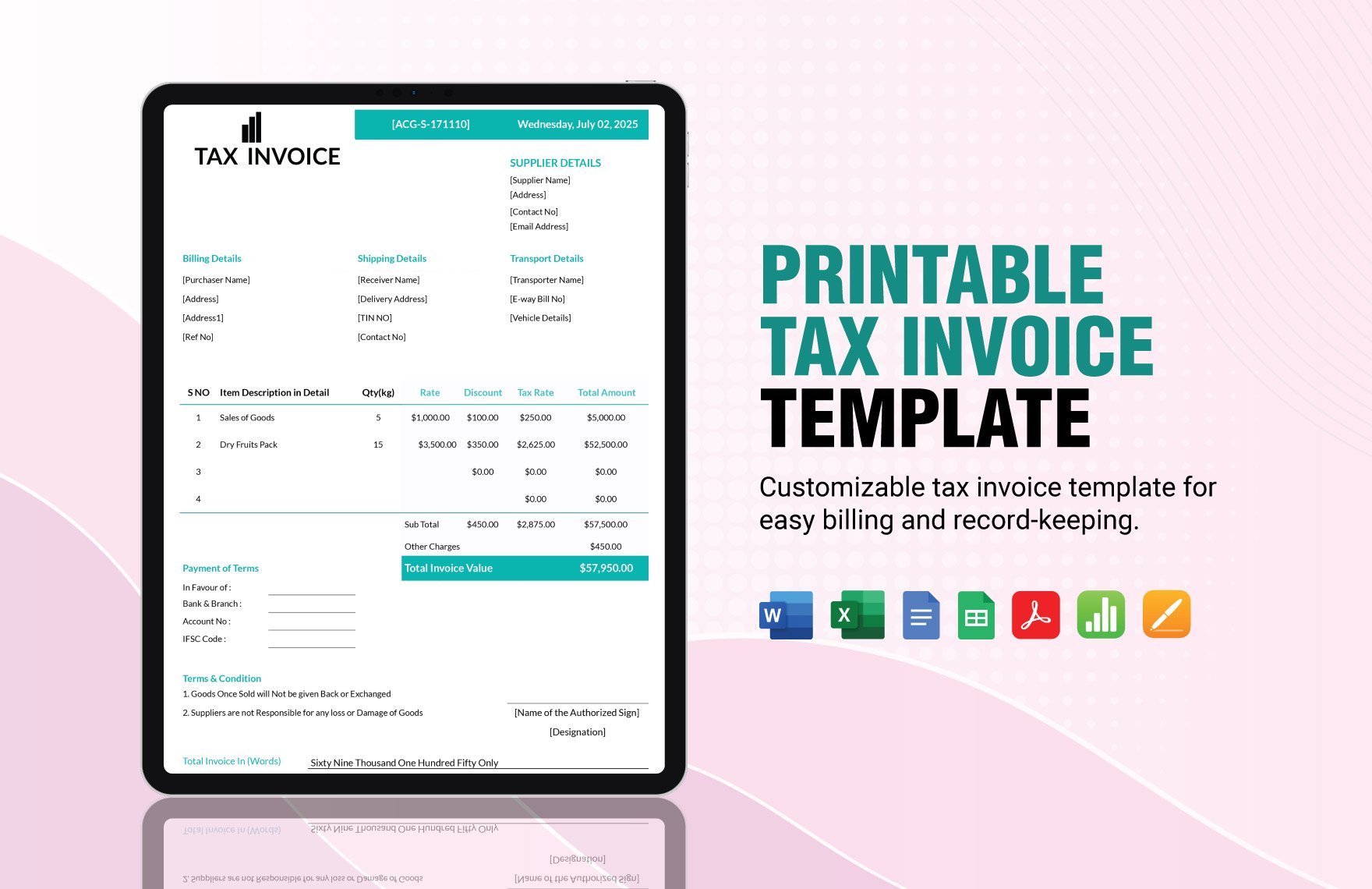

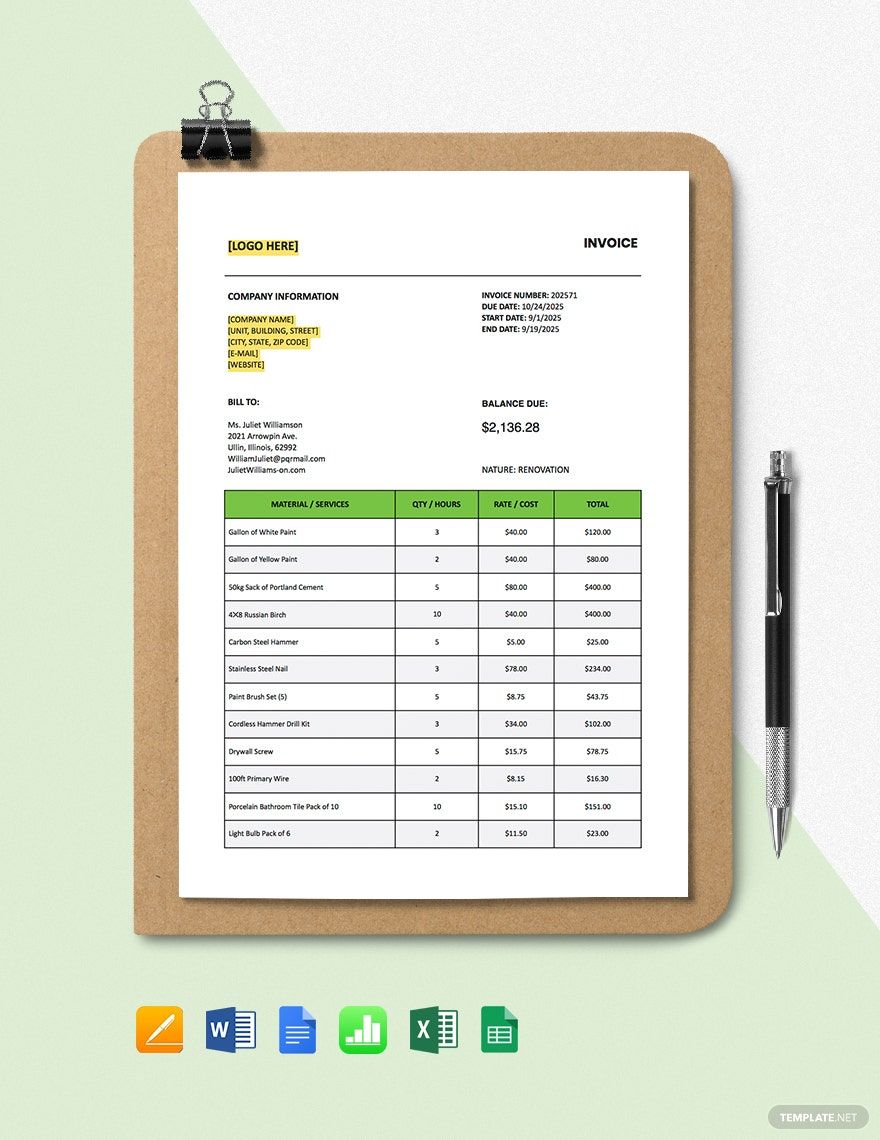

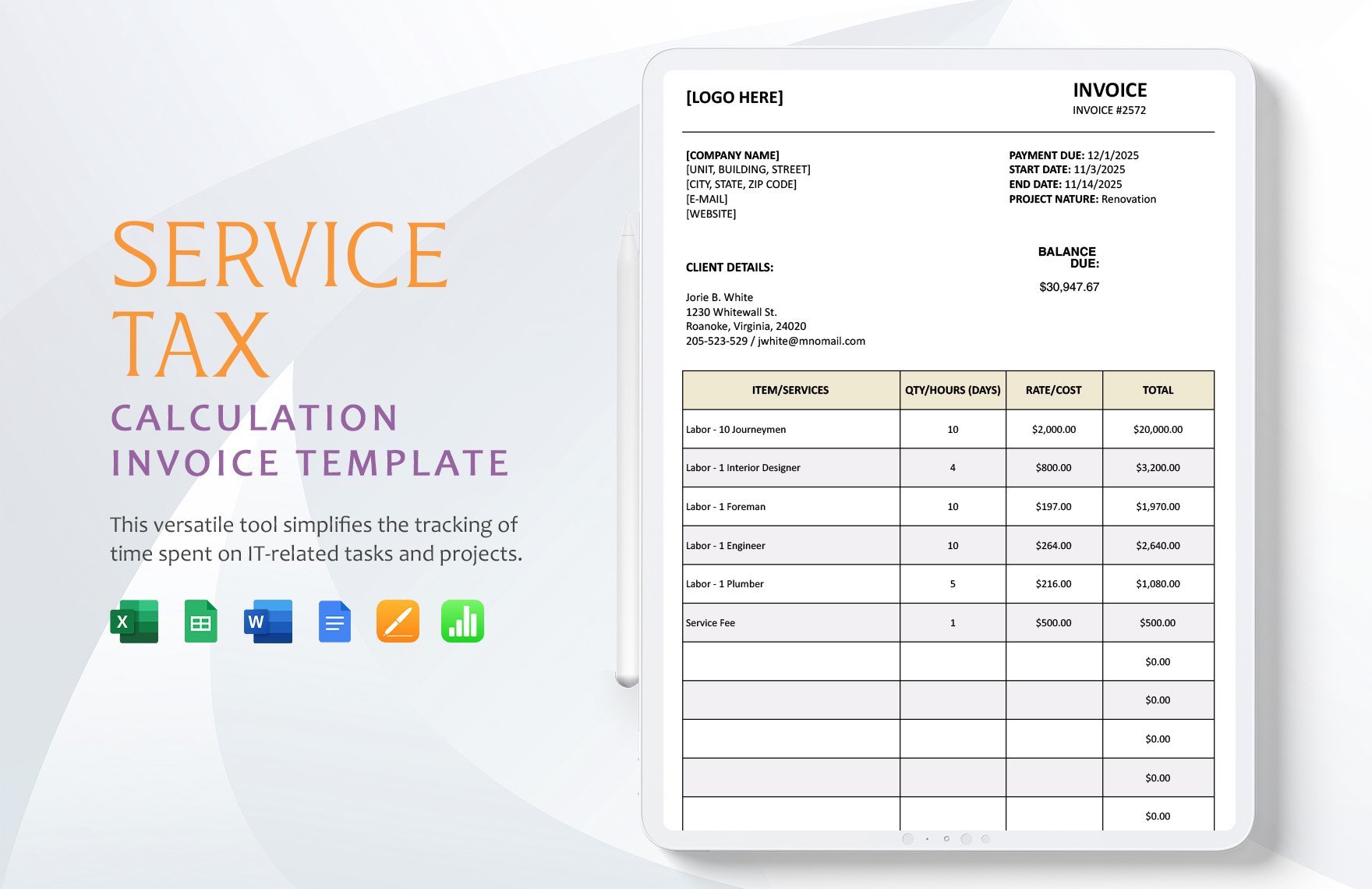

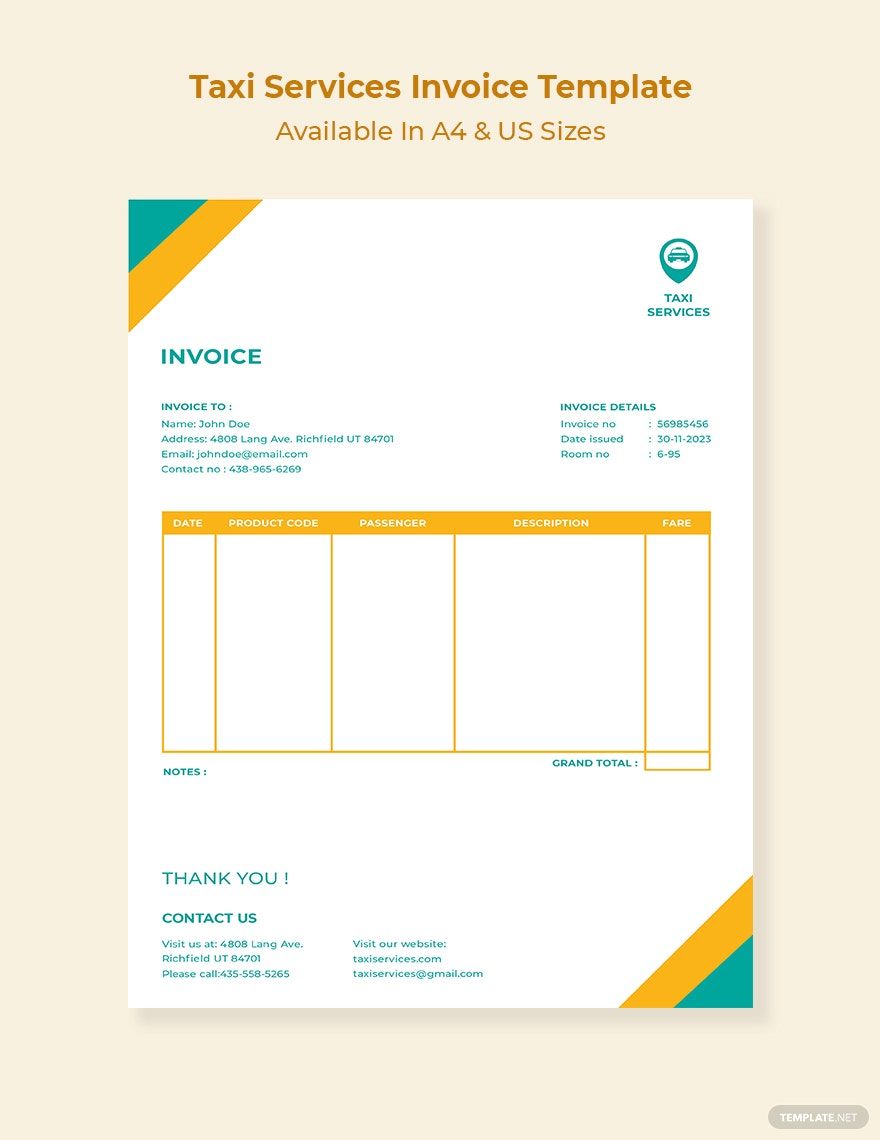

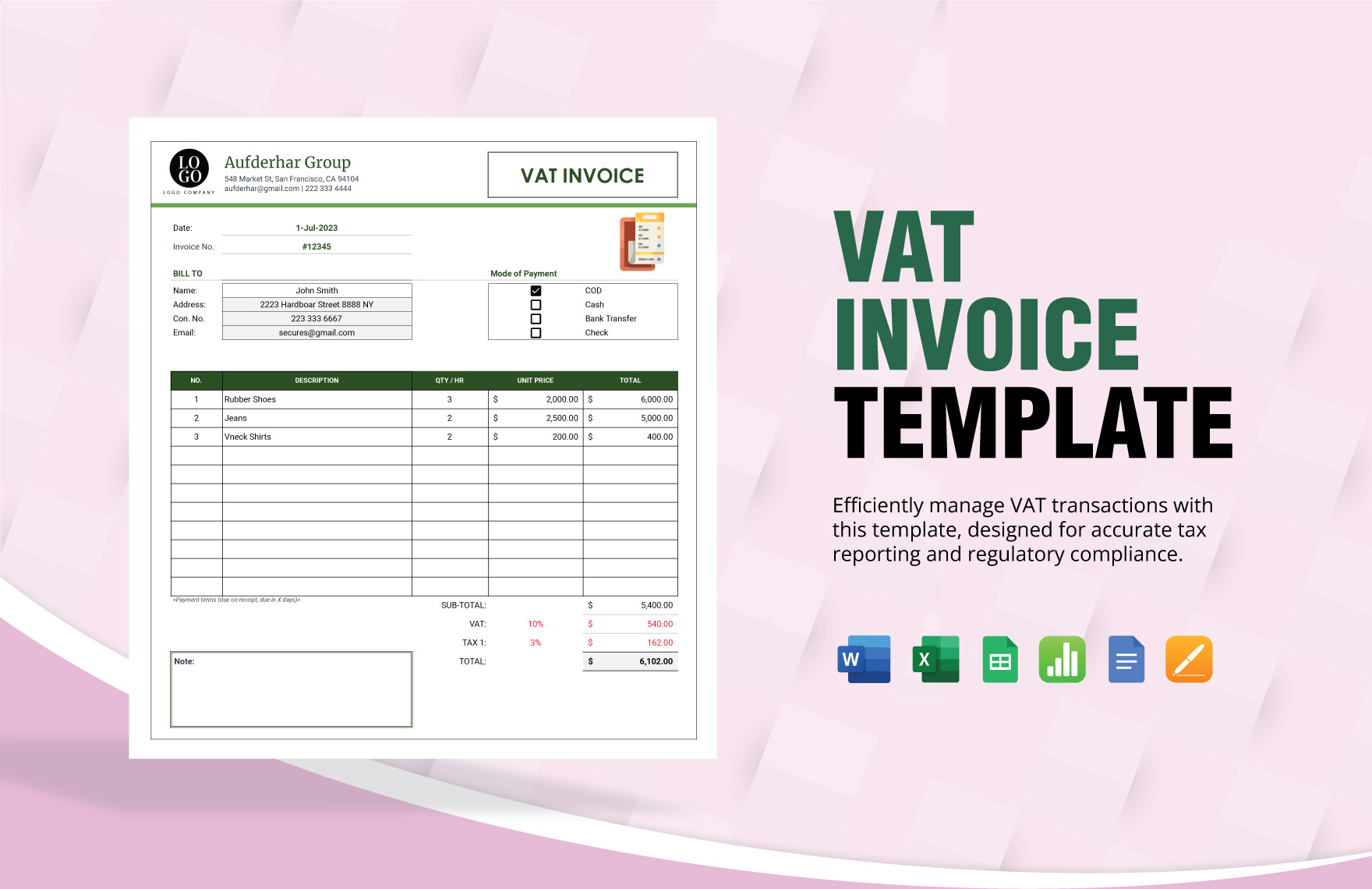

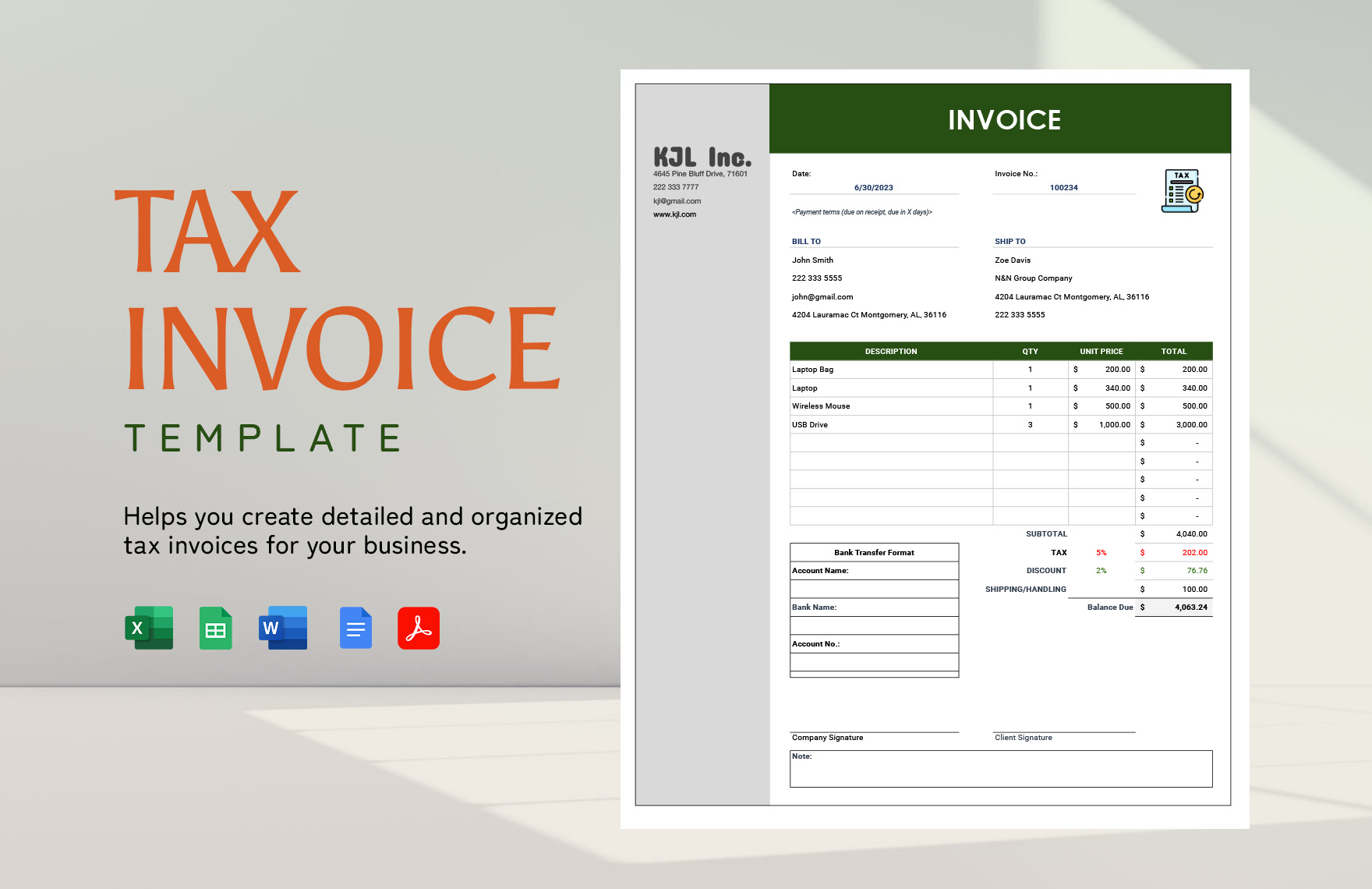

Transform your invoicing process with our expertly crafted Tax Invoice Templates in Microsoft Word by Template.net. Our Pre-designed templates are perfect for small business owners and freelancers who want to create polished and professional invoices effortlessly. Whether you’re looking to send a bill for services rendered or track sales transactions, our templates have got you covered. Benefit from the ease of downloadable and printable files in Microsoft Word, saving you precious time and resources. Our Free templates, featuring customizable layouts tailored for both print and digital distribution, ensure that no design skills are needed to achieve a professional appearance.

Discover a wide range of Pre-designed Tax Invoice Templates ready to meet your business needs in Microsoft Word. We continually update our library to deliver fresh designs and innovative solutions, catering to diverse industries and styles. Whether you need to download and deliver them via email or print hard copies for your records, our templates offer versatility for any method of sharing. Maximize your invoicing efficiency by leveraging both Free and Premium templates, giving you the flexibility to adapt to any situation. Explore our collection today and enhance the professional image of your business effortlessly.

Frequently Asked Questions

What page size is used for a tax invoice?

When creating a tax invoice, both A4 and US letter sizes are commonly used.

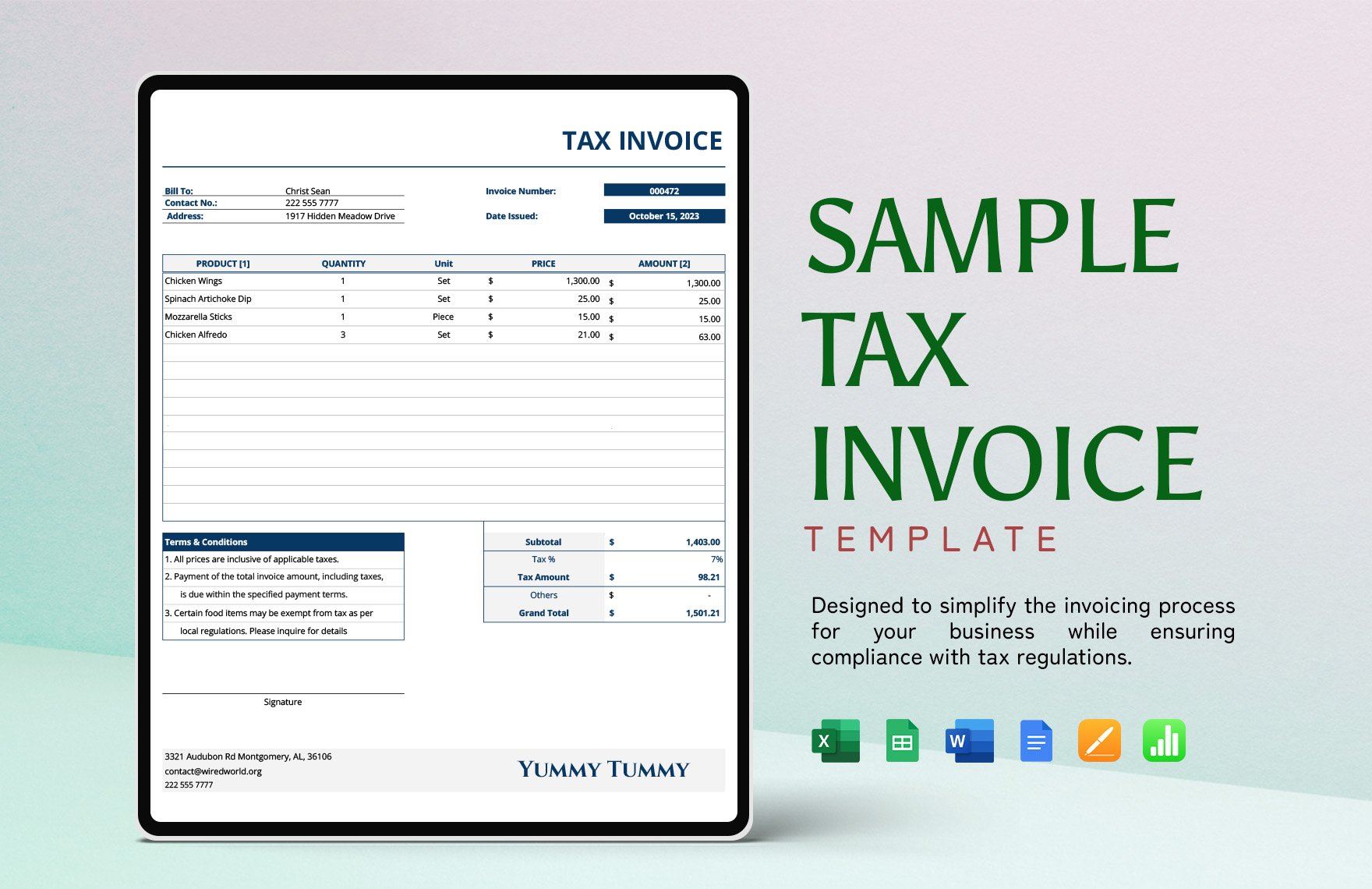

What are the components of a tax invoice?

A tax invoice is generally made up of the following:

- Invoice title, ID number, date

- Department or organization information

- Recipient information

- Tax payment details

What are some programs used for making a tax invoice?

Some example applications include:

- MS Word

- MS Excel

- Apple Pages

- Google Docs

What file format is used in adding a logo to a tax invoice?

Use either a .jpeg or .png file when inserting a logo into a tax invoice.

Is .gif a viable file format for inserting a logo into a tax invoice?

No, .gif files are not suitable for logos due to their poor image quality.