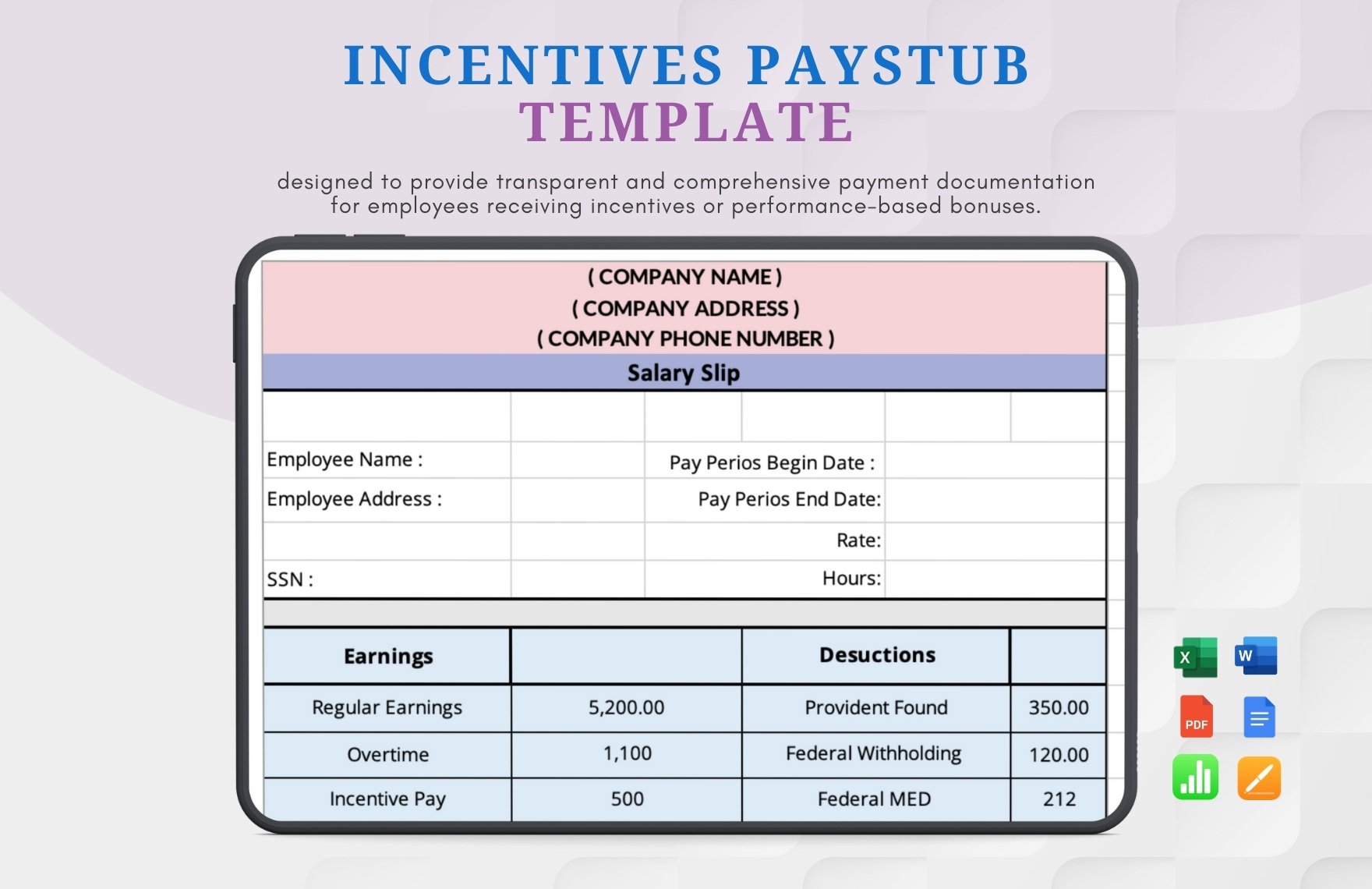

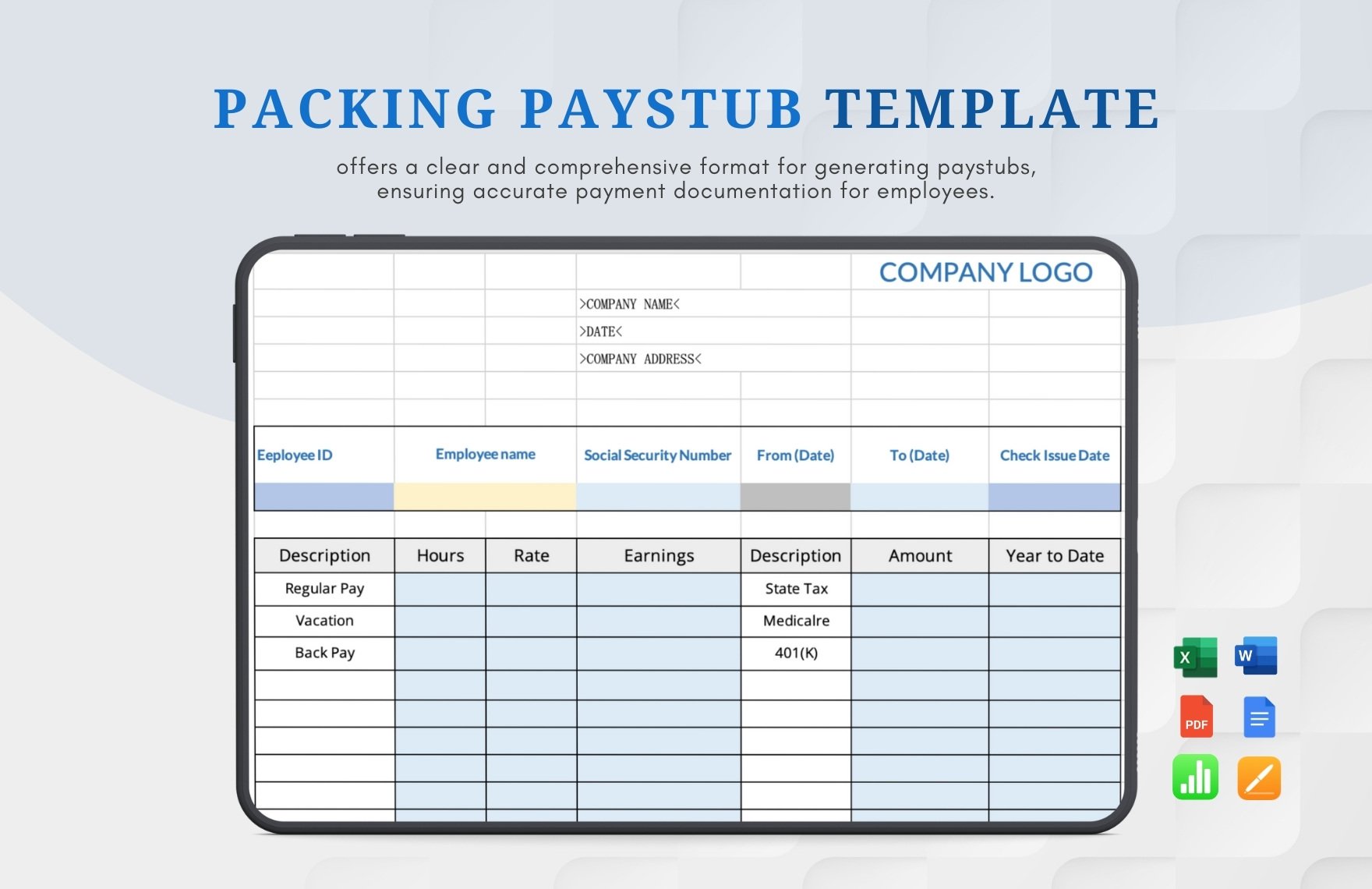

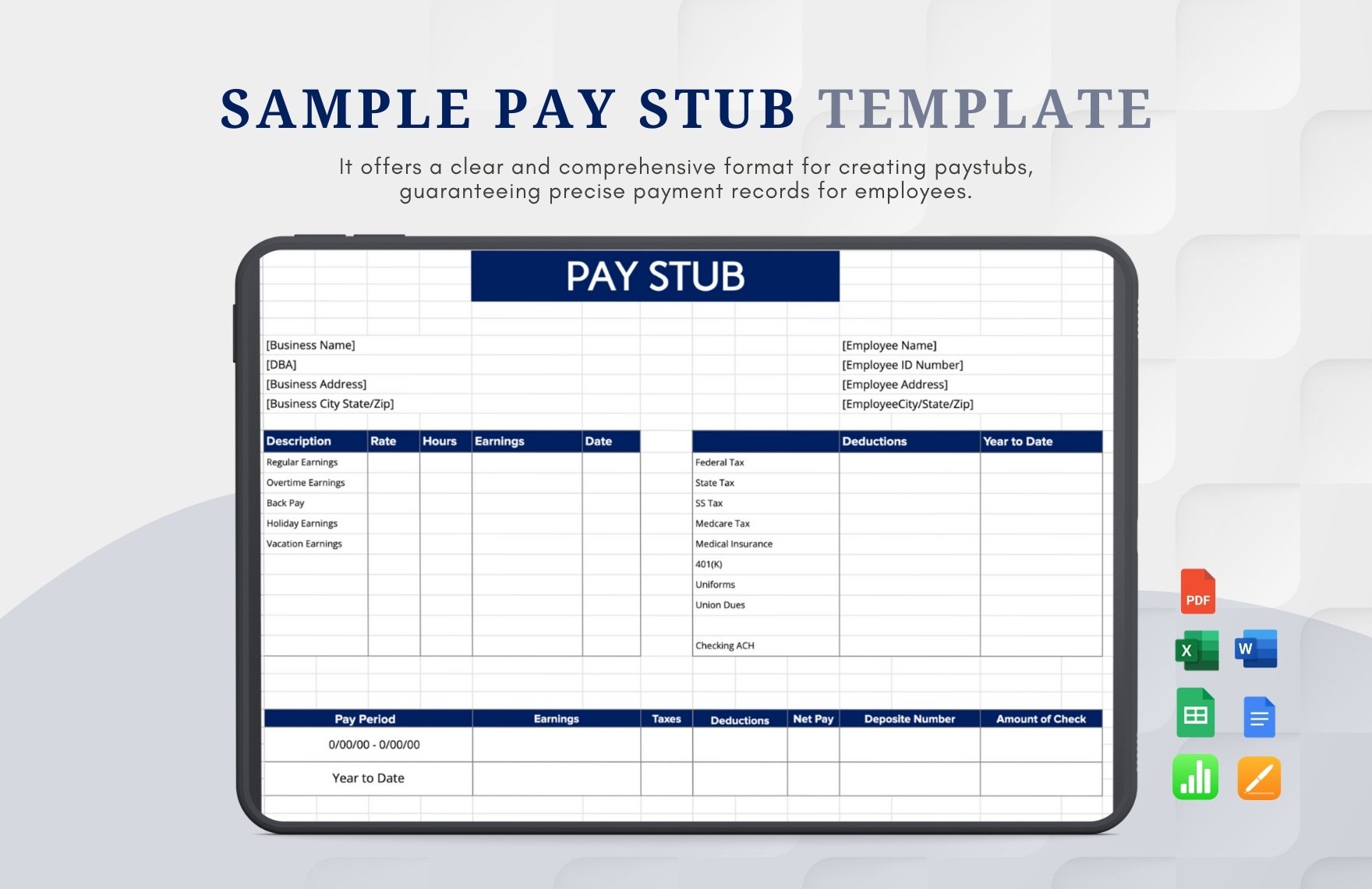

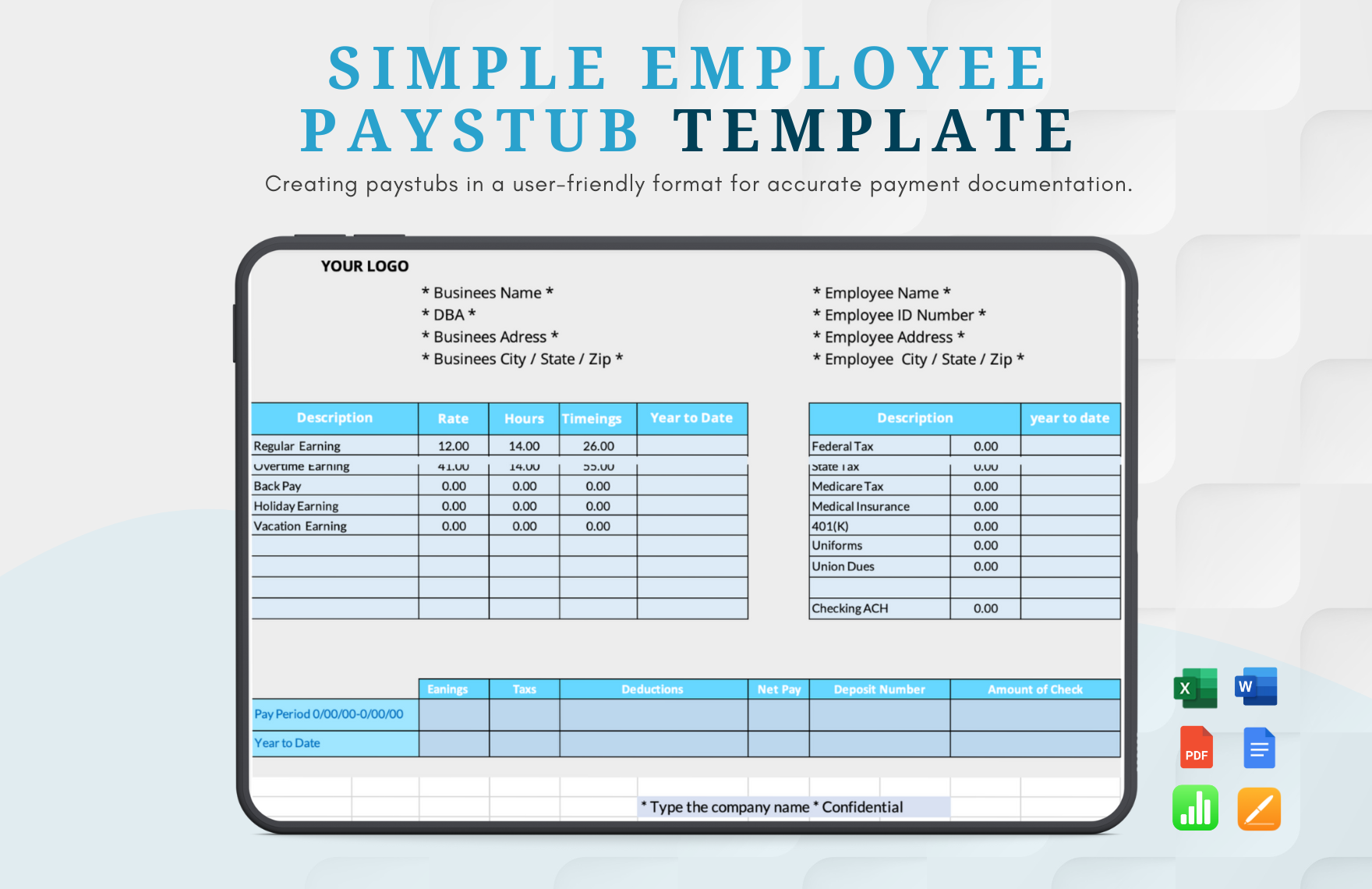

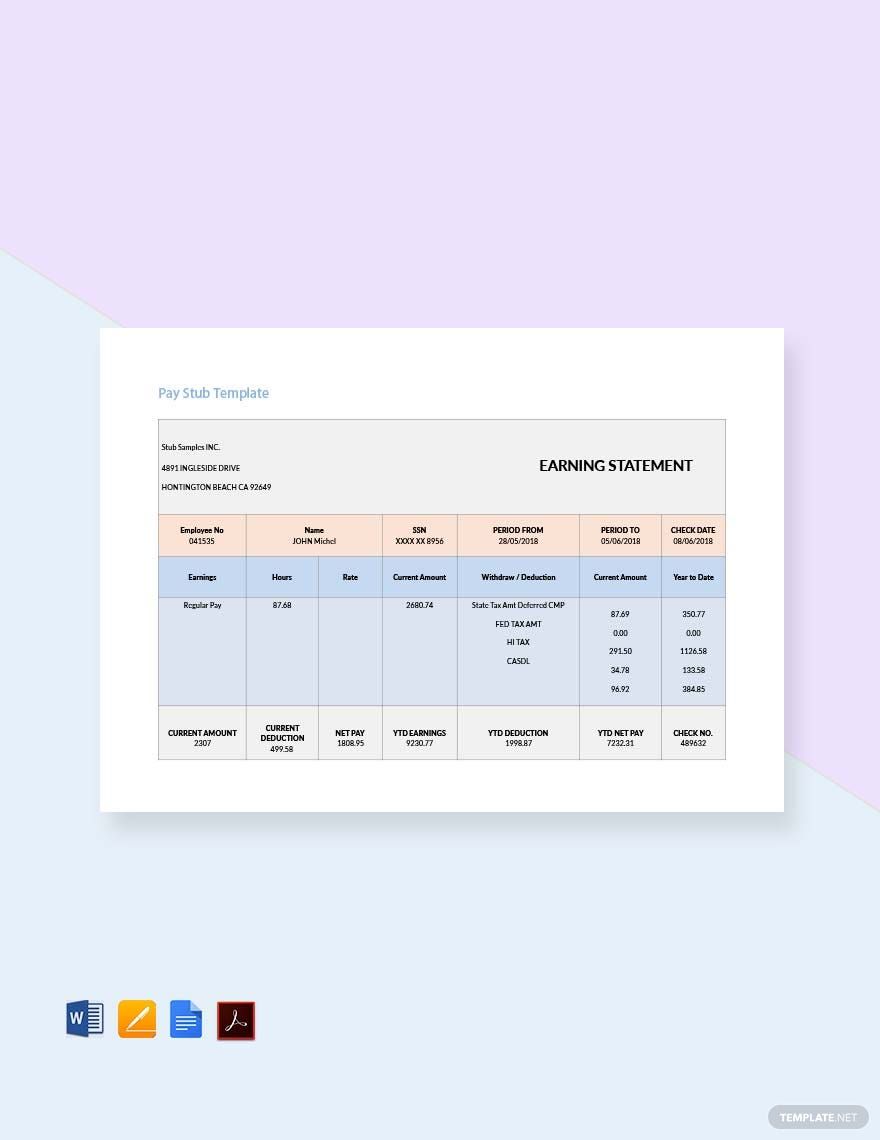

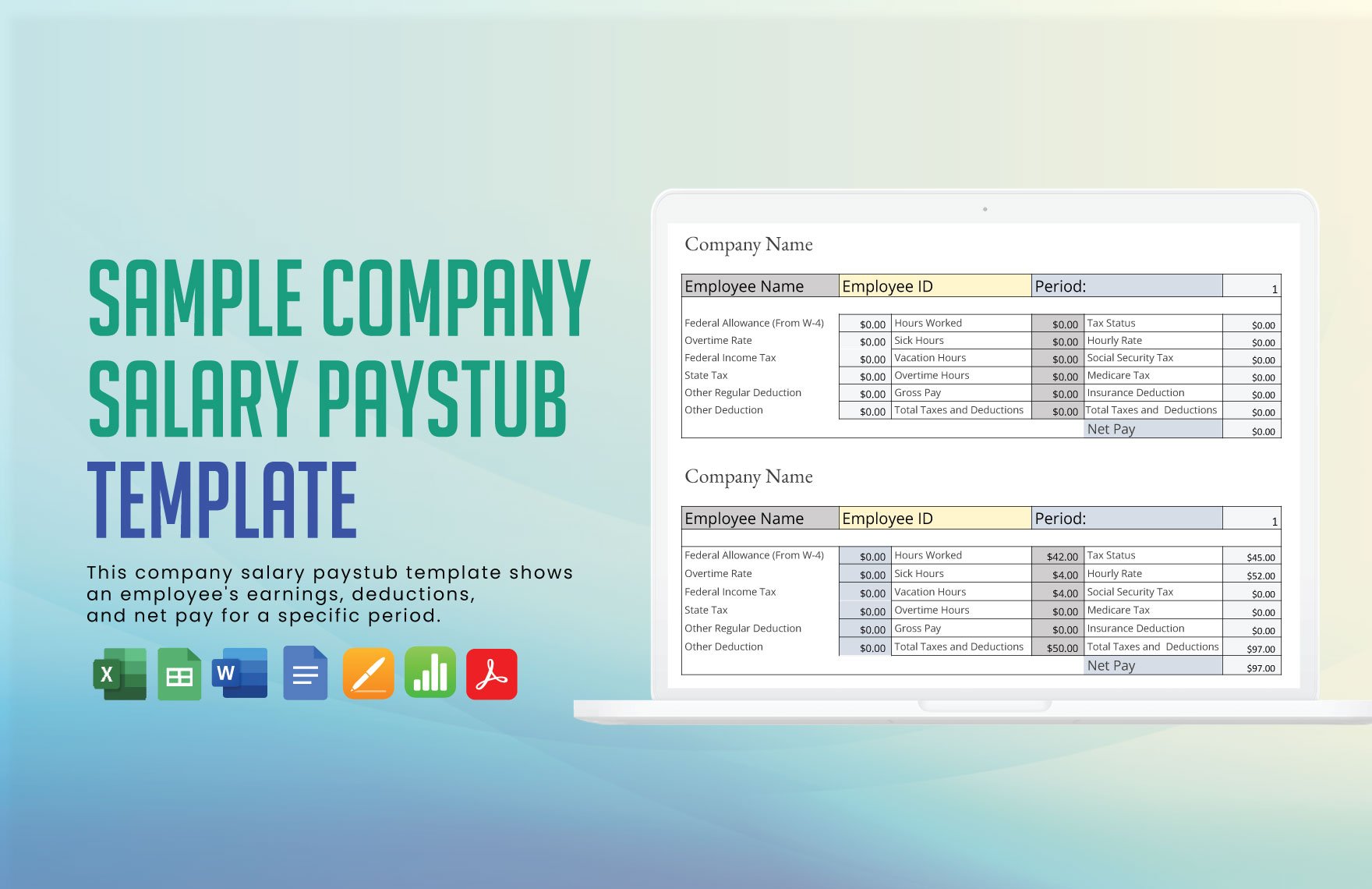

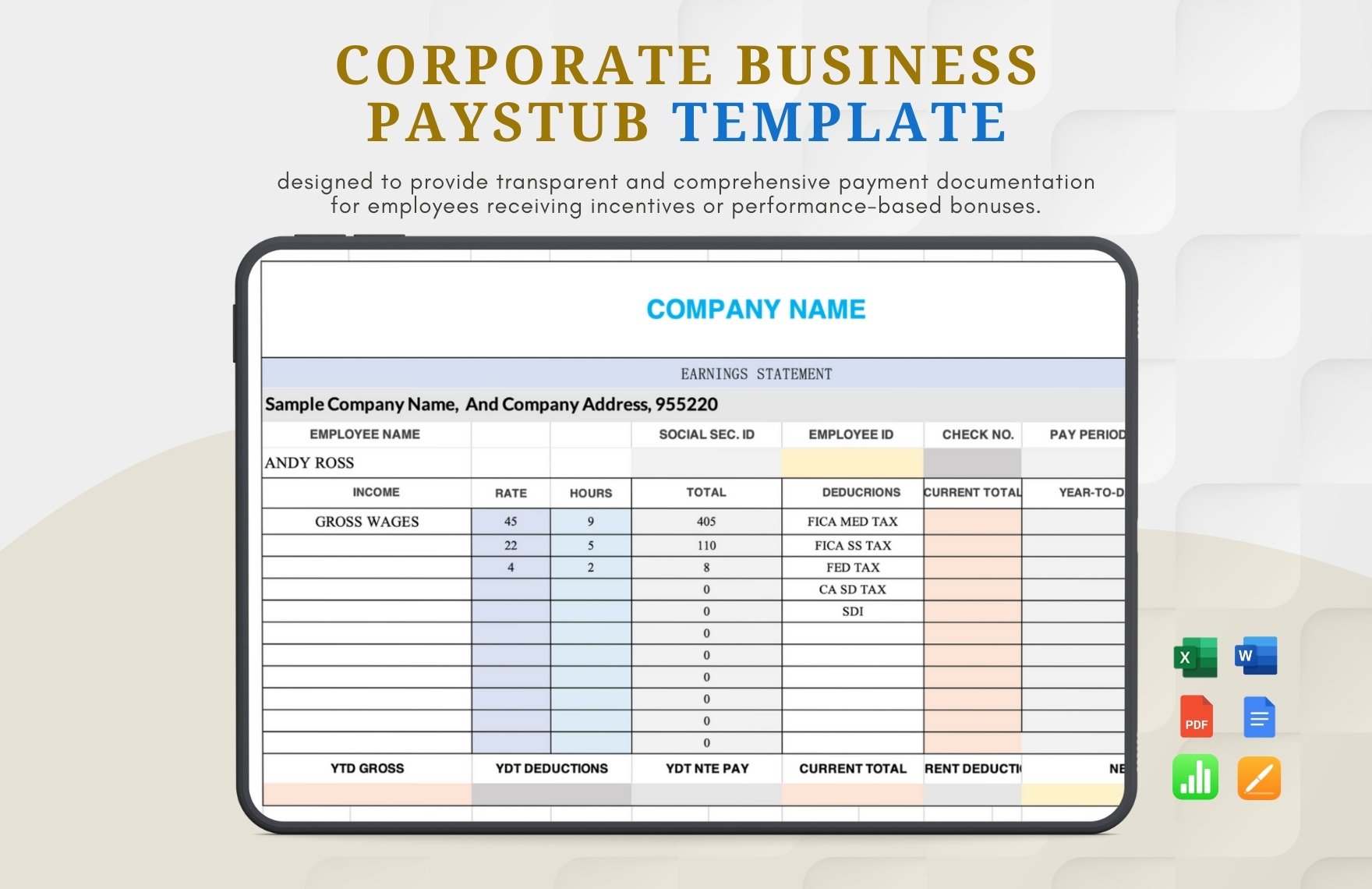

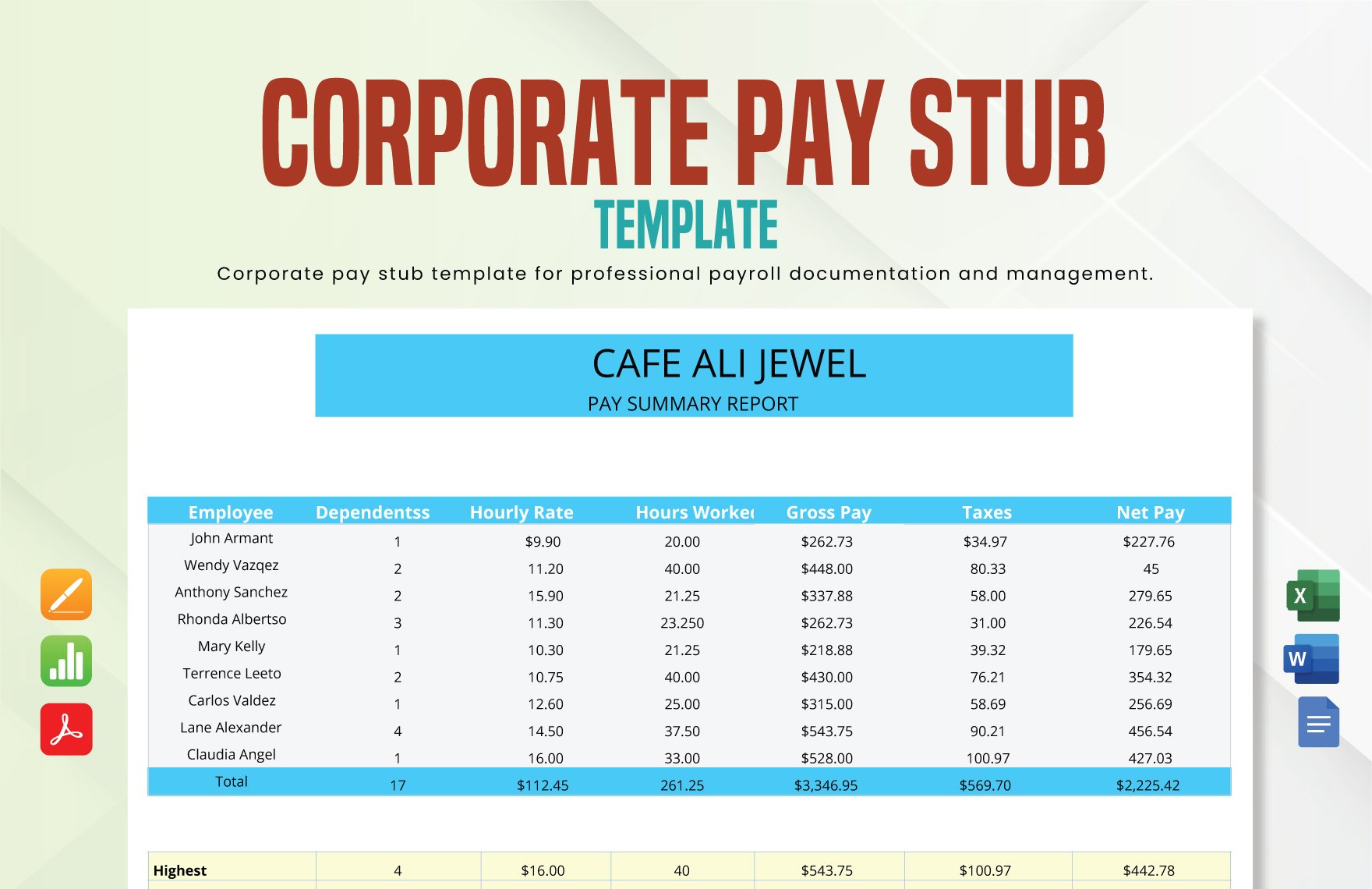

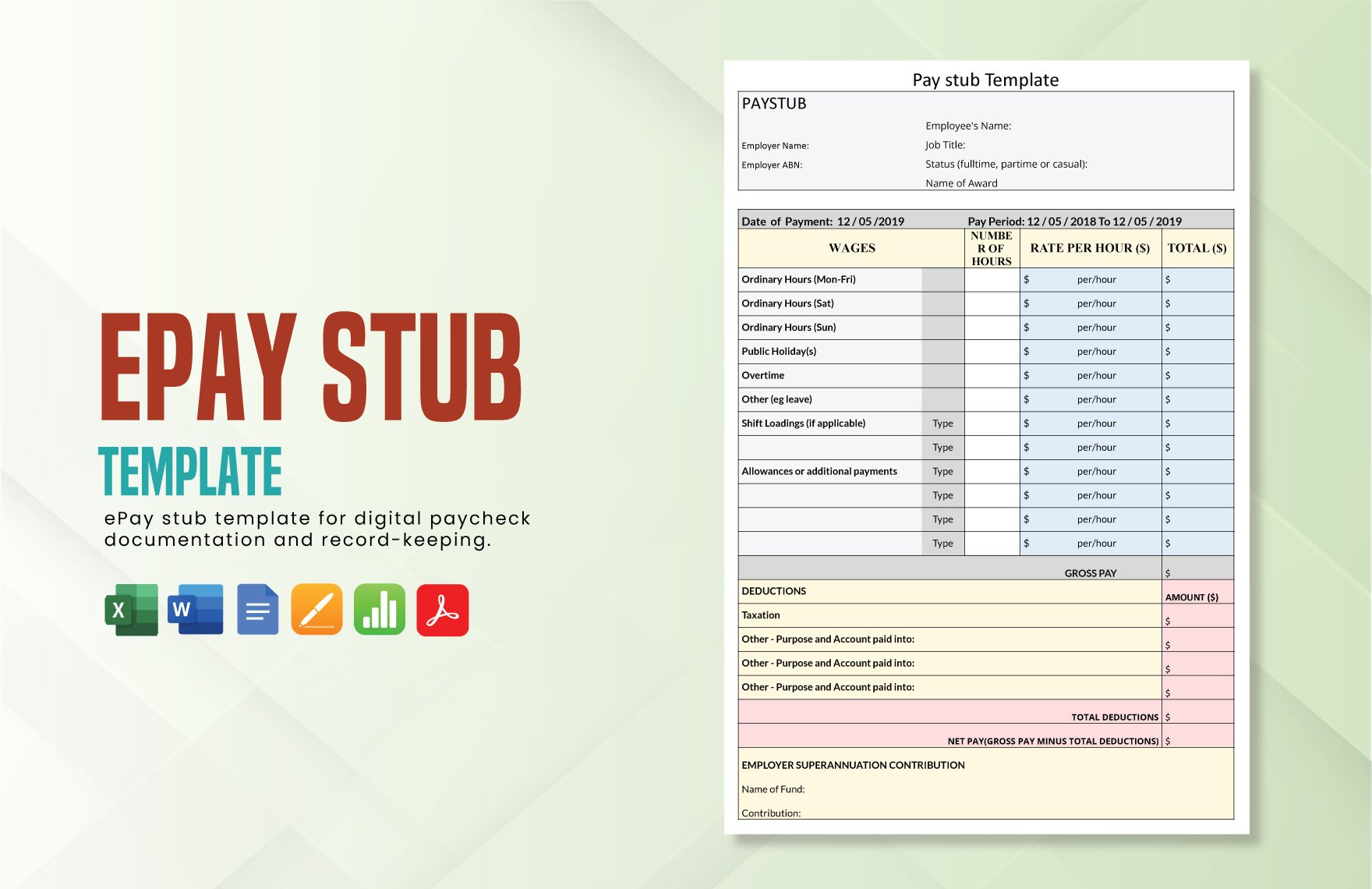

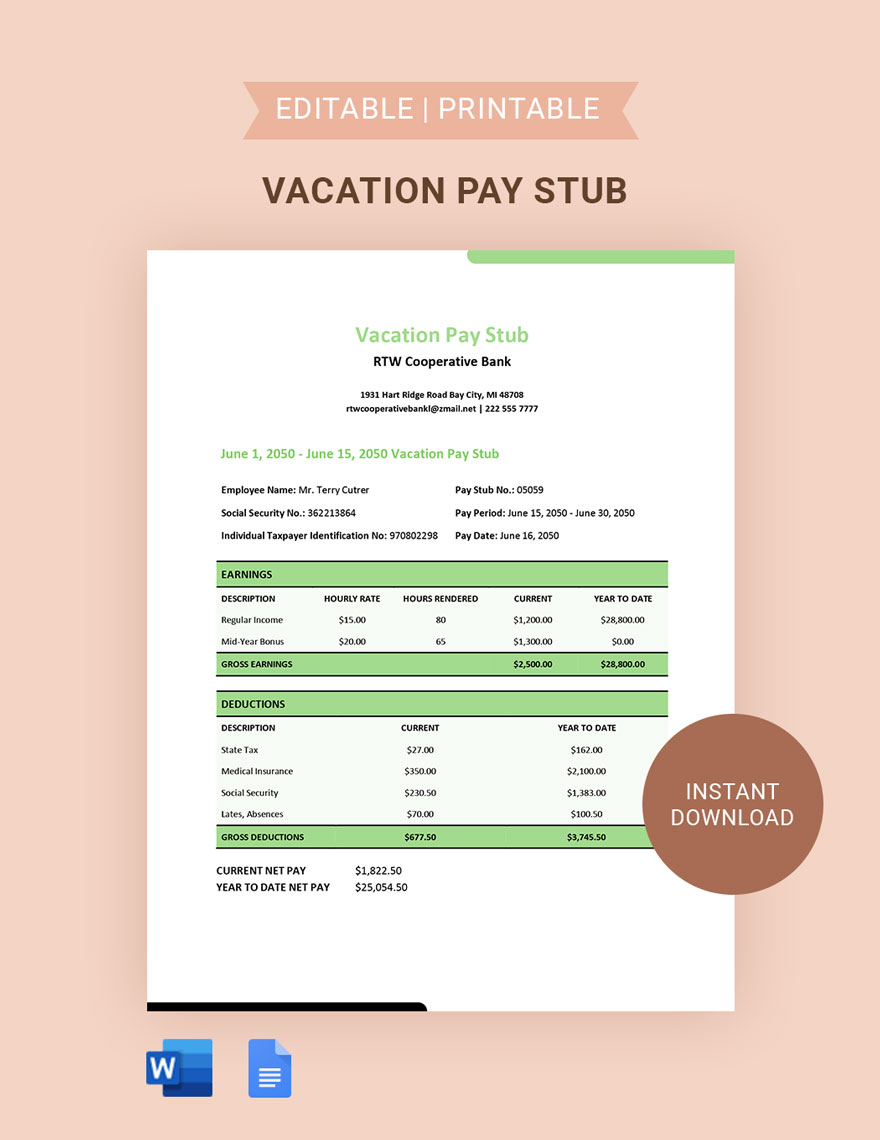

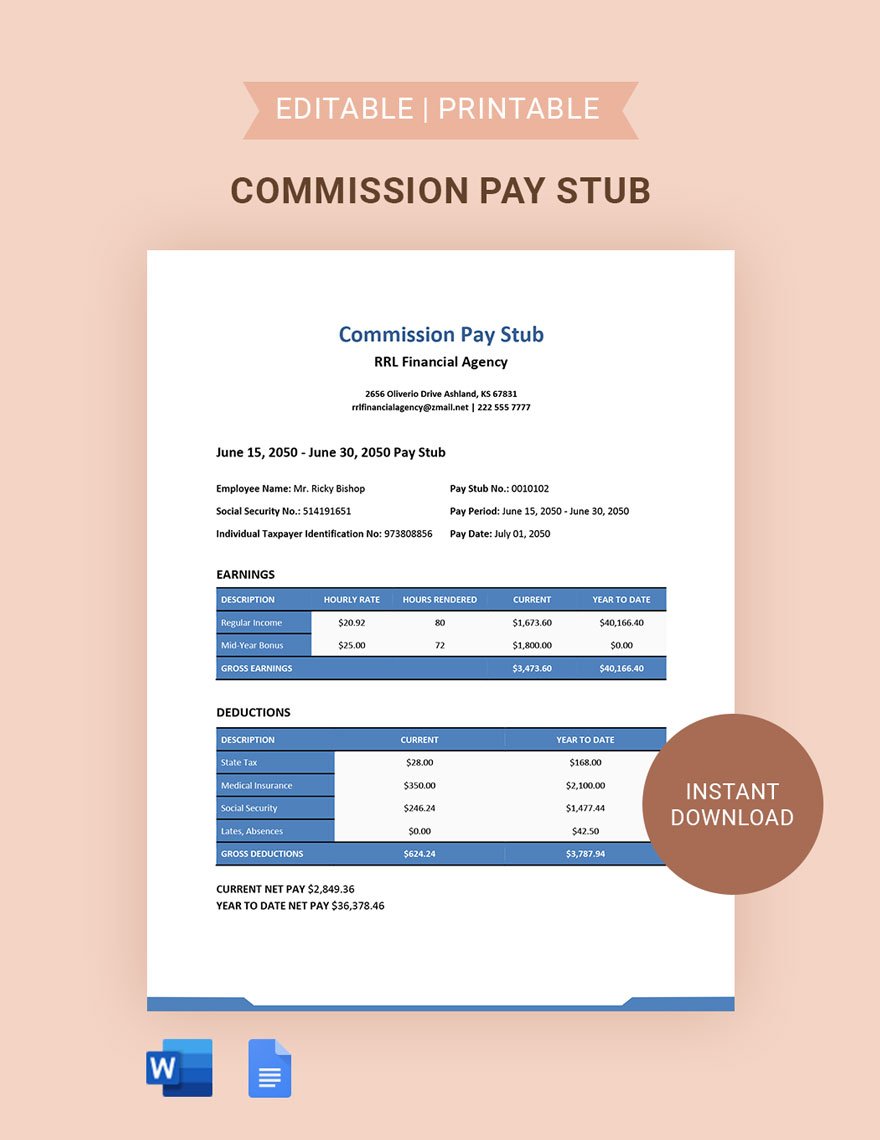

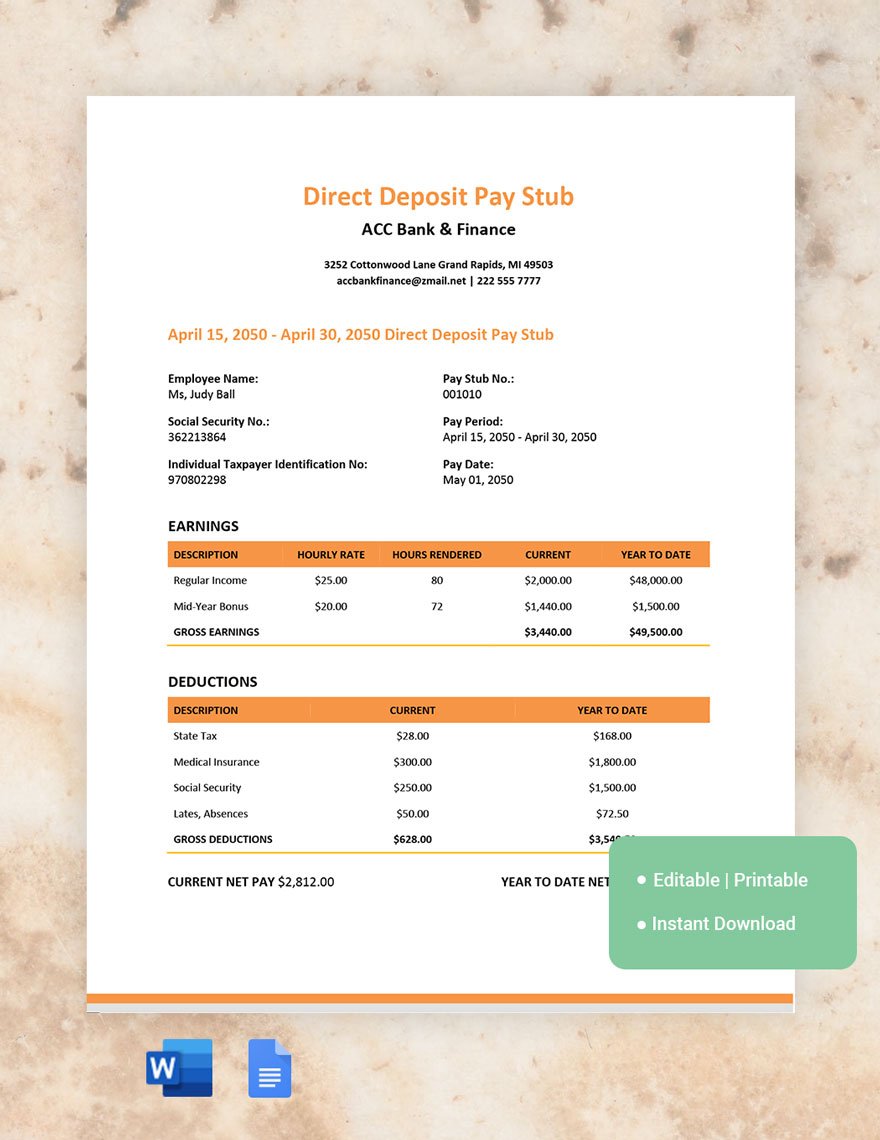

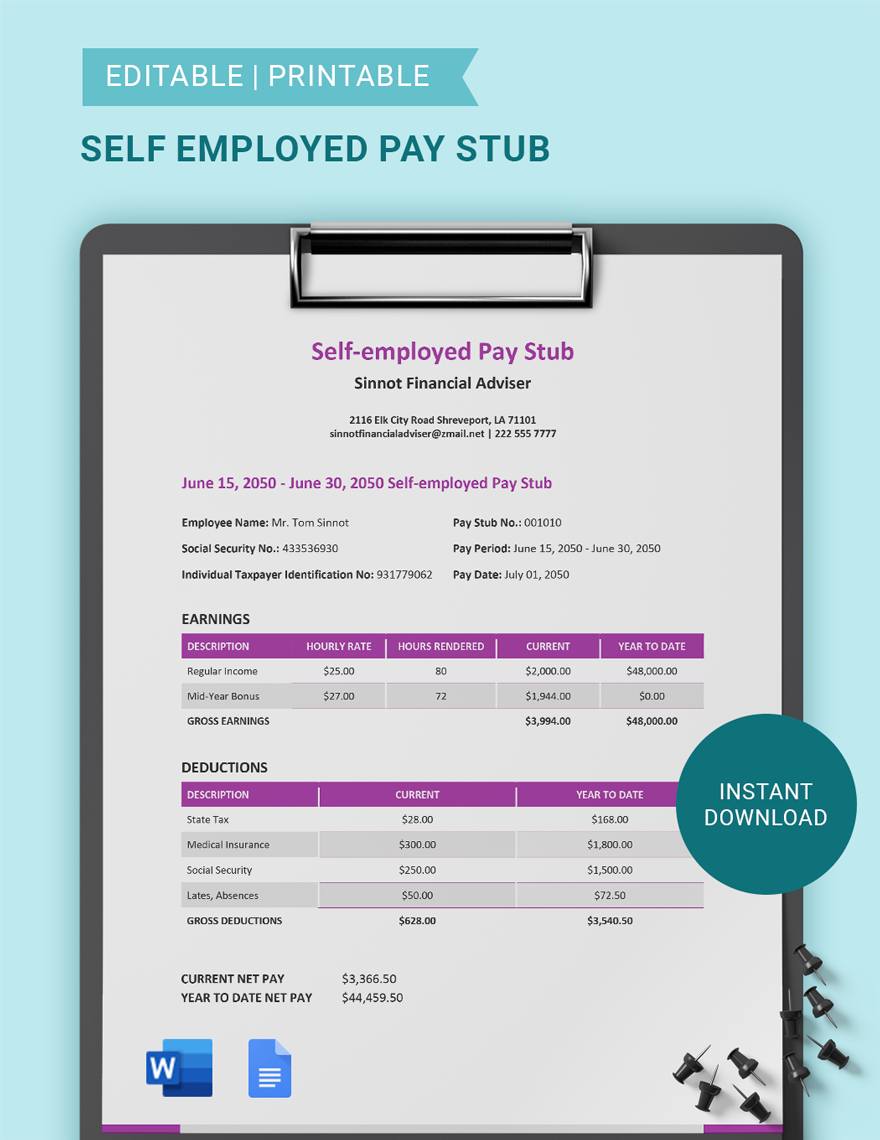

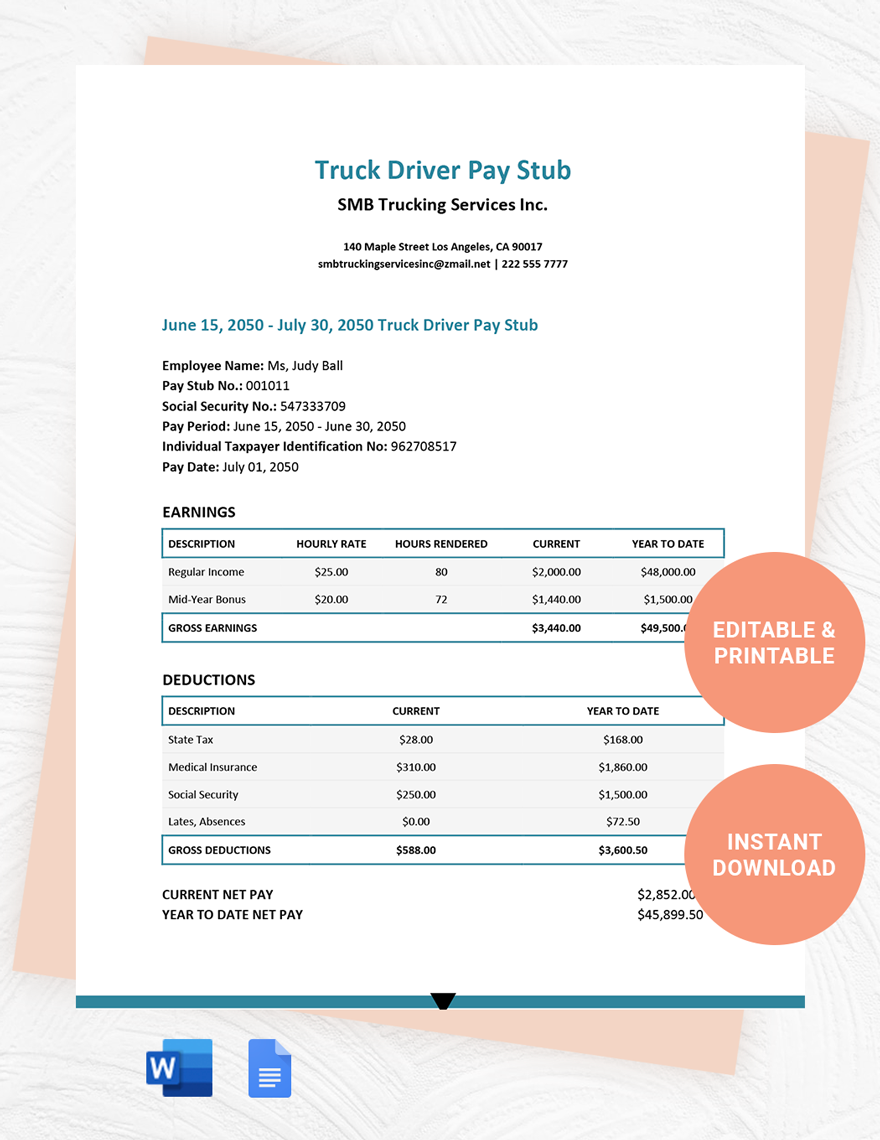

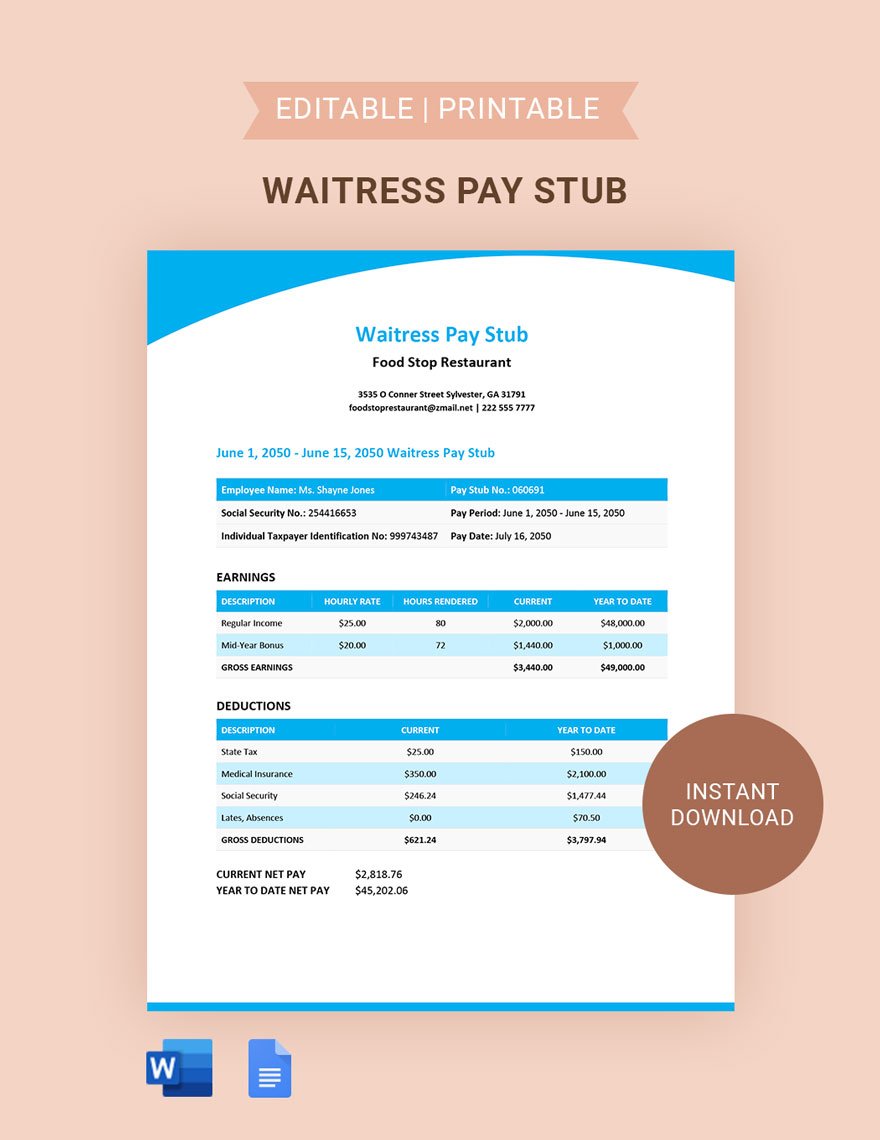

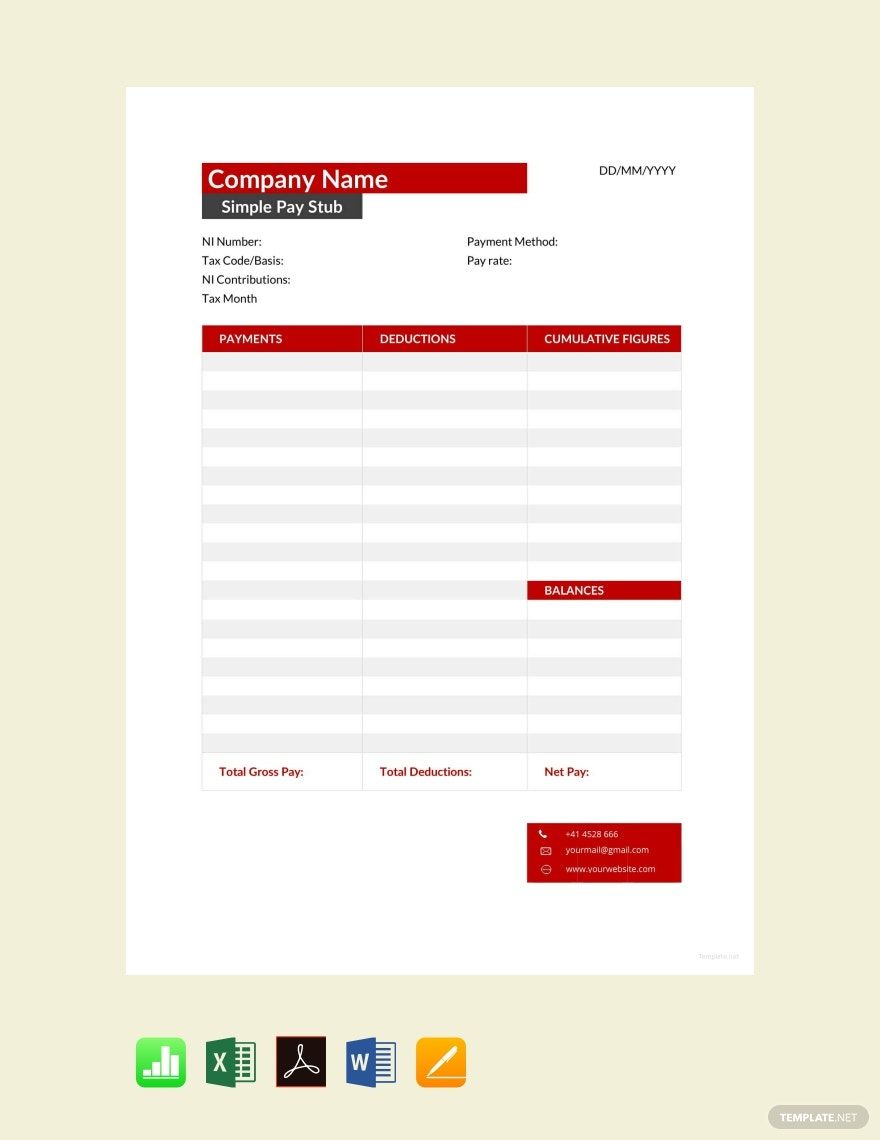

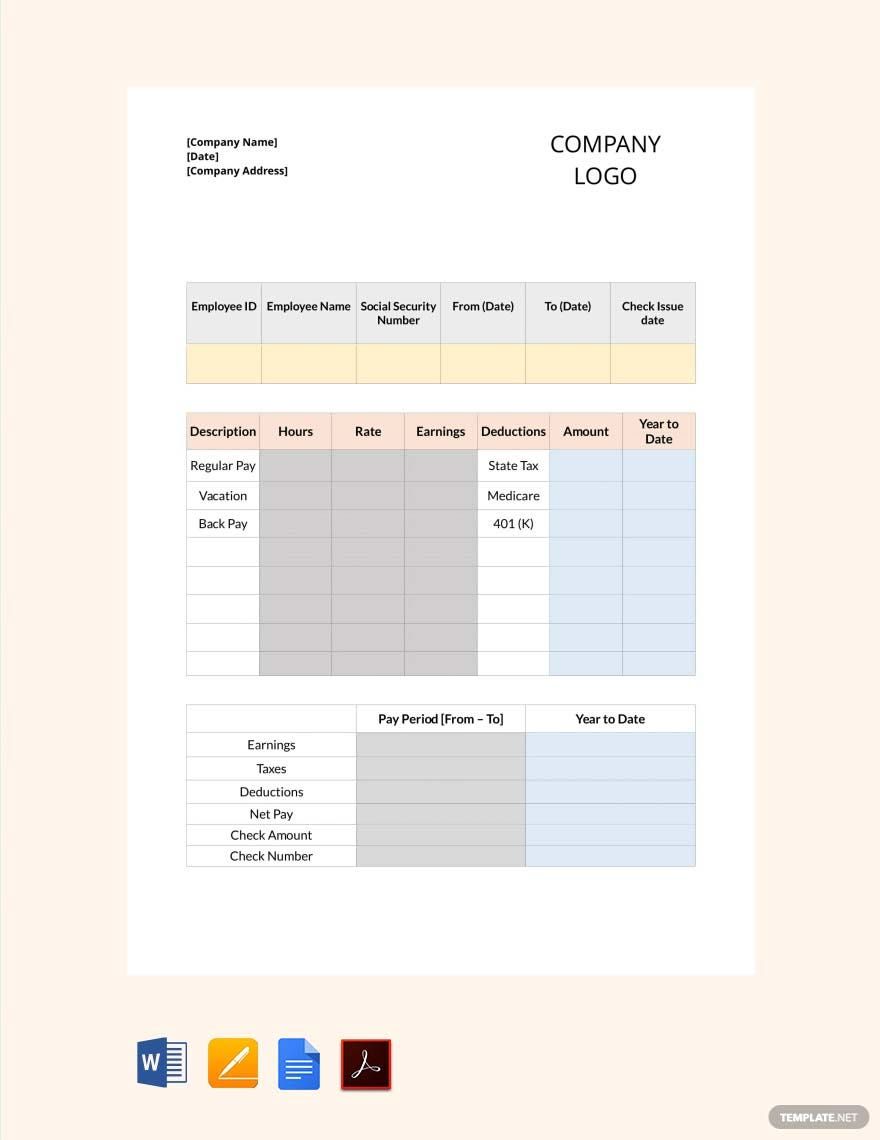

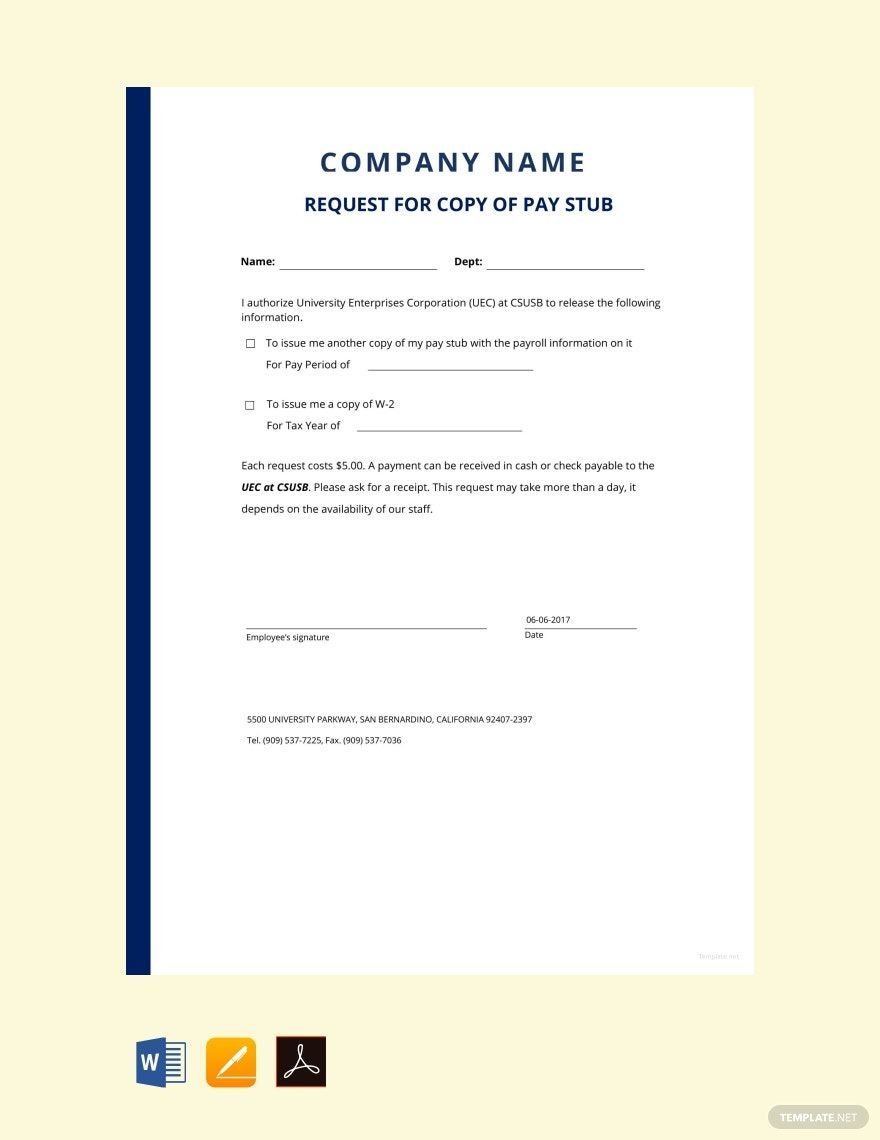

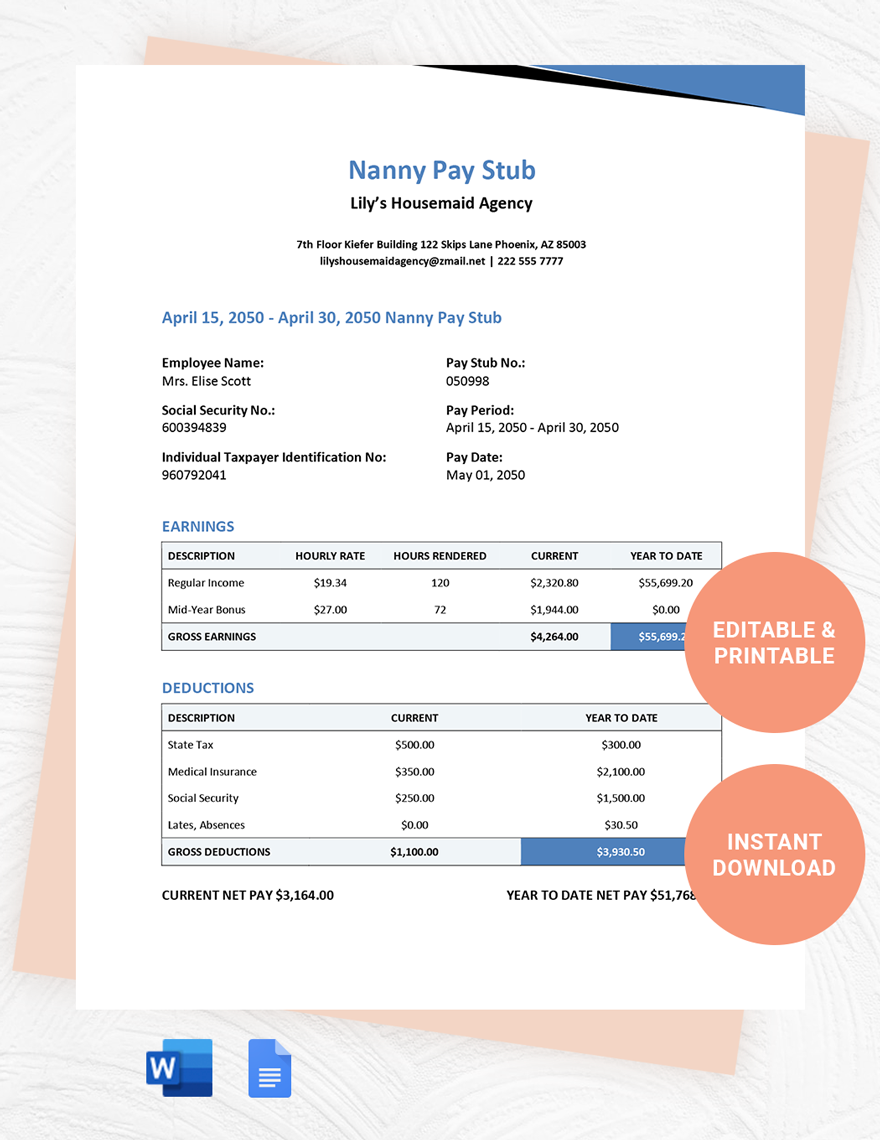

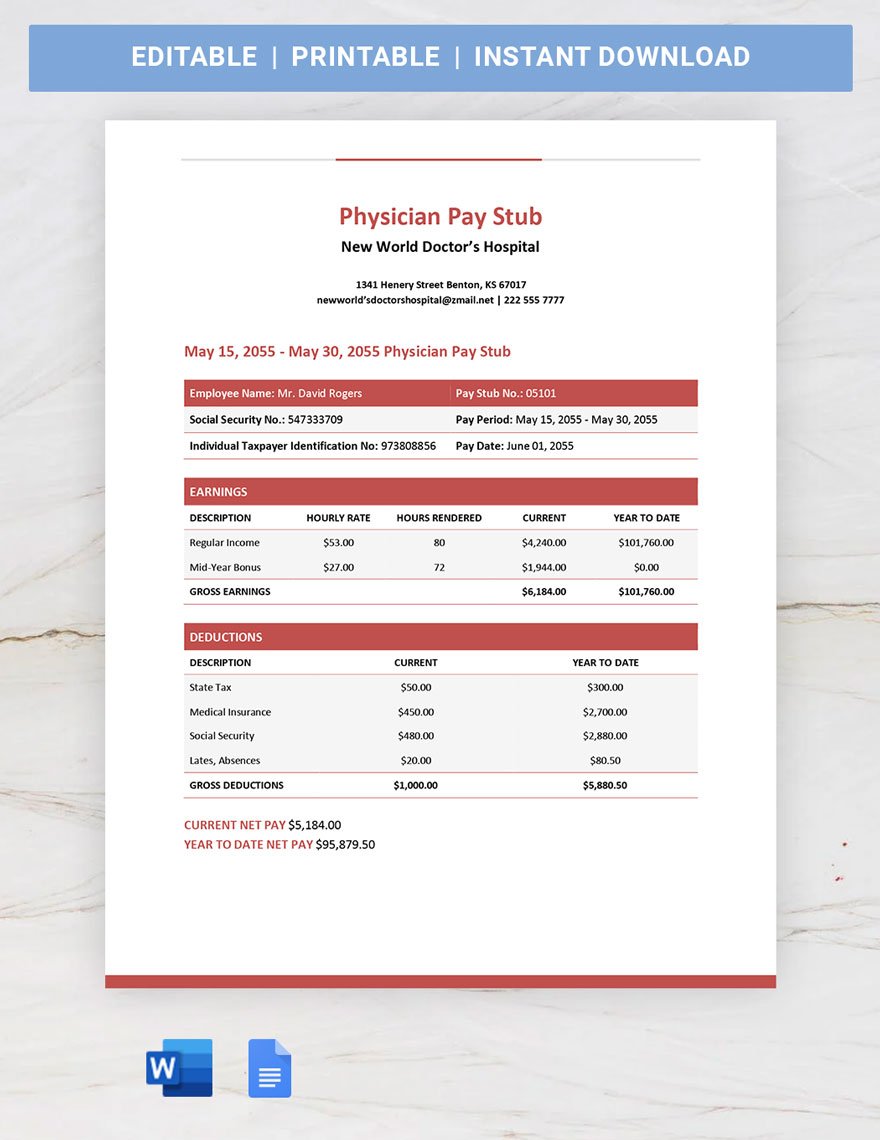

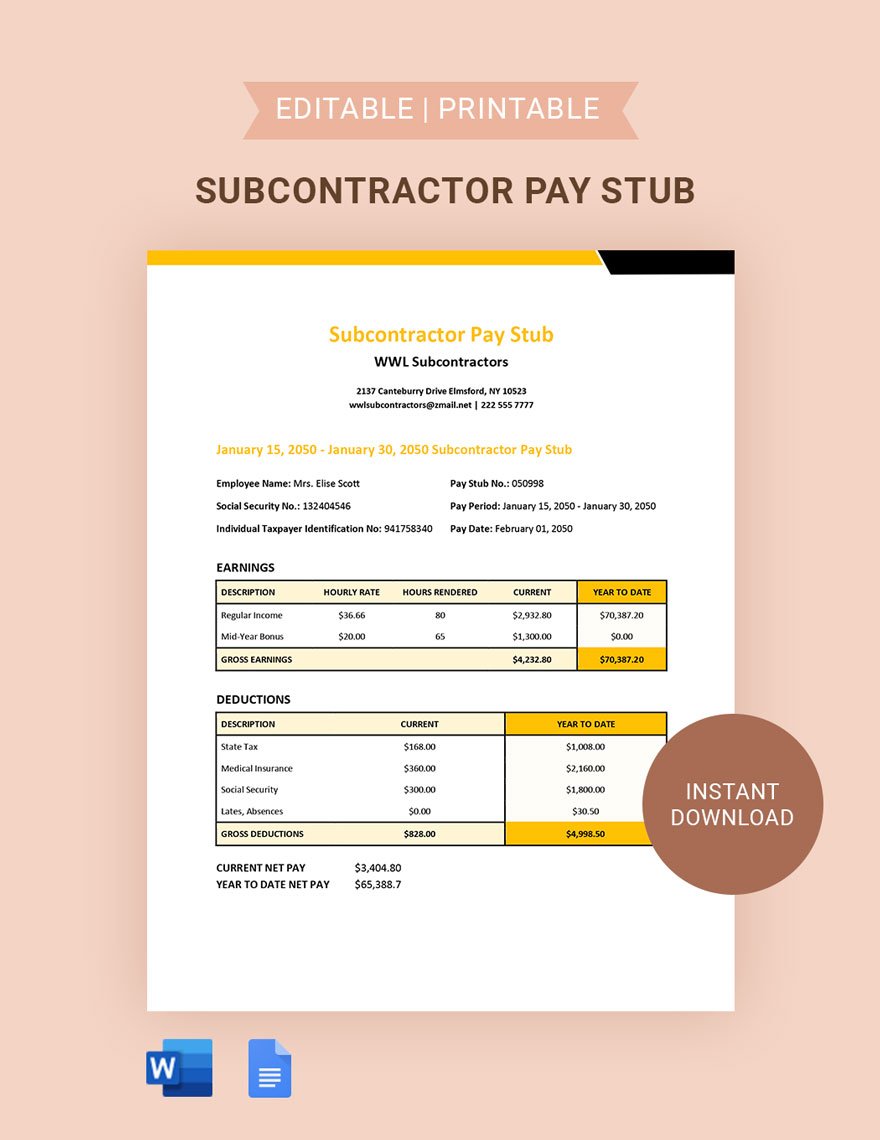

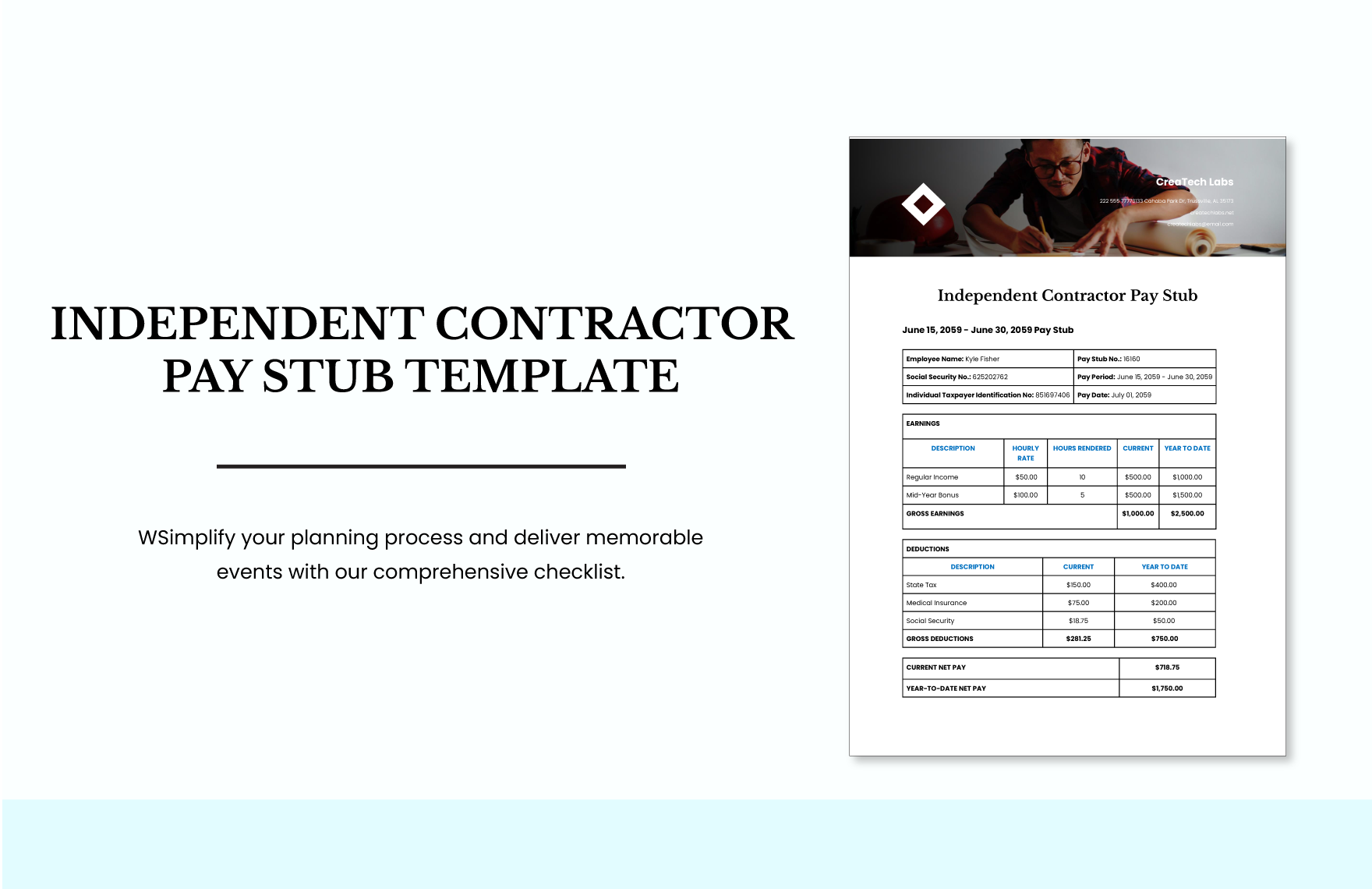

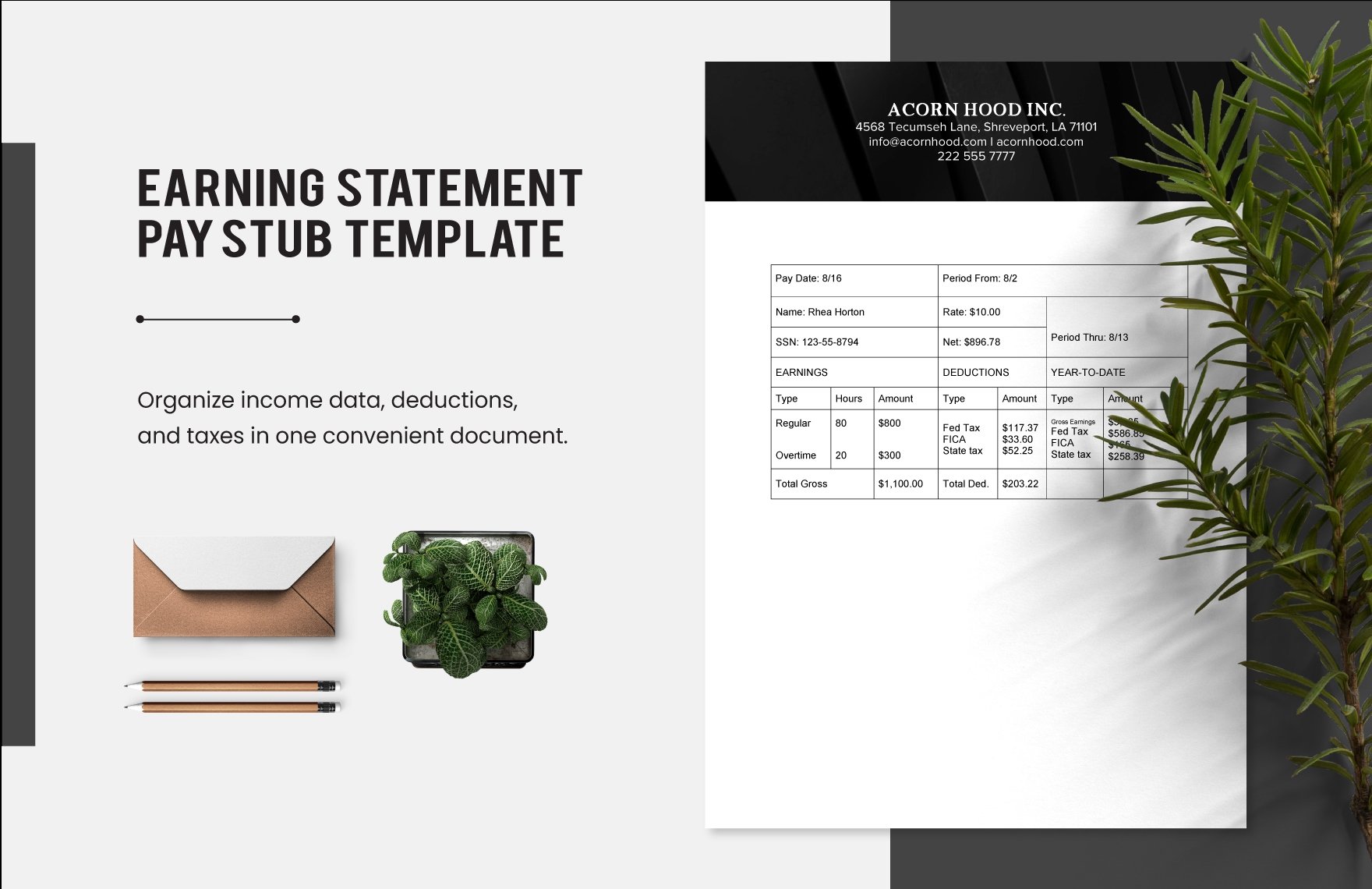

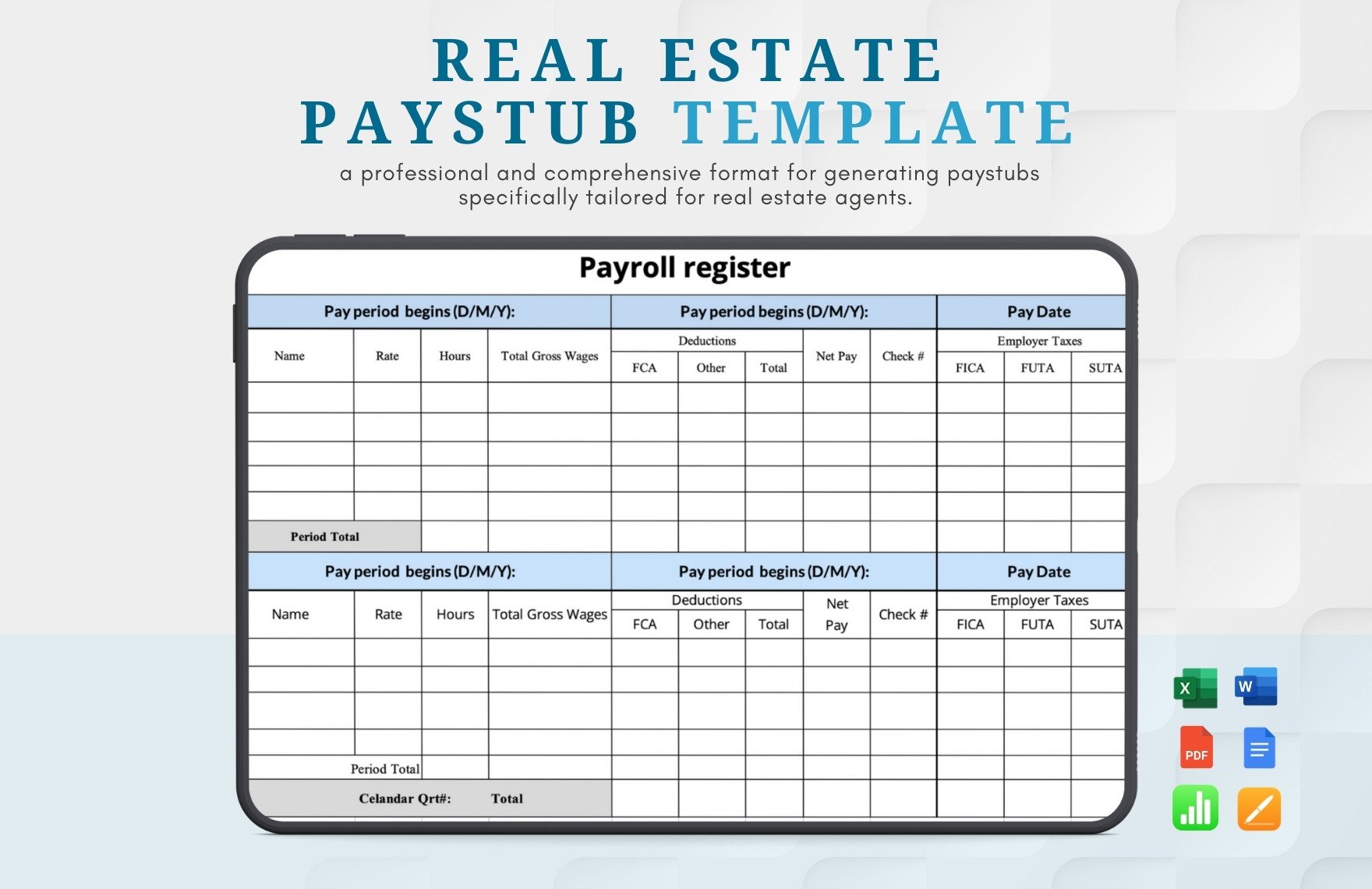

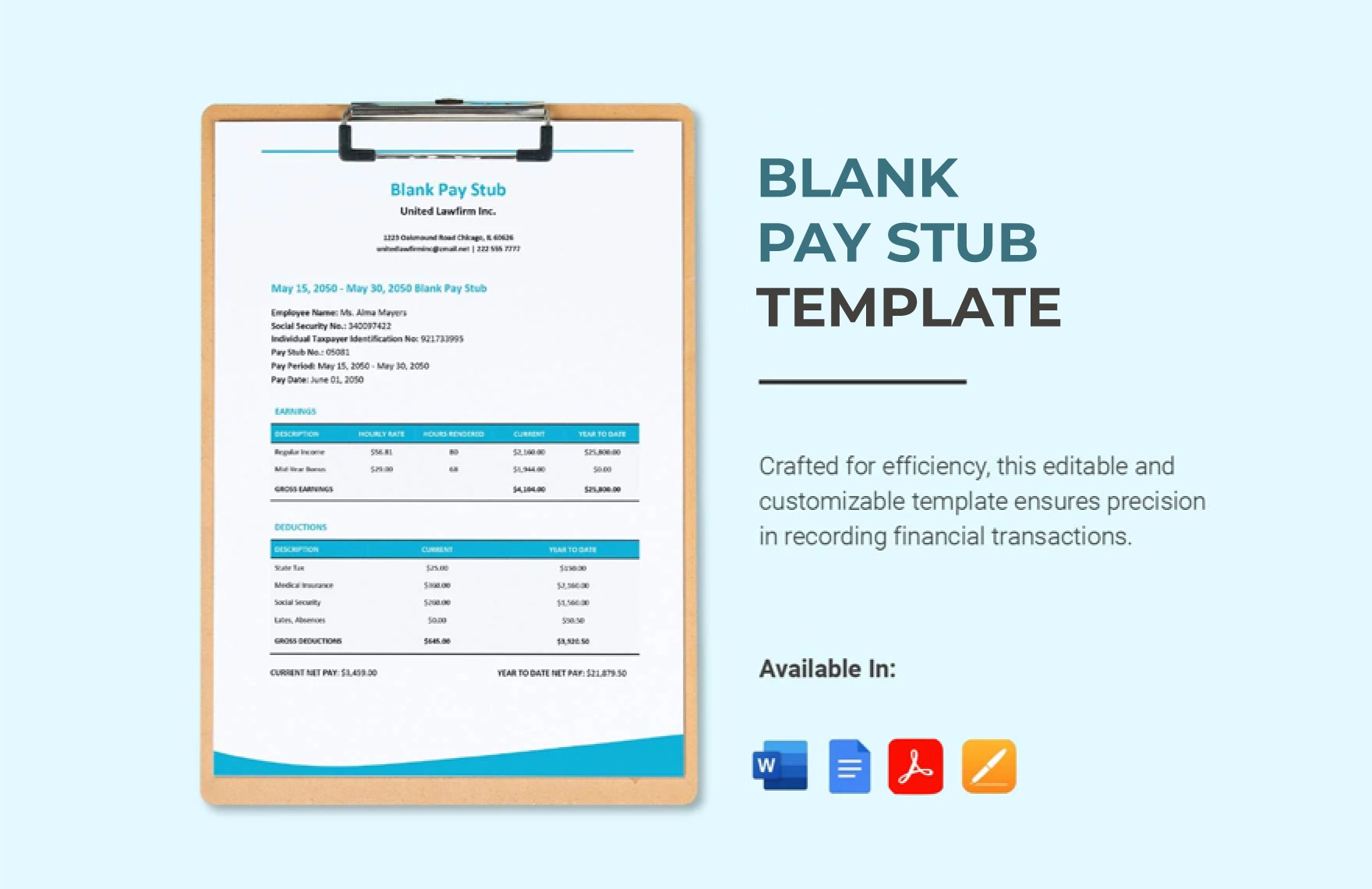

Send out an accurate and detailed pay stub sheet to your employees this payday with the use of our high-quality and printable Pay Stub Sheet Templates that are all 100% customizable in Adobe PDF file format. With these easily editable templates at your disposal, you can now easily create a pay stub sheet that showcases well-detailed and more understandable salary computations for your business's employees. The best thing about these files is that all of them are professionally designed with suggestive headings, easy to edit texts, and can instantly be downloaded anytime, anywhere, and on any device! Whether it's a bonus pay stub template, real estate pay stub template, blank pay stub templates, or earning statement pay stub template, we have them all here at Template.net, print-ready! Waste no more time and make the most out of these free templates by downloading them today!

How To Make Pay Stub Sheets In PDF

Paystub sheets are essential documents in the payroll process that are often sent out to employees as a form of a paycheck that shows the total amount of take-home pay that the employee has earned together with the total amount of deductions removed from the pay. These documents are often done by the accounting personnel to ensure that the proper computation of earnings is correctly followed. Learn how you can create these corporate documents in Adobe PDF with the help of some tips that we have presented below.

1. Know The Basics

A typical pay stub sheet is just like any other sample sheet. It also has the basic details about the employee's name, contact details, and the area of designation. Following that is a brief table that showcases the separate computation of earnings from the deductions, followed by the total amount of net pay. For a better illustration, you may look up some sample pay stub sheets online and see how they are created and presented.

2. Amounts Should Be Exact

Avoid using excessive estimations and roundups in your pay stubs, especially when it comes to handling estimate sheets because this would lead to improper computations. To help you with this, you may ask the services of an accountant who are very particular with every dollar and cents to ensure that you'll be able to generate pay stub sheets that are not just accurate but also professional looking.

3. Don't Leave Out Important Info

If you don't have any prior knowledge about how these payroll documents are done, then the chances are high that you'll easily forget to include some of the vital information needed in it. Some of the crucial and vital information that should not be left out are the gross pay, taxes, deductions, contributions, and lastly, the overall net pay. Make sure that important details like these are appropriately highlighted in your upcoming assessment sheet making or any business sheet in particular so that they become more visible to the eyes of its readers.

4. Calculate Properly

Calculating accounting documents like pay stubs are usually done by following a certain formula, and normally this one-time formula is also used for the entire company employees as well. To make sure that they are correct and accurate, this formula should be updated from time to time. You may also seek professional services when it comes to calculating them to ensure that you'll get exact number figures for your computation.

5. Review Everything

After finishing everything, you must review it first before you generate it. Check the common issues that usually happen in a pay stub sheet such as proper adding of numbers correctly, clarity of the formatting, typos and spelling errors, as well as the overall clarity and legibility of the document. If these issues are properly addressed correctly, then you can now confidently send out your accomplished pay stub sheets.