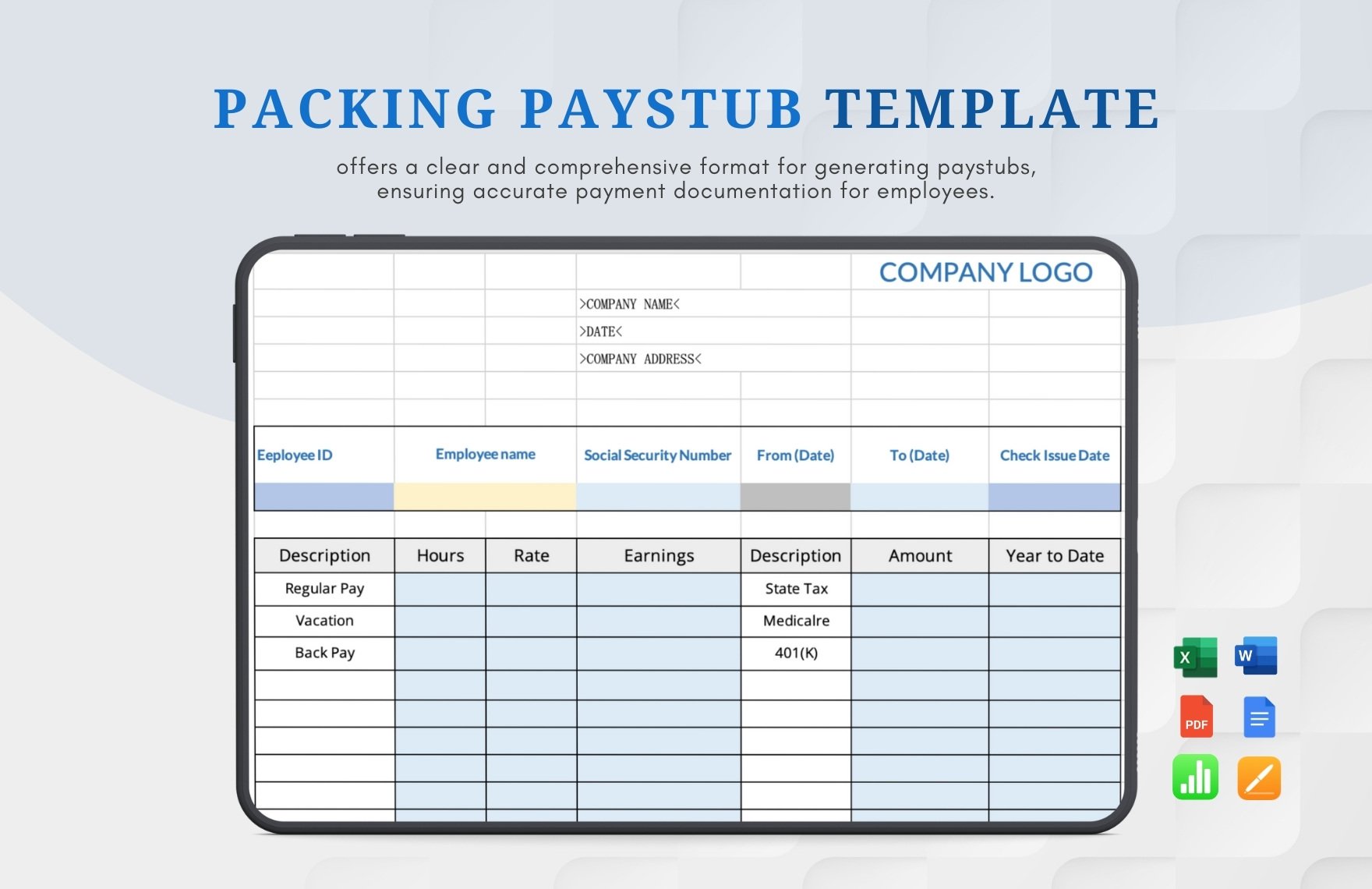

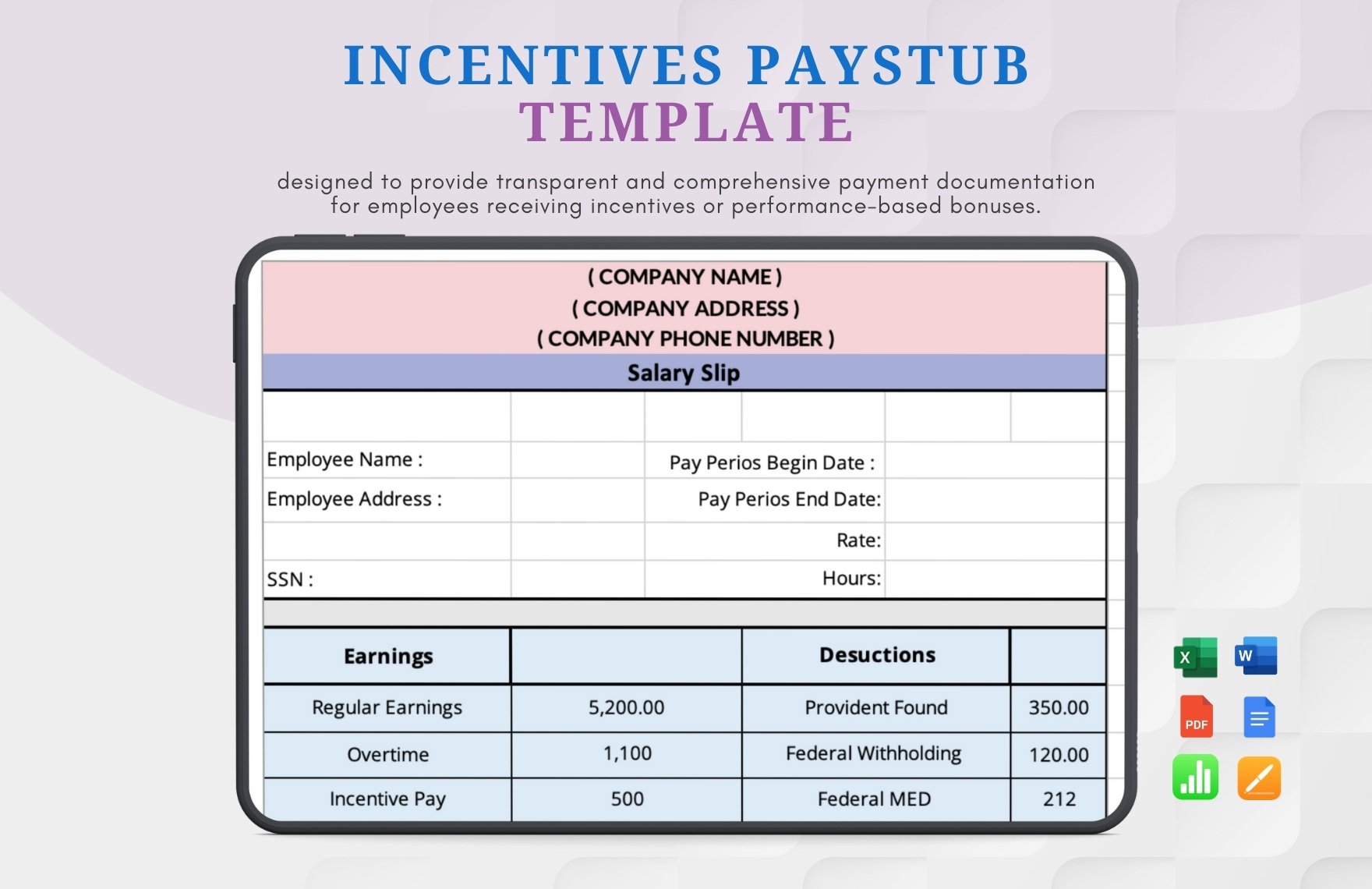

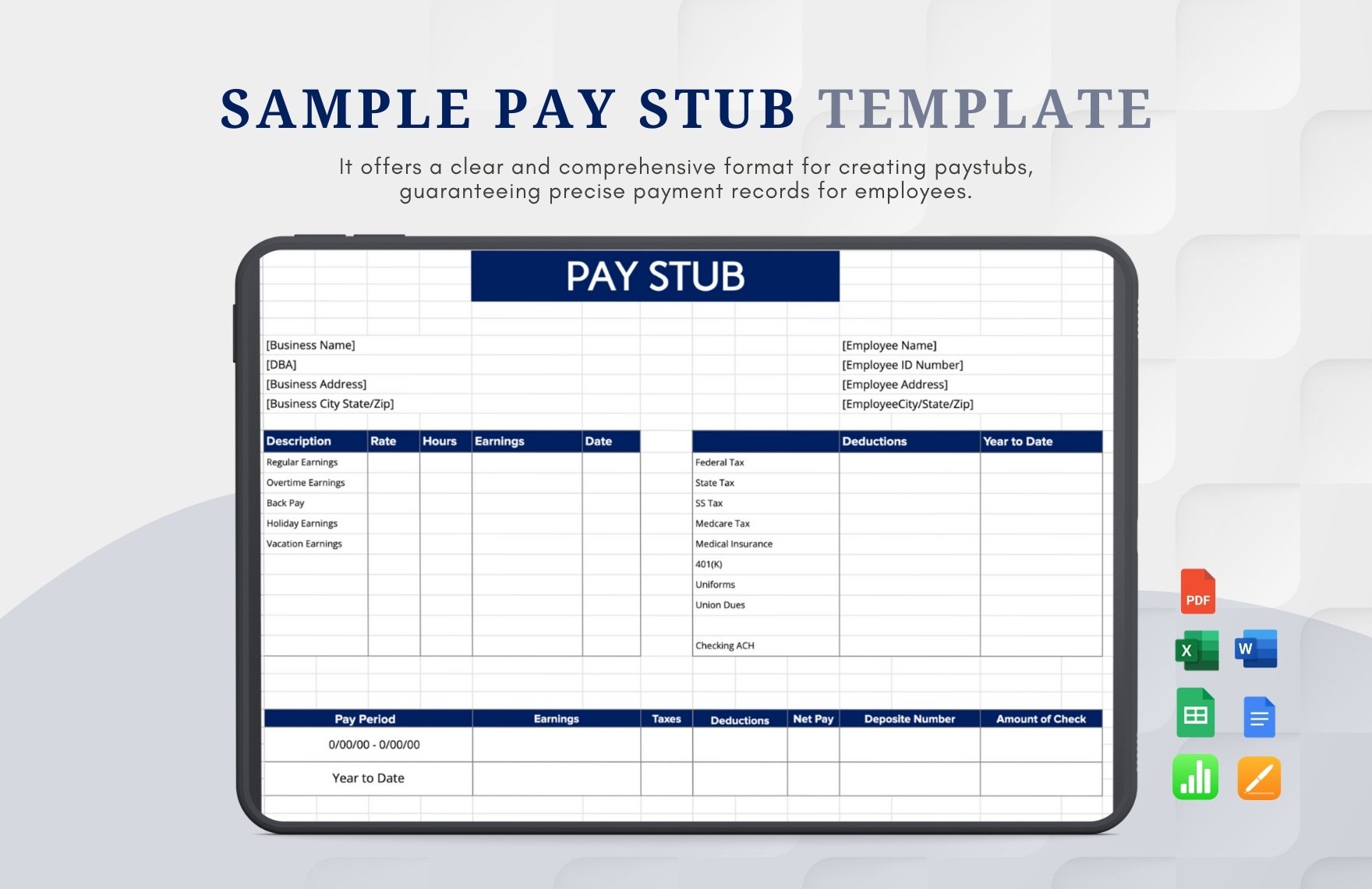

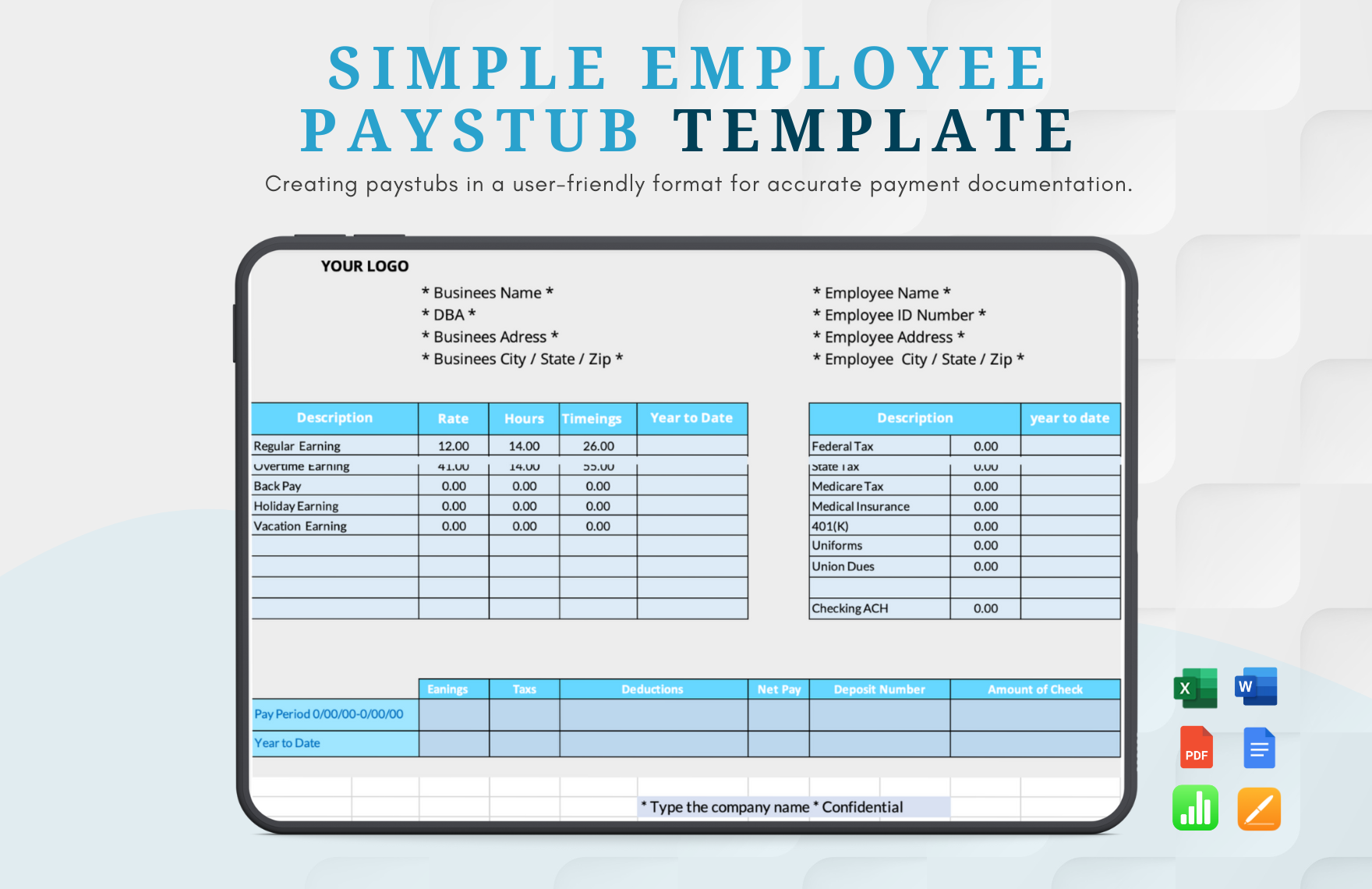

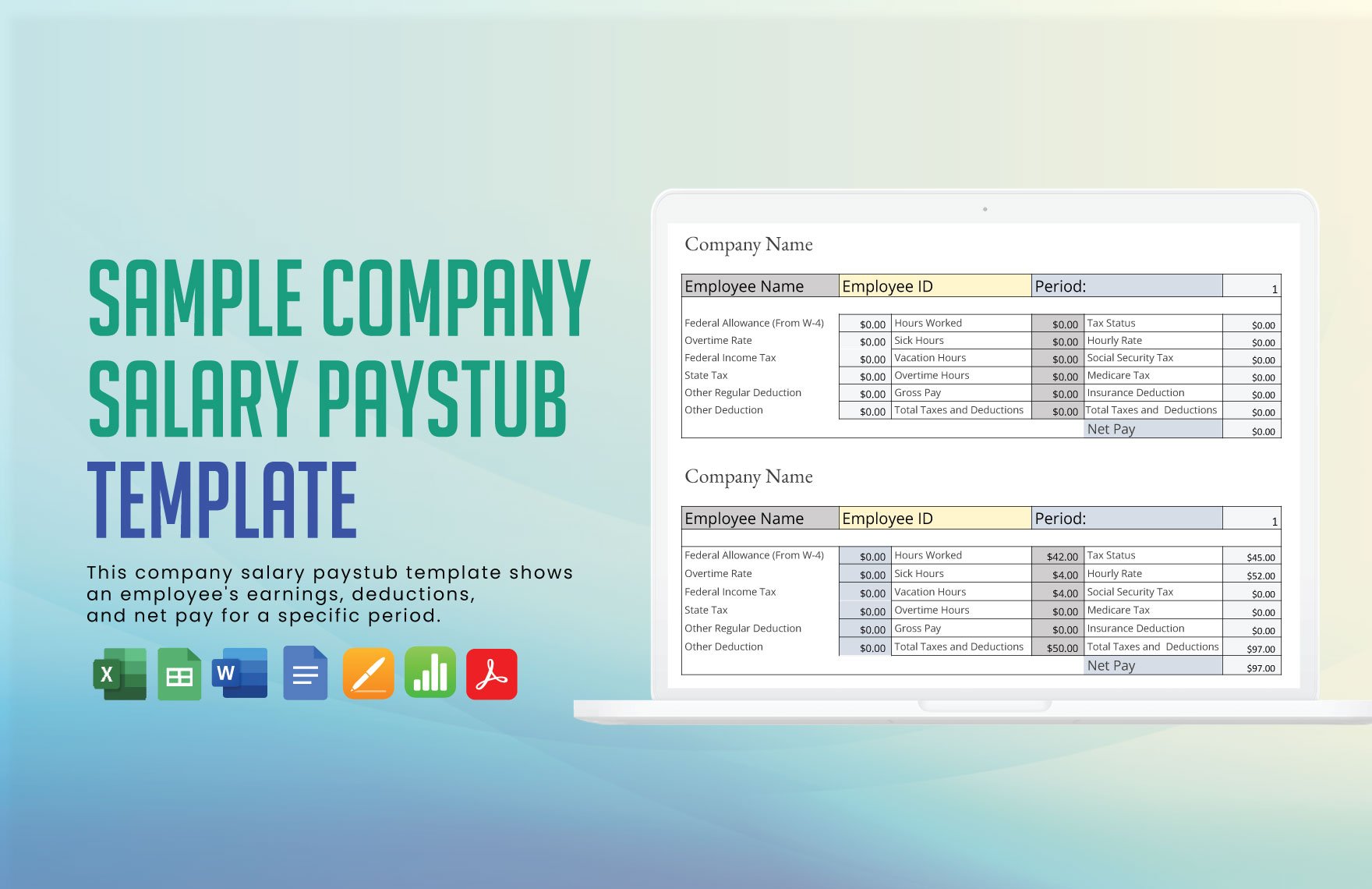

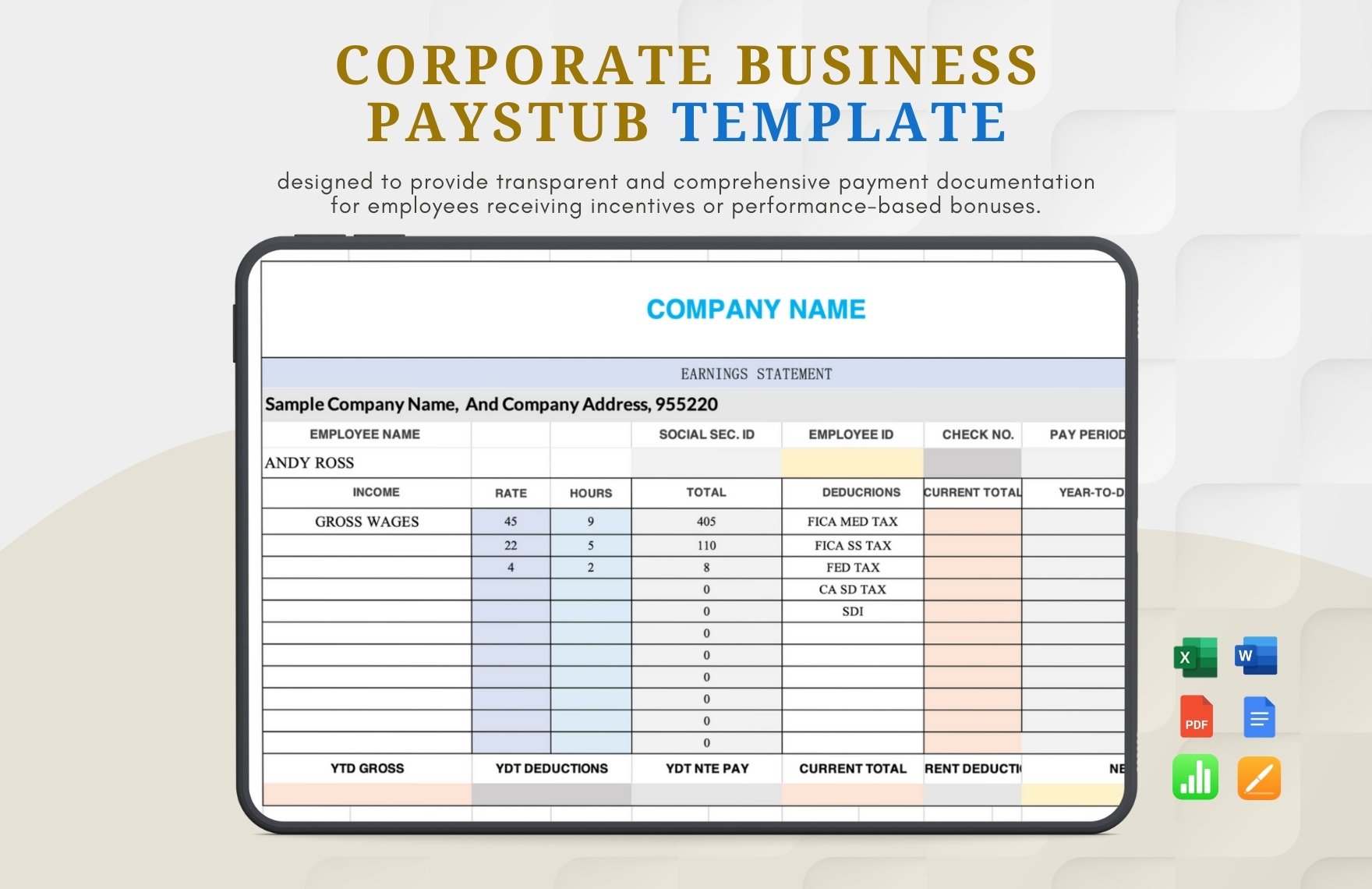

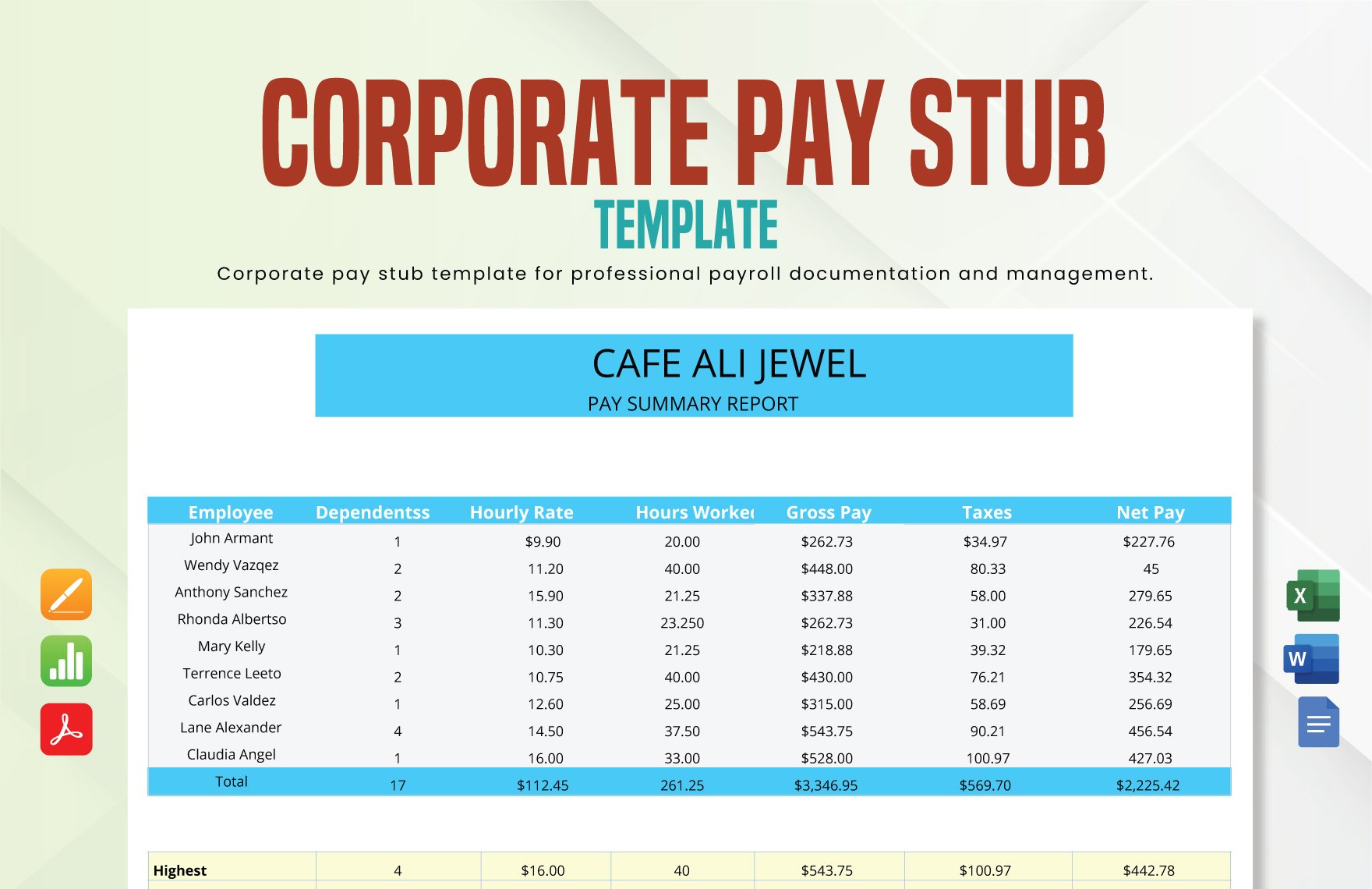

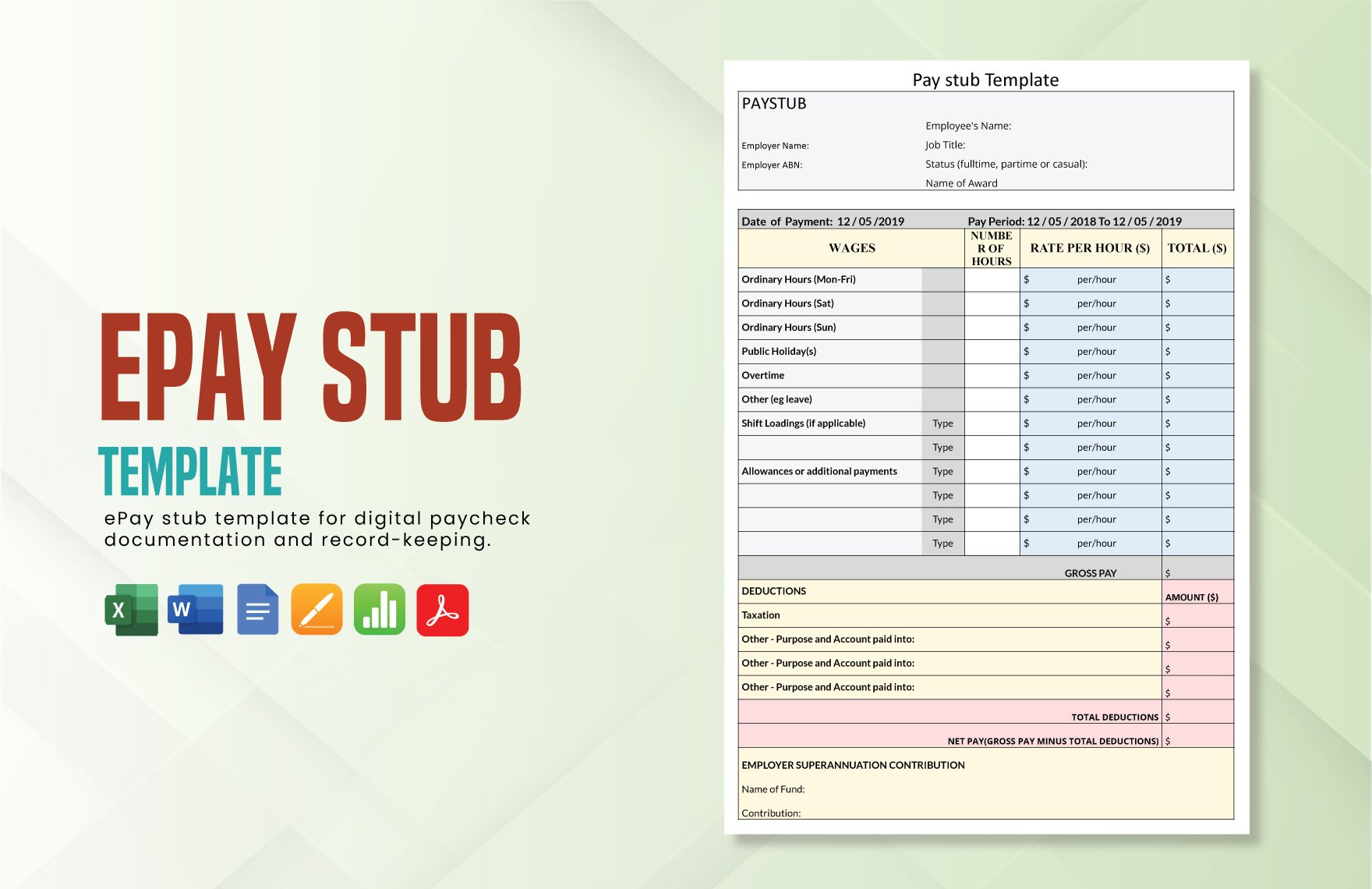

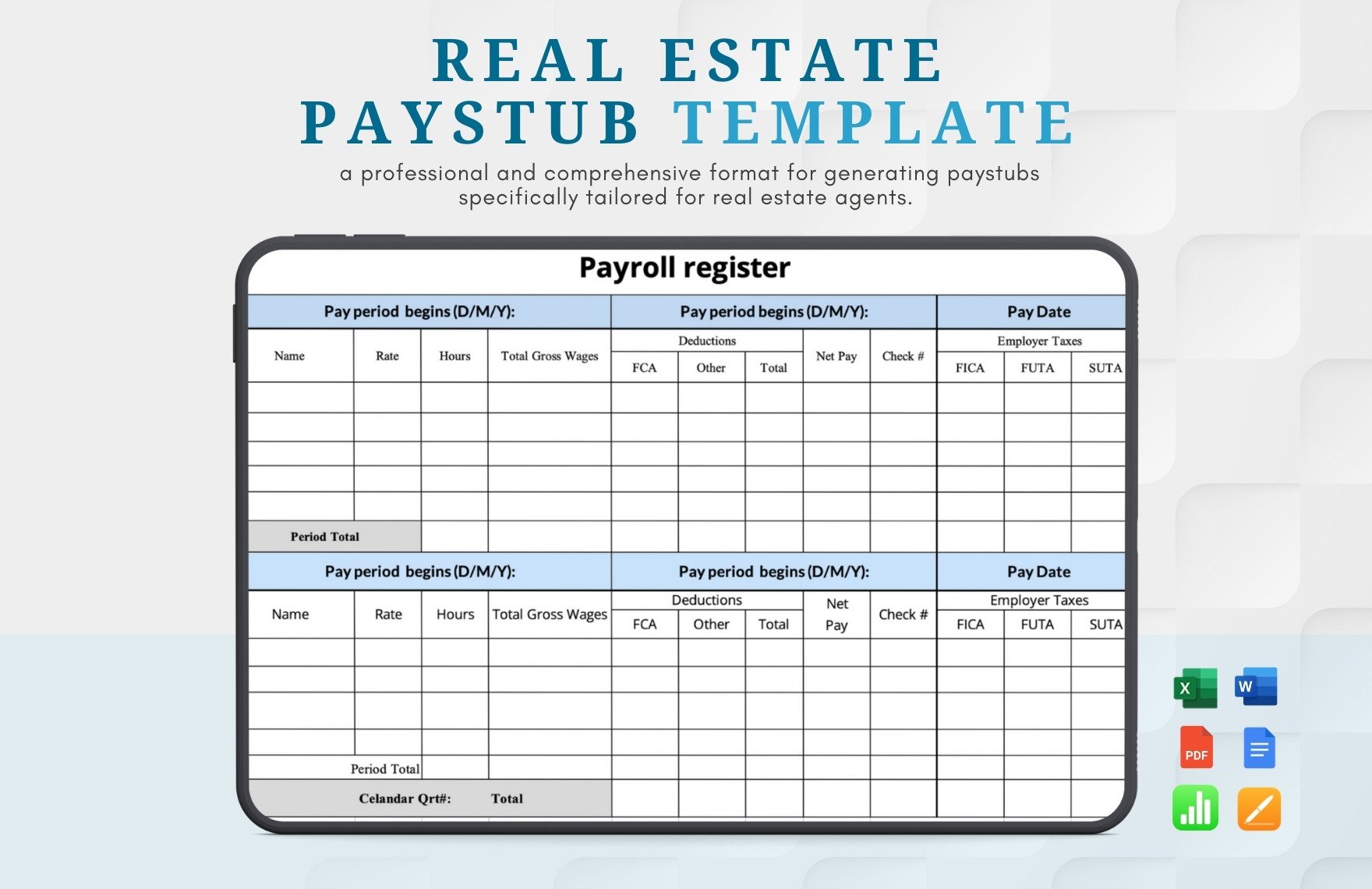

Make a document that is given to an employee with each paycheck and shows the amount earned as well as the amount deducted for taxes, insurance costs, and other necessary deductions. To help you, choose from one of our wide selection of premium pay stub templates that you can download for free. The files are ready-made and easy to use to help you create a personalized pay stub sheet for your company or organization. Open in all versions of Apple Numbers. Available in A4 and US print sizes. Stop wasting time, and start making the best out of it by downloading our templates now!

How To Create A Pay Stub Sheet in Apple Numbers?

A pay stub or paycheck stub is a document that provides complete detail of the payment to the employee. The employer often gives the document to the employee with a perforated edge. Hence, pay stub. This document also helps in addressing any potential disputes, as well as inquiries. If you want the pay stub to fulfill its purpose, check on our list of tips to learn how to make a pay stub sheet in Apple Numbers.

1. Write The Exact Amount

Accountants, your regular employees, and other professionals are keen on the numbers you put in the pay stub. Every dollar and cent counts for people who deal with numbers and money, especially your employees. Don't treat your employees as fools. Never think that your employees don't mind every digit in their paychecks. In which case, don't try to roundup the computation while making the paycheck sheet. Include any decimal that comes off after the calculation. Also, having too many roundups on the pay stub looks unrealistic.

2. Always Include Other Important Information

There are instances where the employee complains due to some discrepancies between their pay stubs and their job offer. Such discrepancies are brought about by deductions for taxes and contributions. If you don't want your employees to complain about their pay, make sure to present their pay stubs clear and comprehensive. Make sure to write the amounts and divide them into three sections: Gross Pay, Deductions (taxes and contributions), and net pay. The gross pay is the amount before you made the deductions, while the net pay is the amount the employee receives after the deduction.

3. Take Advantage Of Apple Numbers's Convenient Features

Open your MAC or any compatible device and launch Apple Numbers. Similar to MS Excel, Google Sheets, and other spreadsheet programs, Apple Numbers let you establish cells and use them to fill in details. When it comes to computing a larger amount of numbers, Apple Numbers helps you crunch them down. Also, Apple Numbers provides you with our professionally made pay stub templates which are easily downloadable, printable, and customizable. Which means you don't need to work from scratch anymore.

4. Include The Payment Inclusions And Exclusions

The payment inclusions include the particular days that are covered. Doing so helps the employees know that the days they report for work are well-compensated. Aside from the payment inclusions, don't forget to provide exclusions as well. Should the employee committed absences, make sure it's spelled out. In this case, you'll need to make a timekeeping sheet to present such matters clearly.

5. Always Include The Pay Date

There may be instances where the exact payment date is not yet sure. However, it's still important to set clearer expectations. Informing your employees about the specific payment date is an act of courtesy. It's the least you can do to your employees. Well, providing the payment date doesn't have to be completely accurate. The payout may be delayed or advanced; what matters is that you informed your employees well.