Bring Your Financial Goals to Life with Pre-designed Debt Planner Templates in Apple Pages by Template.net

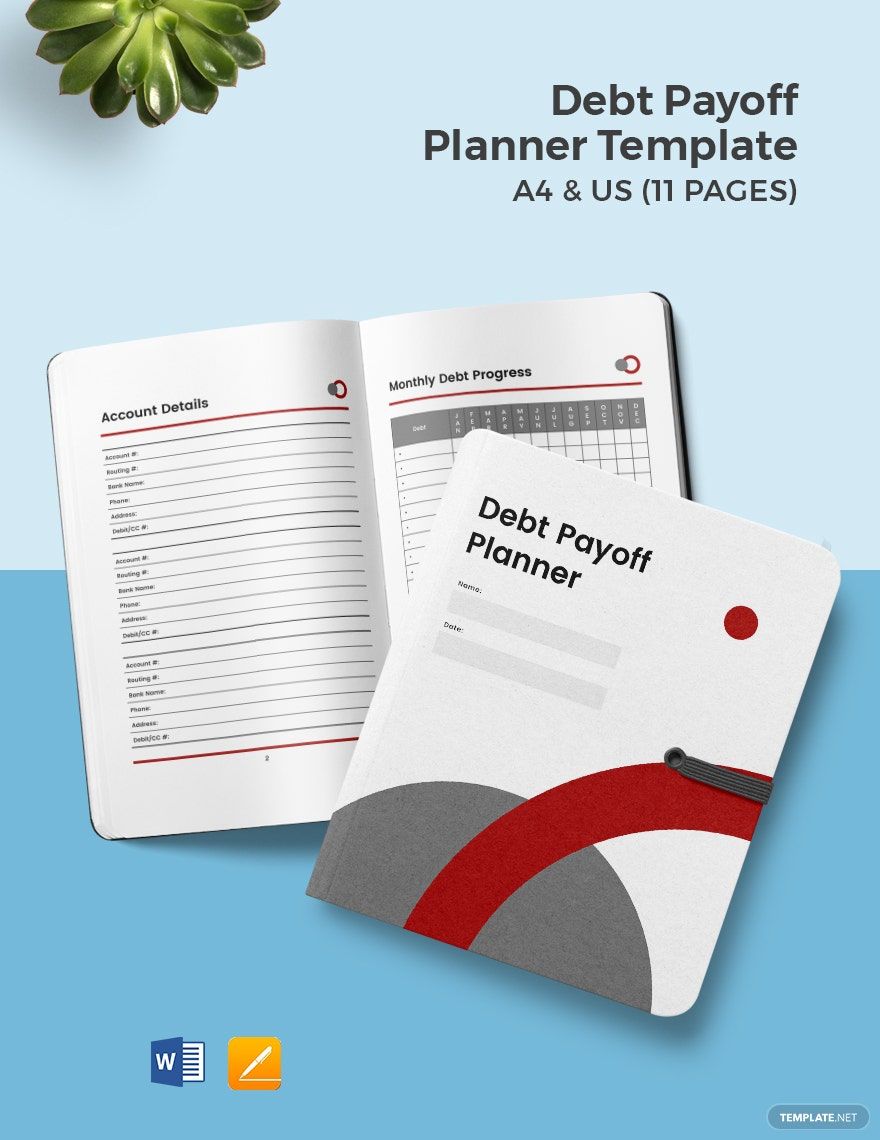

Bring Your Financial Goals to Life with Pre-designed Debt Planner Templates in Apple Pages by Template.net. Achieve meticulous financial planning without hassle using Debt Planner Templates by Template.net to create organized and professional-grade plans quickly and easily with no design experience required. Whether you're looking to comprehensively manage your personal debt or systematically track your monthly expenditures, these pre-designed templates are perfect for all your financial planning needs. With the availability of free downloadable and printable files in Apple Pages, you can access beautiful pre-designed templates that cater to both digital and print distribution, ideal for financial reviews or budgeting presentations. Experience the ease of customizable layouts, ensuring that your planning documents are both functional and appealing.

Explore more beautiful premium pre-designed templates in Apple Pages to expand your financial toolkit with premium design options. Template.net regularly updates its library, ensuring you have fresh and contemporary template choices to suit various financial planning scenarios. Download or share via link, print, or email for increased reach, making it simple to communicate your monetary objectives with partners, advisors, or family members. Make use of both free and premium templates to fully customize and enhance your planning approach for every situation, offering maximum flexibility and adaptability as your financial needs evolve.