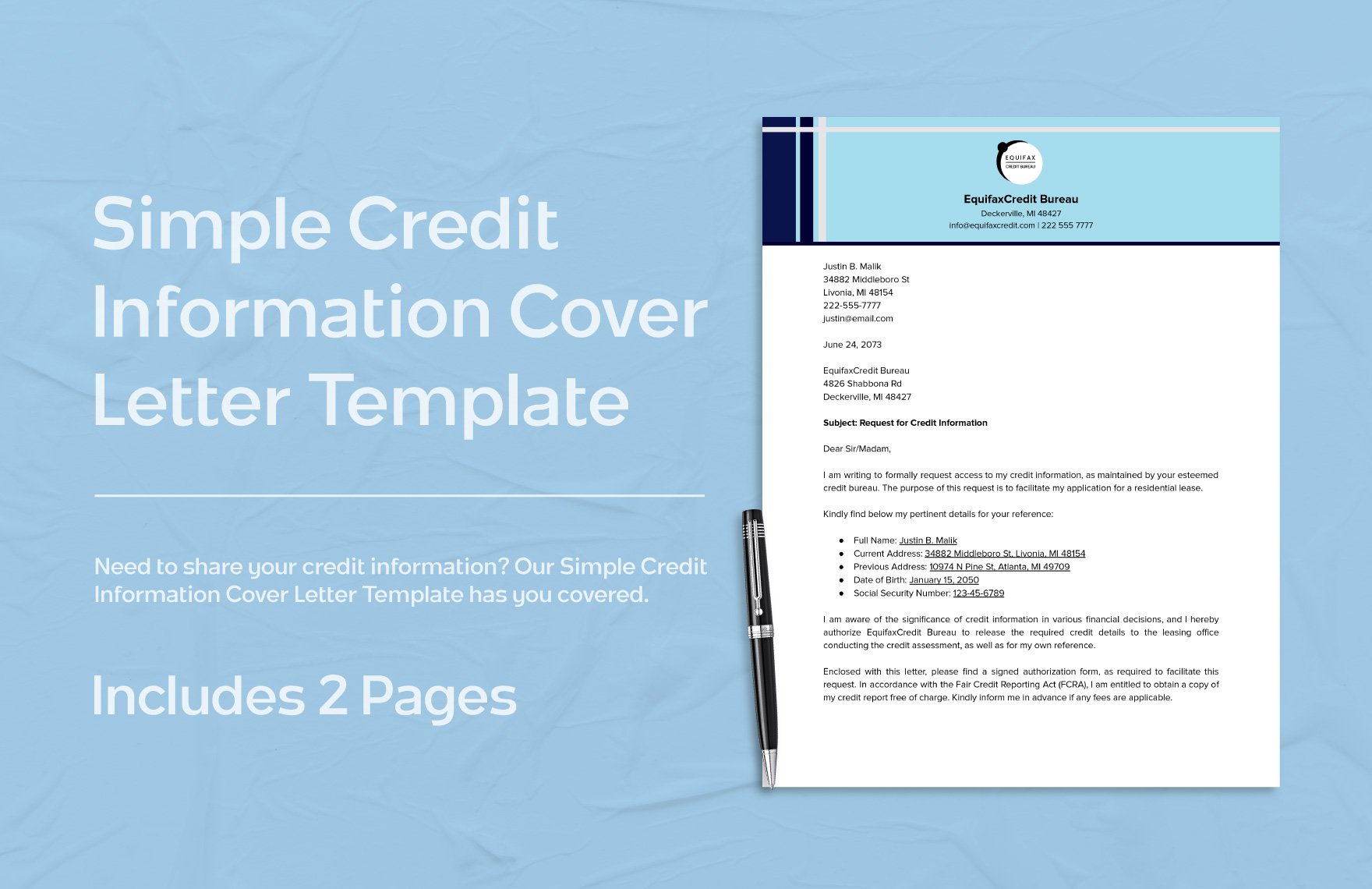

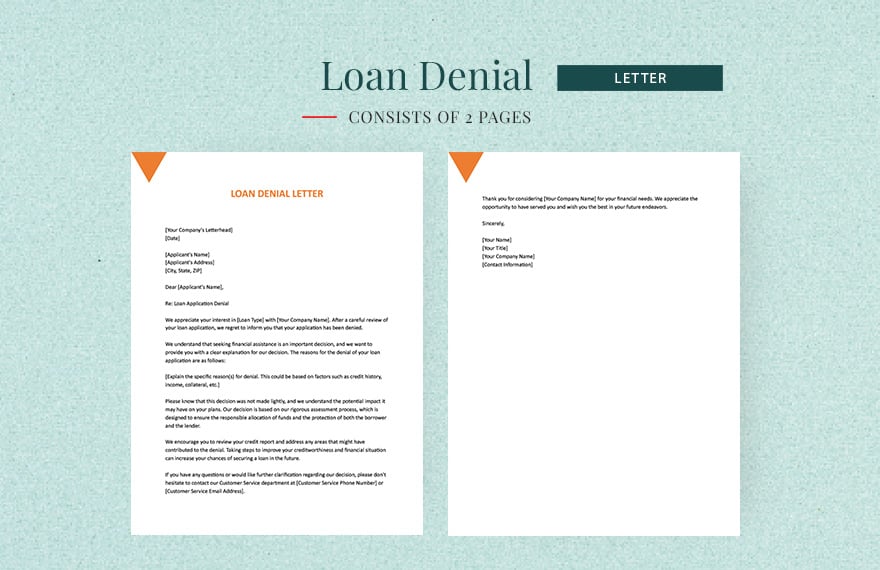

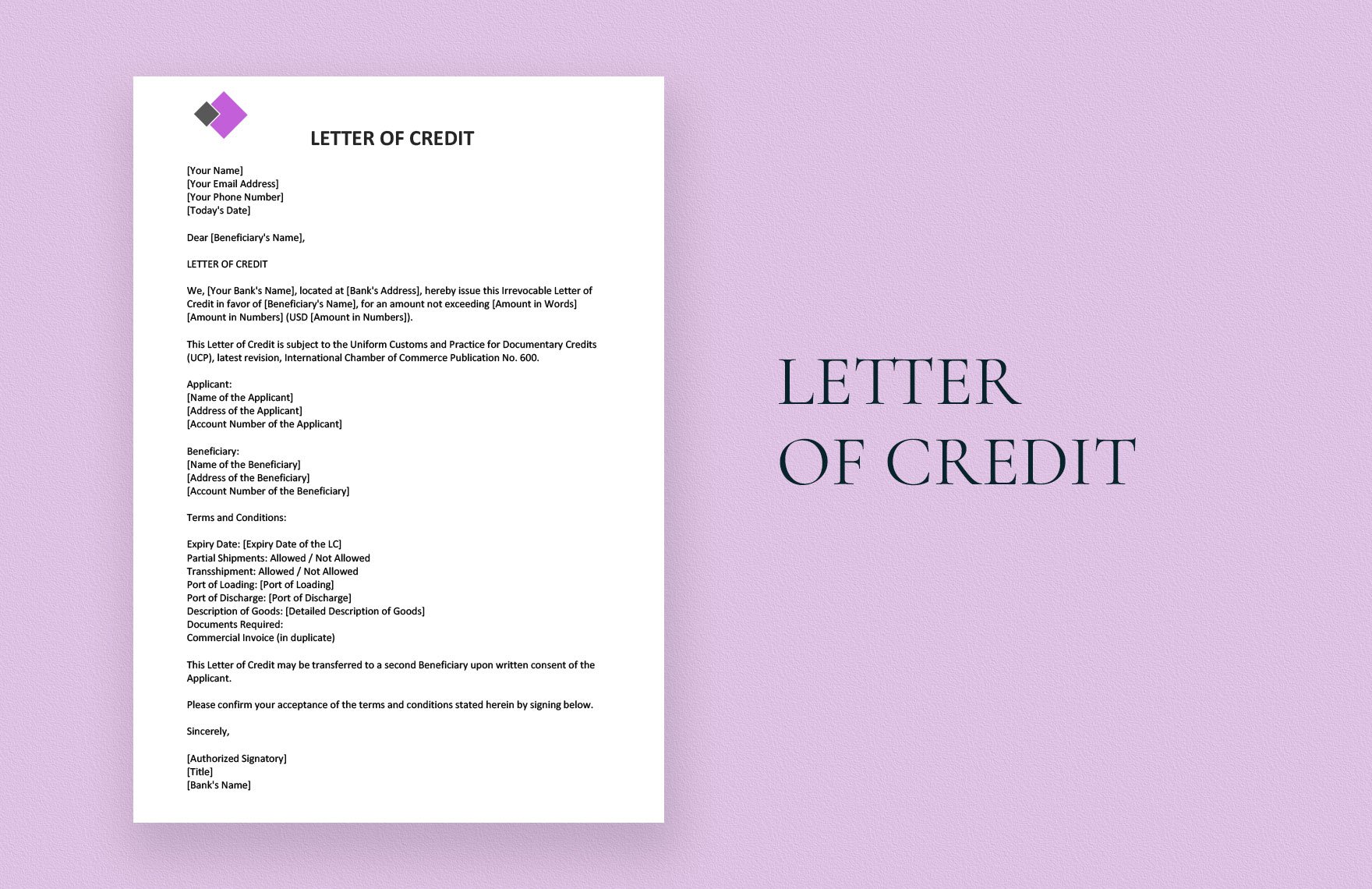

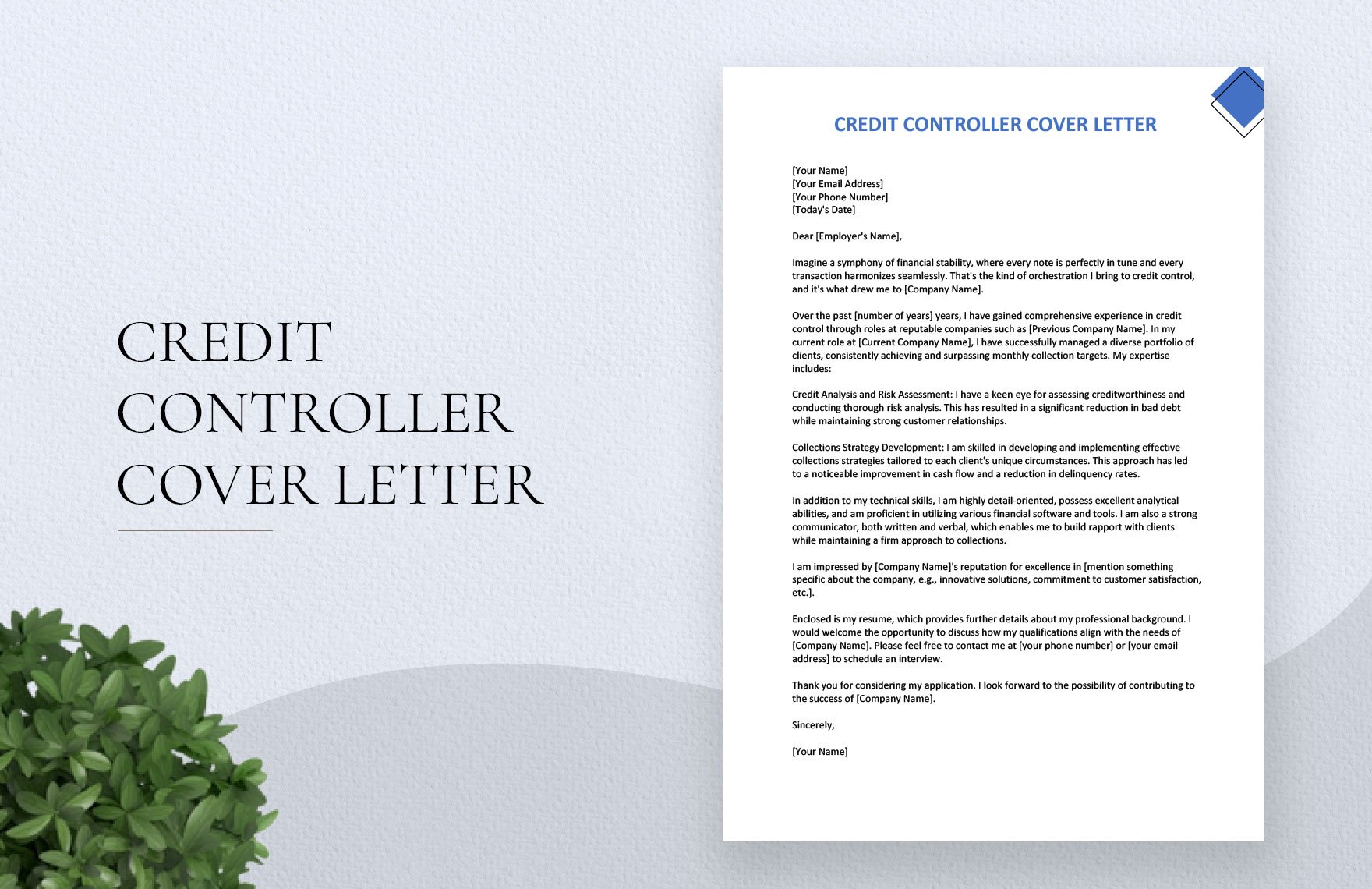

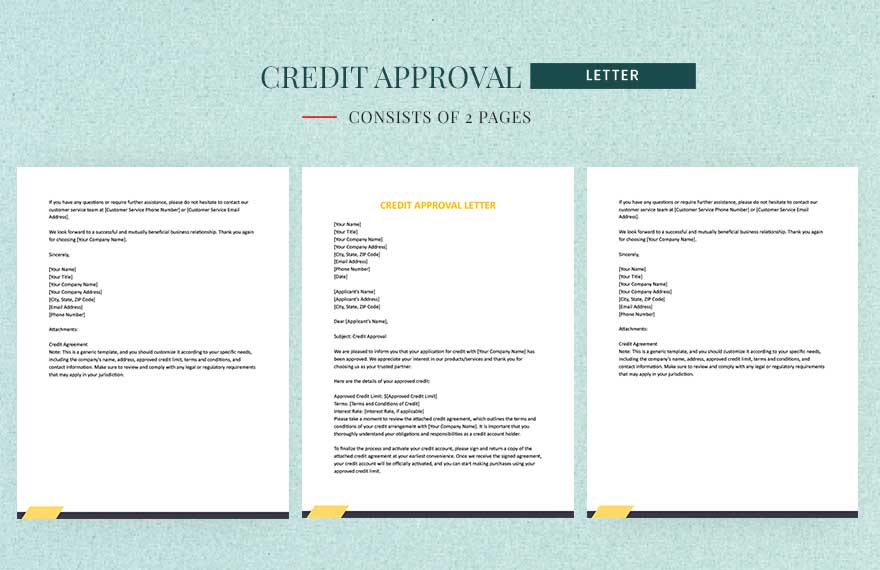

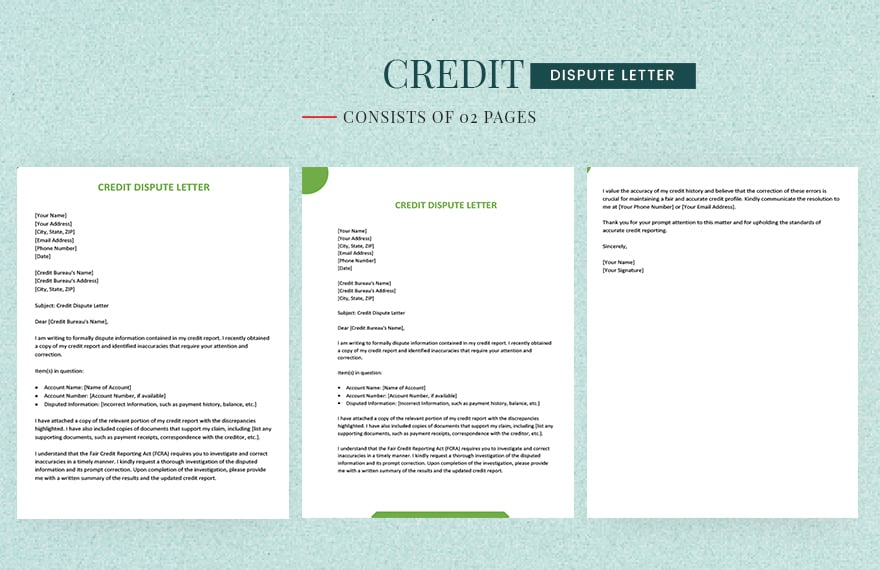

According to the Federal Reserve's report, an average adult in 2019 had $5,673 credit card debt. Speaking of credits, odds are, you have applicants requesting your bank to pay their beneficiary on behalf of them. So, you need credit letters for that. Credit letters will testify that the applicant can pay on the deadline, which will make transactions quicker. So, write professional letters with our collection of ready-made Credit Letter Templates in Word. These templates are 100% editable and printable. We can assure you that these letters are expertly written to fit your standards. Download a template now!

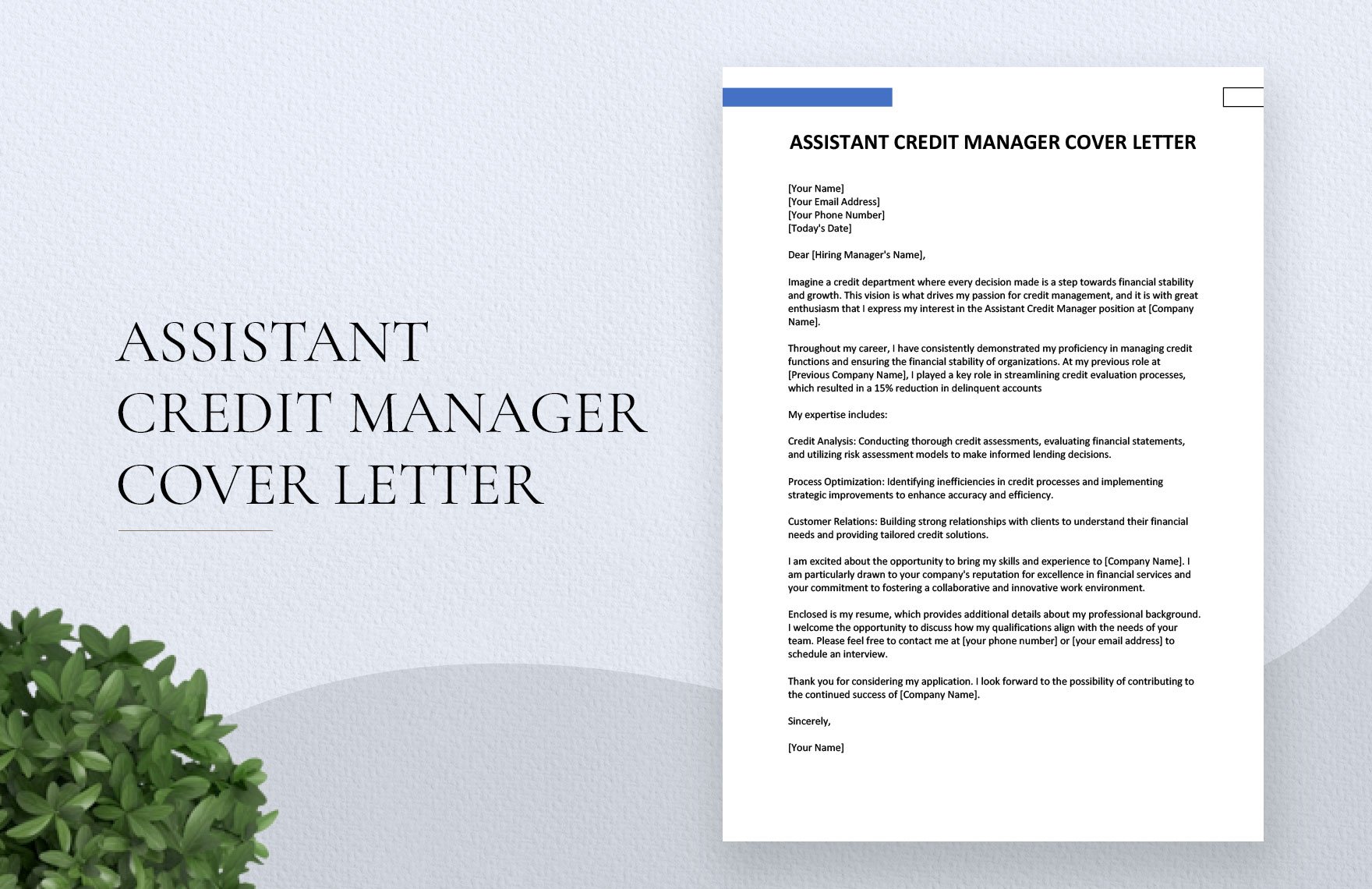

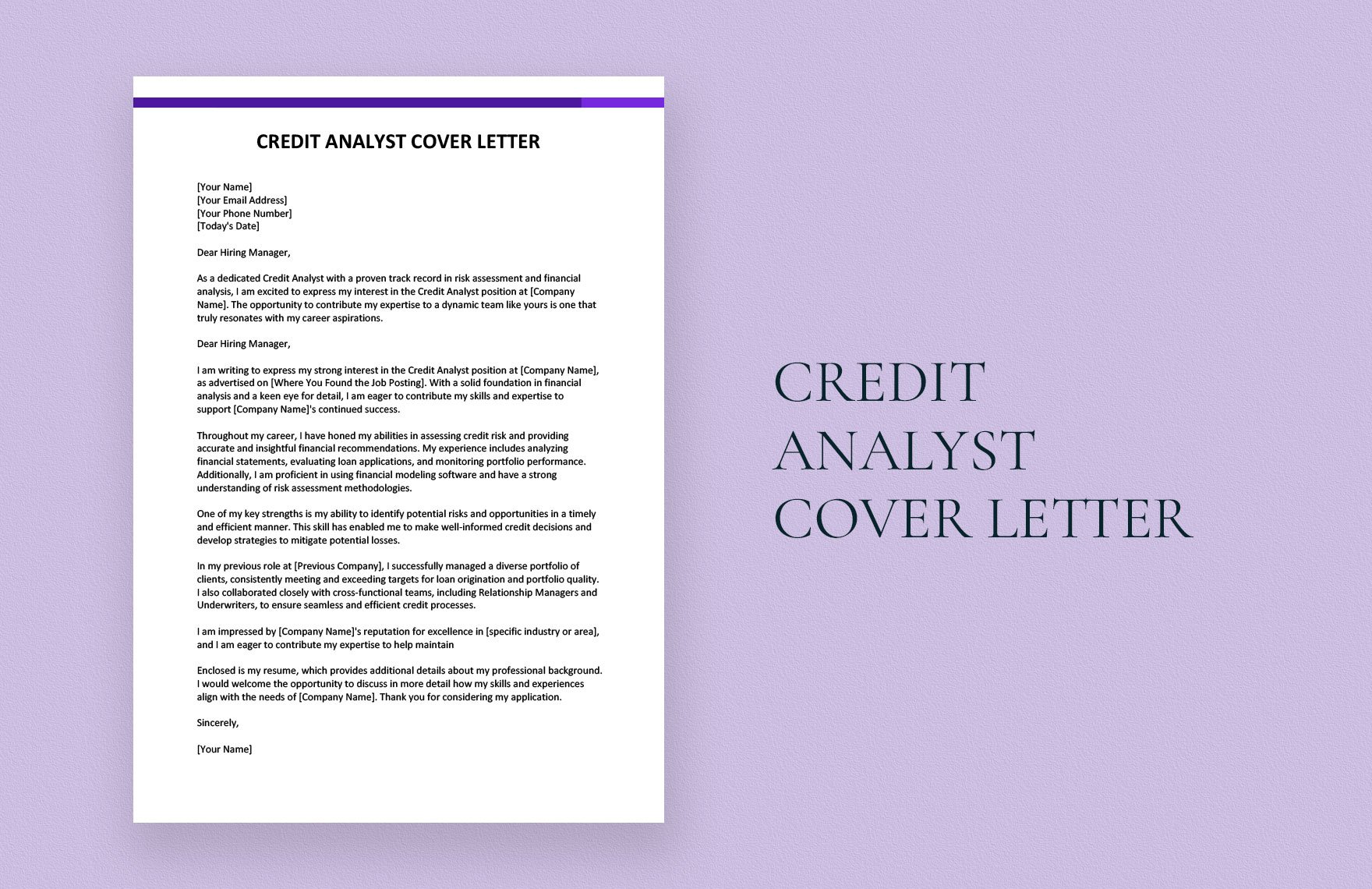

Credit Letter Templates in Word

Explore professionally designed health letter templates in PDF. Free, printable, and customizable options ensure a polished look. Download yours now!