Bring Your Loan Communication to Life with Loan Letter Templates from Template.net

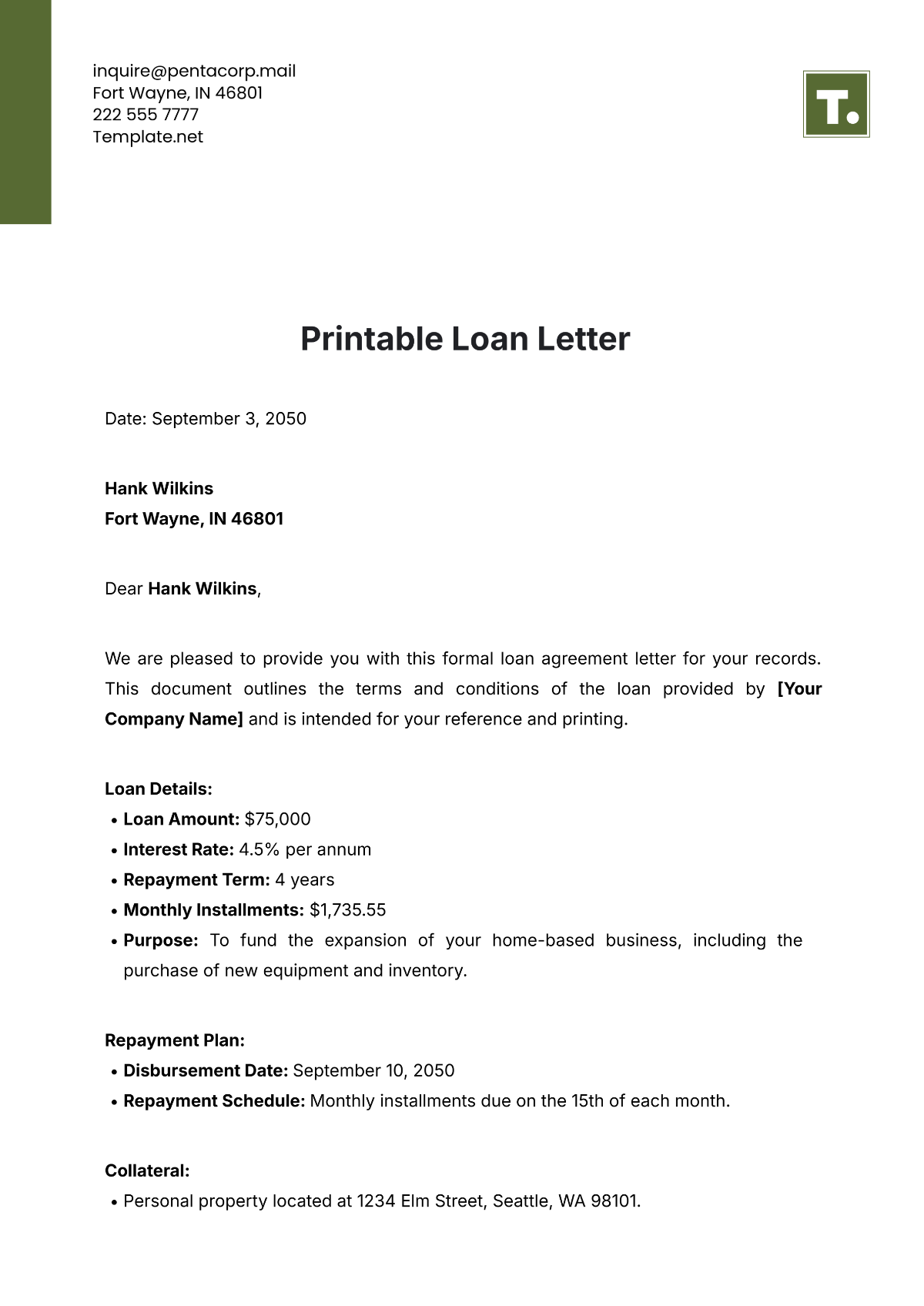

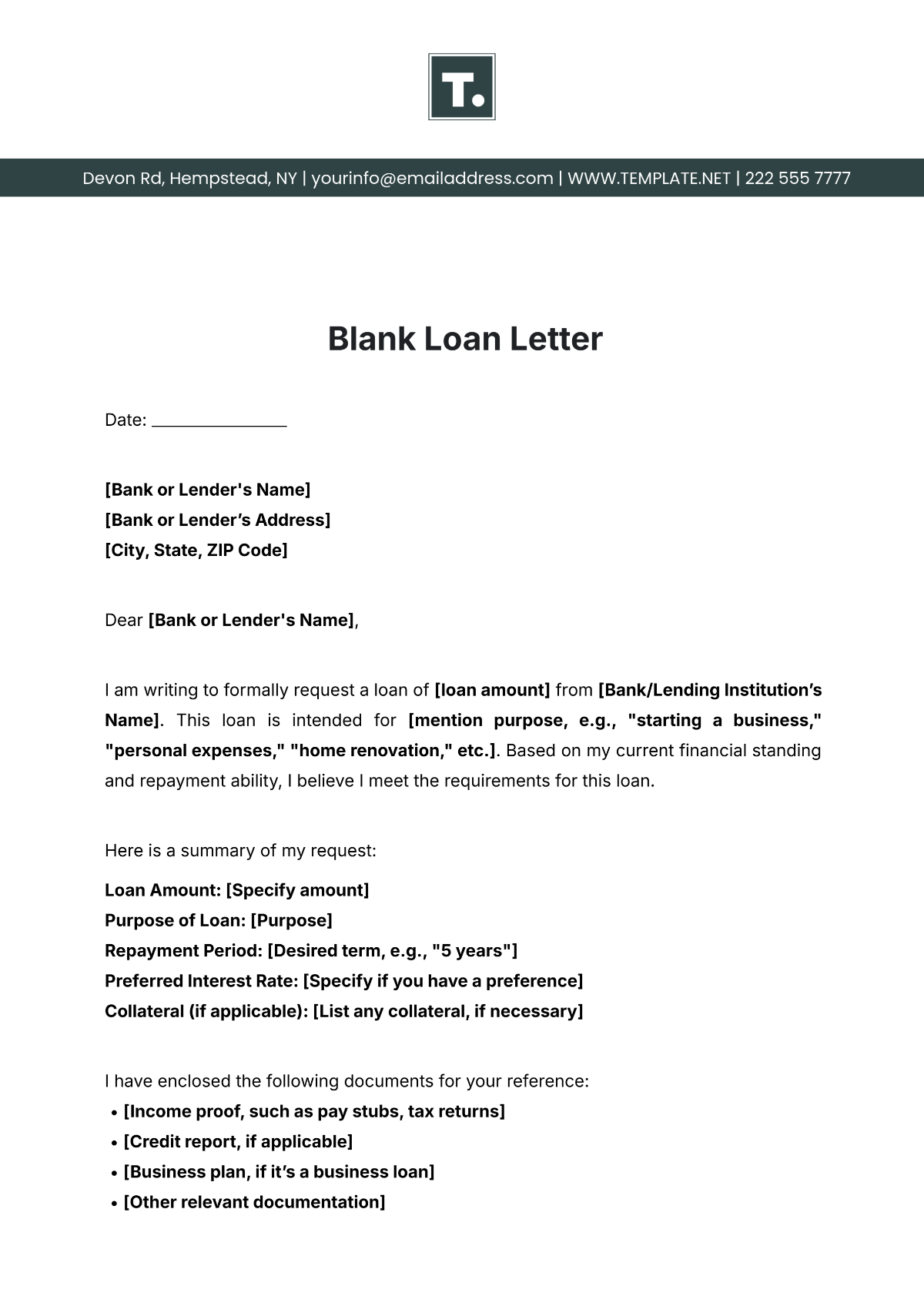

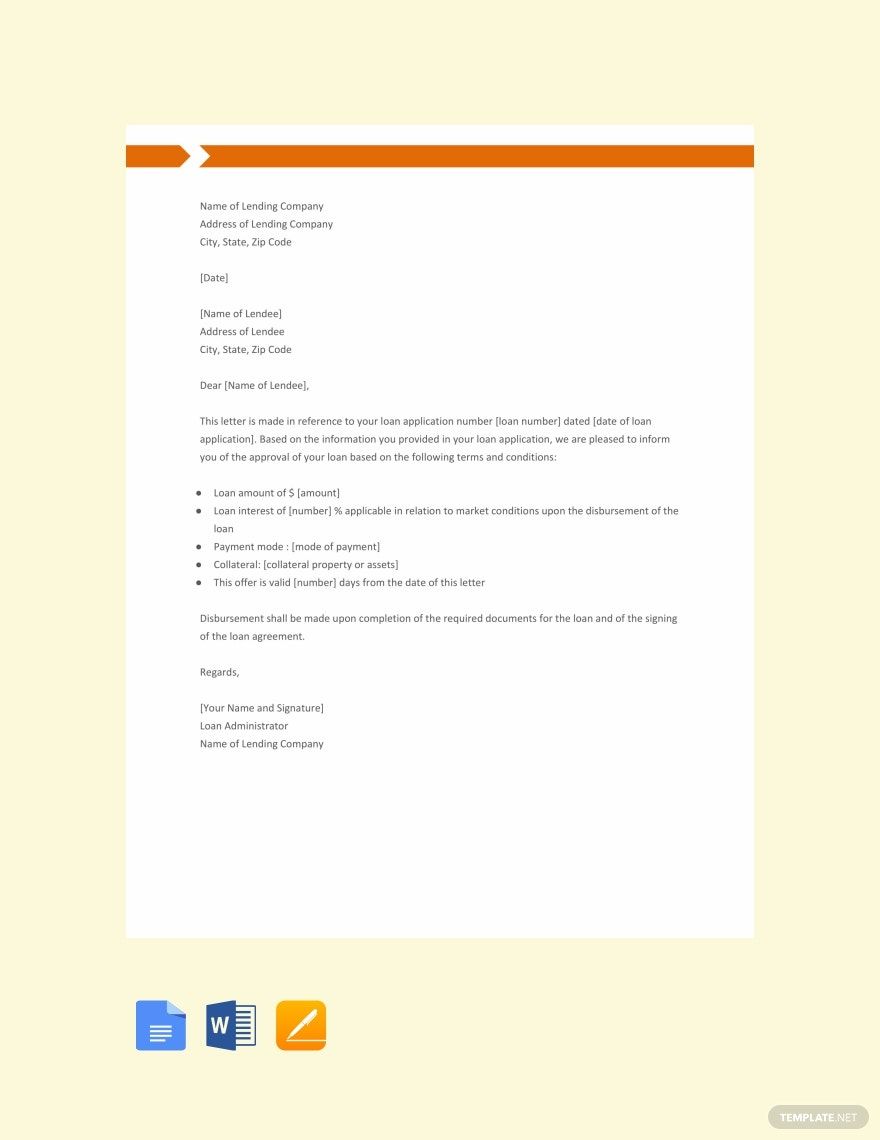

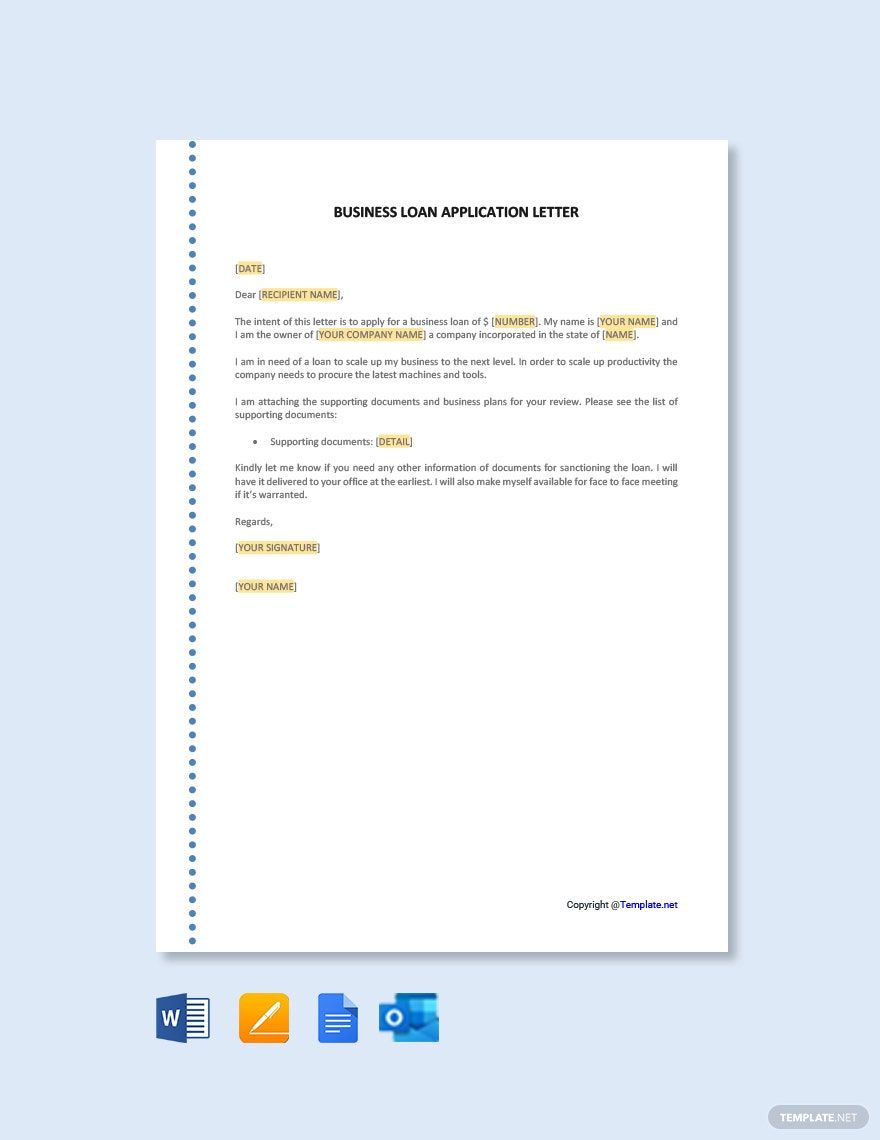

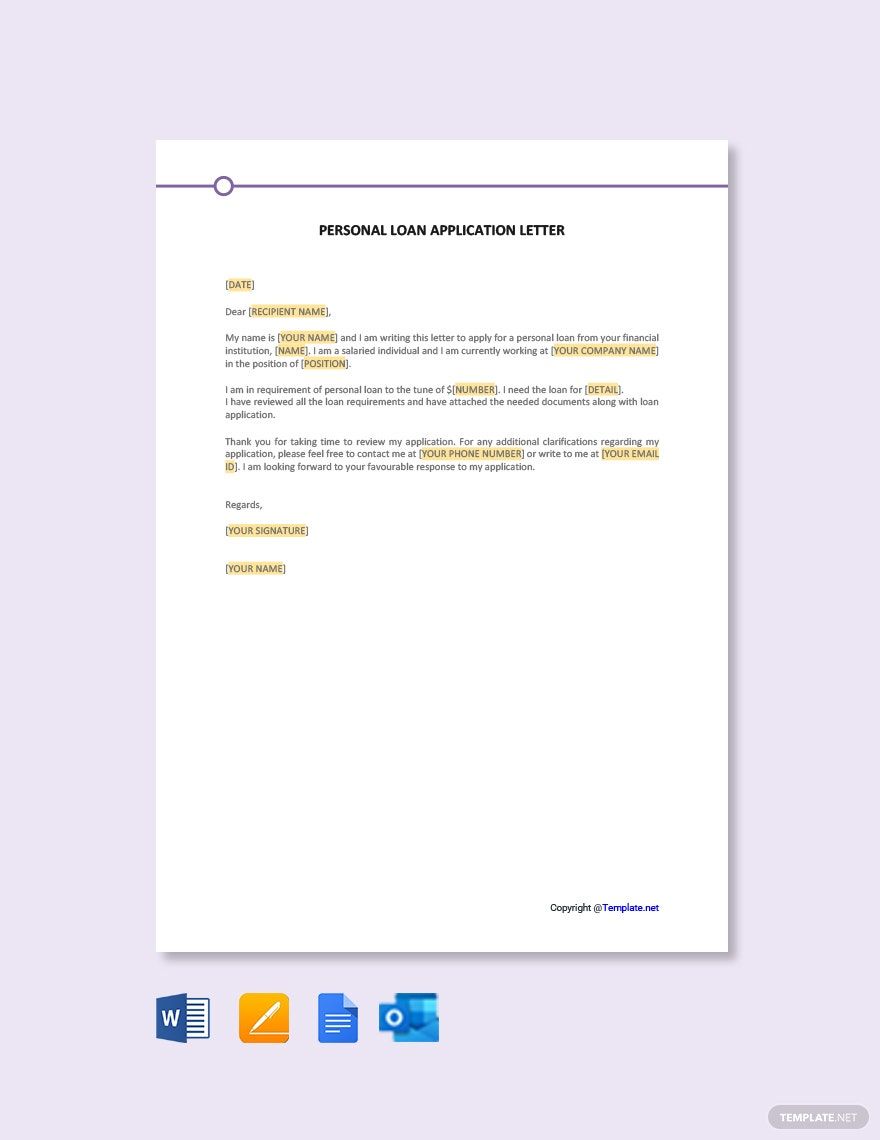

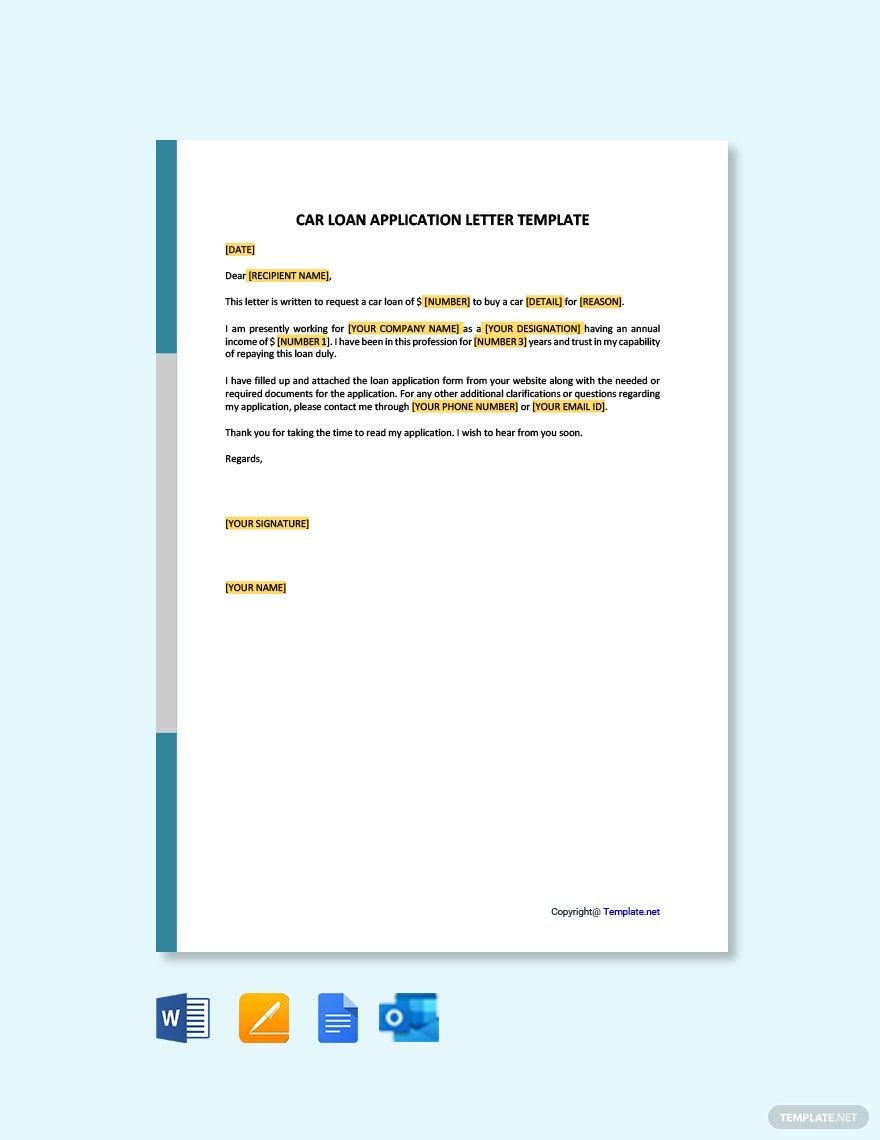

Keep your business communications professional, polished, and personalized with Loan Letter Templates from Template.net. Designed for financial institutions, loan officers, and business professionals, these templates help you keep your clients engaged, streamline your process, and maintain consistent branding without the hassle of starting from scratch. Whether you're promoting a new loan offer or informing clients of policy updates, our templates simplify the task. Each template includes essential details such as loan terms, contact information, and customizable sections to meet your specific needs. With no design skills required, you can benefit from professional-grade designs that make your loan letters not only impactful but also cost-effective. Plus, our templates are suitable for both print and digital distribution, ensuring your communication reaches its intended audience in the most efficient way.

Discover the many Loan Letter Templates we have on hand at Template.net. Simply select a template that suits your communication needs, then swap in your assets and tweak the colors and fonts to align with your brand. For those looking to add a little extra flair, you can drag-and-drop icons or graphics, incorporate animated effects, and utilize AI-powered text tools for dynamic content creation. The possibilities are endless and require no prior design skills, making it a fun and accessible experience for everyone. To keep things fresh, we regularly update our library with new designs, so you'll always find a template to match the current industry trends. When you’re finished, effortlessly download or share your documents via email, link, or export options, making it ideal for multiple distribution channels.