Businesses of all types use a sharing plan to keep the employees motivated to give their best at work to gain profit shares or even self-employed people. We know that creating a sharing plan can be time-consuming and that is why we offer you a very convenient way to have your own business document! We present our 100% customizable, printable, easily editable, and high-quality Sharing Plan Templates. These professionally written templates are very accessible in any device you would use. It can be used in formats like Google Docs, MS Word, and Apple Pages. So, what are you waiting for? Use these templates today!

What Is a Sharing Plan?

A sharing plan is a type of plan that gives the participants, such as employees, the opportunity to gain profit through their hard work and allow them to take their benefits when they leave the company such as retirement. A sharing plan also considers incentive resource programs when the company plan mainly evaluates the participants' performances like, for instance, how they were able to reach the sales goals, then all the members of the group will be rewarded.

A sharing plan involves the value of money that will be distributed to participants. It is pretty much different than the bonuses and extras they will receive. The company gets to decide from year to year on how much to contribute to a participant's certain plans. A modern business plan also has to assess the participants to be qualified with the benefits and rewards.

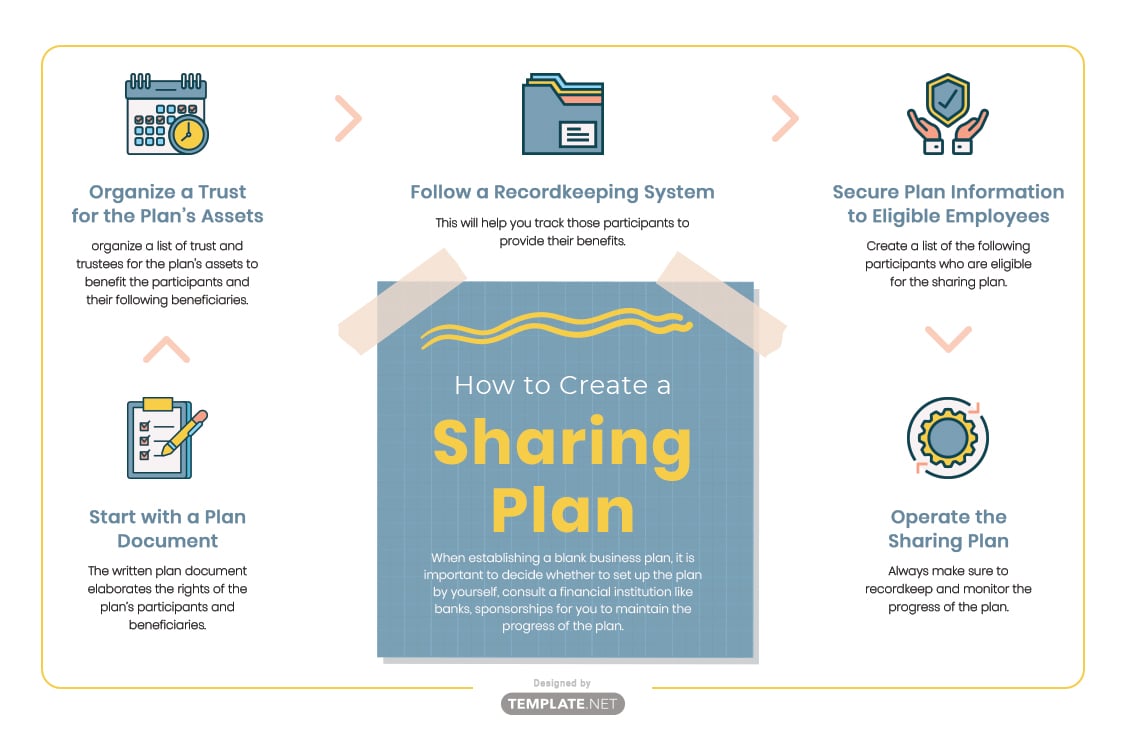

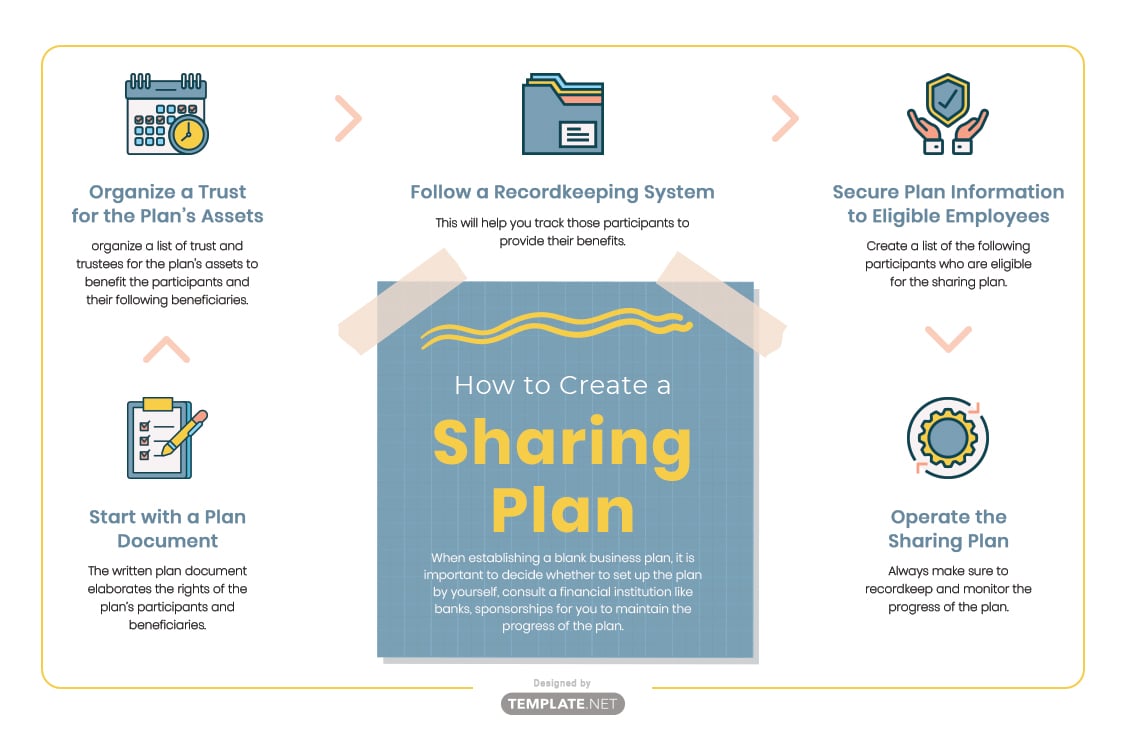

How to Create a Sharing Plan

When establishing a blank business plan, it is important to decide whether to set up the plan by yourself, consult a professional or financial institution like banks, sponsorships, or insurance companies for you to maintain the progress of the plan. Here are the following tips for you to be guided on how to create a sharing plan.

1. Start with a Plan Document

Starting with a legal document will help give the sharing plan structure. The written plan document elaborates the rights of the plan’s participants and beneficiaries. It also guides the plan sponsor and plan administrator in making decisions and executing their responsibilities. Mainly, it explains what benefits are available, how the benefits are being funded, and describes the fiduciaries and eligible participants. The written plan document also helps guide you on how the plan would be amended and what the following procedures are to allocate the plan. You can hire someone to help you with arranging the written plan document. But if you decide to make things on your own, it is important to allow the financial institutions to help you with it.

2. Organize a Trust for the Plan’s Assets

To sort things out easily, organize a list of trust and trustees for the plan's assets to benefit the participants and their following beneficiaries. The trust must have at least one trustee to handle the information regarding data contributions, investment proposals, and distributions. Choosing a trustee is one of the most important decisions you will make when making a sharing plan. If you are making the plan with the sponsors and insurance companies, then the trust is no longer necessary for the contracts.

3. Follow a Recordkeeping System

From the same article, it is important to keep on tracking the attribute contributions, earnings and losses, plan investments, expenses, and benefit distributions. This will help you track those participants to provide their benefits. If the financial institution helps you in managing the plan, it will help keep the required records. Recordkeeping will help your plan when preparing an annual report. Keep track of the data analysis and information to maximize profits and to avoid future predicaments.

4. Secure Plan Information to Eligible Employees

Create a list of the following participants who are eligible for the sharing plan. These participants must be informed about the certain rights, features, and benefits they can get from the business plan. The labor department's article states that a Summary Plan Description (SPD) must be provided to these eligible participants. The Summary Plan Description helps inform participants and the beneficiaries about how the plan would work for them.

5. Operate the Sharing Plan

By the time the participants are able to confirm the basic business plan, start utilizing the sharing plan to see that it works well. Always make sure to recordkeep and monitor the progress of the plan.