Bring Your Professional Communications to Life with Guarantee Letter Templates from Template.net.

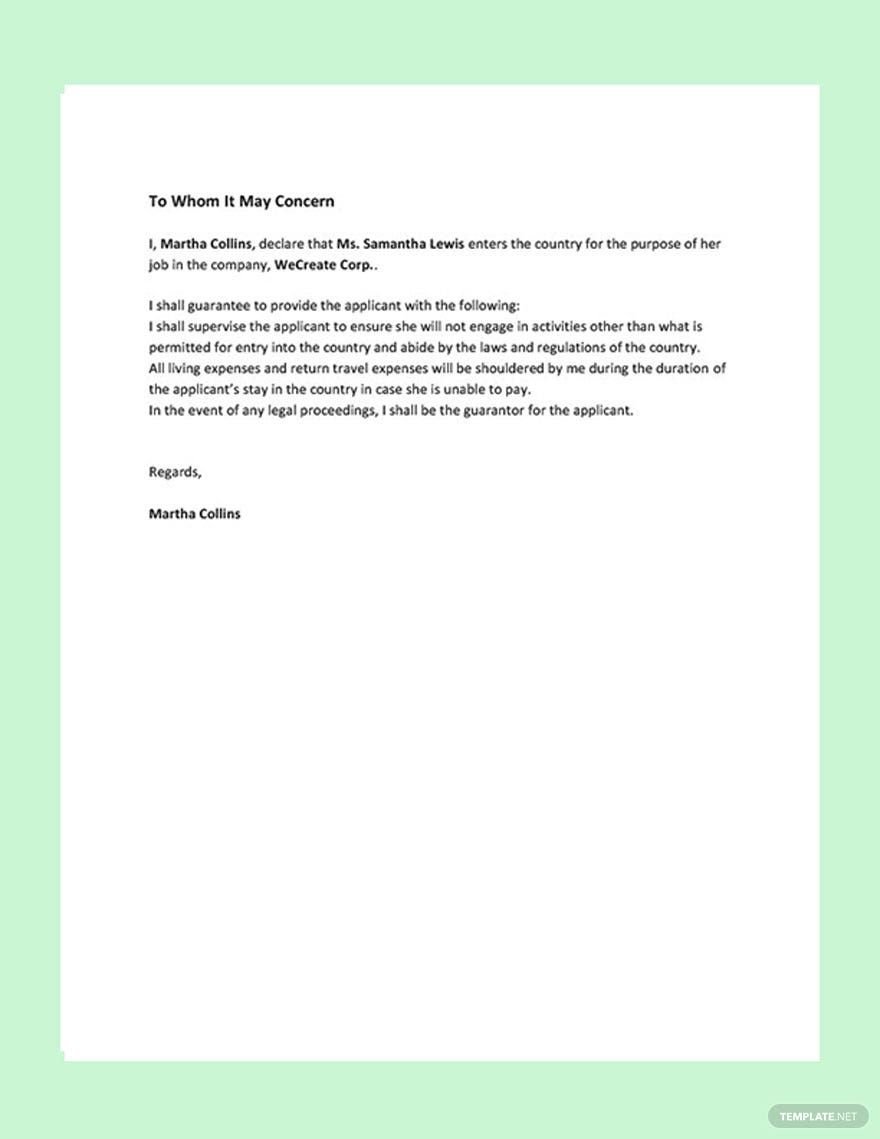

Keep your business communications seamless, reliable, and efficient with Guarantee Letter Templates from Template.net. Ideal for business professionals, small business owners, and entrepreneurs, these templates are designed to help you craft clear and professional guarantee letters effortlessly. Whether you need to reassure a client of a product warranty or underline your commitment to service excellence, these templates have you covered. They come equipped with sample texts that you can personalize and fields where you can insert necessary details like dates, terms, and conditions. With no specialized writing skills required, you’ll benefit from traditional and professional-grade design layouts, perfect for both print and digital distribution.

Discover the many Guarantee Letter Templates we have on hand, ready to be tailored to your specific business needs. Start by selecting a template that fits your situation, easily swap in your branding assets, and adjust colors and fonts to match your company’s aesthetic. Enhance your letters with a simple drag-and-drop of icons or graphics and add animated effects if desired for a modern touch. The possibilities are endless and require no advanced skills, making it simple and fun to create professional documents. With regularly updated templates ensuring you have the latest in design trends, you'll always find inspiration. When you're finished, download or share your letter via link, print, or email, making it ideal for multiple communication channels.