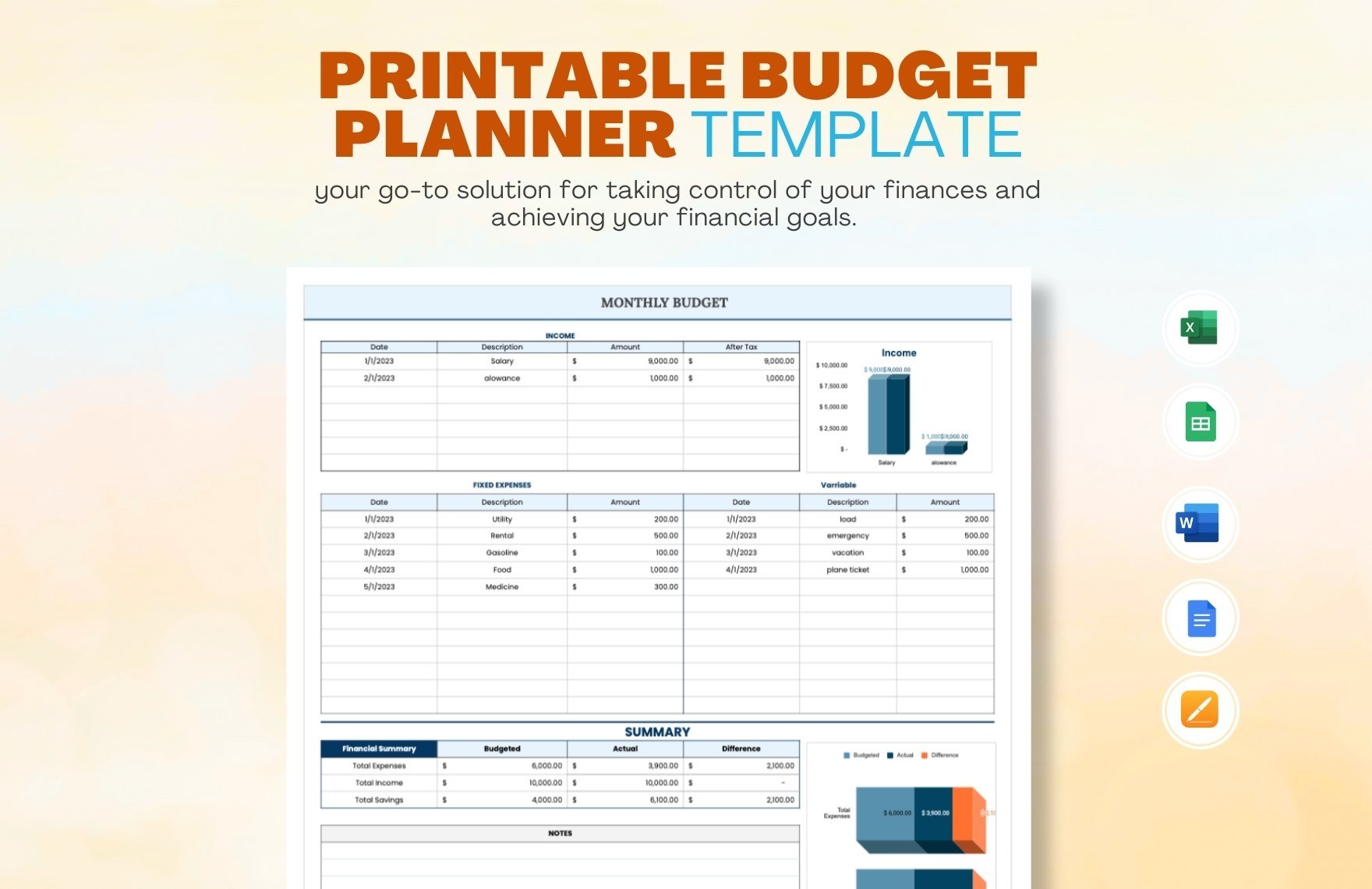

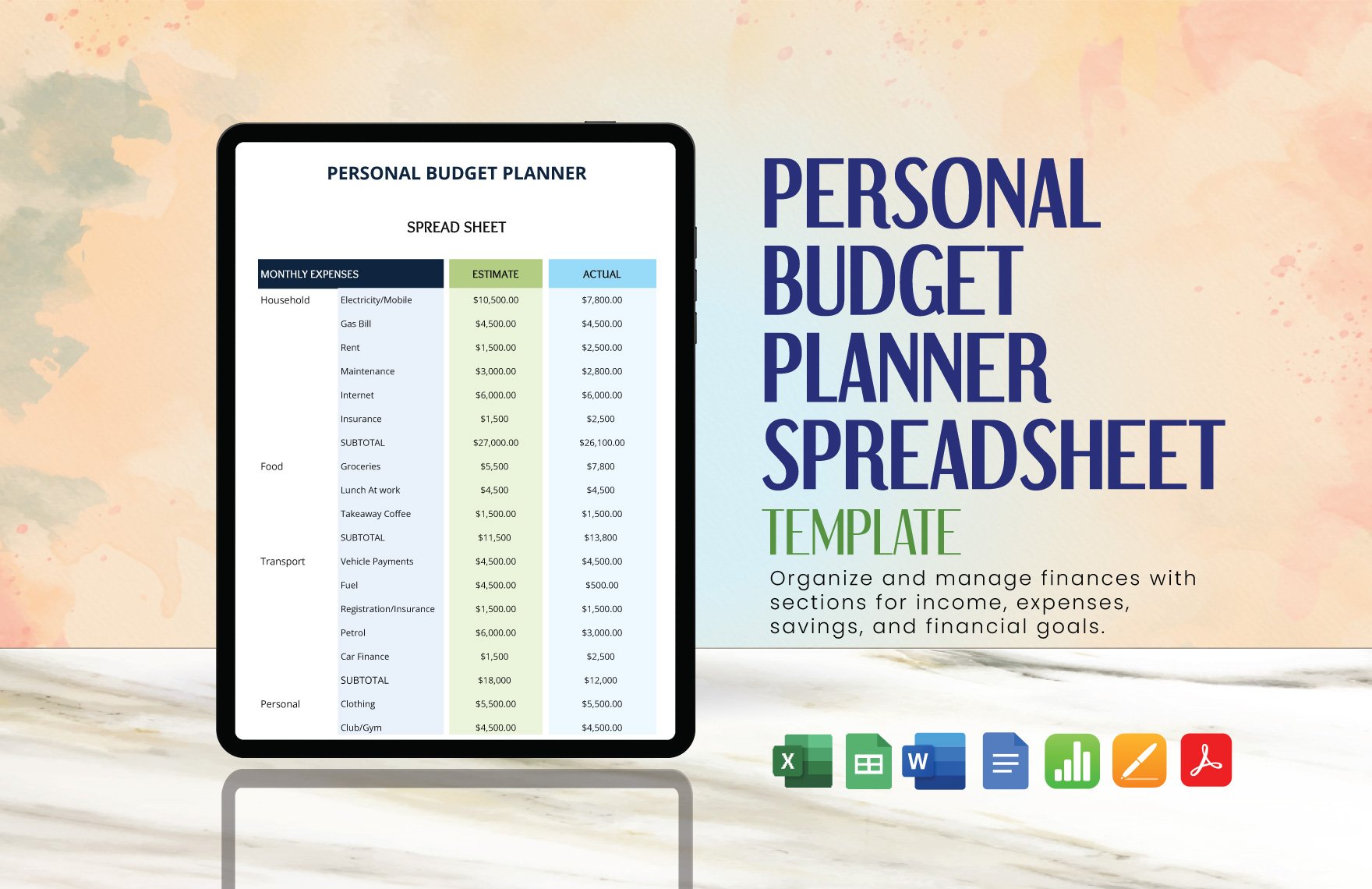

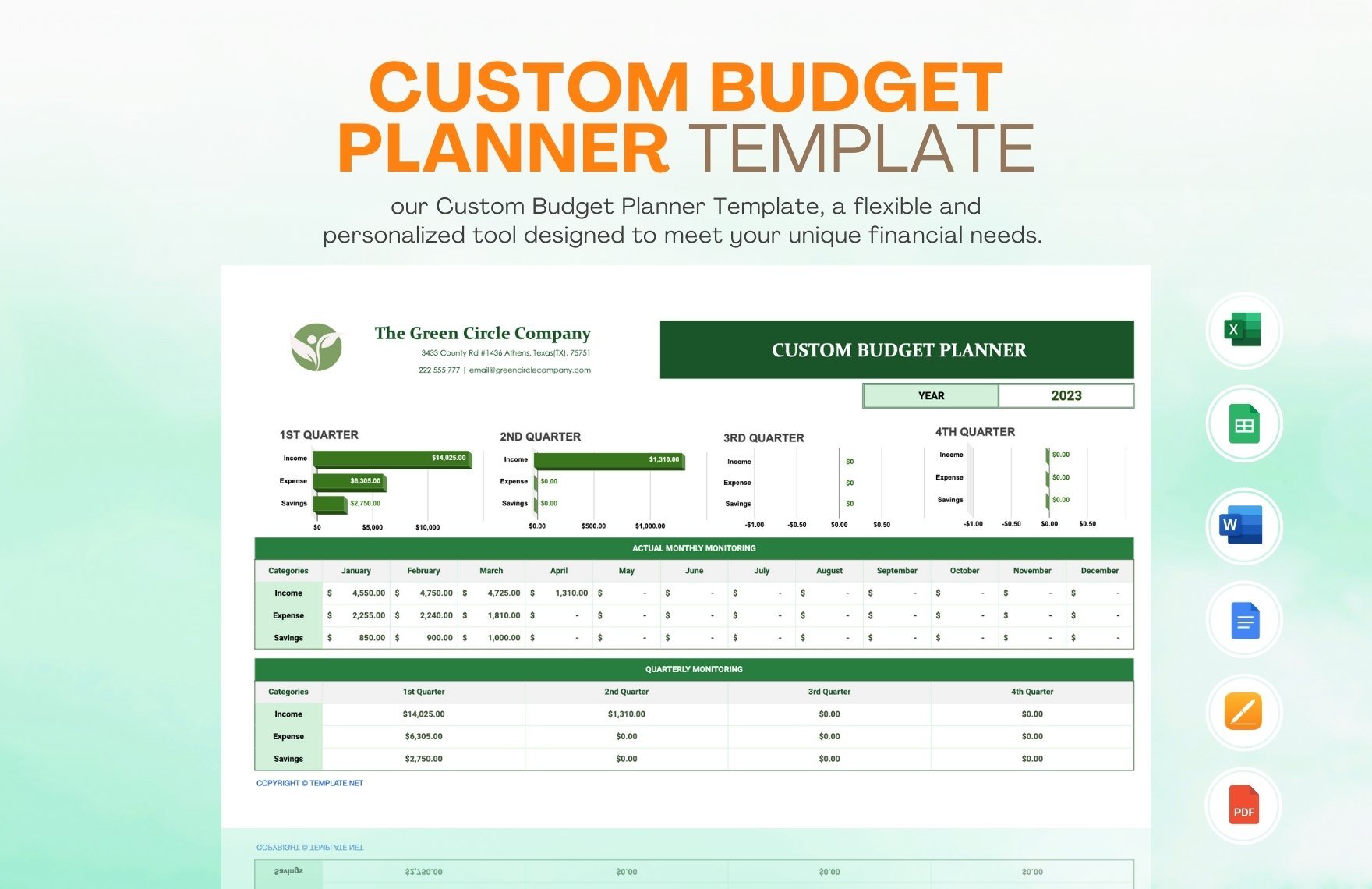

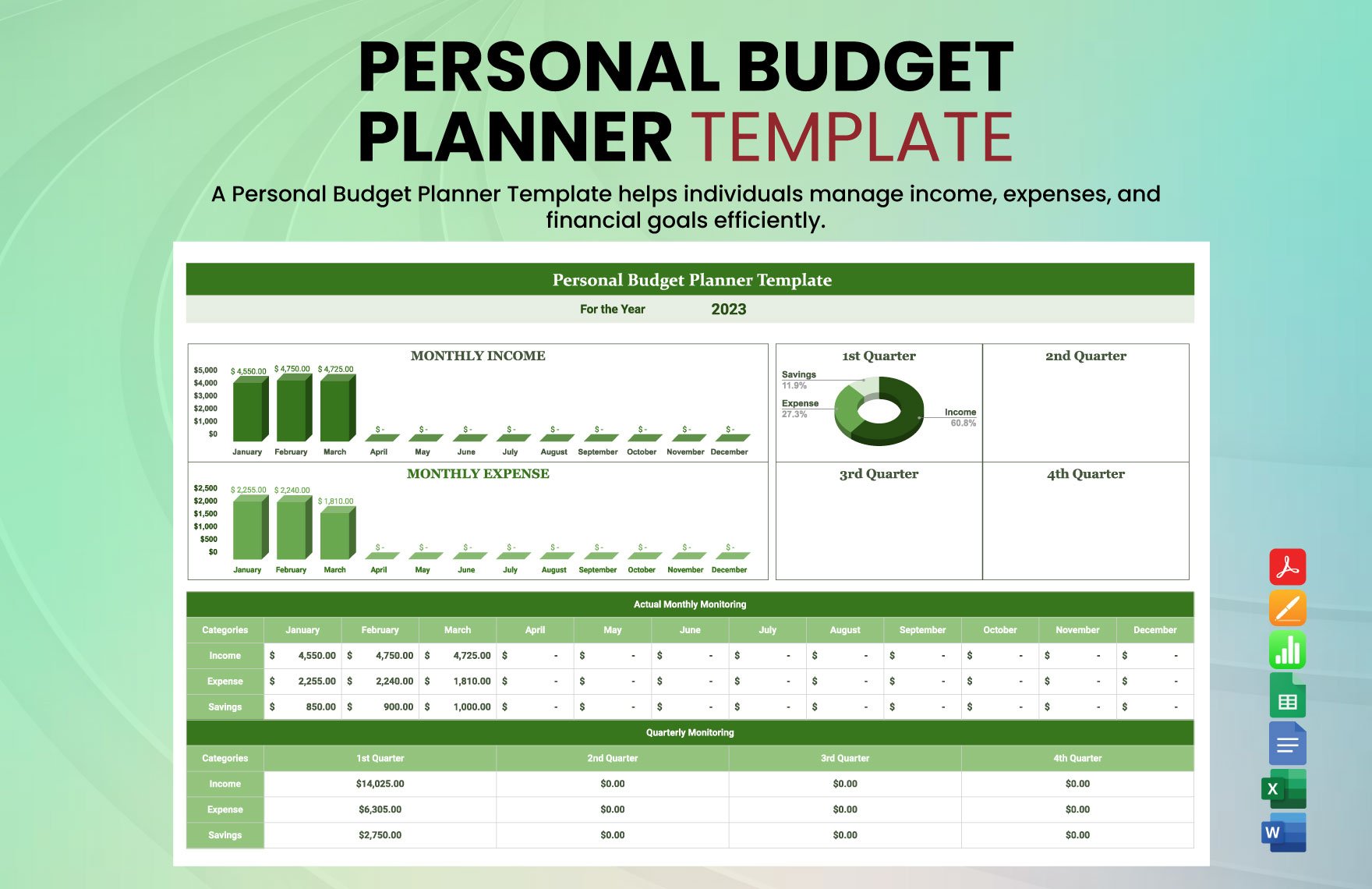

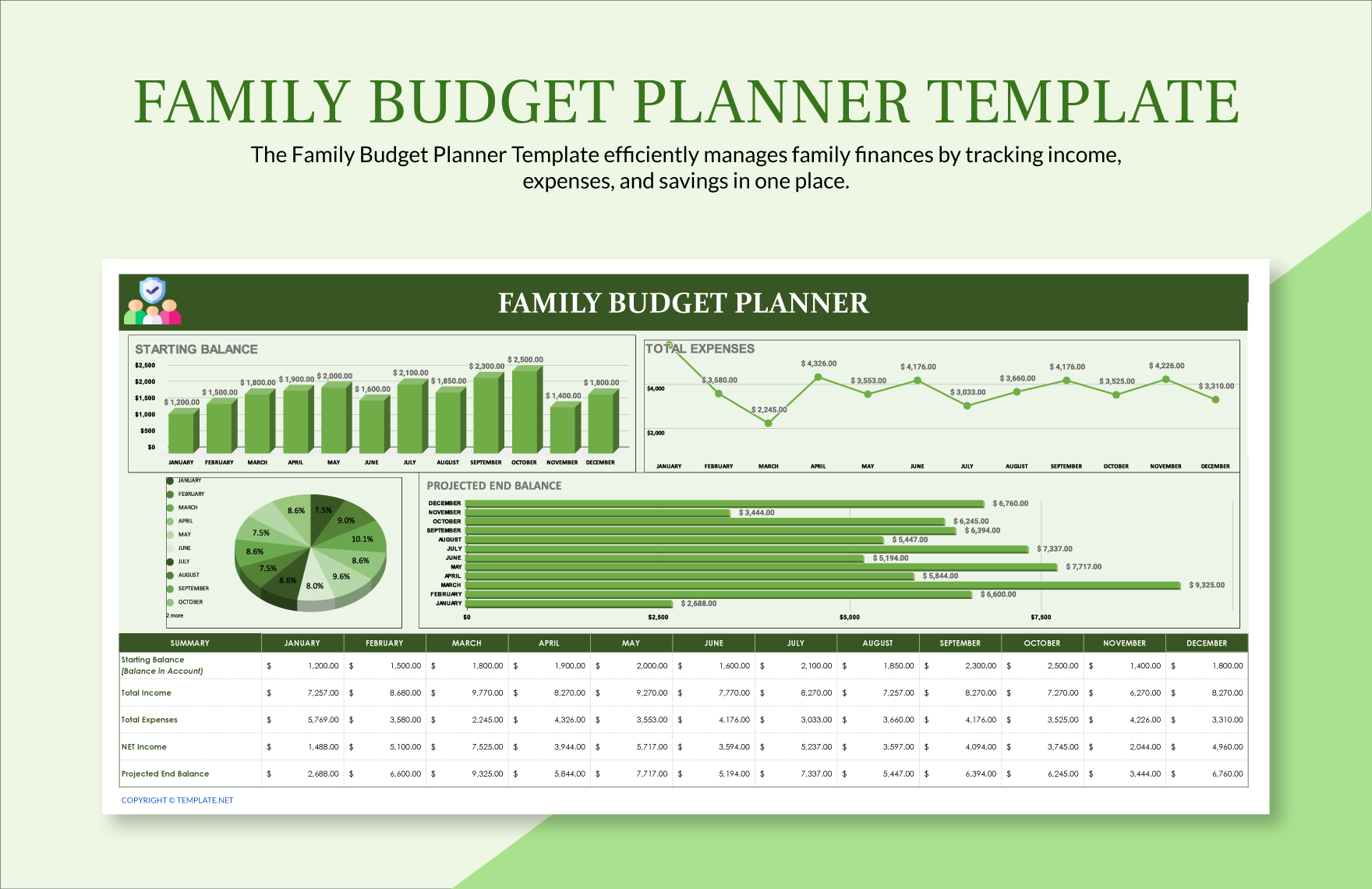

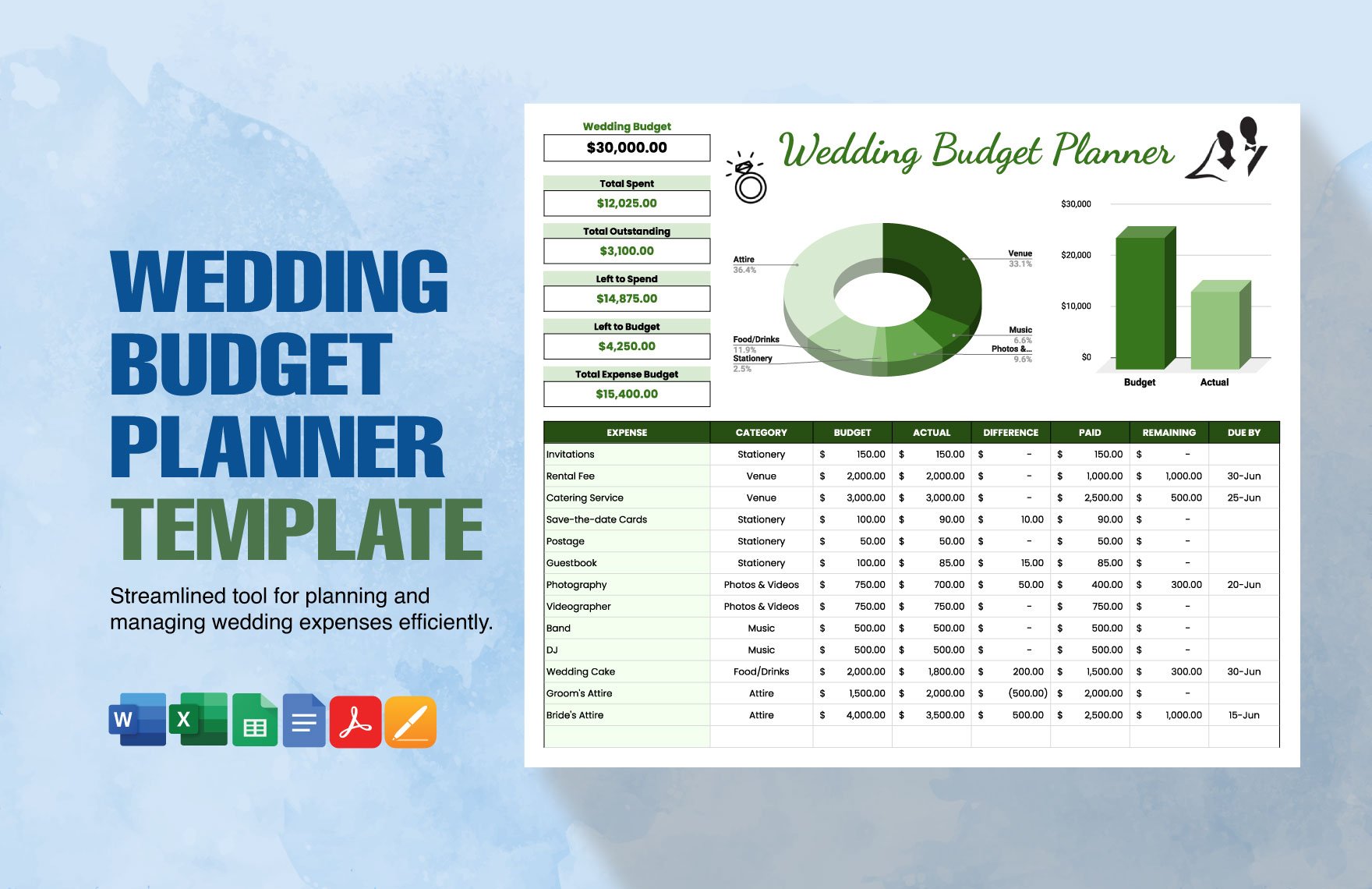

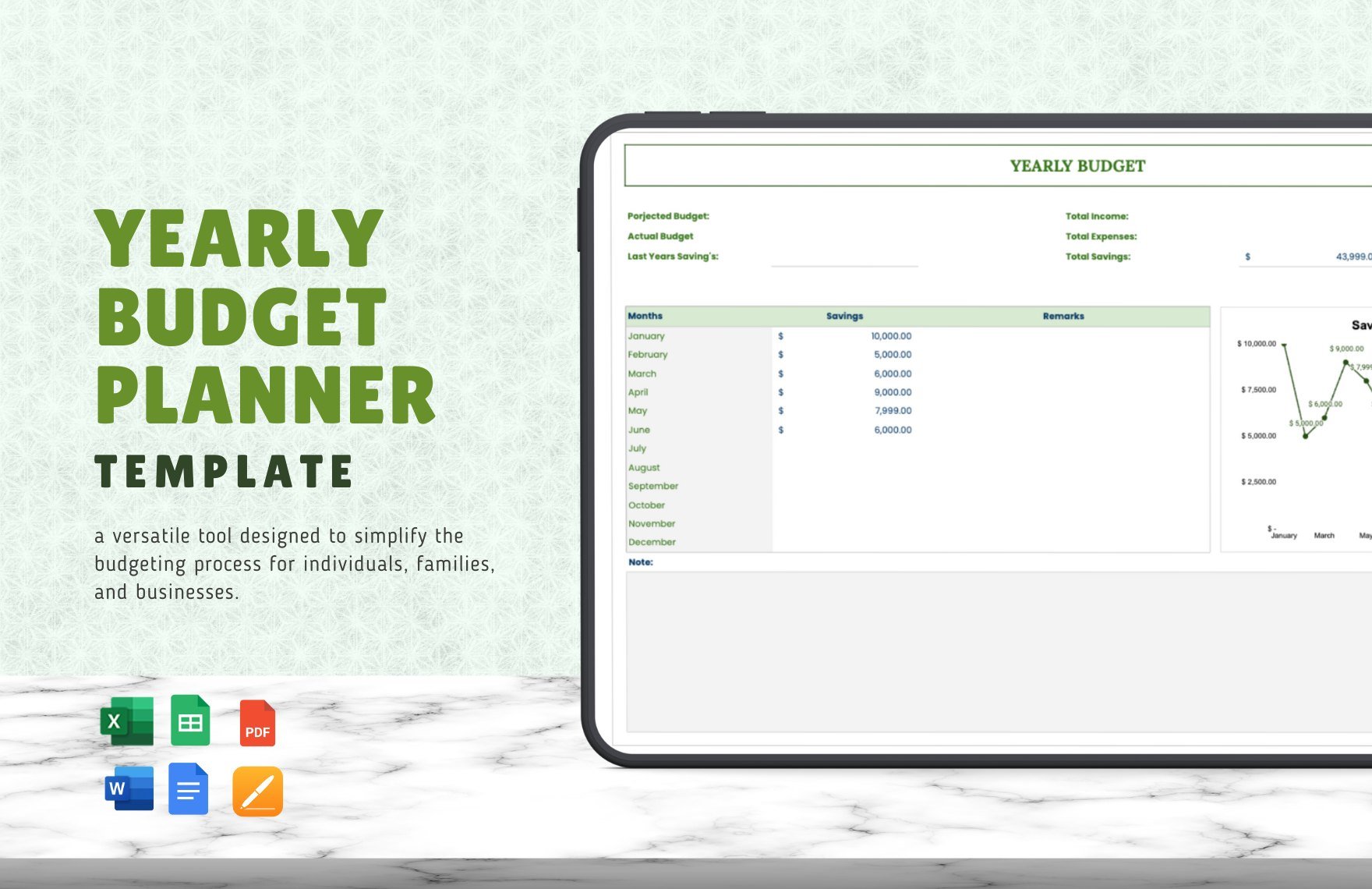

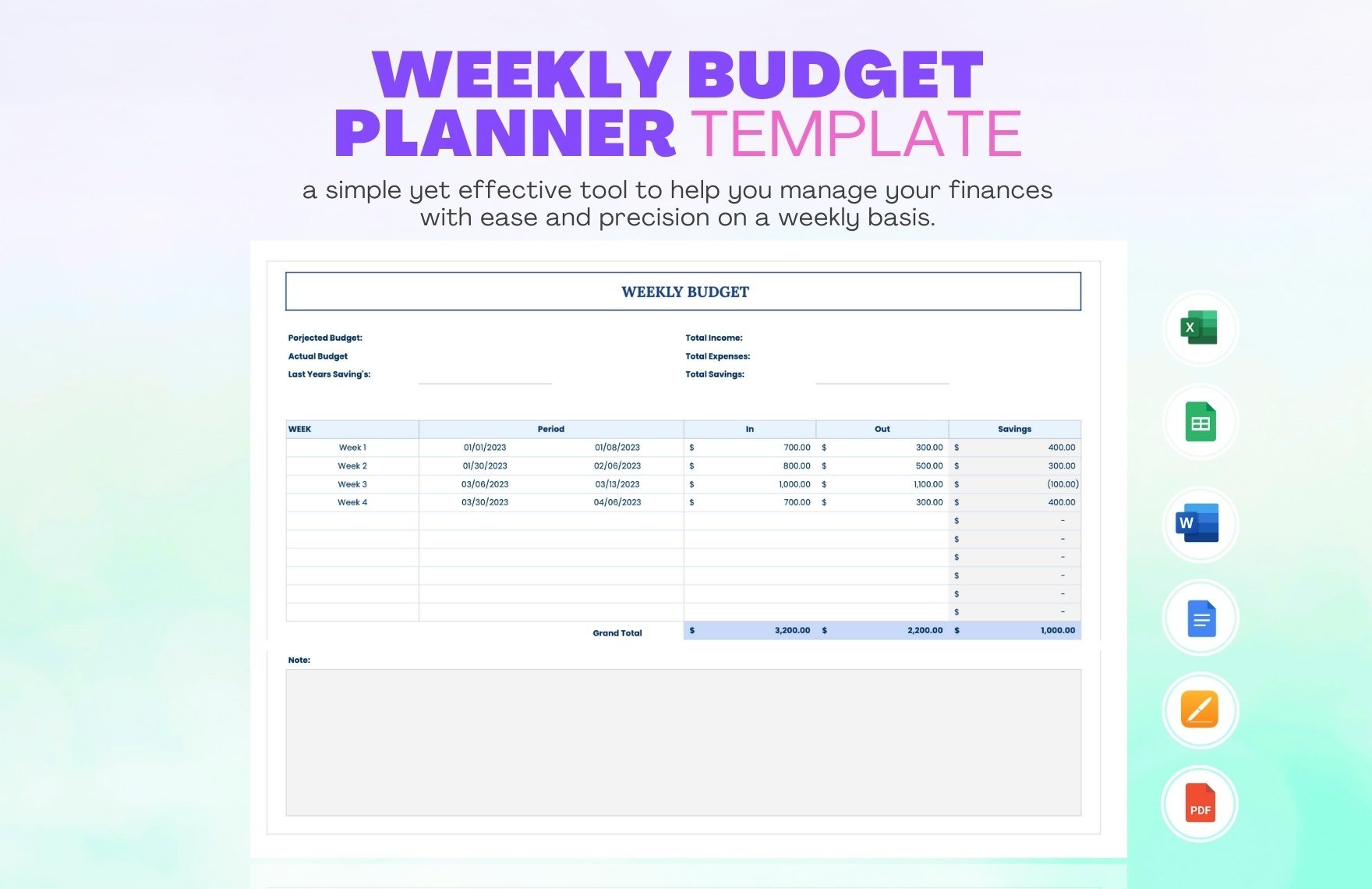

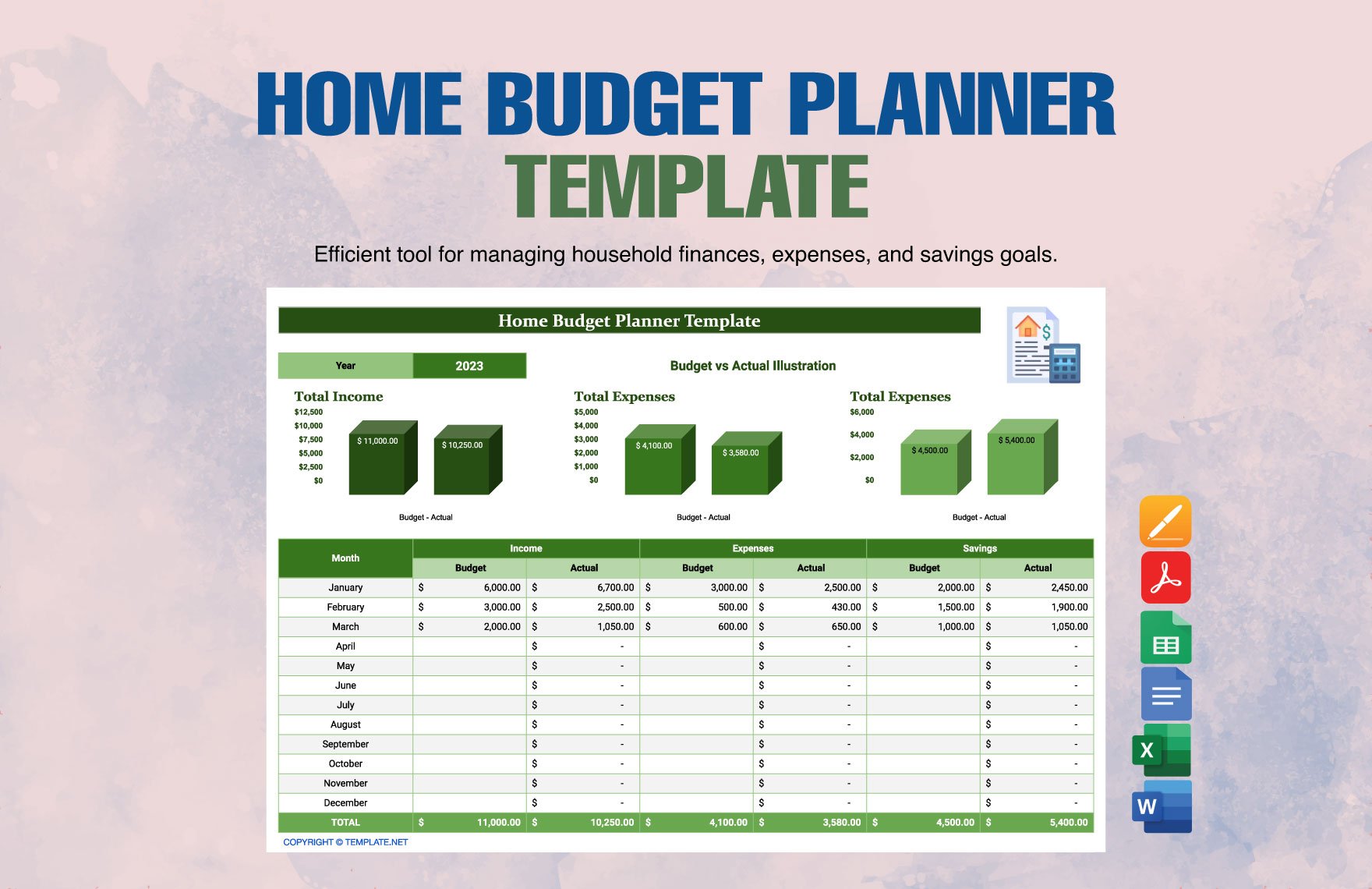

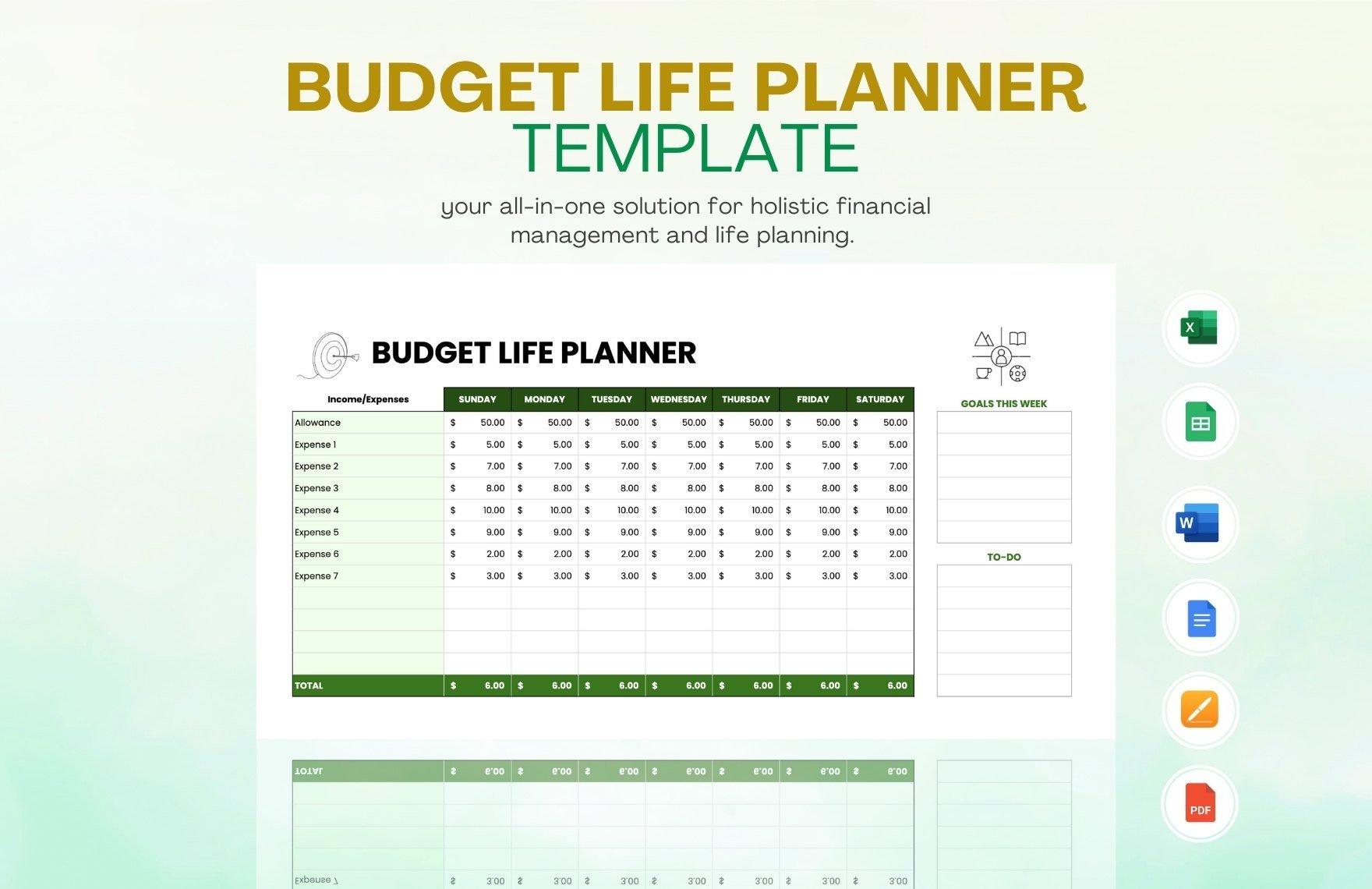

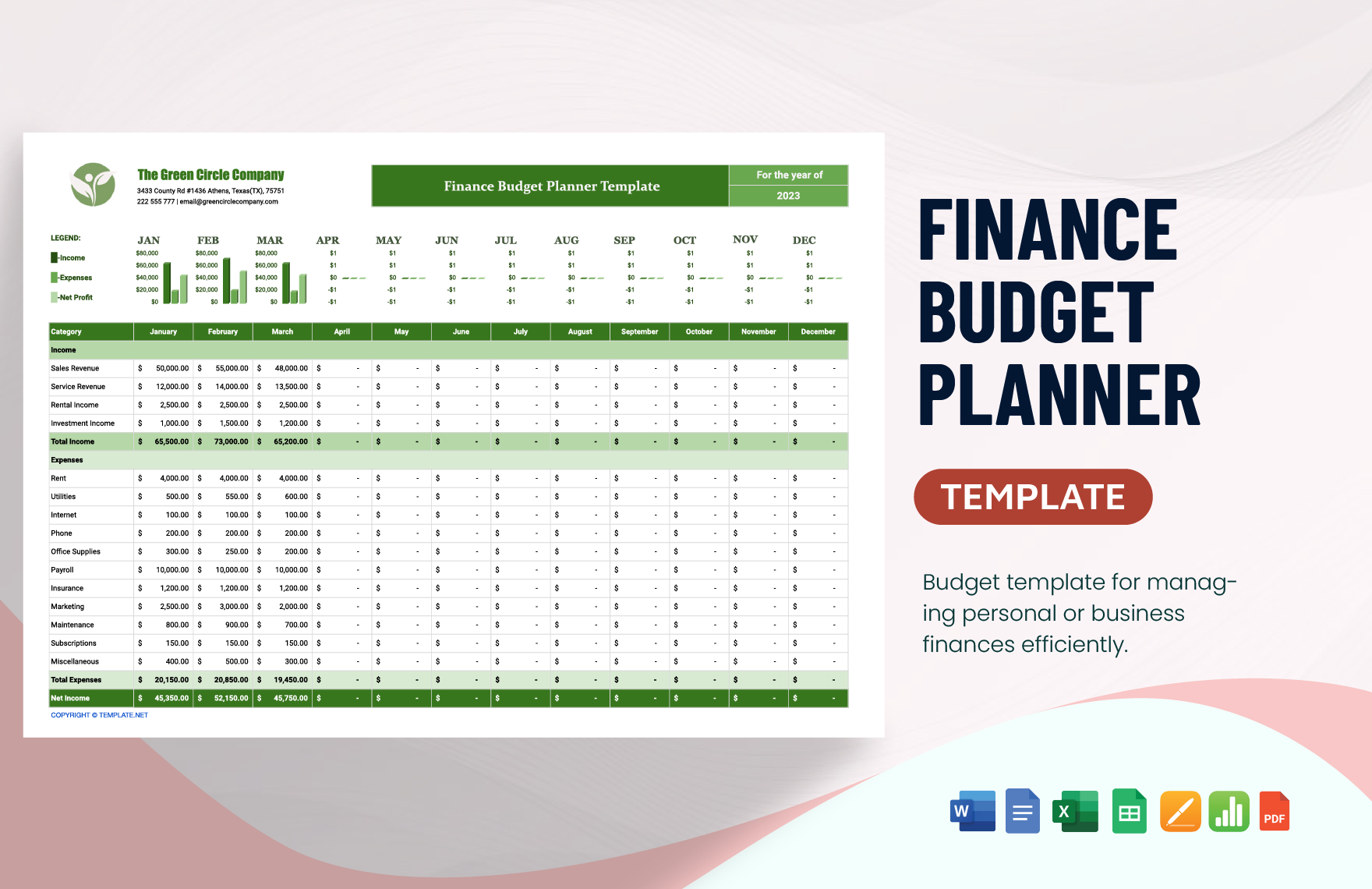

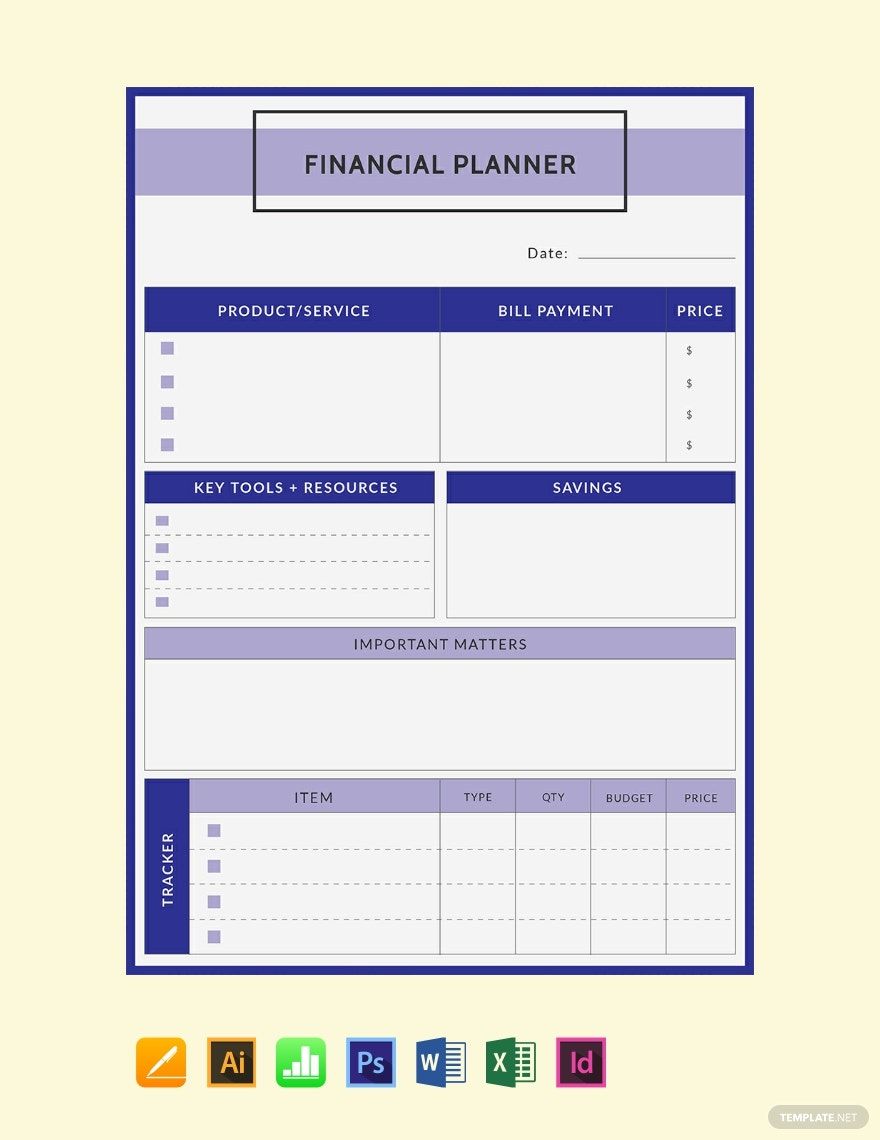

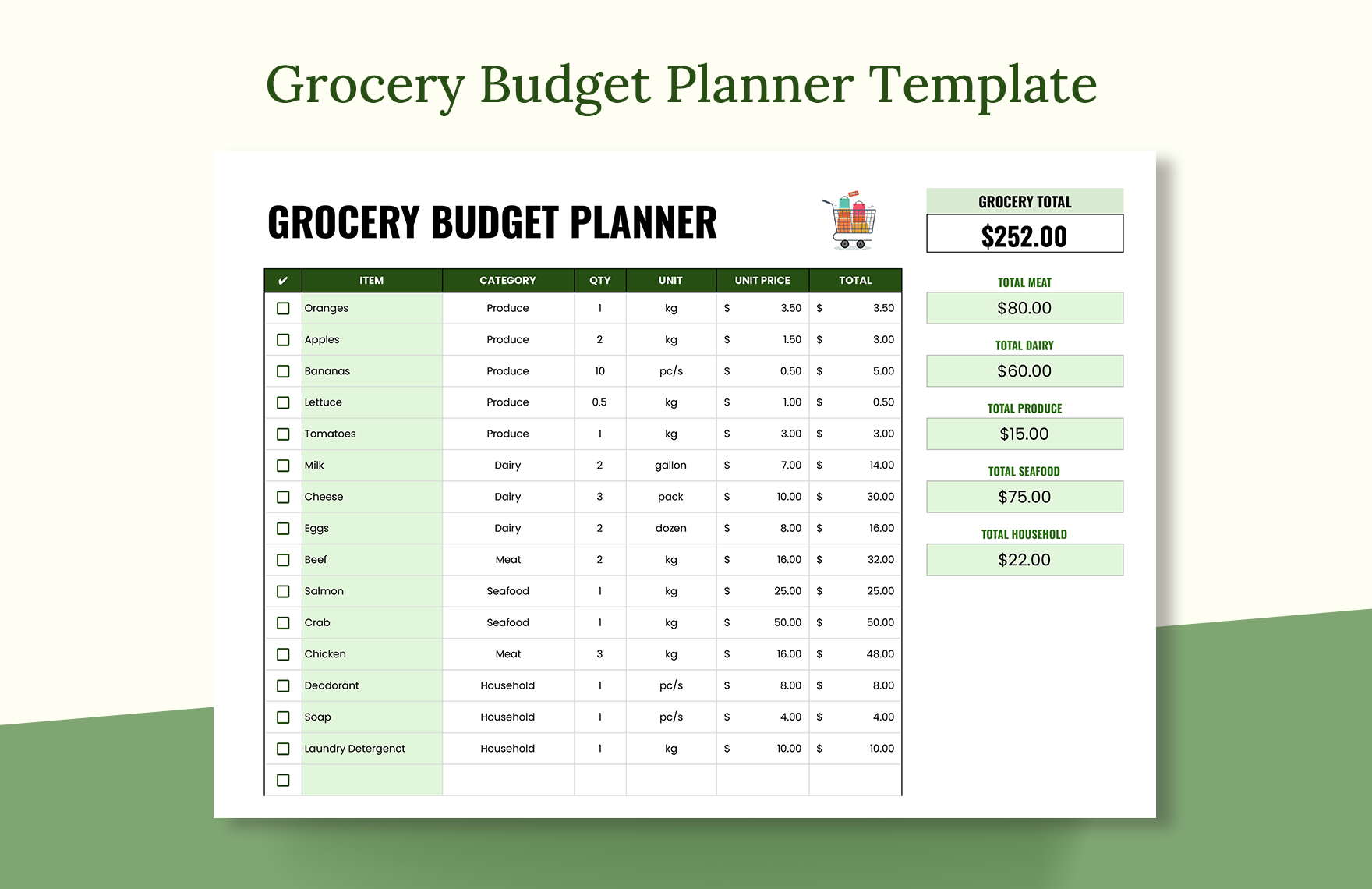

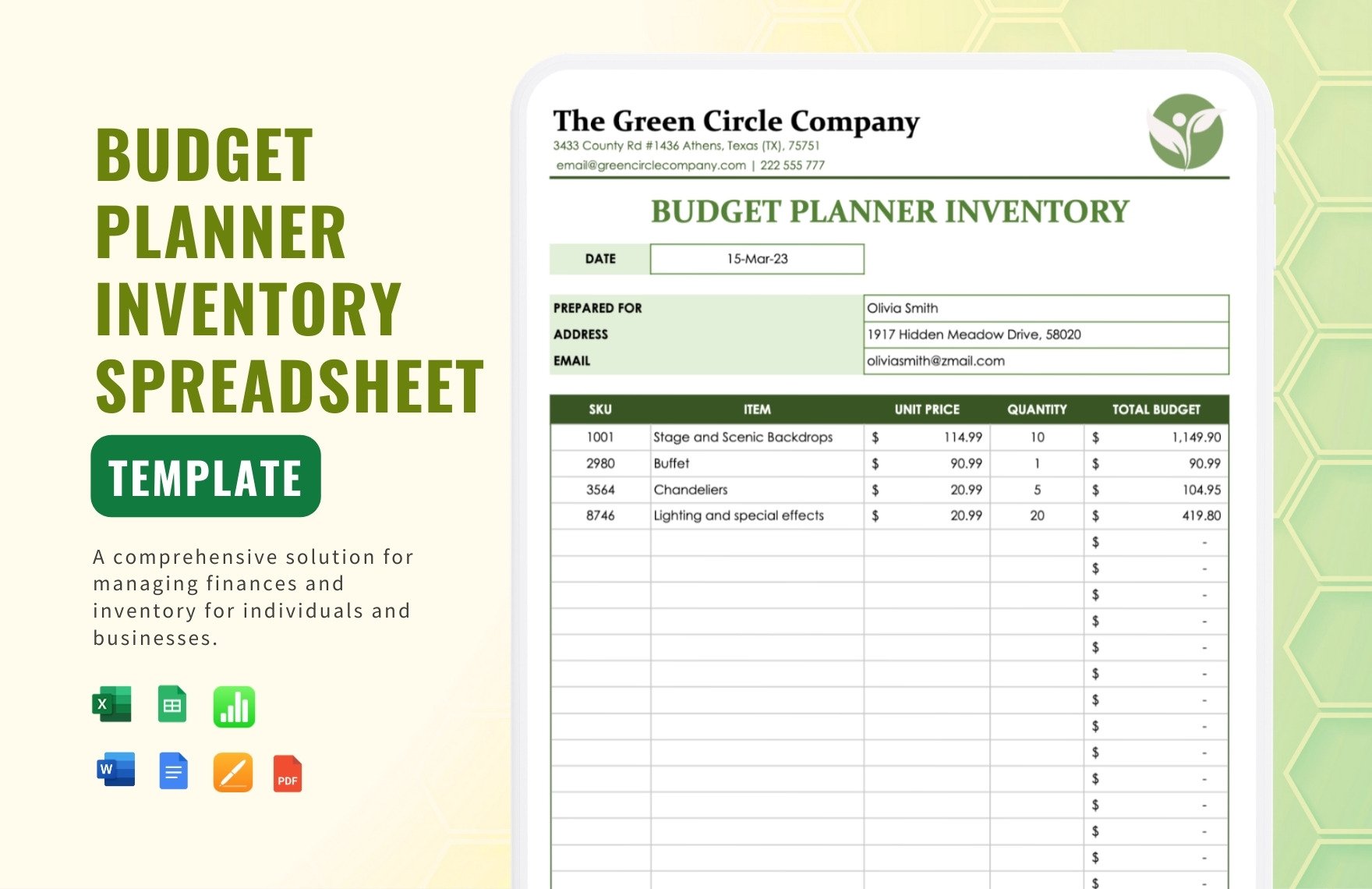

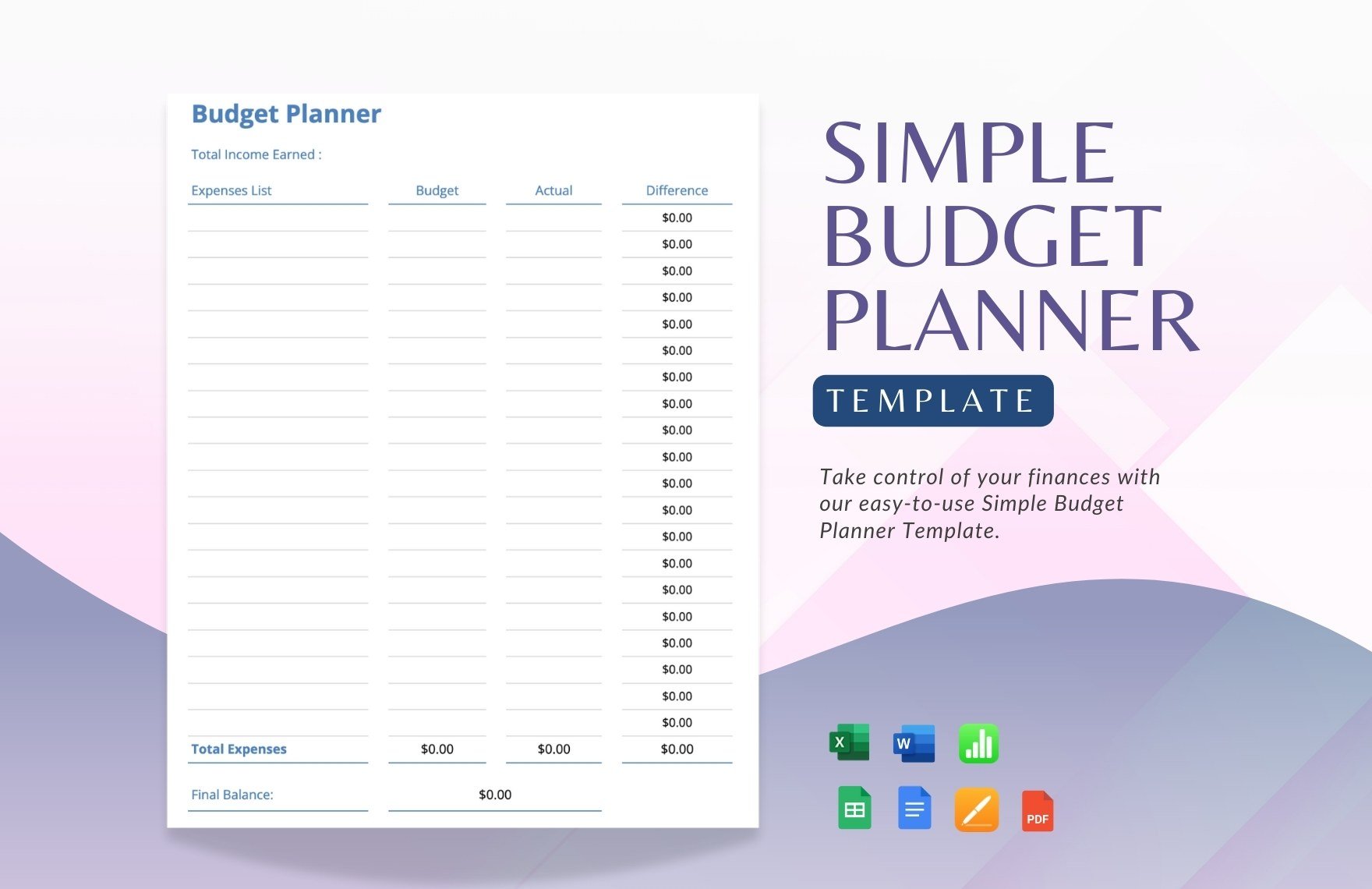

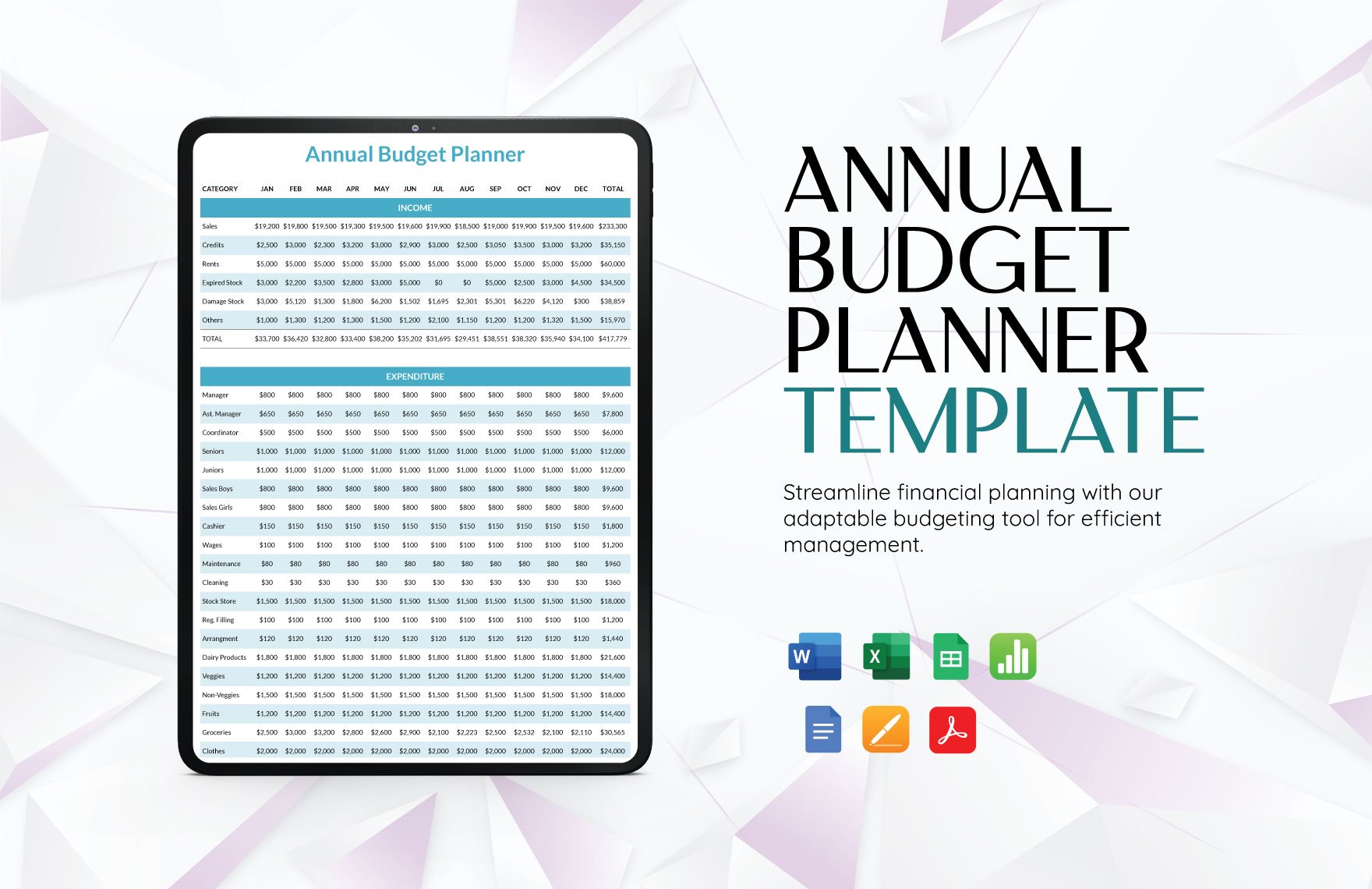

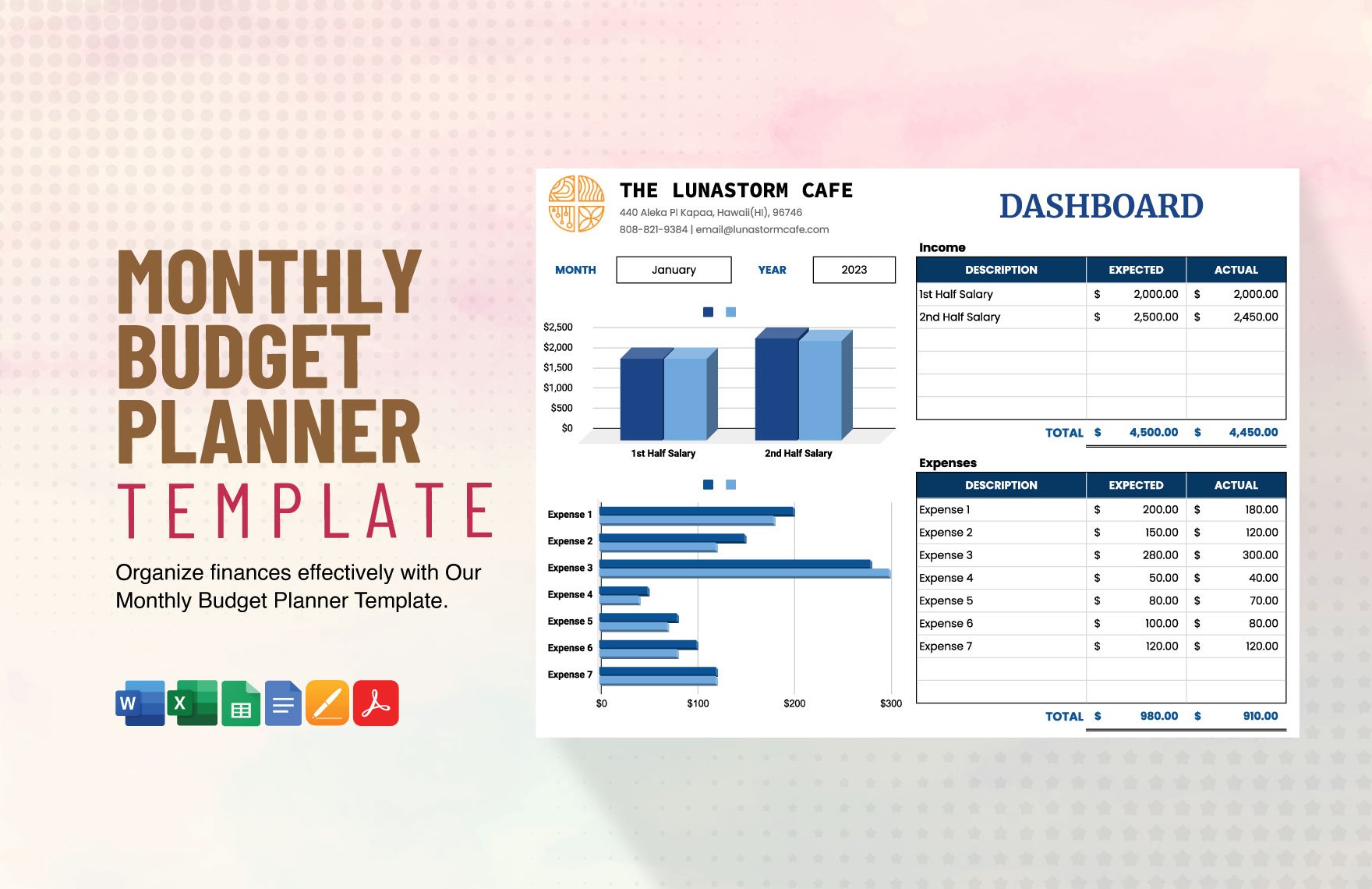

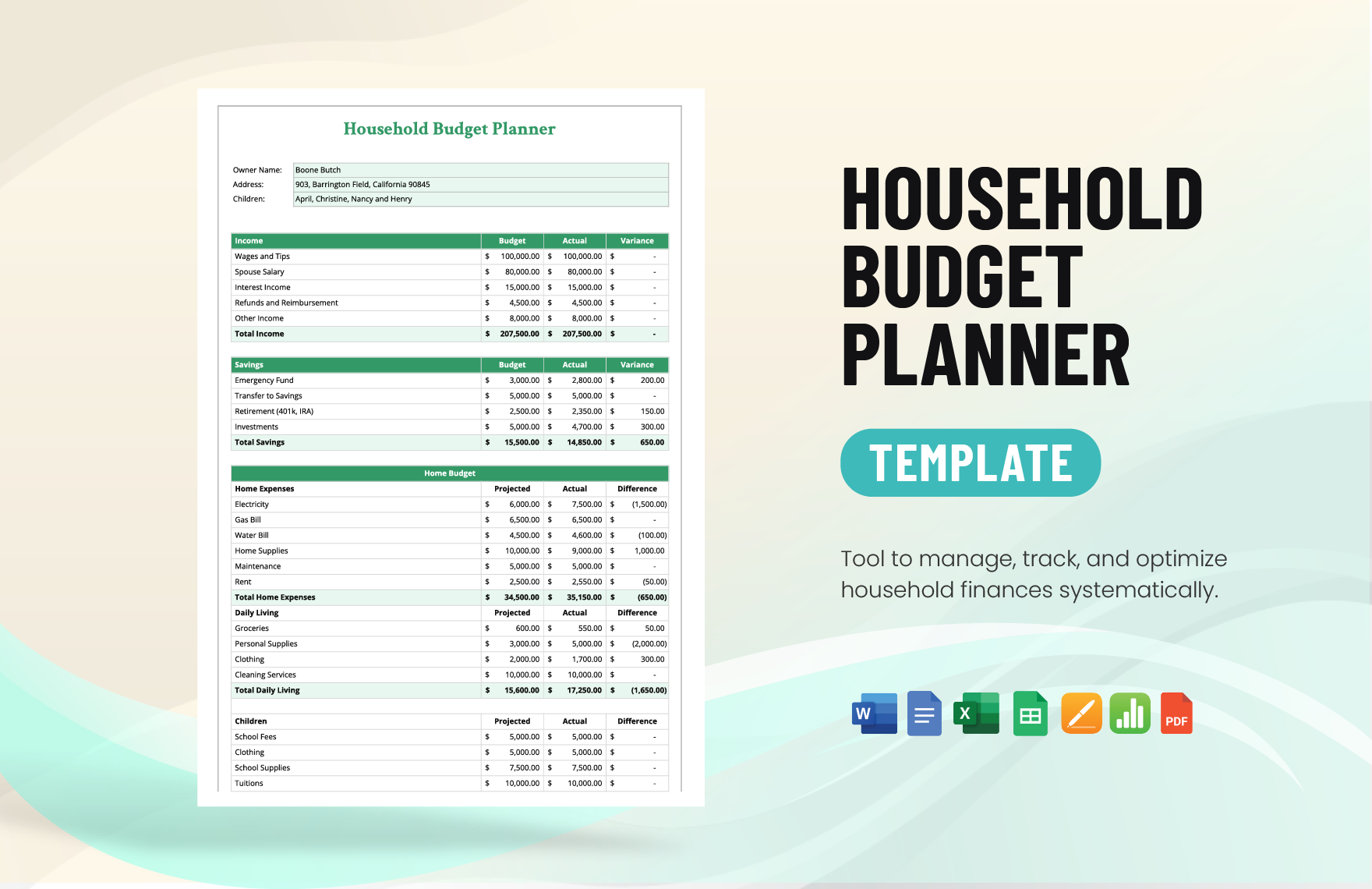

Are you having a hard time cutting off your shopping expenses? Or maybe you are traveling with no budget at all? These instances could either lead you to satisfaction or trouble. In making sure that you won’t go over your monthly budget, now is the time to be responsible with your credit limits. It is indeed easier said than done. But taking chances of being responsible with your expenses will eventually do you good. That is why in making sure that you consistently follow your budget, we offer Ready-Made and High-Quality Budget Planner Templates in Apple Pages. You can customize and print these templates in A4 or US Letter sizes. Now is the perfect opportunity to fix your money problems. Grab a template today!

Budget Planner Templates in Apple Pages

Editable Budget Planner Templates in Apple Pages: Customize with Ease, Printable Designs Ready to Download. Streamline Your Finances Today with Template.net!