Make your Financial Planning to life with Budget Plan Templates from Template.net.

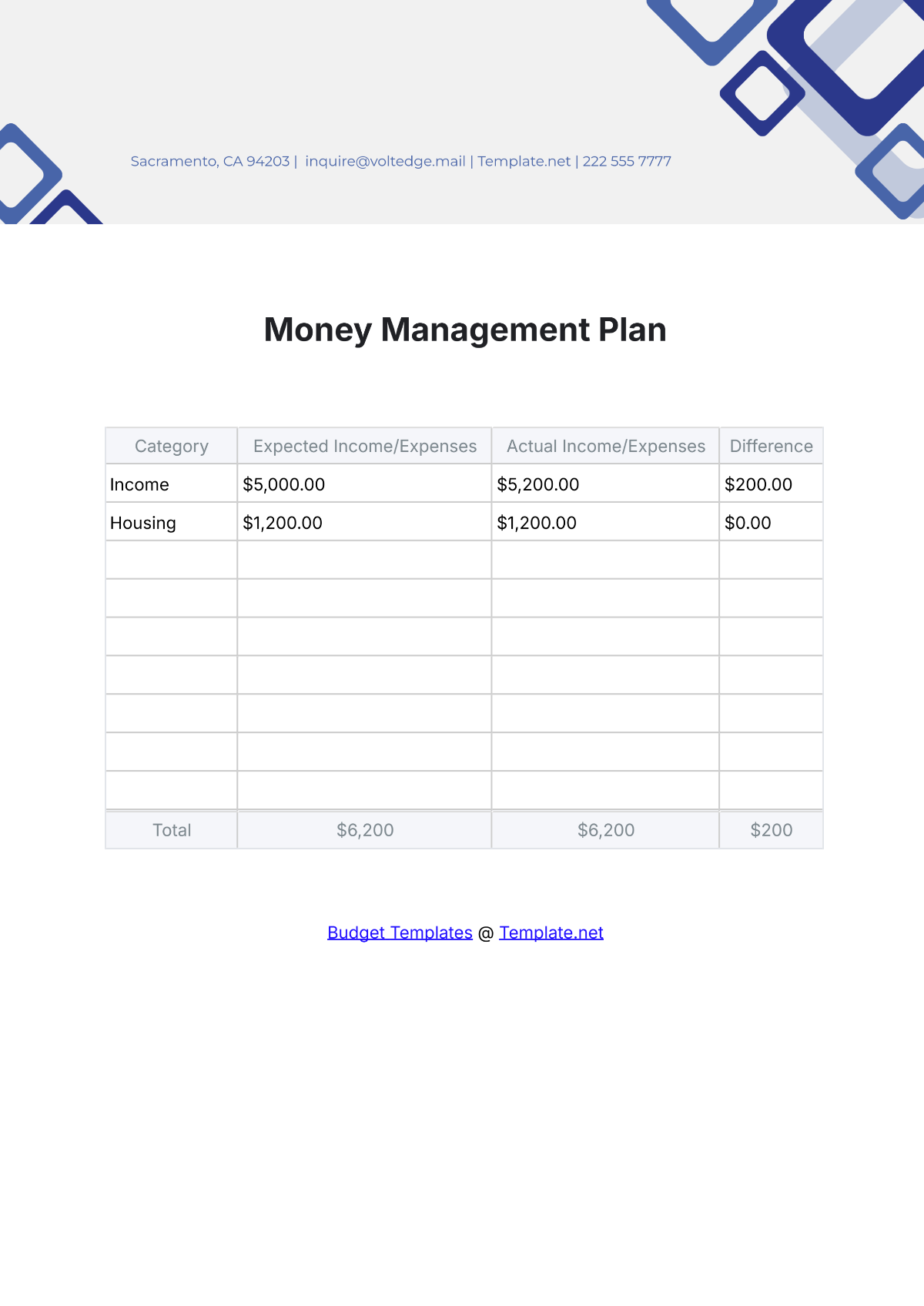

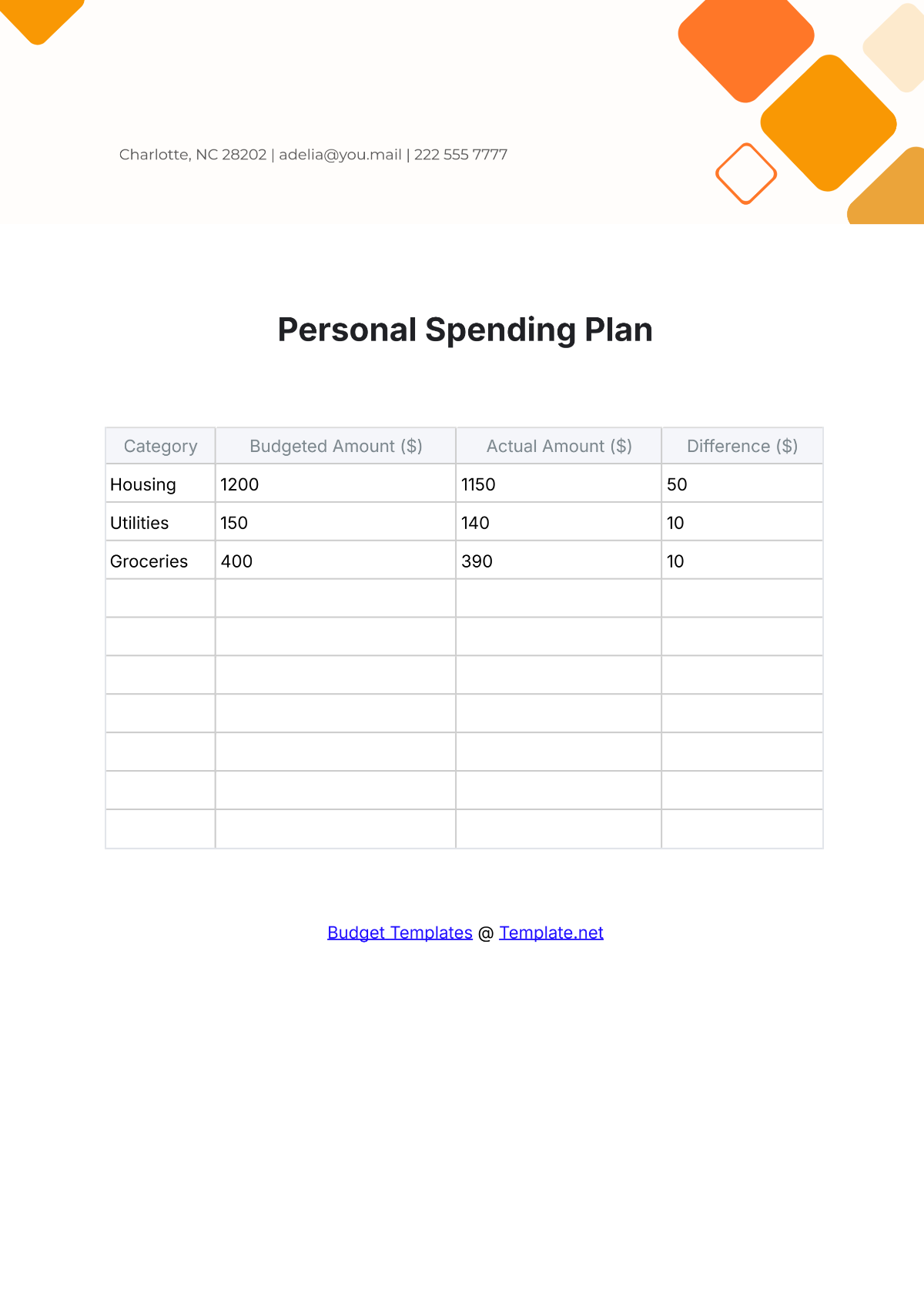

Keep your finances in order, achieve savings goals, and manage expenses effectively with Budget Plan Templates by Template.net, designed for individuals, small businesses, and financial advisors. Whether you're looking to streamline your monthly budget or prepare for taxation season, these templates provide a comprehensive solution. For example, use them to meticulously track income and expenditures or to forecast financial projections for your business operations. They include essential details like calculation fields, expense categories, and summary sections—all ready for your data input. There’s no need for complex software skills, and the templates offer a professional-grade design to present your financial data clearly and effectively. Customize formats suitable for print or digital distribution, ensuring you stay organized and informed.

Discover the many Budget Plan Templates we have on hand, allowing you to tailor your financial visuals with ease. Begin by selecting a template that aligns with your financial objectives, and then swap in your own individual or business financial data. You can easily adjust colors and fonts to suit your preferences or branding. With drag-and-drop capabilities, insert icons or graphics to enhance your presentation, and use AI-powered text tools to simplify content creation. The possibilities are endless and skill-free, enabling anyone to craft precise and informative budget plans. New designs are added regularly to keep your documents fresh and relevant. When you’re finished, download your budget plan for printing or share it digitally, ensuring accessibility and ease of use across multiple channels.