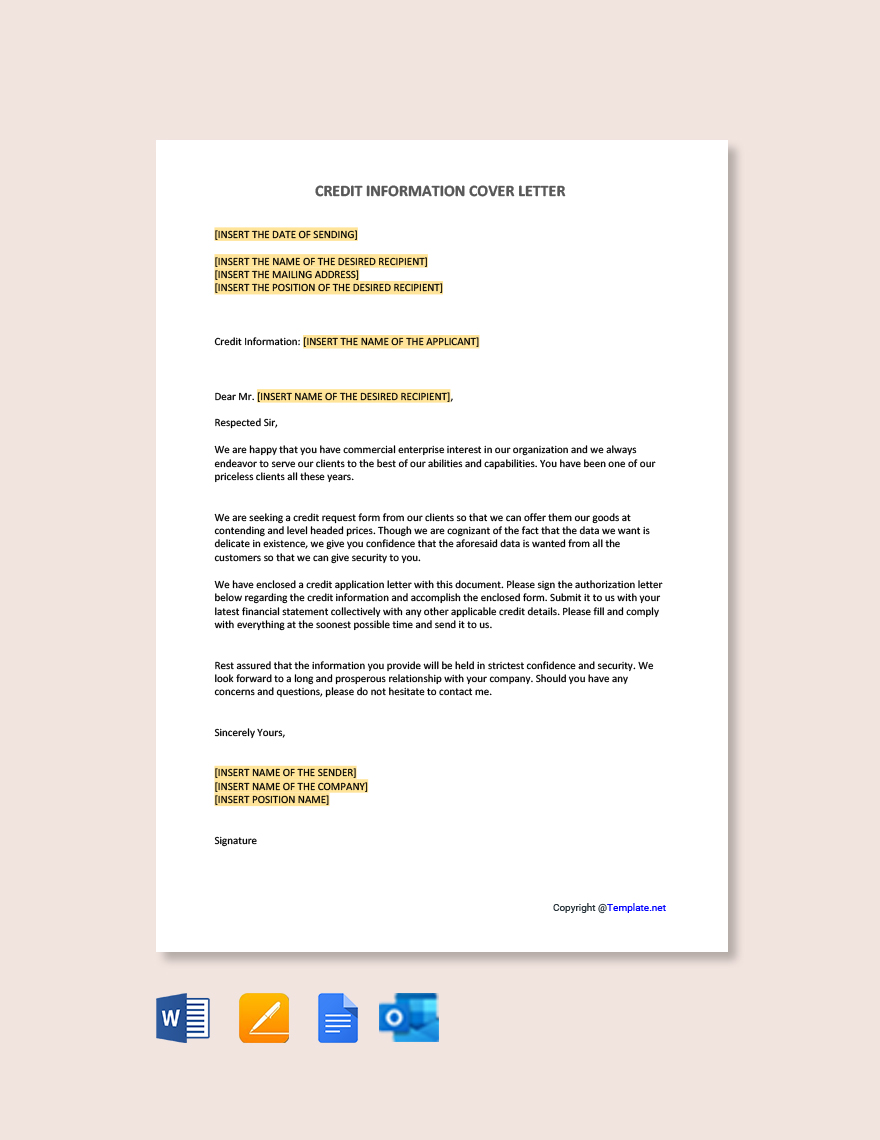

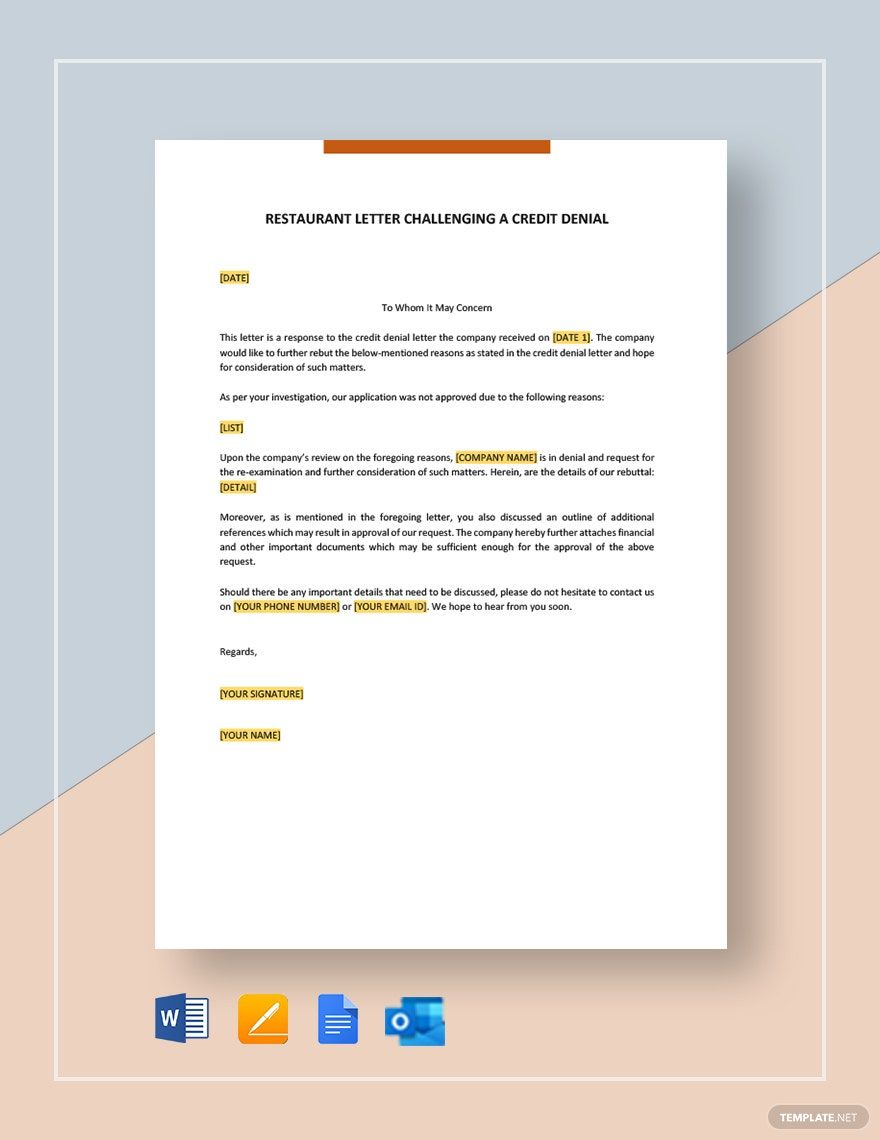

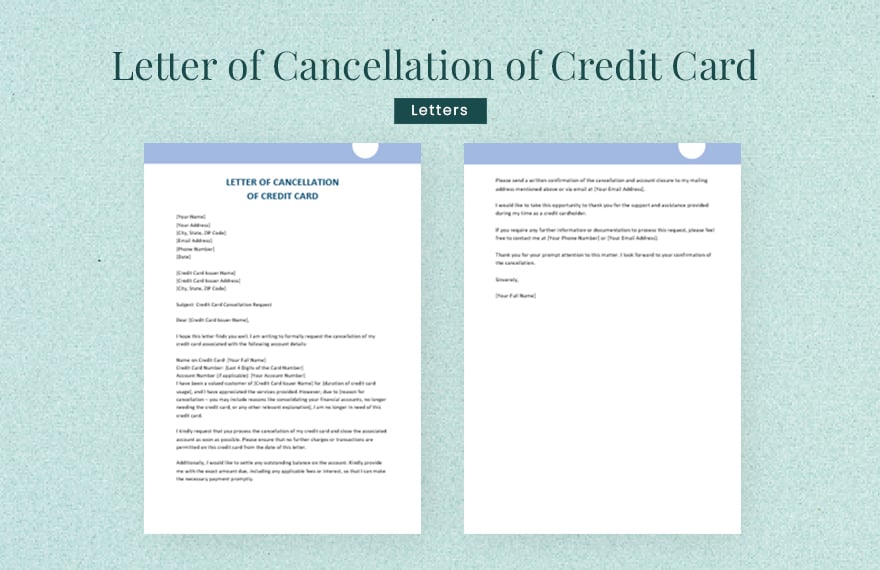

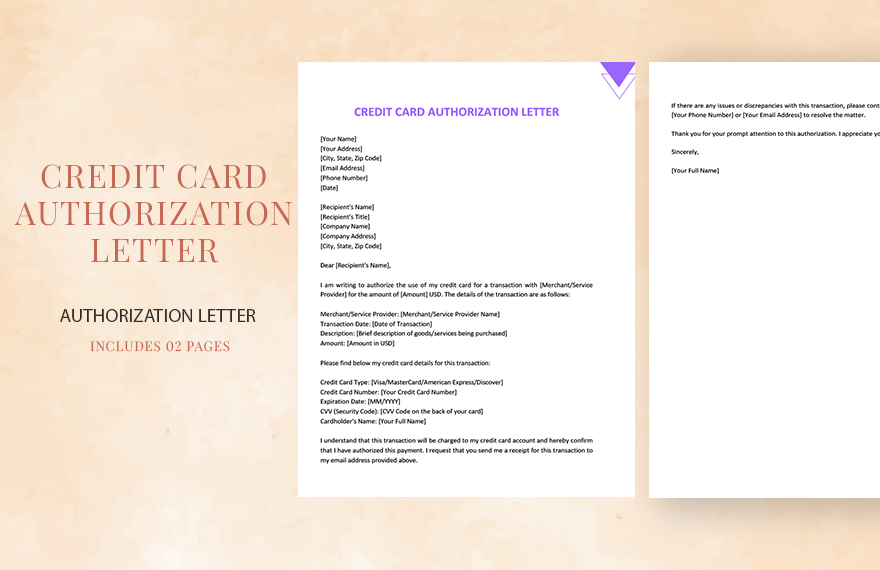

A credit letter is a financial contract between a bank, its customer, and a beneficiary. It guarantees that payment to a seller shall be received by the buyer on time and for the correct amount. If the buyer is unable to make the payment on the purchase, then the bank shall be required to cover the amount of purchase. To make sure that your credit letter is properly written, browse through our library of templates and pick the one that suits you best. Register on our website now to gain access to our editable files and templates.

How to Create Credit Letters

A letter of credit is issued by an importer to a bank, which is sent to an exporter’s bank with details regarding the payment and other obligations to be met by the exporter. Letters of credit are common in international trade, to safeguard the parties against poor service and fraudulent practices. Here are some tips in writing the credit letter:

1. Remain Courteous

Maintain a professional tone no matter what the circumstances: whether the person involved is approved, denied, or discontinued credit, or even when the collection process has begun. A good relationship with your customer will ensure that you keep his business. In case you deny or discontinue a request for credit, for instance, you may leave the door open to future applications to continue their business.

2. Discuss Issues Cordially

If the customer is more than a month late in payments, encourage them to contact you to discuss the lapse. If the payment is past 60 days overdue, with no move toward making payments on the customer’s part, let him or her know the repercussions of such late payments. Do not make empty threats unless you are prepared to follow through.

3. Be Clear

To avoid any miscommunication, make sure that you are clear in your letter and include all information necessary to convey your request or offer to your client. Refrain from creating general letters and instead, cater your letters specifically to each client or customer. Follow a more formal type of writing by being confident and persuasive in your letters, but keep each correspondence brief and straightforward.

4. Proofread

Credit letters should be written professionally: you should be able to have a good command of the language used, so check your grammar and spelling before sending the letter to the client.