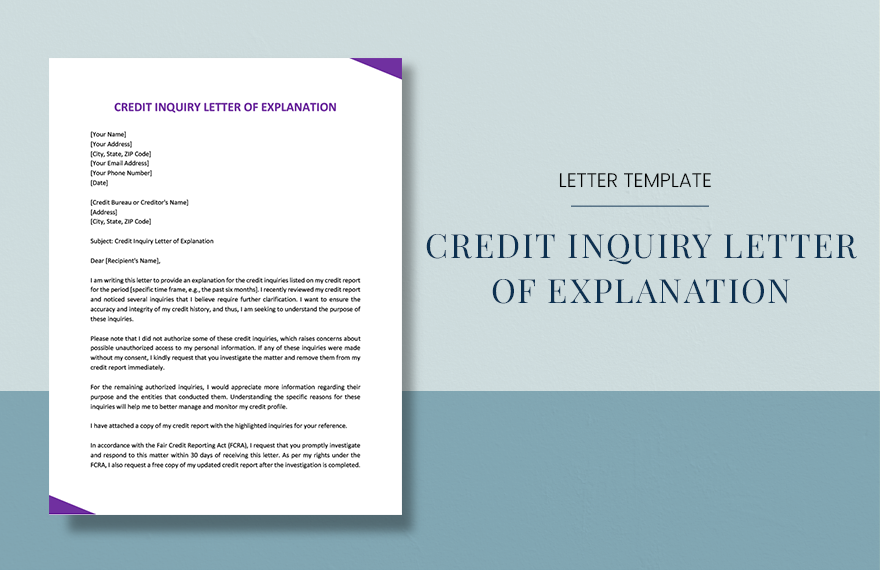

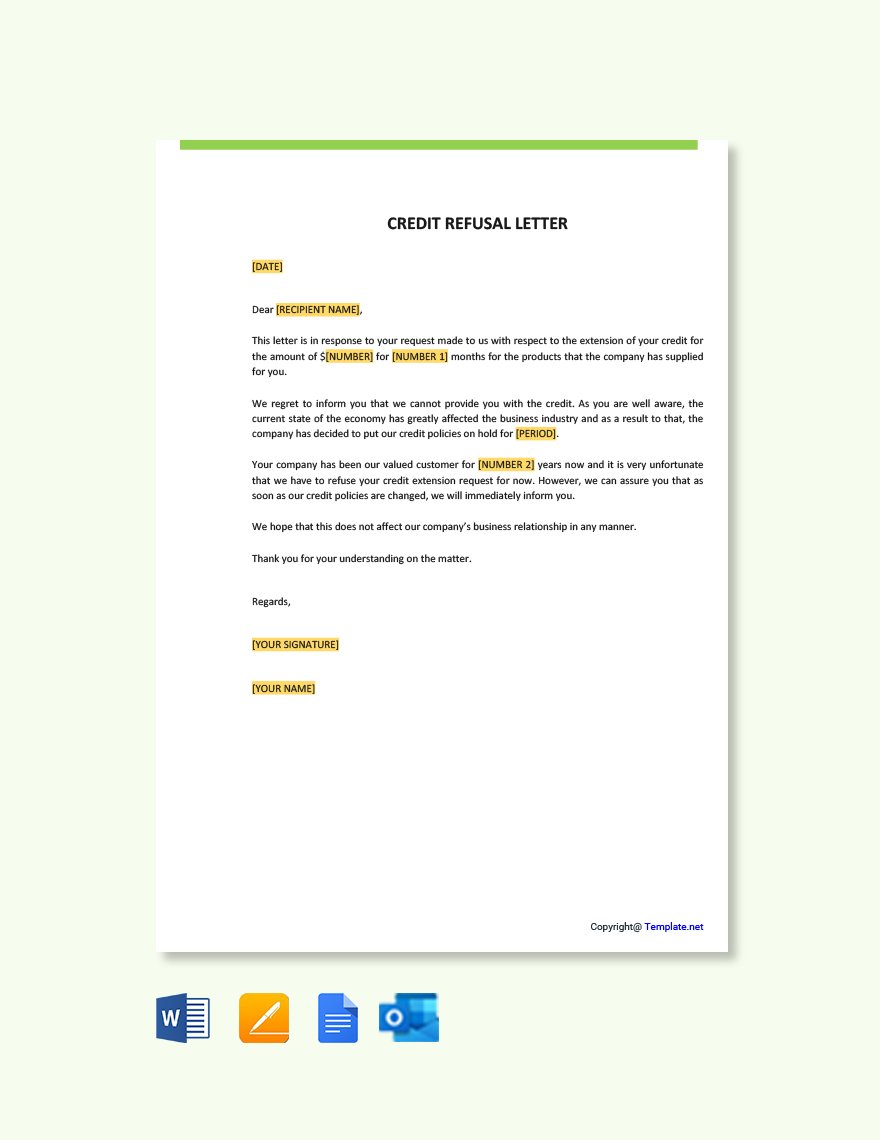

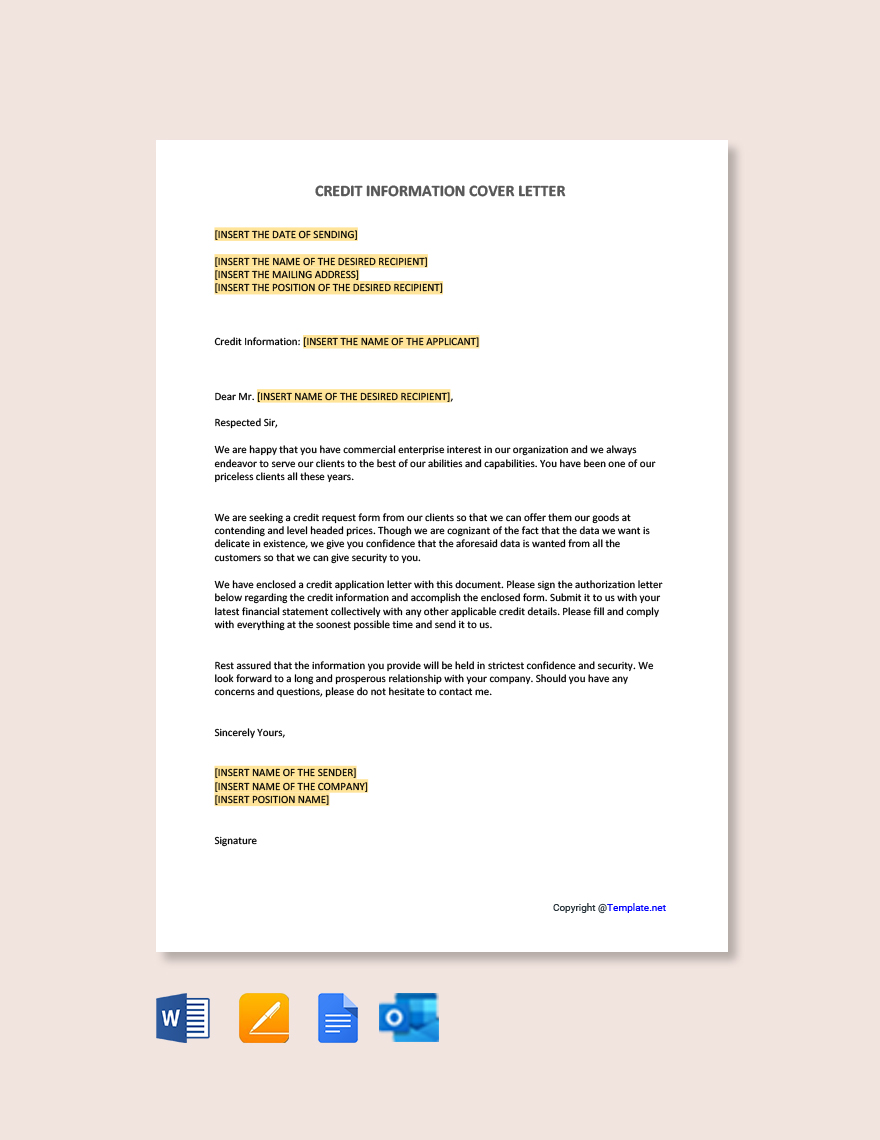

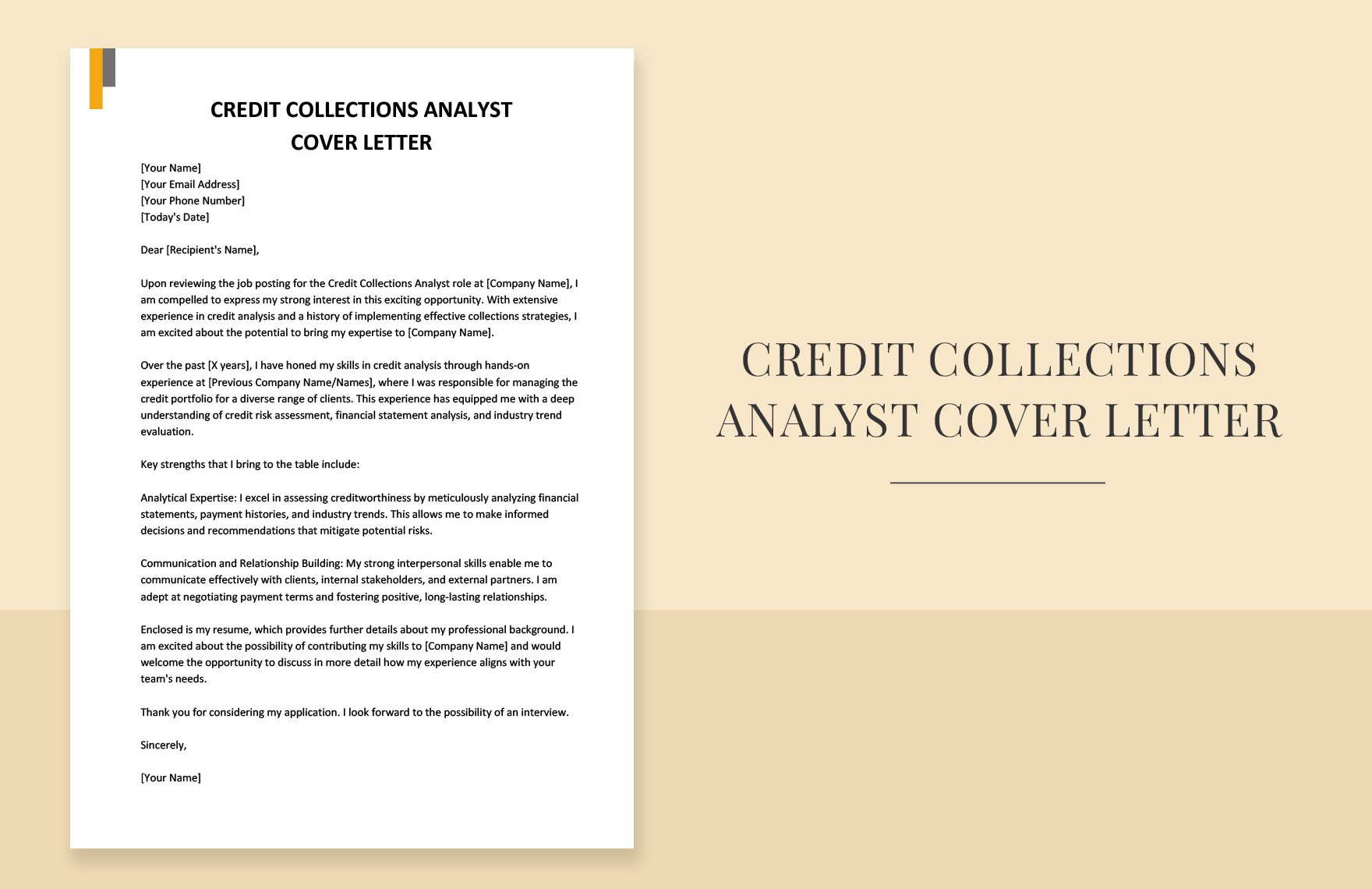

Money is always a big issue. May it be trying to get some or facing delayed payments, communicating such situations is usually expressed through letters. Communicate with your customers now with our Credit Letter Templates in Google Docs! Each template is 100% customizable and printable in the convenience of your home or office. Our templates have original content, so you don't have to waste time thinking of the letter's structure when you write one. You can get these templates in A4 and US Letter Sizes too. Have a smooth transaction with customers by downloading our templates now!

How to Write a Credit Letter in Google Docs

Banks issue credit letters to customers who have pending payments or borrowing money for personal purposes. These types of business letters need an urgent response from the customer. Writing one might be a little challenging. Read our list of tips below to know how.

1. Get Information

Before writing a credit letter, you must know the situation the customer is in. Your letter can contain decisions about terminating the partnership with a customer or asking him to clear overdue payment. Get information about the customer's transaction with your bank since this is the basis of your letter.

2. State the Situation

The first part of your letter should explain the current financial situation of the customer. Be clear and honest in writing this part of the letter. If the customer applies for a bank loan, explain the procedures of the application. If the customer fails to complete a payment, you can give an overview of the penalties that he might face later on.

3. Give Decisions and Alternatives

Every financial situation of the customer needs a quick decision and alternative. For delayed payments, have a firm decision on continuing the transaction with the customer or suggest another way of payment. The same goes for loan application. You need to give a clear process for the customers to carry out their transactions with your bank.

4. Allow Future Possibilities

Based on your decision and the customer's situation, leave some doors open for them to contact you in the future. Leave your contact information in the last paragraph of your simple letter to encourage a response from the customer.

5. Write Simply

Always write your letter in the simplest way possible. Maintain a business-like and straightforward tone. Lastly, check your document for any glaring error before printing it.